|

|

Post by Entendance on Apr 4, 2024 14:19:13 GMT -5

|

|

|

|

Post by Entendance on Apr 8, 2024 13:27:52 GMT -5

|

|

|

|

Post by Entendance on Apr 13, 2024 3:56:24 GMT -5

Iran seized the Israeli ship MSC ARIES in the Strait of Hormuz. This is a big game changer. This once again is confirming that the UAE, Saudi Arabia, Jordan and Qatar are helping Israel bypass the Houthi blockade by land route from the UAE port. Iran is now cutting that route as well. If Hezbollah cut the Mediterranean route with its drones, Israel could fall into a complete trade blockade.

|

|

|

|

Post by Entendance on Apr 16, 2024 3:48:51 GMT -5

'...Trump Media is a Potemkin corporation, a stage set in front of which Trump and his cronies can issue and trade common stock, convertible notes, warrants, and preferred shares, with the sole purpose of extracting billions from a gullible market...'

Reuters and other financial networks are reporting that Trump Media Company, ticker DJT, said that it could sell millions of shares in coming months, including the former president's entire stake. And this is why the stock dropped over 18% on the day. ticker DJT, said that it could sell millions of shares in coming months, including the former president's entire stake. And this is why the stock dropped over 18% on the day.

DJT social-media company insiders have been “locked out” from selling company shares. Now they have filed for the sale of a large amount of shares, including Donald Trump.

The company’s DJT S-1 filing with the U.S. Securities and Exchange Commission includes the potential sale of up to 114,750,000 shares held by the former president.

Many people who invested in this company, some thinking that by investing in the company they would help Trump win the election, have gotten decimated. AND, some private investors who were able to get in and out of the stock rapidly, (likely professionals) on the initial offering, have made a killing.

I would not be surprised to see a class action lawsuit develop moving forward. -Gregory Mannarino

|

|

|

|

Post by Entendance on Apr 19, 2024 2:01:23 GMT -5

|

|

|

|

Post by Entendance on Apr 23, 2024 11:11:32 GMT -5

|

|

|

|

Post by Entendance on Apr 24, 2024 16:03:59 GMT -5

|

|

|

|

Post by Entendance on Apr 25, 2024 8:13:52 GMT -5

U.S. GDP: Lowest Print In 2 Years, Below Lowest Estimates PCE Comes In Red Hot

|

|

|

|

Post by Entendance on Apr 26, 2024 11:49:28 GMT -5

15:00 The military application of silver and its affect on supply & demand

21:30 The Fed has been trapped for over 20 years

27:00 Historical statements by the chairman of the Shanghai Gold Exchange

34:00 BRICS currency update

|

|

|

|

Post by Entendance on Apr 29, 2024 3:07:38 GMT -5

MOSCOW (Sputnik) - The largest European banks that continue to operate in Russia paid more than 800 million euros ($857 million) in taxes in 2023, which is four times more than before the start of Russia’s special military operation in Ukraine, the Financial Times reported on Monday.

Raiffeisen Bank International, UniCredit, ING, Commerzbank, Deutsche Bank, Intesa Sanpaolo and OTP reported that their combined profits in 2023 amounted to more than 3 billion euros, which is three times more than in 2021, the report said. More than half of tax payments in 2023 correspond to Austria’s Raiffeisen Bank International, the report read.

|

|

|

|

Post by Entendance on May 2, 2024 1:57:25 GMT -5

|

|

|

|

Post by Entendance on May 4, 2024 4:34:03 GMT -5

|

|

|

|

Post by Entendance on May 6, 2024 1:15:20 GMT -5

'Poor America. Poor Jerome Powell…

A Real Cliff, Fake Smile

It is no fun to be openly trapped, and even less fun to be in open decline while meekly declaring all is fine.

I have the image of Uncle Sam (or Aunt Yellen) hanging off a cliff with a forced (i.e., political) smile.

Above the cliff is a grizzly bear; below the cliff is a pool of sharks.

In short: Whichever direction one picks, the end result is messy.And yet the markets still wait for Powell to make the right choice.

What right choice? Rate Cut Salvation?

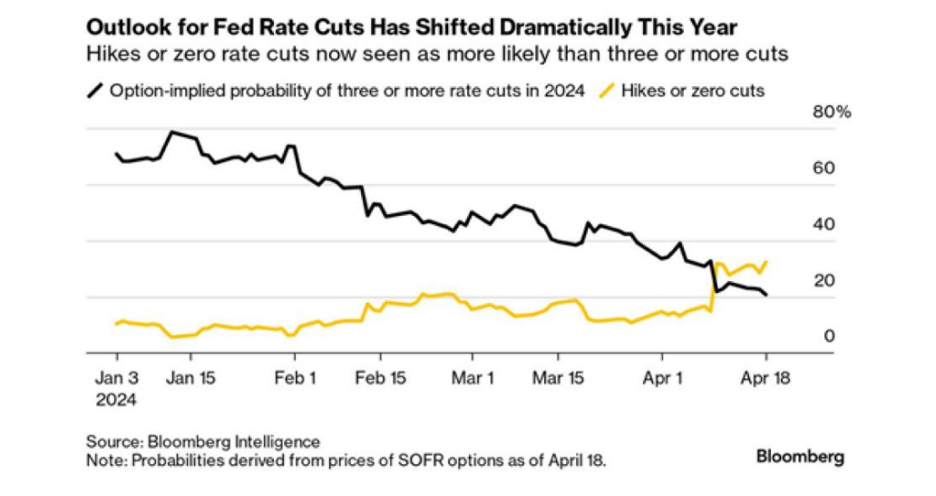

As of today, the markets, pundits and FOMC circus followers are all wondering when Powell’s promised rate cuts will come to save the Divided States of America and its Dollar-thirsty, debt-dependent “growth narrative.”

In January, Powell was “forward guiding” rate cuts and thus, right on cue, the Pavlovian markets, which react to Fed liquidity in the same way Popeye reacts to spinach, ripped north on words alone.

YTD, the S&P, SPX and NASDAQ are rising on rising rates hoping to morph lower.

Even Gold and BTC are rising on rising rates—all of which makes no traditional sense—unless, of course, markets are just waiting for the inevitable rate cuts, right?

And who could blame them? After all, Powell promised the same, and Powell, the voice of “transitory inflation,” never mis-speaks, right?

But now the May markets, and even the Bloomberg Intelligence Reports, are worrying out loud about no rate cuts at all for 2024?

EU Officials Eye Bailout Fund as Source of ‘Cheap Loans to Buy Weapons’ - Report |

|

|

|

Post by Entendance on May 6, 2024 10:53:16 GMT -5

|

|

|

|

Post by Entendance on May 8, 2024 2:04:42 GMT -5

|

|

|

|

Post by Entendance on May 10, 2024 8:29:42 GMT -5

|

|

|

|

Post by Entendance on May 11, 2024 3:54:19 GMT -5

“Every debt crisis leads to a currency crisis.” The looming public and corporate debt could lead to a devaluation of the currency, affecting the market.

The current “magnificent five” is no different than past overvalued companies like Cisco and Microsoft, suggesting a potential bubble.

The backdrop of a global recession, with Germany, UK, China, Korea, and potentially America in recession, will have a significant impact on the market bubble.

We’re running out of back door tricks and may have to resort to front door unlimited QE or some type of reset to justify the mistakes and sins of our Central bankers and politicians.

Gold is disconnected from its typical correlations with interest rates and the strength of the dollar, suggesting a shift in market dynamics.

Powell is trapped and will save the system by debasing the currency, reducing rates so that Uncle Sam can afford their own interest expense.

The trust in the US Treasury is completely changed, especially since the sanctions two years ago, impacting the trust in the US dollar.

|

|

|

|

Post by Entendance on May 15, 2024 2:00:28 GMT -5

|

|

|

|

Post by Entendance on May 16, 2024 23:38:14 GMT -5

|

|

|

|

Post by Entendance on May 17, 2024 5:26:04 GMT -5

|

|

|

|

Post by Entendance on May 18, 2024 4:05:51 GMT -5

Demonic Globalist Elite Starting World War III – Steve Quayle Demonic Globalist Elite Starting World War III – Steve Quayle

Demonic Globalist Elite Starting World War III – Steve Quayle Demonic Globalist Elite Starting World War III – Steve Quayle

|

|

|

|

Post by Entendance on May 21, 2024 4:05:08 GMT -5

We all know the problem with fiat currency: the temptation to print more currency is irresistible, but ultimately destructive: once currency is issued in excess of the actual expansion of goods and services, the result is devaluation / loss of purchasing power, a.k.a. inflation. Here's a snapshot of global money supply:

In response, central banks are adding gold reserves: gold reserves are now larger than the reserves of the second-largest reserve currency, the euro. In response, central banks are adding gold reserves: gold reserves are now larger than the reserves of the second-largest reserve currency, the euro.

Yen Collapse: How the Japanese Central Bank Continues to Commit Treason

|

|

|

|

Post by Entendance on May 28, 2024 1:16:59 GMT -5

Fiscal Armageddon looms and no one in power wants to talk about it.

|

|

|

|

Post by Entendance on Jun 1, 2024 4:54:59 GMT -5

The composite index increased 4% to $4,226 per 40ft container this week and has increased 151% when compared with the same week last year.

The latest Drewry WCI composite index of $4,226 per 40ft container is 198% more than average 2019 (pre-pandemic) rates of $1,420.

The average composite index for the year-to-date is $3,323 per 40ft container, which is $598 higher than the 10-year average rate of $2,725 (which was inflated by the exceptional 2020-22 Covid period).

Freight rates from Shanghai to New York increased 6% or $372 to $6,835 per 40ft container. Likewise, rates from Shanghai to Rotterdam swelled 5% or $271 to $5,270 per feu. Similarly, rates from Shanghai to Genoa rose 4% or $199 to $5,693 per 40ft box. Also, rates from Shanghai to Los Angeles increased 2% or $113 to $5,390 per feu. Also, rates from Rotterdam to Shanghai inched up 1% or $4 to $677 per 40ft box. Conversely, rates from Rotterdam to New York decreased 1% or $19 to $2,222 per 40ft container. Meanwhile, rates from Los Angeles to Shanghai and New York to Rotterdam remain stable. Drewry expects freight rates ex-China to continue rising next week due to the onset of the early peak season.

|

|

|

|

Post by Entendance on Jun 7, 2024 2:14:01 GMT -5

|

|

|

|

Post by Entendance on Jun 7, 2024 23:08:17 GMT -5

Greg Mannarino: Economy What To Expect What's Next & Mistakes MUST LISTEN

|

|

|

|

Post by Entendance on Jun 14, 2024 2:06:03 GMT -5

|

|

|

|

Post by Entendance on Jun 15, 2024 3:49:35 GMT -5

World Container Index - 13 Jun

|

|

|

|

Post by Entendance on Jun 20, 2024 2:12:00 GMT -5

|

|

|

|

Post by Entendance on Jun 22, 2024 8:13:49 GMT -5

Then it will be God without disguise; something so overwhelming that it will strike either irresistible love or irresistible horror into every creature. It will be too late then to choose your side. That will not be the time for choosing: it will be the time when we discover which side we really have chosen, whether we realised it before or not. -C. S. Lewis

|

|