|

|

Post by Entendance on Jan 4, 2020 6:25:34 GMT -5

Myrmikan Research January 14, 2020: Gold Past $10,000 PDF here

Jan Nieuwenhuijs China’s Gold Hoarding: Will It Cause the Price of Gold to Rise?

IMF warns of new ‘Great Depression’,

Russia ahead of the curve due to increased cash & gold reserves

"...The question precious metals investors need to ask themselves is, with the world having become a much more dangerous place in the last few weeks, will gold move down to adjust to a more normal ratio, or will silver prices head up, to re-calibrate the ratio?

If I was a betting man, I’d put my money on a 2020 run on silver..." Ahead of the Herd

The Entendance Beach & Banksters Cartel International

Ex nihilo, nihil:  2020, Silver & The banksters 2020, Silver & The banksters

"...The purpose of the Comex, period, is to give the western Central Banks – primarily the Fed – the ability to control the price of gold..."

Dave Kranzler: The Comex is a complete joke

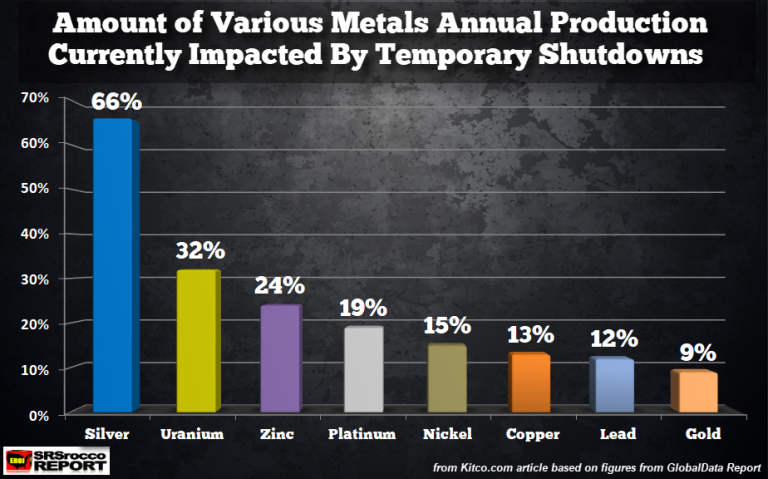

"...Silver may be the metal to watch (and own) in 2020. If global industrial and investment demand picks up even slightly, supply will struggle to keep pace.

In fact, silver mining supply is heading in the opposite direction. The Silver Institute’s World Silver Survey shows production falling at an annual rate of 2%.

Mines have been depleting their silver reserves and haven’t had the incentive to develop new projects given low spot prices and geological challenges due to declining ore grades.

According to Katusa Research, “The average head grade has fallen by over 50% since 2010. This is not a good situation for a miner. In a world where input and production costs are rising yet profit per tonne of rock has fallen by 50%, this poses serious long-term potential problems.”

Investing in a miner is always in iffy proposition, even if you do your homework. The busts tend to outweigh the booms.

And in the case of silver miners, most are primarily in the business of mining other metals (such as lead, copper, nickel, zinc, or gold) – and only mine silver as a byproduct.

The lack of a healthy primary silver mining industry can work to the advantage of physical silver investors. It means that supply will remain constrained in the years ahead.

Even if higher spot prices begin to make mining silver more profitable, the beaten and battered industry won’t have the immediate capacity to grow production to any significant degree. It will take years of rebuilding.

In the meantime, once silver breaks above overhead technical resistance from $20-$21/oz, the path should be clear for a run toward its old record high." -Stefan Gleason

|

|

|

|

Post by Entendance on Jan 21, 2020 6:41:24 GMT -5

Banksters Cartel International XVI

Silver Investing: Tremendous Hidden Value In Every Coin

|

|

|

|

Post by Entendance on Feb 2, 2020 3:53:29 GMT -5

|

|

|

|

Post by Entendance on Feb 4, 2020 3:08:24 GMT -5

...Silver has hit an all-time high of $49 per ounce twice – in January 1980 and then again in April 2011.

If you adjust that $49 high for inflation, you’re looking at a price of around $150 per ounce.

In other words, silver has a long way to run up. As one analyst put it, “With the long-term downside potential of silver very low versus its current valuation, the risk/reward is one of the best investments on the planet.”

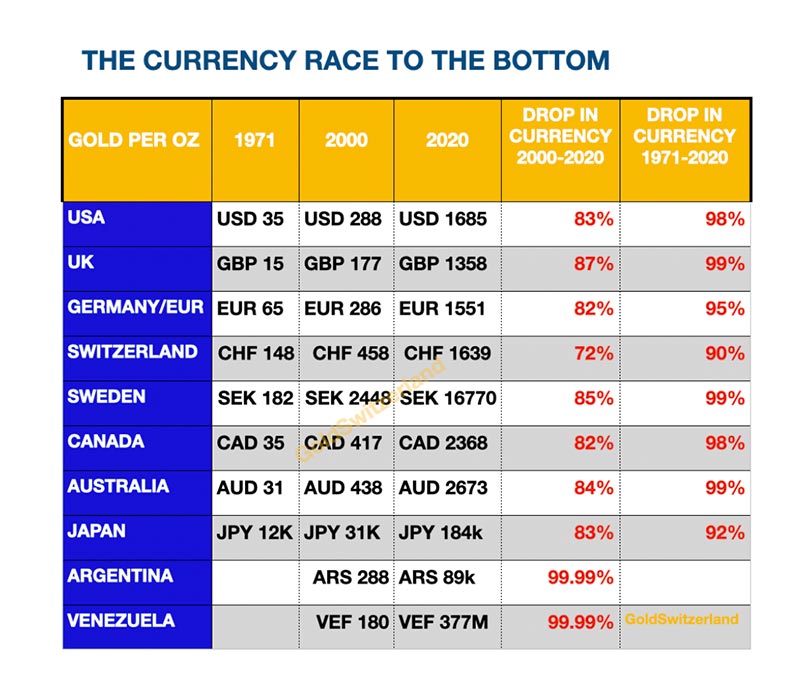

The world’s major central banks continue to debase the purchasing power of their Fiat currencies –by orchestrating consumer and/or asset price inflation... Fiat currency: a currency which is not physically backed! There are 152 fiat currencies that have failed due to Hyperinflation. Their average lifespan was 24.6 years and the median lifespan is 7 years. 82 of these currencies lasted less than a decade and 15 of them lasted less than 1 year.

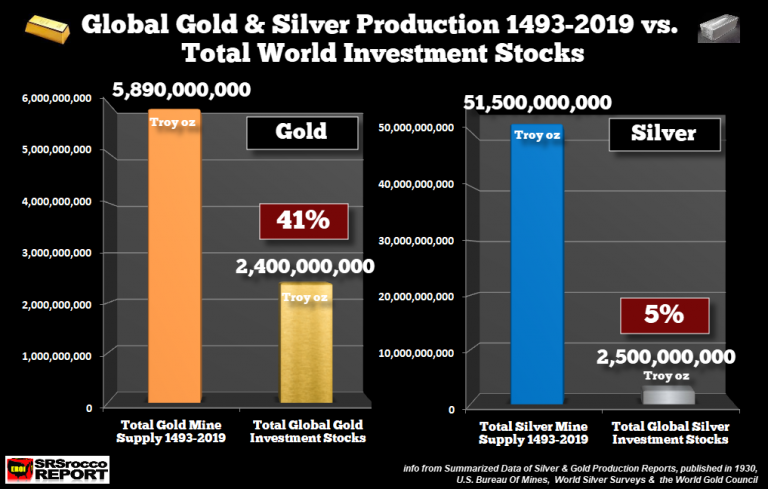

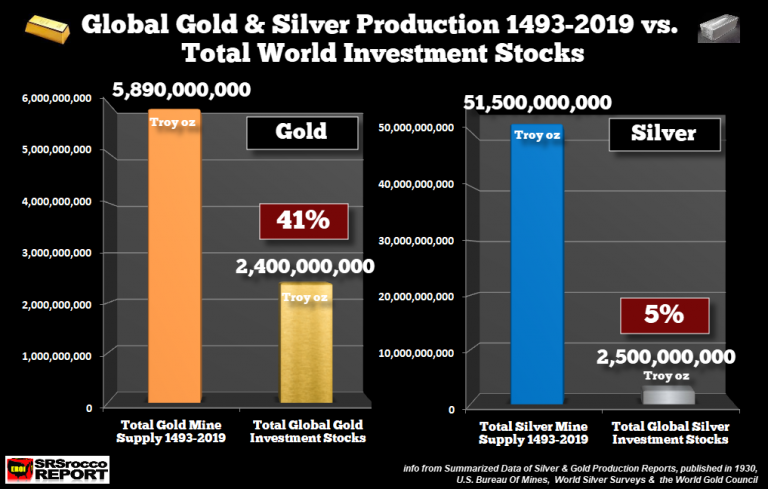

"...why silver will outperform gold in the future. There just isn’t that much more above-ground investment silver stocks in the world as there are gold stocks. Moreover, 41% of the “known” total world cumulative gold production from 1493-2019 is held in above-ground investment gold stocks compared to only 5% for silver.

Again, the world BURNED THROUGH SILVER like mad to supply our massive industrial needs, but also to provide the market with a great deal of inexpensive silver jewelry. Unfortunately, most silver jewelry won’t be recycled, even at a $100 silver price. If a ring contains 10 grams of silver, that’s only $30 worth of silver.

Silver Investors have been given a HUGE GIFT that most don’t realize. Because the world consumed, 10’s of billions of ounces of silver for industrial and jewelry fabrication, most of this will never come back to the market. Which means, when push comes to shove, investors looking to protect wealth, won’t find that much silver available to acquire… only at much higher prices." There’s Just Not That Much Silver Investment Insurance To Go Around

|

|

|

|

Post by Entendance on Feb 20, 2020 4:04:39 GMT -5

If the people only understood the rank injustice of our money and banking system, there would be a revolution before morning. -Andrew Jackson

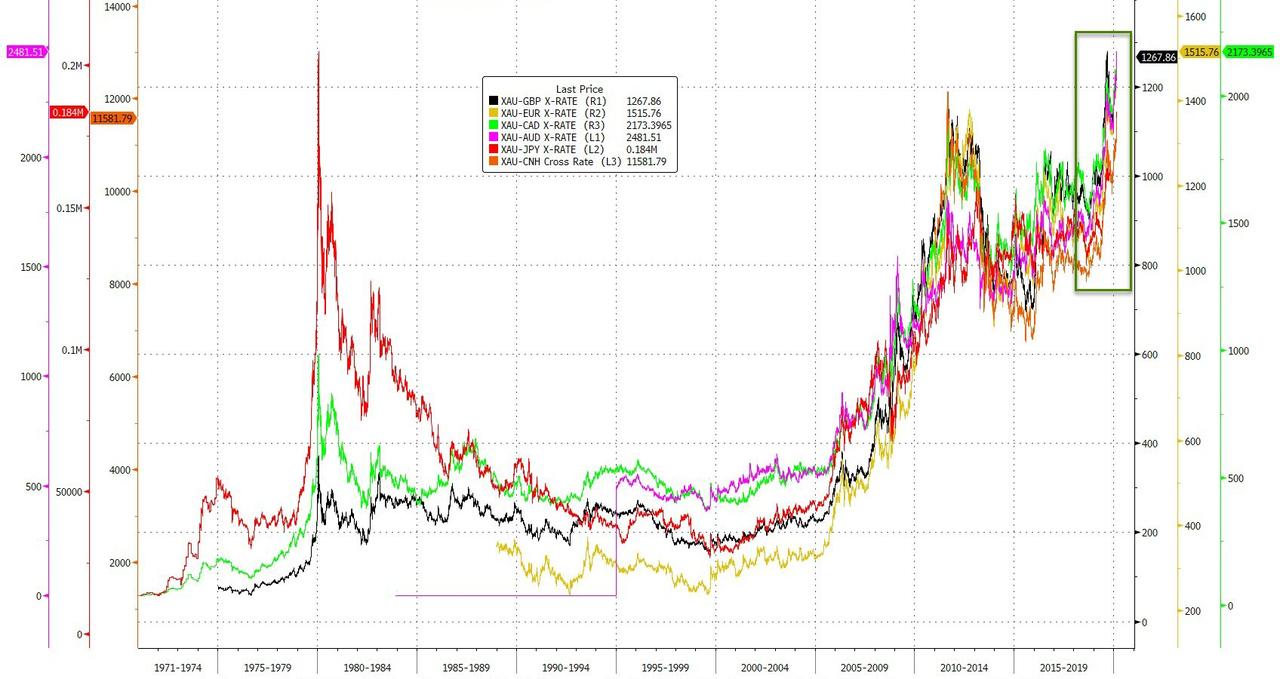

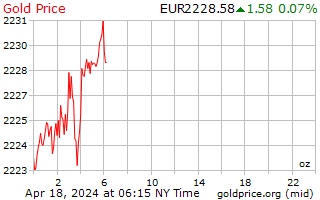

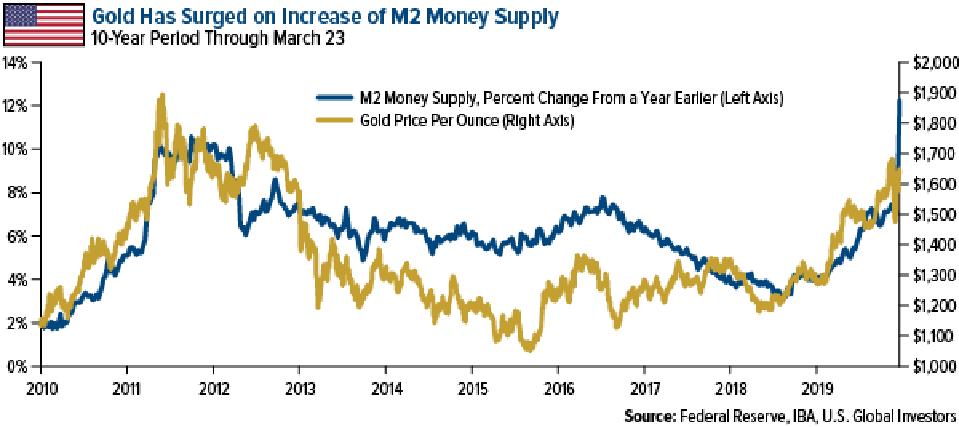

Gold is hitting record highs in many global currencies:

Each bar has a different weight. These bars are used in settlements in the London Metal Exchange and other exchanges and are very heavy compared to smaller bullion bars. Although metal purity is standardized these bars vary greatly in shape, manufacturer (brand) and mass which can vary between 750 and 1,100 oz although the vast majority of the bars will be between 950 and 1030 oz. Good delivery bars are normally readily available in large quantities.

Premiums per oz are lower and these bars always come with a serial number.

Keep stacking! Keep stacking!

In an interview with Wealth Research Group, GATA Chairman Bill Murphy notes that all dips in the gold price in recent months have been quickly bought, indicating tightness in supply. But, Murphy adds, the world's most undervalued asset is silver.

The government solution to a problem is usually as bad as the problem. -Milton Friedman

|

|

|

|

Post by Entendance on Feb 24, 2020 1:09:27 GMT -5

"As the world is approaching the end of another failed monetary experiment, very few people are aware what lies ahead of them and therefore nobody is mentally or financially prepared for the massive shock that will hit the world.

Gold is now signalling to the few who follow the price of gold that there is trouble ahead. But since less than 0.5% of investors own gold, virtually no one understands this important signal. I have told our investors who are in precious metals that they shouldn’t wish for the gold price to go up because when it does, we will enter a phase in history which will be extremely unpleasant. And this is exactly what will happen next..."

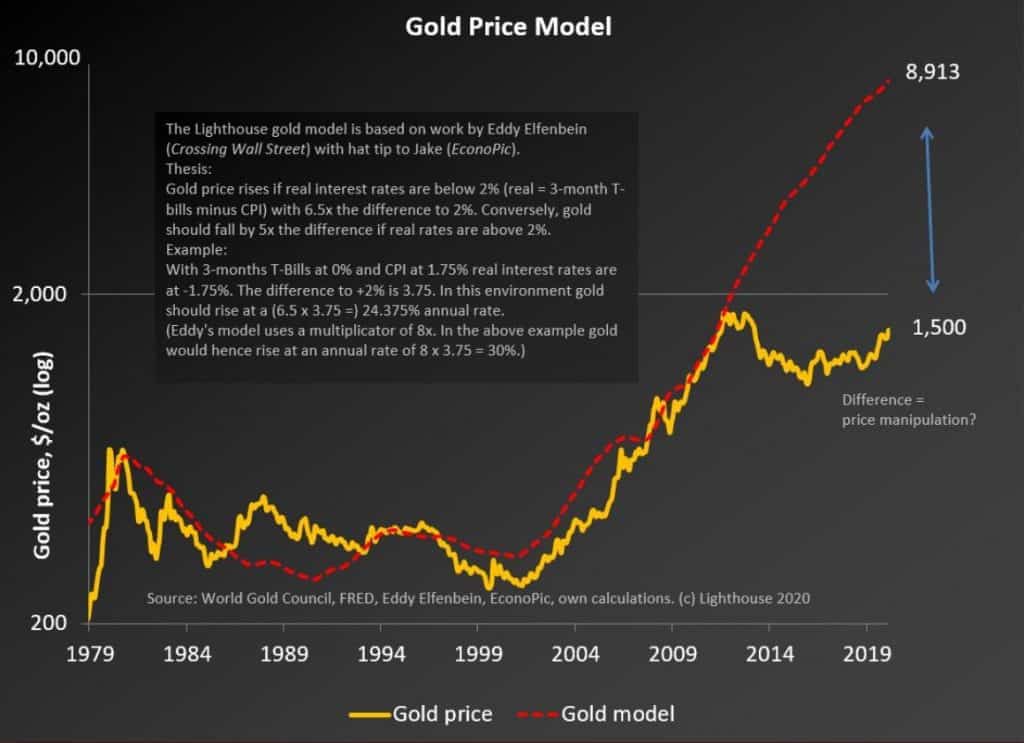

How Gold Is Manipulated

The Silver Series: A Perfect Storm for Silver (Part 2 of 3)

February 26, 2020

International Reserves of the Russian Federation: here

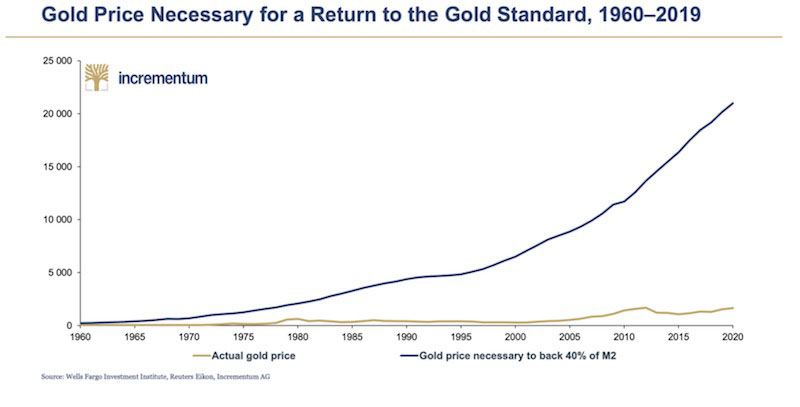

"...At some point, whether it is during the next panic or the following one, the market will discover that much of society's wealth has become entrapped in non-cash-flowing malinvestments. Tax revenues will plummet, and the assets that our central bank holds will be shown to be near worthless...

That is when gold will shoot into the multi-thousands of dollars per ounce...

History allows us to make some projections. The average gold backing for Bank of England liabilities from 1720 to 1900 was 33%. Private banks in the United Kingdom maintained a similar percentage of gold backing during this time.

This percentage was set more by the market than by policymakers: Until World War I, anyone could deposit gold and demand paper or vice-versa. The composition and size of the Federal Reserve's balance sheet require gold to trade above $5,000 to reach one-third backing.

"Looking at American history, Federal Reserve notes were freely exchangable for gold until 1933, and the average gold backing of the Federal Reserve through that time was 54%. To reach that level of backing would currently require a gold price above $8,500. Recall, however, that the above figures occurred when the non-gold assets on central bank balance sheets were nearly all commercial bills. Given the current composition of the Federal Reserve's balance sheet, the market will demand more backing than one third or even a half." January 14, 2020 PDF:

|

|

|

|

Post by Entendance on Feb 28, 2020 5:32:58 GMT -5

The Entendance Beach Free Quick Links For You

⏬

“If you haven’t bought physical gold/silver yet, this is an ideal opportunity to scoop up physical gold/silver at a bargain-basement price. Or, if you already own physical gold and silver, to stock up on more.”

We are, each of us, angels with only one wing, and we can only fly embracing each other.

Basically, you make money by not losing money. Most people realize too late the harsh arithmetic of missteps, that a 50% loss requires a 100% gain just to break even. [It's always darkest before it turns absolutely pitch black  ] ]

|

|

|

|

Post by Entendance on Mar 1, 2020 4:09:10 GMT -5

"NO DOUBT in my mind that we just witnessed a direct intervention by the Plunge Protection Team...last seen (that we know of) on 12/26/18.

As per usual, note the only spikes in volume are on the downside. Massive digital dumping designed to break momentum and engender Spec liquidations.

All week long and in multiple interviews I have stated this repeatedly: PHYSICAL GOLD IS A SAFE HAVEN. DIGITAL GOLD FUTURES ARE NOT.

Now more than ever, it is CRITICAL that you understand the difference.

CARTEL DESPERATION SETTING IN. Keep in mind that, with a 400,000 contract NET short position, every $10 move up in Comex gold creates a paper loss of $400,000,000.

Thus, The Banks are DESPERATE to contain price. As such, you are going to see more of this in the days ahead. Nice to see Benoit Gilson and the great folks at the Bank of International Settlements were suddenly able to develop a cure for the coronavirus this afternoon.

A grateful world is forever in your debt." -9:38 PM · 6 mar 2020 TF Metals Report

(Click on The Entendance Beach Free Quick Links For You within the previous post)

Gold has been around for tens of thousands of years and has been used as money throughout its history.

Fiat currency throughout history has always ended in hyperinflation.

With record debt levels and negative interest rates - the time is now for gold & silver! ***Study History!

Financial writer and precious metals expert Bill Holter says forget about the relatively small sell-off in the gold and silver markets. The big worry shaking the markets is an enormous global credit problem. Holter explains, “Your protection about the credit market coming down is asset money, if you want to call it that. Gold and silver have no liability. They are not issued by a central bank, and there is no promise that has to be kept for it to perform. . . . Dollars, euros, bonds or what have you, those are all liabilities of a central bank or sovereign treasury. They all carry liability, and that’s what the problem is in today’s world. It’s a world completely awash in liability. . . . I think, ultimately, you are going to see a credit meltdown.”

Holter points out the U.S. government “Plunge Protection Team” is not only trying to prop up the stock market, but also is suppressing gold and silver prices. Holter says, “Friday’s hit in the gold market (down $60 per ounce) is obviously an ‘official’ movement because they don’t want people getting the idea that your safe haven is physical gold and silver. In other words, they tried to steer investment away from gold and silver by smashing it with paper contracts.”

Holter, who has two decades of brokerage and equity experience, also points out, “This coming week and the weeks going forward, I am sure there are all kinds of margin calls that will be forced selling. . . . So, this thing could become a self-perpetuating spiral (down).”

What about the Fed riding to the rescue again like in 2008-2009? Holter says, “Zero percent is very close to where we are right now. The Fed does not have the leeway they had back in 2008-2009. They were lucky then to get away with it. The markets are going to call their bluff. That’s pretty much what has happened already.”

Is there no bottom in the stock market here? Holter says, “Basically, that’s correct...A cliff dive into a pool with two inches of water is a good analogy...The global yield curve is fully inverted...

We have never had an inverted yield curve (short interest rates higher than long interest rates) that has not been followed by a recession. It’s going to be inflate or die. If they don’t inflate, the system will implode upon itself.”

Holter predicts, “I think in a short period of time you are going to see swings of $200 to $300 per ounce in gold and $5 to $10 per ounce swings in silver. From the standpoint of so much paper being sold compared to real physical metal, there is going to be a cash call. This will expose the fact that there are 300 or 400 paper ounces for every one real ounce that exists.”

On top of that, with China bailing out everything in China, it may have to back its currency to keep the yuan from hyper-inflating away. If that happens, Holter says, “Gold will have to be substantially higher to do that.”

In closing, Holter says, “Cash generation is slowing, and that is going to be a problem with servicing the existing debt. There is so much debt that it can’t be paid off. That is the problem...I have said this many times, once the credit markets break, distribution will not happen and then it is credit game over.”

|

|

|

|

Post by Entendance on Mar 7, 2020 12:46:25 GMT -5

March 16, 2020

Just received a mail from SD Bullion, you can read it here

Biggest Move in History Coming Soon for Gold & Silver – Bill Murphy

"Dear BullionStar Customers and Friends, "Dear BullionStar Customers and Friends,

This is an important update about our company and the current state of the precious metals industry..."

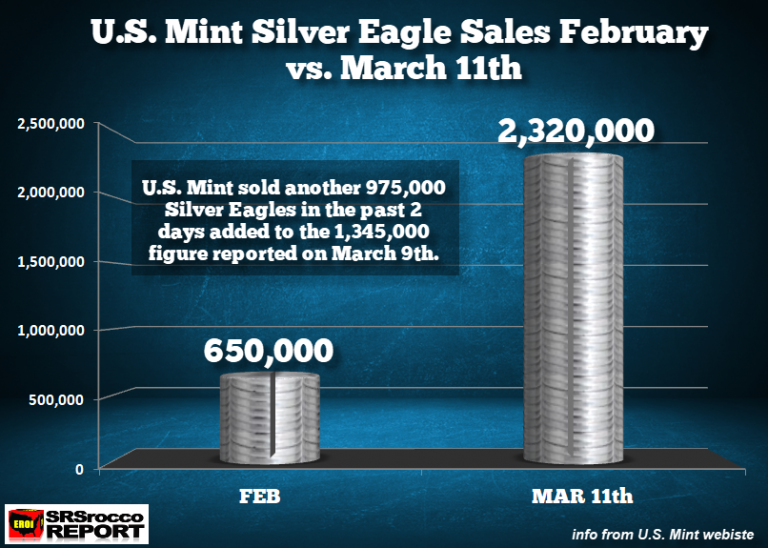

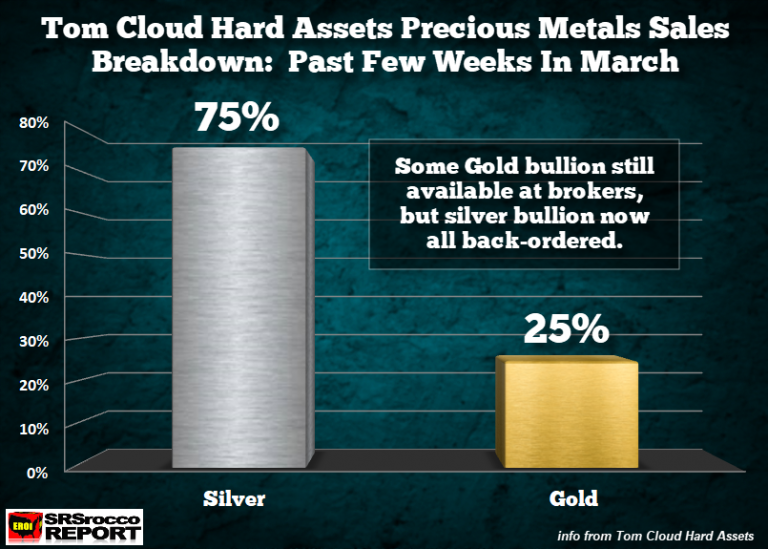

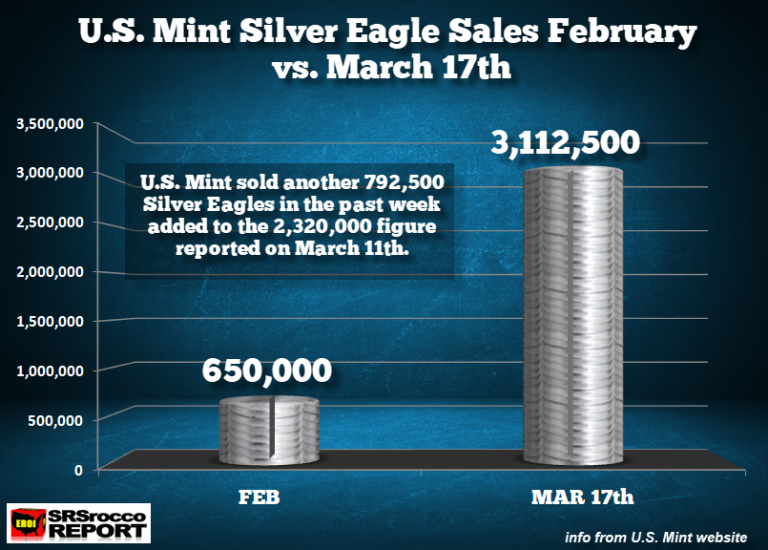

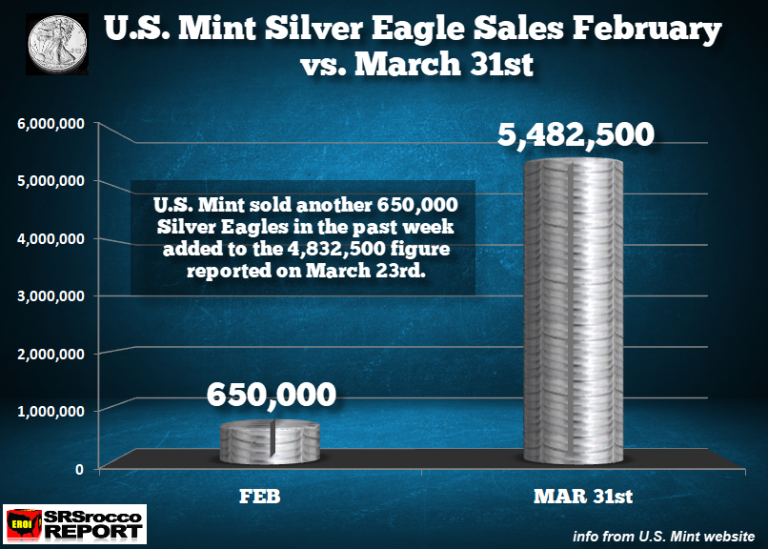

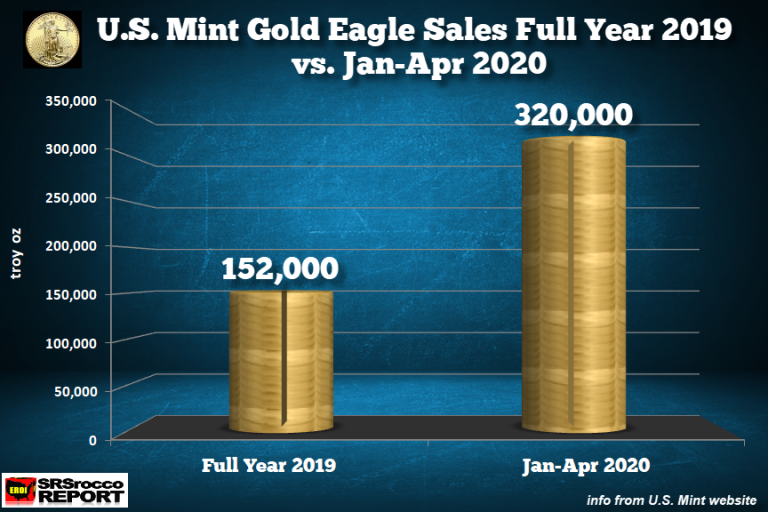

To summarize: In March 2019 the US Mint sold 850,000 silver eagles; in February of this year it sold 650,000; and in the first 12 days of this month it sold 2,320,000. At the moment there are no silver eagles left for sale. Feeling Adventurous? Consider Silver

Two weeks on delivery for physical in UK now on heavy demand. Spreads noticeably widening. It was actually cheaper or as cheap to buy silver a week ago before price tanked. andrew holden

(H/T our member theunderdog61)

"You don’t invest for one day or one week. You invest for the next 3 to 5 years, and that’s what you have to keep in mind. So when you are given occasions like today you just close your eyes and you start buying, and if it goes down you buy more, and if it goes up you buy a bit more."

THE LBMA/COMEX DIGITAL DERIVATIVE AND FRACTIONAL RESERVE PRICING SCHEME IS ONE OF THE GREATEST SCAMS EVER INVENTED. ONE DAY SOON, IT WILL ALL BLOW UP IN SPECTACULAR FASHION AND THE GLOBAL MONETARY SYSTEM WILL NEVER BE THE SAME. INDIVIDUALS MUST BE AWARE OF THIS AND USE THIS TIME TO ACCUMULATE PHYSICAL METAL...AND THIS METAL MUST BE IMMEDIATELY DELIVERED TO A TRUSTED VAULTING COMPANY OR YOUR PERSONAL SAFE. DO NOT, UNDER ANY CIRCUMSTANCES, ALLOW THE BULLION BANKS—THE PURVEYORS OF THIS FRAUD—TO DICTATE THE TERMS OF YOUR PHYSICAL METAL HOLDINGS. -SprottMoney

The Entendance Beach Bill Holter Gregory Mannarino Jeff Clark and Peter Schiff on the same page.

2019: The Entendance Beach "You have to decide ***whether to look like an idiot before the crash or an idiot after it."

Starve the banksters, stack gold & silver bullions, store them outside their banking system.

Meanwhile..."Nothing speaks of panic more than a gamble doubling down after a losing trade. And that’s what the Fe dis doing here..."

"$1700 Gold is the new bankster Maginot line. There is literally no chance of it holding as the world panics out of bubble markets into The Safe Haven asset." -Silver Gold News

"Silver physical demand is rising. Rotation out of general equities and into physical silver and gold bars and coins is a theme of recent." -Scottsdale Mint

"...It's also important to stress that there is only a tenuous connection, if any, between the paper gold futures market and the physical gold market. The reports I've read show very high physical demand internationally, particularly in Asia, while my contacts in the United States are telling me that buying here, while still somewhat depressed, is picking up.

The futures markets don't transmit these supply/demand signals. They are in fact completely insulated from them and those trading the markets don't care in any case. Their only motivation, outside of any covert intentions to manipulate the price, is to sell their positions to some greater fool at a profit.

The simple fact that they can "create" unlimited quantities of paper metal at a keystroke, without any repercussion, would make it a surprise if the gold market wasn't manipulated to some extent..." -Goldnewsletter

Currently, economic, financial and geopolitical risk is unprecedented.

March 10, 2020   Preview Chartbook of the In Gold We Trust Report 2020: here Preview Chartbook of the In Gold We Trust Report 2020: here

Silvers also beneficially disinfects society of central banksters!

March 9, 2020

"...Here’s the thing: Silver is money.

Here’s another thing: It can’t be magically printed or double-clicked into existence. Here’s one final thing: The US dollar, which is unbacked, debt-based fiat currency, has already hyperinflated, and all that’s missing now is the crack-up boom, and while the extent of the global pandemic won’t be fully known until we’ve peaked in cases, which may not even happen for many months from now if not even longer, governments and central banks around the world have shown their cards, and they’re clearly poised to just throw as much “money” at this problem as necessary.

Here’s the dilemma: What can we do about it?

Uh, we can buy silver.

That’s what we can do.

Of all the things in this world, silver is the one thing truly feared by governments and central banks alike, because silver is the money of the people, and governments and central banks do fear and hate the people, but sooner or later, the people will get it, and just like most people were caught off guard without enough toilet paper and n-95 masks, nearly everybody will be caught off guard when they realize they don’t have any real money either.

Therefore, what does the ongoing panic-buying of toilet paper and n-95 masks demonstrate?

It demonstrates that some people will eventually come around.

Some people will “get it”.

The analogy I’ve come up with has to do with sea turtles.

How is it that sea turtles can hatch on the beach and instinctively know how to get to the ocean?

It’s hard coded in their genes.

That’s how.

And in the same way, after thousands and thousands of years of history, I think humans have hard-coded in our genes the understanding that gold & silver are money, and those genes may lay dormant in most people right now, as did the toilet paper and n-95 mask “prepper” genes, but the “gold & silver are money” genes won’t remain dormant for long..." More here |

|

|

|

Post by Entendance on Mar 16, 2020 8:02:24 GMT -5

March 20, 2020

USAGOLD: Relentless paper selling drives gold price lower as coins and bullion disappear into private hoards

"...Central banks and the Bank for International Settlements cannot afford to see a bullion bank blow-up, and doubtless have been working behind the scenes to prevent one. Gold is likely being leased to the bullion banks, giving them some liquidity on paper, but in practice it never leaves the central bank’s vault and therefore its possession. Futures are sold with the purpose of triggering the speculators’ stops, creating an avalanche effect on the price. The intention is for bullion banks to either get at least square in their positions or preferably long, because they know that when the suppression exercise is over, the price of gold and silver will rise dramatically in the face of fiat money expansion..." Payments panic and the ending of fiat currencies

James Anderson of SD Bullion in Michigan demonstrated at YouTube yesterday that while the gold-silver ratio in the futures and future-driven "spot" markets lately has exceeded 120 to 1, over at Ebay, a major marketplace for both coin and bullion dealers and retail customers, the ratio is only 76 to 1. Anderson's analysis is 4 minutes long and is posted at YouTube here

Wall Street’s Crisis Began Four Months Before the First Reported Death from Coronavirus in China; Here’s the Proof

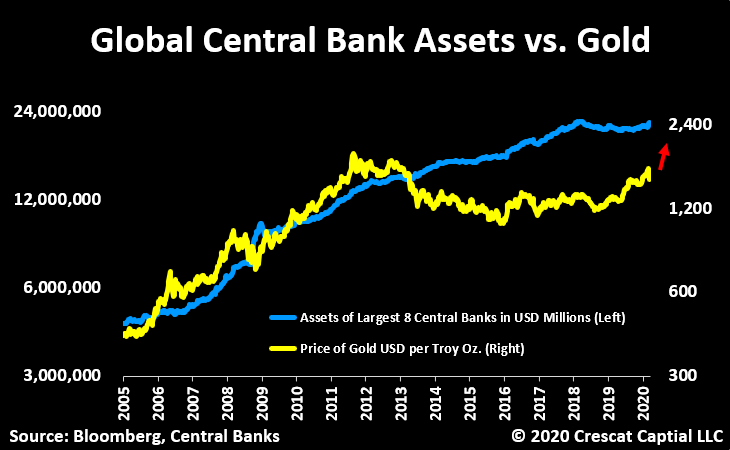

"...The fundamentals have never been better for gold and silver prices to rise making the discounted present value of these companies even better. Global central bank money printing is poised to explode which is important because the world fiat monetary base is the biggest single macro driver of gold prices. Gold itself is already undervalued relative to global central bank assets which targets gold at $2400 an ounce today..." -Kevin C. Smith, CFA

Bullion Bank and Central Bank Collusion - Craig Hemke here

Gold is setting records dating back over 5,000 years — against silver

March 16, 2020 Egon von Greyerz: "...we are based in Switzerland where 70% of all the gold bars in the world are made, we can state that there is currently no shortage of physical gold at the wholesale level. There is ample supply of gold bars currently from the Swiss refiners. But there is high demand for smaller retail bars.

That is the good news. The bad news is that this situation is not going to last long. As we know, the gold price is set in the paper market currently. And when global markets panic, many speculators in paper gold sell their positions for liquidity reasons. This gives the manipulators, with the BIS leading the exercise, a chance to push gold down $100 on a Friday afternoon in Europe over a 3 hour period like they did on Feb 13th. The BIS and their lackeys, the bullion banks, clearly wanted the opportunity to pick up gold at bargain prices before the real rally starts. STOP PRESS

Due to Coronavirus, the Swiss refiners are now cutting down on production as they must reduce the work shifts. At some point it is possible that production must shut down completely. At this stage decisions are taken from day to day. This is likely to lead to shortages of both gold and silver in the short to medium term..."

"...On the demand side, there is very strong and prolonged demand for physical investment precious metals bars and coins. In any properly functioning market, if demand is greater than supply and there is little supply at the current price, then the price goes up or re-rates to a higher level. But this has not been the case with the gold price. Why? Because the price has been subdued and has led to a mis-allocation of supply. Lack of supply leads to an increase in wholesaler premiums, which in turn leads to an increase in retailer premiums to reflect the demand situation. This in turn leads buyers to notice the price disconnect of physical from the price of ‘paper’ precious metal and question the incumbent price discovery mechanism. If only the same was true of financial reporters, who continue to regurgitate ‘margin call’ hearsay." gold price is established in the derivative (COMEX) and synthetic (London) paper gold markets which do not reflect physical demand and supply for bullion

"The western Central Banks, led by the BIS, are operating to push the price of gold and silver as low as possible. It’s a highly motivated effort to remove the proverbial canary from the coal mine before it dies. A soaring price of gold signals to the world that the Central Banks have lost control of their fiat currency, debt-induced profligacy....The most overt signal of the disconnect between the physical and paper markets is coming from large international bullion coin dealers. I have seen three letters from large dealers (BullionStar, JM Bullion and SD Bullion) which detail shortages and an inability to replace what’s being sold..." Extreme Disconnect Between Paper And Physical Gold

|

|

|

|

Post by Entendance on Mar 21, 2020 4:46:38 GMT -5

March 24, 2020 Will throwing 10’s of $ trillions of newly created debt money…fix debt? Never mind the shaky creditworthiness of borrowers, the collateral has now evaporated and nothing can be done to reflate it.

The 3 Swiss big gold refineries in Ticino are in Mendrisio (Argor-Heraeus), Balerna (Valcambi), and Castel San Pietro (PAMP). Swiss-Italian border in red in the map, a few miles from the refineries.

In February the Russian Federation added 12.4 tonnes of gold bars, bringing its strategic monetary gold stockpile to 2289 tonnes

Gold accounted for 0.52% of global financial assets in 2019, so there is plenty of upside potential. Especially as the pace of the virus and its economic ramifications is accelerating, and it’s becoming more evident, we are heading towards the end of today’s financial system, which has been exhausted by decades of reckless monetary policy. -Voima Gold

|

|

|

|

Post by Entendance on Mar 24, 2020 11:22:18 GMT -5

What happens in the real world (not the paper monopoly world) when demand soars and supply disappears?

NONE OF THE WORLD'S 3 LARGEST GOLD REFINERS BASED IN TICINO, SWITZERLAND WILL OPEN THIS COMING WEEK.

THE CLOSURE IS LIKELY TO BE LONG. THIS WILL PUT ENORMOUS PRESSURE ON THE PRICE OF PHYSICAL GOLD.

A PRICE EXPLOSION FOR PHYSICAL IS VERY LIKELY. Egon von Greyerz

"GOLD SHOULD BE AT 6000 & SILVER AT 500..."-Mannarino

The central bank system is the greatest scam ever perpetrated on an ignorant public. The eternal enemy of every central bank is... Gold (& Silver). -Richard Russel

"Let’s take a look at the general situation here in Switzerland. Our country refines about 70% of the gold available worldwide. Due to the coronavirus crisis, logistics chains have been severed, production facilities have suffered operational cutbacks or simply shut down, as is currently the case in Ticino, where all refineries have been closed for this week. Nobody knows yet what it will look like next week. The Canadian Mint will not deliver any metals for the next 3 months because of the border closures and the situation in other mints does not look much better either..."

"Only physical gold can truly protect your wealth through the eventual crisis and monetary reset. If you have some...great. If you don't...you might try to find some before the music stops playing and the scramble for seats begins." Paper Gold vs Physical Gold

The floating gold and silver supply is gone: “People are hiding gold and silver like they hide toilet paper and guns right now,”Owning gold and silver is crucial, especially during crisis times like these when physical bars and coins become scarce. “Gold and silver are God’s money. They have been here since the Earth was formed. Your only counterparty is God, not the bank,” he said.

PAPER GOLD MARKET WILL COLLAPSE

|

|

|

|

Post by Entendance on Mar 31, 2020 4:25:56 GMT -5

April 2, 2020

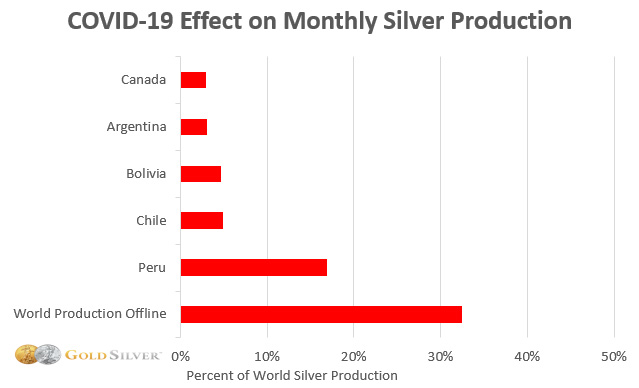

Mining in Mexico has been shut down by government decree until the end of April as part of measures to contain the COVID-19 virus outbreak, having not been granted an exemption as an essential service. Mexico mining suspension to hit silver supply

“We’re seeing an unprecedented situation where huge customer demand and the disconnect between physical prices and spot prices is driving buy premiums high. Spot prices coming from London or New York are completely detached from the reality on the ground.”

The Entendance Beach PMs links: anytime, your DD research on Physical Silver and Physical Gold is here

"Whoever doesn’t learn to dance in the rain will struggle to survive the virtually non-stop storms that the world will experience in the next few years. The abrupt downturn in the global economy, triggered but not caused by coronavirus, came as a lightning bolt out of the blue. Thus, most people are paralysed and will fall helplessly as the world unwinds 100 years of mismanagement and excesses, caused primarily by bankers, both central and commercial..."

"...Is there not even one vaulted 400 oz gold bar in the whole of New York? Why is COMEX rushing in a new contract deliverable in 400 oz gold bars when it is reporting that there are zero 400 oz gold bars in its approved vaults. Is this all just a smoke and mirrors exercise with the bullion bankers in London and New York laughing over champagne as mainstream new reports claim the very same bankers are scrambling to charter private jets laden with gold bars from London to New York? "...Is there not even one vaulted 400 oz gold bar in the whole of New York? Why is COMEX rushing in a new contract deliverable in 400 oz gold bars when it is reporting that there are zero 400 oz gold bars in its approved vaults. Is this all just a smoke and mirrors exercise with the bullion bankers in London and New York laughing over champagne as mainstream new reports claim the very same bankers are scrambling to charter private jets laden with gold bars from London to New York?

And finally, are JP Morgan vault staff currently scrambling to rush 400 oz gold bars across the tunnel between the NY Fed gold vault and Chase Manhattan gold vault under Liberty Street in southern Manhattan? Inquiring minds would like to know."

I truly thought I had seen all that was possible in the creation of paper gold when the Comex rolled out its “pledged gold” category which enabled technically insolvent banks like HSBC and JP Morgan – the only two Comex banks to have taken advantage of this new gold derivative product – to use paper gold to satisfy the performance bond requirement of CME clearing members.

But now the LBMA and CME operators have rolled yet another paper gold derivative productive in the hopes that the two entities can stave off defaulting on futures and forward contractual delivery requirements. The Accumulated Certificates of Exchange (“ACE”) facilitates the “fractional” delivery of a 400 oz gold bar.

There’s just one minor problem with this set-up. According to the Cambridge Dictionary, the word “delivery” is defined as: “the act of taking goods, letters, packages, etc. to people’s houses or places of work.” To me this means if I want delivery of the 100 oz bar of gold for which I contracted, I would like to have the 100 ozs deposited in the location of my choice so that I can possess the gold bar for which I paid upfront. In effect, the Comex has technically defaulted on the contractual terms of the 100 oz Comex futures contract. It’s only a matter of time before the markets wake to this reality. At that moment we will see the $100-$200 or more daily moves in gold that many have discussed as an eventuality. - Dave Kranzler

ALERT! Institutional shortages of physical gold and silver have impacted hedging facilities in the New York Comex futures market, creating a unique market condition where the spot prices of gold and silver at which a physical dealer can hedge - and therefore use as a basis to price it products - is currently trading approximately $20 higher (gold) and 20¢ higher (silver) than what our pricing system indicates in the menu bar above. USAGOLD |

|

|

|

Post by Entendance on Apr 3, 2020 3:00:42 GMT -5

"...The moral of that story and the lessons that we can learn are simple – don’t believe the pronouncements of the powers that be in the London and US gold markets, especially during a crisis. In March 1968, during the last days of the London Gold Pool, as the central bank cartel ship began to sink, theystodd steadfast in denials that anything was amiss, brazenly saying that “the London Gold Pool reaffirm their determination to support the pool."

This time around, with their hollow claims about “healthy stocks of gold in London and New York”, and that the “LBMA has offered its support to CME Group”, the names may have changed but the denial strategy remains the same. It therefore seems that while history doesn’t repeat itself, it still often rhymes."

"...The sum total of all the developments at the LBMA and COMEX last week reinforces the fact that there is a huge shortage of physical gold (and, by extension, silver) inventories available to cover all promises for delivery. As more people are willing to pay ever-higher premiums to get their hands on bullion-priced physical coins and ingots, the risk of collapse—a formal default—of the “paper” gold and silver markets is also rising."Did The London/New York Markets Default On Gold Deliveries?

"If any of what we are seeing within our markets is factual and true, then why can no one find and buy real physicals at the Comex prices? As far as getting bars from the Comex Warehouses, we are told it’s still happening but that has to be questionable, at best. Yet the disparities between what is called Comex, the last place on the planet to buy anything in size, is suppose to be the real, then why is there no place here in the USA with product in stock?

Buyers across our country cannot find physicals period! If there is an ounce sold, sellers are refusing to accept any deal without a substantial premium to Comex. Both Coasts are showing a $10 spread for Silver. As far as Gold, just add $200 to Comex’s price anywhere and you’ll be close enough to getting that ounce, maybe. Check yourself, most suppliers are out of everything..."

|

|

|

|

Post by Entendance on Apr 5, 2020 4:15:32 GMT -5

Insert a silver bar to continue. Insert a silver bar to continue.

Three of the biggest gold refineries says they will partially reopen after a two-week closure that disrupted global supply of the metal.

Valcambi, Argor-Heraeus, and PAMP, located near the Swiss border with Italy, were shut March 20 by a local government order that closed non-essential industry to contain the spread of the coronavirus. Valcambi and Argor said on Sunday they had received government approval to partially reopen on April 6. PAMP said on Friday it had permission to restart. They said this was on condition that they observe more stringent hygiene and safety measures.

Valcambi and PAMP said this meant they would operate at less than 50-percent capacity. Argor said it would have a “reduced-work regime,” splitting staff into three groups working separate shifts. Swiss gold refineries to reopen at sharply reduced capacity

(H/T The Gold Anti-Trust Action Committee)

Among others...

|

|

|

|

Post by Entendance on Apr 9, 2020 3:52:41 GMT -5

"...The official story was there, finally, a shortage of 100-ounce COMEX deliverable bars and the rules of delivery had to be changed to accept 400-ounce LBMA bars instead because those LBMA bars couldn’t be smelted down. The Swiss gold refineries are all shut down thanks to COVID-19.

That’s the official story.

I’m sure someone believes it. Since the demand for physical gold is currently off the charts. And while all of the analysts were telling us that there’s plenty of gold out there the reality is quite different..."

Each bar has a different weight. These bars are used in settlements in the London Metal Exchange and other exchanges and are very heavy compared to smaller bullion bars. Although metal purity is standardized these bars vary greatly in shape, manufacturer (brand) and mass which can vary between 750 and 1,100 oz although the vast majority of the bars will be between 950 and 1030 oz. Good delivery bars are normally readily available in large quantities.

Premiums per oz are lower and these bars always come with a serial number.

|

|

|

|

Post by Entendance on Apr 15, 2020 8:42:20 GMT -5

"Imagine, if you will, there was no coronavirus. No haz-mat suits, medical masks & gloves, no make-shift morgues. No terminally ill patients hooked up to ventilators, no horrible deaths without love ones close, no lockdowns, no social distancing, no deserted streets, no bailouts, no emergency wage supplements, just a regular spring with birds chirping and flowers blooming.

Of course there is no getting away from the covid-19 pandemic that has slammed into populations and economies like a “God of chaos” comet. It seems to have permeated civilization, threatening lives, livelihoods, and the way we conduct ourselves professionally and socially.

I’d just like to put it into perspective, by looking back at where we were, before all this madness began. Because in the wise words of philosopher George Santayana, “Those who cannot remember the past are condemned to repeat it.”

It is tempting, while still in the thick of the pandemic, to don rose-colored glasses, but weeks before the onset of covid-19, we were writing how things were not going as well as they appeared, with the global economy.

And while it’s also tempting to base gold’s current run on heavy demand for the world’s oldest safe haven, it is worth noting that, for all of 2019 and during the first two months of the year, gold was reacting to events that had nothing to do with a global health emergency.

In this article we are placing gold on a timeline that begins last summer, rolls into the present situation, and ends with some bold predictions as to what the future could look like for gold, the grand-daddy of precious metals, and its little brother silver. Spoiler alert:

We conclude that current economic conditions are forming an extremely solid foundation for a precious metals bull market that, imho, will last at minimum the length of the pandemic, and likely well into the recovery.

Past: Our story begins with one-year price charts for gold and silver..."

Do they really have 92 tons that can be delivered this month?…Stay tuned!

Conclusion – Audit the COMEX

"Why I own Physical Silver #4"

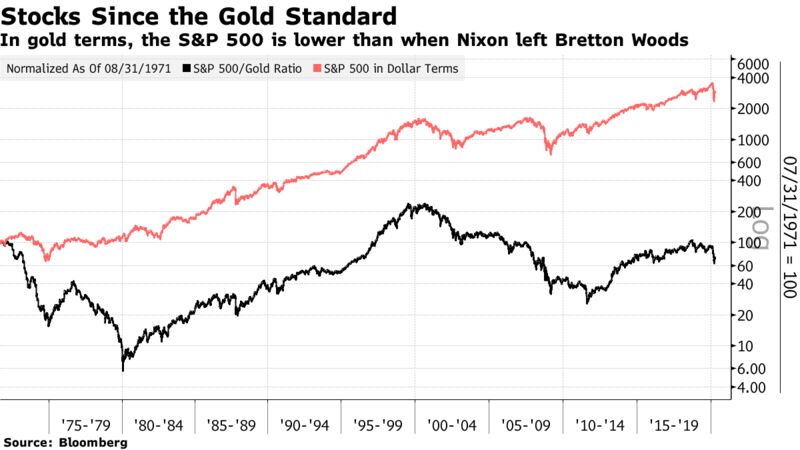

"...it is undeniable that the decision by President Richard Nixon to break that link in 1971 had a profound effect on what followed. If we regard gold as the continuing true measure of monetary stability, it suggests that stock markets’ gains in the almost 50 years since are almost entirely due to “money illusion,” or the erosion of the dollar’s buying power...

...In gold terms, the stock market was higher than in 1971 for a few years around the top of the dot-com bubble, and again for a few months at the top of the latest bull market. It is now almost 30% below where it was in 1971.

To be clear, stocks would still have been a better investment than gold in 1971, because these numbers don't include reinvested dividends. But this exercise suggests that stocks’ function as a store of value is largely an artifact of the dollar. The higher gold price also suggests that confidence in the dollar is waning..." History suggests that buying the market's biggest stocks is a bad idea. They have nowhere to go but down. (H/T Tom from Florida)

LAST CHANCE TO SAVE YOUR WEALTH

"...Investors who don’t take immediate action are going to lose most of their investment assets. If you own property without debt, you can at least hold on to it but you will stop looking at it as an investment. But sadly most investors in conventional assets, like stocks and bonds, will be paralysed, hoping that Central Banks and Governments will save them yet one more time. But it won’t happen this time as more worthless debt cannot solve a debt problem.

So I urge you to take action now.

Stocks will very soon start the next downleg in the secular downturn that started a few weeks ago. So there is a last little window to get out at what will seem like fantastic prices just a few months from here.

Gold has now started the acceleration phase and made new highs in most currencies except for in US dollars. The 2011 high of $1,920 will soon be reached on the way to much, much higher levels.

The three biggest gold refiners in the world in the Swiss canton of Ticino are now operating again but only at 1/4 of normal capacity. So there will be very little physical gold available. Our company can still get hold of gold but the tight supply situation will lead to prices going up rapidly and spreads widening.

Remember that you are not holding gold for illusory gains in worthless paper money. Instead, physical, and only physical, gold is life insurance against a collapsing world economy and monetary system."

U.S. Mint halts gold coin output just as demand is surging here

|

|

|

|

Post by Entendance on Apr 20, 2020 10:26:26 GMT -5

Don't steal. Governments hate competition. -Anonymous

"Unlimited" Levels of Quantitative Easing (QE) Support the Case for Precious Metals

"For those STILL unaware (LOL, that's my comment. E.), Wall Street via the COMEX suppresses PM prices by employing paper derivatives. EBAY this morning: a 2011 Silver Maple Leaf sold for $25.55 and a 100oz. Engelhard Silver Bar is currently bid at $1,925.00 with 3 hours left in the auction. This illustrates the REAL price of Silver."-private message from a member

BTW, forget T.A.

The technicians do not help produce yachts for the customers, but they do help generate the trading that produces yachts for the brokers. -Burton Malkiel The technicians do not help produce yachts for the customers, but they do help generate the trading that produces yachts for the brokers. -Burton Malkiel

Not your vault, not your gold. You better own precious metals directly, with no counterparty risk: they are not exposed to any creditor obligations.

Store Gold/Silver outside the banking system! Only own your precious metals in safe vaults. Facilitated "outside" of the banking system NO DEPENDENCE on the functioning of stock exchanges or banks.

Protect against unprecedented debt levels, bank bail-ins, government confiscation, derivatives implosion, central planning.

Gold is just beginning, gold is REAL money. The next decade for gold is going to be explosive with all this unprecedented debt!

You have a fiat monetary system which means that you can print whatever amount of money you want – and that’s what central banksters do.

Fiat currency: a currency which is not physically backed! When adopting a gold-backed currency, the one who moves first has a massive advantage over the others!

The world’s major central banks continue to debase the purchasing power of their Fiat currencies –by orchestrating consumer and/or asset price inflation.

The banksters don't even have the guts to call it printing money out of thin air instead they hide behind the term 'quantitative easing'. QE has been a massive deceit & a huge factor in driving inequality!

In a time where money printing seems endless, remember - the central banksters cannot reproduce gold as they do with fiat currencies. E.

|

|

|

|

Post by Entendance on Apr 22, 2020 12:24:48 GMT -5

WASHINGTON, April 22, 2020 (GLOBE NEWSWIRE) --  Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal. Favorable structural changes, such as vehicle electrification and a rebound in the key field of photovoltaics, fueled solid industrial demand. Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal. Favorable structural changes, such as vehicle electrification and a rebound in the key field of photovoltaics, fueled solid industrial demand.

Total global silver demand in 2019 grew by 0.4 percent despite an ongoing global trade war affecting many industries. Silver industrial demand was resilient, slipping by 0.1 percent last year, with several key segments of silver industrial fabrication expanding, primarily silver’s use in photovoltaics, which grew by 7 percent to its second highest annual level. Of note, for the fourth consecutive year, silver mine supply declined in 2019, falling by 1 percent.

These developments, along with many other highlights, are discussed in World Silver Survey 2020, released today by the Silver Institute. In addition to a review of the key developments in 2019, this year’s Survey also examines the outlook for the 2020 silver market. The Survey was researched and produced for the Silver Institute by Metals Focus, the London-based independent precious metals consultancy.

Meanwhile...

|

|

|

|

Post by Entendance on Apr 29, 2020 1:27:24 GMT -5

"With massive pressure in the physical market where both the LBMA bullion banks and Comex are unable to meet their obligations to deliver physical gold, it is only a matter of time before gold breaks out properly. I don’t like making sensational forecasts of the gold price since that attracts the wrong buyers. Still 10x today’s price or $17,000 is certainly realistic with just normal inflation. The attached chart by goldchartsrus confirms that level. Gold adjusted for real inflation would be at $18,100 to be equal to the 1980 top of $850..."

Exclusive: Scotiabank to close its metals business - sources Exclusive: Scotiabank to close its metals business - sources

ScotiaMocatta, which has existed as a bullion bank since the 17th century, is shutting down

Scotiabank's metals business closure could impact daily gold price discovery — analysts

"Scotia has far smaller gold inventories in its New York vault than fellow LBMA paper gold 'clearers' JP Morgan and HSBC. Scotia also has no 400 oz gold bars in its NY vault according to CME COMEX vault report. See XLS - last line"

Meanwhile...

(H/T Tom from Florida)

|

|

|

|

Post by Entendance on May 1, 2020 3:37:26 GMT -5

It costs 5 cents to print a 1 dollar bill.

It costs 12 cents to print a 100 dollar bill.

It costs zero to create a billion dollars in the Fed database.

Fiat currency = zero intrinsic value, it is just belief.

Gold as an investment is made for times like these

"...Horwitz asked today: "Where is the manipulation?"

It is all around him if only he will look. But to deny manipulation while refusing to look, refusing to address even one of the many documents of manipulation, isn't market analysis. It is disinformation.

That is, Horwitz means to deceive, as Kitco does by publishing his disinformation. Fortunately they're not very clever about it, but even so they are abusing the newcomers to the sector, who are easier to cheat when they don't know what's really going on -- don't know that gold is the secret knowledge of the financial universe and that the gold market is where all the world's marbles are at stake. It's no place to be ignorant."

As the gaping spread between London/LBMA spot gold prices and front-month COMEX gold futures prices persists for a sixth week triggered by the bullion bank exchange-for-physicals liquidity blowup on March 23, one unappreciated aspect of this gold price discovery scandal is that daily London LBMA Gold Price auctions are deliberately ignoring Comex gold prices when setting the opening price (starting price) in the twice-daily gold price auction. As the gaping spread between London/LBMA spot gold prices and front-month COMEX gold futures prices persists for a sixth week triggered by the bullion bank exchange-for-physicals liquidity blowup on March 23, one unappreciated aspect of this gold price discovery scandal is that daily London LBMA Gold Price auctions are deliberately ignoring Comex gold prices when setting the opening price (starting price) in the twice-daily gold price auction.By ignoring the much-higher Comex gold futures prices while setting the LBMA gold auction starting price, the auction administrator -- the Intercontinental Exchange Benchmark Administration -- is ignoring current market conditions in the gold market. (A stated methodology of the auction is to use current market conditions.) The LBMA Gold Price auction is thus shortchanging global gold market participants and investors who all use the LBMA Gold Price benchmark (the final price from the auction) as a critical reference rate.

The motivation? To take the spotlight off the fact that the London spot gold market is broken and that the LBMA market makers have liquidity problems...

Video of the week: The Pricing System Is Broken

Physical Gold Premium Summary – 5/1/20

Meanwhile...Printed Money for the banks, always available; printed out of fine air, as usual, to the banksters

|

|

|

|

Post by Entendance on May 14, 2020 11:25:56 GMT -5

May 17, 2020

(H/T Tom from Florida)

With the 1,000 Ounce Silver Bar there is no better and no cheaper way to invest in large quantities of silver. These bars are perfect for customers looking to invest in the metal itself, with no preference regarding the mint. You won’t find anything closer to spot price, and it also makes for a great addition to any silver collection. These bars represent the best value for money for investors looking to buy large investment-grade quantities of this precious metal.

1,000 Ounce Silver Bars were created with serious investors in mind!

Silver 1000 oz LBMA Good Delivery bar:

each bar has a different weight. These bars are used in settlements in the London Metal Exchange and other exchanges and are very heavy compared to smaller bullion bars. Although metal purity is standardized these bars vary greatly in shape, manufacturer (brand) and mass which can vary between 750 and 1,100 oz although the vast majority of the bars will be between 950 and 1030 oz. Good delivery bars are normally readily available in large quantities.

Premiums per oz are lower and these bars always come with a serial number.

|

|

|

|

Post by Entendance on May 20, 2020 2:02:54 GMT -5

Countries went on a gold-buying spree before coronavirus took hold – here’s why

"...Crispin Odey, one of Europe’s highest-profile hedge fund managers, said that governments may ban private gold ownership if they lose control of inflation in the wake of the coronavirus crisis.

“It is no surprise that people are buying gold. But the authorities may attempt at some point to de-monetise gold, making it illegal to own as a private individual,” Odey wrote in a letter to investors seen by Bloomberg. “They will only do this if they feel the need to create a stable unit of account for world trade.”..." Odey Says Governments May Make Private Gold Ownership Illegal

Dear Friend of GATA and Gold (and Silver): While the big disparity between spot gold and near-term gold futures prices seems to have closed, the TF Metals Report's Craig Hemke writes tonight at Sprott Money, a similar disparity has developed between spot silver and near-term silver futures prices.

These disparties, Hemke writes, signify a lack of confidence that metal is as available for immediate delivery as the "shills and apologists" for the fractional-reserve gold and silver banking system claim.

Hemke writes: "Growing physical demand will stress the banks and their system to greater degrees, and the eventual collapse of this scheme will lead to a new pricing structure that is related to supply and demand of physical metal, not the supply and demand of digital derivatives."

Hemke's analysis is headlined "A Crisis of Confidence -- Part 2" and it's posted at Sprott Money here

|

|

|

|

Post by Entendance on May 25, 2020 1:47:38 GMT -5

The case for owning precious metals is easy to make, especially silver. According to Rubino, it now takes 100 ounces of silver to equal the value of 1 ounce of gold. That’s a near record of 100 to 1 silver/gold ratio. Rubino contends, “The silver/gold ratio says silver is clearly a buy based on historical trends and the relationship between gold and silver. . . . You would expect silver going forward to outperform gold, and you would expect gold to go up as well. . . . This is now a bull market, and they will both go up, but silver will outperform gold. . . . There is just so much more debt in the world, and there is so much more of a need for safe haven assets that you would expect silver to blow right through its previous high levels. This time around, it could be totally spectacular with what happens with silver. There is going to come a time when everyone will want to talk about silver, but that day is not yet.”

Global gold mining company AngloGold Ashanti says it temporarily halted operations on a voluntary basis

"...If you haven’t done so already, place a reasonable percentage of whatever assets you have in gold and silver, and ideally of this a significant percentage in physical gold and silver...  ...The reason that this article is titled “Getting Positioned for the WORST DEPRESSION IN THE HISTORY OF THE WORLD” is that debt and derivatives have never built up to such vast levels on a global scale before. It will take a correspondingly severe depression to eliminate this gargantuan mountain of dross..." ...The reason that this article is titled “Getting Positioned for the WORST DEPRESSION IN THE HISTORY OF THE WORLD” is that debt and derivatives have never built up to such vast levels on a global scale before. It will take a correspondingly severe depression to eliminate this gargantuan mountain of dross..."

When investors and collectors are considering the various bullion programs to add to their stack, generally the focus is on metal content, purity, and the potential for the premium invested (beyond spot price) upfront could appreciate in value as years go by and other releases are added to the series. This can be broadly defined as premium appreciation.

Premium appreciation behaves comparable to any secondary market. The right mix of supply and demand, series continuity, and a standard of quality design and minting must be achieved to support the premiums rising in value in the secondary market.-SDBullion

|

|

|

|

Post by Entendance on May 27, 2020 10:53:15 GMT -5

Extended Version (350 pages) PDF

Compact Version (100 pages) PDF

The presentation of the In Gold We Trust report 2020 can be viewed here

In Gold We Trust Report 2020 -Aufbruch in eine goldene Dekade

(H/T Tom from Florida)

|

|

|

|

Post by Entendance on Jun 2, 2020 12:39:50 GMT -5

12:40p ET Thursday, June 4, 2020

"Dear Friend of GATA and Gold:

On behalf of Kinesis Money, London metals trader Andrew Maguire today interviews GATA Chairman Bill Murphy about gold and silver market manipulation, the heavy involvement of JPMorganChase & Co., the diminishing effectiveness of the usual smashdowns in the market, and the growing tightness in the physical market for the monetary metals, which foreshadows big surges in prices."

|

|

|

|

Post by Entendance on Jun 9, 2020 8:38:30 GMT -5

Nous avons besoin d’or parce qu’il ne peut être imprimé constamment par des bureaucrates pour renflouer les banques qui ont trop prêté, les gouvernements surendettés et les compagnies zombies, tout en envoyant la facture d’inflation et de dévaluation monétaire à tout le monde. -Maxime Bernier

(We need gold because it cannot be printed by bureaucrats to repeatedly bail out overleveraged banks, overindebted governments, and zombie companies, while sticking the inflation and monetary debasement bill to everyone else.) -Maxime Bernier

"...The world is running out of its HIGH-GRADE, easy to get to silver deposits. While there are still some high-grade silver deposits still remaining in the world, the primary mining industry continues to BURN through its better quality reserves. At some point, production from these top seven silver mines will no longer be able to offset the declines from falling ore grades.

Investors have no idea what a deal they are getting in acquiring silver for such a great deal when we compare it to most of the over-valued financial paper assets and real estate. The few silver miners in the world may just surprise the market when investors begin to move into them in a BIG WAY."

|

|

|

|

Post by Entendance on Jun 13, 2020 0:37:27 GMT -5

June 14, 2020

(H/T our member theunderdog61)

|

|

|

|

Post by Entendance on Jun 16, 2020 3:33:27 GMT -5

|

|

|

|

Post by Entendance on Jun 18, 2020 3:28:36 GMT -5

The issue which has swept down the centuries…and which will have to be fought sooner or later…is the people vs. the banks.

Liberty is not a means to a higher political end. It is itself the highest political end. – Lord Acton

|

|

2020, Silver & The banksters

2020, Silver & The banksters

your currency calcolator is

your currency calcolator is

Ancient Egypt:

Ancient Egypt:

Keep stacking!

Keep stacking!

Stagflation, Commodity Price Indices &

Stagflation, Commodity Price Indices &

The E. Beach &

The E. Beach &

]

]

The “Elephant in the Room”

The “Elephant in the Room”

***SWISS GOLD REFINERS CEASE PRODUCTION –

***SWISS GOLD REFINERS CEASE PRODUCTION –

Insert a silver bar to continue.

Insert a silver bar to continue.

The Four Horsemen Hate Silver

The Four Horsemen Hate Silver

Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal. Favorable structural changes, such as vehicle electrification and a rebound in the key field of photovoltaics, fueled solid industrial demand.

Global silver demand was pushed higher in 2019, with a 12 percent increase in investment demand as retail and institutional investors focused their attention on the long-term investment appeal of the white metal. Favorable structural changes, such as vehicle electrification and a rebound in the key field of photovoltaics, fueled solid industrial demand. GOLD ETFs

GOLD ETFs

Exclusive: Scotiabank to close its metals business -

Exclusive: Scotiabank to close its metals business -

As the gaping spread between London/LBMA spot gold prices and front-month COMEX gold futures prices persists for a sixth week triggered by the bullion bank exchange-for-physicals liquidity blowup on March 23, one unappreciated aspect of this gold price discovery scandal is that daily London LBMA Gold Price auctions are deliberately ignoring Comex gold prices when setting the opening price (starting price) in the twice-daily gold price auction.

As the gaping spread between London/LBMA spot gold prices and front-month COMEX gold futures prices persists for a sixth week triggered by the bullion bank exchange-for-physicals liquidity blowup on March 23, one unappreciated aspect of this gold price discovery scandal is that daily London LBMA Gold Price auctions are deliberately ignoring Comex gold prices when setting the opening price (starting price) in the twice-daily gold price auction.

Silver hasn’t been this cheap

Silver hasn’t been this cheap

...The reason that this article is titled “Getting Positioned for the WORST DEPRESSION IN THE HISTORY OF THE WORLD” is that debt and derivatives have never built up to such vast levels on a global scale before. It will take a correspondingly severe depression to eliminate this gargantuan mountain of dross..."

...The reason that this article is titled “Getting Positioned for the WORST DEPRESSION IN THE HISTORY OF THE WORLD” is that debt and derivatives have never built up to such vast levels on a global scale before. It will take a correspondingly severe depression to eliminate this gargantuan mountain of dross..."