|

|

Post by Entendance on May 20, 2018 17:02:57 GMT -5

July 23, 2018: ***The dark side of Amazon Jeff Bezos net worth

20 years ago: $1.6 billion

10 years ago: $8.2 billion

5 years ago: $28.9 billion

2 years ago: $45.2 billion

1 year ago: $72.8 billion

Now: $150 billion

"...the purpose of "Prime Day."

It's not to offer you some sort of deal on things you actually want or need. It's to psych you into paying upward of $100 a year for something you don't need -- an intangible membership that brings nothing of real value beyond "faster, sometimes" shipping, along with conning you into placing spying devices with always-active microphones (or worse, cameras) in your house!

In other words it's simply a sop to get you to fork up money for something of no value or worse.

Why shouldn't Bezos take advantage of people being stupid? If you want to shower money on the guy who has done more to screw US small business than anyone else in the history of the country, and has reaped billions by ****ing Americans out of their jobs and companies, well have at it.

Frankly were I a small businessman I'd find a way to discover if a potential customer was a PRIME member and, if they were, charge 'em an extra 20% on everything they bought in my store. Why not when that sort of price discrimination is not only legal the exact same sort of thing is used by Spamazon to screw American businesses in order to favor Chinese ones!" Karl Denninger here

***Spamazon Facesucker Netfux

Stagnant wages are stirring populist anger and making “CEO” a dirty word.

Can the market be trusted to correct itself, or has capitalism broken the economy? Here H/T Tom from Florida

More on Amazon here & here |

|

|

|

Post by Entendance on Jul 19, 2018 10:46:05 GMT -5

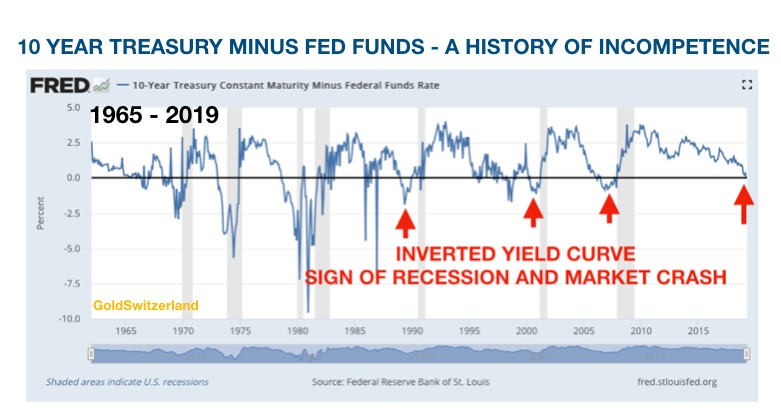

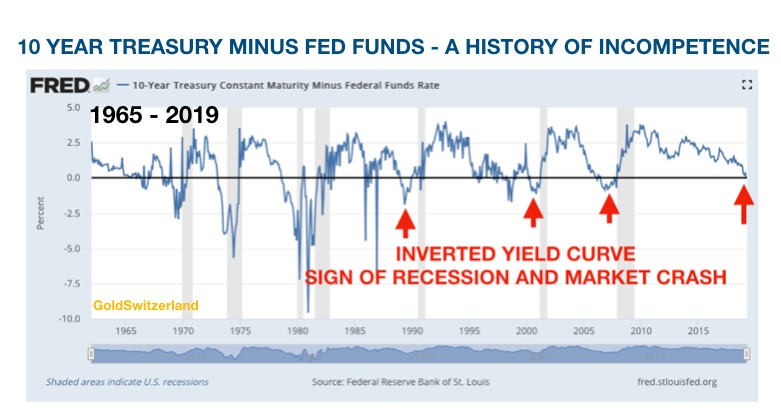

"... It is absolutely unreal how the world pays so much respect to mediocrity or even incompetence when it comes to running the financial system. Central banks and their heads have created this monster balloon which is now waiting to be popped. They have given the world the impression that they have been instrumental in saving the world economy when they in fact have created the bubble..." Here

"...the European Banking Commission in 2010 stress tested 91 of the largest European banks. All the Irish banks passed, only to be bailed out four months later. A stricter stress test was devised by the ECB in 2011, which passed Dexia and Spain’s Bankia as sound, as well as the whole Cypriot banking system. Dexia, based in the Low Countries, failed within three months, Bankia was so obviously insolvent it’s a mystery how they were ever passed, and the whole Cypriot banking system collapsed two years later. It’s not just the Europeans either...

...Central banking’s monetary policies have destroyed the randomness of economic activity that with sound money leads to economic progress without meaningful disruption.

•The overriding mistake is to believe that business cycles are endemic to free markets. The cycle is one of credit imposed on the economy. Central banks have put the cart before the horse.

•Successive credit cycles accumulate debt, until there is a crisis of larger magnitude. The current cycle has been of declining interest rates since 1981, generating a valuation boom that has driven bond yields to all-time lows, and equities to all-time highs. This cycle is unlikely to survive the current trend of rising consumer prices, because of the unprecedented accumulation of private sector debt.

•The evolution of equity investment has probably reached its end-point with the widespread use of ETFs. ETFs have convinced the investing public that investment is risk-free, for the same psychological reason banks thought that securitisation of mortgages banished lending risk.

•Successive credit cycles have seen the expansion of consumer debt earlier and earlier. The result is consumer wealth is apparent rather than real, adding to the general complacency.

•The banks are stuffed full of overvalued assets, which they have helped to puff up by lending money for further purchases of the same asset classes. Market purchases by central banks and sovereign wealth funds have made financial distortions even worse.

•Regulators have compounded systemic risk, not reduced it. Their focus has been directed by internal groupthink and the construction of artificial risk criteria such as Basel II and Basel III, which fail to address risk properly. On this and capital adequacy, banks both lobby and game the system, and are considerably more fragile than regulators would have us believe."

***Central bank manipulation of money is intended to force everyone to act the same way at the same time.

*** HERE

***Central Banks Produce Dire Consequences for the Free Market

Where is the new Ferdinand Pecora?

|

|

|

|

Post by Entendance on Aug 6, 2018 12:14:08 GMT -5

|

|

|

|

Post by Entendance on Sept 4, 2018 2:12:05 GMT -5

"This month marks the 10th anniversary of the Wall Street/Fed/Treasury created financial disaster of 2008/2009. What should have happened was an orderly liquidation of the criminal Wall Street banks who committed the greatest control fraud in world history and the disposition of their good assets to non-criminal banks who did not recklessly leverage their assets by 30 to 1, while fraudulently issuing worthless loans to deadbeats and criminals. But we know that did not happen.

You, the taxpayer, bailed the criminal bankers out and have been screwed for the last decade with negative real interest rates and stagnant real wages, while the Wall Street scum have raked in risk free billions in profits provided by their captured puppets at the Federal Reserve. The criminal CEOs and their executive teams of henchmen have rewarded themselves with billions in bonuses while risk averse grandmas “earn” .10% on their money market accounts while acquiring a taste for Fancy Feast savory salmon cat food.

I find the cognitive dissonance and normalcy bias regarding what has actually happened over the last ten years to be at astounding levels. As someone who views the world based upon a factual assessment of financial, economic and global data, I’m flabbergasted at the willful ignorance of the populace and the ease with which the ruling class has used their propaganda machine to convince people our current situation is normal, improving, and eternally sustainable..."

10 YEARS LATER – NO LESSONS LEARNED ...and this is still a porn economy. E. |

|

|

|

Post by Entendance on Sept 5, 2018 1:40:15 GMT -5

"...the public remains in complete denial when it comes to Amazon and Jeff Bezos..."

Amazon is Far More Dangerous and Powerful Than You Want to Admit

$1,000,000,000,000 in value: do people even understand what a large number this is?

Is there anything even under the hood to support this insane valuation? 2 companies....1/9 US GDP....wtf Given the clear links between Amazon and the surveillance state, am I the only one who finds it mind-boggling that so many people are willing to place an Amazon created “virtual assistant” named Alexa into their homes and treat it as part of the family?

July 23, 2018: ***The dark side of Amazon Jeff Bezos net worth

20 years ago: $1.6 billion

10 years ago: $8.2 billion

5 years ago: $28.9 billion

2 years ago: $45.2 billion

1 year ago: $72.8 billion

Now: $150 billion

"...the purpose of "Prime Day."

It's not to offer you some sort of deal on things you actually want or need. It's to psych you into paying upward of $100 a year for something you don't need -- an intangible membership that brings nothing of real value beyond "faster, sometimes" shipping, along with conning you into placing spying devices with always-active microphones (or worse, cameras) in your house!

In other words it's simply a sop to get you to fork up money for something of no value or worse.

Why shouldn't Bezos take advantage of people being stupid? If you want to shower money on the guy who has done more to screw US small business than anyone else in the history of the country, and has reaped billions by ****ing Americans out of their jobs and companies, well have at it.

Frankly were I a small businessman I'd find a way to discover if a potential customer was a PRIME member and, if they were, charge 'em an extra 20% on everything they bought in my store. Why not when that sort of price discrimination is not only legal the exact same sort of thing is used by Spamazon to screw American businesses in order to favor Chinese ones!" Karl Denninger here

***Spamazon Facesucker Netfux

Stagnant wages are stirring populist anger and making “CEO” a dirty word.

Can the market be trusted to correct itself, or has capitalism broken the economy? Here H/T Tom from Florida

More on Amazon here & here |

|

|

|

Post by Entendance on Sept 10, 2018 5:26:19 GMT -5

|

|

|

|

Post by Entendance on Sept 18, 2018 1:19:54 GMT -5

Just so we're clear

"I would say that Alan Greenspan will go down in history as the worst Chairman of the Federal Reserve in the history of the United States" HERE

Also here

|

|

|

|

Post by Entendance on Oct 13, 2018 4:27:43 GMT -5

|

|

|

|

Post by Entendance on Oct 30, 2018 1:57:57 GMT -5

|

|

|

|

Post by Entendance on Jan 14, 2019 12:29:48 GMT -5

Davos 2019 Looms "Western greed and excess is symbolized by the annual gathering of the World Economic Forum in Davos, Switzerland. The WEF catered to the billionaire class and coddled private equity founders as their outsized influence displaced the basic needs of common citizens. What does the WEF have in store for 2019? It's globalization 4.0... ...Globalization 1.0-3.0 ended up with economic gains going to the Davos class. Average people have been living under a new world where our voices do not matter and our pay does not go up...

...No one should trust this group. Their desire for more power and money is clear." Davos 2019 Looms

Globalization

|

|

|

|

Post by Entendance on Feb 26, 2019 14:28:59 GMT -5

|

|

|

|

Post by Entendance on Mar 4, 2019 11:58:13 GMT -5

|

|

|

|

Post by Entendance on Mar 28, 2019 7:34:52 GMT -5

|

|

|

|

Post by Entendance on Apr 3, 2019 6:18:34 GMT -5

2019 banksters Cartel International

“WE ENSURE THAT MONEY RETAINS ITS VALUE” “WE ENSURE THAT MONEY RETAINS ITS VALUE”

This statement appears on the website of the world’s oldest central bank. You wonder how the bank could have the audacity to make such a statement. In this century alone, the country’s currency has lost 80% in value and since 1971, the currency lost 99%. Obviously the fall in the currency is measured against gold which is the only money that has survived intact in history.

WHO ARE THE CENTRAL BANKS KIDDING?

Gold, the only honest and sound money left. E.

|

|

|

|

Post by Entendance on May 7, 2019 5:43:19 GMT -5

"Why in the year 2019 after many precious metals trading scandals, a cartel of 12 investment banks in London (five US controlled, two Canadian, one Swiss, one French, and three Anglo-Asian) still gets the privilege of setting international gold and silver prices in their shadowy and opaque marketplace?" here

|

|

|

|

Post by Entendance on May 11, 2019 4:05:43 GMT -5

Bullion Star gold researcher Ronan Manly wonders why the U.S. Mint at West Point, New York, periodically displays its working vault for coin manufacture but never the 11 storage vaults in which most of the U.S. Treasury gold held at West Point is purportedly stored.

Manly writes: "The constant references by the U.S. Mint to 54 million ounces of gold held in storage for the U.S. Treasury while showing the visiting media gold bars used in the bullion coin-minting process -- that are stored in a completely different room -- is a disingenuous and misleading exercise by the West Point mint. On their periodic outings to the West Point facility, the visiting media could at least question why they are only ever shown a working vault housing gold bar inputs into the mint's bullion coin programs, and not even the corridors and 11 compartment doors where the 54 million ounces of deep-storage gold are claimed to be held." The only gold the US shows – A working vault at West Point

|

|

|

|

Post by Entendance on May 22, 2019 1:44:14 GMT -5

Banksters Cartel International VIII

Gold rigging deniers are too lazy to look at the documentation

"...Central Banks and their client, primary dealer Banks have a long and sordid history of overt and covert gold price manipulation and suppression. An intellectually honest person can readily discover the truth of this historical fact. Any Money Manager, Newsletter Generalist, or System Apologist that persists in claiming "conspiracy theory" simply betrays his or her own intellectual laziness and dishonesty." The Question of Gold Price Manipulation?

The Beach & Banksters Cartel International

|

|

|

|

Post by Entendance on Jun 7, 2019 11:04:58 GMT -5

"Game over. The grand central bank experiment of the last 10 years has ended in utter and complete failure. The games of cheap money and constant intervention that have brought you record global debt to the tune of $250 trillion and record wealth inequality are about to embark on a new round of peddling blue meth again...This is not capitalism, nor does this ongoing farce constitute free market price discovery. It’s politburo based central planning, desperately trying to keep the balls in the air...." Game Over |

|

|

|

Post by Entendance on Jun 28, 2019 10:07:44 GMT -5

"How many second chances should a criminal recidivist get? JPMorgan Chase has logged in guilty pleas to three criminal felony counts in the past five years; it has a criminally-charged precious metals trader singing to the Feds currently as JPMorgan admits in regulatory filings that it’s under a new criminal investigation in that matter; the bank has paid $36 billion in fines for wrongdoing since the financial crash, including $1 billion for trading exotic derivatives in London with bank depositors’ money and losing at least $6.2 billion of those depositor funds (the London Whale scandal). And in just the past year it has proven that it’s “game on” for more regulatory fines and illicit profits..."

Fed’s Stress Test: Should JPMorgan Chase Have Gotten a Second Chance?

banksters |

|

|

|

Post by Entendance on Jul 22, 2019 2:45:46 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

At least the Financial Times now has come clean about its hostility to gold -- as well as to free markets and elementary journalism.

This weekend GATA's friend Chris Kniel of Orinda, California, sent to the newspaper's chief economic columnist, Martin Wolf, the excellent summary of gold and silver market manipulation just written by Bullion Star gold researcher Ronan Manly, Gold and Silver Price Manipulation -- The Greatest Trick Ever Pulled

Wolf replied derisively and dismissively: "This is a matter of absolutely no importance whatsoever. Who cares about the prices of useless metals?"

Stunned by such a counterfactual assertion, Kniel prompted Wolf to elaborate, receiving this from the FT columnist: "I mean to dismiss the whole monetary history of gold. It has no significance in the modern world. It is, as Keynes said, a barbarous relic."

Actually, Keynes' "barbarous relic" remark was made not about gold itself but about the gold standard for currencies. Keynes wasn't denying gold's use as money. But that is the least of the problems with Wolf's reply.

Who cares about the prices of useless metals? "No significance in the modern world"?

For starters, governments themselves care... More here

The lack of credibility for any central banks is a liability not directly on the BALANCE SHEET. More here

|

|

|

|

Post by Entendance on Sept 1, 2019 3:30:59 GMT -5

|

|

|

|

Post by Entendance on Sept 29, 2019 1:25:31 GMT -5

Hugo Salinas Price: As an illustration of the enormous harm that is done to humanity by conceited men and women who think they own the Truth, I present to you the case of Dr. Ignaz Semmelweis...The Semmelweis Reflex |

|

|

|

Post by Entendance on Nov 6, 2019 0:06:30 GMT -5

"Lawlessness breeds lawlessness.

Why are you surprised, given the example of lawlessness that we have embraced at the national level?

How much of the rule of law and integrity are we willing to surrender for the sake of easy money and stock market gains and political power?

Thomas Paine once wrote that 'these are the times that try men's souls.' In his original pamphlet he used the word 'try' in the sense of testing, or straining.

There is also another meaning to the word, and that is 'judge,' and a soul is a soul.

The craziness will continue until the market crashes, or some other collision with reality brings the cycle of lies to a stop.

But that is a collateral event to what is really at stake, for you personally, in what really matters. But it is still not too late— repentance, forgiveness, and thankfulness." -Jesse

(The past year has been a good one for the precious metals. Gold is up 22.8% since November 1, 2018. Silver is up 24.9% over the same period. For the month of October, gold posted a 2.7% gain and silver a 6.4% gain.) Ain't seen nothing yet. E. |

|

|

|

Post by Entendance on Jan 18, 2020 5:59:45 GMT -5

"...What was this smoke and mirrors all about? Just imagine how much more public anger there would be against Wall Street’s fat cats and their bailout kingpins at the Federal Reserve if the media had reported the real unemployment rate along with the fact that Wall Street banks and their foreign derivative counterparties had received a secret $29 trillion bailout from the Fed, allowing them to pay billions in bonuses to their miscreant bosses, while average Americans’ lives and dreams were shattered."

|

|

|

|

Post by Entendance on Jan 30, 2020 5:30:17 GMT -5

"...There is only one thing worse than the reality that Wall Street continues its crime wave after creating the worst economic collapse in the U.S. since the Great Depression. It’s the reality that essential work like that of Better Markets’ researchers is censored by mainstream media. We could not find one mainstream media news outlet that carried this story yesterday or today."

|

|

|

|

Post by Entendance on Feb 2, 2020 3:15:53 GMT -5

February 16, 2020

"...The truth is that only now – TWO MONTHS INTO THE EPIDEMIC – is WHO sending a “team” to “start investigating” the virus. Tedros said there was no need for measures that “unnecessarily interfere with international travel and trade,” and he specifically said that stopping flights and restricting Chinese travel abroad was “counter-productive” to fighting the global spread of the virus.

This is the Director General of the World Health Organization. On February 4th.

“We call on all countries to implement decisions that are evidence-based and consistent,” said Tedros. Roger that.

There’s just one problem.

The “evidence” here – taken without adjustment or question from the CCP – was a baldfaced lie.

And everyone at WHO knew it.

How do I know that everyone at WHO knew that the official Chinese numbers were a crock on Feb. 4?

Because WHO-sponsored doctors in Hong Kong published independent studies on Jan. 31 showing that the official Chinese numbers were a crock..."

"...social media networks are setting themselves up as the arbiters of truth, making it seem as though the rest of us are incapable of separating good information from bad information..."

|

|

|

|

Post by Entendance on Feb 12, 2020 0:39:17 GMT -5

"...No government or central bank will admit that rising inflation in essential goods is a direct consequence of financial and fiscal repression, and economic history always shows us that their reaction to rising discontent will be more financial repression and economic intervention..."

|

|

|

|

Post by Entendance on Feb 15, 2020 4:02:25 GMT -5

Gold price hits all-time highs in euro, yen;

USD next?

|

|

|

|

Post by Entendance on Mar 4, 2020 7:04:01 GMT -5

Seychellois Rolph Payet, who is heading the first meeting of the Basel Convention's Plastic Waste Partnership in his homeland, told reporters that "Seychelles has made a lot of effort to try and deal with this issue. A lot of non-government organisations have worked together to pick up the plastics." Payet said the discussion was also on "actions that we are taking internationally to resolve the issue of plastic waste. Most of the plastic waste is produced outside of Seychelles and are being dumped in our waters by the current. The only solution is to stop the source where the plastic originates." Here

...Since 1950, the world has created 6.3 trillion kilograms of plastic waste — and 91 percent has never been recycled even once, according to a landmark 2017 study published in the journal Science Advances. Unlike aluminum, which can be recycled again and again, plastic degrades in reprocessing, and is almost never recycled more than once. A plastic soda bottle, for example, might get downcycled into a carpet. Modern technology has hardly improved things: Of the 78 billion kilograms of plastic packaging materials produced in 2013, only 14 percent were even collected for recycling, and just two percent were effectively recycled to compete with virgin plastic. “Recycling delays, rather than avoids, final disposal,” the Science authors write. And most plastics persist for centuries...

|

|

|

|

Post by Entendance on Mar 31, 2020 17:24:30 GMT -5

The same world leaders now demanding we follow "social distancing" were, as little as 3 weeks ago, encouraging people to congregate in huge crowds.

“The leveraged share buyback game has ended, which also means an end to the phony earnings growth.” |

|

“WE ENSURE THAT MONEY RETAINS ITS VALUE”

“WE ENSURE THAT MONEY RETAINS ITS VALUE”

More at

More at