|

|

Post by Entendance on Dec 15, 2021 10:44:13 GMT -5

|

|

|

|

Post by Entendance on Dec 22, 2021 6:19:44 GMT -5

McEwen Mining: Exploration @ Fox McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce that drilling continues to deliver good widths and grades at the Fox Complex, both from exploration at Stock and delineation at Froome.

Highlights include:

Assay results show the potential of the Stock mineralized zones to extend to depth and down plunge. What has been outlined to date will contribute to our immediate growth plans.

Drilling is planned for 2022 to investigate the intercept in hole S21-202, which encountered 21 meters (m) of 4.29 g/t gold. If this intercept connects to mineralization at Stock West, it will materially enlarge the boundaries of the Stock West system.

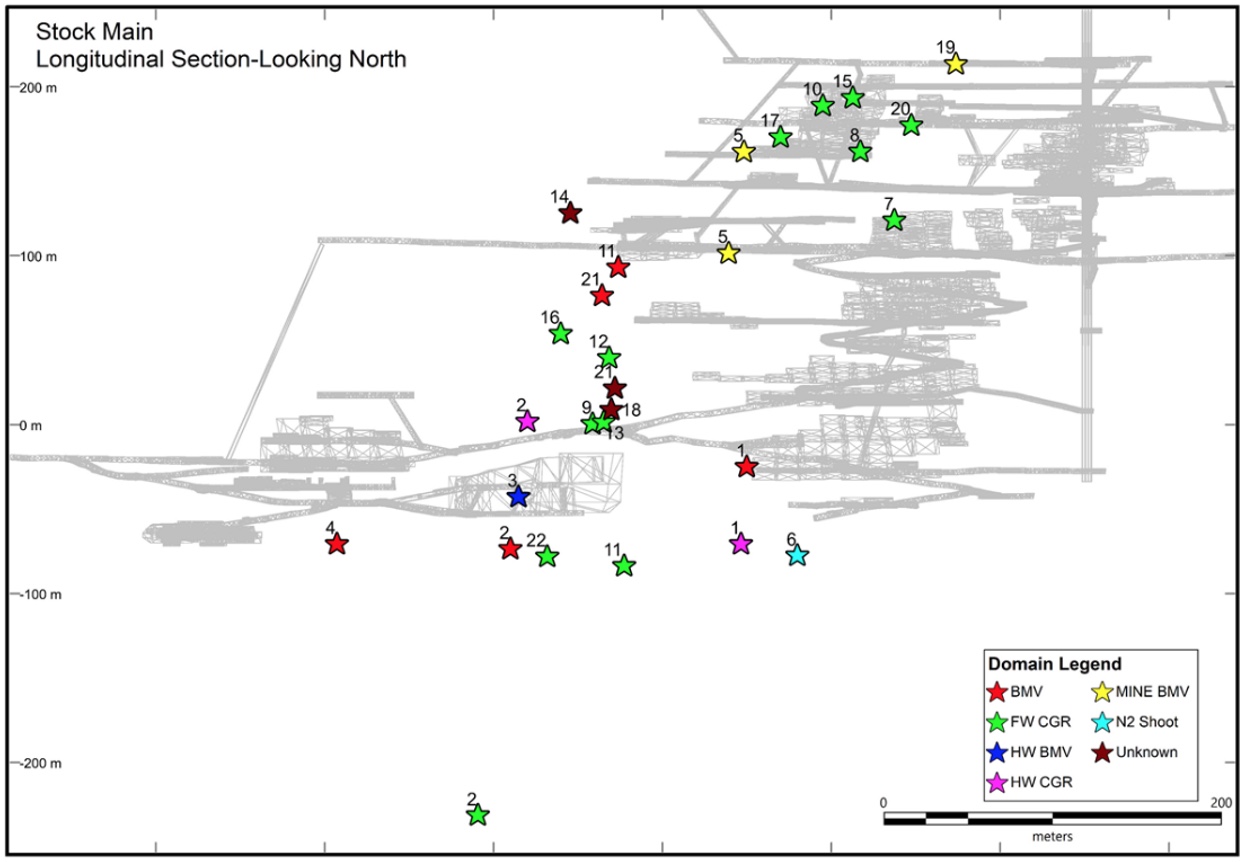

Assay results are starting to arrive from our exploration on Stock Main (the historic Stock mine). Visible gold has been noted in several drill cores, such as in hole SM21-024 that returned 9.1 m of 7.43 g/t gold including 2.6 m of 23.72 g/t gold, within 25 m of surface.

Stock West & Main

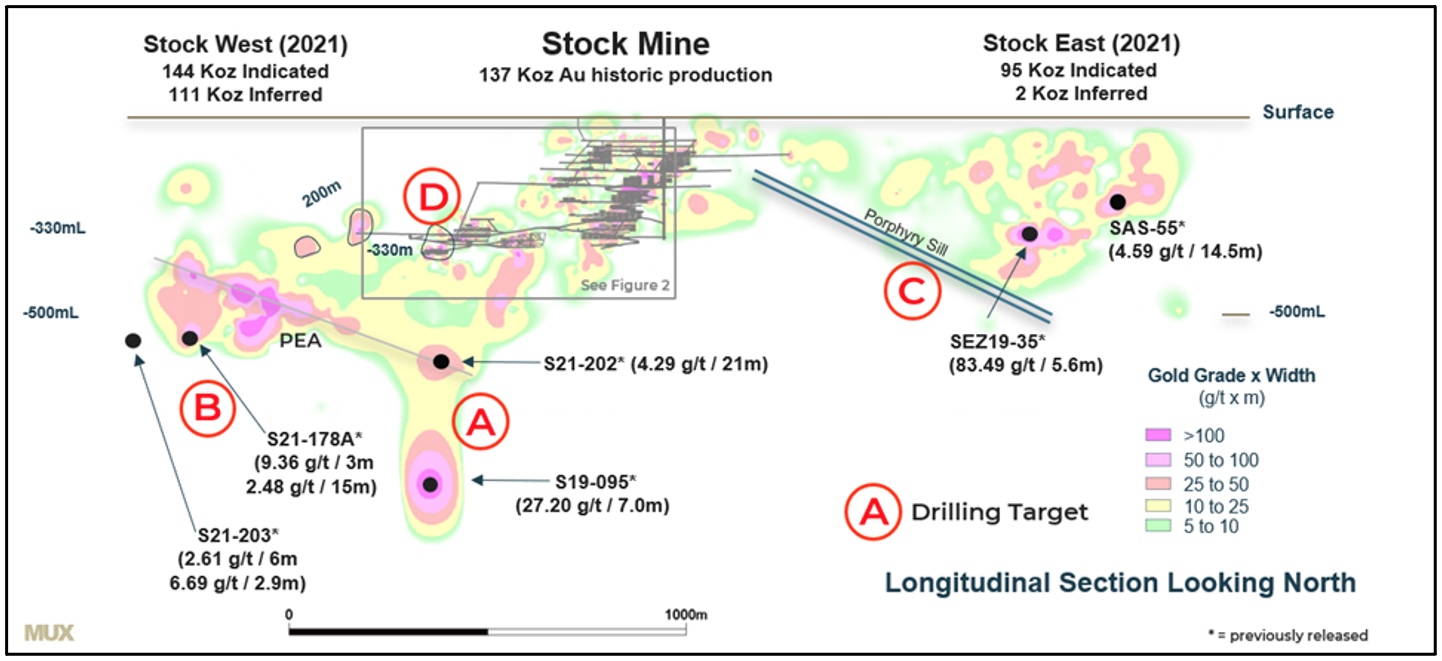

Drill results from holes S21-202 (released on Nov. 3, 2021) and S19-95 (released on Sep. 4, 2019 - 7.0 m (core length) of 27.2 g/t gold) confirm that mineralization remains open to depth and the east (see Figure 1). The intercept in S21-202 is an over 200 m step-out along a prominent shallow eastern plunge from mineralization at Stock West. The current geologic interpretation suggests a possible connection of a further 250 m to the intercept in hole S19-95.

The host lithology of the Stock West mineralization, which also occurs in hole S21-202, was recently intersected in the footwall of the Stock mine. These observations support our confidence that the property is early in its discovery phase of development.

Forty-six surface drill holes were completed at Stock West (see Table 1) and Stock Main (see Table 2) since the last exploration update in May 2021.

Progress made at the Stock Property in 2021 will be reflected in the pending Preliminary Economic Assessment (PEA) for the Fox Complex, which is currently being finalized for publication.

Figure 1: www.globenewswire.com/NewsRoom/AttachmentNg/95d0f9b3-13f4-4fd0-9caf-b122f557cc91Froome Mine

The best new result is 20 m (true width) of 7.43 g/t gold – Hole 200-F085-14

Three hundred and seventeen underground drill holes were completed for delineating the Froome orebody during 2021 (see Table 3). The Froome mine, while only a short distance from the Black Fox mine, is different in important ways that offer several advantages, such as a straighter, shorter, and more efficient underground haulage route, and wider more consistent mineralization that is amenable to lower-cost bulk mining methods. Mining started earlier this year and has been meeting expectations on key ore quality indicators such as gold grade, dilution, and total ounces produced.

Delineation drilling has expanded the deposit further to the west than previously designed, giving the Fox Complex team confidence that the Froome mine life will be extended. 2022 diamond drilling will focus on resource expansion at depth to extend the Froome mine life (see Figure 2).

|

|

|

|

Post by Entendance on Dec 23, 2021 1:58:55 GMT -5

McEwen Copper: Los Azules Progress Report McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to provide a summary of the work at the Los Azules copper project in San Juan, Argentina, that started in earnest this July 2021. Our two immediate objectives on our path to designing and constructing the copper mine of the future are to:

Advance Los Azules from its current stage of development (Preliminary Economic Assessment or PEA) to a Pre-Feasibility Study (PFS); and

Construct a new road, the ‘ Northern Access Road’ , that will provide critical year-round access to Los Azules. The current ‘ Exploration Road’ is generally only usable five months of the year due to winter weather.

Below is a photographic account of our activities to date.

Background

On July 6, 2021, we announced the creation of McEwen Copper and our intention to raise US$80 million in a private offering comprised of 8,000,000 shares priced at $10.00 per share. We closed the first $40 million tranche of the placement in August with Rob McEwen, and the balance of the financing is expected to close in January 2022. Assuming completion of the $80 million financing, McEwen Mining will retain 69% ownership in McEwen Copper, and new shareholders will hold 31%. McEwen Copper will continue to hold a 100% interest in the Los Azules project.

Los Azules is one of the largest undeveloped copper porphyry deposits in the world. It is located along the prolific Andes Copper Belt as shown in the location map below: Photo 1 - Work starting in July to open the Exploration Road Photo 2 - By September 27 th , we had reopened the Exploration Road to Los Azules, and the camp provisioner and caterer (Caterwest) had started setting up our work campsites. Below is a picture of the Exploration Road being improved. If you look closely, you can see the road continuing beyond the front-end loader.

Photo 3 - While opening the Exploration Road, on July 19 th we also started the construction of the Northern Access Road . Pictured here is the start of the eastern end of this new road. A prominent San Juan-based road construction firm (Zlato) is building the road for us. The construction of the road has been divided into five sections. Photo 4 - By late November, we had completed Section 5 and approximately 50% of Section 4. We are awaiting permits, expected in Q1 2022, to advance construction of the remaining sections. The expected completion date of the Northern Access Road is mid-2022. Photo 5 – Back on the Exploration Road, the road was reopened to our first work camp, Candidito, by August 25 th on the road to Los Azules.

On December 1st, the medical services and emergency rescue teams had arrived at site and exploration drill platforms were being constructed.

By December 20th, 36 drill platforms had been constructed and 2 of the 10 exploration drills had arrived on site. The other 8 drills are expected to be arriving throughout January and into February. Drilling will start on January 4th. The first phase of our drill program will involve a 174,000-foot (53,000 m) program. It is designed to convert the Inferred mineral resources to the Indicated category, as well as to test deeper exploration targets, where historic drilling had ended in strong copper mineralization.

McEwen Copper currently has 282 people supporting the exploration drilling program at Los Azules, with approximately 85% being from San Juan. Photo 8 and 9 - The first two exploration drills to arrive at the site. Photo 10 – At Los Azules, McEwen geologists orienting the drillers from Major Drilling, with the rock conditions that they will be encountering.

Project Development Workshop

This past week, December 14th to 16th, we held an intensive workshop with senior management of both McEwen Mining and McEwen Copper and a powerful group of consultants and advisors. A total of 30 individuals well versed in designing and building, and operating copper mines, especially in South America, gathered physically and virtually from Argentina, Chile, USA, Canada, Australia, and New Zealand.

The workshop started with a presentation from Whittle Consulting from Australia, who for the past three months have been evaluating various development scenarios for the Los Azules Project. Their work suggests there is considerable room to improve the economics of the project.

Companies involved in moving Los Azules to PFS are:

Bechtel Corporation, the largest construction company in America with a long history of advancing, building and developing large copper concentrators and infrastructure projects globally, including the recent feasibility study update on the El Pachon project approximately 75 km south of Los Azules; and

Samuel Engineering, who will help oversee project management, controls, metallurgy and processing plant design, is a full service multi-disciplinary project development and execution company bringing a team with extensive large copper project experience in South America, including past involvement at the Los Azules project; and

Stantec, a full service engineering and consulting firm, with offices in Argentina, Chile, and Peru, including select subcontract consultants will focus on geology, resource and reserve estimates, mining engineering, hydrology, geotechnical and the tailings, waste, and water management facility design.

Our overarching goal is to design a mine that will be the model for copper mining in the 21 st century. One that supplies the raw material to enable a greener world, while incorporating the use of renewable energy sources to have a low-carbon footprint and that uses technological innovation to achieve an energy efficient mine.

At several points during the workshop, Jason F. McLennan of McLennan Design in Seattle, a prominent figure in the field of architecture and green building movement, shared his thoughts on technologies, visions and attitudes on how mining could change to contribute to a healthy world and how lessons learned in other industries could be applied to transform certain elements of mine operations, infrastructure and facilities.

We all left the meeting energized and believing that the future of mining will be exciting, new and game-changing. For the world to make considerable progress towards a lower carbon emissions world, the world needs responsible mining to provide the materials to make that a reality.

We at McEwen Copper, along with our consultants, plan to design, build, and operate a facility, a community, that will be at the leading edge of a changing attitude in mining towards protecting our planet.

To view a .PDF of this news release click here: mcewenmining.com/files/doc_news/archive/2021/20211222_McEwen_Copper_Update.pdf

|

|

|

|

Post by Entendance on Jan 7, 2022 5:43:06 GMT -5

IT'S THEM OR US. TERTIUM NON DATUR. IT'S THEM OR US. TERTIUM NON DATUR. (There is no third possibility)

TORONTO, January 6, 2022 - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) reports that it has fallen below the New York Stock Exchange ("NYSE") continued listing requirement related to the price of its common stock. The NYSE requires that the average closing price of a listed company's common stock be above US$1.00 per share, calculated over a period of 30 consecutive trading days. The Company was notified by the NYSE on January 5th, 2022 that the average price of its common stock for the previous 30 trading days was below $1.00 per share.

McEwen Mining intends to take steps to regain compliance with the NYSE continued listing requirements. Under NYSE rules, the Company has a period of six months to bring its share price and 30-day average closing share price back above $1.00. During this period, the Company’s common stock will continue to trade on the NYSE, subject to all other continued listing requirements. At the end of the six-month remedy period, if the share price has not recovered, the Company's stock will be subject to NYSE suspension and delisting procedures. The Company's listing on the Toronto Stock Exchange ("TSX") is unaffected by any actions of the NYSE.

|

|

|

|

Post by Entendance on Jan 19, 2022 10:52:22 GMT -5

|

|

|

|

Post by Entendance on Jan 20, 2022 6:13:34 GMT -5

...“We’ve seen a number of majors come in and take a close look at Argentina,” McEwen said. “That in itself is giving more comfort to foreign investments.”

For now, he wants to increase Los Azules’s value by moving to pre-feasibility stage over the next year and a half. The company is deploying drill teams and building an access road, although work has been delayed by cultural preservation efforts after hitting fossils...

Copper Majors Are Taking Another Look at Argentina,McEwen Says

McEwen reports FY 2021 consolidated production jumped 34% Y/Y to 154.4K gold equiv. oz., consisting of 118.5K gold oz. and 2.57M silver oz., and Q4 output rose 29% Y/Y to 40.1K gold equiv. oz., consisting of 31.3K gold oz. and 682.7K silver oz.

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report consolidated production for the full year of 2021 was 34% higher than in 2020 and Q4 2021 was 29% higher than in Q4 2020. Production guidance for 2021 was achieved. Full year production was 154,410 gold equivalent ounces(1)(“GEOs”) consisting of 118,500 gold ounces and 2,572,000 silver ounces. In Q4, production was 40,150 GEOs consisting of 31,300 gold ounces and 682,700 silver ounces.

In Q4 2021, our attributable production from San José(2) was 682,700 silver ounces and 11,300 gold ounces, or 20,200 GEOs, which was in-line with our expectations; Black Fox production of 9,460 GEOs was also in-line with our expectations; Gold Bar production of 9,950 GEOs was above our expectations; and El Gallo produced 540 GEOs from residual leaching.

Notes:

(1) 'Gold Equivalent Ounces' are calculated based on a gold to silver price ratio of 94:1 for Q1 2020, 104:1 for Q2 2020, 79:1 for Q3 2020, 77:1 for Q4 2020, 68:1 for Q1 2021, 68:1 for Q2 2021, 73:1 for Q3 2021 and 77:1 for Q4 2021.

(2) The San José Mine is 49% owned by McEwen Mining Inc. and 51% owned and operated by Hochschild Mining plc.

Technical Information

Technical information pertaining to mining operations contained in this news release has been reviewed and approved by Peter Mah, P.Eng., COO of McEwen Mining and a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A., the owner of the San José Mine, is responsible for and has supplied to the Company all reported results from the San José Mine. McEwen Mining’s joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

|

|

|

|

Post by Entendance on Jan 22, 2022 3:40:00 GMT -5

|

|

|

|

Post by Entendance on Jan 27, 2022 5:44:14 GMT -5

McEwen Mining: Fox PEA – Higher Production, Longer Life McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to provide summary results from the Fox Complex Preliminary Economic Assessment ("Fox PEA" or "PEA"), which outlines a mine life of over twelve (12) years, generating average annual production of 71,980 gold ounces, at average cash costs and all-in sustaining costs ("AISC") per ounce under $800 and $1,225, respectively.(1)(2) Peak annual gold production of approximately 100,000 ounces occurs in Years 6 to 10 of the mine life.

"The Fox PEA is an important step forward for us. It translates our exploration success into a business case that increases mine life and production rates and lowers costs per ounce! It also provides a clearer picture of where future exploration should be focused to add value. "The Fox PEA is an important step forward for us. It translates our exploration success into a business case that increases mine life and production rates and lowers costs per ounce! It also provides a clearer picture of where future exploration should be focused to add value.

Our commitment and investment in exploration has provided the foundation for this study, and ongoing exploration success continues to further enhance the expansion potential at Fox. While the PEA is an encouraging first iteration, continuing exploration success, improved economics, and a shorter payback period is required before we decide to advance the project.

I am also pleased that the Froome mine was successfully brought into production in 2021, is performing as planned, and is expected to continue for at least another three years while our expansion plans and drilling progress," commented Rob McEwen, Chairman and Chief Owner... Press Release Details here |

|

|

|

Post by Entendance on Feb 14, 2022 1:33:01 GMT -5

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce a financing to fund continued exploration at the Fox Complex in the Timmins region of Ontario. These funds will be employed to build on the business case outlined in our recently announced preliminary economic assessment (see news release dated January 26, 2022).

The financing consists of a US$15,080,000 (Cdn$19,212,500) private placement offering (the “Offering”) of 14,500,000 flow-through common shares (within the meaning of subsection 66(15) of the Income Tax Act (Canada)) priced at US$1.04 (Cdn$1.325) per flow-through common share (the “Offering Price”). The Offering is expected to close on March 1, 2022 (the “Closing”) and is subject to customary closing conditions, including approval from the TSX and NYSE.

The proceeds of this Offering will be used exclusively for qualifying Canadian Exploration Expenditures (CEE) on McEwen’s properties in the Timmins region.

|

|

|

|

Post by Entendance on Feb 17, 2022 8:26:28 GMT -5

McEwen Copper anuncia Incorporación de Nuevo Directivo

TORONTO, February 17, 2022 - McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to announce that Michael Meding has joined as Vice President of Andes Corporacion Minera SA. in Argentina. Mr. Meding is accountable for the overall direction and management of the Los Azules copper project in San Juan. He will play a significant role in taking McEwen Copper through its next phases of technical studies, upcoming IPO, and development as a global model for environmentally and socially responsible green mining.

Mr. Meding has over 20 years of international experience, primarily with major mining companies such as Barrick Gold and Trafigura, including extensive experience with project development and operations in Argentina. While at Barrick Gold's Veladero mine in Argentina, he played a key role in the turnaround, extension of the mine life, and subsequent strategic partnering with Shandong Gold. Mr. Meding is trilingual (Spanish-English-German) and holds an MBA from Indiana University in Pennsylvania and an MBA from the Leipzig Graduate School of Management in Germany.

McEwen Copper Inc., una subsidiaria de McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), se complace en anunciar que el Sr. Michael Meding se ha incorporado como Vicepresidente de Andes Corporación Minera SA. en Argentina. El Sr. Meding tiene a su cargo la dirección y administración general del proyecto de cobre Los Azules en San Juan. Desempeñará un papel muy importante en la conducción de McEwen Copper a través de las próximas fases de estudios técnicos, la pronta Oferta Pública Inicial de Acciones (OPI) y el desarrollo como modelo global de minería verde en términos medioambientales y sociales.

El Sr. Meding cuenta con más de 20 años de experiencia internacional, principalmente en grandes empresas mineras, tales como Barrick Gold y Trafigura, incluyendo vasta experiencia en el desarrollo de proyectos y operaciones en Argentina. Durante su desempeño en la mina Veladero de Barrick Gold en Argentina, jugó un papel fundamental en el proceso de cambio de rumbo, la ampliación de la vida útil de la mina y la posterior asociación estratégica con Shandong Gold. El Sr. Meding es trilingüe (español-inglés-alemán) y posee título de Maestría en Administración de Negocios de la Universidad de Indiana en Pennsylvania y título equivalente de la Escuela de Posgrado en Administración Leipzig en Alemania.

|

|

|

|

Post by Entendance on Mar 1, 2022 7:19:29 GMT -5

McEwen Mining GAAP EPS of -$0.05, revenue of $35M; issues FY22 guidance

Revenue of $35M (+26.4% Y/Y).

For 2022, our gold equivalent production guidance is 153,000 to 172,000 GEOs.

Fox production for Q4 and 12M 2021 was 18% and 23% higher, respectively, compared to Q4 and 12M 2020.

Cash costs and AISC per ounce sold for the 12M period both dropped by 21% and 11%, respectively, compared to 12M 2020.

McEwen Mining: 2021 Year End and Q4 Results

March 1, 2022TORONTO, March 01, 2022 -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today reported fourth quarter and full year results for the period ended December 31, 2021.

Cash and liquid assets (2) and working capital at December 31, 2021 were $63.5 million and $32.6 million, respectively.

Our operations delivered production in line with our guidance. For the full year 2021, production was 154,410 gold equivalent ounces (GEOs)(1), above the midpoint of guidance for the year and 34% higher than 2020 production.

Production costs/oz for 2021 decreased compared to 2020 and additional reductions remain a focus. Cash costs(2) per GEO sold from our 100%-owned mines in 2021 were $1,453 representing a decrease of 18% compared to 2020. All-in sustaining costs (“AISC”)(2) per GEO sold from our 100%-owned mines in 2021 were $1,635, representing a decrease of 21% compared to 2020.

For 2022, our gold equivalent production guidance is 153,000 to 172,000 GEOs (see Table 5).

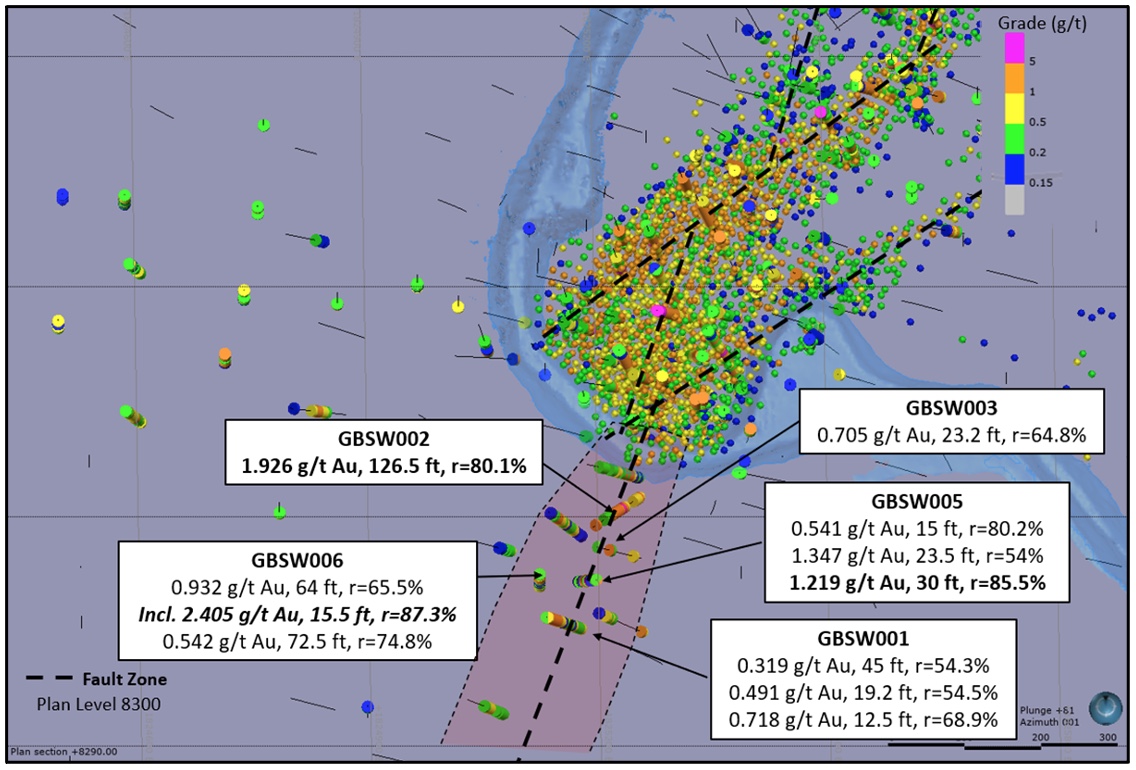

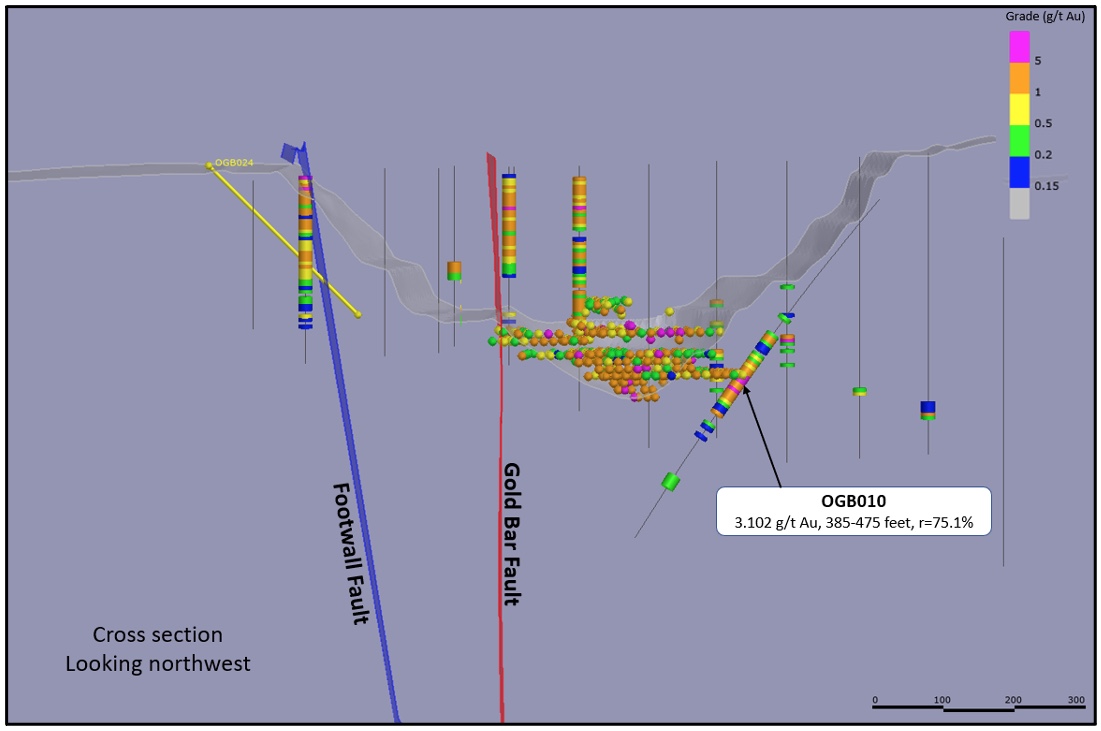

We continued to invest aggressively in exploration, completing 254,800 feet (77,700 meters) of drilling at the Fox Complex, and 17,500 feet (5,300 meters) of drilling at Gold Bar.

Our 100%-owned mines generated a cash gross profit of $17.3 million(2) in 2021 and a gross loss of $6.5 million. Cash gross profit (loss) is calculated by adding back depletion and depreciation to gross profit (loss).

Our consolidated net loss in 2021 of $56.7 million, or $0.12 per share, relates primarily to investment of $35.0 million in advanced projects and exploration, general and administrative costs of $11.4 million, and a gross loss of $6.5 million from our operations.

Fox Complex PEA outlined potential to extend the mine life by 9 years, generating average annual production of 80,800 gold ounces at average cash costs and AISC per ounce of $769 and $1,246, respectively.

A webcast will be held on Wednesday, March 9th at 2 pm EST. Please see the details further here

Operations Update

Fox Complex Canada (100% Interest)

Fox production for Q4 and 12M 2021 was 18% and 23% higher, respectively, compared to Q4 and 12M 2020. Cash costs and AISC per ounce sold for the 12M period both dropped by 21% and 11%, respectively, compared to 12M 2020.

Black Fox mine wound down during 2021 as production shifted to the Froome mine. We realized a milestone on September 19th, 2021 when commercial production was reached at the Froome mine, three months ahead of schedule. To date, mineralized material extracted from the Froome mine produced grades that are consistent with the resources model and mine plan.

On January 26, 2022, we announced the results of our PEA for the Fox Complex. The PEA presents estimates for a positive business case for the Fox Complex expansion project, with potential average gold production of 80,800 gold ounces per year over nine (9) years, after the depletion of the current resources at Froome. The economic analysis estimates an after-tax IRR of 21% at a gold price of $1,650/oz, and average cash costs and AISC per ounce of gold of $769 and $1,246, respectively. Additional exploration work on the Fox Complex properties will be conducted throughout 2022 to support ongoing studies necessary to advance the expansion project and shorten the payback period.

We remain focused on our principal exploration goal of cost-effectively discovering and extending gold deposits adjacent to our existing operations, that can contribute to near-term gold production. During 2021, we incurred $15.0 million in exploration initiatives at Fox. The exploration budget for 2022 at the complex is $10.0 million.

Gold Bar Mine, USA (100% Interest)

Gold Bar production for Q4 and 12M 2021 was 66% and 57% higher, respectively, compared to Q4 and 12M 2020. Production increased significantly in 2021, primarily due to improved heap leach operating efficiencies and no materially adverse COVID-19 impacts on operations. Cash costs and AISC per ounce sold for the 12M period dropped by 20% and 29%, respectively, compared to 12M 2020.

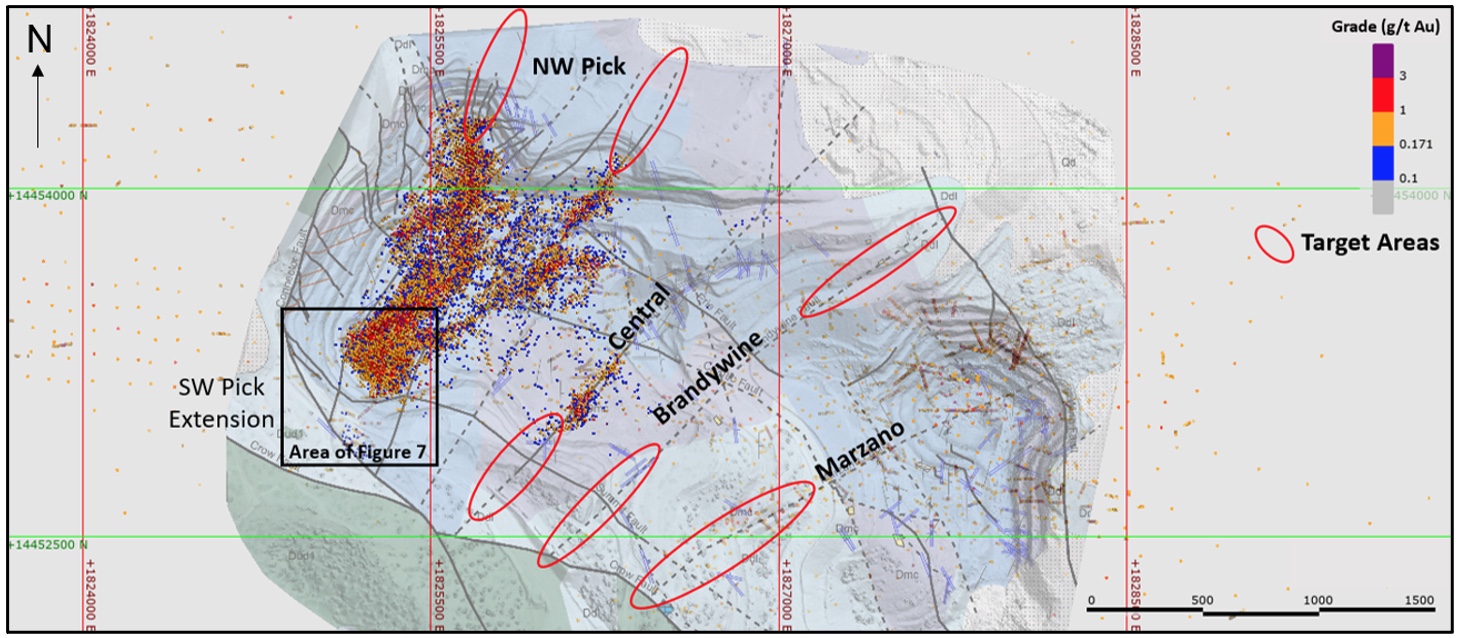

The permitting process to access ore at Gold Bar South satellite deposit is ongoing and we anticipate receiving the permit in Q1 of 2022. The initiation of gold production from Gold Bar South is planned for the second half of 2022.

In 2021, we spent $4.2 million on exploration activities, including metallurgical, geotechnical and drilling programs for a cumulative 8,620 feet (2,627 m) at Ridge and Tonkin Rooster. Delineation drilling programs were conducted at Atlas Pit, SW Pick Extension, and Cabin North, with a cumulative 8,629 feet (2,632m) completed. Delineation drilling at Cabin North and the SW Pick Extension is ongoing. The Gold Bar exploration budget for 2022 is $2.5 million.

San José Mine, Argentina (49% Interest)

San José attributable production(3) for Q4 and 12M was 38% and 41% higher, respectively, compared to Q4 and 12M 2020. Cash costs and AISC per ounce sold for the 12M period increased by 2% and 6%, respectively, compared to 12M 2020.

Gold and silver production increased in 2021 due to the lifting of COVID-19 restrictions that impacted operations throughout 2020. We received $10 million in dividends from our interest in San José in 2021, compared to $0.3 million received in 2020.

McEwen Copper (81% Interest)

Activities at Los Azules ramped up in Q4, with the opening of the seasonal exploration road, the activation of two camps, the start of construction of a new all-year access road, and the preparation of drill pads and roads to support the current drilling program. Drilling started in January 2022 and there are currently five rigs operating, increasing to seven in March.

On February 17th, 2022, Michael Meding joined as Vice President responsible for the overall direction and management of the Los Azules project. Mr. Meding has over 20 years of international experience, primarily with major mining companies such as Barrick Gold and Trafigura, including extensive experience with project development and operations in Argentina. While at Barrick Gold's Veladero mine in Argentina, he played a key role in the turnaround, extension of the mine life, and subsequent strategic partnering with Shandong Gold.

An extensive team of experts have been engaged to advance the Los Azules project to a pre-feasibility stage, including the following:

Bechtel Corporation, the largest construction company in America with a long history of advancing, building and developing large copper concentrators and infrastructure projects globally, including the recent feasibility study update on the El Pachon project approximately 75 km south of Los Azules;

Samuel Engineering, who will help oversee project management, controls, metallurgy and processing plant design, is a full service multi-disciplinary project development and execution company bringing a team with extensive experience in large South American copper projects, including past involvement at the Los Azules project;

Stantec, a full service engineering and consulting firm, with offices in Argentina, Chile, and Peru, will focus on geology, resource and reserve estimates, mining engineering, hydrology, geotechnical and the design of tailings, waste, and water management facility;

Whittle Consulting from Australia, with over 35 years of leadership in the field of integrated strategic planning and optimization; and

McLennan Design in Seattle, led by Jason F. McLennan, a prominent figure in the field of architecture and green building movement. McLennan is the creator of the Living Building Challenge – the most stringent and progressive green building program in existence.

Our overarching goal is to design a mine that will be the model for copper mining in the 21 st century, one that supplies the raw material to enable a greener world, while incorporating the use of renewable energy sources and technological innovation for a low-carbon footprint and energy efficient mining.

Conference Call and Webcast

Management will discuss our Q4 and Year-End 2021 financial results and project developments and follow with a question-and-answer session. The conference call and webcast is being held later than usual this quarter due to executive site visits. Questions can be asked directly by participants over the phone during the webcast. McEwen Mining Q4 and Year-End 2021 Results

Date: Wednesday, March 09, 2022

Time: 02:00 PM Eastern Standard Time

To call into the conference call over the phone, please register here

|

|

|

|

Post by Entendance on Mar 3, 2022 7:04:30 GMT -5

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce the closing of the previously announced private placement offering (the “Offering”) of 14,500,000 flow-through common shares (within the meaning of subsection 66(15) of the Income Tax Act (Canada)) priced at US$1.04 (Cdn$1.325) per flow-through common share for total gross proceeds of US$15,080,000 (Cdn$19,212,500). The sole bookrunner for the Offering was Cantor Fitzgerald Canada Corporation and PearTree Canada structured the flow-through donation placement.

The proceeds of this Offering will be used exclusively for qualifying Canadian Exploration Expenditures (CEE) on McEwen’s properties in the Timmins region.

This press release is not an offer of common shares for sale in the United States. The common shares may not be offered or sold in the United States absent registration or an available exemption from the registration requirements of the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act") and applicable U.S. state securities laws. McEwen will not make any public offering of the securities in the United States. The common shares have not been and will not be registered under the U.S. Securities Act, or any state securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities, in any jurisdiction in which such offer, solicitation or sale would be unlawful.

|

|

|

|

Post by Entendance on Mar 7, 2022 13:41:47 GMT -5

McEwen Mining El Gallo 2020 Sustainability Report link to flipbook Here |

|

|

|

Post by Entendance on Mar 10, 2022 3:18:36 GMT -5

McEwen Mining MUX CEO Rob McEwen on Q4 2021 Results

Company Participants

Rob McEwen - Chairman and Chief Executive Officer

Segun Odunuga - VP and Controller and Interim CFO

Peter Mah - COO

Michael Meding - Vice President, Andes Corporación Minera S.A.

Steve McGibbon - EVP of Exploration

Conference Call Participants

Jake Sekelsky - Alliance Global Partners

Joseph Reagor - Roth Capital Partners

John Tumazos - John Tumazos Very Independent Research

Heiko Ihle - H.C. Wainwright

Rob McEwen

Hello to and welcome to fellow shareholders and investors. As you know, we've been working to turn our fortunes around. Today we're going to discuss the progress that we made in 2021 and provide our outlook for this year.

In 2021, we had a number of notable steps of improvement. We increased our production, lowered the cost, cost per ounce at our operations delivered positive exploration results along with a preliminary economic assessment for our Fox complex showing that there's a 10 year life out in front of there and we created McEwen copper to fund the advancement of our losses of this copper project.

Today on the call, a number of our officers will be talking about 2021 results and looking forward into this year. And we're going to start with Segun Odunuga. You're up Segun.

Segun Odunuga

Thank you, Rob. Good day, everyone. Our financial performance continue to improve our power [ph] at Fox Complex mine in 2021 after a 2020 mark, by the beginning of the COVID-19 pandemic. Although mostly [ph] currently imported by COVID-19, our operation -- our 50-50 gold ratio operation at [indiscernible] money to generate $10 million in dividend payments to maximum mining during 2021.

Our liquid asset at the end of the year, which includes cash and cash equivalents of $54.3 million including distributed cost of $6.3 million, investments in short term investment -- investment in short term pressure be cash equivalent of $1.8 million and precious metal inventory of $1 million. We have $63.9 million as of 30 of 2021. In 2021 we completed three financing transactions, which including a $40 million -- $40 million private replacement for the advancement of project.

At the Fox complex here in Ontario in Canada, before obtain commercial production during 2021 ahead of schedule. We are expecting that the nine will continue to deliver as plan during 2022. Also in 2022 we are primarily we'll continue to monitor operating margin by reviewing capital expeditions, materials contract, improving to our management systems, and also bring synergies to our procurement of recurring between operations through the year started, as we all are aware and know what is starting in the global arena right now, we started the year with a very high cost, which already impacting our cash for half of about $25,000.

We expect to see offset with the increasing gold price life at current gold price averaging $1900. This is something that we are expecting that the impact would be -- will especially impact us, even though the diesel price is increasing, but we expect to see offset with the gold price.

We'll be working in those in 2022 to advance the project. So this study will be accounted in our income statement our financials. So we expect to see our in statement in 2022 be impacted by spending that we are doing at Los Azules. Subsequent to the year hand at March 5, we raised $15.1 million through a flow through financing that will be used exclusively for our qualifying calendar exploration expenditure on building, on the business case applied in the PA for the Fox complex and these are all the costly things that we will be working towards in 2022.

Peter Mah

Thank you, Rob. Thank you, Segun. The three highlights for 2021 were improved production, lowering costs and advancing our pipeline of growth projects. I'll just take a moment to go through some of those highlights. For Q4 2021, consolidated production was 31,300 gold ounces and 683,000 silver ounces. So 40,150 GEOs or 33% higher than Q4 2020.

Our consolidated production for 2021 was 154,410 GEOs above the midpoint of our guidance for the year and about 34% higher than 2020. Production cost per ounce for '21 decreased compared to 2020 an additional reduction remain for the focus for this year. Cash cost for yield sold from our one mine in 2021 were 1453 representing an 18% decrease over last year and all-in sustaining costs were 1635 or 21% below 2020.

For 2020, we are forecasting production between 153,000 to 172,000 GEO of the shift into each region quickly here, Fox Complex production from in Q4 2021 was 9460 GEOs, 18% higher compared to mining out a Black Fox since Q4 2020. Fox Complex production 2021 was 30,060 GEOs or 23% higher in production 2020. Production guidance in 2022 at the complex based on a full year production firm, were flowing into the production and commercial past commercial and whole production there. We'll be wrapping up to around 44,000 to 49,000 GEO.

2021 cash costs all on GEO were 11 and 1461 or a 1% down from same period last year. For 2022, we'll just keep continuing little downward trend efforts and working improved efficiency as we advance our firm project. We also came up with a Fox PA [ph]. It adds another 80,800 ounces of gold. So again, growing our scale, helping spread our fixed costs that will add on after the firm is completed. We have about another 2.5 years of firm left. We added a year of resources in 2021.

The IRR on that project is 21% and it's got some nice low cost ounces, cash cost being up 770 and all in sustaining being around 1246. Exploration Fox well there -- exploration continues through 2022. Steve will touch on that more, a bit later. Gold bar in Nevada, our production for Q4 2021 was 9950 GEO or 66% higher compared to Q4 2020. Operations in Nevada produced 43,850 deals for 20 representing 57% increase over 2020. This was the improved production was mainly due to improved operating efficiencies and lesser material impact or sorry, no material impacts on COVID-19, no suspension of operations.

2021 cash cost and all-in sustaining for GEO for Gold Bar where 1,687 instead 1,753 deal down in 2020. Production guidance for Gold Bar in 2022 is 38,000 to 44,000 GEO. We'll continue addressing reduced costs in 2022. We anticipate placing more on the leach pad, which will reduce our glomeration costs and increasing the rom placement to about 80% from a historical 50%.

Other highlights we've changed mining contractors to new fixed unit rate contract and start proving out to help lower cost compared to last year. San Jose moving South Argentina 49% interest. The San Jose contributor production for Q4 2021 was 20,200 GEOs, 38% higher than Q4 2020, and as well for the full year per year production of [indiscernible] higher compared to a 2020. Gold ounce per production increased the lessening COVID restrictions that impacted operations in 2020.

That's it. And I'll now turn over the presentation to Steve, who'll talk about our exploration plans and results.

Steve McGibbon

Thank you, Peter, and good afternoon, everyone. During 2021, we invested $20.9 million in exploration at Fox Complex in Nevada and delivered solid results in three important projects. Those being increasing the mine life of room, completing our initial resource estimate at South West and completed initial assessments of Tonkin Rooster and Atlas in Nevada.

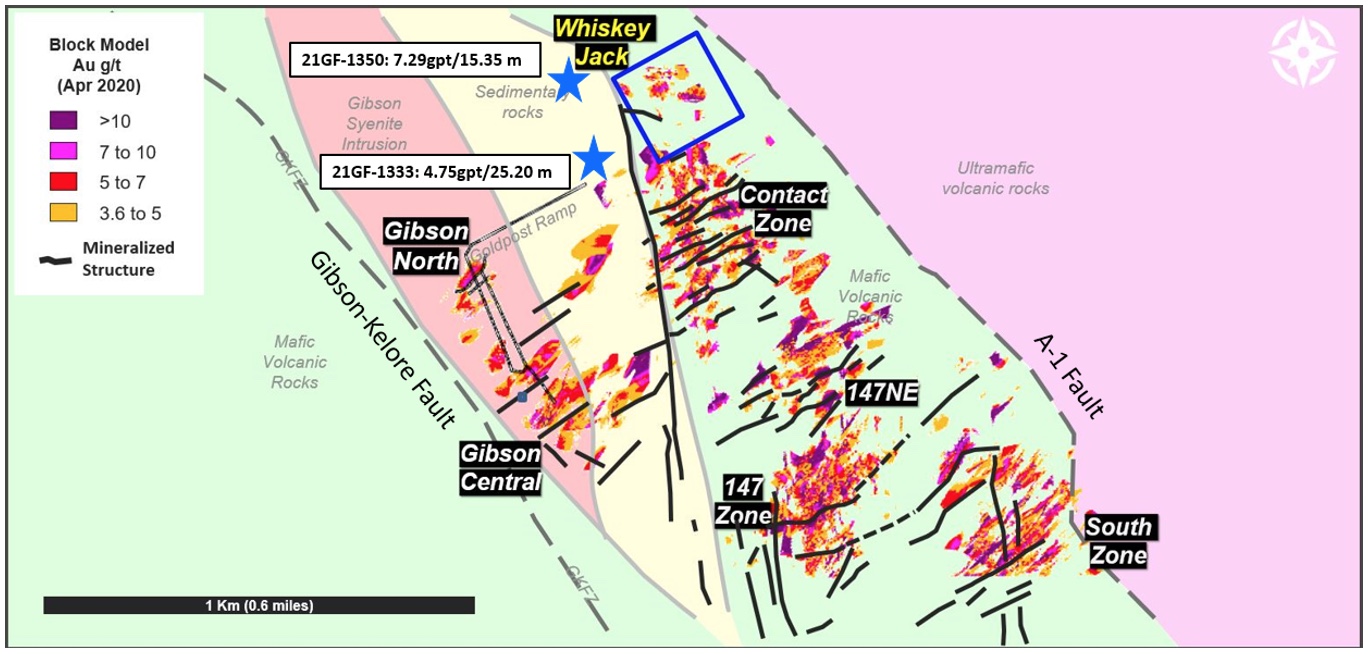

We remain focused on our principle goal in 2022 of one, cost effectively discovering and extending gold deposits adjacent to our existing operations. Two, drill testing, very attractive exploration targets at stock, and three, seeking to expand through still further to depth in other areas. During 2021, we completed over 250,000 feet or 77,000 meters in drilling focused on Stock and Grey Fox properties. 2021 delineation drilling at Peru has expanded the deposit further to the West. The best 2021 results from drilling was a 20 meter true width interceptive 7.43 grams per ton gold in whole 200F 08514.

2022 Diamond drilling will focus on extending mine life through resource expansion of depth. In 2021, 24,300 GEOs were produced from through [ph] and as that year end, 2021 indicated resource additions at firm and Gray Fox of some 317,000 ounces having discovery cost of less than $55 per ounce. And in addition, we released an initial resource estimate of Stock West that includes 144,000 ounces indicated and 111,000 ounces of incurred material.

The stock exploration area is adjacent to our stock mill, which currently processes from through. Drilling plans for 2022 will follow up on the 2021 drilling in plus 21202, which encountered 21 meters two width of 4.29 per ton material at Stock West and Maine. This connects to mineralization at Stock West, it will materially enlarge the boundaries of the Stock West utilization system.

Visible gold has been noted in several drills from our exploration on Stock Maine and historic stock mine. Shallow drill intercepts include 9.1 meters of 7.43 gram per ton gold including 2.6 meters of more than 23 grams per ton gold within 25 meters of surface from gold SM21024. The expiration budget for 2022 at Fox is about $10 million.

Now at Gold Bar in 2021, we completed 17,500 or 5,300 meters of drilling, which included some 8,620 feet, 2,630 meters of metallurgical geotechnical and drilling programs at Ridge and Tonkin Rooster. Delineation programs were conducted at Atlas pit Southwest pit extension and Cabin North.

The Gold Bar exploration budget for 2022 is $2.5 million and will be targeting replacement of mining depletion and growth of mineral resources and reserves. Modelling of delineation drilling at Cabin North and at Southwest pit extension is ongoing. We will focus on near mine exploration that can offset mining depletion and grow mineral resources over time.

San Jose, our 49% interest in Argentina, the San Jose mine mining is funding a pro rata portion of a $3.5 million exploration program for 2022. The San Jose property surrounds nuances Cerro Negro mine, and is host to high grade epithermal gold and silver deposits. Important areas of exploration in 2021 where San Jose and Saavedra located in the center of the property. Exploration drilling in the mine area at San Jose returned several encouraging results in 86.3 meters of 44.4 grams per ton gold in the Betania vein 1.9 meters of 14.5 grams per ton, and 342 grams per ton silver in Jimena vein and 4.3 meters of 14.9 grams per ton in gold and nearly 1400 grams per silver in the Amelia vein.

[indiscernible] is a new nearly acquired property, 70 kilometers south of San Jose. It represents a bulk mineralization target, six initial holes and 1800 meters of plant drilling for 2022 is to demonstrate continuity of high grade silver results that have been recognized on surface.

This concludes the exploration portion of the presentation. And I will pass that back to Rob.

Rob McEwen

Thank you, Steve. I'd like to now introduce the newest member of our team Michael Meding. He is looking after our material and copper. He has spent seven years working for Barrack in San Juan province, Argentina both at Veladero mine and [indiscernible]. He has extensive experience in San Juan. He lived there for seven years and two or three daughters were born there. So he has strong connections there politically and commercially. So, we just returned from a trip down to the property.

And I asked Michael to speak about that, Michael?

Michael Meding

Thank you so much, Rob. As Rob said, the senior management just came back from San Juan Argentina. There, we visited our Los [ph] properties and had the opportunity to meet key stakeholders, including South Juan Governor Minister of Mines, [indiscernible] and the [indiscernible] were all positive about our project and advance it to advance as quickly as possible.

We visited the site and also had the opportunity to drive a new access road that we are currently developing that is significantly lower than our current exploration road, which will almost allow for year round access to the sites and should help us to develop the properties quicker. We also had the opportunities to see our drill program advancing and this is an exciting opportunity as we have heard by all stakeholders that we met during that visit.

Rob McEwen

Very good. Thank you, Michael. Before starting question answers, I want to make a couple of comments; for those of you unfamiliar with the term GEO which you heard, it's not that we're employing a lot more are geologists, but the GEOs are gold equivalent ounces and in that is converting the silver ounces have come out of our operations in Argentina and some in Nevada are converted to a gold equivalent and that's what is referred to as GEOs.

Michael just mentioned the new access road we're looking at is lower. That's lower elevation and it lacks the high, our current route in there as two high mountain passes that we have to pass that are prone to getting closed because of snow loads and this new route is quite an important development for that project.

I want to say that looking forward our production for 2022 we expected the trend of lowering cost per ounce to continue and there will be a slight increase in production, but I want to alert everybody to the fact that in the first quarter, we're going to experience higher cost of COVID and was a large contributor to that, but it's contributed to a lot of companies having higher costs, but we have, it was higher costs, both in Siemens and in Nevada.

So Q1, there'll be a hiccup and cost are projected to be lower going forward for the balance for the year. There are a number of questions that have been asked and I wanted to speak to them before opening up for further questions. Cost guidance was given by Peter just now and Segun for the year. There is the commodity prices. There is some sensitivity given by Segun on oil and the offset of a higher gold price. It's a big issue, we're trading below a $1 and the New York Stock Exchange as many as you know, has given us notice that they don't like stocks below a dollar. And if within a six month period, it isn't trading above a dollar, then you face two decisions. One to accept delisting or you go and think about a consolidation.

We've had some experience with this before and each time we've entered into this danger zone, we've been able to escape it and think that we will be able to do that again. There are a number of reasons for that one, the exploration that Steve spoke about, we believe it will allow us to reduce the payback period in the preliminary economic assessment for the Fox Complex which would be quite positive because that is projected to be a nine year mine life as we know it. We have annual production of about 80,000 ounces a year or about almost 60% higher than what we're currently doing and a significantly lower cost, but it's important to get the payback done.

Two, we'll be coming out later this year with our progress at Los Azules where we'll be updating the preliminary economic assessment. We've been looking at the project going through a number of simulations optimization simulations, and believe there is a larger deposit there and a more deposit -- profitable deposit using a $3 proper price and copper is now above $4.5, so 50% higher.

We decided to the best way to develop this project or to fund the development of Los Azules was to put it into a separate company and some people have questioned that decision. It was largely driven by a desire not to issue a lot of shares in mining to fund it and it was also so we wanted to reduce the potential for significant solution in order that would be required to fund the project within the mining.

But also there is a very distinct preference by most investors for specific plays like a pure copper play or a pure precious metal play and that's why we put it out. A question relating to the McEwen Mining copper is when do we expect to close the $60 million to $80 million financing we announced last year. And we hope to conclude that -- we expect to conclude that in the first quarter of this year.

Still relevant to McEwen Mining and McEwen copper with this financing that we expect to close by the end of the first quarter, McEwen which have 69% interest in McEwen copper. There's been some people asking, well, what would the percentage ownership be following the IPO? The IPO is still sometime away, but I do believe that Los Azules represent a very valuable asset for us that we will enhance its value in its form as a separate company and it would be appear very attractive to copper investors.

As you heard earlier on, or may have, the Canadian Mining Journal ranked it as the 10th or the ninth largest undeveloped copper deposit in the world. We also at the McEwen level and McEwen mining level, we had $50 million of debt that we were to start the retirement of it in August of this year. Now we will be moving that we expect to have that pushed out by a year, taking that immediate need off our balance sheet and there's also some people saying why hasn't management been buying? Well there long blackout periods that we have to observe when we're releasing financials or any significant news of the company such as preliminary economic assessment. So that's largely been why people haven't been adding to their positions.

In terms of profitability, you should know that since McEwen copper will be a subsidiary of McEwen mining and McEwen mining being a large shareholder, the money we spend at Los Azules, a large portion of it will be reflected on our income statement as an expense. So the question of profitability will be up in the air for quite a while as we're spending money there. Operationally, our mines are generating positive cash flow.

And with that, I'd like to open it up for question and answers.

Jake Sekelsky, Alliance Global Partners

Hey Rob. Thanks for taking my questions. I think you mentioned that cost guidance was given on the call. I might have missed it. My apologies for that Rob. Would you mind just walking us through that again?

Segun Odunuga

Sure. First quarter is going to be quite expensive. I'll do it on a consolidative basis first. Cash of $1900, all-in sustaining 24.50, second quarter $1400 cash, $1850, all in sustaining, third quarter $1,230 and $1,550 and in the fourth quarter $1,200 cash and $1,350 all in sustaining. It was COVID and weather that affected both Black Fox and Gold Bar during the first quarter. And that caused that bump up and a problem in the mill with a piece of equipment also at Black Fox. But you can see the trend aside from that ugly bump in the first quarter is progressively lower.

Jake Sekelsky

Yeah, no, that's helpful and it's good to see the trend in the second half. Okay. And then just quickly at Gold Bar you mentioned in the release potentially bringing on the Gold Bar South satellite deposit in the second half of the year. Any color on development costs that you expect to incur there during the first quarter to kind of bring that comment into the mine's life.

Rob McEwen

I'll ask Peter to shed some light on that.

Peter Mah

Yeah. Thank Rob. Hi Jake. Yeah, Gold Bar the CapEx for the year is around $10 million. We're expecting to be able to bring that project on in the second half of this year. So we moved it forward from the feasibility spend, if you will. Most of that spend is to expand the heat leach pad, build the Gold Bar South road and construction and pay some big growth credit.

Jake Sekelsky

Got it. Okay. That's all on my end. Thanks guys.

Joseph Reagor, Roth Capital Partners

Hey Rob and team. How you guys doing? So you mentioned weather impacting Q1 like Gold Bar, but looking back to Q4 the grade, was you quite a bit below the first three quarters? Was that planned or was that something where the resource didn't match expectations,

Rob McEwen

Peter, please.

Peter Mah

Yeah. In Q4 we changed out the mining contractor and transitioned to core unit rates. So we didn't quite get the strip we had hoped for and ore release so things have gone well now. All the contractors fully transitioned and we expect to get back on track this year.

Joseph Reagor

Okay. And then looking at the guide for this year particularly at Gold Bar I think when we've talked about this, maybe even over a year ago, there was kind of an expectation at sometime around 2022, 2023, there'd be an uptick grade. As you guys completed some pre-stripping activities and got to a higher grade part of the resource. Has that been pushed out? Is it just not as high as maybe we'd anticipated. Any additional color you can give as far as like going forward expectations on grade?

Rob McEwen

Yeah. I'm not sure which timeframe you're referring to, but so we're still in West and obviously that mining's extended out longer than the feasibility by adding in some other opportunity or as we call it. So we've been mining some waste or, and this year we continue to do that. The higher grades will actually come with Gold Bar South in the mine plan. And we're advancing that ahead of the feasibility quicker into this half of the year on the permit is progressing well. We're expecting approval in the next month caveat though that although the Gold Bar South grades are expect to be hotter the recoveries are slightly lower.

Joseph Reagor

Okay. And then looking at MSC and I realize guidance there is provided by your partner. But, there was a pretty decent jump in both cash costs and on sustaining costs in Q4. What do you guys attribute that to? And do we expect that to continue into 2022?

Rob McEwen

Large part of that cost came from COVID? The mine was largely evacuated for a period of several weeks. There were a number of people that were infected with COVID and they came in and shut down the mine. They didn't have the product, had the expenses,

Peter Mah

The San Jose pandemic I expected that where were tally up to be, I believe $11.4 million in 2020. So significant pandemic loss delays, as Rob mentioned

Joseph Reagor

And no issues in Q1 so far.

Peter Mah

They started opening their board. We heard we've gone down. So it's improving. I guess stay guarded. We didn't see that going but things seemed to be getting back to normal when we were there.

Joseph Reagor

Okay. All right. I'll turn it over. Thanks guys.

John Tumazos, Very Independent Research

So with all these great metals prices, maybe there's a shot of selling Al or the 49% of Marina San Jose, or eventually McEwen Copper. Do you have enough confidence to borrow $25 million, maybe buy 25 million shares. If you were to sell Marina San Jose, the proceeds would be a lot more than that for example, even Al GaIo might be that much or more, might also address your NYSE issues too.

Rob McEwen

Yes, yes. We have been gathering into move some of our assets. We just haven't been able to conclude a transaction on that, but definitely that would be I think high on list would be reducing the debt or eliminating it. And with the extra funds using it on some of the area issues suggested there.

John Tumazos

If I can ask a second question, looking at the MD&A beginning around page five, it mentions reserves at San Jose. I'm looking at the resources for Ontario, it were about the same as the end of 2020, but more at Grey Fox and Stock West and less at four and what you call others or other than the first five zones.

Could you explain in the progress where the Ontario reserves the resources, excuse me, stayed the same And the documentation that Peter, Steve and the team need to do to classify reserves at 100% projects. And I'm assuming that the absence of much gross profit or net profit in current periods is not relevant because if you doubled Ontario production, the costs would fall and the results would improve if more, tons, grade, more zones, but correct me if that impression is wrong and then current results have an impact. I'm just trying to understand the reserve and resource accounts better.

Rob McEwen

Sure. I'll ask Peter and Steve to weigh in on that question.

Peter Mah

Steve, do you want to go first on re resource or I can lead out.

Steve McGibbon

Yeah, go ahead Peter.

Peter Mah

Okay. yeah. Thanks John. Lots of moving pieces there in Ontario. As I mentioned room, you know, remind a year and we kept drilling with mine X and, and added a year's resource, which really is in our mind plan. So it added to our mind planning inventory. So we, we stayed flat there on a resource reserve basis by mining a year out and by adding another year so very positive. We're and tried to do the same this year, maybe slightly less maybe 30,000 40,000 ounces targeted to add at, from Great Box and went up with some drilling around there. More focus was on stock west. And we came out with the made in resource of about 200,000 ounces and about a hundred and 85,000, if my memory's correct was in the mine plan which made the PA so although it might seem that some of the PA resources decrease they're there, they just need more drilling and, and what we've added in was what we believe were the more sure mind plan constrained ounces into the PA.

So that's why there's a bit of difference between PA mine planning and the financial models you see in there and the resource numbers and why we decided to raise some more flow through funds. They both unlock Great Box and room fuller. A full look hadn't been done I know, unintended in the past and so when we started putting mining shapes on that again, for the same reason, we thought some of the drilling or areas would require more drilling. So that might be part of the reason for some of the reductions you saw it fuller. That's really all I have there, Steve overview. Maybe,

Steve McGibbon

Maybe Peter, what I'll add to that for our 2022 plan, as I had mentioned we believe there's still an opportunity to increase further the resources that firm most notably from our drilling at the bottom of the deposit, also our near surface drilling at Stock West where we believe there's an opportunity to ultimately improve the payback period that was in the PPA and that would come by adding some additional ounces near surface approximate to the stock mine.

There's further delineation to be undertaken at Stock West over time and from an exploration standpoint, while it may not show up in resources this year, any success we have following up the 4.3 gram per ton intercept with 21 meters is going to certainly signal probably a meaningful increase in the reserve over time. A little further at depth and at San Jose, what I can at least best speak to now is the new property at San Jose proper that has veins on surface that is a very attractive bulk mineralization opportunity. And that's really the focus of a good portion of the exploration program there this year.

John Tumazos

Thank you, Steven and Peter, if I ask a little more. There's 235,000 measured indicated inferred ounces called others. And I think that might be Black Fox or Stock Central or Buffalo Anchorite or Davis and Tisdale. Do any of those four projects have resources? And could you tell us kind of which one is the biggest one in others?

Rob McEwen

Steve. Peter,

Steve McGibbon

Yeah, I'd say the biggest one in the other category would likely be Stock East which was around 95,000.

John Tumazos

The Stock East is broken out Steven.

Steve McGibbon

Oh, I'm sorry.

John Tumazos

It's approaching Stock Central.

Steve McGibbon

I'd have to go back and, and kind of do a tabulation on that, John. And certainly I could put that back to you.

Rob McEwen

In ancient times before Steven, before Peter, when Lexam VG gold stood alone or was brought into the McEwen mining, my recollection is that there are three deposits, Fuller, Davis and Tisdale and Buffalo Ankerite, were much larger resources. I'm assuming the drilling wasn't was too widely spaced in the current [indiscernible] and management just interpret the resources, smaller, pending more info drilling. Is that fair?

Rob McEwen

That'd be a fair state.

Steve McGibbon

Thank you very much. Thank you for putting up with all my questions.

Heiko Ihle, H.C. Wainwright

At that moment too, Can you guys -- can you guys hear me okay?

Thanks for taking my question for the second, right. And thanks for taking the first time too. Hey, Hey Rob do geo -- most of my questions been answered, but geopolitical rates are all over the news right now. I mean, obvious reason in, in your conversations with investors or potential business partners, do you feel you're getting enough credit for the geo politically state jurisdictions they have to have? I mean I'm thinking of Russian oil versus non Russian oil. I'm thinking about North American source uranium versus every other source of uranium. Do, do we, that he do enough credit for that? And if no, what can the analyst community and, and your Company do to maybe lead up to that?

Rob McEwen

I don't think political risk has come into the consideration for North of America -- for Canadian and American assets. There was questions and it remains about Mexico, but Mexico is a small, small part of our portfolio today. And Argentina has dominated the area of concern. I'd say about our asset.

With the recent development in Chile and Peru, in terms of the political leaning at the parties elected and the amount of Copper produced by those nations, there's been a decided shift to Argentina And it's looking better, but I think they have to do a better job of convincing investors. It's a good place.

But we have, Glennco talking about it and developing their mine. That's close to Los Zulu. You have for making a very large statement about working to develop the hydrogen green energy of Argentina. They're also exploring near us. You have London working to develop a copper mine and the same problem. So I think you need to see more of that and you're seeing some good copper drill holes that I'd say Argentina is better than the Congo, or Go ahead. Sorry.

Heiko Ihle

I, I said I would, so it's probably just about everybody else?

Rob McEwen

So I guess right now the political conflicts are just illustrating the short supply of metals in face of the demand profiles that are being constructed.

Heiko Ihle

But I guess I, I guess I -- I agree with every single word you said, but, but probably on just a little bit more, I mean, do you think that investors give you full? I mean, most fear assets are in places where you could walk alone and at night and, and be just fun. And do you think you get enough credit for them being in that state already in the marketplace? And if, no, how do you think we might be able to achieve this?

Rob McEwen

As I said, I don't think there's any concern about the location of our Canadian and American assets. There's more concern about the operation results coming out of them. And then Argentina, I think people -- Argentina should do a better job of grant and we should be doing a better job of just highlighting the types of capital investments moving into the country. But Argentina needs to be changing a few of the rules to make it look like an even more attractive time. So I would say the, Argentinian asset is receiving the largest discount.

Heiko Ihle

Got it. Okay. And then just a quick clarification in your entire model, what figure do you guys use for salary inflation for the remaining year? And, and I assume all of that is baked into the guys, correct?

Rob McEwen

Salary inflation across the board?

Heiko Ihle

Yes. Rob McEwen

Hmm. I'll have to ask Steven and Peter for that one

Steve McGibbon

Question. Great

Peter Mah

Consolidated.

Rob McEwen

It was, it was just about what inflation factor did we factor into compensation levels for this year?

Peter Mah

Yeah, I'm just. I think we were around in Nevada. And [indiscernible]do you have the, the exact numbers?

Unidentified Company Participant

Yes. Our U.S operation, we factor in 4.5% inflation rate and at current operations, we factor in 3.5% inflation rate.

Rob McEwen

Okay. Thank you, Heiko?

Heiko Ihle

Yeah, that was it on my end. Thank you all so much. And, and sorry about being muted there. Well not sure what happened.

Rob McEwen

Oh, you don't need to apologize. Thank you.

Hi Ronnie.

Unidentified Analyst

Hi, Rob. Rob. I've been a long-term shareholder and I watched the McEwen share price, five years ago in March. It was trading at $4 a share and gold was trade -- gold was trading at between $1,200 and $1,300 an ounce. Fast forward today. We're less than 90 cents -- 90 cents per share and gold is trading for $2,000 an ounce, which is very, very disappointing. I'd like for you to give some color on that.

And my, my next, my question is if you cannot improve your cash flow and profitability in the near future, would you be, would you be willing to sell the whole Company to a large or minor?

Rob McEwen

Oh, Well, depends. If you had a bid, you'd look at it, right?. I'd have to say we, we encountered some, some natural problems that were unanticipated and we experienced some Serious operational issues.

And I share your disappointment in a very large way. I think we have some interesting assets in particular, and it might sound different because you bought it as a precious metal Company, but we happen to have a very large copper resource that makes every other asset look very small right now.

And I don't think that's getting value, but as we've in the past two years, you've seen copper more than double and recently seen a lot of other commodities trying to do the same thing. And it has, it's very big size. So we're trying to bring the costs down. We're going along nicely. And then a couple of operational missteps, big missteps happened that shouldn't have, but that's water under the bridge right now. I pretty confident we're going to rebuild that, That it's testing everyone's patience.

Unidentified Analyst

Okay.

Rob McEwen

Yeah, I, to get copper going, I put in $40 million, my total investment in the Company is now $200 million. So, and trading at about half the value I paid. So not happy about that at all. And we're working to resolve that and we spoke about the cost. There's a bump in the first four order, but we're heading down and the margins will be increasing, Hopefully.

Unidentified Analyst

Yeah, I guess the share process, what really I'm looking at when a lot of the other minors they thought doubled tripled in the last four years and here we are 75% less in,

Rob McEwen

We went the wrong way.

Unidentified Analyst

Yep.

Rob McEwen

So well I think better times are coming. I see them, but It's been hard on everyone. I don't have anything further to add to that.

Unidentified Analyst

Thank you.

Bill Powers, a private investor

Yes. Hi, Ron. Thanks for taking my question here today. Just a quick question on I guess the cost going and forward what is going to be, is it the big drop into Q3 versus a slight uptick into Q4 or about a 20% uptick in 20 in Q4? What is kind of the surrounding factors for that?

Rob McEwen

Improved production at fruit in terms of number of ounces and getting through some of the a large waste removal at gold bar.

Unidentified Analyst

Okay. And how quickly could we see a decision? I know improved metals prices at at stock west. I know, or going forward there. I know you're there's, you're actively drilling. What is the, I, I guess, do you need another six months, another year? Could you give us some idea onwhat the timeframe's looking like on that front?

Rob McEwen

We're exploring and very encouraged by what's going on with stock mine. We put out our initial for a preliminary economic assessment and it projected a nine year life average production of 80,000 ounces a year, which would be about 60% higher than what we're projecting for this year. It, however, had a payback period that was not attractive, that this was a six years. I think we were using 1750 on it, or what a higher gold price, I assume, shorter period, but we're, we expect that the exploration work we're doing will expand the resource space and have a positive impact on the pay period.

Unidentified Analyst

So I mean, I guess the question is you have near surface material at stock and stock west as far as looking for ways to bring that forward. Is that something, I guess, how much more before I know it's been it's been up to two years before you would go forward with a decision on construction there. I guess, is there ways to do a, a smaller initial investment to get that would, those to me would seem to be pretty profitable ounces given the proximity to the, to the mill as well as not having a, a royalty on it?

Rob McEwen

Yes, that's true. That's true. Peter, would you like to give a little more flavor there?

Peter Mah

Yeah, absolutely. Yeah, we're very encouraged and a very astute to question. I think that's an exciting project. We have enough resources you see in the PEA to go after it now. What Robin and Steve have been talking about is drilling up higher in and around the old workings. And the host unit that stock left is, in the foot wall of stock main, the historical working.

So we're busy grilling around the old workings and around near around the new stock West ramp to try and find around a hundred thousand ounces in the upper part of the mind that we could easily access and, and, and start mining while we developed the ramp all the way down to stock west. So that's, that's the strategy. Drilling's been, been encouraging as, as Rob says, we're, very excited about that.

We've started of preparing the baseline work and the, and the work to submit a permit application. So if things work out in the drilling and on the back of that, we see that resulting in, in much less dilution of the shareholders. It's about a year to get down to the top of stock west and about a $10 -- $10 million estimate on the, on the cap to do that.

So it's, it's something we could do quickly and we're working on and hoping to bring something in the second half of this year for, for decision for maybe next steps and further advancement.

Unidentified Analyst

Okay. Now that's, that sounds, I mean, I that's I mean, with prices, I think your, your base case was 1650 at today plus or minus 2000 and a way to move that forward would be, I think very welcomed by pretty much all shareholders, just given it the impact it could have and in moving things forward.

I guess the other thing I I'm blasting is Mexico. I saw that you put out some, a little news on that. Is that something that is in the cards as far as selling or potentially developing at know there is fairly there's some options that involve relatively low initial capital. Is that something that you guys are looking actively looking at right now?

Peter Mah

Yep. We're -- Hi, Rob absolutely. We're looking at each of those strategic options. There are still some folks in the data room looking at purchasing the asset. We haven't remained idle ourselves on other options.

We've identified a low capital option for about $29 million for phase one. And Stephan and team have been coordinating with ASA on a potential gold loan option to finance and build phase one. The permitting has been advancing as you may all know the, the input tailing disposal permitted, but we've also been advancing the power permits per compressed natural gas.

So we have the team there. We have two potential mills that we could achieve that low CapEx cost board. We're working on getting locations for those mills and the, and the final detailed engineering designs and all the steps that go with that that would be something like a 12 to 18 month construction period from the time we take the decision hit the go button.

So the, at the price of gold at, at these levels, you look at the robust upside case, if you will, in the feasibility, it's quite attractive. I think payback at, at, around the 1900 gold reduced to just around a year on the $29 million. So it's looking to be a really good and, and averaging 30,000 ounces of gold for the first six or seven years at a, at a cost of 7,000 bucks. So it could be a really gas generator for essentially [indiscernible] mining or, or an employer?

Unidentified Analyst

No, I, and I mean, especially if it can be done partially through a debt financing, I mean, that's a that sounds like you've put some more work on that. I mean, certainly that's a would imagine very attractive with the payback of a year. So anyway, I hope P keep us updated on all of that. And anyway, thank you for all your time today.

Mark Ellot

Thank you. Hi, Rob. We spoke a few months ago, believe or not about the Copper IPO, but quick question. Since I work for international data corporation our job is to really put names out there. And I think with your Company, do you have any ideas or plan to get more analysts or coverage on wall street? Because I think that would help with your visibility quite a bit?

Rob McEwen

Yes. Well we wanted to move the copper project forward to a degree and then communicate with the street COVID was restricting that at first, but no, that's in the plan you had ways to do that effectively?

Unidentified Analyst

Yes, we do, but that's a whole another conversation. I just wanted to see if you had plan, because I don't think a lot of big banks or Wall Street or there's not enough coverage. And I know that the future is bright with your Company. So that was my purpose of the question.

Rob McEwen

Well, there, there was some work. We were, we're working to update the preliminary economic assessment that was done in 2017 and included in that would be some of, some of the results coming from the optimization and work that's being done by Australian Company called Whittle consulting.

And they're envisioning through all the simulations they've done What appears would be larger and more profitable than what the PEA suggested. So we, we want to fine tune that and granted it's a, it's a preliminary economic assessment, but it, It shows that working at a $3 copper price, you can improve the economic by considerable degree in when you, if you were to plug in today price,

Unidentified Analyst

It's

Rob McEwen

A very attractive

Unidentified Analyst

Definitely. That's all I have. Thank you so much.

Rob McEwen

You're welcome, Mark. Thank you.

Jeffrey, a shareholder

Hey I like your thoughts since the announcement of McEwen Copper, we've talked about this that was I believe July 6th, 2021, the price of McEwenmineand may was a $35. And since that announcement has gone down a black diamond slope To the price we see today I'd like your thoughts on why the market And investors have given that a thumb down.

And Secondly, you've created the McEwen Copper and you said have stayed in the past to show the value of between mining. Why not why not sell your golden silver properties? Cause they they're just not, it seems like they're hemorrhaging money and just go full forced into the McEwen Copper and. Also You give an update on the CFO's condition And finally, what would be the de delisting date from the new, the New York stock exchange? I know those were like three questions at you, but you anyway Sure. Give some sure. Yeah?

Rob McEwen

Yeah. Well, let's start with the CFO. She had a stroke in December mid-December that led to a brain aneurysm and some brain surgery. She's been recovering well and expects to report back to work next week. Okay. You be on a, on a part-time basis.

Okay. And we're all ha very happy about that. We learned that when they went into the operating, when she went into the operating theater, the doctors gave her a 30% chance of living. So it was very sudden and very sad and but were delighted to see her recovering. She was an athletic individual and that contributed to that recovery.

So as a retired anesthesiologist, that's great to hear my question was just because anytime the, when the market or when the Company reports CFO leaving or whatever, temporary leave that always gives investors a sensible alarm. But anyway, that's good news.

With respect to selling gold, I mean, are our other assets and just concentrating on the copper if you were to look at the potential of the assets that we hold, certainly today, it would appear that the largest potential return and the longest life asset would be Los Azules. And that's never escaped me. It's always been one of my favorite assets in our portfolio because of its size and its economic power once developed.

What was important though, there were, we did a PEA some time ago and a number of majors looked at it and there were some, they said, well, there are a couple of things that we would've liked to have seen you done before to convince this, that this is a great deposit. And so they were looking at us and saying our finances were weak. We had this big deposit, let's put some low ball in there and see what we can get it.

Since then proper price has gone from $2 to now better than four and a half. And we look at well, could we finance it by just financing the McEwen mining? And I'm really not happy with the number of shares we have outstanding in McEwen mining. And John Tumazos was saying, well, let's, let's buy some back. But we didn't have the financial strength to advance our gold and silver assets at the same time as advancing the copper. So I know some people have wondered, well, why didn't I just put the $40 million into McEwen and right.

And, and you look at it and say, we're going to have to issue a ton of shares. So I thought if we could advance and I didn't want you a ton of shares in McEwen. I said, alright, if investors prefer a pure play over an [indiscernible] gold copper built let's create a separate Company and that we can get should create value.

Once we get it fully financed for a McEwen mining and it retains a large interest, it retains a royalty The suggests a 36 year life and copper 50% high and what it was, but the project was all remote.

Unidentified Analyst

Hey, Rob can with, with Moses joys from the day from day one, I guess, how were you going to develop that originally your plan before you, went into the Smith McEwen copper.

Rob McEwen

Oh,

Unidentified Analyst

You follow me on that? I mean, what,

Rob McEwen

Yeah, yes, yeah, no, it's a good question. I looked at it at first, I thought, okay, we're supposed to have gold bar and it was going to be up and running. We had a positive cash flow, surplus cash flow that it would allow us to develop.

Unidentified Analyst

Okay.

Rob McEwen

Gold bar flew into a wall, right. And we had to scramble for the last two, the years to try to repair the damage of a wrong geological model that sucked enormous amounts of cash out of our system.

So, and okay. I took on debt, believing in the projections on gold bar and said, well, I'd rather have debt and we can repay it. But in hindsight, it would've been better to do equity and not have that amount of debt on. And it's not a lot of debt, but it's, it's certainly weighing heavily on the Company right now,

Unidentified Analyst

Rob. So on those projections who made those projections with Gold Bar way off as apparently

Rob McEwen

We used this from a firm recognized geologic consultant SRK[ph] and they looked at our resources, came up with a geological interpretation,

Unidentified Analyst

Okay.

Rob McEwen