|

|

Post by Entendance on Sept 8, 2022 3:07:32 GMT -5

Putin is now assembling a new gold-backed multi-currency system The financial war between Russia with China’s tacit backing on one side, and America and her NATO allies on the other has escalated rapidly. It appears that President Putin was thinking several steps ahead when he launched Russia’s attack on Ukraine.

We have seen sanctions fail. We have seen Russia achieve record export surpluses. We have seen the rouble become the strongest currency on the foreign exchanges.

We are seeing the west enter a new round of European monetary inflation to pay everyone’s energy bills. The euro, yen, and sterling are already collapsing — the dollar will be next. From Putin’s point of view, so far, so good.

Russia has progressed her power over Asian nations, including populous India and Iran. She has persuaded Middle Eastern oil and gas producers that their future lies with Asian markets, and not Europe. She is subsidising Asia’s industrial revolution with discounted energy. Thanks to the west’s sanctions, Russia is on its way to confirming Halford Mackinder’s predictions made over a century ago, that Russia is the true geopolitical centre of the world.

There is one piece in Putin’s jigsaw yet to be put in place: a new currency system to protect Russia and her allies from an approaching western monetary crisis. This article argues that under cover of the west’s geopolitical ineptitude, Putin is now assembling a new gold-backed multi-currency system by combining plans for a new Asian trade currency with his new Moscow World Standard for gold...

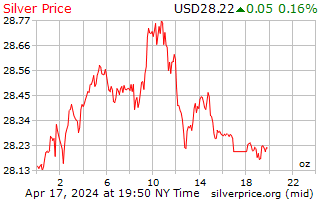

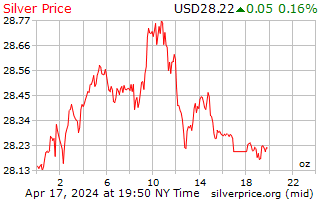

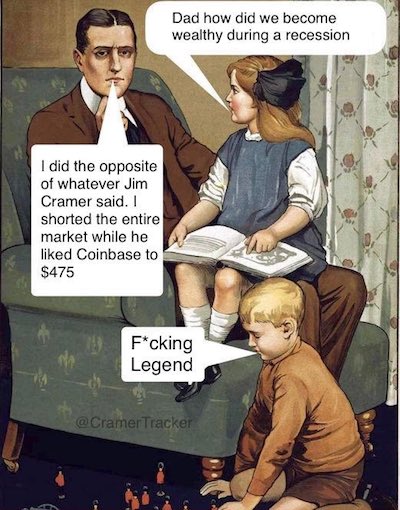

'...A key point to end on is that we should aim to take advantage of the artifically low price of silver and silver investments at this time which is due to the market being rigged by the likes of J P Morgan. When the debt market eventually blows up – and this is a question of when not if – a tidal wave of money is going to flood into this market and you don’t want to be trying to buy on limit up days that may well come one after the other. Much better to buy now when you can browse in peace before the mob shows up like on a Black Friday sale, and it cannot be overstated how important it is to have some physical silver in your possession for use in the event of the banks slamming their doors and ATMs no longer working, which can be in the form of either coins or small bars. When bartering for everyday items silver is a lot more practical than gold.' - Clive P. Maund HERESee EIGHT forms of SILVER for barter and asset protection - PrepWithMike

|

|

|

|

Post by Entendance on Sept 12, 2022 2:28:41 GMT -5

ETF Silver held in London ETF Silver held in London

'There is an unprecedented situation emerging in London, where the relentless hemorrhaging of one of the world’s largest stockpiles of silver is now well and truly under way.

For the last 9 months, this stockpile of silver, held in the LBMA vaults in London, has been consistently falling each and very month, and has now reached an all time low (since vault holdings records began in July 2016).

These vaults comprise the precious metals storage facilities in and around London run by the bullion banks JP Morgan, HSBC and ICBC Standard Bank, as well as the London vaults of three security operators, namely Brinks, Malca-Amit and Loomis. Since the system of vaults is administered and coordinated by the London Bullion Market Association (LBMA), these vaults are collectively known as the ‘LBMA Vaults'...

...The existence of ETF silver in London is key to the ability of the LBMA bullion banks to control the market and the silver price.

LBMA bullion banks / ETF Authorised Participants appear to use London silver ETFs as a top up fund for physical silver, scaring the market by bringing the paper silver price lower and flushing out / triggering institutions and retail to sell ETF units, at which point the bullion banks pick up and convert these units, thereby obtaining extra metal that’s needed to meet physical demand. In fact, as physical silver demand rises, bullion banks will try to get the price lower so as to have access to the silver that is held by the ETFs... ... Only time will tell, but with physical silver demand firing on all cylinders and massive amounts of silver leaving the LBMA London vaults, the bullion bank tactics of rinse and repeat in creating a ‘paper’ silver price unconnected to physical demand and supply is becoming more and more exposed.'

Egon von Greyerz, Founder of Gold Switzerland says it is time for investors to batten down the hatches; unlike the years 2000 and 2008 financial fiascos, 2022 could rival both in risk and volatility.

Gold, silver and mining shares are "incredible values... potentially moving up by multiples."

Egon notes that central bank monetary-schemes disrupt Adam Smith's invisible-hand, leading to increased uncertainty, the antithesis of their stated purpose.

Amid record monetary expansion in the wake of the 2019 pandemic, the near zero-money mechanism is unwinding via rate hikes by the FOMC and their cohorts; the resulting deleveraging will exacerbate the fiasco.

Key takeaway: Amid unparalleled paper-money printing and eroding purchasing power, wealth preservation requires a bullion allocation ratio of 80% gold and 20% silver.

|

|

|

|

Post by Entendance on Sept 15, 2022 0:45:42 GMT -5

Not all sociopaths wield knives and knotted cords. Some wear suits and are articulate. Obsessively driven, they use the law for their advantage. Lawlessness is their addiction, their will to power. What they want is to fill the emptiness in their being by consuming others. They find no commonality with the ordinary contentment of life, because of their alienation from all that is human. This is the undeniable lesson of the last century. There are monsters, and they walk among us. -Jesse

“Idaho will now have its own (larger) ‘Fort Knox,’ except that the U.S. Bullion Depository has not been credibly audited since 1953.”

|

|

|

|

Post by Entendance on Sept 17, 2022 3:58:26 GMT -5

People ask me all the time how much money should I put into gold, how much should I put into silver or gold and silver collectively and my standar answer now is whatever you don’t want to lose – Bill Holter

Short and Sweet

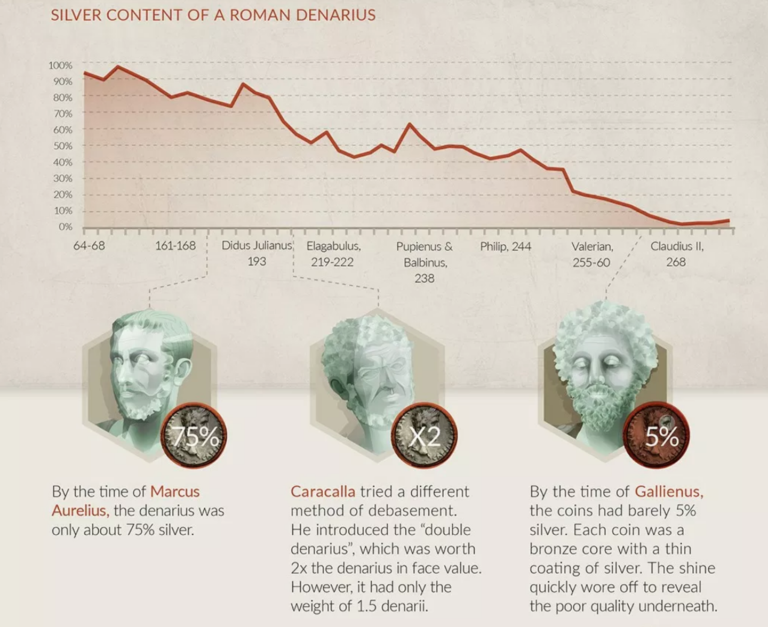

Inflation is a process not an event

But history, as we are learning now, shows runaway inflation can come suddenly and without warning

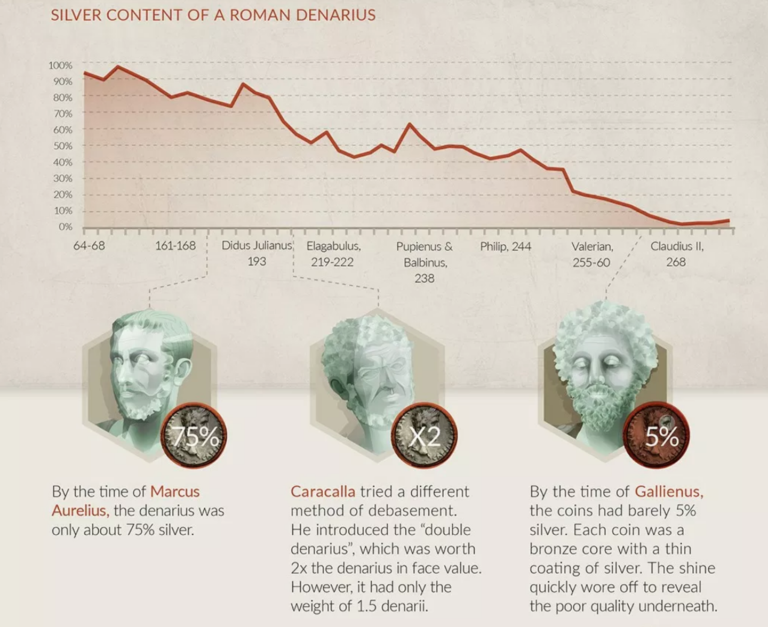

We sometimes forget that inflation is a process rather than an event. One of the better-known examples of that axiom is the nearly two centuries-long debasement of Rome’s silver denarius. The Roman citizen who had the wisdom to hedge that process by going to gold at nearly any point along the way ended up preserving some portion, if not all, of his or her wealth. Those who did not suffered its debilitating effects. In the inflationary process, the line between cause and effect is not always a straight one, and its timing difficult to discern. History teaches us, though, that when runaway inflation does arrive, it comes suddenly, without notice, and with a vengeance. That is why it pays to view gold as a permanent and constantly maintained aspect of the investment portfolio. “A change of fortune,” Ben Franklin tells us, “hurts a wise Man no more than a change of the Moon.”

|

|

|

|

Post by Entendance on Sept 21, 2022 3:28:18 GMT -5

|

|

|

|

Post by Entendance on Sept 23, 2022 2:52:58 GMT -5

|

|

|

|

Post by Entendance on Sept 24, 2022 4:49:43 GMT -5

|

|

|

|

Post by Entendance on Sept 27, 2022 3:55:20 GMT -5

'...if – God forbid! – the Kremlin will face what the Russian military doctrine calls “a threat to the existence of the Russian Federation,” its nuclear weapons will not point to some location on the European continent, but more likely across the Atlantic...' |

|

|

|

Post by Entendance on Sept 29, 2022 2:05:29 GMT -5

Eurasia will lead the world back to gold, Macleod tells Maguire

'What has been occurring in the gold and silver markets is nothing short of extraordinary. In the face of all objective and measurable conditions in the physical markets pointing to higher prices, instead prices have collapsed over the past six months by amounts comparable to the sharpest selloffs in history. From the price top of March 8, gold has fallen as much as $450 (22%), while silver has fallen by as much as $10 (36%) in recent dealings.

Yet, all visible signs point to extreme physical tightness, the likes of which I have never seen, in everything from the most persistent retail premiums in silver in history, to surging wholesale physical demand in India and China – all with no notable increase in actual supply. To an extent never witnessed before, the past six months have featured the sharpest divergence between surging physical demand and a steep and highly-counterintuitive historical price collapse. To any believer in the free market law of supply and demand, it has been the strangest (and most trying) time ever – or at least the strangest time in my near 50-year experience...'

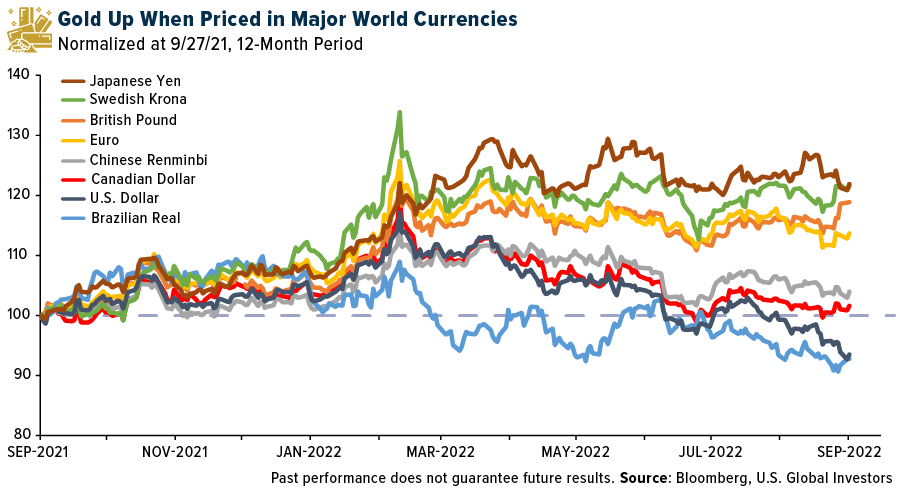

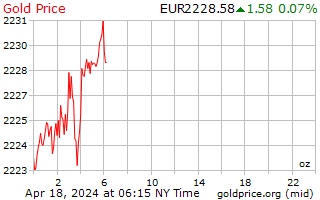

In the UK gold is living up to expectations )

If one reads all the headlines about gold one could be forgiven for thinking that 2022 has been a pretty disastrous year for those banking on the yellow metal to preserve their wealth, This is indeed the case for U.S. gold holders where the gold price has declined around 9%, although that is less than half that seen in most U.S. equities since the beginning of the year – even more in the NASDAQ stocks - but in the case of UK gold holders and holdings valued in pounds sterling it has been a very different story altogether due to the fall in value of the pound against the dollar so far this year. This has been a similar experience in other areas of the world where local currencies have been in strong decline against their U.S. counterpart.

In pound sterling terms, the gold price has actually appreciated by no less than 13% while the FTSE all share index for comparison has declined by around 10% over the same period. With the Bank of England following the U.S. Federal Reserve with an aggressive interest rate raising policy to fight inflation, and commenting that the UK economy is probably already in at least a mild recession, one can anticipate further equity price slippage, while the gold price can probably still hold its own making it a continuingly good wealth protection choice for investors.

Of course the UK is not the only country where the gold price has been appreciating in the local currency due to the U.S. dollar’s strength – there are many others. We have already reported on the resultant strength of the Australian gold mining sector during the most recent quarter due to the almost A$42 per ounce gold price rise during Q2 resulting from a 6 cent movement in the exchange rate between the U.S. and Australian dollars. With producer costs mostly in Australian dollars the miners mostly saw some good cost benefits. Although these would inevitably close over time, the short term advantages will have been beneficial. (see: Australian annual gold output 317 tonnes – Surbiton).

Even in the Euro, which has also seen a strong decline in currency parity against the U.S. dollar, the gold price is up a little over 6% and in the Japanese Yen up 13% - a similar level to the UK. Of the other supposedly ‘strong’ currencies, the gold price is down marginally, though, in the Swiss Franc and the Canadian Dollar, but not by as much as in the U.S. currency. In some of the world’s weaker currencies , however, gold’s appreciation year to date will have been far greater, so its wealth protection capabilities in your own domestic situation depends very much on one’s domicile.

All currencies fluctuate – even the mighty U.S. dollar and there is a feeling that it may well be flying too high at present. There is the possibility it may start to come down from its peaks when there is a realisation of quite how much the servicing of the huge U.S. debt position will cost at the higher interest rate levels currently in place, and likely to be further increased. -Lawrie Williams

|

|

|

|

Post by Entendance on Oct 1, 2022 7:24:14 GMT -5

'...A thought came to mind in regards to the global play on precious metals. Comex has truly weakened, the collapse in Volumes (once, more than triple the daily OI) and Open Interest are proof of that. It’s also quite obvious someone wants a war and with that, their could be ways to weaken an enemy before it starts. G. Edward Griffin’s book; “The Creature From Jekyll Island” tells the tale of Napoléon Bonaparte’s war expansions. The Rothschild family organized the theft of Napoleon’s gold making them unable to proceed with any success. My point being, a broke country cannot war.

With the weakening of positions at the Comex in both Silver (its OI high was 246,078) and Gold (698,541), the same type of theft could be done at the exchange levels. China and Russia together, can simply “ask” for sharply higher prices for all physicals, blowing out all “offers” at the LBMA and Comex, draining everything or, the LBMA and Comex will be forced to match these sharply higher prices. What if Comex and LBMA did the reverse to Russia and China?...'

|

|

|

|

Post by Entendance on Oct 4, 2022 2:10:54 GMT -5

|

|

|

|

Post by Entendance on Oct 6, 2022 4:09:28 GMT -5

'...Because gold is not an investment like shares in a company, and has no credit risk, there is no chance it can default, or go bankrupt. As a result, while it’s volatile, and can suffer drawdowns, those drawdowns inevitably resolve themselves over time. '...Because gold is not an investment like shares in a company, and has no credit risk, there is no chance it can default, or go bankrupt. As a result, while it’s volatile, and can suffer drawdowns, those drawdowns inevitably resolve themselves over time.

As an investor, you therefore have some comfort that any drawdown in the gold price is simply part of the market cycle (gold is not immune to bull and bear markets), rather than a potential message that the drawdown will be permanent.

Investments in individual companies offer no such comfort. While a drawdown in the price of a particular stock may just be part of the market cycle and an overall stock market sell off, it could also be a warning sign that the company in question is facing serious problems and could be headed toward bankruptcy...' Embracing gold’s volatility

|

|

|

|

Post by Entendance on Oct 8, 2022 3:45:04 GMT -5

|

|

|

|

Post by Entendance on Oct 11, 2022 3:26:22 GMT -5

July 13, 2011:

Republican Rep. Ron Paul of Texas questions Federal Reserve chairman Ben Bernanke about whether gold is money or not.

August 17, 2011

Ron Paul's Greatest Interview: Gold, Silver, Freedom, Free Markets, & Sound Money

2021

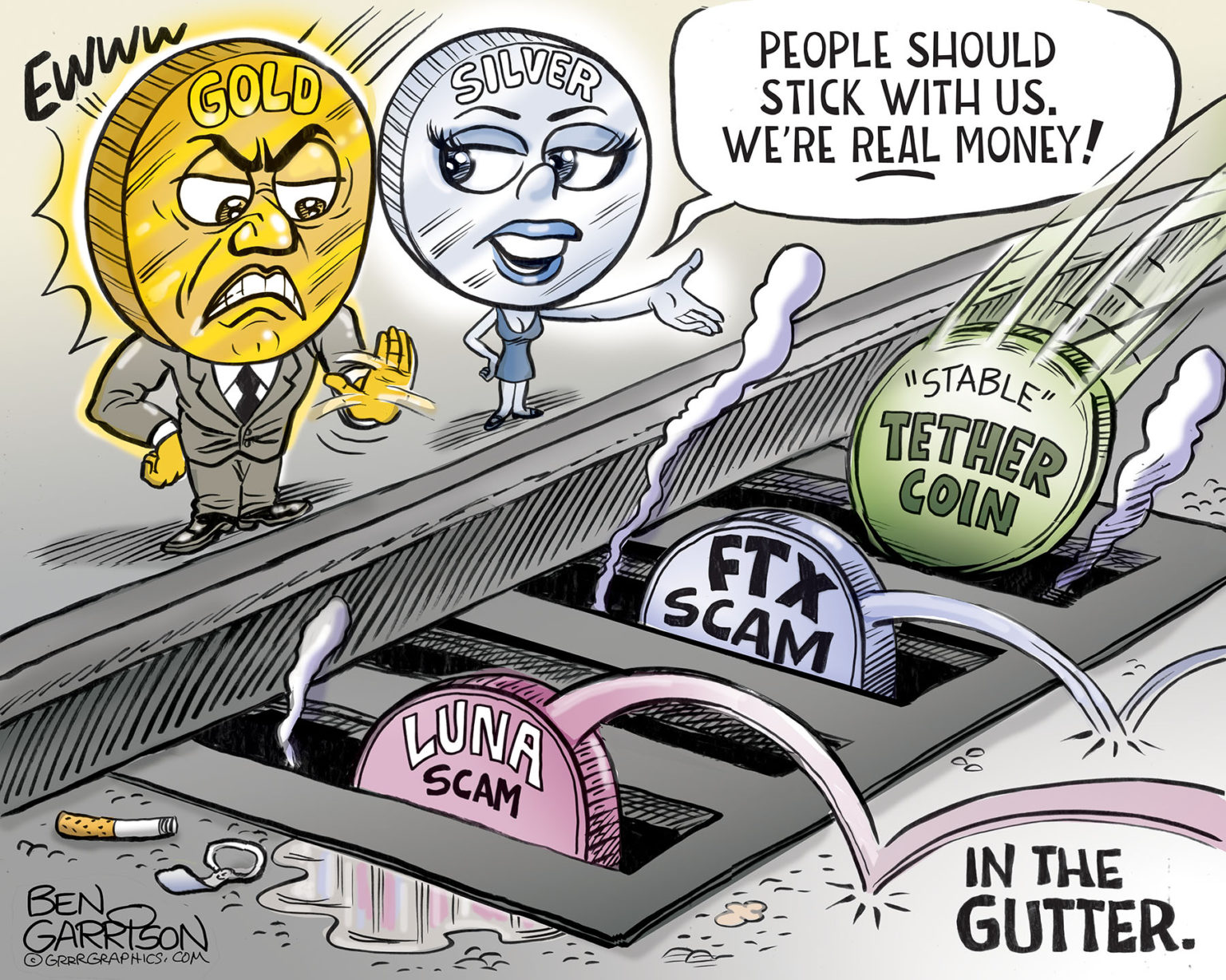

Bitcoin is going to its intrinsic value, which, contrary to popular belief, is not zero but negative because... Bitcoin is going to show us how many fools populate the World... |

|

|

|

Post by Entendance on Oct 12, 2022 1:38:01 GMT -5

|

|

|

|

Post by Entendance on Oct 13, 2022 2:54:19 GMT -5

Banksters Cartel International LVII

Illustrations for this presentation can be found Illustrations for this presentation can be found here here

|

|

|

|

Post by Entendance on Oct 14, 2022 2:45:28 GMT -5

'Physical gold and silver have throughout history acted as the ultimate insurance of wealth. This time will not be different.'

WITH STOCKS AND DEBT UP 50X IN 50 YEARS WITH STOCKS AND DEBT UP 50X IN 50 YEARS

Government Bond “Illiquidity” Crisis |

|

|

|

Post by Entendance on Oct 15, 2022 4:06:01 GMT -5

Nam tua res agitur, paries cum proximus ardet. -Quintus Horatius Flaccus

It is your concern when your neighbors’s wall is on fire...You too are in danger when your neighbor’s house is on fire

è in ballo anche la casa tua, se brucia la casa del vicino

Ton intérêt est en jeu, quand la maison du voisin brûle Dein Eigentum wird gefährdet, wenn des Nachbarn Haus brennt.

'...the LBMA and COMEX markets are using forward contracts to force gold down into value pricing so they can take physical delivery for themselves before the metals skyrocket in USD.

Smart money is catching on, as flows out of worthless paper gold and into physical gold mark a new direction...'

Illiquidity Causing Full-Blown Panic In World Markets

If you are tired of witnessing silver (and gold) continuing to be manipulated in price, here’s a no-cost, no-risk, high potential return action you can take that will only involve a few minutes of your time. Quite literally, there’s absolutely nothing to lose and quite a lot of potential good to be had. If you are tired of witnessing silver (and gold) continuing to be manipulated in price, here’s a no-cost, no-risk, high potential return action you can take that will only involve a few minutes of your time. Quite literally, there’s absolutely nothing to lose and quite a lot of potential good to be had.

The Commodity Futures Trading Commission (CFTC) is the taxpayer-funded federal commodities regulator whose main mission is to prevent and root out manipulation and protect the public. Four of the five commissioners have only been in office for little more than six months and it’s not clear that they are even aware that silver has been manipulated in price on the COMEX. Here is your opportunity to ensure that this is an issue they should be concerned about. Please take the time to copy and paste the enclosed letter and email it to addresses listed. If you would prefer using your own name and not mine, you have my permission to do so.

US citizens might also consider forwarding the same to your local congressman or woman, and senators, asking them to send it on the CFTC, which will guarantee the agency will respond.

Commodity Futures Trading Commission

Three Lafayette Centre

1155 21st Street, NW

Washington, DC 20581

rbehnam@cftc.gov

kjohnson@cftc.gov

cgoldsmithromero@cftc.gov

smersinger@cftc.gov

cpham@cftc.gov

Dear Chairman Behnam and Commissioners,

The evidence has become overwhelming that the price of silver does not reflect developments in the physical world of supply and demand. There has developed a physical shortage in both the retail and wholesale silver market accompanied by declining inventories. Nevertheless, the price has fallen. Increasingly, there has developed among the public a conviction that the culprit for this mispricing is trading by a handful of large traders in silver futures on the Commodities Exchange, Inc. (COMEX), owned and operated by the CME Group, Inc.

The Commission has considered the question of a silver price manipulation in the past. I would call on the Commission to explain why such large and concentrated dealings, particularly on the short side of COMEX silver futures, are not artificially depressing the price. I would also call on the Commission to end what many believe to be an ongoing price manipulation. Thanks for your consideration and attention to this matter.

Sincerely,

Theodore Butlerwww.butlerresearch.com |

|

|

|

Post by Entendance on Oct 19, 2022 1:07:47 GMT -5

|

|

|

|

Post by Entendance on Oct 22, 2022 5:41:44 GMT -5

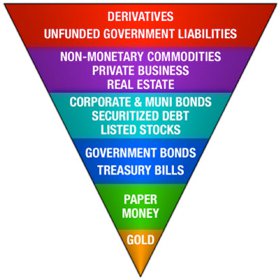

DERIVATIVES – THE MOST DANGEROUS FINANCIAL WEAPON CREATED

|

|

|

|

Post by Entendance on Oct 25, 2022 0:39:05 GMT -5

This week's "Live from the Vault" from program Kinesis Money, a conversation between London metals trader Andrew Maguire and coin and bullion dealer Andrew Schectman of the Miles Franklin distributorship, examines the incongruity of falling gold and silver futures prices amid overwhelming demand for real metal. Schectman says he has never seen such a divergence between the prices between "paper" and real metal. This divergence, Schectman says, reflects a "price as misdirection" scheme by large players in the metals markets by which they can obtain the last remaining supplies before a big change in the financial world.

That change, Schectman says, is a revolt against Western hegemony, which is already underway...

During September, silver inventories held in the vaults of the London Bullion Market Association (LBMA) in London fell by a massive 4.93%, and are now at a new record low. LBMA silver holdings now total only 27,101 tonnes (871.3 mn ozs), and have fallen every month for 10 straight months. During September, silver inventories held in the vaults of the London Bullion Market Association (LBMA) in London fell by a massive 4.93%, and are now at a new record low. LBMA silver holdings now total only 27,101 tonnes (871.3 mn ozs), and have fallen every month for 10 straight months.

Over on COMEX in New York, the Registered silver total is now only 1186 tonnes (38.13 mn ozs), a five year low. During September, the LBMA vaults in London lost 1404 tonnes (45.166 mn ozs) , which is more silver than in the whole COMEX Registered category.

The LBMA even conceded in its latest update on silver vault stocks in London that “Some contributors noted that increased client demand led to a number of physical silver exports.“. The contributors here refer to the Vault Operators within the London LBMA market, which are HSBC, JP Morgan, ICBC Standard, Brinks, Malca Amit, and Loomis.

Nicky Shiels, precious metals analyst for MKSPAMP, echoed that view when reporting back from the LBMA’s annual conference in Lisbon last week, when she said that conference delegates predicted a “super bullish Silver [price] ($28.30!)" in a year’s time “as the focus was on physical tightness driven by unprecedented demand“. See tweet above.

An important contributor to this ‘unprecedented demand’ for physical silver is India where silver imports have been zooming ahead. Silver imports into India totalled 1812 tonnes in July, 1149 tonnes in August and initial estimates for September are about 1700 tonnes. Up until August 2022 (8 months), India’s silver imports totalled 6517 tonnes. Adding September’s ~ 1700 tonnes, gives 8217 tonnes for 9 months of 2022 so far. Which if annualised this nearly 11,000 tonnes, which is one-third of the world’s annual silver supply.

Back on COMEX, the CME’s ‘published’ silver total (where they include 100% of Eligible) is 304.1 million ozs (9458 tonnes). That figure is the lowest level ‘COMEX Eligible + Registered silver’ since 19 June 2019. But that doesn’t even include the CME’s own guidance of applying a 50% haircut on the Eligible total. When this 50% haircut is applied, the total silver in the COMEX vaults is just 171 mn ozs. People point to the COMEX Registered silver total and say that silver can move from the Eligible category to the Registered category. But that’s not entirely true and only applies to a portion of the Eligible category. More Eligible category silver could of course come into play and move to Registered. But only at a higher silver price. With silver demand firing on all cylinders, and with demand destinations such as India securing an ever higher percentage of annual silver supply, expect the silver market to provide plenty of fireworks in the months ahead. |

|

|

|

Post by Entendance on Oct 29, 2022 3:21:32 GMT -5

|

|

|

|

Post by Entendance on Oct 31, 2022 11:43:56 GMT -5

|

|

|

|

Post by Entendance on Nov 4, 2022 11:14:30 GMT -5

'...Debts, Debts, Debts Everywhere!

Let’s take a semi anal-retentive examination of national debts, shall we?

We are going to use the data from the World Debt Clocks provided by US Debt Clock.org. Here are some housekeeping parameters and some personal observations:

The data used is a snapshot taken as of September 22, 2022. Table 1 below is a summary of the world debts as listed on US Debt Clock (USDC) on September 22, 2022. All the data are constantly changing.

National debt (or public debt) is defined as the money or credit owed by all levels of the government, from the local level to the central government.

Private debt is the money or credit owed by private households or private corporations.

External debt is the total of national (public) debt and private debt owed to nonresidents, i.e., foreigners or foreign nations.

The Gross Domestic Product or GDP is the value of all goods and services a nation produces in a particular year (usually the calendar year).

In Table 1, I have rounded off all the GDP numbers from USDC to the nearest Billion USD.

USDC purposefully calculates the US “national (public) debt to GDP” ratio using some off balance sheet income that is not listed. This accounting trick is not used for any of the other nations. USDC’s US “national debt to GDP” ratio is listed as 97.71%. I calculated it as 103.50% which is the correct figure.

I back calculated the external debts using (1) the “external debt to GDP” data and (2) the GDP data provided by USDC.

I calculated the “national debt to population” ratios (national debt per capital) using (1) the national debt and (2) the population data of each nation provided by USDC.

I also calculated the “external debt to population” ratios (external debt per capital) using (1) the external debt and (2) the population data of each nation provided by USDC.

Taiwan, which is a province of China, is listed like a nation by USDC. Since Taiwan is not a nation, I deleted Taiwan’s data from Table 1.

South Africa, for some reason, is not included in the list of nations by USDC. South Africa, one of the BRICS nations, has a GDP (estimated at $345 Billion for the end of 2022) greater than Portugal ($266 Billion) and Greece ($288 Billion) which are included by USDC.

Ok, now we can get started!

Here is Table 1 which is taken from USDC as of September 22, 2022 around 12 noon EST:  Table 1 is not that interesting by itself. However, spreadsheets like Microsoft’s Excel and Apple’s Numbers allow us to sort these seemingly hodgepodge data into some very interesting extrapolations and observations.

Before we get bored with numbers and roll our eyes, there is a reason to be anal-retentive with these 7 tables. The last third part of this article goes to the meat of this article. So read on and stay focused!

Table 2, which is more interesting, is a list of the 10 largest national debts in descending scale, starting with the largest indebted nations first.

Of course, the United States of America is #1!

I haven't yet met a woman who told me, 'I wish I had shorter legs'. I haven't yet met a woman who told me, 'I wish I had shorter legs'. |

|

|

|

Post by Entendance on Nov 7, 2022 3:41:15 GMT -5

'In years to come many investors will look back upon the past weeks and months as another great opportunity missed, to be added to the list that most of us keep or have in our heads of other great opportunities missed, but you, dear reader, do not have to be among them. 'In years to come many investors will look back upon the past weeks and months as another great opportunity missed, to be added to the list that most of us keep or have in our heads of other great opportunities missed, but you, dear reader, do not have to be among them.

That great opportunity is the Precious Metals sector which now looks set to soar imminently...' |

|

|

|

Post by Entendance on Nov 8, 2022 1:23:02 GMT -5

Your secretary/treasurer, interviewed this week by Patrick Vierra for Silver Bullion TV in Singapore, discussed indications that the trade in "paper gold" is being wound down even as the U.S. government seems to have succeeded in persuading financial markets that gold is no longer a good hedge against currency debasement. Foremost among those indications is the sharp decline this year in gold swaps undertaken by the Bank for International Settlements, the gold broker for major central banks. Also discussed is evidence that the Federal Reserve has intervened in the gold market via gold swaps and the extreme dichotomy between the prices of "paper" gold and real metal. Your secretary/treasurer, interviewed this week by Patrick Vierra for Silver Bullion TV in Singapore, discussed indications that the trade in "paper gold" is being wound down even as the U.S. government seems to have succeeded in persuading financial markets that gold is no longer a good hedge against currency debasement. Foremost among those indications is the sharp decline this year in gold swaps undertaken by the Bank for International Settlements, the gold broker for major central banks. Also discussed is evidence that the Federal Reserve has intervened in the gold market via gold swaps and the extreme dichotomy between the prices of "paper" gold and real metal.

The interview also covers the steady flow of gold from West to East, the knowledge of the Chinese and Russian governments of U.S. gold price suppression policy, and the possibility of an international gold revaluation that reliquefies central banks while devaluing government debt.

Anti-Gold Propaganda Fails Anti-Gold Propaganda Fails

|

|

|

|

Post by Entendance on Nov 12, 2022 4:11:40 GMT -5

'...Since Bitcoin is almost a religion for many investors, very few have got out but are instead hoping for the next rally to $100,000, $250,000 and much higher...'

GATA Chairman Bill Murphy and many monetary metals expert friends of GATA will speak this Saturday, November 12, at the Silver Fest III internet conference sponsored by Chris Marcus of Arcadia Economics.  Attendance will be free with simple registration. Attendance will be free with simple registration.

In addition to Murphy and Marcus, speakers will include David Morgan of The Morgan Report, Bullion Star's researcher Ronan Manly, First Majestic Silver's Todd Anthony, James Anderson of SD Bullion, Andy Schectman of Miles Franklin, GoldMoney research director Alasdair Macleod, Robert Kientz of Gold Silver Pros, Dave Kranzler of Investment Research Dynamics, and market analyst Bill Holter.

The Lord loves the one that loves

the Lord

And the law says if you don't give,

then you don't get loving

Now the Lord helps those that help

themselves

And the law says whatever you do

is going to come right back on you

We all making out

Like we own this whole world

While the leaders of nations

They're acting like big girls

With no thoughts for their God

Who provides us with all

But when death comes to claim them

Who will stand,

and who will fall?

The Lord loves the one that loves

the Lord

And the law says if you don't give,

then you don't get loving

Now the Lord helps those that help

themselves

And the law says whatever you do

is going to come right back on you

We all move around,

with objectives in mind,

to become rich or famous,

With our reputations signed,

But the few that can reach,

to this coveted slot,

don't escape old age creeping,

through their bodies,

like a rot

While the Lord loves the one that loves

the Lord

And the law says if you don't give,

then you don't get loving

Now the Lord helps those that help

themselves

And the law says whatever you do

is going to come right back on you

|

|

|

|

Post by Entendance on Nov 15, 2022 4:24:54 GMT -5

'The gap between fiat currency values and that of legal money, which is gold, has widened so that dollars retain only 2% of their pre-1970s value, and for sterling it is as little as 1%. Yet it is commonly averred that currency is money, and gold is irrelevant. 'The gap between fiat currency values and that of legal money, which is gold, has widened so that dollars retain only 2% of their pre-1970s value, and for sterling it is as little as 1%. Yet it is commonly averred that currency is money, and gold is irrelevant.

As the product of statist propaganda, this is incorrect. Originally established in Roman law, legally gold is still money and the states’ debauched currencies are not — only a form of credit. As I demonstrate in this article, the major western central banks will be forced to embark on a new round of currency debasement, likely to put an end to the matter...'

'...The only thing that will matter, the only thing that will change what is going on is when the ATMs shut off and, all of a sudden, people cannot get money out of the bank. That would change things really fast. I think it will happen. All we need is one highly connected derivative bank to go down, and they all go down. They can bail out a trillion-dollar bank, but they cannot bail out a $2 quadrillion failure, and that is what is coming. The moment that hits is when everybody will say, okay, nobody is getting paid off...We are going to find out in about a month how many counterparties in the FTX debacle will be translated into the derivatives, which is probably 100 times bigger than what happened on FTX. Every one of those people on the FTX ledger was placing derivative bets that were hedging their crypto position. Now, their crypto positions have disappeared. The actual cryptos are no longer there...that is what was hedging this transaction. There are two sides to a derivative trade. If one side loses, they double lose. So, we could see a massive, massive fallout from the derivative mess...'

‘Big Short’ Michael Burry projects gold to rise amid ‘contagion’ of crypto scandals

|

|

|

|

Post by Entendance on Nov 18, 2022 12:37:46 GMT -5

London metals trader Andrew Maguire, interviewed by Shane Morand for this week's "Live from the Vault" program for Kinesis Money, says the closing of the gold lease positions of the Bank for International Settlements shows that central banks and bullion banks are now heavily long gold and ready for the monetary metal's upward revaluation, which he expects at the turn of the year.

|

|

|

|

Post by Entendance on Nov 22, 2022 3:19:53 GMT -5

Rejoice in the Lord always. I will say it again: Rejoice!

Let your gentleness be evident to all. The Lord is near.

Do not be anxious about anything, but in every situation, by prayer and petition, with thanksgiving, present your requests to God.

-The Epistle of Paul and Timothy to the Philippians 4 4-6

|

|

.png)

ETF Silver held in London

ETF Silver held in London

.JPG)

Rising Inflation, Falling Markets

Rising Inflation, Falling Markets  Why China may soon reveal “astounding”

Why China may soon reveal “astounding” E. on

E. on  Politicians, little pieces of scum crap –

Politicians, little pieces of scum crap –  Physical Gold & Silver

Physical Gold & Silver

Silver Inventories Plummet

Silver Inventories Plummet  Gold has never been

Gold has never been  The Time To Own Gold Is Now Because

The Time To Own Gold Is Now Because

Bob Moriarty:

Bob Moriarty:

The U.S. Is Winning

The U.S. Is Winning

The Bear Trap – Is It Finally Set?

The Bear Trap – Is It Finally Set? Gold Has Served as an Impressive Store of Value

Gold Has Served as an Impressive Store of Value

)

***History of

***History of

London Gold Dealer

London Gold Dealer

)

)

THE FED’S STRONG USD POLICY:

THE FED’S STRONG USD POLICY:

'...Because gold is not an investment like shares in a company, and has no credit risk, there is no chance it can default, or go bankrupt. As a result, while it’s volatile, and can suffer drawdowns, those drawdowns inevitably resolve themselves over time.

'...Because gold is not an investment like shares in a company, and has no credit risk, there is no chance it can default, or go bankrupt. As a result, while it’s volatile, and can suffer drawdowns, those drawdowns inevitably resolve themselves over time.

Russians embrace precious metals:

Russians embrace precious metals:

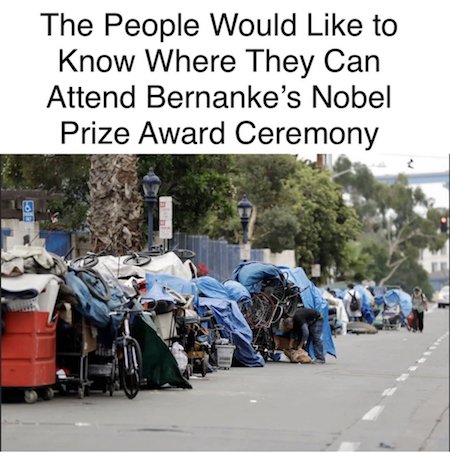

Ben Bernanke Winning The Nobel Prize In Economics

Ben Bernanke Winning The Nobel Prize In Economics

March 1, 2021

March 1, 2021

Illustrations for this presentation can be found

Illustrations for this presentation can be found

zerohedge blocked me

zerohedge blocked me

If you are tired of witnessing silver (and gold) continuing to be manipulated in price, here’s a no-cost, no-risk, high potential return action you can take that will only involve a few minutes of your time. Quite literally, there’s absolutely nothing to lose and quite a lot of potential good to be had.

If you are tired of witnessing silver (and gold) continuing to be manipulated in price, here’s a no-cost, no-risk, high potential return action you can take that will only involve a few minutes of your time. Quite literally, there’s absolutely nothing to lose and quite a lot of potential good to be had.

Are Gold and Silver

Are Gold and Silver

John Exter’s

John Exter’s  Egypt's new currency gauge might be based on gold,

Egypt's new currency gauge might be based on gold,

During September, silver inventories held in the vaults of the London Bullion Market Association (LBMA) in London fell by a massive 4.93%, and are now at a new record low. LBMA silver holdings now total only 27,101 tonnes (871.3 mn ozs), and have fallen every month for 10 straight months.

During September, silver inventories held in the vaults of the London Bullion Market Association (LBMA) in London fell by a massive 4.93%, and are now at a new record low. LBMA silver holdings now total only 27,101 tonnes (871.3 mn ozs), and have fallen every month for 10 straight months.

)

.jpg) Ronan Manly:

Ronan Manly:

...

...

'In years to come many investors will look back upon the past weeks and months as another great opportunity missed, to be added to the list that most of us keep or have in our heads of other great opportunities missed, but you, dear reader, do not have to be among them.

'In years to come many investors will look back upon the past weeks and months as another great opportunity missed, to be added to the list that most of us keep or have in our heads of other great opportunities missed, but you, dear reader, do not have to be among them.

POLO METAPHORS, BOND FAILS &

POLO METAPHORS, BOND FAILS &  Anti-Gold Propaganda

Anti-Gold Propaganda The E. Beach &

The E. Beach &

Attendance will be free with

Attendance will be free with  GOLD REVALUATION:

GOLD REVALUATION:

Keynote Presentation by

Keynote Presentation by  E.

E.

Gold is important to me

Gold is important to me

Dr. Robert Malone:

Dr. Robert Malone:

Specifications for

Specifications for