|

|

Post by Entendance on Mar 10, 2017 5:10:14 GMT -5

Apparet id quidem… etiam caeco: the EU project is dead. The EU is arrogance personified. Apparet id quidem… etiam caeco: the EU project is dead. The EU is arrogance personified.€, the currency of a failed political experiment: a one for all currency doomed to fail even before it was launched.

August 2017: Germans making fun of Trump and lauding Merkel. Here

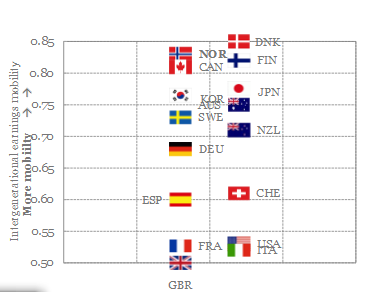

Here Fred & EntendanceInvestors Beach keep on showing you why. And this is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many.

The question is how long it will take for the whole thing to break up.

Psychopathic Times (Narcissist Nation) The Entendance Beach mentioned & inserted here Psychopathic Times (Narcissist Nation) The Entendance Beach mentioned & inserted here

20.05.2017 Greece: "Finance Ministry inspectors are about to start seeking out the owners of undeclared properties, while the law will be amended to allow for financial products and the content of safe deposit boxes to be confiscated electronically.

The plan for the identification of taxpayers who have “forgotten” to declare their properties to the tax authorities is expected to be ready by year-end, according to the timetable of the Independent Authority for Public Revenue.

Tax authorities will receive support from the Land Register to that end, as by end-September IAPR inspectors are set to obtain access to the company’s database to draw details on properties. Any taxpayers identified as having skipped the declaration of their assets to the tax authorities will be asked to comply and declare them, along with paying the tax and fines dictated by law.

The IAPR is also waiting for Parliament to pass regulations permitting the mass confiscation of safe deposit box contents and financial assets such as securities. To date the process has been conducted in handwriting and is therefore particularly slow in locating the assets of taxpayers who have either concealed incomes or have major debts to the state.

Once the necessary regulations are in place for the operation of an automatic system to collect debts, the tax authorities will be able to issue online confiscation notices and immediately get their hands on the contents of safe deposit boxes, confiscating cash, precious stones, jewelry and so on. They will also be able to confiscate shares and other securities.

This year the tax authorities will focus their efforts on confiscations as they try to reduce the huge pile of expired debts to the state. In this context the Independent Authority for Public Revenue will auction 27 properties belonging to state debtors by the end of next month, with the aim of collecting 2.7 billion euros by the end of the year from old debts and another 690 million euros of new debts from major debtors."

***Tax authorities to chase undeclared properties

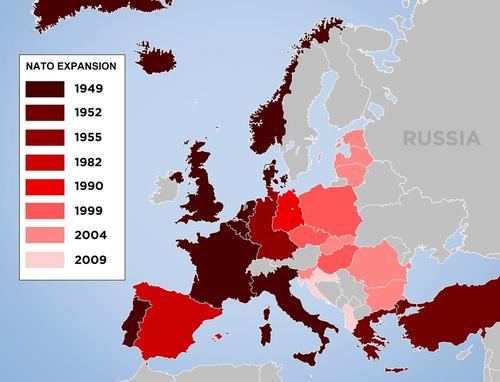

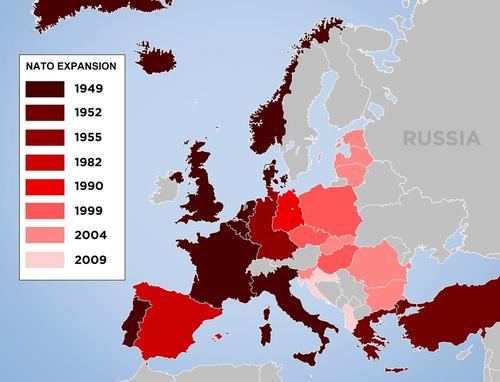

The purpose of NATO since the end of the Cold War in 1991 has been to destabilize Europe & encourage more war to pretend its not redundant.

As a direct result of US & NATO Regime Change operations, Slave Markets are now thriving in Libya Eisenhower warned us.

Nato and the Great Man-Made River of Gaddafi: What happened to it??

"...The EU in its present form cannot continue, and any options that would have allowed reforming it have been closed off due to its very structure. To preserve the EU, Germany would have to convince its own people to take quite a few steps back. That is never going to happen..."

Warning from Paul Craig Roberts:"...The United States no longer has a leftwing, and neither does Europe, Greece least of all, a country whose “leftwing” government has agreed that Greece’s creditors can loot and plunder the Greek people and the public assets of Greece in behalf of the One Percent. The British Labour Party is as rightwing as the Conservatives, and the French socialist party is more rightwing and much more acceptant of American overlordship than General Charles De Gaulle.

In Germany the electorate has put in place as Chancellor of Germany a US puppet who represents Washington, not the German people. And she will continue to represent Washington, even if it means war with Russia. In Germany the electorate has put in place as Chancellor of Germany a US puppet who represents Washington, not the German people. And she will continue to represent Washington, even if it means war with Russia.

The leftwing, once a force that attempted to hold governments accountable, has merged with the American Empire. The American “left” has now joined with the military/security complex to deep-six the prospect of detente with Russia..."

***Futures & More

Insisto firmiter: The EU project is dead. (Latecomers might read: ***Cognitive Dissonance, Confirmation Bias Economics & Politics)

Europe is not the same as the European Union. The European Union is only an episode in Europe’s history and is doomed to failure. EU is a failing political project with a currency that has caused economic misery and whose migrant policy has brought great division. The eurozone is not just a currency area, it is a capital accumulation regime in which certain tendencies prevail — including the tendencies to remove social protections, to decrease wages, and to abolish the social and political rights that are the core of citizenship. These effects are embedded in the architecture and the operation mode of the eurozone.

This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many. Here Fred & EntendanceInvestors Beach show why.

***PER QUELLI CHE L’€ NON FUNZIONA PERCHE’ SBAGLIARONO IL CONCAMBIO A 1936,27!

***Qui tacet, consentire videtur. Italiani ***Qui tacet, consentire videtur. Italiani

Apparet id quidem… etiam caeco. March 22, 2016-March 9, 2017: The stunning hypocrisy of the EU

Quod hodie non est, cras erit. March 1, 2016-March 6, 2017: Italians Did It Better!

“We are being schooled in an extraordinary cognitive dissonance...”***Why do politicians continue to push the zombie creed of austerity? Meanwhile...Germany’s ‘powerhouse’ economy is cracking

ALL you need to know about ***the ebola merkel

|

|

|

|

Post by Entendance on Mar 11, 2017 6:00:13 GMT -5

|

|

|

|

Post by Entendance on Mar 23, 2017 4:45:26 GMT -5

|

|

|

|

Post by Entendance on Mar 25, 2017 4:22:51 GMT -5

|

|

|

|

Post by Entendance on Mar 28, 2017 4:08:00 GMT -5

μολὼν λαβέ (having come, take them)

***Think of it. Always.***

***Poverty in Greece Gone Up 40% Since 2008

"...A perfect crime. After all, Deutsche Bank and Goldman Sachs helped cook the books so Greece could join the eurozone.

This really is a golden age for international criminal cabals. Al Capone was a chump."

***Greece to Surrender Gold, Utilities and Real Estate in Exchange For Pieces of Paper Printed in Brussels

"Sometimes you have to marvel at the absurdity of the financial universe in which we live.

On one side of the Atlantic, we have the United States of America, which triggered yet another debt ceiling disaster last Thursday when the US government’s maximum allowable debt reset to just over $20 trillion.

Of course, the US national debt is pretty much already at $20 trillion.

(That’s roughly $166,000 per taxpayer in the Land of the Free.)

This means that Uncle Sam is legally prohibited from ‘officially’ borrowing any more money.

But far be it from the US government to start living within its means. Sacrilege!

These guys have zero chance of making ends meet without going into debt.

Just last year, according to the government’s own financial report, their annual net loss totaled $1 TRILLION, and the national debt increased by $1.4 trillion.

And that was in a relatively stable year. There was no major war or financial crisis to fight. It was just business as usual.

This year isn’t going to be any different.

So, cut off from their normal debt supply (the bond market), the Treasury Department is resorting to what they call “extraordinary measures.”

They’re basically pillaging government employee retirement funds, and will continue to do so until Congress raises the debt ceiling.

It’s a repeat of what happened in 2015. And 2013. And 2011.

Pretty amazing to consider that the “richest” country in the world has to plunder retirement funds in order to keep the lights on.

Former US Treasury Secretary Larry Summers said it perfectly when he quipped “How long can the world’s biggest borrower remain the world’s biggest power?”

Then, of course, on the other side of the Atlantic, we have Greece, which is now in its NINTH YEAR of a major debt crisis.

Incredible.

Greece has had nine different governments since 2009. At least thirteen austerity measures. Multiple bailouts. Severe capital controls. And a full-out debt restructuring in which creditors accepted a 50% loss.

Yet despite all these measures GREECE IS STILL IN A DEBT CRISIS.

Right now, in fact, Greece is careening towards another major chapter in its never-ending debt drama.

Just like the United States, the Greek government is set to run out of money (yet again) in a few months and is in need of a fresh bailout from the IMF and EU.

(The EU is code for “Germany”…)

Without another bailout, Greece will go bust in July– this is basic arithmetic, not some wild theory.

And this matters.

If Greece defaults, everyone dumb enough to have loaned them money will take a BIG hit.

This includes a multitude of banks across Germany, Austria, France, and the rest of Europe.

Many of those banks already have extremely low levels of capital and simply cannot afford a major loss.

(Last year, for example, the IMF specifically singled out Germany’s Deutsche Bank as being the top contributor to systemic risk in the global financial system.)

So a Greek default poses as major risk to a number of those banks.

More importantly, due to the interconnectedness of the financial system, a Greek default poses a major risk to anyone with exposure to those banks.

Think about it like this: if Greece defaults and Bank A goes down, then Bank A will no longer be able to meet its obligations to Bank B. Bank B will suffer a loss as well.

A single event can set off a chain reaction, what’s called ‘contagion’ in finance.

And it’s possible that Greece could be that event.

This is what European officials have been so desperate to prevent for the last nine years, and why they’ve always come to the rescue with a bailout.

It has nothing to do with community or generosity. They’re hopelessly trying to prevent another 2008-style meltdown of the financial system.

But their measures have limits.

How much longer do Greek citizens accept being vassals of Germany, suffering through debilitating capital controls and austerity measures?

How much longer do German taxpayers continue forking over their hard-earned wages to bail out Greek retirees?

After all, they’ve spent nine years trying to ‘fix’ Greece, and the situation has only become worse.

For a continent that has been at war with itself for 10 centuries and only managed to play nice for the last 30 or so years, it’s foolish to expect these bailouts to last forever.

And whether it’s this July or some date in the future, Greece could end up being the catalyst which sets off a chain reaction on both sides of the Atlantic." -Simon Black

Fire sale. The minister actually called these practices ‘cannibalistic’, and rightly so. And that’s not even the best of it. A Greek paper details how a Greek bank, Alpha Bank, lends the money to German investors to buy up Greece’s Public Power Corp. That is about as close to cannibalism as you can get. Economic warfare 101. ***Troika Pushes Greece To Sell Up To 40% Of State-Controlled Power Utility

More warfare, more cannibalism. Airports also ‘privatized’, ‘reformed’. Alpha Bank is also the largest lender in this case. Nice partners too: “..the International Finance Corporation (€154.1 million), a member of the World Bank Group [..] is also the sole provider of euro interest rate hedging swaps...”***Fraport Greece Signs Funding Deal With 5 Lenders

But domestic credit is still collapsing. And so is the economy, of course. ***Contraction Of Credit Continues Unabated In Greece

Mikis Theodorakis: In Tough Times, Greeks Become Heroes or Slaves

Inquiring Minds Researching Only: ***4 pages about Greece

***Why Brexit Makes Gold A Buy Sound and Honest Money: Fred & Entendance Gold & Silver Beach

|

|

|

|

Post by Entendance on Mar 30, 2017 5:38:23 GMT -5

|

|

|

|

Post by Entendance on Mar 31, 2017 9:34:48 GMT -5

Under plans being considered by Ministers, the EU could end up owing Britain billions!

According to The Telegraph, the UK could be entitled to £9 billion from the European Investment Bank as well as a further £14 billion in property and other assets we’ve helped pay for over the years.

A government source said: “This is being presented in a binary way as a divorce bill, in which we owe them. It’s not like that. It’s more like leaving a gym or a club. You don’t continue to pay for other people to use the facilities after you leave”.

The Lords’ Committee concluded that the Government doesn’t legally have to pay Brussels anything, The EU may come to regret coming out with the ridiculous £50 billion figure so early!

Brexit Leader Farage: European Union Just Lost Whatever Credibility they Had in the U.S. Video here

"...The idea that the EU is in control of anything is like saying the captain of the Titanic was in control of the ship going down..." More Ridiculous Brexit Discussions Regarding “Control”:***Domino Theory in Play?

Von den übrigen 27 EU-Mitgliedern forderte Schäuble Geschlossenheit. Man werde versuchen, „die verschiedenen EU-Staaten mit ihren speziellen Interessen gegeneinander auszuspielen“. Das gelte auch für Deutschland mit seinen großen Automobilproduzenten und anderen Exporteuren. „Aber wir dürfen uns nicht teilen lassen, sondern müssen einig sein in den Gesprächen mit der Regierung in London“, forderte der CDU-Politiker... ***Schäuble zu Brexit: Für Briten „keine Rechte ohne Pflichten“

***Germany made €100bn profit on Greek crisis

"....Mass immigration from incompatible cultures, particularly from the Islamic world, is gradually undermining law and order in many Western cities. If Western media refuse frankly to acknowledge this fact, they are putting the long-term survival of our societies seriously at risk."

***Measuring Redenomination Risk In Italy

"...Welcome to the new Italy, where the replacement of the original population, once known as Italians, is in full swing..." ***A planned forced replacement of Europeans

|

|

|

|

Post by Entendance on Apr 4, 2017 4:47:39 GMT -5

"...La base del Movimento 5 Stelle non esiste praticamente più. Chi osa contestare ciò che viene deciso in alto viene deriso, umiliato, vilipeso e infine cacciato. Le persone intelligenti o indipendenti sono state già spunte fuori, restano solo coloro che sono interessati esclusivamente al potere, senza mai entrare nel merito delle questioni. Il potere per il potere. La dinamica da partito fascista, a lungo adottata, ha passato il testimone ad una dinamica da organizzazione criminale: omertà, dossieraggi, macchine del fango. Solo la criminalità organizzata - non certo un partito politico - si regge su degli stilemi simili...."***Con Farmacap il M5S passa dai modi fascisti ai modi mafiosi. Ma tutti tacciono "...La base del Movimento 5 Stelle non esiste praticamente più. Chi osa contestare ciò che viene deciso in alto viene deriso, umiliato, vilipeso e infine cacciato. Le persone intelligenti o indipendenti sono state già spunte fuori, restano solo coloro che sono interessati esclusivamente al potere, senza mai entrare nel merito delle questioni. Il potere per il potere. La dinamica da partito fascista, a lungo adottata, ha passato il testimone ad una dinamica da organizzazione criminale: omertà, dossieraggi, macchine del fango. Solo la criminalità organizzata - non certo un partito politico - si regge su degli stilemi simili...."***Con Farmacap il M5S passa dai modi fascisti ai modi mafiosi. Ma tutti tacciono

(Jan 10, 2017 at 12:00am Caro Carlo...)

*** Riflessioni sulla democrazia diretta e su quanto sia ipocrita proporla a Roma

"...buona parte della discesa del potere d'acquisto (pari, come ho detto, allo 0.9%) è spiegata dalla discesa dei redditi nominali (pari allo 0.6%). Sì, siamo in media più poveri, e solo un terzo di questo impoverimento è spiegato dai (maggiori) prezzi: due terzi sono spiegati dai (minori) salari..." -Alberto Bagnai qui

Euro area is not working. Period.

***Youth Unemployment Shows Euro-Area Recovery Not Working for All

The Greek economy cannot survive. It will keep on shrinking. There is no other possibility as long as there is a Troika. Economies run on consumer spending, and that keeps on falling in Greece. It needs stimulus, not austerity. Europe is creating a powder keg here. ***Austerity-Crushed Greek Households Keep Cutting Food Purchases

Meanwhile...Frontex plays a very ugly role here. We saw that coming from miles away. ***New Evidence Undermines EU Report Tying Refugee Rescue Group to Smugglers

More at Bota na conta do Papa |

|

|

|

Post by Entendance on Apr 6, 2017 3:49:19 GMT -5

***Islamic Banks are Increasing their Share of the EU Market

***Mr. Bean-draghi

"...As it seems, people in the euro area about to learn an old lesson: namely that unbacked paper money — which is what the euro represents — cannot be trusted. Or, as Thomas Paine put it: “Paper money appears at first sight to be a great saving, or rather that it costs nothing; but it is the dearest money there is.”

***The Next Step in Europe's Negative-Interest-Rate Experiment

![]()

***Euro Saves Germany, Slaughters the PIGS, & Feeds the BLICS

***Europe's Out-of-Control Censorship

"...If Western Civilization is to be salvaged, those who seek its destruction must be removed from their positions of authority and influence. Whether through political means, armed revolt, or de-legitimization, those who hold such power must be toppled. Exposing “Pope Francis” for what he is, or is not, will go a long way in that most vital and necessary task." ***Traitor to Western Civilization

More at Bota na conta do Papa

|

|

|

|

Post by Entendance on Apr 7, 2017 17:28:24 GMT -5

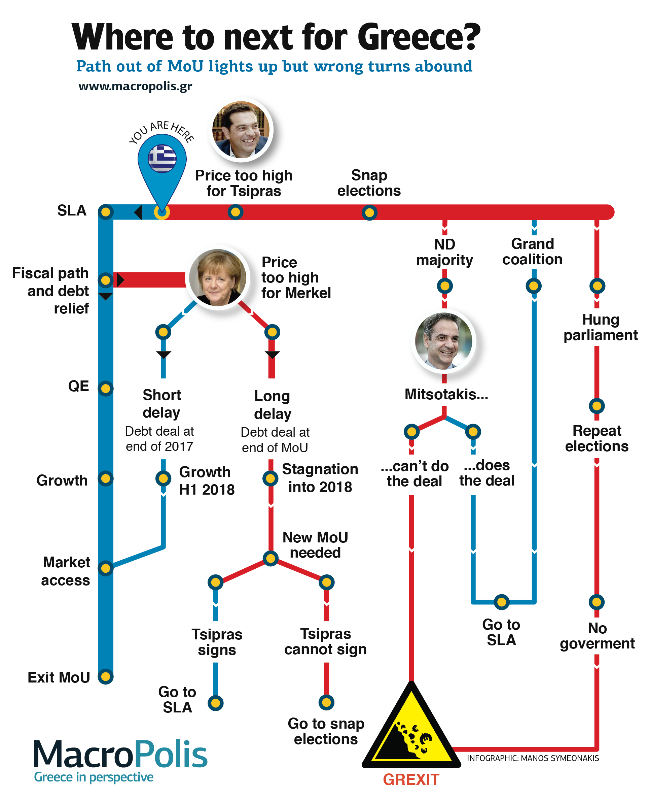

This could well be the end of Tsipras, and of SYRIZA...Greece on course to avoid debt default as Athens agrees pension cuts

This article identifies the headwinds faced by the EU in the wake of Brexit. Without the UK, not only does the EU lose much of its importance on the world stage, but the Commission’s budget is left with an enormous hole. That is the decline. The fall is well under way, with capital flight significantly worse than generally realised, as a proper understanding of TARGET2 imbalances shows. Not only is the ECB running out of options, but without major support from Germany, France and Italy, Brussels itself faces a financial crisis. In a highly unusual move, Jamie Dimon of JP Morgan in a letter to his shareholders this week backtracked on his earlier pre-Brexit threat to move jobs from London, declaring that the problem is Europe itself. Decline…….and fall

The abandonment of the EU by Britain looks like a stroke of luck – for Britain, if she can extricate herself in time. It exposes the EU for what it is: a failing post-war project. An agglomeration of disparate nations, cobbled together, planned by America in the post-war years, now finds the new American President no longer supports it. The parent is abandoning its child, and so is Britain, American’s closest strategic partner... ***The decline and fall of the EU

"As we watch the so-called migration crisis, we pose to ourselves questions. What’s the sense, what’s the purpose? We are told we need workforce, yet there are millions of unemployed young Europeans; we are told we are paying for the sins of the yesteryear of colonialism, yet drawing people from the third world, we strip the countries of origin of brains and hands i.e. act as colonialists. We are told these are refugees, yet we must get down to work to integrate them as if refugees by definition were not people who plan on returning to their war-torn countries after the conflict is over. We are told the third-world immigrants are enriching us, yet we observe street riots, crime rate increase, reinforced police units in our streets and a number of East European countries defending themselves from being blessed with this enrichment. We are told the newcomers will integrate, yet we see separate city boroughs, no-go zones, oriental attire on the increase and parallel societies. We are told diversity is our strength, and yet we receive news now and again about ethnic, racial and religious conflicts from regions around the globe which are immersed in diversity. We are told this, we are told that, but none of the advanced arguments add up, and we instinctively feel an approaching disaster. What is really going on? If it is not economy, aid, enrichment, neo-colonialism, then what is it? Why all of a sudden this influx of aliens, why all of a sudden this readiness to accommodate them? Africa or Asia (as any other continent) have been ravaged by wars for centuries, and yet Europe has never ever before experienced the human flood therefrom. What’s going on?..." ***Heresies or Inexplicable Collective Behaviour

Fred & EntendanceInvestors Beach, Bijoutier, Outer Islands, Seychelles

"You’re never going to save everyone. There are some people that are never going to get it. It’s sad, but true.

There will always be investors that can’t help themselves or get out of their own way.

I used to think everyone could be saved if they would only learn. But changing behavior is simply too difficult for many.

In order for one group of investors to prosper, another group has to fail. It’s an unfortunate truth of the financial markets."

-Ben Carlson

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

|

|

|

|

Post by Entendance on Apr 12, 2017 9:44:55 GMT -5

...“Fake elites create their own realities” — so said the billionaire businessman turned politician with a heartfelt streak of the populist and an occasional motor-mouth to get him into hot water. He transformed an entire political landscape while campaigning for the rights of the domestic worker versus global labor, against the EU, against international interventionism and for strongly vetted immigration as part of a maverick agenda to shake up and stay aloof of the post-war international system.

Yet this is not Trump, but rather his wealthier Swiss counterpart — Christoph Blocher —who anticipated the new American president by more than a decade. Blocher, who is now vice president of the Swiss People’s Party (SVP) and its former head through 2007, rose, Tillerson-like, from lowly student trainee to CEO of the Swiss plastics maker EMS Chemie. He is the best example of the anti-globalist, Trump spirit that is also spreading throughout Europe.

“People feel powerless against those who rule them, and for them, Trump is a release valve,” Blocher said in an interview after the November elections in the US. “The unexpected result ... should give pause to those who are in power around the world.”

This coming year, France, and Germany — and possibly Italy — will hold elections in which debate is likely to be driven by populist parties over issues including immigration. In Switzerland, Blocher has presided over certain campaigns that invited EU wrath for their severity. These included the 2009 Swiss referendum against building of minarets on mosques, which captured 57.5 percent of the national vote; the initiative to expel foreign criminals, garnering 52.3 percent, and the Stop Mass Immigration Initiative, which passed at 50.3 percent.

Blocher is one among many anti-globalist Europeans who have taken the stage in the past several years, a spotlight that is joined by the likes of Marie Le Pen of France, Geert Wilders of the Netherlands, the rise of the ‘Alternative for Germany’ party; Viktor Orban of Hungary, not to mention the Brexit vote itself. Essentially, the EU experiment is over because it was never wished for in the first place and Trump is a kind of transatlantic spiritual horseman to hasten in the apocalypse.

It has been a long time coming: just over a decade ago, the French voted down the European Constitution Treaty, which was supposed to replace existing EU treaties and institute key changes such as the appointment of an EU foreign minister. This was followed by an even stronger “No” in the Netherlands three days later. These “No” votes succeeded where the Danish 1992 “No” to the Maastricht Treaty and the Irish 2000 “No” to the Treaty of Nice had failed, forcing EU leaders to come up with a new reform treaty, the Lisbon Treaty.

Europe never learned from those lessons, but Trump did: the Brexit referendum of last July emphasized a key reality of twenty-first-century politics, that the divide is not so much Left versus Right but one of globalists versus localists.

On the one hand are the global financial authorities, the EU, the banks and big business and many pro free-trade economists; on the other a strange combination of radical leftists opposed to austerity and ‘neoliberalism’ (however defined), as well as nationalists and conservatives. The difference these days is that the former also go in for utopian ideals, whether it’s the euro or immigration, because they ignore the social implications of trendy group-think and think only in terms of economics not history.

Part of the problem is that Europhiles often confuse the EU with the original post-war European project, which was based on the concepts of peace, harmony, and social justice. In the wake of World War II and the Holocaust, the European project set out to build a united continent. On the eve of the euro launch in January 1999, Germany’s finance minister Oskar Lafontaine poetically spoke of “the vision of a united Europe, to be reached through the gradual convergence of living standards, the deepening of democracy, and the flowering of a truly European culture.”

Instead, Europe has been transported light years from this utopian vision. After several years of austerity, the Eurozone crisis has escalated into a social catastrophe. The cost has been borne out in terms of jobs, wages, economic growth, and blighted lives. Currently, there are almost 21 million unemployed people in the EU. For its part, the Maastricht criteria were intended to facilitate the convergence toward the euro and, beyond this, to ever closer union among members. In order to qualify for the euro currency, both Greece and Italy turned to the likes of Goldman Sachs, JP Morgan, and other banks. The banks advised them to mask debts using derivatives. The rest, as they say, is history.

The End of an Era?

As the London Spectator recently observed, Trump’s attitude to Europe is nothing short of revolutionary. With a few words in Trump Tower, he seems to have torn up decades of US State Department policy. “People want their own identity,” he says, “so if you ask me, others, I believe others will leave.” He believes, as has been mentioned, in nation-states, and he does not see the EU as representative of the continent. In fact, he says, it is “basically a vehicle for Germany.”

It’s hard to overstate the effect of these words on the EU. The whole project of the European Union was always nurtured with American backing: since the Marshall Plan, US policy has been to consolidate Europe’s strength. America used trade and NATO to make the continent a bulwark against the East. Often, this meant putting off or sacrificing America’s short-term economic gains in the interests of security and world peace.

Trump has no time for that. He believes that the world has changed, and he wants better deals for America now, and Europe — a real set of allies — is paying attention. ***The Anti-Globalist Agenda

***Le Pen sets out presidency plans

|

|

|

|

Post by Entendance on Apr 19, 2017 4:33:59 GMT -5

|

|

|

|

Post by Entendance on May 8, 2017 13:19:08 GMT -5

They're all happy with Macron's win...France Elects Its Bankster

"See you on the barricades, babe"

Rothschild Banker & Globalist Corporate Fascist Macron renames his party to La République En Marche

Or R.E.M. End of the world as we know it. <...Viviamo, si sa, un’epoca in cui cadono le illusioni sulla democraticità delle nostre istituzioni, un’epoca di massiccia e costante guerra psicologica, un’epoca in cui la razionalità è una merce sempre più rara. Sono tempi in cui si potrebbe leggere sul giornale: “la nuova sfida della frittata: diventare uovo”...>

(...Rationality is an increasingly rare commodity. There are times when one could read in the newspaper: "the new challenge of the omelette: to become an egg"...)

Meanwhile...Europe: Social Media Giants Will Force You To Use ID Cards To Log-in

Entendance on twitter |

|

|

|

Post by Entendance on May 10, 2017 4:33:52 GMT -5

Yes, Le Pen was right. Merkel rules France. "When Alexis Tsipras became prime minister in 2015 he raised the hopes of the radical left across Europe. But after six months, the turnaround of the SYRIZA-Independent Greeks coalition government was complete, as it adapted to the European order of things.

The conclusion is that guerrilla talk is good for coffee shops and that politics and policy are formed and enforced elsewhere..." European monotony

EU Sociopaths & Psychopaths: Your Complete Guide To The Predator Class is here

"...Brainwashed as the French are that it is fascist to stand up for France, the French voted for the international bankers and for the EU.

The French election was a disaster for Europeans, but it was a huge victory for the American neoconservatives who will now be able to push Russia to war without European opposition." Paul Craig Roberts: French Election A Catastrophe For World Peace

"First mistake: Emmanuel Macron’s handlers played Beethoven’s “Ode to Joy” instead of the French national anthem at the winner’s election rally. Well, at least they didn’t play “Deutschland Über Alles.” The tensions in the Euroland situation remain..." James Howard Kunstler: Paris Afterparty

They want it all, all of Greece. Beware. Germany says Greece to use Gold, real estate as collateral if IMF out of program

Meanwhile...Brussels pisses on Greek courts. Greek Court Finds New Pension Cuts Illegal Under Greek, European Law

Nothing new here. Will anything change now that an EU body finds the same many others have before them? Damning Findings From EU Audit Of Greek & Italian Refugee “Hotspots” (Oxfam)

Buy gold & silver bullions, then store them outside their banking system. E.

|

|

|

|

Post by Entendance on May 18, 2017 4:54:33 GMT -5

|

|

|

|

Post by Entendance on May 23, 2017 5:00:00 GMT -5

"...Italy may think that it is protecting G7 leaders such as Angela Merkel from potential terrorist attacks during the G7 meeting in Taormina by closing Sicilian harbors to migrants. But by shielding from reality politicians who are already solidly detached from it, they are exposing the European citizenry -- whom those politicians are supposed to protect -- to even greater risks." ***Europe's Leaders: Shielding Themselves from Reality

Meanwhile...Greek Debt Groundhog Day: Deal Collapses After 8 Hours Of Negotiation

"...For the good of mankind, not only should Jorge Bergoglio be ignored as supreme Roman pontiff, but he should likewise be ignored when speaking on any and all public policy matters." ***Papal Delusions

|

|

|

|

Post by Entendance on May 25, 2017 5:16:02 GMT -5

|

|

|

|

Post by Entendance on Jun 5, 2017 6:41:37 GMT -5

|

|

|

|

Post by Entendance on Jun 6, 2017 2:58:10 GMT -5

June 24, 2017:*** How to safely protect your life your liberty and your assets

***The ECB Blames Inflation on Everything but Itself***

"...While the outlook for Europeans may currently appear grim, it is not hopeless. While Pope Francis and Angela Merkel cannot at present be deposed for their crimes, ***they can be defeated in the court of public opinion. For Europe to become once again the center of human civilization, the ideals of multiculturalism and the fraud of global warming must be slain on ideological grounds..." "...While the outlook for Europeans may currently appear grim, it is not hopeless. While Pope Francis and Angela Merkel cannot at present be deposed for their crimes, ***they can be defeated in the court of public opinion. For Europe to become once again the center of human civilization, the ideals of multiculturalism and the fraud of global warming must be slain on ideological grounds..."

Italian Banks: "Nell’era del neo liberismo lo Stato serve principalmente a questo: a sollevare i ricchi privati dalle loro responsabilità e ad evitare che paghino per gli errori, le manipolazioni, i giochi irresponsabili, le grassazioni che hanno compiuto. Ed è quanto sta accadendo anche con la generosa offerta di Banca Intesa di comprare per un euro la Popolare di Vicenza e Veneto Banca, soffocate ormai dalle conseguenze di gestioni opache: detto così, come del resto viene comunicato dai canali televisivi, sembrerebbe un atto di generosità mentre al contrario si tratta di una vera e propria truffa nei confronti dei cittadini, uno di quei giochi che l’elite è ormai libera di fare avendo in mano l’informazione e tenendo in tasca la politica.

Banca Intesa infatti vuole affrontare la spesa di un euro, ma solo per la parte buona dei due istituti di credito, ovvero gli sportelli, i beni patrimoniali, i titoli di stato posseduti e i crediti esigibili, ovvero quelli in massima parte detenuti dai poveracci col mutuo o con il micro prestito , mentre lascerà i titoli tossici, i crediti inesigibili o che non si vogliono esigere, le partecipazioni azionarie fallimentari alla creanda “cattiva banca” (in italiano si esce fuori dagli eufemismi anglofoni) che in sostanza si accollerà tutti i debiti e che ovviamente verrà finanziata dallo stato e dai piccoli risparmiatori con in mano le obbligazioni subordinate. Il mondo della politica ringrazia perché questa generosa offerta gli evita di perdere la faccia nel caso di una bancarotta che prevederebbe anche la mattanza dei conti sopra i centomila euro, secondo gli accordi che loro stessi hanno firmato. Conti che prevalentemente sono quelli di chi per vocazione o necessità fa affari con la politica e che si vendicherebbero.

Banca Intesa sa bene come sfruttare questa gratitudine estorta al prezzo di un euro: per ora si accontenta appena di chiedere la messa in mora della democrazia, della giustizia e della stessa Costituzione, esigendo per portare a termine l’operazione una serie di norme che la sollevino da tutte le pendenze legali presenti, future o semplicemente possibili che riguardano gli istituti incamerati. Insomma lo Stato, ovvero tutti noi, non è altro che un donatore di sangue affinché i ricchi possano fare affari estorcendo di fatto prestiti a fondo perduto per ripianare le voragini create dagli errori e dagli inganni. Nulla viene dato in cambio, non c’è alcuna contropartita in denaro e nemmeno alcuna nazionalizzazione che dovrebbe essere quanto meno doverosa in questi casi, ma solo debito pubblico che i cittadini dovranno ripagare in corpore vili e arricchimento privato: una delle ragioni per cui l’Europa canaglia chiude un occhio sugli sforamenti su questo capitolo e su quello di Monte Paschi.

Quanto all’arricchimento privato non c’è alcun dubbio: i soli prestiti personali e al consumo ( senza contare i mutui casa) ammontano ormai a quasi 260 miliardi di euro e con un interesse medio del 9 per cento l’anno, significa per il sistema bancario un trasferimento di circa 24 miliardi l’anno. E così Banca Intesa che già fa la parte del leone in questo campo si approprierà di molte posizioni sul microcredito al consumo sui quali potrà ampiamente lucrare. Del resto questo è il nuovo territorio di caccia delle banche dal momento che una parte notevole di questi prestiti avviene direttamente con la cessione del quinto dello stipendio (parliamo in gran parte dell’impiego pubblico a quello privato o precario ci pensano le finanziarie) realizzando un corto circuito tra lavoro e rapina. Parlo di rapina perché in realtà le operazioni di prestito delle banche non corrispondono a nulla se non alla digitazione di cifre su una tastiera, sono operazioni fittizie che trasferiscono il valore reale del lavoro in un debito senza alcun corrispettivo o con corrispettivo minimo, mai più alto del 5% del valore nominale complessivo.

Tutto questo ovviamente sta creando una bolla italiana che si aggiunge a quella in preparazione al di là dell’atlantico: per ora fa pil, anche se in misura molto modesta visto che il credito al consumo finisce per gran parte su prodotti importati e dunque realizzati altrove, ma si prepara a fare boom in un futuro probabilmente più prossimo di quanto non si pensi. L’unica soddisfazione sarà almeno di veder travolto un governo indecoroso e un ceto politico che azzanna democrazia per sopravvivere."

"...***tutto lo squadrone grillino del XIV aspetta pazientemente fine mese per passare all'incasso. Persone che sovente non avevano avuto mai un impiego in vita loro, oggi riescono a arrivare al ventisette e riscuotere fior di migliaia di euro..."

Roma:***12 mesi in 24 punti. Il disastro Raggi che nessuno avrebbe potuto prevedere ***L'incresciosa e misteriosa storia della querela di Paola Taverna contro Roma fa Schifo

Bilderberg Meeting: This year, Fabiola Gianotti, the Director General of CERN, is an unusual participant... it becomes abundantly clear that real science is in the hands of the global elite...***Why Is The Director of CERN At The Bilderberg Conference? ***Big Changes at Bilderberg This Year… A Good or Bad Sign?

The female versions of those old men who go on sex vacations to Thailand. Completely disgusting.

***Aging Open Border Swedish Spinsters Are Sleeping With Their Migrant Boy-Toys

Meanwhile...

"...Since the demographic decline is observable in all Western countries, we are in for Europeans being gradually replaced by peoples from Africa or South Asia. We are now at the eleventh hour and if we do not put an immediate stop to all immigration, the Dutch society will vanish into thin air..." ***Cerberus 2.0 predicts with scientific precision the disappearance of the Dutch population

◾The infiltration of this ideology is reminiscent of the spread of communism and should be defeated similarly -- not with weapons, but by exposing its true nature and providing an alternative. The West first must abandon, however, the notion that radical Islam is an internal Muslim issue, any more than communism was a "Russian issue" that "the Russians" needed to solve. ***Defeating Extremist Islam - A Western Imperative

In Gold We Trust 2018 Report!

|

|

|

|

Post by Entendance on Jun 27, 2017 5:25:20 GMT -5

|

|

|

|

Post by Entendance on Jun 30, 2017 12:25:18 GMT -5

|

|

|

|

Post by Entendance on Jul 15, 2017 4:44:25 GMT -5

*** Southern Europe: getting poorer and hotter.

***The War On Cash ***The War On Cash

Money that could have helped Greece escape the claws of Schäuble & all. The pattern is not coincidental. *** Germany Profits From Greek Debt Crisis

"The Mediterranean island of Cyprus is a place where Europe and Asia converge in a struggle for geopolitical influence. Now its importance in the international arena has increased as never before: the war in Syria, attempts at NATO expansion and the Chinese New Silk Road project – all of these processes affect Cyprus one way or another and make it a focus area for many countries, including Russia..." ***Cyprus is at the Crossroads of the “Civilization Clash”

***Europe's Quietly Growing Poor Population Is Getting Louder

"With the Italian banking system in the spotlight, analysts have highlighted that Germany’s lenders are still not out of the woods, saying shipping loans and too many bank branches are some of the very real problems they are currently facing. German officials repeatedly tell EU members from the south of Europe to restructure their banking systems but industry experts believe they have a problem of their own as federal elections approach. “Germany is overbanked, too many banks, very little consolidation has taken place,” Carsten Brzeski, chief economist at ING Germany, told CNBC via email on Wednesday. There are approximately 2,400 separate banks with more than 45,000 branches throughout the country and over 700,000 employees, according to Commercial Banks Guide, an industry website..." ***German banks pose a threat that politicians want to hide, economist says

The Fred & E. Beach: all on Italian Banks

Evidence ***emerging from the Vatican in recent days strongly suggests Pope Francis is transforming the Catholic Church into a socialist political organization that embraces the LGBT agenda.

***Germany's Quest for 'Liberal' Islam

***Enjoy your day at the Beach ***Enjoy your day at the Beach

|

|

|

|

Post by Entendance on Jul 25, 2017 4:46:38 GMT -5

thanks to mr. Bean-draghi

***There Are More ‘Zombie’ Companies In Europe Now Than Pre-Lehman

“The Netherlands says they won’t let the UK be an offshore tax haven. That’s because they don’t want them taking their business.” ***Netherlands and UK are biggest channels for corporate tax avoidance

A tour de force by Bill Mitchell. Germany’s profiting so much off of Greece’s despair that it can hide its own economic pitholes with it. ***Germany fails to honour its part of the Greek bailout deal

"We could say that, just looking at the plight of Southern European countries after years of EU-imposed austerity, where trust in the European project is fading, while the euro currency is increasingly under question.

This time however, we look eastwards, at big, bad Visegrad. The group composed of Poland, Czechia, Slovakia and Hungary has shared and separate interests.

Among the former is their unwillingness to take part in the refugee relocation program. Why? Because Angela Merkel invited them without first consulting the rest of Europe.

This is unbearable for the EU leadership, who loves diversity and wants to pass it off as a way forward, unless it’s diversity of opinion, a core tenet of the liberal democracy they claim to represent. Liberalism that once was about “I disapprove of what you say, but I will defend to death your right to say it’’, a quote maybe erroneously attributed to Voltaire, has now become “I disapprove of what you say, so just don’t say it’’.

The problem is even deeper. The Visegrad bloc has gained independence from a forced solidarity, another international project, the Soviet Union, less than 3 decades ago. Their experience makes them wary of unelected, centralized utopias. And yet once again they found that they have been entrapped in another one. Just when they thought they left one dystopia to join the free world, the free world itself has turned into one. Solidarity is voluntary, it can’t be forced. Angela Merkel’s approach resembles that of the Soviets rather than free people. There’s a second element of discord in this diatribe: multiculturalism. Once again, the EU leadership has decided it’s a way forward, regardless of the discontent rising in Western countries against it..." More here  ***Bota na conta do Papa ***Bota na conta do Papa

Italiani: Ai rimasti

|

|

|

|

Post by Entendance on Aug 4, 2017 3:10:00 GMT -5

Well, if you build yourselves €1 billion offices, who cares? ***European commission spending thousands on 'air taxis' for top officials

What’s Keeping Italy’s Government Debt from Blowing Up?

***Even Italian banks are dumping Italian government bonds

How detructive mr. Bean-draghi’s and other central bankers’ QE really is. The bonds may go nuts, but Draghi IS nuts. Or rather, Europeans are nuts not to stop him.

"...If you want to earn a yield of about 2.4%, which instrument would you rather have in your portfolio, given that both produce about the same yield, and given that one has a significant chance of defaulting and getting you stuck with a big loss, while the other is considered the safest most boring financial investment out there?

The answer would normally be totally obvious, but not in the Draghi’s nutty bailiwick. That this sort of relentless and blind chase for yield – however fun it may be today – will lead to hair-raising losses later is a given. And we already know who will take those losses: The clients of these institutional investors, the beneficiaries of pension funds and life insurance retirement programs, the hapless owners of bond funds, and the like.

In terms of the broader economy: When no one can price risk anymore, when there’s in fact no apparent difference anymore between euro junk bonds and US Treasuries, then all kinds of bad economic decisions are going to be made and capital is going to get misallocated, and it’s going to be Draghi’s royal mess..." ***Euro Junk Bonds and “Reverse Yankees” Go Nuts

"...the relative effort to suppress the price of gold and silver is more intense now than in 2008. Given what occurred in 2008, I have to believe that fear emanating from the western banks currently is derived from events unfolding “behind the curtain” that are worse than what hit the system in 2008..." ***Western Central Bank Fear Of Gold Is In The Air

***Why haven’t any IMF officials been prosecuted for malpractice in Greece? ***Why haven’t any IMF officials been prosecuted for malpractice in Greece?

|

|

|

|

Post by Entendance on Aug 31, 2017 4:19:51 GMT -5

"...The AfD was founded in 2013 by a bunch of economics professors — at first they were mockingly called “Professorenpartei” (“professor’s party”) — who were fed up by the crisis in Greece and demanded a German exit from the Eurozone. Among them were economists like Joachim Starbatty and Roland Vaubel, known in Germany for their free-market ideas. The goal was to found a party which would reconcile the cultural conservatism that was lost in the conservative CDU and the liberal economic policies that were lost in the classical-liberal party, the FDP. However, the AfD focused increasingly on refugees instead of the euro, which led to the departure of many of its founding members in 2015, including the leader up to that point, Bernd Lucke..." ***Germany's New Political Party Is Just Another Big-Government Party

'I Want People to Open Their Eyes':***Why Ex-CDU Member Left German Ruling Party

German Election September 24:***What are the Coalition Possibilities?

"A new party will be on the ballot in the German national elections on September 24, with the  promising name ADD, “Allianz Deutscher Demokraten” (“Alliance of German Democrats”)..."More here promising name ADD, “Allianz Deutscher Demokraten” (“Alliance of German Democrats”)..."More here |

|

|

|

Post by Entendance on Sept 2, 2017 16:18:41 GMT -5

Geert Wilders talked at The Ambrosetti conference, Italy, Villa d’Este, September 2, 2017 "Ladies and gentlemen,

Thank you for having me here today. I applaud the fact that you invite someone who does not share your enthusiasm for the European Union. Or your European dream as Euro commissioner Frans Timmermans just called it. To be honest: his dream is my nightmare..."

***The Europe We Want

|

|

|

|

Post by Entendance on Sept 30, 2017 4:06:11 GMT -5

|

|

|

|

Post by Entendance on Oct 4, 2017 4:34:34 GMT -5

|

|

|

|

Post by Entendance on Oct 25, 2017 8:04:18 GMT -5

|

|

|

|

Post by Entendance on Nov 6, 2017 10:27:08 GMT -5

– German gold demand surges from 17 ton-a-year to a 100 ton-plus per year – German gold demand surges from 17 ton-a-year to a 100 ton-plus per year

– €6.8 Bln spent on German gold investment products in 2016, more per person than India and China

– Germans turned to gold during financial crises and ongoing euro debasement

– Evidence of latent retail demand on increased economic concerns

– “Gold fulfils an important long-term, wealth preservation role in German investors’ portfolios”...

November 6, 2017***German Investors Now World’s Largest Gold Buyers

"Ms. Merkel is in effect a lame duck." ***German Election: Merkel's Pyrrhic Victory

°°°°°°°°°°°°°°°

"◦It could take months rather than weeks for the coalition to be agreed. Any Jamaica variant – CDU, Greens and Free Democrats will be weak. The SDP aren’t going to play in coalition, but could stay neutral outside having learnt (like the UK Liberals) that standing to close to power got them torched.

◦There is a significant chance we won’t get a coalition deal – which is not being factored by market. Senior German insiders tell me there is a 35% chance of second vote. Some contacts close to the FDs are saying 50%.

◦Even if a new coalition is agreed it’s going to be very left leaning and much weaker than the previous Merkel Christian Democrat Alliance administration. (Even the CDU alliance is under pressure from the increasing strident Bavarian Christian Social Union – who remind me of Theresa May’s new found chums in Northern Ireland.)

◦A new coalition is going to be a fraxious grouping of contradictory bluster.

◦Germany is likely to be far more inward looking under this next administration and therefore less focused on sorting our European problems. Whoever fills the Finance ministry, their default response to any developing crisis in Europe will be ”Nein”!

◦Germans are not used to multiple elections – and a second vote early next year would be massive negative for Merkel herself – she may even have to stand down if coalition looks like falling. That could be massive shock.

◦The coalition parties all feel they will benefit from swings towards them because of the success of the right-wing AFD. That is going to push them both to demand more in negotiations with Merkel, and to fear a second election less. Both the FDs and the Greens are going to push for big concessions and a bigger role in the negotiating phase of the new coalition. They both feel a second election might play to them if folk switch to them in fear of the scale of the AFD vote, plus they see Merkel as damaged goods. They are apparently willing to push it right to the wire and don’t fear a second vote. The Greens and FDs are diametrically opposed on many policies. Common sense will not be a common commodity.

◦This has profound implications for the so-called French/German axis as it slides towards Paris. We are not going to see a new German government “waste time” on issues like closer EU union, European Banking Union, or critical finance issues like reforming ESM or new approaches on QE and Bailout funds. Forget Wiedemann for ECB president, it’s more likely to another Frenchman (Trichet II) – I’m sure its already underway.

In short.. Germany negotiations could get very fraxious while Europe is dragged down in its wake. I doubt the markets have discounted it yet."

***8 Reasons Why Bill Blain Is Suddenly Very Worried About Germany

***Merkel’s days as German Chancellor are probably now numbered

***All Things Must Pass

|

|

Apparet id quidem… etiam caeco: the EU project is dead. The EU is arrogance personified.

Apparet id quidem… etiam caeco: the EU project is dead. The EU is arrogance personified.

Psychopathic Times (Narcissist Nation) The Entendance Beach mentioned & inserted here

Psychopathic Times (Narcissist Nation) The Entendance Beach mentioned & inserted here

In Germany the electorate has put in place as Chancellor of Germany a US puppet who represents Washington, not the German people. And she will continue to represent Washington, even if it means war with Russia.

In Germany the electorate has put in place as Chancellor of Germany a US puppet who represents Washington, not the German people. And she will continue to represent Washington, even if it means war with Russia.

***Qui tacet, consentire videtur. Italiani

***Qui tacet, consentire videtur. Italiani

***

***

"...La base del Movimento 5 Stelle non esiste praticamente più. Chi osa contestare ciò che viene deciso in alto viene deriso, umiliato, vilipeso e infine cacciato. Le persone intelligenti o indipendenti sono state già spunte fuori, restano solo coloro che sono interessati esclusivamente al potere, senza mai entrare nel merito delle questioni. Il potere per il potere. La dinamica da partito fascista, a lungo adottata, ha passato il testimone ad una dinamica da organizzazione criminale: omertà, dossieraggi, macchine del fango. Solo la criminalità organizzata - non certo un partito politico - si regge su degli stilemi simili...."***

"...La base del Movimento 5 Stelle non esiste praticamente più. Chi osa contestare ciò che viene deciso in alto viene deriso, umiliato, vilipeso e infine cacciato. Le persone intelligenti o indipendenti sono state già spunte fuori, restano solo coloro che sono interessati esclusivamente al potere, senza mai entrare nel merito delle questioni. Il potere per il potere. La dinamica da partito fascista, a lungo adottata, ha passato il testimone ad una dinamica da organizzazione criminale: omertà, dossieraggi, macchine del fango. Solo la criminalità organizzata - non certo un partito politico - si regge su degli stilemi simili...."***

***

***

"...While the outlook for Europeans may currently appear grim, it is not hopeless. While Pope Francis and Angela Merkel cannot at present be deposed for their crimes, ***

"...While the outlook for Europeans may currently appear grim, it is not hopeless. While Pope Francis and Angela Merkel cannot at present be deposed for their crimes, ***

4 pages on***

4 pages on***

***

***

***

*** promising name ADD, “Allianz Deutscher Demokraten” (“Alliance of German Democrats”)..."More

promising name ADD, “Allianz Deutscher Demokraten” (“Alliance of German Democrats”)..."More

Welcome to Eurabia: ***

Welcome to Eurabia: *** Europe needs “brave banks” willing to conquer new territory

Europe needs “brave banks” willing to conquer new territory

***

***

– German gold demand surges from 17 ton-a-year to a 100 ton-plus per year

– German gold demand surges from 17 ton-a-year to a 100 ton-plus per year