|

|

Post by Entendance on Oct 25, 2015 3:58:08 GMT -5

Investors without the humility to admit mistakes are not going to last long. On the other hand, good investors who are willing to analyze their mistakes and be frank about what environments will and will not favor their strategies have the chance to transcend and become great. Remember: "There is only one corner of the universe you can be certain of improving, and that's your own self.”― Aldous Huxley

“Better to preserve capital on the downside rather than outperform on the upside” – William J. Lippman

Fred & Entendance Beach Mental Hygiene

"The power to change the world , is where it has always been . Not with the political powers , but in ourselves" .-Theo Ikummaq

Die Macht, die Welt zu ändern, befindet sich dort, wo sie schon immer war. Nicht bei den politischen Mächten, sondern in uns selbst.

Il potere di cambiare il mondo sta dove è sempre stato. Non dentro i palazzi del potere, ma dentro di noi.

|

|

|

|

Post by Entendance on Dec 17, 2015 9:42:39 GMT -5

|

|

|

|

Post by Entendance on Jan 12, 2016 16:43:12 GMT -5

"...An acute shortage of readily marketable physical gold is developing that we believe will deepen in years to come. This possibility seems to be unrecognized by those who are short the gold market through paper contracts.

The relentless dumping of synthetic or paper gold contracts since 2011 by speculators in Western financial markets has caused the shortage. The steady selling has driven down the price of physical gold, hobbled the gold-mining industry, and drained the stores of gold held in the vaults of Western financial centers.

We believe that the shortage will worsen because (1) the precursors of production (exploration, discovery, reserve life) are very negative, (2) the mining industry has little financial credibility and seems unlikely to attract capital even with a big rise in gold prices, and (3) refining capacity limitations tend to create supply bottlenecks when physical demand spikes..."

John Hathaway: Utopia For the Paper Gold Alchemists

Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours.

|

|

|

|

Post by Entendance on Jan 14, 2016 13:26:03 GMT -5

•European Union, January 2016, new EU bank bail-in procedures implemented on New Year's Day via the Bank Resolution and Recovery Directive. Central to the BRRD is the single resolution mechanism. The European Council (EU institution that defines the general political direction and priorities of the European Union ) said in a November 30, 2015, press release, "The single resolution mechanism (SRM) is aimed at ensuring the orderly resolution of failing banks without recourse to taxpayers' money. This will involve both a systematic recourse to the bail-in of shareholders and creditors, in line with the EU's directive on bank recovery and resolution, and the possible recourse to the SRF..." Note that bit about "creditors." From my research on the subject, it has been argued that the terms "creditors" and "depositors" are interchangeable. As such, depositors may be on the hook for a future EU bank bail-in as a result of this new setup...How to safely protect your life your liberty and your assets

Is Europe Choosing to Self-Destruct? Is Europe Choosing to Self-Destruct?

***************  The World’s Most Famous Case of Hyperinflation (Part 1 of 2) The World’s Most Famous Case of Hyperinflation (Part 1 of 2)

The World’s Most Famous Case of Hyperinflation (Part 2 of 2)

********************** ***Privatizzazioni: così ci siamo fatti rubare tutto!

There will be no sustainable rally based on fundamentals, and no general return to prosperity and growth, until the system is reformed.

As Simon Johnson noted a few years ago, there has been a financial coup d'etat. We talk about these things like they are abstractions, almost stories, things that are happening to someone else.

But it is real, and it is affecting your lives, and the real economy, every day.

"...In other words, S&P is now nothing more than a lackey for Brussels, threatening to send Polish yields higher if Poland does not fall in line...." S&P Enters The Latest European Scandal: Downgrades Poland From A- To BBB+

Quelli che ‘l’euro era giusto, ma il cambio era sbagliato’

|

|

|

|

Post by Entendance on Jan 31, 2016 5:56:34 GMT -5

|

|

|

|

Post by Entendance on Feb 12, 2016 11:32:11 GMT -5

|

|

|

|

Post by Entendance on Feb 15, 2016 6:43:51 GMT -5

Banksters!

Jeff Nielson: The Mystery of the One Bank: its Owners? " Roughly 2 ½ years ago ; readers were introduced to a paradigm of crime, corruption, and control which they now know as “the One Bank”. First they were presented with a definition and description of this crime syndicate.

That definition came via a massive computer model constructed by a trio of Swiss academics, and cited with favor by Forbes magazine . The computer model was based upon data involving more than 10 million “economic actors”, both individuals and corporations, and the conclusions which that model produced were nothing less than shocking.

The One Bank is “a super-entity” comprised of 144 corporate fronts, with approximately ¾ of these corporate fronts being financial intermediaries (i.e. “banks”). According to the Swiss computer model; via these 144 corporate tentacles, the One Bank controls approximately 40% of the global economy . The only thing more appalling than the massive size of this crime syndicate is its massive illegality.

Some of the strongest laws in the Western world were created precisely to prevent such corporate concentration from ever coming into existence, and thus the crime, corruption, and conspiracy which automatically accompanies it. These are our “anti-trust laws”, laws which our puppet governments have long since ceased to enforce. The evidence of this crime/corruption/conspiracy is all around us.

On a near weekly basis; the Big Banks of the West are caught-and-convicted (but never punished ), perpetrating criminal conspiracies literally thousands of times larger than any other financial crimes in human history. The U.S. government has now publicly proclaimed that its Big Banks have a license to steal .

All of these Big Banks are tentacles of the One Bank, and the list of names here (as identified by the Swiss researchers) is almost as infamous as the mega-crimes which they commit: Goldman Sachs, JPMorgan, Bank of America, Morgan Stanley, Citigroup, Deutsche Bank, Barclays, Credit Suisse, and UBS – for starters. But for many readers, this is now old news.

We observe the crimes of these corporate fronts, every day of our lives. We feel the impact of their crimes (on our standard of living) every day of our lives. However, these “banks” are ultimately merely the inanimate tools of crime. What many readers are now intent upon knowing goes beyond these tools, or even the mega-crimes which they are used to commit.

What people want to know is more basic. Who are the Criminals – the real Criminals? In this respect; we are not talking about the mere bankers, themselves. From the lowliest market-manipulating thugs to the upper stratosphere of CEO’s and central bankers, these are all merely foot soldiers, the psychopathic employees of the real Criminals.

The information wanted by readers is not the names of these employees. They are all nothing more than easily replaceable parts. The information of real value can be encapsulated in one, simple question: who owns the One Bank?

At first glance; the question appears elementary. The One Bank is a financial crime syndicate which controls 40% of the global economy – a global economy with annual GDP of roughly $70 trillion. Clearly the owners of the One Bank would have to be “the world’s richest people” (richest men?).

Here the Corporate media is only too happy to be of service to us. Once a year; we are presented with a “world’s richest list”, which is then parroted by all of the other outlets of the Big Media oligopoly, ad nauseum. Thus, we simply peruse this list for the names at the top, and we have our “owners” of the One Bank. Et voila!

Not so fast. As most regular readers are already well aware; the mainstream media oligopoly is nothing but more of the One Bank’s tentacles. Perhaps we should look a little more closely, before we simply pluck the names from the top of the list, and hail them as the One Bank’s owner-criminals?

In fact, such skepticism is well-justified. These supposed “world’s richest” lists, produced by the propaganda arm of the One Bank, are not worth the virtual paper on which they are written. Exposing the absurdity of such lists requires nothing more than accumulating some aggregate financial data, and then pulling out a calculator.

Fortunately, all of that work has already been done in a previous piece . Skipping to the bottom line; if we take the “world’s richest list” data, along with aggregate data on global wealth (all supplied by the Corporate media), we are presented with a world where total global wealth is supposedly a number in the low $10’s of trillions.

Meanwhile, if we look no further than the oceans of paper “wealth” fabricated by the financial sector (and the One Bank crime syndicate), already we approach a quantum somewhere around ½ quadrillion dollars, i.e. $500 trillion, and this completely excludes all real wealth in the world, in the form of hard assets.

The conclusion is obvious: more than 90% of the actual wealth in the world today (real and paper) is hidden from us , in terms of any data made readily available to the general public. This unimaginable hoard of wealth is certainly not being hidden by the vast majority of people at the bottom of the wealth totem-pole, therefore it can only be hidden at the top.

Equally clear; 90+% of all humanity’s wealth won’t be found by simply closer scrutiny of the supposed “world’s richest” people. If all of their fortunes were more than ten times larger than what is currently being reported, even the mathematically-challenged dolts of the mainstream media would quickly figure out that there was something amiss.

Instead, the only rational answer is that there is another, entire tier of the “world’s richest”, an echelon above all the B-List Billionaires on the official lists. The real “world’s richest” are, in fact, not billionaires at all, but rather trillionaires: the Oligarch Trillionaires who own (among other things) the One Bank.

How wealthy are these Oligarchs? Not only are these Oligarchs wealthy enough to be able to hide their names (and fortunes) from all public scrutiny, these trillionaires wield enough power to even prevent the word “trillionaire” from being recognized as an official word in our dictionaries. This absurdity was also noted in that prior commentary.

Consider this. We live in a world of banker-created, fraudulent, paper currencies, where the amount of paper instruments merely sloshing around in the world’s markets is in the thousands of trillions, yet, officially we have no word for “trillionaire”. This is like imagining a world where large numbers of (fat) sheep, cows, and pigs roamed the plains, but there was no word for “carnivore”. If you have one, you must have the other.

The Oligarch Trillionaires may be able to hide in the shadows, even in a world where every inch of the planet is regularly scanned by spy satellites, because they control (most of) the governments who own/operate these satellites. They may be able to cover up most traces of their obscene hoards of wealth, and even prevent us from learning the precise quantum of those hoards.

However, this doesn’t mean that the Oligarch Trillionaires have managed to erase all knowledge of their existence. For those looking for names which are at least probable candidates for the (real) “world’s richest” list, there is no better place to start than Charles Savoie’s historical chronology, The Silver Stealers.

In that compendium; Savoie has traced the deeds of many of these Oligarch families over the past 100+ years. He also identifies many of the (heavily overlapping) “organizations” which they have created, as vehicles for the administration/control of their Empire. For those who are skeptical that such a conspiracy-of-the-wealthy could trace back so far, we also have historical references.

In 1907, U.S. Congressman (and career prosecutor) Charles Lindbergh Sr. presented “The Bankers Manifesto of 1892” to the U.S. Congress. This grandiose declaration of the oligarchs of the 19 th century, antecedents of the Oligarch Trillionaires of today, is as prophetic as it is despicable.

In part, it reads:

When through the process of law, the common people have lost their homes they will be more tractable and easily governed through the influence of the strong arm of government applied to a central power of imperial wealth under the control of the leading financiers. People without homes will not quarrel with their leaders.

Look around us. The numbers of Homeless people in North America today already total in the millions, ignored by puppet governments which serve the Trillionaires, ignored by a mainstream media controlled by the Trillionaires. Meanwhile, a “central power of imperial wealth” rampages across the globe: the United States. Equally, there can be absolutely no doubt that it is “under the control of the leading financiers”, the Trillionaires.

Beyond the cast of suspects presented by Charles Savoie as the owning families behind the One Bank, one name (and clan) stands out above all others: the Rothschilds. We reach this conclusion via two, entirely separate lines of reasoning.

The One Bank is a crime syndicate which ultimately derives virtually all of its wealth/control via the power of the printing press, in the form of all of the West’s (and the world’s) private central banks, and primarily the Federal Reserve. When we search for some criminal clan most likely to base its empire of crime on the money-printing might (and corruption) of a central bank, we don’t have to look very far.

Give me control of a nation’s money, and I care not who makes its laws. - Mayer Amschel Rothschild (1744 – 1812)

Alternately, we reach this same conclusion via simple logic. We live in a world being (deliberately) drowned in debt . This is a process which, again, traces back roughly a century and more. In a world of debt, whoever starts with the largest fortune collects the most interest. In a world with total GDP of $70 trillion but total, outstanding debt in excess of $200 trillion, whoever collects the most interest will be the richest person on the planet.

Therefore, whoever was the richest person yesterday will be the richest person today. Whoever was the richest person a hundred years ago would almost certainly be the richest person today. In the 19 th century; the Rothschild clan was universally regarded as the wealthiest “house” on the planet. Then any/all precise records of their wealth simply disappeared – not the wealth itself.

The One Bank is a crime syndicate which is literally a blight against all humanity. Its owners are guilty of the worst crimes-against-humanity. And, ultimately, as the One Bank strips humanity bare of all its wealth, these Owners make it harder and harder for themselves to continue to hide."

More here

|

|

|

|

Post by Entendance on Feb 27, 2016 5:42:33 GMT -5

“... in the case of a country like Italy, where the banks own around €400 billion of government debt and are already severely undercapitalised, the effects on the banking system would be catastrophic.”

"...When Italy finally succumbs to reality, this year or next, the European project as they call it will face insurmountable hurdles and collapse on itself. In our view, seeing the parasitical edifice in Brussels disappear can only lead to good things. Maybe the Brits will save us the agony and end it June 23rd. One can only hope."

***How Italy will fail and drag down the European Project

|

|

|

|

Post by Entendance on Mar 9, 2016 16:23:51 GMT -5

***This 4,000-year old financial indicator says that a major crisis is looming ***This 4,000-year old financial indicator says that a major crisis is looming

EU-Turkey refugee deal a historic blow to rights EU-Turkey refugee deal a historic blow to rights

Refugee Shell Game

"...Refugees from war -torn countries are per definition not ‘illegal’. What is illegal, on the other hand, is to refuse them asylum... The funniest, though also potentially most disruptive, consequence of the proposed deal may well be that the visa requirements for the 75 million Turks to travel to Europe are to be abandoned in June, just 3 months away, giving them full Schengen privileges. Funny, because that raises the option of millions of Turkish people fleeing the Erdogan regime travelling to Europe as refugees, and doing it in a way that no-one can call illegal.

There may be as many as 20 million Kurds living in Turkey, and Erdogan has for all intents and purposes declared war on all of them. How about if half of them decide to start a new life in Europe? Can’t very well send them back to ‘safe third country’ Turkey." Be careful what you wish for, Angela

Mr. Bean-Draghi at his best

Got Silver?

|

|

|

|

Post by Entendance on Mar 23, 2016 13:19:46 GMT -5

Anyone so gullible as to think the Western media tells the truth should listen to this German journalist. Recently, Dr. Ulfakatte went on public television stating that he was forced to publish the works of intelligence agents under his own name, also adding that noncompliance with these orders would result in him losing his job.

He recently made an appearance on RT news to share these facts:

"I’ve been a journalist for about 25 years, and I was educated to lie, to betray, and not to tell the truth to the public.

But seeing right now within the last months how the German and American media tries to bring war to the people in Europe, to bring war to Russia — this is a point of no return and I’m going to stand up and say it is not right what I have done in the past, to manipulate people, to make propaganda against Russia, and it is not right what my colleagues do and have done in the past because they are bribed to betray the people, not only in Germany, all over Europe..." ***World Class Journalist Spills the Beans, Admits Mainstream Media is Completely Fake

***Credit Suisse Loss Forecast Revives Europe Bank Credit Concerns

Credit Suisse CEO Tidjane Thiam says Credit Suisse CEO Tidjane Thiam says he was surprised by his companies build up of risky and illiquid positions. Leading to big 1Q writedown he was surprised by his companies build up of risky and illiquid positions. Leading to big 1Q writedown

...putting aside the question of how the CEO is not informed about the risk of his book, remarkable banks admit a liquidity exposure risk ...

Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010 Swiss National Bank Admits It Spent $470 Billion On Currency Manipulation Since 2010

|

|

|

|

Post by Entendance on Apr 6, 2016 16:01:02 GMT -5

We live in a world of sin and sorrow, infected by a fraudulent democracy, facebook, and a corrupt money system... When you say you “have some money,” you usually believe that there is, somewhere, an electronic database in which it is recorded that you are the owner of some amount of currency.

You have $100,000 in your account, right? Does it mean that there is a little cubbyhole somewhere, with your name on it, in which you will find a stack of 1,000 Ben Franklins? Nope. Not even close. No cubbyhole. No stack of money. No nothing. Today, banks – and this could be said of the entire financial system – no longer have “money.” They have credits and debits. Your deposit is your bank’s liability and your asset...

Rotten to the Core

|

|

|

|

Post by Entendance on Apr 7, 2016 11:48:21 GMT -5

|

|

|

|

Post by Entendance on Apr 16, 2016 5:08:30 GMT -5

Banks refusing to transfer funds abroad

...Very often when a client wants to transfer funds out of his bank to buy gold through our company, the bank puts up all kind of obstacles. Often the bank will tell the client that he can’t transfer more than 100,000 dollars or Swiss Francs. Recently one American bank froze the account when the client instructed it to make a transfer to Switzerland of several hundred thousand dollars. When the client then demanded to unblock the funds, the bank reported the transaction to a fraud investigation unit. This is a first in our experience but it does show that banks will go to any length to stop transfers. Whether this obstruction was from government organisations or just internal in the bank is hard to say. What is very clear however is that in the next few years, many countries will implement exchange controls and there will be no possibility of transferring funds out of the country.

|

|

|

|

Post by Entendance on May 20, 2016 16:35:46 GMT -5

|

|

|

|

Post by Entendance on Jun 17, 2016 5:37:44 GMT -5

|

|

|

|

Post by Entendance on Jul 9, 2016 11:09:02 GMT -5

German Deutsche Bank faced threat of bankruptcy - ANALYSIS

More here More here

Many readers will notice I keep coming back to the chart below. This is Deutsche Bank’s CDS spread and it keeps going the wrong way fast (a CDS is a measure of risk – higher is bad). Things at European banks are not going okay, with Italian banks at the centre of the latest headlines (massive amounts of bad debt).

I’ve long highlighted Deutsche Bank as a canary in the coal mine for financial risk in Europe. “If Deutsche Bank were to go under, it would not be like Lehman Brothers where the doors were shuttered one day and everyone was out of a job the next. The German Government would take it over but not before much distress in the system. The problem is that Deutsche Bank has the second largest derivative book in the world behind JP Morgan and that is a serious concern. If the viability of Deutsche Bank were put in jeopardy, we would see many other Euro banks go under which would kick up all kinds of stress in the system reminiscent of 2008”.

|

|

|

|

Post by Entendance on Jul 20, 2016 9:40:43 GMT -5

Six Major Events That Will Change History

Investors globally have never faced risk of the magnitude that the we are now exposed to. But sadly very few are aware of the unprecedented risks the world is facing. For the ones who understand risk and take the right decisions, it will “lead to fortune”. Only very few will choose that route. Instead most investors will continue to live in the hope that current trends will go on forever but sadly these people will end up “in shallows and in miseries”.

Risk is now staring us all right in our face but very few people can actually see it.

Let’s just be clear what some of the events that will change the face of the earth are:

1.No Sovereign state will ever repay their debt – That is an irrefutable statement and anyone who doesn’t understand that lives in denial.Sovereign debt has increased exponentially in the last couple of decades and governments neither can nor have the intention of ever paying their creditors. They can’t even afford to pay the interest and this is why an ever increasing number of countries have negative interest rates. So not only will they not repay the capital but investors now pay bankrupt nations for the privilege of holding their worthless paper. It is incomprehensible that investors are prepared to hold nearer $100 trillion of debt with no yield or negative yield and no chance of getting their money back. No one worries about the return OF their money and now it seems that investors don’t even worry about getting a return ON their money. This is a shocking state of affairs that eventually will lead to a total collapse of all sovereign debt.

2.No bank will ever give depositors their money back – I know that very few believe this statement. Because, if bank depositors did, they would not hold around $200 trillion of assets in the financial system plus another $1.5 quadrillion derivatives in the banking system. Bank stocks in Europe, whether it is Deutsche Bank in Germany or bank Monte Paschi in Italy are continuing to crash to new lows. As I stated in a recent article, the share price of most European banks as well as many US banks like Citigroup or Bank of America have collapsed 70-95% since 2006 and they are on their way to ZERO. Consumer borrowing is still growing exponentially. Student loans in the US is now $1.4 trillion up a MERE 3x since 2006. And the delinquency rate is increasing exponentially as most students can’t find a job. 3.Stock markets will fall 90% or more – I know that most investors will think that this is a sensational statement from someone totally deranged. But let me just remind investors that when the Dow crashed 90% between 1929 and 1932, the economic conditions in the USA and the rest of the world were far superior to the ones we are experiencing currently. Economic conditions are deteriorating fast worldwide but stock markets are continuing to go up to dizzy levels. Investors are putting their faith in funny or printed money. S&P earnings have declined for 5 straight quarters. The Dow is now valued at a dizzy 24x GAAP earnings. And sales revenue, adjusted for share buybacks is down 1/3rd since 2006. Yes, governments worldwide will this year launch the most massive money printing programme in history. But that will be like pushing on a string and will have zero effect on the world economy. The time when the misconceived Keynesian methods of creating prosperity by printing worthless pieces of paper (or electronic money) is now passed. The printed money will only exacerbate the debt problem. And the world will soon learn that you cannot solve a problem by applying the same methods that caused the problem in the first place. 4.Property markets will collapse – Low interest rates and speculative frenzy have created bubble property markets worldwide. We had the first warning signal in 2006 but through massive money printing and guarantees to the extent of US$25 trillion, governments and central banks managed to postpone the inevitable. Since then global debt has increased by 2/3rd and interest rates have declined from around 6% to zero or negative. In Switzerland a 15-year mortgage now costs 1.25% and in Sweden you don’t need to ever amortise your mortgage. And in the UK, 6 major commercial property funds have now frozen redemptions. That represents 50% of the commercial property funds and is a grave sign that should be taken as seriously as the 2006 subprime crisis. China with its $34 trillion debt and many ghost towns and empty properties will also have massive problems.

5.Currencies will go to ZERO – The deficit spending of most countries and ensuing debt explosion will put continues pressure on all currencies. Most currencies have lost 97-99% in real terms in the last 100 years. The last 2-3% fall will probably take place in the next 4-7 years. But the problem is that this last fall is 100% from now. This means that all currencies will go to their intrinsic value of ZERO in the next few years. So any cash savings will be worthless.

6.Geopolitical risk, terrorism and social unrest – These risks are higher than ever in history whether it is in the Middle East, between the US and Russia, China etc or civil unrest in Europe, the US, China or the rest of the world. Social unrest, terrorism and civil war will also become part of normal life in many countries. What has happened in Paris, Brussels, Nice, Orlando, Baton Rouge and Turkey is just the beginning of a trend that will spread across the globe. It will lead to a much less safe world for many years. It will also reduce tourism and commercial flights dramatically. In a less secure environment, people will choose to stay at home.

The above sounds to many like a prophecy of doom and gloom. For investors who want the good news, they can just listen to any TV channel or read the newspapers. There are very few places where risk is spelt out properly. I obviously hope that my forecasts above are totally wrong. But I fear that I will be right. And therefore I believe that it is essential for investors as well as people who don’t have much to protect to take whatever measures they can.

Gold and silver will not solve all the potential problems or catastrophes that the world will encounter in the next few years. But it is probably the best insurance that investors can hold to protect capital against the potentially biggest destruction of wealth that the world has ever encountered. Naturally it must be physical gold and silver and it must be held outside of the financial system.

Egon von Greyerz

Founder and Managing Partner

Matterhorn Asset Management AG

|

|

|

|

Post by Entendance on Aug 12, 2016 3:53:42 GMT -5

|

|

|

|

Post by Entendance on Aug 30, 2016 7:43:59 GMT -5

750 million people. Add China’s polluted water, and you get well over a billion...

‘Toxic levels of arsenic’: Over half of S. Asia groundwater unusable for 750mn people, study says

More than half of south Asia's groundwater too contaminated to use – study

In the 2015, the World Water Development Report authored by the UN Environment Program (UNEP) warned that only 60 percent of the world’s demand for water will be met by existing resources at the current rate of use by 2030.

That would leave 40 percent of the population without access to the water it needs, the UN body said, and signs of this impending crisis are already there for all to see.

In South Asia, cities are increasingly feeling the pressure of population growth and urbanization. Previous media reports suggested that most Indian cities face daily water shortages, while in the Pakistani city of Karachi electricity and water shortages have led to protests and citywide unrest. |

|

|

|

Post by Entendance on Sept 11, 2016 4:28:03 GMT -5

And the Ship Goes Down

A currency crisis awaits

Tom Conrad: Negative rates make no sense. These bankers pretend it’s stimulative, that it will impel people to borrow but the economic distortion is huge. Where does the bank make any money? You’re entirely destroying the time-value of money. The bank is now totally dependent on its central bank to provide the cash it used to receive from the borrower.

|

|

|

|

Post by Entendance on Sept 12, 2016 4:17:56 GMT -5

The Majority of the World’s Population Lives in This Circle

There are now at least 3.8 billion people living inside the highlighted circle, and that’s not even including the tally from countries that are partially in the circle like Pakistan or Russia.

The circle holds 22 of the world’s 37 megacities – massive cities that hold at least 10 million inhabitants. It also includes the five most populous cities on the planet: Tokyo, Jakarta, Seoul, Karachi, and Shanghai, which alone combine to hold 144.5 million people.

This geographical region also holds many of the emerging markets of the future, countries that the World Economic Forum expects will lead global growth in years to come. Vietnam, Myanmar, Philippines, Indonesia, and Bangladesh are in the area highlighted, and Pakistan is partially there as well. The circle contains a lot of people, but it also has:

•The highest mountain (Everest)

•The deepest ocean trench (Mariana)

•More Muslims than outside of it.

•More Hindus than outside of it.

•More Buddhists than outside of it.

•More communists than outside of it.

•The least sparsely populated country on earth (Mongolia)

|

|

|

|

Post by Entendance on Oct 4, 2016 1:37:35 GMT -5

New IMF SDR weightings:

USD 41.73% (prev 41.9%)

EUR 30.93% (prev 37.4%)

RMB 10.92% (prev 0%)

JPY 8.33% (prev 9.4%)

GBP 8.09% (prev 11.3%)

The New SDR Will Lead To Gold And Silver Shortages

|

|

|

|

Post by Entendance on Nov 17, 2016 12:15:13 GMT -5

"Perceptions may well change when the global illusions of solvency and "growth" collapse in a heap..."

***The Pressing Problem Nobody Dares Discuss

The Fourth Industrial Revolution:*** what it means, how to respond

The System Won’t Survive the Robots It’s really just a matter of time; the working man’s deal with his overseers is half dead already. But there’s still inertia in the system, and even the losers are keeping the faith. Hope dies slowly, after all.

Nonetheless, the deal is collapsing and a new wave of robots will kill it altogether. Unless the overseers can pull back on technology – very fast and very hard – the deal that held through all our lifetimes will unwind.

We All Know the Deal

We usually don’t discuss what the “working man’s deal” is, but we know it just the same. It goes like this:

If you obey authority and support the system, you’ll be able to get a decent job. And if you work hard at your job, you’ll be able to buy a house and raise a small family.

This is what we were taught in school and on TV. It’s the deal our parents and grandparents clung to, and it’s even a fairly open deal. You can fight for the political faction of your choice and you can hold any number of religious and secular alliances, just as long as you stay loyal to the system overall.

This deal has been glamorized in many ways, such as, “Our children will be better off than we are,” “home ownership for everyone,” and of course, “the American Dream.” Except that it isn’t working anymore, or at least it isn’t working well enough.

Among current 20- and 30-year-olds, only about half are able to grasp the deal’s promises. That half is working like crazy, putting up with malignant corporatism and trying to keep ahead of the curve. The other half is dejected and discouraged, taking student loans to chase degrees (there’s more status in that than working at McDonald’s), or else they’re pacified with government handouts and distracted by Facebook.

The deal is plainly unavailable to about half of the young generation, but as I noted above, hope dies slowly and young people raised on promises are still waiting for the deal to kick in. It’s all they know.

Regardless, the deal has abandoned them. It has made them superfluous.

Here’s Why Put very simply, the deal is dying because two things can no longer coexist:

#1: New technology.

#2: A system geared to old technology.

Let’s start with new technology: New machines and methods have made so many jobs obsolete that there aren’t enough to go around. Both North America and Europe are already filled with the unemployed or underemployed children of industrial workers. But at the same time, we are suffering no shortages; we have an overflow of stuff and a double overload of inane ads trying to sell it all. And there’s something important to glean from this:

Where goods abound, additional jobs are not required.

We don’t need more workers. Machines are producing plenty of stuff for us, and this becomes truer every day.

Item #2 is the system itself; let’s confront that directly too: The system was designed to reap the incomes of industrial workers. Everything from withholding taxes to government schools was put in place to maximize the take from an industrial workforce. Whether purposely or simply by trial and error, the Western world was structured to keep industrial workers moving in a single direction and to reap from them as they went. Call it “efficient rulership” if you like, but the system is a reaping machine.

Technology, however, has advanced beyond the limits of this machine; it has eliminated too many jobs. At the same time, regulations make it almost impossible for the superfluous class to adapt. Nearly everything requires certification and starting a business is out of the question; fail to file a form you’ve never heard of and the IRS will skin you alive.

This system, however, will not change; the big corps paid for the current regulatory regime, and they still own their congressmen... MUST READ...MORE here

Former McDonalds CEO Crushes The Minimum Wage Lie: "It's Cheaper To Buy A Robot Than Hire At $15/Hour"

June 3, 2016 Walmart shows off new drone technology to replace workers Il robot consumatore

|

|

|

|

Post by Entendance on Dec 30, 2016 17:29:59 GMT -5

(ANSA) - MILANO, 30 DIC - Il 2016 è stato un anno da dimenticare per le banche italiane. Gli istituti quotati in Borsa sul Ftse Mib hanno bruciato 43 miliardi di euro di capitalizzazione, con l'indice Ftse Banche Italia sceso del 39%. Unicredit ha 'perso' 14,8 miliardi (-46,8%), Intesa 11 miliardi (-21,4%), Banco Popolare 4,95 miliardi (-75,7%), Ubi Banca 3,4 miliardi (-57,8%), Mps 3,2 miliardi (-87,8%), Bpm 2,46 miliardi (-60,8%), Fineco 1,39 miliardi (-30%), mentre Mediobanca (-12%) e Bper (-27,6) hanno perso circa 930 milioni a testa.

|

|

|

|

Post by Entendance on Jan 4, 2017 19:04:03 GMT -5

Bullion Star today has posted an interesting "infographic" about exchange-traded gold funds and its main point seems to be to remind investors that when they buy shares in gold ETFs, they are facilitating the fractional-reserve gold banking system -- that is, facilitating the artificial inflation of the gold supply, making gold seem more plentiful than it is and thus undermining the gold price. The Bullion Star "infographic" is here |

|

|

|

Post by Entendance on Jan 20, 2017 8:13:33 GMT -5

***Populism; the Danger? What About Debt?

"...Next up and out of the blue comes UniCredit, the country’s largest bank. It is seeking to raise €13bn of desperately needed capital but large as though this is, the biggest problems, according to the FT is that the smaller banks, like Banca Etruria, are now in a perilous position and on the verge of falling over the cliff edge.

Italy has banks on every street corner, with more branches per capita than any other OECD country. The lack of growth (occurred since it joined the Euro), has suppressed much needed profits on the one hand whilst seeing poor wage growth on the other, causing drastically increased non-performing loans that now add up to an eye-watering €360billion..."

|

|

|

|

Post by Entendance on Apr 6, 2017 5:08:21 GMT -5

"...The dollar’s reign as the world reserve currency will come to an end someday. But before that happens, the penny will likely go into the dustbin of monetary history." ***Death of Penny – What It Means!

Gold bullion refers to specific pieces of physical metal held in your name and title. It is not a paper proxy for gold, but the real thing—and you own it outright.

When you own gold bullion, you can never suffer a default. There’s no counterparty to make good on a paper contract. Once you buy gold bullion, it’s yours, and it doesn’t require the backing of any bank, government, or brokerage firm.

Gold is...

•Liquid – easily convertible to cash

•Portable – you can hold $50,000 in a small coin tube

•Divisible – splitting up diamonds changes their value

•Durable – how long would wheat last as money?

•Consistent – one piece of real estate is always different than another

•Convenient – copper coins of sufficient value would be too bulky and heavy

•Value dense – high value held in a small quantity

•Private and confidential – you control who knows you own it

Gold has been considered valuable for thousands of years, and it will always have value. No matter what the social, political, or financial climate has been in the world, gold has never gone to zero or defrauded an investor. It is the ultimate form of money.

***Only own physical precious metals in safe vaults in safe jurisdictions!***

***SUPERNOVA, WAR AND $64 TRILLION GOLD ***SUPERNOVA, WAR AND $64 TRILLION GOLD

|

|

|

|

Post by Entendance on Apr 11, 2017 4:41:19 GMT -5

|

|

|

|

Post by Entendance on Aug 10, 2017 3:45:39 GMT -5

"Until proven otherwise, Bitcoin, and all cryptocurrencies for that matter, are faith-based “currencies,” just like the U.S. dollar or any other fiat currency. Instead of “full faith and credit of the U.S. Government,” cryptocurrencies require full faith in blockchain technology. The Daily Coin posted an interview with Ken Schortgen of The Daily Economist in its revealed that: “The NSA developed blockchain technology and released the information in a white paper that has been uncovered by Ken Schortgen, Jr., The Daily Economist HERE

Built to be skeptics, we have been wondering why Governments and Central Banks tolerate Bitcoin and all of the other cryptos if indeed the cryptos are the digital equivalent of the gold standard. As it turns out, the NSA de facto has the ability to hack crypto blockchains. We are certain the NSA is not the only entity globally with that ability. Furthermore, the cryptocurrencies are absorbing a lot of fiat currency that likely would otherwise be flowing into gold and silver. It reminds us of GLD and SLV, both of which have absorbed billions of institutional cash into two “black hole” vaults that have yet to withstand a bona fide independent audit.

In this episode of we bravely shred the Bitcoin and cryptocurrency mystique, which are more emblematic of the global asset bubble than a suitable substitute for gold and silver’s monetary function:

A cataclysmic financial eruption may not happen today, and it may not happen tomorrow, but you certainly want to be prepared for that eventuality. The best protection you can get is physical gold. -Peter A. Grant

Fred & EntendanceInvestors Wealth Preservation Principles: Store Gold/Silver outside the banking system

Direct ownership by the account holder

Custody control by investor

100% reputable privately owned vault

Maximise elimination of counterparty risk

Storage in a politically stable country

Transact with the most reliable liquidity providers

No compromise on privacy and security.

***Bitcoin Civil War Coming Soon-Kevin Lawton

"Today, the scars of the global financial crisis remain. There have been trillions of dollars in losses. And in a world of subpar economic growth, even optimists are downbeat about whether the economic medicine has been taken.

The crisis highlighted a number of key problems which remain unresolved.

Firstly, excessive debt. In the aftermath of the world market crash, rather than pushing for debt destruction, world leaders used fiscal and monetary policy to fan demand. Global debt now stands at a staggering US$215 trillion.

Then there is ineffective regulation. Despite genuine attempts to stop risky lending and products – from tougher financial regulations under Dodd-Frank (now under attack by the Trump administration) to higher capital requirements under Basel III – problems persist..." ***Ten years since the global financial crisis, world still suffers 'debt overhang'

***Risky mortgages, shadow bankers threaten Vancouver housing market's stability

All about Debt Slavery All about Debt Slavery

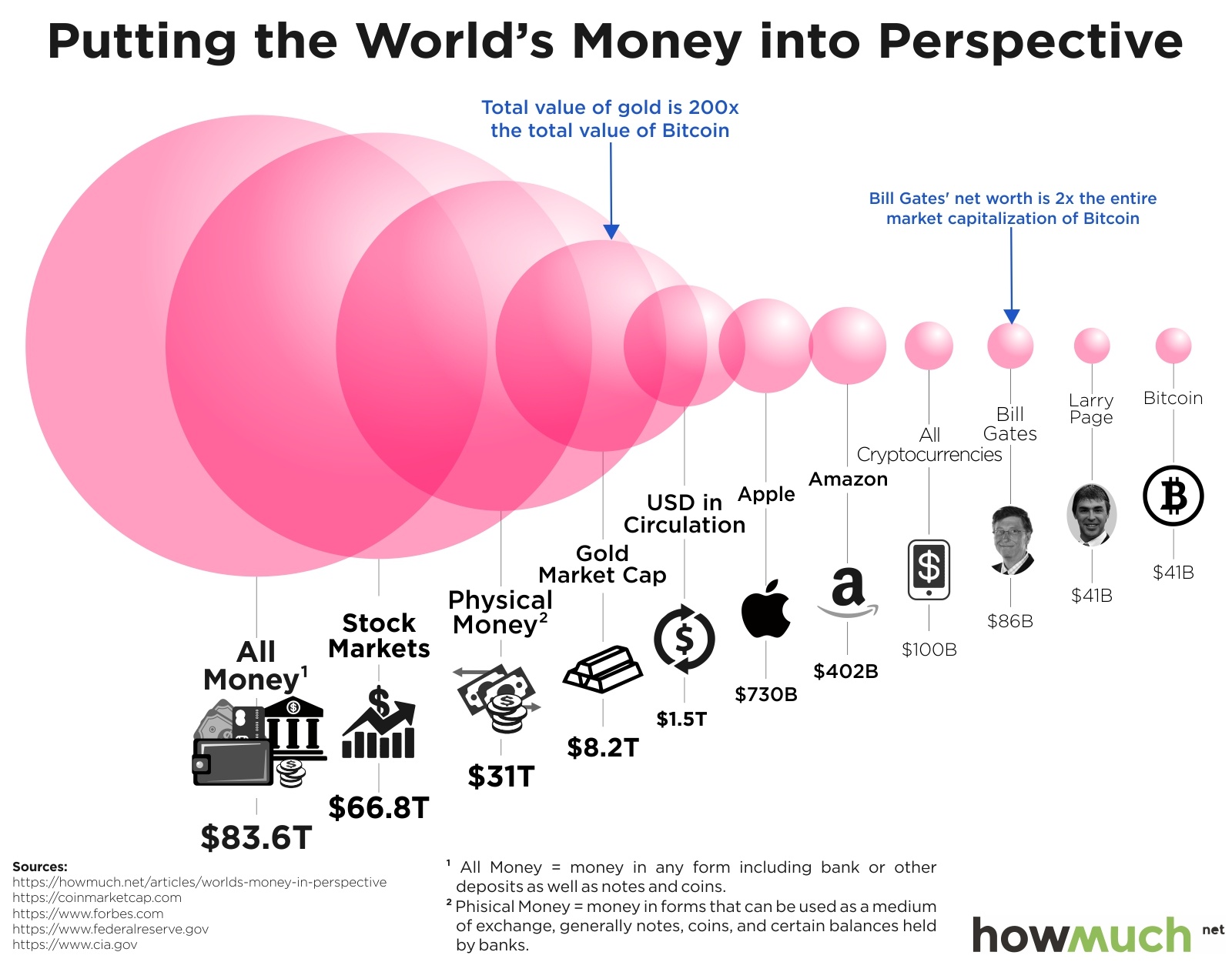

***The Bitcoin Economy, in Perspective

"...a quick point about the cryptocurrencies. When the U.S. blocked Iran’s access to the SWIFT trade settlement system, India began to pay for the oil it imports from Iran with gold. These were very large-dollar transactions. We have yet to hear any reports of sovereign nations using Bitcoin or other cryptos for payment to settle trade agreements. For me, this highlights yet another difference between the use of gold as a currency vs the cryptos. I want to make it clear that I’m not in the anti-cryptocurrency camp, but I do believe that, ultimately, precious metals (gold and silver) are much more functional as a form of money than the cryptos. Bitcoin debuted for peer-to-peer transactions in 2009. Gold has functioned for this purpose for over 5,000 years. My preference in this situation is to bet big on the form of money that has pedigree." ***Oil, Gold and Bitcoin

*************

"I have always stated the cryptocurrencies have nothing to do with wealth preservation. It is electronic money with no underlying asset..."

Egon von Greyerz:***Western Governments Moving To Enslave People And Steal Assets Ahead Of Global Collapse And Skyrocketing Gold

*************

"A quick primer for those who don't understand how these work.

Digital "currencies" are all basically the same. There is a finite number of a given "coin" type at inception; each has a cryptographic "key" that must be discovered in order to "acquire" it, which the proponents argue is similar to digging it out of the ground, and thus it is called "mining" them.

However, each successive coin in a given currency is harder to "mine" than the previous one; the cryptographic series is designed intentionally this way. The first few coins are easy and they get more difficult as the number of them mined is a greater percentage of the whole. The designer attempts to slightly outpace the growth rate of processor capability to solve said problem so that (1) it's reasonably practical to "mine" them at the outset but (2) as time goes on it becomes more difficult at a fast enough rate that the stock of said coins is not completely exhausted at any given time, NOR does it become so prohibitively difficult that there is no point in trying.

The "coins" are designed to be "self-proving" through a technology known as "blockchain" in the generic sense. In order to confirm your coin is valid (and owned by you) others must reproduce your published "signing" result on the coin you claim to have mined. In addition to prevent your "coin" (which is just a series of bits -- that is, a number) from being duplicated (counterfeited) whenever you exchange it with someone else they have to sign the "coin" and that transaction has to be published and the signature verified by some number of others before the "spend" is considered to be good. Once it is considered good then ownership of said coin has passed to the new person. Though this mechanism the transfer of a given coin from its mining onward can be irrevocably traced and it is thus impossible (in theory anyway) for someone to duplicate (counterfeit) said coin.

Digital "coins" are divisible and such divisions are just as valid as an original, but again a division must be confirmed and signed as well. Thus you can spend 1/10th of a coin, the person who has 1/10th can spend half of that (or 1/20th of the original) and so on.

The design of these systems, however, is intentionally deflationary. That is, not only is it harder and harder to "mine" more coins but any coin in which the signature cannot be confirmed because the person who last signed it loses their signing key is irrevocably lost.

There are nuances between all the different "coins" but they all share a common set of problems...

...go ahead and play if you wish folks, but just recognize that you're riding a ponzi scheme -- and that all of them, without exception, eventually collapse." Karl Denninger:***Digital 'Currencies' Are ALL A Scam ********************

"...However, the Bitcoin dream-money will have an unhappy end for many people, because its end will come before the official dream-money has vanished.

Why will this happen?

Because all the official dream-monies - the Dollar, the Euro, the Yuan, etc - have nanny shepherds. The shepherds are the issuing Central Banks, who do not want their dream-money digits to rise strongly in value, nor to fall strongly in value. Rising dream-money digits means that the economies of the related Central Banks will see falling exports, rising imports and sluggish economies. Falling dream-money digits means that the related economies will have inflationary problems and social unrest. The Central Banks issuing their dream-monies want stability for their digits, not sudden changes.

The Bitcoin and other new dream-money digital "currencies" have no shepherds to look after them. The Bitcoin rose from a few pennies when it was born not long ago, to $2500/$2400 US Dollars a digit, as of this writing.

The Bitcoin price depends on the dreams of the world public. While it has been going up, due to its novelty, the rise in price has been spectacular, because buyers have outnumbered sellers. But there is no shepherd in charge. When the public changes its mind - and it will, sooner or later - then, just as there was no resistance to its rise in value, there will be no resistance to its fall in value. People will rush to sell their Bitcoins, and find that their value is falling by the minute. Very few buyers will want to "catch a falling knife". "Once burnt, twice shy": the Bitcoin and its imitators will have become a fable regarding the folly of mankind.

The world's public is notoriously fickle. When the public gets tired of this dream, sales will begin, and just as fast as it went up - or faster - the Bitcoin price will collapse, leaving nothing but sorrow for the holders of this dream-money, when they wake up..." ***This Insubstantial Pageant Faded...

Bitcoin is High Reward & High Risk –*** Warren Pollock

***Yes, Bitcoin Is A Bubble And It’s About To Burst

54-Year Market Veteran –*** Gold & Silver Are Now The Cheapest Assets On The Planet***

Cognitive dissonance is a powerful drug. ***All about Confirmation Biases & Cognitive Dissonance

***Cryptocurrencies? No, thanks

***How gold performs during periods of deflation, chronic disinflation, runaway stagflation and hyperinflation ***How gold performs during periods of deflation, chronic disinflation, runaway stagflation and hyperinflation

***Inspire Yur Day At The Beach***

|

|

|

|

Post by Entendance on Aug 31, 2017 9:20:24 GMT -5

|

|