|

|

Post by Entendance on Aug 11, 2022 6:02:13 GMT -5

McEwen Mining: Q2 2022 Results

August 11, 2022

TORONTO, Aug. 11, 2022 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today reported its second quarter (Q2) results for the period ended June 30th, 2022.

Fox Complex performed well, producing 11,200 GEOs, the highest quarterly production in over three years, at cash costs of $985 per GEO and AISC of $1,290 per GEO.

Average cash costs(2) per GEO sold from our 100%-owned mines in Q2 was $1,169, 15% below our guidance midpoint of $1,380 per GEO. Average all-in sustaining costs ("AISC")(2) per GEO sold from our 100%-owned mines was $1,549, 11% below our guidance midpoint of $1,740 per GEO.

Production was 27,600 gold ounces and 704,600 silver ounces, or 36,100 gold equivalent ounces(1) (GEOs)(see Table 1), compared to 40,700 GEOs during Q2 2021.

San José mine delivered solid results producing 19,600 GEOs at cash costs and AISC per GEO sold of $1,144 and $1,468, respectively.

Gold Bar mine progressed the development of the Gold Bar South deposit, which is expected to contribute to lower-cost production later this year and through 2023.

Our consolidated net loss in Q2 was $12.4 million, or $0.26 per share (giving effect to the 1-for-10 reverse share split on July 28th), which relates primarily to $14.4 million investment in our Los Azules copper project, $4.8 million in other exploration and advanced projects, and a gross profit of $4.2 million from our operations.

Our 100%-owned mines generated a cash gross profit(2) of $7.7 million in Q2 and a gross profit of $4.2 million. Cash gross profit is calculated by adding back depletion and depreciation to gross profit.

Cash and cash equivalents at June 30th, 2022, totaled $47.8 million.

We are saddened to announce that Dr. Donald R. M. Quick, a Director of the Company and its predecessors since 2008, passed away in July following a brief illness. Dr. Quick made important contributions to the boards of McEwen Mining and Minera Andes during his 14 years with the companies. Among his many qualities, he was a great friend and colleague, and will be dearly missed.

A webcast will be held on Thursday, Aug 11th at 11:00 am EDT. Please see the details further below.

Operations Update

Fox Complex, Canada (100% interest)

Fox produced 11,200 GEOs in Q2 at total cash costs and AISC of $985 and $1,290 per GEO sold, respectively. This compares to 7,100 GEOs at total cash costs and AISC of $917 and $1,088 per GEO sold, respectively, in Q2 2021.

Fox achieved the highest quarterly production since Q3 2018 of 11,200 GEOs, as the mine rebounded from a slow start to 2022, resulting from mechanical issues at the mill and a COVID-related labour shortage. Fox production benefitted from the large stockpile accumulated during Q1 and increased during Q2, and the effects of the ongoing mill debottlenecking process. Mill throughput is expected to continue to improve during the remainder of the year resulting in strong H2 production. Drilling below the mineral resources envelop at Froome has been successful and is expected to extend the mine life.

In Q2, we incurred $2.6 million for exploration. Our exploration spend at Fox for 2022 & 2023 is forecasted to be $10.0 million and $15.0 million, respectively. During the remainder of 2022, exploration will complete up to 39,000 m (128,000 ft) of drilling and will focus on:

Continuing delineation and expansion of the Stock West deposit, particularly toward the West;

Expansion of shallow mineralization identified near the Stock Mine;

Test areas of high grade from 2021 drilling at the Gibson and Whiskey Jack targets at Grey Fox to potentially expand the resource;

Follow up on deeper priority targets at the Stock property, where attractive results from initial drilling show significant potential.

The objective of all our work is to continue to improve upon the Preliminary Economic Assessment (PEA) for the Fox Complex (see news release dated January 26, 2022). The PEA presents estimates for a positive business case for the Fox Complex expansion project, with potential average gold production of 80,800 gold ounces per year over nine (9) years, after the depletion of Froome. The economic analysis estimates an after-tax IRR of 21% at a gold price of $1,650 per ounce and average cash costs and AISC per ounce of gold sold of $769 and $1,246, respectively. Ongoing exploration is designed to reduce the funding requirements and improve the payback period by delineating additional resources in strategic locations to facilitate a greater degree of internal funding.

Recent encouraging drill results at the Stock Property that may support improvement to the PEA include:

• 5.47 g/t Au over 7.7 m true width (TW) (Hole SM22-070)

• 6.62 g/t Au over 8.3 m TW (Hole SM22-090)

• 5.62 g/t Au over 11.4 m TW (Hole SM22-089)

Holes SM22-070 and SM22-090 intercepted shallower footwall green carbonate mineralization between 250 m to 300 m (800 to 1,000 ft) below the surface. Hole SM22-089 intersected mineralization 457 m (1,500 ft) below surface in the separate footwall grey carbonate host unit.

Gold Bar Mine, USA (100% interest)

Gold Bar produced 5,100 GEOs in Q2 at total cash costs and AISC of $1,562 and $2,108 per GEO sold, respectively. This compares to 14,100 GEOs at total cash costs and AISC of $1,463 and $1,619 per GEO sold, respectively, in Q2 2021.

Gold production continued to be below expectations due to the presence of carbonaceous material that is being treated as waste and lower contract mining rates resulting from a staffing shortage. During the quarter, 505,000 tonnes of mineralized material was mined but only 171,000 tonnes was processed, compared to 646,000 tonnes mined and 727,000 tonnes processed during the same period of 2021. However, heap leach recovery rates are outperforming our model, resulting in a potential increase in the leach pad inventory and assumed gold recovery. Drilling conducted at the Central Zone of the Pick deposit, designed to evaluate the presence of carbonaceous material, has encountered significantly less carbon; further metallurgical testing is underway.

On April 1st, 2022, we received regulatory approval to amend the plan of operations to include the Gold Bar South (GBS) deposit. We are planning to start construction of the access road in Q3, and GBS is expected to contribute to production in Q4. GBS has positive attributes compared to the current mining areas, such as a much lower waste tripping ratio, oxide mineralization with no carbonaceous material, and a higher average gold grade partially offset by lower heap leach recovery. Most of the ore mined in 2023 is expected to be sourced from GBS.

In Q2, we spent $1.2 million for exploration and conducted some 3,660 m (12,000 ft) of drilling, with a focus on drilling around the Pick and Atlas pits. At Pick, drilling targeted in-fill of the Phase 2 pit to improve the confidence in non-carbonaceous oxide mineralization. In addition, drilling targeted extensions of mineralization at the North pit wall along the controlling faults. At Atlas, drilling included a sonic program to evaluate mineral potential within the historic Atlas waste dump and targeted three attractive areas around the historic open pit. San José Mine, Argentina (49% interest)

San José attributable production for Q2 was 11,100 gold ounces and 704,600 silver ounces, for a total of 19,600 GEOs. Total cash costs and AISC for the quarter were $1,144 and $1,468 per GEO sold, respectively. This compares to 18,200 GEOs at total cash costs and AISC of $1,105 and $1,500 per GEO sold, respectively, in Q2 2021.

San José production recovered from COVID-19-related issues experienced in Q1. Despite the slow start to the year, the San José mine is expected to meet production guidance of 69,500 to 77,500 GEOs (49%).

In Q2, 3,600 m (11,800 ft) of exploration drilling were completed around the mine area (Agostina and Ayelen SE veins), and 700 m (2,300 ft) were completed at the Ciclon project. Drilling highlights include 7.5 g/t gold and 84 g/t silver over 4.1 m (hole SJD-2468) and 6.9 g/t gold and 648 g/t silver over 1.5 m (hole SJM-594). An additional 2,000 m (6,600 ft) of exploration drilling is planned in Q3.

McEwen Copper (76% interest)

The Los Azules project, located in San Juan, Argentina, is one of the world's largest undeveloped open-pit copper porphyry deposits. Surface drilling at Los Azules concluded in late May, with some 13,500 m (44,300 ft) completed to date in 2022. Three primary objectives of the program include:

Improve confidence in the resource by converting Inferred mineral resources to the Indicated category;

Accelerate project advancement with metallurgical, hydrological and geotechnical drilling and

Test the limits of the depth extension of the higher-grade mineralization.

Results from this drilling program will be used to update the 2017 Preliminary Economic Assessment (PEA). In the PEA, estimated Indicated and Inferred mineral resources were 10.2 and 19.3 billion lbs. of copper, respectively. Extensive enterprise optimization work is underway on potential larger scale, lower cost and lower carbon footprint alternatives. The updated study is planned to be released in Q1 2023.

Future drilling will evaluate the potential to expand the deposit at depth. While the median depth of drill holes within the Los Azules resource database is 175 m (575 ft), it is not uncommon for porphyry copper mineralization to extend well beyond 1,000 m (3,280 ft) of depth. Numerous drill holes at Los Azules have encountered strong copper grades below the 2017 PEA pit bottom, with all three holes drilled to a depth of over one kilometer ending in copper mineralization.

McEwen Copper spent $14.4 million in Q2 to advance the Los Azules project. On June 21st, 2022, McEwen Copper announced the closing of the second tranche of a private placement offering comprised of a $10 million investment by the Victor Smorgon Group advised by Arete Capital Partners, both of Australia, and $5 million from other investors, for total gross proceeds of $15.0 million. The amount raised in the first and second tranches of the private placement now stands at $55.0 million.

McEwen Copper has built an experienced management team in Argentina to advance to a feasibility level of technical study after completion of the updated preliminary economic assessment. Planning is underway for the next drilling season that will start in Q4 2022.

NYSE Listing

On July 28th a 1-for-10 reverse split of the Company’s common stock became effective on the NYSE and TSX exchanges. As a result, the Company has regained compliance with the NYSE’s continued listing standards.

Table 1 here provides production and cost results for Q2 & H1 2022 with comparative results for Q2 & H1 2021 and our guidance range for 2022.

Conference Call and Webcast

Management will discuss our Q2 financial results and project developments and follow with a question-and-answer session. Questions can be asked directly by participants over the phone during the webcast.

Thursday

August 11 th , 2022 at 11:00 am EDT

Webcast URL: HERE Call into the conference over the phone Please register here Participants who cannot access the internet can dial-in using the numbers below:

Participant Toll-Free Dial-In Number: 1 (888) 330-2398

Participant Toll Dial-In Number: 1 (240) 789-2709

Conference ID: 67121

The webcast will be archived on McEwen Mining's website at www.mcewenmining.com/media following the call.

|

|

|

|

Post by Entendance on Aug 13, 2022 5:11:45 GMT -5

Company Participants

Rob McEwen – Chairman and Chief Owner

Perry Ing – Chief Financial Officer

William Shaver – Chief Operating Officer

Stephen McGibbon – Executive Vice President-Exploration

Michael Meding – Vice President, McEwen Copper and General Manager

Conference Call Participants

Jacob Sekelsky – Alliance Global Partners

May, for Heiko Ihle – H.C. Wainwright

Mark Ehlert – LendUS

Rob McEwen

Thank you, operator. Good morning, ladies and gentlemen, and welcome – the first quarter of this year was a lot weaker than our second quarter. Second quarter was much stronger. We had higher production and lower cost per ounce. The drivers of this improvement were our Fox Complex that delivered its best performance since 2018 and the San Jose mine, which bounced back sharply, delivering in Q2, what it should have done in Q1.

Looking ahead, we expect Gold Bar South to be in production in the fourth quarter of this year, and it will be delivering more ounces, and lowering Gold Bar’s cost per ounce. Exploration at the Fox Complex has been successful, building the gold resources at Stock, and should result in a significant reduction in the payback period from its current six years towards our goal of less than three years for the FOX, PEA, which we published in January of this year.

The PEA, I’d like to stress, outlines a longer mine life extending into the mid-2030s, and a higher average annual production of 80,000 ounces, which is almost twice this year’s guidance for production at Fox Complex.

Progress at McEwen Copper’s Los Azules project has been substantial. During the year, a strong management team with extensive experience operating in Argentina has been assembled. Drilling, there has improved our knowledge of the deposit and will result in a big conversion of inferred resources into the indicated category. Multiple simulations have been conducted to optimize the mine planning. These results and other results will be included in the updated Los Azules PEA that will be released early next year.

I also want to stress what we believed was very important to preserve, and that was our listing on the New York Stock Exchange, and that led to a 10-for-1 consolidation. I say the importance of maintaining it because 90% of our trading volume occurs on that exchange.

Now I’d like to ask Perry to present our financials.

Perry Ing

Thanks, Rob. Good morning, everyone. It’s a pleasure to be back at the McEwen Mining as CFO after several years away, and having the opportunity to rejoin a strong management team. Having joined halfway through the second quarter, I do observe that, obviously, the company experienced significant operating challenges during the first quarter as well as various other times during the COVID pandemic. But I do believe the company is now well positioned from a financial, operating and leadership perspective for success in the second half of the year and into the future.

Looking at our results, I don’t intend to read out a lot of numbers, but I’ll just touch on our GAAP earnings. So starting with that, on a GAAP basis, we reported a consolidated net loss for the quarter of $12.4 million or $0.26 a share. That includes $19.2 million invested in exploration and advanced projects, of which $14.4 million relates to the Los Azules copper project. If you look at just our operating assets, we actually generated $4.2 million in positive gross profit from our operations.

As Rob mentioned, we completed a share consolidation just recently, in July, and our results on a per share basis for the second quarter are retroactively reflects that 10-for-1 consolidation.

Looking now at our gold – at our production for the quarter. Production improved significantly compared to the first quarter. Production was 27,600 ounces of gold and 704,600 ounces of silver for a total of 36,100 gold equivalent ounces. So this represents an increase of approximately 44% from the first quarter as we experienced COVID-related labor shortages at both the Fox Complex and San Jose mine during the first quarter.

The improved throughput in the second quarter is reflected in our cash cost and all-in sustaining costs for the quarter, which were $1,169 and $1,549 per ounce, which were 15% and 11% below the midpoint of our annual guidance for the year. As Rob noted, the highlight was strong production from the Fox Complex of 11,200 gold equivalent ounces.

Production was also very strong at the San Jose mine, which produced 19,600 ounces. The only disappointing result was from the Gold Bar mine, which produced 5,100 gold equivalent ounces for the quarter due to the continued presence of carbonaceous at ore. But as Rob noted, we have a plan in place to accelerate mining from the Gold Bar South project, and we believe we’ll show positive benefits from that by the fourth quarter. I’ll leave further discussion on this topic to Bill Shaver.

And finally, looking at our treasury. Our cash and equivalent balance stood at $44 million, and including restricted cash at $48 million at June 30. This is down just over $10 million from the beginning of the year. But I’ll note that our accounts payable and accrued liabilities balance decreased by approximately $14 million since the beginning of the year.

From a capital market standpoint, our primary activity during the quarter was the completion of a $15 million private placement by our McEwen Copper subsidiary in late June. So now McEwen Copper has raised $55 million of the intended $80 million first tranche financing. Following this transaction, McEwen Mining’s ownership of Los Azules is now – now stands at 76%.

So with that, I’ll now turn the call over to Bill for a review of operations.

William Shaver

Thank you very much, Perry, and good morning. I am also happy to have been called upon to join the McEwen management team as COO. I’ve been here about three months, and in that time, have visited all of our operations, including Mexico and Argentina, and have been to each of the operating entities several times. We are happy to report that Q2 has been a safe quarter with 1 minor medical aid involving a diamond driller who had a cut to his hand that required some stitches. I might just comment in my visits around to the various sites. I’m reasonably happy with state of our environmental, social and reclamation matters as well as our safety programs.

At the Fox Complex, we had a relatively good quarter, producing 11,200 gold equivalent ounces of record, apparently for the best quarter in three years. The cost per ton and per ounce were in line with budgets and expectations, and the mine was significantly ahead of schedule and tons of ore produced and most of the other measures for development, production drilling and backfilling.

Exploration is also confirming lower extension of the ore at the Froome deposit, which will extend the mine life into late 2024 and/or early 2025. We are also fully engaged in debottlenecking the process plant, which we hope will improve no throughput, improve reliability and reduce unanticipated downtime. To that end, we’ve installed a new screen tower in the month of July, and have purchased a rebuilt cone crusher to improve reliability in this portion of the plant.

The screen will direct the pine ore that is already the right size directly to the ball mill, thereby passing the cone crusher and improving the performance of the cone crusher and allowing more time for maintenance of this part of the plant. At the same time, we’re improving maintenance capability of the plant personnel. All of these things will increase the mill throughput, which will result in more gold production at a lower cost as we move forward.

At Gold Bar, we had a tough quarter due to the carbonaceous ore that Perry mentioned. This was encountered in the pit. This ore, which is preg-robbing, cannot be placed on the leach pad as it attracts and keeps gold captured in this material. This impacted our productions and costs for the quarter. We were able to mitigate this situation to some extent by pivoting to other ore sources.

We did carry out a 10-hole drilling program on an very intense basis to try to quantify the carbonaceous material, and we now have the results of that study. And we feel we have the situation under control in terms of understanding where we cannot mine. And we see – but we do see the impact of this continuing into Q3 in terms of our production.

Part of our strategy is to move ahead more quickly on the Gold Bar South project. To that end, we have all of the permits now in hand, and we’ll be starting the access road and site development this month. This will allow us to have ore production from Gold Bar South in Q4. And – as you may know, the grade at Gold Bar South is generally a little bit better. And of course, the ore is very clean of deleterious elements.

The stripping ratio at Gold Bar South will be lower and the ore haul is shorter, although the recovery may be lower long-term. And we plan to mine as much ore from Gold Bar South in Q4, and continue mining into 2023. And the plan is to concentrate on the best grades possible in Q4 and into 2023.

In Mexico, we have completed the leaching as planned in the month of July. And I would say I’m happy to say that we’re carrying on with the remediation plan for the waste dumps and other parts of the site. And this work is going well and looks very, very good.

We also have come up with a different approach to the processing of the leach pad material with a traditional mill in a manner which will reduce the CapEx significantly, and basically make that a project that we should be able to finance from a mixture of some of our present financing, a little bit better production from some of our operations. And this will – we’re in the midst of completing a study on this, and we anticipate that this might start in 2022 – 2023, rather.

So in summary, I’m relatively happy with our progress to date. We have a good dedicated group of people working hard to do a little bit better. We have some critical personnel holes that we need to fill, and there’s some more process driven discipline that we need in the organization, but we’re in the midst of putting that into place.

So with that, I’ll thank you very much. And now I’ll turn it over to Steve for some exciting exploration results, both in Timmins and at Los Azules. Thank you.

Stephen McGibbon

Thank you, Bill, and good morning, everyone. Our Q2 exploration investments in Ontario and Nevada totaled $3.8 million, and they’re generating exciting results and positioning us for a strong second half of the year. The goal at each is to extend the life of our mines and grow our mineral resource base. Firstly, at the Fox Complex near Timmins. True underground drilling has continued to produce positive exploration results, as Bill alluded to, and these are extending mineralization to depth. Recently, hole 225-L041-118, around 5.2 grams per tonne gold over 8.6 meters at 100 meters below the mine’s access ramp. We are drilling and delineating to depth with 2 drills at the 20 to 25 level in the mine.

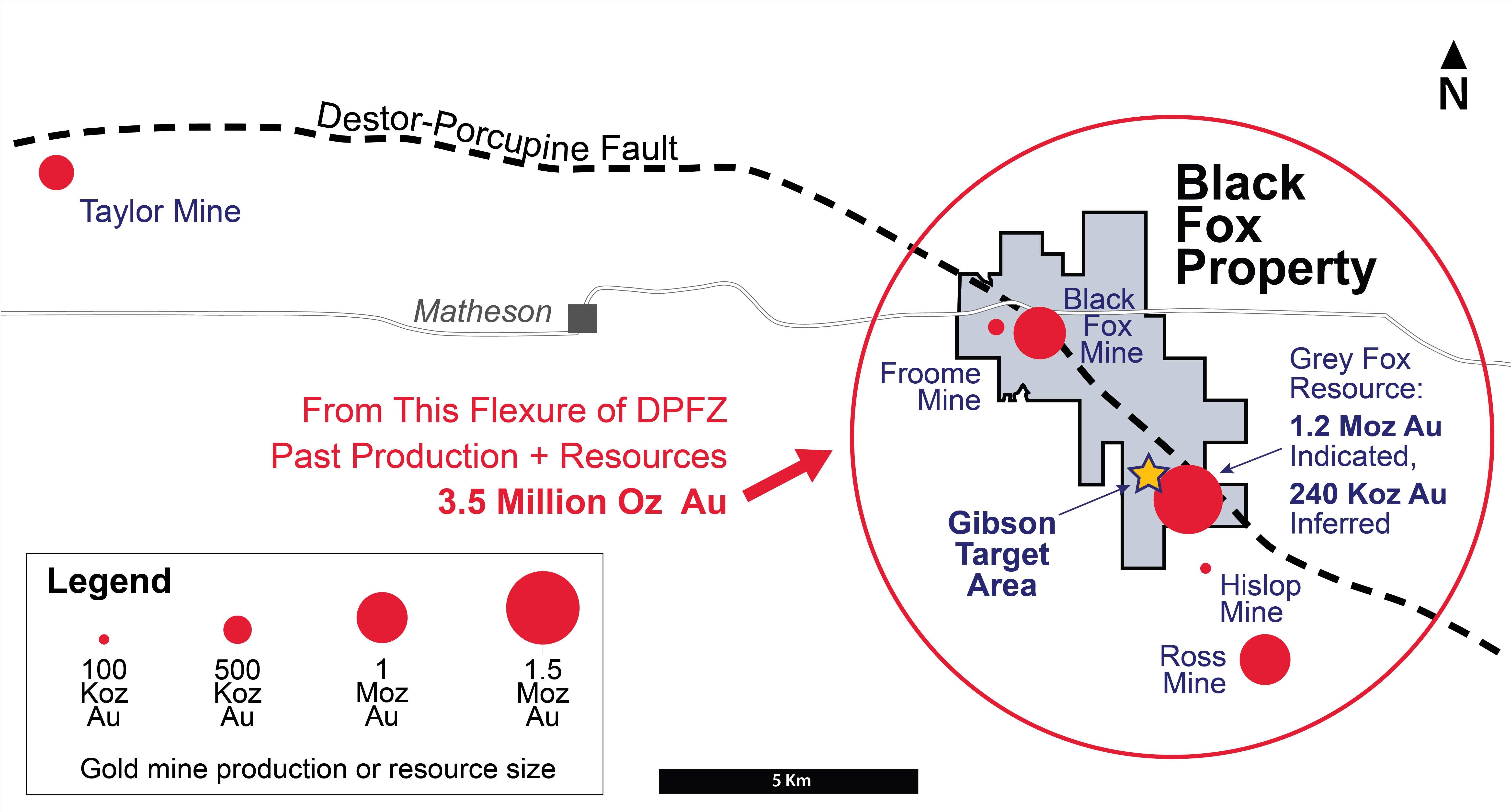

On surface, our stock property covers 8 kilometers or 5 miles of the Destor-Porcupine Fault Zone, and includes 3 gold deposits that occur within a 3-kilometer or 2-mile length that are open for expansion. In 2022, we have four key target areas near our stock property mill with excellent potential to materially grow mineral resources based on poorly tested vertical and lateral trends.

During Q2, we continued drilling mineralization proximal to the past producing stock mine with a view that a successful campaign could shorten the payback period in the Fox PEA delivered earlier this year. We have confirmed multiple areas with attractive initial results that can be expanded with additional drilling from surface or in time from underground.

Recently, our success included identifying a deeper mineralized body close to the Destor-Porcupine Fault Zone. Today, we reported on encouraging drill results at the Stock property hosted in our green carbonate or host that may support improvement to the PEA.

These results included two holes, 5.47 grams per tonne over 7.7 meters true width, and 6.62 grams per tonne gold over 8.3 meters true width. These holes intercept mineralization at about 500 meters below surface. We have a third hole, pending results, that includes visible gold noticed while core logging. We anticipate reporting on these and other exploration results from Fox in a press release in the very near future.

At Gold Bar, Q2 result activities focused on several areas in the mine on the Pick extensions to the north and infill of the Pick Phase 2 pit. At the Atlas pit, our highest grade past-producing open pit located 3 miles west of the Gold Bar mine, drilling got underway on three target areas proximal to the historic pit, including following up on hole OGB-010 drilled in 2021 that intersected 3.1 grams per tonne gold over 27 meters or about 90 feet at the East Atlas target. That drilling has been just completed, and we hope to be reporting on results in the near future as on.

At San Jose, in Argentina, 3,600 meters of drilling were completed on the mine site exploration program and a further 700 meters of drilling at the Ciclon Este project located about 70 kilometers south of San Jose. Mine site drilling result highlights include 7.5 tonnes or – grams per tonne gold and 84 grams per tonne silver over 4.1 meters, and 6.9 grams per tonne gold and 648 grams per tonne silver over 1.5 meters.

An additional 2,000 meters, or 6,600 feet of exploration drilling is planned in Q3. The San Jose property surrounds Newmont’s Cerro Negro mine and is host to high-grade epithermal gold and silver deposits.

Finally, at Los Azules, our exploration program completed about 13,500 meters or more than 44,000 feet of drilling prior to the close of the field season in late May. All assay results from the exploration holes have been returned and are being included in the PEA update slated for early 2023.

This drilling is confirming mineralization of historic intercepts using the 2017 PEA mineral resource estimate. Recently, return to assays include hole AZ22-158, which intersected 222 meters of 0.95% copper, including an interval comprising 44 meters of 1.38% copper in the supergene-enriched zone.

Importantly, we believe we are meeting one of our primary goals of converting previous inferred mineral resources to indicated resources and thus improving our confidence in the ore body. Our drilling often extended to depth well below the 2017 PEA pit with mineralization that continued to the bottom of the completed holes, giving us more confidence that there is plenty of room for the resource to grow much more.

I will now turn the presentation over to Michael, who will tell you more about our developments at Los Azules.

Michael Meding

Thank you, Steve. The Los Azules project located in San Juan, Argentina is one of the world’s largest undeveloped open pit copper porphyry deposits. According to Mining Intelligence, we are a top 10 by resource. If you look at it, we are top five by resource not owned by a major. As Steve mentioned, we completed some 13.5 kilometers surface drilling with good results, as we have published in our latest press releases.

Three primary objectives of the past and upcoming drilling program includes: to improve confidence in the resource by converting Inferred mineral resources to the Indicated measures category, accelerate project advancement with metallurgical, hydrological and geotechnical drilling, and to test the limits of the depth extension of the higher-grade mineralization.

Results from this drill program will be used to update the 2017 preliminary economic assessment in which estimated indicated Inferred mineral results were 10.2 billion and 19.3 billion pounds of copper, respectively. The update of PEA study, as Steve mentioned, is planned to be released in the beginning of 2023.

We have built a strong management team in Argentina, as already mentioned by Rob, that will support us going from the updated PEA into the preparation of a definitive feasibility study and demonstrates our confidence in the accelerated development of this project. As shown in our annual meeting presentation, we have seen significant mineralization below the prior pit outline and in our deeper vertical holes.

Our existing geophysical work indicates promising targets to the Southwest and the Northeast of our main mineralization that we aim to test further in our upcoming drilling program, combined with infill resource drilling.

There our aim is to convert resource to the measured category for the first five years of future production, and we are executing additional metallurgical testing to analyze the option of an initial long-life heap leach operation, which could significantly lower the required CapEx, logistics costs and environmental footprint, and should provide an attractive business case.

We have brought together a world-class team, including seminal engineering, Bechtel, Stantec and most recently [indiscernible] to support the definition and development board for the PEA update. Work towards the development of the PEA basis has begun with the initiation of metallurgical testing program leveraging prior work and the completion of the geo metallurgical model to ensure a comprehensive understanding of the deposits.

Extensive enterprise optimization work with middle consulting from Australia is underway on a potential, larger scale, lower cost and lower carbon footprint alternatives. Based on the new information from the completed drilling and geological logging, resource and geological modeling upgrades are being refined for the inclusion in the PEA.

McLane Design, a renowned architectural design from the green architectural space, has also been working to assist in incorporating regenerative and sustainable design concepts already into the PEA at this point in time. As reported, Los Azules is now accessible during most of the year via two access roads, which will make further development safer and more cost effective.

We have successfully used the Southern Access Road at the end of last season, and leveraged shared resource together with Altar from Aldebaran Resources and Glencore, El Pachón, which are neighboring projects. The company is currently preparing for the upcoming drilling season beginning of Q4 this year. Our road crew is already improving access to the project size for an early start.

I will now turn back the presentation to Rob. Thank you.

Rob McEwen

Thank you, Michael. I trust you will agree that our operating performance represents a big improvement over our past. In addition to our improving precious metal operations, you’ve heard from Michael is that there’s a lot of activity at Los Azules and McEwen Copper. And I’d just like to go over some numbers with you and illustrate why we believe that Los Azules represents a very large asset for us, and will play a big role in the future value of the company.

So what’s Los Azules works? Well, one comparison could be with a project, a copper project in the same province in Argentina that sold earlier this year for $485 million. It’s called Los Azules – Josemaria. Josemaria is located at a higher altitude than us that are 900 meters higher. So they’re into an area that has potential problems with glaciers. The resource base of Los Azules is over twice the size of Josemaria.

Los Azules’ copper grade is significantly higher than Josemaria’s. The projected CapEx of Los Azules is lower, and the NPV higher. Los Azules is closer to infrastructure such as highways and power grid. And according to Goldman Sachs, based on 2018 numbers, Los Azules was in the lowest cost quartile of the industry for undeveloped copper projects, and Josemaria was in the highest cost quartile.

So I thought I’d look at it and say, well, if we were to look at that $485 million and say – discounted by 50%, and say that’s the value of it for McEwen Mining. And that would be – McEwen Mining owns 76% of McEwen copper right now. That – at a 50% discount of the $485 million, that would work out to a per share value of $3.88 a share.

If you said, well, it’s not 50% discount, maybe it’s the same price. Los Azules is worth $485 million. Then there is a $7.78 value per share behind every share of McEwen Mining. And then if you said, well, it’s more than twice the size. It’s higher grade, it’s closer to infrastructure, and you get a 50% premium, then you have better than $11.60 a share value behind every share McEwen Mining for that 76% interest.

So when you’re looking at McEwen Mining, we have exposure to two of the critical metals for the future. We have gold, which is the ultimate form of money. And we have copper, which is the metal of electrification of clean energy going forward. So what you get is 100,000 to 150,000 ounces of gold at an improving cost, plus 76% interest in one of the world’s largest undeveloped copper projects.

And right now, we are trading well below the value of Los Azules contained in our company. I’m quite optimistic that we’re going to see improving results for our operations, and the advancement of Los Azules is quite exciting in terms of building value for all of us shareholders.

I’d now like to open the session up to question and answers.

And before you get any questions online, I have a number of them that have come in ahead of this call. So there’s – the first question comes from Angie’s and Christian [indiscernible] of Oregon. They say, we are long-time shareholders who want to know when you will declare regular dividends again with the investment in new mines behind us? What is the plan for sustained growing income that supports a dividend.

I’m a big believer in dividends. And when we are in Goldcorp, we got to a point we are paying monthly dividends. We’re not at that point, yet. I think we’re a considerable distance from that, but we’re building our assets to get to that point in the future.

The second question from Gillian Tessier. What is management planning to do in order to stop the slide in the stock? Well, I think we have better results this quarter, and we’re going to see continued improvements in our operations and continued growth in our copper and that should translate into an improving share price.

John from British Columbia. Will the company need to do any financing for the remainder of 2022? I’ll ask Perry to jump in?

Perry Ing

Sure, Rob. I think from the treasury side, I think on McEwen Mining, we’ve stabilized the balance sheet. So we don’t foresee any need for McEwen Mining to raise equity during the remainder of 2022. Obviously, for McEwen copper, it’s now completed a $55 million of the intended $80 million first tranche financing to advance the Los Azules copper project. So there’s a potential to execute that before the IPO. But other than that, no plans to raise financing.

Rob McEwen

And another question for Perry. This is from Steve Ellis. What are the current projections on when the company will make a profit?

Perry Ing

That’s a good question, Rob. Obviously, as McEwen Mining, the U.S. GAAP reporting company, we expense exploration. So as long as we’re consolidating the results of Los Azules and continuing to spend lots of money advancing the project. Those will always be deducted from the company’s actual profitable operations. So it’s really a bit of an accounting exercise, but I’ll say that the company’s operations as demonstrated this quarter were quite profitable.

Rob McEwen

Thank you, Perry. Next question from Belgium. And I’m going to refer this to Michael. With the recent sharp decline in copper prices, how does management see the evolution of McEwen copper in the near future?

Michael Meding

So we don’t build a mine based on a McEwen spot price. We look into the longer-term future. But even looking at today’s spot prices for copper, we think that the Los Azules project will be very profitable. At the moment, we use in our simulations, $3.25 for valuation. And looking forward into the electrification, and what is going on with greenification of our economies, we think there will be significant need for copper in the future, and this will be supported by the copper price, and there’s a significant upside potential for Los Azules. So we’re quite comfortable with regards to the Los Azules project at this point in time.

Rob McEwen

Thank you, Michael. Marie, says, second question, how does management see the evolution of McKean Mining for the rest of this year and for the coming year?

That’s an easy one. We see continued improvement in operations. As Michael said, we see the copper project growing in profile, and we’ll be delivering updated preliminary economic assessment early next year, and we’re driving towards – after that, a feasibility study on the project, where we think there’s – it will become a property that should attract significant attention. And just this morning, I saw someone commenting on the copper price and suggesting a $10 a pound that’s coming in the future. Operator, open for questions online.

Jacob Sekelsky, Alliance Global Partners

Thanks for taking the question. Hey, Rob. So just looking at costs, I mean, they obviously decreased substantially quarter-over-quarter. Do you think there’s further room for improvement in the second half? Or should we expect levels to what we saw in Q2. I know it’s a difficult question with the inflationary environment, but any color there would be helpful.

Rob McEwen

I’ll ask Bill to jump in there.

William Shaver

Yes. So yes, that’s a good question. And I guess the – where we have to look to improve cost is improve production at the Fox complex. So if we look at our cost for Q2, we were slightly under our budget in terms of production, but right on target for cost per ounce and cost per ton. So if we can improve the ore production or the ore processing production, that will have a follow-on impact on our operating costs. So I guess in terms of that operation, it will lower the cost.

In the third – in the – yes, in the third quarter, at Gold Bar, we hope to get back closer to our budget numbers. And so that – in terms of the production of coal. So that should help the cost per ounce at Gold Bar. And then the combination of those two will overall hopefully reduce the cost.

And going forward, when we ramp up Gold Bar South, which has a little bit higher grade, shorter distance to the mill, a little bit lower recovery, lower stripping ratio, then that should help the overall operating cost. And again, I think as we move forward, the ore grade in some of the exploration work that Steve has been doing appears to be at least consistent with what we have seen in the mining operations up till now. So I think the road forward is around trying to improve each of our assets that are operating, and to look to the future expansion in any way that we can.

Jacob Sekelsky

Okay. That makes sense. And sticking with Gold Bar South, can you maybe just touch on the number of ounces that you guys have in the mine plan for that area? And I guess, how long do you expect Gold Bar South to be the dominant source of feed at Gold Bar?

William Shaver

So the total ounces in Gold Bar South recovered is something in the order of 120,000 ounces. And it should operate through 2023 and on into 2024. Based on the present data, it will – in terms of the resource and – that operation will end in 2024. But what we’re hoping is that once we get into the operation and see exactly where the ore is that we’re a bit optimistic that we’re going to find some more ore there.

So once we get our teeth into Gold Bar South and understand how the all occurs and so on, there will be some exploration work that we have to do to understand the extensions of the ore to the north and south, and also downward to lower elevations, which – I would say, the north and south, we’re a bit more optimistic about than the possibility of the ore extending deeper. So I hope that answers your question to some extent.

Jacob Sekelsky

That was helpful. That’s all for me. Thanks again.

May, for Heiko Ihle, H.C. Wainwright

This is May calling in for Heiko. Thanks for taking our call today. So we’re looking at Fox, and you spent $2.6 million on exploration in the quarter. Extrapolating that to the year, we’re at $10.4 million. So right in line with your forecast of $10 million. And then next year, we’re looking at $15 million of spend. So a strong 50% increase. Can you provide a bit of color on where exactly those funds will be spent? And how much of the 50% increase is attributable to higher costs? And how many meters do you think you can drill in 2023?

Rob McEwen

Steve, would you like to do…

Stephen McGibbon

Yes. So I can certainly add color to that question. Firstly, drilling costs – if we look back a year ago, our two primary concerns with respect to drilling was: one, the availability of drills; and two, the likely cost increase in drilling in the future, late 2022, 2023. And what we’ve seen so far this year that drills generally have been more available than what we had felt a year earlier. Perhaps the drillers are increasing their capacity with more drills. And we found that our drilling costs are in line and specifically at Fox, below what we had budgeted for unit cost for the year. So that has been gratifying certainly for us.

You mentioned the spend on the year-to-date for exploration. Our plan on surface at the Fox Complex for the second half of this year is to complete about 39,000 meters of drilling, and that will take for the most part, five drills drilling continuously, both at the Stock property and at the Fox – Black Fox property, primarily at Grey Fox. We – in order to complete our goals for 2023. A very important part of the program next year will be to ensure we’re prepared and actively drilling on targets that can typically only be drilled in winter often because of difficult conditions, and we’re beginning preparation for that part of our program next year.

And on average, the exploration program this year has begun to migrate from delineation-related work focused on improving the payback on the PEA, in and around the Stock Mine and on the margins of Stock West. That drilling is continuing. But now we’re also migrating toward looking at a very attractive targets that we’ve been aware of and we have been planning to follow up in the future program, some of those targets will be deeper than have been drilled in the last year, 1.5 years, but also have the potential to – with success bring meaningful improvement to our resource base, either at Stock or on Grey Fox.

So we believe the second half of the year is going to be quite an exciting one. We are accelerating our spend versus the first half of the year. And we expect the second half of the year, the spend will be in the order of about $7 million at the Fox Complex. And similarly, we’re – we expect to be ramping up drilling in time in Nevada as well. But specific to Fox, we are planning already for our winter drill program and expect to have quite an exciting program taking us through to the end of next year.

May, for Heiko Ihle, H.C. Wainwright

Great. Thank you. That helps a lot.

Mark Ehlert, LendUS

Okay. Thank you so much. Just a question for Rob. When you were going over the valuation and comparing it to Josemaria, were you talking about pre or post split value?

Perry Ing

Hi, Mark. Rob had to step out of the room for – take a call. But maybe Stephen can answer these questions.

Stephen McGibbon

Yes. So Rob’s numbers were split as reverse basis per share value.

Mark Ehlert

Great. Thank you so much. I only asked because I know that it is highly sensitive to the price of copper. Just wanted to make sure. That’s all for me. Thank you all.

Perry Ing

Thanks, Mark.

As I mentioned, Rob, I had to step out of the room. But on behalf of the management team at McEwen Mining, thanks for joining the second quarter results call, and we look forward to speaking to you again in the future.

|

|

|

|

Post by Entendance on Aug 18, 2022 2:48:44 GMT -5

|

|

|

|

Post by Entendance on Aug 31, 2022 14:26:03 GMT -5

TORONTO, Aug. 31, 2022 -- McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to announce the closing of the third and final tranche of the previously announced private placement offering (the “Offering”) of up to 8,000,000 common shares of McEwen Copper Inc. priced at US$10.00 per common share. The third tranche is comprised of a $25 million investment by Rio Tinto’s copper leaching technology venture, Nuton (“Nuton” or the “Investor”), and $1.85 million from other investors. The total Offering has been increased to 8,185,000 common shares, with the amounts raised in the three tranches of the private placement totalling $81.85 million.  McEwen Copper is well-funded to advance its Los Azules Project, located in the mining friendly province of San Juan, Argentina. The next milestones are the upcoming drilling season from October 2022 to June 2023, the completion of an updated preliminary economic assessment (PEA) in early Q1 2023, and the planned IPO of McEwen Copper in H1 2023. McEwen Copper is well-funded to advance its Los Azules Project, located in the mining friendly province of San Juan, Argentina. The next milestones are the upcoming drilling season from October 2022 to June 2023, the completion of an updated preliminary economic assessment (PEA) in early Q1 2023, and the planned IPO of McEwen Copper in H1 2023.

In connection with the Offering, McEwen Copper entered into a collaboration agreement with Nuton (the "Nuton Collaboration Agreement”) to advance our understanding of the potential application of heap leach technology at Los Azules, including the testing of Nuton® Technologies for compatibility with Los Azules copper mineralization. Leaching has many potential economic and environmental benefits over a conventional milling scenario, including lower water and energy consumption, no large tailings storage facility or dam, and typically lower capital and operating costs.

McEwen Copper Chief Executive Rob McEwen said: “Los Azules is among the largest undeveloped copper assets in the world. We recognize the potential opportunity of using Nuton Technologies to produce copper in greater amounts, more rapidly, and with less impact on the environment and water resources. I trust that our relationship with Nuton and Rio Tinto will accelerate the process of realizing the enormous potential of Los Azules.”

Rio Tinto Chief Executive Copper Bold Baatar said: “This agreement will allow us to evaluate the potential to commercially deploy Rio Tinto’s innovative Nuton Technologies for copper leaching in McEwen Copper’s planned development of Los Azules. Our Nuton Technologies have the capacity to unlock increased copper production for Rio Tinto and our partners, with a low carbon footprint and leading environmental performance.”

The principal terms of the Nuton Collaboration Agreement include:

Nuton will invest $25 million in McEwen Copper, acquiring 2.5 million common shares at $10.00 per common share, for post-closing ownership of 9.73%.

McEwen Copper and Nuton will jointly undertake copper leach testing using Nuton Technologies with samples from Los Azules. McEwen Copper has agreed to grant exclusivity to Nuton for one year in the area of novel, patented or trade secret leaching technology, while it will continue its independent test work and studies using conventional leach technologies.

Nuton will have the right to select one nominee who will be appointed as a director or observer to the Board of McEwen Copper. This right will continue for as long as Nuton holds greater than 7.5% of the issued and outstanding shares of McEwen Copper.

McEwen Copper and its controlling shareholders will not complete a liquidity event (such as the planned IPO) until after March 31, 2023.

McEwen Copper has agreed to limit related party transactions in certain situations until the earlier of the planned IPO (or alternative liquidity event) or Nuton ceasing to hold 7.5%.

Customary standstill and lock-up agreement between the Investor and its affiliates and McEwen Copper and its affiliates.

Other customary representations and warranties.

About McEwen Copper

McEwen Copper Inc. holds 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA. McEwen Mining Inc. (NYSE/TSX:MUX) owns a 68% share of McEwen Copper.

About Los Azules

Los Azules was ranked in the top 10 largest undeveloped copper deposits in the world by Mining Intelligence (2022). Its current copper resources are estimated at 10.2 billion pounds at a grade of 0.48% Cu (Indicated category) and an additional 19.3 billion pounds at a grade of 0.33% Cu (Inferred category).

About Nuton

Nuton is an innovative new venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leach-related technologies and capability – a product of almost 30 years of research and development. Nuton® Technologies offer the potential to economically unlock copper sulphide resources, copper bearing waste and tailings, and achieve higher copper recoveries on oxide and transitional material, allowing for a significantly increased copper production. One of the key differentiators of Nuton is the potential to deliver leading environmental performance, including more efficient water usage, lower carbon emissions, and the ability to reclaim mine sites by reprocessing mine waste.

About Rio Tinto

Rio Tinto is the second largest mining and metals company in the world, operating in 35 countries, and producing the raw materials essential to human progress. It aims to help pioneer a more sustainable future, from partnering in the development of technology that can make the aluminum smelting process entirely free of direct greenhouse gas (GHG) emissions, to providing the world with the materials it needs – such as copper – to build a new low-carbon economy and products like electric vehicles, charging infrastructure and smartphones.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy, nor shall there be any sale of these securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

|

|

|

|

Post by Entendance on Sept 6, 2022 6:09:36 GMT -5

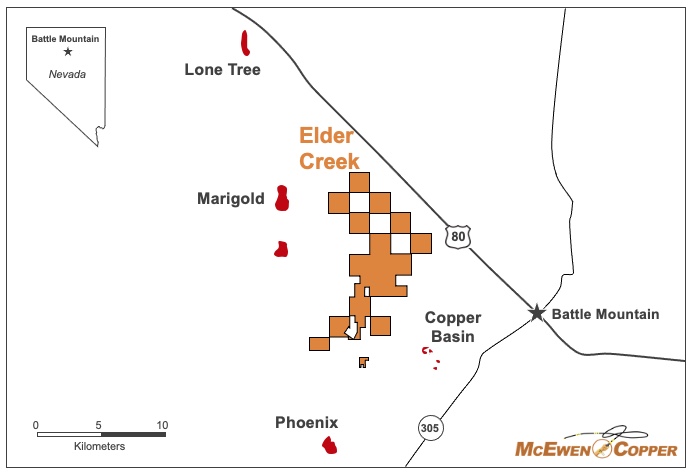

McEwen Copper Options Elder Creek Project to Rio Tinto

TORONTO, Sep 6, 2022 - McEwen Copper Inc., a subsidiary of McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to announce that it has entered into a binding term sheet with Kennecott Exploration Company (“KEX”), a subsidiary of Rio Tinto, for an option to earn a 60% interest in and joint venture the Elder Creek property in Nevada (see Figure 1) by spending US$18 million.

The principal terms of the agreement are:

KEX will have the right to earn a 60% interest in Elder Creek by investing $18 million over a maximum of seven years (the “Expenditure Commitment”).

KEX will be the operator of the Elder Creek project during the term of the agreement.

Following completion of the Expenditure Commitment, KEX and McEwen Copper will form an unincorporated 60:40 joint venture.

Other customary representations, warranties and conditions.

Figure 1 – Elder Creek property location map

McEwen Copper Inc. holds 100% interest in the Los Azules copper project in San Juan, Argentina and the Elder Creek project in Nevada, USA. McEwen Mining Inc. (NYSE/TSX: MUX) owns a 68% share of McEwen Copper.

About Elder Creek

This Project consists of 577 unpatented mining claims in Humboldt and Lander counties, Nevada. It is prospective for porphyry copper mineralization and well placed in a district hosting several large copper and gold mines, including Marigold, Lone Tree and Phoenix. McEwen Mining Inc. holds a 1.25% net smelter return (NSR) royalty on all the claims that comprise the Elder Creek property.

About Rio Tinto

Rio Tinto is the second largest mining and metals company in the world, operating in 35 countries, and producing the raw materials essential to human progress. It aims to help pioneer a more sustainable future, from partnering in the development of technology that can make the aluminum smelting process entirely free of direct greenhouse gas (GHG) emissions, to providing the world with the materials it needs – such as copper – to build a new low-carbon economy and products like electric vehicles, charging infrastructure and smartphones.

|

|

|

|

Post by Entendance on Sept 9, 2022 6:06:53 GMT -5

|

|

|

|

Post by Entendance on Sept 15, 2022 9:15:17 GMT -5

McEwen Mining/McEwen Copper Rob McEwen, Chairman & CEO:

|

|

|

|

Post by Entendance on Sept 20, 2022 13:27:07 GMT -5

|

|

|

|

Post by Entendance on Sept 22, 2022 8:24:23 GMT -5

|

|

|

|

Post by Entendance on Oct 5, 2022 4:35:24 GMT -5

|

|

|

|

Post by Entendance on Oct 19, 2022 6:43:52 GMT -5

|

|

|

|

Post by Entendance on Oct 29, 2022 3:54:16 GMT -5

Rob McEwen & Michael Meding

EXECUTIVE CHAIRMAN & CHIEF OWNER (RM), VICE PRESIDENT & GENERAL MANAGER (MM), MCEWEN COPPER, MCEWEN MINING

interview

|

|

|

|

Post by Entendance on Nov 2, 2022 5:20:27 GMT -5

MCEWEN MINING:

Q3 2022 Results and Webcast

TORONTO, November 2nd, 2022 - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) will report Q3 2022 operating and financial results after the market closes on Friday, November 4th, 2022. We invite you to join our conference call on Monday, November 7th, 2022, from 11:00 am EST, where management will discuss our Q3 2022 financial results and project developments and follow with a question‑and‑answer session. Questions can be asked directly by participants over the phone during the webcast.

|

|

|

|

Post by Entendance on Nov 7, 2022 6:28:18 GMT -5

November 7, 2022 McEwen Mining: Q3 2022 Results

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) reports its third quarter (Q3) results for the period ended September 30th, 2022.

“This year has been much better than the previous three! While we still have issues to resolve, such as increasing our treasury by producing more ounces at a lower cost, we can clearly see a brighter future. At the Fox Complex, where we have had a history of high operating cost/oz we are making good progress reducing our cost. I am pleased to say that in Q3 our cash cost/oz at Fox fell to $774, our lowest since mid-2018. This is well below the industry average. Our next important area to improve at Fox is the process plant (mill). Specifically, we need to increase the throughput because our mine is now producing more ore than our mill can process. As a result, we have a large surface stockpile of ore equivalent to more than two months of production.

At Gold Bar, we are looking forward to starting to mine our Gold Bar South (GBS) deposit this quarter. We are expecting to have a much lower cost/oz than our YTD cost because we will be mining higher grade ore at GBS, with half the strip ratio and no problematic carbonaceous material.

In Mexico, we recently acquired a complete process plant on very advantageous terms that will help significantly reduced projected capital requirements for our Fenix project. This acquisition has made Fenix more attractive to build and could provide a new long life mine for McEwen Mining.

The San José mine, where we have a 49% interest, put in a strong quarter and its exploration is continuing to extend its high-grade veins and discover new veins.

We completed an $82 million financing for McEwen Copper in a very tough equity market. Rio Tinto, the second largest mining company in the world, through its subsidiary Nuton, now owns 9.7% of McEwen Copper, as a result of its investment of $25M. Also, Nuton is testing the Los Azules copper mineralization to see if it can accelerate and increase copper recoveries. Another of Rio Tinto’s subsidiaries, Kennecott Exploration, signed an option to earn 60% interest in McEwen Copper’s other copper project, Elder Creek, by spending $18 million on exploration. Elder Creek is located in Nevada.

In July our shares outstanding underwent a 10 for 1 consolidation. This was an unfortunate but necessary action done to protect our listing on the NYSE, which is our principal exchange and where our trading volume is the highest.

Production guidance for 2023 is 150,000 to 170,000 gold equivalent ounces (GEOs).

Later in this release I will explain why I believe MUX is an attractive investment” said Rob McEwen, Chairman and Chief Owner.

A webcast will be held on Monday, Nov 7 th at 11:00 am EST . Management will discuss our Q3 financial results and project developments and follow with a question-and-answer session. Questions can be asked directly by participants over the phone during the webcast.

Monday

November 7 th , 2022 11:00 am EST

Please register here:

conferencingportals.com/event/ZSafhHZi

Participants who cannot access the internet can dial-in using the numbers below

Participant Toll-Free Dial-In Number:

1 (888) 330-2398

Participant Toll Dial-In Number:

1 (240) 789-2709

Conference ID: 67121

Selected Operational & Financial Information

Cash and cash equivalents at September 30th, 2022, totaled $54.9 million.

Q3 Production was 26,200 gold ounces and 852,200 silver ounces, or 35,700 gold equivalent ounces(1) (GEOs)(see Table 1), compared to 42,900 GEOs during Q3 2021.

YTD Production was 74,650 gold ounces and 1,894,100 silver ounces or 97,000 GEOs compared to 114,200 GEOs during 9 months to Sept. 30, 2021.

Revised guidance for 2022 production is 134,600-141,800 GEOs, reflecting a decrease of approximately 6,500 GEOs at Fox and 14,000 GEOs at Gold Bar due to carbonaceous material encountered throughout 2022, which should be alleviated with Gold Bar South beginning production, and an adjustment due to the gold:silver price ratio.

Average cash costs(2) per GEO sold from our 100%-owned mines (Fox & Gold Bar) in Q3 was $1,219, in-line with our guidance. Average all-in sustaining costs ("AISC")(2) per GEO sold from our 100%-owned mines was $1,659, slightly above our guidance midpoint of $1,475 per GEO.

Our 100%-owned mines generated a cash gross profit(2) of $5.8 million in Q3 and a gross profit of $1.5 million. Cash gross profit is calculated by adding back depletion and depreciation to gross profit.

Our consolidated net loss in Q3 was $10.5 million, or $0.21 per share, which relates primarily to $7.8 million spent on the Los Azules project, and $5 million on exploration and advanced projects at our mines. It is important to understand that MUX will continue reporting losses for some time because it is required to consolidate 100% of the expenses incurred by McEwen Copper for the development of Los Azules in its financial statements despite owning 68%.

Our exploration programs are focused on defining near-term mine resources that could extend our mine lives and contribute to future profitability. An update on our exploration activities will be released in the coming weeks.

Operations Update

Fox Complex, Canada (100% interest)

Fox achieved the lowest quarterly cash cost since mid-2018 of $774 per GEO sold. We believe there is good potential to further reduce costs and increase production at Fox Complex by increasing mill throughput. We plan to start crushing at the Froome mine site prior to transportation to the mill, which should relieve stress on the primarily crushing circuit.

In Q3, we incurred $2.7 million for exploration at Stock and at the Black Fox properties.

Gold Bar Mine, USA (100% interest)

Gold production continued to be low due to the presence of carbonaceous material that is being treated as waste and lower mining rates resulting from a contractor staffing shortage.

Development of the Gold Bar South deposit is underway. First ore is expected later in Q4. GBS has superior attributes compared to the current mining areas, because of its much lower waste stripping ratio, oxide mineralization with no carbonaceous material, and a higher average gold grade partially offset by lower heap leach recovery. Most of Gold Bar’s production in 2023 will be from GBS.

In order to increase our mining rate, a new mining contractor has been engaged and mobilization of equipment has started with a staged ramp up expected to be fully implemented in January 2023.

In Q3, we spent $1.1 million for exploration activities.

McEwen Copper (68% interest)

McEwen Copper is a key component of MUX’s value proposition. The Los Azules project is one of the world's largest undeveloped open-pit copper porphyry deposits. During the quarter, study work continued in parallel with preparation for the new drilling season which started in mid-October.

The closing of the $81.85 million financing was a critical step to fund activities necessary to complete an updated PEA (Preliminary Economic Assessment) for the Los Azules project. These activities included additional drilling, completing a new resource model, life of mine plan, baseline monitoring for environmental permitting, community development and relations, other technical work and general corporate purposes. McEwen Copper spent $7.6 million in Q3 to advance the Los Azules project. Publication of an updated PEA on the Los Azules copper project is planned for Q1 2023 and in Q2 an IPO is planned along with MUX completing a secondary financing reducing its interest to increase its treasury.

In the 2017 PEA, Los Azules is designed as an open pit copper mine with a 36-year life. However, it is possible that Los Azules could become ultimately an even larger mine, with a longer life, since numerous drill holes have shown strong copper mineralization extending below the pit bottom. It is not uncommon for porphyry copper deposits such as Los Azules, to extend well below 1,000 meters (3,280 feet) depth. During this season’s drill program, two deep high-grade targets will be drilled.

Table 1 provides production and cost results for Q3 & 9M 2022 with comparative results for Q3 & 9M 2021 and our Revised guidance range for 2022.

Our El Gallo project produced 170 GEOs in Q3 2022, 900 GEOs in 9M 2022, 560 GEOs in Q3 2021 and 2,500 GEOs in 9M 2021. Residual heap leaching ceased in July 2022.

Table 1 Notes:

'Gold Equivalent Ounces' are calculated based on a gold to silver price ratio of 90:1 for Q3 2022, 83:1 for Q2 2022, 78:1 for Q1 2022, 73:1 for Q3 2021 and 68:1 for Q1 & Q2 2021. 2022 revised production guidance is calculated based on 85:1 gold to silver price ratio.

Cash gross profit, cash costs per ounce sold, all-in sustaining costs (AISC) per ounce sold are non-GAAP financial performance measures with no standardized definition under U.S. GAAP. For definition of the non-GAAP measures see "Non-GAAP Financial Measures" section in this press release; for the reconciliation of the non-GAAP measures to the closest U.S. GAAP measures, see the Management Discussion and Analysis for the year ended December 31, 2021 (as amended) filed on Edgar and SEDAR.

Represents the portion attributable to us from our 49% interest in the San José Mine.

What might MUX be Worth?

“Value, like beauty, is frequently in the eye of the beholder. I am often asked what I think MUX is worth and I want to share my answer with you.

I have arrived at a high/low range of value for MUX by adding up the some of its parts. Here are the parts: MUX has a 68% interest in McEwen Copper, it owns 100% of three gold mines: Fox Complex, Gold Bar and El Gallo/Fenix, a 49% interest in the San José gold/silver mine, a portfolio of five royalties (NSRs) and a collection of exploration properties.

The operating challenges we faced in recent years have severely damaged our credibility with our shareholders and the market. As a result, few investors have taken a close look recently at our assets. If they did, I believe some would see the potential value that I see today. Yes, our cash is tight, our costs/oz are high and our mine lives are currently short, but that has been changing for the better. So let me show you my math and how I had arrived at a possible potential value for MUX of $8 to $30/share .

In this valuation estimate I have compared Los Azules to two copper projects, Josemaria and Filo, that are in the same province in Argentina as Los Azules. Compared to Los Azules these projects are located at substantially higher elevations, are at a greater distance from critical infrastructure (highways and power grid), have a smaller published copper resource base and copper grade, and they have public market values. Josemaria was purchased for $485M in April and Filo Mining has a market capitalization of $1.6B. The low end of the range is based on 50% of Josemaria’s purchase price and high end on Filo’s market capitalization.

For the valuation estimate of MUX’s gold and silver mining interests, we compared the average Enterprise Value (EV) per GEO production of five smaller producers. The low end of range is based on 50% of their multiple and the high end at par with their multiple. Please refer to the footnotes.

Table 2 Notes:

McEwen Mining has 51 million fully diluted shares

McEwen Mining owns 68.1% of McEwen Copper which owns 100% of Los Azules and Elder Creek

Josemaria purchase price was $485 million. ($485M x 50% x 68.1%) / 51M

Filo Mining market capitalization $1.6 billion. ($1.6B x 68.1%) / 51M

Elder Creek value is based on earn-in ($18M / 60%) x 68.1% / 51M

Royalties: 1.25% NSR on Los Azules and Elder Creek, plus three other royalties. Est. $35M / 51M

Average peer group (Jaguar Mining, Silvercorp, Fortitude, Gold Resource, Endeavour Silver) EV/GEO multiple 2.14x higher than MUX

Average peer group EV/GEO x 50%

As you can see, I believe there is considerable potential value in MUX, and that is a big reason why I have a personal financial commitment of $220M in MUX and McEwen Copper. Another way to look at MUX is that its current share price of $3.66 reflects the low end of potential value of the company’s ownership in McEwen Copper and you get all the other assets for free,” said Rob McEwen, Chairman and Chief Owner.

For the SEC Form 10-Q Financial Statements and MD&A refer to: www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000314203

|

|

|

|

Post by Entendance on Nov 8, 2022 2:56:07 GMT -5

McEwen Mining Inc. (MUX) Q3 2022 Earnings Call

Company Participants

Rob McEwen – Chairman and Chief Owner

Perry Ing – Chief Financial Officer

William Shaver – Chief Operating Officer

Stephen McGibbon – Executive Vice President-Exploration

Michael Meding – Vice President and General Manager-McEwen Copper Conference Call Participants

Jake Sekelsky – Alliance Global Partners

Heiko Ihle – H.C. Wainright

Joseph Reagor – Roth Capital Partners

Mike Kozak – Cantor Fitzgerald

John Tumazos – John Tumazos Very Independent Research

Rob McEwen Rob McEwen

Hello, ladies and gentlemen. Thank you for joining us today. During Q3, we addressed a number of the overhanging concerns about McEwen Mining. First, the financing of McEwen Copper, we completed an $82 million financing in a really tough market. And not only did we complete it, but we had the second largest mining company in the world becoming a shareholder through its subsidiaries. We had high costs at our operations at Fox.

And in the third quarter, we turned in operating costs. Cash costs per ounce below industry averages at $774 per ounce. At Gold Bar, we saw our production fall in the first half of the year as a result of carbonaceous ore and it resulted in unusually high cost, unacceptably high cost. We are opening up the Gold Bar South deposit and it has no carbonaceous ore, it has higher grade ore, and it's a lower strip, so we should be seeing lower cost production coming from there.

We also had, in Mexico, it looked like we were coming to the end of the life of the mine. We did have a feasibility study there for a project called Fenix and we've improved the economics of it considerably with the purchase of a process plans on very advantageous terms. These issues all obscured the value of McEwen Mining in my mind. And with these resolved and a steady improvement going forward, I believe that the value of McEwen Mining will become more apparent. And after the presentations of my associates, I will talk about the value I see behind McEwen Mining.

So I would now like to turn it over to Perry Ing.

Perry Ing Perry Ing

Thanks, Rob. I'll provide a brief overview of our third quarter financial results. I'll start by stating that our 100% owned mines generated a cash gross profit of $5.8 million and a gross profit of $1.5 million. You can compare that to our reported GAAP loss of $10.5 million or $0.21 a share, which generally reflects the fact that the $7.6 million we invested in Los Azules along with $5.1 million on exploration and other projects is expensed rather than capitalized.

As Rob mentioned, our results reflect a ten-for-one share consolidation that was completed in July during the quarter. Having completed that share consolidation, McEwen Mining has now regained full compliance with NYSE’s share price listing requirements. Looking at gold equivalent production just on a consolidated basis, production for the third quarter was 35,700 gold equivalent ounces, which was roughly equivalent to the production in the second quarter of the year and down approximately 16% from approximately 43,000 gold equivalent ounces produced in the third quarter of 2021.

I'll have Bill Shaver talk about our production details, but overall, I'll characterize our quarter as generally being strong at Fox and San Jose. But continuing to experience challenges at Gold Bar as Rob alluded to. In terms of cash cost, as Rob stated earlier, we reported $774 as cash costs per ounce and all-in sustaining costs of $1,308 per ounce, driven by our strong performance from our underground operations which continues to produce or well ahead of current mills throughput.

We were also assisted by a weaker Canadian dollar. The U.S. Canadian dollar exchange rate of approximately C$131, was about $0.05 weaker than the same period in 2021. Just as a detail on our production at Fox, if you look at our inventory balances are about $6 million. There's about a $6 million build in ore inventory stockpiles just in the third quarter alone. And that ore is that now sitting in surface stockpiles at our mill. So going forward, this should allow for some greater flexibility in our mind sequencing and some cost saving opportunities.

In Nevada, looking at Gold Bar, our cash costs were $1,712 ounce and all-in sustaining at $2,049 an ounce, although these figures are down slightly from the first half of the year, they remain elevated compared to the prior year due to low production levels resulting from carbonaceous ore issues and are well above spot gold prices. We noted our mining contractor demobilized for the end of the quarter. We believe that this will have a limited impact on our cash flows, as we expect digital ounces and the leash pad and we expect to begin south production within the next quarter. Finally, looking at our 49% cone San Jose mine in Argentina, they generally had a good quarter with cash costs of $1,223 per ounce and all-in sustaining costs of $1,562 an ounce, which a significant improvement from the first half of the year where they experienced COVID related production issues as well as [Technical Difficulty] the San Jose mind during the quarter. But we are optimistic for the future depending on silver and gold prices.

Finally, looking at our treasury, our cash equivalent balance stood at $55 million at the end of the quarter, which is roughly unchanged from the $54 million at the beginning of the year. As Rob noted, this included the completion of $82 million in private placements, of which approximately $42 million was completed during 2022 and 27 million during the quarter, primarily from subsidiary of Rio Tinto. Following that private placement, McEwen Mining – ownership McEwen Mining coffer was approximately 68%.

So with that, I'll turn it over to Bill Shaver, our COO.

William Shaver William Shaver

Thank you very much. Perry, good morning, everyone. The third quarter was a reasonable quarter, though, not as good as we hoped it would be. We are making progress though at all operations to make our future brighter. On the safety front, we had a good quarter. We had one minor medical aid where a worker felt a neck pain while lifting an oxygen cylinder.

On the environmental front, we had no environmental events to report in the third quarter. Also at the Fox Complex, the tailing management facility construction to raise all of the dams by approximately two meters was completed on time and on budget.

Also at the Fox Complex, we had an excellent month in the mine producing ore containing 13,146 ounces versus a budget of 12,441 ounces. This raised the amount of stockpiled ore at the mine and at the milling process to 112,000 tons. This represents a value of approximately $10 million after milling cost and applied recoveries from the mill.

Unfortunately, we have continued to have some mechanical issues in the Fox processing plant that have constricted the availability in the plant to approximately 77% for the quarter. So this has allowed this stockpiled ore to increase substantially over the quarter. In October, the plant availability was significantly better at 90% based on the nominal rate of 50 tons per hour or 1,200 tons a day. Thus the plant operated at approximately 1,100 tons a day. We produced 9,000 gold equivalent ounces in the quarter, but what we need to do is increase the rate in the processing plant so that we can decrease the amount of stockpiled or the mine itself is in a very sweet spot of the mining life where any mines find themselves from time to time and where we can produce more or then we can in fact process at this time.

In order to address the situation, we are debottlenecking the process plant in a very systematic way, while at the same time reducing costs at the mine to stay within our cost per tonne budget. And we are being successful both in the mine and in the plant of keeping the cost as per our budgets.

We will also install a crushing plant at the mine to relieve the stress on the front end of the plant. We hope that this will allow the ore to go reasonably quickly through the front end of the mill directly into the grinding and leaching circuits. We hope this will relieve the stress on the overall plant availability and improve throughput.

At the Gold Bar mine in Nevada, we have come to a position where we have a better understanding of the carbonaceous minerals that occur in the ore and have a capacity to Rob or from the pregnant solution. This has complicated the mining process of separating ore and waste in the pit. However, we are getting this also under control. Gold Bar produced 7,200 ounces for the quarter. The Gold Bar South project, which we are in the midst of starting, was impacted by permitting delays of approximately two months. We will now see production from Gold Bar South in December.

On a positive note, we have engaged a competent contractor who has completed the road to Gold Bar South over the last six weeks, so we will not lose any time on this front. We have also engaged a new contractor to operate the mine. This contractor is mobilizing equipment to the site this month to take over the work.

This contractor has started the preliminary mining at Gold Bar South with the first row arriving at the site last week. At the same time, we have moved approximately 100,000 tonnes of ore that we had next to our crushing plant through the plant and onto the leach pad. We completed this in October and we now have that material under leach.

We pour 2,500 ounces of gold in October and anticipate we will have 4,500 ounces over November and December. This will allow us to have positive cash flow in the fourth quarter of approximately $4.5 million.

Going over to Mexico, we have been able to develop an approach to get the El Gallo project back in production. We will reprocess the heat leach pad, which has a grade of 0.6 grams per tonne to accomplish this as Rob had mentioned, we have acquired a 7,000 tonne per day gold processing plant, which operated recently at another mining operation in Mexico.

This plant is approximately 150 kilometers away from our site and was pre-purchased recently on quite favorable terms. At El Gallo, we will assemble only the grinding cyclones and leaching portions of the plant and use the present El Gallo gold recovery circuit to operate the mining of this leach pad.

Some minor changes in our permit are required and we are also making some final updates to the project evaluation analysis and some engineering and scheduling studies are being undertaken. The results of all of these will result in a favorable return on the project and a reasonably small capital cost of between $12 million and $15 million. We hope to have this plant running late next year or early in 2024.

Thank you very much. I will now turn over to Steve for an update on our latest exploration results.

Stephen McGibbon Stephen McGibbon

Thank you, Bill, and good morning, everyone. I’m not going to quote grades and intercepts today but rather talk more about plans and opportunities coming in 2023 based on work completed in Q3 and Q4. I am happy to say we will release an exploration press release shortly for the Fox Complex. That release will update key results including a near surface discovery east of the mill at Stock and solid info results that highlight the quality of our Stock West deposit.

We have very good early results at Grey Fox that are a follow-up to 2021 successes as well. Surface exploration in Nevada is near completion for the season and is just ramping up again at San José where spring in the Southern Hemisphere has begun. At the Fox Complex, we are drilling at both Stock and Grey Fox during Q4.