|

|

Post by Entendance on Oct 18, 2017 16:21:17 GMT -5

In 2009 E. (that's me  ) in his already nuked website wrote: <All policy makers have done to date has been to squander public funds to protect the full interests of bankers. Stop Bailing Out Billionaire Bankers! ) in his already nuked website wrote: <All policy makers have done to date has been to squander public funds to protect the full interests of bankers. Stop Bailing Out Billionaire Bankers!

The poor people bailing out the rich people. This is a porn economy. We have a bunch of zombies that are only around at this point because the taxpayer is propping them up.

Can we just drop the pretence and start calling the bank bailout what it is: Financial terrorism.

Terrorism can be defined as achieving one’s aims through fear. And it sure seems to me that bankers and their friends in government are extorting money from the taxpayers (you and me) with a threatening “or else” that goes something like this: “Give us the money or the entire financial system will implode.

The reason we’re in such a mess is that people got greedy. They were using leverage and structured products to hide problems, to make it look as if they were making huge profits when they really weren’t. These banks were paying high bonuses and high dividends on phantom profits.

How can you expect to find solutions in the crowd that caused the problems? These incompetent corporate clowns should be falling on their own swords.

To me, this financial crisis is nowhere near over for one simple reason: we continue to perpetuate the VERY same business practices that created it in the first place and the bureaucrats that designed this bailout are either in the pocket of the banks or they're incompetent.>

October 2017

"...Wall Street did not accidentally run a barge aground and leave a small oil slick on the Hudson River. Wall Street did not accidentally release tainted lettuce that sickened a few dozen people. What Wall Street did was intentional and criminal: it financially engineered a toxic subprime house of cards which it knew from its own internal reviews was going to collapse; it then molded the toxic product into inscrutable bundles; it sold the bundles to unsuspecting investors around the globe while making side bets that it would all come crashing down. Then, after causing the greatest financial collapse in the United States since the Great Depression, Wall Street’s unrepentant scoundrels paid themselves billions of dollars in bonuses with taxpayer bailout funds..." ***The Power Players Behind Silencing Wall Street Reformers

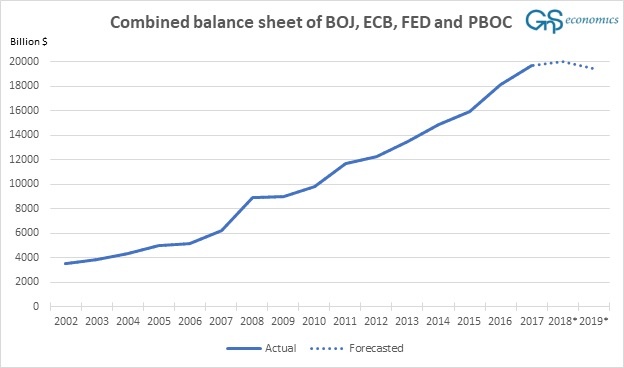

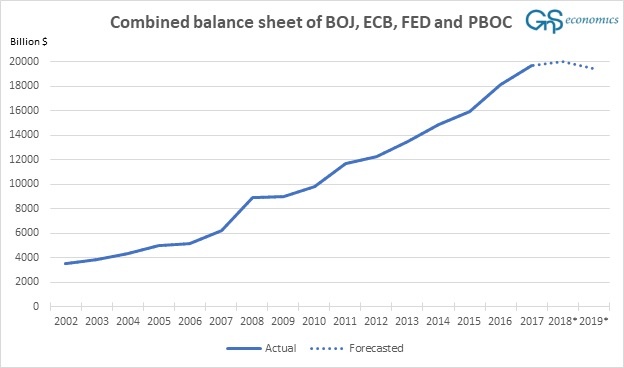

Intellectual incest at major central banks?

H/T RudyHavenstein

BONUS

|

|

|

|

Post by Entendance on Oct 26, 2017 5:48:45 GMT -5

***Which Companies Have The Most Tax Havens?

"Where has all the money gone?

Gone to taxes.

Where have all the taxes gone?

Gone to governments.

Where have all the governments gone?

Gone to bankers for loans and more money.

Where have all the bankers gone?

Gone to buy politicians.

Where have all the politicians gone?

Gone to buy voters.

Where have all the voters gone?

Gone to work for money.

Where has all the money gone?

Gone to taxes.

And repeat..." ***When will they ever learn?***

|

|

|

|

Post by Entendance on Nov 2, 2017 18:01:19 GMT -5

***America's new Fed Chair grew wealthy from his time with The Carlyle Group

***Fed Officially Goes Carlyle ***Fed Officially Goes Carlyle

"...Over the past 15 months, I have made light of Fed Governor Jerome (Jay) Powell because of his answer to a question I had asked him at a symposium presented by the Chicago Global Initiative. I asked Governor Powell, “Who guarantees the balance sheet of the ECB?” Without hesitating, Powell said, “THEY HAVE A PRINTING PRESS.” If this is his answer to issues of debt overhang I will be closely watching the precious metals if Powell actually became Fed Chairman. Janet Yellen has proven far more competent than Jerome Powell would be under any top of stressful central bank situation.

In my mind Powell would prove to be a new G. William Miller: A weak Fed Chair that was inept in a crisis situation. The current global financial situation is too fraught with danger for Powell’s PRINTING PRESS. I know this is theoretical but having bashed Gary Cohn I feel Powell is another one of Wall Street’s marionettes. Maybe the strings attached to him are his greatest asset, but not for me." *** Be Very Afraid Of Jerome Powell and His Printing Press

H/T Tom from Florida

"...By nominating Powell, Trump sends a message to Wall Street that the Fed will continue policies that are favorable to the stock market... Which is why you should be prepared for anything..." - Birch Gold Group here

Karl Denninger:***Declaration Of INTENT to Violate The Law

End The Fed? ... Libertarian Republicans? ... #AskRonPaul

“The last duty of a central banker is to tell the public the truth.” –Alan Blinder, former Federal Reserve Board Vice Chairman More here

|

|

|

|

Post by Entendance on Nov 7, 2017 13:13:00 GMT -5

Banksters Cartel International I

"...Financial services industry employees are trained to talk customers out of buying gold. They do this by pointing out its price volatility and riskiness. (The public has no idea that the gold price is manipulated, and fake.) If the customer still wants to buy it, then the broker steers them into electronic gold, such as bullion bank-controlled ETFs and major mining company equities.

This sterilizes the investor’s funds, and prevents them from being used to buy physical precious metals, which would interfere with the price rigging crime by increasing physical demand for and the price of gold, given its consistently tight supplies. It would also lessen capital flows onto the Gold Looting Field, the exact opposite of the Deep State manipulators’ agenda...

...The larger purpose behind the Deep State’s electronic gold products, beyond current profits, is to concentrate investment gold in a select number of locations that will be easy to control and raid when the time comes...

...For investors, electronic gold is nothing but modern day Fools’ gold. For the Deep State, it is a free ride, on investors’ backs, to the most massive physical gold theft of all times.

Taken together, we believe these factors present a compelling argument why investors should exit all of the electronic gold products specified at the beginning of this article, and convert the proceeds into physical gold and/or non-Deep State-controlled equities of companies in which they have full confidence that managements are working for them, not the bullion banks. The fact is that the Deep State manipulation of the gold price is never going to end until people stop buying electronic gold and providing the liquidity the Deep State needs to continue perpetrating the gold price rigging crime..." ***Electronic Gold: The Deep State’s Corrupt Threat to Human Prosperity and Freedom

***Banksters Cartel International II

***Banksters Cartel International III

Gold & Silver Manipulation: The Biggest Financial Crime In History, Part I & II

|

|

|

|

Post by Entendance on Nov 9, 2017 4:35:06 GMT -5

1. The earlier "euros"

2. Lending out not-existing money

3. The money circulation

4. 'Euro'-plan 1970

5. End of the gold standard 1971

6. The silent coup of 1974

7. The defective euro

8. Emergency solutions for the euro

9. When the euro collapses ***The bankers and the euro

"THE ISSUE WHICH HAS SWEPT DOWN THE CENTURIES AND WHICH WILL HAVE TO BE FOUGHT SOONER OR LATER IS THE PEOPLE VERSUS THE BANKS." -LORD ACTON

The biggest trend that I see is a real detachment from reality. E. The biggest trend that I see is a real detachment from reality. E.

"Central Banksters could care less about our safety and care about one thing and one thing alone: Control of the money system and control over every facet of your financial life. This is why they hate physical money and this is why they hate gold and silver.

Resist this movement my friends, this won't be the last shot they fire." -Nathan McDonald

***here

***Global Gold Investment Demand To Overwhelm Supply During Next Market Crash

***Elephants will fly |

|

|

|

Post by Entendance on Nov 10, 2017 4:42:43 GMT -5

|

|

|

|

Post by Entendance on Apr 17, 2018 22:25:11 GMT -5

The issue which has swept down the centuries and which will have to be fought sooner or later is the people versus the banks. -John Dalberg

COMEX is by far the largest and most active futures exchange in the world for trading precious metals futures including gold futures contracts and silver futures contracts.

***CFTC Files Eight Anti-Spoofing Enforcement Actions against Three Banks (Deutsche Bank, HSBC & UBS) & Six Individuals

***Eight Individuals Charged With Deceptive Trading Practices Executed on U.S. Commodities Markets

Banksters Cartel International II Banksters Cartel International II

"...The CFTC is bringing the charges under what it calls “commodities fraud and spoofing schemes“. Spoofing of orders is illegal under the US Commodity Exchange Act. The 3 banks in question are Deutsche Bank, UBS, & HSBC. As part of the CFTC’s prosecution, Deutsche Bank is being fined US$ 30 million, UBS US$ 15 million, and HSBC US$ 1.6 million..." ***Spoofing Futures and Banging Fixes: Same Banks, Same Trading Desks

BlackChicken • Tue, 04/17/2018 - 20:37

"Thank God we have free and transparent markets. Seriously, can we skip over the fines and just hang these thieving fuckers?"

FlyinHigh philipat • Tue, 04/17/2018 - 21:09

"I have but one question ! Why do these named fucks still breath?"

CamCam • Tue, 04/17/2018 - 21:47

"Gold will break when nothing else will hold it back. Until then, keep living. You can't time this, its impossible. Keep acquiring little by little, keep having fun, keep paying of that debt, and when it happens it happens"

YourAverageJoe • Tue, 04/17/2018 - 22:35

"This same fucking shit, over and over again.

Its cheap now. Buy if you can, then close your ears and eyes.

It will be valid when nothing else is." More comments here

Sound and Honest Money:*** Fred & Entendance Gold & Silver Beach

**************** Conosco Warren Pollock dal secolo scorso. Un vero Uomo Per Gli Altri, un serio professionista e un grande antesignano del nostro credo imperativo <Starve The Beast>. Meditate, folks, meditate. E.

***Entendance on twitter ***Banksters Cartel International I ***Banksters Cartel International III

|

|

|

|

Post by Entendance on Jun 4, 2018 17:06:00 GMT -5

The UniCredit whistleblower “Crime doesn’t pay.

Actually it does, handsomely. If you are a banker or large financial player, it pays wonderfully. You get filthy rich committing the crimes and after... you continue to get filthy rich.

What doesn’t pay is reporting crime.

Not long ago I read a rather good book about a small number of honest people who did not understand this dirty fact. It was a book telling the stories of the handful of honest and tragically idealistic insiders who blew the whistle about banking fraud and crime during the Global Bank Debt Crisis. It was full of disturbing facts. Not the least of which is that not one of their stories ended well.

All of the stories involved the whistleblower following the law and reporting their concerns.

In every story the result was being threatened with punitive, some might say vindictive, legal action by the very banks whose wrong doing they had reported. In every case the ‘Proper Authorities’, in charge of regulating the banks, hung the whistleblowers out to dry.

All the whistleblowers were blackballed from their profession and lost their livelihoods..." ***The Steady Enmity of Powerful People H/T Tom from Florida

The issue which has swept down the centuries…and which will have to be fought sooner or later…is the people vs. the banks.

– Lord Acton

|

|

|

|

Post by Entendance on Jun 5, 2018 15:31:24 GMT -5

Banksters Cartel International IV

"...Older people who’ve benefited from the status quo their entire lives will naturally support a propagation of the status quo. That’s the last thing we need right now... ...It’s impossible to know exactly what will come next, but it’s a safe bet we’re on the precipice of enormous change based on an imminent turning of the generational cycle. Whether it leads to a better or worse world will depend on the level of consciousness we bring to it. The world is ours to create, let’s not screw it up."   ***Beware Former Central Bankers Telling You to Work More ***Beware Former Central Bankers Telling You to Work More

***Trade Wars Mean a Higher Gold Price

Ted Butler say, “let me be clear, both JPMorgan and the CME Group are stone-cold crooks when it comes to silver.” Here’s why…

***Great Frauds (Like The Silver Manipulation On The COMEX) Require Darkness

"...This will be the summer of discontent for the West especially. The fact that populism is still a rising force among these nations is a clue of broad public skepticism about maintaining the current order. No wonder the massive bureaucracies vested in that order are freaking out..." ***The Summer of Discontent |

|

|

|

Post by Entendance on Jun 30, 2018 2:14:44 GMT -5

***The Fed Gives Wall Street Banks Okay to Prop Up Their Stock Prices

Europe Is Breaking Up Over Immigration:***What Would Happen in Case of a Banking Crisis?

"...today’s euphoric stock markets remain hyper-risky. They are still trading at dangerous bubble valuations despite the largest corporate tax cuts in US history! And that’s at a time when the Fed and ECB are slowing and reversing their long years of QE which fueled this exceptional bull. A major bear market that will at least cut stock prices in half is way overdue, don’t be fooled by this extreme complacency.

Prudent investors have to overcome this groupthink herd euphoria and protect themselves from what’s coming. That means lightening up on overvalued stocks, building cash, and buying gold. Central banks have a long history of trying and failing to eliminate stock-market cycles. The longer they are artificially suppressed, the worse the inevitable reckoning as these inexorable market cycles resume with a vengeance."

|

|

|

|

Post by Entendance on Jul 5, 2018 7:18:36 GMT -5

Banksters Cartel International V

"The fractional banking system is soon coming to an end with the most massive bang" ***US DEBT EXPLOSION & WEIMAR II

|

|

|

|

Post by Entendance on Jul 14, 2018 0:18:53 GMT -5

Buying gold today is a statement that you believe that global economic events may spiral out of the control of Central Bankers. It is insurance against some sort of massive monetary policy mistake that cannot be fixed without re-conceptualizing the global economic regime. – W. Ben Hunt

Mike Mish Shedlock: "Anyone holding money in Italian banks is a fool" Pam Martens and Russ Martens: "These Charts Prove It’s Time to Break Up the Big Wall Street Banks"

Beware!

The strong tendency in us to interpret all new information through the lens of our prior beliefs. Whatever your political philosophy is, you can easily immerse yourself into media outlets, social media and internet content that exclusively reaffirm your convictions. One can comfortably spend hours a day consuming political & economic information without once encountering a differing viewpoint: confirmation bias

|

|

|

|

Post by Entendance on Jul 18, 2018 4:03:33 GMT -5

July 19, 2018: "...It is absolutely unreal how the world pays so much respect to mediocrity or even incompetence when it comes to running the financial system. Central banks and their heads have created this monster balloon which is now waiting to be popped. They have given the world the impression that they have been instrumental in saving the world economy when they in fact have created the bubble..." Here

"...Hedge your bets against the Fed shell game while there’s still time..." ***Fed Sweeps Yield Curve Under the Rug - What Are They Trying to Hide?

The central banksters and their crony politicians hate gold for the same reason tanning salons hate the sun. Because gold cannot be printed or destroyed, it exists in limited and quantifiable amounts, and therefore, unlike paper money, there is a limit, a tether, on the amount of incompetence and financial mismanagement our elected governments can get away with without being called to account.

On the other hand, the amount of paper (or digital) currency that a government can create (usually through the mechanism of its “agent,” or third-party central bank) is limited only by the amount of available ink and paper, the processing capacity of its computer systems, and the ignorance of its citizens. And all of these are now in plentiful supply, it would seem...

"...And this idea that risks aren’t there, or if they’re there, that they don’t matter because central banks will always bail out the markets at the smallest squiggle, and that therefore risks no longer need to be priced in – that’s a pandemic attitude today..."

"...The trade war can and will cause various problems within the global economy, but the greater cause of fiscal distress will always be central banks. They are to blame for any future crisis..."

|

|

|

|

Post by Entendance on Jul 27, 2018 2:25:45 GMT -5

|

|

|

|

Post by Entendance on Aug 11, 2018 4:21:49 GMT -5

"...Prins believes that another epic financial crash is inevitable, writing that “Eight years after the crisis began, the Big Six US banks – JPMorgan Chase, Citigroup, Wells Fargo, Bank of America, Goldman Sachs, and Morgan Stanley – collectively held 43 percent more deposits, 84 percent more assets, and triple the amount of cash they held before. The Fed has allowed the biggest banks on Wall Street to essentially double the risk that devastated the system in 2008.”

In summary, writers on both sides of the political spectrum see the Fed as a disfigured central bank which has lost its way. What will it take for Congress to wake up?" We Do Know How Bad the Federal Reserve Is

here here

Jump: Fort Knox

Ex Nihilo, Nihil Updated

Bota na conta do Papa

Grasping For Salvation: Italia

|

|

|

|

Post by Entendance on Aug 28, 2018 4:24:06 GMT -5

"...Emerging market countries became addicted to Fed liquidity over the past decade, using no-cost loans and the weakened dollar to prop up stock markets, bonds and their own currencies. They were the first to see a stock market rebound after bailouts were launched, and now they are the first to see their stock markets plunge as the Fed removes the punch bowl. Emerging market equities have recently suffered an approximate 15% drop as dollar liquidity dries up.

The trade wars have provided perfect cover, distracting the public from the fact that without constant and expanding money creation by the Federal Reserve, assets around the world are plunging in value...

...When an addict is unable to get the drug he desires from his traditional source, he will look for alternative sources. Meaning, emerging markets are going to seek out other options to replace the dollar by necessity.

One might wonder if the Fed is aware that they are creating the very conditions that will cause the demise of the dollar. And the answer is yes – they are perfectly aware. Jerome Powell admitted in October 2012 that tightening of QE and higher interest rates could cause severe fiscal crisis. Today, Powell is the Fed chairman, and he is pursuing the very actions he warned about in 2012. If this does not tell you that the Fed is a deliberate saboteur of our system, then I don’t know what does.

We commonly focus on the consequences of Fed policies within America, but rarely consider how the Fed’s actions might hit foreign markets, and then circle around like a boomerang to hit the U.S.

We know that higher interest rates will eventually crush corporate stock buybacks, which have kept U.S. stock markets in an artificial bull market for years. August is known as the most aggressive month for stock buybacks and this is reflected so far in the recent market rally. But, corporations are already weighted with historic levels of debt not seen since the Lehman crisis, and higher rates will drag them down into even deeper waters. Though, with emerging markets, we see the threat of something far more damaging – the end of the dollar as world reserve.

The consequences? It is possible, though perhaps unprecedented, that the dollar index will decline even while dollar liquidity is being cut. Meaning, severe price inflation as foreign holders of dollars dump them back into U.S. markets as they turn to a basket-based monetary system.

This would likely lead to an explosion in gold prices, but beyond that, an explosion in most commodity prices for Americans. Global banks are more than happy to initiate their “reset” in this manner, as Trump’s trade wars can be used as the perfect cover for any pain that is felt during the transition.

If prices do indeed spike and stocks plummet, tariffs will be blamed instead of the central bankers. When enough fear has been induced in the populace, the IMF and its banker patrons can “ride to the rescue” with the same SDR-based basket system that China and Russia have been calling for as a replacement for dollar hegemony. In this scenario, America is painted as the bumbling villain that gets what he deserves, while the world is saved from the edge of destruction by the very banking elites that created the catastrophe in the first place." Emerging Markets And The End Of Dollar Dominance

Meanwhile... Venezuela to sell certificates backed by gold ingots to pensioners as inflation surges H/T Tom from Florida

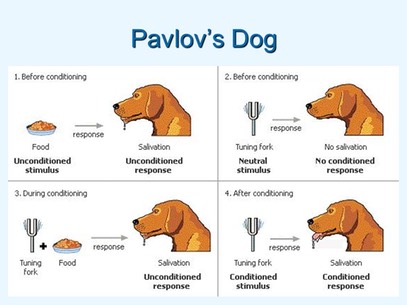

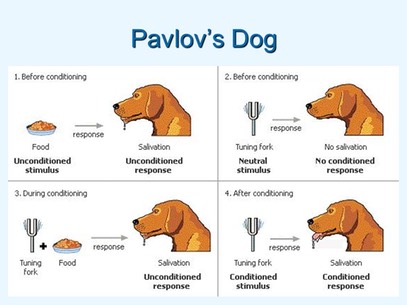

Pavlov's Dog In his initial experiments, Pavlov rang a bell and then gave the dog food; after a few repetitions, the dogs started to salivate in response to the bell. Pavlov called the bell the conditioned stimulus because its effects depend on its association with food.

As related to the stock market (February 2009-August 2018), every time stocks dipped, bears thought "this was the one". Yet, every dip was nothing more than a bell-ringing buy opportunity, often times coupled with lovie-dovie statements by someone on the Fed. Even minor dips were bell-ringers!

Big Banks Are Using Data Profiling to Prey on Unsophisticated

The U.S. Debt Problem Can No Longer Be Ignored The U.S. Debt Problem Can No Longer Be Ignored

Avoid paper gold products, just starve the beast: buy gold & silver bullions, then store them outside the banking system. E. |

|

|

|

Post by Entendance on Sept 2, 2018 1:25:32 GMT -5

Macroeconomic analyst Rob Kirby says the big elephant in the global financial room, that nobody wants to acknowledge, is the still “missing” $21 trillion from the DOD and HUD. Kirby contends, “They don’t want to believe it. They don’t want to believe that, at least, $21 trillion in extra dollars has been created out of thin air. It is siloed, and I would say it is siloed in dark places like the Exchange Stabilization Fund (ESF), which is the secretive adjunct to the U.S. Treasury. I would also contend that this enormous cache of dark money is exactly what is used to do dirty tricks like rig the precious metals market because that is a very expensive operation to carry out. That is not a sustainable sort of thing. The Fed . . . knew years and years ago that they were going to hit a point where the amount of money that they would need to be put into the system would have to grow vertically. This is why they created and siloed at least $21 trillion extra dollars.”

Kirby also says the extra $21 trillion “missing” dollars has been a well-kept secret. Kirby says, “This is a true secret, and I am going to say a true secret of the Deep State. This is why everybody avoids this at all costs.”

What is the downside to massive money printing? Kirby says, “Is everything going to be okay in America when people really realize how much money there really is in existence. When people realize instead of money supply being “X,” and it’s really 10 times “X,” is everything going to be okay then? I don’t think so. Once there is widespread acceptance that the money supply is not “X,” but it is 10 times “X,” 10 “X” is going to come home to America very quickly. That 10 “X” worth of money is going to be buying anything that isn’t nailed down things, and it might be buying things that are nailed down. We are going to get a hyperinflation. There is absolutely no doubt in my mind. It’s not a question of if, it’s only a question of when.”

Kirby, who is also a broker of physical precious metals by the ton for wealthy clients, says people are quietly panicking. Kirby explains, “If you look at a duck moving across the water, it looks very graceful. But if you take a picture of what’s going on underneath the waterline, you see the duck paddling seriously. In the precious metals space, what we see above the waterline is the reckless suppression of physical precious metals . . . but what’s really going on beneath the waterline is mega, mega money is on a ‘seek and acquire’ mission to secure physical precious metals in amounts that would stagger most people. . . . There will come a point where physical precious metal will be hard, if not impossible, to find in exchange for fiat currency...The amount of money seeking physical precious metals would alarm a lot of people. You are talking stupid amounts of money.”

|

|

|

|

Post by Entendance on Sept 8, 2018 5:08:20 GMT -5

Ex Nihilo, Nihil: The Fred & Entendance Beach Mentioned at The Banksters Bonuses Daily

Bailout, Bail-in

Time Deposits Demand Deposits Unsound Banking How Banking Works Today Unsound Banking: Why Most of the World’s Banks Are Headed for Collapse

“The next crisis is also likely to result in social tensions similar to those witnessed 50 years ago in 1968"

Your Money In The Bank Will Be Gone

"For anyone who has money in the bank today, it is virtually guaranteed that in the next years either the bank will be gone or the money will be worthless, or probably both.

Governments and Central Banks are now supreme experts in the total destruction of your money.

They are constantly adding new methods so let’s just look at a few of them:

*Zero or Negative interest rates – Over time, together with bank charges, your money will slowly be confiscated.

*Bail-ins – No one will bail you out. Instead the insolvent banks will take your money to save the bank. *Ban cash – Within a few years, cash will be virtually banned in many countries. So you will not see your money again and the bank and the government will tell you what you can do with it.

*Forced savings in government bonds – Bankrupt governments will force you to invest in bonds for 30 years or longer. The bonds will be worthless at maturity.

*Money Printing – Finally if the money isn’t already gone, governments will totally destroy it by printing so much that it will become worthless.

The world is now starting the final phase of the failed experiment in creating wealth and prosperity for a select few and massive debt and misery for the masses.

It all started with the creation of the Fed in 1913. This led to a global credit creation and money printing extravaganza of a magnitude that the world has never seen before. We have now reached the point when it makes no difference who becomes US president or what the Fed or the IMF will do. No, now we are at the point that von Mises so succinctly defined:

“There is no means of avoiding the final collapse of a boom brought about by credit expansion. The alternative is only whether the crisis should come sooner as the result of voluntary abandonment of further credit expansion, or later as a final and total catastrophe of the currency system involved.”

The latter is guaranteed – Only Gold will protect you." -Egon von Greyerz

Corporate and consumer debt, which has accumulated over the last decade far beyond its capacity to be repaid, will go bad all at once

Italy's Target 2 liabilities have hit fresh high as capital flight seems to continue amidst high political uncertainty

E. on twitter

|

|

|

|

Post by Entendance on Sept 16, 2018 2:55:32 GMT -5

Investment advisor and former Assistant Secretary of Housing, Catherine Austin Fitts, predicts the global financial system “will take some big hits before the end of the year.” Fitts explains, “Right now, economists say the dollar is ‘dangerous and dominant.’ It’s still, if you look at the market shares around the world, it’s still very, very significant portion of total reserves. So, it’s still very important. At the same time, the U.S. dollar hegemony is probably not going to last forever . . . So, I think the long term dollar looks very weak. Short term, it doesn’t look like it’s coming apart anytime soon, as far as I can see. What that means is when you have something that is dangerous and dominant, you have the possibility of extreme volatility events. That’s the new code word for the ‘you know what’ hits the, you know what. Whether it’s different countries exploding economically, or we whether are pressuring people that makes them very uncomfortable, these kinds of fights over shrinking pies are very dangerous because they mean covert wars. They mean overt wars, and the more we steal pies from each other instead of make new pies, the worse the situation gets. That’s what you are seeing. The system is not stable.”

Fitts goes on to say, “The real push are for real assets: real assets reflected in a stock, or real assets reflected by real estate or precious metals.”

There is good reason people are going to real assets. The U.S. government is “missing” $21 trillion between the DOD and HUD. This fact was uncovered by Fitts and economist Dr. Mark Skidmore last year. What was the government’s answer to this gigantic accounting fraud that is the size of the federal deficit? Give the government’s budgets basically classified national security status. Fitts says, “Apparently, the people leading the audit have come to them and said if we do this audit, we will disclose classified projects. So, the board (Federal Accounting Standards Advisory Board – FASAB) came out with a new policy. I say it is illegal. You cannot do it under the financial management laws, and you certainly cannot do it under the Constitution, and it said you can keep classified off the books, which means you can cook the books and you can basically do whatever you want. This matches up with the waiver given to the national security advisor that says corporations, if he waives them (regulations), can also cook their books with the SEC. Now, we have the corporations making money, and they can cook their books under the law, and apparently the government can too. So, when the board made the statement and announced this new policy, they made the point that if they didn’t do this, the only alternative was to redact the Department of Defense financial statements, which meant you would have to redact the U.S. government’s financial statements, which means we have reached “Never, Never Land,” which also means the whole thing is a joke. . . . As a matter of policy, they are saying you have to give them, for the IRS, for the Census and all these other things, complete financial disclosure and honest financial disclosure by pain of law or you go to prison, but they can make up whatever they want. They can publish financial statements that are complete fiction with no accountability to you and call it national security. What this is doing is engineering complete financial insecurity for every American citizen. This is the end of financial security.”

In closing, Fitts says, “I am a gold fan...You also want to have as little leverage and debt as possible...I am also a silver fan, and I am getting reports that silver is getting hard to find. Gold is down 8% for the year and silver is down 16%, but go and try to buy a bunch of silver. It’s tough.”

2015:

|

|

|

|

Post by Entendance on Sept 21, 2018 4:14:30 GMT -5

The Entendance Beach & FED Jerome Powell

Kneel before your private equity overlords, Carlyle?

What does Carlyle mean?In English the meaning of the name Carlyle is: From the protected tower; from the walled city.

Has the Federal Reserve Joined the Deep State in an Attack Against Trump?

By The Time The Fed Hits Its Goals, The Markets Will Be Crashing

***America's new Fed Chair grew wealthy from his time with The Carlyle Group

***Fed Officially Goes Carlyle ***Fed Officially Goes Carlyle

"...Over the past 15 months, I have made light of Fed Governor Jerome (Jay) Powell because of his answer to a question I had asked him at a symposium presented by the Chicago Global Initiative. I asked Governor Powell, “Who guarantees the balance sheet of the ECB?” Without hesitating, Powell said, “THEY HAVE A PRINTING PRESS.” If this is his answer to issues of debt overhang I will be closely watching the precious metals if Powell actually became Fed Chairman. Janet Yellen has proven far more competent than Jerome Powell would be under any top of stressful central bank situation.

In my mind Powell would prove to be a new G. William Miller: A weak Fed Chair that was inept in a crisis situation. The current global financial situation is too fraught with danger for Powell’s PRINTING PRESS. I know this is theoretical but having bashed Gary Cohn I feel Powell is another one of Wall Street’s marionettes. Maybe the strings attached to him are his greatest asset, but not for me." *** Be Very Afraid Of Jerome Powell and His Printing Press

H/T Tom from Florida

"...By nominating Powell, Trump sends a message to Wall Street that the Fed will continue policies that are favorable to the stock market... Which is why you should be prepared for anything..." - Birch Gold Group here

Karl Denninger:***Declaration Of INTENT to Violate The Law

End The Fed? ... Libertarian Republicans? ... #AskRonPaul

“The last duty of a central banker is to tell the public the truth.” –Alan Blinder, former Federal Reserve Board Vice Chairman More here

|

|

|

|

Post by Entendance on Oct 5, 2018 9:35:31 GMT -5

Banksters Cartel International VI

"This past week, we saw that the Bank of Nova Scotia was charged by the Commodity Futures Trading Commission with multiple acts of spoofing in gold and silver futures between June 2013 and June 2016. Traders placed orders to buy or sell precious metals futures contracts with the intent to cancel the orders before execution, the CFTC said.

So, the tin-foil hat wearers are back out in full force screaming about how this market rigging has caused gold to collapse over the last seven years. Unfortunately, anyone who believes this is simply not dealing with the facts of any of the supposed “manipulation” cases. You see, believing that these manipulation cases caused the gold market to drop from is 2011 high is no different from believing that a paper cut can cause someone to bleed to death..." More Evidence Of Manipulation In The Gold Market

All about Banksters Cartel International

"...Consider the ludicrous absurdity of all this. At their recent echo-capitulation lows, the gold miners' stocks were trading at prices first seen 16.4 years ago when the whole gold price was considerably smaller than their current profits! That makes no sense at all, it's an extreme anomaly resulting from unsustainable extreme bearishness. Like any stocks, gold-stock price levels must ultimately reflect their underlying earnings..." Gold Stocks Recovering 2

|

|

|

|

Post by Entendance on Oct 12, 2018 2:10:15 GMT -5

"In order for the bankers to establish what they call their “New World Order,” they need chaos to tenderize the masses, but they also have to be seen as saviors that deserve to be in a position of authority over the global economy. They need to create disasters so they can then ride in on their white horse and save us from those disasters." -Brandon Smith

"No regulatory penalties, no criminal indictments for fraud, no clawbacks, no prohibitions of bonuses at least during early phase of financial market recovery, all of this sticks in my mind as unjustifiable and imprudent, as it taught a lasting lesson that bankers had immunity." - Dr. Harald Malmgren

Meanwhile...in Italia...

E. on twitter |

|

|

|

Post by Entendance on Oct 14, 2018 1:49:06 GMT -5

...The “perfect storm”

The collapse of the ‘everything bubble’ created by central banks does thus directly threaten not just asset markets but also the real economy. If (when) the asset markets crash, we will see a dramatic fall in global liquidity which will paralyze both capital investment and consumption. A perfect storm in global capital markets, banking sectors and—most importantly—the real economy is likely to develop with frightening speed.

What this means is that we might be heading to the largest economic crash in human history, whose aftermath would not spare any corner of the global economic order. This is truly a scenario from our worst nightmare, and we know the creators. Central bankers have set us up. The (ominous) problem with global liquidity

Entire Federal Budget Now National Security Secret – Dr. Mark Skidmore

Investment advisor and former Assistant Secretary of Housing, Catherine Austin Fitts, predicts the global financial system “will take some big hits before the end of the year.” Fitts explains, “Right now, economists say the dollar is ‘dangerous and dominant.’ It’s still, if you look at the market shares around the world, it’s still very, very significant portion of total reserves. So, it’s still very important. At the same time, the U.S. dollar hegemony is probably not going to last forever . . . So, I think the long term dollar looks very weak. Short term, it doesn’t look like it’s coming apart anytime soon, as far as I can see. What that means is when you have something that is dangerous and dominant, you have the possibility of extreme volatility events. That’s the new code word for the ‘you know what’ hits the, you know what. Whether it’s different countries exploding economically, or we whether are pressuring people that makes them very uncomfortable, these kinds of fights over shrinking pies are very dangerous because they mean covert wars. They mean overt wars, and the more we steal pies from each other instead of make new pies, the worse the situation gets. That’s what you are seeing. The system is not stable.”

Fitts goes on to say, “The real push are for real assets: real assets reflected in a stock, or real assets reflected by real estate or precious metals.”

There is good reason people are going to real assets. The U.S. government is “missing” $21 trillion between the DOD and HUD. This fact was uncovered by Fitts and economist Dr. Mark Skidmore last year. What was the government’s answer to this gigantic accounting fraud that is the size of the federal deficit? Give the government’s budgets basically classified national security status. Fitts says, “Apparently, the people leading the audit have come to them and said if we do this audit, we will disclose classified projects. So, the board (Federal Accounting Standards Advisory Board – FASAB) came out with a new policy. I say it is illegal. You cannot do it under the financial management laws, and you certainly cannot do it under the Constitution, and it said you can keep classified off the books, which means you can cook the books and you can basically do whatever you want. This matches up with the waiver given to the national security advisor that says corporations, if he waives them (regulations), can also cook their books with the SEC. Now, we have the corporations making money, and they can cook their books under the law, and apparently the government can too. So, when the board made the statement and announced this new policy, they made the point that if they didn’t do this, the only alternative was to redact the Department of Defense financial statements, which meant you would have to redact the U.S. government’s financial statements, which means we have reached “Never, Never Land,” which also means the whole thing is a joke. . . . As a matter of policy, they are saying you have to give them, for the IRS, for the Census and all these other things, complete financial disclosure and honest financial disclosure by pain of law or you go to prison, but they can make up whatever they want. They can publish financial statements that are complete fiction with no accountability to you and call it national security. What this is doing is engineering complete financial insecurity for every American citizen. This is the end of financial security.”

In closing, Fitts says, “I am a gold fan...You also want to have as little leverage and debt as possible...I am also a silver fan, and I am getting reports that silver is getting hard to find. Gold is down 8% for the year and silver is down 16%, but go and try to buy a bunch of silver. It’s tough.”

2015:

|

|

|

|

Post by Entendance on Nov 1, 2018 12:59:43 GMT -5

02 November 2018 EBA publishes 2018 EU-wide stress test results 02 November 2018 EBA publishes 2018 EU-wide stress test results

Banks individual results Banks individual results

*******************

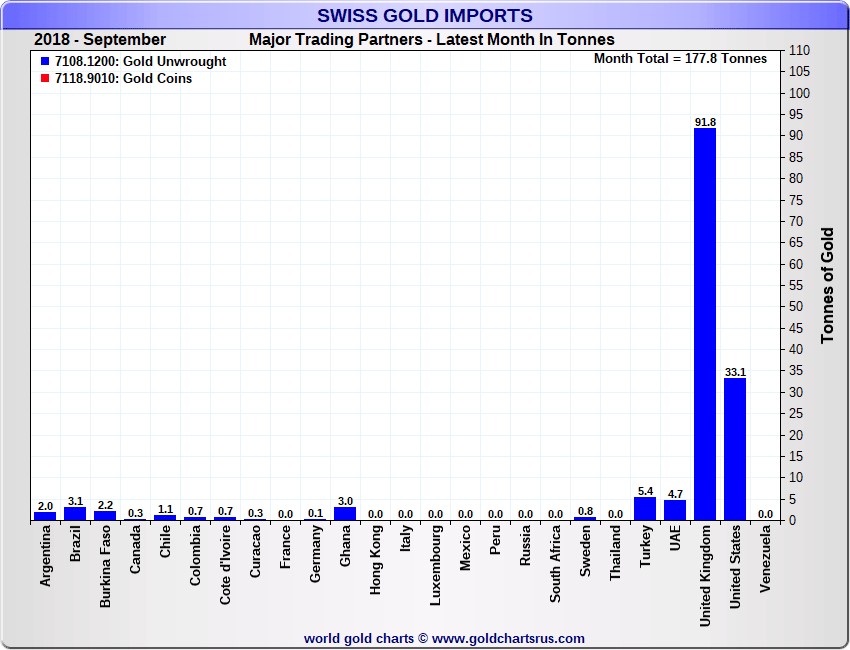

"...NO CENTRAL BANK PUBLISHES A PHYSICAL GOLD AUDIT

The US for example haven’t had a physical full audit since Eisenhower’s time in the 1950s. Therefore it is impossible to ascertain what the true holding is. But it would be surprising if the US actually has half of the 8,100 in an unencumbered physical form. If they haven’t sold it covertly, they have most likely leased a major percentage to the market through the bullion banks. That gold no longer stays in London and New York but is bought by China and India and shipped to these countries via Switzerland. The bullion banks then issue an IOU to the central banks which is only backed by paper since the physical will never return from Asia.

CENTRAL BANK GOLD COMING OUT OF LONDON AND NEW YORK

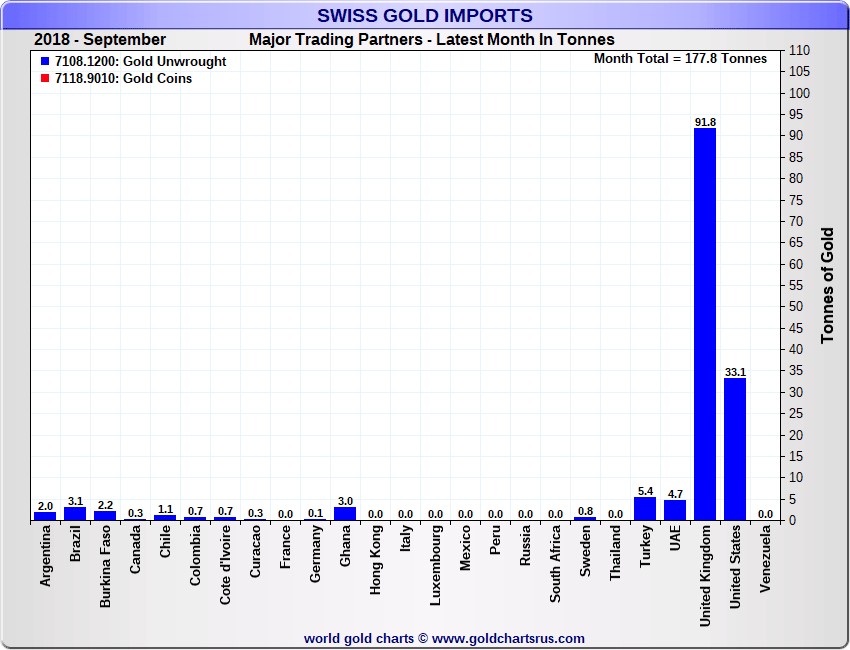

Last month Switzerland imported 92 tonnes of gold from the UK. We know of course that the UK is not a gold producing country. So these are 400 oz bars from UK bullion banks that are bought by Swiss refiners to break down into 1 kg bars and ship to China and India. The majority of the 33 tonnes that came from the US in September is also 400 oz bars from US bullion banks. Most of this UK and US gold is likely to come from central banks.

As regards the IMF 2,800 tonnes, a major part of that is probably double counted with the US and other central bank gold. Germany has repatriated some of their 3,400 oz of gold but 50% it is still held abroad with 1,250 tonnes in New York and 440 tonnes in London. Most of the German gold officially held in London and New York has most likely found its way to China and India too.

So not only does the Comex not even hold 1/100th of physical to back its paper gold but the bullion banks are in the same boat. And this is a boat full of worthless paper gold that will soon sink as the market discovers that there is a massive shortage of physical gold. At that point, it will be impossible to get a market price for gold as it will go “No Offer” which means that there is no gold offered at any price due to no availability of physical gold..." WHERE IS ALL THE GOLD GOING?

Meanwhile...DGCX On Track To Break Annual Volumes Record H/T Tom from Florida

|

|

|

|

Post by Entendance on Dec 15, 2018 8:07:37 GMT -5

|

|

|

|

Post by Entendance on Jan 11, 2019 6:06:38 GMT -5

For we wrestle not against flesh and blood, but against principalities and powers, against the rulers of the darkness of this world, against spiritual wickedness in high places. -Ephesians 6:12

Just some, only some bank fines the last 20 years:

Bank of America: $58.4B

JPMorgan: $29.7B

Citigroup: $17.2B

Wells Fargo: $14.7B

Deutsche Bank: $12.5B

Goldman Sachs: $9.6B

HSBC $5.7B

ING $1.5B

while Danske Bank is fined in the range of $8B over a $220B money laundering scandal, among others.

When reached out for a comment, each bank had the same two words to say: "Worth it".

"...Wall Street has crashed the financial system and economy of the United States as a result of self-dealing and obscene greed. It needs to be policed as if it’s a major terrorist threat.

Now for a look at a few of the firms that want to run this new stock exchange..." A Wall Street Felon and High Frequency Traders Announce Plan to Form Stock Exchange

"It took just eight minutes for Italy’s coalition partners, Five Star and the League, to renege on their flagship promise never to bailout a bank, reports Bloomberg. The new decree will allow the government to guarantee Carige bonds up to a maximum value of €3 billion, making it easier for the lender to retain access to the funding market. The government also wants the option, if necessary, to recapitalize the bank by injecting as much as €1 billion into its coffers despite having lambasted the previous government for doing the exact same thing with MPS..." Italy’s New Government Eats Its Words, Joins Bank Bailout Club

|

|

|

|

Post by Entendance on Jan 19, 2019 4:26:13 GMT -5

January 22, 2019

January 21, 2019 "As the US economy falls into another Federal Reserve-caused economic downturn, support for auditing the Fed will grow among Americans of all political ideologies. Congress and the president can and must come together to tear down the wall of secrecy around the central bank. Auditing the Fed is the first step in changing the monetary policy that has created a debt-and-bubble-based economy; facilitated the rise of the welfare-warfare state; and burdened Americans with a hidden, constantly increasing, and regressive inflation tax..." Ron Paul: Fire the Fed?

January 21, 2019 "It is destined to go down as one of the greatest journalistic and regulatory failures of our time – the lack of serious attention by investigative business reporters and the U.S. Department of Justice to the glaring fact that the largest Wall Street banks continue to trade their own and each other’s bank stocks in their own Dark Pools.

Dark Pools function as unregulated stock exchanges inside the bowels of the largest Wall Street banks. Making the situation even more dicey, some of the big banks own more than one Dark Pool, raising the possibility that there could be cross-trading between those pools to artificially inflate or depress stock prices.

JPMorgan Chase owns two Dark Pools; Citigroup currently owns at least two although it owned a lot more in the past; Morgan Stanley owns three; and then there is the Dark Pool that a consortium of Wall Street banks quietly own together. That one is called Level ATS. According to Wall Street’s self-regulator, FINRA, Level ATS is owned by Citigroup, Credit Suisse, LB I Group, Merrill Lynch LP Holdings, and Fidelity Global Brokerage Group.

After being repeatedly charged with collusion, should global banks be allowed to team up on the darkest of trading markets, i.e., Dark Pools? Should felon banks like Citigroup and JPMorgan Chase be allowed to trade the stocks of their own bank? Should any Wall Street bank be allowed to trade its own stock in darkness?..."The Silence on Wall Street’s Dark Pools Is Deafening

2019 banksters Cartel International: HERE

"As the new year begins, we find that the Federal Reserve is insolvent on a mark-to-market basis. Should we care? Should the banks that own the stock of the Fed care? "As the new year begins, we find that the Federal Reserve is insolvent on a mark-to-market basis. Should we care? Should the banks that own the stock of the Fed care?

The Fed disclosed in December that it had $66 billion in unrealized losses on its portfolio of long-term mortgage securities and bonds (its quantitative easing, or QE, investments), as of the end of September. Now $66 billion is a big number — in fact, it is equal to 170% of the Fed’s capital. It means on a mark-to-market basis, the Fed had a net worth of negative $27 billion.

If interest rates keep rising, the unrealized loss will keep getting bigger and the marked-to-market net worth will keep getting more negative. The net-worth effect is accentuated because the Fed is so highly leveraged: Its leverage ratio is more than 100 to one. If long-term interest rates rise by 1%, I estimate, using reasonable guesses at durations, the Fed’s mark-to-market loss would grow by $200 billion more.

The market value loss on its QE investments does not show on the Fed’s published balance sheet or in its reported capital. You find it in “Supplemental Information (2)” on page 7 of the Sept. 30, 2018, financial statements. There we also find that the reduction in market value of the QE investments from a year earlier was $146 billion. Almost all of the net unrealized loss is in the Fed’s long-term mortgage securities — its most radical investments. Regarding them, the behavior of the Fed’s balance sheet has operated so far just like that of a giant 1980s savings and loan.

And so, the question becomes, does this deficit matter? Would any deficit be big enough to matter?

All the economists I know say the answer is “no” — it does not matter if a central bank is insolvent. It does not matter in their view even if it has big realized losses, not only unrealized ones. Because, they say, whenever the Fed needs more money it can just print some up. Moreover, in the aggregate, the banking system cannot withdraw its money from the Federal Reserve balance sheet. Even if the banks took out currency, it wouldn’t matter, because currency is just another liability of the Fed, being Federal Reserve notes. All of this is true, and it shows you what a clever and counterintuitive creation a fiat currency central bank is.

Of course, on the gold standard, these things would not be true. Then the banks and the people could take out their gold, and the central bank could fail like anybody else. This was happening to the Bank of England when Bonnie Prince Charlie’s army was heading for London in 1745, for example. But we are not on the gold standard, very luckily for an insolvent central bank..."

BankThink The Fed is technically insolvent. Should anybody care?

"...The growing “everything bubble” encompasses not just stock markets or housing, but auto markets, credit markets, bond markets, and the dollar itself. All of these elements are now tied directly to Fed policy. The US economy is not only addicted to stimulus measures and near-zero interest rates; it will die without them.

The Fed knows this well..."

Will Globalists Sacrifice The Dollar To Get Their New World Order?

here

Gold & Silver: wealth preservation investors are not be concerned with short term price movements & instead hold physical Gold/Silver as insurance against counterparty risk which is greater than any time in history.

|

|

|

|

Post by Entendance on Feb 4, 2019 4:00:54 GMT -5

"...The bankers can only win the game if people are dependent on the elite for everyday necessities. The bankers have created a society of dependent people that they can exploit. They can only continue to exploit people as long as they are dependent on the bankers for the things they need. Once this dependence is broken the bankers lose much of their control on society. This dependence is broken by people who can provide their own necessities..." How Do You Beat The Bankers At Their Own Game?

Not your vault, not your gold. Case in point: Venezuela & Bank of England

"Since this level of manipulation has never, ever occurred in history, no one can predict the magnitude of the collapse that will take place..." More here

“We destroyed everything. We not only destroyed the financial markets, we destroyed society. I’m going for June of this year. The reset button gets reset after a few days of a flash crash that can’t be stopped. We’re flash crashing to hell, piece by piece by piece, until all of a sudden, the motion of the entity cannot be stopped.” Video here |

|

|

|

Post by Entendance on Feb 20, 2019 13:32:36 GMT -5

|

|

|

|

Post by Entendance on Mar 17, 2019 13:41:02 GMT -5

|

|

) in his already nuked website wrote: <All policy makers have done to date has been to squander public funds to protect the full interests of bankers. Stop Bailing Out Billionaire Bankers!

) in his already nuked website wrote: <All policy makers have done to date has been to squander public funds to protect the full interests of bankers. Stop Bailing Out Billionaire Bankers!

***

***

Banksters Cartel International II

Banksters Cartel International II

***

***

02 November 2018

02 November 2018  Banks individual results

Banks individual results

"As the new year begins, we find that the Federal Reserve is insolvent on a mark-to-market basis. Should we care? Should the banks that own the stock of the Fed care?

"As the new year begins, we find that the Federal Reserve is insolvent on a mark-to-market basis. Should we care? Should the banks that own the stock of the Fed care?

so...enjoy his latest tip, a great PDF

so...enjoy his latest tip, a great PDF