|

|

Post by Entendance on Nov 6, 2023 11:08:06 GMT -5

McEWEN MINING Q3 2023 RESULTS CONFERENCE CALL

TORONTO, November 3, 2023 - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) invites you to join our conference call following the release of our Q3 2023 financial results on Thursday, November 9th, 2023 at 11:00 AM EST, where management will discuss our financial results and project developments and follow with a question-and-answer session. Questions for the call can be emailed in advance to info@mcewenmining.com, or can be asked directly by participants over the phone during the webcast.

Q3 Results Conference Call - Thursday, November 9th, 2023, at 11:00 AM EST

Calling in:

Participant Toll-Free Dial-In Number: (888) 210-3454

Participant Toll Dial-In Number: (646) 960-0130

Conference ID: 3232920

Webcast Registration Link:

events.q4inc.com/attendee/253960288

An archived replay of the webcast will be available approximately 2 hours following the conclusion of the live event. Access the replay on the Company’s media page at www.mcewenmining.com/media.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Its Chairman and Chief Owner has personally provided the company with $220 million and takes an annual salary of $1.

|

|

|

|

Post by Entendance on Nov 9, 2023 3:33:13 GMT -5

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) reports its results for the third quarter (Q3) and nine months ended September 30th, 2023. Operational and Financial Highlights

Consolidated GEO production in Q3 improved by 8% compared to both Q2/23 and Q3/22. We produced 38,500 GEOs(1) in Q3, and 104,400 GEOs for the nine months ended September 30th. We reiterate our consolidated production guidance is at the lower end of our range of 150,000 to 170,000 GEOs for the year (see Table 1). We continue to meet safety standards at our 100% owned operations. During Q3, we had no lost-time incidents at our Fox Complex, Gold Bar Mine, and El Gallo operations.

In Q3, our Fox Mine Complex performed well, producing 11,200 ounces (oz) gold and remains on track to meet guidance of 42,000 to 48,000 oz gold for the year. Cash costs(4) and AISC per GEO(4) sold for the Fox Complex were $1,078 and $1,288, respectively . We expect annual cash costs(4) per GEO(4) sold to be 10% above of our 2023 guidance. Figure 1 highlights the turnaround in production at Fox that has occurred since 2021.

In Q3, the Gold Bar Mine produced 9,500 oz of gold, an increase of 20% compared to Q2/23. Production continues to increase quarterly, though delays from extreme weather and labor constraints during 2023 have impacted our annual outlook. We now expect production from Gold Bar to be between 36,500 to 40,000 oz gold. Cash costs(4) and AISC per GEO(4) sold for the Gold Bar mine were $1,529 and $2,160, respectively. AISC was affected by a $4.5 million sustaining capital investment in a heap leach pad expansion, which was substantially completed during the quarter. Additional mining crews and the completion of our heap leach expansion are expected to result in increased production in Q4/23 (see Figure 2), allowing Gold Bar to quickly realize recoveries on material stockpiled during the last quarter. While this should reduce costs per ounce in the fourth quarter, we still expect the average costs for the year to be 10% to 15% higher than our 2023 guidance.

In Q3, the San José Mine produced 17,800 GEOs, an increase of 3% compared to Q2/23 due to a modest improvement in processed tonnes. Our joint venture partner and mine operator, Hochschild Mining, reiterates production guidance of 66,000 to 74,000 GEOs for the year. Cash costs(4) and AISC per GEO(4) sold for San José were $1,445 and $1,953, respectively. We expect costs to remain approximately 15% above 2023 guidance due to additional capital development costs associated with the operator’s revised mine plan.

We continue to advance our exploration program at Los Azules aiming to deliver all information required for the feasibility study. During Q3, we completed planning and preparation work for the 2023-2024 drilling campaign, which has a target of 157,000 feet (48,000 meters) and includes additional exploration, infill, geotech, hydrological and hydrogeological drilling. 14 out of a total of 18 to 20 planned drill rigs are currently operating and we have drilled 19,600 feet (6,000 meters) to date. We invested $18.5 million in our Los Azules copper projectduring Q3 primarily to build a winter camp, further improve our road access, and to construct a logistics facility in San Juan.

Subsequent to the quarter end, McEwen Copper closed financings with Stellantis and Nuton, a Rio Tinto Venture, raising ARS$42 billion (Argentine Pesos) and $10.0 million, respectively, at a price of $26 per share, which implies a market value of $800.0 million for McEwen Copper. As part of these private placements, McEwen Mining received $6.0 million from the sale of 232,000 McEwen Copper common shares. McEwen Copper’s share ownership structure is now: McEwen Mining 47.7%, Stellantis 19.4%, Nuton 14.5%, Rob McEwen 12.9% and 5.5% other shareholders. The implied market value represents a value accretion of $207 million for McEwen Mining (from $175 million to $382 million of implied ownership value), representing a value of $7.48 per fully diluted McEwen Mining share.

Consolidated cash and cash equivalents were $49.1 million (of which $47.5 million is to be used towards advancing the Los Azules copper project) and consolidated working capital $72.3 million as of September 30, 2023. We also reported investments of $40.8 million, which consist of liquid securities held in Argentina to mitigate inflation and devaluation risks.

In Q3, we reported a gross profit of $3.8 million and cash gross profit(4) of $11.9 million from our 100% owned precious metal operations , compared to a gross profit of $1.5 million and cash gross profit(4) of $5.8 million in Q3/22. Higher revenues driven by a 34% increase in GEOs sold and a 10% increase in realized gold prices led to improvements in gross profit and cash gross profit(4). Including our 49% ownership of the San José Mine, we reported a total cash gross profit(4) of $22.3 million compared with a total cash gross profit(4) of $13.8 million in Q3/22.

In Q3, we reported a net loss of $18.5 million, or $0.39 per share, compared to a net loss of $10.5 million, or $0.21 per share in Q3/22. Compared to our gross profit, our net loss was the result of higher year-over-year exploration and advanced project expenditures, including an $18.5 million investment in exploration activities at our Los Azules copper project.

In Q3, we reported an adjusted net loss(4) of $4.2 million compared to an adjusted net income(4) of $6.4 million in Q3/22. Adjusted net loss(4) excludes the expenses of McEwen Copper and our interest in the San José mine, a metric that we believe best represents the results of our 100% owned precious metal operations. Compared to our cash gross profit(4) of $11.9 million, the adjusted net loss(4) includes $6.6 million in exploration and advanced project expenditures at our Fox Complex, Gold Bar mine and Fenix Project operations, $8.5 million in non-cash depreciation, and $3.7 million in general and administrative expenses.

Revenues of $38.4 million were reported from the sale of 20,620 GEOs from our 100% owned operations at an average realized price(4) of $1,920 per GEO . Including our 49% ownership of San José Mine, Q3 revenue would have increased by $31.6 million. This compares to Q3/22 revenues of $26.0 million from the sale of 15,400 GEOs from our 100% owned operations at a realized price of $1,742 per GEO. Including our 49% ownership of San José Mine, Q3/22 revenue would have increased by $32.0 million.

It is important to note that because of the recent McEwen Copper financing, MUX’s ownership in McEwen Copper is below 50%, and we expect to no longer consolidate the financials of McEwen Copper. From Q4/23 onward we expect to begin to account for McEwen Copper as an equity investment . The Company expects to conclude soon on the accounting impacts of our recent financing. The resulting impact on our financials on a go-forward basis, should McEwen Copper be deconsolidated, will be noticeable. Specifically, the carrying value of our investment in McEwen Copper ownership may increase significantly in line with the recent financings, and we expect that our cash and liquid assets and expenses will decline markedly.

Webcast

A webcast will be held on Thursday, November 9th, 2023 at 11:00 AM EST, where management will discuss our financial results and project developments and follow with a question-and-answer session. Questions for the call can be emailed in advance to info@mcewenmining.com, or can be asked directly by participants over the phone during the webcast.

Q3 Results Conference Call - Thursday, November 9 th , 2023, at 11:00 AM EST

Calling in: Participant Toll-Free Dial-In Number: (888) 210-3454

Participant Toll Dial-In Number: (646) 960-0130

Conference ID: 3232920

Webcast Registration Link:

events.q4inc.com/attendee/253960288

An archived replay of the webcast will be available approximately 2 hours following the conclusion of the live event. Access the replay on the Company’s media page at www.mcewenmining.com/media.

Table 1 provides production and cost results for Q3 & 9M 2023 with comparative results for Q3 & 9M 2022 and our Forecast and Guidance for 2023. Our Forecast for 2023 reflects production to September 30th and management's current estimates for Q4 2023. Notes:

(1) Gold Equivalent Ounces (GEOs) are calculated based on a gold-to-silver price ratio of 90:1 for Q3 2022, 83:1 for 9M 2023, 82:1 for Q3 2022, and 83:1 for 9M 2022. 2023 production guidance is calculated based on an 85:1 gold-to-silver price ratio.

(2) The San José Mine is 49% owned by McEwen Mining Inc. and 51% owned and operated by Hochschild Mining plc. Production is shown on a 49% basis.

(3) El Gallo Mine (on care and maintenance) is expected to recover 2,300 oz gold in 2023 from plant and pond cleanout.

(4) See disclosure below about Non-GAAP Financial Performance Measures used in this release.

(5) Production figures may not add due to rounding.

Figure 1 below shows the Fox Mine Complex actual annual production 2018-2022 and the 2023 forecast.

Figure 2 below shows Gold Bar Mine’s daily ounces processed through the process plant from Jan 1, 2023 to Oct 31, 2023.

Financial Statements and MD&A refer to: www.sec.gov/cgi-bin/browse-edgar?action=getcompany&CIK=0000314203

Technical Information The technical content of this news release related to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A. (“MSC”), the owner of the San José Mine, is responsible for and has supplied to the Company all reported results from the San José Mine. McEwen Mining's joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

NON-GAAP FINANCIAL PERFORMANCE MEASURES

We have included in this report certain non-GAAP financial performance measures as detailed below. In the gold mining industry, these are common performance measures but do not have any standardized meaning and are considered non-GAAP measures. We use these measures in evaluating our business and believe that, in addition to conventional measures prepared in accordance with GAAP, certain investors use such non-GAAP measures to evaluate our performance and ability to generate cash flow. Accordingly, they are intended to provide additional information and should not be considered in isolation or as a substitute for measures of performance prepared in accordance with GAAP. There are limitations associated with the use of such non-GAAP measures. We compensate for these limitations by relying primarily on our U.S. GAAP results and using the non-GAAP measures supplementally. We do not provide a reconciliation of forward-looking non-GAAP financial measures to their most directly comparable GAAP financial measures on a forward-looking basis because we are unable to predict items contained in the GAAP financial measures without unreasonable efforts.

The non-GAAP measures are presented for our wholly-owned mines and the San José mine. The GAAP information used for the reconciliation to the non-GAAP measures for the San José mine may be found in Note 9, Investment in Minera Santa Cruz S.A. (“MSC”) – San José Mine. The amounts in the tables labeled “49% basis” were derived by applying to each financial statement line item the ownership percentage interest used to arrive at our share of net income or loss during the period when applying the equity method of accounting. We do not control the interest in or operations of MSC and the presentations of assets and liabilities and revenues and expenses of MSC do not represent our legal claim to such items. The amount of cash we receive is based upon specific provisions of the Option and Joint Venture Agreement and varies depending on factors including the profitability of the operations.

The presentation of these measures, including those for MSC, has limitations as an analytical tool. Some of these limitations include:

The amounts shown on MSC’s individual line items do not represent our legal claim to its assets and liabilities, or the revenues and expenses; and

Other companies in our industry may calculate their cash gross profit, cash costs, cash cost per ounce, all-in sustaining costs, all-in sustaining cost per ounce, average realized price per ounce, and liquid assets differently than we do, limiting the usefulness as a comparative measure.

Adjusted Net Income or Loss and Adjusted Net Income or Loss Per Share

Adjusted net income or loss is a non-GAAP financial measure and does not have any standardized meaning. We use adjusted net income to evaluate our operating performance and ability to generate cash flow from our wholly-owned operations in production; we disclose this metric as we believe this measure provides valuable assistance to investors and analysts in evaluating our ability to finance our precious metal operations and capital activities separately from our copper operations. The most directly comparable measure prepared in accordance with GAAP is net income or loss. Adjusted net income is calculated by adding back McEwen Copper and MSC’s income or loss impacts to our consolidated net income or loss...

|

|

|

|

Post by Entendance on Nov 9, 2023 13:43:47 GMT -5

McEwen Mining Inc. (NYSE:MUX) Q3 2023 Earnings Conference Call November 9, 2023 11:00 AM ET

Company Participants

Rob McEwen - Chairman, Chief Owner

Perry Ing - Chief Financial Officer

William Shaver - Chief Operating Officer

Michael Meding - Vice President, General Manager, McEwen Copper

Jeff Chan - Vice President, Finance

Carmen Diges - General Counsel and Secretary

Stefan Spears - Vice President, Corporate Development

Conference Call Participants

Marcus Giannini - H.C. Wainright

Jake Sekelsky - Alliance Global Partners

Joseph Reagor - Roth MKM

John Tumazos - John Tumazos Very Independent Research

Rob McEwen

Thank you, operator. Good morning fellow shareholders and guests. Welcome to our Q3, 2023 conference call. The individuals you all heard on the call with me will be participating in our question-and-answer period.

I'm going to start by highlighting our share performance over the past 13 months, from September 1, 2022 to present. I picked that date because that is when the market began to see the value of our strategy to finance our McEwen Copper assets separately. Since that time, our share price has increased 133% and has far outperformed the performance of the Dow Jones Industrial Average, NASDAQ, the price of gold, price of copper, and the ETFs of GDX and GDXJ, representing the gold sector.

I believe our superior share performance has been driven by the success we have achieved financing our subsidiary, McEwen Copper, where we have raised privately equity of close to US$400 million during this period.

Recognizing the impressive size and value of McEwen Copper's Los Azules project are two global giants, who have provided three quarters of these funds. Stellantis, the world's fourth largest car manufacturer, and Rio Tinto, the world's second largest mining company, through its Nuton Venture arm.

With the end of winter in the southern hemisphere, we are back up at Los Azules and moving aggressively to complete all the activities necessary to deliver a feasibility study in the first quarter of 2025.As a result of the latest financing, the implied value of McEwen Copper has increased to $800 million, which gives McEwen's 47.7% ownership interest a value of $382 million, which translates into a value of $7.48 per fully diluted share of McEwen Mining.

I expect our investment in McEwen Mining will continue to grow in value as we advance our large Los Azules project and the demand for copper increases. McEwen Copper is one of our assets. The others are gold and silver mines and a portfolio of five royalties.

I believe these assets represent considerable underlying value. The range of our estimated value per share is from $9.32 a share to $29.17 a share, and our share price is currently trading around $7.20 a share. Details of these calculations can be found on our website under our latest corporate presentation.

I believe our next performance driver will be our gold and silver mines. After enduring a very challenging three years, we are seeing very encouraging signs that the fortunes of these operations are finally turning around. Production is increasing at all three of our mines, and it appears that we could achieve the low end of the range of guidance we gave for production this year of just over 150,000 ounces of gold equivalent.

Regarding cost per ounce, we expect the Fox Mine Complex should deliver within our guidance range, while Gold Bar and San Jose are likely to come in 10% to 15% over the cost guidance we've given. Gold Bar had a particularly difficult nine months. However, this quarter we are putting on a big push to drive up production, and that would result in lower cost per ounce.

You might ask, what are these encouraging signs? At the Fox Mine, annual gold production in 2020 had fallen to 24,400 ounces. Since then, it has increased steadily, and we are expecting to reach 45,500 ounces by year end, an improvement of 86%. At the Gold Bar Mine, daily gold production was a meager 50 ounces at the start of the year. But as the year progressed, the daily gold recovery increased and has averaged year-to-date 92 ounces. And in late October, it really began to accelerate, and by month end it was over 210 ounces, and has continued to climb higher since then.

These improvements are a very welcome change, but our share price still has a long way to climb before many of you and myself get back to our cost. I believe the combination of the advancement of Las Azulas, the improving operating performances of our mines, and our continuing exploration efforts will continue to lift our share price, hopefully to the levels we were all expecting when we invested.

Many of you have asked the very important question, when will we make a profit? I'm sorry to say, I'm unable to give an exact date, but this might surprise you. It could be as early as year-end. Our Fox and San Jose mines are now generating positive cash flow, and Gold Bar is expected to generate positive cash flow this quarter. Our expenses have been large for two principal reasons. One, we've been consolidating the financials of McEwen Copper and its Las Azulas project, where exploration and development expenses are high.

In addition, we have invested heavily in exploration at Fox and at Gold Bar, a major leach pad expansion and exploration expenses represented more than $200 an ounce just in the third quarter.

Starting this quarter, our financial statements are likely to change significantly. We expect to be no longer consolidating McEwen Copper's financials due to our ownership interest dropping below 50% as a result of the recent McEwen Copper financing. The impact will significantly lower our cash balance, our total expenses, and produce a large unrealized capital gain that will be reflected in both our income statement and balance sheet.

Recently, we put out a press release that we filed a new base shelf prospectus, and we've had some calls this morning and yesterday. Are we going to do an issue? I want to emphasize that this is not an offering prospectus. We, like most other companies, routinely file these base prospectus just to provide updated information, to put us into a position where we could react if we saw an opportunity, and we've done this in the past every few years with a similar base shelf prospectus.

I think the market right now is a very attractive market to be looking for opportunity, and we will continue to do so. The price is right. We were established to grow, but the prior year's challenges effectively put any consideration of that on hold. Today, the timing is right, and we want to be positioned to act defensively.

Marcus Giannini, H.C. Wainright

Hi, Rob and team. This is Marcus Giannini calling in for Heiko. Thanks for taking our questions.

Rob McEwen

Happy to.

Marcus Giannini

So, at Gold Bar, you stated in your release that costs increased due to delays from extreme weather and labor constraints during 2023, and then you expect the average cost for the year to be 10% to 15% higher than your guidance. Given these projections, how much of these increases do you view as, say, transitory, and how much of this should we model into 2024? And can you provide any color on the different factors contributing to these expected increases?

Rob McEwen

Bill, would you like to handle that?

Bill Shaver

Yeah, sure. Thanks very much for the question. Yeah, we expect going into 2024 that we will be at or below the guidance that we gave for this year for the following reasons. This year we have spent about $5 million on exploration drilling, and that will continue into next year, probably at about that same value.

But this year we also built a new leach pad, which was completed about two or three weeks ago, at a cost of about $7 million. And so that has – those two things have plus or minus $200 impact on our cost per ounce.

So, the pad is finished. It was finished basically in the scheduled amount of time and was completed on budget. And as well, if you remember, we changed contractors at the end of 2022. And so the ramp up early in the year was challenging, in part because of the weather and so on.

But now our contractor is doing very well. Their production numbers are higher than required. And the amount of material that we're putting onto the old leach pad is now approximately 6,000 tons per day. And we're also putting 4,000 tons a day onto the new leach pad, where we have permission at this point to put material on the pad, but we still don't have permission to put cyanide onto that pad. But we anticipate getting that permit this week or next week.

And basically, so we see the production of gold going to increase for sure for the next two months and hopefully carry on into the New Year. As Rob mentioned earlier, we're basically at something like plus 200 ounces per day right now. So we're looking for, in the range of 6,000 ounces per day or per month for the next couple of months.

And I guess we anticipated that that would have started earlier, but we started the construction on a new leach pad late, because of the winter weather from last winter. And we finished it in exactly the amount of time that we said we would, but it was a month late. So rather than the gold production popping up in October, it hasn't happened until while the last couple of days of October and now November and December. So that kind of explains what the situation is going to look like going forward.

Production of funds in good shape, and so we should have a reasonable start to the year next year.

Marcus Giannini

Okay. Yeah, no awesome, that was great. And then just one quick follow-up regarding Los Azules, given that $18.5 million spent this quarter, can you maybe provide some color on where you see this figure trending over the next few quarters? Are there any additional, big ticket items, apart from the feasibility work and drilling?

Rob McEwen

Mike, would you like to answer that?

Michael Meding

Yeah, sure. So the majority of the cost will be mainly on drilling. We have a very comprehensive campaign. We aim to drill more than 48,000 meters. We already have 14 rigs mobilized and will scale up to more than 18. So that is the driver of investment in Los Azules.

Marcus Giannini

Okay, perfect. Yeah, that's it for me. Thanks a lot, guys.

Jake Sekelsky, Alliance Global Partners

Hey, Rob and team. Thanks for taking my questions.

So it looks like costs at Fox were lower in the quarter as the turnaround's taking hold. I'm just curious, is this related mainly to the grade profile or do you think this $1,300 an ounce level is something you can expect going forward?

Rob McEwen

Bill?

Bill Shaver

So yeah, I mean, as you probably know, we've increased the production at the Fox Complex from something like 950 tons a day up to now closer to say 1,275. And maybe even a little bit more than that right now. We're up closer to 1,400 tons a day.

And I guess we did have a few issues with some stoke sequencing where the grade wasn't quite behaving itself, nothing extreme. But – so as we, we expect the grade to be in the back up into the four gram range as we move forward here. So the production for the last quarter – well, as we've gone through the whole year, every quarter we improved the production. So we're in a position now where we think the production going into next year will look pretty much like the last quarter.

Jake Sekelsky

Okay, that's helpful. And then, Rob, you touched on the M&A landscape a bit towards the end of your remarks. Obviously, valuations have come down across the board, whereas you've held up pretty well in a difficult market. I'm just curious, if you expect to take a proactive approach here, if the right opportunity pops up or if you feel that you have your plate full right now? Any thoughts there would be helpful.

Rob McEwen

I'd like to see our currency value a little better and share price before acting. But in terms of the market environment, I think it's offering terrific value, particularly in the junior and in the explorer space. It's just, we've seen these cycles before, and this just looks like we're getting ready for a big run up in the price of gold, and it's good to be looking for opportunity to get a larger mass.

Jake Sekelsky

Makes sense, and I couldn't agree more there. Thanks again, guys.

Joseph Reagor, Roth MKM

Hey, Rob and team. Thanks for taking my questions.

So, kind of following on what Jake just asked, should we look at it like, you guys would be looking for a certain type of asset, whether it be early stage exploration that's highly promising or something that's late stage that's in permitting. Where is your thoughts there?

Rob McEwen

That's a good question. Well, one, we're contemplating and looking, because we feel our assets are starting – they've turned around, and we have a more stable, solid base to push off from. I think if one's looking, we could use more cash flow, probably a producer or someone who's, I think, more attractive space would be someone who's got a permit, so you don't have to worry about the time delays. It isn't going to cost a lot of money to put into production, and has some good exploration potential.

Joseph Reagor

Okay, fair enough. And then…

Rob McEwen

Probably within the Americas.

Joseph Reagor

Yeah, fair thing to add there. And then looking at the balance sheet, so if we ex out the cash that's in McEwen Copper, you got $6 million in to start the quarter. Do you feel comfortable with that, call it $7 million to $8 million level of cash moving forward? Is there like a certain minimum you guys would like to maintain? Or is there room there to add, say, flow through or something like that in the future to keep advancing projects like stock?

Rob McEwen

We expect our cash balance to grow during the quarter considerably. Flow through, in that we always have exploration. That might be a consideration going forward, just as a way of – an inexpensive way of exploring.

Joseph Reagor

Okay, and if the cash balance does grow a bit for the McEwen parent company, like is there a certain level you'd like to maintain once you get above it, going forward to just provide the proper financial flexibility quarter-to-quarter?

Rob McEwen

That will be very dependent on the market, our share price? We think it's undervalued at the moment, so not keen to release many shares into an environment like this.

Joseph Reagor

Fair enough. All right, thanks for the color, Rob. I'll turn it over.

John Tumazos, Very Independent Research

Congratulations on all the different progress, especially in Argentina. Rob, how do you think Los Azulis is going to transition from the equity placement stage with a consortium of shareholders and McEwen Mining running the exploration project to one of those great big company mine operators?

You know how they like to get presents from their suppliers and act like they are in command. How long do you expect that McEwen will continue to run the exploration project? And when is the right time to let one of those great big beasts tell you what to do?

Rob McEwen

Good question, John. We've just raised some money, so that allows us to weather some of the turbulent markets that are around us. We'd like to get to a feasibility or close to a feasibility. We do have conversations with those big companies when they certainly have the expertise to build.

But we're on our way. We're trying to build a new model here for mining that could make mining more attractive to the general population and more supportive. I think I'd like to see a stronger market for copper before we get into serious discussions with the big ones.

And at the same time, our next steps will be talking to some of the large providers of capital, that – so we get a sense of we'd be in a better bargaining position with the majors, knowing what the costs of capital are. So I don't have a date for you, John, but we're moving in that direction to get...

John Tumazos

So we're probably still running the ship for a couple more years.

Rob McEwen

Yes. Yes.

John Tumazos

Thank you. Congratulations on so much progress so quickly now.

Rob McEwen

Thanks, John. I appreciate it.

Thank you fellow shareholders, ladies and gentlemen. The best is yet to come. Thank you.

|

|

|

|

Post by Entendance on Nov 14, 2023 9:33:02 GMT -5

Bullion Star infographic dramatically illustrates gold price suppression by U.S. Bullion Star infographic dramatically illustrates gold price suppression by U.S. |

|

|

|

Post by Entendance on Nov 16, 2023 6:23:54 GMT -5

|

|

|

|

Post by Entendance on Nov 17, 2023 3:04:07 GMT -5

'...Rob McEwen’s strategy of making data freeware and staging a competition for exploration targets was a stroke of genius, popularizing the Gold Corp story and getting free information about his existing mine...'

|

|

|

|

Post by Entendance on Nov 21, 2023 6:02:49 GMT -5

|

|

|

|

Post by Entendance on Nov 22, 2023 8:23:39 GMT -5

TORONTO, Nov. 22, 2023

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce a financing to fund continued exploration and development at the Fox Complex in the Timmins region of Ontario.

The proceeds of this financing will be used exclusively for qualifying Canadian Exploration Expenditures (CEE) and Canadian Development Expenditures (CDE), within the meaning of subsection 66(15) of the Income Tax Act (Canada), on McEwen’s properties in the Timmins region:

Part 1 (CEE) of the financing consists of a US$7.3 million (Cdn$10,007,600) private placement of 788,000 flow-through common shares at a price of US$9.27 (Cdn$12.70); and

Part 2 (CDE) of the financing consists of a US$8.8 million (Cdn$12,008,550) private placement of 1,115,000 flow-through common shares at a price of US$7.86 (Cdn$10.77),

(Part 1 (CEE) and Part 2 (CDE) together being the “Offering”).

The Offering of 1,903,000 flow-through common shares for US$16.1 million (Cdn$22,016,150) is expected to close on December 14, 2023 (the “Closing”) and is subject to customary closing conditions, including approval from the TSX and NYSE.

This press release is not an offer of common shares for sale in the United States. The common shares may not be offered or sold in the United States absent registration or an available exemption from the registration requirements of the US. Securities Act of 1933, as amended (the "U.S. Securities Act"), and applicable U.S. state securities laws. McEwen will not make any public offering of the securities in the United States. The common shares have not been and will not be registered under the U.S. Securities Act, or any state securities laws.

|

|

|

|

Post by Entendance on Dec 5, 2023 7:14:53 GMT -5

|

|

|

|

Post by Entendance on Dec 6, 2023 8:26:22 GMT -5

|

|

|

|

Post by Entendance on Dec 10, 2023 5:09:57 GMT -5

|

|

|

|

Post by Entendance on Dec 13, 2023 10:40:08 GMT -5

TORONTO, December 12, 2023 - McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report consolidated production in the October-November period has increased to 29,600 gold equivalent ounces (“GEOs”)(1), a significant improvement over the first nine months of the year. In November, Gold Bar production increased to 7,800 gold ounces. As a result of the strong performance at Gold Bar, partially offset by slightly lower production at Fox and San José, our forecast for the full year 2023 is now estimated at 154,200 GEOs (see Table 1).

“Gold Bar has picked up the pace in the fourth quarter due to higher ore crushing rates combined with an expansion of the heap leach pad, which resulted in a large gold inventory on the heap leach pad starting to produce in October. Monthly production is projected to remain strong in December and into Q1 2024. The additional production from Gold Bar, combined with the announced flow‑through equity financing for Fox exploration and development, puts us in a good financial position to enter 2024. Our focus is on driving continued operational improvements and growth projects across the organization,” commented Rob McEwen, Chairman and Chief Owner.

McEwen Copper

Eighteen drill rigs are currently on site at Los Azules and over 18,000 meters of drilling have already been completed, representing more than one-third of the planned meters for this season’s campaign.

Recently, key management and directors from McEwen Mining and McEwen Copper visited the project to review the progress made towards delivery of the feasibility study for the future Los Azules Mine (see Inset Photo). Michael Meding, Vice President and General Manager of McEwen Copper, commented: “We are very pleased with the progress at Los Azules since 2021, when McEwen Copper was created to drive forward the development of one of the world’s largest undeveloped copper projects. Our vision is to develop Los Azules as a model for the future of mining.”

|

|

|

|

Post by Entendance on Dec 14, 2023 2:33:09 GMT -5

McEwen Mining Appoints a New Director

TORONTO, Dec. 13, 2023 -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to welcome Nicolas Darveau-Garneau as the newest member of our Board of Directors.

Nicolas Darveau-Garneau (“Nick”) is an artificial intelligence (AI) and digital transformation expert with over 25 years of experience. As Google’s Chief Evangelist, Nick worked with the C-suites of more than 800 of Google’s top customers to help them accelerate their digital transformation. He also worked as Chief Strategy and Growth Officer at Coveo, a leading AI company that provides advanced AI enterprise search solutions and relevant recommendations for powering e-commerce and customer service. Nick has been a technology entrepreneur, investor, and analyst since 1995. He was a co-founder of MSN.com at Microsoft and of four other internet companies, three of which he sold.

Nick was also a management consultant at McKinsey & Co. and a senior equity analyst at Sanford C. Bernstein, a top-ranked Wall Street firm known for its research in equity investment. Nick is on the Board of Directors of the TMX Group (TMX: X), Industrial Alliance Group (TMX: IAG), Alida and the Institute of Corporate Directors. Mr. Darveau-Garneau graduated with a Bachelor’s degree in Mathematics from the University of Waterloo and an MBA from Harvard Business School.

“On behalf of our Board, I am very pleased to welcome Nicolas Darveau-Garneau as a new Director. I look forward to working with Nicolas; he brings valuable expertise as a seasoned digital entrepreneur and insights into how McEwen Mining could utilize today’s technologies to improve the way we operate and to seize opportunities to grow, ” said Rob McEwen, Chairman & Chief Owner.

|

|

|

|

Post by Entendance on Dec 20, 2023 2:58:25 GMT -5

|

|

|

|

Post by Entendance on Dec 22, 2023 7:26:44 GMT -5

|

|

|

|

Post by Entendance on Dec 24, 2023 2:44:05 GMT -5

The gold miners’ stocks have suffered something of a lost year, with this small contrarian sector largely overlooked. Investor apathy remains high despite miners’ soaring earnings fueled by much-higher gold prices. But 2023’s unusually-subdued gold-stock price action was driven by several major anomalies that have run their courses. As markets normalize in 2024, gold miners have lots of mean-reversion rallying to do...

Gold Stocks’ Lost Year |

|

|

|

Post by Entendance on Dec 30, 2023 5:48:34 GMT -5

|

|

|

|

Post by Entendance on Jan 27, 2024 3:57:13 GMT -5

|

|

|

|

Post by Entendance on Jan 29, 2024 4:58:04 GMT -5

Supply & Increased Demand

Preservation Of Value

Zero Counterparty Risk

Safe Haven Asset

|

|

|

|

Post by Entendance on Jan 31, 2024 2:20:14 GMT -5

Canadian entrepreneur Rob McEwen is in talks to raise about $100 million for a copper project in Argentina, at a time when miners are betting that deregulation by the new government of Javier Milei will boost prospects for the industry.

His closely-held firm, McEwen Copper Inc., is speaking with existing holders — which include automaker Stellantis NV and a Rio Tinto Group venture — as well as prospective new investors, he said in an interview. The idea is to secure fresh funds within six months for feasibility and engineering work. Longer-term options include expanded partnering with a major mining company such as Rio Tinto.

“We’re socializing the concept,” McEwen said Monday. “Just getting in front of a lot of people who finance large projects, not only for our immediate needs but for the longer term.”

The industry veteran who founded Goldcorp Inc. is hoping President Milei’s efforts to free up Argentina’s tightly controlled economy will help unlock vast copper deposits in San Juan province. That’s where McEwen wants to build the $2.5 billion Los Azules mine that would start up toward the end of the decade, when demand for the wiring metal is expected to accelerate in the shift away from fossil fuels.

Milei, a libertarian who took office on Dec. 10, wants to cut red tape as well as do away with customs and capital restrictions. If he can win over congressional opposition, such changes would reduce risks for investors, who remain optimistic yet cautious, McEwen said. The challenge for Milei is to move swiftly because metal markets are cyclical and financing windows can shut quickly, he said.

Los Azules isn’t waiting around for change. It already has 21 drill rigs on site, and it’s working on a renewable-energy supply deal from YPF Luz and a leaching method that would help it to be carbon neutral. It hopes to obtain an environmental permit this year, have a feasibility study ready in early 2025 and do pre-construction work from 2026, Michael Meding, who heads McEwen Copper, said in the same interview.

McEwen’s copper unit had planned to go public, but it’s now focusing on raising money privately since market conditions aren’t ripe for an IPO, McEwen said. He and Meding recognized that the investment climate for mining generally is tough, but said that tax incentives proposed for large Argentine infrastructure projects in Milei’s signature legislation could help lure partners.

“We think that we would classify as a large-scale infrastructure project and that would generate additional taxation stability,” Meding said. “And that would be very helpful in future financing discussions with the international community.”

|

|

|

|

Post by Entendance on Feb 13, 2024 5:09:01 GMT -5

McEwen Mining: 2023 Production and Guidance for 2024 TORONTO, Feb. 12, 2024 -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report full year and fourth quarter 2023 production results that represent a significant improvement year-over-year and compared to prior quarters. Consolidated production in Q4 2023 was 49,850 gold equivalent ounces (“GEOs”)(1), and full year production for 2023 was 154,600 GEOs. These results were consistent with our latest forecast (Q3 results press release dated Nov 8, 2023) and within our guidance range for the year (press release dated Mar 14, 2023).

Gold Bar production accelerated during Q4 and the month of December, making new records for the quarter and the month, through the addition of mining crews and the completion of the heap leach pad expansion. At Fox, production continued steady above 10,000 GEOs. San José production continued to strengthen throughout the year, past the operational challenges of the first quarter.

Chart 1: 2023 Quarterly Production - Gold Bar, Fox, San José and Consolidated (GEOs) In 2023, Gold Bar produced 43,700 gold ounces, within guidance range, Fox produced 44,450 gold ounces, also within guidance range, and San José produced 65,650 GEOs, slightly below guidance range (see Table 1).

Our consolidated production is recovering after experiencing a challenging period from 2020. Looking ahead, while we forecast lower production in 2024, the historic production trend remains positive. Chart 2: Historic Consolidated Annual Production (Thousand GEOs) 2024 Production and Cost Guidance

For 2024, we expect to produce in the range of 130,000 to 145,000 GEOs attributable to MUX from all operations (see Table 2). The reduction compared to 2023 is primarily driven by lower output from our Fox operation and from San José, which is operated by our partner Hochschild Mining. We are currently evaluating potential areas for enhancing production and profitability, and we will update our guidance accordingly once any further improvements are implemented.

Table 2: 2024 Production & Costs per GEO Guidance

At Fox in 2024, we will be starting the development of underground ramp access to the Stock orebodies, particularly Stock West, which will become the primary source of feed following the completion of mining the Froome deposit in 2026. This capital investment is partially funded by the US$16.1 million flow-through financing completed in December 2023.

At Gold Bar in 2024, the first half of the year is expected to deliver higher production relative to the second half, due to a scheduled waste stripping phase in the Pick pit, in preparation for the 2025 mining program. The mining sequence continues to be optimized.

McEwen Copper

Twenty drill rigs are currently on site at Los Azules and over 36,000 meters (118,000 ft) of drilling have been completed so far this season, to advance all areas that contribute to the upcoming Feasibility Study (FS), which is expected to be published in Q1 2025.

At the Los Azules Project, we've made significant progress. Our drilling program is over halfway complete, with 36,000 meters drilled out of the 55,000 planned for our comprehensive feasibility study. The work necessary for the completion of the feasibility study includes mineral resource estimation, metallurgical testing, equipment selection, final completion and cost estimation of design for the mine and our facilities. Additionally, we will work to advance our power and road infrastructure plans and establish preliminary site-wide water balance including pit dewatering.

On the ground, we've made tangible progress with the drilling program, construction of our winter camp and improvements to the exploration road facilitating year-round operations. We're also on track with environmental permitting, reflecting our commitment to responsible development.

Financially, we've been diligent in protecting our treasury. The majority of our funds have been invested in depository receipts of foreign and major Argentinean corporations, to shield us from devaluation. This strategic move ensures that the Los Azules project's financial backbone stays robust in supporting our project development.

“We are adapting to a changing environment in Argentina, recognizing the importance of current political and economic reforms for the future stability and growth of the nation. Mining is a vital component of Argentina’s economy and, under the right conditions, one that is poised to grow significantly and support the country’s economic recovery,” said Michael Meding, VP of McEwen Copper and General Manager of the Los Azules Project.

Notes:

(1) 'Gold Equivalent Ounces' are calculated based on a gold-to-silver price ratio of 84:1 for Q1 2023, 83:1 for Q2, 2023, 82:1 for Q3 2023, 85:1 for Q4 2023. 2023 production guidance is calculated based on an 85:1 gold-to-silver price ratio.

(2) The San José Mine is 49% owned by McEwen Mining Inc. and 51% owned and operated by Hochschild Mining plc. Production is shown on a 49% basis.

(3) El Gallo Mine (on care and maintenance) produced 704 GEO and 797 GEO in Q4 and FY2023, respectively, from plant and pond cleanout.

Technical Information

The technical content of this news release related to financial results, mining and development projects has been reviewed and approved by William (Bill) Shaver, P.Eng., COO of McEwen Mining and a Qualified Person as defined by SEC S-K 1300 and the Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects."

Reliability of Information Regarding San José

Minera Santa Cruz S.A., the owner of the San José Mine, is responsible for and has supplied the Company with all reported results from the San José Mine. McEwen Mining’s joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns 47.7% of McEwen Copper which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing its share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has personally provided the company with $220 million and takes an annual salary of $1.

|

|

|

|

Post by Entendance on Feb 23, 2024 4:29:29 GMT -5

McEwen Copper Reports Improved Copper Recovery

Metallurgical Testing Delivers a 3.2% Increase In Predicted Copper Recovery at Los Azules

TORONTO, February 22, 2024 - McEwen Copper Inc., 47.7% owned by McEwen Mining Inc. (NYSE: MUX) (TSX: MUX), is pleased to announce results from the recently completed Phase 1 copper heap leaching metallurgical tests undertaken at SGS Chile Limitada in Santiago, Chile. The test results were produced utilizing conventional bio-heap leaching technology and generated an average copper recovery of 76.0%. This represents an increase of 3.2% over the recovery rate used in the June 2023 Preliminary Economic Assessment (PEA) for Los Azules. These test results were reviewed by Jim Sorensen and Michael McGlynn at Samuel Engineering Inc., who are responsible for the development and oversight of the metallurgical programs.

Phase 1 Results

Based on the Phase 1 test results available at the time and prior historical column test work, the PEA used an average copper recovery of 72.8% by employing conventional bio-heap leaching technology (see results published June 20th, 2023). Final results of Phase 1 show an increase in the average recovery to 76.0% in approximately 230 days of leaching over the planned 27-year life of the project. Average net acid consumption was also reduced by 8.3% relative to the PEA.

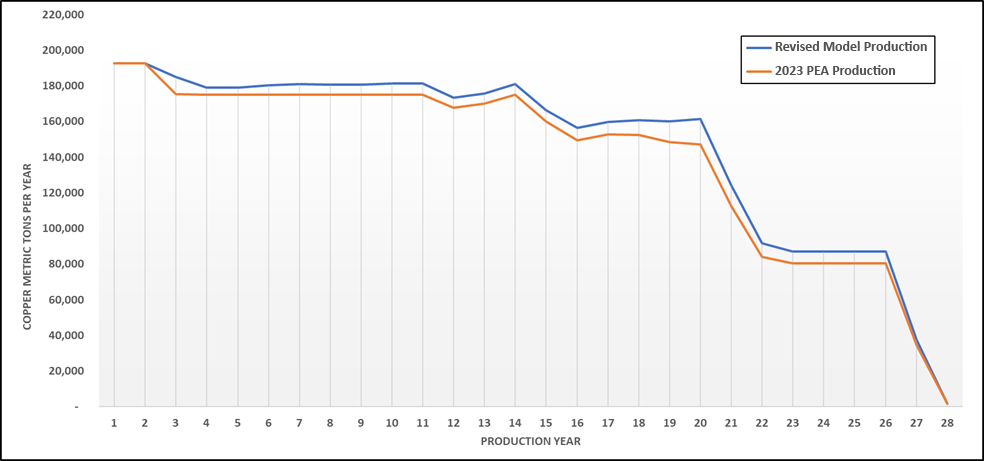

The potential impact of the 3.2% increase in average recovery and 8.3% reduction in net acid consumption can be illustrated by selectively adjusting the PEA Base Case financial model, which results in a life of mine copper cathode production increase of 172,000 tonnes and an after-tax NPV(8%) increase of approximately $262 million. This disclosure should not be taken to modify or update the conclusions of the PEA.

Deposit Mineralogy

Located in San Juan, Argentina, the Los Azules deposit consists primarily of secondary copper mineralization (supergene zone of predominantly chalcocite), with minimal oxide copper content. Additionally, there is a deeper primary copper (hypogene zone of predominantly chalcopyrite with some zones of significant bornite).

Metallurgical Testing Phases

Preliminary results from the Phase 1 program along with historical metallurgical testing at Los Azules were used to support the 2023 Preliminary Economic Assessment (PEA), which proposed an environmentally friendly heap leach alternative to a conventional copper concentrator. The testing program is now advancing with two additional phases (2 & 3) currently underway to support the Feasibility Study (FS). Drilling activities related to the current study work started in 2021 and are continuing into 2024. The leach testing protocols are based on conventional bio-leaching methods used extensively in commercial applications for supergene copper mineralization. The current phases, 2 & 3, are being conducted at SGS Chile and Alfred H. Knight (ASMIN Industrial Limitada) laboratories, both located in Santiago, Chile.

The Phase 1 program was initiated using drill core from drilling programs completed prior to 2021, but not older than 2015, for a total of 21 column tests. Started in 2022, Phase 1 has now been completed and final results received. Preliminary results of this work and prior historical leach testing information were used for the PEA metallurgical assumptions.

The Phase 2 program utilizes drill core from the 2022-2023 drilling campaign and focuses on deposit-wide variability testing, leaching protocol optimization and scalability. A total of 34 column tests are in progress, with results expected in Q2 2024.

The Phase 3 program is also started, utilizing additional drill core material from the ongoing 2023-2024 drilling program. Phase 3 testing is focusing on the material of the initial 5-year mine plan, as delineated in the PEA. A total of 33 additional column tests are planned as part of this final confirmatory testing program, with results anticipated in Q4 2024.

The combined metallurgical programs comprise a total of 88 column tests to be used for the FS metallurgical design basis and geo-metallurgical model.

Copper assaying is conducted using a sequential method to determine the relative amounts of acid soluble (CuAS) and cyanide soluble (CuCN) copper mineralization (oxides and secondary sulfides). When combined, these two partial assay methods are generally considered readily soluble copper (CuSOL), extractable with conventional heap leaching technologies. Copper assayed that does not report to these two partial assay methods is classified as residual copper (CuRES) and is considered copper that requires additional time or is potentially not recoverable with conventional heap leaching technologies.

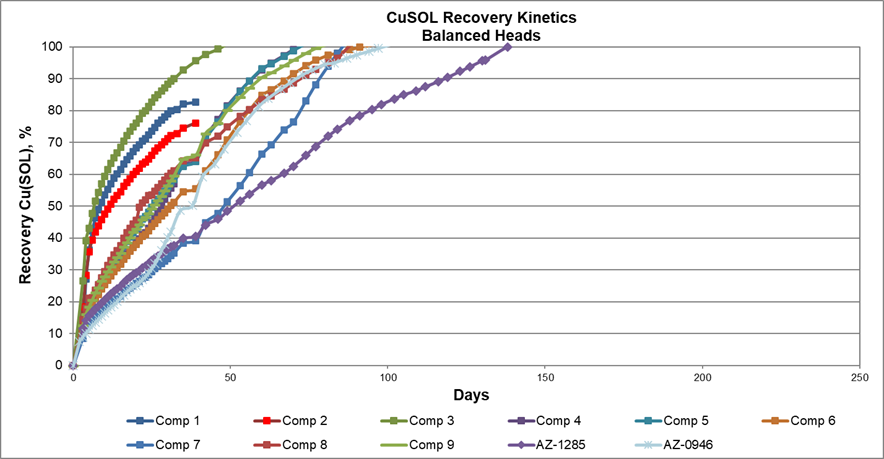

The finalized results from the Phase 1 metallurgy program for tests completed at minus ½" and ¾" crush sizes confirmed that soluble copper (CuSOL) component recovery is 100% for all leachable resources. The information in Figure 1 below shows the minus ¾" (19 mm) test results. The PEA envisions a minus ¾" crush size for the heap leaching feed in the commercial application.

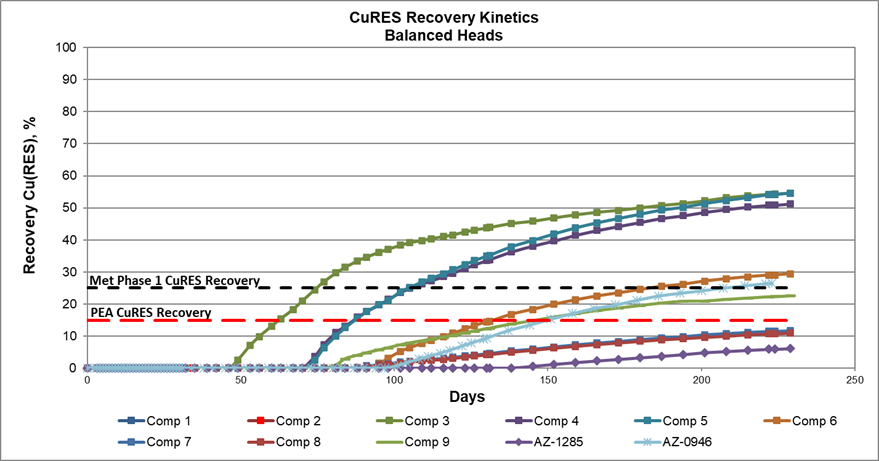

The recovery results for the residual copper (CuRES) component shown in Figure 2 indicated an average recovery of 25%, an increase of 10% from the 15% preliminary recovery assumption used in the PEA. The additional residual copper recovery when applied to the entire resource increases the overall average recovery from 72.8% to 76.0%.

Figure 3 below illustrates the increase in potential copper production throughout the mine life, attributable to the improved recovery, in comparison with the PEA assumptions. The initial two production years do not show additional recovered copper, as the design capacity of the electrowinning plant considered in the PEA is fully utilized.

The sulfuric acid consumption has also been updated with the Phase 1 final results. The averaged net sulfuric acid consumption reported in the PEA was 18 kilograms per ton of ore processed. The finalized Phase 1 testing now indicates a reduction of 8.3% to 16.5 kilograms per ton. The primary reason for the reduction of acid consumption is minimizing excess acid in the leaching solutions and operating the columns at a pH closer to 2.0 pH than the historic column work at 1.2 pH, which minimizes acid consumption by excess unmineralized gangue material dissolution. This lowered acid requirement may also improve the project economics, both NPV and IRR, by reducing the operating costs for copper produced and increasing revenue from the same tonnes mined.

Bioleaching Summary

Copper bioleaching has been a commercially applied technology at altitudes similar to the Los Azules site and as much as 1,000 meters higher for several decades, in multiple locations around the world. Testing is conducted in conventional leach test columns by inoculation of the columns with naturally occurring bacterial ferrooxidans and thiooxidans prior to introduction of the leach solution. Bacterial cultures for the inoculum were sourced from the testing laboratories and adapted to the Los Azules leach material. Ferrooxidans convert the ferrous iron in solution to ferric iron, while thiooxidans convert the sulfur produced in the copper sulfide leaching activity to sulfuric acid/sulfate. Ferric iron is the key chemical component necessary for leaching of copper sulfide material. Bioactivity in the tests is monitored by measurement of the ferrous/ferric ratios and electrochemical oxidation potential in the leaching solutions.

ABOUT MCEWEN COPPER

McEwen Copper is a well-funded, private company which owns 100% of the large, advanced-stage Los Azules copper project, located in the San Juan province, Argentina. McEwen Copper is a 47.7% owned private subsidiary of McEwen Mining, which is listed on NYSE and TSX under the ticker MUX.

Los Azules is being designed to be distinctly different from conventional copper mines, consuming significantly less water, emitting much lower carbon levels and progressing to be carbon neutral by 2038, being powered by 100% renewable energy once in operation. The project’s recently updated Preliminary Economic Assessment (PEA) projects a long life of mine, low production costs per pound, a short payback period, high annual copper production, and an after-tax IRR of 21.1%.

ABOUT MCEWEN MINING

McEwen Mining is a gold and silver producer with operations in Nevada, Canada, Mexico and Argentina. In addition, it owns approximately 47.7% of McEwen Copper, which owns the large, advanced stage Los Azules copper project in Argentina. The Company’s goal is to improve the productivity and life of its assets with the objective of increasing the share price and providing a yield. Rob McEwen, Chairman and Chief Owner, has a personal investment in the company of US$220 million. His annual salary is US$1. |

|

|

|

Post by Entendance on Feb 26, 2024 11:55:03 GMT -5

McEwen Copper: Update on Assay Results at Los Azules

February 26, 2024

Remaining assays from the 2022-2023 season, highlights include:

446 m of 0.63% Cu, including 76 m of 0.92% Cu (AZ23228MET)

TORONTO, Feb. 26, 2024 -- McEwen Copper Inc., 47.7% owned by McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to announce assay results from the final unreleased drill holes of the last season (2022-2023). The results from this period not only validate previous drilling results but also confirm the continuity of mineralization and extend the mineralization.

Selected Highlights:

Hole AZ23205MET returned 257 m of 0.76% Cu within the Enriched zone.

Hole AZ23228MET returned 446 m of 0.63% Cu in the Enriched zone, including 76 m of 0.92% Cu.

Hole AZ23230MET returned 250 m of 0.68% Cu in the Enriched zone, including 192 m of 0.83% Cu.

The objective of the 2022-2023 drilling campaign was to collect information needed as the project advances towards the completion of a Feasibility Study in Q1 2025. Work continues during this field season (2023-2024) and includes resource drilling that will convert the initial 5-year pit resources to Measured and Indicated categories and will further upgrade resources from Inferred to Indicated. In addition to resource drilling, geotechnical, metallurgical, hydrogeological, exploration, and condemnation drilling are also being performed.

With the closing in October 2023 of a US$10.0 million investment by Nuton, a Rio Tinto venture, and the ARS $42 billion investment by Stellantis, the Los Azules Project is fully funded for the 2023-2024 drilling campaign. McEwen Copper is currently seeking funding to support feasibility-level engineering and pre-construction work. Another record-setting drill season is underway at Los Azules with over 62,000 meters of drilling, of which 43,000 meters have been completed to date.

“Argentina’s new president is taking important initiatives to unlock the country’s potential to become a significant supplier of critical minerals to the world, to combat climate change and at the same time strengthening the economy,” said Rob McEwen, Chairman and Chief Owner.

“McEwen Copper’s Los Azules project is progressing at light speed towards completing a feasibility study by Q1 2025 and it has already delivered significant economic benefits to the neighbouring communities. It is a very large copper resource, where recent exploration drilling suggests it definitely has room to grow,” said Michael Meding, Vice President and General Manager of McEwen Copper.

|

|

|

|

Post by Entendance on Feb 28, 2024 10:48:55 GMT -5

McEwen Mining:

Stock Exploration Update

Aggressive Exploration Generating a Bright Future at Stock

Stock West and Stock Main gold resources increase by 31%, mineralization continuing at depth;

Stock East emerging as a potential new source of near-term production. Assay highlights:

Drillhole SEZ24-86: 121.5 g/t Au over 0.4 m (3.91 oz/t Au over 1.3 ft) (Fig. 2)

Drillhole SEZ24-84: 6.5 g/t Au over 10.2 m (0.21 oz/t Au over 33.5 ft) (Fig. 3)

Drillhole SEZ24-88: 4.5 g/t Au over 10.4 m (0.14 oz/t Au over 34.1 ft) (Fig. 3)

TORONTO, February 28th, 2024 -- McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) is pleased to report on three outcomes of its large exploration investment at the Stock Mine property, part of the Fox Complex, in the prolific Timmins gold district of Northern Ontario, Canada: One, a 31% year over year increase of gold resources at Stock West and Stock Main (historical Stock Mine), with Two, confirmation of good grading structures plunging to depth; and Three, Stock East emerging as a potential new near-term source of future revenue.

31% Resource Growth (Inferred + Indicated) and the Importance of Structures at Stock West and Main

Geological interpretations suggest that two principal structures that plunge to depth, emanating from the historical Stock Mine (see Fig. 1) control the mineralization of Stock West and Stock Main. Resources identified within these structures in 2023 account for most of the 31% increase in the Stock West and Main resource (see Table 2) when compared to year end 2022. The infill drilling at Stock West completed in 2023 demonstrated an increase in the widths of the mineralized zones with a slight decrease in the overall grade. Drilling along the deeper part of structures accounts for about half of the 31% increase in the updated resource estimate and demonstrates the potential for these structures to extend to depth and remain highly prospective for additional exploration and resource growth.

Stock East Emerging

Drilling in late 2023 and continuing into 2024 was designed to assess Stock East’s potential to be a shallow source of near-term revenue during the construction phase of the access ramp at Stock West. Assay results from the infill drill program successfully identified mineable widths and grades. In addition, the block model updated in 2022 has been successful in forecasting the projected grades and widths for the new drilling. Stock East mineralization appears to be controlled by two plunge directions, with one similar to that seen for the rest of Stock structures (see Fig. 1 in upper right-hand corner and Fig. 3)

An assay result from drillhole SEZ24-86 that returned 121.5 grams per tonne (g/t) gold (Au) over 0.4 meters (m), equivalent to 3.91 ounces per tonne (oz/t) Au over 1.3 ft (see Fig. 2), is very intriguing because of its high grade, proximity to surface and position outside the main mineralized zone (lying approximately 75 m in the hanging wall to the main Stock East zone). Its orientation suggests that earlier drilling may have missed other possible high-grade occurrences. To date, all of the drilling at Stock East has been in a mostly North to North‑West orientation, therefore this particular intercept may have been mostly missed. Additional follow-up drilling is warranted to determine its true geometry.

Some of the key drill results from our recent drilling programs are listed below; see Fig. 3: Also shown in Fig. 3 are earlier assay values of attractive grades and widths.

SEZ23-69:

SEZ24-71:

SEZ24-84:

SEZ24-85:

SEZ24-88: 7.1 g/t Au over 4.8 m

4.5 g/t Au over 7.7 m

6.5 g/t Au over 10.2 m

3.5 g/t Au over 5.3 m

4.5 g/t Au over 10.4 m 0.23 oz/t Au over 15.8 ft

0.14 oz/t Au over 25.3 ft

0.21 oz/t Au over 33.5 ft

0.11 oz/t Au over 17.4 ft

0.14 oz/t Au over 34.1 ft

The location of Stock East is strategic for multiple reasons:

From a geological perspective:

The Stock East zone lies close to the splay point of the NE-SW trending Nighthawk Lake fault and the E-W trending regional Destor-Porcupine fault (see Fig. 2). Such splays are known in the district to be good traps for gold mineralization. The host rocks at Stock East are a combination of altered mafic & ultramafic volcanics and quartz breccias.

From an operational perspective:

It is located only 700 meters East of our mill (see Fig. 1); Stock East is a shallow deposit positioned just 400 meters from the proposed ramp to Stock West, that could be quickly and inexpensively accessed; and it could potentially provide early revenue during the construction of the Stock West ramp.

The current drilling program aims to upgrade the majority of the Inferred mineralization to the Indicated category while also targeting higher grade (>10 GxM, grade x true width) sections of the zone. We are also updating the resource for Stock East to include these new intercepts, targeting completion by the end of Q1 2024 (see Table 1) |

|

|

|

Post by Entendance on Mar 1, 2024 2:02:20 GMT -5

McEwen Mining press release (NYSE:MUX): FY GAAP EPS of $1.15.

Revenue of $166.23M (+50.5% Y/Y).

Net income for the year was $54.7 million or $1.15 per share versus a 2022 net loss of $81.1 million or $1.71 per share 2023 Net income $1.15/share vs. 2022 net loss $1.71/share

McEwen Mining Inc. (NYSE: MUX) (TSX: MUX) today reported its fourth quarter (“Q4”) and full year 2023 financial and operational results. Net income for the year was $54.7 million or $1.15 per share versus a 2022 net loss of $81.1 million or $1.71 per share! Gold production at the Fox Complex and Gold Bar mine came in just above the low end of guidance and San José just below guidance. However, cash costs(1) and AISC(1) per ounce remain 12-18% higher than guided and need more attention.

Growth Plans for 2024

“Our biggest single asset with the greatest near-term potential to increase our share value is our 48% owned subsidiary McEwen Copper. Its 2nd and 3rd largest shareholders are global giants, Rio Tinto and Stellantis, the world’s 2nd largest mining company and the world’s 4th largest automaker, owning 14.5% and 19.4% of McEwen Copper, respectively. McEwen Copper is driving hard, with 22 drills operating on site, to complete the necessary work to deliver a bankable Feasibility Study in Q1 2025.

“Compared to conventional copper mines, Los Azules is designed with a much lighter impact on the environment, initially emitting one third (1/3) of the CO2-e emissions and progressing to net-zero carbon by 2038, utilizing one quarter (1/4) the water, powered by 100% renewable electricity, and producing sustainable copper cathode.

“At our Canadian and Mexican mines we are advancing two important development projects. At the Fox Complex, the construction of the underground ramp access to the Stock orebodies will start in Q1. The Stock West deposit will become the primary source of production following the completion of mining at the Froome deposit in 2026. At the Fenix project, construction is expected to start in H2. Both of these projects are designed to extend the mine lives by over 9 years,” said Rob McEwen, Chairman and Chief Owner.

Individual Mine Performance and Growth (see Table 1 and 2)

Fox Complex, Timmins, Canada

Fox performed well in 2023, achieving its annual production guidance. Mill throughput achieved a record average of 1,300 tonnes per day in Q4, the highest since our acquisition in 2017. As a result, mill throughput in Q4 was 36% higher than in Q4 2022. This is an important achievement by our team in Canada, as we aim to continue to increase mining productivity and mill throughput capacity during 2024 in preparation for production from our Stock West project. While we work to develop our ramp access to Stock West in 2024, with completion expected by the end of 2025, we also intend to conduct exploration activities at Stock East and Stock Main. We see operational improvements and cost savings at Stock as compared to Froome due to the close proximity of the Stock Mill (expected savings of $7 per tonne), softer material enabling higher mill throughput, and deposits which are not encumbered by a meaningful royalty or a stream (Froome’s 2023 stream cost estimated at $108 per ounce produced). Exploration activities are also underway with our Grey Fox project where we see significant long-term growth potential. In 2023, cash costs(1) of $1,157 per GEO sold were higher than our annual guidance of $1,020 per GEO sold due to moving to contractor crushing in early 2023, however AISC(1) of $1,351 per GEO sold came in below guidance of $1,465 per GEO sold, as a result of reduced sustaining capital expenditure requirements enabled by the productivity improvements achieved by contractor crushing.

Gold Bar, Nevada, USA

Despite weather conditions in early 2023 that led to flooding and a slowdown of production at Gold Bar, our team ramped up gold production significantly through Q4, as planned, and achieved its annual production guidance. Cash costs(1) of $1,565 per GEO sold and AISC(1) of $1,891 per GEO sold were 12% and 13% higher than annual guidance of $1,400 and $1,680 per GEO sold, respectively, but improved compared to 2022 as a result of mine contractor and crushing crew productivity, as well as the expansion of our heap leach pad, which was completed on time and on budget. Our Q4 unit costs were significantly below annual guidance at cash costs(1) of $1,253 and AISC(1) of $1,467, and we expect similar trends during H1 2024.

San José, Santa Cruz, Argentina(4)

San José had a difficult start to 2023 as seen in our Q1 results. The team at San José was quick to respond by implementing operational changes that resulted in consistent quarterly improvements to production and unit costs. This was achieved through mining and processing more tonnes containing higher average gold and silver grades compared to Q1. As a result, San José achieved annual production of 65,800 GEOs(2) in 2023, slightly under the production guidance range of 66,000 to 74,000 GEOs(2). Annual cash costs(1) of $1,413 per GEO sold and AISC(1) of $1,840 per GEO sold remained 12% and 18% higher than guidance of $1,250 and $1,550 per GEO sold, respectively, as a result of lower than expected metal grades. By Q4, cash costs(1) of $1,228 per GEO sold and AISC(1) of $1,573 per GEO sold were achieved, which was in line with annual guidance. With the investment in improving the mine plan in mid-2023 and recent exploration results indicating better than expected grades on portions of 2024 production targets, we expect operations to continue to improve. Early 2024 production and financial results have exceeded expectations to date.

Advances in Q4 2023

McEwen Copper: Financings with Stellantis and Nuton (Rio Tinto) were closed in Q4, raising ARS $42 billion and $10.0 million, respectively, at a value of $26.00 per share, implying a market value of $800 million for McEwen Copper. Concurrently with these transactions, McEwen Mining sold 232,000 common shares of McEwen Copper in return for $6.0 million. After the closing of these transactions, Stellantis and Nuton own 19.4% and 14.5%, respectively, of McEwen Copper, while the Company’s ownership decreased to 47.7%.

Safety at all of our operations was excellent with no lost-time incidents.

Gold Bar: During Q4, we achieved new daily, monthly, and quarterly production records as a result of the improvements in mining productivity, the addition of crushing crews and the completion of the heap leach pad expansion.

Fox Complex: We achieved the highest average daily mill throughput on record since acquisition in 2017, reaching 1,300 tonnes per day during Q4, and are currently reviewing improvements in 2024 to mining productivity and processing flowsheets to continue to increase throughput levels.

In December, the Company completed a private placement offering of 1,903,000 flow-through common shares for gross proceeds of $16.1 million (CAD $22.0 million) to be used exclusively to support exploration and development work at the Fox Complex, which includes the development of the Stock ramp.

We continue to invest heavily in exploration and the results have been most encouraging, particularly at Los Azules, where the resource base increased by 27%, and at the Fox Complex, where the results allow us to see the potential for significant increase in mine life at Stock and Grey Fox.

Financial Results

McEwen Mining ceased being the majority owner of McEwen Copper after the October 2023 financing (moving from 51.9% to 47.7% ownership), therefore for the fourth quarter and moving forward the Company’s financial statements no longer consolidates McEwen Copper on a 100% basis, and instead accounts for McEwen Copper as an equity investment. As a result of the deconsolidation of McEwen Copper, we recognized a gain of $224 million and an investment value of $384 million based on the value per share achieved in our October financing.

Notice to reader: Under US GAAP, McEwen Mining consolidates 100% of the accounts of its fully owned and majority owned subsidiaries in its reported financial results. Entities over which we exert significant influence but do not control (such as Minera Santa Cruz S.A. (“MSC”), the operator of the San José mine, and McEwen Copper, the owner of the Los Azules copper project) are presented as equity investments on our balance sheet.

Net income for full year 2023 was $54.7 million, or $1.15 per share, compared to net loss of $81.1 million, or $1.71 per share for full year 2022. Our net income for full year 2023 improved primarily as a result of the $224.0 million accounting gain recognized on the deconsolidation of McEwen Copper. Net income for Q4 was $137.9 million, or $2.88 per share, compared with a net loss of $37.4 million, or $0.79 per share for Q4 2022.

Liquidity and Capital Resources

We reported consolidated cash and cash equivalents of $23.0 million and consolidated working capital of $22.7 million as at December 31, 2023, compared to the respective numbers at December 31, 2022, of $39.8 million and negative $2.5 million. The reported consolidated cash balance at December 31, 2023 does not include cash balances held by McEwen Copper given the deconsolidation recognized in Q4 2023; while our cash and cash equivalents balance of $39.8 million included $38.1 million attributable to McEwen Copper.

During 2023, we decreased our total debt by $25 million or 38% to $40 million and entered into the Third Amended and Restated Credit Agreement effective May 23, 2023.

The Company also holds a portfolio of royalties including a 1.25% net smelter royalty at both our Los Azules and Elder Creek properties, together with other royalties on properties in Nevada, Yukon, Canada and in Santa Cruz, Argentina.

Exploration

Exploration results from the Stock deposits at the Fox Complex were published in a separate press release on February 28th. Highlights include a 31% increase in gold resources compared to 2022. Drilling in the Stock East deposit area returned high grade intersections up to 121.5 grams per tonne (3.91 oz/t) in an orientation that suggests that earlier drilling may have missed other possible high-grade occurrences.

Gold Bar exploration activities are currently focused on discovering near mine resources. Additional drilling targets have been identified at our Pick and Cabin pits to expand upon results from our 2023 drilling.

McEwen Copper

New metallurgical and exploration results from Los Azules were published in news releases dated February 22nd and 26th. Metallurgical highlights include a 76% expected average copper recovery (3.2% higher compared to the 2023 NI 43-101 Preliminary Economic Assessment (“PEA”)) during the 27-year life of mine and 8.3% lower acid consumption, resulting in a potential increase in the project after-tax NPV(8%) of $262 million(3). Exploration highlights included 446 m of 0.76% including 76 m of 0.92% (hole AZ23228MET). Our 2023-2024 drilling season began in October 2023; during Q4 we completed over 74,000 feet (22,627 meters) of drilling out of a full season target of 203,000 feet (62,000 meters). A full complement of 22 drill rigs is operating on site to reach this target.

Confirmatory metallurgical testing and a large drilling campaign to upgrade resources, as well as geotechnical, hydrological, and geohydrological works are well underway to support the delivery of the feasibility study by early 2025.

We own a 47.7% interest in McEwen Copper Inc., which holds a 100% interest in the Los Azules copper project in San Juan, Argentina, and the Elder Creek exploration project in Nevada, USA. The last financings completed by McEwen Copper with Stellantis and Nuton (Rio Tinto) gave the Company a market value of $800 million. This translates to $384 million for McEwen Mining shareholders’ 47.7% ownership.

Management Conference Call

Management will discuss our Q4 financial results and project developments and follow with a question-and-answer session. Questions can be asked directly by participants over the phone during the webcast.

Friday

Mar 1, 2024

at 10:00 AM EST

Toll Free (US & Canada): (888) 210-3454

Toll Free Dial-In Other Countries: events.q4irportal.com/custom/access/2324/

Toll Dial In: (646) 960-0130

Conference ID Number: 3232920

Event Registration Link: events.q4inc.com/attendee/876515509

An archived replay of the webcast will be available approximately 2 hours following the conclusion of the live event. Access the replay on the Company’s media page at www.mcewenmining.com/media.

|

|

|

|

Post by Entendance on Mar 1, 2024 13:10:16 GMT -5

McEwen Mining Inc. Q4 2023 Earnings Conference Call March 1, 2024 10:00 AM ET Company Participants

Rob McEwen - Chairman and Chief Owner

William Shaver - COO

Jeff Chan - VP, Finance

Michael Meding - VP and General Manager of McEwen Copper

Conference Call Participants

Heiko Ihle - H.C. Wainwright

Joseph Reagor - ROTH Capital

John Tumazos - John Tumazos Very Independent Research

Rob McEwen