|

|

Post by Entendance on May 7, 2023 3:46:37 GMT -5

'...We are talking about this in terms of a banking crisis, but I believe we are very close to literally a banking apocalypse where we could see dozens and, ultimately, hundreds of banks fail here in the United States...Basically, at this point, we’ve got hundreds of banks that are essentially insolvent. They are walking zombies. One recent study said there are about 186 banks on the verge of failure. So, we are going to see a lot more banks fail. If you look at the banks that have already failed in 2023, (SVB, Signature and First Republic) it is greater than all 25 banks that failed in 2008 combined. So, already, the banking crisis of 2023 is worse than the banking crisis in 2008. But, here’s the kicker, we’re only one third of the way through the year...' Doom Loop Will Cause Total Societal Meltdown – Michael Snyder '...We are talking about this in terms of a banking crisis, but I believe we are very close to literally a banking apocalypse where we could see dozens and, ultimately, hundreds of banks fail here in the United States...Basically, at this point, we’ve got hundreds of banks that are essentially insolvent. They are walking zombies. One recent study said there are about 186 banks on the verge of failure. So, we are going to see a lot more banks fail. If you look at the banks that have already failed in 2023, (SVB, Signature and First Republic) it is greater than all 25 banks that failed in 2008 combined. So, already, the banking crisis of 2023 is worse than the banking crisis in 2008. But, here’s the kicker, we’re only one third of the way through the year...' Doom Loop Will Cause Total Societal Meltdown – Michael Snyder

|

|

|

|

Post by Entendance on May 8, 2023 16:42:48 GMT -5

'Since the banking crisis began making headlines at expensive media real estate, the narrative has been that deposits are fleeing the small commercial banks and flooding into the biggest banks that are perceived as too-big-to-fail and thus offer a safer venue for deposits.

Because these mega banks are the same ones that the Fed has been bailing out since the financial crisis of 2008, that narrative requires believing that our fellow Americans are dumber than a stump.

We decided to check out that narrative for ourselves. Not only is that scenario wrong, but it is so decidedly wrong, and it’s so easy to get the accurate figures, that from where we sit it looks like there might have been an agenda by someone to harm smaller banks...'

Total assets lost in bank failures

(2001 to present)

Some well-informed analysts tend to say that Switzerland is a schmutzig country. Now we probably know why.

|

|

|

|

Post by Entendance on May 11, 2023 2:13:30 GMT -5

|

|

|

|

Post by Entendance on May 13, 2023 5:44:07 GMT -5

|

|

|

|

Post by Entendance on May 22, 2023 8:16:03 GMT -5

#1. The money isn’t really yours. You’re just another unsecured creditor if the bank goes bust.

#2. The money isn’t actually there. It’s been lent out to borrowers who are illiquid or insolvent.

#3. The money isn’t really money. It’s credit created out of thin air.

Here Come the CBDCs Here Come the CBDCs

This is all to lay the groundwork for the march into Central Bank Digital Currencies (CBDCs) which will seek to accomplish three objectives of Late Stage Globalism:

Eliminate privacy – making all transactions trackable, traceable and taxable in realtime.

Introduce controls on how, when and why you are spending your own money. Think China-style social credit, which in its Westernized form will almost certainly involve personal carbon footprint quotas.

And most importantly (otherwise we wouldn’t be calling it “Late Stage Gobalism”):

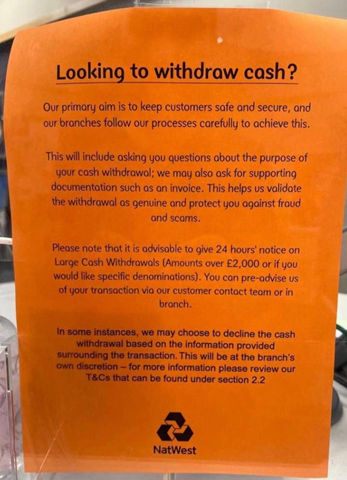

Extend the runway of fiat currencies – which are about to hit the wall as a long-wave debt super-cycle reaches its crescendo.Withdrawing your own cash? NatWest bank wants to know why – and see proof

JPMorgan Chase and Jeffrey Epstein Were Both Involved in a Strange Offshore Company Called Liquid Funding

In Gold We Trust report 2023 In Gold We Trust report 2023

|

|

|

|

Post by Entendance on Jul 22, 2023 2:03:50 GMT -5

|

|

|

|

Post by Entendance on Jul 26, 2023 4:20:57 GMT -5

|

|

|

|

Post by Entendance on Jul 30, 2023 2:28:09 GMT -5

At the Mercy of the Big Banks

...Because once they get us off of cash and completely onto a digital system, then the banks will have absolute control over each and every one of us.

'...July 13, 2023, JP Morgan Chase Bank suddenly informed me they are closing all of my business accounts, both banking and investment accounts, along with the personal accounts of my CEO, my CFO and their respective spouses and children.

No reason for the decision was given, other than there was “unexpected activity” on an unspecified account. The oldest of these accounts has been active for 18 years.

Continuing, Mercola warned that what Chase Bank has done to his business, his business associates, and the family members of his business associates is a warning to people generally because it is a type of action that may become much more widespread soon:

This is what the new social credit system looks like, and what every soul on the planet can expect from the central bank digital currencies (CBDCs) that are being rolled out. Go against the prevailing narrative of the day, and your financial life will be deleted with the push of a button.

It’s difficult enough trying to navigate this hurdle today. Once everything is digitized, cash eradicated and the social credit system completely integrated and automated, this kind of retaliatory action for wrongthink could be a death sentence for some people...'

|

|

|

|

Post by Entendance on Jul 31, 2023 7:28:24 GMT -5

|

|

|

|

Post by Entendance on Aug 4, 2023 1:51:22 GMT -5

Dear Friend of GATA and Gold: Gold market researcher Jan Nieuwenhuijs notes today that some European central banks, particularly the German Bundesbank, openly acknowledge that national gold reserves, as registered in central bank gold revaluation accounts, are capable of restoring a central bank's solvency against any and all losses from their holdings of government bonds.

That is, for central banks with gold reserves, revaluing gold upward is a powerful mechanism of money creation -- and of currency and debt devaluation (call it repudiation if you'd like) -- and central banks with balance sheets showing losses may eventually be on the same side of the market as gold investors, and indeed already may be surreptitiously, as they are surreptitious in most important things they do.

This is essentially what the U.S. economists Paul Brodsky and Lee Quaintance wrote in a study brought to your attention by GATA 11 years ago ---https://www.gata.org/node/11373 --- and what the Scottish economist Peter Millar wrote in a study brought to your attention by GATA 16 years ago: www.gata.org/node/4843 |

|

|

|

Post by Entendance on Aug 5, 2023 4:00:14 GMT -5

Quick Summary Bullets:

BlackRock has a massive influence, with assets under management totaling $10 trillion, which is larger than the GDP of all countries except the U.S. and China.

BlackRock’s influence is so significant that they have the power to make companies fire boards, replace CEOs, and leaders if they don’t align with their interests.

“You have a strategy on how to beat the guy. You take a year Jiu Jitsu two years this this that boom one fight he knows. I’m never gonna touch you again screw this thing.”

The concern is that defense contractors want more wars and more people dying because it leads to higher profits.

“Today the guy running BlackRock is really the president of the United States if we look at the kind of influence.”

BlackRock’s control over ETFs and their ability to downgrade companies based on ESG scores gives them significant influence and power in the financial world.

ESG ratings may be influenced by the desire for control rather than solely financial motivations.

Transcript Summary:

00:00 BlackRock, State Street, and Vanguard dominate the S&P 500, influencing industries like defense, Hollywood, and pharmaceuticals with their massive assets under management.

State Street, BlackRock, and Vanguard are the largest shareholders in 88% of the companies on the S&P 500, including defense contractors like Raytheon, General Dynamics, and Boeing.

BlackRock, with $10 trillion in assets under management, has a significant influence in various industries, including defense, Hollywood, and pharmaceuticals, and its size rivals the GDP of the United States and China.

02:24 BlackRock, along with State Street and Vanguard, wields immense power in the business world, being able to control companies, fire boards, replace CEOs, and influence various organizations and initiatives.

BlackRock has gained significant control over other companies and organizations, including a $400 billion contract to rebuild Ukraine, and is tied to influential entities such as the National Education Association and the Open Society Foundation funded by George Soros.

BlackRock, State Street, and Vanguard have significant power and influence over companies, being able to fire boards, replace CEOs, and control various aspects of the business world.

04:27 BlackRock’s influence is a concern, similar to dealing with a bully, and there is a need for enforcement of monopoly laws.

BlackRock has significant influence, but there is a strategy to fight against it, just like dealing with a bully.

There is concern over the monopoly-like influence of BlackRock and the lack of enforcement of monopoly laws, as demonstrated by the dominance of iPhones in the American market.

06:23 Defense contractors’ influence has been reduced by companies like BlackRock, resulting in only 5 companies competing for a $744 billion budget, raising concerns about the military industrial complex’s impact on anti-establishment presidents.

Defense contractors make money by securing government contracts, and the influence of companies like BlackRock has reduced the number of defense contractors from 51 to 5, who are now competing for a $744 billion budget.

Defense contractors want more wars and more people dying because it leads to higher profits, which is a concern due to the influence of the military industrial complex on anti-establishment presidents.

07:55 Larry Fink, president of BlackRock, wields significant influence in multiple industries and is compared to a commander-in-chief, raising concerns about the weaponization of ESG and his political and financial background.

Companies should be allowed to operate independently and go public separately, without overcharging and with open contracts.

Larry Fink, the president of BlackRock, has significant influence in various industries and is compared to the commander-in-chief, with concerns about the weaponization of ESG and his background in politics and finance.

09:38 BlackRock controls all the ETFs in America and uses their influence to dictate actions through ESG ratings, even giving a better score to Philip Morris than Tesla, all driven by their desire to protect their own money.

10:56 Some wealthy individuals engage in questionable activities due to a desire for new experiences and lack of fulfillment, while others shift their motive from money to control and seek power and influence over political leaders.

Some individuals, despite having immense wealth and luxurious lifestyles, engage in questionable and unusual activities, possibly due to a desire for new experiences and a lack of fulfillment.

The motive for individuals with immense wealth shifts from money to control, as they desire to be in a position of power and influence over presidents and prime ministers.

12:38 Soros sees himself as a God and believes he was anointed by God, living out his Messianic fantasies.

Soros sees himself as a God, as stated in a 2004 interview with 60 Minutes.

Soros believes he was anointed by God and had Messianic fantasies, which he now feels comfortable living out.

|

|

|

|

Post by Entendance on Aug 8, 2023 1:32:03 GMT -5

.jpeg) World Bank Group Goes Woke World Bank Group Goes Woke

'We are writing to inform you that we cannot continue serving you.

As a result of this decision, your account will be closed within 14 days from the date of this letter. Any remaining account balances will be sent by check to the address we have on file.'

|

|

|

|

Post by Entendance on Aug 12, 2023 2:05:19 GMT -5

|

|

|

|

Post by Entendance on Aug 15, 2023 0:53:12 GMT -5

Ferragosto, or Assumption Day, is an Italian national holiday celebrated on August 15. Assumption Day is a nationwide public holiday in Italy. Many businesses and shops in Italy are closed on August 15 although on the coast and near major tourist sites shops are more likely to be some open. Most museums and tourist sites are open on August 15. Italians head to the beach for Ferragosto, so the coast (and coastal roads) are usually very crowded while the cities may be fairly empty. Ferragosto, or Assumption Day, is an Italian national holiday celebrated on August 15. Assumption Day is a nationwide public holiday in Italy. Many businesses and shops in Italy are closed on August 15 although on the coast and near major tourist sites shops are more likely to be some open. Most museums and tourist sites are open on August 15. Italians head to the beach for Ferragosto, so the coast (and coastal roads) are usually very crowded while the cities may be fairly empty.

The Global Fiat Currency Regime Turns 52 Today

Interesting to note, that address to the world was given on what day of the week in 1971?

You guessed it: A Sunday evening.

Typical.

Let’s recap the last several major changes in the monetary system in the last several decades:

•1933/1934 Gold demonetized for citizen’s daily use, and gold revalued from $20.67 in 1933 to $35 in 1934 (in other words – dollar devaluation).

•WWII Bretton Woods era (US pegs to gold, nations peg to US dollar)

•1965 Silver removed from coinage.

•August 15th, 1971 – Nixon ‘temporarily’ suspends convertibility of dollar into gold (kills off remaining tie to sound money)

From 1971 to the present, the system is commonly referred to as the “petro-dollar” era. This scheme was devised in the 1970s, and the foundation of the scheme is that nations, mainly Saudi Arabia, would sell their oil for US dollars only. This placed a permanent demand for the US dollar as oil is the most consumed commodity in the world. This standard has been backed up by the might of the US military.

Where do we find ourselves now?

We find ourselves near the end of the current monetary system. The pure fiat monetary system is a debt based system that requires unsustainable, exponential growth in debt.

This system will come to an end. Un-backed fiat currency systems always do.

|

|

|

|

Post by Entendance on Aug 18, 2023 2:00:24 GMT -5

Buying Physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve the tyrant banksters.

|

|

|

|

Post by Entendance on Aug 20, 2023 5:08:26 GMT -5

|

|

|

|

Post by Entendance on Aug 22, 2023 13:50:57 GMT -5

|

|

|

|

Post by Entendance on Aug 26, 2023 2:30:39 GMT -5

As is often the case, we are navigating by the stars under cloudy skies. -Jerome Powell, Fed Chair, Jackson Hole Remarks, August 25, 2023

Gary Gensler’s SEC Is Drawing a Dark Curtain Around Child Sex Trafficker Jeffrey Epstein, His Money Man Leslie Wexner and Their Ties to JPMorgan |

|

|

|

Post by Entendance on Sept 17, 2023 2:13:29 GMT -5

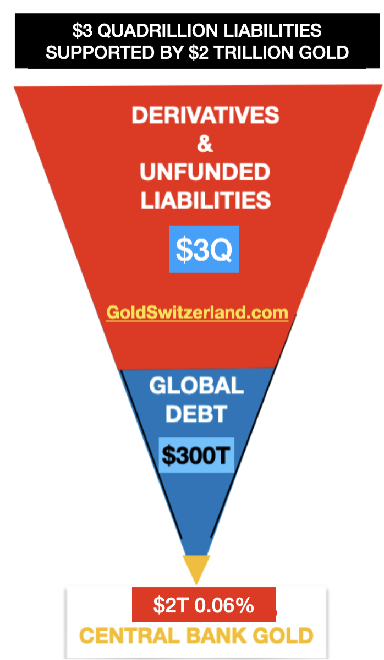

...Polny says this is a precursor to the dollar totally tanking and tanking hard. Polny explains, “When Nixon took us off the gold standard in 1971, there was not a billion dollars in circulation...We are now in the quadrillions of dollars, which means the money factor is off the charts. It’s insanity and insane. In other words, who cares what the money supply is. The money is worthless. That’s the point I am trying to make. Since Nixon took us off the gold standard, the money has become completely worthless.”

Polny says, “What did Rothchild say in the 1800’s? ‘Allow me to control the money supply, and I care not who makes the laws.’ Does that sound like what is going on right now? When you can create money out of thin air, you can basically buy and pay off anybody and everything everywhere. So, what ends up happening is the whole world ends up being controlled by the guys controlling the money...Everything going on as horrific or ugly as it might appear is all in Gods plan. They are walking right into a trap, and it is a trap of Biblical proportions. This is the greatest trap in history...We are going to see volcanic eruptions, and it will be coupled with a market collapse.” Polny predicts things will get bad for the economy and the dollar at the end of September and the beginning of October. He says “expect chaos,” and then he expects a financial collapse by the end of the year. Polny says, “God is about to flip the financial scales, and that means this will be the greatest financial event in human history...'

|

|

|

|

Post by Entendance on Sept 27, 2023 10:51:44 GMT -5

Banksters Cartel International LXXIII

'JPMorgan Chase would like the public to believe that it’s going to walk away from the sleaziest financial crime of the century just $365 million poorer in the process. That’s just not going to happen...'

|

|

|

|

Post by Entendance on Sept 30, 2023 5:00:28 GMT -5

|

|

|

|

Post by Entendance on Oct 1, 2023 2:17:22 GMT -5

'So sad and so obvious. JP Morgan is back in the Price Driver's seat in the COMEX silver derivative market so expect the rigs to become more violent and more obvious. Also, after a few months of increased Silver Eagle Sales the US Mint has once again STOPPED sales of Silver Eagles only half way through September in order to help with the Silver Price Suppression! The closer we get to the end the more intense the Silver Price Rigging will become. Stay in your lawn chairs and WATCH THE SHOW!'

Potential Collapse of the US Dollar

“The surge in gold prices in weakening currencies suggests that the US dollar may be poised for a complete collapse.”

“When a foreigner starts losing on his investments in a foreign currency, he just tries to get the hell out of it… The dollar is poised for a complete collapse.”

The potential collapse of the US dollar is something we should be aware of and it’s not far away.

The Scramble for rubles to buy oil highlights the vulnerability of the US dollar, indicating a possible complete collapse of the currency.

“US Dollar Poised For Complete Collapse!”

Impact on Global Financial System

Foreigners within the US banking system hold a staggering $32 trillion in investments and bank deposits, highlighting the potential impact of any financial crisis on a global scale.

“The currencies are beginning to face obvious problems, leading to the Central Banking cartels’ response and the looming crisis in the gold paper market.”

The Chinese government’s encouragement of its citizens to buy gold suggests their concern over the instability of the Western financial system and the potential collapse of the US dollar.

“The addition of six new nations to the BRICS formation, including the three largest oil producers in the world, spells the end of the Petro dollar and US dominance.”

The consolidation of the BRICS and Shanghai Cooperation Organization into a single mega block will make it more challenging for the West to maintain political power and hegemony, potentially leading to the reintroduction of gold backing into currencies.

Importance of Owning Gold

“Unless you’ve got your own precious metals, I think you’re in trouble.”

“There is a shortage, you have to bid up to get physical gold.” – Despite the falling paper price of gold, there is a shortage of physical gold, leading to increased bidding and a potential crisis in the gold market.

As the price of gold rises, it reflects the devaluation of currencies like the dollar, leading to a potential crisis in the paper markets due to a lack of physical gold to deliver.

“If you do not own gold, you have no understanding of history or economics.” – Alasdair Macleod

“Their currency in real terms is valueless… You need to own gold.” – Alasdair Macleod highlights the importance of owning gold as a hedge against a potentially collapsing US dollar.

|

|

|

|

Post by Entendance on Oct 2, 2023 16:50:14 GMT -5

'...Jamie Dimon made the mistake of coming into the radar of Reich in 2018. According to Reich, Dimon phoned him in 2018 at his office at UC Berkeley and launched into a “diatribe” because Reich had criticized JPMorgan Chase publicly on the topic of the degree of concentration of big Wall Street banks…'

The deception is getting more extreme. The deflection of blame from central banks and world “leaders” whom are directly responsible for the current situation is in full swing...

Pam and Russ Martens: JPMorgan Chase gets another fine, for 40 million derivative violations

'In the eyes of Wall Street veterans who are paying close attention to what’s going down at the mega banks on Wall Street, federal regulators are making the crime wave at these banks worse, not better. The federal fines for egregious behavior at these banks are getting smaller and more meaningless by the day. Take, for example, what happened on Friday...'

Over and Over Again: Goldman’s Corporate Culture of Violating Federal Laws, Getting Caught, and Settling Federal Enforcement Cases

Concurring Statement of CFTC Commissioner Christy Goldsmith Romero on CFTC v. Goldman Sachs Over and Over Again

|

|

|

|

Post by Entendance on Oct 5, 2023 7:42:42 GMT -5

The taking of your securities for collateral

JPMorgan’s relationship with goldUnwinding the financial system |

|

|

|

Post by Entendance on Oct 7, 2023 7:46:14 GMT -5

|

|

|

|

Post by Entendance on Oct 11, 2023 16:07:59 GMT -5

Starve the banksters, exit their fake markets, keep on stacking physical Gold & Silver. |

|

|

|

Post by Entendance on Oct 16, 2023 4:00:33 GMT -5

Banksters Cartel International LXXIX 'Dear Friend of GATA and Gold:

Bullion Star's Ronan Manly reviews the extensive criminal records of JPMorganChase traders in the monetary metals market and then enumerates 11 areas in which the bank retains its dominance of that market.

Manly might have added that while the bank is essentially a criminal conspiracy against the monetary metals industry, the industry has yet to express any objection to the bank's conduct, either through individual mining companies or through the industry's trade association, the World Gold Council.

Indeed, the World Gold Council seems to function mainly to ensure that there never is a world gold council.' -GATA

Silver is the real power of the people, and it is the one thing the Cartel fears more than anything in the entire world because if the Cartel can maintain control of Silver, the Fed and the Federal government can maintain freedom and liberty destroying power over the people, and it’s obvious we’re at the end of the current Cartel’s grip on Silver, with the “current Cartel” being the ESF (Exchange Stabilization Fund), the Fed, and agents acting on behalf of one or both. Unless it’s not blindingly obvious, let me go ahead and spell it out: This fight will go on for the Cartel until the bitter end, and the closer we get to that end, the uglier and nastier the markets and the economy will be. -Paul “Half Dollar” Eberhart

|

|

|

|

Post by Entendance on Oct 16, 2023 10:20:15 GMT -5

'Treasury Secretary Janet Yellen said the U.S. can afford supporting two countries — Israel and Ukraine — simultaneously.

WHAT SHE MEANS IS THE US CANNOT AFFORD NOT TO SUPPORT TWO WARS SIMULTANEOUSLY!

These THINGS, and Yellen is a THING cannot EVER tell you the truth.

War, the expansion or WAR, the propagation of WAR is the business of “The Government,” or in this case THE FEDERAL RESERVE WHO IS THE GOVERNMENT.

What IT/SHE cannot tell you is the entire system is illiquid, its running out of cash RAPIDLY! And WAR, FEAR, TERROR, SUFFERING, PAIN, is the mechanism by which they can pull liquidity into the system.' - Gregory Mannarino

|

|

|

|

Post by Entendance on Oct 19, 2023 15:15:00 GMT -5

|

|

|

|

Post by Entendance on Oct 22, 2023 4:20:26 GMT -5

Precious metals expert and financial writer Bill Holter warned in August of financial trouble coming to America sooner than later. He gave a long list that now includes a global war. Even without war, there is no stopping the financial fall that is coming. Central banks are, once again, the biggest buyers of gold this year. What is going on? Holter says, “The central banks fully understand the math behind the financial system of the West is broken. The Western financial system cannot survive the math...Once we got to 0% interest rates on the bottom, the rates could not go down any further, and the debt continued to pile up. The U.S. Treasury is going to be paying $1.5 trillion a year just in debt service. That number, a few years ago, had been around $400 billion a year. So, the debt service has quadrupled, and there are no more tricks in the bag. Precious metals expert and financial writer Bill Holter warned in August of financial trouble coming to America sooner than later. He gave a long list that now includes a global war. Even without war, there is no stopping the financial fall that is coming. Central banks are, once again, the biggest buyers of gold this year. What is going on? Holter says, “The central banks fully understand the math behind the financial system of the West is broken. The Western financial system cannot survive the math...Once we got to 0% interest rates on the bottom, the rates could not go down any further, and the debt continued to pile up. The U.S. Treasury is going to be paying $1.5 trillion a year just in debt service. That number, a few years ago, had been around $400 billion a year. So, the debt service has quadrupled, and there are no more tricks in the bag.

Holter thinks the Fed is being forced to prop up the dollar and explains, “They have to keep interest rates up; otherwise, the dollar is going to be sold. You are already seeing that in the Treasury markets...That is the reason you are seeing interest rates spike as hard as they have. We are up to about 5% on a 10-year Treasury...Because interest rates are going higher, banks are losing deposits. JPMorgan Chase has lost over a quarter of a trillion dollars in deposits. The whole banking system has lost over a trillion dollars.”

Holter points out that interest rates were effectively 0% not that many years ago. That has changed dramatically with dramatic consequences. Holter says, “We are in the biggest bear market in credit in the history of the world. In other words, we have had more losses in the credit markets than there has ever been in the history of history. The credit bubble has popped.”

Holter goes on to say, “What happens to the dollar if an aircraft carrier goes down? The value of the U.S. dollar will absolutely collapse. The credit markets will collapse. I do not want to downplay a nuclear war. It is unthinkable, but if you just look at the financial markets, it’s system over. The system is done . . . . Without credit...Everything runs on credit. Everything you do and everything you buy runs on credit. If credit stops, the real economy completely stops. That’s where your ‘Mad Max’ scenario comes in...Everything stops once credit stops.”

Holter thinks commercial real estate is a monster problem, and, now, with 8% 30-year mortgage rates, residential real estate is going to start tumbling. This is just one of many headwinds sinking the economy. Holter predicts, “Mathematically, from a financial standpoint only, forget about geopolitical events. Mathematically, the financial system is going to come down. I think the odds are very good that this is going to happen before the end of this year. Add in the geopolitical events, and that’s just another spark that will create fire underneath the paper the system is.”

There is much more in the 44-minute interview

Mathematically Financial System Is Going Down – Bill Holter Mathematically Financial System Is Going Down – Bill Holter

Middle Eastern officials could cut off oil supplies – AP

|

|