|

|

Post by Entendance on Sept 22, 2023 7:33:26 GMT -5

When you see that in order to produce, you need to obtain permission from men who produce nothing;

when you see that money is flowing to those who deal not in goods, but in favors;

when you see that men get rich more easily by graft than by work;

and your laws no longer protect you against them, but protect them against you;

...you may know that your society is doomed.

Atlas Shrugged - Ayn Rand

The difference between school and financial markets?

In school, you're taught a lesson and then given a test. In financial markets, you're given a test that teaches you a lesson.

Action without study is fatal. Study without action is futile.

There is a reckoning coming, and a hard lesson in market and monetary economics.

Act accordingly. E.

Se tu

chiudi gli occhi

e mi baci,

tu non ci crederai

ma vedo

le mille bolle blu

e vanno leggere, vanno

si rincorrono, salgono

scendono per il ciel.

Blu le mille bolle blu

Blu

le vedo intorno a me

blu

le mille bolle blu

che volano e volano e volano

Blu

le mille bolle blu

blu

mi sento dondolar

blu

tra mille bolle blu che danzano

su grappoli di nuvole

Dentro a me le arpe suonano

bacio te

e folli immagini

giungono.

Blu

le mille bolle blu

blu, le vedo intorno a me blu, le mille bolle blu

che volano, mi chiamano, mi cercano

Amor

impazzisco di gioia

se vedo passeggiar

nel vento, le mille bolle blu

un bacio, ancora un bacio

si avvicinano

eccole eccole

sono qui

West's suppressed Gold price is increasingly arbitraged in East, Maguire says

|

|

|

|

Post by Entendance on Sept 23, 2023 3:01:02 GMT -5

The QT show started less than a year ago. German home prices -11%, ECB assets -19%.

|

|

|

|

Post by Entendance on Sept 25, 2023 7:40:57 GMT -5

'...Given that the data will be available to 3,000 outside contractors, it will soon be a hacker’s paradise, if it isn’t already.

Actually, it won’t even need to be hacked, all it takes is one nefarious outside contractor.'

An empire of pain |

|

|

|

Post by Entendance on Oct 1, 2023 2:35:04 GMT -5

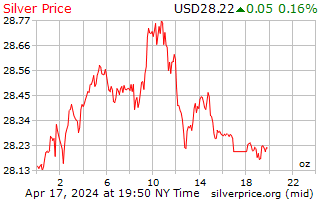

'So sad and so obvious. JP Morgan is back in the Price Driver's seat in the COMEX silver derivative market so expect the rigs to become more violent and more obvious. Also, after a few months of increased Silver Eagle Sales the US Mint has once again STOPPED sales of Silver Eagles only half way through September in order to help with the Silver Price Suppression! The closer we get to the end the more intense the Silver Price Rigging will become. Stay in your lawn chairs and WATCH THE SHOW!'

Potential Collapse of the US Dollar

“The surge in gold prices in weakening currencies suggests that the US dollar may be poised for a complete collapse.”

“When a foreigner starts losing on his investments in a foreign currency, he just tries to get the hell out of it… The dollar is poised for a complete collapse.”

The potential collapse of the US dollar is something we should be aware of and it’s not far away.

The Scramble for rubles to buy oil highlights the vulnerability of the US dollar, indicating a possible complete collapse of the currency.

“US Dollar Poised For Complete Collapse!”

Impact on Global Financial System

Foreigners within the US banking system hold a staggering $32 trillion in investments and bank deposits, highlighting the potential impact of any financial crisis on a global scale.

“The currencies are beginning to face obvious problems, leading to the Central Banking cartels’ response and the looming crisis in the gold paper market.”

The Chinese government’s encouragement of its citizens to buy gold suggests their concern over the instability of the Western financial system and the potential collapse of the US dollar.

“The addition of six new nations to the BRICS formation, including the three largest oil producers in the world, spells the end of the Petro dollar and US dominance.”

The consolidation of the BRICS and Shanghai Cooperation Organization into a single mega block will make it more challenging for the West to maintain political power and hegemony, potentially leading to the reintroduction of gold backing into currencies.

Importance of Owning Gold

“Unless you’ve got your own precious metals, I think you’re in trouble.”

“There is a shortage, you have to bid up to get physical gold.” – Despite the falling paper price of gold, there is a shortage of physical gold, leading to increased bidding and a potential crisis in the gold market.

As the price of gold rises, it reflects the devaluation of currencies like the dollar, leading to a potential crisis in the paper markets due to a lack of physical gold to deliver.

“If you do not own gold, you have no understanding of history or economics.” – Alasdair Macleod

“Their currency in real terms is valueless… You need to own gold.” – Alasdair Macleod highlights the importance of owning gold as a hedge against a potentially collapsing US dollar.

|

|

|

|

Post by Entendance on Oct 2, 2023 8:14:30 GMT -5

The Yield on 10-Year Treasury Notes Hits a 16-Year High; Stocks Lose Ground in 8 of Last 10 Sessions;

Pam and Russ Martens: JPMorgan Chase gets another fine, for 40 million derivative violations

'In the eyes of Wall Street veterans who are paying close attention to what’s going down at the mega banks on Wall Street, federal regulators are making the crime wave at these banks worse, not better. The federal fines for egregious behavior at these banks are getting smaller and more meaningless by the day. Take, for example, what happened on Friday...' Over and Over Again: Goldman’s Corporate Culture of Violating Federal Laws, Getting Caught, and Settling Federal Enforcement Cases

Concurring Statement of CFTC Commissioner Christy Goldsmith Romero on CFTC v. Goldman Sachs Over and Over Again

|

|

|

|

Post by Entendance on Oct 5, 2023 7:43:27 GMT -5

Gold premiums in Moscow and Shanghai will bust Comex, Maguire says

The taking of your securities for collateral

JPMorgan’s relationship with gold

Unwinding the financial system |

|

|

|

Post by Entendance on Oct 12, 2023 1:08:06 GMT -5

|

|

|

|

Post by Entendance on Oct 14, 2023 4:11:29 GMT -5

It's frightening to think that you might not know something, but more frightening to think that, by and large, the world is run by people who have faith that they know exactly what's going on. -Amos Tversky

Give a small number of people the power to enrich themselves beyond everyone's wildest dreams, a philosophical rationale to explain all the damage they're causing, and they will not stop until they've run the world economy off a cliff. -Philipp Meyer

The US has been in a cycle of bubbles, busts, and crashes since at least 1995, and more likely since Alan Greenspan became the Chairman of the Federal Reserve in August, 1987.

The cycle is the same, only the depth and duration seems to change in a continuing 'wash and rinse' of the public money and the real economy.

It has become a machine for transferring income, wealth, ownership, and power to the very top.

This is not 'the new normal.' This is financial corruption and the erosion of systemic integrity.

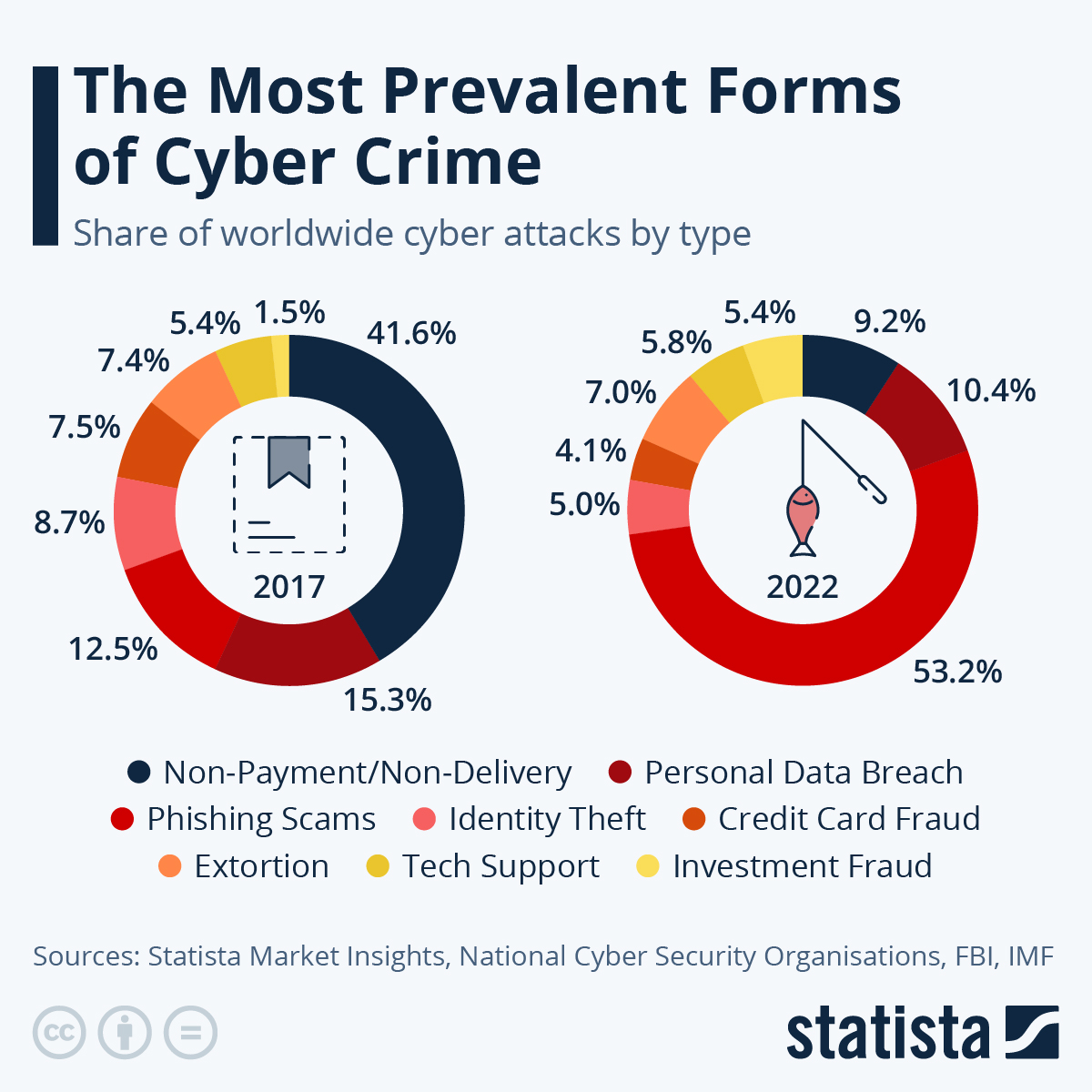

Are there any markets that have not been shown to have been systematically manipulated, for years?

This is just institutionalized looting. -Jesse

|

|

|

|

Post by Entendance on Oct 19, 2023 7:38:40 GMT -5

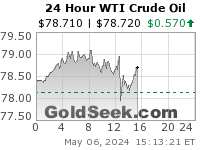

IS IT ALL ABOUT ENERGY – OIL & GAS?

|

|

|

|

Post by Entendance on Oct 24, 2023 16:37:14 GMT -5

|

|

|

|

Post by Entendance on Oct 28, 2023 5:15:12 GMT -5

|

|

|

|

Post by Entendance on Oct 31, 2023 1:20:08 GMT -5

|

|

|

|

Post by Entendance on Oct 31, 2023 13:21:41 GMT -5

'...Just a regional quick war...'

|

|

|

|

Post by Entendance on Nov 2, 2023 11:10:15 GMT -5

'A new article in The Guardian details the enthusiasm among the masters of Wall Street for the wars in Gaza (and Ukraine), issuing "buy" orders all around for US weapons manufacturer stocks. Meanwhile, Gaza's largest refugee camp was blown to pieces yesterday. The Biden Administration is now considering sending US troops as "peacekeepers" once the smoke clears. Good idea?...' 'A new article in The Guardian details the enthusiasm among the masters of Wall Street for the wars in Gaza (and Ukraine), issuing "buy" orders all around for US weapons manufacturer stocks. Meanwhile, Gaza's largest refugee camp was blown to pieces yesterday. The Biden Administration is now considering sending US troops as "peacekeepers" once the smoke clears. Good idea?...'

Wall Street Eyes 'Explosion Of Profits' From Gaza Destruction |

|

|

|

Post by Entendance on Nov 4, 2023 4:56:45 GMT -5

|

|

|

|

Post by Entendance on Nov 7, 2023 16:50:36 GMT -5

|

|

|

|

Post by Entendance on Nov 11, 2023 8:34:15 GMT -5

A downgrade in a country’s credit rating can indicate increased sovereign risk. Gold is considered a non-sovereign asset, meaning it is not directly impacted by the financial health of any single country.

|

|

|

|

Post by Entendance on Nov 13, 2023 8:35:41 GMT -5

A downgrade in a country’s credit rating can indicate increased sovereign risk. Gold is considered a non-sovereign asset, meaning it is not directly impacted by the financial health of any single country.

Bullion Star infographic dramatically illustrates gold price suppression by U.S.

As the world’s preeminent money, now and throughout history, gold is seen by governments and monetary authorities as strategically critical and often a matter of national security.

Not least in the United States, where although the US government and US banks downplay gold, it is precisely because they are terrified of gold’s rise, that these entities are heavily involved in the gold market in a nefarious manner.

This visually stunning new infographic from BullionStar puts the spotlight on the deep involvement of the US Government and Wall Street banks in the gold market, and their nefarious manipulation of precious metals prices, illustrating:

• The supposed size and location of the US Treasury Gold Reserves but the fact that the US Gold has not been properly audited in over 70 years. What is the US Treasury hiding?

• Five massive Wall Street banks dominant the gold market, trading gigantic trading volumes of COMEX gold futures in a giant paper trading game.

• The international gold price is set by paper gold trading in New York and London, and not by physical gold demand and supply, a flawed pricing that causes physical shortages and high premiums.

• Although Wall Street banks have been prosecuted for manipulating precious metals and their traders jailed, the same banks still continue to operate with impunity in the gold market.

• There is continual gold price suppression during New York (NY) trading hours, with returns during NY hours a fraction of returns outside NY hours. This is statistically impossible.

• A US Government group, the Plunge Protection Team (PPT), oversees interventions into markets. This PPT was infamously active in the US silver market during February 2021 where it oversaw a ‘tamp down’ of the silver price to prevent a financial system crisis.

• The US Government, Wall Street and the US mainstream media constantly work to prevent gold gaining in popularity. This is done to protect the US financial system and the reserve status of the US dollar.

• That this price manipulation can’t go on forever. When it fails, the gold price will again be determined by the forces of supply and demand for physical gold.

|

|

|

|

Post by Entendance on Nov 18, 2023 8:20:35 GMT -5

|

|

|

|

Post by Entendance on Nov 20, 2023 16:48:25 GMT -5

Western policies of massive money printing are driving up inflation and food prices, according to the Russian president...

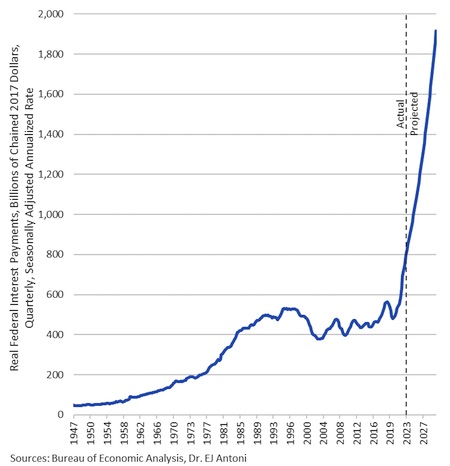

“Interest on the federal debt is now so immense that it’s consuming 40% of all personal income taxes… If federal finances continue on their current path, we are only a few years from the entirety of income taxes being needed to finance the debt…”

The U.S. is facing a slow moving fiscal crisis for the first time in decades

|

|

|

|

Post by Entendance on Nov 25, 2023 5:21:08 GMT -5

Bo Polny: '...From the 1970’s, we went from millions to billions to trillions to quadrillions of dollars. This is the math. We are in the quadrillions of dollars...It’s crazy because the money has expanded so much it’s a joke right now. It doesn’t make sense anymore. It’s just a complete utter joke. That is all the money system is now. Another word for joke is fraud. The money system is a complete and utter fraud. This money has gone around the globe. They take pallets of money and buy off politicians, and anything they want to buy off, they can...'

Horrifying & Historic US Dollar Crash – Bo Polny Horrifying & Historic US Dollar Crash – Bo Polny

Horrifying and Historic US Dollar Crash - Bo Polny Horrifying and Historic US Dollar Crash - Bo Polny

|

|

|

|

Post by Entendance on Nov 27, 2023 9:06:37 GMT -5

|

|

|

|

Post by Entendance on Dec 1, 2023 8:45:03 GMT -5

The problem with powerful organizations and people is that they lose focus on the bigger picture and eventually see only themselves.

Power and possessions will invoke in their adherents a kind of moral astigmatism.

And over time these elite often foster and advance some rather cruel and unusual economics and domestic policies which their academic and media sycophants are only too happy to rationalize and support.

Such are the ways of the worldly, and the allure of the abyss. As old as Babylon, and evil as sin. -Jesse

|

|

|

|

Post by Entendance on Dec 5, 2023 5:05:01 GMT -5

|

|

|

|

Post by Entendance on Dec 9, 2023 4:59:19 GMT -5

World markets are hardly markets at all

|

|

|

|

Post by Entendance on Dec 12, 2023 3:20:16 GMT -5

'...This article argues that the current decline in price inflation is temporary, and that interest rates will rise significantly in the coming years. The conditions which led to the IMF having to rescue Britain from insolvency in the mid-1970s are being repeated in the US today, along with the other G7 nations. Germany’s relative fiscal rectitude is negated by the debt traps on other euro area G7 nations.

Like the British experience five decades ago, today’s economic establishment is blindsided. Additionally, the debt trap problem centres on the US dollar, partly due to her high debt to GDP ratio and partly due to unprecedented levels of foreign ownership of dollar credit and financial investments.

This article has explained why along with the other G7 members the US Government is in a debt trap, which can only end in a dollar crisis. It might have even begun this week, with the Fed pivoting from its attempts to limit inflation to rescuing the economy from recession. Inevitably, a declining dollar is going to lead to its purchasing power declining and encourage foreign liquidation of the currency. Against this background, the funding problem for soaring budget deficits can only be resolved through higher interest rates and bond yields.

When interest rates and bond yields inevitably begin to rise again, the value of financial assets in foreign ownership will fall. The prospect of losses is sure to accelerate liquidation of foreign owned dollars and assets. And where the dollar goes, eventually all other fiat currencies will follow.

It is no exaggeration to say that we are almost certainly seeing the beginning of the end of the era of pure fiat currencies, bookended by the 1970s and 2020s. Though they won’t say so in public, central bankers also see it as a growing possibility, which is why they are accumulating physical gold as rapidly as possible.'

|

|

|

|

Post by Entendance on Dec 16, 2023 5:40:47 GMT -5

Matthew Piepenburg December 17, 2023

|

|

|

|

Post by Entendance on Dec 18, 2023 8:40:30 GMT -5

|

|

|

|

Post by Entendance on Dec 27, 2023 8:36:41 GMT -5

'...The outlook for the Gold price in 2024 is all about the dollar, rather than Gold. From Russia taking the presidency of BRICS next week, to the failure of America’s proxy war in Ukraine along with Middle Eastern uncertainties there will be much that can go wrong for the dollar’s global status.

No wonder the outlook for the dollar price of Gold is so good'

Russia, Iran Officially Ditch U.S. Dollar for Trade

|

|

|

|

Post by Entendance on Dec 30, 2023 6:16:59 GMT -5

'...the 10-year Treasury yield...That was funny too. It ended 2023 at 3.88%, to the basis-point where it had ended 2022 (3.88%), and so it went absolutely nowhere over those 12 months, but it sure climbed a big mountain for 10 months with a lot of blood (including banks that collapsed), sweat, and tears, and then, amid the mania about the Fed’s gazillion rate cuts in 2024, it hop-scotched all the way back down in two months.

In this cycle, the 10-year yield had first reached 3.88% on the way up in September 2022.

Barely visible on this chart: the 10-year yield actually rose for the past two days by a combined 9 basis points, as the mania about the Fed’s gazillion rate cuts began to fade.' -Wolf Richter

|

|

)

.gif)

.png)

The Road To Ruin:

The Road To Ruin:

'A new article in The Guardian details the enthusiasm among the masters of Wall Street for the wars in Gaza (and Ukraine), issuing "buy" orders all around for US weapons manufacturer stocks. Meanwhile, Gaza's largest refugee camp was blown to pieces yesterday. The Biden Administration is now considering sending US troops as "peacekeepers" once the smoke clears. Good idea?...'

'A new article in The Guardian details the enthusiasm among the masters of Wall Street for the wars in Gaza (and Ukraine), issuing "buy" orders all around for US weapons manufacturer stocks. Meanwhile, Gaza's largest refugee camp was blown to pieces yesterday. The Biden Administration is now considering sending US troops as "peacekeepers" once the smoke clears. Good idea?...'

How US/Israeli Axis of Evil Funds

How US/Israeli Axis of Evil Funds

Horrifying & Historic US Dollar Crash –

Horrifying & Historic US Dollar Crash – Prices of New Houses Drop Further, -18% Year-over-Year, Sales Drop,

Prices of New Houses Drop Further, -18% Year-over-Year, Sales Drop,

.jpg)

Will oil prices rise

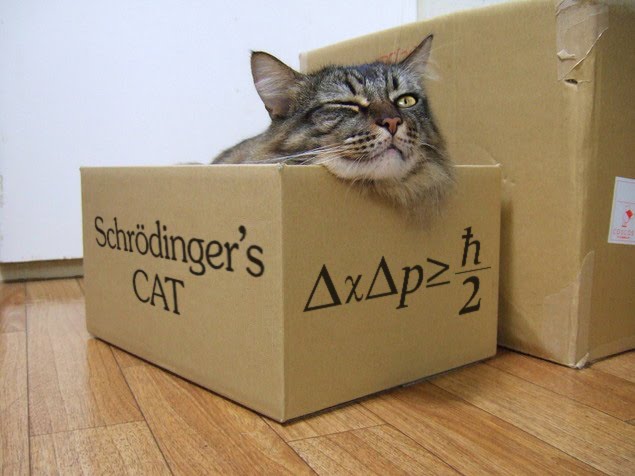

Will oil prices rise  What is it that kills the cat? !June 03, 2016 !

What is it that kills the cat? !June 03, 2016 !  DC's

DC's