|

|

Post by Entendance on Jul 26, 2017 16:48:40 GMT -5

No room for anti-Americanism at Fred & Entendance Beach

"...Fuck the price. Focus on the value. Use price to buy undervalued and sell overvalued. Keep its weighting constant in your overall portfolio. But stop trading it because some salesman told you to." ***Stop Trading Gold Now

"There's simply no point in attempting to report what's going on when nobody gives a shit..."

***How I Know Facebook Is LYING

***Time To Die, Americans

Asinus asinum fricat. -Cicero One donkey scratches another donkey (when an ass rubs an ass, when a couple of donkeys are engaged in mutual admiration, shit happens) L'âne frotte l'âne Два сапога пара L’ignorante loda l’altro ignorante

The Absolute Must Read at The E. Beach is ***here |

|

|

|

Post by Entendance on Jul 28, 2017 7:10:59 GMT -5

|

|

|

|

Post by Entendance on Jul 28, 2017 23:36:39 GMT -5

|

|

|

|

Post by Entendance on Aug 2, 2017 17:06:37 GMT -5

|

|

|

|

Post by Entendance on Aug 4, 2017 5:04:14 GMT -5

These deaths are not tragedies, they are crimes ***A Million Children Are at Risk of Death by Cholera in Yemen

***Noi siamo responsabili ***Noi siamo responsabili

Ma...nel frattempo...La fabbrica delle bombe, gli operai: No alla riconversione

***Italiani -Ormai la salvezza è solo individuale

August 2017***Biological Warfare: US & Saudis Use Cholera to Kill Yemenis

***********************

<For decades, in discussing the ever-increasing hegemony of the world’s principal governments (US, EU, et al), I’ve been asked repeatedly, “When will the governments understand that this obsession they have to become all-powerful is not in the interests of the people?”

The answer to this question has also remained the same for decades: never.

Although most all thinking people will readily admit that they regard their government (and governments in general) to be both overreaching and corrupt, they somehow attribute political leaders with a desire to serve the people. This is almost never true.

In my own experience in working with (and against) political leaders in multiple jurisdictions, I’ve found them to be remarkably similar to each other in their tendency to be shortsighted, self-aggrandising and almost totally indifferent to the well-being of their constituents. Indeed it’s a real rarity to encounter a political leader who does not fit this description.

Therefore, we should take as a given, that all political leaders will continue to pursue their own power and wealth, at the expense of their citizenries.

This, then, begs the question, “If they won’t stop themselves in this progression, is there no other outcome than eventual total slavery to the government?”

Well, here, history informs us that this is not the case. All governments will tax the people as much as they can, regulate them as much as they can, socially dominate them as much as they can and remove as many rights as they can. However, they rarely totally succeed and, even when they do, the clock is ticking against them.

In 1999, I began to warn that the US military would steadily increase its warfare against other nations and would only cease their military expansion if and when economic collapse made it impossible to continue the expansion.

In 2008, I began to warn that the US, EU and other jurisdictions would eventually attempt to eliminate the use of paper currency, or “cash,” and force all people to rely almost totally on electronic transfers of money. (I had pictured plastic credit cards being used – I hadn’t imagined at that time that smartphones would make such transactions even easier.)

In addition to the above abuses, I projected that these jurisdictions would become more collectivist, would increase legislation to dominate their citizens socially and would eventually come to resemble police states.

But, at the same time, I projected that, although I believed that all these developments would increase steadily, both in magnitude and frequency, they would reach a peak point, then begin to unravel – and would do so more quickly than they had been implemented.

This would happen for two reasons, and neither of these reasons come from some crystal ball. They come from history.

As has always occurred, for millennia, such rapidly-expanding excesses cannot be created by governments without creating debt. The more rapid the level of change, the greater the debt necessary.

Today, we’re witnessing the greatest level of debt the world has ever seen. As always in history, this is a ticking time bomb.

The second reason is that, such rapidly-expanding excesses cannot be created by governments without creating resentment. The more rapid the level of change, the greater the resentment.

Taken as a whole, what this means is that all of the increased hegemony, of every type, rises to a peak, then collapses – often all at the same time.

We can see the economic warning signs as the financial institutions have run out of new measures and are now relying on band-aid measures. This tells us that we’re entering the final years (or possibly months) of the debt mania. Consequently, the only remaining measures will come under the heading of abuse to the consumer within the system.

Militarily, we see the end nearing, as the world becomes ever-more resentful of the US as the self-imposed world policeman. (This is particularly acute outside of the US, as those who live outside the reach of the US media understand that the US has, for years, been inventing its excuses for warfare, where there was no real justification.

For many years, I’ve said that we’ll know that the unravelling will be very near when the creators of the abuse begin to realise that the hegemony is nearing its end and is due for a reversal.

Recently, two events have occurred that suggest that this part of the process has begun.

First, the EU has launched public consultation to get the pulse of the people of Europe on their War on Cash programme (which they term, “de-cashing”).

The findings, even though the questions were phrased to make it difficult to oppose the concept, indicate that more than 99% of respondents see no benefit in de-cashing. Further, 87% regard the use of cash as an essential personal freedom.

Although the people of Europe have tolerated one hit after another from Brussels, de-cashing may well prove to be their Waterloo.

As this was occurring, across the pond in the US, the military has performed a study to learn how much further they can push the world with their present level of aggression and have determined that, “the status quo that was hatched and nurtured by U.S. strategists after World War II,” and has been dramatically expanded in recent decades, “is not merely fraying, but may, in fact, be collapsing.”

It’s often assumed that empires tend to expand until a point at which they subside, but this is not the case. Very much like a market bubble, they tend to reach a dramatic peak just before they collapse. Almost invariably, those who are the last to understand that the end is near are those who are at the very apex of power. Therefore, rather than back off their programme of hegemony, they expand right until economic collapse destroys it. Like heroin addiction, greater amounts of the drug are injected, right until the fatal overdose takes its toll.

What this means to the reader is that, although he may either live in, or in some way be under the control of one of the current empires, his lot is far from hopeless, but he must be wise enough to keep his powder dry until the collapse is under way.

From the present day until the collapse, the empires will increase taxation, increase regulation, increase warfare, increase social dominance and remove the rights of their people in evermore dramatic ways.

Those who seek to sidestep this process might well pursue international diversification as a bridge to freedom. In this race against time, nations will make it increasingly difficult to escape and freedom will only be realized after the collapse. The greater the preparedness today, the greater the likelihood of coming out the other side in several years, with wealth and freedom intact.> -Jeff Thomas

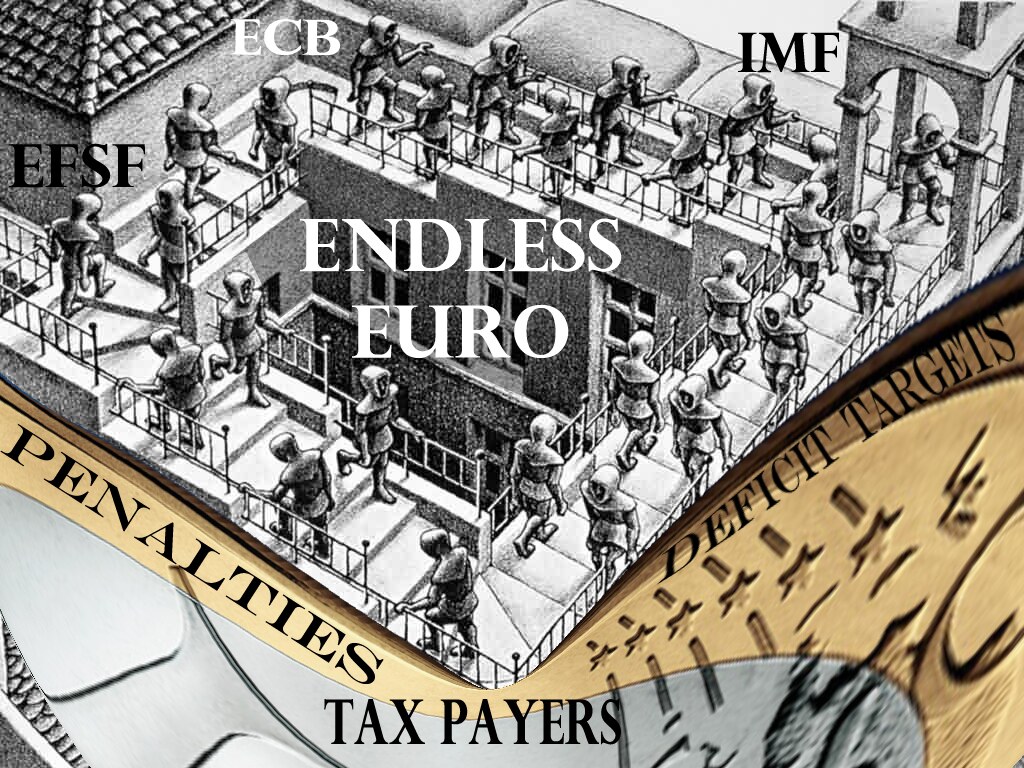

***DEBT SLAVERY + FAKE MONEY = FINAL COLLAPSE*** ***DEBT SLAVERY + FAKE MONEY = FINAL COLLAPSE***

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

|

|

|

|

Post by Entendance on Aug 16, 2017 5:34:39 GMT -5

|

|

|

|

Post by Entendance on Aug 20, 2017 5:27:33 GMT -5

"...For those who have not traveled and immersed themselves in formerly colonized countries, it is hard to understand that although there was piping for water and sewage in Roman days, it still isn’t available for a very large segment of the world’s population..." ***The Future of the Third World

|

|

|

|

Post by Entendance on Aug 22, 2017 4:05:19 GMT -5

|

|

|

|

Post by Entendance on Aug 31, 2017 3:59:45 GMT -5

"...To refer to the trading of stocks as a “market” is not only an insult to any dictionary in the world that carries the definition of “market,” but it’s an insult the to intelligence of anyone who understands what a market is and the role that a market plays in a free economic system. By the way, without free markets you can’t have a free democratic political system.

The U.S. stock is rigged beyond definition. By this I mean that interference with the stock market by the Federal Reserve in conjunction with the U.S. Government via the Treasury’s Working Group on Financial Markets – collectively, the “Plunge Protection Team” – via “quantitative easing” and the Exchange Stabilization Fund has destroyed the natural price discovery mechanism that is the hallmark of a free market. Capitalism does not work without free markets..." More here

***Veritas filia temporis Updated

***Sound & Honest Money Updated ***Sound & Honest Money Updated

|

|

|

|

Post by Entendance on Sept 2, 2017 15:21:29 GMT -5

<The dollar has a bric around it's neck?> -Tom Russia & BRICS to counter 'excessive domination' of certain few reserve currencies -*** Putin

What crypto-euphoria says about gold – Compliments of Doug Pollitt – Pollitt & Co. Acrobat after CLICKING*** here

H/T Tom from Florida

<How does bitcoin derive its value? How do people know this market is not being cornered? I still do not understand how you know which crypto will be the standard. Everyone knows the value of crypto but no one knows how to value gold? What a narrative, E.> -Tom From Florida

Tom, un amico, un fratello in spirito e luce. Insieme dal 2004, a divulgare, spiegare e interpretare il gioco dei mercati finanziari e l'investimento in metalli preziosi. Tom, per sua scelta personale che io rispetto, non posta più nulla in rete da anni, ma mi affianca H/24 e mi sostiene nei miei sempre più frequenti momenti di "what the fuck". Tom, un Uomo per gli Altri. Senza Tom io sarei scomparso volentieri dal web già nel 2009. Io e Tom non abbiamo proprio mai avuto nulla da perdere, solo da dare. Finchè il Signore vorrà. Tom, anche a nome di chi non ti conosce, grazie. E.

E. on twitter |

|

|

|

Post by Entendance on Sept 13, 2017 3:40:13 GMT -5

"The dollar imperium is in its painful death agony and its patriarchs are in reality denial " ***Gold Oil Dollars Russia and China

"History is replete with examples of hubristic regimes that appeared invincible and everlasting, but quickly fell with severe and quite nasty retribution from their enemies" ***The United States of Hubris

Don't Get Hooked***Chapter VIII

|

|

|

|

Post by Entendance on Sept 15, 2017 10:12:24 GMT -5

"Now that gold has become overbought on Comex, the price is vulnerable to being trashed, yet again, by the too-big-to-fail banks. It is a familiar operation in gold futures markets, where speculators buying contracts protect themselves with stop-losses.

All the TBTF banks need is a pause in the speculator’s buying and a little good news (bad for gold). Ideally, the active contract will be running into maturity, so the speculators are forced to put up or shut up: in other words, sell the contract, roll it into another later maturity, or stand for delivery.

Bearing in mind these speculators are running highly leveraged positions, greed turns to fear on a sixpence. The TBTF banks will have supplied the speculators with their longs by going short. From the moment you go long, you are trapped in a trader’s version of Hotel California.

The TBTFs start off sitting on losses, not worrying for them, being TBTF. But they know how to turn it around. Just pick a quiet moment, sell a few billions-worth of contracts, and take out all those stops. It is a cycle of events that happens time after time, a money machine for the bullion banks. Just occasionally, it goes wrong, because the physical markets take back control of pricing away from futures markets. But what the heck, these guys will be bailed out by the Fed, or the Bank of England. Meanwhile their traders have made bonuses quarter after quarter.

Speculators fall for it every time. Sooner or later, they argue, the TBTF traders will get their comeuppance. But now that gold has risen $140 in less than two months, we are due for another rinse cycle in the Comex washing machine. Gold is as overbought as it has ever been. The punters are due to be cleaned out again. Only a fool would bet otherwise. But, this time it just might be different.

For this time to be different, the dollar will have to continue to weaken. Not much else can save the bulls from the TBTF bullion banks. This article discusses the prospects for the dollar, and concludes that, other than a technical rally in the short-term, the prospects for the dollar are not good.

There are four fronts opening that could drive the dollar down: the stagnating US economy, oil producer nations discarding the dollar, the interests of China moving towards abandoning the dollar, and lastly, the commercial interests of the major bullion banks shifting towards the China story. We shall consider each in turn.

US economy stagnating

All the hype during President Trump’s first hundred days, when he behaved like a latter-day Franklin Roosevelt in a flurry of initial activity, is being replaced by cold reality. The dollar first rose, and then started to decline. The fiscal benefits of tax reform remain pie in the sky. The stimulus to American industry from tariffs and import duties on imported goods, on second thoughts, is no stimulus, and merely raises the costs faced by consumers. Most of The Donald’s anti-establishment, reforming team has resigned, replaced in the White House by three establishment generals. In a banana republic, the press would call it a military coup. Make America Great Again is now not much more than an empty phrase.

President Trump’s election appears to have set up the dollar for a substantial decline, as this reality sinks in. His policies are being exposed as bombastic and autarkic. By isolating America from the benefits of world trade, she gets almost no benefit from the rapid transformation progressing the Asian continent from economic backwater to economic powerhouse.

Meanwhile, the accumulation of debt is unproductive and a burden on the economy, still financing wasteful government deficits, and inflating consumption. Consumers’ income has failed to keep pace with the cost of living for at least the last two credit cycles. And with the consumer becoming overburdened with a legacy of debt, the economy is struggling, no longer in crisis, but going nowhere.

Those analysts who unwisely think trade protectionism will create American jobs fail to understand that trade deficits arise from a combination of government deficits, the expansion of bank credit, and low savings. Yet these are the policies the government and the Fed are actively pushing for economic recovery. Consequently, the budget deficit next fiscal year is likely to be another $500bn, which we can add to the running total.

For the dollar’s prospects, the most important thing to know is that since 1980 the accumulated deficit on the balance of payments, of which the balance of trade is the major component, will have totalled over $11 trillion by the end of this year. The accumulated balance of payments deficit serves as an indication of the scale of foreign ownership of dollars, only $4.36 trillion of which is identified in central bank reserves around the world. Much of the balance of foreign-owned dollars is owned by businesses, engaged in global trade.

The management of dollar balances is crucial for these businesses’ profitability. They will have noted that on a trade-weighted basis the dollar peaked in January, and since then has lost 7.5%. That is a severe impact on profits. They will be on the alert for further signs of weakness, and will have noted the improving trade prospects for Europe and the Eurozone, which have driven the euro up against the dollar by 15% this year. Furthermore, the Eurozone is running a trade surplus of an estimated €200bn for 2017, leading to an underlying contraction of euros in foreign ownership. The Chinese renminbi (or yuan), has risen 7.3% against the dollar this year, affecting corporations trading with China. Most importantly, it affects oil producers selling into their largest single market. They will be watching the dollar’s progress from here.

There is little doubt that the non-US world owns substantial quantities of the dollar, and can be spooked into selling. For this reason, the poor relative performance of the US economy compared with the more dynamic performances of China, Japan and Europe places the dollar at a severe long-term disadvantage on the foreign exchanges.

Oil producers moving away from USD

The pact between Nixon and Saudi Arabia back in 1973 set the dollar up as the exclusive settlement currency for oil exports, following the collapse of the Bretton Woods Agreement in 1971. Since then, the very few countries that threatened to sell oil for other currencies, notably Iraq under Saddam Hussein, and Libya under Colonel Gaddafi, have met with unfortunate accidents. The only countries to successfully challenge the dollar’s oil hegemony have been Russia, China and Iran, but not without adverse consequences. And now, Venezuela is ditching US Imperialism by selling her oil for a range of currencies, excluding US dollars.

Perhaps Venezuela hasn’t been listening. The experiences of Iraq and Libya sent a clear message to other countries about the consequences of denying dollar hegemony. In the case of Iran, the Americans even leant on SWIFT through the EU, the supposedly independent interbank settlement system, to freeze out all transfers involving Iran in 2012. Iran’s currency all but collapsed under this pressure. But tactics of this sort create more resentment than anything else, and have undermined goodwill among non-aligned countries. The Russians, powerful enough to survive America’s financial wrecking tactics, have now set up their own rival to SWIFT, as well as other moves to make them entirely independent of the dollar.

Increasingly, the Russians and Chinese, as well as the Shanghai Cooperation Organisation which they lead, are encouraging oil producers to sell oil for consumption in Asia for Asian currencies, principally the yuan. To achieve this objective China is developing capital markets to improve the yuan’s liquidity and acceptance as a trade medium. However, she knows that she must offer something more than an alternative to the dollar than the yuan, with its shorter and less certain track record. And this is where physical gold comes in, sound money that is no government’s liability, universally recognised as such even by those that publicly deny its monetary credentials.

China long knew gold would be central to her geopolitical strategy as well as her own long-term security. In the last few years, she has dominated physical markets. She is the largest gold mining nation by far. There can be no doubt she has accumulated substantial undeclared gold reserves since 1983, when the central bank was first appointed for this purpose. She is on the verge of offering oil producers the facility in the Shanghai futures markets to swap oil for yuan and yuan for gold, sourced from outside China. There can be little doubt that oil producers will see this as an attractive alternative to the dollar. Russia and Iran are already signed up. Other countries, such as Venezuela, heavily dependent on Chinese oil demand, appear to be in the process of doing so. But the real prize will be Saudi Arabia.

Saudi Arabia needs money, and if Western capital markets do not provide it in return for a minority stake in Aramco, there’s little doubt the Chinese will strike a deal. The policy of turning the world’s oil suppliers away from the dollar and in favour of the yuan for exports to China has made significant progress in recent months. The next key development will be the full implementation of a yuan futures contract for oil, and that could be introduced in the coming months. When that happens, the dollar’s function as the sole reserve currency will effectively cease.

China’s foreign reserves

China has accumulated a large pile of foreign reserves, the equivalent of $3 trillion. This accumulation, perhaps over $2 trillion of it in dollars, is the consequence of past currency management, the objective having been to enhance the profits of Chinese-based manufacturers exporting to other countries. The early development of the Chinese economy was just an initial phase that encouraged strong flows of inward investment followed by net exports. Furthermore, the Chinese are avid savers, putting aside as much as 40% of their earnings, leading to large and persistent trade surpluses.

On the ground, Chinese economic success has brought substantial improvements to the lives of China’s population. The economy is now being refocused towards services and technology, maturing from its export-led model into a fully-fledged advanced economy with a rising middle class. Furthermore, China has a requirement for enormous quantities of raw materials to satisfy her infrastructure plans, which encompass the whole of Asia.

The need for holding large quantities of dollars, the result of neutralising capital inflows and then suppressing the yuan for export price competitiveness, has now passed. China requires far more modest dollar balances, so she will almost certainly invest them in stockpiles of base metals and the raw materials required for the future. This change in policy is already evidenced by the yuan rising against the dollar by over 7% this year, cheapening commodity imports by this amount compared with dollar prices.

There can therefore be little doubt that China will be a big seller of dollars in future. Her problem is if she is too aggressive in this policy, she will trigger selling by other Asian central banks, and could even risk having her $1.1 trillion holdings of US Treasuries frozen by the US Government. She must tread carefully, unless it suits her to become more aggressive in an escalating financial war. Her policy therefore, is likely to be a seller of dollars into strength rather than weakness. The consequence for the dollar is any price recovery is likely to be capped, and therefore limited in scale and duration.

The banks are changing allegiance.

The major global banks are being forced to refocus their activities towards China and her Asian strategy. Infrastructure development needs financing, and this is being coordinated through the Asian Infrastructure Development Bank. China is internationalising her own capital markets through Hong Kong and London. America is deliberately excluded from these activities.

This does not mean that China is against American banks. Her objective is to do business with all foreign banks competitively so long as it does not involve dollars. This leaves the American banks with a decision: do they go with President Trump’s mantra of making America great again and desist from helping China, or do they do their commercial duty for the benefit of their shareholders, and seek to profit from China’s anti-dollar strategy?

Nowhere is this conflict more acute than in the market for gold and silver. Now that China controls both these physical markets, the major bullion banks have no option but to join the Shanghai International Gold and the International Futures Exchanges. Soon, they will no longer be driving prices down on Comex, predominantly as bears supplying paper contracts to speculating buyers. Instead, they will have to become buyers of physical bullion to deliver to the Shanghai physical and futures markets. It is early days, but already ANZ Bank, UBS, BNP Paribas, Standard Chartered, HSBC, JP Morgan (London Branch) and Goldman Sachs are among the leading banks that have made or are making this transition.

Conclusion

There are large quantities of dollars ready to flow away from foreign ownership, a legacy of the days when businesses were unquestioningly happy to hold them as the principal reserve and trade currency. There has been little alternative until now. Furthermore, China’s central bank probably owns half of all the world’s central banks’ dollar reserves, and it is now in her interests to reduce that exposure.

America is isolated from the global economic growth story, which is centred on China and the Chinese-led development of Asia. America’s abuse of her dollar privilege over the years has left a legacy of mistrust in the non-aligned countries, and these countries are now driving the world’s economic progress. At the Asian economic feast hosted by China and Russia, the only guest not invited is America.

America’s poor state finances and her reliance on monetary stimulus will ensure a continuing supply of dollars to the foreign exchanges through persistent trade deficits. The Trump presidency looks like being a disaster for the dollar, and as soon as this becomes apparent in the foreign exchanges, selling is likely to escalate. And as the dollar slides, it should begin to lose its status as the settlement currency for increasing numbers of oil exporting nations.

The final curtain on the Make America Great Again mantra will be the growing covert support for the Chinese opportunity from major international banks, driven by commercial reality. They simply cannot afford to stand by, and there are early indications of JPMorgan and Goldman Sachs positioning themselves to be physical traders and suppliers of bullion in Shanghai. It would be a surprise if more Western bullion banks do not follow their lead.

Whether this is the time physical gold demand begins to take over pricing leadership from futures markets, only time will tell. But there can be no doubt that the balance of interests for China is turning to now see a weakening dollar. However, China is surely aware of the disruption she will cause in Western dollar-centric markets if she precipitates significant dollar weakness, and therefore strength in the gold price. She will not want to be blamed for overtly triggering the dollar’s demise as a reserve currency, which probably explains why she has deferred the launch of the yuan-for-oil contract, and is proceeding cautiously.

Obviously, geopolitics plays a central role in timing, with America desperate to oppose China in partnership with Russia as the dominant state on the Eurasian continent. The consequences of ending America’s financial hegemony are not to be underestimated, and China will not take such a step lightly. However, investors in Western financial markets appear to be beginning to get the message that the heyday of the dollar is now over, there is a significant decline ahead, and therefore mainstream investing institutions need to reconsider their asset allocations in favour of physical gold at the expense of the dollar." -Alasdair Macleod

A REMARKABLE TUTORIAL VIDEO ON GOLD & SILVER HERE

|

|

|

|

Post by Entendance on Sept 17, 2017 15:41:24 GMT -5

***Stay Away from Bitcoin, It's an ‘Absolute Bubble’ Says Tocqueville's Hathaway

Dumb all over ***Just 4% Own Over 95% Of Bitcoin

September 19, 2017***Bitcoin is Precise But Not Accurate - Keith Weiner

"...Imagine that a friend is building a casino and asks you to invest. In exchange, you get chips that can be used at the casino’s tables once it’s finished. Now imagine that the value of the chips isn’t fixed, and will instead fluctuate depending on the popularity of the casino, the number of other gamblers and the regulatory environment for casinos. Oh, and instead of a friend, imagine it’s a stranger on the internet who might be using a fake name, who might not actually know how to build a casino, and whom you probably can’t sue for fraud if he steals your money and uses it to buy a Porsche instead. That’s an I.C.O..." ***Is There a Cryptocurrency Bubble? Just Ask Doge

"...The interesting question is not whether Bitcoin is a fraud, but is Bitcoin a tulip bulb or is Bitcoin a Beanie Baby? I’ve been saying for weeks, if not months, absolutely yes. The theory of Bitcoin having value is, one, that it’s limited in quantity, which is true, and two that it’s free of government interference. Well, while it’s true that while Bitcoin is limited in quantity, the number of Bitcoins are not limited. There are 600 different variations of Bitcoin now, and they’re certainly not limited, and if you can have 600, you can have 6,000. The other theory being that it’s free of government interference, China has just made it illegal and proven that that’s not true.

I wouldn’t go so far as to say Bitcoin is fraud, but Bitcoin has absolutely no value now, and it’s going to cost people a lot of money. Okay, it’s gone from 4,700 to 3,500 in a week, and it’s going to go from 3,500 to zero. Now, it might go from 3,500 to 10,000 first, but it’s going to end up being zero. Bitcoin is a pseudocurrency. It’s no more suitable as money than salt or big round rocks..."

In collaboration withTom from Florida

2 pages at The Entendance Beach:*** Bitcoin & Cryptocurrencies Updated |

|

|

|

Post by Entendance on Sept 20, 2017 4:30:02 GMT -5

"...The real threat to us all is the central banking and international banking apparatus, including the BIS and the IMF. From now until the end of this year, remain vigilant." More here

"Central Banksters could care less about our safety and care about one thing and one thing alone: Control of the money system and control over every facet of your financial life.

This is why they hate physical money and this is why they hate***gold and silver.

Resist this movement my friends, this won't be the last shot they fire." -Nathan McDonald

"Help, Lord, for no one is faithful anymore;

those who are loyal have vanished from the human race.

Everyone lies to their neighbor;

they flatter with their lips

but harbor deception in their hearts.

May the Lord silence all flattering lips

and every boastful tongue

those who say,

“By our tongues we will prevail;

our own lips will defend us—who is lord over us?”

“Because the poor are plundered and the needy groan,

I will now arise,” says the Lord.

“I will protect them from those who malign them.”

And the words of the Lord are flawless,

like silver purified in a crucible,

like gold refined seven times.

You, Lord, will keep the needy safe

and will protect us forever from the wicked,

who freely strut about

when what is vile is honored by the human race." -Psalm 12

|

|

|

|

Post by Entendance on Sept 25, 2017 5:44:22 GMT -5

|

|

|

|

Post by Entendance on Sept 29, 2017 15:47:21 GMT -5

"...Debt doesn't matter -- right up until it does.

So goes the chestnut.

In actual practice, however, it's much worse: Increasing debt tends to make equity valuations go up right until it matters, then it makes them crash.

There is exactly zero attention being paid to this. But the truth of it is found in every recent, and in fact all the nasty historical drawdowns in the market. Let's just go through a few of the really bad ones, specifically:

1873

1929

2000 and

2008

All of them shared the same basic paradigm.

In 1873 it was long-term railroad debt centered on the premise of silver mining. When that blew up it put the US into Depression and destroyed market valuations in a form and fashion deep enough that it became known as the "Long Depression"; a moniker and derisive standard that stood unchallenged until the 1930s.

In 1929 of course it was both stock market margin debt along with real estate, much of it in Florida, that led to the 1929 crash and the government's intervention led to the 1930s Great Depression.

In 2000 the accumulated idiocy of internet companies running on a "cash burn" model, a "business mode" that distills down to "we don't need to make money, we'll just borrow it" (said "borrowing" coming from issuing worthless shares into a white-hot IPO market) led to the crash of 2000-02.

And in 2008, of course, it was the outrageous practice of issuing worthless debt for all manner of housing and commercial real estate, much of it repackaged into various exotic instruments for the very purpose of hiding the risk and fraud they contained, that led to the collapse of the housing market, the stock market, and nearly the entire banking system.

Today we are doing the same thing. We're just hiding it differently, exactly as has been done with all other instances of the same scam. It's very necessary, you see, to use a different place in the economy to run the scam and to make it nice and complex because if you try to run the exact same one or make it too simple then people will point it out...." More here

|

|

|

|

Post by Entendance on Oct 2, 2017 11:28:05 GMT -5

"...provoking nuclear powers such as Russia and China is the most extreme form of recklessness and irresponsibility...Russia is not going to be hung like Saddan Hussein or murdered like Gaddafi..." Paul Craig Roberts here H/T Tom from Florida |

|

|

|

Post by Entendance on Oct 10, 2017 15:29:14 GMT -5

A sublime piece of writing from Ben Hunt

"We think we are wolves, living by the logic of the pack. In truth we are sheep, living by the logic of the flock." "It’s not what the crowd believes. It’s what the crowd believes that the crowd believes. The power of a crowd seeing a crowd is one of the most awesome forces in human society. It topples governments. It launches Crusades. It builds cathedrals. And it darn sure moves markets."

PDF***Sheep Logic*** ***Sheep Logic H/T Tom from Florida

|

|

|

|

Post by Entendance on Oct 17, 2017 15:54:29 GMT -5

<...Those who’ve never scratched below the surface to take a closer look at what’s going on may be unclear how Nixon’s closure of the gold window has been so destructive for so many people. This is understandable; most are unable to diagnose it. However, the ultimate effect of these actions, including debt servitude, has been demonstrated for millennia...." ***The Downright Sinister Rearrangement of Riches <...Those who’ve never scratched below the surface to take a closer look at what’s going on may be unclear how Nixon’s closure of the gold window has been so destructive for so many people. This is understandable; most are unable to diagnose it. However, the ultimate effect of these actions, including debt servitude, has been demonstrated for millennia...." ***The Downright Sinister Rearrangement of Riches

***Debt has grown 2.5x faster than GDP ***Debt has grown 2.5x faster than GDP

"Nearly 10 years since I first began a rigorous intellectual inquiry into the element Gold (Au). Today I feel vindicated as Goldman Sachs, the prestigious global investment bank, published a private 100 page report to its ultra rich clients dedicated entirely to Gold. What's so unique about this report is for the first time in at least 50 years (since gold was demonetized by President Nixon) the true story of gold as understood by the ancients and most of the population in the east is being properly told by a western financial institution. Gold's physical properties, its history, and even the importance of 24 karat gold jewelry for savings."***Roy Sebag Here

H/T Tom from Florida

Kings, governments, dictators, financiers, mathematicians and many other powers have tried to dethrone Gold for thousands of years. They all lost.

The biggest mistake ever

"I directed [Treasury] Secretary Connolly to suspend temporarily, the convertibility of the dollar into gold or other reserve assets, accept in amounts and conditions determined to be in the interest of monetary stability and in the best interests of the United States." — President Richard M. Nixon, August 15, 1971

"Nearly 50-years later, I think we can all agree there was nothing "temporary" about it. Nixon also called concerns about devaluation a "bugaboo," claiming that "the effects of this action will be to stabilize the dollar." In reality, nothing could have been further from the truth. The dollar tumbled in value against other currencies and against gold.

At the time of Nixon's speech, gold was trading around $43 per ounce. By January of 1980, it had reached a high of $850, nearly a 20-fold increase.

The dollar index has fallen about 9% YTD in 2017. The recent 3% corrective bounce seems to have lost momentum, suggesting the dominant downtrend is re-exerting itself. A weaker dollar into year-end bodes well for higher gold prices over the same period. This may be the last opportunity to buy gold at these levels." -Peter Grant |

|

|

|

Post by Entendance on Oct 24, 2017 7:52:55 GMT -5

“The last duty of a central banker is to tell the public the truth.” –Alan Blinder, former Federal Reserve Board Vice Chairman

The central bank system is the greatest scam ever perpetrated on an ignorant public. The eternal enemy of every central bank is... Gold. -Richard Russell

Central banksters & Lies |

|

|

|

Post by Entendance on Nov 3, 2017 7:00:55 GMT -5

|

|

|

|

Post by Entendance on Nov 8, 2017 16:37:52 GMT -5

***The Saudi purges hit the DC lobbyists***

Saudi methods may be different but the gist of what they are after isn't - when countries run out of money, they expropriate whoever has it.

Think of this episode as Cyprus 2.0, the desert edition. -Simon Mikhailovich

Ask Bank Depositors in Cyprus (2013) & Greece (2015) if a bank deposit is money… They learned the HARD way when banks were closed! E.

The Entendance Beach:***Cyprus

The Entendance Beach:***Saudi Arabia

****************************** "...What is driving US equity prices now is classic bubble action. Stocks are being bought, not with regard to any fundamentals for the most part, but for the sheer momentum of ever rising prices by speculators.

Having created this asset bubble, again, in conjunction with the financiers and Wall Street, the Fed is deathly afraid of anything that will break the mirage and put the banking system at risk.

And we are seeing, like a dog returns to its vomit, the Banks start taking up the kinds of leveraged risks that brought us to the brink in the great unwinding of the housing bubble in 2008.

Surely they must care. Surely they must have a caution for the damage they will cause to untold thousands of innocents. And if not the money men, then those who are sworn to restrain their greed.

As John Kenneth Galbraith observed in his masterwork, The Great Crash of 1929, 'The sense of responsibility in the financial community for the community as a whole is not small. It is nearly nil.'

And you can toss in the political and corporate media elite in there as well. It's a club, and you aren't in it.

Have a pleasant evening." -Jesse |

|

|

|

Post by Entendance on Mar 13, 2018 9:13:56 GMT -5

"All my life I have been fighting against the spirit of narrowness and violence, arrogance, intolerance in its absolute, merciless consistency. I have also worked to overcome this spirit with its evil consequences, such as nationalism in excess, racial persecution, and materialism. In regards to this, the National Socialists are correct in killing me.

I have striven to make its consequences milder for its victims and to prepare the way for a change. In that, my conscience drove me – and in the end, that is a man's duty." - Helmuth James Graf von Moltke, Executed in Plötzensee Prison on 23 January 1945

"Silence in the face of evil is itself evil: God will not hold us guiltless. Not to speak is to speak. Not to act is to act." - Dietrich Bonhoeffer, Executed in Flossenbürg Camp on 9 April 1945

As journalist activist Carl von Ossietzky put it, 'we cannot hope to affect the conscience of the world when our own conscience is asleep.'

Heroic virtue shines across the vast seas of history like beacons to those in the troubled waters of general deception...-Jesse

|

|

|

|

Post by Entendance on Apr 17, 2018 23:06:13 GMT -5

"...famed analyst Mark Mobius told Financial News that a 30% drop in stock values was a possibility. "The market looks to me to be waiting for a trigger," he said.

He then put the spotlight on a lingering concern of our own. "ETFs," he said, "represent so much of the market that they would make matters worse once markets start to tumble. You have computers and algorithms working 24/7 and that would basically create a snowball effect. There is no safety valve to prevent further falls, and that fall could escalate very quickly." Most investors are aware of Charles Mackay's writings about the madness of crowds. One day we will be reading about the madness of machines..."

Updated!!***Banksters Cartel International II

***Entendance on twitter

|

|

|

|

Post by Entendance on Jun 8, 2018 5:25:40 GMT -5

Basically, you make money by not losing money. Most investors realize too late the harsh arithmetic of missteps, that a 50% loss requires a 100% gain just to break even. Basically, you make money by not losing money. Most investors realize too late the harsh arithmetic of missteps, that a 50% loss requires a 100% gain just to break even.  E. E.

|

|

|

|

Post by Entendance on Jun 22, 2018 6:56:57 GMT -5

"One of the odd notions that has come down through the years is that a gold standard system has “social costs.” It does not. It creates a profit. Of course, it does take effort to dig gold out of the ground. However, gold production never ceased after the end of the world gold standard in 1971. Roughly half of all the gold ever mined, in all of history, has been mined after 1971. Annual production today is the highest in history, and about double what it was in 1970. People seem happy to continue paying those “costs.” If one is to use gold coins, then someone needs to pay for this gold. Who pays? Is it “everyone”? The government? Taxpayers? Who?

Let’s say an economy uses gold coins only. There is no paper money. (For simplicity, we will also assume no banks.) Someone works all week and gets a one-ounce gold coin in payment on Friday. The person has “paid” for this coin with a week’s worth of work.

Now, let’s have an economy with no gold coins, just paper banknotes linked to gold. Let’s say there’s a banknote worth one ounce of gold. (The U.S. $20 banknote, before 1933, was worth about 0.97 of an ounce of gold.) Someone works all week, and gets a banknote worth one ounce of gold in payment on Friday.

The “cost“ to the person of the gold coin and the banknote are the same. One week of work. The government is in much the same situation. Whether its taxes are paid in coinage or in banknotes, the outcome is about the same. The difference is at the currency issuer – the producer of the banknotes, which would be a central bank today. Let’s say that the currency issuer has a “100% reserve” system. For every banknote, there is an equivalent amount of gold in a vault. This situation is not much different than where gold coinage was used exclusively. The amount of gold is the same. Now, let’s say that the currency issuer has a 20% reserve, which was a typical level among private currency issuers in the U.S. during the 19th century. The other 80% of reserves consists of interest-bearing debt. Today, that would most likely be government bonds. The amount of gold used by the monetary system has now fallen by 80%, replaced by interest-bearing bonds. The interest income from the bonds produces a profit for the currency issuer. If you had a floating fiat paper currency, with no gold at all, the “cost” of the money would still be the same – a week’s worth of work. However, the assets of the currency issuer could be 100% interest-bearing debt. Thus, we see that the “cost” of the money is the same in all cases – a week’s worth of work. The question is the “profit.” In a 100% bullion reserve system, there is no profit. However, with a 20% reserve system, there is quite a bit of profit. This profit accrues entirely to the currency issuer – today, a central bank. We can also see that the profit enjoyed by the currency issuer doesn’t really change much, from a 20% bullion reserve/80% debt gold standard system and a 100%-debt system. The difference is only the 20% portion. The other 80% is identical. (In practice, today’s central banks still hold gold bullion reserves.) So, the gold standard system’s profitability is actually much the same as the floating fiat system’s profitability. Some economists – including David Ricardo, in 1817 – have suggested ways of operating a gold standard system with no gold bullion reserves at all. The “gold exchange standards”, or currency-board systems, common in the 20th century, were one example of this. They are “100% debt” systems. I suggest that you shouldn’t be too concerned about maximizing the profitability of central banks. They can look after it well enough themselves. Concern yourself with the quality of the currency. For nearly two centuries, 1789 to 1971, the U.S. embraced the principle of gold-based money, and became the world’s economic superpower. Money was simple, stable, reliable and predictable. Despite short-term setbacks, the middle class grew steadily wealthier, generation after generation. Today’s economists talk a big talk, but in the past forty-five years of floating currencies, have they ever been able to produce that kind of result? Mostly, they just bounce from one crisis to another, blowing bubbles along the way and leaving a train of wreckage in their wake. Have they learned anything? They seem to have gotten pretty good at “kicking the can”, avoiding a minor crisis with further distortions that lead to a bigger crisis later. I think that there will eventually be a big enough crisis that people say: “Enough is enough. You’ve had your chance. Now it is time for you to go.” But before then, we will have to know what we will replace them with." The Nonexistent 'Social Costs' of a Gold Standard System Nathan Lewis

"This chart is a follow-up to one posted last week on the performance of gold during the gold standard and fiat money eras. It compares the performances of gold and stocks since 1971. A $10,000 investment in gold in 1971 would be worth about $370,000 today. By comparison, a $10,000 investment in stocks in 1971 would be worth about $280,000 today. We should keep in mind too that gold is in the early stages of recovery from a major sell-off while stocks are trading at all-time highs.

Warren Buffett made a rather noisy argument recently that stocks vastly outperformed gold since 1942. A $10,000 stock investment in 1942, he says, would have become $51 million by 2018 – a figure that took many by surprise. That phenomenal return rests primarily on the compounding effect of reinvested dividends. What Buffett left out of the analysis, though, is the eroding effect of taxes and inflation. Had he included it, those returns would have returned to Earth and the discussion on stocks and gold would have returned to the chart shown above. A comparison between stocks and gold before 1971, when the gold price was fixed at $35 per ounce, is a pointless exercise."

***The Entendance Beach Gold & Silver University

The gold standard sooner or later will return with the force and inevitability of natural law, for it is the money of freedom and honesty.

-Hans Sennholz

|

|

|

|

Post by Entendance on Jul 1, 2018 1:44:04 GMT -5

"Central bankers were put on earth to destroy the value of money printed on paper&as long as they exist that is what they are going to do." -Michael Lewitt

"If history teaches anything, it is that government cannot be trusted to manage money. When currency is not redeemable in gold, its value depends entirely on the judgment and the conscience of the politicians. (That is the situation in this country today.) Especially in an economic crisis or a war, the pressure to inflate becomes overwhelming. Any alternative may seem politically disastrous. Whether it be the Roman emperors repeatedly debasing their coinage, the French revolutionary government printing a flood of assignats, John Law flooding France with debased money, or the Continental Congress issuing money until it was literally "not worth a Continental," the story is similar. A government in financial straits finds its easiest recourse is to issue more and more money until the money loses its value. The entire process is accompanied by a barrage of explanations, propaganda and new regulations which hide the true situation from the eyes of most people until they have lost all their savings." – Scientific Market Analysis |

|

|

|

Post by Entendance on Jul 6, 2018 5:40:23 GMT -5

"Sometimes I think of what’s taking place in the financial markets as the greatest hypnotic thought experiment in history." More here

|

|

|

|

Post by Entendance on Jul 17, 2018 8:25:35 GMT -5

Sero in periclis est consilium quaerere -Publilius Syrus Sententiae, S, 42

E' tardi chiedere consiglio quando ci si trova in pericolo

It is too late to seek advice in the midst of dangers

Reset Explained

|

|

|

|

Post by Entendance on Jul 19, 2018 10:42:57 GMT -5

"...It is absolutely unreal how the world pays so much respect to mediocrity or even incompetence when it comes to running the financial system. Central banks and their heads have created this monster balloon which is now waiting to be popped. They have given the world the impression that they have been instrumental in saving the world economy when they in fact have created the bubble..." More here |

|