|

|

Post by Entendance on Jun 20, 2020 2:43:09 GMT -5

"...Silver investors are sitting on an excellent investment that few understand the powerful fundamental dynamics.

I say, let the Federal Reserve and U.S. Government continue to print trillions to prop up the markets. The more money they print and the more debt is added to the system, the better the fundamentals to own precious metals, especially silver."

|

|

|

|

Post by Entendance on Jun 24, 2020 3:22:21 GMT -5

Physical Silver & Gold:

Gold is forever wealth. Empires come and go. Gold remains. |

|

|

|

Post by Entendance on Jul 1, 2020 2:52:40 GMT -5

|

|

|

|

Post by Entendance on Jul 8, 2020 2:48:42 GMT -5

Banksters Cartel International XX

"...Bullion banks are between a rock and a hard place. For years they’ve been playing the hedge funds as an angler hooks and plays a fish. That game has ceased and there is no easy way for them to get level. For the moment they are trying to put a lid on the price, but the cost has been rising open interest, and therefore rising mark-to-market positions.

The August active contract runs off the board at the end of this month and bullion banks are likely to be forced into large delivery volumes again. Furthermore, the exchange for delivery arbitrage facility between Comex and the LBMA is broken, allowing Comex premiums to London spot to go unchallenged.

It is increasingly possible the gold contract is evolving into deep crisis, and that force majeure might have to be declared if, as seems increasingly inevitable, a wider banking crisis ensues." A potential crisis in Comex gold

|

|

|

|

Post by Entendance on Jul 11, 2020 5:41:41 GMT -5

The weekend gold & silver videos are available here

Gold & Silver in The Cayman Islands: SWP

Buying physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve a tyrant. E.

|

|

|

|

Post by Entendance on Jul 21, 2020 5:46:46 GMT -5

Buying physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve a tyrant. E.

|

|

|

|

Post by Entendance on Jul 23, 2020 4:03:57 GMT -5

With the 1,000 Ounce Silver Bar there is no better and no cheaper way to invest in large quantities of silver. These bars are perfect for customers looking to invest in the metal itself, with no preference regarding the mint. You won’t find anything closer to spot price, and it also makes for a great addition to any silver collection. These bars represent the best value for money for investors looking to buy large investment-grade quantities of this precious metal.

1,000 Ounce Silver Bars were created with serious investors in mind!

Each bar has a different weight. These bars are used in settlements in the London Metal Exchange and other exchanges and are very heavy compared to smaller bullion bars. Although metal purity is standardized these bars vary greatly in shape, manufacturer (brand) and mass which can vary between 750 and 1,100 oz although the vast majority of the bars will be between 950 and 1030 oz. Good delivery bars are normally readily available in large quantities.

Premiums per oz are lower and these bars always come with a serial number.

Specifications for a Good Delivery Silver Bar

Weight

Minimum silver content: 750 troy ounces (approximately 23 kilograms) maximum silver content: 1100 troy ounces (approximately 34 kilograms) However, it is recommended that ideally refiners should aim to produce bars within the following weight range.

Minimum silver content: 900 troy ounces (approximately 29 kilograms)

Maximum silver content: 1050 troy ounces (approximately 33 kilograms)

The gross weight of a bar should be expressed in troy ounces in multiples of 0.10, rounded down to the nearest 0.10 of a troy ounce.

Dimensions

The recommended dimensions for a Good Delivery silver bar are approximately as follows:

Length (Top): 300 mm +/- 50 mm Undercut: * 5-15 degrees

Width (Top): 130mm +/- 20 mm Undercut: * 5-15 degrees

Height: 80 mm +/- 20

Fineness

The minimum acceptable fineness is 999.0 parts per thousand silver.

Marks

Serial number

Assay stamp of refiner

Fineness (to three significant figures)

Assays

It is essential that all GD bars contain the amount of metal stated by the marked assay as marked on the bar and its weight. Assays of GD bars are determined by the refiner at the point of manufacture.

The Entendance Beach is the perfect place to start off!

- In a world drowning in debt, you don't want to be a creditor. Gold and silver are your assets.

- When you look at the big picture and the trajectory of central bank policy, there is no reason to expect the bull run in gold and silver to slow down anytime soon.

- Gold is just beginning, gold is REAL money. The next decade for gold is going to be explosive with all this unprecedented debt!

- Bailing out debt with more debt is kicking the can down the road. How long can you kick it? We don’t know until we will find out you can’t kick it any further.

- The Entendance Beach, just for Uncolonized Minds! This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many.

- The world’s major central banks continue to debase the purchasing power of their Fiat currencies –by orchestrating consumer and/or asset price inflation...

- The banksters don't even have the guts to call it printing money out of thin air instead they hide behind the term 'quantitative easing' QE has been a massive deceit & a huge factor in driving inequality!

- Fiat currency: a currency which is not physically backed! When adopting a gold-backed currency, the one who moves first has a massive advantage over the others!

- You have a fiat monetary system which means that you can print whatever amount of money you want – and that’s what central banksters do.

- In a time where money printing seems endless, remember - central banksters cannot reproduce gold/silver as they do with fiat currencies.

- Gold money is the source of all Good. Paper money is the source of all Evil. -Ayn Rand

- Physical Gold isn't debt, equity or any other financial promise. It doesn't rely on anyone else's survival to exist. It can't be destroyed any more than it can be created at will.

- Physical Gold is instant liquidity. Gold has served as money/barter in every period of distress in history. Gold and silver are direct enemies of fiat dollars or fiat anything.

- Physical Gold is scarce and cannot be manufactured or printed Gold is eternal All the gold ever produced still exists! Fiat means money issued by government not backed by anything as opposed to gold!

- Store Gold/Silver outside the banking system! Only own your precious metals in safe vaults. Facilitated "outside" of the banking system NO DEPENDENCE on the functioning of stock exchanges or banks.

- Not your vault, not your gold. You better own precious metals directly, with no counterparty risk: they are not exposed to any creditor obligations.

- Every ounce of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system.

- Gold has been money for 5,000 years. Gold is the only money that has survived in history. In every major crisis, gold has been used as money.

- Gold is scarce. It’s independent. It’s not anybody’s obligation. It’s not anybody’s liability. It’s not drawn on anybody. Gold & Silver are still widely under-owned despite enormous asset bubbles!

- Kings, governments, dictators, financiers, mathematicians and many other powers have tried to dethrone gold for thousands of years. They all lost.

- Protect against unprecedented debt levels, bank bail-ins, government confiscation, derivatives implosion, central planning. Why on earth would anyone want to have savings in fiat currency?

Fiat currencies don’t float. They just sink at different rates. -Anonymous

"...Gold, on the other hand, has none of those risks.

It’s practically indestructible. You can drop it and it won’t break. It doesn’t rust. Melt it down and it is still valuable.

It’s small enough to store securely, or transport if need be.

And it REALLY holds its value.

The amount of gold it took to buy a high-end house 1,100 years ago in the Islamic Kingdom of Cordoba equals about the same price of a high-end home today.

4,000 years before that, merchants in the fertile crescent, at the very birth of civilization, were trading gold in exchange for goods.

Obviously most people don’t consider too many generations into the future when making investment decisions.

Most of us invest for the here and now… so it’s nice that gold has a lot of upside investment potential today.

As I’ve written before, the more money that central bankers print in their Covid bailouts, the more valuable gold becomes.

And I just wrote earlier this week that silver has already become one of the best performing assets in the world right now, plus gold has also been quite strong.

But aside from having substantial present-day potential, gold is also a forever asset that has already proven its worth over 5,000 years..."Gold has outlasted every company, every piece of art, every government bond

GITA (Gold is the alternative) to the banksters

Gimme a break

|

|

|

|

Post by Entendance on Jul 28, 2020 1:29:31 GMT -5

The Precious Metals Bull Market Is Beginning To Rage

US Mint has reduced silver, gold coin supplies to purchasers. Virus may reduce Mint's coin output for 12-18 months -BBG US Mint has reduced silver, gold coin supplies to purchasers. Virus may reduce Mint's coin output for 12-18 months -BBG

July 28, 2020: The U.S. Mint has reduced the volume of gold and silver coins it’s distributing to authorized purchasers as the coronavirus pandemic slows production, a document seen by Bloomberg shows

"...it is totally irrelevant what the gold price will be tomorrow or in 6 or 12 months time. We are holding physical gold to protect against a rotten financial system and currencies which will be printed to death..."  |

|

|

|

Post by Entendance on Jul 30, 2020 3:14:18 GMT -5

"In the past decade, thousands of Americans and investors around the globe attempted to protect themselves from rampant government spending and central bank money printing by buying gold and silver.

Yet they lost on their investment. But not because they made a bad trade. Rather, because they were cheated. By investment bank J.P. Morgan..."

|

|

|

|

Post by Entendance on Aug 2, 2020 3:04:55 GMT -5

"The Swiss population owns 920 tonnes in private gold, next to 1,040 tonnes in official gold reserves. In total, Switzerland likely has the highest amount of gold per capita in the world."

Governments never learn. Only people learn. -Milton Friedman

Our present reality:

1. Infinite quantitative easing

2. Debt monetization

3. ZERO or negative interest rates

4. M2 money supply going parabolic

5. Prolonged negative rate rates

6. Endless stimulus

Keep this in mind when you see the bearish gold headlines in the weeks to come. -

La Maison Joubert, présente depuis 1909 dans le quartier de la Bourse de Paris, est une entreprise reconnue et spécialisée pour l'Or et l'Argent d'investissement, la numismatique ainsi que l'achat et la vente de devises. (H/T our member theunderdog)

|

|

|

|

Post by Entendance on Aug 5, 2020 3:52:35 GMT -5

There is ample room for Fear of Missing Out (FOMO) to kick in as the managed money and big spec hedge funds sat out much of the recent rally.

(H/T our member the underdog)

"Silver is a vital commodity to our way of life. Silver is a precious metal that is being trashed as an industrial metal. As a result, it is within years of becoming the first metal to become extinct, according to the USGS. At some point, the shortage is going to become so obvious that people are going to rush to turn in their depreciating dollars for real silver money. That is just the monetary demand for silver. Industrial and strategic demand is another huge factor we should consider. Silver is a precious metal a monetary metal and an industrial metal, Industry alone requires over 900 million ounces each year.

Silver has antibiotic, antibacterial anti-fungal, and anti-microbial properties. Silver is used in Dentistry, Photography, electronics, mirrors, optics, medicine and in clothing. Silver is the best thermal conductor of all metals, and The Best Electrical Conductor, Silver is also an important catalyst in chemical processing.

As far as getting it out of the ground, that will take energy which seems to be only getting more expensive, China is now the world’s third-largest silver miner after Mexico and Peru, and the world’s largest silver refiner.

The US geologist society has predicted that Silver will be the first element of the periodic table to run out by 2020. Physical silver outperformed the mining stocks by four times during the last bull market. Only about 2% of COMEX silver contracts are actually settled by physical delivery, and the rest are settled for cash or rolled over, Decades of market manipulation has made silver the most underpriced commodity in history..." -patrickmercierx

Wholesale silver continues to be difficult, if not completely impossible to find

|

|

|

|

Post by Entendance on Aug 11, 2020 2:37:02 GMT -5

"The debt dam is crumbling as central bankers and government officials frantically refill the escaping lake with eye droppers." Here

This Global Depression Will Be Brutal – Tens Of Millions Of Americans Can’t Pay Their Bills And Are In Danger Of Eviction Here

The Economy Is Mortally Wounded Here

Economic prosperity is no longer the priority Here

"I say it UNEQUIVOCALLY: I’m not selling my mining shares or physical metals since ANY EFFORT and every bit of energy spent in attempting to time this trade is A WASTE when my focus should be on how to earn more money in my businesses, so I can put it towards BUYING the DIPS." Here

"I’m not arrogant enough to pretend I can lay out the exact price roadmap ahead, but with the death throes of a decades-long silver price suppression will come countervailing price reactions proportionate to the previous suppression. In other words, if something has been manipulated in price for as long as I allege silver has been manipulated, the price reaction when the manipulation ends will be in line with how long the manipulation lasted. We all know that when manipulations end, they end violently in the opposite price direction and in much shorter time than the life of the original manipulation." -Ted Butler

|

|

|

|

Post by Entendance on Aug 12, 2020 0:40:19 GMT -5

...The reasons the gold price is on a rising trajectory are still the same. Confidence in paper assets (including paper gold products) is falling. Indeed, with the gold price back at the price range where it was just over 2 weeks ago, you could say its déjà vu all over again. The only difference this time around is that we have seen the volatile swings what the gold price is capable of, both on the up and downside, as new support and resistance is mapped out. Increasingly, $100 moves will become commonplace as the gold price goes higher. This is something that James Sinclair predicted at least 12 years ago.

I will leave you with the sub headline of the Zing News 31 July article, which says (translated from Vietnamese): “Compared with the shock [rise] of gold prices in 2011, the current strong rise in gold prices is not dominated by fear. Instead, the support of the gold price is stronger and more sustainable.”...

Paper gold and paper silver traders, LOL

Texans have a phrase "All hat and no cattle." This phrase applies to pretend cowboys that dress and talk the part, pretending to be what they aren't. When someone talks big, but cannot back it up, they are all hat, no cattle. The list below contains other similar phrases you might find laughable.

All booster, no payload.

All crown, no filling.

All foam, no beer.

All hammer, no nail.

All icing, no cake.

All lime and salt, no tequila.

All missile, no warhead.

All shot, no powder.

All wax and no wick. |

|

|

|

Post by Entendance on Aug 13, 2020 0:48:27 GMT -5

“It's always darkest before it turns absolutely pitch black.”

The Great Silver Crisis is Coming: Videos

Meanwhile...  "The US capital markets mascot has gone rogue" -Tom from Florida "The US capital markets mascot has gone rogue" -Tom from Florida

"...understand “why” you bought gold or silver in the first place. If you purchased to “make a profit” then good luck to you. If you bought to get out of the system (GOTS), then stay out of the system and move further capital to safety on this pullback if able. As for volatility, the last couple of weeks and yesterday are only the beginning tremors before the total eruption which also means the meltdown of fiat and credit. Please use your common sense and your own eyes to see credit (which is now 120 days late all over the world) is broken to the point it cannot be fixed.

The explosion in global demand for metal is a direct result of big money understanding the only place to hide in a credit meltdown can only be where liability does not exist..." This Is NOT 2011!

|

|

|

|

Post by Entendance on Aug 18, 2020 1:55:53 GMT -5

August 23, 2020: your videos are here

"We need more gold over here" August setting up to be month of highest delivery notices issued at COMEX second to June. -MacroTourist

"I'm sure every reader that has an interest in the metals/mining sector is aware that Berkshire Hathaway bought half a million shares of Barrick in the second quarter. Of course, what everyone wants to know is have they added to that position, or added other positions, and was this decision made by Buffett or his lieutenants? I suppose eventually we'll know the answers to those questions, but for now, the important takeaway is that one of the world's smartest generalists has decided that the sector has merit. That will likely force other active managers and wealthy individuals to examine what's going on that might have caused him to do something that seems so out of character, because in the past he's been disdainful of gold and, as everyone knows, mining can be a very tough business, which is not something Buffett would overlook. While it's true mining is tough and hasn't been especially profitable in the prior 20 years, the lessons that were learned from roughly 2011 to 2016 and the change in the price has created an environment whereby these companies are not expensive on a prospective earnings or cashflow basis (and that implies higher dividends). This is a point I've made for quite some time and obviously the purchase by Berkshire is at least validation that in fact the valuations and financial "metrics" are indeed compelling..." - B.F. |

|

|

|

Post by Entendance on Aug 25, 2020 3:43:44 GMT -5

(H/T Tom from Florida)

Potential New US Sanctions to ‘Paradoxically’ Boost Russia’s Gold Bullion, Report Says (H/T our member theunderdog)

The fine of $124 million that Scotiabank has agreed to pay the U.S. government for manipulating the gold and silver markets with "spoofing" is tiny compared to the offense, London metals trader Andrew Maguire says in his interview this week with Shane Morand of Kinesis Money, but that's because the fine is not the end of the case against the bullion bank. Scotiabank, Maguire says, remains vulnerable to criminal charges of wire fraud and so is cooperating with the U.S. Justice Department in prosecution of the biggest gold and silver market-rigger of all, JPMorganChase.

Further, Maguire adds, the prosecution is linked to a pending "reset" of gold and silver prices.

In connection with that "reset," Maguire says, the Bank for International Settlements has built an unprecedentedly large unallocated foreign-exchange gold position as it distributes desperately needed metal to banks around the world.

Behind the extraordinary recent volatility of the gold and silver markets, Maguire says, the banks are striving to shake out speculators while getting long themselves.

|

|

|

|

Post by Entendance on Aug 31, 2020 2:09:22 GMT -5

"...The antidote to the current monetary system and all its toxic effects: physical precious metals, in particular gold and silver, are the insurance against all the arbitrary experiments and monetary manipulation of the last decades.

They can’t be printed and controlled by central banks and they cannot be used to support and transmit any of their political goals and agendas.

This is why I expect physical precious metals to play a key role in the foundations of any truly free society.

Without the financial shackles of fiat money, direct control can be reclaimed and reasserted by the individual..." -Claudio Grass

“I warn you that politicians of both parties will oppose the restoration of gold, although they may outwardly seemingly favor it. Unless you are willing to surrender your children and your country to galloping inflation, war and slavery, then this cause demands your support. For if human liberty is to survive in America, we must win the battle to restore honest money.“ -Howard Buffett, 1948

|

|

|

|

Post by Entendance on Sept 4, 2020 0:58:57 GMT -5

"If you think that price inflation runs at about 1.6% you have fallen for the BLS’s CPI myth. Two independent analysts using different methods — the Chapwood Index and Shadowstats.com — prove that prices are rising at a far faster rate, more like 10% annually and have been doing so since 2010... ...Taking these factors into account, the collapse in purchasing power of a currency which has been deployed to save financial assets and failed, once the general public finally understands the consequences, will likely be surprisingly rapid. In 1923 Germany, the final collapse took roughly six months.

In 2020 America it could take as little as a few weeks.

Other currencies that refer to the dollar for their relative values are sure to suffer the same fate,

not helped by the fact that their central banks have been pursuing similar monetary policies and will likely cooperate with each other to the bitter end." ***Inflation — running out of road

|

|

|

|

Post by Entendance on Oct 15, 2020 4:47:33 GMT -5

Silver is both an industrial as well as precious metal. It is used in many electric and electronic products. Also, the demand for photo-voltaic or solar panels is expected to explode in the next 5-10 years... SILVER – THE INVESTMENT OF THE DECADE

|

|

|

|

Post by Entendance on Nov 1, 2020 3:34:42 GMT -5

-- Gold has increasing appeal of gold as a hedge against financial market risks.

-- The decline of a currency's value mirrors the decline of the society served by the currency.

But there are other worthy observations in the letter too. It's posted at USAGold:

"Gold bar and coin investment demand strengthened in Q3 2020, gaining 49% y-o-y to 222.1t. Q3 global investment of 494.6t increased 21% y-o-y, while y-t-d volume increased by 63%..." Gold Demand Trends Q3 2020 "Gold bar and coin investment demand strengthened in Q3 2020, gaining 49% y-o-y to 222.1t. Q3 global investment of 494.6t increased 21% y-o-y, while y-t-d volume increased by 63%..." Gold Demand Trends Q3 2020

Financial writer Bill Holter and renowned gold and financial expert Jim Sinclair warn that no matter who wins this Presidential Election, the next administration will have to navigate the so-called financial reset that has already started. Holter contends, “ Mathematically, our financial system is bankrupt. Can they string it along another year or two? I don’t know, but I do know if we go full blown socialism, it’s like pulling the pin on the hand grenade. It goes off right away. Everything blows up faster and harder. A lot of people are not factoring in is when this thing goes down . . . I hope it goes down under the rule of law. Under socialism, the rule of law is basically what they say it is. . . . The U.S. will immediately move to a financially broken status.” Sinclair agrees with Holter and says, “If the socialists take over, the system blows up instantaneously. The Green Revolution will have such an impact on business and put so many people out of jobs without any way to replace those jobs. It would actually be a political event and an economic sin.” Sinclair goes on to say there will be “massive deflation” in this financial reset, and that would be good for gold. Sinclair continues, “Gold will hit entirely different prices that have never been conceived before because of all the debt. So, people think deflation when they see a market rip apart. That clicks in people’s minds that is a negative for gold. It is one of the most important ingredients to significant appreciation in the gold price. There is no comparison to this gold market now and anything we have gone through before. . . . The potential for gold on the upside is extraordinary on the upside. . . . There will be a form of inflation in everything that you need and will cost you more. Everything that you don’t need, like your Tesla, will fall through the floor into a black hole.” How high can gold go considering exploding federal debt and a Federal Reserve balance sheet that doubled to more than $7 trillion in a little more than a year? Holter does the astounding and yet simple math. Holter explains, “The number is over $100,000 per ounce for gold now. If you take the 260 million ounces that we (U.S. Treasury) supposedly have and take the 260 million ounces and divide it into the current debt which is $27 trillion, it’s well over $100,000 per ounce now. In other words, if we had to back our debt in gold, the gold would have to be priced at over $100,000 per ounce.” Sinclair offers hope and a way out of the financial mess we face. It involves a Trump Win that will preserve the Constitution and the rule of law. Sinclair explains, “We have a crash that can be built back. There is a road forward. The road forward starts to make itself clear in 2032. 2032 will be the end of the impact to what is about to happen no matter who is elected. . . . The economic problem is quite serious. . . . If the rule of law is respected and the police are not defunded, free speech is allowed, the Second Amendment is maintained, then there is a way forward and there is a repair. It will come back together. However, if none of those exist . . . it is a total social and political change irreparable in nature.” In other words, if we can maintain the rule of law and the U.S. Constitution, America can and will recover. Let’s pray that happens. Join Greg Hunter of USAWatchdog.com as he talks to Bill Holter and Jim Sinclair of JSMineset.com in this in-depth one hour interview.

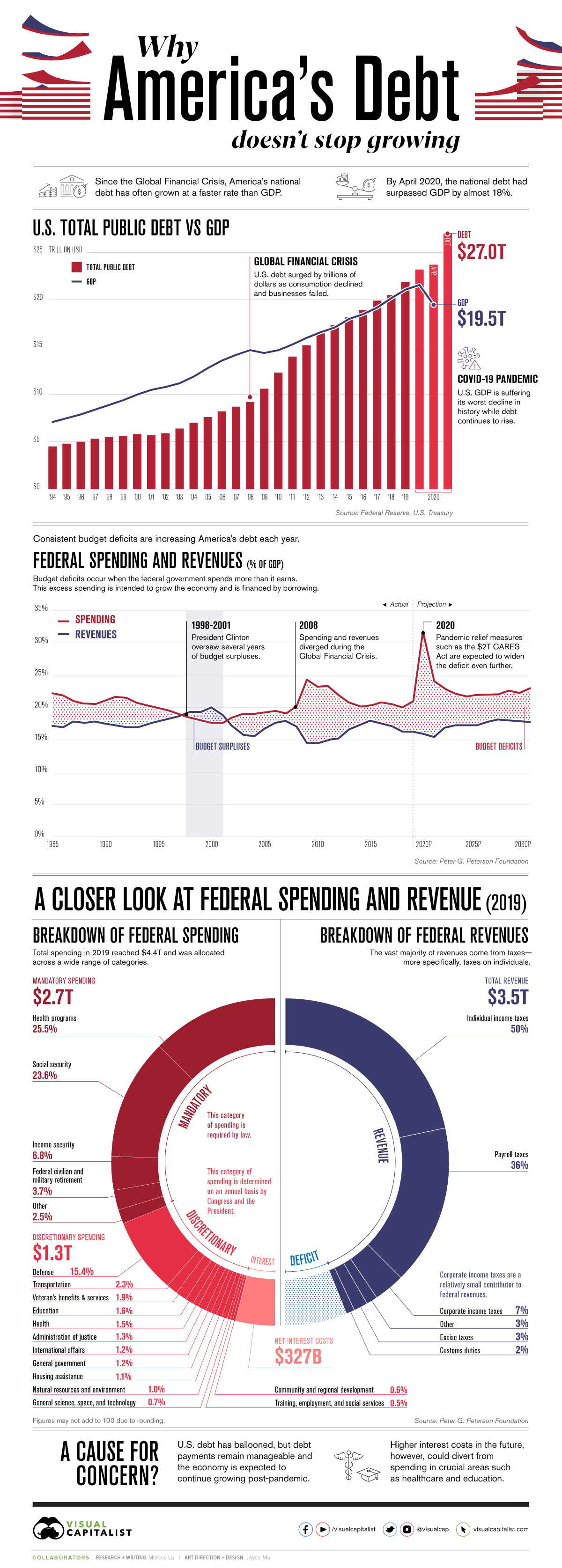

Why America’s Debt Doesn’t Stop Growing

Public sector debt has been a contentious topic for many years. While some believe that excessive government borrowing can be harmful over the long term, others have argued that it acts as a powerful tool for stimulating growth.

In the U.S., the latter view appears to have taken hold. Since 2008, America’s national debt has surged nearly 200%, reaching $27 trillion as of October 2020. To gain a better understanding of this ever-growing debt, this infographic takes a closer look at various U.S. budgetary datasets including the 2019 fiscal balance.

America’s Debt vs. GDP What’s Preventing the Debt From Shrinking? Breaking Down the 2019 Fiscal Balance Federal Spending Federal Revenues Is America’s Debt a Cause for Concern? More here

(H/T Tom from Florida)

(H/T our member theunderdog)

"...The first wave of Covid-19, which is leading to bankruptcies throughout the Eurozone, is now being followed by a second wave, which will almost certainly take out a number of important banks, in which case the cross-border euro system will implode..." ***The destruction of the euro

|

|

|

|

Post by Entendance on Nov 18, 2020 6:46:20 GMT -5

|

|

|

|

Post by Entendance on Nov 22, 2020 3:13:09 GMT -5

"...To save yourself, you have to preserve your wealth, your dollar assets. To do that, you have to convert your dollars into physical gold and silver, precious metals and just hold them..." - John Williams |

|

|

|

Post by Entendance on Nov 26, 2020 4:40:11 GMT -5

|

|

|

|

Post by Entendance on Nov 29, 2020 2:21:38 GMT -5

"...The reason why there is growing income inequality since 1973 is a direct result of this monetary mayhem..." -David Howden The Entendance Beach & Inequality: 4 pages! |

|

|

|

Post by Entendance on Dec 5, 2020 6:11:15 GMT -5

"...Those who argue that gold monetary systems are antiquated relics of an ante-technological, ante-digital era should reconsider their position. To anchor a ledger to physical gold requires minimal effort compared to fiat or cryptocurrencies. Therefore, as we have argued, governments have ceased to do this for fiscal reasons, rather than because of any limitations intrinsic to gold or any advantages intrinsic to modern moneys.

The only obstacle standing between mankind and the implementation of a gold monetary standard today is that governments must make the decision to transparently reserve a unit of money in circulation to a weight of gold. This is the truth of the matter, not the truism. It is a truth which I believe, in our lifetime, will be rediscovered. It will only require one nation, one leader, one society to make this decision, a decision which will profoundly impact its citizens and their relative prosperity, and which will reshape the course of geopolitical history in the years to come.

The golden road remains constant, for it is permanently paved by the hand of God within the natural world.

(H/T Tom from Florida)

|

|

|

|

Post by Entendance on Dec 10, 2020 5:45:47 GMT -5

And remember, where you have a concentration of power in a few hands, all too frequently men with the mentality of gangsters get control. -John Dalberg Lord Acton

Manipulation of the gold and silver markets by the U.S. Federal Reserve and Treasury Department is far more significant than the manipulative "spoofing" done in those markets by JPMorganChase and other bullion banks, GATA Chairman Bill Murphy says in an interview with Edson Miranda.

Fed’s Billions in Emergency Repo Loans to Wall Street Didn’t Go Away in June; They Just Went Dark

|

|

|

|

Post by Entendance on Dec 13, 2020 6:00:03 GMT -5

|

|

|

|

Post by Entendance on Dec 17, 2020 5:09:26 GMT -5

|

|

|

|

Post by Entendance on Dec 18, 2020 11:36:16 GMT -5

|

|

|

|

Post by Entendance on Dec 23, 2020 1:46:33 GMT -5

December 30, 2020: What comes next? 2 VIDEOS

!

"I’m not stacking anymore. I’m hoard piling!"

|

|