|

|

Post by Entendance on Apr 20, 2021 4:10:09 GMT -5

EU Court Rules Against Civil Liberty Mandatory vaccines are ‘necessary in democratic society,’ don’t infringe human rights, EU court rules

Gordon G. Chang

Bob Moriarty

"For anyone who needs an update on how World War I began, just read the headlines of today and change the names slightly. No one country actually started that war. The rulers of all of them did stupid things, one after another and all of a sudden the world was in flames. The same silly shit is happening today... ... In August of 1914 we had a similar situation where the great powers of the world simply slid into conflict without anyone in particular causing the war. This time clearly the US, Nato, the CIA and Ukraine are the aggressors. The US has 500,000 personnel in over 800 foreign bases surrounding both China and Russia. Russia has 14 foreign bases surrounding no one. There is an excellent chance there will be war. There is also a high probability of it going nuclear. No one will win. Hundreds of millions or perhaps billions of people in the world will die." *** The Guns of April

Jeff Thomas

"...The very same events occur, falling like dominoes, more or less in order, in any empire, in any age: The reach of government leaders habitually exceeds their grasp. Dramatic expansion (generally through warfare) is undertaken without a clear plan as to how that expansion is to be financed. The population is overtaxed as the bills for expansion become due, without consideration as to whether the population can afford increased taxation. Heavy taxation causes investment by the private sector to diminish, and the economy begins to decline. Costs of goods rise, without wages keeping pace. Tax revenue declines as the economy declines (due to excessive taxation). Taxes are increased again, in order to top up government revenues. In spite of all the above, government leaders personally hoard as much as they can, further limiting the circulation of wealth in the business community. Governments issue bonds and otherwise borrow to continue expansion, with no plan as to repayment. Dramatic authoritarian control is instituted to assure that the public continues to comply with demands, even if those demands cannot be met by the public. Economic and social collapse occurs, often marked by unrest and riots, the collapse of the economy, and the exit of those who are productive.  In this final period, the empire turns on itself, treating its people as the enemy. In this final period, the empire turns on itself, treating its people as the enemy.The above review suggests that if our schoolbooks stressed the underlying causes of empire collapse, rather than the names of famous generals and the dates of famous battles, we might be better educated and be less likely to repeat the same mistakes. Unfortunately, this is unlikely. Chances are, future leaders will be just as uninterested in learning from history as past leaders. They will create empires, then destroy them. Even the most informative histories of empire decline, such as The Decline and Fall of the Roman Empire, by Edward Gibbon, will not be of interest to the leaders of empires. They will believe that they are above history and that they, uniquely, will succeed. If there is any value in learning from the above, it is the understanding that leaders will not be dissuaded from their aspirations. They will continue to charge ahead, both literally and figuratively, regardless of objections and revolts from the citizenry. Once an empire has reached stage eight above, it never reverses. It is a “dead empire walking” and only awaits the painful playing-out of the final three stages. At that point, it is foolhardy in the extreme to remain and “wait it out” in the hope that the decline will somehow reverse. At that point, the wiser choice might be to follow the cue of the Chinese, the Romans, and others, who instead chose to quietly exit for greener pastures elsewhere." *** How Empires End

|

|

|

|

Post by Entendance on May 9, 2021 3:46:40 GMT -5

Financial writer John Rubino says there is no easy way out for the financial and political mess the United States has created for itself. Rubino starts with the economic problems and explains, “Now, inflation is starting to spread. . . . Look at lumber. If you are trying to build a house, it’s $35,000 more now than it was two years ago just because of lumber. Iron ore, house prices, grains, food and you name it, we’ve got inflation going on. At the same time, we have an apparent labor shortage. All these companies are coming out and saying we would love to take on all the business we are being offered to us, but we don’t have enough people. Even Uber and Lyft cannot find enough drivers. It’s weird it is happening this soon, but we should not be surprised since we dumped tens of trillions of dollars into the economy over the past year. This is what you would expect if you get the money supply going up 30% or 40%, which it did. This is what you get. The economy overheats. Now, we are confronted with the nightmare scenario in a fiat currency system. Inflation starts to pick up, which it is. That sends interest rates higher, which is happening. That threatens all the heavily indebted people out there because as rates go up, their costs rise. Then they go bankrupt in increasing numbers, and the system collapses. We are in the early stages in that kind of a process, and I don’t think anybody knows what to do about it.”

It seems Sam Zell knows what to do. Who is Sam Zell? Rubino says, “Well, Sam Zell is one of the biggest real estate investors in the world. The guy has a history of being right at the big turning points. He will build a massive commercial real estate empire with billions and billions of dollars of offices and shopping malls and stuff like that. Then towards the end of the cycle, he will start selling. He will basically get out at the peak of the market. Then the market tanks, and he buys back in. So, he’s a really good indicator of where the economy is going because he has such a history of being right. So, now, the guy is buying gold. I think this is the first time I have ever heard of him doing that. He usually just sells his real estate and goes to cash. Now, he’s selling out of some of his real estate, and instead of putting it into a bank, he’s buying gold with it. This is a good sign from a smart guy. . . . This guy is right so frequently, the fact that he is buying gold is a really good gold buying signal.”

Rubino goes on to warn, “I think the next stage in the market psychology is when people figure out there is no adult supervision left in these markets. Daddy is not going to come home and fix this. We are at the point where there are no solutions, and that’s when things spin out of control. . . .The Mad Max scenario is the extreme end of the spectrum of possibilities, but there can be political and financial chaos where something like the Great Depression or something like the Weimar Germany hyperinflation becomes a real possibility. . . . This is beyond the ability of any individual to fix. We can’t save the system.”

76 years ago, the banner of the 150th Idritsky Division was hoisted over the burning Reichstag, announcing to the world that the war in Europe had ended, and the Nazi forces routed. Nazi Germany surrendered at 1:00 AM Moscow Time on 9 May 1945, and the anniversary is celebrated in many other countries on 8 May because of the original time difference.

The Entendance Beach & Russia: 7 pages

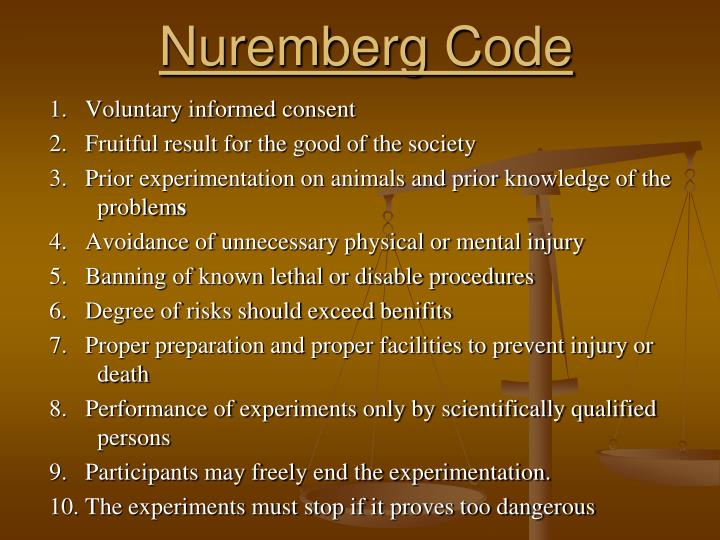

"From May 1943 until January 1945, Nazi doctor Josef Mengele worked at Auschwitz, conducting pseudo-scientific medical experiments. Many of his cruel experiments were conducted on young twins..."

"...We continue to forget the lessons of the past. We worship “science” now. Decades of diligence and actual science, which were carefully crafted by our parents and grandparents, have been swept under the carpet under the guise of emergency in matter of months, and “science” takes that to mean all limits are off. Yes, governments and armies etc. would love to experiment on you and I, and tell us it’s for our own best sake. If we just wear a ring or a watch or an app, we will all benefit from centralized medical systems checking our symptoms 1000 times a second and beaming it all into some database, what could be better for us?

And maybe this is indeed inevitable, but it also contradicts a lot of what we, until now, consider to be freedom and liberty, of our decisions about our own existence, without anyone else interfering. And then on top of that they will try to force you into getting another mRNA jab, and then another, until you have very obviously no longer the genetic make-up that you were born with.

We are born into this world as healthy people, and we use our healthcare systems to correct in the still rare instances that we are not. But we will lose that presumption if and when we will be monitored 24/7 from the day we are born. Even while we are as healthy as our ancestors were when they were born. Do we benefit from this?..."

|

|

|

|

Post by Entendance on May 23, 2021 1:49:21 GMT -5

“When they have to admit the inflation rate is 10%, my number is going to be up to around 15% or higher. My number rides on top of their number.”

Right now, the Shadowstat.com inflation rate is above 11%. That’s if it were calculated the way it was before 1980 when the government started using accounting gimmicks to make inflation look less than it really is. The Shadowstats.com number cuts out all the accounting gimmicks and is the true inflation rate that most Americans are seeing right now, not the “official” 4.25% recently reported.

Williams says the best way to fight the inflation that is already here is to buy tangible assets. Williams says, “Canned food is a tangible asset, and you can use it for barter if you have to...Physical gold and silver is the best way to protect your buying power over time.” Gold may be a bit expensive for most, but silver is still relatively cheap. Williams says, “Everything is going to go up in price.” The Video: Inflation & Implosion – Hyperinflation in 2022 – John Williams

|

|

|

|

Post by Entendance on Jun 30, 2021 6:19:28 GMT -5

The current combination of monetary debasement, populism and social unrest is neither a new phenomenon nor a coincidence. The late Roman empire shaved silver coins as it disintegrated; Henry VIII replaced silver coins with copper to pay for wars against France and Scotland; the British empire allowed double-digit inflation to erode bondholders’ wealth following the War of Independence; the Weimar Republic precipitated an inflation spiral.

Comparing these examples to QE may sound extreme. Yet the biggest debasement in history may be the one we are experiencing now under the form of a $20tn central bank experiment, which is de facto depreciating money by boosting the price of all assets it can buy. -Alberto Gallo

|

|

|

|

Post by Entendance on Jul 7, 2021 23:19:40 GMT -5

Reality is merely an illusion, albeit a very persistent one. -Albert Einstein

|

|

|

|

Post by Entendance on Jul 31, 2021 2:33:06 GMT -5

Necessity is the plea for every infringement of human freedom. It is the argument of tyrants; it is the creed of slaves. -William Pitt

|

|

|

|

Post by Entendance on Aug 24, 2021 4:14:27 GMT -5

"Yeah, there's one coming.

I know, I know "this time its different."

No it isn't.

Biden and his pals are following up the insane money-printing nonsense that Trump did for four years. He never met a single entity that he wouldn't blow for a $20 and that carried over right into being President.

The worst part of it was what he did with health care, which I pointed out I suspected he was lying about before the election and literally on election night I reported from a bar when the three planks in his platform on same disappeared within minutes of the election being called for him.

I have pointed out that for over a decade that Medicare and Medicaid spending was unsustainable and was going to blow up.

You'll have to pardon the cynic in me if I note that paying a hospital $30,000 once to shove a tube down a Senior's throat might be the cheapest $30,000 ever spent and you get to score political "caring" points and make nurses dance at the same time.

Now we have "infrastructure." Including in "infrastructure", I might mind you, is a study on how to impose a federal highway mileage tax on anything that moves. You see, that's been done indirectly via the gas tax for decades, but if you want to make it illegal to build or sell gas-powered cars...

Then there's infrastructure in the form of a mandated automatic DUI checker on every new vehicle within the next three years. That's right -- get in, push the button, the car has to check if you're intoxicated. Now as far I know this technology on a passive basis doesn't currently exist, but I could be wrong. It most certainly does exist for those who have been convicted of DUI and have a hose sticking out of their dashboard. Read for that one folks? It's in there.

There's no "inflation" eh? Well, wait until your Obamacare policy renewal statements come up. They're going to start being priced and released in the next month or so. What I've heard so far is that the average requested increase is 30%. Anyone care to bet if the corporate pricing is going to be better? You know damn well it won't be.

Then there's this curious dislocation in the employment data I wrote about. What is it? Not sure yet, but it suggests that about a million people who were supposed to show up in the workforce didn't -- about a 50% reduction. Since it takes 17 years from the time you screw until said workforce "addition" (defined: persons age 16+, not institutionalized) show up the cause can't be people deciding not to screw during the pandemic, can it?

What's that leave? Death, and this is 2021, not 2020.

So you have supply pressure boosted by money printing and..... disappearing people.

And a hell of a lot stawks trading at nose-bleed P/Es simply because when there's a hell of a lot of money flying around out of Trump's and Biden's *******s it goes somewhere, and the somewhere has been the stock market.

Ok.

Ultimately the question is the same: Where's the final demand for those goods and services?

It had better show up or price is rather more-likely to revert back to something a bit more-sane -- like it or not." - Karl Denninger: Ready For The Crash?

I am more concerned about the return of my money, than the return on my money. – Mark Twain

You have to decide whether to look like an idiot before the crash or an idiot after it. |

|

|

|

Post by Entendance on Sept 6, 2021 1:07:17 GMT -5

"...WE BUY PHYSICAL GOLD BECAUSE:

◾It has been money for 5,000 years

◾It is the only money which has survived throughout history.

◾It guarantees stable purchasing power over time.

◾It is scarce – It cannot be printed. (Unlimited paper gold creation will soon collapse.)

◾It is durable – All the gold ever produced still exists.

◾It is nobody else’s liability – Thus no counterparty risk.

◾It is held and traded outside a fragile financial system – Thus gives independence.

◾It is the ultimate wealth preservation asset and insurance against a rotten world economy..." More here |

|

|

|

Post by Entendance on Sept 29, 2021 4:08:53 GMT -5

|

|

|

|

Post by Entendance on Nov 1, 2021 2:56:43 GMT -5

Castles in the air cost a vast deal to keep up. -Edward George Earle Bulwer-Lytton

PREPARE FOR THE GREATEST CRISIS EVER

So instead, we normal mortals need to focus on our own survival of the “Greatest Financial Crisis Ever”.

The solution is of course easy.

Get out of debt as much as you can

Sell all bubble assets like stocks, bonds and property

Own some gold and silver stocks

Cut down on expenses to cope with lower income or pension

Think about family and friends that will need your help in the crisis

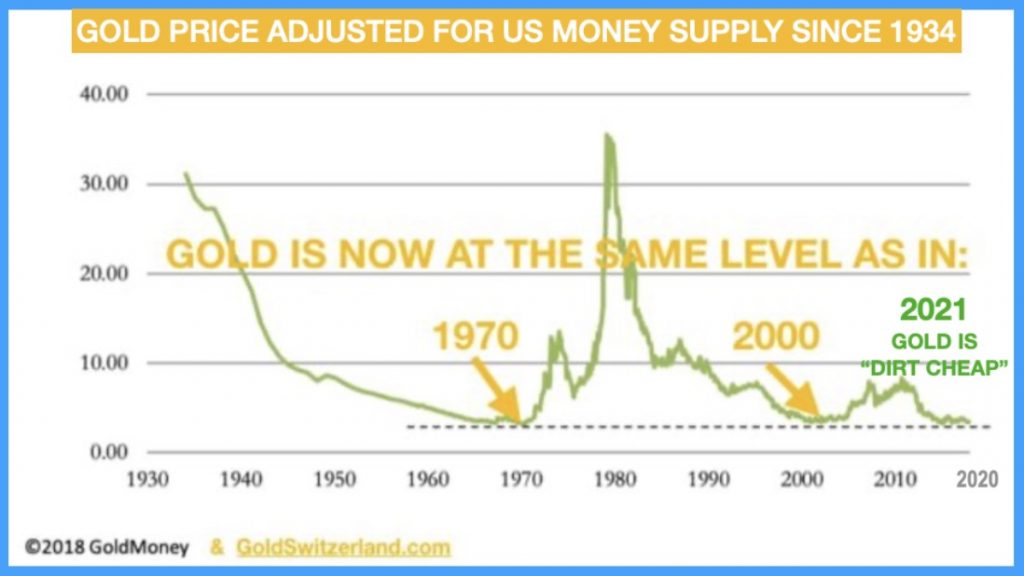

Buy as much physical gold and silver you can afford – they are the most unloved and undervalued assets you can own in the coming hyperinflationary crisis.

Finally, the graph below

proves that gold in relation to US money supply is as cheap as in 1970 and in 2000. Please don’t ignore the opportunity of a lifetime to both preserve your wealth and own an asset with a substantial wealth enhancement opportunity. - Egon von Greyerz

|

|

|

|

Post by Entendance on Nov 5, 2021 5:59:16 GMT -5

|

|

|

|

Post by Entendance on Nov 14, 2021 2:53:25 GMT -5

|

|

|

|

Post by Entendance on Nov 20, 2021 14:46:32 GMT -5

|

|

|

|

Post by Entendance on Dec 5, 2021 4:43:56 GMT -5

Evergrande issues letter stating they cannot make bond payments...DEFAULT!

Returning to limited government, creating a more free market order, having a less intrusive government, etc. requires sound money. Sound money is not a guarantee of a free society, but a free society is impossible without sound money. - Patrick Barron

|

|

|

|

Post by Entendance on Dec 29, 2021 13:27:01 GMT -5

Breaking:

The Pfizer 6 month data shows that Pfizer's COVID-19 inoculations cause more illness than they prevent. Plus, an overview of the Pfizer trial flaws in both design and execution: PDF

The Pfizer Inoculations Do More Harm Than Good: VIDEO |

|

|

|

Post by Entendance on Jan 4, 2022 2:59:04 GMT -5

IT'S THEM OR US. TERTIUM NON DATUR. IT'S THEM OR US. TERTIUM NON DATUR.

2022 A Challenging Year 2022 A Challenging Year I remember when 1984 was in the distant future. We wondered if our destiny was going to be Big Brother’s police state. But 1984 turned out to be the middle of the Reagan years. Liberals didn’t like Reagan’s rhetoric, but his policies worked. Supply-side economics cured stagflation, and we were working to end the cold war. It was difficult not to like a president who could quip in response to an assassination attempt on his life, “I forgot to duck.” New ideas reinvigorated US economic and foreign policy. Our future had brightened. Soviet President Gorbachev agreed to the reunification of Germany on the assurance from the George H.W. Bush administration that in exchange NATO would not move one inch to the East. But the Clinton regime, with Republican Bob Dole egging them on, dishonored the word of the United States government and moved NATO to Russia’s borders, thus restarting the Cold War that Reagan and Gorbachev had ended. In a series of lawless actions–the bombing of Yugoslavia, the invasions of Afghanistan and Iraq, the bombings of Pakistan territory–together with dismissive treatment of Russia, Washington, lost in its arrogant hubris as “the world’s only superpower,” awoke and aroused Russia and brought her out of her docility. At the Munich Security Conference in 2007 Putin said that the lawless behavior of the US was undermining peaceful relations based in international law. He said Washington’s monopolistic dominance in global relations left no room for the interests and concerns of other countries and he criticized Washington for unbridled hyper use of force in international relations. Washington and its vassals were astonished at Putin having the gall to annoy the superpower, but wrapped up in remaking the Middle East in Israel’s interest, paid no attention to him. Washington and its vassals were again astonished in 2015 when Putin blocked the Obama regime’s invasion of Syria and, together with the Syrian Army, defeated the mercenaries Washington sent to overthrow Assad. Faced with Washington’s destruction of the arms control agreements reached over decades, in 2018 Putin announced a stunning array of new weapons systems such as hypersonic and random trajectory nuclear missiles that made it apparent to independent experts that the US was suddenly a second-rate military power. No one has listened to us, Putin said. “You listen to us now.” But no one did. Washington is too comfortable snug in its arrogance and hubris and holds firmly to what is now a delusion of its omnipotence. Washington even thinks it can bring Ukraine and the former Russian province of Georgia into NATO. The Kremlin’s response to Washington’s madness has sharpened the issue: “Get off our doorstep, or we will drive you off.” This is a demand, and it is not negotiable. Given the total uselessness of the US media that serves only the elite interest groups that control America, Americans themselves are unaware that their idiot government has brazenly provoked a situation in which Russia has told Washington to get your bases and military maneuvers away from our borders or suffer the consequences. Americans are so totally uninformed that they could be incinerated before they knew there was a problem. 2022 opens with two unprecedented crises. One is the attempt by governments in the “Free West” to use Covid to turn crumbling democracies into police states. The other is the prospect of Armageddon, given the lack of intelligent and reasonable leadership everywhere in the Western World. Can you identify any intelligent leader anywhere in the Western world? No? Neither can I. The West’s leaders are nothing but whores for the controlling interest groups. They have probably never had an independent thought in their entire lives and are incapable of thinking. How are such useless beings going to deal with a serious crisis? Look at the people in the Biden regime. They are a collection of jokes. There is nothing there. Where is a secretary of state capable of reassuring the Kremlin and easing Washington out of its commitment to American hegemony? He is nowhere to be found. The situation is extremely serious, because Russia is facing an aggressor whose leaders are disconnected from reality. Biden, who is only there part of the time, has advisors from the Russian-hating neoconservatives at the Center for New American Security funded by the US military/security complex and oil companies. The state department official who oversaw the overthrow of the elected government of Ukraine is now the Undersecretary of State. The warmongers responsible for Clinton’s bombing of Yugoslavia in the 1990s and for all of Washington’s illegal wars in the 21st century are ensconced in the Biden regime. US Senators from both parties are demanding that Biden stand up to Putin. Republican National Committee chairwoman Ronna McDaniel berated Biden for even accepting a phone call from Putin! Republican US Senator Roger Wicker, a member of the Senate Armed Services Committee, called for raining destruction on Russia’s military capability from our Navy in the Black Sea and refuses to rule out a first strike on Russia with nuclear weapons. Michael McFaul, the Russophobe Obama sent as US Ambassador to Russia, dismissed Putin’s demand that the US respect Russia’s security concern as “Russian paranoia.” With Democrats and Republicans united in stupidity, with Stephen Cohen dead, and with no one to say Whoa! how is the Biden regime, burdened by fools and idiots, going to realize that the Kremlin has had enough? Patriotic Americans have always wrapped themselves in the flag. USA! USA! USA! The neoconservatives have told them that they are exceptional and indispensable with the right to rule the world. Americans are not even aware that Washington has created a crisis. The Russian government has reached the conclusion that its years of accepting provocations and insults, relying instead on diplomatic efforts to reach a peaceful and reasonable accommodation, did not succeed. As Putin said, we retreated and retreated in the interest of peace, and now they are on our doorstep and we have nowhere left to which to retreat.And still Washington does not hear. - Paul Craig Roberts

|

|

|

|

Post by Entendance on Feb 2, 2022 13:45:06 GMT -5

[Basically, you make money by not losing money. Most people realize too late the harsh arithmetic of missteps, that a 50% loss requires a 100% gain just to break even. It's always darkest before it turns absolutely pitch black [Basically, you make money by not losing money. Most people realize too late the harsh arithmetic of missteps, that a 50% loss requires a 100% gain just to break even. It's always darkest before it turns absolutely pitch black  The E. Beach Wealth Principles] The E. Beach Wealth Principles] |

|

|

|

Post by Entendance on Feb 21, 2022 8:12:06 GMT -5

|

|

|

|

Post by Entendance on Mar 6, 2022 5:14:36 GMT -5

|

|

|

|

Post by Entendance on Mar 13, 2022 3:49:57 GMT -5

Quod fugere credas, saepe solet occurrere. -Publilius Syrus

You often run into something you thought you were fleeing

Ce que tu crois fuit vient souvent à ta rencontre Ciò da cui credi di sfuggire, spesso è solito venirti incontro

Last year about this time, precious metals expert and financial writer David Morgan was warning about massive money printing and the so-called “everything bubble” popping. Inflation is the pin, and it found the bloated debt bubble. Now get ready for some pain as Morgan explains, “It’s going to get bad, and I mean really bad. There is already mass starvation at the lower end of the economic scale in third world countries... Prices are going to be untenable for many people, especially those in the middle class. When you get gasoline going up to the $5, $6, $7 range and you’ve got food going up to the level it’s gone up to and continues to go up to, it’s going to be bad. I am focusing on real stuff, not the bond market or what the price of gold is going to do. I am talking about day-to-day living...When gasoline goes from $3.50 per gallon to $5.50 per gallon and you start doing the math on how much it takes to fill up your car and drive it back and forth to work every day, all of a sudden you’ve got diminishing returns. Then factor in what your heating bills and what your grocery bill is going to be. So, there is going to be a lot of people at the margin, and the margin keeps moving up. It’s a few percent of the population. Then it’s 10% and then 20% and so on. When food gets to be 50% of your budget, then there are food riots. That’s the trend...and I think we will get there...We know the ‘Arab Spring’ was not about politics. It was about food. We are going to see ‘Arab Springs’ spring up all over the place because of food costs and availability. You can have a lot of money and not be able to get food too.” Last year about this time, precious metals expert and financial writer David Morgan was warning about massive money printing and the so-called “everything bubble” popping. Inflation is the pin, and it found the bloated debt bubble. Now get ready for some pain as Morgan explains, “It’s going to get bad, and I mean really bad. There is already mass starvation at the lower end of the economic scale in third world countries... Prices are going to be untenable for many people, especially those in the middle class. When you get gasoline going up to the $5, $6, $7 range and you’ve got food going up to the level it’s gone up to and continues to go up to, it’s going to be bad. I am focusing on real stuff, not the bond market or what the price of gold is going to do. I am talking about day-to-day living...When gasoline goes from $3.50 per gallon to $5.50 per gallon and you start doing the math on how much it takes to fill up your car and drive it back and forth to work every day, all of a sudden you’ve got diminishing returns. Then factor in what your heating bills and what your grocery bill is going to be. So, there is going to be a lot of people at the margin, and the margin keeps moving up. It’s a few percent of the population. Then it’s 10% and then 20% and so on. When food gets to be 50% of your budget, then there are food riots. That’s the trend...and I think we will get there...We know the ‘Arab Spring’ was not about politics. It was about food. We are going to see ‘Arab Springs’ spring up all over the place because of food costs and availability. You can have a lot of money and not be able to get food too.”

It’s not just physical assets that are going to be affected, but the financial system too. Morgan says, “What is all this going to do to the financial system? It’s breaking, but it’s been broken for a long time. We just have not seen the end result—yet. I don’t think the bankers really thought this through all the way. If you look at the way Russia is, they are a hardened people. They are used to suffering. They are used to standing in line for bread and potatoes. They are not like other nations...This is going to get uglier and uglier and harder and harder. I do not think this is going to get resolved anytime soon.”

What does Morgan see coming? Morgan says, “There are going to be cyber-attacks, and they are going on right now. There is going to be communication breakdown. Number three, there are going to be consequences that nobody can see at this point. And to reiterate, it’s a mess, and it’s going to get messier, and it’s not going to be resolved quickly.”

Morgan see’s gold at $2,300 by the end of this year and silver near $40 per ounce. In 2023, all bets are off, and Morgan contends you could see both metals way higher than they are now. Morgan says, “Silver will outperform gold in the long run on a percentage basis...Silver will outperform gold four to one.” Morgan also says, “Demand for the metals from pensions funds and other big money managers is a “trend that is just getting started.”

Morgan also talks about the importance of cash and what the signal will be to get out of the U.S. dollar.

|

|

|

|

Post by Entendance on Mar 21, 2022 12:35:41 GMT -5

Humanity's moment of MASS AWAKENING will only occur as humanity faces total EXTINCTION from global war

|

|

|

|

Post by Entendance on Apr 1, 2022 9:24:45 GMT -5

|

|

|

|

Post by Entendance on Apr 10, 2022 3:01:37 GMT -5

Millions About to Lose Everything – Bo Polny Millions About to Lose Everything – Bo Polny

|

|

|

|

Post by Entendance on Apr 11, 2022 2:19:49 GMT -5

|

|

|

|

Post by Entendance on May 2, 2022 7:49:41 GMT -5

|

|

|

|

Post by Entendance on May 7, 2022 12:49:30 GMT -5

As Economic Armageddon Arrives With The Most Deadly Financial Storm In History, The Time Has Come To Settle The Economic Wreckage Of The Past And YOU Are The Collateral!

February 11, 2020

|

|

|

|

Post by Entendance on May 9, 2022 10:13:20 GMT -5

H/T Tom from Florida At The Entendance Beach we don't try to come up with the right answers; we focus on coming up with good questions.

|

|

|

|

Post by Entendance on May 17, 2022 10:41:51 GMT -5

"...The 40-year decline in interest rates has turned, the four-decade quiescence of inflation has turned, the era of low-cost extraction of abundant hydrocarbons has turned, the cycle of being able to "borrow our way out of trouble" has turned and the era of rewarding hyper-speculation has turned.

How gradual or dramatic the new cycle will be is unknown. If we imagine all these dynamics as a pendulum, the pendulum has been pushed by frantic can-kicking to systemic extremes that will reverse to extremes at the other end of the spectrum (minus a bit of friction).

The decline phase of S-Curves can be gradual or a cliff-dive. While we don't know the decay / unraveling trajectory yet, we can anticipate all these long cycle turns reinforcing each other. It's all one system, after all, and the decay / unraveling of each subsystem will accelerate the decay / unraveling of the other subsystems.

As a general rule, it's a good idea not to stand in the way of the pendulum. Put another way, it's considerably safer to be in the stands watching the great beasts slouching towards Bethlehem than being on the blood-soaked sand of the Coliseum, clutching a wooden sword and a shredded net."

|

|

|

|

Post by Entendance on May 21, 2022 2:04:12 GMT -5

|

|

|

|

Post by Entendance on May 30, 2022 10:26:59 GMT -5

|

|

In this final period, the empire turns on itself, treating its people as the enemy.

In this final period, the empire turns on itself, treating its people as the enemy.

In this final period, the empire turns on itself, treating its people as the enemy.

In this final period, the empire turns on itself, treating its people as the enemy.

NUREMBERG CODE -

NUREMBERG CODE -

Entendance

Entendance

E.

E.

The Entendance Beach

The Entendance Beach

IT'S THEM OR US. TERTIUM NON DATUR.

IT'S THEM OR US. TERTIUM NON DATUR.

2022 A Challenging Year

2022 A Challenging Year

February 2, 2022:

February 2, 2022:

[Basically, you make money by not losing money. Most people realize too late the harsh arithmetic of missteps, that a 50% loss requires a 100% gain just to break even. It's always darkest before it turns absolutely pitch black

[Basically, you make money by not losing money. Most people realize too late the harsh arithmetic of missteps, that a 50% loss requires a 100% gain just to break even. It's always darkest before it turns absolutely pitch black

.png)

More

More COUNTDOWN timetable to Russian retaliation

COUNTDOWN timetable to Russian retaliation THE WEST HAS

THE WEST HAS

.jpg)