|

|

Post by Entendance on Jan 4, 2017 18:54:32 GMT -5

|

|

|

|

Post by Entendance on Jan 17, 2017 11:45:20 GMT -5

|

|

|

|

Post by Entendance on Jan 22, 2017 11:14:58 GMT -5

End of 2017 Gold Up & Dollar Down-Nomi Prins Best-selling author Nomi Prins says two of the big wild cards are Donald Trump and Europe. Prins explains, “The biggest wild card is a combination. Trump is a wild card, but so is Europe. Right now, the political lens goes over to Europe. It’s caught between its old and potentially new structure and potential new political leadership. I think that is a major wild card now. That snakes through Russia, and that snakes through Eurasia relationships, and that relates back to Trump. The wild card is the linkages among those things.”

Prins, who is a former top Wall Street banker, also thinks it’s hard to define the bad guys and the good guys. Prins contends, “From an economic standpoint, everyone has side deals. So, there is no positive or negative economy. . . . All countries do good things, and all countries do bad things. What is happening right now is all of the alignments between countries have been changing. . . . The reality is there are going to be a lot of things renegotiated, and it’s not just Trump and the U.S. doing the renegotiating. All the other countries are negotiating as well. If there is enough antagonism with how Trump is going to renegotiate those agreements . . . that could limit trade into the U.S., and that could limit our bargaining power. . . . That is all in flux this year.”

Prins correctly predicted no financial crash for 2016. Prins’ upcoming book is titled “Artisans of Money.” It is all about central bank money creation. What does Prins say about this year? Prins predicts, “In 2016, I pegged the non-crash. . . . Central bankers were finding new ways to extend their money creation policies. That is what kept the markets up. There was a separate bid on the markets after Trump was elected. It was on the expectation that he would be good for growth, that he would be good for infrastructure and that he would create jobs. I do think there is a little juice in the central banks. I keep thinking there shouldn’t be, but they keep surprising all of us with their ability to boost the markets. They have artificially stimulated so many different asset bubbles, whether it’s debt, which is epic, or stock markets, many of which are at historic highs. If we have a crash, it will be in the second half of 2017. The promises, the rate hikes, the dollar being high could collapse into the realities of the stability and this artificialness. I am not sure about a crash this year, but if we see a big decline, it will be in the last quarter.”

On the U.S. dollar, Prins says, “I think with the expectation of things going well, the dollar will be keeping a bit of a bid. It will be within a range but staying fairly up. I think the dollar will turn around and weaken in the second half of the year. . . .That’s why, in the last half of the year, gold will catch more of a bid.” (Meaning prices for gold will rise according to Prins.)

Join Greg Hunter as he goes One-on-One with two time best-selling author and former top Wall Street banker Nomi Prins of NomiPrins.com.

"...Every gram of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system. What you have done is removed those “dollars” from the hands of government. They now have fewer “dollars” to use to purchase weapons of war, surveillance technology and the other weapons they use against us. Today would be a good day to remove a few “dollars” from their hands and place another weapon in your back pocket. Gold and silver are free from tyranny, accepted around the world in good faith and provides a piece of insurance from, what appears to be, a system in change..."

Fred & EntendanceInvestors Private Beach. Members Only Area.

|

|

|

|

Post by Entendance on Mar 4, 2017 4:27:32 GMT -5

“I am more concerned about the return of my money, than the return on my money.” – Mark Twain

"As the Fiscal Year 2018 budget, and particularly its war component are floated, it has become clear that without continued, massive military spending, paid for with mass-produced electrons masquerading as money, U. S. GDP would collapse, taking the country’s financial and monetary systems with it. The nation, whose real economy has been hollowed out, for profit, by the Deep State plunderers, has become significantly reliant upon deliberately contrived wars and military tensions for its economic survival.

With systemic monetary risk now at an unprecedented level, intensified by a new, partisan, “politics of defeat,” scorched earth agenda being implemented by those displeased with the results of the 2016 election, there has never been a more dangerous time for people to denominate their wealth in unbacked, baseless, debt-drugged dollars.

The absolute last thing the Deep State, and particularly its Banking Division (the Bank State), can allow the people to figure out at this time is that there is a far more safe, secure and potentially profitable way for them to position their financial assets than dollar-denominated bank deposits: precious metals. A widespread movement into metals at this time would damage the Bank State and its umbrella organization, the Deep State, because their future profits require the control and progressive expropriation of the people’s money.

Therefore, a March rate hike is guaranteed, for three primary reasons. First, precious metals prices must be pummeled as much as possible, in order to scare uninformed people away from the easy, safe and logical financial refuge metals provide. Even though the “rates up, metals prices down” reflexive reaction is absurd, it has been baked into the trading algorithms so that it will occur no matter what other factors might be in play when rates are increased. Strategic Deep State price fraud, which is perpetrated by internationally signaled, time-coordinated and algorithmic inside trading, ensures that metals prices can reliably be controlled. At least for now. When physical demand finally increases in a material way, the price fixing fraud will collapse.

Second, the Bank State must increase the incentive for people to keep their money in its institutions, while it pushes forward, as fast as possible, with its cash elimination agenda. Once cash is eliminated, the banks will no longer have to worry about bank runs, which would otherwise be historic when the wheels coming flying off the thoroughly debauched monetary system, an event we view as inevitable.

Third, the Federal Reserve System is now 100% politicized, and run by sneaky, die-hard political ideologues who lie about why they do what they do and what they really think. Those who run the Fed are despondent that despite implementing for eight YEARS an interest rate policy specifically designed to enable Obama to create a totally false illusion of economic “recovery” by massively increasing government spending with trillions of phony, deficit, zero-interest-rate “dollars,” the people saw through the economic lie and defeated the Fed’s next intended puppet, Clinton.

Yellen, Fischer and the other partisan Fed governors are simply not going to allow Trump to turn around, in a matter of months, an economy that the Deep State and the Fed have systematically been looting, at mind-boggling and astronomical profit to themselves, for the past decade. Nor are they going to allow Trump to bask in DJIA-record glory. Therefore, the power- and money-obsessed functionaries at the Fed and within the Deep State, who all totally buy into the scorched earth agenda, are going to bring down the economy and markets, even if it means that every single private pension fund and the net worth of every non-connected citizen collapses with it. They couldn’t care less about that, as we are about to see, because they will have a scapegoat for what they, themselves have wrought: Trump. The Fed, in league with many others, is now doing everything in its power to rig the 2018 mid-term elections, in order to live up to its Sole Mandate, which is the preservation of political power.

While we deeply admire what President Trump is trying to do to expose to the people and turn around the fake economy in which the nation is drowning, we believe the challenge of reversing, in the short amount of time available to him, decades’ worth of asset stripping, corruption and for-profit economic destruction is beyond extreme. And the constant political obstructionism he is up against, which is increasingly treasonous, might make the achievement of his worthy objective impossible.

With this as our backdrop, let us move on to the geopolitics of gold, which while it might seem abstract and removed, we believe is highly relevant to your personal financial situation.

Aside from being tedious, politicized and baseless drama, the ongoing demonization of Russia, particularly with respect to its so-called rigging of the 2016 U.S. Presidential election, makes no common sense. But it makes perfect Deep State sense. It is about war-mongering, global destabilization, internationalized looting and the continued plunder of the American people, the for-profit enterprises in which the Deep State specializes.

We believe that there is actually a more specific reason for the demonization of Russia than the above, usual suspects. This is a case where one should not just follow the money; one should follow the gold.

For the past fifteen plus years, physical gold supplies have been like Lazarus: they keep rising from the Dead. Just when it appears that a serious supply-demand imbalance is about to precipitate futures market delivery problems and therefore increased prices, supply miraculously appears out of nowhere to alleviate the shortage and stabilize or depress prices.

This surprise supply has primarily come from sovereign central banks: for example, 1,500 metric tonnes from one-time sound money nation Switzerland; 600 from France; 430 from the United Kingdom (most at the bear market’s absolute low price of around $255.00/ ounce; central bank “genius” for all to see); 300 from Netherlands; 225 from Portugal; 240 from Spain; 180 from Venezuela and counting; 90 from Brazil. And the list goes on.

Each sovereign sale has produced needed physical gold at times of supply – demand imbalance, many of which have been critical. This has enabled the paper gold price manipulation fraud to persist without any failures to deliver or the need to set a true, as opposed to fake gold price. A delivery failure, even a minor one, would expose and terminate the Deep State’s enormously profitable price rigging fraud, and has therefore been prevented at all cost.

The Deep State’s overthrow of legitimate, sovereign governments has been another means by which needed gold supply has been injected into the pipeline. After Libya was overthrown, 143 tonnes of the nation’s gold disappeared. Dozens of additional tonnes disappeared from Iraq subsequent to its invasion.

Ukraine provides another example. Immediately after Neocon, Deep State functionary and State Department plant Victoria “F**k the EU” Nuland launched the for-profit coup d’etat in Ukraine, 43 tonnes of the nation’s gold, worth $1.7 billion at $1,200 per ounce, were airlifted out of the country in the middle of the night and went missing.

(As a side note, it is worth mentioning that while the cargo plane’s exhaust was dissipating into the Ukrainian atmosphere, Vice President Biden’s storied son, Hunter, miraculously appeared on the Board of Directors of Burisma Holdings, the largest private natural gas producer in Ukraine. Biden was joined by close friend Devon Archer, a lead fundraiser for by-then Secretary of State John Kerry’s 2004 presidential bid. Archer is also the former college roommate and current business partner of Kerry’s stepson, Christopher Heinz (an heir to the H. J. Heinz fortune). These two ascendancies to Burisma’s Board were curious, given that Biden and Archer had no natural gas production or Ukrainian business experience whatsoever, did not speak one word of Ukrainian and had never previously stepped foot in the country. This gives us better insight into the true nature of the Deep State’s murderous, gold-seeking and highly profitable coups.)

While the perfectly-timed materializations of sovereign gold have plugged the Delivery Failure dike at various critical moments, there have been two persistent demand problems that have bedeviled the Deep State’s designs: Russia and China.

China’s official gold reserves surged from 395 tonnes in Q2, 2000 to 1,838 tonnes in Q3, 2016. This number, impressive in itself, dramatically understates China’s actual, official gold reserves, which many well-informed analysts put at 5,000 tonnes, minimum. China’s official reserves do not include the thousands of additional tonnes imported into the country for the private sector during the same period.

While the Deep State routinely pummels the paper price of gold both to mint fraudulent profits on the futures exchanges and scare financially naïve western citizens away from it, the Chinese government urges its citizens to buy gold, which they do by the millions of ounces. The Chinese government knows what is coming, and wants its citizens to be prepared. Apparently, capitalism and communism have traded places, which will result in an exorbitant cost to the people of the west.

Meantime, Russia’s gold supply increased from 343 tonnes in Q2 2000 to 1543 tonnes in Q3, 2016.

Remarkably, it increased by 508 tonnes from Q1, 2014 to Q3, 2016, alone. This occurred when Russian sanctions, which were intended to destroy Russia’s economy and currency, were in place. The sanctions were not only expected to halt Russia’s ongoing gold purchases, but also force them to sell some or all of their existing reserves in order to raise cash, which is exactly what Venezuela has been forced to do since early 2014.

Chess Master Putin went in the exact opposite direction, by dramatically increasing the nation’s purchases of gold. This was unexpected and has put the Deep State on the defensive. It had counted on fresh supply from Russian to keep the supply – demand balance in equilibrium, and to prevent the Delivery Failure dike from breaching.

One way the Deep State reacted to Russia’s unexpected, continued demand was to engineer the out-of-nowhere Indian rupee demonetization, which stripped the Indian people of the cash they have traditionally used to purchase gold. This plan was effective at reducing Indian gold demand in the beginning, but is now backfiring, just as the attempt to reduce Russian gold demand backfired.

If China and Russia continue to buy gold at current rates, the only way the Deep State’s paper gold price manipulation fraud can continue is if other sovereign gold reserves are put into play, or, if physical demand is somehow diminished. While the Deep State is pursuing both tactics, their options are shrinking.

Even though sovereign gold sale risks remain, the value of nations’ reserves at the current fake price of gold is absolutely meaningless when compared to their exploding debts.

For example, Italy’s 2,452 tonnes of gold are worth $95 billion at $1,200 per ounce; the government’s debt is $2.45 trillion. France’s 2,436 tonnes are worth about the same, $95 billion; it national debt is $2.44 trillion. The same situation exists in virtually every western nation. Therefore, even if these countries were to sell all of their gold, it would not buy them any meaningful or lasting fiscal or financial relief whatsoever. There has never been a more pointless time for nations to sell their gold, particularly at today’s fake price.

To further amplify this point, the United States is reported to own 8,133 tonnes of gold, supposedly the world’s largest stockpile. (We disagree; to us, the arithmetic is clear that China now owns more.) This is the equivalent of 261.5 million ounces troy ounces, or about 0.82 troy ounces per citizen. At $1,200 per ounce, the reserve is worth $314 billion. The nation’s actual, annual deficits are roughly $1 trillion per year, more than three times the value of the entire gold reserve. The nation’s existing debt and contingent, unfunded liabilities exceed $200 trillion. Therefore, the nation’s gold supply could only pay off 0.16%, or one sixth of one percent of the nation’s current obligations. If it has not already done so, the United States could sell every ounce of the people’s gold and it would not make one bit of difference to the nation’s fiscal situation.

The U.S. gold reserve has not been professionally, comprehensively audited since 1953. We will not go into the U.S. gold audit topic here, because it has already been well documented. You can find the details with a simple search, if you wish to learn more. But we would like to point out something that is not typically noted.

In order to create positive “optics,” the United States government consistently massages, manipulates and even totally misrepresents a wide variety of financial, economic and monetary statistics (such as GDP, unemployment, inflation, money supply, interest rates, retail sales and many others). These positive optics are viewed as being crucial to preserving confidence in the nation’s economy and fiat currency.

Accordingly, one would expect that if the United States gold reserve actually exists, physically and unencumbered, the government would go out of its way to prove and advertise it, in order to create the favorable optics it spends so much time and effort engineering about everything else.

Instead, they refuse to conduct a professional audit, invoking the truly ridiculous excuse that it would be too costly to do so. One specialist has estimated that a comprehensive, independent audit would cost $10 million, which is approximately 1 MINUTE of federal spending, literally. So the expense excuse makes no common sense, and arouses serious and legitimate suspicion about the true state of America’s gold reserve.

The foregoing factors help explain the intensifying demonization and scapegoating of Russia. The Deep State needs to prevent Russia from continuing to buy gold in quantity, and is therefore intensifying its efforts to damage the country’s reputation, economy and currency.

Based on these and several other factors, the Inferential Analytics model is signaling that there is a strong probability the Deep State’s gold price manipulation fraud is dying, and that the imbalance in physical gold supply is becoming systemic and reaching a point where it can no longer be bridged with sovereign, stolen or fake supplies. This increases the risk of futures market delivery failure. The occurrence of any significant endogenous event at this time, such as an unexpected military, social, economic or financial disruption, that provokes a further reduction in supply or even a modest increase in demand, would dramatically increase the probability of delivery failure and a resulting, necessary, sharp increase in the price of gold.

The fact that the paper gold price manipulation fraud is reaching the end of the line due to deteriorating supply – demand fundamentals is exactly why we are seeing a radical, concurrent Deep State escalation of the War on Cash. Cashlessness is the Deep State’s upcoming Looting Field, and is designed to replace Gold market price fixing as its next, organized, long-term method of plunder. The elimination of cash will result in the largest looting spree ever orchestrated by the Deep State.

Every time the Deep State hatches a new looting scheme, they dress it up in false righteousness, phony morality and motherhood. In the case of cash elimination, they say it is needed to fight terrorism, drug laundering, tax evasion and crime. This is a huge, concocted, pre-packaged lie; the same kind that Hitler and Goebbels used. Hitler said and proved that if you make the lie big, and repeat it again and again, the people will come to believe it. This is the exact kind of lie the Deep State is telling to push its corrupt, greed-diseased, epically evil cash elimination scam.

While the Deep State demonizes Russia to perpetuate its gold price fixing profit center for as long as possible, it is simultaneously building, as fast as it can maximum security prisons for the people’s money. For the bricks, they intend to use your cash; for the mortar, they are mixing a stinking amalgam of their lies, corruption and greed. We can be sure of one thing: if we allow them to imprison our money in their cashless prisons, they will grind it into oblivion by fees and fraud, and our financial slavery will become inescapable. Please, do not underestimate what is happening all around you, and use your current quasi-freedom wisely." -Stewart Dougherty here H/T Tom from Florida Maximise elimination of counterparty risk: store Gold/Silver outside the banking system

***IT WILL GO ALL HORRIBLY WRONG

|

|

|

|

Post by Entendance on Mar 6, 2017 5:29:47 GMT -5

|

|

|

|

Post by Entendance on Mar 9, 2017 6:51:50 GMT -5

The conventional view serves to protect us from the painful job of thinking.” -John Kenneth Galbraith

It is an unfortunate reality that most people tend to be oblivious to massive sea changes in geopolitics and economics...

Suave, mari magno turbantibus aequora ventis

e terra magnum alterius spectare laborem;

non quia vexari quemquamst iucunda voluptas,

sed quibus ipse malis careas quia cernere suavest.

suave etiam belli certamina magna tueri

per campos instructa tua sine parte pericli;

sed nihil dulcius est, bene quam munita tenere

edita doctrina sapientum templa serena,

despicere unde queas alios passimque videre

errare atque viam palantis quaerere vitae,

certare ingenio, contendere nobilitate,

noctes atque dies niti praestante labore

ad summas emergere opes rerumque potiri.

(Pleasant it is, when over the great sea the winds shake the waters,

To gaze down from shore on the trials of others;

Not because seeing other people struggle is sweet to us,

But because the fact that we ourselves are free from such ills strikes us as pleasant.

Pleasant it is also to behold great armies battling on a plain,

When we ourselves have no part in their peril.

But nothing is sweeter than to occupy a lofty sanctuary of the mind,

Well fortified with the teachings of the wise,

Where we may look down on others as they stumble along,

Vainly searching for the true path of life. -Lucretius)

***A Visual Study Guide to COGNITIVE BIASES

|

|

|

|

Post by Fred on Apr 11, 2017 9:12:45 GMT -5

|

|

|

|

Post by Entendance on Apr 20, 2017 8:14:49 GMT -5

|

|

|

|

Post by Entendance on May 12, 2017 10:44:37 GMT -5

(All about mr. Bean-draghi) (All about mr. Bean-draghi)

"...The ECB’s interest rates cannot be lowered any further, especially in the face of the FED tightening up its monetary policy. If the ECB soon reduces the supply of money and the real estate prices continue to rise, then the bubble will surely burst. And we know from history that a real estate market crisis is followed by recession.

What is the European Commission after with its new stratagem? The answer seems obvious: it wants to help big banks to hold an even tighter grip on the European economy and see how the Europeans are gradually caught in the poverty trap." ***How securities are fabricated causing the real estate bubble to grow

◾Own physical gold and silver bars and coins. No ETFs, no paper gold or silver.

◾Own your own bars or coins and don’t own a share in a co-owned total stock of gold or silver.

◾Store the metals in ultra-secure vaults outside the banking system.

◾Store the majority of your metals outside your country of residence, in a safe jurisdiction with a long history of rule of law and real democracy.

◾Only store metals at home that you can afford to lose. You might have a safe hiding place but that is not enough. Burglars will threaten your husband, wife or children.

◾Only buy gold from first class gold refiners with LBMA approval. In recent days Comex have suspended registration of Elemetal Refiners in the US (formerly NTR metals) due to a federal probe into smuggling of $ billions of illegally mined gold. LBMA has also taken them off their approved list. Elemetal is a major US refiner but their credentials might be questionable.

◾The 4 biggest Swiss refiners have been in business between 50 and 150 years. They produce 60-70% of all the gold bars in the world. They also have a reputation for producing the highest quality gold bars in the world.

◾There is a lot of fake gold produced in the world which looks like perfect bars or coins from reputable refiners. I have myself seen perfect gold bars made in China. But inside there was tungsten. As the gold price goes up, there will be more fake gold. That is why it is critical to buy through reputable companies that buy freshly minted gold from Swiss refiners.

◾Eliminate counterparty risk. Investors must have direct ownership of the bars or coins and not have a subaccount of another company. Investors must have direct access to the vault without the approval of a third party.

◾The metals must be insured for all risks by a major international insurer.

◾Do not self-store with a vault. In some vaults, it is possible for individual investors to do self-storage. This is a false economy. Deal with a company that can provide instant liquidity. If gold or silver are taken out of the LBMA chain of integrity, most major banks or gold dealers will not take the metals back. For small quantities, it might be possible but for bigger quantities, it could be impossible to sell the gold or silver. When you self-store, liquidity can be a major problem.

◾Do not store gold with any bank. This includes private safe deposit boxes in the bank. In the case of a bank failure or extended bank holiday, you might not get access to your gold for a very long time. There are also many cases of governments opening bank safe deposit boxes.

◾Finally, the most important advice I can give investors is to choose a company that has a long track record of stability and reliability. Even more important that the management or owners of the company have an impeccable record over a long time. Whenever I go into business with a company, I always base it on the individuals in charge. They are your partners and their history and track record is more important than all other criteria. Obviously, the business must also produce good products or services and be financially sound.

War or no war, gold and silver have finished the correction down since the 2011 peak and are now on their way to new highs well above the previous peaks. Gold should attain $10,000 and silver $500, at least, in today’s prices. But since hyperinflation is very likely, the actual prices could be multiples of those levels. Shorter term, the metals seem to be in a hurry and gold should reach $1,360 relatively quickly as I have indicated lately.

I have stressed many times that gold and silver should not be seen as investments but as the most important wealth preservation asset anyone can ever hold. Throughout history, during all periods of crisis, whether it is an economic crisis like hyperinflation or geopolitical like war, gold and silver have always been the best insurance. The coming period is unlikely to be an exception to that rule." -Egon von Greyerz

***All You Need To Know about Your Allocated Gold & Silver***

EXK Endeavour Silver Corp

MUX: McEwen Mining

Entendance on twitter

|

|

|

|

Post by Entendance on Jun 5, 2017 12:25:16 GMT -5

The Last Hurrah Of A Global Debt Bonanza

You have to decide whether to look like an idiot before the crash or an idiot after it.

"...By manipulating markets and creating infinite liquidity, central banks are not just temporarily putting off the demise of the financial system, they are also creating a false prosperity by fueling global stock markets to new highs. No one should be under the illusion that all is well on ‘Stock Street,’ and that the new highs we are seeing in many markets around the world are based on real growth. This rise is primarily liquidity driven, leading to over valuations and P/E ratios not seen since the 2000 stock market bubble..." ***Whether People Believe It Or Not...***

HERE

***Cognitive Dissonance, Economics & Politics

|

|

|

|

Post by Entendance on Jul 11, 2017 2:27:09 GMT -5

|

|

|

|

Post by Entendance on Jul 19, 2017 2:24:05 GMT -5

"Though stock markets in general are meaningless and indicate nothing in terms of the health of the economy they still function as a form of hypnosis, or a kind of Pavlovian mechanism; a tool that central bankers can use to keep a population servile and salivating at the ring of a bell. As I have mentioned in the past, the only two elements of the economy that the average person pays attention to in the slightest are the unemployment rate and the Dow. As long as the first is down and the second is up, they aren't going to take a second look at the health of our financial system..."***Don't Be Fooled - The Federal Reserve Will Continue Rate Hikes Despite Crisis

"...As Chindian citizens get more wealth, they buy phones, cars, and other gadgets. They also buy more gold. Unlike phones and cars, it’s very hard to increase the supply of gold. The bull era will be created by an ongoing failure of gold supply to meet the exponential demand growth from Chindian citizens...

...The price of gold will be driven relentlessly higher from this process not just in terms of price, but in terms of time. Empires tend to peak after about 200 years...

...The relentless rise of the Chinese and Indian gold-oriented empires should move the gold price consistently higher for the next 100 – 200 years...

...The West is in decline, and the decline could become a stagflationary nightmare. For wealth building purposes, I would suggest that the world gold community should view the decline of the West as very thick icing on a bull era cake..."***Pruning The Golden Tree

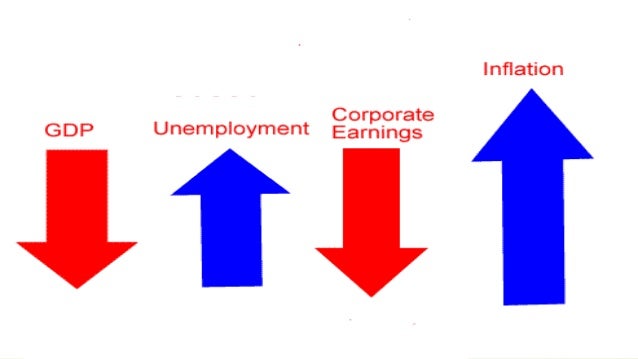

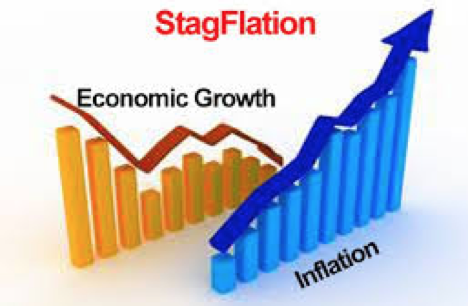

What is 'Stagflation'

A condition of slow economic growth and relatively high unemployment – economic stagnation – accompanied by rising prices, or inflation, or inflation and a decline in Gross Domestic Product (GDP). Stagflation is an economic problem defined in equal parts by its rarity and by the lack of consensus among academics on how exactly it comes to pass.

Fred & EntendanceInvestors Beach: All about Stagflation In collaboration with Tom from Florida

2017:***the Euro Area Breakup

***The War On Cash

***Bota na conta do Papa

***Italiani

***Inspire Your Day at the Beach! |

|

|

|

Post by Entendance on Aug 1, 2017 13:35:33 GMT -5

|

|

|

|

Post by Entendance on Aug 11, 2017 2:01:34 GMT -5

|

|

|

|

Post by Entendance on Aug 27, 2017 4:27:11 GMT -5

Nam tua res agitur, paries cum proximus ardet. -Quintus Horatius Flaccus

(It is your concern when your neighbors’s wall is on fire

You too are in danger when your neighbor’s house is on fire)

Diventa affar tuo, quando la parete del vicino va a fuoco.

“I can’t believe that people cannot see beyond the BS, but you’re fed it in the news by the vomit brokers. I want to make this clear that you are considered by the mainstream media (MSM) to be stupid. You are considered basically zombies. So, all they are (MSM) are channeling you to their position. They will bring you to the point that you will say it’s better for everybody if I just die of starvation, or it’s good for the world if 90% of the world’s population is destroyed. When you have the richest people in the world believing that, believe me, you have got a problem. This is a spiritual war, and Lucifer is the ultimate rebel. . . . Even Hollywood has become more outspoken with its love affair with Lucifer and his plan to rule the world. So, we are seeing every single day the vilification that is a traditional moral, or anything that has to do with our borders, culture, our heritage, our monuments, our statues and everything, everything is being defaced. That’s what the Romans did. When one Roman conqueror came in, he wanted to obliterate the other ones. Same thing with the pharaohs in Egypt. . . . This is exactly what they are doing to our nation. . . . This is a spiritual war..." ***We Are Facing Overthrow of United States – Steve Quayle

***Steve Quayle

"...European countries facing a sexual assault crisis directly as a result of mass immigration of Muslim migrants from North Africa and the Middle East. Migrants that come in numbers ranging from the hundred thousands to the millions have gone into European countries and have brought third-world cultures and practices into first-world countries. This has resulted in the clear Islamization of Germany — women have been mistreated, raped, and abused — and the German government only allows for it to continue. One display of this Islamization that has occurred is shown in the German state of Bavaria, where a school sent a letter to the parents of students warning them not to allow their daughters to wear any clothing that may be deemed revealing, because 200 incoming Syrian migrants had just been settled next to the gym (which ended up being closed as a result of this migrant settlement.)

The school’s headmaster Martin Thalhammer was quoted as saying that modest clothing should be adhered to in order to “avoid discrepancies.” Thalhammer also said that revealing tops, blouses, or short minskirts could “lead to misunderstandings.”

This comes as an unsurprising consequence of Germany’s extreme immigration policies. The trend seems to be that the more Muslim migrants a country takes in from Islamic countries, the more that country’s liberal and free culture will be eroded. Germany is not alone with this problem, even though the country has taken in more migrants than all other European countries (more than twice as many as any other European country.) In Germany alone, crimes committed by Muslim migrants rose by 79% from 2014 to 2015 — with there being 1,688 cases of sexual assault on adults and children, as well as 458 rapes. Crime rose an additional 52.7% from 2015 to 2016 — with many of these crimes also being sexual offenses. One article by ex-Muslim extremist turned anti-extremism activist Maajid Nawaz details the urgency of dealing with the sexual assault epidemic in Germany and the drastic consequences of ignoring it due to political correctness.

To summarize the points made in this piece, I will state the main ideas already written here:

Point 1/3: It is true that Islamic scripture promotes sexual assaults such as rape and pedophilia, and that this is a major problem considering these scriptures are used as a life manual by over 1.8 billion people in the world who are growing in number.

Point 2/3: This has proven to be a reality that is having a terrible effect on the world, as shown by the horrific acts by Boko Haram, ISIS, and Muslim migrants in Europe.

Point 3/3: We must stop allowing political correctness and cultural relativism to make us turn a blind eye to atrocities promoted in the Quran and hadith that are acted out in the real world by Muslims." ***Islam and Sex Abuse

|

|

|

|

Post by Entendance on Sept 6, 2017 7:12:09 GMT -5

Not only did Wall Street get bailed out and the public sold out, but its power became more concentrated...

In 2009 E. wrote: <All policy makers have done to date has been to squander public funds to protect the full interests of bankers. Stop Bailing Out Billionaire Bankers!

The poor people bailing out the rich people. This is a porn economy. We have a bunch of zombies that are only around at this point because the taxpayer is propping them up.

Can we just drop the pretence and start calling the bank bailout what it is: Financial terrorism.

Terrorism can be defined as achieving one’s aims through fear. And it sure seems to me that bankers and their friends in government are extorting money from the taxpayers (you and me) with a threatening “or else” that goes something like this: “Give us the money or the entire financial system will implode.

The reason we’re in such a mess is that people got greedy. They were using leverage and structured products to hide problems, to make it look as if they were making huge profits when they really weren’t. These banks were paying high bonuses and high dividends on phantom profits.

How can you expect to find solutions in the crowd that caused the problems? these incompetent corporate clowns should be falling on their own swords.

To me, this financial crisis is nowhere near over for one simple reason: we continue to perpetuate the VERY same business practices that created it in the first place and the bureaucrats that designed this bailout are either in the pocket of the banks or they're incompetent.>

September 2017: “Far from selfless arbiters of right and wrong, CEOs are as responsible as anyone in America for skyrocketing inequality, climate crisis, waves of consumer fraud, and the biggest financial meltdown since the Depression. Condemning the unpopular views of an unpopular president whom they see as an inferior businessman is no sacrifice, especially when they are simultaneously plotting with administration officials to win as many perks as possible. CEOs aren’t ‘finding their voice’; they’re finding a way to control government like a marionette, while hiding the strings.”

***Wall Street Is the Most Dangerous Example of Corporate Domination |

|

|

|

Post by Entendance on Oct 3, 2017 10:48:10 GMT -5

Dedicated To Women Chapter IV Den Frauen Gewidmet Kapitel IV Dedicato Alle Donne Capitolo IV

Western establishments are opting for a full population replacement to keep the ball rolling. "Brazil, Russia, India, China and South Africa: the promising role of the BRICS countries has disappeared whilst the US still has the characteristics of a waning power and the European Union failed to become the world’s leader. The global economy cannot operate without a decisive intervention from central banks.

The Western powers did not succeed in bringing democracy to the Middle East and the conflicts with Islamists are intensifying. Nationalism in Europe is on the rise while the global elites keep on foisting a multicultural programme on their respective societies. The increasing uncertainty, the lack of convincing economic recovery and of global leadership is the result of the far-reaching changes in demographics with no comparable historical precedent. Since populations in Africa and South Asia are exploding whereas those of the developed world are shrinking, Western establishments are opting for a full population replacement in Europe and the USA; conversely, Japan and China will keep their borders shut, and we will see a 60% population decrease there. The reversal of a population decline can take 50 to 100 years." -Gefira

***Demographics will decide the world’s history EURABIA UPDATED

***Islam and Feminism***

***Sharia Watch UK Ltd.

Feminists Need To Know —***Islam Kills Women

***A Woman Worth Less Than A Man In Islam

***What Makes Islam So Different?

***I was raped by THOUSANDS of men from the age of just 14

Dedicated To Women Chapter I

Dedicated To Women Chapter II

Dedicated To Women Chapter III Dedicated To Women Chapter V

|

|

|

|

Post by Entendance on Oct 18, 2017 4:55:51 GMT -5

|

|

|

|

Post by Entendance on Apr 30, 2018 3:03:46 GMT -5

Updated: All you need to know about the banksters & the € Updated: All you need to know about the banksters & the €

18 years after its launching the euro still doesn't work well. An essential element is still lacking to make it a durable currency. Behind the scene the central banks are still keeping it upright with temporary emergency solutions.

Content:

1. The earlier "euros"

2. Lending out not-existing money

3. The money circulation

4. 'Euro'-plan 1970

5. End of the gold standard 1971

6. The silent coup of 1974

7. The defective euro

8. Emergency solutions for the euro

9. When the euro collapses ***HERE

No room for anti-Americanism at Fred & Entendance Beach

...Every gram of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system. What you have done is removed those “dollars” from the hands of government. They now have fewer “dollars” to use to purchase weapons of war, surveillance technology and the other weapons they use against us. Today would be a good day to remove a few “dollars” from their hands and place another weapon in your back pocket. Gold and silver are free from tyranny, accepted around the world in good faith and provides a piece of insurance from, what appears to be, a system in change...

Investors without the humility to admit mistakes are not going to last long. On the other hand, good investors who are willing to analyze their mistakes and be frank about what environments will and will not favor their strategies have the chance to transcend and become great. Remember: "There is only one corner of the universe you can be certain of improving, and that's your own self.”― Aldous Huxley ***************

There’s an incredible amount of risk in the financial system right now. Governments all over the world are broke, central banks are borderline insolvent, many commercial banking systems are dangerously undercapitalized.The currency wars are back, and currencies are being devalued everywhere.

Debt bubbles are starting to burst, and economic growth worldwide is grinding to a halt.

“Better to preserve capital on the downside rather than outperform on the upside” – William J. Lippman

***The Real Fight Is Within: Mental Hygiene

"...The EU is a loose collection of separate sovereign nations that came together in times of plenty. These nations will always, when pressured, seek their own advantages, never that of the collective if it means a disadvantage for themselves. The whole idea behind the union has been, from the start, that of a tide that lifts all boats. And that promise has already been smashed into a corner, bruised and broken beyond repair.

After Greece there can be no doubt of that. And the other separate EU-member economies are not exactly doing well either. Mario Draghi pumps €60 billion a month into the eurozone engine, but it keeps leaking just as hard and the best it can do is sputter.

In institutions such as the EU, organized like the EU, power will inevitably flow towards the center. And at some point in that process, democracy will vanish into thin air. Draghi’s €60 billion will just as inevitably benefit the power center most, and leave the periphery ever poorer. This is not an unfortunate coincidence, it’s built into the union’s structure. Which is therefore not merely undemocratic, it’s inherently anti-democratic.

Nobody in Europe ever voted for Jean-Paul Juncker -or had the chance to- to represent them, at least not in any direct democratic fashion. And nobody outside of Germany ever voted for Angela Merkel -or had the chance to- . Yet, these are arguably the most powerful people in the EU. That in a nutshell is what’s wrong with and in Europe.

Financial and political power reside with the rich and powerful nations, and they acquire more of each as they go along. This is unavoidable in the present situation. It can only be corrected by decentralization of power, but since that would run counter to what Brussels and Berlin envision (more power for themselves), it’s not going to happen. Europe will not be ‘democratized’.

Or put it this way: the only way EU nations can regain democratic values is by leaving the union. That is also the only real vote Europeans have left; a vote within the EU structure goes wasted. Ask the Greeks.

Europeans need to acknowledge that the EU has failed, and inexorably so. Schengen is already dead, walls and fences are popping up everywhere. All the rest is just make-believe. There will never be a consensus on the ‘distribution’ of the numbers of refugees. Views and national interests are too far apart.

And the vested interests in the centers of power are too strong. Merkel may be Europe’s unelected leader, but she will always put German interests before those of the 27 other nations. This may be accepted in 7 years of plenty, but it won’t be in the 7 lean years.

Meanwhile, it’s the hundreds of thousands of refugees who pay the price for the fundamental faultlines in what was supposed to bring and hold Europe together..."more here DEMOCRACY is not an empty dream, but rather, a POSSIBILITY. The first step is to stop believing the lies.

|

|

|

|

Post by Entendance on May 22, 2018 8:05:57 GMT -5

"...You are not being protected from “disinformation” by a compassionate government who is deeply troubled to see you believing erroneous beliefs, you are being herded back toward the official narrative by a power establishment which understands that losing control of the narrative means losing power. It has nothing to do with Russia, and it has nothing to do with truth. It’s about power, and the unexpected trouble that existing power structures are having dealing with the public’s newfound ability to network and share information about what is going on in the world..." ***Wikipedia Is An Establishment Psyop

***The Friendly Mask Of The Orwellian Oligarchy Is Slipping OffH/T Tom from Florida

1. Mass Marketing

2. Defining Social Norms

3. Classifying Information and Keeping Secrets

4. Education

5. Fake News

6. Entertainment Industry

7. Food

8. Financial System

***Don't Get Hooked Chapter V

|

|

|

|

Post by Entendance on Jul 10, 2018 2:59:12 GMT -5

|

|

|

|

Post by Entendance on Jul 16, 2018 3:39:54 GMT -5

|

|

|

|

Post by Entendance on Aug 7, 2018 4:36:53 GMT -5

"...You’re being sold out, your rights and freedoms are being sold out, while you’re busy looking at pictures of what your friends had for dinner last night. And if that’s your thing, fine, but not before and until you’ve checked what is happening to your life and liberty, and that of your children, while you’re watching the next photo of a creme brulée or some cute kitten 1000 miles away. How are you going to be informed, and stay informed, of what’s happening in the world, of what your government does and plans, if your media, both old and new, conspire to let you know only what they want you to, and to present a version of the world, of reality, that they invented in order to safeguard their future and that of their sponsors? Who’s going to tell you what happens behind the infinite layers of curtains?

What is most important here is not who Alex Jones is, or what he’s done and said. What’s most important is that he stands up for Julian Assange as the media, across the board, is either silent or actively smearing Assange with impunity..." Here

"The world is a dangerous place, not because of those who do evil, but because of those who look on and do nothing." -Albert Einstein

Use www.duckduckgo.com/ or www.startpage.com/ instead of Google Search

www.fastmail.com/ is a nice alternative to Gmail.

***FIRST THEY CAME FOR ALEX JONES

***Now That Facebook, YouTube And Apple Have Come For Alex Jones, Now They Will Start Coming After The Rest Of Us

***In A Corporatist System Of Government, Corporate Censorship Is State Censorship

***How the Coming Global State is Being Reached

***Financial Health of U.S. Consumer Will Determine Severity of the Next Recession

***A Margin Call for the Entire American Economy

|

|

|

|

Post by Entendance on Aug 21, 2018 13:08:42 GMT -5

"...If the Speculators (the Chumps) as a group are long the US$, short Comex gold, short bonds and short the VIX in record numbers, it can be assumed that the Commercials (the House) are short the US$, long Comex gold, long bonds and long the VIX in record numbers. And this gets back to the argument made earlier in this post. Which side consistently wins, the Chumps or The House?

And to that end, is The House simply betting against the Chumps by taking the other side of their trades or are The Commercials (largely major, Fed Primary Dealer Banks) actively positioning a trap door under the Speculators who expect an autumn of falling gold, rising interest rates and low volatility.

Thus now is not the time to be complacent. The Commercial Banks have positioned themselves to profit handsomely from any combination of a lower dollar, higher gold prices, lower interest rates and/or a crashing stock market. You would be wise to heed their unspoken warning and take action to prepare accordingly." More here

|

|

|

|

Post by Entendance on Sept 17, 2018 5:33:49 GMT -5

The cost of carrying debt has been rising gradually and there are noticeable measurable impacts that the pundits are of course oblivious to since they have to explain every day’s movements and not the real trend.

The dreaded nightmare of stagflation: weaker home prices and a sinking US dollar on one hand, and rising commodity and gold prices on the other hand. E.

"What we are facing is not a deflationary crisis like 2008, but a stagflationary one. With emerging markets getting ready to de-dollarize and true inflation already spiking, the Fed has no basis to initiate even more fiat creation, nor do they intend to. Their entire policy trend recently has been about STOPPING inflation. The Fed will continue to raise interest rates into the crisis and make it even worse." -Alt-Market

Grasping For Salvation: Italia |

|

|

|

Post by Entendance on Oct 21, 2018 7:22:45 GMT -5

October 21, 2018: What Can Bite You This Week?

"...The relationship between bond yields and the general price level in the context of manufacturing still exists. It has only been buried, because manufacturing has become a minor part of the modern economy. The saver is euthanised, and private sector wealth has become overly-dependent on financial speculation.

It will not end well." How Gibson’s paradox has been buried

US Nuclear Missiles Deployed in Italy, … against Russia: Video here

A new study looked at sea, rock, and lake salt sold around the world. Here’s what you need to know. Microplastics found in 90 percent of table salt |

|

|

|

Post by Entendance on Nov 3, 2018 6:25:26 GMT -5

|

|

|

|

Post by Entendance on Jan 13, 2019 3:59:29 GMT -5

The scenarios of the collapse Scenario I: Global Depression Scenario II: Systemic Meltdown Scenario III: The fairy tale "...The desperate measures of central bankers and China enacted after the financial crisis have pushed the global debt and financial alchemy to never-seen heights. The global financial system has become rigged with leverage, moral hazard and regulatory failures to a point where a “purge” has become all-but-impossible to avoid. This is the end." ************** Brandon Smith: "the crash of the “everything bubble” has been deliberately initiated by central bankers. The worst is yet to come in 2019." ************** Egon: "...What we do know is that risk in asset markets and in the financial system is now greater than any time in history due to the size of global debt of $250 trillion, plus unfunded liabilities and derivatives of another $1.75 quadrillion giving a total risk of over $2 quadrillion..."

We Are All Confident Idiots

Porn numbers: Debt to GDP Ratio |

|

|

|

Post by Entendance on Feb 17, 2019 4:54:38 GMT -5

|

|

|

|

Post by Entendance on Mar 3, 2019 4:32:19 GMT -5

"The global slowdown in manufacturing progressed another notch in February. Among the top four manufacturing giants in the world, the US is the cleanest dirty shirt. Together, they produced 58% of the world’s “value added in manufacturing” in 2016:

•China: $3.08 trillion (26% of global total)

•US: $2.18 trillion (18% of global total)

•Japan: $979 billion (8% of global total

•Germany: $718 billion (6% of global total) ...China’s small and mid-size manufacturers sink Japan dragged down by domestic demand & exports Germany dragged down by exports and cars Eurozone dragged down by Germany, Italy & Spain The US, the cleanest dirty shirt, so to speak..." US is Cleanest Dirty Shirt Among Manufacturing Giants. China, Japan & Germany Sink

|

|