|

|

Post by Entendance on Mar 11, 2023 8:14:08 GMT -5

|

|

|

|

Post by Entendance on Mar 14, 2023 5:38:52 GMT -5

Stage Is Now Set for Increased Production and Lower Costs in 2023

Welcoming Nuton & Stellantis as Shareholders of McEwen Copper

TORONTO, March 14, 2023 ( GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today reported fourth quarter and full year results for the period ended December 31, 2022.

“2022 was an important transition year for McEwen Mining. Our Fox operation in Timmins showed the largest improvement from 2021, with a 22% increase in gold production, 8% lower cash costs per ounce and steady all-in sustaining costs per ounce. Our operation in Nevada has now transitioned production to our Gold Bar South pit, a new mining contractor has been instated, and production is increasing,” commented Rob McEwen, Chairman and Chief Owner. “Our McEwen Copper subsidiary reached several milestones during 2022 and early 2023, including, building a seasoned Argentine management team, improving critical access to Los Azules with the completion of a second route to site, advancing technical studies, cementing our commitments to government and local stakeholders, and welcoming two strategic investors: Nuton (a Rio Tinto Venture and part of the world’s 2nd largest mining company) and Stellantis, the world’s 4th largest automobile manufacturer and mobility provider.”

Looking Ahead

For 2023, our production guidance is 150,000 to 170,000 GEOs (see Table 1).

Subsequent to the year end, a subsidiary of Stellantis N.V. invested ARS$ 30 billion, and Nuton LLC, a Rio Tinto Venture, agreed to increase its investment by $30 million, to acquire shares of McEwen Copper. Subsequent to these transactions, each of Stellantis and Nuton own 14.2% of McEwen Copper, and McEwen Mining owns 52%. As a result, the implied valuation of McEwen Copper is now approximately $550 million on a 100% basis.

Looking at 2022

Our McEwen Copper subsidiary completed three tranches of financing during 2021-2022, raising a total of $81.9 million for Los Azules exploration and pre-development activities.

In 2022, production was 133,300 gold equivalent ounces (GEOs)(1), slightly below our revised guidance range of 134,600 to 141,600 GEOs due to lower than planned production at the Fox Complex during the final days of the year (see Table 2).

Our 100%-owned mines (Fox Complex and Gold Bar) generated a cash gross profit of $19.2 million(2) in 2022 and a gross loss of $0.5 million. Cash gross profit is calculated by adding back non-cash depletion and depreciation to gross profit (loss).

We incurred advanced project expenditures of $41.3 million at Los Azules net of foreign exchange gains, or, on a gross basis, a $61.1 million contribution to net loss. Under U.S. GAAP, we continue to expense our Los Azules project costs.

Our consolidated net loss in 2022 of $81.1 million, or $1.71 per share, relates primarily to investment of $81.7 million in advanced projects and exploration (including 100% of Los Azules expenses) offset by a gain of $19.8 million on foreign exchange transactions, general and administrative costs of $11.9 million, tax expenses of $5.8 million, and a gross loss of $0.5 million from our operations (see Table 4).

Cash and liquid assets(2) at December 31, 2022 were $46.2 million.

Production costs per ounce for 2022 were $1,276 for cash costs(2) per GEO sold from our 100%-owned mines, representing a decrease of 12% compared to 2021, and $1,688 for all-in sustaining costs (AISC)(2) per GEO sold, representing an increase of 3% compared to 2021 (see Table 3).

We continued to invest aggressively in exploration, completing 181,100 feet (55,200 meters) of drilling at the Fox Complex, 16,900 feet (5,200 meters) of drilling at the Gold Bar Mine, and 73,500 feet (22,400 meters) at the Los Azules project.

A webcast will be held on Tuesday, March 14th at 11:00 am EDT. Please see the details further below.

Notes:

'Gold Equivalent Ounces' are calculated based on a gold to silver price ratio of 77:1 for Q4 2021, 72:1 for 2021, 85:1 for Q4 2022 and 84:1 for 2022. 2023 production guidance is calculated based on 85:1 gold to silver price ratio.

Cash gross profit, cash costs per ounce, all-in sustaining costs (AISC) per ounce, and liquid assets are non-GAAP financial performance measures with no standardized definition under U.S. GAAP. For definition of the non-GAAP measures see "Non-GAAP- Financial Measures" section in this press release; for the reconciliation of the non-GAAP measures to the closest U.S. GAAP measures, see the Management Discussion and Analysis for the year ended December 31, 2022 filed on Edgar and SEDAR.

McEwen Mining shares issued and outstanding at Dec 31, 2021 were 459,187,391 and at Dec 31, 2022 was 47,427,584, following a reverse share split effective July 28, 2022.

Represents the portion attributable to us from our 49% interest in the San José Mine.

Operations Update

Fox Complex, Canada (100% Interest)

Production from the Black Fox Mine stopped in Q4, 2021 and started at the Froome Mine. As a result, production in 2022 increased 22% year over year, costs were slightly lower, and the safety record improved.

In addition, Froome’s production exceeded mill capacity; therefore 120,000 tonnes of mineralized material was stockpiled at the end of 2022, ready for processing in 2023.

The Froome Mine produced 9,870 GEOs in Q4 2022, bringing the full year 2022 production to 36,650 GEOs. This represents increases of 4% and 22% respectively from the comparable periods in 2021.

Cash cost per GEO sold in 2022, was $1,020 and AISC per GEO was $1,465 compared to costs in 2021 of $1,108 and $1,461, respectively.

In recent years, we have invested significant capital in exploration. The principal focus has been on discovering resources adjacent to our existing operations in order to increase gold production, extend the mine life and shorten the payback period of the PEA. During 2022, we incurred $11.4 million in exploration activities at Fox. The exploration budget for 2023 at the complex is $15.0 million.

The Preliminary Economic Assessment (PEA) for the Fox Complex published on January 26, 2022 details our expansion plans for the Fox Complex, to occur after we complete mining at the Froome Mine. As a result of our investment in exploration, we have found sufficient new gold resources that allow for extending the mine life, planning a doubling of gold production and significantly reducing costs per ounce. The economics are attractive, providing for a mine life of an additional 9-years where the average annual gold production is 80,800 oz with average cash costs and AISC per ounce of $769 and $1,246, respectively.

Gold Bar Mine, USA (100% Interest)

A record safety milestone was achieved in 2022, operating for over 1,000 days without a lost-time incident.

Production at Gold Bar was adversely impacted by encountering carbonaceous ore that could not be processed and the delay in mining as we transitioned to a new mining contractor. As a result, the mine production was 39% lower year-over-year with 7,940 GEOs in Q4, and 26,620 in 2022.

Cash cost and AISC per GEO sold were $1,622 and $1,989 for the year 2022. The year-over-year 4% decrease in cash cost per GEO was primarily a result of reduced contract mining costs. AISC per GEO for the year 2022 was 14% higher due to expenditures on reclamation, exploration, plant and equipment, and securing environmental credits for the Gold Bar South (GBS) project.

In 2023, production has shifted to GBS, which does not contain carbonaceous ore, has a lower waste stripping ratio and a higher average gold grade compared to previous mined areas at Gold Bar. The change of the mining contractor in Q4 2022 is expected to drive improved production efficiencies in 2023.

In 2022, $4.8 million was invested in exploration, including drilling 16,900 feet (5,200 meters) of core and reverse circulation drilling focused on targets around the mine, such as near-mine extensions at Cabin North, Pick and potential extensions at the Atlas Pit. The exploration budget for 2023 is $5.5 million.

San José Mine, Argentina (49% Interest)

Our share of the San José mine production was 69,130 GEO in 2022, 10% lower than in 2021. The decrease is attributable to lower processed tonnes due to the impact of COVID-19 and mill availability issues in Q1 2022. Together with a decrease in gold and silver prices in 2022 compared to 2021, the dividend received was only $0.3 million in 2022, compared to $9.8 million received during 2021.

Q4 2022 cash costs and AISC per GEO of $1,321 and $1,701 respectively. These costs were still high but substantially better than in Q4 2021, decreasing by 23% and 17% respectively compared to Q4 2021. Production costs in 2021 were adversely impacted by COVID-19.

2022 cash costs and AISC per GEO were $1,306 and $1,714, an increase of 3% and 7% respectively compared to 2021, as a result of lower GEOs sold partially offset by lower production costs.

McEwen Copper (52% Interest)

On August 31, 2022, McEwen Copper completed a US$81.9 million offering including a $25 million investment by Nuton, a Rio Tinto Venture.

On October 24, 2022, McEwen Copper signed an option agreement with Kennecott Exploration Company (“Kennecott”), a subsidiary of Rio Tinto. By spending $18 million over up to seven years, Kennecott can earn a 60% interest in the Elder Creek property and form a 60:40 joint venture with McEwen Copper.

Subsequent to December 31, 2022, we announced the closing of an ARS $30.0 billion investment by FCA Argentina S.A., a subsidiary of Stellantis N.V. (“Stellantis”) to acquire shares of McEwen Copper and of a second investment of $30 million by Nuton that increases their investment to $55 million. The Stellantis transaction consisted of a private placement of 2,850,000 common shares, and the purchase of 1,250,000 common shares indirectly owned by McEwen Mining in a secondary sale. The Nuton transaction consisted of a private placement of 350,000 common shares, and the purchase of 1,250,000 common shares indirectly owned by McEwen Mining in a secondary sale. The proceeds of the private placement will be used to advance the development of the Los Azules copper project in San Juan, Argentina, and for general corporate purposes. Subsequent to the transactions, Stellantis and Nuton each own 14.2% of McEwen Copper, while McEwen Mining’s ownership is reduced to approximately 52%. McEwen Mining plans to use the proceeds from the secondary sales to reduce its debt by 38% and increase its treasury to fund production growth.

About Stellantis

Stellantis N.V. is one of the world's leading automakers and a mobility provider. Its storied and iconic brands embody the passion of their visionary founders and today’s customers in their innovative products and services, including Abarth, Alfa Romeo, Chrysler, Citroën, Dodge, DS Automobiles, Fiat, Jeep®, Lancia, Maserati, Opel, Peugeot, RAM, Vauxhall, Free2Move and Leasys.

About Nuton

Nuton is an innovative new venture that aims to help grow Rio Tinto’s copper business. At the core of Nuton is a portfolio of proprietary copper leach-related technologies and capability – a product of almost 30 years of research and development. Nuton™ Technologies offer the potential to economically unlock copper sulphide resources, copper bearing waste and tailings, and achieve higher copper recoveries on oxide and transitional material, allowing for a significantly increased copper production.

Exploration Drilling

Drilling has focused on increasing drill hole density to upgrade the copper mineral resource classification to measured and indicated and to better define the payback pit design; providing metallurgical, hydrological, and geotechnical data to support mine design; and testing for potential extensions of the copper resource to the north, south and at depth. Drilling started in January and went to May, when it stopped for the winter in the southern hemisphere, then restarted in October and is currently ongoing. There were 6 drill rigs on site in 2022, and 5 more were added in early 2023.

From 2022 to date we have drilled over 105,000 feet (32,000 meters) in 98 drill holes. Recent results include 236 m of 1.39% Cu and 0.19 g/t Au including 42 m of 2.78% Cu (hole AZ23191) for delineation and 1,052 m of 0.29% Cu including 480 m of 0.42% Cu (hole AZ22174) for exploration.

A total of $61.2 million was spent in 2022 at the Los Azules project to advance drilling, engineering and project feasibility work. The first step is updating the PEA that is expected to be published in Q2 2023.

Road Construction

In 2022, a major advance was made that will accelerate the development of Los Azules with the completion of a new low altitude access road (maximum 11,155 feet ASL), which we share in part with other mining projects, including El Pachón and Altar. The importance of having a second road into the site at 2,000 feet lower altitude means we now have almost year-round access.

Technical Studies

The updated PEA will include all available information on drilling, assay and metallurgical testing obtained during the 2017, 2018 and 2022 exploration seasons. During the quarter we continued work on trade-off studies (related to power supply and the potential for renewables, mining methods and processing options), an updated glacier study, and initial geotechnical field of work for the design of heap leaching, tailings and waste storage facilities. Hydro-geological holes have commenced and complement the works on assessing historical information and re-establishing existing water monitoring locations.

Currently, we are developing a scenario for Los Azules as an open pit mine that initially processes leachable copper content in a heap leach, with a solvent extraction and electrowinning facility to produce LME Grade A copper cathodes. This scenario would greatly reduce capital expenditures as compared to 2017’s PEA using concentrator technology, in addition it would be more environmentally sensitive due to its much lower water consumption and carbon footprint. The project design makes use of renewable energy, reducing overall complexity and improves its financial attractiveness.

Metallurgical studies continue, including with Nuton’s technology for heap leaching of copper ore. Initial results show promising recoveries and reduced acid consumption for the scenario described above.

The Exploitation Environmental Impact Report preparation has been awarded to Knight Piesold, with the drafting of the report underway and on track for submitting to permitting authorities in April 2023.

El Gallo Mine and Fenix Project (100% Interest)

Activities at the El Gallo mine in 2022 were limited to residual leaching as part of closure and reclamation plans. The residual leaching activities of the El Gallo mine, ceased in July 2022.

The capital required to build the Fenix Project was reduced materially in September 2022 with the purchase of a second-hand gold processing plant and associated equipment for $2.8 million. The purchase includes substantially all the major components required to start the Fenix Project. This equipment was estimated at $25.3 million in our Fenix Project feasibility study, published in February 2021.

Multiple strategic alternatives continue to be evaluated for the project including financing options, lower capital costs, potential base metal evaluation.

Conference Call and Webcast Management will discuss our Q4 and Year-End 2022 financial results and project developments and follow with a question and answer session. Questions can be asked directly by participants over the phone during the webcast.

Tuesday

Mar 14 th 2023

11:00 AM EDT

Toll Free (US & Canada): (888) 330-2398

Outside US & Canada: (240) 789-2709

Conference ID Number: 67121

Event Registration Link: conferencingportals.com/event/ZSafhHZi

Webcast Link: events.q4inc.com/attendee/387697089

The webcast will be archived on McEwen Mining's website at www.mcewenmining.com/media following the call.

Technical Information

The technical content of this news release related to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A., the owner of the San José Mine, is responsible for and has supplied to the Company all reported results from the San José Mine. McEwen Mining’s joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

CAUTIONARY NOTE REGARDING NON-GAAP MEASURES

In this release, we have provided information prepared or calculated according to United States Generally Accepted Accounting Principles (“U.S. GAAP”), as well as provided some non-U.S. GAAP ("non-GAAP") performance measures. Because the non-GAAP performance measures do not have any standardized meaning prescribed by U.S. GAAP, they may not be comparable to similar measures presented by other companies.

Cash Costs and All-in Sustaining Costs

Cash costs consist of mining, processing, on-site general and administrative costs, community and permitting costs related to current operations, royalty costs, refining and treatment charges (for both doré and concentrate products), sales costs, export taxes and operational stripping costs, and exclude depreciation and amortization. All-in sustaining costs consist of cash costs (as described above), plus accretion of retirement obligations and amortization of the asset retirement costs related to operating sites, sustaining exploration and development costs, sustaining capital expenditures, and sustaining lease payments. Both cash costs and all-in sustaining costs are divided by the gold equivalent ounces sold to determine cash costs and all-in sustaining costs on a per ounce basis. We use and report these measures to provide additional information regarding operational efficiencies on an individual mine basis, and believe that these measures provide investors and analysts with useful information about our underlying costs of operations. A reconciliation to production costs applicable to sales, the nearest U.S. GAAP measure is provided in McEwen Mining's Annual Report on Form 10-K for the year ended December 31, 2022.

Cash Gross Profit

Cash gross profit is a non-GAAP financial measure and does not have any standardized meaning. We use cash gross profit to evaluate our operating performance and ability to generate cash flow; we disclose cash gross profit as we believe this measure provides valuable assistance to investors and analysts in evaluating our ability to finance our ongoing business and capital activities. The most directly comparable measure prepared in accordance with GAAP is gross profit. Cash gross profit is calculated by adding depletion and depreciation to gross profit. A reconciliation to gross profit, the nearest U.S. GAAP measure is provided in McEwen Mining's Annual Report on Form 10-K for the year ended December 31, 2022.

Liquid Assets

The term liquid assets used in this report is a non-GAAP financial measure. We report this measure to better understand our liquidity in each reporting period. Liquid assets is calculated as the sum of the Balance Sheet line items of cash and cash equivalents, restricted cash and investments, plus ounces of doré held in precious metals inventories valued at the London PM Fix spot price at the corresponding period. A reconciliation to the nearest U.S. GAAP measure is provided in McEwen Mining's Annual Report on Form 10-K for the year ended December 31, 2022.

CAUTION CONCERNING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements and information, including "forward-looking statements" within the meaning of the Private Securities Litigation Reform Act of 1995. The forward-looking statements and information expressed, as at the date of this news release, McEwen Mining Inc.'s (the "Company") estimates, forecasts, projections, expectations or beliefs as to future events and results. Forward-looking statements and information are necessarily based upon a number of estimates and assumptions that, while considered reasonable by management, are inherently subject to significant business, economic and competitive uncertainties, risks and contingencies, and there can be no assurance that such statements and information will prove to be accurate. Therefore, actual results and future events could differ materially from those anticipated in such statements and information. Risks and uncertainties that could cause results or future events to differ materially from current expectations expressed or implied by the forward-looking statements and information include, but are not limited to, effects of the COVID-19 pandemic, fluctuations in the market price of precious metals, mining industry risks, political, economic, social and security risks associated with foreign operations, the ability of the corporation to receive or receive in a timely manner permits or other approvals required in connection with operations, risks associated with the construction of mining operations and commencement of production and the projected costs thereof, risks related to litigation, the state of the capital markets, environmental risks and hazards, uncertainty as to calculation of mineral resources and reserves, and other risks. Readers should not place undue reliance on forward-looking statements or information included herein, which speak only as of the date hereof. The Company undertakes no obligation to reissue or update forward-looking statements or information as a result of new information or events after the date hereof except as may be required by law. See McEwen Mining's Annual Report on Form 10-K for the fiscal year ended December 31, 2022 and other filings with the Securities and Exchange Commission, under the caption "Risk Factors", for additional information on risks, uncertainties and other factors relating to the forward-looking statements and information regarding the Company. All forward-looking statements and information made in this news release are qualified by this cautionary statement.

The NYSE and TSX have not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining Inc.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 52% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has personally provided the company with $220 million and takes an annual salary of $1.

|

|

|

|

Post by Entendance on Mar 15, 2023 6:15:21 GMT -5

McEwen Mining Inc. (NYSE:MUX) Q4 2022 Earnings Conference Call March 14, 2023 Company Participants

Rob McEwen - Chairman and Chief Owner

Perry Ing - Chief Financial Officer

William Shaver - Chief Operating Officer

Michael Meding - Vice President and General Manager of McEwen Copper

Stefan Spears - Vice President, Corporate Development

Conference Call Participants

Jake Sekelsky - Alliance Global Partners

Heiko Ihle - H.C. Wainwright

Mike Kozak - Cantor Fitzgerald

John Tumazos - John Tumazos Very Independent Research

Rob McEwen

Good morning, ladies and gentlemen.

Today, I'll start with a discussion about gold and then our share price performance and follow up with factors driving our future.

With all the uncertainties in the world, many people are asking why the price of gold hasn't climbed much higher. I believe that most investors feel that we have entered into a new era where very low interest rates and massive monetary stimulation are here to stay. And the gold's reputation as a store of wealth is no longer relevant or needed in a world of awash with easy money.

However, as we all know, the unexpected happens quickly. Rising interest rates and an unexpected bank failure are vivid reminders, gold still has a role to play in your portfolio. I suspect more investors will start adding gold and gold shares to their portfolio and they will follow the lead of a select number of central banks who became large gold buyers in 2022. In fact, their purchases were the largest purchases made in the past 50 years by central bankers. Perhaps they too are concerned about holding too much of their reserves in fiat currencies.

So, during 2022, the price of gold outperformed not only gold equities, but also the Dow Jones. Gold increased 1% year-over-year, and at the yesterday's close, it was up 6% since December 31, 2021. During that same period, the senior and junior gold equities as measured by the ETFs, the GDX and the GDXJ registered losses of 10.5% and 15%, respectively in 2022, while the Dow was down 3.7%. But if we look back another year to December 31, 2021, and come forward to yesterday's close, the GDX was down 9.1%, the GDXJ down 16.2%, and the Dow was down 12.4%.

We weren't as lucky in 2022. Our share price was hammered. It was down a painful 36%. Fortunately, it has recovered much of this loss and has increased an impressive 136% since the end of last year, December 31, 2022. And if we look back to December 31, '21, our share price is only down 13.1%, which is less than the GDX decline of 16.2%, and very close to the decline of the Dow Jones Industrial Average of 12.4%.

So, looking at our stock chart, from a technical perspective, it looks very promising. With our share price having broken out on the upside through its 50, 100, 300 day moving averages. Driving this price improvement is our demonstration of improving operational performance, good exploration results, production growth, and lower cost per ounce, along with the growing recognition that McEwen Copper's Los Azules project is a large copper resource with large strategic shareholders, Rio Tinto, the world's second largest mining company, and Stellantis, the world's fourth largest automobile manufacturer and mobility provider.

For 2023, we are looking at a production increase of 12.5% to 27.5% over what we did in 2022, and our costs are expected to decline by about 5%. In 2022, our Fox Complex and Gold Bar mines generated operating profits, but the accelerated activities at our subsidiary McEwen Copper and its Los Azules project and our heavy investment in exploration contributed significantly to our large reported loss.

I will now ask Perry to provide details on how we performed financially in 2022 and more importantly what we see going forward in 2023. He will be followed by our Director and Interim Chief Operating Officer, Bill Shaver, who will comment on our success in stabilizing our mine operations and where we see growth in those operations. Bill will be followed by Michael Meding, our Vice President and General Manager of McEwen Copper, who will outline our progress at Los Azules and the financings we recently completed and the strategic shareholders we have.

Perry, off to you.

Perry Ing

Thank you, Rob. Good morning, everyone.

As Rob mentioned, I'll provide an overview of our fourth quarter and full year results for 2022, and then I'll discuss the impact of the recent Stellantis and Nuton, Rio Tinto transactions for our balance sheet.

These transactions are, obviously, transformative for the company. We'll deleverage our balance sheet in a rising interest rate environment and allow the company to advance its Fenix project in Mexico, as well as continue to explore aggressively in Ontario and Nevada without issuing additional equity, especially at these current gold prices.

For the Los Azules project, these transactions will bring two things. First, it brings on a key partner in the project in Stellantis and strengthens the relationship with another in Rio Tinto. It also provides significant funding to Argentina to continue our aggressive exploration efforts and provide McEwen Copper further flexibility in the timing of a potential IPO.

First off though, I'll start with a review of McEwen Mining's consolidated results for the prior year. It is important to note that we report McEwen Copper as a consolidated entity and reflect 100% of its expenditures on Los Azules on our income statement. As a U.S.-listed company reporting under U.S. accounting standards, we do not have the option of capitalizing the exploration and development costs at the project or any of our other projects for that matter until we have a completed feasibility study and permits for development, unlike many of our Canadian listed peers that often capitalize these costs at a much earlier stage.

In terms of looking at our headline figures, we reported a loss for the quarter and year of $37.4 million and $81.1 million, respectively. This translates into $0.79 per share and $1.71 per share, respectively. As ** for the loss for the year is due to the expensing of costs at Los Azules net of foreign exchange gains realized. A further 25% roughly is due to exploration and development costs at our 100% owned properties. The remainder of the loss figures per share reflect our G&A costs and certain one-time tax charges. I also note that the per share amounts reflect the 10 for 1 share consolidations completed in July of last year, which re-established the company's compliance with NYSE share price listing requirements.

Looking at our 100% owned mines, we generated a cash gross profit of $7.9 million for the quarter and $19.2 million for the full year, respectively. On a gross profit basis, these operations were essentially breakeven, a significant improvement over 2021 performance.

Looking at gold equivalent production, production for the fourth quarter of 37,300 gold equivalent ounces was down just under 10% compared to the fourth quarter of 2021, driven by a decrease of approximately 2,000 ounces at Gold Bar as they transition into the new Gold Bar South pit during the quarter.

Full year production of 133,300 gold equivalent ounces was down approximately 14% year-over-year. Again, the decrease was primarily driven at Gold Bar due to carbonaceous ore issues experienced earlier in the year as well as the transition into Gold Bar South in the fourth quarter of the year.

At the San Jose mine, production was down approximately 10% year-over-year due to issues with COVID and at the mill in the first quarter of 2022. Bill Shaver will cover off these line operations in further detail.

So, the revenue and cost standpoint realized gold prices were roughly unchanged at the $1,800 level for both 2022 and the prior year. Gold prices were slightly lower in the fourth quarter of 2022, but appears to have rebounded well into the first quarter of this year so far.

Looking at costs, we noted significant improvement in cash costs at our 100% owned operations at $1,276 per ounce, which have decreased steadily since 2020, but lower cost reported at both the Fox Complex and Gold Bar compared to the prior year. All-in sustaining costs were largely consistent with the prior year and reflect the cost of bringing Gold Bar South into production at -- in Nevada. At the San Jose mine, both cash costs and all-in sustaining costs increased incrementally over the prior year, reflecting lower production due to the issues I noted previously.

Finally, looking at our treasury, at the end of the year, our cash and equivalent balance stood at $44 million compared to $60 million at the beginning of the year.

Now, I'll turn the attention to the recent transactions with Stellantis and Nuton, Rio Tinto and how it impacts our balance sheet and working capital on a go-forward basis. These transactions all closed within the past three weeks. The transaction included an offering of primary shares directly from the McEwen Copper and a component of secondary shares, which are the shares of McEwen Copper owned by McEwen Mining. The details are summarized in our news release, so I'll just try to encapsulate it at a high level.

Essentially, McEwen Mining, if we look at it as a standalone company, it receives $48 million. McEwen Copper receives approximately ARS30 billion. The price point of these transactions -- the price point at which these transactions are valued from McEwen Copper standpoint has nearly doubled the initial $10 per share amount when we did the investments in June and August of last year. Following these transactions, McEwen Mining's ownership of McEwen Copper reduces from approximately 68% at the end of 2022 to 51.9% today.

In terms of the proceeds to McEwen Mining, we intend to use $25 million of the proceeds to retire the secured debt to Sprott Lending, which will reduce our total debt from $65 million to $40 million, saving the company significant interest costs going forward.

With our enhanced treasury, we believe we now have the funds on hand to build Phase 1 of the Fenix project in Mexico and bring that operation into production within the next year without raising additional capital.

As far as McEwen Copper's treasury, the ARS30 billion is a significant amount. At official exchange rate, this is equivalent to over $150 million. Using less official measures, such as a Blue Chip Swap rate, this is approximately equal to about $80 million. With this round of financing completed, McEwen Copper is well positioned to execute its drilling and development program for the remainder of the year and into 2024, which Michael will outline.

So, based on these transactions, the urgency to complete an IPO in the first half of 2023 has been eliminated.

So, with that, I'll turn the presentation over to Bill Shaver.

William Shaver

Thank you very much, Perry. Good morning, shareholders.

This morning, I'd like to leave you with three messages with regard to our operations. We have improved mining operations at the Fox Complex and are improving milling operations, which will result in higher output and lower cash costs in 2023. At Gold Bar, we have successfully transitioned to a new contractor and we have moved the operations to Gold Bar South pit, which will produce most of the ore in 2023. And based on the first two months of production, we are fully transitioned on both fronts, that being the new contractor and full operations. Cash costs for these operations will be approximately $1,100 per ounce in 2023, which is a significant improvement of approximately 15% from 2022. And lastly, at the Fenix project, as Perry has mentioned, we have moved the plant -- that we purchased last year to the plant site and are at -- in the working stages of planning production in early 2024.

The last quarter of 2022 was challenging, but hard work by all our mining operations helped us overcome these hurdles, making Q4 a reasonable quarter. We are also making progress in stabilizing and improving operations, so we can obtain predictable outcomes for gold production and costs in 2023 and into the future. And so far, this year, we are on track.

On the safety front, in 2022, we had two low severity lost-time incidents in January and March at our El Gallo operations. And for the rest of the year, we were lost-time accident free. At the Fox Complex, we have operated for a full year in 2022 with no lost-time injuries. And at Gold Bar, we recently passed three years without a lost-time injury.

On the environmental front, we -- there were no environmental events recorded in 2022.

Now, I'll turn it over to each of the operations. At the Fox Complex, we had a very challenging year with our mill, which continued to have significant availability issues, which hampered our throughput. This resulted in us missing our gold production last year. At the same time, the mine had an excellent year, which resulted in a stockpile build up to 120,000 tonnes by year-end. This represents a value of approximately $15 million after milling and recovery.

On a positive note, we have now undertaken crushing of the ore at the mine prior to it being shipped to the mill. This lowers the amount of work that the mill needs to do in processing the ore. This decision was followed -- was following a test program to prove this concept last year. We have been able to get our production tonnage through the mill successfully in Q1 of 2023 and are looking forward to improving the throughput when we get the contract crushing plant that we have planned for the remainder of the year at Froome into place. This plant will be commissioned in early April, which will allow us to reduce the size of stockpile we have at the Fox mill, transforming it into gold and therefore cash. We anticipate we will meet our budgeted cash call for the year of $922 per ounce.

At the Gold Bar mine in Nevada, 2022 was also challenging with our issues of preg-robbing ore and our parting of ways with our mining contractor at the start of Q4. Notwithstanding these issues, we transitioned the mine plan successfully to main production in Q4, and we are happy to tell you we have successfully transitioned to a new contractor who is now in full production. We also completed the move to the Gold Bar South pit and are now in full production in this pit. Gold production from Gold Bar has been on budget for the first two months of this year and we're looking forward to a good year from operations.

At the Fenix project in Mexico, we have been able to develop an approach to get the Fenix project in production in a timely manner and at a significantly lower capital cost. We will reprocess the heap leach pad, which has a grade of 0.6 grams per tonne. To accomplish this, we have acquired a used 7,000 tonne per day gold processing plant, which operated recently at a local mining operation. We have moved 80% of this plant to our site. And for Fenix, we will initially assemble only the grinding circuit, the cyclones and the leaching portion of the plant and use the present El Gallo gold recovery circuit. This will reduce the CapEx to approximately $12 million with the potential to increase the throughput as we move into production and prove that this plant will give the required outputs. There are a few minor changes in our permits that are required, but we hope to have this plant operating late this year or early in 2024.

With that, I thank you very much. And now I'll turn it over to Michael for an update on our world-class Los Azules project.

Michael Meding

Thank you so much, Bill.

I will quickly highlight our financing and strategic importance of our new shareholders, then report on our drilling, exploration and study work, and finally mention what we did last year and in 2023 concerning our enhanced organizational and ESG competence in Argentina.

McEwen Copper completed $81.9 million offering, including a $25 million investment by Nuton, a Rio Tinto Venture, on August 31, 2022, followed on October 24, by an option agreement with Kennecott Exploration, another subsidiary of Rio Tinto, for potential earn in of 60% for Elder Creek by investing $18 million over seven years. Subsequent to December 31, 2022, we announced the closing of an ARS30 billion investment by Fiat Chrysler Argentina, a subsidiary of Stellantis, to acquire shares of McEwen Copper and of a second investment of $30 million by Nuton that increased the investment to $55 million.

Now, Nuton is an innovative new venture with the portfolio of proprietary copper heap leach related technologies and capabilities at the core, a product of almost 30 years of research and development. Those have the potential to economically unlock copper sulfide resources and achieve higher copper recoveries on oxide and transitional material. Rio Tinto is the world's second biggest mining company, bringing significant financial and technical resources to McEwen Copper and the Los Azules project.

Stellantis, on the other hand, is one of the world's leading automakers. It produces iconic brands such as Alfa Romeo, Chrysler, Citroen, Dodge, Fiat, Jeep, Lancia, Maserati, Opel, Peugeot, Ram, Vauxhall and others. And in Argentina, Stellantis produces about 160,000 cars yearly, has about 3,000 employees and is present with manufacturing in Buenos Aires and in Cordoba, Argentina. Partnering with Stellantis is an expression of a paradigm shift for downstream customers of copper. Companies realize that copper is a mineral critical to the green energy and mobility transition. And to my knowledge, it's the first time an automotive company has invested in a copper company.

Subsequent to those transactions, Stellantis and Nuton each own 14.2% of McEwen Copper. McEwen Mining's ownership is now approximately 52%.

Now I'm going to talk about drilling, exploration, site and study work. A total of $41.3 million was incurred in 2022 at the Los Azules project to advance drilling, engineering and project feasibility work. Drilling has focused on increasing drill hole density to upgrade the copper mineral resource classification to measured and indicated and to define the payback pit design better, to provide metallurgical, hydrological and geotechnical data to support mine design and [step-out] (ph) exploration testing for potential extensions of the copper resource to the north, south and the depth of this already vast deposit, which Mining Intelligence ranked in 2022 as the ninth largest undeveloped copper project by copper resource size.

In 2022, drilling started in January and went to May when it stopped for the winter in the southern hemisphere, then restarted in October and is currently ongoing. Since October 2022, there were six drill rigs on site and five more were added in early 2023. From 2022 to date, we have drilled over 105,000 feet, approximately 32,000 meters, in 98 drill holes to increase geological confidence and we see that drill results are generally consistent with our model.

Beyond our robust delineation results, published in January and March this year, we recently published our northern step-out exploration results with 1,052 meters of 0.29% copper including an interval of 480 meters of 0.42% copper, which demonstrates the potential of the deposits to the north. The updated PEA will include all available information on drilling, assay and metallurgical testing obtained until early 2023 and is now slated for publishing during Q2 this year.

We are developing a scenario for Los Azules as an open pit mine that initially processes leachable copper content in a heap leach, with a solvent extraction and electro winning facility to produce copper cathodes. This scenario is more environmentally sensitive due to its much lower water consumption and carbon footprint, and is de risking the project due to lower complexity. The project design makes use of renewable energy, which will allow for low carbon footprint production and improves financial attractiveness. While the PEA as a base case considers economic leaching without Nuton technology, we are excited to be able to test heap leaching using their technology, which could represent a very interesting upside scenario, and initial results are promising.

We are in preparation for the filing of the environmental permit application for the exploitation stage to the San Juan mining authorities. The drafting of the report is underway and on track for submitting it to the authorities in April 2023.

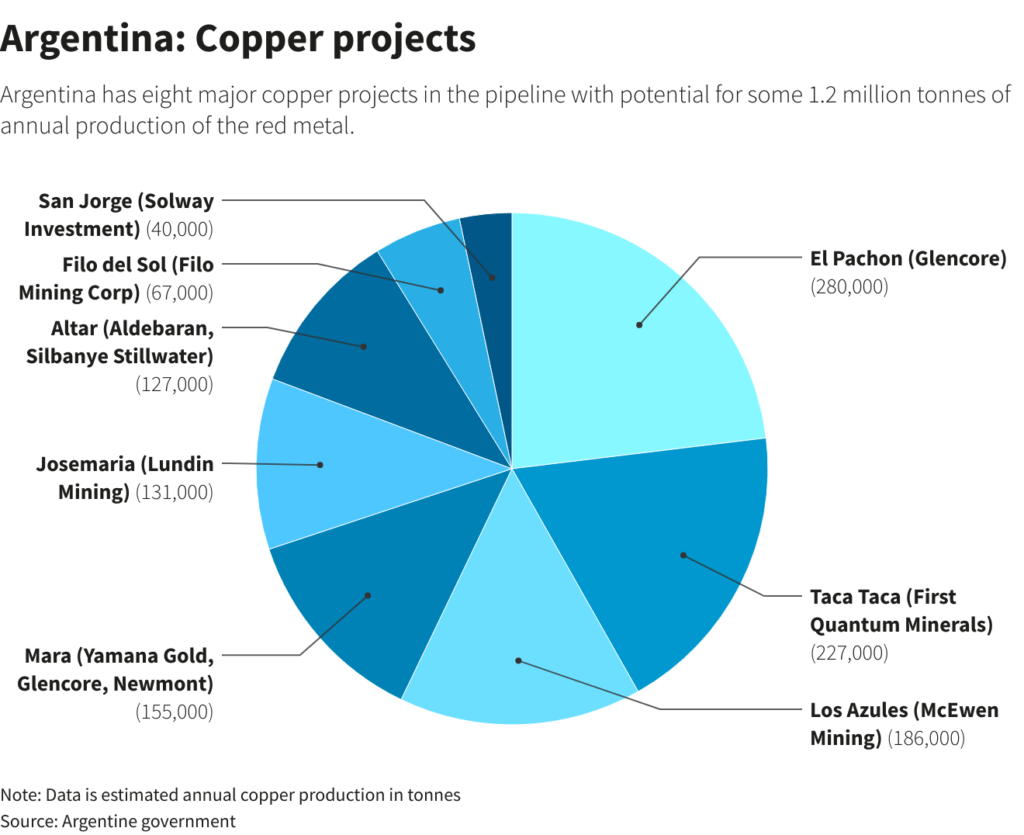

In 2022, a major advance was made that will accelerate the development of the Los Azules project with the completion of a new low altitude access roads, which goes to a maximum of about 11,000 feet or approximately 3,400 meters above sea level, which we share in part with other mining projects, including El Pachon from Glencore and Altar from Aldebaran Resources. The importance of having a second road into the site at more than 2,000 feet low altitude means that we now have almost year-round access to the site. In addition, we upgraded the exploration roads, the former existing roads, to allow for articulated 18 wheelers to get to site, a significant logistics improvement, lowering costs and quickening transports.

With regards to our organization, a strong and experienced management team was set up in Argentina in 2022. With management team members having a total of over 180 years of experience in Tier One operations, the majority in San Juan, Argentina where the project is located.

To further cement our relations with local communities, we opened up our community affairs office in Calingasta in San Juan where the project is located, to have even closer relations with the community we are operating in. And I can report that we are happy to receive ongoing support to develop our project there.

This concludes my report on McEwen Copper. Thank you for your attention and I will now turn it back over to Rob.

Rob McEwen

Thanks, Michael.

I'd like to say I've always felt that Los Azules was a tremendous asset for McEwen Mining. The problem was in 2022, our share price was scraping along the bottom and our treasury was small. But in order to advance Los Azules, we needed a lot of money. And the thought of trying to do a financing when we -- our share price was at historic lows was just not that attractive or possibly feasible.

So, we decided the best way to advance Los Azules and build its value and surface the value for McEwen Mining and allow it to access financing was to create McEwen Copper and fund it separately. And I believe we have been successful in surfacing value. We've attracted the second largest mining company in the world as a shareholder and the fourth largest automobile manufacturer in the world. So, both did extensive due diligence on this, on Los Azules, and just confirming that we do have a very large, very attractive copper projects that will likely be one of the larger copper mines in the world when it is built.

So, last August, we raised $82 million at a share price of $10. And now seven months later, we've completed an even larger financing of $30 million and ARS30 billion at an average price of approximately $18.75. As a result, the implied value of Los Azules has increased from $260 million to $550 million. And that's excluding the 1.25% royalty that McEwen Mining holds on this property. So, now behind every share of McEwen Mining, on a fully diluted basis, is a value of $5.70 from Los Azules. Back in mid-2020, our share price was around $3 a share.

Looking ahead, with our operations performing much better than they have in the past, with prospects of growth at our Fox Complex where we can see the potential to double production and further reduce cost to below $900 an ounce; mining at Gold Bar, we're in a new deposit that is higher grade and lower strip, and assuming the winter doesn't frustrate our plans, we'll be increasing production by better than 50%; and we're looking at the Fox Complex increasing production anywhere from 15% to 30% and keeping its costs around a $1,000 an ounce, we're looking at 150,000 to 170,000 gold equivalent ounces, representing an increase between 13% to 28%.

McEwen Mining trades at a significant discount to its peer group and our objective is to get up and exceed that peer group economic value for gold equivalent ounce. And when we do that, along with continuing to progress our Los Azules project, I think that the value behind McEwen Mining is going to increase and I see a value of somewhere between $7 and $28 a share.

And you might be wondering how I got that number. There are -- and it's really the sum of the parts. We have Los Azules in there. And compared to two other copper projects in the same province in Argentina, we're at a lower altitude closer to the infrastructure, then they are roads powered. Based on the published resources, we have a larger resource and a higher copper grade than either of those two properties, yet, one has a value -- was purchased at $485 million last April and the other one has a market cap of about $1.9 billion.

So, you could see -- I think we are in a position to be somewhere between that $500 million and $2 billion for the value for Los Azules. We have five royalties -- non-producing royalties, 1.25% on Los Azules, 1.25% on McEwen Coppers, other copper project, Elder Creek, which you heard earlier has been optioned by Rio's exploration arm Kennecott Copper, and then we have our gold assets that are trading well below our peer group. So, I think there's quite a bit of room to grow. And I think we're in really good position to push forward on that front.

The investment that we have brought in recently into McEwen Copper, although it reduced our interest -- our ownership interest, it increased the value significantly of that asset. And it allowed us to reduce McEwen Mining's debt and put money in the treasury of McEwen Mining to further the development of our Fox Complex, expand down in Mexico and fund our exploration program.

So, if any of you are interested in buying -- getting exposure to McEwen Copper, right now, the best way to do it is through the shares of McEwen Mining or wait for the IPO of McEwen Copper.

Jake Sekelsky Alliance Global Partners

Hey, Rob and Perry.

Rob McEwen

Hi, Jake.

Jake Sekelsky

Thanks for taking my question.

Rob McEwen

Go ahead.

Jake Sekelsky

So, just starting with Gold Bar, you mentioned the change of contract during Q4. Can you give us any color on the improvements you've seen since making that switch, and if you're able to quantify them at all?

Rob McEwen

Sure. I'll ask Bill to address that question.

William Shaver

Thanks very much for the question. Yes, I guess, there's two aspects to the improvement. The first aspect is that we have a significantly different contractual arrangement with this group. And that, along with their performance, has brought the relationship to a very professional relationship, which is contractually, I guess, not complicated. And that has been nice to see from my perspective and also from the site's perspective.

And they have successfully transitioned in a relatively short time, approximately three months from the time we first started talking to them until we had a contract in place and they were on site. And they are now totally ramped up as the Gold Bar South project, which is a new mining operation. If you were there a year ago, it was a big hill out in the middle of the desert. And now, it's a full-scale mining operation, producing about 100,000 tonnes of ore a month and between 300,000 and 400,000 tonnes a month of waste.

So, it's been a relatively smooth transition. We've had this fall and early winter, I guess, the toughest winter that they've had in the decade in Nevada from the perspective of snow and rain. So, with those challenges and seeing the success of the first two months where we're basically right on budget, I think that tells me we're on the road to seeing better performance as the year goes on. As the contractor becomes more comfortable and also as the amount of workspace that we have in the pits expanding, because right now it's a very small pit, because of the fact that we're just starting.

I hope that answers the question.

Jake Sekelsky

That's helpful. And then, just looking at Los Azules, obviously, looking at the recent financing and increased cash position from McEwen Copper, I'm just wondering if this has changed your thinking on the IPO timeline with a longer cash run. Obviously, I think you have a bit more flexibility and kind of take a market [indiscernible] approach. Any thoughts here would be helpful.

Rob McEwen

Sure, Jake. With the financing -- well, I'll go back a bit. We had thought we'd complete the updated PEA and use it as the basis for going public in this first half of the year. And as you mentioned, with the financing now completed, the urgency to do a financing is no longer there. And so, we'll have the ability to think of it financing later this year or into early next year, but in a more buoyant marketplace.

Jake Sekelsky

Got it. Okay. That makes sense. That's all on my end. Thanks again.

Rob McEwen

Thank you.

Heiko Ihle, H.C. Wainwright

Hey, Rob. Thanks for taking my questions.

Rob McEwen

Hi, Heiko. Go ahead.

Heiko Ihle

[indiscernible] last week. One of our questions or primary question really is the contractor at Gold Bar South. I mean, you got new people there. What kind of efficiencies have they brought with them already to improve production? How much more do you think you can see? And even more importantly, do you think any of those efficiencies can be extrapolated to other sites?

Rob McEwen

Bill, once again, could you jump in?

William Shaver

Yes. So, I guess the potential upside at Gold Bar South is that we will have -- once we get up to full operations, which we're very close to now, we will have the ability to ramp up production to a higher level. I don't think we've completely figured out exactly what that capability is. And one of the things we have to be a bit careful with is that the life of this pit is relatively short. It's between 12 and 18 months. So, we want to make sure that we run the operation is -- in a very efficient manner to make sure that we optimize the -- optimize not necessarily maximize the production out of the pit. And we also have to make sure that we get the right recoveries from the operation. At the same time, at Gold Bar, we also need to expand our leach pad this year, and that work is now getting underway and will be completed sometime in the late summer, August, September.

So those are some of the complicating factors, But, so far, as I mentioned earlier, we're right on budget and on schedule in terms of production. And it's -- now, I guess, the thing we're not absolutely clear on is what the recovery will be from this ore, although early indications are that the recovery will be higher than what we have in our study. So, I think, we're looking good for the future. It's a question of managing all of our operating costs. We need a little bit of cash to do some exploration work. And I think all of that can happen out of Gold Bar to ensure we know where we're going next after Gold Bar South.

Rob McEwen

Heiko, in terms of applying what we're doing at other sites, this contractor is specific to this mine and I don't think they'll go -- we'll be using them at other sites at this point.

Heiko Ihle

No, I didn't mean physically move them over. I meant, more of the techniques. But that was helpful nonetheless.

My next question was going to be pointing out your market cap, still you own 52% of McEwen Copper and that's $286 million right there, which puts a $100 million on the rest of the company. Including net debt, you're still looking at $100 million, $120 million, $130 million or whatever. You did a, I think, terrific job describing how you plan on unlocking all of this earlier on the call, to that I thank you. The one thing I think I'd like to see just a touch more color on is the management time priorities for the senior team for the company. I assume there's at least some people that are going to have some overlap, and how you expect time priorities to be spent, please?

Rob McEwen

Michael has done a wonderful job of assembling a very seasoned Argentinian management team, which are handling much of what's going on in McEwen Copper at Los Azules. And then, we have oversight from Toronto on the financing and also the other property, Elder Creek, which is largely being run -- the program will be run by Rio Tinto's Kennecott copper arm over the next number of years.

Michael, perhaps you could talk about the team you've assembled and their backgrounds?

Michael Meding

Yes, sure, Rob. No problem. So, what Rob has said, is that we set up a local management team. So, in Argentina, we have myself or the majority of my time. I have about 16 years in Latin America and 10 in San Juan in Argentina. I spent about seven years with Barrick being responsible in financing operations for their -- for all of their assets in Argentina.

Then, we have our project director, who's American, but who also relocated to San Juan in Argentina to be directly connected with the team. And then, the next line of management from human resources with a person more than 16 years in Tier One, Tier Two operations to our legal manager, 20 years of experience with Barrick and -- in natural resources. Our environmental and health and safety manager, [20] (ph) years of experience in Tier One operations with Barrick.

Through all the different functions, we have a very, very strong team that is capable of bringing this project from where it currently is over to feasibility, engineering and construction and operation. Rob?

Rob McEwen

Yes. So, Heiko, does that covers your...

Heiko Ihle

Yes, it does. Thank you very much. Appreciate it.

Rob McEwen

Thank you.

Mike Kozak, Cantor Fitzgerald

Yes, good afternoon, everybody. Thanks for hosting the call. A couple of questions from me. First one, you put out 2023 cash cost and ASIC guidance in your December 21 press release last year. But I -- that guidance was noticeably absent from your press release this morning. Was that just an unplanned omission? Or should I interpret that as your previous 2023 cash cost guidance should no longer be relied upon?

Rob McEwen

I'm sorry to say, an omission.

Mike Kozak

Okay. So, you can just say reiterate the cost guidance. Good. All right. Second one, yes, so -- and Michael you mentioned that the PEA at Los Azules is now expected in Q2, which is small delay from Q1 before. Now on the site visit a few weeks ago, it's abundantly clear just how much work is going on there right, exploration drilling, met testing, the geotech drilling, new iterations of the life of mine plan that seem to be changing like almost constantly. So, my question is by pushing the PEA to Q2 from Q1, how much and what type of extra data might you be able to jam into that PEA that you otherwise wouldn't have been able to -- that could presumably improve the project economics there?

Rob McEwen

I was just going to say one aspect is deciding on the base case. We've done a number of optimization runs and we're just finalizing that base case and getting agreement across the board on all of our consultants.

Mike, do you want to add further information?

Michael Meding

Sure. Yes. What we looked at beginning of this year was that we had some interesting additional drilling information that we wanted to include. And this requires update on the work around the mineral resource estimate from the works of the [geostatisians] (ph) over to the geos to the mine planning. And while we said, well, we're going to publish -- we're going to complete the PEA by end of Q1. We now think, okay, we are going to complete it end of this month, beginning of next month depending on the optimization work that Rob just mentioned, because we still think that we can do some further work that will run a couple of weeks later publishing of the PEA, especially in the framework of the obtained financing that gives us more headroom to look for, as Rob said before, a buoyant financial market. So, we have the time we want to make sure that we get the best possible outcome for this PEA. I think we owe that to our shareholders.

Mike Kozak

No, that makes perfect sense. Thanks for that color. Maybe just one follow-up. And you touched on this briefly. I was going to ask on it anyway. But you mentioned that now you've upgraded that exploration road, so that you can get 18-wheeler trucks in there. Can I then assume that if you wanted to you would now be able to winterize the camp? I'm not saying if you will or if you won't, but is that possible now to enable drilling year-round?

Michael Meding

Yes. So, as we had highlighted before, and Rob had mentioned in prior press release, one of the things that is critical for us is access to site. And access to site we have through the exploration road and through the southern road. And on top of that, we upgraded the exploration road, as you said, to bring tractor trailers to site. Now this means that a potential construction of a winter camp, a true four-season camp with fixed installations, is now possible much more efficiently. So, should we decide to go forward and construct this camp, then we could think about winter drilling this season, but we're currently evaluating that and look for what is the most cost effective and efficient solution and also what is required from a study program point of view to be able to complete the feasibility study by end of 2024.

Mike Kozak

Okay. Very good. Very helpful. Thanks. That's all from me.

Rob McEwen

Thanks, Mike.

John Tumazos, Very Independent Research

Thank you very much, and congratulations on all the progress. In your press release, you mentioned 42 meters of 2.78% copper and hole AZ23191 on Los Azules. Could you tell us how deep that was? And whether it was oxide leach mill open pit or underground ores?

Rob McEwen

Mike, care to cover that question?

Michael Meding

Sure. The section is in our press release where you can see where the copper mineralization is. So, best is to open that up. The 174, the exploration one, is mostly primary, and the 3191 is mostly secondary, and then goes into primary.

John Tumazos

Is primary mill ore or leach ore?

Michael Meding

Primary would be either mill ore or using a technology such as Nuton's heap leaching technology or [indiscernible] technology.

John Tumazos

So, it's not an old fashioned leech, but it might be a tomorrow heap leech?

Michael Meding

No.

Rob McEwen

Yes. Today, it's the mill. It would be a mill today. But thinking that there is advances taking place in recovering metals, that -- we're hoping we'll see a heap leach alternative.

John Tumazos

Thank you for clarifying and helping me. Could you just repeat the 2023 cost guidance that was omitted from the release? I didn't get it that quickly.

Stefan Spears

Hi, John. It's Stefan Spears on the line. Yes, so in December, we guided on a consolidated basis, so that's 100% owned operations cash costs of $1,200 and all-in sustaining of $1,500; Gold Bar, we guided cash cost of $1,400, all-in sustaining of $1,680; Fox was $1,000 cash cost and $1,320 all-in sustaining; and San Jose at $1,250 cash costs and $1,550 all-in sustaining.

John Tumazos

Thank you. Concerning the mill at El Gallo and the ramp at Stock, could you give some indication as to what month in 2024 or early or late 2023 that might begin production and what the monthly production rate might be?

Rob McEwen

Bill, could you address that question?

William Shaver

Yes. So, with regard to Fenix, we anticipate that we would have that plant running, say, in the first quarter of 2024. And the tonnes per day is somewhere around 3,500 to 4,000 tonnes a day.

And with regard to Fox and the start of the ramp there, what we hope to be able to do is to construct the portal in the last quarter of this year and then be in production sometime in the first -- late in the first quarter or the second quarter of next year from ore that's relatively close to surface that we have been drilling feverishly over the last couple of months.

I guess, basically what I'm saying is that there is ore very close to surface, which will take something less than three months to develop. And then, we'll continue driving the ramp down towards -- well, towards Stock West, but also with a possibility of heading to Stock East where we also have some ore that's relatively close to surface. And of course, as you probably know the better ore in the Stock West deposit is quite deep anywhere from 200 to 400 meters deep.

John Tumazos

Bill, if I could follow-up. Maybe it's too much to ask you what the gold output could be in 2024 from Stock since you're still infilling the gold to finalize the grade. Concerning El Gallo at 3,500 tonnes per day, how much gold per month or per quarter would that be given the grades and recoveries?

William Shaver

With regard to Fox, we anticipate that we would be able to continue production at the same rate as we are planning for 2023 at Fox. So that's somewhere in the range of about 4,000 ounces per month. And to tell you the truth, I don't remember the production number from El Gallo, but it's [496, 24 times 30] (ph)...

Unidentified Company Representative

1,500 a month?

William Shaver

Yes, it's about 1,500 ounces per month from Fenix project.

Yes. So, it'll -- from a cash generation perspective, Fenix will be a very, very good project with a relatively short payback period, because we've basically worried the capital cost down to something in the range of $12 million.

John Tumazos

Thank you for all those explanations, Michael and Bill.

William Shaver

No problem.

Michael Meding

Pleasure.

Rob McEwen

You're welcome, John.

Unidentified Analyst

Yes. Thanks for such a great conference call today. But question on the Stock. I know you were planning to do quite a bit of drilling and it sounds like from Bill's recent comments that you're planning to drive a shaft down and then start producing ore. I guess, is this at the point where Froome production is I guess continue to go forward? Or is this going to be produced along with Froome?

William Shaver

So that's a really good question. So, just for your interest, we'll do 100,000 meters of drilling this year at Stock with possibly some of that, in fact, not at Stock, but at Grey Fox and a couple of other projects, but a substantial amount of drilling will be completed at Stock. So, conceptually at this point, Froome will continue at least to the first quarter of 2026.

And so, the transition across to Stock will be one where we will be mining at Stock before we're out of ore at Froome. And so, that's where we hope to increase the tonnage in 2024 -- increase the tonnage coming from the Fox Complex, which will increase the total amount of coal that we are producing. However, at this point, I can't tell you what that coal production might look like, in part because we haven't all of the resources put together in mine plans for that period of time. But I would venture that it will be a couple of thousand ounces a month once we get it ramped up.

Unidentified Analyst

Okay. And so, you would -- the idea would be that, I mean, it sounds like Froome is still a fair amount of exploration that it keeps getting extended as far as its terminal date. It sounds like there's still a fair bit of exploration you're planning to do there. And so, would this -- would additional adjustments need to be made to the mill to accommodate this ore? Or is that in your plans for this year to accommodate ore -- the increased throughput since it sounds like that's kind of a bottleneck as of right now?

William Shaver

That's correct. The mill has been a bottleneck. Crushing the ore at the mine has significantly lifted the pressure on that, because we're basically -- the plan going forward there is to basically crush down to 6 millimeters, haul that across and put it directly into the ball mill and leaching part of the circuit.

What we have to determine this year is what the long-term configuration of that mill will actually be. Will we go to crushing at the Stock site as well? Or will we do something innovative at the front end of that plant, such as a larger ball mill, some other kind of tower mill to do grinding? But at the present time, we're -- part of our task this year is to figure out what that long-term solution is and then to implement that so that we can take advantage of not only ore from Froome, but also of course Stock, but also to have a view on what the future might hold at Grey Fox.

Unidentified Analyst

Okay. And one last question. As far as getting back on track in San Jose, I know there was a drop off in production last year. What changes are -- Hochschild or -- and you and Hochschild planning to make to kind of get production back up, or is it planning to operate at a lower level this year?

Stefan Spears

Sure. So, it's Stefan speaking. So, production should rebound. Obviously, they're not anticipating any of the issues they had in early 2020 to be repeated in 2023. And our partner Hochschild is projecting a significantly lower cost as well relative to last year. If you look at Hochschild's guidance, I believe they're guiding around $1,400 all-in sustaining. And yes, so I'd say overall a substantial improvement at San Jose.

Unidentified Analyst

Are you -- will this potentially -- are you expecting dividends? I guess, if production goes where things do rebound, is that something that they'd give guidance on so far?

Stefan Spears

It's certainly something we're expecting. But we don't have the ability to provide any real color on that at this point.

Rob McEwen

Okay. Thank you so much.

So, it was a year of big numbers. Over the past 15 months, large losses that were largely a function of the consolidation of the work being done at Los Azules. And we will expect that to continue as long as McEwen Mining is over 52% of the ownership and up to the feasibility study at Los Azules, which we expect to have at the end of '24. But we consolidate all of the expenditures, as Perry said, that occur in Los Azules and it has an adverse impact on our earnings.

We also have a large exploration program this year that probably will not be as large next year at our other properties and that contributed to the loss. The mines are generating operating profit. So -- and we're looking at increased production and an improved cost per ounce.

I do think the copper assets will play -- continue to play a very large role in building the value of McEwen Mining, but I'm not discounting at all, the precious metal assets catching up and we hope to surpass our peer group valuation.

With that, I'd like to thank everyone for attending and look forward to our next exploration updates.

|

|

|

|

Post by Entendance on Mar 22, 2023 3:18:30 GMT -5

|

|

|

|

Post by Entendance on Apr 1, 2023 4:32:46 GMT -5

|

|

|

|

Post by Entendance on Apr 5, 2023 6:10:53 GMT -5

April 5, 2023 McEwen Copper:

Los Azules – New Assay Results

Significant Infill Intercepts

0.50% Cu over 502 m, including 0.87% Cu over 172 m (AZ22181)

1.00% Cu over 282 m, including 1.40% Cu over 172 m (AZ22186)

0.66% Cu over 500 m, including 0.92% Cu over 276 m (AZ22184A)

TORONTO, 5 April 2023 – McEwen Copper Inc., 52%-owned by McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to report the latest assay results from Los Azules, where an ongoing drilling program continues to deliver consistent infill results. Located in San Juan, Argentina, the Los Azules Project has many features comparable to world-class copper-gold deposits in South America, including a thick blanket of higher-grade Enriched (or Supergene) mineralization. Highlights

Hole AZ22183 returned an Enriched zone intercept of 0.87% Cu over 152 m (est. true thickness) which expands mineralization from adjacent high-grade results drilled in prior programs (Figure 1 and 2). In hole AZ22184A, an Enriched zone interval grading 0.92% Cu over 276 m (est. true thickness) occurs in a hydrothermal magmatic breccia within the core of the deposit (Figure 3). This breccia unit acts as a conduit for mineralizing fluids, sometimes forming higher grades within the broader porphyry mineralization at Los Azules.

Hole AZ22181 returned an Enriched zone intercept of 0.87% Cu over 172 m (est. true thickness) and fills a gap between high-grade holes drilled earlier in 2022 (Figure 4).

Hole AZ22186 includes an interval grading 1.00% Cu over 282 m (true thickness of 247 m) in the Enriched zone nearby a historic high-grade‑ intercept (Figure 5).

“We have four different drilling contractors with 13 drills turning,” commented Michael Meding, Vice President and General Manager of McEwen Copper. “This initiative also involves training and optimizing the entire value chain, with the significant engagement of local suppliers and services.”

After resuming the exploration program in October 2022, drilling has now reached the 25,000 meters initially planned and will continue until the end of the field season. Key objectives of the program include:

Increasing drilling density to upgrade the classification of shallower copper resources to measured and indicated categories.

Providing metallurgical, hydrological and geotechnical data for the feasibility study mine design to be completed in late 2024.

Testing for extensions of Los Azules mineralization to the north, south and at depth... |

|

|

|

Post by Entendance on Apr 11, 2023 5:28:53 GMT -5

Canada concentrates ~75% of🌎world's mining companies.

🇨🇦Canada's Ambassador in Argentina Reid Sirrs and 🇦🇷San Juan Minister of Mines Carlos Astudillo visited Los Azules, a worldwide top 10 copper project by resource as ranked in 2022 Mining Intelligence.

|

|

|

|

Post by Entendance on Apr 20, 2023 5:13:52 GMT -5

|

|

|

|

Post by Entendance on Apr 21, 2023 2:31:39 GMT -5

|

|

|

|

Post by Entendance on May 1, 2023 8:19:53 GMT -5

|

|

|

|

Post by Entendance on May 2, 2023 1:55:53 GMT -5

|

|

|

|

Post by Entendance on May 3, 2023 10:11:53 GMT -5

McEwen Mining Q1 2023 Results Conference Call

May 3, 2023

TORONTO, May 03, 2023 -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) invites you to join our conference call following the release of our Q1 2023 financials results on Tuesday, May 9th, 2023 at 11:00 AM EDT, where management will discuss our financial results and project developments and follow with a question-and-answer session. Questions for the call can be emailed in advance to info@mcewenmining.com, or can be asked directly by participants over the phone during the webcast.

Tuesday May 9 th 2023

at 11:00 AM EDT

Toll Free (US & Canada): (888) 330-2398

Outside US & Canada: (240) 789-2709

Conference ID Number: 67121

Event Registration Link: conferencingportals.com/event/ZSafhHZi

Webcast Link: events.q4inc.com/attendee/775071696

An archived replay of the webcast will be available approximately 2 hours following the conclusion of the live event. Access the replay on the Company’s media page at www.mcewenmining.com/media. |

|

|

|

Post by Entendance on May 5, 2023 10:33:28 GMT -5

McEwen Copper: Los Azules – New Assay Results

May 5, 2023

Significant Infill Intercepts

231 m of 0.97% Cu , including 188 m of 1.09% Cu (AZ22182A)

550 m of 0.50% Cu , including 216 m of 0.72% Cu (AZ23196) TORONTO, May 05, 2023 -- McEwen Copper Inc., 52%-owned by McEwen Mining Inc.(NYSE: MUX) (TSX: MUX), today reports the latest assay results from Los Azules, where an ongoing infill drilling program continues to delineate copper mineralization in the core of the deposit. Infill drilling serves several purposes: providing better data density to upgrade confidence in the mineral resources, providing material and data for metallurgical, geotechnical, and hydrological studies, and potentially defining higher grade mineralization by drilling inclined holes across vertical structures (such as breccias).

Located in San Juan, Argentina, the Los Azules Project has many features comparable to world-class copper-gold deposits in South America, including a thick blanket of higher-grade Enriched mineralization.

Highlights

Hole AZ22182A intercepted an Enriched zone of 231 m of 0.97% Cu (est. true thickness) and a Primary zone with mineralization that remains "open" at depth.

Hole AZ23196, returned an overall intercept of 550 m of 0.50% Cu (est. true thickness) and included 216 m of 0.72% Cu within the Enriched zone portion.

Drilling completed during the current season to April 30th stands at 32,758 m in 125 holes, having exceeded the 25,000 meters initially planned. Drilling will continue until the end of the field season in May and will resume in October, at the end of winter in Argentina.

More here |

|

|

|

Post by Entendance on May 7, 2023 3:48:56 GMT -5

|

|

|

|

Post by Entendance on May 8, 2023 6:35:32 GMT -5

High Grades Near Surface in Proximity to the Proposed Ramp System to Stock West

Hole SM23-145: 18.9 g/t Au over 9.4 m

Hole SM22-116: 18.7 g/t Au over 3.0 m

Hole SM23-133: 11.9 g/t Au over 2.6 m

|

|

|

|

Post by Entendance on May 9, 2023 3:39:54 GMT -5

TORONTO, May 08, 2023 -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today reported its first quarter (Q1) results for the period ended March 31st, 2023.

“This quarter we completed a series of large financing transactions involving shares of our McEwen Copper subsidiary, which has increased the market value attributable to our copper business to $550 million (for 100%) from $257 million at the conclusion of the prior financing round in August 2022. As 52% owner, McEwen Mining shareholders are benefitting from this value accretion, which validates the strategy we set out in July 2021 to surface value from Los Azules by funding it independently,” said Rob McEwen, Chairman and Chief Owner. “Our 100% owned precious metal mines generated a gross profit this quarter, although McEwen Copper expenses obscures our improved performance on a net basis. We continue to invest in exploration as the most cost-effective means to extend the life of our operations with positive results.”

Financial Results