|

|

Post by Entendance on Apr 20, 2015 12:09:12 GMT -5

|

|

|

|

Post by Entendance on Jul 18, 2015 7:22:45 GMT -5

MUX McEwen Mining Receives Insurance Proceeds McEwen Mining Inc. (NYSE:MUX)(TSX:MUX) ("McEwen Mining" or the "Company") is pleased to announce it has received reimbursement for approximately 80% of the fair value of the loss due to the robbery that occurred on April 7th, 2015 at the El Gallo Mine. Consequently, the financial impact of the robbery is reduced to approximately US$1.6 million, and McEwen Mining now has cash and precious metals totaling US$33 million.

"Our relentless focus is on financial performance, improving the sustainability of our operations, achieving exploration success, and technological innovation at our existing and future mines," commented Rob McEwen, Chief Owner. "The robbery is behind us, and we have invested in additional security measures to protect our employees and products."

The Investment Doctor: •McEwen's El Gallo mine continues to outperform, but investors should be warned the output might drop by 50% during this quarter.

•The San Jose mine is performing okay-ish but won't generate any positive free cash flow this year.

•McEwen's insurance company has wired $6.4M as compensation for the damages after an armed robbery - that's more than I was hoping for... McEwen Mining: A Record Production And A Higher Than Expected Insurance Payment Strengthen The Balance Sheet

The good old days at Mux...

Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours.

Updated Strategy &Trading Videos

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

|

|

|

|

Post by Entendance on Aug 7, 2015 10:46:37 GMT -5

* Mit dummen und unnützen Diskussionen um Finanzmedien im Morast versinken?

* Müde vom sinnlosen ungehobelten Geschwätz der bezahlten Basher über deinen bevorzugten Titel ?

* Wünschen reine Luft und reines Wasser zu genießen?

* Willig auf dem weißesten Sandstrand der Erde zu liegen und dein Gemüt zu bräunen und deinen Geist von Anderer Inkompetenz zu entgiften?

* Dann ist dies dein Strand, mitten im Indischen Ozean!

* Schließe dich uns an werde ein Mitglied! Trete einer ausgewählten internationalen Gruppe bei, bei der die Anonymität gewährleistet ist. Wir bieten mehr Fakten als Meinungen, für Fred und mich ist das Wissen eine Waffe.

* Wenn du wünschst am "großen Spiel" teilzunehmen, dann bist du am rechten Strand. Werde ein Mitglied!

* Geniesse diesen Standort und verbreite die Neuigkeit dieser Webseite!

* Lasst uns alle gemeinsam diesen Ort zu einem blühenden Club für Vortrefflichkeit, Bildung und Information machen. Entendance

*BOGGED DOWN INTO stupid and useless discussions on financials media?

*Tired of rude rants without sense coming from paid bashers on your favourite stock?

*Willing to enjoy clean air and clean waters?

*Eager to lay on the whitest sand of the world just to tan your soul and to detoxify your mind from others' incompetence?

*Then this is your beach, in the middle of the Indian Ocean!

*Join us: become members! Enter a select International group where anonymity is guaranteed! We here provide more facts than opinions, to Fred and to me knowledge is a weapon.

*If you wish to participate in the Great Game, you’re in the right beach! Become a member!

*Enjoy your staying and spread the news about this web site!

*Let's all together make this place a thriving sheltered Club for Excellence, Education and Information

Entendance

Diventa membro, unisciti a noi, questo posto è per menti aperte!  Entendance I want to talk about where you live... Entendance I want to talk about where you live...

|

|

|

|

Post by Entendance on Jan 15, 2016 6:27:47 GMT -5

20 Terrible Ways to Trade Good trading is very basic; it’s trading with an edge to capture a trend in your own time frame, while managing your risk exposure carefully with the right position sizing and stop loss.

There are endless ways to trade badly. You can change these if you make an effort and become self-aware. Be on the lookout for these pitfalls.

Here are the top 20 |

|

|

|

Post by Entendance on Feb 1, 2016 5:57:45 GMT -5

Rob McEwen: $5,000 Gold Still A Reality, In the Meantime Invest Wisely!

Summary

•What will a future look like with $5,000 gold?

•Why Rob decided to focus his entrepreneurial attention on mining?

•Is McEwen Mining on the right course going forward?

•How a new regime has changed mining in Argentina and could this lead to the story of 2016?

•Why mining on the whole is a poorly managed industry?

Rob McEwen founded the largest gold company in the world by market cap - Goldcorp (NYSE:GG). Today, Rob is Chairman and CEO of McEwen Mining (NYSE:MUX), a company in which he owns 25%. He has weathered many cycles in mining and created tremendous shareholder value during bear markets and bull markets. So what does he see in store today?

Firstly, Rob explains that investors, fixated on the US dollar price of gold, are missing the big picture. Gold is performing well against almost all other currencies and gold companies are beginning to generate stronger profits. All the ingredients are in place for the next stage of the bull market to begin!

Case and point is McEwen mining, which has increased production, instated a dividend, and paid off all its debts. Rob is aiming to achieve inclusion in the S&P 500 in the coming years, a lofty goal that has only been achieved by two miners today - Newmont and Freeport.

There are still exciting discoveries to be made, along with enormous gains, which can empower one to do great good in the world.

Palisade Radio Host, Collin Kettell: Welcome to another episode of Palisade Radio. This is your host, Collin Kettell. On the line with us today is Rob McEwen. He is the founder and former CEO of the world's largest gold producer by market cap and that is Goldcorp, of course. But Rob is now the current CEO and Chairman of McEwen Mining. Rob, welcome to the show.

Chairman and CEO of McEwen Mining Inc., Rob McEwen: Thank you, Collin, pleased to be on it.

CK: You know mining is arguably the worst business in the world. That is a quote from my friend, Doug Casey. It is a harsh statement, but there is some truth to be found there. Mining has not advanced significantly from a technological standpoint in the past couple decades. Political disruptions are always looming. You have the cyclical nature of the commodities which means constant ups and downs and then there is the environmental impact. But, obviously, there must be positive aspects of mining, and you have seen a lot of success in the sector. I want to start out by asking you, Rob, why have you dedicated your entrepreneurial endeavors towards mining?

RM: Well, I have a strong affinity for gold. I think it is money so I focused most of my attention on gold mining. There is some silver now but it is a precious metal as well. I think that the governments around the world, from time to time, are very abusive of their money supply and irresponsible with the amount of debt, and that individuals need to take steps to protect themselves against the actions of the government. Sometimes the governments get carried away with their zeal to make everybody happy and debase the currency and I think we happen to be in one of those times.

I also grew up in the investment industry. I spent eighteen years of my life in the investment industry, around gold bullion, gold mining shares. I met a number of promoters and a few of them did really well. One fellow in particular made a discovery and then lost it. He made a fortune, lost it; another discovery, another fortune, lost it. Third time, third discovery he kept his fortune. It demonstrated to me that all the big deposits in the world, all the exciting discoveries in the world have not been made and that is going to continue. It is an area when the gold market or the precious metals market is running, you have enormous gains that can be realized there.

It is also an industry, as you said, and quoting Doug Casey, that is a poorly managed business. Coming from the investment industry, I felt I had a different perspective than a lot of the people in the industry. I did not grow up with the same assumptions that became fundamental to my thinking about the industry so I was able to challenge them. I was able to import technologies and attitudes from other industries and put it into an old industry that is in great need of other perspectives. When you can do that you can ask questions that are difficult for people in the business to ask because it is not something they think about because of the fundamental unquestioned assumptions that lie in the industry.

I think it is possible to gain great financial rewards and with those rewards you can do a lot of good things with society and hopefully make the world better as a result of the gains you make in this industry. It is an industry where the probability of finding a new discovery is very, very low, but the possibility exists, and that is what is exciting about the industry. You can innovate, you can grow, and you can ride on the jet stream.

CK: Well that is exciting and it is a very true point. I want to ask you about the cycle that we are in today. You have been through at least a few of these ups and down cycles, and by some measures the one that we are in today in terms of the mining stocks has gone on longer and has gone down further arguably than any of the ones in the recent past. How much of the slump today is due to just normal commodity cycles of up and down, and is there anything that you can point to the blame for why we are in the situation that we are in?

RM: The slump is not that much longer. If you look back to the '70s, 1970 gold was $40 an ounce. It ran up to $200 an ounce so a five-fold increase by the beginning of '74 when it became legal for Americans to own gold again. Two years later it was just below $100, around $96, and then in '78 it got back up to $200. There was a four-year period where gold was down and then recovering. There were some pretty big losses there, losses of value, a lot of people discouraged by the performance of the industry. We saw it again, in '99, 2001 where gold was down at $250 an ounce.

When I look at the industry it is cyclical. Investors have to keep that in mind that there will be a time it is going to go the other way, and that is just the nature of the beast. But I would say right now the state of the market is determined by the US dollar price of gold. Everybody seems to be fixated on the dollar price of gold and they are saying, "Alright, gold is off 45% from its high. The big gold stocks, the leaders are down even further. Their balance sheets are encumbered by heavy debt load. Their income statements are being reduced in size by hedging, by selling metal streams, by selling royalties, and just the low price of metal." People are saying, "I do not want to be here."

But if you look at gold in other currencies it is going up. In some currencies, in the Canadian dollar, in the Australian dollar it is 25% off its old high. If you would look at gold in Russian rubles or in Brazilian real it is at all time high. It is higher than what it was back in Sept 2011 when it was US $1,900, but in their local currency it is much higher. If you go back, again, to the '70s, the late '70s, in Sept. 1979 gold was $400 an ounce and then by January of '80, three, four months later, it was up to $800 an ounce. During that period the gold shares did not run as much as gold. In fact it took until Sept of '80 before the gold shares hit their high. But gold in January was $800 and then it fell off to $650, and what the market was not appreciating was Sept of '79 at $400 and Sept '80 it is $650. Gold is up more than 50% and you started seeing couple of quarters linked together of increasing cash flow and higher earnings, and that is when the market started buying.

Today we have a very similar situation happening in that Canadian, South African, and Australian gold stocks are all starting to generate healthy cash flow and, in a number of cases, increasing earnings. Well, they are starting to get earnings and they are improving. These stocks are starting to move as a result of their local expenses are in their domestic currency, but the revenues are in dollar terms and the revenue lines have been opening up for them and they are making money. You are starting to see some interesting moves in the stock. I mean if you look at the 52-week lows and the current price of, say, the Dow, it is +5%. If you look at gold it is +7%. If you look at the GDXJ, the index for junior gold, it is up 12%, and the GDX, the senior gold stocks, they are up 13%, so better than twice what the Dow has done, low to current in the last 52 weeks. If you look at Barrick, which has gotten all sorts of terrible press, since October it is up 62%. Our own stock, we got beaten up badly, but since July of last year to now we are up over 80%.

This is a sector that a lot of people have gotten out of their portfolio. It is under owned. It is unloved, and yet it is starting to generate some very interesting gains and as more of those accumulate I think you will see more people coming into the market.

CK: I have heard a couple main themes in the last six months, the first one you just touched on with the Canadian and Australian dollars being relatively low against the US dollar. The other one has been the steep decline in oil prices. Rob, since you are the CEO and you are leading an actual mining company that sees the input cost of oil going into your production cost, I want to ask you how much of a significant factor you think that that actually place if that is going to help in the turnaround of these mining shares moving up?

RM: Collin, it depends on the type of mine and where they are located. For open pit operations fuel cost will be a definite consideration, an improvement in the economics; underground, it is to a much lesser degree. Then in certain countries, we operate in Mexico and Argentina. They subsidize our fuel cost so we do not have as much of a benefit as other countries where there is no subsidy by the government, but it had a definite improvement. If you would look at Australia, Canada, South Africa with their own subsidies, the impact of the fuel cost would be greater, a greater positive for those companies.

CK: Thank you for that Rob. On to McEwen Mining, I want to talk about some of the results which you just released last week. Reported record production for 2015 was 22% increase year over year which is fantastic. As far as I know you have over $30 million in cash and cash equivalents with no debt. I see you have really not only done a great job in this environment, but you built an even stronger company as a result of this bear market and very well-positioned to come out of it. What can you tell us about what is going on at McEwen Mining?

RM: Thank you for those comments. Well, as you stated 2015 was a good year for us despite our share performance. Production went up, cost went down, and we were generating cash flow in all quarters. Treasury increased so much so that we are able to declare a dividend or capital distribution and do some share repurchase. I think what it is largely about is having financial discipline in place so that you are not jumping whenever someone comes along and says, "Here is some money that you are not diluting your shareholders."

A large part of that comes from my own holdings in the company. I own 25% of the company and my cost of those shares is $127 million. When I wake up each morning I am thinking not about how big the company needs to be, but how do we grow it in such a way that we increase the value behind every share and that is reflected in a higher share price?

I think companies like Remarco would be the classic case of what not to do. In their case they fought really hard to get a permit and they got their permit, unfortunately, at the bottom of the gold market, and they still wanted to build their mine. They rushed out and raised $300 million and diluted their shareholders by 80%. I do not think that is the way to build a mining company, and if one was a large shareholder in a company you definitely would not have done that. The gold is not going to go away and you can build up when the metal price is better and you can see strong returns for your shareholders.

We have not sold royalties or metal streams and we do not hedge. To me that is taking it all off the top line and in depressed metal prices it just further shrinks the margins so that when you look at the performance of companies that were the royalty companies and the metal streaming companies as opposed to the producers they gave away their margins and you can see the outperformance by the royalty companies and the metal streamers very clearly, and that is the price. People say, "Well, I will raise my money that way and it will be non-dilutive to my shareholders." And that is true. But what they do not say is that it is giving up the profits that the shareholders were expecting to see.

To me it is like payday loans or a convenience store where you pay a premium for that convenience, you pay a premium for that money in this market. We have not done that and we will not do that because of the shareholders.

CK: Rob, one other event that has been going on is the New York Stock Exchange and I am reading this from a press release back in November stipulating that the average closing price of a listed company stock be above $1 per share. Of course, a couple months ago, McEwen Mining was struggling with keeping the dollar per share. But that may not be an issue anymore; you are well above the $1.20 a share. I do not know if you passed the required 30-consecutive trading days to maintain the NYSC listing, but what can you tell investors about that process?

RM: Yes, we received a notice back in July that we have fallen below the $1 level and if you are down for more than an average of 30 days. You take an average of 30 days your closing price below a dollar. They measure it at every month end. There will be this Friday. It will come up for review by the New York Stock Exchange and barring any major reversal in the gold price and the share price between now and Friday. I have my fingers crossed and my toes crossed. I think we have put that behind us or will have put it behind us by the close on Friday. They measure every month at every month end. I am hopeful, very hopeful it will not be an issue come close on Friday.

CK: Great! Thank you for that. Well, I want to ask you about the future looking out over the next few years. We just discussed that you have built a company that has lasted through a bottom and a bottom can only last so long. You have made predictions in the past for gold to hit $5,000 an ounce or above which is not an outlandish thing to predict considering it almost hit $2,000 already. What would the mining sector look like when gold is at $5,000 an ounce?

RM: Well, there will probably be a few more smiles in the industry. What will it look like? Well, I think right now we are going through a phase where there will be further consolidation. The seniors going into this are right now shedding assets. They are trying to pay down their debts. I think there will be new leaders out there and they will come from the ranks of the intermediates. There will be new names that will be leading the market ahead. They will have more aggressive management. They will probably see more ownership in the companies and they will be a little bit more careful at least in the next three, five years about how they build their projects, where they build their projects, and how much capital they need to build them. I would expect there should be a good margin in the business and we will be one of the better performing sectors in the market three, four years out.

CK: Okay. In terms of McEwen Mining, what does the next few years look like? I knew that you guys just brought on a new president a few weeks ago which is Colin Sutherland. He is going to be helping you with leadership moving forward and planning for hopefully better market conditions. But you did this with Goldcorp. You merged several companies together and you just made a Goliath of a mining company. I would assume that you are trying to replicate that success through McEwen Mining. What are your plans to do so?

RM: Our goal is to qualify for the S&P 500. You might wonder why? What drives me there are a couple of reasons. One there is a lot of money invested in the S&P 500 stocks. Index funds invested directly in the S&P had assets under management of more than $1.7 trillion, so a very large pool of money and there is only one gold stock in there and that is Newmont.

We have a gold and copper company, Freeport, but that is it in terms of the space of companies in that mining companies, precious metal companies in there, and 99.9% of all the precious metal companies in the world are non-American companies. In order get into this index you have to be an American company. McEwen mining is a Colorado incorporated company so we meet that fundamental test. We need a much larger market cap than what we have today. But I think over the next five years we can grow considerably. We are expanding what we do domestically and organically, but we will have to do one or two M&A transactions to get up to that size. Getting into the S&P 500 provides you a better shareholder base, a larger, more stable shareholder base, and a lower cost to capital, so it gives you competitive edge over all the other producers out there.

As I said this is an opportune time to be looking for opportunities to combine with other companies. It is much more inexpensive than it was three, four years ago, and that is the attraction. But first it was putting our company on a very solid basis where you are not pressured by debt. You have not given away revenue through metal streaming and royalties, and you are building cash. We are on the right foot going forward right now. That is where we are, achieve our goal and not build the comp any for the sake of size; build it for the sake of the underlying value per share and the share price.

I do not take a salary. I do not get a bonus. I do not have any options. I have not taken a salary or gotten a bonus for ten years. I am going to make my money exactly the same way my shareholders make money and that is through a higher share price.

CK: Well, that is certainly not an easy combination to find in the mining sector today. Before we end I just want to ask one last question pertaining to Argentina where, of course, McEwen has production and assets. The regime just changed down there and things have already been changing quite a bit. There has been an inflationary currency crisis down there the last few years. The new government, I believe, just let the exchange rate float. They are saying they are pro-business. Are you having or seeing any effects for McEwen from this new regime at this point?

RM: Yes we are. We have a mine in Argentina, our San José Mine. We own 49% and our partner, 51% partner, Hochschild Mining, operates it. The change in the currency and the removal of an export tax on doré gold which is the bar we pour at the mine will have an immediate impact on the cash flow and earnings of that operation. They have removed a lot of the restrictions on taking money out. We were never really subject to that. But they are moving quickly. They are very pro-business, very pro-mining. I think anyone with assets in Argentina are going to see those assets revalued by the marketplace as time goes by. I think a big hurdle for the country will be negotiating with their creditors in New York and getting that behind them and opening the capital markets to the country.

None of the ministers that have been appointed by the new government are career politicians. They are all people who came out of the business world and they are looking at their country and they want it to move forward. Out are the days where a very populous government spends to buy votes. I think Argentina is going to be the turnaround story of 2016 for the mining community.

CK: Alright, well, Rob, it has really been a pleasure having you on. I know you are a busy man and you have a busy schedule so thank you for cutting out the half hour to talk to our audience and share your story on McEwen Mining. I would give your coordinates and information, but everybody knows McEwen Mining and they know Rob McEwen so they know where to find you. Thanks so much for coming on, Rob.

RM: Colllin, it has been a pleasure. Thank you for your interest.

Rob has been associated with the mining industry for 29 years. His career began in the investment industry, and then in 1990 he stepped into the mining sector. Rob is the founder of Goldcorp Inc., where he took the company from a market capitalization of $50 million to over $10 billion. Rob is currently the Chairman, CEO and largest shareholder of McEwen Mining Inc. and Chairman of Lexam VG Gold Inc., exploring for gold, silver, copper, in Canada, USA, Mexico and Argentina.

|

|

|

|

Post by Entendance on Feb 2, 2016 7:10:46 GMT -5

MUX McEwen Mining Regains Compliance With NYSE Listing Standards

TORONTO, Feb. 02, 2016 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce receipt of notification from the New York Stock Exchange (the “NYSE”) that it has regained compliance with the NYSE’s continued listing standards regarding the minimum price of its common stock.

Chief Owner, Rob McEwen, stated: “This is wonderful news and it highlights our strong operational performance in 2015, where we increased our gold/silver production, decreased our production cost/oz., generated free cash flow and steadily built our treasury over the year. Also, during the year we declared and paid our first ever semi-annual capital distribution. Our share price appreciation since July, 2015 reflects the value in exercising financial discipline and resisting the temptation to finance at the bottom of the market. We refused to give away our future upside. We have not and will not sell metal streams, sell royalties or hedge our future production. At this time, we are debt free, we have $33 million in cash and bullion. As you can see, we have no pressure on our balance sheet and we will be paying our second capital distribution on February 12th. This is a great way to start 2016.”

|

|

|

|

Post by Entendance on Feb 25, 2016 16:57:20 GMT -5

MUX McEwen Mining Acquires Property in Nevada TORONTO, Feb. 24, 2016 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce that it has completed the purchase of the Afgan-Kobeh property in Nevada for $450,000 in cash. Afgan-Kobeh is an attractive acquisition for McEwen Mining because it hosts a near surface, oxide gold resource in close proximity to our Gold Bar Complex which is expected to begin development in 2017. The objective is to develop the property into a satellite resource that can contribute to the production from Gold Bar. The property has immediate exploration potential with several historical higher-grade drill intersections open laterally and at depth. McEwen Mining plans to conduct a drill program beginning in May 2016 with the objective to increase the known mineralization.

Property Location and Description

The Afgan-Kobeh property is located towards the southeast limit of the Battle Mountain-Eureka-Cortez mineral trend in Eureka County, Nevada. The Afgan deposit is approximately 3 miles (5km) to the southeast of the main ore bodies comprising the Gold Bar Complex (see Fig. 1). Afgan is similar to other sedimentary-rock hosted gold deposits in Nevada in that disseminated and oxidized gold mineralization occurs in the Webb Formation and Devils Gate Limestone lithologies.

Mineral Resource Estimate

A report titled “Updated Technical Report Afgan-Kobeh Property Eureka County, Nevada USA,” dated June 13, 2011, was published by the prior owner in accordance with compliance and disclosure requirements of Canadian National Instrument 43-101 (NI 43-101). Mine Development Associates of Reno, Nevada prepared the technical report that includes a mineral resource estimate for the Afgan deposit using a cutoff grade of 0.006 ounces per ton (opt) or 0.2 grams per tonne (gpt). The mineral resource includes drill information from 181 holes, for a total of 63,303 feet (19,295 meters) of drilling. The summary provided below is for informational purposes only and has not been verified by McEwen Mining...

More here

|

|

|

|

Post by Entendance on Mar 22, 2016 6:30:44 GMT -5

"Conditions are never just right. People who delay action until all factors are favorable are the kind who do nothing."

-William Feather

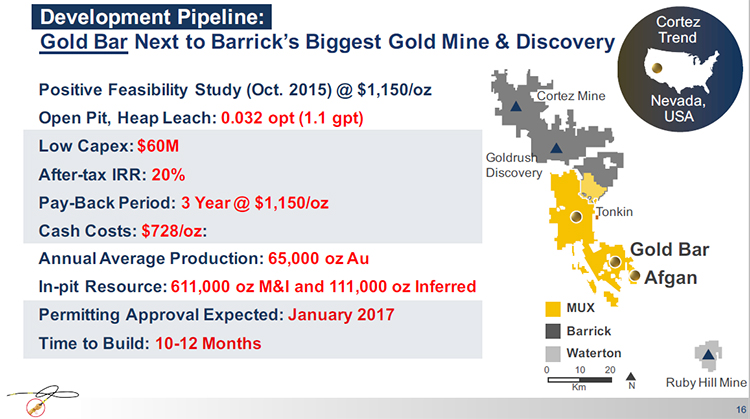

5 REASONS TO OWN MUX 2016 PDAC Investors Luncheon Corporate Presentation - Rob McEwen

To know and not to act is not to know.

-Chinese saying

|

|

|

|

Post by Entendance on Mar 27, 2016 4:23:50 GMT -5

MUX Rob McEwen doesn't like mining types with no skin in the game VIDEO here

HIGH HOPES Chief owner, president and CEO of McEwen Mining, Robert McEwen has set a strategic goal for McEwen Mining to get into the S&P 500 Index to gain a competitive advantage, as there is currently only one gold company in the index. “The S&P 500 is a very exclusive group of companies and most companies in the precious metals industry can never get in, even if they meet the high financial requirements for admission. Since a fundamental requirement is to be an American company, that precludes more than 99% of the industry. However, McEwen Mining can because it is a Colorado-incorporated company,” he boasted. Of course, being included in the S&P 500 would provide the miner with exposure to a significant pool of capital (more than $1.7-trillion is invested by index funds in S&P stocks), a more stable shareholder base, lower cost of capital, and exposure to the world’s most active market for precious metal companies...

More Reads at Fred & EntendanceInvestors Private Beach. Members Only Area. Just Register!

When central banks and politicians “manage” global currencies, we can expect:

•Exponentially increasing debt and currency devaluations

•Massive inflations and deflationary crashes.

•Transfer of wealth from the many to the few.

•Derivatives exceeding $1,000 Trillion and eventually a crash.

•A mathematically inevitable financial collapse.

•Monetary and fiscal madness.

•Booms and busts.

•Much higher gold and silver prices.

It has happened before and it will happen again

|

|

|

|

Post by Entendance on Mar 31, 2016 8:02:48 GMT -5

McEwen Mining, Inc. (MUX on NYSE & TSX) Achieves Positive Improvements in Silver and Gold Production and Cash Flow in Mexico, a new pro mining government in Argentina and *** Getting Ready to build Gold Bar in Gold Rich Nevada

here

More here

"...Much of the action in gold is the result of pure profit-taking after prices advanced to their best since February 2015, a 13-month high. The pullback is fairly natural considering the strong rally that the gold market has experienced over the the course of 2015.

Interestingly enough, recent economic data in the U.S. has been unimpressive of late. First, the most updated consumer spending numbers for February were a disappointment, and included a downward revision of January’s figures, as well..."

Lower Gold Price Offers Buying Opportunity

"I expect Gold to go to $10,000." Watch here

Gold and Silver will thrive as paper assets are increasingly infected by financial viruses! Fred & E. Private Beach: Become Members!

|

|

|

|

Post by Entendance on Apr 7, 2016 8:07:41 GMT -5

MUX: over $2 MUX stock is eligible for margin (maintenance requirement: 75%)

|

|

|

|

Post by Entendance on Apr 9, 2016 3:43:23 GMT -5

Specifically to those who mine gold and silver.

Consider changing the policy of shipping your product into the warehouses that supply bullion which backs up futures contracts.This procedure is helping those who are depressing the price that you receive for your bullion!

Instead you need to 'starve the paper market', and think of ways to convert your bullion into retail products. There is rapidly growing demand on the retail side for finished products!Here are some examples... An open letter to mining CEO’s

Updated Strategy &Trading VIDEOS

|

|

|

|

Post by Entendance on Apr 19, 2016 16:32:35 GMT -5

MUX McEwen Mining Reports Q1 Production Results, Royalty Acquisition TORONTO, April 19, 2016 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce production highlights of the first quarter 2016 and one acquisition.

Highlights

•Total production in Q1 was 37,958 gold equivalent ounces(1), a 14% increase over Q1 2015.

•Increased production guidance for 2016 to 144,000 gold equivalent ounces.

•Acquired the Net Smelter Return (NSR) royalty on our El Gallo Mine and El Gallo Silver deposit.

•Strong balance sheet: $43 million(2) in liquid assets and no debt!

El Gallo Mine, Mexico – A Record Quarter

In Q1 the mine produced 20,101 gold equivalent ounces, compared to 15,391 gold equivalent ounces during same period in 2015. Production in Q1 set a new quarterly record as a result of processing higher grade ore stockpiled in the previous quarter. Production in subsequent quarters is expected to be lower as the influence of higher grade ore diminishes during the year. Full year guidance for El Gallo in 2016 is now increased to 55,000 gold equivalent ounces. The 2016 exploration budget for Mexico is $4 million.

Today we acquired the existing tiered NSR royalty (the “Royalty”) on the El Gallo Mine, currently paying 3.5% of gross revenue less allowable deductions. The purchase price consisted of a $5.25 million payment on closing and a conditional deferred payment of $1 million to be made on June 30, 2018. The Royalty ceased being payable at the end of February 2016. This transaction will enhance the future profitability of the El Gallo Mine and removes a royalty burden on existing and potentially new deposits inside the Royalty’s area of influence, including the El Gallo Silver deposit.

San José Mine, Argentina (49%)(3)

Our attributable production from San José in Q1 was 8,960 gold ounces and 667,319 silver ounces, for a total of 17,857 gold equivalent ounces. Compared to Q1 2015, gold and silver production was down 5% and up 4% respectively. Q1 production is typically lower than other quarters due to mill shutdown and maintenance over the holidays.

Full year production guidance for San José in 2016 is 45,000 gold ounces and 3.3 million silver ounces, for a total of 89,000 gold equivalent ounces attributable to us. The 2016 exploration budget is $4.5 million.

Nevada Exploration

Exploration drilling is planned to begin on the newly acquired Afgan-Kobeh property in mid-May. The primary objective of this drilling is to expand the size of the existing resource.

Financial Results

Operating costs for the quarter ended March 31st, 2016 will be released with our Quarterly Financial Statements in early May.

ABOUT MCEWEN MINING (www.mcewenmining.com)

McEwen Mining’s goal is to qualify for inclusion in the S&P 500 Index by creating a high growth, profitable gold and silver producer focused in the Americas and Europe. McEwen Mining's principal assets consist of the San José Mine in Santa Cruz, Argentina (49% interest), the El Gallo Mine and El Gallo Silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, USA, and the Los Azules copper project in San Juan, Argentina.

McEwen Mining has total of 298 million shares outstanding. Rob McEwen, Chairman and Chief Owner, owns 25% of the Company.

Footnotes:

(1) 'Gold Equivalent Ounces' are calculated based on a 75:1 silver to gold ratio.

(2) Figures updated as of April 18, 2016. Includes cash, cash equivalents and precious metals at market. Net of royalty and property acquisitions mentioned herein.

(3) The San José Mine is owned by Minera Santa Cruz S.A., which is a joint venture 49% owned by McEwen Mining Inc. and 51% owned and operated by Hochschild Mining plc.

RELIABILITY OF INFORMATION REGARDING THE SAN JOSÉ MINE

Minera Santa Cruz S.A. (“MSC”), the owner of the San José Mine, is responsible for and has supplied to the Company all reported results from the San José Mine. McEwen Mining's joint venture partner, a subsidiary of Hochschild Mining plc, and its affiliates other than MSC do not accept responsibility for the use of project data or the adequacy or accuracy of this release.

TECHNICAL INFORMATION

The technical contents of this news release has been reviewed and approved by Nathan M. Stubina, Ph.D., P.Eng., FCIM, Managing Director and a Qualified Person as defined by Canadian Securities Administrator National Instrument 43-101 "Standards of Disclosure for Mineral Projects".

|

|

|

|

Post by Entendance on May 3, 2016 3:18:01 GMT -5

MUX MCEWEN MINING BUYS ATTRACTIVE EXPLORATION TARGET NEAR EL GALLO MINE McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce the purchase of mineral properties located approximately 6 miles (10 km) from the El Gallo Mine (the “Acquired Properties”) for $250,000 plus a 2% NSR royalty retained by the seller over the Acquired Properties.

“This is an attractive exploration target because of its proximity to the El Gallo Mine, and fits with our strategy of investing in opportunities that have the possibility to extend the life of our mine,” said Rob McEwen, Chairman and Chief Owner.

The Acquired Properties lie on an important mineral trend over 7km long which is contained within our larger claim block. The acquisition completes the consolidation of the district surrounding the El Gallo Mine and El Gallo Silver deposit, and adds an area of considerable exploration potential. McEwen Mining has explored extensively along this trend and previously discovered two satellite mineral resources (Twin Domes and Las Milpas). The Acquired Properties and surrounding area is characterized by favorable alteration signatures and abundant anomalous gold and silver mineralization in surface rock and soil samples. Recent exploration adjacent to the Acquired Properties revealed an area of structurally controlled gold mineralization in shallow percussion drilling and in deeper core drilling. Now that this acquisition is complete we will expand our exploration program in the area.

The Acquired Properties consist of two mineral claims (totaling 1,040 acres), which were 100% owned by the seller, as well as the sellers' rights to four additional mineral claims (totaling 930 acres) under an option agreement that is the subject of a legal dispute. We will attempt to settle the litigation and obtain title to the disputed claims.

About McEwen Mining www.mcewenmining.com

McEwen Mining’s goal is to qualify for inclusion in the S&P 500 Index by creating a high growth, profitable gold and silver producer focused in the Americas and Europe. McEwen Mining's principal assets consist of the San José Mine in Santa Cruz, Argentina (49% interest), the El Gallo Mine and El Gallo Silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, USA, and the Los Azules copper project in San Juan, Argentina.

McEwen Mining has a total of 298 million shares outstanding. Rob McEwen, Chairman and Chief Owner, owns 25% of the Company.

TECHNICAL INFORMATION

The technical contents of this news release have been reviewed and approved by Hall Stewart, BSc, CGP, RG, consulting geologist and a Qualified Person as defined by Canadian Securities Administrators National Instrument 43-101 "Standards of Disclosure for Mineral Projects".

|

|

|

|

Post by Entendance on May 13, 2016 7:51:06 GMT -5

MUX Gold Investment Letter New Blog Report: A Chat With Rob McEwen of McEwen Mining

here |

|

|

|

Post by Entendance on May 22, 2016 2:23:47 GMT -5

MUX McEwen Mining - Minera Andes Acquisition Corp. Announces Special Resolution at Annual Meeting

McEwen Mining – Minera Andes Acquisition Corp. (TSX:MAQ) (OTC:MCEEF) announces that owners of the Corporation’s shares (“Exchangeable Shares”) will be asked to approve a special resolution to amend the Articles of Incorporation at the Annual and Special Meeting. If approved, the special resolution would result in all outstanding Exchangeable Shares becoming common shares of McEwen Mining Inc.

The reasons owners of Exchangeable Shares should consider approving the proposed special resolution are:

•Reduce our corporate expenses and listing fees associated with the current share structure;

•Superior trading liquidity of common shares that are traded on the NYSE and TSX; and

•Owners of Exchangeable Shares receive eligible dividends, while owners of common shares receive return of capital. Return of capital is generally not taxed1 in the US & Canada.

McEwen Mining – Minera Andes Acquisition Corp. has retained the services of D.F. King to assist in the solicitation of proxies in connection with the Annual and Special Meeting.

The Annual and Special Meeting will be held on May 31, 2016 from 4:00 PM Eastern Time, at 150 King Street West, 16th Floor, Toronto, Ontario, in the Conservatory Room.

The full information on the resolutions for the annual meeting was supplied in the Information Circular that was mailed to shareholders on April 20, 2016 and is available on SEDAR (www.sedar.com) and at www.envisionreports.com/MAQ2016. It is important that shareholders understand the implications of this transaction as described in the Information Circular and that they consult their own legal, financial and tax advisors to determine the tax consequences of an exchange in their individual circumstances.

The proxy deposit date for the annual meeting is May 27, 2016. If you are holding Exchangeable Shares as of the record date, the management would like to encourage you to consider voting for this year’s resolutions. If you have any questions or if you need assistance in casting your vote, please contact our Investor Relations department at 647-258-0395, toll free 866-441-0690 or email at info@mcewenmining.com.

As of the record date of April 11, 2016, over 114 million Exchangeable Shares have been converted to common shares of McEwen Mining, representing 84.4% of the issued McEwen Mining – Minera Andes Acquisition Corp. shares. Management would like to thank all their shareholders who participated to the effort of converting their shares.

1 We advise you to obtain advice from a tax professional familiar with your specific situation.

The TSX has not reviewed and do not accept responsibility for the adequacy or accuracy of the contents of this news release, which has been prepared by management of McEwen Mining – Minera Andes Acquisition Corp.

Mihaela Iancu

Investor Relations

Tell: 647-258-0395 ext 320

Toll Free: 1-866-441-0690

info@mcewenmining.com

www.mcewenmining.com

150 King Street West

Suite 2800, P.O. Box 24

Toronto, Ontario, Canada

M5H 1J9

|

|

|

|

Post by Entendance on Jul 11, 2016 7:04:58 GMT -5

|

|

|

|

Post by Entendance on Jul 28, 2016 12:14:42 GMT -5

Rob McEwen has possibly the best reputation for success and rewarding shareholders in the industry. He is extremely ethical and only benefits if shareholders benefit. For example, he pays himself no salary, he issues himself no bonuses, no options, and no rewards. He only gains if the stock price rises. Now, that is very rare in this world. |

|

|

|

Post by Entendance on Aug 4, 2016 5:30:29 GMT -5

MUX McEwen Mining 2Q EPS 3c VERSUS (0.05)

MUX McEwen Mining 2Q Net $8.4M

Return of Capital (Yield): The next semi-annual return of capital installment of a ½ cent per share will be distributed to shareholders of record on August 24, 2016. The distribution will be paid on August 29, 2016.

MUX McEwen Mining Q2 2016 Operating & Financial Results McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce consolidated quarterly production of 39,555 gold equivalent ounces(1), which accounts for 27,888 ounces gold and 875,006 ounces silver. The Company reported net income of $8.4 million(2) and $21.3 million as well as earnings from mining operations of $19.3 million(3) and $38.8 million(3) for the three and six months ended June 30, 2016, respectively.

The Company generated $4.8 million and $19.5 million of net cash flow from operations for the three and six months ended June 30, 2016 respectively. During the quarter we purchased a royalty on our El Gallo property for $5.3 million which reduced our cash flow but increased our future leverage to higher gold and silver prices.

We ended the second quarter of 2016 with liquid assets of $55.7 million composed of cash of $36.7 million, precious metals of $14.3 million and marketable securities of $4.7 million. The Company has no debt. As at August 2, 2016 we had liquid assets of $51.8 million.

Table 1: Q2 Comparative Financial Results Table 2: Q2 Comparative Production and Financial Results Operating & Financial Highlights

|

|

|

|

Post by Entendance on Aug 22, 2016 5:03:16 GMT -5

MUX McEwen Mining Appoints Donald Brown as Sr. Vice President, Projects TORONTO, Aug. 22, 2016 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce that Mr. Donald Brown will join the Company on August 29, 2016 as our Senior Vice President of Projects. Mr. Brown has a proven track record of delivering superior results and will lead the advancement and future development of our portfolio of global assets including the Los Azules copper project in Argentina and the El Gallo Silver project in Mexico, as well as assisting our current team with the ongoing development of the Gold Bar project in Nevada.

Mr. Brown is a seasoned mining professional having previously held roles as Vice President of Projects for Glencore and Construction Manager for Bechtel Mines and Metals. He has worked on many large scale mining projects in all stages of feasibility, development and operations such as Antamina, Las Bambas and Antapaccay in Peru, and El Pachon in Argentina. Mr. Brown holds a Masters of Science in Rock Mechanics and Mining Engineering from Newcastle University, he is a Chartered Professional Engineer (Australia) and also a Registered Mine Manager (Australia).

“We are very pleased to welcome Donald to our team. He comes with considerable experience in large and complex precious and base metal projects internationally, which I believe will better position us to grow organically from the development of our extensive portfolio of assets," said Rob McEwen, Chairman and Chief Owner.

About McEwen Mining www.mcewenmining.com

McEwen Mining’s goal is to qualify for inclusion in the S&P 500 Index by creating a high growth, profitable gold and silver producer focused in the Americas and Europe. McEwen Mining's principal assets consist of the San José Mine in Santa Cruz, Argentina (49% interest), the El Gallo Mine and El Gallo Silver project in Sinaloa, Mexico, the Gold Bar project in Nevada, USA, and the Los Azules copper project in San Juan, Argentina.

McEwen Mining has a total of 299 million shares outstanding and 305 million fully diluted. Rob McEwen, Chairman and Chief Owner, owns 25% of the Company.

|

|

|

|

Post by Entendance on Sept 8, 2016 5:09:41 GMT -5

MUX McEwen Mining Appoints New Chief Operating Officer

TORONTO, Sept. 08, 2016 (GLOBE NEWSWIRE) -- McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce the appointment of Xavier Ochoa as Chief Operating Officer (“COO”), effective immediately and the departure of the Company’s current COO, William Faust effective September 30, 2016. Mr. Ochoa is a seasoned executive, bringing more than 25 years of operational experience to the McEwen team and will be instrumental in the continued growth and development of our projects.

Rob McEwen, CEO and Chairman of McEwen Mining stated: “We would like to welcome Xavier to the team; he has an outstanding track record delivering growth and operational excellence globally. He brings to this position a strong reputation for managing underground and open pit operations in a variety of jurisdictions, and has a proven track record in enhancing production, reducing operating costs and improving capital effectiveness. We continue to strengthen our management team as we advance our assets with the primary goal of enhancing shareowner value.”

Mr. Ochoa joins McEwen having previously held senior executive positions with other multi-national mining companies. Most recently, he held the position of Mine General Manager at Goldcorp’s Cerro Negro operation in Santa Cruz, Argentina, where he was responsible for the successful underground mine commissioning, and leading an operating team of 1,600 people. Prior to this, he was the General Manager at the Tintaya and Antapaccay Copper Mines for Glencore and Xstrata in Peru, leading the commissioning and ramp-up of a 70,000 tonne per day processing plant. Mr. Ochoa also held the roles of General Manager and Engineering Manager at El Pachon in Argentina and Chile for Xstrata where he led the engineering efforts to advance the projects to feasibility study levels. Mr. Ochoa holds a Bachelor of Science in Mining Engineering from the University of Arizona in Tucson, Arizona.

We would like to thank Mr. William Faust for his valuable contribution to McEwen Mining. Mr. Faust will be pursing new opportunities following a transition period, and we wish him all the best in his future endeavors.

|

|

|

|

Post by Entendance on Oct 13, 2016 5:11:23 GMT -5

McEwen Mining Backs FY16 Production Guidance Of 144,000 Gold Equivalent Ounces MUX McEwen Mining 3Q Total Production 36,496 Gold Equivalent Ounces MUX McEwen Mining reports Q3 total production was 36,496 gold equivalent ounces using a gold to silver ratio of 75:1, on target to achieve 2016 guidance of 144Kgold equivalent ounces Briefing.com

MUX McEwen Mining Reports Q3 Production, Mexico Exploration Drill Results McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce that total production for the third quarter (“Q3”) was 36,496 gold equivalent ounces using a gold to silver ratio of 75:1, or 24,281 gold ounces and 916,168 silver ounces. Production is on target to achieve our 2016 guidance of 144,000 gold equivalent ounces, or 99,500 gold ounces and 3,337,000 silver ounces... More here |

|

|

|

Post by Entendance on Nov 3, 2016 5:47:12 GMT -5

MUX McEwen Mining Q3 2016 Operating & Financial Results McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce that senior management will be hosting a conference call to discuss our Q3 2016 financial results and project developments on Thursday, November 3rd, 2016 at 11:00 am ET. For dial-in, webcast and replay details see below:

McEwen Mining will be hosting a conference call to discuss the Q3 2016 results

and project developments on: DATE Thursday November 3rd, 2016 at 11:00 am ET

WEBCAST:

www.gowebcasting.com/lobby/8247

TELEPHONE:

Participant Dial-in numbers: (877) 291-4570 (North America) / (647) 788-4919 (International)

Conference ID: 9405095

REPLAY:

Dial-in numbers: (800) 585-8367 (North America) / (416) 621-4642 (International)

Conference ID: 9405095

03/11/2016 14:00 ET - 10/11/2016 23:59 ET

|

|

|

|

Post by Entendance on Nov 3, 2016 6:15:17 GMT -5

•McEwen Mining (NYSE:MUX): Q3 EPS of $0.01

•Revenue of $13.43M (-40.3% Y/Y)

MUX McEwen Mining Third Quarter Report 2016

TORONTO, Nov. 03, 2016 McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce consolidated quarterly production of 36,496 gold equivalent ounces(1), comprised of 24,281 ounces gold and 916,168 ounces silver. For the three and nine months ended September 30, 2016, the Company reported net income of $4.2 million(2) or $0.01 per share and $25.5 million or $0.09 per share, respectively. Earnings from mining operations(3) were $18.9 million and $57.7 million over the same periods. Net income for the three months ended September 30, 2015 was $2.6 million or $0.01 per share and net loss for the nine months ended September 30, 2015 was $5.5 million, or $0.02 per share.

For the three and nine months ended September 30, 2016, the Company generated $4.9 million and $24.4 million of net cash flow from operations, respectively. We ended the third quarter of 2016 with liquid assets(3) of $62.5 million composed of cash of $38.8 million, precious metals of $16.6 million and marketable securities of $7.1 million. The Company has no debt, and has not done any financings, sold any metal streams, royalties, or hedges against precious metals. As at October 31, 2016 we had liquid assets of $60.3 million.

Our 2016 production guidance remains 99,500 gold ounces and 3.3 million silver ounces, or approximately 144,000 gold equivalent ounces. However, we are reducing our original guidance for total cash costs and all-in sustaining costs (“AISC”) from $780 and $935 per gold equivalent ounce, respectively, to $700 and $860. This is attributable to the reduced cost levels at the El Gallo Mine in the first nine months, which we expect to continue for the rest of this year.

In addition, the Company announces the promotion of Xavier Ochoa from Chief Operating Officer to President and Chief Operating Officer, effective immediately. Simultaneously, the Company announces the departure of its former President, Colin Sutherland.

Operating & Financial Highlights

Production

Production in Q3 totaled 36,496 gold equivalent ounces, which includes 11,849 gold equivalent ounces from the El Gallo Mine, and 12,527 gold ounces and 909,017 silver ounces attributable to us from our 49%(4) interest in the San José Mine. Year to date production totaled 114,009 gold equivalent ounces, which includes 47,590 gold equivalent ounces from the El Gallo Mine, and 33,839 gold ounces and 2,443,527 silver ounces attributable from the San Jose Mine.

Production Costs

Consolidated total cash costs, all-in sustaining costs (AISC) and all-in costs per gold equivalent ounce in Q3 were $677, $884 and $1,023, respectively. At the El Gallo Mine total cash costs and AISC were $598 and $680 per gold equivalent ounce, respectively. At the San José Mine total cash costs and AISC were $707 and $850 per gold equivalent ounce, respectively.

Ounces Sold

Sales in Q3 totaled 35,879 gold equivalent ounces, including 22,976 gold ounces and 967,778 silver ounces. Year to date sales totaled 110,830 gold equivalent ounces, comprised of 75,677 gold ounces and 2,636,594 silver ounces.

Earnings from Mining Operations

Earnings from mining operations were $18.9 million or $0.06 per share for Q3, compared to earnings of $13.4 million or $0.05 per share for the three months ended September 30, 2015 (“Q3 2015”). For the nine months ended September 30, 2016 earnings from mining operations were $57.7 million or $0.19 per share compared to $44 million or $0.15 per share for the nine months ended September 30, 2015.

Cash Flow

Net cash provided by operations was $4.9 million or $0.02 per share for Q3, compared to $10.7 million or $0.04 per share in Q3 2015. For the nine month ended September 30, 2016, net cash provided by operations was $24.4 million or $0.08 per share compared to $16.6 million or $0.06 per share for the prior year comparable period.

Net Income (Loss)

Consolidated net income was $4.2 million or $0.01 per share for Q3, compared to $2.6 million or $0.01 per share in Q3 2015. For the nine months ended September 30, 2016, net income was $25.5 million or $0.09 per share compared to a loss of $5.5 million or a loss of $0.02 per share in the prior year comparable period. The improved earnings are a result of an increase in net income from our investment in Minera Santa Cruz (“MSC”), partially offset by a small increase in all-in sustaining costs at the El Gallo Mine compared to Q3 2015. Furthermore, in 2015 the Company recognized impairment charges.

Average Realized Prices

The average realized prices of gold and silver sold during Q3 were $1,328 and $20.13 per ounce, respectively. On a year to date basis, average realized prices of gold and silver sold were $1,262 and $17.95, respectively.

Treasury

We ended the third quarter of 2016 with liquid assets of $62.5 million composed of cash of $38.8 million, precious metals of $16.6 million and marketable securities of $7.1 million. The Company has no debt, and has not done any financings, sold any metal streams, royalties, or hedges against precious metals. As at October 31, 2016 we had liquid assets of $60.3 million.

Return of Capital (Yield)

We paid the semi-annual return of capital installment of a ½ cent per share, which was distributed to shareholders of record on August 29, 2016. Based on our share price yesterday our yield is 0.3% per share.

Redemption of Exchangeable Shares

At its Annual Meeting held on June 6, 2016, shareholders of McEwen Mining – Minera Andes Acquisition Corp. voted to allow the early redemption of Exchangeable Shares. On August 22, 2016 each remaining Exchangeable Share was redeemed for one common share of McEwen Mining Inc. Now there is only one class of shares outstanding, common shares and as at yesterday there are 300 million outstanding.

El Gallo Mine, Mexico (100%)

The El Gallo Mine produced 11,849 gold equivalent ounces in Q3 2016, in line with our guidance, compared to 19,558 gold equivalent ounces during the same period in 2015. Production in Q3 was lower than the prior quarter due to lower grade material, as we previously forecasted (1.4 gpt in Q3 2016 vs. 2.3 gpt in Q2 2016). This decrease in average grade is the result of moving from the higher grade Samaniego pit to the lower grade Lupita pit. Our full year guidance for El Gallo remains 55,000 gold equivalent ounces. A total of 47,590 gold equivalent ounces have been produced in the nine months ended September 30, 2016.

For 2016, we have budgeted $4.0 million for sustaining costs and capital expenditures, and $3.0 million for exploration activities. During Q3 we spent $1.1 million at the El Gallo Mine, which mostly related to the replacement of the excess pond liner and other pond and site improvements, and $0.9 million in exploration activities both of which aligned with our full year plans.

San José Mine, Argentina (49%)

Our attributable production from San José in Q3 was 12,527 gold ounces and 909,017 silver ounces, for a total of 24,647 gold equivalent ounces. Compared to Q3 2015, gold and silver production increased by 3% and 4% respectively. Tax reforms, including the elimination of export tax on doré and concentrate, and other macroeconomic developments in Argentina, as well as the devaluation of the Argentinean Peso, have resulted in a significant improvement in operations and cash flows at San José in 2016. As a result, we received $7.9 million in dividends from MSC(4) in Q3. We have received $13.3 million in dividends year-to-date against an original dividend forecast of $7.5 million for 2016, and, in comparison, the Company received $0.5 million in dividends for all of 2015. The Company expects to receive additional dividends throughout the year provided gold and silver prices remain at current or higher levels.

The 2016 exploration budget remains at the increased level of $6.5 million. This is the first time in several years that a significant budget has been allocated to exploration.

Gold Bar Advanced-Stage Project(5), Nevada, U.S. (100%)

As outlined in our Feasibility Study dated September 19, 2015, the upside case for Gold Bar at $1,300/oz gold provides improved economics over the original base case of $1,150/oz.

The Company estimates that we will receive a permitting decision from the Bureau of Land Management during the third quarter of 2017. This final permit, if received, will allow us to begin construction of the mine, which we estimate will take 12 months. Production is estimated to begin the following year in 2018. For 2016, we have budgeted approximately $3.5 million to be spent towards advancing the project closer to the production stage, of which $1.9 million has been spent during the nine-month period ended September 30, 2016. Mine permitting and engineering activities continue to advance at Gold Bar.

El Gallo Silver Advanced-stage Project(5), Mexico (100%)

During the third quarter we continued to analyze development plans for the El Gallo Silver project.

Los Azules Exploration Project, Argentina (100%)

The Company is nearing completion of an updated Preliminary Economic Assessment (“PEA”) for Los Azules. We believe the recent policy shifts in Argentina such as the elimination of export taxes, the devaluation of the peso and the lifting of certain import restrictions on equipment will improve the economics of Los Azules over the previously published PEA completed in 2013. For 2016, we have increased our budget from $0.9 million to $3.4 million reflecting our recently increased levels of study to advance the project. The Company anticipates that the increased budget levels will continue into 2017 as it prepares to commence a drill program early next year, contingent upon weather conditions as the winter season normally ends during the fourth quarter of the calendar year. More here

MUX McEwen Mining Q3 2016 Operating & Financial Results McEwen Mining Inc. (NYSE:MUX) (TSX:MUX) is pleased to announce that senior management will be hosting a conference call to discuss our Q3 2016 financial results and project developments on Thursday, November 3rd, 2016 at 11:00 am ET. For dial-in, webcast and replay details see below:

McEwen Mining will be hosting a conference call to discuss the Q3 2016 results

and project developments on: DATE Thursday November 3rd, 2016 at 11:00 am ET

WEBCAST:

www.gowebcasting.com/lobby/8247

TELEPHONE:

Participant Dial-in numbers: (877) 291-4570 (North America) / (647) 788-4919 (International)

Conference ID: 9405095

REPLAY:

Dial-in numbers: (800) 585-8367 (North America) / (416) 621-4642 (International)

Conference ID: 9405095

03/11/2016 14:00 ET - 10/11/2016 23:59 ET

|

|

|

|

Post by Entendance on Dec 22, 2016 14:16:19 GMT -5

MUX Rob McEwen, chairman and chief owner of McEwen Mining (TSX: MUX; NYSE: MUX), looks back on the year that was, and ahead to what the next year may hold in store for gold.

The Northern Miner: It’s been one of the toughest years on record for commodities and we thought we’d ask you to reflect on the past year and offer your views on what the mining industry might expect in 2017.

Rob McEwen: 2016 was a surprise in many ways — pleasant in the beginning and perplexing as we approach the year end. Right now the election of Trump and Republican control of the Senate and Congress has introduced a brand new variable that I know most investors never contemplated. I’ve been really impressed by how President-elect Trump plans to change their economy to make it stronger by simplifying regulations, lowering taxes, speeding up the pace of approval of capital investments, incentives for repatriating the offshore profits of U.S. multinationals, and then putting in a very seasoned group of executives into his Cabinet. It is showing real serious intent and talent to kick-start the economy. Given this scenario, it is easy to understand why there is a rush of money into the U.S. dollar and particularly into its equity markets. With large planned expenditures on defence, on infrastructure, and a made-in-the-USA policy procurement policy, I expect their labour market will tighten, prices of goods and services will start to increase, and cost push inflation will appear later in the year.

Since the election, the Dollar has climbed in value against many of the currencies of its trading partners, interest rates are trending higher, money is moving out of the bond markets and into U.S. equity markets. I believe these abrupt changes in asset values will be a problem for the derivative market and for borrowers of U.S. denominated debt. Furthermore, I expect the damage caused by these big swings is going to surface next year and reinforce the reasons for investors to have a gold investment.

TNM: So where do we go from here?

RM: Clearly gold was going up with the prospect of a win by the Democrats, but now with the Republican’s absolute victory, the gold price is having trouble holding its gains made during the year. While it has been in a downtrend since the election, lately the price has been trading in a fairly narrow band. Most days the price is closing up in Asia and Europe then getting squashed in America. It appears that American investors believe a big positive change is coming and they don’t need exposure to gold. While investors in Asia and Europe feel their economic outlook is less certain and that they need the risk insurance afforded by gold.

Clearly, investors in America like President-elect Trump’s Cabinet appointments and his plans for accelerating the economy. And there are very good reasons to believe these plans will get started quickly because Capital Hill will be able to get bills passed. The legislative logjams that characterized the Obama years are over, and that’s a huge positive. As an aside, I have to wonder what Canada’s response is going to be to this massive competitive shift in tax rates, simplification of regulations and trade policy. Ottawa is going to have to start working overtime devising and executing a response to keep industry, top talent and markets.

TNM: Is the recent sell-off in gold overdone?

RM: It has been a quick drop. Is it over done? I don’t know. I suspect the first 100 days of President Trump’s term will set the tone for the strength of the dollar and the price of gold in US dollars. However in the interim, I expect the price of gold quoted in other currencies to climb.

TNM: Last week the U.S. Fed raised its interest rate by 25 basis points and signaled that it plans to raise rates as many as three times next year. How will that play into the gold sector?

RM: Short-term negative, intermediate-term little impact. Economic activity is likely to accelerate with the large capital investment planned by the Trump government. In the late 1970s, inflation was running fast, interest rates were in the teens, and gold was reaching new highs. In March 1980, the Federal Reserve Chairman pushed the Fed funds interest rate to 20%. And only then did the price of gold and inflation fall. Today, the Fed funds rate is 0.75 %. This is just an illustration to show that gold and interest rates can go higher, much higher together, before depressing the investment demand for gold!

TNM: What is your prediction for the average gold price in 2017?

RM: My 2016 prediction was doing well up until this summer and then crashed after the election. Based on my belief that government debt levels are going to continue to grow dramatically, rising interest rates will make it more expensive to service, the massive, opaque derivatives market is vulnerable to the large relative moves by currencies, and declining bond prices all conspire to make gold an attractive alternative investment today. So, my gold price outlook is US$1,800 by year-end 2017.

TNM: What are some of your favourite companies in the junior gold space and which ones have you invested in?

RM: I think Golden Predator has an interesting property in the Yukon. They’re getting some very splashy gold grades. Nighthawk Gold is exploring on a property that’s been around for a long time and they too are pulling good grades and intercepts. There’s Pure Gold Mining in the Red Lake camp. Their geos believe that they are looking at another structure — a folded structure — that might be a repeat of what was mined in the past. G4G Capital, which is going to be renamed White Gold, has a most innovative and successful CEO, Shawn Ryan. The company has a large land package in the Yukon with promising exploration results, and its treasury has enough money for three years of aggressive exploration without having to go back to the capital markets. Agnico Eagle has recently become a large shareholder. Abitibi Royalties I like. Its CEO, Ian Ball, has been running it well. It has a tiny share float outstanding, no debt, a strong treasury and a growing royalty revenue stream. Another interesting gold explorer with production capacity is Quebec-based Monarques Gold. Its management was acquiring when most people were hiding in the closet out of fear of everything going lower. They are building on a good resource base and have recently bought a nearby production facility. Also, I like Goldquest, which has a good sized deposit in the Dominican Republic, and Integra Gold, which has forward-looking management that has been using technology to unlock the potential of an old mine.

TNM: What about the impact of central banks on the gold price going forward?

RM: Recently, the Central Bank of India eliminated their 500 and 1,000 rupee notes in an effort to stop corruption and improve their tax collection efforts. An outcome of this action was a near collapse of their economy and a large jump in the premium over the market price of gold. Gold will remain an important monetary asset for enlightened central bankers. Perhaps the new government in Washington will recognize the inherent value of gold and take steps to once again link the dollar to gold at a much higher price than where it trades today.

TNM: What about China?

RM: Here is an example of an enlightened Central Bank. China and Russia have been buying gold. Why? I‘ll suggest because they appreciate its value and that they want to back their currencies with gold in order to make their currencies more attractive than the other fiat currencies of the world.

TNM: And then there are digital currencies and platforms like Bitcoin.

RM: The prospect of widespread use of digital currencies is a worrisome development for anyone who has concerns about big government, cyber theft of one’s deposits, and a power grid failure that could deny access to one’s savings. I like physical gold and view it as a better alternative. It can’t be hacked or stolen online.

TNM: You’re one of five judges on the Goldcorp/Integra DisruptMining competition next March, which will reward the most innovative ideas and technologies that can be applied to the mining sector.

RM: I was really delighted to be asked to be a judge. I’m a big believer that innovation will improve profit margins for miners. Integra and Goldcorp should be complimented on this initiative. It’s encouraging people to see and try out new technologies, and also to ask contestants from other industries to cross-fertilize ours. One day, hopefully soon, our politicians will understand that the mining industry is of vital importance to Canada’s future.

|

|

|

|

Post by Entendance on Dec 28, 2016 17:33:16 GMT -5

|

|

|

|

Post by Entendance on Jan 17, 2017 3:53:42 GMT -5

Gold Stocks: A Fabulous Rally Accelerates

Although its gold production is down from record levels seen in 2015, McEwen mining said in a release Monday that the company met its 2016 production guidance. According to the report, the company saw total precious metal production of 145,530 equivalent ounces, down almost 6% from record production of 154,529 gold equivalent ounces in 2015. The company said that Last year it produced 101,482 ounce of gold and 3,303,709 silver ounces. The company also said that it was able to double its liquid assets to $64 million last year in cash equivalents and precious metals. Because of its strong performance last year McEwen mining is also offering its third semi-annual return of capital of ½ cent per share will be paid on February 14th, 2017 to shareholders of record as of the close of business on February 3rd, 2017. Last week, Rob McEwen, chairman of McEwen Mining, was inducted into the Canadian Mining Hall of Fame.

McEwen Mining reports FY16 production in-line with guidance Co announced annual consolidated production in 2016

145,530 gold equivalent ounces using a gold to silver ratio of 75:1 (vs guidance of 144,000)101,482 gold ounces (vs 99,500 guidance) 3,303,709 silver ounces (vs 3,337,000 guidance) -Briefing.com

***McEwen Mining Reports 2016 Full Year and Q4 Production Results

early endings with mux.....gold, silver, copper...underowned....Mexico, argentina, US.....plus optionality on juniors he has taken stake in... -Tom from Florida |

|

|

|

Post by Entendance on Feb 1, 2017 9:09:17 GMT -5

MUX McEwen Mining goes ex-dividend today •McEwen Mining (NYSE:MUX) had declared C$0.005/share semi-annual dividend, in line with previous. •Payable Feb. 14; for shareholders of record Feb. 3; ex-div Feb. 1.

•CEO knows how to make money for shareholders.

•Currencies are being devalued across the globe.

•San Jose mine spins off $13 million in dividends.

Rob McEwen is not your typical CEO. After a highly successful tenure as founder of Goldcorp (NYSE:GG), he launched McEwen mining (NYSE:MUX) and is banking on a robust stock price move, since he commands a paltry salary of only $1 per year.

Mr. McEwen wants his management decisions to align with his stockholders as he owns a substantial 25% of McEwen stock. With 300 million shares outstanding and the stock trading just shy of $4.00 per share, this is a $1.23 billion company.

Argentina has dramatically improved the financial fortunes of the company's 49% owned San Jose mine, by cutting onerous taxes that had driven miners out of their country. 51% owner Hochschild mining has delivered $13 million in dividends to McEwen Mining- through the first 3 quarters of 2016, with expectations of more to come. Hochschild has been cutting mining costs and the lifting of capital controls by Argentina President Macri has allowed the free market to properly devalue the peso currency. Mining costs have plunged alongside the weaker peso and new investment and exploration should lead to an expansion of gold and silver production.

The great Fidelity Magellan Fund Manager Peter Lynch stated that small company stocks make big price moves and large companies tend to make smaller moves. This fact is very applicable to the mining industry for those small companies that have strong balance sheets. McEwen Mining holds $62 million in cash, precious metals, and liquid securities and 0 debt through September 2016.

The 100% owned El Gallo mine in Mexico is also seeing a sharp decline of all in cash costs to $680 per ounce of gold equivalent (gold and silver converted to gold). The Mexican peso has devalued sharply and mining production costs have fallen accordingly. Gold price is hovering around $1,200 per ounce, but McEwen sees a potential high price of $5,000 in the next few years. Silver price has risen from an average of $14.86 in early 2016 to $17.50 per ounce amid continued reports of strong physical demand from both investors and industry.

McEwen is looking to propel the company into the S&P 500 stock index, through additional acquisitions or mergers. The deal has to be "good" for his stockholders as he is the largest one. One of the requirements of the S&P 500 is that the company must be based in the United States, and McEwen Mining was incorporated in Colorado. There is only one miner currently listed in the index, so the next miner to join-will experience some heavy share purchases and the stock price will jump higher.

Fiat paper money currency continues to be devalued as the central banks seem to believe that printing more paper currency will remedy weak economic conditions. There are huge debt problems in the United States and China, and paper currency inflation is only creating havoc across economic markets everywhere. India has confiscated paper money and China continues to attempt to control capital outflow. Venezuela is experiencing crippling inflation of 122% in 2015 and 546% in 2016 (CIA report) and the United States is vastly understating inflation when it excludes the crushing rise in healthcare costs from the failed Affordable Care Act. As citizens experience loss of paper currency purchasing power, they will continue to purchase hard assets, including silver and gold. China and Russia central banks continue to purchase gold, possibly as a prelude to backing a more stable currency. Noted silver metal analyst Ted Butler reports that JP Morgan has accumulated 80 million ounces of silver in their COMEX warehouse.

The reported manipulation of silver prices by Deutsche Bank among many others has set up a bullish scenario for miners who maintained their fiscal discipline during the period of price suppression. The suppressed price has shut down mining production because its arbitrary price was pushed below the cost of producing the precious metal. The stronger surviving miners such as McEwen, are now in a position to capitalize on these rebounding gold and silver prices. New miners will try to move in to production mode, but it takes time to do so. Rising demand and limited supply creates rising profits.