|

|

Post by Entendance on Aug 8, 2017 11:39:33 GMT -5

income chart~cantillon effect...went parabolic like debt!

"The message is straightforward. Only a few decades ago, the middle class and the poor weren’t just receiving healthy raises. Their take-home pay was rising even more rapidly, in percentage terms, than the pay of the rich.

The post-inflation, after-tax raises that were typical for the middle class during the pre-1980 period — about 2 percent a year — translate into rapid gains in living standards. At that rate, a household’s income almost doubles every 34 years. (The economists used 34-year windows to stay consistent with their original chart, which covered 1980 through 2014.)

In recent decades, by contrast, only very affluent families — those in roughly the top 1/40th of the income distribution — have received such large raises. Yes, the upper-middle class has done better than the middle class or the poor, but the huge gaps are between the super-rich and everyone else..."

***Our Broken Economy, in One Simple Chart*** H/T Tom from Florida

***Dutch Sandwich Updated

|

|

|

|

Post by Entendance on Sept 28, 2017 5:48:14 GMT -5

|

|

|

|

Post by Entendance on Oct 2, 2017 9:47:58 GMT -5

"Vladimir Putin is doing his part to keep the upswing in gold alive.

Since the Russian president went on a geopolitical offensive in Ukraine in 2014, the haven asset had its first annual gain in four years in 2016 and is on track for another in 2017..."

***Russia Gold Rush Sees Record Reserves For Putin Era

"At this juncture it’s clear that the attempt of the Trump Administration and related circles in the US military industrial complex have failed in their prime objective, that of driving a permanent wedge between Russia and China, the two great Eurasian powers capable of peacefully ending the Sole Superpower hegemony of the United States. Some recent examples of seemingly small steps with enormous future economic and geopolitical potential between Russia and China underscore this fact. The Project of the Century, as we can now call the China One Belt One Road infrastructure development–the economic integration on a consensual basis by the nations of Eurasia, outside the domination of NATO countries of the USA and EU–is proceeding at an interesting pace in unexpected areas..."

***Eurasian Economic Transformation Goes Forward

RUSSIA vs. USA:***Where’s The Gold Going??

***Italiani ***Italiani

Sound and Honest Money:***Fred & Entendance Gold & Silver Beach

***Gimme a break!

Ex nihilo, nihil: ***The banksters |

|

|

|

Post by Entendance on Oct 8, 2017 3:08:12 GMT -5

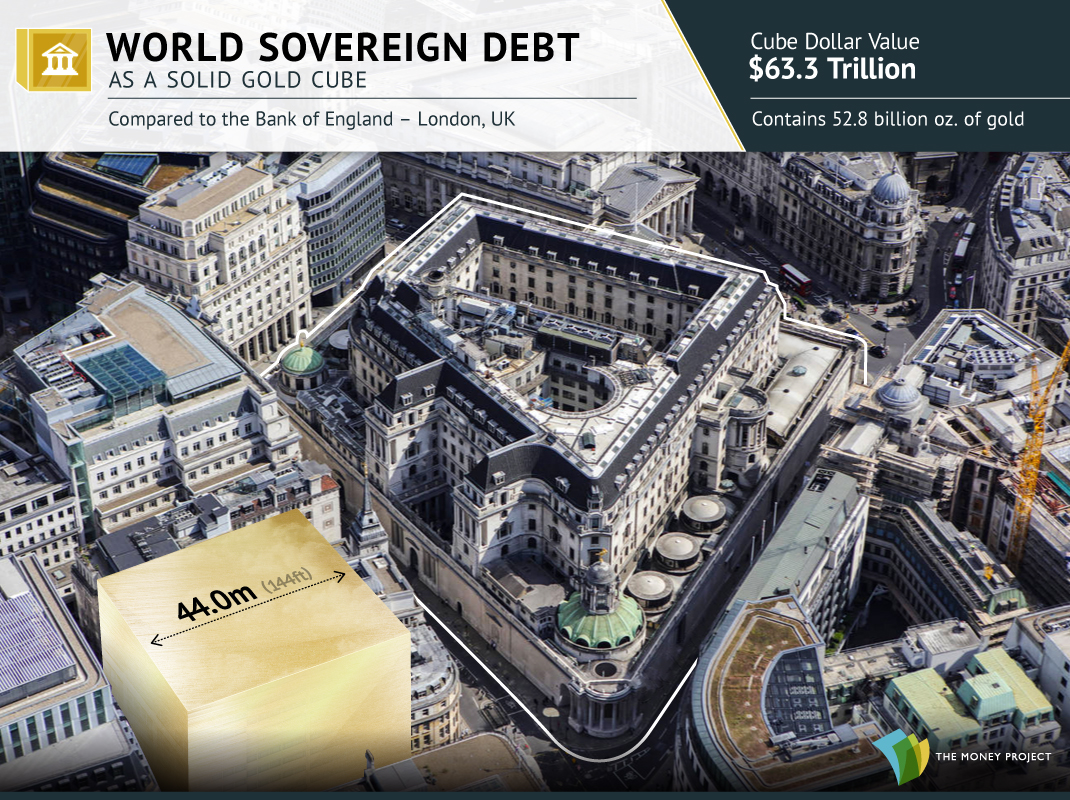

"...The Bible says that the person who borrows is a servant to the lender and so this nation has been borrowing trillions of dollars. When I was a kid America was the lender. Somewhere in my lifetime we flipped from being the lender to being the borrower. Who did this, who had this plan, this agenda? Somebody brought us there. A plan at the very top of this country's food chain to entrap this nation in debt and so now we're in bondage to foreign lenders..."

***Deeply Embedded Satanic Cult in Control of Powerful Institutions

The Entendance Beach & Debt Slavery The word "Debt" at the Entendance Beach: 11 pages!

|

|

|

|

Post by Entendance on Oct 27, 2017 4:15:24 GMT -5

A Celebration Of The Greatest Act Of Financial Alchemy (Ever)

"The Swiss National Bank (SNB) has pulled off the greatest act of alchemy by printing copious amounts of Swiss francs (CHF) and turning the currency into real corporate assets. The SNB has grown its balance sheet to CHF800 billion from CHF500 billion in 2015, 85 percent of which is foreign exchange holdings in various forms. As the SNB struggled to weaken the franc to prevent the ultimate safe-haven currency from strengthening and putting the Swiss economy into a DEFLATIONARY SPIRAL. The Swiss experiment began January 15, 2015 as the SNB officially removed the EUR/CHF PEG, which it was attempting to HOLD. Yet the market kept buying the franc despite the SNB’s efforts (the PEG had a 1.20 floor).

The day the SNB pulled the plug the EUR/CHF cross dropped to 0.8500 all the way from 1.2015. Yep, you’re reading that right. The Swiss franc appreciated almost 33% in one day. (If you go back to Notes From Underground in December 2014/early January 2015 you will see that I predicted the PEG breaking since I was monitoring the SNB’s massive currency intervention and yet they couldn’t get it off the 1.20 floor.)

Regardless, the critical point for today is that the EUR/CHF has recently rallied 8% since June, even as the SNB has slowed its intervention. Somebody has been selling Swiss francs versus the euro. I don’t know who, what or why but this provides the SNB the greatest opportunity to unwind the greatest act financial engineering. Ever. The EUR/CHF is approaching the previous PEG FLOOR and as the U.S. embarks upon QT the SNB will also have to unwind this massive stimulus. For the record, the entire range for the 33 months was made on that single day in January 2015. Amazing. I am advising the SNB President Thomas Jordan to begin purchasing SWISS FRANCS and to begin selling its massive portfolio of global equities that it has purchased. The SNB owns shares of stock in more than 4,000 different stocks, including 2% of Apple, all bought with newly printed francs.

The recent rally in BITCOIN pales in comparison to the wealth created by the Swiss printing presses. Thomas Jordan, the world does not often provide such an opportunity to unwind a Frankensteinian experiment without suffering severe damages. The Swiss economy has held up well and price inflation is nil. The world’s other central banks will not be given such an opportunity. CARPE DIEM! How the world’s equity and bond markets will react to any effort by the SNB to unwind is a great unknown but let the experiment begin." Here the comments

The Entendance Beach & Switzerland:***2 PAGES

|

|

|

|

Post by Entendance on Apr 17, 2018 1:17:46 GMT -5

|

|

|

|

Post by theunderdog on May 20, 2018 3:57:05 GMT -5

June 13, 2018***Much of bitcoin's 2017 boom was market manipulation, researcher says June 13, 2018***Much of bitcoin's 2017 boom was market manipulation, researcher says

• New research says at least half of the 2017 rise in bitcoin prices was due to coordinated price manipulation using another cryptocurrency called tether.

• The 66-page paper says that tether was used to buy bitcoin at key moments when it was declining, which helped "stabilize and manipulate" the cryptocurrency's price.

• "In general I research things that are potentially illegal, and there's a lot of rumors surrounding potential questionable activity in cryptocurrencies," says University of Texas finance professor John Griffin, who has a decade-long track record of flagging fraud in financial markets.

***The Hustlers Fueling Cryptocurrency’s Marketing Machine

H/T Tom from Florida ("opposed to gold/silver which is coordinated selling...?BUT that's a conspiracy...")

"...Central banksters and politicians will not voluntarily change a system that benefits them. Tax cuts, more spending, out-of-control transfer payments, entitlements, wars, Big Pharma, bankers, and military contractors will make certain that spending, debt and devaluation increase..." ***The Stairway To Heaven

If they used crypto, they'd have no history?...LOL

"...Scientists can finally track the civilization’s economic booms and recessions—thanks to the exhaust of its massive coin-making operation, preserved for centuries in Greenland’s ice sheet....

...Lead pollutants have become enormously important because they give us information that we don’t get from literary sources. The one chart that’s there—I can already see that chart being produced in 50 articles over the next 10 years,” said Bernard about the above graph. “It’s great stuff.”

Lead emissions are not a perfect record of Roman prosperity, however, because scholars still don’t know how Rome thought about its economy. Coins were clearly important: At the height of the Roman Empire, coins were so standardized that the same money could theoretically be used to buy goods, services, and slaves across modern-day Syria, Spain, Italy, and Turkey.

“The size of this integrated monetary zone is unparalleled,” said Bernard. “And the volume of coinage seems larger than any time before or afterward—it really shows the integration of the Roman economy and the level of trade that was going on.”

Yet for all these coins, it remains unclear how Rome managed its money in a modern sense. “What we’d love to have is a document that says Rome had a state monetary policy,” said Bernard. But none have ever been found. So scholars have argued about whether Roman leaders ignored liquidity or inflation, simply ordering a new round of coins whenever the government faced a large expense; or whether leaders managed money more strategically. Nero’s order to debase the currency in 64 a.d. suggests that the Empire, eventually, did see some value in increasing the amount of money in circulation..." ***Ancient Rome’s Collapse Is Written Into Arctic Ice H/T Tom from Florida

The Updated War On Cash is here

|

|

|

|

Post by Entendance on May 26, 2018 7:44:08 GMT -5

"...In ancient Greece in the fifth century, Athens the rising power, had challenged the ruling power Sparta, and went to war against one another on the fear of the rise of the other. And almost a century ago, Germany, the rising power and Britain the ruling power started World War I following the ancient example of Sparta and Athens. The war to end all wars ended four years later with Europe in ruins, the German Kaiser gone and England similarly losing a good part of its economic strength. Then two decades later, the Second World War ended with the defeat of rising axis powers Germany and Japan by the allies, led by America, the ruling power. Today Professor Allison’s, “Destined For War: Can America and China escape Thucydides”, raises the point that American fears are not about steel and aluminum but that the roots for China’s rising strength are due to the technological revolution. China has already overtaken the US here. Amid the deepening economic rivalery between China and the US, the parallels with previous periods are hard to avoid. Noteworthy is that in those instances where there was no war, there was instead a painful adjustment of attitudes and actions.

Dominoes of Destabilization

As the Fed’s quantitative tightening intensifies, the financial system will contract further raising alarms over the $164 trillion of debt held by the US, Japan and China. Inflation long feared to be dormant has picked up as the sanctions have affected everything from aluminum to oil. And, ominously the benchmark 10 year Treasury yield continues to breach levels not seen in seven years, indicating rising inflation expectations and stormy times ahead.

A decade after the global financial crisis, the world led by the United States has loaded up on debt again. In 2009, when President Obama took office, the national debt was $7 trillion. The non-partisan Congressional Budget Office estimates that debt at $17 trillion and will top $20 trillion in a couple of years. America has run deficits for years, flooding the world with cheap dollars. It is America’s Achilles heel.

Mr. Trump’s stimulus package of tax cuts will boost the fiscal deficit and deepen the trade deficit, as Americans spend more, undermining Trump’s efforts to eliminate the trade balance. Ironically, America’s large debt load will make it more dependant upon China, the very country that he is bashing. America’s finances are in shambles. In truth, China’s economy is more financially complementary than competing directly with the US economy. Only four nations have a higher debt to GDP ratio than the United States; Greece, Italy, Portugal and Japan. Trump’s tax cut will cost $5.5 trillion in lost revenues and add over $1 trillion to the deficit over the next decade, deepening the hole in America’s debt to GDP currently over 100 percent..." ***Recommendations PDF

More here

***Goodbye Mario, Goodbye Euro ***Goodbye Mario, Goodbye Euro

***This is the End of the Euro H/T our member theunderdog |

|

|

|

Post by Entendance on Jun 8, 2018 4:24:26 GMT -5

"Every day, close to $5 trillion of currency gets exchanged on global markets.

It’s a market that’s running continuously for 24 hours per weekday around the world – and transactions can happen using different mechanisms, such as spot transactions, outright forwards, foreign exchange swaps, currency swaps, or the use of other types of options.

But what fuels changes in this extremely liquid and busy market, and why are the exchange rates between countries constantly in flux?"

The central bank system is the greatest scam ever perpetrated on an ignorant public. The eternal enemy of every central bank is... Gold. - Richard Russell

***Gold Silver & Forex

|

|

|

|

Post by Entendance on Jul 2, 2018 9:35:25 GMT -5

|

|

|

|

Post by Entendance on Aug 8, 2018 10:27:29 GMT -5

"...Owning physical gold for wealth protection purposes is the best preserved secret in the West. In this part of the world, virtually nobody holds gold. At the same time, the wise people in the East continue to buy all the gold that is produced annually. China, India, Iran, Turkey, Russia and many more Eastern nations understand history and economics. That is why they are accumulating major gold reserves at these levels.

If you understand the 5,000 year significance of gold as the only surviving money in history, you should follow the example of the East." ***INSURE YOUR WEALTH OR LOSE IT ALL

Alasdair Macleod, Ivan Bebek and Michael Oliver are this week’s guests. History tells us that an ounce of gold has retained 100% of its purchasing power since the Roman Republic. But what price of gold in US dollars should we expect when the Fed responds to the next financial crisis by creating exponentially more dollars out of thin air than the trillions of fraudulent money it created in response to the past financial crisis? Alasdair Macleod will opine on that topic as well as why another financial crisis is inevitable. And he will provide some ideas about how you might protect yourself and your loved ones. Ivan Bebek, whose Auryn Resources has several gold targets in North America that are being explored this summer, will update us on their progress, and Michael Oliver will join us to update us on his latest views on gold and other key markets. ***Valuing Gold In A World Awash With Dollars

|

|

|

|

Post by Entendance on Aug 23, 2018 5:20:37 GMT -5

"The greatest tool at the disposal of globalists is the use of false paradigms to manipulate public perception and thus public action. The masses are led to believe that at the highest levels of geopolitical and financial power there is such a thing as “sides.” This is utter nonsense when we examine the facts at hand.

We are told the-powers-that-be are divided by “Left” and “Right” politics, yet both sides actually support the same exact policy actions when it comes to the most important issues of the day and only seem to differ in terms of rhetoric, which is meaningless and cosmetic anyway. That is to say, it's nothing but Kabuki theater.

We are told that corporate power must be balanced by government power and that government power must be balanced by “free markets,” when in reality corporations are chartered and protected by governments and free markets simply don't exist in today’s economy. In the case of social media “censorship,” we are told that the solution is to use government power to enforce "fairness" instead of simply launching our own alternative platforms. Yet, social media corporations exist in the form of monopolies exactly because of government power and intervention in business. The abuses of one “side” are being used to push us into the arms of the other side, which is just as abusive.

In terms of geopolitics, we are told that national powers stand “at cross-purposes;” that they have different interests and different goals, which has led to things like “trade wars” and sometimes shooting wars. Yet, when we look at the people actually pulling the strings in most of these countries, we find the same names and institutions. Whether you are in America, Russia China, the EU, etc., globalist think tanks and international banks are everywhere, and the leaders in all of these countries call for MORE power for such institutions, not less.

These wars, no matter what form they take, are a circus for the public. They are engineered to create controlled chaos and manageable fear. They are a means to influence us towards a particular end, and that end, in most cases, is more social and economic influence in the hands of a select few. In each instance, people are being convinced to believe that the world is being divided when it is actually being centralized.

The key to any magic show is to get the audience to participate in the lie; to get them to focus on the distracting hand, to assume that what they are seeing is actually what is really happening - to suspend their skepticism.

Make no mistake, what we are seeing in geopolitics today is indeed a magic show. The false East/West paradigm is as powerful if not more powerful than the false Left/Right paradigm. For some reason, the human mind is more comfortable believing in the ideas of division and chaos, and it often turns its nose up indignantly at the notion of “conspiracy.” But conspiracies and conspirators can be demonstrated as a fact of history. Organization among elitists is predictable.

Globalists themselves are drawn together by an ideology. They have no common nation, they have no common political orientation, they have no common cultural background or religion, they herald from the East just as they herald from the West. They have no true loyalty to any mainstream cause or social movement.

What do they have in common? They seem to exhibit many of the traits of high level narcissistic sociopaths, who make up a very small percentage of the human population. These people are predators, or to be more specific, they are parasites. They see themselves as naturally superior to others, but they often work together if there is the promise of mutual benefit.

The closest thing I can relate narcissistic sociopaths (and thus globalists) to in mythology would be vampires..."

Thursday, 23 August 2018 In The New Multipolar World The Globalists Still Control All The Players

Exposing hypocrisy

"...After studying the behavior of globalists and their organizations for quite some time, I have noticed that their psychological patterns tend to match with a narrow band of people that are best described as “criminally insane.” More accurately, globalists behave like high-functioning narcissistic ***sociopaths and psychopaths. But what are the traits of such people? Let’s take a look at some of them… False Sense Of Superiority – Self-Aggrandizement... Manipulation And Coercion... Lack Of Empathy For Others...

Desperate Need For Adoration..." ***Globalists Are Psychologically Broken Non-Humans

Con #1: Globalism Is About “Free Markets” Con #2: Globalism Is About A “Multipolar World” Con #3: Nationalism Is The Source Of War, And Globalism Will End It Con #4: Globalism Is Natural And Inevitable... ***How The Globalism Con Game Leads To A New World Order

A Spiraling Problem:***Plastics

The Entendance Beach:*** All About Globalists ***All About Globalism ***All About Globalization

EU, €, ITALIA, VATICAN...It's a big club, and we aren't in it. ***Grasping For Salvation: Italia

***Italiani -Ormai la salvezza è solo individuale ***Bota na conta do Papa

God has great rewards for those who remain faithul

"We are hard pressed on every side, but not crushed; perplexed, but not in despair; persecuted, but not abandoned; struck down, but not destroyed." -2 Corinthians 4:8-9

|

|

|

|

Post by Entendance on Sept 13, 2018 4:58:04 GMT -5

"...For now, educating the general liberty movement and the people around us on these issues remains the best method for throwing a monkey wrench into the globalist machine. Countering their psyops should be our pinnacle task, and falling into the narrative traps they create must be avoided. They have spent a considerable amount of thought and energy trying to co-opt our efforts, and that should give everyone pause. For if we were not a true threat, why would they bother with us?" Understanding The Tactics Of Subversive Globalism

Bijoutier Island, Outer Islands, Seychelles Con #1: Globalism Is About “Free Markets”

Con #2: Globalism Is About A “Multipolar World”

Con #3: Nationalism Is The Source Of War, And Globalism Will End It

Con #4: Globalism Is Natural And Inevitable... HERE

|

|

|

|

Post by Entendance on Oct 5, 2018 4:12:56 GMT -5

"...Major social media companies are cooperating wholeheartedly with mass surveillance efforts as they share personal data with governments around the world regularly...

...This is why mass surveillance is evil, regardless of whether someone is breaking the laws or not. It gives government the power to dictate and mold behavior by inspiring self-censorship rather than holding people directly at gun point. It is tyranny enforced in a less obvious way; a prison in which the prisoners maintain the locks and the chains and the bars. Individuals do not dare do anything outside of collective norms for fear that it could be interpreted as socially negative. Punishment might include loss of access to the economy itself, and when most people are living from paycheck to paycheck, this could mean death." How Globalists Plan To Use Technology And Poverty To Enslave The Masses |

|

|

|

Post by Entendance on Oct 11, 2018 3:20:29 GMT -5

"Since 2013 China continues to absorb physical gold from the rest of the world at a staggering pace. Worth noting is that gold imported into the Chinese domestic market is not allowed to be returned in the foreseeable future.

Because ownership and the disposition of these volumes of gold likely will be of great importance next time around the international monetary system is under stress, it’s well worth tracking China’s progress of imports – especially because the mainstream media and most consultancy firms are in denial of these events." - Koos Jansen, BullionStar

The Entendance Beach & China: 6 pages

|

|

|

|

Post by Entendance on Oct 24, 2018 11:47:00 GMT -5

"During the month of September, the Swiss economy, home to the world's largest gold refineries, imported 177.8 tonnes of non-monetary gold and exported 119.4 tonnes of non-monetary gold. This is according to recently released Swiss trade statistics.

Non-monetary gold is any gold that is not central bank gold. Non-monetary gold shipments between countries shows up in trade statistics. Central bank gold shipments between countries do not show up in trade statistics, simply because the world's central banks like to keep their gold shipments and gold trades totally opaque so as to downplay the global monetary importance of gold.

Of the 177.8 tonnes of gold imported into Switzerland from abroad during September, 91.8 tonnes (51%) came from the London gold market which is seeing a heavy drain right now, with a further 33.1 tonnes being imported from the USA (18.7%). September's gold imports into Switzerland were the 2nd highest monthly gold import total on record for the last 20 month's following August's 182 tonne inflow.

On the export side out of Switzerland, of the 119.4 tonnes of gold the Swiss sent out around the world during September, 37.5 tonnes was sent to mainland China, 28.9 tonnes to Hong Kong, and a further 16.6 tonnes to India. Together, these three countries imported a huge 83 tonnes of gold from Switzerland (66.5% of September's total). In fourth place was Thailand which imported 7.7 tonnes from the Swiss last month. Interestingly, Germany and France took in a combined 10 tonnes of gold from Switzerland last month also.

September's gold flows in and out of Switzerland follow the classic pattern all too familiar these days of huge amounts of gold flowing from the West to the East, specifically to Asia where the importance of physical gold is fully appreciated." -Ronan Manly

|

|

|

|

Post by Entendance on Jan 18, 2019 5:07:14 GMT -5

Felix, qui potuit rerum cognoscere causas -Publius Vergilius Maro Fortunate who was able to know the causes of things Dichoso aquel que puede conocer las causas de las cosas Heureux qui a pu pénétrer la raison des choses Glücklich, wer den Dingen auf den Grund sehen konnte Fortunato colui che ha potuto conoscere le cause delle cose

"In particular, over a protracted period of good times, capitalist economies tend to move from a financial structure dominated by hedge finance units to a structure in which there is large weight to units engaged in speculative and Ponzi finance." - Hyman Minsky, The Financial Instability Hypothesis

Twenty-five years ago, when most economists were extolling the virtues of financial deregulation and innovation, a maverick named Hyman P. Minsky maintained a more negative view of Wall Street; in fact, he noted that bankers, traders, and other financiers periodically played the role of arsonists, setting the entire economy ablaze. Wall Street encouraged businesses and individuals to take on too much risk, he believed, generating ruinous boom-and-bust cycles. The only way to break this pattern was for the government to step in and regulate the moneymen.

Many of Minsky’s colleagues regarded his 'financial-instability hypothesis,' which he first developed in the nineteen-sixties, as radical, if not crackpot. Today, with the subprime crisis seemingly on the verge of metamorphosing into a recession, references to it have become commonplace on financial web sites and in the reports of Wall Street analysts. Minsky’s hypothesis is well worth revisiting." - John Cassidy, The Minsky Moment, The New Yorker, 4 February 2008.

"The period of financial distress is a gradual decline after the peak of a speculative bubble that precedes the final and massive panic and crash, driven by the insiders having exited but the sucker outsiders hanging on hoping for a revival, but finally giving up in the final collapse." - Charles Kindelberger, Manias, Panics, and Crashes: A History of Financial Crises

"The sense of responsibility in the financial community for the community as a whole is not small. It is nearly nil. Perhaps this is inherent. In a community where the primary concern is making money, one of the necessary rules is to live and let live. To speak out against madness may be to ruin those who have succumbed to it. So the wise in Wall Street [and in the professional and credentialed class] are nearly always silent." - John Kenneth Galbraith, The Great Crash of 1929

"People who lost jobs — and those are in the millions in 2008, 2009, and 2010 — have now gotten jobs, that’s true, but the jobs they’ve gotten have lower wages, have less security and fewer benefits than the ones they lost, which means they can’t spend money like we might have hoped they would if they had got the kinds of jobs they lost, but they didn’t...

The big tax cut last December, 2017, gave an awful lot of money to the richest Americans and to big corporations. They had no incentive to plow that into their businesses, because Americans can’t buy any more than they already do. They’re up to their necks in debt and all the rest.

So what they did was to take the money they saved from taxes and speculate in the stock market, driving up the shares and so forth. Naive people thought that was a sign of economic health. It wasn’t. It was money bidding up the price of stock until the underlying economy was so far out of whack with the stock market that now everybody realizes that and there’s a rush to get out and boom, the thing goes down." -Richard Wolff: The Next Economic Crisis Is Coming

Bubbles most often resolve their imbalances irresponsibly and jarringly, with a correction that is sharp and destructive. It is often triggered by some seemingly trivial event, especially if its predatory mispricing of risk has been allowed to fester for an extended period of time.. How can this be?

Credit cycles explain bubbles in modern finance, but the elite protect themselves and their banks from the effects. Hence, only the middle and working class loses. And this has been the case for many years now. Hence the growing unrest abroad, and the decisions by the electorate at home that seem to puzzle and provoke the very comfortable 'credentialed' class.

The reason for this is quite easy to understand. Those who benefit the most from the bubble both actively and passively help sustain it. They are reluctant to surrender any potion of their enormous advantage and personal gains, even if it might be better for them in the long term.

They do not consider the damage that may be done to the underlying social fabric that supports and protects their wealth. Contrary to all of the familiar assumptions, they are not acting rationally or prudently, even for themselves. Their focus is short term and short-sighted. They are drunk on their own success.

The interpreters and creators of the prevailing narrative are themselves beneficiaries of the bubble economy, and will go to great lengths to misdirect the public discussion from any root causes, and often from its very existence. They will distract the public with inflammatory issues, economic fear, stage-managed spectacles, and manufactured complexity. And finally, in the extremes of their shamelessness, they will seek to blame the victims for their lack of sophistication and the government for its efforts to restrain their predatory frauds.

This enables the cycle of boom and bust to repeat and worsen beyond all reasonable expectations.

The lesson from history is that a system based on the ascendant greed of powerful insiders is rarely rational and self-correcting, and is often spectacularly self-destructive. And those with the most power, in their wonderful self-delusion, simply do not care until it is too late. They are blinded by the moment, in their competition with each other, and the insatiable nature of greed itself. 'Enough' is not in their reckoning.

To this end governments are fashioned, and people organize themselves from the damage that can be done to society as a whole by a few. Unfortunately people forget, and it seems that at least once every generation or so the madness slips loose its restraints, and this sad lesson from history repeats.

And so once again the world must face its rendezvous with destiny. -Jesse

"The first rule of the Dunning-Kruger club is you don’t know you’re a member of the Dunning-Kruger club"

Euro-Gold Ratio Is A Canary In The Monetary Coalmine |

|

|

|

Post by Entendance on Jan 27, 2019 5:00:43 GMT -5

"...All in all, this effect causes other problems which we probably wouldn’t have without central banks. And as usual, government causes problems which wouldn’t happen without its interference." The Cantillon Effect and Populism

H/T Tom from Florida

income chart~cantillon effect...went parabolic like debt!

"The message is straightforward. Only a few decades ago, the middle class and the poor weren’t just receiving healthy raises. Their take-home pay was rising even more rapidly, in percentage terms, than the pay of the rich.

The post-inflation, after-tax raises that were typical for the middle class during the pre-1980 period — about 2 percent a year — translate into rapid gains in living standards. At that rate, a household’s income almost doubles every 34 years. (The economists used 34-year windows to stay consistent with their original chart, which covered 1980 through 2014.)

In recent decades, by contrast, only very affluent families — those in roughly the top 1/40th of the income distribution — have received such large raises. Yes, the upper-middle class has done better than the middle class or the poor, but the huge gaps are between the super-rich and everyone else..."

***Our Broken Economy, in One Simple Chart*** H/T Tom from Florida

***Dutch Sandwich Updated

|

|

|

|

Post by Entendance on Mar 2, 2019 7:12:26 GMT -5

|

|

|

|

Post by Entendance on Mar 28, 2019 5:10:09 GMT -5

|

|

|

|

Post by Entendance on Apr 14, 2019 4:55:57 GMT -5

|

|

|

|

Post by Entendance on Apr 29, 2019 18:03:11 GMT -5

todays fleck

Welcome to Centrally (Mis)planned Capitalism

04-29-2019

"It's time to rage against the unelected idiots who have taken over the world, literally. By that I mean the central bankers who are, in fact, central planners (think the Politburo). They have "planned" to achieve certain outcomes, such as just the right amount of inflation, in the current case 2% (regardless of the fact that inflation rate is calculated in a way that suppresses actual price hikes), and they want "full employment." Their attempt to achieve these targets has literally warped everything.

From Level Playing Field to Insane Playground In the old days central bankers worried about "sound money." That was their only goal. It seems quaint, but it worked drastically better than what they're doing now (which has been an epic failure). They made sure the money was sound, and capitalism took care of itself, here in the U.S. and other places.

Now, with their ridiculous money printing and negative interest rates, they have created a situation where we have an immense bifurcation of wealth and capitalism itself is being questioned, though we're not really experiencing bona fide capitalism any more. Instead we have a bastardized version of cronyism that I call "centrally planned capitalism," which has a lot of the same problems that communism and socialism do.

By that I mean there is an elite, moneyed class with a tremendous concentration of wealth and power, while the vast majority of people have practically nothing, just as those in the inner circles of power in socialist and communist regimes had everything they wanted (at least compared to the average person), while everyone else struggled.

Central bankers have in effect made money worthless and caused bond markets to be priced nonsensically. Their policies have gotten us to a point where we have civil strife here in the U.S. and other countries as well. Socialism is rearing its ugly head because people are so angry at the inequality and they are blaming capitalism.

The point of my rant, however, is to lay blame where it belongs, that being with these unelected financial policymakers who over the course of the last 25 years have slowly ratcheted up the takeover of everything. Greenspan was an idiot, he created a bubble, he and Bernanke tried to bail that out with easy money that caused the housing and credit bubble. That nearly wiped out the financial system, partially because the Fed didn't regulate the investment banks like they were supposed to, after Greenspan helped get Glass-Steagall abolished.

Out of Left, and Right, Field The policies instituted here and elsewhere from roughly 2010 to 2012, and which are in place now, have created bond markets that make no sense, equity markets that no longer function as such, as they're basically just playgrounds for algorithms and those who believe in the central banks. Meanwhile the enormous frustration of the poor and middle-class people has given us politicians like Donald Trump and Ocasio-Cortez, just to pick two extreme examples.

In sum, capitalism hasn't failed, the central bankers have failed. They have hijacked capitalism to the detriment of nearly everyone and they are going to continue to do what they do until the whole thing blows up. When that is, I don't know, but eventually they will be seen as the reckless and irresponsible entities that they are.

I'm not saying individuals at the central banks set out to be, or are, inherently evil. Rather, for some reason, they are too blind to see the problems they have created and they just continue to make them worse. I hope sooner rather than later enough markets blow up in a way that their credibility is finally called into question.

I suspect will have more to say about this topic prospectively as I've been giving it more thought after seeing stories about what's wrong with capitalism, along with the other looney headlines about the "ending of inflation," "can this bull market go on forever," and similarly crazy ideas that have come about because we've been living in the twilight zone for the last decade, thanks to the unelected fools I've just ranted about.

Right ON Time Turning to the action, the indices were modestly higher through midday, as bullish bravado basically trumps all else. Just to show how brazen and careless people are, ON Semiconductor decided to pre-release its earnings on Saturday (something I have never seen before). It was able to make the (previously lowered) number but had to lower guidance (it is another chip maker that has been discussing a second-half recovery without any data).

Last quarter ON wanted everyone to believe business was about to get better, which it didn't. Based on its end markets, it's not likely there will be a second-half boom. However, despite the Saturday preannouncement, early on the stock rallied about 4% today before reality set in and caused it to fall 1%.

I know this is just one example, but I used to think it was bad when occasionally a company would report news late Friday night, and I've only seen that a couple of times. Larry Ellison comes to mind, of course, although that was recently trumped by Facebook's filing after markets closed on Good Friday.

Losing Their Minds It seems to me that psychology is even more disconnected now than it was in late 1999 to 2000. The only time I've seen such incredibly rabid madness and disregard of the things that matter to companies was 1989 in Tokyo, a scene I was pretty sure I would never see repeated. For the most part, valuations aren't that absurd, but the mindset is just about as brazen. Back then, in order to understand the market you needed to be a "shinseiji," literally a newborn human, because if you had prior experience you couldn't make any sense of it (or profit). Not that any of that matters, because the only thing that does is when something cracks the current psychology and a freefall ensues on the downside, but that is not today's business."

|

|

|

|

Post by Entendance on May 11, 2019 4:59:33 GMT -5

|

|

|

|

Post by Entendance on May 18, 2019 3:31:29 GMT -5

|

|

|

|

Post by Entendance on Jun 8, 2019 2:21:11 GMT -5

|

|

|

|

Post by Entendance on Jun 14, 2019 11:58:14 GMT -5

|

|

|

|

Post by Entendance on Jun 21, 2019 17:17:41 GMT -5

The Brexit Party is here to stay

Theresa May said over 100 times we would leave on March 29th. We need action, not more empty words from the Conservative party. -Nigel Farage Nigel Farage Brexit |

|

|

|

Post by Entendance on Aug 31, 2019 17:59:59 GMT -5

|

|

|

|

Post by Entendance on Dec 4, 2019 17:21:58 GMT -5

Felix qui potuit rerum cognoscere causas

Debt Bubble to End All Bubbles |

|

|

|

Post by Entendance on Dec 25, 2019 12:44:32 GMT -5

Germans lining up to buy gold to evade negative interest rates. Correction: *Smart Germans*. The other Germans are donating their life savings to climate hoax and zombie EU banks.

Warteschlange Degussa_gold in Köln. Vertrauen in den Euro und unsere Politik muss enorm sein. |

|