|

|

Post by Entendance on Dec 21, 2018 9:25:34 GMT -5

Politics is a show business for ugly people. Politics is a show business for ugly people.

Un paese con molti, tanti, troppi sguaiati Pulcinella (mediocrità e cialtroneria) a credibilità zero ? (Cosa sapere sugli stupidi che non credono di esserlo) Your call.

"Con il nuovo governo la politica si è trasformata in una forma di religione..." Abbiate fede! Ma intanto è ancora austerità…

Do not believe what governments say, because they will tell you what they want you to believe.

Do not believe anything coming out of the intelligence services; if the information is good it is highly unlikely to come your way, and if good information does come your way, it will be indistinguishable from conspiracy theories. [Most of what they distribute to the public is a distraction or wrong…]

Do not believe conspiracy theories because they are almost never true. Do not believe government statistics. Do not believe western analysis, financial or otherwise, particularly when commenting on China or Russia.

Do not believe the mainstream media; it usually toes the establishment line.

Central banks extract wealth from governments, businesses and individuals. They distribute that wealth to their owners and to the political and financial elite. Any appearance that the central bank is helping the middle class is a happy coincidence with a short life expectancy.

All central banks and commercial banks devalue currencies, which reduces the purchasing power of currency units and raises prices for everyone. The process is intentional because it assists the transfer of wealth to the political and financial elite. Our financial system benefits the political and financial elite. The bottom 95% struggle under heavy debt loads and higher prices as the banking cartel demands interest and extracts a slice from almost all transactions.

Either massive inflation or default will be needed to extinguish overwhelming debt. Pick your poison and remember the banking cartel created those choices. Western central banks discourage gold ownership by citizens and prefer an indebted citizenry. Asian central banks accumulate gold and encourage their citizens to own gold. Gold imported into Asia comes mostly from western gold hoards and western central banks. It will never return. Protect your savings and retirement with something that retains value. Gold and silver bullion and coins have a multi-thousand year history during which they maintained value. Unbacked paper currency units always decline in purchasing power, usually to zero. Gold and silver prices will rise as currencies are devalued. Capital will shift out of paper and into real money—gold and silver. Gold and silver are not always the best vehicles for preserving purchasing power. Their prices increased from 2002 to 2011, but fell after 2011. The stock market has boomed since 2011 while gold and silver fell. Because stocks have begun their bear market and gold and silver prices have bottomed, moving capital from stocks to gold and silver is sensible.

Act like an Asian central bank. Accumulate gold and silver, avoid the debt-based and guaranteed-to-devalue Federal Reserve currency units, and avoid sovereign debt. Ignore mainstream media, government statistics, and other distractions. Recycle devalued fiat currency units into real money: gold and silver. Gary Christenson

Jan 1, 2019 4:20am: The Delusional Leaders of the Eurozone

Previously on The Beach:

"Great minds discuss ideas. Average minds discuss events. Small minds discuss people." ***Are you a Gossip?

Nel caso qualcuno non se ne fosse accorto, non li supportiamo più. Qui le motivazioni Nel caso qualcuno non se ne fosse accorto, non li supportiamo più. Qui le motivazioni

The Entendance Beach: senza mezzi termini e stolte tattiche, per l'uscita dall'EU lager e dall'€.

Qui alla spiaggia non demordiamo: fuori dall'EU, fuori dall'€, reset e ritorno al gold standard.

Aug 10, 2018-Dec 22, 2018 Grasping For Salvation: Italia Jun 28, 2017-Aug 8, 2018 Italiani -Ormai la salvezza è solo individuale

March 1, 2016-March 6, 2017: Italians Did It Better!

March 22, 2016-March 9, 2017: The stunning hypocrisy of the EU

2017: the Euro Area Breakup The jesuit pope

2019? Iniziamo bene. La guerra al cash registra un nuovo attore, il comune di Roma a guida ortottera. Leggere qui per credere. Esposti qui. Le previsioni della spiaggia non solo si sono avverate (confrontate i post dal marzo 2016 all'agosto 2018) ma volgono decisamente al peggio.

|

|

|

|

Post by Entendance on Jan 6, 2019 7:19:28 GMT -5

Porn Economy Updated Feb. 17, 2019: 85% of all leveraged loans — one of the most-risky types of corporate debt — are now "covenant-lite." ***The risky 'leveraged loan' market just sunk to a whole new low

January 14, 2019 (EUR) Euro-Zone Industrial Production w.d.a. (YoY) (NOV)

Actual: -3.3%

Expected: -2.1%

Previous: 1.2%

January 11, 2019 Italy rounded out the miserable EMU industrial output performance in November. Recall last week investors learned German industrial production crashed by 1.9% (for a -4.7% year-over-year pace) and earlier this week, France reported a 1.3% drop (-2.1% year-over-year). Today investors learned that Italian industrial output slumped 1.6% (-2.6% year-over-year). "...These are not only horrid numbers, they are unexpectedly and shockingly horrid numbers.

Blame Game

•France will blame the "yellow vest movement"

•Germany will blame cars and diesel and water levels on the Rhine

•Italy will blame France and Germany

But the numbers are what they are.

On top of it, Brexit concerns are in play as are Trump tariffs and a slowdown in China.

Add it all up and what do you get?..."

R E C E S S I O N

***The ECB Itself is a Risk

More here plus

U.S. Government Debt Bomb Much Higher Than Americans Realize

Roma è in dissesto finanziario

ECB calls in administrators to save Italy’s Carige Carige: chi paga il conto ***Porn economy

"Not a penny more" may be a nice rallying cry when in opposition, but when actually faced with the choices, the lesser evil is often chosen, no matter how distasteful.

Banca Carige shows that Italy remains master of the bank bailout "It took just eight minutes for Italy’s coalition partners, Five Star and the League, to renege on their flagship promise never to bailout a bank..." Italy’s New Government Eats Its Words, Joins Bank Bailout Club

Italian Banksters & their politicians: 4 pages

Gold and Silver will thrive as paper assets are increasingly infected by financial viruses!

Gold isn't debt, equity or any other financial promise. It doesn't rely on anyone else's survival to exist.

You better own precious metals directly, with no counterparty risk: they are not exposed to any creditor obligations.

EntendanceInvestors: Physical Gold & Silver, Long on EXK / MUX

FX / geared ETFs traders.

The great Russian opera singer, Feodor Chaliapin Sr., lost his entire fortune–then worth more than a million pounds–in the Russian revolution. This disaster seared him. He left Russia after the Revolution and went to live in France where in 1931 he bought gold bars and put them in a safe in his cellar in Paris. He was interviewed by the British Sunday Express newspaper on the 5th of May 1935, when he said, ‘People in Britain think governments cannot collapse. They think banknotes are money; banks are impregnable. But I have had everything I made in 25 years stripped from me. I was reduced to singing for tea in which there was sawdust, and bread in which there was wood. With my bar of gold and a pen knife I shall never go hungry.’ — Anecdote told by Haruko Fukuda, World Gold Council chair, in 2000 to the Business Club Zurich

"First reset...then the second reset..."

|

|

|

|

Post by Entendance on Jan 15, 2019 5:27:41 GMT -5

January 17, 2019 "...The banking system is a terrible risk. With leverage of 10 to 50 times, banks will be unable to meet their obligations to depositors and clients. Thus, money will first be bailed in and eventually lost as the bank defaults..." HERE & here

Ignorance often refuses or rather can't recognize itself. "If you're incompetent, you can't know you're incompetent... the skills you need to produce a right answer are exactly the skills you need to recognize what a right answer is." Why ignorance fails to recognize itself

Banche? Tempesta perfetta

The Entendance Beach: senza mezzi termini e stolte tattiche, per l'uscita dall'EU lager e dall'€.

Qui alla spiaggia non demordiamo: fuori dall'EU, fuori dall'€, reset.

Charles Hugh Smith: The Decline and Fall of the European Union "This exhaustion of the neocolonial-neofeudal model was inevitable, and as a result, so too is the decline and fall of the European integration/exploitation project.

That a single currency, the euro, would fracture rather than unite Europe was understood long before the euro's introduction as legal tender on January 1, 2002. The euro, the currency of 19 of the 28 member states of the European Union, is only one of the various institutions tying the member nations of the European union together, but it is the linchpin of the financial integration touted as one of the primary benefits of EU membership.

Skepticism of the benefits of EU membership is rising, as citizens of the member nations are questioning the surrender of national sovereignty with renewed intensity.

The technocrat elite that holds power in the EU is attempting to marginalize critics as populists, nationalists or fascists, overlooking the untidy reality that the actual source of tyranny is arguably the unelected bureaucrats of the EU who have taken on extraordinary powers to strip the citizenry of member states of civil liberties (i.e. the right to dissent) and of meaningful political enfranchisement.

As I have patiently explained since 2012, the underlying structure of the EU is neocolonialism, specifically, neocolonial-financialization. Stripped of artifice, the financial institutions of the EU core have colonized the EU periphery via the euro and the EU and imposed a modernized system of extractive serfdom on the citizenry of the core and periphery alike.

To understand the neocolonial-financialization model, we must revisit the classic model of colonialism. In the old model of Colonialism, the colonizing power conquered or co-opted the Power Elites of the region, and proceeded to exploit the new colony's resources and labor to enrich the core or center, i.e. the Imperial nation and its ruling elites.

This traditional model of colonialism was forcibly dismantled in the 1940s-1960s. Former colonies established their political independence, a process that diminished the wealth and control of former colonial powers.

In response, global financial powers sought financial control rather than political control. This is the key dynamic of the Neocolonial-Financialization Model(May 24, 2012), which substitutes the economic power of financialization (debt, leverage and speculation) for the raw power of conquest and political control.

The main strategy of financialization is: extend cheap credit to those with limited access to capital.

Those with limited access to capital will swallow the bait and willingly agree to onerous conditions.

Then, when the credit expansion reaches levels that cannot be supported, the lenders demand collateral and/or favorable trade and financial concessions.

These tactics have been well-documented in books such as The Shock Doctrine: The Rise of Disaster Capitalism and Confessions of an Economic Hit Man.

But the economic pillaging of former colonies has limits, and as a consequence the global financial powers developed the Neocolonial Model, which turns these same techniques on one's home region.

Thus Greece and other capital-poor European nations were recognized as the periphery that could be exploited by the core, and the euro was the ideal tool to exploit the economies of nations which could never have generated credit/housing bubbles without the wide-open spigots of cheap credit flooding their economies.

In Neocolonialism, the forces of financialization are used to indenture the local Elites and populace to the financial core: the peripheral "colonials" borrow money to buy the finished goods manufactured in the core economies, enriching the Imperial Elites with A) the profits made selling goods to the debtors B) interest on credit extended to the peripheral colonies to buy the core economies' goods and "live large", and C) the transactional skim of financializing peripheral assets such as real estate and State debt.

In essence, the French and German banks colonized Europe's periphery nations via the financializing euro, which enabled a massive expansion of debt and consumption in the periphery. The banks and exporters of the core extracted enormous profits from the periphery via this expansion of debt and consumption.

The assets and income of the periphery are flowing to the core as interest on the private and sovereign debts that are owed to the core's money-center private banks.

Note how little of the Greek "bailout" actually went to the citizenry of Greece and how much was interest paid to the financial powers. The core has stripped Greece of collateral and political independence, just as the colonial powers of the 19th century stripped the African and Indo-Asian regions of income, assets and political independence.

This is not just the perfection of neocolonialism but of neofeudalism as well.The peripheral nations of the EU are effectively neocolonial debtors of the core, and the taxpayers of the core nations are now feudal serfs whose labor is devoted to making good on any financialization schemes that go bad.

Neocolonialism benefits both the core's financial Aristocracy and the periphery's oligarchies. This is ably demonstrated in the essay Misrule of the Few: How the Oligarchs Ruined Greece.

The EU has finally reached the endgame of the Neocolonial-Financialization Model. There are no more markets to exploit with financialization, no more assets to strip, and the serfs (a.k.a. yellow vests) of the core are tiring of being stripmined in service of the EU kleptocracy.

At this point, the financial Aristocracy has an unsolvable dilemma: writing off defaulted debt also writes off assets and income streams, for every debt is the core's asset and income stream. When all those phantom assets are recognized as worthless, the system implodes.

This exhaustion of the neocolonial-neofeudal model was inevitable and as a result, so too is the decline and fall of the European integration/exploitation project." The Decline and Fall of the European Union

15 gennaio 2019

Rapporto 2019 povertà a Roma A Roma aumentano disuguaglianze e povertà: 100mila famiglie senza lavoro

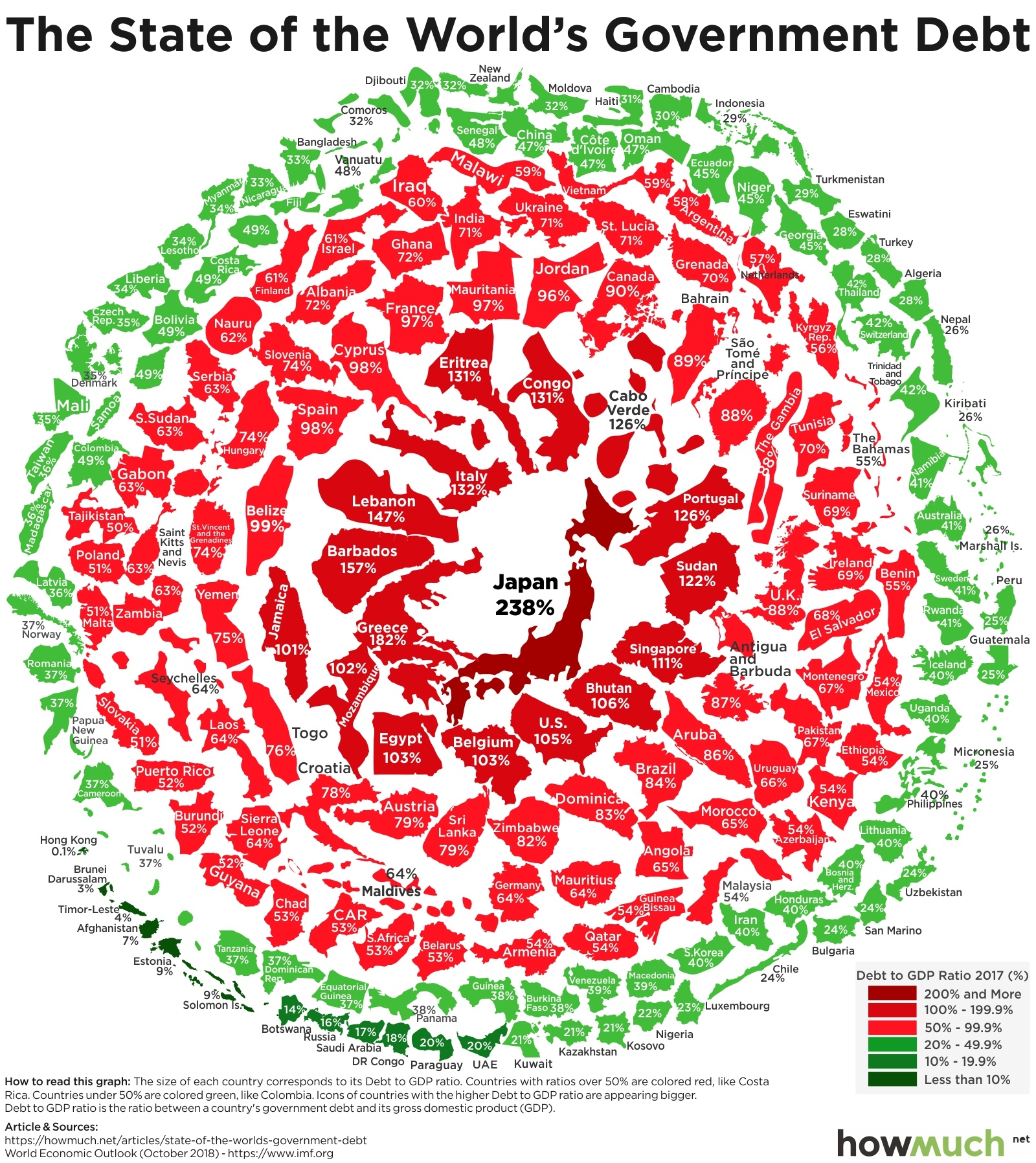

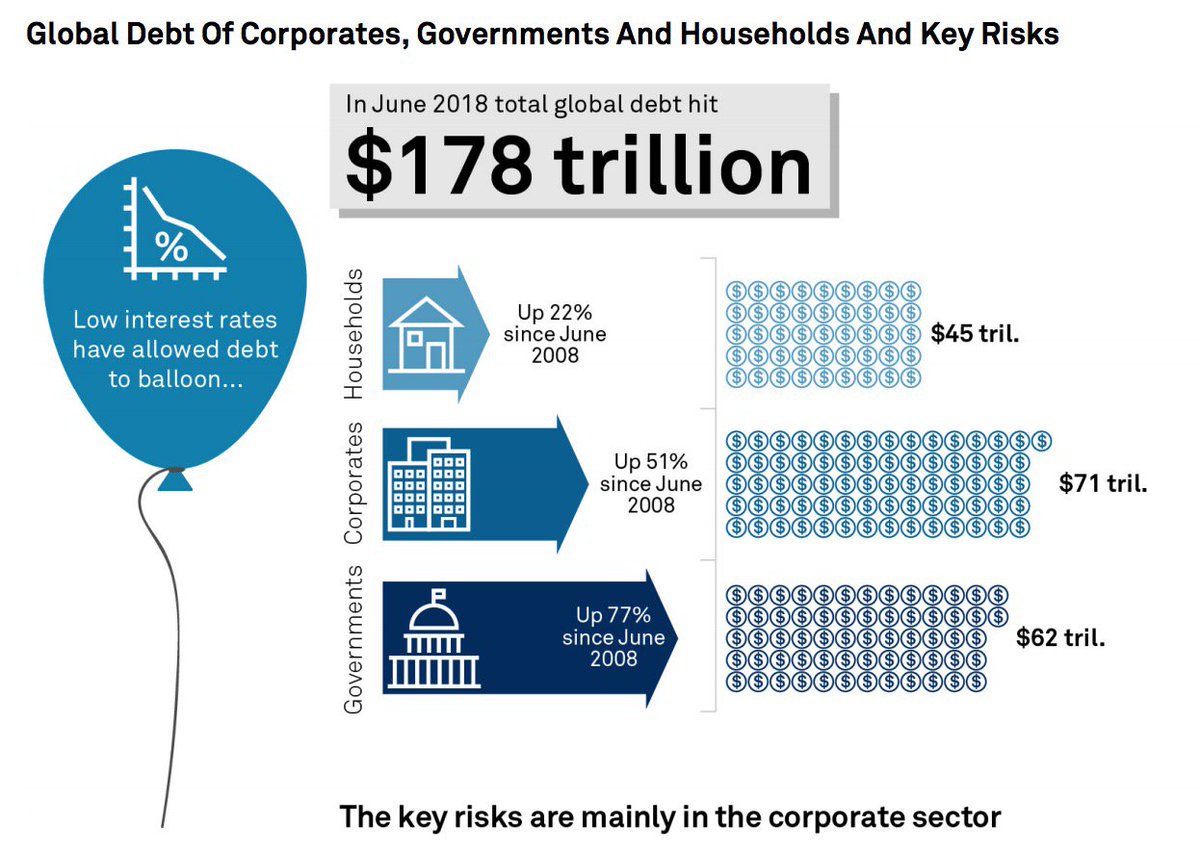

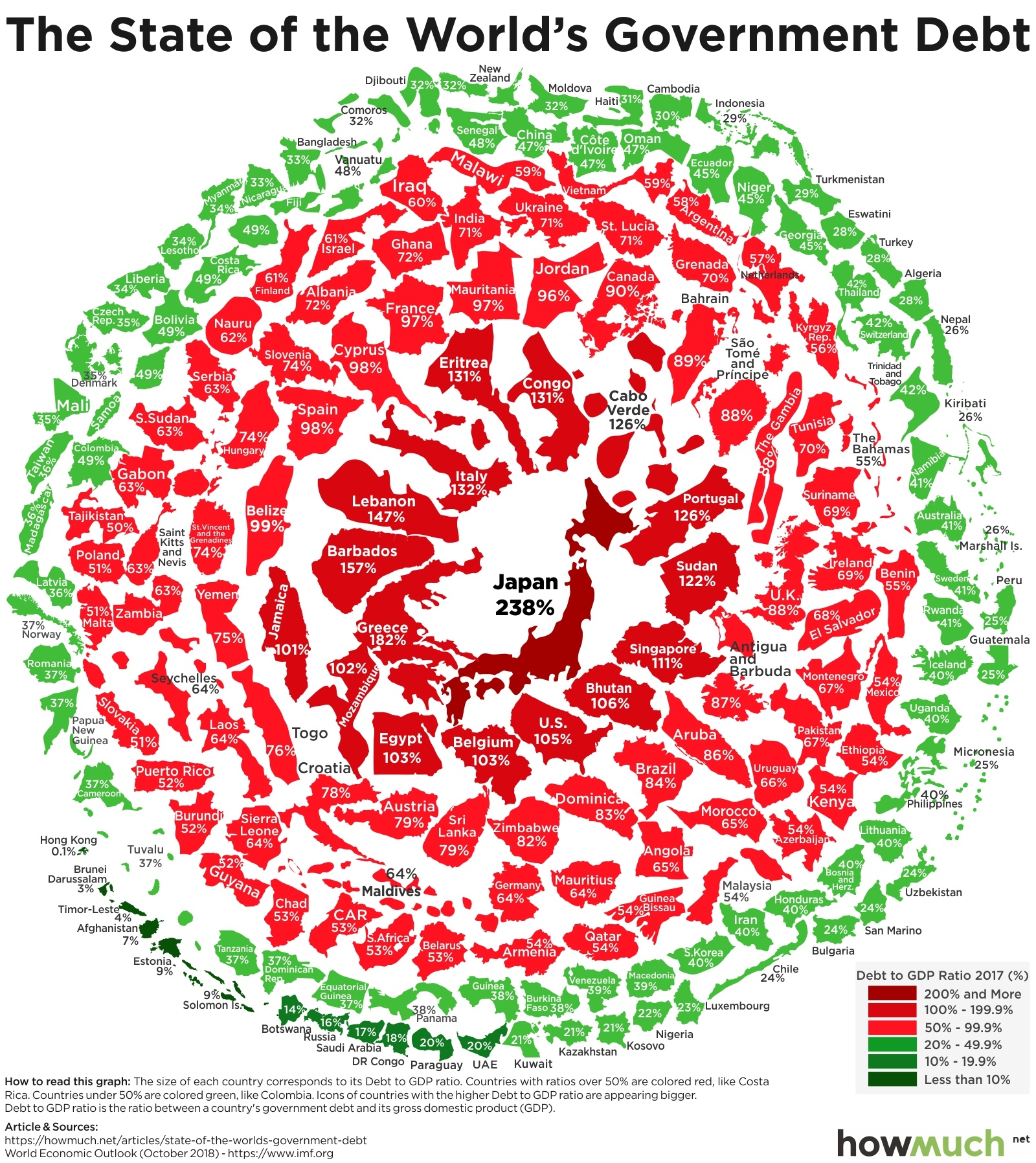

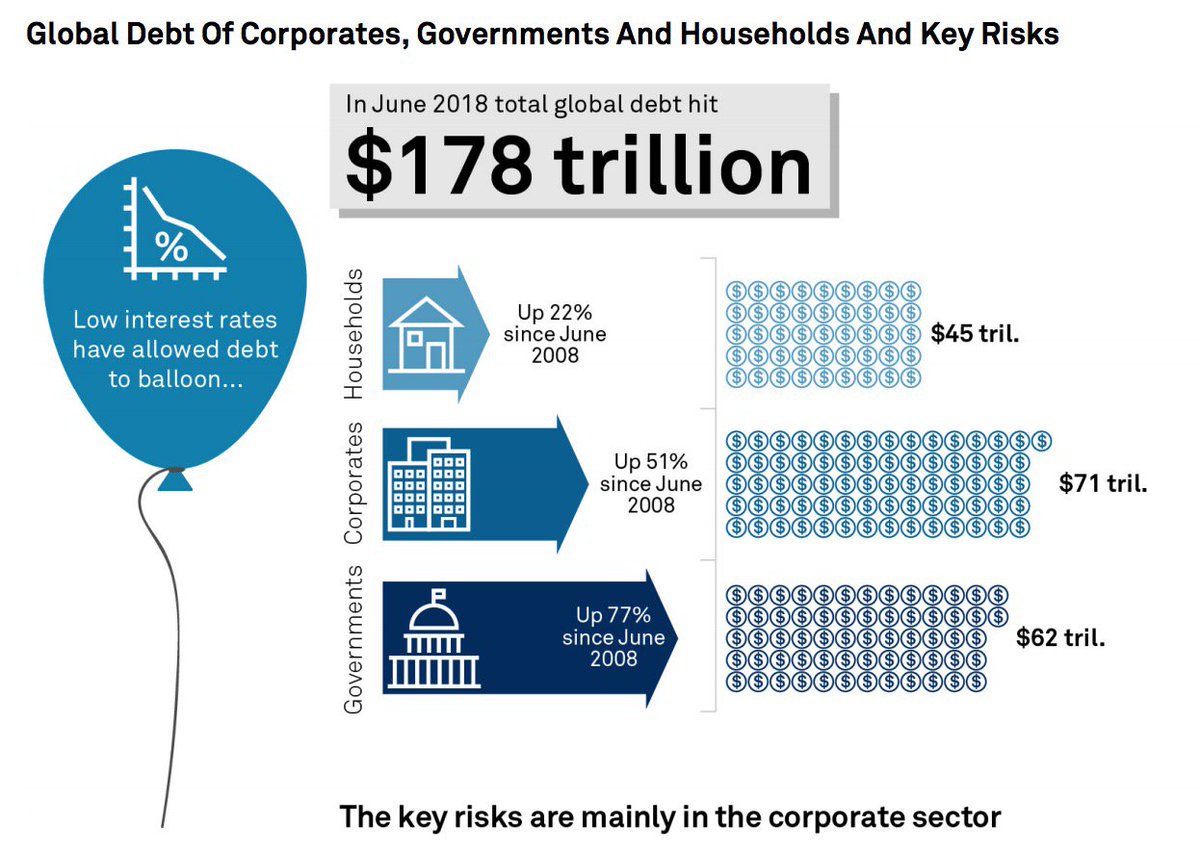

Global Debt Surpasses 244 Trillion Dollars As Nearly Half The World Lives On Less Than $5.50 A Day

January 16, 2019 "If you appease bullies they always come back for more" -Nigel Farage

|

|

|

|

Post by Entendance on Jan 20, 2019 7:32:21 GMT -5

"In che senso?" Capitolo X

... ...  ...che vor dì? ...che vor dì?

“...perché se tu fiderai nelli italiani, sempre avrai delusione; la ignoranza non avendo né fine, né regola, né misura, procede furiosamente e dà mazzate da ciechi" -I Ricordi politici e civili Francesco Guicciardini (Firenze, 1483 - Arcetri, 1540)

Non contestateli, vi direbbero che lo fate perché siete piddini. Prima...dopo...Non annoiateli con le contraddizioni insite nel reddito della gleba, perché vi risponderebbe(ro) così così Non affannatevi, siete solo circondati da tanti (rimasti) millennials coll'account su farcebook

e  lo smartphone in mano, in attesa dell'obolo del sistema, perché a loro non interessano le chiacchere, mò vònno li sordi. lo smartphone in mano, in attesa dell'obolo del sistema, perché a loro non interessano le chiacchere, mò vònno li sordi. -Sovranità? Ma dde che stamo a parlà?' -EU? €?...e sti caxxx. -Debbiti? na cifra...ma che vòi li mia...e'nnamo... -Conoscendo cosa sta arrivando, chi pensi si prenderà cura di te? Auguri

"...A colossal and historical mistake by the ECB if indeed a recession unfolds.

No wonder everybody wants to be in recession denial. To warn of a recession is to reduce confidence risking bringing a recession about. To publicly deny risk of a recession is an effort to keep confidence propped up..."

TECHNOLOGY: DISTRACTING, DISTURBING, DECEIVING & DELUDING OURSELVES TO DEATH

"The social media/search giants have mastered the dark arts of obfuscating how they're reaping billions of dollars in profits from monetizing user data, and lobbying technologically naive politicos to leave their vast skimming operations untouched..."

January 22, 2019 Want to Heal the Internet? Ban All Collection of User Data

Fintanto che TU userai farcebook, comprerai attraverso spamazon, avrai una televisione davanti, ti ciberai mentalmente di chiacchere sugli altri, continuerai a possedere un auto e la userai a sproposito, consumerai qualunque sostanza solida o liquida per cambiare il tuo stato mentale, non riuscirai a startene quieto con più libri sulle ginocchia, lascerai i pochi o tanti soldi che credi di avere in mano ad altri, farai il tifo per altri invece che investire in te stesso, non chiuderai ogni debito che hai, non imparerai ad ascoltare il silenzio, non studierai come rinunciare ai tuoi impulsi compulsivi, non smetterai di pensare che ti sia dovuto alcunché, continuerai a frequentare quelli che conosci unicamente perché temi la solitudine, non rischierai di fare scelte di rottura col tuo passato, la forza di gravità Ti terrà in basso e Tu rimarrai quello che sei. Fintanto che TU userai farcebook, comprerai attraverso spamazon, avrai una televisione davanti, ti ciberai mentalmente di chiacchere sugli altri, continuerai a possedere un auto e la userai a sproposito, consumerai qualunque sostanza solida o liquida per cambiare il tuo stato mentale, non riuscirai a startene quieto con più libri sulle ginocchia, lascerai i pochi o tanti soldi che credi di avere in mano ad altri, farai il tifo per altri invece che investire in te stesso, non chiuderai ogni debito che hai, non imparerai ad ascoltare il silenzio, non studierai come rinunciare ai tuoi impulsi compulsivi, non smetterai di pensare che ti sia dovuto alcunché, continuerai a frequentare quelli che conosci unicamente perché temi la solitudine, non rischierai di fare scelte di rottura col tuo passato, la forza di gravità Ti terrà in basso e Tu rimarrai quello che sei.

Ci vuol altro, Te ne sei accorto? E.

Women for Others, Real Leaders: Nomi Prins MUST WATCH: "We need a structural systemic change" Mettete i sottotitoli,sostituite alla parola Fed la parola ECB (banca centrale europea) e poi ditemi cosa c'è di strano quando qua alla spiaggia sosteniamo da anni che il problema è/sono *l'ignoranza di ognuno su come queste strutture funzionano **i politici che dovrebbero capire e cambiare lo stato del sistema (esemplare l'incapacità del duo b&b) e non lo fanno perché...decidete voi il perché.

"...Technology is wasted on people who haven’t been taught to think critically, have been indoctrinated by government run schools to be subservient cogs in the machine, and believe feelings and emotions are more important than knowledge and understanding. The proliferation of social media (Twitter, Facebook, Instagram) has resulted in the dumbing down of human interactions and replacement of discussing issues with virtue signaling, selfies, faux manufactured outrage, and glorifying shallow celebrities. We’re addicted to technology. It is incomprehensible our society has embraced technology for amusement, trivialities, and superficial displays of diversion, rather than advancement of knowledge, proliferation of ideas, and cultural progress and enrichment. The works of Aristotle, Socrates, Shakespeare, Dickens, Twain, Tolstoy, Steinbeck, Orwell and Huxley are available with one click of your iGadget, but instead the masses choose to play Angry Birds, Candy Crush, and Madden, while worshipping at the altar of Kardashian. So much knowledge and wisdom at your fingertips, guaranteed to make you smarter and 99.9% choose to amuse themselves into a stupor of ignorance..." TECHNOLOGY: DISTRACTING, DISTURBING, DECEIVING & DELUDING OURSELVES TO DEATH |

|

|

|

Post by Entendance on Jan 26, 2019 8:27:43 GMT -5

"...2012 saw the Italian Government on its knees.

Crippled by unmanageable debts which needed repaying, Italy was completely shut out of international credit markets. The long standing, extremely popular Silvio Berlusconi was primed to do what Italy had become so well known for. No no...not playing soccer, drinking coffee, or driving fast cars, but repudiating existing debt and devaluing their currency.

Berlusconi was weeks from yanking Italy out of the EU, opting out of the Euro, and bringing back the Lira, and then re-denominating its existing debts in Lira and going back to… well… being Italy. And Brits who are perpetually suffering from the miserable weather were eyeing up their favourite Italian getaways wondering just how cheap they would get this time around. The playbook was a typical one, and seeing it for what it was no sane investor was

about to throw a bone their way.

So enter Brussels who, sensing the risks to allowing the 3rd largest economy in the Eurozone to give them the finger, moved in swiftly removing Berlusconi from office and

appointing in his place a technocrat. With this move came liquidity injections into the

Italian banking sector. Ahhh...all was saved! Not quite.

It’s hard to state how incredible this maneuver really was, and furthermore how little press it garnered. Consider for a moment that an unelected group of pointy shoes removed the democratically elected head of state of a sovereign nation , and not a single bullet was fired in the process.

And realise this: Berlusconi was no girls blouse. We’re not talking about a Theresa May pushover here. The only thing tougher than this guy is the residue of a Weetabix left in a cereal bowl for a week, which is the toughest substance ever encountered by mankind.

In all seriousness, this was arguably one of THE most dangerous events in the last decade . Why? Because it emboldened these thugs in Brussels. Now they knew that they could control member states and enforce their will.

Theory had been tested and proved correct.

If anyone doubted the true intent and dictatorial nature of the beast that was growing in Brussels then what happened in Italy in 2012 should have once and for all put to rest any doubts.

What this action was of course designed to do was to send a very clear warning message to all member states. Don’t screw with us because we’re the Fourth Reich, and this time we don’t need thugs in black boots to take you out back, we can and will take you down in our suits, ties and pointy shoes.

Times change, but human nature never changes. Never..."  Specific Focus: The European (dis)Union Specific Focus: The European (dis)Union

Previously on the Beach: Aug 10, 2018-Dec 22, 2018 Grasping For Salvation: Italia

Jun 28, 2017-Aug 8, 2018 Italiani -Ormai la salvezza è solo individuale

March 1, 2016-March 6, 2017: Italians Did It Better!

March 22, 2016-March 9, 2017: The stunning hypocrisy of the EU

2017: the Euro Area Breakup

Loukanikos jesuit alumni

Inquiring Minds Only* Bonus links: "It's a process, not an event" Collapse Is Already Here & Refusal to hand over Venezuelan gold means end of Britain as a financial center

|

|

|

|

Post by Entendance on Feb 2, 2019 1:07:25 GMT -5

Capitulation to irrelevance: Italia 2019

Italy's GDP is still below the 2008 level. PMIs from Germany and Italy show the entire eurozone on verge of contraction.

Italy is back in recession for the third time in a decade. This one may be particularly hard as Italian Manufacturing Shrinks at Worst Rate in Six Years.

•Italy's purchasing managers’ index (PMI), a measure of business conditions in the sector, sank to 47.8 in January - a sharp drop from 49.2 in December, and below the 50 neutral mark. This meant the sector has been shrinking for fourth consecutive months.

•Jobs in industry fell for the first time in four years in January as new orders dropped sharply and output was down.

•New orders fell for the sixth consecutive month, suggesting that output in subsequent months may be lower.

•The slowing Italian sector dragged on the eurozone overall, which was close to standing still. The overall PMI was 50.5, down from December’s reading of 51.4, increasing the chances that it is now in recession.

•Germany also dragged on overall eurozone figures, as its powerful manufacturing sector contracted for the first time in four years. Again, this is likely to worsen further as new orders fell as the fastest rate in more than six years...Italy Heads for 2nd Lost Decade

"...Confidence: The combination of political turmoil, weak international growth, worries over debts and the long-term travails of Italy’s banks has left the country’s businesses on edge. Investment remains is muted as companies hold off committing to any big financial decisions.

Debt: Italy’s government has debts of more than 130pc of GDP - a tottering pile that limits its spending power, threatens higher taxes on workers and businesses, and risks destabilizing financial markets. Countries do not rack up debts like this by accident: borrowing and spending is a tried and tested way to pep up growth. However, at this level, debt is now a constraint on the economy.

Banks: The banking crisis began a decade ago, but Italy’s lenders were never fully cleaned up.

Permanent Crisis: Italy’s eternally slow growth rate indicates there are very fundamental problems with the structure of its economy. Yet successive governments have also struggled to make any of the necessary reforms, despite constant urging from economists including those at the European Central Bank. The economy is heavily regulated, with access to many professions tightly limited and an inflexible jobs market..."

****Italy in Recession With Very Troubled Banks

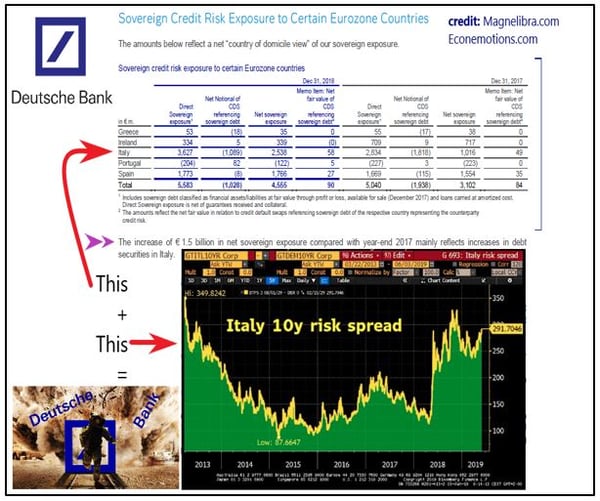

Inquiring Minds Only! Bonus link: The absurdity known as “TARGET2″

"...Italy’s NPL problem could be exacerbated by the economy’s recent slowdown. Economic output as measured by GDP shrank by 0.2% in the fourth quarter, following a 0.1% drop in the third quarter, statistics agency Istat reported on Thursday, putting Italy once again in a “technical recession.” The declines are small for now, but if they pick up momentum, triggering a fresh cascade of bankruptcies, job losses, and mortgage defaults, the banks’ NPL problems would swell with renewed vigor.

This is all happening at a time that monetary conditions in the Eurozone are beginning to tighten. While the ECB’s Main Refinancing Operations Announcement Rate remains anchored at 0%, the central bank has finally ended its four-year QE program, one of the largest expansionary monetary experiments of recorded history. Since QE funds were instrumental in keeping a lid on Italian sovereign bond yields, this is bad news for both the Italian government and the Italian banks that are among the biggest holders of Italian government debt..." -Wolf Richter here

Moral disgrace: Venezuela, EU & Article 233 |

|

|

|

Post by Entendance on Feb 13, 2019 4:54:48 GMT -5

21 febbraio 2019 Italian banksters: più diamanti vendi più ti premio

19 febbraio 2019 Il fatturato dell'industria italiana, a dicembre 2018, diminuisce del 3,5% rispetto a novembre, subendo il ribasso più forte sul mercato estero. Comunicato stampa qui

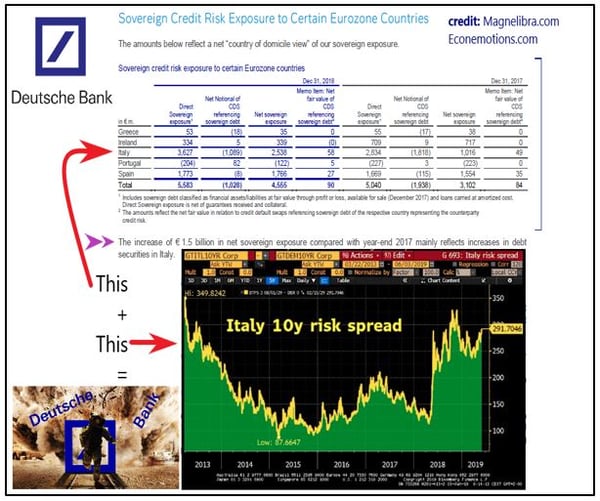

17 febbraio 2019 PER NUTRIRE IL DEBITO ITALIANO NEL 2019 SERVONO 400 MILIARDI DI EURO...La mappa delle banche europee esposte al rischio Italia

2019: "Vendo oro!" La sòla ortottera dell'oro revisited

Bank of Italy's Gold

WIKILEAKS: PAOLO BAFFI, GOVERNOR OF BANK OF ITALY, DISCUSSES EMS AND ITALIAN ECONOMIC PROSPECTS WIKILEAKS: PAOLO BAFFI, GOVERNOR OF BANK OF ITALY, DISCUSSES EMS AND ITALIAN ECONOMIC PROSPECTS

16 febbraio 2019: La Cia riscrive la storia di Bankitalia

Maurizio Blondet: BANKITALIA la succursale dell'usura internazionale

February 13, 2019 Italy government won't sell 'a gram' of gold reserves: League lawmaker

The Italians Want To Sell Some Gold: Well Now, There Might Be A Problem With That

Facts: the Bank of Italy has the third-largest central bank holding of gold reserves in the world after the US and Germany, owning 2,452 tonnes according to the World Gold Council, which at today's prices would amount to just over $103 billion. Meanwhile...  Italy's total debt load is more than €...click here Italy's total debt load is more than €...click here

"...The Italian gold in New York could be long gone.

The last time there was proof that this gold was actually in the Fed vaults in New York was between 1974 and 1978 when about 542 tonnes of this gold was used as collateral in a series of US dollar loans provided by Germany’s Bundesbank. If Italian politicians want to harness the liquidity of the Italian gold, they could also push for a new international loan of some sort, with Italian gold again used as collateral. But that assumes that the Italians have the gold they claim to have, and there is no independent proof of this.

It is admittedly very odd that when many of the large gold holding countries were selling gold in the 1990s and 2000s such as the Netherlands, Belgium, the UK, France, Switzerland. Spain, Portugal, Canada, and Australia, that Italy sold “not one ounce” as Beppe Grillo highlighted. Perhaps the Bank of Italy did sell a lot of gold in the 1990s or 2000s but was too embarrassed to say so, and kept it a secret. Stranger things have happened, and in the world of scheming central bankers, anything is possible..." ****Italy’s Gold enters the Political Fray. But who really owns it?

Meanwhile...in Venezuela... Maduro Warns Against 'Robbing Venezuela of Gold' Amid Bank of England Dispute

|

|

|

|

Post by Entendance on Feb 21, 2019 13:01:54 GMT -5

Crescita? Growth? Ancora? "Cycles are perhaps the most natural and common occurrence in the universe. The planets orbit the sun, seasons change, day turns to night and night back to day, humans are born, grow old and die.

Some of these cycles are more pleasant to think about than others, but their consistent occurrence remains factually unassailable. Indeed, it could be said that a human life itself consists of an endless series of encounters with various cycles. Cycles of the natural world and cycles created by humans themselves. Human created cycles are the focal point of today’s piece.

I’ve been writing a lot about cycles over the past few months since it’s become increasingly clear that the artificial economic cycle we’ve been living in for about a decade is on its last leg. In order to understand how significant this is, it’s important to recap what the last ten years actually represented.

It didn’t represent a healthy economic growth cycle, but rather an insanely irresponsible, and arguably criminal, manufactured bubble boom where central banks printed enormous amounts of money to inflate asset prices like stocks, bonds and real estate. In this deranged mission they succeeded, but at a great cost to social stability. While many still attempt to deny it, any honest assessment of the post-crisis response will conclude that government and central bank policy helped further enrich the people who needed help the least... ...The point I’m trying to make is we have a whole bunch of major cycles all at key inflection points simultaneously colliding with each other, yet the consensus view seems to be that the status quo’s just gonna continue along as it has in the past.

It won’t. The next few years will change everything." You Can’t Stop the Cycle

The Eurozone “is not sufficiently armed to face a new economic or financial crisis.” French banks are heavily exposed to Italy...

Feb 23, 2019: New Economic or Financial Crisis in the Eurozone Could Start in Italy: French Government Frets

Feb 22 2019 04:03 PM ET Fitch Affirms Italy at 'BBB'; Outlook Negative

"Sardi e capre vanno abbandonati?"

Italia... what can possibly go wrong?  Source: Italian Government Data in €  Italy Debt Clock Italy Debt Clock

in US$  here

8 anni persi...November 13, 2011 Italy and Greece: Rule by the Bankers

"Europe’s most dangerous stock of public borrowing—some 1.5 trillion euros ($1.7 trillion)—is concentrated on the balance sheets of banks in Rome and Milan. But a rout could quickly sweep in lenders in Frankfurt, Paris and Madrid—the main banks in the rest of Europe are holding more than 425 billion euros of sovereign and private Italian debt, based on a Bloomberg analysis of European Banking Authority data... " Why Italy’s Debts Are Europe’s Big Problem

Crisis Brewing in Italy will lead to default, exit from the Euro, or both

Gold isn't debt, equity or any other financial promise. It doesn't rely on anyone else's survival to exist.

Physical Gold and Silver: the only form of money that is not simultaneously someone else’s liability.

Meanwhile...  "...Try to ask central banks simple questions about their gold and you will see that not one central bank will ever divulge important information about its gold, or its gold operations, or its gold related policy discussions with other central banks. The Bundesbank, the Bank of England, the New York Fed, the Bank for International Settlements, the European Central Bank, the IMF, the Swiss National bank, De Nederlandsche bank, the Swedish Riksbank, the Banque de France, Banca d’Italia. The list is endless. All of these central banks keep a lid on revealing anything substantive about their gold holdings and their gold activities, and none produce proper weights lists of their gold bars.

Due to the secrecy of the gold lending market,  there is zero confidence that the Western central banks have the amount of gold that they claim to have." -Ronan Manly here there is zero confidence that the Western central banks have the amount of gold that they claim to have." -Ronan Manly here

|

|

|

|

Post by Entendance on Feb 28, 2019 9:40:53 GMT -5

Since April, Italy’s quarter-on-quarter GDP has been sharply declining with the country recently entering a technical recession – defined as two consecutive quarters of contraction.  Italy Debt Clock? here Italy Debt Clock? here

Bank of Italy's Gold Saga Updated “Bank of Italy’s golden reserves amount to between 80 and 90 billion euros ... less than 10 percent of its total assets,..Like the rest of its assets, it cannot be used for monetary financing by the Treasury" -Bank of Italy’s Governor Ignazio Visco (Italy's total debt load is more than € 2,518,000,000,000)

March 4, 2019 Italy public debt level climbed again in 2018: Highest Since Mussolini

*****************************

"...Salvini, coi suoi due economisti con 10kg di Vinavil fra culo e poltrona politica, e Di Maio con Casaleggio, vi hanno mentito su tutto. Hanno calato le braghe di fronte a Bruxelles in 5 minuti con una spesa pubblica che è un insulto alla storia italiana. I padani si sono rimangiati la Eurexit perché “eh, abbiamo beccato solo il 17% e quindi sticazzi le promesse elettorali, ma la poltrona ce la teniamo”, mentre Salvini ...Votare per un parlamento i cui legislatori non possono fare le leggi, e i cui legislatori devono lottare come assassini se vogliono opporsi a potentissime leggi fatte da gente che nessuno elegge – cioè votare alle elezioni per il Parlamento Europeo – è rendersi complici intenzionali di una dittatura. Se non lo sapevate, ora lo sapete perché avete letto queste righe. Quindi le scuse stanno a zero, italiani." "...Salvini, coi suoi due economisti con 10kg di Vinavil fra culo e poltrona politica, e Di Maio con Casaleggio, vi hanno mentito su tutto. Hanno calato le braghe di fronte a Bruxelles in 5 minuti con una spesa pubblica che è un insulto alla storia italiana. I padani si sono rimangiati la Eurexit perché “eh, abbiamo beccato solo il 17% e quindi sticazzi le promesse elettorali, ma la poltrona ce la teniamo”, mentre Salvini ...Votare per un parlamento i cui legislatori non possono fare le leggi, e i cui legislatori devono lottare come assassini se vogliono opporsi a potentissime leggi fatte da gente che nessuno elegge – cioè votare alle elezioni per il Parlamento Europeo – è rendersi complici intenzionali di una dittatura. Se non lo sapevate, ora lo sapete perché avete letto queste righe. Quindi le scuse stanno a zero, italiani."

GUIDA ALLA VERGOGNA CHIAMATA ELEZIONI EUROPEE

"...if the recession leads to job shedding then falling tax revenue and higher social security spending can see fiscal numbers deteriorate quickly..." The unfolding economic crisis in Italy as adult diapers enter the inflation basket H/T our member theunderdog61

How Individuals Can Reset The Financial System

HERE |

|

|

|

Post by Entendance on Mar 7, 2019 6:29:37 GMT -5

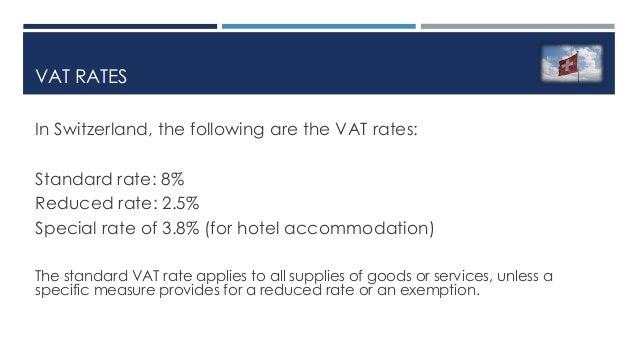

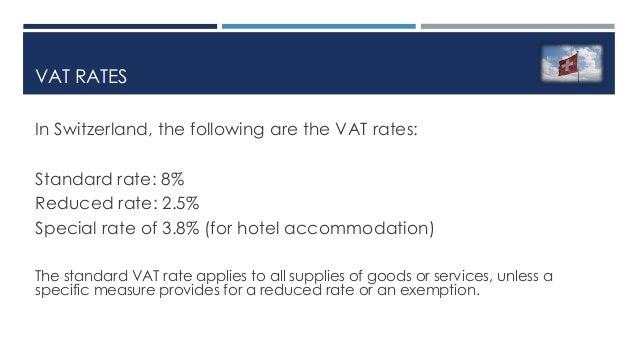

Where to buy your physical silver. TAXES:What you need to know when buying/importing SILVER BARS/COINS. VAT RATES.

No GST / VAT / Sales tax in Singapore PDF & in Cayman Islands PDF

"Silver is so cheap at under $15.50/oz. that even if it goes on to follow in palladium’s footsteps and triples in value, it will still sit below its former all-time high of $49.50/oz.!

What other asset class offers the opportunity to triple your money as a warm-up before prices break to new highs? Not stocks. Not bonds. Not real estate.

The value opportunity that now exists in silver is unique. But not unprecedented. Silver has been extremely depressed before…and gone on to post spectacular bull market gains.

If silver enters a mania phase like it did in the late 1970s, you can expect to see all sorts of headlines about supply deficits, panic buying among industrial users, rampant speculation in futures markets, a possible default on futures contracts for physical metal, thieves and scam artists coming out of the woodwork, and so on.

Right now the mainstream financial media isn’t finding much to write about in the silver market. Big banks and other institutional traders take out enormous short positions in the COMEX, confident that speculative “buyers” on the other side won’t demand to take delivery of physical metal.

The shenanigans that take place in rigged paper markets are just business as usual…for now.

But when real physical shortages emerge, the price suppression efforts on the futures markets may finally fail spectacularly. The only way to make sure you participate fully in a bull market for a scarce metal is to own it in physical form. -Stefan Gleason Bonus Link:  How to Clean Silver Coins How to Clean Silver Coins |

|

|

|

Post by Entendance on Mar 7, 2019 19:01:21 GMT -5

"...Forse stò fore, ie songo pazzo,

ma vuje m'avite rutte o' cazzo." -James Senese

"...In a vicious bond bear market of the scale likely to accompany the next credit crisis, Italy alone could crash the whole Eurosystem.

That could happen by the end of this year, because when things go wrong the pace calamities usually accelerates..." March 14, 2019 The start of EU disintegration

07/03/2019 Default Or Exit: A Battle Between Italy And The EU Is Inevitable

Grandi italiani alla ribalta

"...Instead of admitting that its radical experimental monetary policies were a colossal error as the economic growth is now dwindling despite or because of the stimulus, and instead of gradually raising its policy rates above the rate of inflation to end its brutal “financial repression,” and instead of shedding the bonds on its balance sheet to push up long-term interest rates and force a restructuring of the bogged-down European economy so that it would liquidate or restructure the debts of zombie companies and lighten the load of restructured companies to allow them to have a fresh start – all of it at investors expense – the ECB does the opposite..." Mar 8, 2019 Old ECB Stimulus Fails to Stimulate

People like this?

If it were up to me I’d lock’em all way! draghi: 3 pages

Mr. Bean-draghi: 2 pages

mario draghi: 2 pages

Porn Economy Updated

"In the euro area, shaky banks survive because they are kept afloat with national tax injections or via opaque network of rescue institutions such as EFSF, ANFA, EFSM, and ESM. The ECB's asset purchases and the TARGET2 payment system have turned out to be a quasi unconditional credit system: around a trillion euros have been handed out via TARGET2 to ailing southern European banks, with gradually eased collateral requirements. The unresolved financial and government debt crises, the extended low interest rate policy of the ECB, and EU pressure toward fiscal austerity have all contributed to the huge capital outflows from the euro area (around two trillion euros since 2012)." -Mises Institute

Elezioni EU? Qui professiamo Fuori dall'EU, fuori dall'€, reset, di conseguenza non andiamo a legittimare, votando, una bestia che noi consideriamo nefanda. Pensate piuttosto alle tasche vostre, così come i gentiluomini politici pensano bene alle loro: Gold will be the last man standing.

Those standing on a foundation of bullion gold, that is in or out of the ground, will not only survive but they will also thrive. End of story... ma, per chi ancora dormisse...An Italian paper gets it: Central banks push gold futures down so they can get more metal here e in italiano qui. Economists can forecast the next financial earthquake about as well as seismologists can predict a tsunami. They know it only after they see it, but then it’s too late to take cover. 188 Internet Shutdowns In 2018 Show Why Physical Gold Is Ultimate Protection

Stàteve buono guagliù! Entendance |

|

|

|

Post by Entendance on Mar 20, 2019 7:42:17 GMT -5

Italy Could Spark The Next Global Debt Crisis Italy Could Spark The Next Global Debt Crisis

"Unworthy politicians, indulgent citizens and inequality did for Rome"

Lessons from the fall of a great republic

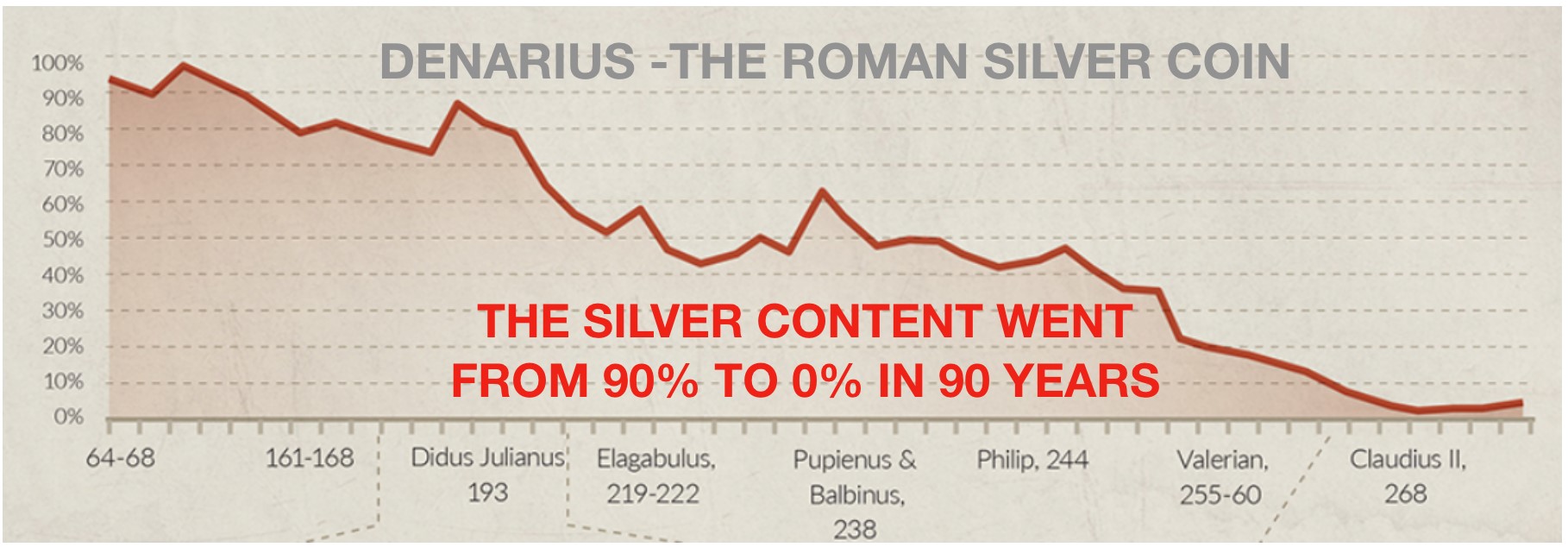

"...Governments have many tricks in their bag to steal the citizens’ money.

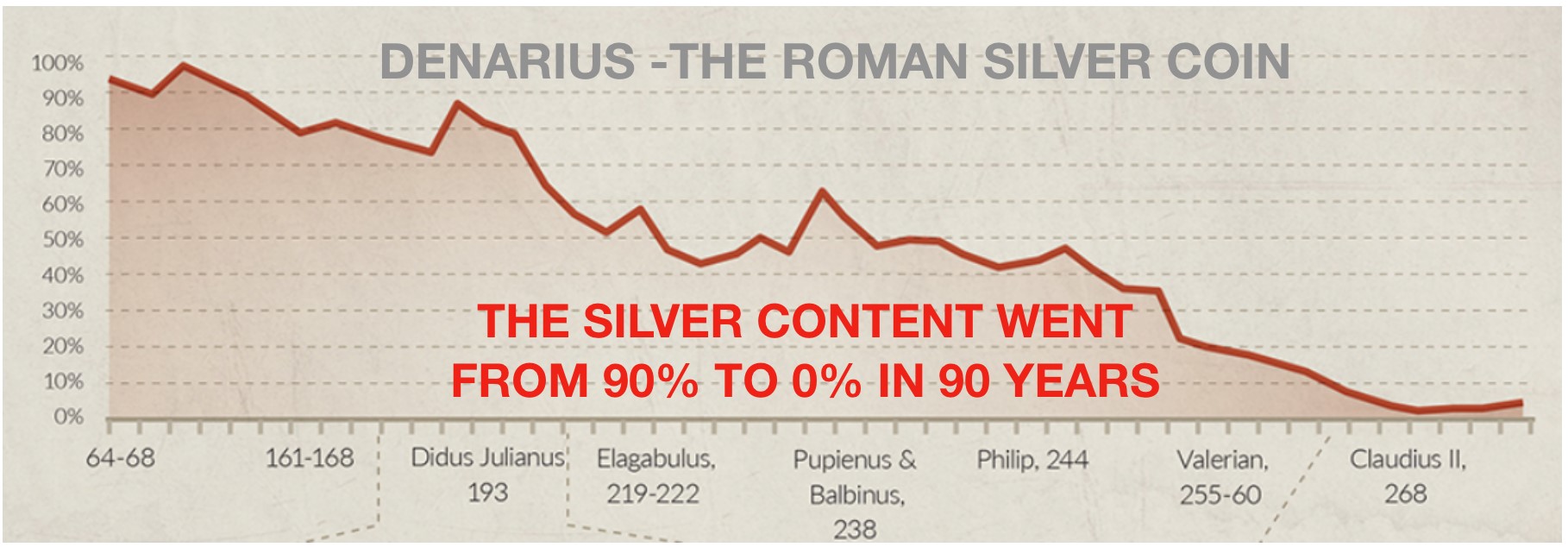

The easiest way is to debase the currency. And this all governments have done with superb skill throughout history. As the Roman Empire started to crumble the value of the currency, the silver Denarius, fell rapidly. In those days, money printing consisted of reducing the silver content of the coin. So from almost 90% silver in 180 AD, the rulers cheated their people by using less and less silver to coin the Denarius. By 270 AD, around 90 years later, the silver coin was both silver-less and worthless..." More here

"...The chart shows how four major currencies have declined measured in gold over the last fifty years. The yen has lost 92.4%, the dollar 97.42%, sterling 98.5%, and the euro 98.2% (prior to 2001 the euro price is calculated on the basis of its constituents)... The gold price will be at multiples of current levels in all currencies, including the dollar...The problem investors will then face is mathematical. There are probably less than 30,000 tonnes of monetary gold, excluding Asian jewellery, in private hands, today worth about $1.1 trillion. According to The Boston Consulting Group, in 2015 there were $71.4 trillion of portfolio assets, of which $36.1 trillion were in US dollars. With the monetary gold held outside government reserves being about 1.5% of portfolio assets, how do you replace non-performing fiat-currency dependent assets with a portfolio designed with sound money in mind?

This is why the return to sound money will destroy the West’s financial system, driving the purchasing power of gold higher, measured against commodities, goods and services, while that of paper fiat moves towards worthlessness. The destruction of financial wealth could easily compare with 1929-32, and if it wipes out fiat currencies will be even worse."

Meanwhile...March 26, 2019: Russia adds more than 1,000,000 ounces of gold to country's vast stockpile |

|

|

|

Post by Entendance on Mar 28, 2019 2:39:32 GMT -5

04/04/2019 The Euro’s $2.7 Trillion Italy Problem

04/04/2019 Italy Is Said to Cut Economic Growth Forecast to Just 0.1%

04/01/2019: What suits Germany does not suit Italy. The euro could face a quicker destruction, simply by the Eurozone falling apart

It’s complacency that gets you killed Told ya. "Il tuo oro è il nostro oro". Chiunque non capisca o si disinteressi, merita davvero ciò che gli accadrà. La noncuranza uccide. Auguri. *************** In February 2019, the number of employed people moderately declined compared with January (-0.1%, -14 thousand); the employment rate decreased to 58.6% (-0.1 percentage points). The fall of employment involved mainly people aged 35-49 years (-74 thousand), while people aged over 50 continued to go up (+51 thousand). ISTAT

Recessione. Diminuiscono gli occupati permanenti di 33mila unità e anche quelli a termine di 11mila. In un mese -44mila occupati dipendenti. 1 aprile 2019 ISTAT

"The banking cartel, central banks and governments create debts – dollars, yen, pounds, and euros and inject them into economies. Those new currency units make existing units less valuable. They purchase less—called devaluation—and prices rise. The devaluation process accelerates every year and is unlikely to change (without a huge reset) because it benefits governments and the banking cartel.

Prognosis: More devaluation is inevitable, along with higher prices..."The Big Picture on Debt and Devaluations

Mr. Bean-draghi on the prowl: The European Central Bank needs to approve any operation in the foreign reserves of euro zone countries, including gold and large foreign currency holdings, the ECB’s President Mario Draghi said on Thursday.

L’oro degli italiani? Non più, è della BCE. Parola di Draghi

Controlling The Wire

"...The first problem with the EU is that, though it is called a union, it isn't really one. To be sure it has a flag, an anthem, a parliament, a council of ministers, and even pseudo-embassies in many countries, but despite such trappings of a state, the EU is essentially an economic club; not a state. Even then, the EU is basically concerned with two branches of the economy: industry and agriculture, sectors that represent around 32 percent of the combined gross domestic product (GDP) of the 28 member states. In the case of Britain, which is primarily a service-based economy, industry and agriculture account for around 25 percent of GDP.

The EU's annual budget accounts for around one percent of the total GDP of its 28 members. However, on average, the state in the 28 member countries controls the expenditure of around 50 percent of GDP.

Key aspects of the economy, including taxation, interest rates and, apart from members of the Eurozone, national currencies are not within the EU's remit.

The EU's member states represent many different historical memories and experiences. The British are shaped by two centuries of colonial experience, followed by a brief flirtation with social-democracy morphing into the Thatcherite version of capitalism caricaturized in a single word: greed. The EU's Nordic members emerge from seven decades of social democracy with "welfare" as the key concept.

Germany and Austria pride themselves in their "social market" economic model, which is regarded with deep suspicion in other European countries. Italy, and to a lesser extent Greece, Spain and Portugal have a "black-and-white" model in which the unofficial or black economy is almost as big as the official one. The Benelux three, Belgium, Holland, and Luxembourg have lived with what they call "social capitalism" -- a system in which the principal role of the state is redistributing the wealth created.

France, depending on the party in power at any given time, has vacillated between the German-Austrian and the Benelux models.

The Central and Eastern European members were all parts of the Warsaw Pact and the Soviet-dominated Comecon and used to expecting the state and the party in control, to take all decisions and cater for all needs.

The 28 member states also have different political systems, ranging from traditional monarchies to republics with a revolutionary background and nations emerging from the debris of empires.

They also have long histories of enmities with one another. Leaving aside a long history of wars, some lasting over 100 years, little love is lost between the French and the Germans or the British for that matter. For the Hungarians, the number-one hated people in the world are the Romanians who still rule over four million "captive Hungarians" whose territory they annexed in 1919.

The Irish love the Brits as much as the Dutch love the Germans, that is to say not very much. Italians still remember oppression under the Austrians and the Spanish haven't forgotten their struggle against Napoleon.

It is a wonder that the EU has managed to bring together so many nations in a region that has the longest and most intense history of national rivalries and enmities compared to any other region in the world. Part of that success was due to fears fomented by the Cold War and hopes risen after the fall of the Soviet Empire.

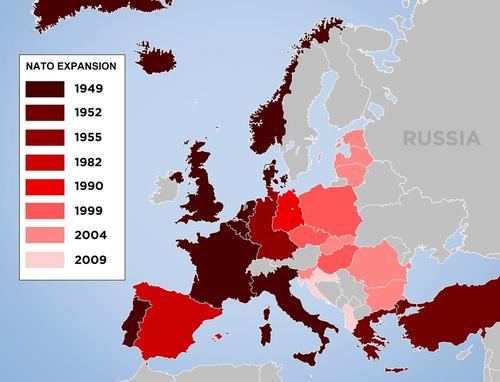

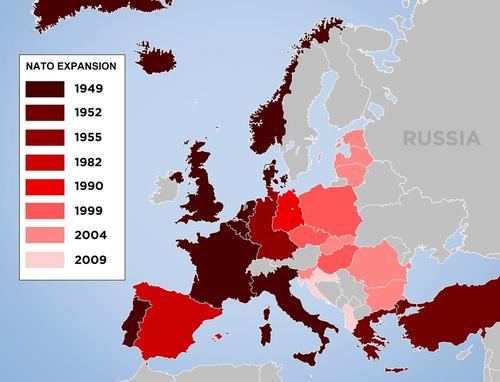

The Western European nations felt they needed to set aside old enmities to face up to the Communist "beast from the East". In the post-Soviet era, the Central and Eastern European nations hurried to join the EU and NATO to put as much blue water as possible between themselves and their Russian former oppressors.

Needless to say, the United States encouraged the formation of the original Common Market and supported its morphing into the EU as part of a grand strategy to contain the USSR. In that context, the EU played a major role in ensuring peace and stability in a continent that has witnessed most of the wars that humanity has seen in its history.

The EU has also done a great job with the so-called mise à niveau (bringing up to standard) policy of helping new members achieve some measure of parity with the founding members in key fields of the rule of law, democratic values, economic regulations, and international behavior.

Brexit has highlighted the key challenges that the EU faces..."

Elezioni EU? Qui professiamo Fuori dall'EU, fuori dall'€, reset, di conseguenza non andiamo a legittimare, votando, una bestia che noi consideriamo nefanda.

24 maggio 2019 "L’ambulantato a Roma ha toccato vette mai viste prima. Bancarelle ovunque, sui marciapiedi, in curva, nei giardini, davanti ai monumenti. Un commercio ipertrofico e troppo spesso vicino all’illegalità come sta emergendo dall’inchiesta che ha visto protagonisti alcuni membri della famiglia Tredicine e altri esponenti delle associazioni di categoria..." Niente spostamento delle bancarelle. Il M5S fa macchina indietro

Vote for Nobody. capitale a 5 stelle "Bureaucracy is a construction designed to maximize the distance between a decision-maker and the risks of the decision." Ci vuol altro.

|

|

|

|

Post by Entendance on Apr 6, 2019 9:07:29 GMT -5

"A great number of those working for liberal causes are not only shy but borderline collusive. They want change to happen nicely, and it won't. They want decency to come about without anybody suffering or being embarrassed, and it won't. And most of all they want to give many of the enemies of open government the benefit of the doubt, and I don't. It's not just a difference of approach, it's a complete schism in our respective philosophy. You can't go about disclosure in the hope that it won't spoil anybody's dinner." - Julian Assange

THE 2019 MUST WATCH VIDEO

Chris Powell 21:39"...and I think that at that point the central banks got back together, I'm just guessing but they are the biggest players in the gold market, several banks got back together and said hey this is getting out of control, we got to start smashing the gold down in the futures market and I think it's what they did"

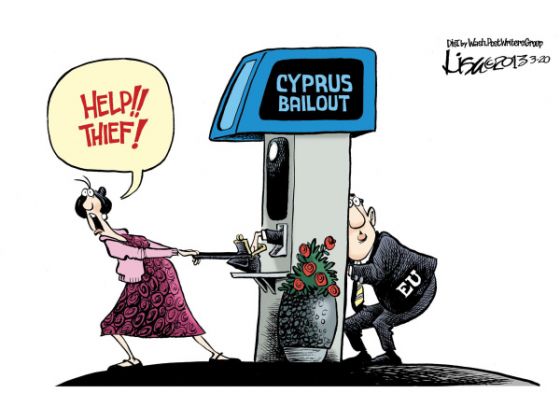

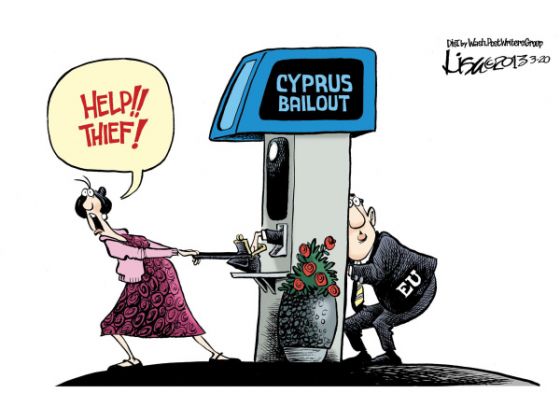

Simon Black: "March 15, 2013 was a pretty normal day in Cyprus. It was a Friday, and most people were looking forward to a relaxing weekend.

The next morning the entire nation woke up in horror..."

Dagli U.S.A. all'Italia, passando per Cipro: the truth is always hidden in plain sight. (Things always become obvious after the fact)

Alla spiaggia, con Fred e Tom, l'abbiamo spiegato per primi -Jul 2, 2017 at 12:39pm-: il gas, dentro la grotta del cane, stava salendo e il video di Mannarino ieri ce lo ha confermato, da 19:58 in poi. (Chiunque si registra e diventa membro della spiaggia, oltre a poter compulsare "The Members Only Area" usufruisce del servizio di private messages e, se lo desiderasse, può quindi scrivermi riservatamente)

"...Depositors with more than EUR 100,000 lost 47.5% of their deposits. This was justified by pointing to the Russian connection in Cyprus—yes, Cypriot banks had Russian depositors. However, plenty of Cypriots also lost half their deposits.

We all take banks for granted. Imagine not being able to get basic working capital loans, not being able to get a mortgage, not being about to effect transactions for fear of keeping capital in the Cypriot banking system. In the ECB’s desire to hurt a few Russians, they hurt over 1 million Cypriot citizens..."

Qui alla spiaggia ci si è sperticati a presagire che quel che stava avvenendo in Grecia  e a Cipro sarebbe accaduto altrove e le menate infinite della UE sul Brexit ne sono una testimonianza e prova (c'è sempre dietro lei, come spiega Luongo qui e Lago qui, insieme al pool di ex-alunni, da pochi conosciuti, in Italia persino con tanto di "quotidiano"-guarda qui/leggi qui, ma ben noti a Cassandra). e a Cipro sarebbe accaduto altrove e le menate infinite della UE sul Brexit ne sono una testimonianza e prova (c'è sempre dietro lei, come spiega Luongo qui e Lago qui, insieme al pool di ex-alunni, da pochi conosciuti, in Italia persino con tanto di "quotidiano"-guarda qui/leggi qui, ma ben noti a Cassandra).

Siamo vicini al redde rationem e coloro che ancora abboccano alle esche avranno un imprevisto risveglio:

pain never shows its face until it’s too late. A breve sarò di nuovo in giro per incontri individuali/meetings di gruppo e poi relax, perciò assente dalla spiaggia virtuale.

(Forewarned is forearmed/Uomo avvisato è mezzo salvato)

8 Aprile 2019 Niente di nuovo, almeno per me, nell'articolo di Blondet qui, ma comunque terribilmente realistico. Perché niente di nuovo e perché scrissi nel 2017 che Ormai la salvezza è solo individuale?

April 11, 2019 The biggest problem with Italy’s economy is that many of its problems are chronic and deep seated: Italy’s fiscal health is once again in serious decline Italians do it better: Italy's UniCredit says it is among banks accused of running bond cartel Italy: One in Five Arrests Are Foreigners Despite Being 8.7 Percent of Population And how about European stocks?

"I don’t want to do anything with Europe. The € might go up, but I have no interest in European bonds which yield negative. In addition, European equities have been a persistent value trap. Europe's problems are unbelievable. Part of it has to do with negative interest rates. Just look at the merger talks between Deutsche Bank and Commerzbank: One seemingly bankrupt German bank merging with another, not quite so bankrupt but not healthy German bank. So, it’s like, what do you get when you merge two unhealthy banks together? One unhealthy bank."

The EU was set up to be 100% corrupt, anti democratic, unaccountable, power grabbing and unreformable as a tool for the Globalist Ruling Elites to control Europeans. What the EU does not want you to know about the EU:

The Entendance Beach Members Only Area: "...Trouble is likely to start with either the dollar or the euro. In a deepening recession, the euro will struggle with escalating problems in the PIGS, Brexit, US trade protectionism and systemic risks in the Eurozone’s banking system. The Eurozone could easily disintegrate. A falling dollar, over-owned in the context of declining international trade, is also a racing certainty. A race to the bottom for both currencies is becoming the increasingly obvious outcome of a slump in world trade..." Here Register & become members!

April 12, 2019 "The fall of the EU and the Euro is inevitable. The unelected and unaccountable Brussels elite is desperate to stop the sinking ship from going to the bottom. They are doing what they can to stop Brexit. Just like they have interfered in Ireland, Denmark, Greece, and Italy. But they will not succeed. Italy’s economy and banking system is in a hopeless position and the coming crisis and default will have severe repercussions for French Banks, Spanish Banks, the ECB and thus the global financial system. That is one of the potential triggers for the next global crisis which will be much bigger than the 2007-9 one" Here

22 aprile 2019 Attorno alla merda di elefante

28 Apr 2019 Germans do it better: The vast gold hoards held by Germany’s population

Fred & Entendance Beach Members Only Area: Register & Become A Member!

Fred & Entendance Beach Members Only Area: Aways Updated!

Fred & Entendance Beach Members Only Area: a thriving sheltered Club for Excellence, Education and Information!

May 8, 2019 The good news is renewal becomes possible when the entire rotten status quo collapses in a putrid heap of broken promises, dysfunctional institutions, blatant lies, unpayable debts and cascading defaults. The Great Unraveling Begins: Distraction, Lies, Infighting, Betrayal |

|

|

|

Post by Entendance on May 11, 2019 3:29:56 GMT -5

"In che senso?" Capitolo XI

Inghilterra Italia: trova la differenza!

***Debt is the Hidden Issue in The European Elections *** Plan for the worst and hope for the best: here

Inghilterra Italia: trova la differenza! L'attuale edizione di questa spiaggia virtuale nacque prevalentemente in forma divulgativa proprio perchè mi resi conto, dalla fine del secolo scorso, come fosse difficile, per chi non avesse passato parte della sua vita dentro le stanze del sistema, coglierne le sue strategie e tecniche, atte unicamente a conseguire l'unica priorità: il continuo consolidamento dello status quo. Di conseguenza, come curatore di menti e portafogli, ho sempre evitato di emettere affermazioni di principio, mentre ho tentato di portare fatti e dati ed ho cercato di condividere le mie conoscenze specifiche, al fine di facilitare la lettura di ciò che è, contrapposto a quel che l'agenda del sistema vuol far apparire come reale. Anch'io sono membro inconsapevole del club Dunning-Kruger: spesso mi trovo a dare per scontate, data la mia esperienza/competenza, situazioni che invece per tanti altri sono ingarbugliate, confuse, e spesso incomprensibili, o all'opposto chiarissime (l'altra faccia di membri del club Dunning-Kruger...più sono incompetenti, meno realizzano la loro carenza ed anzi sono convinti di possedere la verità). Il sistema, con il suo Padre e Principe della Menzogna che governa la globale struttura di peccato di questo mondo, ostacola la visione intera del puzzle e ne offusca e nasconde le molteplici tessere, con lo scopo di creare assuefazione, rassegnazione, paura e sottomissione. L'ho visto all'opera in molteplici circostanze ed ho imparato a stanarlo, sempre con rispetto e prudenza, vista la sua principale arma, la morte del corpo e dell'anima. Vabbè, ma perché, di sabato, questo pippone/pistolotto di premessa? Chi come me ha trascorso e trascorre molto tempo ai tropici, è consapevole del cambio delle maree e delle conseguenze: con la bassa marea si nota ciò che altrimenti non si vede, così come, se al cambio di marea da alta a bassa si nuota nel punto sbagliato, dove cioè c'è una apertura del reef, si rischia di essere portati fuori dalla corrente e il ritorno a terra è cosa solo per esperti (che peraltro non si azzarderebbero mai ad entrare in acqua lì e durante il cambio). Il cambio di marea è in atto. L'acqua bassa fa finalmente emergere i rifiuti sul fondale. La corrente sta cambiando. Il sistema resiste e pompa altra acqua, per rimanere a galla.

Si confronti la situazione politica in Inghilterra e in Italia e, al fine di una migliore assunzione di questo pistolotto, si usi il motore di ricerca della spiaggia in alto a sinistra per inserire qualunque termine/cognome/parola e verificare cosa ne esce fuori, visto che ci si è sfiancati a scrivere dal 2015 ad oggi (lol) e l'archivio, quindi, è sufficientemente esaustivo.

In Inghilterra, Farage col suo neo-costituito movimento-partito Brexit ha definito chiaramente la priorità: uscire dalla gabbia/prigione EU. E vincerà.

In Italia, nel 2019, ancora si farnetica di questa EU da riformare dall'interno, da modificare, senza uscirne.

Con l'appoggio di Bergoglio e degli ex-alunni dei gesuiti sparsi ovunque nel sistema, grazie anche a tradimenti dell'ultima ora (peraltro finalmente esposti, oltre che da questa spiaggia, da tanti altri in rete, compresi Paolo Barnard e Marco Mori), il fronte del "rimaniamoci dentro per cambiarla" è preponderante, almeno sui media di regime e nei loro sondaggi.

Quali armi usa questo schieramento per vincere e finire così di spolpare l'osso Italia anche qualora diventasse cadavere putrido? L'appartenenza (ricercate questa parola nel motore della spiaggia!), la sollecitazione di bassi istinti e l'etichettatura dei "diversi" in varie forme simboliche, tutte tendenti ad evocare fantasmi del passato e a far scattare riflessi canini di pavloviana memoria.

Occorre far dimenticare la Grecia, Cipro, i tassi d'interesse negativi, i burocrati non eletti che impongono ciò che loro non subiscono, l'ambaradam di miliardi di euro delle loro strutture di costi ubicate dove sappiamo, che mantengono centinaia di migliaia di parassiti. Occorre far dimenticare il piano di immigrazione forzata, esposto in questa spiaggia laddove ci si è interessati del papa gesuita, vòlto al definitivo conseguimento di Eurabia. E nel frattempo, grazie all'obolo del reddito della gleba, alla confusione in casa degli ortotteri e all'assist di economisti neo eletti rivelatisi voltagabbana, le chiacchere narcotizzanti imperano. Tutto pur di evitare che prevalga il buon senso di affrontare il taglio del nodo di Gordio e quindi il reset di questi venti anni passati a delocalizzare, massacrare salari, premendo solo su "lo vuole l'Europa" (che poi è voler far passare la falsa equivalenza fra EU e Europa, menzogna esposta qui da subito). Io non voterò per alcuno, personale e discutibile ma sempre personale mia scelta, in quanto io non legittimerò col voto ciò che non accettai sin dalla sua forzata creazione.

Certamente, però, inorridisco di fronte ai capitoni che si divincolano nel secchio, come ebbi modo di dire in un faccia a faccia col professore che mi pare non nasconda il suo narcisismo, col suo sentenziare che, a mia opinione, denota spocchia e arroganza (la bassa marea della poltrona?). Certamente non solo l'unico a ricordare gli esempi dati, con la propria vita, da Enrico Toti e dai ragazzi della Folgore .

Mentre le sabbie mobili crescono inesorabilmente. E. Bonus links: *The only way is Brexit **The EU has never been able to help the poor to free themselves.

E. on twitter "In che senso?" 27 capitoli qui |

|

|

|

Post by Entendance on Jun 3, 2019 2:17:03 GMT -5

"...fra quelle voci, quelle lobbies, quei personaggi squadra- e- compasso che si sono avvicendati, ad un segnale convenuto, per “sostenere Radio Radicale”, abbiamo sentito anche quella di Claudio Borghi. E poi c’è stato il voto della Lega a favore. Che dire?..." H/T our member theunderdog61

June 11, 2019 Italy's Government Will Collapse

“The government consists of a gang of men exactly like you and me. They have, taking one with another, no special talent for the business of government; they have only a talent for getting and holding office. Their principal device to that end is to search out groups who pant and pine for something they can't get and to promise to give it to them. Nine times out of ten that promise is worth nothing. The tenth time is made good by looting A to satisfy B. In other words, government is a broker in pillage, and every election is sort of an advance auction sale of stolen goods." -H.L. Mencken

Yield Curve Collapse Signaling Warning Signs Yield Curve Collapse Signaling Warning Signs

June 6, 2019: EU Commission says Italy's rising debt justifies launch of a disciplinary procedure against Italy

Tutto come ampiamente previsto qui alla spiaggia. - Disabili lasciati indietro, con gli importi della pensione d'invalidità lasciati immutati, miseramente inadatti ad assicurare dignità.

- Pensionati nuovamente falcidiati dall'inizio dell'anno ("lo vuole il reddito della gleba, la quota cento, l'EU").

- Le rimaste ed i rimasti, mediamente imbambolati da tv smartphone illusioni e dissonanza cognitiva, mediamente incapaci di realizzare la drammaticità che si protrae, senza soluzione di continuità, dall'ingresso nell'EU e dall'adozione dell' €, sprofondano nelle sabbie mobili.

E lorsignori, con dame a seguito, hanno festeggiato al Quirinale. Una memorabile prossima calda estate da reset.

Oro e argento fisico, fuori dal loro sistema.

Bonus links: *"La manovra è un disastro e causerà un disastro" Flat tax e reddito di cittadinanza **Faremo chiudere Roma fa schifo

“Reality is far more vicious than Russian roulette. First, it delivers the fatal bullet rather infrequently, like a revolver that would have hundreds, even thousands of chambers instead of six. After a few dozen tries, one forgets about the existence of a bullet, under a numbing false sense of security. Second, unlike a well-defined precise game like Russian roulette, where the risks are visible to anyone capable of multiplying and dividing by six, one does not observe the barrel of reality. One is capable of unwittingly playing Russian roulette – and calling it by some alternative ‘low risk’ game.” -Nassim Nicholas Taleb, Fooled by Randomness: The Hidden Role of Chance in Life and in the Markets

Ripeto, a proposito del grafico qui in basso per chi se lo fosse perso, quanto scrissi qui: Pensate alle tasche vostre.

June 15, 2019 Wolf Richter: The FTSE Italia All Share Bank index fell 19% over the past two months and has plunged 58% since the Italian banking crisis has resurfaced in mid-2015

|

|

|

|

Post by Entendance on Jun 20, 2019 1:48:15 GMT -5

"...But Roma collapsed...They did two disastrous things to solve their deficit: First, they kept raising taxes which became punitive...Second, they debased the currency which led to inflation..." How to Destroy a Civilization

Italia... what can possibly go wrong?  Source: Italian Government Data in €  Italy Debt Clock Italy Debt Clock in US$ here (Ha imparato da Kasparov: Cassandra ha colpito di nuovo)

Cognitive dissonance: An Italian disease 20 Brilliant Ways People Avoid Their Feelings (and the Havoc it Wreaks)

*********************************

Capitulation to irrelevance: Italia "Speditemi urgentemente il doppio del campionario:***qua sono tutti scalzi!"

***************************  Olimpiadi invernali 2026, l'ennesima sòla perpetrata a danno dei tifosi: QUI & QUI Olimpiadi invernali 2026, l'ennesima sòla perpetrata a danno dei tifosi: QUI & QUI

*************************** Capitulation to irrelevance: Italia I think we are long past the time when illusions could be dismissed as wishful thinking or as acts of naive desperation. Men truly go mad in herds, and come to their senses slowly, one at a time. And some, in their stubborn pride, never will. -Jesse  Italy has lost economic weight in the world. While in the 1990s, before the introduction of the euro, the country accounted for >5% of global GDP, it now accounts for less than half of this share, and the trend continues to fall. Italy has lost economic weight in the world. While in the 1990s, before the introduction of the euro, the country accounted for >5% of global GDP, it now accounts for less than half of this share, and the trend continues to fall.

Italy has not really benefited from the euro. Italy's per capita GDP as % of EU’s has crashed from 122% of avg EU to 96%. If the trend continues, even Spain may soon have overtaken Italy. Italy has not really benefited from the euro. Italy's per capita GDP as % of EU’s has crashed from 122% of avg EU to 96%. If the trend continues, even Spain may soon have overtaken Italy.

"...I tifosi non guardano agli atti ufficiali ma ovviamente ***questi tifosi hanno una scusante, tutta gente in difficoltà, non ha tempo per informarsi, è molto sofferente, quindi io capisco tutto, però il tifo in questo momento condannerà la Repubblica ad un inesorabile fallimento..."

22 GIUGNO 2019, VIDEO: La risposta strategica di Conte a Bruxelles...direzione USE!

Dedicato ai "tifosi": Repetita iuvant

QUI QUI QUI QUI QUI

**************************

Sven Henrich: "...For cutting rates again is making wealth inequality even greater, is again punishing savers, pushing wealth toward the asset class holders and encouraging ever more debt accumulation. In short: Make the bubble even bigger. Debt is higher than ever, growth is weak and 10 years of cheap money policies by central banks have failed to produce growth and/or meet artificial inflation targets.

Let’s do it all again, except it’s different this time. It’s worse. Much, much worse.

But no central banker will never admit it..."

***Fuori dal sistema dei banksters ***Fuori dal sistema dei banksters

"Europe has been warned. Any use of monetary levers to hold down the euro exchange rate will be deemed a provocation by the Trump administration.

Further cuts in interest rates to minus 0.5 percent or beyond will be scrutinized for currency manipulation. A revival of quantitative easing will be considered a devaluation policy in disguise, as indeed it is, since the money leaks out into global securities and depresses the euro. The Bank for International Settlements says E300 billion of Europe's QE funding reached London alone between 2014 and 2017.

If the ECB copies the Swiss National Bank and starts to amass foreign assets directly to cap currency strength Europe will face certain retaliation.

Whether the Swiss can get away with their policy for much longer is an open question. The SNB has foreign holdings of $760 billion -- near 120 percent of GDP -- and owns slices of Apple, Microsoft, Amazon, Facebook, and Exxon.

As the global economy falters we are entering the next phase of currency warfare. There is going to be an ugly fight for scare global demand.

What is striking about Donald Trump's tweets against the ECB this week is how quick he was to see the significance of Mario Draghi's policy pirouette in Sintra -- already dubbed "whatever it takes II" by bond markets -- and how quickly he pounced:

Mario Draghi just announced more stimulus could come, which immediately dropped the euro against the dollar, making it unfairly easier for them to compete against the USA. They have been getting away with this for years, along with China and others. -Donald J. Trump June 18, 2019

This has the imprint of his trade guru Peter Navarro.

The dollar is of course overvalued. The Federal Reserve's broad dollar index reached a 17-year high in early June. The manufacturing trade deficit has ballooned to $900bn.

These imbalances have been made worse by Mr. Trump's own policies. His tax cuts at the top of the cycle have pushed the budget deficit to 4 percent of GDP. They forced the Fed to jam on the brakes last year.

This "loose fiscal/tight money" regime is the textbook formula for a strong currency. But the White House is not going to admit this. It is going to blame foreigners, and foreigners are not innocent either.

The eurozone is chief global parasite. It has been sucking demand out of the global economy with current account surpluses of E300 billion to E400 billion. China is a saint by comparison. This "free rider" behavior is the result of the euro structure and the austerity bias of the Stability Pact and German ideology amplified through currency union.

The rest of the world pays the price for euroland's half-built experiment and its failure to stimulate -- that is to say its failure to create a joint treasury with shared debt issuance that would make an investment revival possible in the depressed half of Europe.

Mr. Navarro has special twist on this: The warped mechanism of monetary union allows Germany to keep the implicit Deutsche Mark "grossly undervalued" and to lock in a beggar-thy-neighbor trade advantage over southern Europe. Hence Germany's chronic current account surplus of 8.5 percent of GDP.

Mr. Trump's White House has had enough of this and the battleground is over the currency. Democrats are singing from the same hymn sheet. Presidential candidate Elizabeth Warren has launched a campaign of "economic patriotism" with active currency management.

The Economic Policy Institute in Washington proposes buying the bonds of any country engaged in currency manipulation to neutralize the effect. The U.S. Treasury is in charge of currency policy and can effectively order the Fed to support U.S. foreign policy objectives.

It reminds me of the Reagan Doctrine during the Cold War: playing Moscow at its own game by sponsoring guerrilla insurgencies (Nicaragua, Afghanistan, etc). It bled the Soviet Union dry.

This is the new world order that Mario Draghi faces as he tries to stop the eurozone from sliding into a deflationary quagmire. The ECB's market measure of inflation expectations -- 5-year/5-year swaps -- have collapsed with all the nefast consequences this has for nominal GDP growth and Italy's debt trajectory.

Yields on 10-year Bunds have crashed to minus 0.30 percent. The bond markets are signalling an ice age. Clearly the decision to shut down the E2.6 trillion QE program in January and declare mission accomplished -- when Euroland was already in an industrial recession -- was a policy blunder. It was forced upon Mr. Draghi by hawks.

He is now taking revenge on the ECB's governing council with a fait accompli. Unless the eurozone starts to recover "additional stimulus will be required," and for good measure: "If the crisis has shown anything, it is that we will use all the flexibility within our mandate to fulfil our mandate," he said in Sintra.

This pledge was made without first securing the consent of the Teutonic bloc. Angela Merkel's Christian Democrats called it “an alarming signal for the ECB's integrity.” This time Mr. Draghi may have overreached in every sense.

The ECB can of course buy corporate bonds and bank debt (a shield for Italy). It can do some stealth monetization of public debt. But plain-vanilla QE at this stage is tinkering. Little more stimulus can be extracted by pulling down the long end of the yield curve. The curve is near inversion already.

"It is ceremonial. The ECB is powerless. It is scrounging about trying to create a sense of action, but none of this has any effect," says Ashoka Mody, a former bailout chief in Europe for the IMF and author of "Eurotragedy: a Drama in Nine Acts."

The deflationary cancer is now so deeply lodged in the eurozone that it would take helicopter money or People's QE -- monetary financing of public works -- to fight off any future global slump. Such action would violate the Lisbon Treaty and would test to destruction Germany's political acquiescence in the euro project.

In truth QE in Europe has always worked chiefly through devaluation. The euro's trade-weighted index fell 14 percent a year after Mr. Draghi first signalled in 2014 that bond purchases were coming. That was powerful stimulus. When the euro climbed back up the eurozone economy stalled.

It takes permanent suppression of the exchange rate to keep euroland going. As the Japanese have discovered, it is very hard for an economy with near zero inflation and a structural trade surplus to stop its exchange rate from rising unless it resorts to overt currency warfare. That is exactly what Mr. Trump is not going to allow.

Every avenue of monetary stimulus is cut off in the eurozone. Only fiscal stimulus a l'outrance -- 2 or 3 percent of GDP -- will be enough to weather a serious crisis. That too is blocked.

“The ECB has masked the fragility over the last seven years and nobody knows when the hour of truth will come,” said Jean Pisani-Ferry, economic adviser to France's Emmanuel Macron and a fellow at the Bruegel think tank.

“There is no common deposit scheme for banks. Cross-border investments are retreating. The vicious circle between banks and states could come return any moment,” he said.

Mario Draghi's rhetorical coup in July 2012 worked only because he secured a partial approval from Germany for the ECB to act as lender-of-last resort for Italy's debt (under strict conditions). That immediately halted an artificial crisis. The situation today is entirely different. The threat is a deflationary slump. The ECB has no answer to this.

Markets thought they heard a replay of "whatever it takes" in Mr. Draghi's speech and hit the buy button. But economists heard another note in Sintra: a plaintive appeal for EMU fiscal union before it is too late.

The exhausted monetary warrior was telling us that the ECB cannot alone save the European project a second time." -Ambrose Evans-Pritchard

•Chi si ferma di più alla spiaggia?

|

|

|

|

Post by Entendance on Jul 25, 2019 1:12:44 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

When different sovereign states are responsible for their own economic policies and are able to print and issue their own currencies on world markets, any distortions and maladjustments which occur in trade balances is alleviated by changes in exchange rate values – in short, devaluation. This will hopefully restore such imbalances and return to a trade equilibrium.