|

|

Post by Entendance on Apr 13, 2019 2:58:55 GMT -5

No one has busted more Banksters than the Banker who came in from the cold — NomiPrins, who fled from her top post at Goldman Sachs to tell the story of frightening 'Collusion'. Nomi Prins: The central banking heist has put the world at risk

"...In 2008, banking had become so centralized and the fraud/leverage so extreme that the implosion of a relatively marginal slice of the mortgage market (subprime mortgages) triggered a loss of faith and liquidity that very nearly brought down the entire global financial system.

Rather than clean house, politicos bailed out the banks and regulators added new regulations that left the system essentially unchanged. As was easily predictable, the regulations increased the banks' costs and created incentives to move mortgage origination into non-bank (and thus less regulated) entities. Extreme levels of debt and overvaluation characterize the entire global economy, and are not limited to any one nation or sector.

When this crisis gathers steam, there will be few avenues of escape...."

THE 2019 MUST WATCH VIDEO

Chris Powell 21:39"...and I think that at that point the central banks got back together, I'm just guessing but they are the biggest players in the gold market, several banks got back together and said hey this is getting out of control, we got to start smashing the gold down in the futures market and I think it's what they did"

The man who has anticipated the coming of troubles takes away their power when they arrive.

Increases are of sluggish growth, but the way to ruin is rapid. -Seneca

"In the apparently simpler world two hundred years ago, the foreign minister of Napoleon Bonaparte, Charles Maurice de Talleyrand (1754 – 1838) could opine wisely like a Taoist sage that the “The art of statesmanship is to foresee the inevitable and to expedite its occurrence.” It sounds good until you realise that it begs the question of how you can foresee what is inevitable.

Inevitability usually appears with greatest clarity only in retrospect and political conflict always takes the form of contest about what form the future will take. Groups with an agenda try to convince people with a rhetoric that implies inevitability for their aspirations. The neo-liberal worship of the great God “Free ( ie unregulated ) markets”, and an idological campaign for their quasi religion waged over several decades which corresponded to the rise of debt and the finance sector, created a temporary mainstream consensus, at least among the chattering classes, of TINA – for “There Is No Alternative” . If there is no alternative to something it is inevitable. That’s the apparent logic even if it is turns out not to be true. Sometimes there really are no solutions. It is utterly complacent to believe that there are always solutions for problems. It is often easier to resolve problems during a period of growth when resources for solutions are plentiful and compromise can be afforded. In times of contraction this is not the case. Apparent “solutions” are then purchased at the expense of others – whose interests are invalidated by demonising and scapegoating them or by dishonest PR strategies spread in the corporate media and bought politicians that only argue one side of the picture.

Too big to fail – too important to jail – elite criminality!

In this context hoping that “policy” and “policy makers” in government will rescue a floundering populace is likely to disappoint. Instead politicians are pre-occupied by rescuing “too big to fail” institutions – run by managers who are too important to jail. They are trapped – needing to rescue the very people whose recklessness appears to be a major source of the difficulties. The term economists give for this is “moral hazard”. Situations of moral hazard are compromising and deeply unpopular. The impression that the people who created the mess get away unscathed while everyone else loses leads to a collapse in the moral authority of government itself – and generates a “criminogenic environment” as managers get a sense of their impunity. In order to create that impunity what often happens is that white collar criminals deliberately create complexity to hide their dishonesty – elite fraud and endemic corruption. Worse still lobbyists write the rules – as happened in the UK in regard to the regulation of fracking. At a further stage along the path the rules are unenforced – people are appointed who ensure a de-supervision process. The only people against whom the law and regulation is enforced are the people who protest. Meanwhile inequality accelerates because those at the top are rescued whatever they do – while those at the bottom are left to eat the losses – paying for the rescues. This problem of elite criminality is particularly a problem in London which the financial authorities have made a centre for tax evasion and the evasion of financial regulation – in conjunction with a network of overseas tax havens like the Channel Islands, the Isle of Man and, further afield, remnants of the British Empire. London is also the bolt hole for a variety of oligarchs and mafias – who use the purchase of property in London as a “wealth preservation” and money laundering opportunity. This bids up the cost of living and makes London unaffordable for ordinary people – while corrupting the British political elite.

In this context to expect policy makers in central governments to rescue ordinary people is naive. They are there to rescue the system of which they and their friends are the beneficiaries. Indeed in recent years there has been a culture change in the UK and the US in which there is not only de-regulation but de-supervision – a largely invisible process in which the rules are not enforced and the people put in charge of supervisory agencies think it is OK to use public office to enrich themselves and to protect their cronies from prosecution. With people like this in charge we cannot expect that the people who have refused to acknowledge climate change in 30 years – and have obstructed awareness of problems where action would be to their detriment. Disaster capitalism – profits earned by producing “bads” rather than “goods”!

Worse still, they seek to profit from the growing chaos and have a vested interest in even worse problems – producing “bads” rather than goods – armaments, security technologies and services, prisons and arrangements to use prison labour, drugs (legal and illegal), merchants of spin and misleading propoganda, loan sharking and use of odious debt to enslave desperate people.

The policies that are needed would focus on security and safety for ordinary people and their success would be measured in the winding down of these “disaster capitalist” business sectors, in the need of their managers and workers to retrain for socially and environmentally useful and benign forms of production. Given the uncertainty and confused babble arising from media and mainstream politicians, no one can tell the future. The very last thing that we need is a new set of panaceas promising a comprehensive programme to resolve all wrongs. The future looks grim – and while there are things that can be done it does not look as if much can be expected from those in positions of government power or from the media – except misrepresentations, misinterpretations and policies that make the situation worse. This may lead, at worst, to comprehensive economic collapse and perhaps nuclear war." -Brian Davey

Cartel Desperate To Keep Gold & Silver Prices Down Right Up Until The Collapse Cartel Desperate To Keep Gold & Silver Prices Down Right Up Until The Collapse

Research Study on Ongoing Crime Spree by Wall Street Mega Banks Gets News Blackout: Here’s Why

If Your Friends Are Bulls, Don’t Show Them These Charts

The Globalists Depopulation Agenda Is Real: This Is What They And The 'Big Pharma Mafia' Don't Want Us To Know! |

|

|

|

Post by Entendance on May 7, 2019 3:21:15 GMT -5

|

|

|

|

Post by Entendance on May 18, 2019 3:44:15 GMT -5

"...Yes, this was a tedious 3-1/2 hour hearing to sit through. But if you’re not paying attention to what these mega banks and their regulators are up to, you’re likely to become their next victim." Here

Banksters & Precious Metals : "YES, WE CAN" The Cinderella Story Will End |

|

|

|

Post by Entendance on Jun 11, 2019 9:55:39 GMT -5

Banksters Cartel International IX

Could JPMorgan Chase Be Hit with a Fourth Felony Count for Rigging Precious Metals Markets?

Obviousness of gold market rigging helps central banks but there's a limit

Dear Friend of GATA and Gold:

Responding to your secretary/treasurer's observation Sunday that central bank and government interventions against gold have been becoming more obvious --

www.gata.org/node/19134

-- our friend C.W. writes that the more obvious interventions against gold become, the more effective they are.

"As more investors see that the gold market is relentlessly and successfully suppressed," C.W. writes, "they (to quote Sam Goldwyn) 'stay away in droves.' The suppressors have found that there are no sanctions against their activities and so have concluded that the more widespread the belief that they are controlling the gold price, the better. That is why the rigging is so obvious. "Although Stein's Law ("If something can't go on forever, it will eventually stop") applies here, I am not sure I will live long enough to see it, and such a feeling also depresses sentiment." * * *

C.W. is right, but only to an extent. For central banks and governments long have concealed their interventions against gold --

www.gata.org/node/12016 -- and even now refuse to acknowledge them formally --

gata.org/node/18210

gata.org/node/18832 gata.org/node/17793

-- and still refuse to acknowledge them because they realize that acknowledging them would cause bigger problems, demolishing the myth of free markets generally and, by informing ignorant market participants, of whom there are still many, drive them out of rigged markets and impair the necessary publicity for the prices that discourage other investors.

The increasing obviousness of government and central banks interventions is less a strategy than a consequence of the increasing difficulty of market rigging. Gold price suppression is discouraging production and causing tightness in the physical market that "paper gold" cannot relieve as easily as it used to.

Indeed, the manipulation and suppression of the gold price depend on a certain number market participants being deceived all the time. If manipulation and suppression did not depend on this deception, governments and central banks would proclaim their gold price suppression every day.

This manipulation and suppression also depend -- perhaps most of all -- on the dignity of mainstream financial news organizations. They can overlook market rigging by governments and central banks and maintain their dignity only if it is not officially acknowledged. Mainstream financial news organizations will never pose to governments and central banks any critical questions about market rigging or anything else, but if the rigging ever was officially acknowledged, the news organizations would lose too much face by not reporting it. Word would get around among journalists themselves and market participants and before too long and what remains of the credibility of the news organizations would be shot.

So with their gold market rigging governments and central banks now are enjoying the benefits of both suspicion and ignorance. Market participants who are suspicious of intervention stay out of the gold market, and market participants who are not suspicious stay in it, get fleeced, and in getting fleeced help governments and central banks publicize the manipulated and suppressed prices.

That's why exposure of government and central bank intervention in the gold market and other markets remains the prerequisite of ending imperialism and restoring limited and accountable government, free markets, fair dealing among nations, and democracy.

That exposure is GATA's work and the basis of our appeal for financial support:

gata.org/node/19134 Please consider helping us.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

Banksters Cartel International

(People can believe whatever they want. But sooner or later, real life intervenes.)

"It's the banksters again!" |

|

|

|

Post by Entendance on Jun 19, 2019 1:43:35 GMT -5

June 24, 2019 OCC Report: JPMorgan Chase and Citibank Control 76 Percent of all Precious Metals Contracts at 5,362 Federally-Insured Banks

Banksters Cartel International X

June 20, 2019 Goldman Sachs Is Quietly Trading Stocks In Its Own Dark Pools on 4 Continents

***************************

"I intentionally start writing this mere minutes away from Fed chair Jay Powell’s latest comments. Intentionally, because the importance ascribed to those comments only means we have gotten so far removed from what capitalism and free markets are supposed to be about, that it’s pathetic. The comments mean something for rich socialists, but nothing for the man in the street. Or, rather, they mean that the man in the street will get screwed worse for longer.

And it’s not just the Fed, all central banks have it and do it. They play around with rates and definitions and semantics until the cows can never come home again. And they have such levels of control over their respective societies and economies that the mere use of the word “markets” should result in loud and unending ridicule. There are no markets, because there is no price discovery, the Fed and ECB and BOJ got it all covered. Any downside risks, that is.

But it doesn’t, because the people who pretend they’re in those markets hang on central banks’ every word for their meal tickets. These are the same people we once knew as traders and investors, but who today function only as rich socialists sucking the Fed’s teats for ever more mother’s milk.

Our economic systems have been destroyed by our central bankers. Who pretend they’re saving them. And we all eat it up hook line and sinker. Because the rich bankers and their media have no reasons to counter Fed or ECB actions and word plays, and because anyone who’s not a rich banker or investor is kept by the media from understanding those reasons.

What the Fed and ECB have done, and the BOJ, between Greenspan and Bernanke and Yellen and Powell and Draghi and Kuroda, is they have made it impossible for economies to let zombies go to die as they should. They have instead kept those zombies, banks, corporations, alive to the point where they are today a very big live threat to those economies, and growing. Look at Deutsche Bank.

How healthy do you think your economy can be if all the wealthy people are focused on whether Powell uses the word “patient” or not in his notes? Why would a vibrant company or entrepreneur give a flying damn about whether he does or not use a certain word? There is no reason.

But we have let our central banks take over, and that’s what they did. And it will be very hard to take back that power, but we will have to. Because central banks, while pretending to guard over the entire economy, in fact only protect the interests of commercial banks, and rich “investors”. And then tell you it’s the same difference.

There’s a case to be made that Paul Volcker was right when he raised US interest rate in the 1980s, but after Volcker it’s only been one big power and money grab for Wall Street, starting with Alan Greenspan and the housing bubble he blew. The Oracle my behind.

Japan is only just beginning to assess the damage Kuroda and Abenomics have done, and that’s at a point where both these men are still in power, and hell bent on doing more of the same. Something all central banks have in common; there are very few tools in their boxes, so they just repeat and repeat even as they fail. And that failure, by the way, is inevitable.

The Bank of Japan by now owns half the country, and they just want to do more. Kuroda’s plan to get rid of deflation was to force the Japanese to spend their money/savings. But the fully predictable result was that the grandmas did the exact opposite: they clued into the fact that if he wanted that, they had reason to be afraid, and so they sat on their money. And now it’s ten years later.

Draghi is going to leave in a few months’ time, and he’ll lower rates even more (towards 0º Kelvin), even if he knows that’s a really bad idea (it is), because at this point it’s about his legacy (after me, the flood). Same thing that Bernanke, Yellen did, clueless intellectuals who told themselves they had a grip on this. They never came near. That’s why they were elected, for being clueless. Wall Street doesn’t want Fed heads who know.

The pivotal moment was when Bernanke said they were running into “uncharted territory”, and then never looked back and started pretending he knew where he was. He didn’t and none of them ever did since. But they have academic degrees, and they’re willing to sell their souls for money, so there you are.

Central banks, or let’s say handing them the powers that we have, are the worst thing we have ever invented, and that’s saying something in the age of Pompeo and Bolton and Trump and the Clintons. The latter may take us into war with Iran, or any other country from a long list, but central banks are set to destroy our societies and economies from within.

It’s real simple: your central bank does NOT serve your interests. So get rid of it. Don’t wonder whether it’ll use the word “patient” or raise or lower rates by 25 or 50 points, get rid of the entire thing. There’s nothing there that benefits you, it only ever benefits bankers.

Now, of course, if you’re a banker…" Central banks should be abolished

Smashes of the gold price when it approaches $1,350 have become so obvious as to signal that the gold cartel is desperate to defeat demand for the monetary metal, GATA Chairman Bill Murphy tells Dunagin Kaiser of Reluctant Preppers.

Update: We won, they lost!

"...Trump’s peculiar willingness to tie his fate to the often fickle stock market raises the question of just how far he might go to keep it moving higher. As Wall Street On Parade has previously reported, Trump’s Securities and Exchange Commission is already allowing the mega banks on Wall Street to trade their own stocks in their own Dark Pools (including JPMorgan Chase and Goldman Sachs) and Trump is relentlessly bullying the Chairman of the Federal Reserve, Jerome Powell, to take monetary actions that would be favorable to the stock market.

Confidence in the U.S. Department of Justice is also not exactly at its zenith right now and if there is any evidence between now and election day that Donald Trump is attempting to get the Justice Department to back off any criminal investigations in order to protect the stock market – that could derail his election as well..." President Dow

ECB Insiders Out Draghi as Fabricator & Schemer, and Talk to Reuters

|

|

|

|

Post by Entendance on Jun 26, 2019 3:20:48 GMT -5

|

|

|

|

Post by Entendance on Jul 13, 2019 7:19:23 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

“You’ve assigned us the job of two direct, real-economy objectives: maximum employment, stable prices. If you assigned us [to] stabilize the dollar price of gold, monetary policy could do that, but the other things would fluctuate and we wouldn’t care,” Powell said from Capitol Hill. “We wouldn’t care if unemployment went up or down. That wouldn’t be our job anymore.” – Jerome Powell in response to a question about returning to the gold standard. Everything about that answer is incorrect. Read here why

The Fed Could Use a Golden Rule Abandon the Ph.D. standard, which brought the era of government bailouts and too big to fail.

By James Grant

Gold is Doing Better Than The World's Major Currencies. John Murphy here

Bitcoin is nothing more than a distraction, created to direct widespread public worry away from concern about the eventual collapse of the Dollar's value. Hugo Salinas Price here |

|

|

|

Post by Entendance on Jul 20, 2019 3:40:18 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

Banksters Cartel International XII

Oh, and speaking of my complete contempt for Jerome Powell and his minions, I continue to applaud precious metals; their ascent is clearing shoving a knitting needle into the eyeballs of every central bank criminal on the planet. Here’s to gold and silver!!! Tim Knight here

“The suspicions that the system is rigged in favor of the largest banks and their elites, so that they play by their own set of rules to the disfavor of the taxpayers who funded their bailout, are true. It really happened. These suspicions are valid. Incentives are baked into the system to take advantage of it for short-term profit. The incentives are to cheat, and cheating is profitable because there are no consequences.” Neil Barofsky, TARP Inspector General

Phil Butler: The Banking Elite Are Cannibalizing Greece and the World

Decades of central bank intervention have left us with an unavoidable insolvency crisis. We’ve Arrived At The End Of The Road

Michael Snyder: A Bank With 49 Trillion Dollars In Exposure To Derivatives Is Melting Down Right In Front Of Our Eyes

There is probably no other topic in the gold and silver markets which incites heated debate more than the subject of precious metals price manipulation.

That prices in the precious metals markets are manipulated is not speculation, it is fact, a fact made clear again recently by the Commodity Futures and Trading Commission´s (CFTC) ruling against investment bank Merrill Lynch Commodities Inc (MLCI) for spoofing pricing of gold and silver futures contracts on the COMEX exchange.

The number of investigations, legal cases, class actions and financial headlines involving precious metals manipulation are now so pervasive that it’s hard to keep track of which cases are in motion and which investment banks are under scrutiny at any given time.

But beyond the profit and greed driven bullion bank manipulations gold and silver prices, there is also the issue of central bank policy interventions to suppress the gold price by outright gold sales or using the opaque and secretive gold leasing and lending market. This is a less talked about manipulation given the secrecy of everything to do with central banks and gold, as well as a reluctance of the financial media to broach the subject and a reluctance of regulators to ´go there´ by even looking at central bank gold market activities. Ronan Manly: Gold & Silver Price Manipulation – The Greatest Trick ever Pulled

I am a "conspiracy theorist". I believe men and women of wealth and power conspire. If you don't think so, then you are what is called "an idiot". If you believe stuff but fear the label, you are what is called "a coward". @davidbcollum

Pam Martens and Russ Martens: Senator Compares Facebook’s Libra Association to Spectre in James Bond Movie

Doug Casey: This is why I predict the Greater Depression will be… well… greater.

|

|

|

|

Post by Entendance on Aug 31, 2019 5:30:59 GMT -5

|

|

|

|

Post by Entendance on Sept 17, 2019 0:32:43 GMT -5

Banksters Cartel International XIII

"The revelations are just beginning. There is so much more.

The US announced that three traders at JPM were being charged with criminal manipulation of the precious metals markets.

Indeed, the prosecutors used racketeering and criminal enterprise language that suggested the possible application of RICO statute to the Bank.

Let's see if anything genuine comes of this. It has not done so in the past.

And the usual stiffs and hacks will say that this is just a few traders gaming some deals. Nothing to see here. Move along. We like things the way they are.

After all we have seen in so many markets, how anyone can just dismiss this as just a few bad apples seems to be almost incredible.

They have no good judgement and no shame. They have blinded themselves with their egos, their greed, and the love of the familiar favor of corruption. It is best to see things as they are and judge accordingly.

It is important to note that this criminal activity occurred over a long period of time, during the Obama Administration.

Eric Holder and Gary Gensler had an awful, chronically negligent, and inexcusable track record of upholding the law when it came to the Banks, and with their friends and donors on Wall Street." -Jesse

JPMorgan inherited 'spoof' method from Bear Stearns and refined it, indictment says A powerful vindication of silver market analyst and whistleblower Ted Butler, who long has said the racket began with JPMorganChase's acquisition of Bear Stearns! HERE

JP Morgan Was Criminally Rigging The Gold & Silver Markets In A Conspiratorial Racket? INCONCEIVABLE!

Nessun risultato senza preparazione VII

No result without preparation Chapter VII here |

|

|

|

Post by Entendance on Oct 3, 2019 2:15:25 GMT -5

Goldmoney Insights October 03, 2019

Alasdair Macleod: "...Sentiment in banking circles will turn on a dime, when bankers stop believing their mollifying in-house economists and pay attention to what their banking antennae tell them. They will rapidly discover that the crisis in international trade is undermining the creditworthiness of domestic non-financial businesses. They will also do everything they can to reduce counterparty risk with foreign banks deemed to be at risk of bankruptcy in their own markets. As night follows day, another banking crisis will rapidly escalate, this time likely to be on a greater scale than ten years ago. And the evidence from failures in the dollar repo market in recent weeks points to the banking system beginning to unravel now.

Between the wars, the world suffered a deflationary depression. This time, we appear to be travelling towards an inflationary depression."

The cancer that remains

"The banks are bigger than they have ever been;

they are just as full of rubbish derivatives;

they have, again, offloaded their worst loans to Fannie Mae and Freddie Mac;

stocks are more overinflated in value against real earnings and not just tax-disguised earnings..."

Banksters Cartel International XIV

"...So, anyway, if you want to bury your head in the sand, ignore the evidence and indictments, and claim that all you've just read is nonsense and "conspiracy theory," knock yourself out. A wise man once said, “it’s impossible to save someone who doesn’t want to be saved.” Indeed. All I can do is explain to you how these "markets" actually operate and remind you that the manipulation remains ongoing and active. You can take it from there.

One day, The Banks will either voluntarily or involuntarily leave this business and prices will be allowed to find a true equilibrium between physical metal and fiat currency. In the meantime, you must understand that the greedy, criminal, COMEX market-making Banks will continue to fight us every step of the way...regardless of whether a few of their trading Monkeys are indicted/incarcerated."

There’s Nothing Normal About the Fed Pumping Hundreds of Billions Weekly to Unnamed Banks on Wall Street:

Prolonged low interest rates are having significant negative effects on banks’ core business and role in the economy, the Bank of International Settlements (BIS) warned in a new paper, just weeks after the ECB reduced its policy rate deeper into the negative...

|

|

|

|

Post by Entendance on Oct 23, 2019 2:38:45 GMT -5

Sound and Honest Money Updated? Click here

|

|

|

|

Post by Entendance on Nov 21, 2019 1:33:13 GMT -5

|

|

|

|

Post by Entendance on Dec 10, 2019 6:30:17 GMT -5

"...As proof that market stresses are growing, this morning the New York Fed offered $25 billion in a 28-day repo loan to 24 of Wall Street’s trading houses (primary dealers). There was an outsized demand for that money with bids submitted for $43 billion. The New York Fed provided only its planned $25 billion in loans, meaning that $18 billion in needed liquidity went unfilled. In addition, the New York Fed provided $56.40 billion in an overnight repo loan.

The problem with all of the narratives that have surfaced thus far on the repo loan crisis is that this market historically has turned over $1 trillion daily in loans in the U.S. Since the Fed is only providing approximately $100 billion a day, clearly the biggest banks and money market funds are making loans to those counterparties that they believe are good risks. This supports the thesis from Wall Street On Parade that the biggest banks are backing away from lending to those institutions that are deemed a bad risk or are heavily interconnected to an institution deemed to be a bad risk – even for an overnight loan since the institution could file for intraday bankruptcy.

This is precisely the scenario that led to credit seizing up and banks refusing to lend to one another in 2008.

Adding to the thesis that the crisis is not improving, during questioning by the House Financial Services Committee last Thursday, U.S. Treasury Secretary Steve Mnuchin said that the New York Fed was called before the Financial Stability Oversight Council (F-SOC) last week to answer questions on what has happened to the proper functioning of the repo loan market. F-SOC is made up of the heads of every major federal regulator of banks and Wall Street. It was also created under the Dodd-Frank financial reform legislation to prevent another epic financial crisis like that of 2008." BIS Drops a Bombshell: Four U.S. Mega Banks Are Core of Repo Loan Crisis

"...the materialization of this worst-case scenario would just mean even more QE from the Fed..." here

Wolf Richter: "...My recommendation has changed..."

Dave Kranzler The Fed’s Repo QE: The Underlying Problems Are Escalating

Life is about the management of risk. -Jesse Livermore

Meanwhile...

ECB balance sheet has hit a fresh lifetime record ECB balance sheet has hit a fresh lifetime record

|

|

|

|

Post by Entendance on Jan 1, 2020 7:43:00 GMT -5

No room for anti-Americanism at Fred & Entendance Beach

Brandon Smith: "... Don't participate, and refuse to support new banker wars. Don't be a War Pig"

Ellen Brown: Repo Madness

Banksters Cartel International XV The Entendance Beach & Banksters Cartel International

2020: Who Will Buy All this Debt?

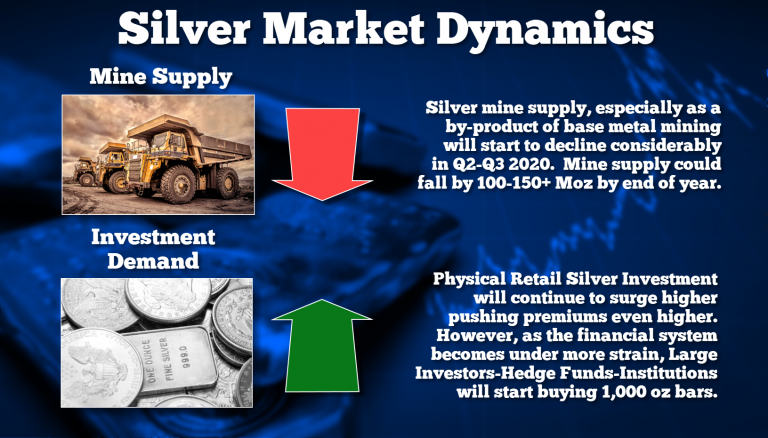

2020, Silver & The banksters

"Gold and silver investors buy metals because they are scarce. Precious metals are by nature difficult to find, and hard to produce. Consequently, above ground stocks are limited and valuable, particularly when priced in unlimited fiat currencies-

The bankers and government officials behind these fiat currency systems don’t like stable monetary benchmarks such as gold putting their inflation schemes on full display. They absolutely hate that gold works as a refuge.

Inflation is a stealth tax. Instead of overtly raising taxes, politicians simply borrow and print the money needed for more government. They just need people not to notice.

Which brings us to the futures markets for gold and silver..."

January 6, 2020

Bullion Banks Used Paper Gold And Silver To Restrain Price Advance In 2019

"Comex gold contracts were brought to life in 1974. Correspondence between senior officials in, and advisors to, the Nixon Administration discussed the need to create an “investment” vehicle to “capture” institutional investment money directed into gold in order to prevent the rapid rise in gold after Nixon closed the gold window. If you are curious, the letters are posted in the GATA archive. Since the introduction of paper gold, the Comex – gold and silver trading – has evolved into what can only be described as a caricature of a “market.” The open interest in gold contracts is nearly 10x the amount of physical gold reportedly held in Comex vaults; it’s 60x the amount of “registered” gold, or the gold designated as available for delivery.

Total open interest on the Comex as of last Thursday is 787k contracts representing 2,459 tons of paper gold. Global annual physical gold production is around 2,700 tons. The net short position of the Commercial trader category per the current COT report – “commercials” are primarily the banks which make markets on the Comex – is 134k contracts, or 418 tons of paper gold.

That the open interest in paper gold contracts is nearly equivalent to the amount of actual gold produced yearly by gold mines is an absolute joke. The purpose of the Comex, period, is to give the western Central Banks – primarily the Fed – the ability to control the price of gold. Based on the preliminary o/i report for Friday, the paper gold interest has spiked up to approximately 800,000 contracts.

But the good news is that rapid escalation of open interest in paper gold on the Comex is evidence that the banks are losing their ability to keep a lid on the rising gold price." The Comex Is A Complete Joke

Mon, Apr 3, 2017: Econ 101 -- Silver Market Manipulation

The following table shows what the silver price would be, based on the gold price and the gold/silver ratio

Pam Martens and Russ Martens: Why Is Wall Street the Only Industry in America With Access to the Fed’s Endless Money Machine?

"When current government policies inflate the coming resource bubble, the odds are excellent we’ll be laughing all the way to the bank. Assuming the bank is still there…" Doug Casey here

Take note: "Governments and Central Banks are now supreme experts in the total destruction of your money". E.

E. on twitter

|

|

|

|

Post by Entendance on Jan 14, 2020 3:01:31 GMT -5

"...Buy gold and demand immediate delivery. And then let's see if we can finally begin to see prices reflect true physical gold demand and not fabricated pretend gold supply..." Real Gold vs Pretend Gold

The War On Cash, The War On Gold Updated: Germany

Meanwhile...

"Last Friday, the usually reliable and fact-intensive financial website, Wolf Street, threw a hissy fit over how the Wall Street Journal (and by extension, Wall Street On Parade) is reporting the tallies for the repo loans that the New York Fed has been pumping out every business day since September 17, 2019 to the trading houses on Wall Street..."

32 Misinformation Schemes & Other Tactics Used by Wall Street, Corporate America & the Media,

|

|

|

|

Post by Entendance on Jan 21, 2020 6:33:35 GMT -5

"A five-alarm fire has broken out in a little known, but critically important area of the financial system where high-quality bonds are swapped for cash. The "repo" market, which is short for repurchase agreements, is part of the nondeposit, shadow banking system that remains largely unregulated despite the fact that it was ground zero in the 2008 financial crisis..."

January 23, 2020 Pam Martens and Russ Marten:

"The power to create and dispense infinite money in secret helps central banks rule the world, but most of all they require the negligence of financial journalism." -CHRIS POWELL, Secretary/Treasurer Gold Anti-Trust Action Committee Inc. here

|

|

|

|

Post by Entendance on Feb 7, 2020 14:21:01 GMT -5

Banksters Cartel International XVI

“Can you imagine how attending a lavish party at Jeff Bezos’ $23 million home, along with Jared and Ivanka and the CEO of JPMorgan Chase, Jamie Dimon, might give off the sense to the public that you are not in fact immune from external pressures.” More here “Can you imagine how attending a lavish party at Jeff Bezos’ $23 million home, along with Jared and Ivanka and the CEO of JPMorgan Chase, Jamie Dimon, might give off the sense to the public that you are not in fact immune from external pressures.” More here

"...For many involved in the metals markets, it has been obvious for years that JPMorgan is at the center of a program to rig gold and silver prices. These cries were long dismissed as conspiracy theory. Today few can dispute there has been pervasive, well-orchestrated cheating over nearly a decade, if not much longer.

We now know at least some officials inside the Department of Justice agree. They view the bank’s activities as organized crime, like the mafia.

It remains to be seen whether actual charges will be brought against the bank. So far, only individuals have been charged. Given the bank’s power and influence there is no certainty justice will prevail, even if the evidence is overwhelming.

Finally, there is no certainty as to whether any penalties will be commensurate with the crime. Individual criminals on Wall Street may have been banned from trading and bankrupted by fines. However, it would be unprecedented for a bank the size of JPMorgan to receive a trading ban or fines large enough to meaningfully impact the bank’s operations..." JPMorgan Chase Confirmed as Target of Metals Price Rigging Prosecution

Today Bill Murphy tells us that he thinks the "Gold Cartel" is running out of the physical supply of gold and that the open interest numbers on Comex gold are doing something they rarely ever do.

|

|

|

|

Post by Entendance on Feb 13, 2020 17:31:18 GMT -5

There is likely nothing that criminal senior bankers dislike more than a lower associate ratting them out, and consequently I speculated that Edmonds' continued squealing about his gold spoofing may have placed him in line for retaliation. As a trader for 13 years, Edmonds was not a neophyte at JPMorgan. Still, he testified that more senior bankers at the firm trained him in how to manipulate gold prices lower and that senior advisers at JPMorgan were fully aware of and approved his criminal behavior.

Though much of the publicity about Edmonds' case has been about his gold price manipulation, Edmonds also admitted to manipulating silver, palladium, and platinum prices from 2009 to 2015.

Assistant U.S. Attorney General Brian Benczkowski stated, "For years John Edmonds engaged in a sophisticated scheme to manipulate the market for precious metals futures contracts for his own gain by placing orders that were never intended to be executed."

"...This case was of particular interest to me because to this day I do not believe that this criminal practice has ceased at JPMorgan and at other global banks. In fact, my patrons for the last 18-months have received weekly videos in which I repeatedly and accurately predicted gold price slams, sometimes to within a few dollars of the slam, which should be impossible to accomplish if bankers were still not manipulating gold prices.

Consequently, this practice has likely never stopped simply because the punishment has yet to match the enormity of the crime, with judges levying fines that amount to just a fraction of the profits generated from the spoofing, and no judge yet imposing considerable jail time.

With no real threat of serious prison time and with guaranteed profits many times the amount of the fines, there is no disincentive in the banking industry to cease manipulation of precious metal prices for profit.

Since Edmonds' case was not resolved with the typical slap on the wrist and a fine of pennies on the dollars of criminal profit, I was truly interested to discover if Edmonds or any of his superiors at JPMorgan who were involved with his criminal activity would be sentenced to prison for the first time in the history of precious metal price manipulation.

If the FBI pursued this case aggressively and a few JPMorgan bankers were sent to prison for at least two or three years, then for the first time there would have been a substantial victory for all of us who desire fair pricing mechanisms in gold and silver all over the world.

Serious prison time in a maximum-security prison (and not preferential treatment like the well-connected sex trafficker Jeffery Epstei received) will be the only deterrent to criminal manipulation of gold and silver prices.

The Edmonds case still could free gold and silver prices from the grip of corrupt global bankers, especially if senior bankers JPMorgan are sentenced to long prison terms. Though I am not hopeful that we will see such a positive outcome, it is still important to watch the Edmonds case."

|

|

|

|

Post by Entendance on Feb 26, 2020 6:06:20 GMT -5

March 2, 2020

February 29, 2020 Is Wall Street Behind the Delay in Declaring the Coronavirus Outbreak a “Pandemic”?

Huge Bank Bailout Coming Because of China Virus February 26, 2020 Video: China Virus Accelerating End Stage of Fiat Currency Disease – Wayne Jett

|

|

|

|

Post by Entendance on Mar 4, 2020 4:29:56 GMT -5

In times of war, the law falls silent: at 3:08 we noticed the Dow Jones flashing 25,268 — another whaling to conclude the week.

We next looked in shortly after 4 to tally the final damage.

Yet we were astonished to discover the index had surged to 25,938 in that hour.

For emphasis: That is a 670-point spree in the span of one hour.

It settled down to 25, 864 by closing whistle. But the index closed the day only 256 points in red — a victory of sorts.

What happened?

A quick look at Apple revealed it began rising around 3 o’clock… as if by an invisible hand.

Microsoft displayed a nearly identical pattern. And Amazon. And Google.

All mysteriously jumped at 3 p.m.

We leave you to your own conclusions...Did the Fed Bail out the Market Today?

Banking was conceived in iniquity and born in sin. The bankers own the earth. Take it away from them, but leave them the power to create money, and with the flick of the pen they will create enough deposits to buy it back again. However, take away from them the power to create money and all the great fortunes like mine will disappear and they ought to disappear, for this would be a happier and better world to live in. But, if you wish to remain the slaves of bankers and pay the cost of your own slavery, let them continue to create money."-Josiah Charles Stamp, 1st Baron Stamp

Fed impotence exposed after “unnecessary & panicky” rate-cut … China manufacturing collapse confirmed as factory survey hits record low … 10-year Treasury yield falls to all-time low after Powell press conference …

Gold and silver soar after Fed emergency rate cuts; “Gold sets up for another massive move higher” …- John Rubino

that's the real reason why he is richer than you

|

|

|

|

Post by Entendance on Mar 14, 2020 14:15:06 GMT -5

March 13, 2020

So, Deutsche Bank is the canary in the coal mine? Nenner says, “Definitely. If DB goes, I don’t know what all the other banks are going to do. . . . It looks like DB can go to zero. . . . Next step is $3.90. If it goes to that, it’s finished.”

DB is just one big bank in deep financial trouble, and it’s much bigger than just DB. Nenner says, “Other banks are also down 20%. Italian banks are very important. What happened in Italy? They closed everything down. There is no fashion business anymore. There is no car business anymore. There is nothing going on. How do you think these banks are going to make it?”

Nenner says he is forecasting a banking crisis, and the tip of the iceberg is Deutsche Bank. Nenner says, “They are interconnected to all the other banks in Europe. I don’t know how the other banks can survive if this bank gets into trouble.”

The Entendance Beach & Gregory Mannarino on the same page

"Nothing speaks of panic more than a gamble doubling down after a losing trade. And that’s what the Fe dis doing here. After seeing their emergency rate cut of 50bp going over like a lead balloon and every other central bank emergency action fail (think the BOE’s 50 bp emergency rate cuts and today’s failed ECB additions of QE and liquidity, the Fed felt forced to launch their biggest bazookas yet:

$1.5 trillion in liquidity injections today and tomorrow and at least $500B in repos scheduled until mid April at least..."

2019: The Entendance Beach "You have to decide ***whether to look like an idiot before the crash or an idiot after it."

Starve the banksters, stack gold & silver bullions, store them outside their banking system. E.

|

|

|

|

Post by Entendance on Mar 15, 2020 3:51:00 GMT -5

March 20, 2020

"...You can turn every tree in California into paper, print money and you still cannot bail the US economy out. We have gone over the edge and have slid right into the Greatest Depression. We need to do what we can to produce medicine and to provide medical care for the millions of Americans about to come face to face with the Coronavirus. Tens of thousands of small businesses are being destroyed as I write. Many will never recover no matter what the government does.

But we need to recognize right now that there are very real limits to what government can afford and should do. Bailing out shareholders of companies run by idiots for the sole purpose of enriching shareholders would be as close to insanity as you can find. Boeing will still build aircraft but will be under different ownership. All the airlines will still be flying but will have new shareholders. Banks will still do what banks need to do.

They just don’t need to do it with taxpayer money. Do you want to put your grandchildren into debt slavery on behalf of the shareholders of these companies?

If they fail, let them fail. That’s why we have bankruptcy laws. Rewarding people for fraud and stupidity is a sure road to disaster. Human stupidity is limitless. Government funds are limited." When You Reward Failure, You Encourage Fraud

"Central banks and the Bank for International Settlements cannot afford to see a bullion bank blow-up, and doubtless have been working behind the scenes to prevent one. Gold is likely being leased to the bullion banks, giving them some liquidity on paper, but in practice it never leaves the central bank’s vault and therefore its possession. Futures are sold with the purpose of triggering the speculators’ stops, creating an avalanche effect on the price. The intention is for bullion banks to either get at least square in their positions or preferably long, because they know that when the suppression exercise is over, the price of gold and silver will rise dramatically in the face of fiat money expansion.

What they don’t know yet is the fate of fiat currency. We know from analysing John Law’s experience in 1720 that in 2020 we are likely to see the end of it very soon. Conventionally expressed, that gives gold and silver prices of infinity, and moves of a hundred bucks or so are immaterial."

Wall Street’s Crisis Began Four Months Before the First Reported Death from Coronavirus in China; Here’s the Proof

Reset updated

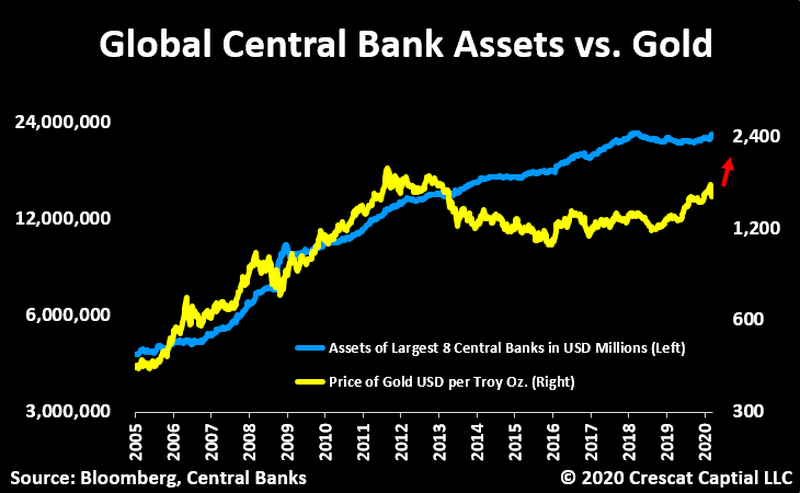

"...The fundamentals have never been better for gold and silver prices to rise making the discounted present value of these companies even better. Global central bank money printing is poised to explode which is important because the world fiat monetary base is the biggest single macro driver of gold prices. Gold itself is already undervalued relative to global central bank assets which targets gold at $2400 an ounce today..." -Kevin C. Smith, CFA here

"This is a demand shock. Meaning the solutions would well be centered on the consumer.

A recovery may be found from the bottom up. But alas, that is not where the power and money reside these days, in this rotten system.

But why keep saying the same old things to the corrupt and willfully blind, when they have placed themselves beyond reason, and redemption. And I'll leave it at that.

Stocks cracked down to new lows yesterday.

The Nasdaq 100 finally broke the 30% decline level, and the SP 500 was there and then some. This is no bear market. This is a crash. The bear market may come later on." -Jesse

The financial elites are pushing a narrative that asset prices, sales and profits will all return to January 2020 levels as soon as the Covid-19 pandemic fades. Get real, baby.

March 17, 2020

Banksters Cartel International XVII

"...when global markets panic, many speculators in paper gold sell their positions for liquidity reasons. This gives the manipulators, with the BIS leading the exercise, a chance to push gold down $100 on a Friday afternoon in Europe over a 3 hour period like they did on Feb 13th. The BIS and their lackeys, the bullion banks, clearly wanted the opportunity to pick up gold at bargain prices before the real rally starts..." -von Greyerz here  Bill Murphy, Chairman of the Gold Anti-Trust Action Committee (GATA), says don’t worry about the recent price drop forced on the markets by the gold cartel with naked short selling. It’s not going to keep prices down for long. Murphy contends, “We have been trying to expose what this gold cartel has been doing. The bullion banks, the Fed, the Treasury, the Bank for International Settlement (BIS) and what they have done is to suppress the price. What has happened after all these years is the gold cartels have run out of enough physical gold to do what they have done. They are lost. They have blown up really. They can act in the paper market, but since May, gold has made one new high after another. . . . They are panicking to get out, and to do that, they are panicking speculators to get out of the gold and silver markets and collapsing the prices.” Murphy says physical gold and silver metal is being bought up at a fast pace with the artificially cheaper prices. Murphy says, “This is another example to how close we are getting to the gold market blowing up. I am talking about $100 per ounce up days will become common . . . because there won’t be any physical gold to meet the demand. It’s going to go bonkers all over the world. They can’t stop it. . . . All I can say right now is they (gold cartel) are panicking the paper speculators out of the gold and silver market so they can cover their massive short positions. It’s absolutely staggering what’s been going on in the past couple of days.

They have created a panic in the paper market, but it’s not happening in the physical market. The U.S. Mint just stopped selling Silver Eagles because they ran out.”

Murphy contends, “Gold and silver prices right now are artificially low because of these (gold cartel) people. This is what’s going to cause the biggest move in history. It’s now coming down to the short strokes, and it’s been a long time coming. I can’t wait for it to happen. Then our (GATA) story will be told, but our story is not as important as getting the truth out to the people so they can take advantage of what’s going on.”

In closing, Murphy says, “The gold cartel has done this (price suppression) year after year after year, and now they have hit the wall. Some of us thought a ‘black swan’ would do this, and it has. It’s a horrible black swan. It’s a black plague, and it’s changing the American way of life for a long time to come.”

|

|

|

|

Post by Entendance on Mar 21, 2020 5:58:30 GMT -5

March 24, 2020

While the corporations and small businesses will receive “billions,”

Wall Street’s mega banks and trading houses will, once again, have trillions of dollars of toxic securities removed from their balance sheets,

|

|

|

|

Post by Entendance on Mar 25, 2020 1:48:55 GMT -5

The central bank system is the greatest scam ever perpetrated on an ignorant public. The eternal enemy of every central bank is... Gold (& Silver). -Richard Russell

Banksters Cartel International XVIII (They’re doing everything they can to put a lid on gold & silver) Increasing physical short squeeze in NY and in London

At this point it really doesn't matter how much money the Fed prints to fund this nonsense as soon the money will be practically worthless anyway.- Peter Schiff

GOLD MARKET Is BLOWING-UP! Huge PROBLEMS At COMEX, LBMA, New York, Canada, South Africa, London And Switzerland OH MY!

"The banks are bluffing by claiming to have lots of supply of LBMA bars in london. My own research indicates that, at current net demand for LBMA bars, and assuming mines remain shut, LBMA bars will run out by June." "The CME PR is out. Two important facts have been withheld: 1)Which banks were short $16B more physical than in CME vaults and required a bail out? 2) How will LBMA metal in London be used to settle delivery in NY during Covid shut-down? Another sad day for "free" markets." -Roy Sebag

The Entendance Beach Wealth Preservation Principles:

Store Gold/Silver outside the banking system

Direct ownership by the account holder

Custody control by investor

100% reputable privately owned vault

Maximise elimination of counterparty risk

Storage in a politically stable country

Transact with the most reliable liquidity providers

No compromise on privacy and security. |

|

|

|

Post by Entendance on Mar 28, 2020 2:52:27 GMT -5

|

|

|

|

Post by Entendance on Mar 30, 2020 10:41:34 GMT -5

Now even the fig leaf is gone. These bailouts are not (or should not be) necessary.

BlackRock not only sells junk-rated bond ETFs under the brand name iShares, but it has some of the largest investment grade corporate bond ETFs, including one that trades under the stock symbol LQD, which was experiencing serious losses and seeing major outflows of money until the Federal Reserve announced recently that it was creating three facilities to buy investment grade corporate debt from the primary and secondary markets, as well as investment grade corporate bond ETFs, along with agency commercial mortgage-backed securities.

And just who is going to be running these facilities for the Federal Reserve? None other than BlackRock – posing an enormous conflict of interest which was readily observable in the market as BlackRock’s investment grade ETFs rallied dramatically on the news.

This is a chart that AIG was eventually forced to release showing that more than half of its bailout money came in its front door and went out the backdoor to pay off Wall Street and foreign trading houses. The chart shows that Goldman Sachs received $12.9 billion of the funds; Societe Generale received $11.9 billion; Merrill Lynch and its U.S. banking parent, Bank of America, received a combined $11.5 billion; the British bank, Barclays, received $8.5 billion; while Citigroup, which was secretly drinking at the Fed’s trough to the tune of $2.5 trillion in cumulative loans to cover its own losses, got $2.3 billion from AIG.

All you need to know about mr. Bean-draghi & the jesuit ex-alumni connection is here |

|

|

|

Post by Entendance on Apr 2, 2020 9:05:19 GMT -5

|

|

|

|

Post by Entendance on Apr 4, 2020 3:38:47 GMT -5

"The banks that are begging for bailouts still cling to their bonuses. To terrorize us into letting them keep their bonuses, the banksters are threatening to release the button on their suicide vests and blow themselves up by not taking the bailouts if they can’t have their bonuses.

You would think the response to that would be a no-brainer: “O.K. Go ahead.” Then just walk off. Watch, however, as the European Central Bank Supervisory Board Chair pretends to be getting firm with the banks because it’s so important that we bail them out on their terms: (The first two-minutes-and-twenty-seconds are all you need listen to. Any more could cause medically unnecessary nausea or brain injury as he goes to say that his recommended conservative measures are “not reflecting a specific fragility” in the European banking system at present. No, there’s none of that. All is well in Bailout Bonus Bonanzaland. They’re just doing unnecessary bailouts.)..." Bailout BONUS Bonanza Going Bonkers … Again!

Wait. They selected the Wall Street bank that raked in the biggest bailout ever with a history of screwing its customers to handle the latest bailout? AND expect them to help protect mom and pops? Nomi Prins (must read her article The Fed, the Virus, and Inequality )

|

|

|

|

Post by Entendance on Apr 7, 2020 3:48:11 GMT -5

Central banker walks into a casino to play blackjack.

Loses every hand but doubles down on each bet.

Croupier says: Aren’t you worried about running out of chips?

Central banker says: No, I make my own chips and I keep playing until I own the casino.

Repetita iuvant

? No way! ? No way!2012: "...the Banksters’ self-proclaimed Endgame is the complete and utter domination of humanity. The object is not Money, but Power. This very small group of Elite already own most of the world, so it’s only natural that they become a bit restless and bored after generations of living in the lap of luxury. Why do the 0.000001% always want to kill and enslave everyone? Hell if I know, but history has shown that Tyrants – be they Kings, Emperors, or Führers – lust after the blood of children once securing power. Psychology was only my minor so I can’t hope to fully explain why the Banksters want to destroy Free Humanity; I just want people to wake up the fact that forces are trying to destroy Free Humanity, and are on pace to accomplish this goal within the next decade or two (if not sooner), unless we do something about it. But, if forced to give an opinion, I would postulate that all of this angst comes from Small Penis Syndrome (SPS). Does that explain these two Bankster minions? Not sure, and No Comment. Anyway, in the days of the Ancients, the primeval craving for death and destruction was sated by good old-fashioned physical violence: Invade a neighboring village, behead the men, enslave the boys, and rape the women. After singing some songs and drinking some drink, pack up the spoils of war and move on to the next enclave. Repeat until reaching an ocean, desert, or impassable mountain range. This is a natural human trait and we have yet to evolve beyond it; unfortunately, advances in technology and exponential growth in Industry have spawned ever more effective ways of slaughtering both neighbors and disobedient peasants. Not Good. Where once taking a human life involved a full cleave of an axe, soon multiple executions required merely the pull of a trigger, or the opening of a valve. The first half of the 20th Century introduced chemical warfare and mass Death From Above, but the rubicon was crossed with the dawn of the Atomic Age in 1945. Nuclear weaponry raised mankind’s Potential Destruction by a factor of, well, a shit ton, and forevermore just one slip up will mean...I’m not as worried about my own fate as I am worried about the survival of the human species... With this in mind, let’s return to the question at hand: Who Are The Banksters? They are not a Council of Thirteen holding Secret Meetings inside the Vatican or under the Great Pyramids. On the other hand, the term Bankster does not simply serve as a metaphor for income inequality as the result of fraud by the upper class. The Banksters I hope to Dethrone are a hybrid of these two extremes; while they are a group of individuals actively working to steer the fate of humanity, their power is more than the sum of a few hundred billionaires’ bank accounts and stock holdings. The current power structure of the Western World – the Banksters – have been in control for quite some time, and have been planning their final heist for more than a century. Time for a history lesson – I’ll be brief.

There are three types of Banksters: Royalty, Old Money, and New Money... A group of Super Elite are in control of everything, and they are going to blow it all apart sometime between tomorrow and, oh, 2020. For real, they’re gearing up to go all-in. God Bless America!" Jun 19,2012 Who Are The Banksters?

In case you missed it...

2016, August 31:

"Trump jumped into bailout mode in response to the depth of the economic crisis triggered by the pandemic. A mountain of money has already been promised to the banks, while many other soon-to-be bankrupt corporations will get unimaginable sums with few strings attached, such as the airlines, Boeing, cruise ships, etc., many of whom, like Boeing, were doing poorly before the crash..." Bail Out the States Not the Banks

|

|

Cartel Desperate To Keep Gold & Silver Prices Down Right Up Until The Collapse

Cartel Desperate To Keep Gold & Silver Prices Down Right Up Until The Collapse

“Can you imagine how attending a lavish party at Jeff Bezos’ $23 million home, along with Jared and Ivanka and the CEO of JPMorgan Chase, Jamie Dimon, might give off the sense to the public that you are not in fact immune from external pressures.” More

“Can you imagine how attending a lavish party at Jeff Bezos’ $23 million home, along with Jared and Ivanka and the CEO of JPMorgan Chase, Jamie Dimon, might give off the sense to the public that you are not in fact immune from external pressures.” More

? No way!

? No way!