|

|

Post by Entendance on Jul 18, 2023 2:45:59 GMT -5

“Imagine that? We have said this for years and been called “conspiracy theorists” for even having the thought. ALL markets are rigged and it starts with Gold and Silver as they are direct competitors to the world’s fiat currencies. It all starts with suppression of Gold’s (and Silver) price so they can point at Gold and say “see, dollar good …Gold BAD!” As the global Ponzi is about to fail, these riggers are about to get the religious experience of their lives! Gold will again be seen as “money”, which will make high quality Gold and Silver bearing properties “banks”. The train is now leaving the station.

You either get on board now and take a ride to the greatest redistribution of wealth in human history, or…wallow with no purchasing power in the debt-based currency system as it bankrupts into a vortex that will take everything paper straight to hell! - Bill Holter

|

|

|

|

Post by Entendance on Jul 19, 2023 3:12:27 GMT -5

'...the use of BRICS gold as an international trade and transaction currency, would most likely have far-reaching consequences:

(1) It would presumably lead to a (sharp) increase in the demand for gold compared to current levels, with not only gold prices measured in US dollars, euros, etc. but also in the currencies of the BRICS countries increasing (substantially).

(2) Such an increase in the gold price would devalue the purchasing power of the official currencies—not only the US dollar but also the BRICS currencies—against the yellow metal. Also, the prices of goods in terms of the official fiat currencies would most likely skyrocket, debasing the purchasing power of presumably all existing fiat currencies.

(3) The BRICS countries would build up gold reserves to the extent that they run, or will run, trade surpluses. They would presumably be the winners of the “currency switch,” while the countries with trade deficits (first and foremost, the US) would lose out...'

|

|

|

|

Post by Entendance on Jul 20, 2023 10:51:06 GMT -5

'...All fiat currencies are threatened

Gold backing for the new trade currency is bound to create problems for BRICS national currencies, which may or may not be fully appreciated by individual BRICS nations. The solution for them is to secure their own currency values, either by setting their own gold standards or linking them to the new trade currency in some sort of currency board arrangement. While many of these nations have a history of currency mismanagement, theirs is essentially a confidence problem which can be resolved by turning their backs on the dollar-based fiat currency system.

All these governments have finances that can be balanced with a little fiscal discipline, because they don’t have the welfare burdens that the advanced economies have to contend with. The benefits to their economies of sound money and the low level of interest rates that comes with it are obvious, and social and economic progress can be expected to be as miraculous as those enjoyed in Britain under her nineteenth century gold standard.

But the introduction of a new trade currency backed by gold will undermine the major fiat currencies which have survived on Keynesian myths, which like those of the proto-Keynesian John Law are about to be terminally challenged. And the euro will have an additional problem arising from the ECB’s committee-designed structure.

Like other central banks the ECB not only reduced interest rates, in its case to unnaturally negative levels, but it paid top euro for government bonds as part of its “asset purchase programmes” — currency-debasing QE to the rest of us. Consequently, since the mark-to-market losses have wiped out its equity many times over, and also the equity of nearly all the national central banks which are the ECB’s shareholders, the whole euro system is technically bust — a situation which will worsen if Eurozone bond yields continue to rise. Furthermore, there are substantial imbalances in the TARGET2 settlement system between the euro system’s members which remain unresolved.

When a central bank has one shareholder such as its government, recapitalising it is relatively simple and can be done in a heartbeat. On its balance sheet the central bank creates a loan in favour of the shareholder, and instead of balancing the asset represented by the loan with a deposit liability, it enters the balancing item as equity. In many jurisdictions, this can be done and subsequently confirmed by the legislature. But the structure of the euro system requires multiple governments to agree to recapitalise their own central banks as well as the ECB. The recapitalisation of the entire system will be far from a fait accompli and almost certainly will become an embarrassingly public issue.

The ECB takes the view that it will hold the bonds on its balance sheet to maturity, so there is no need to mark to market and recapitalise the system. But that assumes monetary plain sailing for a considerable time and that interest rates will decline from current levels and stay down. Otherwise, the euro system will be called upon to rescue overleveraged commercial banks with mounting portfolio losses and bad debts.

But we can now see that if the new BRICS gold backed trade currency replaces the dollar and euro for potentially more than half the world’s trade measured by GDP on a PPP basis, it will lead to catastrophic falls in exchange rates for both the dollar and the euro valued in gold. Assuming that priced in gold commodities continue to be stable (which over time tends to be the case), then the implications for Eurozone states are that after the current dip inflation of prices will remain high and potentially rise even further due to the euro’s loss of purchasing power. Similarly, bond yields will rise above current levels, commercial banks will be destabilised, and the euro system’s hidden losses multiply.

This is why the future of the euro system and the fiat euro itself is at stake. Not only will the euro be on the wrong side of the return-to-gold-backing story, but its structure is an additional, fatal weakness.

Sterling has similar problems to the dollar. London being the centre of financial activities outside the US has led to substantial quantities of sterling accumulating in foreign hands. For now, the increase in interest rates and bond yields has led to the currency recovering against a weakening dollar by 24% since last September. But the increase in rates is causing serious difficulties for residential property, which combined with price inflation is squeezing consumers badly. The UK economy faces the early stages of a nasty credit squeeze, which is clearly evident in the chart below from the Bank of England’s website — the last data point being April.

The consequences for Gold

Apart from monetary stability, the raison d’être for BRICS adopting a gold-backed trade currency lies in its relationship with commodities. This is illustrated in the chart below, which is of oil priced in dollars and gold.

Oil priced in gold has been considerably more stable than priced in dollars, a fact also reflected in any non-seasonal commodity you care to name. For energy and commodity producers, the volatility of the dollar as a pricing medium plays havoc with the values upon which extraction costs are predicated. Additionally, pricing in dollars has depressed the pricing of oil in gold, which is currently half what it was in 1950. This will have been noticed by Russia, Iran, and Saudi Arabia.

Price stability also benefits manufacturers, who in their business calculations can be more certain over long-term cost assumptions. They also benefit from low level interest rate stability that comes with a gold standard, particularly when compared with the current increasing interest rate volatility under the fiat currency regime. Russia is a case in point: the central bank’s interest rate is 7.5%, and the 10-year government bond yields 11.5%, despite June’s consumer price inflation at 2.76%. If the rouble went on a gold standard, and as confidence in the arrangement becomes established the overnight rate is likely over time to drop below 3% and bond yields should decline to not much more.

This argument is sure to have also persuaded the Chinese and other manufacturing nations in the BRICS community that tying production costs to gold is beneficial, exploding the myths about fiat currency flexibility, which have only led to the weaponization of the fiat dollar by the US government.

The benefits of gold-backed currencies are clear. The problems arising from adopting gold standards principally affect the standing of fiat currencies reluctant to embrace gold. China’s exporters are bound to experience the purchasing power of dollars and euros declining, perhaps collapsing completely. This leads to higher prices for Chinese goods in all major fiat currencies. But by sanctioning a new BRICS gold backed currency, the Chinese are now going along with the less visible benefits of valuing export goods in gold, and along with Russia she now has good reasons to put the renminbi onto a gold standard as well.

In short, we are witnessing the end of the fiat currency era, which in pure form has existed since Bretton Woods was abandoned 52 years ago. Americans, Europeans, and the British will experience gold prices rising against their fiat currencies, possibly at an accelerating rate when foreigners start dumping their currencies in favour of gold. But it won’t be gold rising so much, as their fiat currencies failing, just like John Law’s livre.'

Jul 20, 2023 ·Alasdair Macleod

|

|

|

|

Post by Entendance on Jul 24, 2023 2:16:27 GMT -5

'Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.” 'Below we separate the hype from the sad reality of the USD in the face of a new “BRICS currency.”

Net conclusion: The real death of the USD will be domestic not foreign...

The Bell Has Been Tolling for Years

Don’t Bury the Dollar Just Yet

Needed Context for the “BRICS New Currency” Debate

The Trend Away from the USD Is Clear, But It’s Pace Is Not

The BRICS New Currency Is Very Real

China’s Motives Are Also Anti-Dollar

Other Reasons to Take the BRICS+ Currency Seriously

Why the BRICS New Currency Is No Immediate Threat to the USD

The BRICS New Currency: Many Operational Questions Still Open

Cohesion Among the Distrusting?

Basic Math

Geopolitical Considerations & the BRICS New Currency

The USD: Supremacy (Still) vs. Hegemony (Gone)

No Matter What: Gold Wins

The Dollar Will Die from Within, Not from Without

Matthew Piepenburg

July 24, 2023

While the five original BRICS states have their geopolitical differences, they are finding enormous common ground on the geoeconomic front as trade volumes surge and trade routes multiply.

|

|

|

|

Post by Entendance on Jul 27, 2023 3:29:38 GMT -5

Russia to Replace Ukrainian Grain at No Expense for African Countries – Putin

'Il nostro paese è in grado di sostituire il grano ucraino, sia su base commerciale che gratuita per i paesi più bisognosi dell'Africa. Nei prossimi mesi saremo pronti a fornire gratuitamente tra le 25 e le 50 mila tonnellate di grano a Burkina Faso, Zimbabwe, Mali, Somalia, Repubblica Centrafricana ed Eritrea', ha affermato Putin nel corso del forum Russia - Africa.

Il presidente russo ha inoltre promesso che anche le spese di spedizione dei prodotti saranno coperte da Mosca!

🇸🇨 🇧🇯 🇦🇴 🇨🇩 🇳🇦 🇹🇿 🇧🇫 🇬🇲 🇬🇼 🇬🇳 🇩🇯 🇰🇲 🇧🇮 🇲🇬 🇸🇴 🇹🇩 🇬🇶 🇿🇼 🇪🇹 🇸🇩 🇸🇸 🇪🇬 🇲🇱 🇿🇦 🇪🇷 🇨🇬 🇳🇬 🇨🇫 🇺🇬 🇩🇿 🇸🇳 🇬🇭 🇿🇲 🇷🇼 🇲🇿 🇨🇲 🇹🇬 🇲🇷 🇹🇳 🇸🇿 🇱🇾 🇲🇼 🇨🇮 🇬🇦 🇲🇦

|

|

|

|

Post by Entendance on Jul 30, 2023 11:47:22 GMT -5

Charting the Rise of BRICS vs. G7

Accumulating Gold: A strategic game-changer

|

|

|

|

Post by Entendance on Aug 3, 2023 2:52:08 GMT -5

Massive Russian And Chinese Gold Hoards Will Be Used To Back A Gold Currency

Russia’s gold

China’s gold

Why now is the time for rouble and renminbi gold standards

Global gold distribution

'...Not only are there clear advantages to the Russian and Chinese axis from supporting a new trade settlement and commodity purchasing gold-backed currency, but the rapidity of its introduction could take the world by surprise. There is now little doubt that the fiat currency regime based on the dollar has run its course, leaving multiple debt traps to be sprung in the western alliance and an outlook of stagflation or worse.

In other articles for Goldmoney, I have covered the various aspects of an existential crises facing the world’s fiat currency regime. These range from government debt traps, and the bank credit cycle turning down, to the ability of the major central banks to rescue failing commercial banks, given they themselves are in negative equity. The gross values of many derivatives should also be recorded on bank balance sheets, to properly reflect counterparty risks.

To these problems can be added a collapse of the entire bullion trading system, revolving around swaps and leases and frequent rehypothecations of bullion. When the music stops, the extent of the problem which has grown since the early 1980s will become known. The end of the fiat currency system, no doubt accelerated by a move to incorporate gold back into the Russian and Chinese financial systems is likely to be the trigger.

At the very least, if China and Russia’s grand project is to proceed, the renminbi and rouble must be protected from a fiat currency crisis. This is the moment for which the Chinese have been preparing since 1983, and the Russians more recently sparked by western sanctions. They at least have sufficient bullion available to cover their narrow money supply with ample margins and are the two largest nations by goldmine output. A move towards gold backing of other currencies is likely to prove more difficult, because of the shortage of monetary gold due to the double counting of reserves through leasing and swaps. The only solution for many of the BRICS attendees in Johannesburg later this month will be to piggy-back on China’s yuan though a currency board relationship. The rest of the world faces the grim prospect of being ensnared in a widespread fiat currency collapse with no visible escape.'  Gold is replacing the dollar Gold is replacing the dollar

|

|

|

|

Post by Entendance on Aug 11, 2023 8:46:23 GMT -5

|

|

|

|

Post by Entendance on Aug 19, 2023 2:18:23 GMT -5

...Gold backing any currency is like a Dracula to fiat currencies, and the gold/dollar relationship can be expected to react accordingly.

|

|

|

|

Post by Entendance on Aug 22, 2023 1:25:28 GMT -5

15th BRICS Summit in South Africa - International programme - day 3

|

|

|

|

Post by Entendance on Aug 24, 2023 5:43:05 GMT -5

'...We have noted that there is global momentum for the use of local currencies, alternative financial arrangements and alternative payment systems.

As BRICS, we are ready to explore opportunities for improving the stability, reliability and fairness of the global financial architecture...'

|

|

|

|

Post by Entendance on Aug 25, 2023 3:03:35 GMT -5

|

|

|

|

Post by Entendance on Aug 26, 2023 1:36:47 GMT -5

Visualizing the BRICS Expansion in 4 Charts

|

|

|

|

Post by Entendance on Aug 30, 2023 1:34:24 GMT -5

|

|

|

|

Post by Entendance on Aug 31, 2023 0:28:20 GMT -5

The World Is Hurtling Toward A New Gold Standard

'...Saudi Arabia is perhaps more prepared to accept a new gold substitute for trade settlement. And in Iran, it has a new ally in this respect. The BRICS trade settlement currency scheme is far from dead. And anyway, there will come a point when the collapse of the dollar-based western currency system forces China to accept that it must protect its currency, its partnership with Russia, and its hegemonic ambitions by accepting gold as the basis of its own currency values.'

|

|

|

|

Post by Entendance on Sept 2, 2023 4:23:18 GMT -5

|

|

|

|

Post by Entendance on Sept 16, 2023 4:24:34 GMT -5

Russia and the Saudis are driving up oil and diesel prices. But these moves are likely to undermine the rouble more than they undermine the dollar, euro, and other major currencies. Therefore, higher energy prices will rebound on the Russians this winter: if they shiver in Germany, they will freeze in Russia. If the dollar is king of the fiats, the rouble is just a lowly serf. Russia and the Saudis are driving up oil and diesel prices. But these moves are likely to undermine the rouble more than they undermine the dollar, euro, and other major currencies. Therefore, higher energy prices will rebound on the Russians this winter: if they shiver in Germany, they will freeze in Russia. If the dollar is king of the fiats, the rouble is just a lowly serf.

There is little doubt that Putin and his advisers are aware of this problem. Plan A was to introduce a new gold-backed BRICS currency which might be expected to weaken the dollar and euro relative to the rouble. Plan B was more drastic: to back the rouble itself with gold. This is the financial equivalent of dropping a hydrogen bomb on the dollar and the global fiat currency system upon which it is based.

As well as demonstrating why there is no option for Russia but to back her currency with gold, this article shows why it is perfectly possible for Russia to do so during wartime and explains how it can be done. It is, as a matter of fact, very easy for Russia to reintroduce a gold standard for the rouble, but the consequences for the global fiat currency system are nothing short of lethal.

Introduction

For the last decade I have argued that there is a strong financial element in the wars between the Asian hegemons and America. President Trump’s trade policy towards China and his banning of Chinese technology, notably of Huawei, the world leader in G5 mobile technology was not just to suppress competition to America’s technology leadership but also to discourage global capital flows into China, which otherwise might have gone to America. And Ukraine gave President Biden the excuse to cut Russia out of global currency markets.

All had gone quiet, superficially at least, until Russia declared its special operation against Ukraine, setting in motion a sequence of events which rebounded badly on the West. Initially, the rouble soared in value when Putin responded to western energy sanctions by setting his own payment terms. But since then, the rouble has declined and it has become clear that as a fiat currency the rouble will continue to weaken against the dollar. The weakening rouble is the principal chink in Putin’s armour.

In response to sanctions, Putin appointed one of his advisers, Sergei Glazyev, to design a trade settlement currency, initially for the Eurasian Economic Union. It is believed that the scope was widened into a planned BRICS gold denominated currency, confirmed by the Russians ahead of the BRICS summit last month. But for China and India that was a step too far too quickly. China’s yuan is a component in the IMF’s SDR, a hard-won privilege which might have been threatened if it backed gold as a trade settlement medium. India has a history of anti-gold Keynesian monetary policies and is keen to develop trade links with the US and its allies, as demonstrated by its hosting of the G20 meeting last weekend and its prospective free trade agreement with the UK. China may have also been concerned that the consequences might be destabilising for the global currency system.

The hesitancy of the two most populous nations on earth over the gold issue is now creating significant problems for them, as the chart below of their respective currencies shows.

I have inverted the y-axis on both charts to make the point that the current rally in the dollar’s trade weighted index may not mean very much for the euro, which is its largest component, but it is undermining the major Asian currencies badly. When, rather than if the rupee breaks below its current support level, a move to test the INR100 level looks all but certain. And despite zero consumer price inflation in China, the yuan has already broken support and looks like falling even further. No wonder China’s citizens are pushing gold prices up to significant premiums: it is their escape from a falling currency. The Indians have yet to get used to higher gold prices in rupees, but that is likely to be only a matter of time. I have inverted the y-axis on both charts to make the point that the current rally in the dollar’s trade weighted index may not mean very much for the euro, which is its largest component, but it is undermining the major Asian currencies badly. When, rather than if the rupee breaks below its current support level, a move to test the INR100 level looks all but certain. And despite zero consumer price inflation in China, the yuan has already broken support and looks like falling even further. No wonder China’s citizens are pushing gold prices up to significant premiums: it is their escape from a falling currency. The Indians have yet to get used to higher gold prices in rupees, but that is likely to be only a matter of time.

A particular currency target is Russia’s rouble, illustrated in our next chart.

In an attempt to stop the slide, Russia’s central bank raised its interest rate by 3.5% to 12% in August, which initially rallied the rouble, but it is now sinking back towards its recent low against the dollar. But while Putin and his economic advisor Maxim Oreshkin appear to have a reasonable grasp of monetary affairs, the same cannot be said of the leadership of Russia’s central bank. At the time of the interest rate hike, Oreshkin wrote that “a recent acceleration of inflation and the sinking currency were the result of loose monetary policy, and that the central bank “has all the necessary tools to normalise the situation”. The issue is that the central bank has followed expansive fiat monetary policies by allowing M0 money supply to expand by 26% in the year to August. Directly addressing this expansion of central bank credit would have done more to stabilise the rouble than crippling interest rate increases. While much of the destabilisation of the rouble can be attributed to the continuing expense of the war, there can be little doubt that it is also partly due to the dollar’s recent strength. As is the case between the dollar and most other fiat currencies, there is a relative trust factor working against the rouble. Irrespective of interest rate differentials, it is the fact that fiat currency values are tied to nothing more than the faith in them. And Russia now faces the problem that in a fiat currency regime run in western capital markets it can never match the faith and credit in the US dollar. In current currency conditions, the dollar can always undermine the rouble because the US controls the fiat currency agenda.

The weakness of the rouble is perhaps the only real pressure point that America and NATO can apply. The war in Ukraine is turning out to be yet another NATO debacle, which only appears not to be the failure it is due to the western alliance’s control of its media-reporting. In a world driven by propaganda, we cannot know the truth. But any military commander who thinks, as did Napoleon and Hitler, that a land-borne army can defeat the Russians in Eastern Europe is deluding himself. While grinding down the Ukrainian army, the Russians are digging in for the long haul, expecting growing dissent in the NATO membership to undermine its unity. It is a plan which appears to be working.

The energy war could backfire badly against the rouble

Dissent in NATO can be expected to increase this winter, as energy shortages begin to bite. The most recent salvo in the energy war is timed ahead of the northern hemisphere winter. Russia and Saudi Arabia have jointly been squeezing oil supplies, pushing crude prices above the G7’s price caps. One area where energy supplies will hurt the Europeans more immediately is heating oil, which is also regarded as the proxy for diesel prices having increased in dollars by nearly 50% in the last quarter alone.

The importance of diesel is that logistics in Europe (and America) are almost entirely dependent upon it. On top of earlier OPEC+ cuts of 2 million barrels per day, the more recent 1.3 million barrels per day cuts in oil output by Russia and Saudi Arabia are bringing pressure to bear on the supply of distillates (of which diesel is one) and Russia also plans to cut its diesel exports by a quarter, partly due to refinery maintenance (allegedly) and partly to divert supplies to its domestic economy. While the EU’s gas reserves are relatively full at 90% of capacity, it is not nearly enough to see the EU through the winter. From December onwards, there will be a scramble for more supplies. And the end of the agreement on Black Sea grain exports will put further pressure on food prices as well.

Therefore, the western alliance will face further inflationary pressures, likely to give higher interest rates and bond yields a new impetus. Already, there is a credit crisis developing in key western economies, with banks trying to reduce their risk exposure to financial and non-financial markets in the face of a recession. And as the credit crunch intensifies, the likelihood of a new round of bank failures increases.

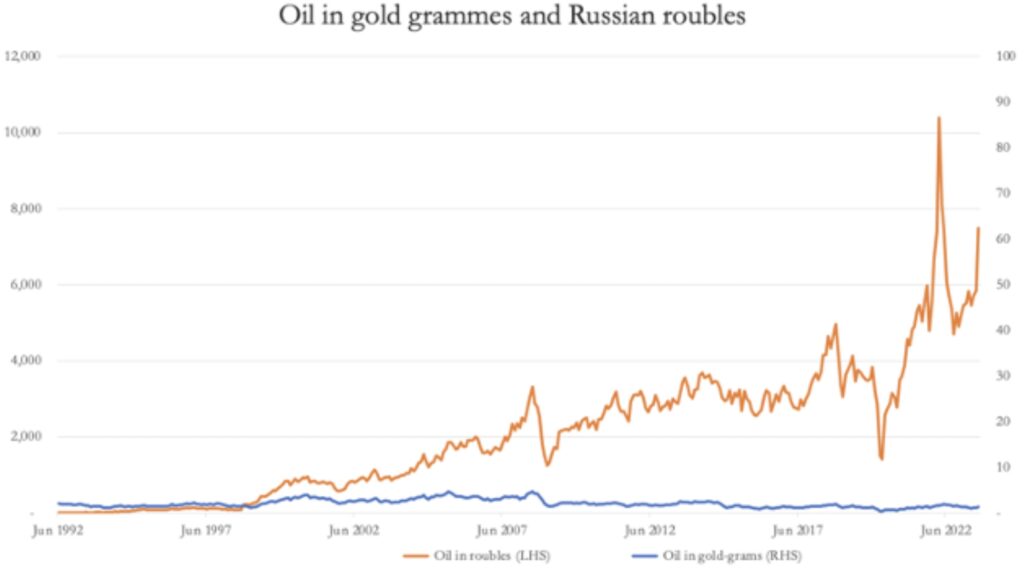

The problem for Russia is that in pursuing energy policies with the intention of undermining the dollar and euro, the consequences for the rouble are likely to be far worse. The next chart, of oil priced in gold and roubles, illustrates the point.

The first point to note is that in 1998, the rouble was redenominated at a ratio of 1000:1. Back-dated by this factor, in June 1992 there were US$7.25 to the new rouble, and a barrel of oil was valued at 2.03 gold-grammes. Today there are nearly 100 roubles to the dollar, and a barrel of oil is over RUB 7,500. As a fiat currency, the rouble has behaved like a third-world currency relative to the dollar, let alone gold. And the domestic price of oil in Russia has soared along with the rouble’s collapse. Furthermore, the exceptional volatility in the rouble price of oil is extremely disruptive for the domestic economy, with heating becoming unaffordable for Russia’s citizens in desperately cold winters.

To quantify this distress, between September last and end-July, priced in roubles the oil price increased from RUB4,707 per barrel to RUB7,500: that is an increase of 59%. In dollars, the price rose from $78.72 to 81.72, up less than 4%. Clearly, the energy battle cannot be won by Putin, because if they shiver in Germany they will freeze in Russia.

The chart above puts Putin’s energy war in its proper context. Withholding energy from western markets will undoubtedly destabilise their currencies. But the blowback on the rouble will be even worse. But Russia’s analysts, including Maxim Oreshkin and Sergei Glazyev (who has already recommended a gold standard for the rouble) must surely know this. And the chart also tells us that priced in gold oil is considerably more stable. In June 1992 a barrel of oil was 2.03 grammes, today it is 1.41 grammes, a fall of 30%. Bearing in mind that gold is real money, and currencies are highly unstable credit, Russia is getting 30% less for her oil today than she did in 1992.

Again, in common with the Saudis, the Russians are aware that American monetary policy has had the consequence of undermining the true value of their oil, something they have been powerless to correct without binding the price of oil to gold. There can be little doubt that Russia’s motivation to take control of energy values was behind its proposal for a new BRICS gold backed currency and that it was part of a two-step plan.

The first step was to send a signal to markets that the era of the fiat dollar was over, justifying the second step which was for Russia and China, followed by other nations in the BRICS camp to evolve their own currencies onto gold standards as a protective response to a declining dollar. But China was not going to take the offensive against the dollar, and the Keynesian Indians were not convinced.

Russia will take the BRICS presidency next year, so we can assume that the new BRICS currency has not gone away. Meanwhile, if Russia is to use the oil weapon against the West, then it must put the rouble onto a gold standard again as a matter of urgency (it was on a gold standard until Khrushchev devalued the rouble in 1961). If Russia prevaricates on this issue, then Putin’s legacy to be a latter-day Peter the Great will be destroyed by his own currency.

The practicalities of a Russian gold standard

In the middle of a war, usually a government suspends its gold standard. This would suggest that Russia can only consider a gold standard after its special operation in Ukraine is over. But the modern equivalent of a gold standard, the currency board, has been successfully established in modern times in nations with far worse budget deficits than Russia. Russia was in the fortunate position of a budget deficit of only 2.3% of GDP last year, despite military spending. This year, military spending has soared, and at a guess the deficit will be about 5% of GDP this year, but government debt to GDP will still be about 20%.

Anything other than ball-park numbers for the Russian economy are difficult to come by, and the volatility of the rouble is a further analytical hazard. But some of these numbers are not substantially different from where Britain was economically in 1816, when a return to the gold standard was planned — the exception being her estimated debt to GDP number, which at nearly 200% was ten times that of Russia today. Therefore, there is no reason why Russia cannot put the rouble onto a gold standard immediately.

In doing so, the objective is simple: to ensure that the purchasing power of circulating credit retains its value in terms of goods and services with as little fluctuation as possible. It would allow savers to accumulate credit balances in their bank accounts, and for businessmen to calculate the profitability of their investments with greater certainty. With income tax currently at a flat 13% rate and corporation tax at 20%, in these conditions economic progress will advance surprisingly rapidly. And there is every reason to expect Russia would quickly become an economic counterweight to the sheer power of China, rather than living off the depletion of her natural resources. It is necessary not just for Russia to distance herself from the fate of the western fiat currency system, but also for President Putin’s legacy.

The method of ensuring monetary stability is equally simple: to bind credit denominated in roubles to gold, which both in law and naturally is the money of the people. It is the highest form of credit, there being no counterparty risk. It’s purchasing power in the general sense has held steady through millennia. Importantly, it removes the currency from political control and dollar influences. It allows for the creation and destruction of credit determined solely by the needs of the Russian people, both as businessmen and consumers.

In constructing a new gold standard for Russia, we can learn from the lessons of the past, particularly the establishment of Britain’s gold sovereign coin fixed at 113 grains (7.99 grammes) to a one pound Bank of England banknote, freely exchangeable at the holder’s option. There were mistakes made in the implementation of Britain’s gold standard in the nearly one hundred years of its existence, but in the light of experience we should know how to avoid them today.

The principal errors incorporated in the 1844 Bank Charter Act were to not realise that redemptions of bank notes for sovereign coin were inconsequential. The occasional runs on the Bank of England’s gold reserves always originated in cheques drawn on the Bank for bullion. Amazingly, this source of encashment was not foreseen by the framers of the Act, leading to crises in 1847, 1857, and 1866. The Act was suspended on these three occasions, the crises were averted, and the Act subsequently reinstated every time.

The observant reader will have noted that these runs on the Bank’s bullion reserves fit in with an approximate ten-year cycle of bank credit expansion and crisis, a cycle still evident to this day. The 1847 suspension came about after the Bank had made immense advances to commercial banks to rescue them from insolvency. But the Bank’s advances were insufficient to stop the crisis. With Parliament staring into an economic abyss, it authorised the bank to issue notes at discretion, and the panic immediately subsided.

Ten years later in November 1857, the Bank’s monetary assets were comprised of gold and silver, which together with its own notes bought in had declined to only £387,144 compared with liabilities to commercial banks of £5,458,000. It was on the point of having to cease trading within the terms of the act. Consequently, the government authorised the Bank to expand its liabilities at its discretion, but at a discount rate of not less than 10%. The following day, the panic passed.

In 1866, the prominent discount house, Overend Gurney failed. Again, the government authorised the suspension of the Act, allowing the Bank of England to expand its liabilities to deal with the crisis, but again at a punitive discount rate of not less than 10%. As before, the run on the Bank of England’s gold reserves ceased.

In all three cases, the suspension of the 1844 Act saved the nation from untold economic damage. In this respect, the Act was a failure. Insisting on the restrictions of the Act come hell or high water and simply letting banks and businesses fail is never an option. Therefore, a successful gold standard must allow for the management and containment of banking crises, the inevitable consequence of periodic over-expansions of credit. There has to be the flexibility to support otherwise solvent commercial banks in times of crisis. In all three cases above, it was the function of the banking department to avert the crisis by extending additional credit. It should not have been the function of the issue department to get involved, and if the separation between the two had been different in its detail, the Act need not necessarily have had to be suspended.

I should mention a further error in the framing of the 1844 Act. At that time, it had been assumed that a drain on the nation’s bullion would only occur if the balance of trade with other nations was unfavourable, because settlements would be conducted in gold. While this was obviously true, there was a far greater influence on bullion flows: differences in discount rates (or interest rates in modern terminology) between centres with currencies on gold standards.

If the interest rate in Centre A exceeds that in Centre B by more than the cost of transporting bullion between them, then bullion will flow from Centre B to Centre A. This is why the setting of interest rates must be solely to regulate bullion flows. To explain further why this is the case, it should be understood that the future value of gold includes the interest accumulated with it, being payable in gold. Therefore, if the sum of principal plus interest is less in one place than another, gold will naturally gravitate from the former towards the latter.

Armed with this knowledge, Russia can easily establish the rouble on a gold standard and maintain it. In light of the foregoing, the following are the basic principles required to achieve this goal.

The objective is to ensure that rouble banknotes and balances held in the Issue Department (see below) are freely encashable into gold coin and bullion.

The issue and redemption activities of rouble banknotes must be transferred from the Central Bank of Russia to a new entity charged solely with managing the note issue, which we will refer to as the Issue Department. The central bank’s gold reserves must also be transferred to the Issue Department. Furthermore, the Issue Department must have the sole power to set interest rates with the mandate of maintaining sufficient bullion balances at all times. By these means, interest rates will no longer be a matter for monetary policy, being handed down to the markets.

The Banking Department will continue with its other functions on behalf of the Russian state, except for the setting of interest rates. It will act as it sees fit in the management of commercial bank failures, extending credit or withdrawing it when necessary to maintain stability in the overall credit system.

The separation between the Banking and Issue Departments must be defined and confirmed in law. As separate entities, each shall have its own balance sheets, so that the credit activities of one are separate from the other.

Along with the power to set interest rates, the Issue Department will be empowered to maintain reserve balances (the counterpart of bullion submitted to it) paying interest at a small discount to the official rate. Assets on the Issue Department’s balance sheet balancing these reserves will be held as interest paying deposits at the Banking Department, allowing the Issue Department to generate sufficient profit between its liabilities and assets to cover its costs and the costs of minting coin.

Any restrictions and taxes on gold coin and bullion must be removed by law. All foreign currency restrictions and controls must be removed as well to permit the free flow of bullion.

Currently, Russia’s official gold reserves are declared to be 2,301 tonnes. It is thought that between two state funds, the Gokhran (State Fund for Precious Metals) and Russia’s National Wealth Fund, Russia has a further 7,000—9,000 tonnes. Their holdings need not be folded into the Issue Department (though it may be advantageous to the funds to do so), but public declaration of their quantity would be helpful to establish the gold standard’s initial credibility.

The rouble must be defined by weight in gold grammes and be fully exchangeable in gold coin. New coin must be minted accordingly, perhaps with a face value of 50,000 roubles and exchangeable in those units (currently the equivalent of about $500, and similar to the value of a British sovereign). The time taken to design and mint the new coin will delay its introduction, but there is no reason why a bullion exchange facility cannot start immediately.

This is how it will work.

The bullion exchange facility operates not through the Banking Department, but through the Issue Department. In order for a commercial bank to have a credit balance with the Issue Department, bullion must be deposited in the first place. And it is here that the lessons learned from the 1844 Bank Charter Act comes into play.

Banks eligible to open an account at the Issue Department can buy gold in domestic and foreign markets, where the lease rate for 12 months is currently less than 2%. We can take that as an indicated rate of interest that global markets pay to borrow gold. Therefore, in one year a holder of 100 ounces of gold has 102 ounces equivalent (assuming the interest accumulates in line with the gold price and is paid in gold — which is not the case). Meanwhile, the Bank of Russia’s key rate is 12%. The uplift in return for a buyer of gold in international markets depositing gold with the Issue Department is 10% accumulating in gold.

It now becomes obvious that Russian and other banks accessing the Issue Department will provide the gold deposits to ensure that the Issue Department will rapidly accumulate all the bullion it needs to operate a secure gold standard. And it is equally clear that with the ability to regulate the interest rate, the issue Department can manage its gold reserves.

In its initial stages, credibility is obviously key. This can be rapidly achieved by the Russian banks supporting the plan, which they are bound to. Any bank on Russia’s SPFS payments messaging system can open an account with the Issue Department. This should be extended to any licenced bank in the Shanghai Cooperation Organisation and BRICS with secure messaging system access to the Issue Department. As well as acting as principals, these banks can operate on behalf of their customers. Russian oligarchs and draft-dodgers who have sold their roubles would almost certainly rush to buy them back, and even deposit gold with the Issue Department through the agency of their banks.

On current interest rate spreads, bullion inflows should be substantial: arbitrage with western bullion markets will ensure it. Given current sanctions against Russia, London and other markets under the control of the western alliance will not be directly available to sanctioned banks, a factor which is likely to provide a significant boost to gold trade in Asian and Middle Eastern markets. Sanctions will not stop gold shipments. Nonetheless, Russia’s success is bound to lead to imitators, almost certainly the Saudis, and if not immediately the Chinese are bound to follow.

A rouble priced in gold will also make energy payments in declining fiat currencies even less desirable to Russia, which will have to be sold — for what? The divide between the fiat world and gold standard currencies is going to become a very wide gulf indeed. A new impetus for the delayed BRICS trade settlement currency is bound to ensue, particularly with Russia taking the BRICS chair in January. India’s hope that payment terms for oil will be set by nations on fiat currency standards should be dismissed.

For the other BRICS currencies, a currency board relationship with a gold backed currency becomes a live option. The more natural alternative to the rouble (which Russia may not desire anyway) is to tie in with China’s renminbi — if or when it adopts a gold standard. China may not be far behind Russia in implementing its own gold standard anyway, because the consequences for the dollar and euro could be sufficiently undermining for China to seek to protect her own currency.

The impact on the dollar of the move to gold standards

Chalk and cheese, oil and water, diamonds and dust: whatever metaphor you care to choose, it must be clear that a mixture of gold standards and fiat currencies will not last long. Priced in fiat currencies, gold’s value might be expected to rise significantly, as central banks in what is now termed The Global South (the Asian hegemons and those aligned with them) move towards replacing fiat currencies in their reserves with gold.

According to Ambrose Evens-Pritchard (Wednesday’s Daily Telegraph), “The Global South holds three-quarters of the world’s $12 trillion of foreign exchange reserves (59 per cent held in dollars)”. And in addition to a $2-plus budget deficit, in the next year the US Government has to refinance about 30% of its existing debt.

Therefore, the impact of a move to gold on funding the western alliance’s deficits will be substantial, because not only will The Global South stop buying their bonds, but they will seek to liquidate their existing holdings. In the absence of severe spending cuts and increased taxes, increasing monetisation of government debt will become inevitable. Kiss goodbye to lower inflation, lower interest rates, and lower bond yields: embrace crashing bond prices and collapsing asset values. What over-leveraged bank can survive the squeeze on their balance sheets? Which of the western alliance’s central banks, already deeply into negative equity will be able to monetise their government’s debt with further QE against a background of soaring bond yields?

Inflation of energy prices, already low measured in gold grammes, is bound to increase measured in collapsing fiat. Truly, if Russia does introduce a gold standard for the rouble, it will be the financial and economic equivalent of a nuclear attack on the entire fiat currency system. There can be little doubt that these consequences for the global financial system are what have made Russia hesitate so far. China is sure to have arrived at a similar conclusion, one reason why she was too cautious to support Russia’s proposal for a gold backed trade settlement medium. But Russia is reaching a point where she has no other way to stabilise her currency.

Russia and NATO (by which we really mean America) have got themselves into positions from which they cannot back down. Unless Russia stabilises her currency, her likely victory in Ukraine will be pyrrhic. Putin’s policy of driving up energy prices will have worse consequences for the Russian people this winter than for Europeans and Americans, because of a collapsing rouble. And a collapsing rouble will also drive up food prices, a combination which will almost certainly destroy Putin’s government.

Whichever way you look at it, it is the currency factor which matters above all else and the Russians have no option but to stabilise the rouble by defining it in gold grammes and making it immediately exchangeable on the lines described in this article.

It will be a tragic end to the dollar-based fiat currency regime.

|

|

|

|

Post by Entendance on Sept 21, 2023 23:30:39 GMT -5

Quick Summary Bullets:

Implications for the Commodity Industry

The weaponization of the commodity industry, particularly in the gold, oil, and base metal sectors, is a developing trend that may have implications for both the BRICS block and the West.

The deliberate reduction in oil supply by Russia and Saudi Arabia is causing a shortage of distillers, particularly heating oil and diesel, which will have a major impact on prices.

The shift towards commodities, such as gold, could lead to a decline in the value of the dollar and euro, causing fiat currency values to plummet.

“If Putin introduces a gold standard for the ruble, it could speed the end of the fiat currency era.”

Russia and potentially China are considering transitioning to a gold-backed currency, which could have significant implications for the Western Alliance and their currencies.

Russia potentially holds a significant amount of gold reserves, with estimates suggesting there may be an additional seven to nine thousand tons beyond their declared reserves.

Potential Crisis and Financial System Impact

The destabilization of currencies and the return of inflation could result in far higher bond yields, reminiscent of the uncomfortable experiences during the post-Bretton Woods era in the 1970s.

“The adjustment going out of Fiat currencies is going to be extremely painful.” – Macleod highlights the potential challenges and difficulties associated with transitioning away from fiat currencies, emphasizing the potential impact on the global economy.

“You have got falling financial asset values.”

The potential crisis may drive yields even higher than the historical level of 15.5 percent, indicating a clear move away from the dollar and towards commodities.

“If the price of oil goes up, the price of everything goes up, leading to potential inflation and the need for the FED to increase rates.”

“You could see a crisis in the bullion banking community quite quickly under those circumstances.”

Geopolitical Shifts and Currency Destabilization

Geopolitical situations, such as the BRICS countries, are pledged to reduce their dependence on the dollar for cross-border settlement, potentially leading to a portfolio flow out of the dollar.

India’s opposition to gold-backed trade settlement currencies shows a clear move away from the dollar and towards commodities.

“They would rather obviously accept Chinese Yuan over Indian rupees for reasons. Firstly the rupees are completely valueless in their hands.” – The value of the Indian rupee is diminishing, leading to a preference for Chinese Yuan.

The potential escalation of conflict in Ukraine could have serious consequences for NATO and the Western world, leading to a major crisis in the financial system.

Major geopolitical changes are happening without the control or influence of the West, leading to a loss of power and influence in global affairs.

|

|

|

|

Post by Entendance on Sept 25, 2023 3:58:35 GMT -5

|

|

|

|

Post by Entendance on Sept 26, 2023 1:00:34 GMT -5

BRICS Expansion Aims to Reduce ‘Dollar’s Decades-Long Dominance’ – Report

Vladimir Putin took part in the plenary session of the second Russia–Africa Summit

🇸🇨 🇧🇯 🇦🇴 🇨🇩 🇳🇦 🇹🇿 🇧🇫 🇬🇲 🇬🇼 🇬🇳 🇩🇯 🇰🇲 🇧🇮 🇲🇬 🇸🇴 🇹🇩 🇬🇶 🇿🇼 🇪🇹 🇸🇩 🇸🇸 🇪🇬 🇲🇱 🇿🇦 🇪🇷 🇨🇬 🇳🇬 🇨🇫 🇺🇬 🇩🇿 🇸🇳 🇬🇭 🇿🇲 🇷🇼 🇲🇿 🇨🇲 🇹🇬 🇲🇷 🇹🇳 🇸🇿 🇱🇾 🇲🇼 🇨🇮 🇬🇦 🇲🇦

|

|

|

|

Post by Entendance on Sept 29, 2023 7:58:13 GMT -5

BRICS Countries Dump $123 Billion in U.S. Treasuries in 2023

|

|

|

|

Post by Entendance on Oct 1, 2023 5:40:27 GMT -5

Potential Collapse of the US Dollar

“The surge in gold prices in weakening currencies suggests that the US dollar may be poised for a complete collapse.”

“When a foreigner starts losing on his investments in a foreign currency, he just tries to get the hell out of it… The dollar is poised for a complete collapse.”

The potential collapse of the US dollar is something we should be aware of and it’s not far away.

The Scramble for rubles to buy oil highlights the vulnerability of the US dollar, indicating a possible complete collapse of the currency.

“US Dollar Poised For Complete Collapse!”

Impact on Global Financial System

Foreigners within the US banking system hold a staggering $32 trillion in investments and bank deposits, highlighting the potential impact of any financial crisis on a global scale.

“The currencies are beginning to face obvious problems, leading to the Central Banking cartels’ response and the looming crisis in the gold paper market.”

The Chinese government’s encouragement of its citizens to buy gold suggests their concern over the instability of the Western financial system and the potential collapse of the US dollar.

“The addition of six new nations to the BRICS formation, including the three largest oil producers in the world, spells the end of the Petro dollar and US dominance.”

The consolidation of the BRICS and Shanghai Cooperation Organization into a single mega block will make it more challenging for the West to maintain political power and hegemony, potentially leading to the reintroduction of gold backing into currencies.

Importance of Owning Gold

“Unless you’ve got your own precious metals, I think you’re in trouble.”

“There is a shortage, you have to bid up to get physical gold.” – Despite the falling paper price of gold, there is a shortage of physical gold, leading to increased bidding and a potential crisis in the gold market.

As the price of gold rises, it reflects the devaluation of currencies like the dollar, leading to a potential crisis in the paper markets due to a lack of physical gold to deliver.

“If you do not own gold, you have no understanding of history or economics.” – Alasdair Macleod

“Their currency in real terms is valueless… You need to own gold.” – Alasdair Macleod highlights the importance of owning gold as a hedge against a potentially collapsing US dollar.

|

|

|

|

Post by Entendance on Oct 5, 2023 10:54:42 GMT -5

Gold premiums in Moscow and Shanghai will bust Comex, Maguire says

'The role of collateral in the LDI crisis...

LDI is going global...

➡️ The taking of your securities for collateral...

...JPMorgan’s relationship with gold ...JPMorgan’s relationship with gold

At the outset, it is worth noting that regulatory bodies tend to give large banks the benefit of the doubt, only looking closely at their compliance activities when they can no longer be ignored. Consequently, large banks have been known to act as if regulations don’t exist. The example above, where it was absolutely plain that JPMorgan Chase was in breach of the regulations with respect to custodial client money in London may or may not have been an exception. We are entitled to assume that some of the smartest lawyers and compliance officers are employed by JPMorgan Chase who should have known better.

This lack of respect for the law was demonstrated in an important case in the gold market, when JPMorgan Chase’s global head of precious metals trading and board member of the London Bullion Market Association was found guilty of attempted price manipulation, commodities fraud, wire fraud and spoofing prices in gold, silver, platinum, and palladium futures [➡️ here] And it is not as if this was an isolated case: it had been going on for eight years involving thousands of unlawful trading sequences. And another colleague heading up the New York gold desk was also found guilty. That was in July 2019. Finally, in 2020 the bank itself pleaded guilty to unlawful trading in precious metals futures markets and was heavily fined.

Inexplicably, with this track record JPMorgan Chase Bank was recently appointed joint custodian of SPDR Gold Shares (GLD) alongside HSBC. This ETF is the largest in existence by far and its sponsor is a subsidiary of the World Gold Council. Why the WGC sanctioned the appointment of a bank whose senior dealers in precious metals have been found guilty of manipulating gold prices and jailed is a mystery. It is not as if having one custodian represents more risk than two. Furthermore, HSBC stores all GLD bullion in its London vaults, so that it is subject to English property law and securities regulation in every respect.

JPMorgan Chase is reported to be considering the transfer of GLD’s bullion to its vaults in New York. It is thought that their vault is linked underground to the Fed’s vault, with the Fed on the north side of Liberty Street and Chase Bank across the road.[iii] It is in this context that we return to David Webb’s analysis of central counterparties, ownership of securities as property being replaced with a “security entitlement”, and the free use of that security entitlement as collateral without the knowledge or agreement of the entitled. And according to the ruling of the New York court effectively extending this facility to JPMorgan Chase as a central clearing counterparty, we may be assembling a picture which will allow JPMorgan Chase to use GLD’s bullion as collateral, or perhaps to lease or swap it, or alternatively to dispose of it in return for a book entry credit.

Our suspicions will be increased when we think through the implications of the proximity of JPMorgan Chase’s vault to the Fed’s vault across the road and circumstantial evidence of a tunnel between the two. Stored in the Fed’s vault is gold for the New York Fed, earmarked for foreign central banks. And when we remember the difficulty Germany had getting the New York Fed to return a paltry 300 tonnes, doubtless our suspicions will go into overdrive.

Undoubtedly, GLD’s trustee The Bank of New York Mellon and the World Gold Council have some serious questions to answer as to why JPMorgan Chase was appointed a custodian. Here are just a few suggestions:

Did the Trustee of the World Gold Council come under pressure or recommendation from any government organisation or monetary authority to appoint JPMorgan Chase a custodian to the SPDR Trust?

Were the Trustee and Council not aware that JPMorgan Chase has a history of market manipulation in gold contracts, and that the bank had pleaded guilty. According to the Office of Public Affairs in the US Department of Justice: “In September 2020, JPMorgan admitted to committing wire fraud in connection with: (1) unlawful trading in the markets for precious metals futures contracts; and (2) unlawful trading in the markets for U.S. Treasury futures contracts and in the secondary (cash) market for U.S. Treasury notes and bonds. JPMorgan entered into a three-year deferred prosecution agreement through which it paid more than $920 million in a criminal monetary penalty, criminal disgorgement, and victim compensation, with parallel resolutions by the Commodity Futures Trading Commission (CFTC) and the Securities Exchange Commission announced on the same day.”

Furthermore, that two of their senior staff were on trial when JPMorgan Chase was appointed custodian, one of which served on the board of the LBMA and ran JPMorgan’s global precious metals desk, and the other an executive director and trader on the New York precious metal desk? And that both men were subsequently jailed and fined for market manipulation in August?

Almost certainly, the Trustee and the World Gold Council’s management won’t be called upon to answer these questions. But the legal position of GLD shareholders’ underlying property assets is compromised by these developments.

Furthermore, authorised participants can borrow their shares from a centralised securities depository and redeem them for physical gold. By hedging their position in futures or London’s forward markets, they are under no pressure to return the gold and close their stock loan. Given this facility, far from GLD being a secure investment in gold bullion, it may already be being used as a source of liquidity for bullion dealers.

There can be little doubt that access to GLD’s property would be a partial solution to urgent problems arising from over fifty years of official suppression of the gold price. As I have written before, after extensive and careful research, analyst Frank Veneroso concluded as long ago as 2002 that between 10,000 and 14,000 tonnes of central bank gold were either leased or swapped. And he further concluded that much of that gold “was adorning Asian women” so would not be returned.

We know that the Bank of England arranges these contracts for its central bank clients. We can only assume that the New York Fed similarly arranges these income generating activities on behalf of earmarked gold in its custody. Worse still is the thought that the New York Fed might have sold off earmarked gold into the markets, which would explain why it refused to let Bundesbank representatives inspect its gold, and initially proved extremely reluctant to return only 300 tonnes out of 1,536 tonnes of Germany’s gold supposedly held in the New York vault. And presumably, it was the Bundesbank’s experience which prompted the Dutch Central Bank to repatriate 122 tonnes of its gold from New York, leaving 190 tonnes behind at the New York Fed.

With the failing of the fiat currency regime, the chickens of gold leasing and price suppression are now coming home to roost. It is becoming apparent that at a minimum the stagflationary conditions of the 1970s are returning, when gold rose from the official rate of $35 per ounce to over $800. And the Fed funds rate rose from about 6% to nearly 20%. After fifty-two years of currency debasement, the starting point for a new rise in the gold price is somewhere between $1500—$2000. And arguably, the dollar is in a far worse position today than it was when President Nixon suspended the Bretton Woods Agreement.

The legal position in the US is shared with the EU and UK, whereby holders of shares in ETFs could find the property in them plundered through the agency of JPMorgan Chase and other central clearing counterparties, where, it seems, their status permits them to deploy bullion and other private property as they see fit.

The bullion banks are currently trying to close their paper shorts and to go long, benefiting from the ignorance of speculators, who believe that higher interest rates are bad for gold. That may be true in markets devoid of systemic and inflation risks, but only these fellows below would take this seriously in the developing situation.

Currently, bond yields are rising strongly, which means that collateral values are falling. It amounts to a credit contraction of up to 30% on longer dated bonds so far. And where collateral backs leveraged interest rate swap positions, calls can be catastrophic.

Fairly quickly, the gold price can be expected to reflect systemic and currency risks, which will trump any meme the three wise monkeys might come up with. Driving the dollar’s falling value measured in goods will be the funding outlook for the US Government. With interest costs likely to rise to $1.5 trillion in the fiscal year just started and the onset of economic stagnation if not outright recession, the budget deficit could easily top $3.5 trillion, perhaps eight or nine per cent of expenditure. And this is at a time of diminishing foreign appetite for US Treasuries.

This takes us back to the enormous mountain of dollar credit in foreign hands, quantified in the table at the beginning of the article. Long term investments, totalling $26.113 trillion, plus a further $10.7 trillion in Eurobonds will all fall in value as interest rates continue to rise. There can be no doubt that foreigners will sell these positions down. Their only problem is what to do with cash dollars, which already amount to over $100 trillion. Other currencies are mostly less attractive than the dollar. There is only one thing to be done, and that is to follow the Singaporeans, who have the prescience to accumulate hard real money without counterparty risk, which is physical gold.

And finally, there are geopolitical considerations. The deteriorating collateral position is surely being observed with concern in Asia and the Global South. The sudden rise in US Treasury bond yields is signalling that a global version of the UK’s liability driven investment debacle is already developing, in which case the collapse of financial market values could escalate rapidly from here.

It is against this background that Russia and Saudi Arabia are driving up energy prices, leading to rising CPI inflation and expectations of higher interest rates to come. Commercial banks will almost certainly intensify credit restrictions as well. Viewed from outside America, it all amounts to intolerable pressures on the US and Eurozone credit systems. And if Russia, perhaps followed by China decide to deploy their gold reserves in order to secure the value of their currencies, it is bound to be the coup de grace for the fiat currency system.'

The Entendance Beach advice to buyers of physical precious metals is the same as always: if you purchased Gold/Silver bars/coins and you can't hold them in your hand, they aren't yours.

YES

◾Each gold bar is directly owned by the investor

◾The investor receives a certificate of ownership with the unique serial numbers of his gold bars

◾Gold storage in specialised bullion vaults outside the banking system.

◾The investor has personal access to his gold

◾The investor can physically withdraw all or part of his gold during office hours or in an emergency

◾The investor can send a representative (e.g. accountant) to inspect the gold

◾The gold is insured by a major international insurer

◾Full control over your own physical assets

NO

◾Exchange Traded Funds – A gold ETF is more of a trading tool which mirrors the price of the underlying asset. Not all Gold ETF's are fully backed by the metal!

◾Futures, Unallocated Gold – A 100% derivative of the physical metal and used for speculative or short term hedging purposes.

◾Bank allocated Gold – Allocated gold in a bank means that, on paper, specific bars belong to you only as long as the bank has adequate stock. You h ave no immediate access to your gold.

◾Bank Safe Deposit Box – You are holding metals outside the Good Delivery chain which makes selling and insurance costly. In case of a longer bank holiday you will not have access.

◾Storing gold at home – If sizeable this is a high risk solution and very difficult to move, insure or sell.

◾Part or Mutual ownership – Owning a share in a bar does not give you full control and access in case of an emergency.

December 1, 2022

Who Is the Custodian of GLD?

➡️JPMorgan will join HSBC in storing bullion for the world's biggest gold-backed exchange-traded fund (ETF) SPDR Gold Trust, also known as GLD, the fund's operator said on Thursday, ending its rival's sole guardianship of the $52-billion stash of gold. -Reuters here

|

|

|

|

Post by Entendance on Oct 11, 2023 4:06:53 GMT -5

US Officials Actively Promoting Idea of Sending Russia's Frozen Funds to Ukraine - Reports

|

|

|

|

Post by Entendance on Oct 13, 2023 4:16:48 GMT -5

The central banks of the states of the East are among the strongest buyers of gold – also within the West Holdings of US Treasuries are reduced The East is expanding its infrastructure for gold trading Private gold demand shifts to the east The price of gold in currencies of the East has increased significantly

Ronni Stoeferle  October 13, 2023 October 13, 2023

|

|

|

|

Post by Entendance on Oct 17, 2023 3:36:40 GMT -5

Russia-Hungary Ties Built on Basis of Taking Into Account Each Other’s Interests - Putin

Putin Meets With Heads of Thailand, Vietnam, Laos, Mongolia in Beijing

|

|

|

|

Post by Entendance on Oct 19, 2023 4:06:22 GMT -5

Egon von Greyerz joins his dear friends and Matterhorn Asset Management advisors, Grant Williams and Ronnie Stoeferle, to address the unique risks—economic, geopolitical, military—making headlines at an alarming rate.

This timely and highly important conversation opens with the financial, political and trade moves from West to East as evidenced by the growing BRICS momentum and its near and longer-term impact on the price of gold as prosperity moves from West to East. Consumer gold demand from India and China, increased central bank demand in the East and rising gold premiums on the Shanghai Exchange suggest that the LBMA hegemony over gold pricing is shifting, as Ronnie discusses...

|

|

|

|

Post by Entendance on Oct 25, 2023 4:41:27 GMT -5

'...there is evidence that China and Russia have prepared themselves for a G7 credit crisis outlined in this article by accumulating substantial quantities of bullion, which they can use to back their currencies. The moment this option is triggered, the entire dollar-based credit system will be threatened with collapse, if only because everyone will wake up to the fact that has been legally true since Rome’s first laws in the Twelve Tables and confirmed by John Pierpont Morgan in testimony to Congress in 1912: that gold is money, everything else is credit.'

'Are the Chinese selling US dollar-denominated assets to buy gold?

It sure looks that way.

Chinese investors sold $21.2 billion in US assets in August alone – primarily US Treasury bonds. Meanwhile, the Chinese government has been buying gold at a steady pace...'

|

|

|

|

Post by Entendance on Oct 27, 2023 8:31:46 GMT -5

'...It’s all about the Strait of Hormuz...

'...Yet the real deal will be to bring down the Wall Street-engineered $618 trillion derivative structure, as confirmed for years by analysts at Goldman Sachs and JP Morgan, as well as independent Persian Gulf energy traders.

So when push comes to shove - and way beyond the defense of Palestine and in a scenario of Total War - not only Russia-Iran but key players of the Arab world about to become members of BRICS 11 - such as Saudi Arabia and the UAE - do have what it takes to bring down the US financial system anytime they choose.

As an old school Deep State higher up, now in business in Central Europe, stresses:

“The Islamic nations have the economic advantage. They can blow up the international financial system by cutting off the oil. They do not have to fire a single shot. Iran and Saudi Arabia are allying together. The 2008 crisis took 29 trillion dollars to solve but this one, should it happen, could not be solved even with 100 trillion dollars of fiat instruments.”

As Persian Gulf traders told me, one possible scenario is OPEC starting to sanction Europe, first from Kuwait and then spreading from one OPEC country to another and to all countries that are treating the Muslim world as enemies and war fodder...'

|

|

|

|

Post by Entendance on Oct 29, 2023 9:21:49 GMT -5

|

|