|

|

Post by Entendance on Mar 1, 2016 8:31:30 GMT -5

Italia Down Italia Down

Aug 31, 2019-July 4, 2020 Down she goes. Italia

Dec 21, 2018-Aug 31, 2019 Capitulation to irrelevance: Italia

Aug 10, 2018-Dec 21, 2018 Grasping for salvation: Italia

Jun 28, 2017- Aug 8, 2018: ***Italiani ***

“If you're not part of the solution, you're part of the problem.” -Sydney J. Harris

2017:***Oltre l'€, per tornare grandi Video Interventi di: Matteo Salvini, Claudio Borghi, Alberto Bagnai, Paolo Becchi, Marco Zanni, Marcello Foa

Antonio M. Rinaldi: "...Stati Uniti d’Europa, €, integrazione, globalizzazione, solidarietà tutti falsi mantra finalizzati al solo scopo di togliere ai paesi la propria sovranità disarcionando i cittadini dal loro sacrosanto diritto nel decidere i propri destini per affidarli a delle elite autoreferenziali di non eletti per favorire unicamente grandi potentati di interessi che non avrebbero altrimenti avuto possibilità di perseguire nello stesso modo e intensità i loro obiettivi..."

Paul Craig Roberts: "What became of the left? Today I answer my question.

The answer is that the European and American left, which traditionally stood for the working class and peace (bread and peace) no longer exists. The cause championed by those who pretend to be the “left” of today is identity politics. The “left” no longer champions the working class, which the “left” dismisses as Trump deplorables, consisting of racist, misogynist, homophobic, gun nuts...”

Gennaio 2017 Alberto Bagnai: La Sinistra tra Unione Europea e sovranità nazionale

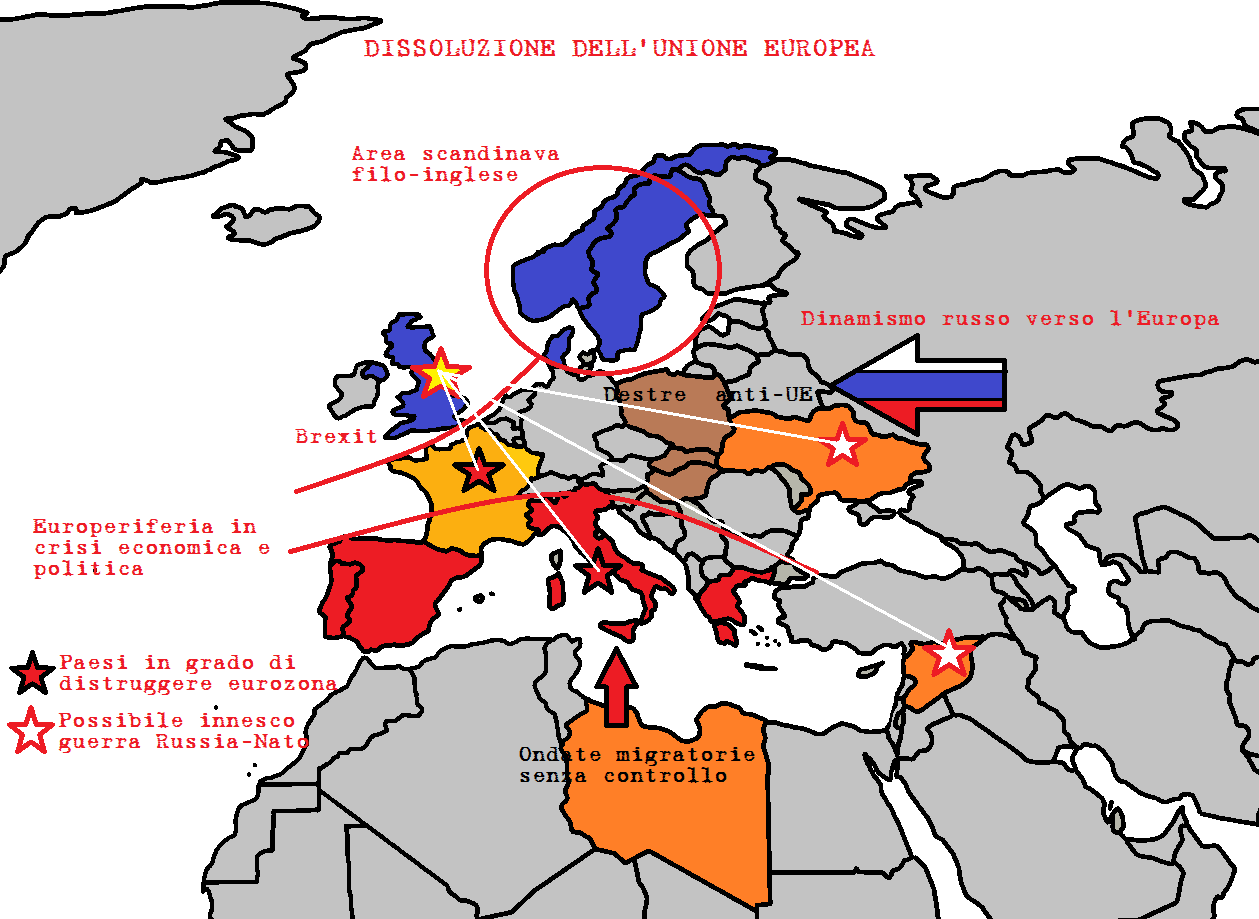

This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many. The EU project is dead. (you might read***Cognitive Dissonance Confirmation Bias Economics & Politics)

Here at Fred & EntendanceInvestors Beach we show why.

The question is how long it will take for the whole thing to break up.

"La differenza fra un cambio fisso e una guerra civile non salta all'occhio. Perché non c'è. Un giorno capirete."

"...I meridionali stanno peggio? Quindi sono peggiori. I giovani non lavorano? Quindi non ne hanno voglia. L'Italia va male? Quindi ci si comporta male. Applicazioni che non differiscono in nulla dalle più famose craniometrie apologetiche dell'arianesimo..."

"...to have a currency for 19 countries with different cultures, different growth rates and productivity and vastly different inflation rates is a total disaster. This is why Italy, Greece, Spain, Portugal and many more EU countries are totally bankrupt.

These countries have been forced to use a currency which has made them completely uncompetitive and unable to export or function.

At the same time, Germany has benefited from a weak Euro which has made their export industries very successful..."

"***It’s a big CLUB. And YOU AIN’T IN IT. You and I are NOT IN the big club..."

Con giornalisti che alla 1° cazzata del politico di turno lo interrompono per dirgli "non dica stronzate", saremmo usciti dall'€ nel 2011. -Grim

sabato 3 dicembre 2011 Euro: una catastrofe annunciata

November 13, 2016: "€ is the worst self-inflicted wound in the economic history." -Roger Bootle at Euro, mercati, democrazia 2016: C’è vita fuori dall’€  Warning: Europe is not the same as the European Union. The European Union is only an episode in Europe’s history and is doomed to failure. Warning: Europe is not the same as the European Union. The European Union is only an episode in Europe’s history and is doomed to failure.

EU is a failing political project with a currency that has caused economic misery and whose migrant policy has brought great division.

The EU is done for. The sooner it’s replaced with a different kind of Europe of trade and co-operation, the better.

***come gli USA porteranno al collasso la UE La scomparsa della sinistra in Europa ***Il tradimento della sinistra

La Seconda Repubblica è finita il 9 novembre 2016

. New: Welcome to Eurabia, formerly known as Europe.

Are Newspapers Captured by Banks?*** Evidence from Italy

"...Io so che quando un governo si rivolge al suo popolo nella lingua di un altro popolo, quel governo ha tradito. La fiducia e i sacrifici di intere generazioni sono state tradite da una classe politica apertamente collusa con interessi estranei a quelli dei nostri concittadini, indipendentemente da colore politico e ceto sociale.

Mi sembra anche stupido insistere sui dettagli tecnici che a voi piacciono tanto. Accomodatevi presso la voce del padrone, se volete abbeverarvene: questo è il sito dove trovate il testo della BRRD. Io non entrerò in tanti dettagli, e chiuderò su un'osservazione semplice. Da millenni la moneta è attributo del sovrano: sulle antiche monete troviamo le effigi dei monarchi. Finché il sovrano è stato espressione diretta e esplicita dei potentati economici (sotto la simpatia formula della "grazia di Dio"), tutto è filato liscio. Poi sovrano è diventato il popolo, e improvvisamente quello che era dato per pacifico, cioè l'esercizio della sovranità monetaria, è stato demonizzato, dalla destra come dalla sinistra, finché non si è riusciti ad estirparlo dal perimetro del controllo democratico degli elettori, per riporlo "al riparo del processo elettorale". Così, i potentati economici hanno ripreso il sopravvento, e le decisioni di un popolo, che siano il referendum contro l'austerità in Grecia, o la scelta di utilizzare il Fondo Interbancario di Tutela dei Depositi per salvare le quattro banche in Italia, sono soggette al loro sindacato, al loro ricatto.

Credo non ci sia altro da aggiungere. Queste parole per voi sono superflue, perché sapete benissimo di cosa sto parlando, e per gli altri sono inutili, perché non lo vogliono sapere. Finché un politico non vi parlerà di abolire il dogma dell'indipendenza della Banca centrale dal governo, cioè quello strano principio per cui Draghi può dire a noi cosa dobbiamo fare, ma noi non possiamo dirgli nulla se non riesce a fare quello che deve fare (tenere l'inflazione al 2%), potete fare anche a meno di ascoltarlo..."

"You’re never going to save everyone. There are some people that are never going to get it. It’s sad, but true.

There will always be investors that can’t help themselves or get out of their own way.

I used to think everyone could be saved if they would only learn. But changing behavior is simply too difficult for many.

In order for one group of investors to prosper, another group has to fail. It’s an unfortunate truth of the financial markets."

-Ben Carlson |

|

|

|

Post by Entendance on Mar 3, 2016 4:19:56 GMT -5

|

|

|

|

Post by Entendance on Mar 5, 2016 8:44:10 GMT -5

"...dalla crisi non potremo uscire se non rilanceremo la domanda con un massiccio intervento di investimenti pubblici (preferibilmente in piccole opere) finanziato con moneta... ...se non si supera la BCE, affidando a banche centrali nazionali il compito di rilanciare con finanziamento monetario di politiche di bilancio nazionali espansive la crescita dei paesi membri, ovviamente in regime di flessibilità dei rapporti di cambio, non si supera la "crisi"... La BCE è la crisi, o, se volete, la crisi è la BCE... ...sarà molto difficile che riusciamo a tirarcene fuori senza un massiccio scoppio di violenza."

Update: June 29, 2016 Monti Fact Checking: "...La conclusione tecnica è che Monti ci ha lasciato con tre monti: un monte di debiti pubblici, un monte di disoccupati, un monte di poveri. Res sunt consequentia nominarum."

"European Central Bank (ECB) head Mario Draghi is running out of options.

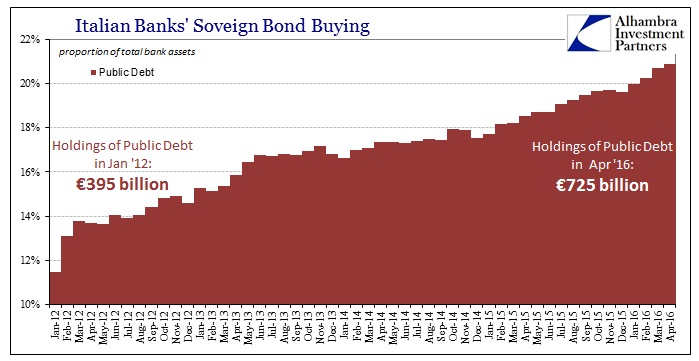

Back in 2012, the EU banking system was on the verge of collapse. At that time, various European banks were lurching towards insolvency as the senior most-asset on their balance sheets (EU member nation sovereign bonds) plunged in value.

As a whole, the EU banking system is leveraged at 26 to 1. At these levels, even a 4% drop in your asset values wipes out ALL equity.

In mid-2012, Greek 10 year bonds were yielding 10%, Spanish 10 year bonds were yielding over 7%, Italy’s were yielding over 6%, etc.

These yields were the result of EU sovereign bonds plunging in value (bond yields rise when bond prices fall). And between their exposure to EU sovereign nations’ bonds as well as the hundreds of trillions of Euros worth of derivatives trades attached to said bonds, EU banks were insolvent.

Desperate to hold the EU system together, in late July 2012, ECB head Mario Draghi walked out on stage at an investment conference in London, and promised to do “whatever it takes” to save the Euro and the EU banking system.

The whole thing was a giant bluff. We know from insiders who were present at the time that Draghi’s comments were “off the cuff” and that in fact he had “no real plan” at the time he said it.

Still, the investment herd bought the hype, piling back into EU Sovereign nation bonds and stocks. Despite the fact nothing fundamental had changed for the EU banking system, within six months EU Financial Ministers were proclaiming, “the worst was over.”

Sadly they were incorrect. And none of them have implemented structural reform to insure that the next round of the Crisis will be contained.

The EU’s inflation rate has not increased the desired amount. Now, I am not a fan of inflation any more than you are. But for Central Banks intent on halting debt deflation by any means possible, inflating the EU’s massive sovereign debt loads away is much preferred to default and the accompanying derivative-fueled systemic implosion.

Since Draghi’s “whatever it takes” comment in July 2012, the EU has launched Negative Interest Rate Policy, or NIRP, (June 2014), cut rates deeper into NIRP (September 2014), launched QE (January 2015), cut rates even deeper into NIRP (December 2015) and extended its QE program through March 2017 (December 2015).

Throughout this period, the EU’s inflation rate has been on a steady decline. Indeed, despite the ECB launching both NIRP and QE, the EU moved into deflation in early 2015. It’s since barely flat-lined at 0%, abetted by even deeper NIRP cuts and extending QE through March 2017.

And just last week it collapsed back into negative again.

In short, Draghi’s actions have failed to produce the desired results. The man is growing desperate.

And so, after having discovered that deeper NIRP cuts and an extension of QE failed to get the desired market reaction, Draghi is gaming the markets for something big next week. Once again he’s promising that he can get the EU to a 2% inflation rate.

Wake up world, the EU hasn’t experienced 2% inflation since BEFORE the Crisis erupted in earnest in 2012. Three NIRP cuts and over €1 trillion in QE later, the EU is on the verge of deflation again.

The EU Crisis will began anew within the next six weeks. When it does, Draghi won’t be able to rein it in. His policies have already failed pathetically for over THREE years straight. And at this point he’s virtually out of ammo to combat another downturn.

Another stock market crash is coming. Smart investors are preparing now in anticipation."

-GAINS PAINS & CAPITAL (investment e-letter published by Phoenix Capital Research) |

|

|

|

Post by Entendance on Mar 15, 2016 5:55:42 GMT -5

Central Banking is the only profession where you get to spend trillions & face no personal consequences for lack of results.

This gentleman is leading people to the slaughter

"...Thanks to Draghi’s QE, US corporations will issue more debt (bonds) in the EU. They’ll take the money they borrowed from gullible Mom and Pop investors in Europe and use it to repurchase shares in their own companies which will boost executive compensation packages and keep voracious shareholders happy. The money will not be used to invest in the future growth of their companies (since consumer demand is weak) or to create the future revenue streams needed to pay back their debts, but to enrich wealthy CEOs who see stock manipulation as a perfectly reasonable way to boost profits.

Got that?

The ECB is going to roll over a half a trillion in debt for nothing???

What a complete fucking outrage! This excerpt really explains how badly we are all getting reamed by these thoroughly-odious and despicable Central Banks. Why is the ECB providing a safety net for insolvent banks that are unable to roll over their own stinking debtpile? These malignant institutions should be dragged into the backyard and euthanized now so we can be done with them once and for all. Instead, Draghi plans to provide billions more in free money so they can continue to bilk the public with their toxic assets, their heinous bunko operations and their endless Ponzi swindles..."

Draghi’s Giant Giveaway; More Handouts for Wall Street

La pistola ad acqua di Draghi La pistola ad acqua di Draghi

"...Draghi’s done. This hole is too deep for him to climb out of. ." "...Draghi’s done. This hole is too deep for him to climb out of. ."

Mr.Bean-draghi committed the ultimate sin... Mr.Bean-draghi committed the ultimate sin...

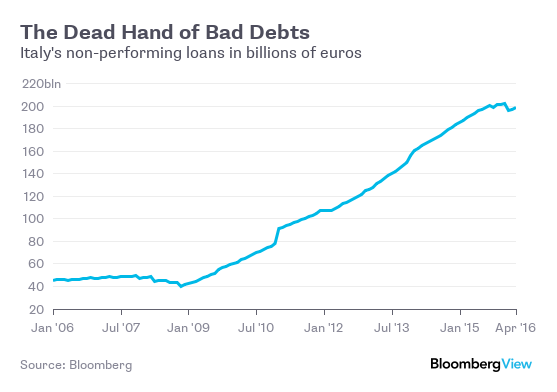

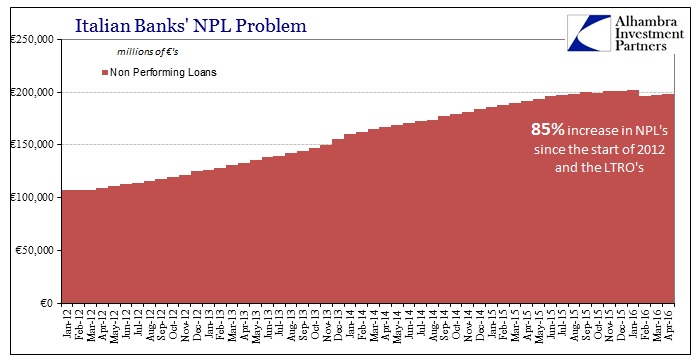

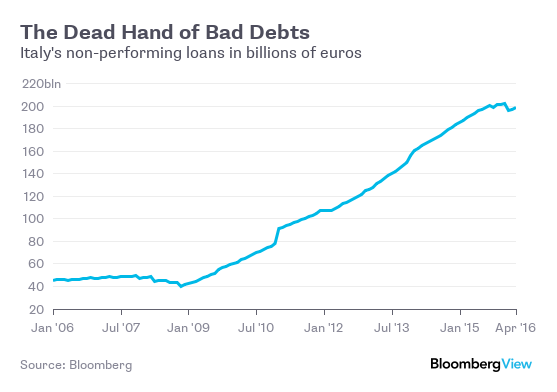

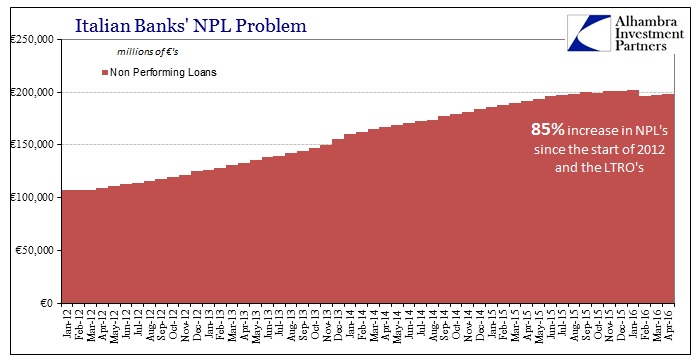

"We could show all kinds of epic fail European markets, but Italian banks - with their exploding NPLs - are the best example. After smashing to a halt limit-up, they fell back to earth to practically unchanged by the close..." H/T ZeroHedge

Gold and Silver will thrive as paper assets are increasingly infected by financial viruses! Fred & E. Private Beach: Become Members!

|

|

|

|

Post by Entendance on Apr 19, 2016 9:39:19 GMT -5

"...Finally, as to the mad money printer who runs the ECB, perhaps he should look at the 10-year bonds of his quasi-bankrupt native land. They closed today at a yield of 1.36%, and that means they are riding the mother of all bond bubbles.

Below is the eight year trend in core consumer inflation in the eurozone. It is up at a 2.1% rate during the period, and 1.0% even during the last 12 months of deflation mongering by Draghi and his henchman. You could well and truly ask, therefore, as to why the mass of Europeans are not better off with 1% as opposed to 2% inflation. The answer that 2% is better-indeed imperative—- is known only to a tiny cadre of central bankers and their acolytes. But they are not telling, just asserting.

No bubbles, Mario?

For crying out loud. Italy’s government is paralyzed, meaning that its fiscal vital signs just keep deteriorating. The spending share of GDP is off the deep end at 51.1% and the debt burden just keeps on rising.

Here’s the thing. Italy is fast turning into a socialist old age colony with a birth rate of only 1.3. On that path, the last Italian will disappear in the next century. But an economy which has been shrinking since 2007 will tumble into national bankruptcy long before.

When the last of the hedge fund front-runners have bought their fill and the Germans finally shutdown the printing presses in Frankfurt, there will indeed be a day of reckoning as the massive bubble under the Italian bond violently deflates.

They will surely christen it the Draghi Bubble—–a fit of insanity every bit as calamitous as that of John Law, the French Revolution and 1929."

Institutionalized Lying—— Why Central Bankers Never See Bubbles

|

|

|

|

Post by Entendance on Apr 20, 2016 4:06:38 GMT -5

This gentleman is leading people to the slaughter

...the ECB's attempt to boost lending via QE and NIRP has been an absolute disaster... at least according to Europe's own banks

***Italy : In the Vatican City, it is the judicial system that is harassing the media in connection with the Vatileaks and Vatileaks 2 scandals. Two journalists are facing up to eight years in prison as a result of writing books about corruption and intrigue within the Holy See. Libertà di stampa, Italia scende al 77esimo posto. Livello di violenza allarmante e ingerenze del Vaticano |

|

|

|

Post by Entendance on Apr 23, 2016 6:28:43 GMT -5

The stunning hypocrisy of EU ruled by jesuit trained pupils

"...con la svalutazione esterna (quella del cambio) il problema si risolverebbe in un altro modo. Verrebbe infatti da dire, ai nostri amici tedeschi: "Fate l'amore, non fate la guerra", o, almeno, tornate in vacanza in Romagna,  che se proprio non avete voglia ci pensiamo noi. Ma purtroppo la loro valuta sottovalutata (l'euro), o, se volete, la nostra valuta sopravvalutata (l'euro), impedisce questa piacevole composizione del conflitto, che verrebbe realizzata rimuovendo la principale causa di attriti europei: l'impasse demografica di un paese che da due millenni aspira ad essere una potenza mondiale, e che non lo sarà mai. che se proprio non avete voglia ci pensiamo noi. Ma purtroppo la loro valuta sottovalutata (l'euro), o, se volete, la nostra valuta sopravvalutata (l'euro), impedisce questa piacevole composizione del conflitto, che verrebbe realizzata rimuovendo la principale causa di attriti europei: l'impasse demografica di un paese che da due millenni aspira ad essere una potenza mondiale, e che non lo sarà mai.

E quando dico mai, intendo mai."

"Per motivi che mi sfuggono, erogare una mancia sembra meno clientelare che finanziare investimenti".

|

|

|

|

Post by Entendance on Apr 30, 2016 2:55:08 GMT -5

Italy's Bank Bailout Fund Already One Third Empty After First Bank Rescue

Draghi Believes Time Is On His Side ***(Methinks He Is Playing With Fire)

H/T Tom from Florida

******

Mr.Bean-draghi: The world’s greatest monetary charlatan is nearly out of tricks.

****************

Bottom line: “..non-performing debt [..] stands at €360bn, according to the Bank of Italy. So is Atlante — with about €5bn of equity — really enough to keep the heavens in place?” Financial Times today: Atlante, a new private initiative backed by the Italian government, is designed to stop the sky falling in. The fund, which takes its name from the mythological titan who held up the heavens, will buy shares in Italian lenders in a bid to edge the sector away from a fully-fledged crisis. Last week’s announcement of the fund, which can also buy non-performing loans, led to a welcome boost for Italian banks. An index for the sector gained 10% over the week — its best performance since the summer of 2012, though it remains heavily down on the year. But Italian banks have made €200bn of loans to borrowers now deemed insolvent, of which €85bn has not been written down on their balance sheets. A broader measure of non-performing debt, which includes loans unlikely to be repaid in full, stands at €360bn, according to the Bank of Italy.

So is Atlante — with about €5bn of equity — really enough to keep the heavens in place? The Italian government has been placed in a highly unusual position. It has become much harder to directly bail out its financial institutions, as other European countries did during the crisis. Meanwhile, a new European-wide approach to bank failure, which involves imposing losses on bondholders, is politically fraught in Italy, where large numbers of bonds have been sold to retail customers. The new fund also comes in the context of an extremely weak start to the year for global markets. “In this market it is impossible for anyone to raise any capital,” says Sebastiano Pirro, an analyst at Algebris, adding that, since November last year, “the markets have been shut for Italian banks”.

The government has been forced into an array of subtle interventions to provide support. Earlier this year, details emerged of a scheme for non-performing loans to be securitised — a process where assets are packaged together and sold as bond-like products of different levels, or tranches, of risk. The government planned to offer a guarantee on the most senior tranches — those with a triple B, or “investment grade” rating.

Updated: Sim sala BIN! (il fallimento di Atlante...)

|

|

|

|

Post by Entendance on May 2, 2016 15:55:57 GMT -5

Mr.Bean-draghi is telling savers to buy more stocks.

As Italian banks collapse again... which should be no surprise one third of the ridiculous bailout fund has already been depleted

"...So there we have it. For those who are saving for retirement, or just wish to be completely risk averse, the ECB's answer to you is too bad. The central planners would like you to invest in stocks so that the next time the market plummets, your cash can be transferred to those that know how the game works, leaving you with nothing at all...Once again, for those who can't see the trend here, central banks only exist to take money from those that actually work (i.e. savers), and transfer it to their good friends who own all of the assets (i.e. those telling you not to save)." ***Here Is Mario Draghi's Advice To Europe's Crushed Savers slaughterer comment on ZH: "... I said it before and I will say it again: Mario should be on trial in the Hague rather than making policy. He is insane, destructive, and a criminal. " remain calm comment on ZH: "I am embarassed to say I am Italian"

Brussels took our democracy, our sovereignty and now they want to destroy our cultures. It's time to...

The EU: a 46 Trillion Euro Lehman Brothers? So much for QE as the answer to the EU’s problems.

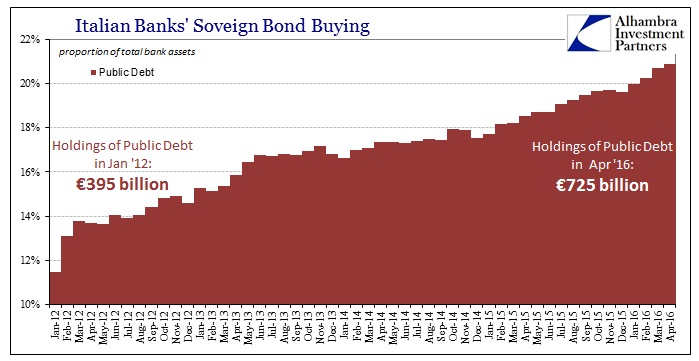

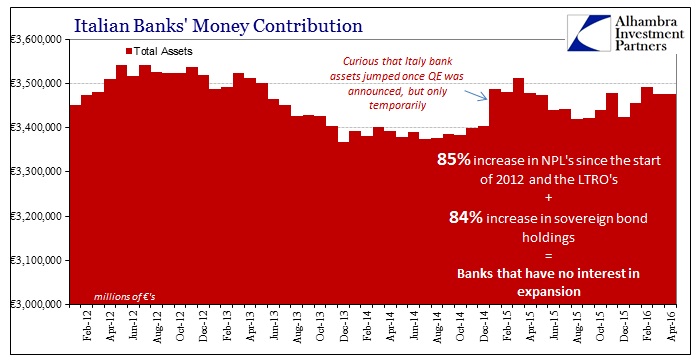

In 2012, during the depth of the EU banking crisis which nearly took the entire EU financial system down, Mario Draghi stated that he would do “whatever it takes” to hold the EU together. Anyone paying attention knew that this was a bluff. True, the ECB and EU leaders had already defied if not broken every condition of the Maastricht Treaty and the Schengen Treaty (the legislation that formed the EU proper). However, even to the most cynical analyst, Mario Draghi’s claim was pushing the envelope a little too hard. Implementing capital controls and border controls limit freedom, but from the perspective of monetary policy, they’re secondary items. The REAL power is that of the printing press. This is how Draghi’s promise to save the EU was different from every other action: it addressed the structure of the EU in its most critical component, namely the control of the currency.

It took the EU two years to cobble together its reasoning for how something that went completely against the Maastricht Treaty would be permitted. As usual it was the Germans (the ultimate holders of the purse strings) who gave the “OK.”

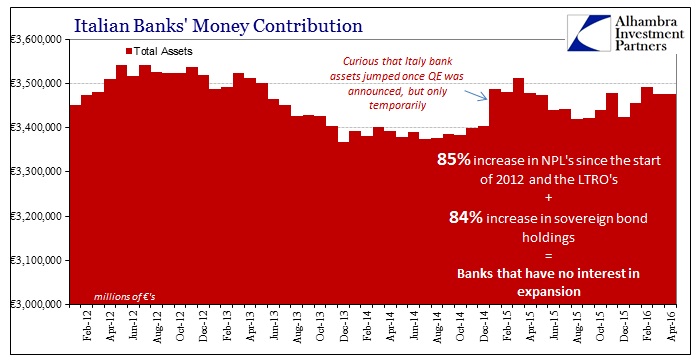

Since being given the green light on QE, Draghi has spent over €600 billion. The ECB’s balance sheet is now approaching its former record high from 2012 after the massive LTRO and LTRO 2 programs. And Draghi has accomplished? Not much of note. The EU’s inflation rate is clearly trending lower. This is AFTER the first ever QE program was both launched and increased in pace form €60 billion to €80 billion per month.

For all intensive purposes, four cuts into NIRP and the first ever QE program represented nothing more than a tiny dead cat bounce in inflation. If you didn’t know the dates of those programs, looking at the above chart you’d be hard pressed to guess anything significant had happened in terms of monetary policy.

Why is this?

Because the structural problems for the EU absolutely DWARF the ECB’s current programs. The EU banking system is €46 trillion in size and leveraged at 26 to 1. At these leverage levels, even a 4% decline in asset values renders the entire financial system insolvent. A 4% decline of €46 trillion represents €1.84 trillion. The ECB’s QE program is roughly a little more than half of this. The real issue is that the ECB is completely cornered. The best it can do is buy EU bonds to drive yields lower in the hope that somehow someone will actually use this to deleverage. Unfortunately that is not human nature. The lower yields go, the more debt EU nations issue. Consider that Spain, Italy and other EU program nations have actually seen their Debt to GDP ratios increase since the 2012 crisis allegedly “ended.”

In short, the ECB’s extraordinary programs have done ZERO to address the structural issues facing Europe and its financial system. Bankrupt nations continue to issue bonds that bankrupt EU banks buy and use as collateral to backstop their derivatives books, which are in the ballpark of hundreds of trillions of Euros.

All the ECB has done is vacuum up this collateral and allow EU banks to continue to value this debt at 100 cents on the Euro. These “solutions” are imaginary at best.

At the end of the day, the EU banking system is one gigantic €46 trillion Lehman Brothers. Given the interconnected nature of the global banking system, this is not Europe’s problem… it is the WORLD’s problem.

Eventually this will trigger another 2008 type event. When, no one can say, but given that the ECB has failed to generate significant inflation, and that most EU nations have seen their Debt to GDP ratios increase since 2012, it’s not far off.

The next Crisis is just around the corner. And it will make 2012 look like a joke. -Phoenix Capital Research

|

|

|

|

Post by Entendance on May 4, 2016 2:37:47 GMT -5

Danno erariale da 3,8 €mld, violazione delle norme di contabilità generale dello Stato e subalternità alle banche d’affari: sono queste le accuse sollevate contro il Ministero del Tesoro dalla Procura regionale della Corte dei Conti del Lazio, nell’indagine sulla ristrutturazione dei derivati finanziari concordata nel 2012 tra Via XX Settembre e Morgan Stanley. Il caso è un edificante esempio della gestione dei derivati: il premier Mario Monti, ex-consulente di Goldman Sachs, ed il ministro dell’Economia Vittorio Grilli, futuro presidente di JP Morgan per i mercati europei, esborsano, senza consultare l’avvocatura generale di Stato, una cifra miliardaria a Morgan Stanley, la cui filiale italiana è presieduta dall’ex-ministro dell’Economia, Domenico Siniscalco. Sui derivati vige il massimo riserbo, perché parlarne significa indagare sui contratti capestro con cui l’Italia fu introdotta all’euro e sulle responsabilità di intoccabili come Carlo Azeglio Ciampi e Mario Draghi... ***Monti, Draghi, Ciampi, tutti ex-alunni dei gesuiti

...C’è uno scabroso segreto sussurrato nei Palazzi romani: di tanto in tanto, come un fiume carsico, esce dalle ovattate stanze del Ministero del Tesoro e della Presidenza del Consiglio, affiora sulla stampa e poi si inabissa di nuovo nel silenzio più omertoso. Parlarne significa entrare nel merito delle scelte su cui il traballante establishment italiano ha costruito la politica degli ultimi vent’anni, l’ingresso nella moneta unica e l’abdicazione ad una funzione economia dello Stato, e sui metodi, poco ortodossi, con cui ha perseguito quell’obbiettivo: lo smantellamento dell’economia mista, l’eurotassa e la stipulazione dei derivati finanziari “per l’Europa”. Sono proprio gli strumenti finanziari derivati ad agitare il sonno della politica italiana in questi ultimi mesi. Appena trapela un’indiscrezione, appena si allenta un poco il ferreo riserbo sull’argomento, sulla schiena di molti corrono i brividi... ***Derivati di Stato, una rapina con molti basisti |

|

|

|

Post by Entendance on May 13, 2016 5:30:16 GMT -5

La prima metà del 2016 è un lunga e sanguinosa mattanza borsistica per le banche italiane: Intesa SanPaolo -30%, Unicredit -40%, Banco Popolare -40%, Banca MPS -50%. E poi gli strascichi delle quattro banche “salvate” nel dicembre 2015, il clamoroso fallimento della ricapitalizzazione della Banca popolare di Vicenza, il timore del ripetersi di un flop simile per Veneto Banca e, soprattutto, l’incubo che qualche istituto “sistemico” imbarchi ancora un po’ d’acqua e coli a picco. Tutta colpa del “bail in”? Più che la causa, il “bail in” è la conseguenza della debolezza del sistema creditizio italiano: arrivati a questo punto dell’eurocrisi, l’infezione si è propagata dall’economia reale alle finanze pubbliche, sino ad infettare i bilanci delle banche. Berlino non ha nessuna intenzione di sobbarcarsi il costo di un salvataggio bancario e mette l’Italia di fronte alla scelta: scaricare le perdite su correntisti ed obbligazionisti o uscire dall’euro. Scenario, quest’ultimo, sempre più concreto...

Banche, la sentina dove confluiscono i liquami dell’eurocrisi ***Il sinistro scricchiolio delle banche: ultimo stadio dell’eurocrisi

All that’s missing is a spark to start the fire. All that’s missing is a spark to start the fire.

***Italy Must Choose Between The Euro And Its Own Economic Survival |

|

|

|

Post by Entendance on Jun 8, 2016 6:12:07 GMT -5

€? EU? There will be blood. €? EU? There will be blood.

The EU economic miracle has been fantastic for young people. Check out the youth unemployment figures... oh wait:

|

|

|

|

Post by Entendance on Jun 9, 2016 5:50:58 GMT -5

|

|

|

|

Post by Entendance on Jun 25, 2016 4:23:12 GMT -5

MPS è stata fondata nel 1472. Ha resistito alle carestie, alle guerre e alle pestilenze, ma non al PD.

"...Needless to say, Italy’s fiscal circumstance is far more dire than even Spain’s. The likelihood that its10-year bonds are money good at last week’s 135 basis points of yield are between slim and none. Either the threat of an exit or a 5-Star/populist coalition government would send the front-runners who scarfed up Italy’s bonds running for the hills.

Since Italy owes upward of $2 trillion on it government accounts alone, its bond market is an explosion waiting to happen. And that means its bedraggled banks are, too.

That’s because one feature of the Draghi Ponzi was that national banks in the peripheral nations started buying up their own country’s rapidly appreciating sovereign debt hand-over-fist. Italy’s banks own upwards of $400 billion of Italian government debt.

That’s the one and same Italian government that cannot possibly cope with its existing 135% debt to GDP ratio. And that’s also before the populists take power and are forced to bailout the country’s already insolvent banking system. The latter will suffer from a shock of capital and depositor flight after the current government falls(soon), and Prime Minister Renzi joins Cameron and Rajoy at some establishment rehab center for the deposed..."

***Bravo Brexit!

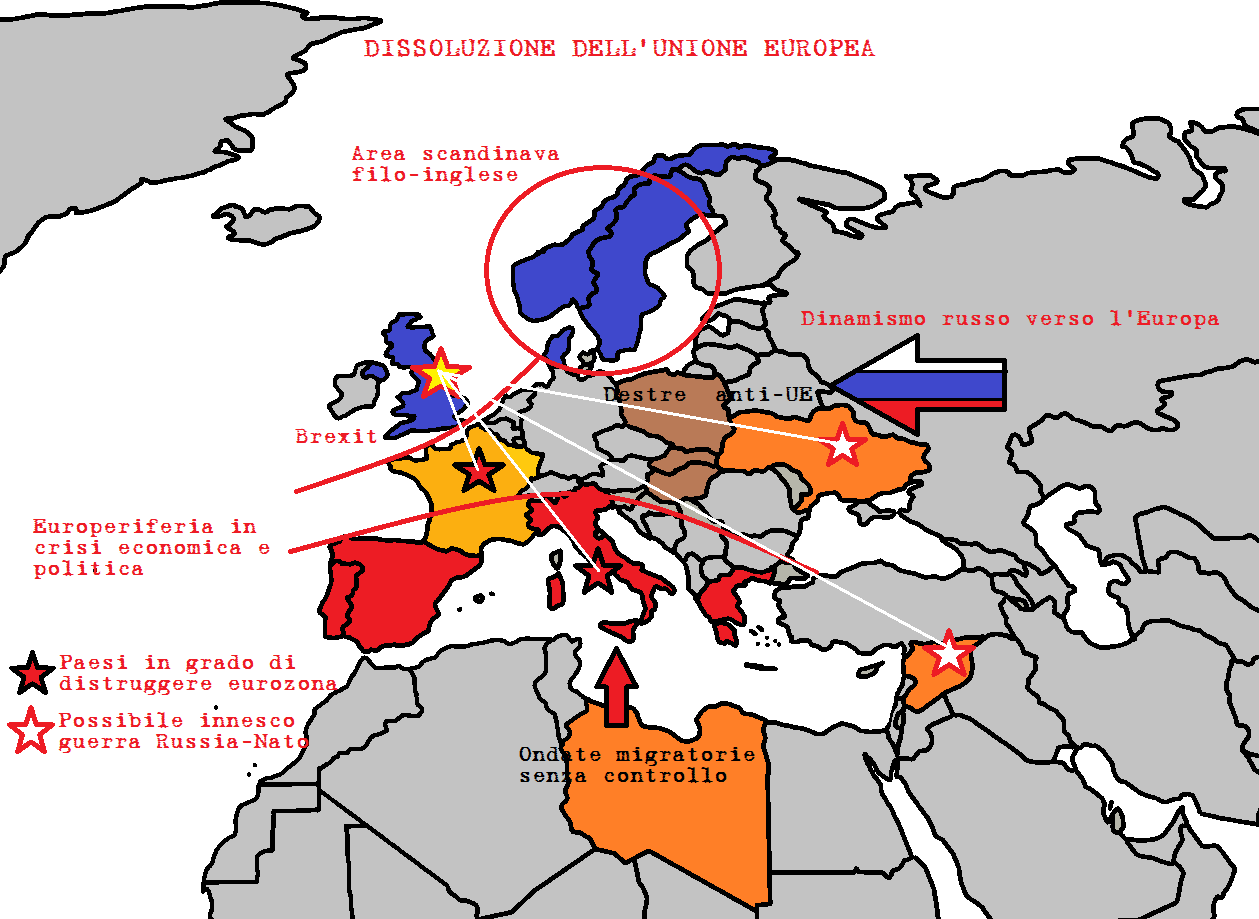

<...La Brexit ha alte probabilità di essere l’innesco della dinamite ammassata sul Continente, dopo otto, lunghi, interminabili, anni di eurocrisi.

Credere che le élite euro-atlantiche gettino la spugna ora, consce che la prossima finestra per strappare la federazione del Continente, i massonici Stati Uniti d’Europa, si presenterà tra 70 o 100 anni, o probabilmente mai più, è però da ingenui.

Occorre aspettarsi colpi di coda da parte di quelle élite che hanno manipolato il voto delle presidenziali austriache, che hanno machiavellicamente ucciso la deputata Jo Cox, che hanno combattuto una spietata guerra psicologica contro il popolo britannico.

Quali possono essere questi colpi di coda?...>  ***Il mondo post-1945 è finito ***Il mondo post-1945 è finito

'Exits-Parade': How the Next EU Referendums Might Be Called

The British are showing the rest of Europe a new way, they no longer have to comply with Corporate EU control.

|

|

|

|

Post by Entendance on Jun 30, 2016 4:41:53 GMT -5

|

|

|

|

Post by Entendance on Jul 1, 2016 4:04:09 GMT -5

€150 billion. Chump change. Wait, there was a eurozone debt crisis in 2011?

Italy’s banks can now issue bonds with the same guarantee sovereign bonds have. But only the solvent ones, as in: those who don’t need it.

This is worse than a band-aid. Just wait till the vultures wake up.

"...the Italian economy has suffered since joining the euro in 1999. Since 2007, its economy has contracted by 10 percent and suffered not one, not two, but three recessions. Competitive export-led growth has been deeply impaired by virtue of Italy’s being effectively yoked to the massive German economy.

Despite the rise of China, Germany has been able to maintain its top three ranking among world exporters. The secret weapon? That would be the euro. In 1998, the year before Germany switched to the euro, the country exported $540 billion. By 2015, that figure had swelled to $1.3 trillion. Italy’s exports have also grown, but not nearly as robustly, coming in last year at $459 billion compared to $242 billion the year before it joined the euro..." *****

Banking Sector Malaise Instead of pondering the obvious problems, what about other things?

1.Targe2 imbalances starting to matter

2.Italian banking woes starting to matter

3.Rising chance that Eurosceptic leaders take control of Italy.

4.What if Eurozone intrabank balances are in question?

My best guess is that Deutsche Bank share prices reflect all of the above but something in the second set of reasons, or something we still do not fully understand is the primary reason behind the collapse.

Brexit Is a Lehman Moment for European Banks Brexit Is a Lehman Moment for European Banks

|

|

|

|

Post by Entendance on Jul 7, 2016 3:14:59 GMT -5

The capitalization of Italy’s banks has dropped by 50-70 percent since the beginning of the year. |

|

|

|

Post by Entendance on Jul 8, 2016 6:54:59 GMT -5

|

|

|

|

Post by Entendance on Jul 10, 2016 5:02:16 GMT -5

***End All The Myths; Italian Version

jesuit-educated minds Who is Mr.Bean-draghi Avles Beluskes exposed the jesuit trained We are all Jesuits

Draghi Wishes for a World Order Populists Will Love to Hate

Non sono sono passate nemmeno tre settimane dal voto sul Brexit e già si va delineando per accenni, ma in maniera inequivocabile la risposta delle oligarchie continentali e statunitensi allo choc subito al referendum: un trauma non tanto dovuto alll’uscita dalla Ue di una Gran Bretagna già ampiamente ai margini dell’unione, ma al fatto che per la prima volta siano stati contestati con successo i meccanismi , le cinghie di trasmissione istituzionali del potere reale, che il dominio dell’informazione sia apparsa potente, ma non onnipotente, che la gestione dell’emotività (vedi assassinio della Cox) abbia mostrato dei limiti. La linea di azione principale non sembra essere quella di rischiosissima di delegittimare il referendum, di ripeterlo o di imbastire quale trucco per renderlo inefficace: questo può soddisfare la rabbia di oligarchi di secondo piano come Juncker o quella dei cortigiani burocrati di Bruxelles, inviperiti per la ricomparsa del popolo e atterriti da un voto che presenta caratteristiche di classe, ma non porta da nessuna parte. Si tratta invece di sfruttare l’evento per fare un salto di qualità e approdare a un Nuovo Ordine che faccia balzare in primo piano aspetti strutturali, ma tenuti finora in secondo piano.

Al vertice della Nato di Varsavia la Merkel innanzitutto e poi la Mogherini (meglio sorvolare sul ridicolo dietro front del guappo sulle sanzioni alla Russia, un clown non può fare che il proprio mestiere) hanno chiaramente ipotizzato per la Ue “un partenariato globale con la Nato” per creare le regole di un “nuovo ordine mondiale”. E naturalmente tutto questo si sostanza con “una battaglia a Sud e a Est” contro il presunto terroismo nell’area mediorientale e nordafricana ormai balcanizzata e contro la Russia colpevole (la faccia tosta, la nullità umana e il servilismo della Mogherini sono da Expò universale) di aver “violato l’ordine di sicurezza europeo”. Insomma l’Europa si ricostruisce a partire dalla Nato e la Merkel in questa operazione di simbiosi tra istituzioni e strumenti militari si è spinta fino a sconfessare il proprio ministro degli esteri Frank-Walter Steinmeier, che aveva giudicato “guerrafondaie” le manovre dell’Alleanza ai confini della Russia. Oltre ad annunciare il riarmo tedesco . Così il presunto strumento di pace tiene in piedi la propria mutazione oligarchica con la guerra e con il conflitto, con il totale asservimento al Washington: a questo punto è inutile nasconderlo, è meglio tenere insieme le percorelle smarrite non con la speranza di un pascolo che non c’è più, che è stato devastato dal latifondista, ma con la paura dei lupi.

D’altro canto, entrata in crisi l’Europa, anche il portavoce e azionista del potere finanziario fa la mossa del cavallo e cambia la scala del discorso: in perfetta sincronia con i discorsi di Varsavia, Draghi si è fatto latore di un messaggio per un nuovo ordine mondiale che ” i populisti ameranno odiare”. Ordine che si sostanzierà nel controllo totale delle banche centrali dei vari Paesi perché come dice Blomberg – complice banditore di tutto questo e perciò bene informato – “le banche centrali sono governate da leggi concepite nei vari Paest e richiedono di perseguire certi scopi, a volte espliciti, in genere legati all’inflazione e alla disoccupazione. Per di più, devono rispondere ai legislatori nazionali, eletti” (qui). Che orrore per gli oligarchi. Come si vede la crisi aperta dal Brexit scopre la trama sottostante alla narrazione europeista e c’è una parte ormai prevalente di potere che non intende lavorare per salvare il salvabile perché lo da già per perso o comunque per precario, né vuole affaticarsi più di tanto a salvare le apparenze e i personaggi che le incarnavano, compreso il povero Renzi abbandonato alla crisi bancaria, ma cerca invece di sfruttare la crisi che si è aperta per passare direttamente alla mossa successiva. Che sia la dittatura finanziaria o la guerra per farla digerire meglio: se le illusioni e gli inganni sparsi a piene mani cominciano a perdere di efficacia e non è più possibile aumentare la dose, meglio far trovare i cittadini di fronte ai fatti compiuti. -ilsimplicissimus

|

|

|

|

Post by Entendance on Jul 13, 2016 14:55:15 GMT -5

|

|

|

|

Post by Entendance on Jul 20, 2016 5:58:20 GMT -5

The problems that Italy’s major banks have been facing recently could well cost Prime Minister Matteo Renzi his post, push the country towards an Italexit scenario and wreak havoc on the whole European banking sector, according to financial analysts.

***How Italian Banks Could Ruin European Economy ***How Italian Banks Could Ruin European Economy

Fred & EntendanceInvestors Private Beach: Gold & Silver

|

|

|

|

Post by Entendance on Jul 27, 2016 2:25:36 GMT -5

The ECB (Eurosystem) consolidated balance sheet hits  a new record (almost €3.4 trillion) a new record (almost €3.4 trillion)

Italian banks are currently being crushed by €360 billion in non-performing loans. According to the European Banking Authority, they make up 16.9% of all lending as of March 2016, and are unlikely to be paid in full. As a result, bank stock prices in Italy have plummeted.  Remember...***We are all Jesuits!

'Haven’t we had enough? Italexit NOW!' Italian journalist blasts 'European GERMAN Union'

A LEADING financial journalist is urging Italy to quit the European Union, in a blistering damnation, in which he blasts the bloc as a German-led MONSTER.

|

|

|

|

Post by Entendance on Aug 1, 2016 9:45:22 GMT -5

August 1, 2016 ***Ten fun facts about the European bank stress tests

So who’s going to bail out the banks?The perfect case in point is Italy’s banking crisis. If the country’s struggling banks are not saved with a combination of public and private money — a process that, to all intents and purposes, began on Friday with the announcement of Monte dei Paschi’s suspension of the ECB’s stress test as well as a €5 billion capital expansion later this year — the resulting carnage could unleash not only a tsunami of financial contagion but also an unstoppable groundswell of political opposition to the EU.

For a taste of just how disastrous the political fallout would be for Italy’s embattled premier, Matteo Renzi, here’s an excerpt from a furious tirade given by Italian financial journalist Paolo Barnard on prime-time TV, addressing Renzi directly:

“You went to meet Mrs. Merkel to ask for a minor public funded bail-out of Italian banks and you got a sharp NO. But did anyone tell you that Germany from 2009 onwards bailed out its failing banks with public money? “Banks, that is, with holes in their balance sheets visible from the Moon.

Germany bailed them out to the tune of €704 billion. It was all paid for by European taxpayers’ money, public funds that is. “It was done through the EU Commission of Mr Barroso and by Mr Mario Draghi at the ECB. Didn’t you know that Mr Renzi? Couldn’t you have barked this right into Ms Merkel’s face?”

|

|

|

|

Post by Entendance on Aug 5, 2016 4:31:31 GMT -5

|

|

|

|

Post by Entendance on Aug 17, 2016 2:15:13 GMT -5

|

|

|

|

Post by Entendance on Aug 20, 2016 1:49:22 GMT -5

***Italian banks dig deeper into trouble with zombie lending

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

|

|

|

|

Post by Entendance on Sept 2, 2016 2:40:51 GMT -5

NEW: IL PIDDINO & L'€ Capitolo I

"An important election is coming up, and I’m not talking about the US presidential election. The upcoming referendum in Italy this fall will have a major macroeconomic impact on the world. But hardly anyone outside of Italy is paying much attention to it—yet..."

***The Italian Referendum Could Result in the Death of the €

***Prima hanno distrutto l’industria, poi il reddito, e ora si prendono i risparmi

Roma***ha un enorme e urgente bisogno di essere salvata dai romani

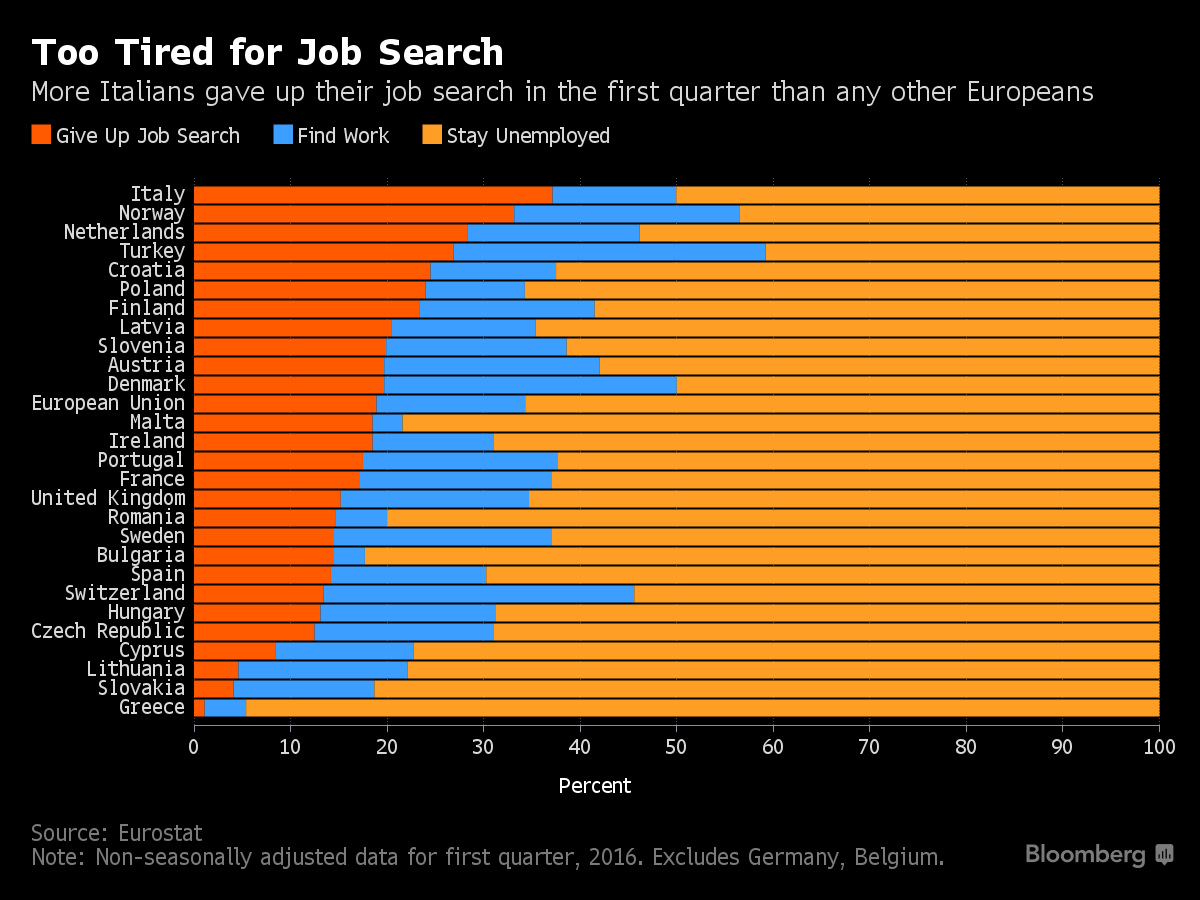

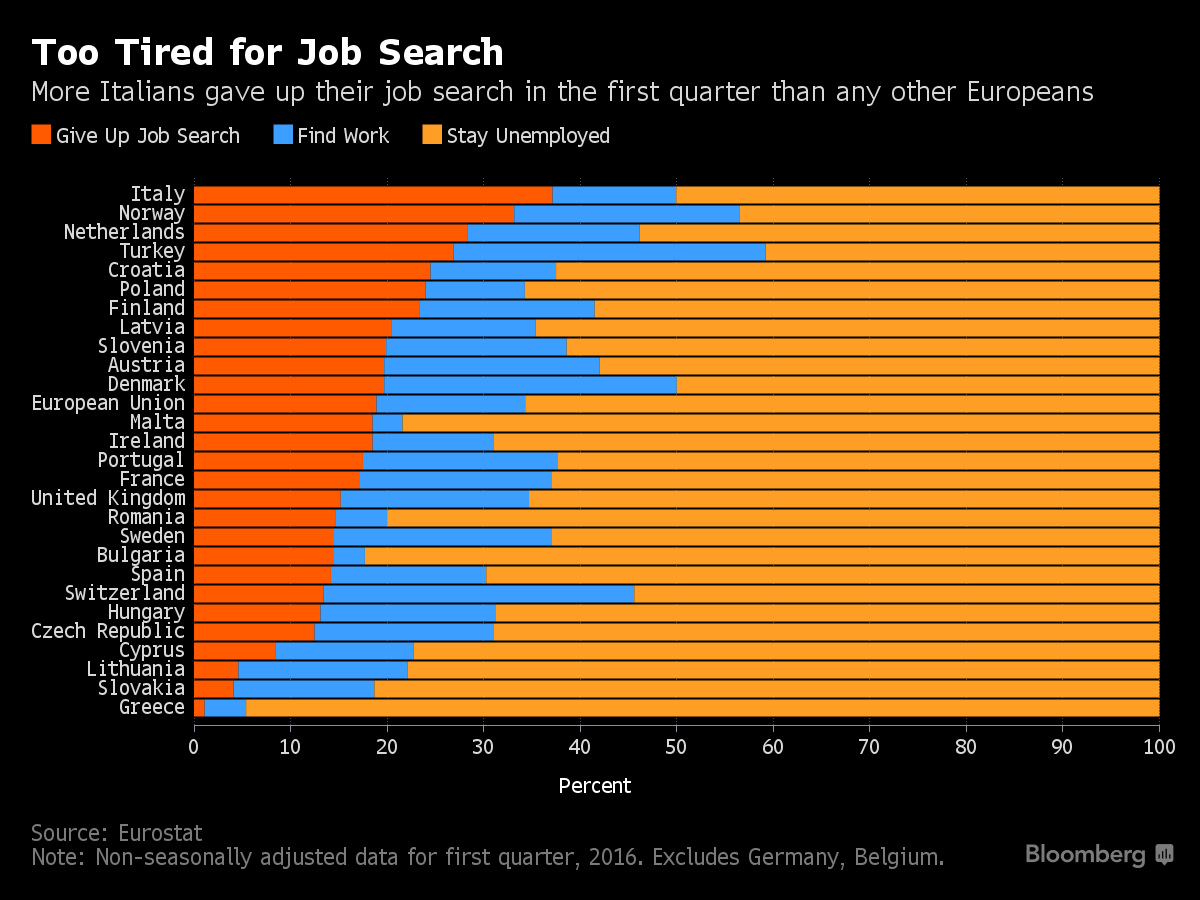

When 'Whatever It Takes' Fails...Unemployed Italians Lead Europe in Abandoning Job Hunt

Italy Quake: ‘If Italians Had Built Like Japanese, No One Would Have Noticed'

***Sul terremoto anche la patacca di Facebook

Estate 2016, il definitivo tramonto del binomio Agnelli-Mediobanca

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen! |

|

|

|

Post by Entendance on Sept 6, 2016 4:10:54 GMT -5

Italy’s banking problem threatens to dramatically worsen the € crisis at the same time as Europe struggles to deal with the migrant crisis. It is becoming more and more clear that the European Union in its current form is not working. |

|

|

|

Post by Entendance on Sept 13, 2016 9:34:38 GMT -5

|

|

|

|

Post by Entendance on Sept 28, 2016 3:46:33 GMT -5

This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many...

"...l'€, e più in generale l'Unione Europea, sono un nemico da combattere (perché lui sta attaccando noi).

Non puoi salvare chi non vuole essere salvato, non puoi liberare chi non vuole essere libero. Il grande inquisitore de “I fratelli Karamazov” sosteneva che l'uomo non vuole la libertà, ma desidera autorità, mistero e miracolo. Il noto blogger del primo secolo fu tentato 3 volte: la prima volta fu sfidato a trasformare una pietra in pane, ma egli voleva che gli uomini fossero capaci di procurarsi il pane da soli (non è libero chi dipende da un altro che gli da il pane – o il reddito di cittadinanza – e che all'occorrenza può anche toglierglielo e che mantiene il mistero su come si fa il pane); poi fu sfidato a mostrare la sua potenza librandosi nel vuoto, ma egli voleva che la fede fosse una scelta interiore fondata su una ricerca personale e non che fosse fondata su dei miracoli esteriori; poi gli furono offerti tutti i regni della terra, ma egli non voleva che gli uomini fossero sottomessi ad un'autorità ma li voleva capaci di autodeterminarsi, capaci di scegliere da soli le regole alle quali sottostare. Il noto blogger del primo secolo resistette alle tentazioni poiché voleva fare un dono agli uomini, il dono della libertà: ma per molti la libertà non è un dono ma un fardello insopportabile rispetto al quale preferire autorità, mistero e miracolo. Molti desiderano un'autorità di fronte alla quale inginocchiarsi, che decida per loro e che li deresponsabilizzi. Molti desiderano che l'autorità agisca nel mistero, che non renda di dominio pubblico i meccanismi interni alle proprie decisioni. Molti vogliono che l'autorità li illuda di essere in grado di compiere miracoli. L'€ ha privato i popoli della libertà e della democrazia, dandogli in cambio autorità, mistero e l'illusione del miracolo.

Il miracolo, il grande sogno europeo: l'illusione che l'adesione alla moneta unica, idolatrata custode di poteri miracolosi e semidivini, avrebbe risolto tutti i nostri problemi. L'€ esiste perché c'è chi non vuole essere libero." --Goofynomics

Un'altra beffa, i conti correnti diventano più cari per pagare le banche salvate

Occhio al conto corrente: arriva la “tassa” sui salvataggi bancari Conti correnti più cari per il fondo salva-banche: la tassa di Ubi, Unicredit, Banco Popolare. Banco Popolare, Unicredit, Ubi hanno aumentato i costi dei depositi dei clienti per recuperare il contributo al Fondo Nazionale di Risoluzione delle crisi bancarie, quello per capirci istituito dalla Banca d’Italia per mettere in sicurezza a novembre scorso Banca Marche, Etruria, CariFerrara e cariChieti che stavano per fallire.

L’ultimo autunno dell’€: Francia ed Italia verso la recessione

"Le parole chiave che hanno portato il clamoroso successo del Movimento 5 Stelle a Roma lo scorso giugno sono poche, semplici, conosciute e condivise. Al primo posto c'è il cambiamento, subito dopo il corretto sentimento di vendetta verso le angherie del PD, ma nei posti altissimi della classifica delle motivazioni che hanno portato i cittadini ad un voto così esasperato e di protesta c'è il degrado. Il settanta per cento dei suffragi che hanno portato in trionfo Virginia Raggi sono in larga parte un voto anti degrado. Illegalità, sporcizia, caos, disordine, impunità sono le cose che i cittadini vogliono cambiare, e le speranze sono state riposte nel movimento di Beppe Grillo.

Oggi i cittadini si svegliano scoprendo che uno dei principali motivi di caos, disordine, illegalità e degrado della nostra città - il commercio ambulante - non è considerato un problema da risolvere, bensì una risorsa da tutelare, per il Movimento 5 Stelle. Un risveglio amarissimo che, ne siamo convinti, farà perdere decine e decine di migliaia di voti al consenso pentastellato. Ma evidentemente difendere mafie e lobbies e assicurarsene i voti è troppo importante per il movimento che governa la capitale e che si candida ad amministrare il paese..." 9 motivi per cui è criminale manifestare in piazza al fianco degli ambulanti

|

|

![]()

Warning: Europe is not the same as the European Union. The European Union is only an episode in Europe’s history and is doomed to failure.

Warning: Europe is not the same as the European Union. The European Union is only an episode in Europe’s history and is doomed to failure.

che se proprio non avete voglia ci pensiamo noi. Ma purtroppo la loro valuta sottovalutata (l'euro), o, se volete, la nostra valuta sopravvalutata (l'euro), impedisce questa piacevole composizione del conflitto, che verrebbe realizzata rimuovendo la principale causa di attriti europei: l'impasse demografica di un paese che da due millenni aspira ad essere una potenza mondiale, e che non lo sarà mai.

che se proprio non avete voglia ci pensiamo noi. Ma purtroppo la loro valuta sottovalutata (l'euro), o, se volete, la nostra valuta sopravvalutata (l'euro), impedisce questa piacevole composizione del conflitto, che verrebbe realizzata rimuovendo la principale causa di attriti europei: l'impasse demografica di un paese che da due millenni aspira ad essere una potenza mondiale, e che non lo sarà mai.

€360 Billion in non-performing loans. They have another €180 Billion or so in troubled loans that are late just some of the time.

€360 Billion in non-performing loans. They have another €180 Billion or so in troubled loans that are late just some of the time. recuse fund dubbed “Atlas”...***

recuse fund dubbed “Atlas”...***

All that’s missing is a spark to start the fire.

All that’s missing is a spark to start the fire. €? EU? There will be blood.

€? EU? There will be blood.

More

More  More

More