|

|

Post by Entendance on Jun 20, 2024 11:24:15 GMT -5

📉Janet Yellen, the BRICS & Gold sales woman of the year😂

|

|

|

|

Post by Entendance on Jul 5, 2024 14:32:27 GMT -5

|

|

|

|

Post by Entendance on Jul 15, 2024 10:25:54 GMT -5

|

|

|

|

Post by Entendance on Jul 30, 2024 6:29:21 GMT -5

An important remark:

There is no such thing as the Palestinian problem. There is no problem between Jews and Muslims.

There is an Israeli problem, the problem is Israel's existence.

Problems started after Israel was established, especially the thieving zionists who came from Europe and usurped the lands of the Palestinian people even though they had no right to do so, are the biggest obstacles to peace.

Supporting Israel, the occupying land and identity thief, is the same as being hostile to Judaism.

Every support given to Zionism and Israel increases Antisemitism.

We call out to the leaders and politicians of all states. Openly supporting Israel is anti-Semitism.

Whoever supports Israel and Zionism should know that this is openly anti-Semitic.

Supporting Zionist Nazis is anti-Semitic.

Supporting the Nazi state of Israel is clearly supporting genocide.

We have absolute no allegiance to the State of Israel.

Read this historical letter!

The Grand Rabbi Of Satmar reiterates the rock solid Jewish values of undivided loyalty to our home country.

We should not suffer from the wrong conception the State of Israel casts upon us.

|

|

|

|

Post by Entendance on Aug 7, 2024 2:36:41 GMT -5

'Conscience. Action. Revolution. Africa in 2024 is the real protagonist of multipolar change. The Global South now has an increasingly strong leadership and has no intention of stopping...'

Meanwhile...Repetita Iuvant:

|

|

|

|

Post by Entendance on Aug 8, 2024 6:38:27 GMT -5

Vae Victis! Woe to the conquered!

Truth stands the test of time; lies are soon exposed. -Proverbs 11:17

What is crooked cannot be straightened; what is lacking cannot be counted. -Ecclesiastes 1:15

Ciò che è storto non si può raddrizzare e quel che manca non si può contare.

Ecclesiastes tells us: 'The thing that hath been, it is that which shall be; and that which is done is that which shall be done: and there is no new thing under the sun.' Myrmikan Research applies this principle to the subject of credit bubbles.

The ancient Greeks discovered that debt could magnify wealth. The debtor feels richer from the use of the borrowed property, while the lender feels richer from the compounding interest yielded by his claim. Both indulge in consumption more freely. As long as the accumulating claims remain contingent, the bubble grows. But, eventually, someone asks to be paid, and the expanding claims on wealth must be reconciled to tangible wealth, much of which has been consumed.

The first recorded credit bubble popped in 594 B.C. Athens. Threatened with a civil war of creditor versus debtor, the Athenian ruler Solon pulled down the mortgage stones to free the debtors and devalued the drachma by 27% to relieve the bankers. Every credit collapse since – from the Panic of A.D. 33 to John Law’s Mississippi Bubble to the Great Depression and many others besides – has followed Solon’s template of debt default and currency devaluation.

The natural remedies, if the credit-sickness be far advanced, will always include a redistribution of wealth: the further it is postponed, the more violent it will be. Every collapse of a credit expansion is a bankruptcy, and the magnitude of the bankruptcy will be proportionate to the magnitude of the debt debauch. In bankruptcies, creditors must suffer. - Freeman Tilden, 1936

And against what is currency and debt devalued? Carl Menger, founder of the Austrian School of economics, was the first to explain that money is liquidity and that Gold is the most liquid asset. Thus, Gold has served as the reference point of value since the origins of money and is that against which currency must be devalued to relieve debts. Paper promises depreciate.

The faith is lost. All with one impulse people rush to seize the gold itself as the only reality left—not only people as individuals; banks, also, and the great banking systems and governments do it, in competition with people. This is the financial crisis. - Garet Garrett, 1932

Myrmikan Research chronicles the collapse of the current, global credit bubble – the largest and broadest in history – analyzing current events from the perspective of Austrian economics and placing them in historical context. January 14, 2019

|

|

|

|

Post by Entendance on Aug 22, 2024 6:24:37 GMT -5

New Russian Residency Law Helps Westerners Escape

|

|

|

|

Post by Entendance on Aug 26, 2024 11:32:47 GMT -5

Vae Victis

|

|

|

|

Post by Entendance on Sept 12, 2024 3:25:23 GMT -5

|

|

|

|

Post by Entendance on Oct 8, 2024 12:30:06 GMT -5

🚨🇾🇪🇵🇸 EPISODE 01: ANSAR ALLAH INTERVIEW

|

|

|

|

Post by Entendance on Oct 12, 2024 10:46:38 GMT -5

Yemen’s military response to Israeli aggression, including missile strikes and imposing a blockade in the Red Sea, delivers a powerful message in the only language Tel Aviv understands, putting on full display Sanaa’s unwavering support for the Palestinian cause... Yemen’s military response to Israeli aggression, including missile strikes and imposing a blockade in the Red Sea, delivers a powerful message in the only language Tel Aviv understands, putting on full display Sanaa’s unwavering support for the Palestinian cause...

|

|

|

|

Post by Entendance on Oct 15, 2024 9:56:47 GMT -5

|

|

|

|

Post by Entendance on Nov 13, 2024 18:01:58 GMT -5

|

|

|

|

Post by Entendance on Nov 17, 2024 7:50:41 GMT -5

November 17, 2024

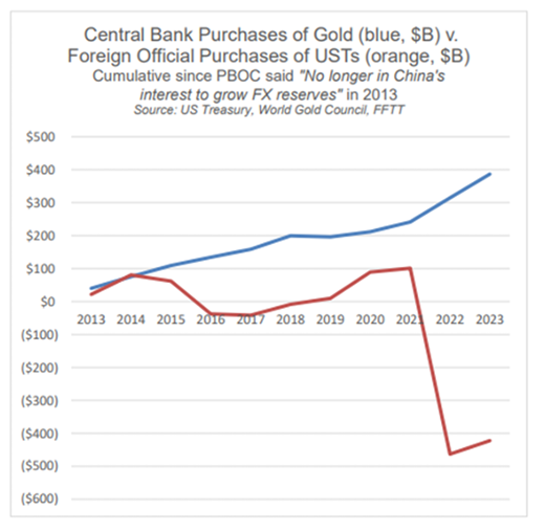

'...The Golden Bazooka Option?

There is, of course, another Bazooka option, one which Gromen and others are slowly raising and which we, of course, cannot ignore.

That is, Trump could have the US Treasury Dept instruct the Fed to officially (and overnight) revalue Uncle Sam’s gold supply (whatever that figure truly is?).

Based upon official US gold data, every $4,000/oz revaluation in US gold would mean an additional $1T in new liquidity for the Treasury General Account, making it that much easier to pay down larger chunks of Uncle Sam’s $35.8T public bar tab.

Be Careful What You Ask For?

Such a move, tempting on its face, is hardly without dramatic ramifications for the dollar’s world reserve status and a staggering global reshuffling of economic power and influence.

After all, under such a revaluation option, the nation who holds the most gold wins, and it’s still unclear to many just who owns what and the most…

Toward this end, the national gold holdings reported by World Gold Council are likely not even close to accurate, so any US gold “revaluation” may give more power to the East than West?

The net-stacking of physical gold by eastern central banks, for example, suggests that such a revaluation possibility has been tactically and strategically on their minds, despite being almost completely off the headlines of a corporate owned Western media....'

|

|