|

|

Post by Entendance on Apr 13, 2017 12:10:29 GMT -5

"...The Deep State looters are mono-maniacally focused on regularly smashing precious metals prices for two primary reasons:

1) It provides them with a vast, recurring, no-lose, totally-illegal-but-never-prosecuted profit source; and,

2) it is an extremely effective way for them to scare everyday citizens away from metals, which is a key DS objective.

If the people ever figure out, en masse, that they would greatly benefit by transferring their money into physical precious metals, as opposed to keeping it in digital bank accounts that can be seized at any time and under any pretext, the Deep State’s looting opportunity will be reduced.

The Deep State works 60x60x24x365, or every second of every day to prevent the people from having that “Aha Moment” of personal financial clarity and sanity.

If the people fully understood how resilient precious metals prices have been despite the constant, multi-year, 24 hour per day, criminal, full-spectrum Deep State manipulation campaign, they would gain a new-found respect for precious metals as assets. Greed-fueled frauds always collapse in time, and when the precious metals price manipulation fraud fails, gold, silver and platinum’s reflexive revaluation will almost certainly be historic.

The Deep State agenda is to eliminate cash as soon as possible and force the people’s money to become nothing but electrons housed in digital currency prisons euphemistically called banks. Next, they will deactivate the precious metals dealers’ bank accounts, making it extremely difficult for citizens who have not already done so to acquire precious metals. This action will be taken under the totally dishonest pretext of combating drugs, crime, terrorism and other fake, so-called dreaded threats. When people get wind that this is coming, a precious metals buying stampede will break out, much the same way that the ammunition buying frenzy developed when rumors spread that Obama was going to sharply control, turbo-tax or even prohibit bullet sales. Time and time again throughout history, people have exhibited a passionate desire to buy the things they expect will be taken away from them. When the precious metals buying stampede is triggered, people throughout the west will learn in a hurry that the quantity of physical precious metals actually available to them is extremely limited and quickly vanishing. Supplies will completely disappear in a day or two, if not before, just as ammunition disappeared from the shelves, nationwide, during that buying explosion..." -Stewart Dougherty here

***GOLD IS PROTECTION AGAINST DAMNED LIES AND WAR*** "...Lies will lead to systemic collapse... ...Start a war to divert attention from economic problems... ...Gold & Silver – the ultimate insurance against a rotten world...

◾Own physical gold and silver bars and coins. No ETFs, no paper gold or silver.

◾Own your own bars or coins and don’t own a share in a co-owned total stock of gold or silver.

◾Store the metals in ultra-secure vaults outside the banking system.

◾Store the majority of your metals outside your country of residence, in a safe jurisdiction with a long history of rule of law and real democracy.

◾Only store metals at home that you can afford to lose. You might have a safe hiding place but that is not enough. Burglars will threaten your husband, wife or children.

◾Only buy gold from first class gold refiners with LBMA approval. In recent days Comex have suspended registration of Elemetal Refiners in the US (formerly NTR metals) due to a federal probe into smuggling of $ billions of illegally mined gold. LBMA has also taken them off their approved list. Elemetal is a major US refiner but their credentials might be questionable.

◾The 4 biggest Swiss refiners have been in business between 50 and 150 years. They produce 60-70% of all the gold bars in the world. They also have a reputation for producing the highest quality gold bars in the world.

◾There is a lot of fake gold produced in the world which looks like perfect bars or coins from reputable refiners. I have myself seen perfect gold bars made in China. But inside there was tungsten. As the gold price goes up, there will be more fake gold. That is why it is critical to buy through reputable companies that buy freshly minted gold from Swiss refiners.

◾Eliminate counterparty risk. Investors must have direct ownership of the bars or coins and not have a subaccount of another company. Investors must have direct access to the vault without the approval of a third party.

◾The metals must be insured for all risks by a major international insurer.

◾Do not self-store with a vault. In some vaults, it is possible for individual investors to do self-storage. This is a false economy. Deal with a company that can provide instant liquidity. If gold or silver are taken out of the LBMA chain of integrity, most major banks or gold dealers will not take the metals back. For small quantities, it might be possible but for bigger quantities, it could be impossible to sell the gold or silver. When you self-store, liquidity can be a major problem.

◾Do not store gold with any bank. This includes private safe deposit boxes in the bank. In the case of a bank failure or extended bank holiday, you might not get access to your gold for a very long time. There are also many cases of governments opening bank safe deposit boxes.

◾Finally, the most important advice I can give investors is to choose a company that has a long track record of stability and reliability. Even more important that the management or owners of the company have an impeccable record over a long time. Whenever I go into business with a company, I always base it on the individuals in charge. They are your partners and their history and track record is more important than all other criteria. Obviously, the business must also produce good products or services and be financially sound.

War or no war, gold and silver have finished the correction down since the 2011 peak and are now on their way to new highs well above the previous peaks. Gold should attain $10,000 and silver $500, at least, in today’s prices. But since hyperinflation is very likely, the actual prices could be multiples of those levels. Shorter term, the metals seem to be in a hurry and gold should reach $1,360 relatively quickly as I have indicated lately.

I have stressed many times that gold and silver should not be seen as investments but as the most important wealth preservation asset anyone can ever hold. Throughout history, during all periods of crisis, whether it is an economic crisis like hyperinflation or geopolitical like war, gold and silver have always been the best insurance. The coming period is unlikely to be an exception to that rule."

Egon von Greyerz HERE

***LIES***

|

|

|

|

Post by Entendance on May 23, 2017 10:37:06 GMT -5

|

|

|

|

Post by Entendance on Jun 1, 2017 3:06:28 GMT -5

|

|

|

|

Post by Entendance on Jul 16, 2017 7:51:40 GMT -5

"...I would look for links between Grasberg and the Jakarta bombings. Or better yet, find another reason to not renew the Freeport lease in 2021 on grounds of massive bribery, illegal environmental degradation and such that is already known and proven. That 16,000 tons of gold would collateralize the lion’s share of Indonesia’s planned infrastructure. And with China rapidly becoming the world gold trading hub, the Beijing-Jakarta economic friendship could have a golden future." ***Indonesia, China, Gold and ISIS

***The logic of a modern gold standard

***Picking Great Gold Stocks 2

Fred & EntendanceInvestors Gold & Silver Beach: He who has the Gold makes the rules. Physical Gold & Silver: Avoid the rush – keep strong and keep stacking. Own physical gold and silver outside a bank! You better own precious metals directly, with no counterparty risk: they are not exposed to any creditor obligations. Storage outside of the banking system is mandatory given the current risks in the economic and financial system. Facilitated "outside" of the banking system: NO DEPENDENCE on the functioning of stock exchanges or banks. A global currency war is occurring. Countries race to debase their currencies against each other. Currency devaluation is the number one reason to own precious metals. Until the monetary fog lifts and un-rigged navigational markers re-emerge, physical gold remains the only hard reference point capable of providing an essential back up plan for one's nest egg. Remember: every gram of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system. Starve the beast.

Psychopathic Times (Narcissist Nation) The Entendance Beach mentioned & inserted here Psychopathic Times (Narcissist Nation) The Entendance Beach mentioned & inserted here

|

|

|

|

Post by Entendance on Aug 1, 2017 1:56:04 GMT -5

China:***Gold reserves to surpass 4,000 tons

In search of the motherlode:***Why Yukon is experiencing a 21st century gold rush

"...Within a 3 year period, we can see roughly that the following quantities of large gold bars were melted down into kilogram bars and sent to Asia:

• 2013: about 2000 tonnes of gold

• 2014: between 1060 and 1275 tonnes of gold

• 2015: between 1136 to 1353 tonnes of gold

...The general movement is one of 995 purity 400 ounce gold bars coming out of gold-backed ETFs, central bank gold holdings and other wholesale gold holdings, and these bars making their way to the Swiss refineries where they are transformed / smelted / recast into smaller 9999 high purity gold bars. The smaller gold bars are then exported from Switzerland to India, China, Hong Kong, and the Middle East.

At the same time as the wider gold market acknowledges and publicises this trend, the establishment gold world and bullion banks (as represented by the London Bullion Market Association) tend to downplay this conversion of 400 ounce gold bars into 1 kilogram bars, presumably because it directly highlights the continual drain of real physical gold out of the London vaults into China and India, gold which has little chance of ever coming back again...." ***The West lost at least another 1000 tonnes of large gold bars in 2015

H/T Tom from Florida

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information! |

|

|

|

Post by Entendance on Aug 10, 2017 8:28:45 GMT -5

|

|

|

|

Post by Entendance on Aug 13, 2017 4:38:16 GMT -5

Risk Greater Than Ever-Egon von Greyerz Financial expert Egon von Greyerz (EvG) says the central bankers did not fix the problem that caused the last global economic meltdown. EvG points out, “Did they save the system? For ten years they did, but they didn’t save it. They made the problem a lot bigger. Global debt has gone from $120 trillion in 2006 to $225 trillion today. Central banks have printed another $18 trillion. So, the situation right now is a lot worse than it was then. So, the bubble is much bigger. And remember last time, interest rates worldwide were around 5% to 6% ten years ago. . . .Today, they are zero or negative in many countries. They cannot achieve anything by adjusting interest rates. Well, they can make them more negative, but people are not going to give them any money with negative interest rates.”

EvG has decades of experience as a top executive in the European banking system, and he contends, “The ECB risks are increasing exponentially. Greece is still bankrupt and will remain bankrupt. If you go around to all the other countries, Ireland, France and all the other countries . . . Italy: the problem is just a lot bigger today than it was. They have done a great job in fooling all of the people most of the time . . . when the risk is greater than ever. It shows if you tell people lies often enough, people will believe it, and that’s what’s happened. This is why when this ends, it’s going to end in tears. It’s not going to end with a slow gradual process of deterioration. It’s going to end with a bang. I am not a pessimist. I am just looking at risk, and the risks are so clear to me. This is a risk that no one can actually do anything about because there is nothing you can do for debts that cannot be repaid. . . . We are living in a lie, and you cannot live on a lie forever.”

EvG vaults gold for wealthy clients in secret vaults in Switzerland and in Asia. What is he seeing first hand from his global clients? EvG says, “It’s interesting that we are seeing big money now starting to actually come into the gold area. They are increasing (holdings) or coming in for the first time, which I would say is quite new, in the last few weeks. People are sensing it. People understand what’s happening. We have our clients we’ve had for the last 15 years, and they are increasing their holdings, but we have new money coming in, and it hasn’t been on the scale we are seeing now. . . . There are people that smell things before they happen. People don’t know why, but people are sensing something is going to happen.”

***The War On Cash

***Italiani: Ormai la salvezza è solo individuale

***Come l’immigrazione sta cambiando la demografia italiana

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

|

|

|

|

Post by Entendance on Aug 15, 2017 6:29:41 GMT -5

CAN THE PRICE OF GOLD POSSIBLY REACH $8,700.00 IN THE YEAR 2019? ***HERE |

|

|

|

Post by Entendance on Aug 23, 2017 2:57:02 GMT -5

• Global monetary policy has recently slid from the most extreme doves (like the ECB) to the most hawkish (Fed)

• A collective slide in the most liquid fiat currencies and financial assets leaves few alternatives for lost investors

• Gold proved itself a primary benefactor of global easing after the onset of QE, and a shift in risk may only intensify that

|

|

|

|

Post by Entendance on Aug 30, 2017 9:05:23 GMT -5

"Many previous commentaries have described and discussed the various ways in which the silver market has been manipulated in the past and is being manipulated today. What has been explained in years past, but missing from recent editions, are the reasons for the serial manipulation of the silver market.

Before getting into the basis for this systemic market crime, it is necessary to briefly identify this manipulation for the sake of newer readers. The parameters could not be more obvious.

Silver is money. Legal tender silver coins are still produced in the national mints of numerous nations – and these mints often struggle to keep the market supplied. Silver is jewelry. In many parts of the world silver jewelry continues to be widely fabricated, and even at its reduced/suppressed price, silver jewelry remains present in our societies.

Nothing has changed there. But over the past century, numerous important industrial uses have also emerged for silver. It is even more valuable today. Now look at the silver/gold price ratio . For over 4,000 years; this price ratio has gravitated around 15:1, virtually identical to the supply ratio between the two metals (17:1).

Despite being more valuable than ever, in the 1980’s and 1990’s the price of silver was driven to a 600-year low in real dollars. The silver/gold price ratio was driven to extremes as great as 100:1. Total perversion of market fundamentals.

This bankrupted more than 90% of the world’s silver mines and drove the silver market into a permanent supply deficit . The silver industry has never recovered because it has never been allowed to recover.

Why?..." ***Why Has Silver Been Suppressed? ***

"...silver is trading at 1.19% (17/1424) of its 1980 high – it is the bargain of the century" ***The Amount Of Dollars In Existence Relative To The Silver Price Points To Much Higher Prices

"Historical precedent coupled with current fundamentals point to the likelihood of an explosive super spike in the silver price and a high price plateau beyond that. In the last super spike in 1979, the white metal went from $6 per ounce, to over $49 just 12 months later. In other words, that's an incredible 700% upsurge over the course of a single year! Today, industrial demand will continually increase along with its investment benefits. These factors will cause the price of silver per ounce to reach new highs, or possibly another huge spike similar to 1980. Let's look at additional factors why we're bullish on the poor man's gold:

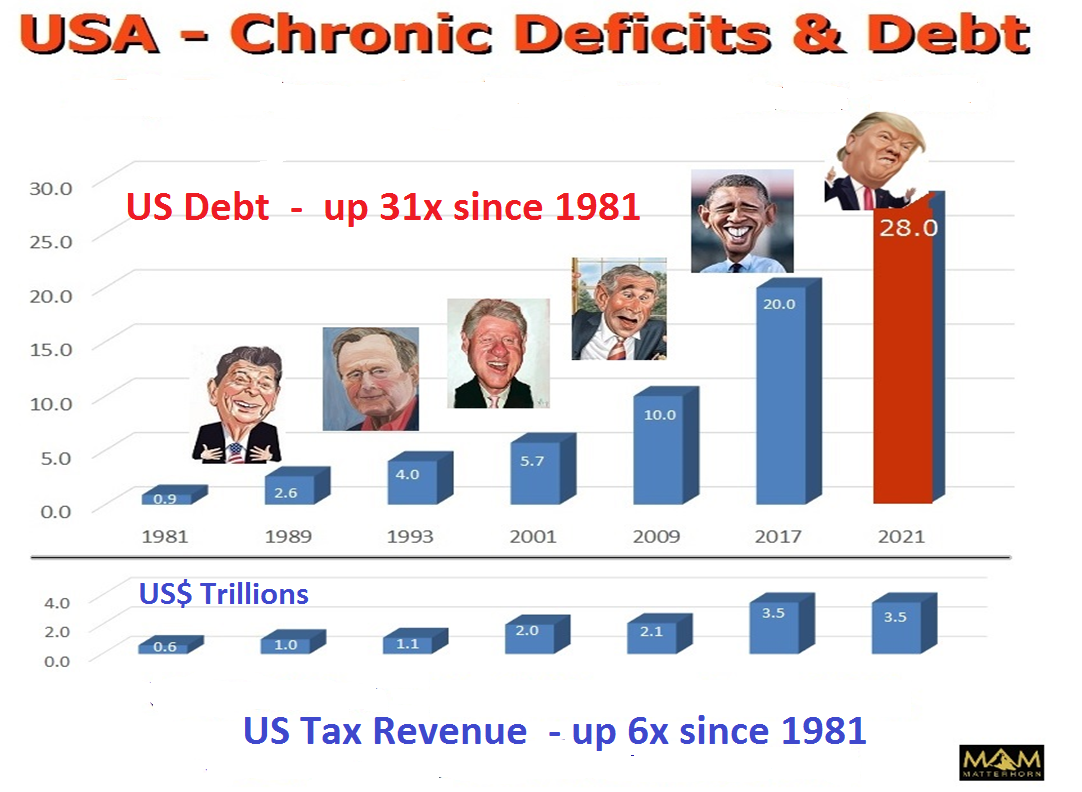

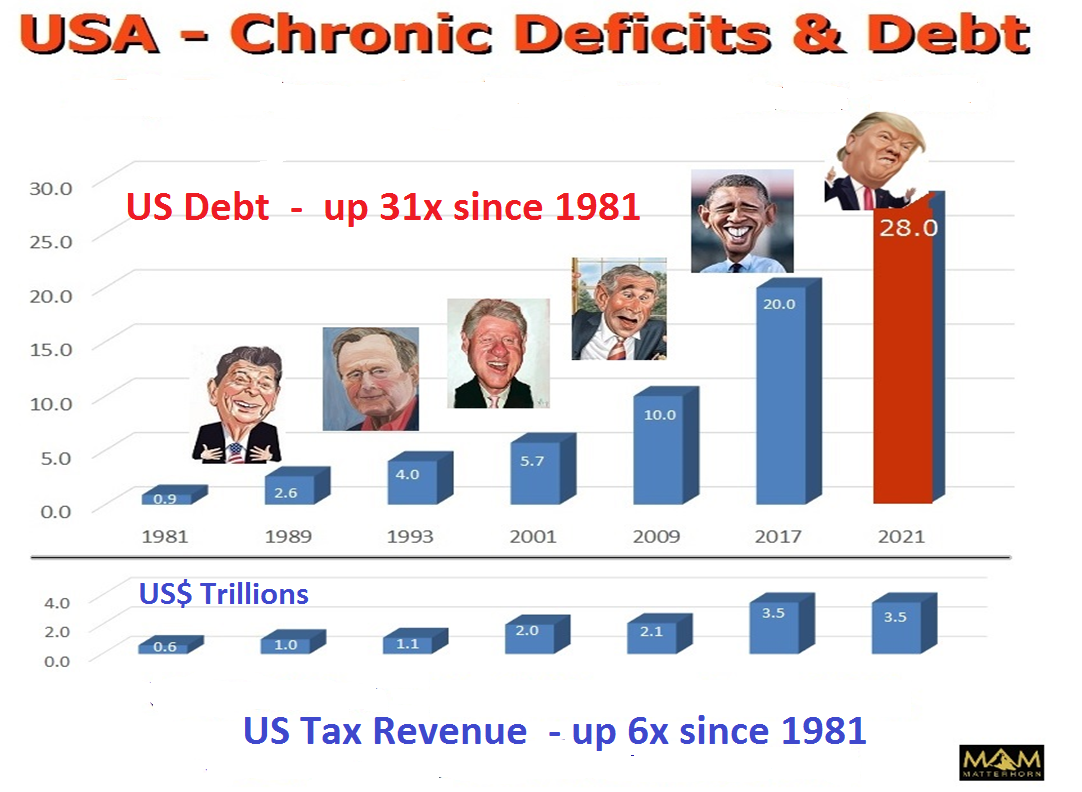

U.S. Debt Level Reaching Tipping Point

The U.S. is reaching record highs in debt and the tipping point may come sooner than later. In 1980, the national debt was a mere $930 billion. Today, it's over $18 trillion officially, with tens of trillions more in "off budget" debts and obligations accumulated in the last 40 years. The Federal Reserve's balance sheet now tops $4 trillion, with no end in sight to ultra-accommodative policies.

Above Ground Silver Inventories Are Diminishing

In 1980, available above ground stockpiles were estimated to be 4 billion ounces. Today, many estimate these stocks at less than 1 billion ounces. And annual consumption has exceeded supply in many years. As industry finds new ways to use silver, the market could experience a long-term supply deficit, and inventory depletion would then accelerate.

Silver Mining Production Appears to be Reaching Its Peak

There may be 18 billion ounces of extractable silver left according to the according to the U.S. Geological Survey. If this is indeed the case, there won't be enough supply left due to the steady increase in demand. Just last year, the demand rose to a record 1,081 million ounces according to The Silver Institute's World Silver Survey 2014. While the demand rises, production has increased less rapidly. So not only are we running out, the supply is diminishing faster than ever.

Global Silver Demand is High and Getting Higher

Considering the record growth in demand last year, all signs are pointing to a continuous increase. In 1980, the world population was 4.6 billion. We've since added another 2.5 billion people. Silver is required in a multitude of industrial, electrical, consumer, health, and energy-related applications critical to today's modern economy. (It is the world's best conductor of electricity and heat, best natural biocide, and best reflector of light.)

Unlike other metals, it is consumed in very small increments, making recycling very difficult. In other words, once it is used, it is usually gone forever, practically speaking.

At the same time, it is generally an incidental cost in the products that use it – such that a dramatic increase in the price will not necessarily cause substitution. A hint of shortages could cause industry users suddenly to hoard the metal and drain remaining available inventories.

•Investor demand is surging. From 1990 to 2005, investors had been net sellers of silver. In 2006, we witnessed what appears to be a major sea change in the market. The public again became net buyers. In 2014, demand for American Eagles soared to a record-high of more than 44,000,000 coins – a number that would surely have been higher if demand had not completely overwhelmed the government-run Mint's production capabilities at times. Other government and private mints around the world have been cranking out coins, rounds, and bars at record-setting levels.

•The gold / silver ratio is currently around 70, which suggests silver is vastly undervalued. The ratio of silver to gold in the earth's crust is 17.5:1 – and the price ratio has hovered in that range for most of recorded history (see graph). If history is any guide, the remaining bull market in precious metals could see silver outperform gold by a factor of 4 or more.

•Save for recent decades, silver coins have been used as money throughout human history and is in the process of reassuming that role. As faith in government fiat money (such as Federal Reserve notes) diminishes, savers and investors worldwide are embracing gold and silver as a store of value. Savvy investors are paying more attention to the declining purchasing power of the U.S dollar than ever before."

Besides Physical Gold & Silver EntendanceInvestors own MUX & EXK shares

"Gold has worked down from Alexander's time. When something holds good for two thousand years I do not believe it can be so because of prejudice or mistaken theory." -Bernard M. Baruch

|

|

|

|

Post by Entendance on Sept 1, 2017 17:01:56 GMT -5

|

|

|

|

Post by Entendance on Sept 8, 2017 1:04:25 GMT -5

"The coming gold and silver moves in the next few months will really surprise most investors as market volatility increases substantially.

It seems right now that “All (is) quiet on the Western Front” as Erich-Maria Remarque wrote about WWI. Ten years after the Great Financial Crisis started and nine years after the Lehman collapse, it seems that the world is in better shape than ever. Stocks are at historical highs, interest rates at historical lows, house prices are booming again and consumers are buying more than ever.

Have Central Banks saved the world?

So why were we so worried in 2007? There is no problem big enough that our friendly Central Bankers can’t solve. All you need to do to fool the world is to: Print and expand credit by $100 trillion, fabricate derivatives for another few $100 trillion, make further commitments to the people in forms of pensions and medical, social care for amounts that can never be paid and lower interest rates to zero or negative.

And there we have it. This is the New Normal. The Central Banks have successfully applied all the Keynesian tools. How can everything work so well with just more debt and liabilities? Well, because things are different today. We have all the sophisticated tools, computers, complex models, making fake money QE, interest rate manipulation management and very devious intelligent central bankers.

Or is it different this time?

All these shenanigans by central banks have created fortunes for the top 1% and massive debts for the rest of the world. For some of us who spend considerable time studying risk, you can make two very distinct conclusions:

◾On the one hand, central bankers have been extremely skilful in using all the tricks in the book, including some new ones, and saved the world by printing unlimited amounts of money, expanded credit exponentially and abolished the cost of borrowing by setting rates at zero or negative. This is the perfect scenario and the Krugmans of this world must be really pleased since this justifies receiving the Nobel Prize and confirms that they have found the perfect method which can be applied indeterminately with great success.

◾On the other hand, for the ones of us who believe that trees can’t grow to the sky and that sound money always prevails, we know that we are in the last stages of a bubble of epic proportions. Fortunately, our side has also received a Noble prize through von Hayek, although it was back in 1974.

This has been a very long battle between the manipulators and the advocates of sound money. With free money and socialism, you can fool most of the people for a very long time. But sadly for the Keynesians, they will run out of ammunition when all the printed currencies return to their intrinsic value of zero. This means you can’t fool all of the people all of the time. As Margaret Thatcher said: “The problem with socialism is that you eventually run out of other people’s money (OPM).” And this is exactly where we are today. The world has run out of OPM. When our company went aggressively into gold and silver in 2002 for our investors and ourselves, we did not believe that the central bankers would be able to manipulate markets for over 15 years. Still, silver was $4 at the time and gold $300, so the manipulation has only been partially successful.

Money printing no longer works

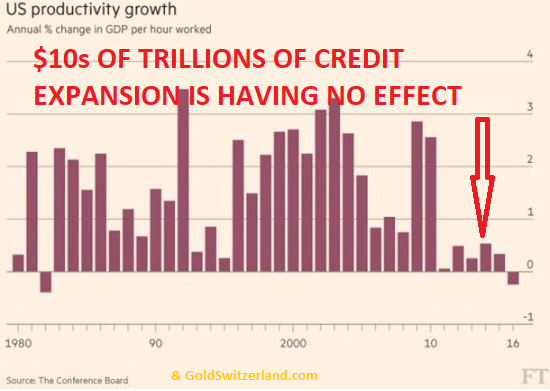

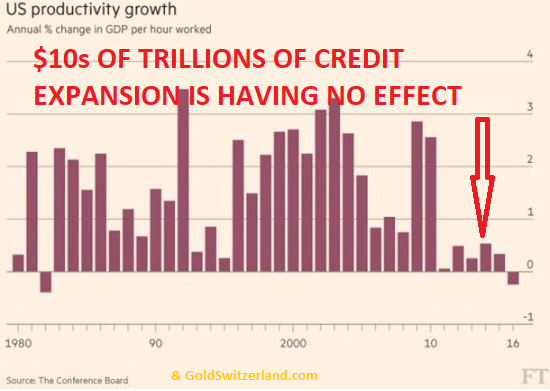

But the signs are now very clear that the money printing experiment is coming to an end very soon. Despite all the trillions of monies created in the world, real GDP has stopped growing.

As the chart below shows, all the money printing and credit expansion is no longer having an effect. Even a child could understand that you can’t grow an economy by printing paper and calling it money but for some reasons, the Keynesians seem to ignore the obvious.

Money printing has benefitted the 1%

The only area which is still very strong is stock markets, property and bonds. This is where all the money printing goes and the 1% believe that their riches are exploding due to their investment skills. Little do they realise that these skills will just vanish into a big black hole in the next 4-7 years as the exploding assets implode and all the global debt with it. Sadly this must happen in order to create a sane world again. We cannot build a world on fake values and fake money. Mankind will not survive in such a world. It will totally destroy itself. It will be hard enough to survive the coming collapse of the Ponzi scheme that has flourished in the last 100 years.

The transition from a false system based on an illusion to real values and real money will be painful for most of the world. The wealthy will lose at least 95% of their assets and many normal people will starve and live in misery. We will have wars, civil unrest, political upheaval and economic devastation. This is what the elite has caused by creating a dishonest system for the benefit of the 1% but to the detriment of 99% of mankind. The problems we will see in coming years are likely to reduce world population by at least 1/3rd which is more than 2 billion people. The combination of wars, civil wars, famine, disease and economic collapse is likely to lead to this. World population has exploded from 1 billion to 7.5 billion in the last 160 years. Statistically there have always been setbacks in history when population has declined substantially whether it is due to wars or disease. During the Black Death of the 14th century for example, World population is estimated to have declined by 50%.

So the risks are major even though we are only talking about probabilities. Things could take longer and they could be less severe. But with risks of this magnitude, the very privileged few who have the possibility to take precautionary measures must do so. Because at some point in the next few years, a financial and economic collapse is inevitable.

Gold has broken out

The autumn of 2017 has for some time looked precarious. The question is what catalyst will pop the bubbles in markets and the economy. Stocks look very vulnerable and overvalued on any criteria. Even though bubbles can always grow bigger, the risk is now unacceptable. At the same time, gold and silver have now finished the long consolidation period since 2013 and resumed the uptrend to new highs.

Explosive metals in the autumn

Moves in the metals could easily be explosive during the autumn. The strength the precious metals are now showing is a very strong indication that the manipulation by central banks, the BIS and the bullion banks is going to fail in the next few months.

I have previously pointed out that at current low demand, the entire mine production of gold and silver is absorbed. Less than 0.4% of global financial assets are invested in gold. The annual silver mine production of $15.5 billion is less than 0.01% of global financial assets. Since all gold and silver production is being easily absorbed currently, with negligible invest demand, there will be no physical gold or silver available at current prices for the coming increase in demand. In addition, the paper market in the precious metals is likely to have major disruptions and fail as the demand for physical metal increases. As institutions and funds start to focus on the physical precious metals and the PM stocks, they will only be able to invest at prices which will be many times higher than current levels. This is what will drive gold to my long-standing target of $10,000 and beyond. With a gold/silver ratio back to the historical level of 15, that would make silver $666. I believe that these levels can be reached in today’s prices and when hyperinflation takes hold we could see multiples of those levels.

If silver today was at the same level against the US monetary base as at the 1980 peak, the price would be 80x greater at $1,424. Although this sounds like fantasy today, it is not unrealistic. Just look at what is happening to Bitcoin. And remember that silver is real money whilst Bitcoin is just an electronic construction with no underlying asset. This won’t stop Bitcoin to go much higher in a Tulip bulb type mania.

Silver will outperform gold

Technically silver is likely to outperform in the next few years. We have always argued that wealth preservation investors should hold gold mainly, due to the volatility of silver. But at this point, silver looks extremely good value so an exposure of say up to 25% silver and 75% gold would be an excellent mix.

The gold and silver universe is miniscule compared to tech stocks

With annual mine production of $128 billion gold and $16 billion silver, this market is so small that it is totally dwarfed by the stock market. Just take some of the most well-known Nasdaq stocks, Apple, Google, Microsoft, Amazon and Facebook. Their total market cap is $3 trillion. Compare that to the annual gold and silver mine production ($143B) and the top 20 gold stocks ($150B) and the top 25 silver stocks ($30B). The total annual precious metals mine production and biggest metals stocks add up to $437 billion. That is only 15% of 5 of the biggest Nasdaq stocks and less than the smallest of those five which is Amazon, valued at $470B. Since these five stocks probably have topped, big investors will liquidate part of their holdings and look for new opportunities. The gold and silver universe is likely to get very crowded as funds and institutions enter.

Physical gold and silver and the precious metal stocks will be a crowded market

Gold in many currencies bottomed in 2013. In dollars, the bottom was in 2015. After the rally in the first half of 2016 and the subsequent correction until December 2016, gold and silver are now on their way to new highs. We obviously will not see a straight line move as there will be temporary stops on the way. But for the ones who are not fully protected against major global risk, now is the time to be fully invested in gold with an important allocation in silver. Precious metals will become an extremely crowded investment sector and the time to get in at reasonable prices is soon ending.

This is a totally unique situation. Seldom has a protective wealth preservation investment also had massive capital appreciation potential. Don’t be left behind. There is too much at risk."-*** Egon von Greyerz

***World markets at a glance NOW & Updated Strategy/Trading VIDEOS***

***Gold Price Is Headed To $1,500 By Year End

|

|

|

|

Post by Entendance on Sept 12, 2017 7:29:35 GMT -5

"Gold, the favourite metal of Indian women, is increasingly becoming popular among scientists as well, though for a different reason. A group of Indian researchers has used gold nanoparticles to develop a simple method to detect lead in wastewater.

The new technique makes use of specially-produced minuscule particles of the yellow metal, and the property of gold nanoparticles to change colour when they ‘bunch-up’ in the presence of metal particles such as lead because of their optical properties..." ***Gold nanoparticles can detect lead in wastewater

***Gold Distributes Wealth, Central Bank Fiat Concentrates It

|

|

|

|

Post by Entendance on Sept 16, 2017 8:50:28 GMT -5

"...Worries are mounting that the long-delayed major stock selloff is looming.

When that fateful event inevitably arrives, gold investment demand is going to explode again just like it did in early 2016. That will catapult gold, silver, and their miners’ stocks dramatically higher. Seeing gold investment demand surge recently even without a stock-selloff catalyst highlights the big latent interest in gold. Usually moving counter to stocks, it remains the ultimate portfolio diversifier every investor needs to own." -Adam Hamilton

"...Bubbles can always grow bigger than we expect. That could also be the case today. But if they grow bigger so will the risk of the bubbles imploding. The risk is massive today on a global basis. If markets continue to defy reality, that makes the reason for insurance even more compelling.

The best insurance is precious metals. For investors who don’t already own precious metals, this is the time to buy physical gold and silver..." -Egon von Greyerz

***Big Trouble For The Silver Market If Mexico Monetizes Its Silver Libertad Coin

|

|

|

|

Post by Entendance on Sept 19, 2017 8:26:15 GMT -5

***Gold Ownership: A Golden Wave

***McEwen Mining ***(NYSE:MUX) -11% premarket after announced after the close yesterday a $40.5M bought deal financing for its recent acquisition of the Black Fox mining complex in Ontario. Mux McEwen Mining? They sell, we keep on stacking shares. Rob McEwen has possibly the best reputation and credibility for success in the industry. He is extremely ethical and only benefits if shareholders benefit. For example, he pays himself no salary, he issues himself no bonuses, no options, and no rewards. He only gains if the stock price rises. It will. Credibility, that is very rare in this world. E.

"...there is a direct correlation between this sudden leap in the amount of gold swaps conducted by the BIS between July and August and the price attack on gold that began two weeks ago. The gold swaps provide bullion bar “liquidity” to the bullion banks who can use them to deliver into the rising demand for deliveries from India, China, Turkey, et al. This in turn relieves the strength and size of “bid” on the LBMA for physical gold which in turn makes it easier for the same bullion banks to attack the price of gold on the Comex using paper gold. This explains the current manipulated take-down in the price of gold despite the rising seasonal demand from India and China..." ***Why Is The BIS Flooding The System With Gold? H/T Tom from Florida

|

|

|

|

Post by Entendance on Sept 21, 2017 13:00:17 GMT -5

September 27, 2017***This Could Send Gold Much Higher Than $10,000

***22 charts and 52 questions that will make you Buy Gold ***22 charts and 52 questions that will make you Buy Gold

***WAKE UP AMERICA – THE DOLLAR IS GOING TO ZERO

"The Chinese have announced that they have perfected a scheme, to be launched formally in the market by the end of the year, by means of which exporters of oil to China will accept the Chinese currency, the Yuan, in payment for the oil; for this deal, the Chinese have added an incentive: the Yuan received by the oil exporters will be exchangeable for gold. This gold will be "sourced" i.e. "purchased" outside of China, for the oil exporters.

Thus, the oil exporters' Yuan will be offered in payment to the so-called "Bullion Banks" in London, who will provide the gold in exchange for Yuan.

We know that this much is part of the plan.

What follows is my understanding of the situation:

The Bullion Banks are the financial entities that control the price of gold by selling futures contracts, i.e. "paper gold", that promise to provide gold at a certain price, to speculators who buy the contracts, and who only wish to make a profit in Dollars on their bets that the price of gold will rise, and do not intend to take delivery of physical gold.

Sometimes the speculators win some Dollars, but the vast majority are perpetual losers, because the Bullion Banks can move the price down at any moment and clear out the speculators who were "long" gold. This game has been going on for years and years.

I suppose that the Bullion Banks are not going to want to accept Yuan, in exchange for the delivery of physical gold. They will first convert their Yuan into Dollars, and the only likely provider of Dollars will have to be the Bank of China, and which, by the way, in any case desires to reduce its Dollar holdings. Thus the Bullion Banks will offer Dollars for gold.

This operation kills two birds with one stone: the oil exporters get their gold from London and China reduces its dollar holdings, which they wish to do.

As I see it, here is where the fun begins.

First, the amount of gold which the Bullion Banks can provide will put a very unusual strain upon them. The Bullion Banks are accustomed to control de price of "paper gold" in such a way that they make it extremely difficult for the holders of "paper gold" contracts to obtain delivery of physical gold.

However, as the Chinese scheme comes into operation, this situation will change: a new purchaser of large amounts of physical gold has come upon the scene. A very upsetting development for the Bullion Banks, never before seen by any of the managers of those banks!

Secondly, the amount of oil that goes to China is enormous; China is the largest importer of oil in the world, eight million barrels a day. Saudi Arabia sells about one million barrels a day to China, for Dollars. If only Saudi Arabia decides to take Yuan and gold for those Yuan, we are talking about one million times $50 Dollars per barrel = $50 million Dollars a day; at $1315 Dollars per ounce, that comes to 38,023 ounces of gold - 1.183 tons - which Saudi would take off the gold market every day. Millions of barrels of oil will have to balance in value against a very limited amount of gold available. 1.183 tons a day means the Saudi will be taking 431.8 tons of gold off the market every year, and they are not the only oil exporters that China is wooing; other oil exporters accepting Yuan payment for conversion into gold, might very easily increase the departure from London of 1,000 tons or more of physical gold, every year, whose destination will be Hong Kong or Shanghai, in addition to the gold London has been providing normally.

Inevitably, the very first operation carried out under the Chinese scheme will produce a noticeable rise in the price of gold. When the Yuan belonging to the oil exporters is offered to the Bullion Banks in London, they will convert the Yuan into Dollars, and their bid for gold will have to rise immediately, and with it, the Yuan price of gold at the prevailing exchange rate.

A higher and rising Yuan and Dollar price of gold, means a smaller and diminishing quantity of gold is exchanged for the oil provided by the oil exporters.

As the oil exporters see that they get less gold for their oil every day, they will all hasten to sell their oil before they get even less gold for their oil. The oil exporters in doubt about this deal, will all pile in to sell oil for Yuan and get gold.

To balance the mass of oil received by China, against a limited amount of available gold in London, it will be necessary for gold to skyrocket upward in Yuan terms, and necessarily, in Dollar terms as well.

In effect, the Yuan will suffer a tremendous devaluation against gold, and so will the Dollar. I cannot imagine at what price the gold/oil trade will finally stabilize, but I think it will have to be at many thousands of dollars per ounce.

Perhaps the Chinese government sees the Yuan devaluation as favorable for China. I have no opinion on that matter. As for a huge devaluation of the Dollar against gold - I leave the consequences to your imagination.

Will China actually carry through with this "Oil-for Yuan-for Gold" scheme?

We shall have to wait and see." -Hugo Salinas Price

H/T Tom from Florida **********************************

"There are probabilities in markets and there are certainties. It is very probable that investors will lose a major part of their assets held in stocks, bonds and property over the next 5-7 years. It is also probable that they will lose most of their money held in banks, either by bank failure or currency debasement.

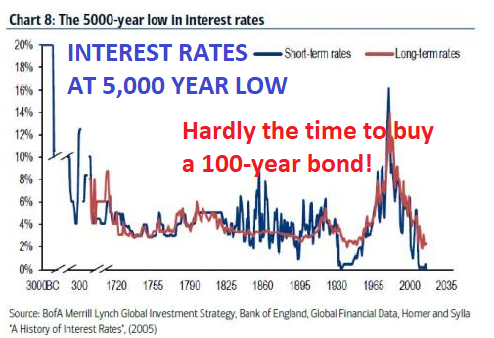

Who buys a bond that will go to Zero?

What is not probable, but absolutely certain, is that investors who buy the new Austrian 100-year bond yielding 2.1% are going to lose all their money. Firstly, you wonder who actually buys these bonds. No individual investing his own money would ever buy a 100-year paper yielding 2% at a historical top of bond markets and bottom of rates.

The buyers are of course institutions who manage other people’s money. These will be the likes of pension fund managers who will be elated to achieve a 2% yield against negative short yields and not much above zero for anything else. These managers will hope to be long gone before anyone finds out the disastrous decision they have taken with pensioners’ money.

But the danger for them is that the bond will be worthless long before the 100 years are up. It could happen within five years.

There are a number of factors that will guarantee the demise of these bonds:

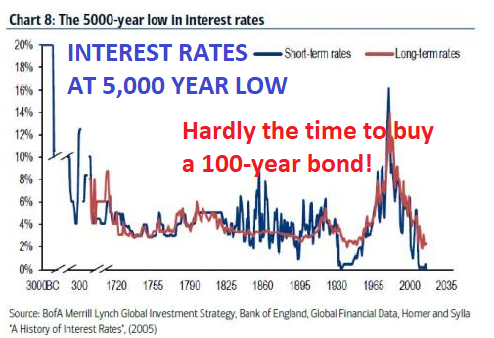

◾Interest rates are at a 5,000-year low and can only go up

◾Inflation will surge leading to hyperinflation

◾Sovereign states are bankrupt and will default

◾The Euro will go to zero not over 100 years but in the next 5-7

But pension fund managers will not be blamed for their catastrophic performance. No conventional investment manager could ever have forecast the events I am predicting above. (They are not that smart). Thus, they are totally protected, in spite of poor performance, since they have done what every other manager does which is to make the pensioners destitute. The average institutional fund is managed based on mediocracy. It is never worth taking a risk and do something different to your peer group. But if you do the same as everybody else you will be handsomely rewarded even if you lose most of the money.

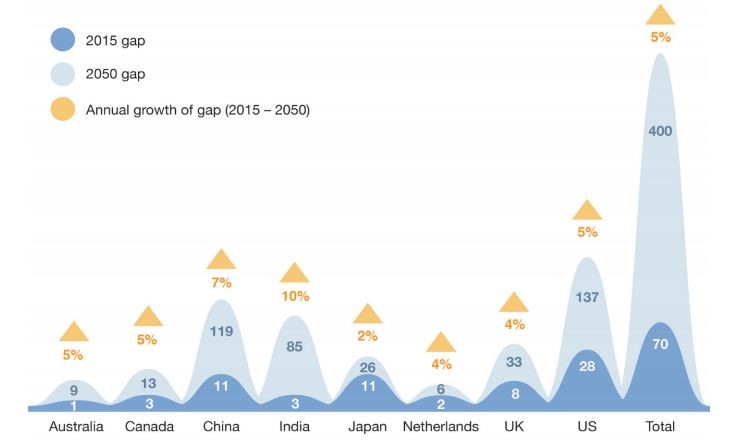

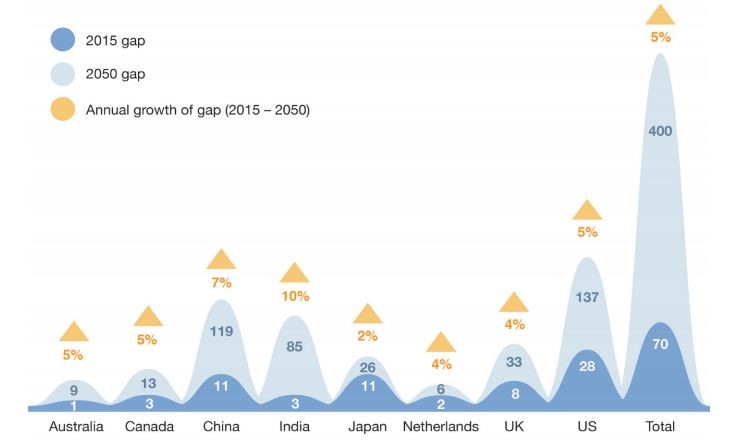

$400 trillion pension gap

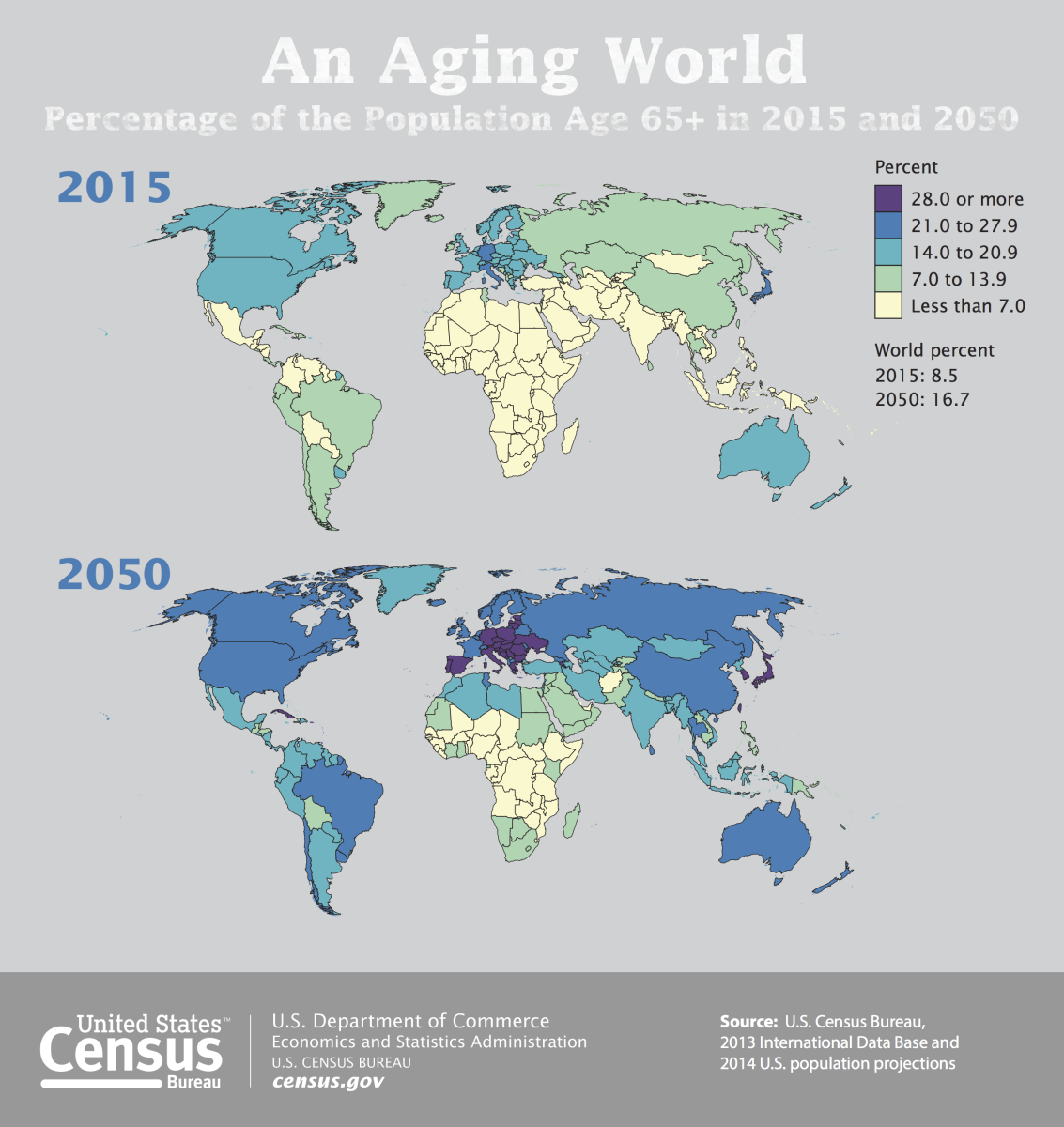

Most people in the world don’t have a pension so they won’t be concerned. But for the ones who are covered by pensions, they won’t be much better off. Most pension funds are massively underfunded and the amount they are underfunded by is absolutely astounding. We are looking at a staggering $400 trillion gap by 2050 according to the World Economic Forum. The biggest gap is of course the US with $137 trillion. The 2015 US deficit was “only” $28 trillion which is 150% of GDP.

The reasons are quite straightforward; an ageing population, inadequate savings and low expected returns. These calculations don’t take into account the coming collapse of all the assets that pension funds invest in such as stock, bonds and property. It is a virtually certain prediction that there will be no conventional pensions paid out in any country over in 5 to 10 years and longer. The consequences are clearly catastrophic. The only country with a well-funded private pension system is India. Most families in India hold gold and as gold appreciates, this will protect an important part of the Indian population.

$2.5 quadrillion global debt

Global debt and unfunded liabilities are continuing to run out of control. With total debt at $240 trillion, pension liabilities at $400 trillion (by 2050), other liabilities such as medical care at say $250 trillion and derivatives at $1.5 quadrillion, we are looking at a total global debt including liabilities of around $2.5 quadrillion.

The US is doing its part to grow debt exponentially. With the debt ceiling lifted temporarily, US federal debt has swiftly jumped by $321 billion to $20.16 trillion. Over the last year US debt has gone up by $685 billion. Over the next few years, US debt is forecast by to increase by over $1 trillion per year. When trouble starts in financial markets in the next couple of years, we will see that debt level increase dramatically by $10s or even $100s of trillions. By 2020, the US will have run real budget deficits every single year for 60 years. That is an astounding record and will guarantee a dollar collapse.

Gif H/T Jacqueline Harris

Interest rates will be 15-20%

As the long-term interest chart above shows, rates are at a historical bottom and the 35-year cycle also bottomed last year. Rates are now in an uptrend and at some point, in the next year or two, will start to accelerate. Within less than 5 years, rates are likely to be in the teens or higher like in the 1970s. Bonds will collapse, including the 100-year Austrian issue, leading to major defaults. With global debt in the $100s of trillions, more and more money will need to be printed just to finance the interest costs. Still more will be printed to prop up failing banks and government deficits. And that is how hyperinflation will start. In parallel, currencies will collapse and finish their move to zero which started in 1913 when the Fed was created.

The Swiss National Bank – the world’s biggest hedge fund

The Fed is a private bank, created by private bankers for their own benefit giving them total control of money. The Swiss National Bank (SNB) is also a private bank, quoted on the Swiss stock exchange. But it is not owned by investment bankers but 45% is held by the Swiss Cantons (States) and 15% by the Cantonal Banks. The rest is held by private shareholders. The shares of the SNB have gone up 2.5x in the last 12 months.

This is the biggest hedge fund in the world with a balance sheet of CHF 775 billion ($808B). This is bigger than Swiss GDP. For comparison, the Fed’s balance sheet is 25% of US GDP. The SNB holds shares for almost CHF100 billion including $80 billion of US stocks. The rest of the SNB holdings is currency speculation with the majority in Euros and dollars. Hardly the purpose of a central bank to speculate in currencies or stocks. Their justification is that buying foreign assets keeps the Swiss Franc low. Imagine when the US stock market turns down and the Euro and dollar weaken. At that point, the chart of the SNB stock will look very different. This is likely to happen in the next few years. Swiss banking and particularly the National Bank used to be conservative, now they are as bad or even worse than the rest of the world. The problem with the Swiss banking system is also that it is too big for the country, being 5 times Swiss GDP. I wouldn’t keep any major capital in the Swiss banks, nor in any other banks for that matter. But the political system in Switzerland is by far the best in the world. Too bad that the banks are not!

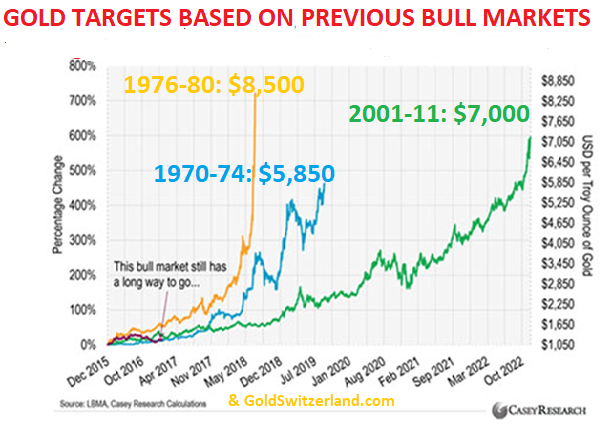

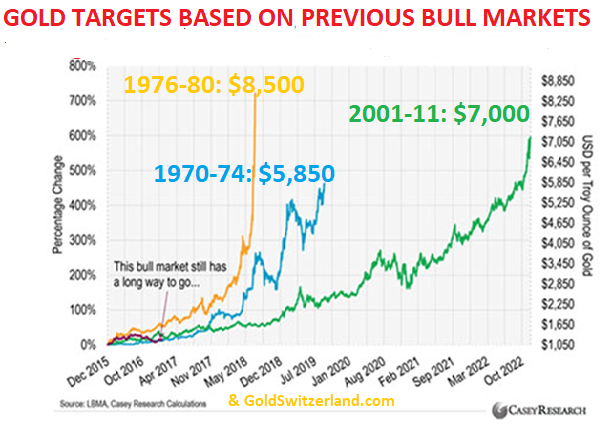

Gold $5,800 to $8,500 based on previous bull markets

Gold and silver are making a temporary pause. The uptrend is clear and acceleration is likely to start this autumn. The chart below shows various projection alternatives compared to previous gold bull markets in the 1970s and in the 2000s. Whichever option we choose, they all lead to a much higher gold price from here between $5,800 and $8,500. Those targets are still well below my long-standing target of $10,000 in today’s money. But as I have stated many times, we won’t have today’s money since with hyperinflation money will become virtually worthless. The eventual dollar price of gold is likely to be multiples of $10,000, depending on how much worthless money will be printed.

Jim Rickards talks about a massive dollar devaluation against gold to solve the US debt problem. He suggests that gold would be revalued to $5,000 which is 4x from today. That is of course one possibility although I doubt the Chinese like many of us believe that the US still owns 8,000 tonnes of gold. China would probably ask the Americans for proof of their holdings and at the same time declare the amount of gold that China holds.

Whoever starts first doesn’t really matter. Because any official revaluation of gold, or just major market price appreciation, will lead to the paper shorts running for cover. At that point, $5,000 will just be a short-lived stop on the way too much higher prices.

Although all this sounds very exciting for gold and silver holders, we must always remind ourselves why we hold precious metals. We are not holding gold for spectacular gains. No, gold is held as insurance for wealth preservation purposes. The risks in the world today are unprecedented in history as I outlined in last week’s article. Therefore, we are holding gold to protect against these risks which are both economic, financial and geopolitical. We are facing the dual risk of a financial crisis with a failing banking system, as well as insolvent sovereign states, leading to all currencies being debased to zero. That is why investors must hold an important amount of physical gold and silver and not worry about daily price fluctuations." -Egon von Greyerz ***PHYSICAL GOLD – THE ONLY PENSION FUND TO SURVIVE

Special Pump-and-Dump Scheme Spikes to High Heaven:*** Swiss National Bank

|

|

|

|

Post by Entendance on Oct 4, 2017 8:18:24 GMT -5

Gold may be setting itself up for higher prices because there just isn't enough of it anymore, this according to mining mogul Ian Telfer Video: ***We're running out of gold as an industry H/T Tom from Florida |

|

|

|

Post by Entendance on Oct 6, 2017 12:01:19 GMT -5

"It's frightening to think that you might not know something, but more frightening to think that, by and large, the world is run by people who have faith that they know exactly what's going on." -Amos Tversky

Egon von Greyerz: "Inflation is coming and it will have a major effect on the world economy and financial markets. This is one of the factors that will drive gold to levels which few can imagine today. Later in this piece, I am discussing 10 Factors which will make gold surge.

No fear

Markets are expressing no fear and seem very comfortable at or near all-time tops. There is no concern that stocks are massively overvalued or that bond rates are at historical lows and only have one way to go. Nor is anyone worried that house prices are at levels which most people can’t afford. Money printing and interest rate manipulation has created such cheap financing that most people don’t look at the price of the property but only at the financing costs. In many European countries, mortgages are around 1%. At that level the monthly cost is negligible for many people. Neither the banks nor the borrowers worry about interest rates going back to the teens as in the 1970s.

So whilst we are waiting for markets to wake up from the dream state they are in now, what signals should we look for and what about timing.

These are the areas that we see as critical and below are our near term and long-term views on:

◾Interest rates / bonds

◾Inflation, Commodities, Oil, CRB.

◾Dollar

◾Stocks

◾Gold

Interest rates – Only one way to go

Interest rates are critical to a world with $250 trillion debt plus derivatives of $1.5 quadrillion and global unfunded liabilities of 3/4 quadrillion. Minor increases in rates will have a catastrophic effect on global debt. Derivatives are also extremely interest rate sensitive. Also, derivatives represent an unfathomable amount that will blow up the global financial system when counterparty fails.

The very long interest rate cycle bottomed a year ago. Since the dollar debt is the biggest, dollar rates are the most important to the world. The US 10-year Treasury bond bottomed in July 2016 at 1.3% and is now 2.3%. US rates have turned up from a 35-year cycle bottom and are likely to go considerably higher into the teens or more like in the 1970s. This could be a very slow process but we could also see a rapid rise. As the 10-year chart shows below, there was a rapid rate rise into December 2016. The 10-month correction finished in early Sep 2017 and a strong uptrend has now resumed.

The long-term trend from 1994 on the chart below, shows the July 2016 bottom. The 23-year downtrend shown from 1994 actually goes back to 1987. This 30-year trend will be broken when the rate goes above 2.6%. With the 10-year at 2.35% currently, we are not far from a break of this trend.

In summary interest rates bottomed in 2016, right on cue as that was the end of the 35-year cycle. The trend is now up for a very long time. This is initially linked to a rise in inflation and will later on be fuelled by a collapse of bond markets and hyperinflation.

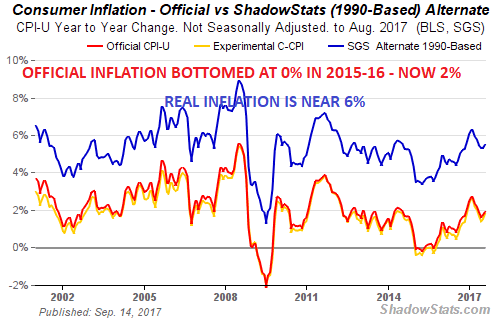

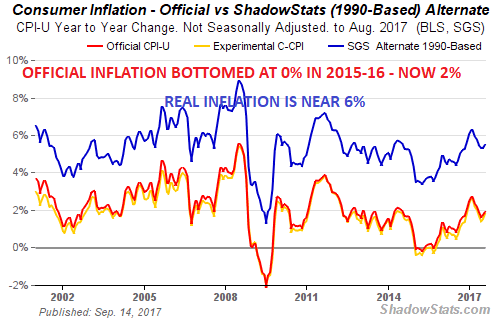

Inflation – On the rise

There are many ways to measure inflation. We can take the official government figures which are manipulated and lagging the real economy. US CPI bottomed in 2015-16 at 0% and is now 2%. If we take the Shadowstat figures, real US inflation is nearer 6% and in a clear uptrend.

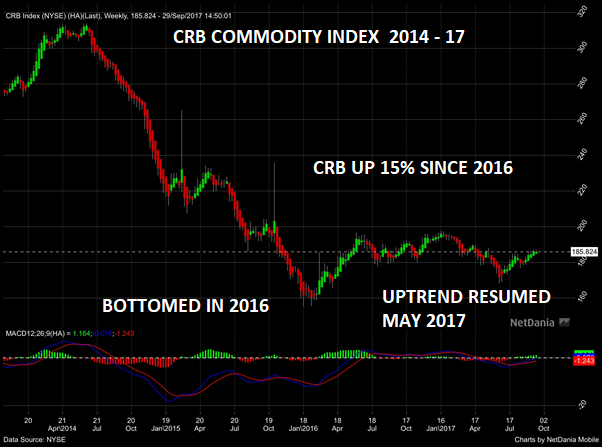

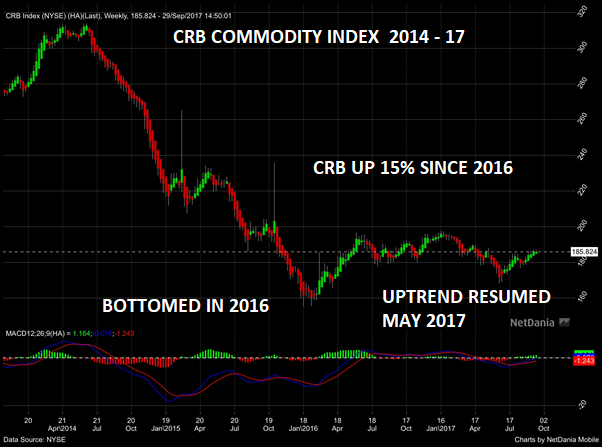

But there are better global indicators for inflation that can’t be manipulated. The CRB (Commodities Research Bureau) index crashed by 50% from 320 in 2014 to 160 in early 2016. That was a significant bottom and the CRB is so far up 15%.

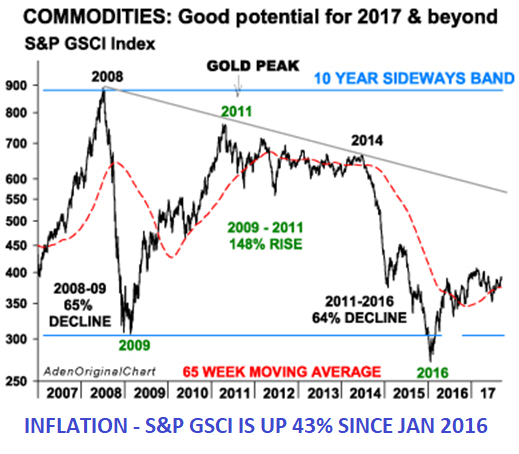

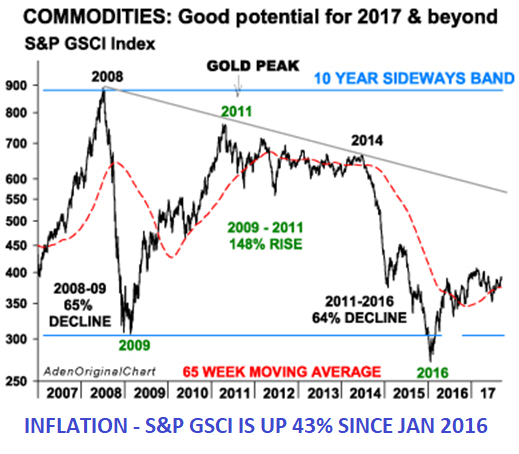

The S&P GSCI Commodity index is heavily linked to energy and shows an even stronger inflationary trend with a rise of 43% since Jan 2016.

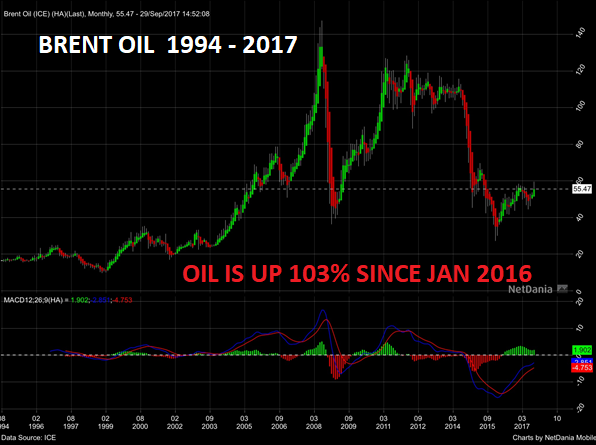

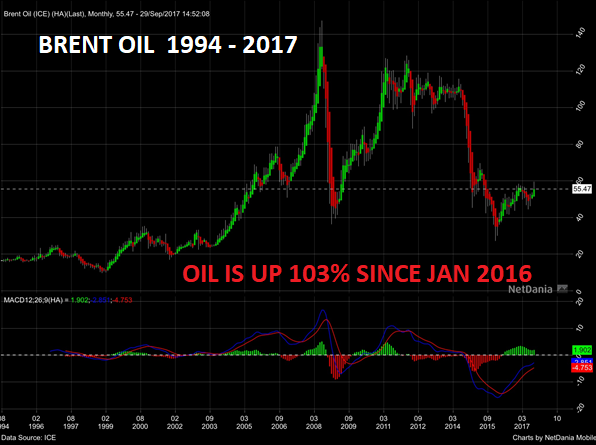

Finally, we have oil as an important inflation indicator. Brent Oil bottomed at $27 in Jan 2016 and is now $56, a rise of 107%.

So whether we take US CPI, various Commodity indices or oil, the trend is clear. They all bottomed around the beginning of 2016 and are now in clear uptrends. This is a strong signal that inflation has bottomed and is likely to increase substantially in the next few years, eventually turning into hyperinflation.

US Dollar – Downtrend will accelerate

The dollar has been in a strong downtrend since 1971 when Nixon ended the gold backing. This was a disastrous decision for the world’s financial system and for the US economy. It has led to a total collapse of the dollar and a financial system based on debt only. The US economy as well as the world economy now rests on a bed of quicksand. The primary reason why the dollar has not totally disappeared yet is the Petrodollar system. This was a clever devise by Nixon’s team in 1974 to agree with Saudi Arabia to sell oil in dollars and to invest the proceeds in US treasury bonds and in the US economy. Saudi Arabia would also buy US weapons and receive protection by the US military. This is what has created a massive demand for dollars globally. But this will soon come to an end with China and Russia introducing an alternative to oil trading in dollars. This will eventually lead to the total demise of the dollar.

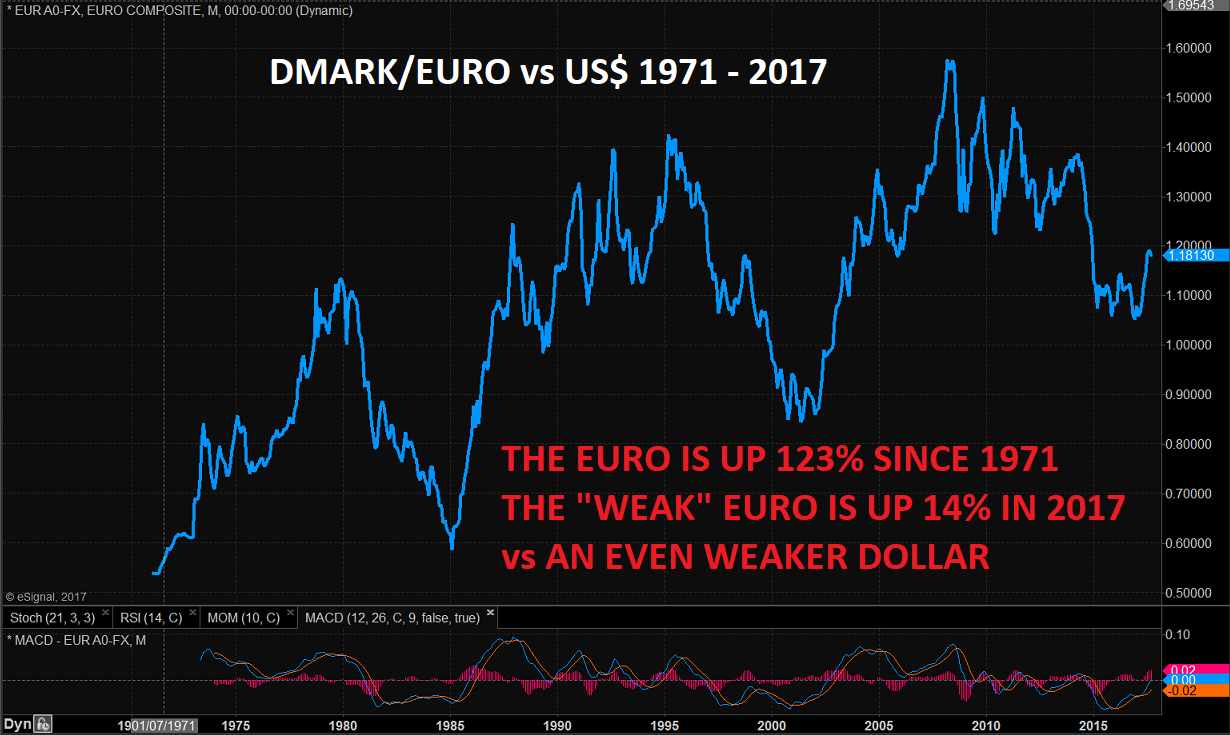

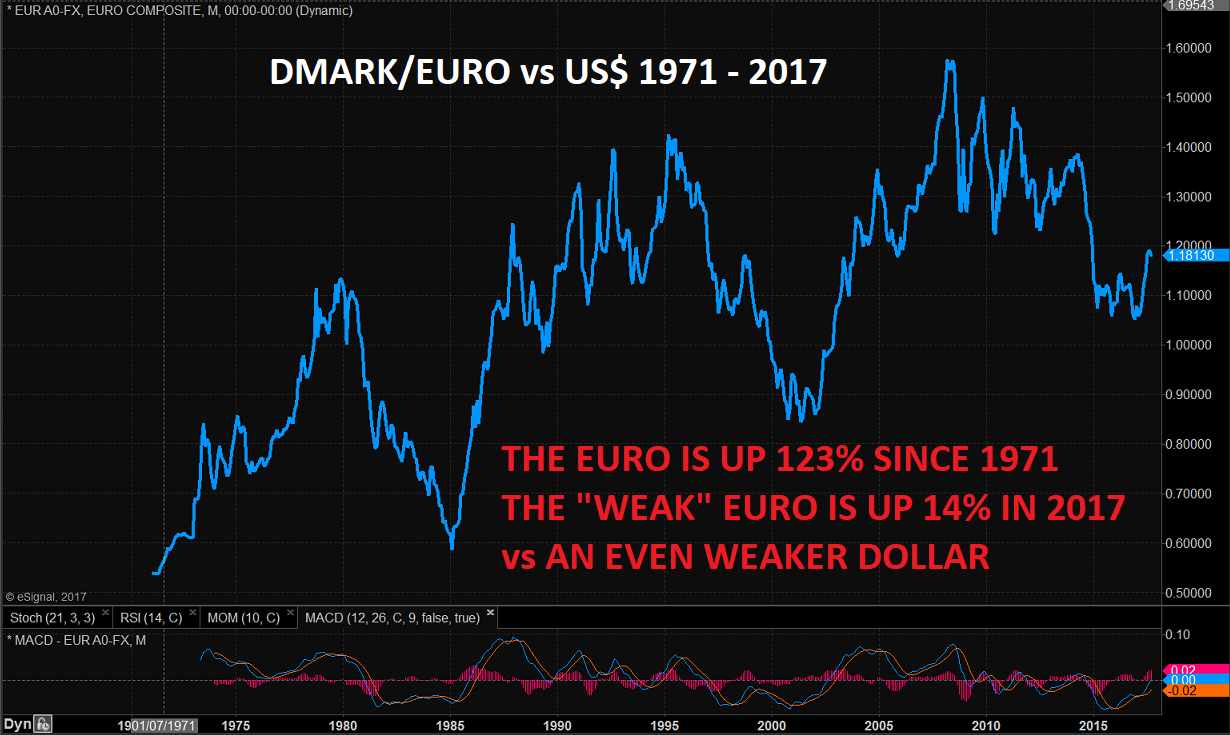

But in spite of the Petrodollar, the US dollar has collapsed against all currencies since 1971. Against the Swiss Franc, the dollar is down 78%. The DMark/Euro has risen 123% against the dollar since 1971. Only in 2017, the Euro has risen 14% against the dollar and this despite of all the problems in Euroland.

We might see temporary dollar strength for a while after the strong fall this year. But the downtrend is very clear and the dollar will at some point within the next few months accelerate down very strongly. The Petrodollar is soon dead and so is the US dollar. The consequences will be disastrous for the US economy and will also lead to a rapid acceleration of US and global inflation.

Stocks – Bubble can expand but will burst

Most stock markets in the world are at or near all time historical high. The significant exception is Japan which peaked in 1989 at 39,000 and is now, 18 years later, at half that level.

The most massive credit expansion and money printing in history has done very little for ordinary people but it certainly has fuelled stock markets around the world. On most criteria, stock markets are massively overvalued, whether we take price earnings ratios, market value to GDP, to sales or margin debt. Stock markets are now in bubble territory and very high risk.

But there is a big BUT! Because bubbles can get much bigger than we can ever imagine. The trend is clearly up and there is nothing today indicating that this trend has come to an end. Normally at market peaks, we see broad participation from retail investors. Normally stocks only turn when everybody has been sucked in. But we are certainly not hearing ordinary investors talking about how much money they are making today in tech stocks like they did in 1998-9. The Nasdaq is up 5x since 2009 just as it was at in the 1990s. The big difference today is that smaller investors are not participating. That may be one of the reasons why this market will go a lot higher. Stock markets peak with exhaustion and we are still not at that stage.

Higher rates will initially make investors more bullish about a strengthening economy. And as bonds decline with higher rates, investors will switch from bonds to stocks. Eventually higher rates will kill the economy and stock markets. But not yet. So we may still see much higher stocks for yet some time and well into 2018. There will of course be corrections on the way there. But there is one major caveat. This latest phase of the long bull markets in stocks has lasted for 8 years already and on most criteria, it is very overbought and high risk. When the market turns, we will see the biggest bear market in history. The coming fall will be much greater than the 1929-32 crash of 87%. Thus, Caveat Emptor (Buyer beware)!

In summary, stocks can go a lot higher but risk is extremely high.

Gold – Long term uptrend will accelerate

So with rising stocks, rising interest rates and a falling dollar how will gold do? That is a very easy question to answer. Just like with commodities, as I have discussed above, gold and silver resumed the long-term uptrend in January 2016. There are a number of factors that will fuel gold’s rise to levels that very few can imagine today.

10 reasons why gold will surge:

1.Failure of the financial system, with massive money printing and currency debasement

2.Gold will follow inflation which will increase strongly eventually leading to hyperinflation

3.Real interest rates will be negative which favours gold. This was the case in the 1970s when gold rose from $35 to $850 despite rates in the mid teens.

4.The death of the Petrodollar and the dollar

5.China’s accumulation of gold on a massive scale and potentially introducing a gold for oil payment system

6.Western Central Bank’s empty gold vaults. CB’s have leased or covertly sold a major part of their gold. That gold is now in China and will never come back

7.Government and bullion bank manipulation of gold will fail

8.The paper gold market will collapse leading to gold going “no offer” which means gold can’t be bought at any price

9.Inflation will increase institutional gold buying substantially. Gold is today 0.4% of global financial assets. An increase to 1% or 1 1/2% would make the gold price go up manifold.

10.With relatively low global demand today, annual goldmine production of 3,000 tonnes is easily absorbed. With falling production, the coming upturn in demand can only be met by much higher prices.

The above 10 factors are neither based on hope, nor fantasy. It is not a question if they will happen but only WHEN. In my view, these events will take place within the next 5 years and most probably faster than that. The compound effect of these 10 factors should push gold up at least 10-fold.

We must remember that 1976-80 gold went up 8.5x from $100 to $850. This time the situation is much more explosive so a 10 fold increase is not unrealistic.

So if you don’t own physical gold or silver, buy some now at these ridiculously low prices and store them safely outside the banking system. If you do own sufficient physical precious metals, just relax and enjoy life, knowing that you are well protected against coming catastrophes." ***10 FACTORS TO PROPEL GOLD 10 FOLD

India, Australia, EU...:The War On Cash Updated |

|

|

|

Post by Entendance on Oct 13, 2017 6:54:32 GMT -5

"Following an article in the Nikkei Asia Review, which reported China will shortly introduce an oil futures contract priced in yuan, there has been some confusion about what it means..." ***Oil for gold – the real story H/T Tom from Florida

Don’t hold gold in a Swiss Bank or in any bank in any country.

"Gold and silver are wealth preservation assets. Therefore, they must not be held within a rotten and massively leveraged financial system. Physical gold and silver must be held in the most secure private vaults outside the banking system and with personal access to the metals by the beneficial owner." MORE here

Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: ***if you purchased it and you can't hold it in your hand, it isn't yours.

|

|

|

|

Post by Entendance on Oct 29, 2017 5:11:50 GMT -5

|

|

|

|

Post by Entendance on Nov 7, 2017 13:05:09 GMT -5

banksters Cartel International

"...Financial services industry employees are trained to talk customers out of buying gold. They do this by pointing out its price volatility and riskiness. (The public has no idea that the gold price is manipulated, and fake.) If the customer still wants to buy it, then the broker steers them into electronic gold, such as bullion bank-controlled ETFs and major mining company equities.

This sterilizes the investor’s funds, and prevents them from being used to buy physical precious metals, which would interfere with the price rigging crime by increasing physical demand for and the price of gold, given its consistently tight supplies. It would also lessen capital flows onto the Gold Looting Field, the exact opposite of the Deep State manipulators’ agenda...

...The larger purpose behind the Deep State’s electronic gold products, beyond current profits, is to concentrate investment gold in a select number of locations that will be easy to control and raid when the time comes...

...For investors, electronic gold is nothing but modern day Fools’ gold. For the Deep State, it is a free ride, on investors’ backs, to the most massive physical gold theft of all times.

Taken together, we believe these factors present a compelling argument why investors should exit all of the electronic gold products specified at the beginning of this article, and convert the proceeds into physical gold and/or non-Deep State-controlled equities of companies in which they have full confidence that managements are working for them, not the bullion banks. The fact is that the Deep State manipulation of the gold price is never going to end until people stop buying electronic gold and providing the liquidity the Deep State needs to continue perpetrating the gold price rigging crime..." ***Electronic Gold: The Deep State’s Corrupt Threat to Human Prosperity and Freedom

AVOID PAPER GOLD: 6 PAGES here

|

|

|

|

Post by Entendance on Feb 9, 2018 11:31:44 GMT -5

"Virtually no investor studies history and the few who do always think it is different today. The most important lesson is that people never learn. If they did, they wouldn’t be invested in a stock market that on any criteria is now at a bubble extreme. And they wouldn’t be invested in a global debt market which has grown exponentially in recent decades and which will become worthless in the next few years as debtors default.

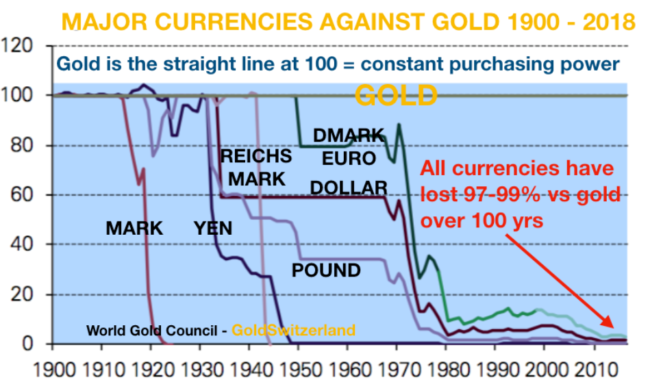

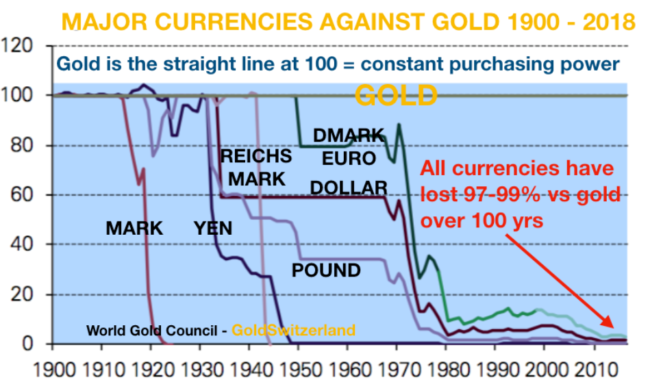

Nor would anyone hold paper money which is down 97-99% in the last 100 years and which is guaranteed to soon fall the final bit to take the value to zero..." ***THE DOLLAR – FROM BOHEMIA TO BUST |

|

|

|

Post by Entendance on Apr 12, 2018 3:11:21 GMT -5

|

|

|

|

Post by Entendance on May 3, 2018 8:21:18 GMT -5

"...The Argentinians and Venezuelans would have avoided misery by holding gold instead of paper money. It is now too late for them as they have little money left. But there is time for Americans, Europeans and other nations to protect themselves today by owning physical gold and silver. Anyone who doesn’t heed this warning is certain to regret it in coming years.

Just follow the wisdom of the East who understand the importance of gold and history, as the chart above shows..." ***GOLD IS GOOD – GREED IS NO GOOD

"Strategic investments are made for the long run and with no intent of short term gains or concern of short term fluctuations. This kind of investing is based on buying undervalued and unloved assets and holding them for a very long term. This is what we did with gold in early 2002 for our investors and ourselves.

Having come down from $850 in 1980, not only did gold represent incredible value at $300 in 2002, but it was also the best insurance possible against a financial system which was turning increasingly unsound. Sixteen years later we are still sitting on our gold. We have seen a high of $1,920 in 2011 and a low of $1,050 in 2015. Have we ever been tempted to sell the gold? No, not for one second. We would rather buy more than sell an ounce.

We will patiently hold the gold until one or more of the following events have happened:

◾The financial system has been miraculously restructured and debt has vanished – IMPOSSIBLE

◾Major sovereign nations are running surpluses and have reduced debt substantially – NEVER

◾The financial system is backed by gold, guaranteeing the value of money – UNLIKELY

◾We can swap some of the gold for real assets at values 90-99% below today – LIKELY

We would never sell gold just because it reaches a certain price. Nobody knows today the level gold will reach. Will it be $10,000, $100,000 or $100 trillion. That depends on the amount of money that will be printed in the next few years. The nominal value of gold at that point is irrelevant. It is only the purchasing power that counts. When the crisis peaks, so will the gold price, although there will be some time lag. At that point it serves no point of course to sell the gold since the financial system will be on its knees. But it could make sense to swap some gold against safe high yielding assets at a bargain price or even against sound businesses that have survived the crisis and can be picked up for a song. There will be plenty of bargains around at that time.

INCREDIBLE INVESTMENT OPPORTUNITIES COMING It is these opportunities that investors should now prepare for. Sell your Tesla shares, Amazons , Facebooks and your government bonds and buy gold and then wait. The next 5-10 years will give us opportunities that only happen once every few hundred years. And due to the massive debt and asset bubbles we are in today, this time the bargains are likely to be greater than any time in history.

Sadly, only a fraction of 1% of the investment population can see this opportunity. But Remember the Golden Rule: “Whoever holds the gold makes the rules...” ***GOLD HOLDERS – CENTENNIAL OPPORTUNITY

|

|

|

|

Post by Entendance on May 15, 2018 9:45:30 GMT -5

|

|

|

|

Post by Entendance on May 17, 2018 9:50:32 GMT -5

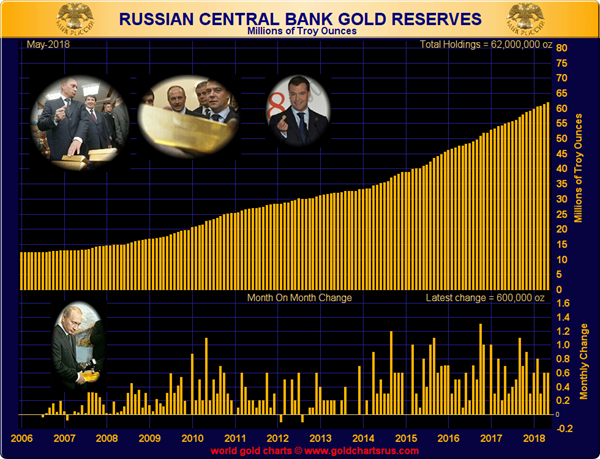

***Russia continuing to increase gold reserves – adds 18.66 tonnes in April ***

***Gold Miners’ Q1’18 Fundamentals

***In Under 20 Years, All Currently Recoverable Gold Will Have Been Mined*** ***In Under 20 Years, All Currently Recoverable Gold Will Have Been Mined***

***Fred & Entendance Beach Gold & Silver University

***Gold 2048: The next 30 years for gold *** H/T Tom from Florida

"...Wonderland slowly ran out of money over a 100 year period. But the debt grew much faster when in 1971 the king, (aka Nixon), decided to replace gold with paper money. Until then all money issued was backed by gold. But the king and queen and their banker friends loved the new era when they were no longer fettered by the discipline of running a balanced budget and could instead just print pieces of paper that they called money. This was a great period for the king and queen and their close friends. Since they got the money first, whilst it still had value, they could buy what they wanted. Once it reached ordinary people, the paper money was already debased and worth a lot less. And the taxes of the people had to increase from virtually nothing 100 years ago to 50% or more if all taxes were included. This was necessary to finance the deficit spending and service the debt.

The king and queen rewarded their banker friends generously for this ingenious invention. Rather than using expensive gold as money, they could just print whatever they wanted at zero cost. They never understood of course, that if you print money at zero cost, it has zero value.... In the end there weren’t even enough tax revenues to pay the interest on the nation’s borrowings. To solve this, the bankers had another ingenious idea, namely to issue debt and make the people pay the state interest on the debt they issued. What a clever idea by the bankers thought the king and queen. That means we can really issue limitless debt so that we and our rich friends get much richer and the people just get more indebted. But ordinary subjects will of course not understand the consequences.

This was the most genius invention by the bankers. The more money, the nation borrowed, the more interest the state received. No one had ever thought about this before to issue debt and rather than pay interest on the debt to receive interest. This meant that the state could borrow unlimited amounts of money and the more they borrowed, the bigger the income..."

***THE MOST INGENIOUS INVENTION IN THE HISTORY OF FINANCE***

***The magic of bank(st)ers |

|

|

|

Post by Entendance on Jun 2, 2018 3:03:00 GMT -5

June 7, 2018 ***ITALY, HYPERINFLATION AND GOLD June 7, 2018 ***ITALY, HYPERINFLATION AND GOLD

"...$10,000 gold combined with a 75% fall in global assets means that gold would represent 17% of total assets. That might sound extremely high. But we must remember that gold at that point will be real money and possibly the only trusted money as fiat currencies are reaching their intrinsic value of zero. Also, many investors will panic out of stocks and bonds and buy gold as the only safe haven investment.

Global assets are today 174x greater than gold. When assets are down 75% and gold $10,000, that makes global asset (excluding gold) just 5x greater than all the gold in the world. This means that global assets would decline 97% against gold between today and 2025. I am sure that many people would be sceptical about these proportions. It seems almost unreal that gold could become so valuable relative to other assets. But in a panic scenario, valuations will be totally different to today’s massive overvaluations. We will see price earning ratios at 1-5, even for good companies. This means that a company can be bought at 1 to 5 years’ earnings. And dividends will be 10-20% from the very few companies that can still afford a dividend. Yields on rental properties will be 20% or more..." ***GOLD – THE ONLY MONEY THAT CAN’T BE DEBASED

***Japan Shows Why — And How — All Fiat Currencies Are Doomed

In Gold we Trust

The gold standard of gold-research

Now in its 12th year, the annual “In Gold We Trust” is THE authoritative report on gold investing, and is required reading for anyone interested in the precious metal market. Ronald-Peter Stöferle and Mark Valek analyze the state of the global financial markets and their influence on gold price developments like no other. In Gold we Trust | Compact Version PDF

Extended Version here

In Gold we Trust

Der Goldstandard aller Gold-Studien

Der jährlich erscheinende Goldreport gilt seit 12 Jahren als Standardwerk für jeden interessierten Goldanleger. Mit Akribie analysieren Ronald-Peter Stöferle und Mark Valek den Zustand der internationalen Finanzarchitektur und deren Wechselwirkungen auf die Goldpreisentwicklung. Mehr hier

***Without gold I would have starved to death |

|

|

|

Post by Entendance on Jun 15, 2018 5:22:35 GMT -5

***What should an intelligent investor do?

June 20, 2018 Brandon Smith: ***America’s Debt Dependence Makes It An Easy Economic Target

***Tiny Asian Nation Hoards Gold as Shield Against Trade War H/T Tom from Florida

June 20, 2018 Financial writer and precious metals expert Craig Hemke says nobody should be comfortable with unpayable global debt that has piled up since the 2008 financial meltdown. A debt reset is locked in, but nobody knows when it will come crashing down. Hemke says, “That’s probably the right way to put it. I would not want to say, hey, there is going to be a debt reset by August 29th. I don’t think that’s the way you want to go with it, but it’s pretty obvious to anyone that we are in this parabolic Ponzi scheme. The debt is now increasing globally at such an exponential rate that, at some point, it becomes unserviceable. Then, at that point, you get this reset they’ve been talking about.”

Hemke points out the same game that was being played to inspire confidence in the banking system back before the 2008 financial meltdown is happening again. Hemke says, “You can see this today, actually, in the attempt to inspire confidence in Deutsche Bank. You can pull up a chart of Deutsche Bank now, and you can clearly see the heavy hand and the overt support of the Deutsche Bank share price. It is about $11. That is about the all-time low it came down to a few weeks ago. In the last few days, it has been clearly supported at $11. . . . Why would central banks be supporting Deutsche Bank? Because if Deutsche Bank began spiraling down through $10 to $9 to $8, you would get this crisis of confidence from the other banks that are all linked to Deutsche Bank and this daisy chain of counter-party risk, and we are right back to where we were in 2008. Yes, some type of reset is coming because, ultimately, the debt is unserviceable. The debt grows so fast you cannot print enough money to service all your existing obligations, especially when the economy starts to collapse and you get another recession.”

Hemke warns that many people own the same ounce of gold held at big banks and don’t know it. Hemke explains, “It’s sort of like the people who show up at the Bailey Building and Loan on George’s wedding day (It’s a Wonderful Life). As long as nobody is making a run for it, and everybody knows your money is invested in Bob’s house and your money is invested in Mary’s house, as long as nobody wants their money right away, George Bailey can run a fractional reserve system like that. It’s only when somebody shows up and says I want my 1,000 ounces of gold, now. I want my metric ton, now. That’s when this whole bullion bank system collapses. Suddenly, we get a realization where land trades directly, dollars for the asset. Art trades directly, dollars for the asset. Gold and silver are going to trade that way as well.”

On the dollar, Hemke says, “I think the dollar eventually goes back down from political risk from the mid-term election, geo-political risk, de-dollarization risk and trade war risk being a part of it too. The dollar resumes its move downward, and the metals begin to rally with increasing momentum.” In closing, Hemke says, “If there is one thing that the average person can do for financial protection that is the acquisition of physical metal. . . . If you want to get into what has been sound money for thousands of years, you would be crazy not to take this discounted price . . . you’d be crazy not to put some of your dollars into physical metal. That’s what the Chinese are doing. That’s what the Russians are doing, and if these nations are converting some of their dollars into physical metal, don’t you think you should do the same?”

June 19, 2018 Crisis Countdown: ***Your Patience Will Be Handsomely Rewarded by the Next Gold & Silver Surge

June 18th, 2018 ***Loving Debt = War on Gold

Weekend June 16, 2018: ***What A Week!!

"...And when my model says it’s time to go much longer of gold, that’s when the portfolio will be 30, 40% gold, because the mining shares will skyrocket, probably like you’ve never seen before, once this happens..." Michael Pento here

***The Volcano Debt Updated ***The Volcano Debt Updated

More here

Politics is the art of preventing people from taking part in affairs which properly concern them. -Paul Valery

|

|

|

|

Post by Entendance on Jun 26, 2018 5:45:49 GMT -5

|

|

|

|

Post by Entendance on Jul 10, 2018 23:39:45 GMT -5

***How NOT To Become A Casualty In The War On Cash All you need to know on The War On Cash is here

***Gold Yearly Logarithmic ***Gold Yearly Logarithmic

"Chart note: Since 1971, the year the United States went off the gold standard, freed the dollar to float against other national currencies and ushered in the fiat dollar international monetary system, gold has appreciated over 3000%. In "Essay on the Coinage of Money" (1526), Conpernicus, the famed astronomer, noted: "Although there are countless scourges which in general debilitate kingdoms, principalities, and republics, the four most important (in my judgment) are dissension, [abnormal] mortality, barren soil, and debasement of the currency. The first three are so obvious that nobody is unaware of their existence. But the fourth, which concerns money, is taken into account by few persons and only the most perspicacious. For it undermines states, not by a single attack all at once, but gradually and in a certain covert manner." Today gold protects its owners against the nemesis of currency debasement as it has over the centuries and during the Copernicus' times."

"...CONCLUSIONS:

Debt is rapidly rising. Higher interest rates take dollars from individuals, businesses and the economy. Marginal borrowers will suffer.

The stock market has risen too far and too fast. Expect a lengthy correction or crash. The DOW correction (probably) began following the high in January 2018. The NASDAQ peaked in June.