|

|

Post by Entendance on Aug 23, 2016 16:35:52 GMT -5

"Investment banks such as Goldman Sachs, Bank of America, and J.P. Morgan, philanthropies such as the Rockefeller Foundation, politicians such as Chicago Mayor Rahm Emanuel and Massachusetts former governor and now Bain Capital Managing Director Deval Patrick, and elite universities such as Harvard have been aggressively promoting Pay for Success (also known as Social Impact Bonds) as a solution to intractable financial and political problems facing public education and other public services..." Wall Street’s Latest Public Sector Rip-Off: Five Myths About Pay for Success "...Pay for Success/Social Impact Bonds ought to be understood as simply one of the latest efforts of the private sector to exploit and to pillage the public sector for profit at a historical moment of uncertain economic growth and a crisis of capital accumulation. New legislation and policy must be developed to limit the access of investment banks to determining, running, and profiting from social programs."

What people across Wall Street cannot figure out is why the Board of JPMorgan Chase, America’s biggest bank by assets, didn’t sack its CEO, Jamie Dimon, at some point between the bank’s first two felony counts in 2014 and its third felony count in 2015. Or, as two trial lawyers, Helen Davis Chaitman and Lance Gotthoffer point out on their web site, during the past five years as JPMorgan Chase racked up $35.7 billion in fines and settlements for “fraudulent and illegal practices.”

JPMorgan Chase’s abuses of its own customers are so vast that Chaitman and Gotthoffer had to create a Wheel of Misfortune to catalog the scams for ease of viewing by the public... Wall Street’s Protection Racket: Mandatory Arbitration

JESUITS TITANIC & JPMORGAN Of Jesuits and JP Morgan The Jesuit Vatican New World Order

"We are all jesuits" "We are all jesuits"

|

|

|

|

Post by Entendance on Aug 25, 2016 10:29:01 GMT -5

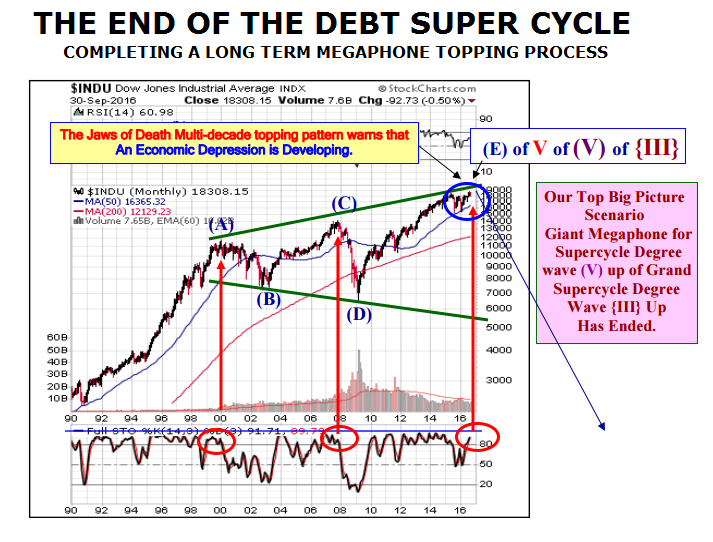

What comes next? Always Updated! *Inquiring minds only! ***The Great Fracturing of the Financial System Has Officially Begun

"...Risk assets are now supported by the new ”Keynesian Put”, the expectation that fiscal measures will be deployed to combat any renewed weakness in the economy/markets (independently of any larger political projects). But asset prices remain primarily supported by excess monetary abundance across the world:

1.There have been 667 interest rate cuts by global central banks since Lehman;

2.G7 central bank governors Yellen, Kuroda, Draghi, Carney & Poloz have been in their current posts for a collective 17 years, yet only one (Yellen in Dec’15) has actually hiked interest rates during this time;

3.Central banks own $25tn of financial assets (a sum larger than GDP of US + Japan, and up $12tn since Lehman);

4.There are currently $12.3tn of negative yielding global bonds (28% of total);

5.There is currently $8tn of negative yielding sovereign debt (54% of total)." ***2016: The chickens come home to roost!

Paul Wiseman:***Why Central Banks May Have Met Their Limit

The best and cheapest insurance against the risks outlined above is to hold physical gold and silver. But it is not enough just to own gold and silver but just as important how they are held. It is a sine qua non to hold metals in physical form, outside the financial system and outside your country of residence. It is also critical to have direct access to your wealth preservation asset which should not be held through a counterparty.

Gold and silver will not protect investors against all the problems that the world will experience in coming years. But if they are held in the right way and place, precious metals will be the best insurance against the massive wealth destruction that will take place in the next few years.

More here

|

|

|

|

Post by Entendance on Sept 1, 2016 5:00:16 GMT -5

"...There is nothing natural about a totalitarian framework — it is a machine that is carefully crafted piece by piece, maintained by the hands of a select few tyrants and fed with the labor, sacrifice and fear of the innocent.

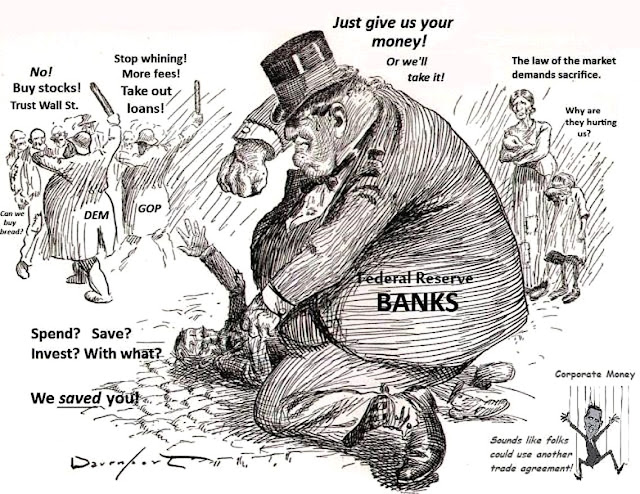

The only solution is to expunge the parasites from our fiscal body. These institutions and the people behind them should not exist. Most if not all of our sociopolitical distress today could be cured if a “brave new world” meant wiping the slate clean and dispelling financial elites and central bankers into a bottomless pit." ***Central Banksters Are Now Ready To Launch Their Brave New World

Unknown Voluntary Servitude

Richard (Rick) Mills Ahead of the Herd

(As a general rule, the most successful man in life is the man who has the best information)

Here’s a long debated topic. Should we leave the creation of new money in the hands of bankers or place its creation solely with our government?

***Let’s try and answer it...

|

|

|

|

Post by Entendance on Sept 2, 2016 2:47:07 GMT -5

The Secret Global Court – ***Why Corporate Criminals and Corrupt Politicians Desperately Want the TPP

"Why Do Central Banks Need To Exist? H/T Tom from Florida The short answer is, they don't. Central Banks function as "legititmized" price control mechanisms. They control the price of money in order to help the elitists confiscate your wealth. That's it. But price controls never last very long and neither do Central Banks. The U.S. is on its third CB in less than 300 years of existence and there's been in a movement in place to get rid of the Fed for at least the last 8 years.

The Daily Coin featured a useful analysis - LINK - of the latest attempt by the western Central Banks to build a "currency sandbox" for everyone to play in because they know the U.S. dollar's role as the reserve currency is coming to an end. The Utility Settlement Coin" is an act of desperation to head off the move by eastern hemisphere emerging economic powers, led by China and Russia, to create a level playing field.

Almost every year the precious metals sector experiences a price correction late in the summer. And almost every year the anti-gold propaganda floods the internet and media. This year is no exception. But the current pullback in the sector has about run its course. This was a healthy pullback after the huge run up in the sector. The next leg higher should be even more exciting.

Finally, the U.S. economy is starting to collapse. Blow away the propaganda smoke being blown by the likes of Janet Yellen, Stanley Fisher and Hillary Clinton and a clear view of the real economic data will show a nasty downturn emerging in housing, autos, general manufacturing and discretionary consumption..."

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

|

|

|

|

Post by Entendance on Sept 13, 2016 3:35:04 GMT -5

|

|

|

|

Post by Entendance on Sept 17, 2016 9:37:04 GMT -5

Interactive DB chart here Interactive DB chart here

More here

"In this publication, we warn regularly of the risk involved in storing wealth in banks. They’ve made the removal of your deposits increasingly difficult, in addition to colluding with governments to allow them to legally freeze or confiscate your money. To add insult to injury, they’re creating reporting requirements with regard to the contents of safe deposit boxes and restricting what can be stored in them – again, at risk of confiscation.

More and more, banks are becoming one of the more risky places to store wealth in any form. Not surprising, then, that many people are returning to those facilities that treat wealth storage the way the first banks did, millennia ago – vault facilities that store your wealth for a fee, but engage in no other banking activities.

But, in suggesting to my readers that such facilities are a better bet, I’ve also repeatedly warned readers that many such facilities don’t store actual, physical gold. They instead provide a contract to you that states that they will deliver an agreed-upon amount of gold upon demand. The trouble with this idea is that it becomes tempting for such facilities to sign such a contract with you and collect the purchase price, but never actually purchase and store any gold. It’s been estimated that the total worldwide value of such contracts equals 150 times the amount of gold in existence in the world.

Uh-oh.

This is why it’s imperative that you purchase only physical, allocated gold..." ***Sorry, You Can’t Have Your Gold

Welcome to Fred & EntendanceInvestors Beach!

Fred & EntendanceInvestors Beach just for Inquiring & Uncolonized Minds THE BEST DUE DILIGENCE FOR YOUR ALLOCATED GOLD & SILVER is at Fred & EntendanceInvestors Private Beach: Gold & Silver

Register Now & Become Members!

|

|

|

|

Post by Entendance on Oct 3, 2016 5:12:17 GMT -5

|

|

|

|

Post by Entendance on Oct 11, 2016 3:57:40 GMT -5

|

|

|

|

Post by Entendance on Oct 19, 2016 11:16:56 GMT -5

"...The silence heard today, though, is that of investors who are doing their level best to see and hear no evil. The blind eye they turn is to central banks ramping up their quantitative easing programs in a desperate attempt to offset their weakening economies.

At over $200 billion a month, the run rate of global QE growth is the fastest since 2011 when Europe was in full blown crisis mode. Central bank purchases are up 10 percent over last year, multiples of the three percent growth seen in 2014 and 2015 according to Bloomberg’s math. The grand total of assets on central banks now stands at $21.4 trillion, about a third of the global economy.

To accomplish these monetary feats, corporate bonds have been added to the QE mix, adding yet another layer of distortion and deception to the relic notion of markets behaving the way nature intended, as price discovery mechanisms. Central banks’ manipulations may well help the current credit cycle see another day. Rational investors will thus have no choice but to sit back once again and watch moral hazard run amuck..."

***Global Debt Investors: The Silence of the Lambs

H/T Tom from Florida

***The Debt Trap Is Global

***America the Beautiful Bankrupt "2016 is shaping up as the year when countless conspiracy theories will be confirmed to be non-conspiracy fact: from central bank rigging of capital markets, to political rigging of elections, to media rigging of public sentiment, and now, commercial bank rigging of silver..." ***Deutsche Bank Pays $38 Million To Settle Silver Manipulation Lawsuit

Exposed: Clinton Team Planted Language, Misled Media on Wall Street Speeches

"The Central Bankers have clearly painted themselves into a corner as a result of their self-inflicted, extended period of “cheap money”. Their policies have fostered malinvestment , excessive leverage and a speculative casino approach to investments. Investors forced to take on excess risk for yield and scalp speculative investment returns, must operate in an unstable financial environment ripe for a major correction. A correction because of the high degree of market correlation that likely would be instantaneously contagious across all global financial markets. Any correction more than 10% must be stopped..."

|

|

|

|

Post by Entendance on Oct 20, 2016 16:43:52 GMT -5

"There’s a new mantra making the rounds of Washington and Wall Street. No matter how big the lie you’re caught in, no matter how much documented evidence exists against you, just deny, deny, deny." ***Goldman Sachs Top Lawyer Is Part of a Secret Banking Cabal as CEO Blankfein Denies One Exists

Led by a class of omnipotent central bankers, experts have gained extraordinary political power. Will a populist backlash shatter their technocratic dream?

<...Two decades ago, in his final and posthumous book, the American cultural critic Christopher Lasch went after contemporary experts. “Elites, who define the issues, have lost touch with the people,” he wrote. “There has always been a privileged class, even in America, but it has never been so dangerously isolated from its surroundings.” These criticisms presciently anticipated the rise of Davos Man – the rootless cosmopolitan elite, unburdened by any sense of obligation to a place of origin, its arrogance enhanced by the conviction that its privilege reflects brains and accomplishment, not luck and inheritance..>

***The cult of the expert – and how it collapsed

H/T Tom from Florida

***Time To Boycott ALL Silicon Valley Companies (And More) ***The Federal Reserve Is Hillary Clinton’s Secret Weapon

***Iceland, Where Bad Bankers Go to Jail, Finds Nine Guilty in Historic Case

Inflation – The Simple Explanation is Theft "Inflation is theft. It is a simple concept that a single mother and a retiree understand but a PhD in Keynesian Economics probably does not. Examples:

In 1971 take $1,000 in crisp new $20 bills and place them in a safe while watching President Nixon blame speculators for the loss of Fort Knox gold. (He “temporarily” severed the last connection between gold and the U.S. dollar.) Spend those dollars in 2016 and you will feel ripped off because they would have bought most of a car in 1971, and in 2016 they might buy only four tires.

Take $400,000 and purchase an airplane in 1971. Today that $400,000 will purchase the helmet for an F-35.

A cup of coffee in 1971 probably cost about $0.25. Today it is $2.00.

WHY?

Dollars buy less because of inflation, but what causes the inflation? Creating dollars from nothing (fractional reserve banking), which increases the total number of dollars in circulation, causes consumer price inflation by reducing the value of each dollar that existed prior to the legalized counterfeiting. There is more to the story but this is the simple answer.

Why would commercial bankers create dollars from nothing? Because it pays so well! If you could sell washing machines and had a zero cost of production, your profits would be higher. If you could loan dollars and your cost to obtain them was zero, your interest earnings would be larger.

Why would the Federal Reserve create dollars from nothing, thereby devaluing all existing dollars, and use those dollars for QE programs to purchase dodgy assets from banks? They created dollars from nothing so they could bail out bankers. Socialize losses (spread the inflation across all dollar holders) and privatize profits (increase bank profits and banker bonuses) has worked for centuries. It also works for the European Central Bank, Bank of Japan, Swiss Central Bank, and the Bank of England.

From Steve Saville – an astute economist:

“Regardless of whether it is implemented via an emperor surreptitiously reducing the precious-metal content of the coinage or by the banking system (the central bank and the commercial banks) creating new currency deposits out of nothing, monetary inflation is a method of forcibly transferring wealth from the rest of the economy to the first users of the new or debased money. In other words, it is a form of theft.”

Repeat: Inflation “is a form of theft.” Central banks want more inflation and often complain there is insufficient inflation in the financial system. Inflation is theft that benefits bankers.

Governments want more inflation because it benefits governments.

Individuals who save money currently earn perhaps 1% on their savings. The increase in U.S. consumer price inflation, as we all know, is far more than 1% per year. Hence, the low interest rates created by the Federal Reserve forcibly extract a huge sum each year from savers, insurance companies, and pension funds for the benefit of … bankers and governments. Estimates of the cost of such “financial repression” suggest that perhaps $300 billion is lost each year.

Inflation is a form of theft. Keynes understood it nearly a century ago when he said, “By a continuing process of inflation, governments can confiscate, secretly and unobserved, an important part of the wealth of their citizens.”

Inflation sucks away a piece of your savings every year. Hyperinflation does the same every day, which is why it is so destructive.

Historically fiat currencies have been inflated into worthlessness as they have been devalued toward their intrinsic value of zero. This has been clear for three centuries, but the theft remains successful so “printing currencies” and inflation of the currency in circulation are still used aggressively. From Benjamin S. Bernanke: <By increasing the number of U.S. dollars in circulation, or even by credibly threatening to do so, the U.S. government can also reduce the value of a dollar in terms of goods and services, which is equivalent to raising the prices in dollars of those goods and services.> -Gary Christenson

"...In the chart below we clearly see how high spirits can push valuations far above what underlying fundamentals suggest reasonable. Since 1990 we have seen three distinct “bubbles” and unsurprisingly every time reality has kicked in and brought exuberance back to earth. It is no reason to think the current, and so far largest on record, deviation from fundamentals will not crash and revert back to the NGDP line.  We can look even further back in time and conclude that these massive financial bubbles are a recent phenomenon that did not occur in the pre-Greenspan era. Household net worth used to be around three times NGDP and would occasionally trade a standard deviation away from its mean, but ultimately revert back. With Greenspan at the helm things changed because along with him came a new group of academics arguing, as Keynes before them, that a semi-boom could be maintained indefinitely. Keynes argued it could be achieved through intelligent fiscal policy, while the new breed of hacks now claimed monetary policy guided by scientific method would ensure eternal bliss. In the beginning it even seemed to work, but people fail to understand that expanding the medium of exchange only redistribute capital away from wealth producers to wealth consumers. It is like having a party on your credit card; fun while it lasts, but only help make you poorer over the longer term.

With concepts like wealth effects (the illusion of being rich, when you are not) and propensity to consume, our leaders actually believe they can sustain economic prosperity without proper wealth creation. The bubbles depicted above are obvious for all to see. The idea that you can be rich only if your neighbor feel rich and your neighbor can be rich only if you feel rich is so preposterous and ingenuous that it is actually hard to comprehend that educated people seriously believe in such notions. Do Janet Yellen really believe she can move rates gradually (we said gradually) higher without popping yet another bubble? It must per definition pop because it cannot sustain itself without being able to bid on the shrinking pie of wealth. Higher rates will make it impossible for these bubbles to continue fund themselves whilst refraining from hiking rates means the pie will shrink more and more as wealth creators are increasingly robbed of their funding. The future path is thus laid down for us and there is nothing we can do at this juncture to avoid the consequences of our past folly." Do our money managers really believe this will end well?

Three ways the banking system is rigged against you

"...No wonder Angela Merkel is her favorite leader... " |

|

|

|

Post by Entendance on Nov 16, 2016 18:09:56 GMT -5

***Italexit? L’imminente crisi bancaria

Finance.The only industry that can turn the most positive/happy person into the most cynical human on earth.

"Today India is on the verge of a major social-political crisis, unless either the government backs off from the decision of banning the currency or some real magic happens. There is chaos in the streets and daily life is slowly but surely coming to a full halt.

What Modi did was not only heavy-handed, hugely arrogant, and of no value, it has been very badly implemented to boot — as everything in India always is — and carries the real potential of escalating and snowballing into something horrific. They could have seen that this was not going to end well by simply using primary school math..."

"...This is Cyprus ten times over – they just haven’t realized it yet...Gold Price Skyrockets in India after Currency Ban..." "...This is Cyprus ten times over – they just haven’t realized it yet...Gold Price Skyrockets in India after Currency Ban..." ***Chaos in the Wake of the Ban

"...The pent up anger of the American people, evidenced in the outcome of the November 8 election, has been brewing since the 2008 crash.."

***Wall Street Democrats Proved Yesterday That They Still Don’t Get It

|

|

|

|

Post by Entendance on Dec 6, 2016 17:45:09 GMT -5

|

|

|

|

Post by Entendance on Dec 11, 2016 17:24:52 GMT -5

***Here’s Why The Banksters Are In Trouble

This is a “Punt Gun” It was used for duck hunting and could kill 50 birds at once. It was banned in the late 1860’s. "Bring back the Punt gun..." -Tom from Florida

DUBLIN — The Tobun family never missed a rental payment on their modest brick rowhouse in eight years. But in February, the couple, who have two young children, received a letter warning that they would be evicted when their lease expired. Forty of their neighbors got the same notice.

When they went to investigate, the tenants, in the working-class suburb of Tyrrelstown, discovered a trail that led all the way to Wall Street.

After Europe was ravaged by a financial and economic crisis, the giant investment bank Goldman Sachs snapped up huge swaths of distressed debt in Ireland, including the loans of Tyrrelstown’s developer in 2014. The developer now wants out of the rental game and is selling the properties. As the owner of the loans, Goldman will reap a large portion of the proceeds.

Goldman has nothing to do with the possible evictions here. But because American banks have played such a large role in Europe’s housing recovery — and have made huge profits in the process — they have become the main target of a growing backlash among homeowners and renters. “Somehow, these funds have gotten involved in our community,” Funke Tobun said. “They’re profiting, but it’s the people who are being made to suffer...” ....“Wall Street firms have made a lot of profit from other people’s misfortunes, and on top of that they’ve systematically structured things so they pay almost no tax,” said James Stewart, a finance professor at Trinity College, Dublin. “So what’s their contribution to society?”

“The amount of harm being done to vulnerable people is immense,” he said.

A broader rebellion has barreled ahead in Spain, where Blackstone, Goldman and other American firms bought residential properties, including subsidized rentals...

...“This is a fight between David and Goliath,” Mrs. Tobun said. “They want us out by force. All we can do is protest.”...

“We believe in miracles,” she added, “but I don’t know how we’re going to win.”...

***Wall Street Is Europe’s Landlord. And Tenants Are Fighting Back.

"Freedom is a system based on courage. We must always tell what we see. Above all, and this is more difficult, we must always see what we see. He who does not bellow the truth when he knows the truth makes himself the accomplice of liars and frauds." Charles Péguy

H/T Tom from Florida

|

|

|

|

Post by Entendance on Dec 15, 2016 3:24:21 GMT -5

|

|

|

|

Post by Entendance on Dec 16, 2016 11:27:14 GMT -5

Deutsche Bank’s clients and potential clients were led to believe that its model was being regularly updated with new “objective” data in order to reflect the current state of trading in the venues to which Deutsche Bank routed orders, so as to direct client orders to the most optimal venue.

From January 2012 to February 2014, technical problems at Deutsche Bank prevented the execution quality rankings from being performed, Schneiderman said in a statement.

"Despite knowing about the problem for over a year, Deutsche Bank did not address the issue," he said.

Increased Scrutiny

U.S. regulators have increased scrutiny of dark pools in recent years. The private trading platforms emerged in the 1980s as a way for institutional investors to trade large blocks of stock without tipping their hand to the rest of the market.

Deutsche Bank Admits Misleading Clients in Dark Pool Trades: BBG

There was one market that DB had not rigged until today......too big to bail (out)...let it sink like Titanic!!

All about Deutsche Bank at Fred & E. Beach is here |

|

|

|

Post by Entendance on Dec 27, 2016 14:23:21 GMT -5

"...So - cash, bitcoin, precious metals, and prepaid cards over $150 are all instruments of the "terrorists" and are now open to confiscation if you are a suspicious person... which, by their rhetoric, you are if you actually hold any of these assets..."

Europe Proposes Confiscating Gold In Crackdown On Terrorist Financing

|

|

|

|

Post by Entendance on Dec 29, 2016 5:10:43 GMT -5

|

|

|

|

Post by Entendance on Jan 2, 2017 5:06:24 GMT -5

|

|

|

|

Post by Entendance on Jan 4, 2017 16:24:54 GMT -5

|

|

|

|

Post by Entendance on Jan 13, 2017 19:22:59 GMT -5

Fred & E Beach Announcements/Breaking News: 8 richest people as wealthy as poorest half of the world – Oxfam

...Baring Asset Management’s Christopher Mahon has one major conviction about 2017: it will be the year in which central-bank bashing by politicians becomes the new normal, so he’s seeking shelter in gold.

“This year is the turning point,” Mahon said in an interview on Monday. “For seven years or so, central banks have largely escaped critique even though one could argue that their policies have been pretty inadequate in many senses. It’s very plausible now that politicians stand up and throw stones at central bankers.”

...For those who lose faith in central banks, gold may be the last holdout. It retains its appeal as an asset that once underwrote the monetary system and it can’t be created at will like currencies and bonds, said Matthew Turner, a Macquarie Group Ltd. economist... ***Central-Bank Bashing Has Gold Only Asset Safe From Meddling H/T Tom from Florida |

|

|

|

Post by Entendance on Jan 18, 2017 12:40:28 GMT -5

***How Deutsche Bank Made €367 Million Disappear

"...A group supporting the protesters called Shut Down Government Sachs released a statement expressing the view that Goldman Sachs “is no longer rigging the system – they are the system.” The group noted:

“From making money from home foreclosures to investing in dangerous oil pipelines like Dakota Access, Goldman Sachs has been instrumental in extracting the wealth, livelihoods, and health of black, brown, and poor communities. And they’ve gotten great at using the federal government to make it happen.

“With Trump choosing several Goldman Sachs’ veterans for his administration, they’ve officially taken over. We have to fight back harder than ever to win back a government by and for the people.”

Unfortunately, it would be naïve to believe that Goldman Sachs is the first Wall Street behemoth to supplant a democratically elected candidate with a pack of their own cronies. The WikiLeaks emails released last year showing how Michael Froman, an executive of the serially corrupt and bailed out Wall Street mega bank, Citigroup, was the invisible hand behind the cabinet appointments by President Obama, should end the naive perception that voters have a voice in Washington. Until public financing of political campaigns replaces corporate financing and seduction of candidates, we’ll continue living under Government Sachs or Government Citigroup or Wall Street’s Government Du Jour."

***Political Revolution Sprouts New Shoots Outside Goldman Sachs |

|

|

|

Post by Entendance on Jan 28, 2017 7:36:52 GMT -5

Federal Reserve Bankers Mocked Unemployed Americans Behind Closed Doors In 2011, unemployment was at a near crisis level. The jobless rate was stuck around 9 percent nationally, an unusually high number due to the continuing effects of the financial crash.

House Democrats were aghast. “With almost five unemployed Americans for every job opening, too many people remain jobless because of a lack of work, not a lack of wanting to work,” said Congressman Lloyd Doggett, D-Tex. So in early November 2011, they introduced a bill to reauthorize Federal unemployment benefits, an insurance program designed to aide those looking for work.

Behind closed doors at the Federal Reserve however, the conversation struck a different tone.

The Federal Reserve’s mandate is to promote “maximum employment,” which essentially means: print enough money so that everyone who wants one has a job. Yet according to transcripts released this month after the traditional five-year waiting period, Federal Reserve officials in November 2011 were debating whether unemployment was caused by bad work ethics and drug use – rather than by the greatest financial crisis in 80 years. This debate then factored into the argument over setting monetary policy.

“I frequently hear of jobs going unfilled because a large number of applicants have difficulty passing basic requirements like drug tests or simply demonstrating the requisite work ethic,” said Dennis Lockhart, a former Citibank executive who ran the Atlanta Federal Reserve Bank. “One contact in the staffing industry told us that during their pretesting process, a majority—actually, 60 percent of applicants—failed to answer ‘0’ to the question of how many days a week it’s acceptable to miss work.”

The room of central bankers then broke into laughter.

Charles Plosser, the president of the Philadelphia Federal Reserve, cited “work ethic” as a common complaint he heard in his district, both in rural and inner city areas. A contact of his who owned 60 McDonald’s restaurants said “passing drug tests, passing literacy tests, and work ethic are the primary problems he has in hiring people.”

His wife, he noted, had attended a meeting in Philadelphia where employers cited literacy, work ethic, and drugs as impediments to hiring.

It was hardly the first time these bankers blamed unemployment on the unemployed, rather than, say, bankers. In an April meeting that year, Richmond Federal Reserve President Jeff Lacker told participants that “Several firms told us of difficulty finding adequate workers, because they preferred to collect unemployment benefits or can’t pass drug tests.” He reiterated that point in November, saying that in West Virginia he was told by an employment agency that “unquestionably the biggest problem in hiring skilled and unskilled workers was the inability to pass a drug test.”

Lacker’s Federal Reserve district includes West Virginia. In August, he again spoke of “widespread reports about hard drug use, OxyContin and methamphetamine, in Appalachia and other rural parts of our District—in particular, Appalachia.”

Apparently his colleagues responded with laughter again, because he then said “Drug abuse and the hardship involved in unemployment aren’t really laughing matters.” Usage, he noted, isn’t higher than the national norm in West Virginia. “It’s hard to pin this down quantitatively,” he continued, wondering if there was “something meaningful there as a contributor to impediments to labor market functioning.”

These debates took place within the Federal Open Market Committee (FOMC), the Federal Reserve body tasked with “influenc[ing] the availability and cost of money and credit to help promote national economic goals.” The debate revealed a split within the Federal Reserve system between “hawks” who worry more about inflation than unemployment, and “doves” who believe that too many are going without jobs. Typically, “hawks” tend to lean to the right politically, and “doves” tend to lean slightly more to the left.

Lacker is one of the most “hawkish” members of the FOMC, which means he tends to be in favor of higher interest rates and higher unemployment to ward off inflation. In 2015, Lacker ascribed increasing inequality to the lack of college education among the poor

Sarah Bloom Raskin, a dovish member of the Board of Governors, countered by saying that unemployment was a function of the financial crisis. “The economy remains mired in the worst slump since that of the 1930s,” she said.

Daniel Tarullo, another dovish Federal Reserve governor appointed by President Obama, called the focus on drug use a “red herring.” He said, “We had that problem 25 years ago, 20 years ago, 10 years ago; we have it today; and we’re going to have it 5 years from now.” He cited housing debt from the largest housing bubble in history as a core driver of unemployment.

The transcripts illustrate how the controversial method of picking Federal Reserve officials plays out in setting monetary policy: The three men who cited work ethic or drug use as a cause of unemployment instead of the financial crash were picked by regional private sector businessmen to lead the local Reserve banks.

The Dodd-Frank financial reform law passed in 2010 mandated that the Federal Reserve Board in Washington approve the choices of private businessmen, but the Board has yet to reject any suggested candidates. The board members who cited the financial crash as causing unemployment were appointed by the president and confirmed by the Senate.

The concept of having private business interests selecting public officials has been criticized by experts. As Wharton professor and author of “The Power and Independence of the Federal Reserve” Peter Conti-Brown put it, “It’s not clear at all that the opaque and obscure process by which the private sector selects the Reserve Bank presidents produces superior central bankers than the public process used to select the remaining principal officers of the United States.” This controversial selection process risks having, as he put it, “a system for enhancing the influence of certain slices of society on our central banking policy.

Lacker and Lockhart are retiring this year. Advocates and experts are putting pressure on the Richmond Federal Reserve to replace retiring Reserve Bank Presidents with someone more attuned to the reality of unemployment. Fed Up, a coalition of advocates seeking to shift the Fed from its traditionally pro-bank policies, is seeking to have the regional bank President’s picked with more attention to the needs of workers.

Jordan Haedtler, deputy campaign manager of Fed Up, lashed out at Lacker’s comments as related in the newly released transcripts. “Even nine years into the recovery, workers are still struggling to get the wages and hours they need,” Haedtler said. “Yet with unemployment above double digits in huge swaths of President Lacker’s district in 2011, he was citing anecdotes about drug use and desire to collect unemployment benefits as key reasons why employers weren’t hiring. Rather than looking for solutions and talking to people who were out of work, he was seeking excuses from employers.”

President Donald Trump has a number of vacancies on the Federal Reserve Board to fill as well. He has been highly critical of Federal Reserve Chair Janet Yellen. He argued, without citing evidence, that she pursued monetary policy goals to help support Barack Obama and elect Hillary Clinton. If Yellen and Tarullo follow custom and step down from their board slots in 2018, Trump could appoint a majority of Federal Reserve board members within two years.

Despite the importance of monetary policy, the Federal Reserve keeps the transcripts of internal deliberations of the committee that sets monetary policy out of public view for at least five years. But the people who attend those meetings take other jobs — some in the financial services industry. In 2010, incoming House Oversight Committee Chairman Darrell Issa questioned whether it was appropriate for the Fed to withhold its deliberations for so long. “If the Fed’s full transcripts can be released sooner, they should be,” he said.

The debate in the Fed and within Congress was ultimately resolved. The Federal Reserve kept interest rates low. And in 2011, a new wave of recently elected Tea Party Republicans and Democrats finally compromised on language to cut unemployment benefits.

Neither West Virginia senator, Shelley Moore Capito nor Joe Manchin, would comment on Lacker’s discussion of the West Virginia drug epidemic and its relationship to unemployment. The Appalachia region, including West Virginia, went strongly for Trump in the 2016 election. -Matt Stoller

|

|

|

|

Post by Entendance on Feb 1, 2017 3:05:24 GMT -5

"...A cash ban wouldn’t have prevented 9/11, nor would it have prevented the Berlin Christmas attack.

What cash controls do affect, however, are the financial options of law-abiding people.

These policymakers and academics acknowledge that banning cash would reduce consumers’ financial privacy. And that’s true.

But they’re totally missing the point. Cash isn’t about privacy.

It’s one of the only remaining options in a financial system that has gone totally crazy. Especially in Europe, where interest rates are negative and many banks are on the verge of collapse, cash is a protective shelter in a storm of chaos.Think about it: every time you make a deposit at your bank, that savings no longer belongs to you. It’s now the bank’s money. It’s their asset, not yours.

You become an unsecured creditor of the bank with nothing more than a claim on their balance sheet, beholden to all the stupidity and shenanigans that they have a history of perpetrating.Banks never miss an opportunity to prove to the rest of the world that they do not deserve the trust that we place in them.And for now, anyone who wishes to divorce themselves from these consequences can simply withdraw a portion of their savings and hold cash. Cash means there is no middleman standing between you and your savings..."

...bank deposits ...banksters...  How can anyone trust these people? How can anyone trust these people?

Where are the indictments?

Breaking:Deutsche Bank agrees $7.2bn penalty with US regulators Deutsche Bank Settles With DOJ: Will Pay $3.1 Billion Civil Penalty

Meanwhile...

Credit Suisse Group AG agreed to pay $5.28 billion to resolve a U.S. investigation into its business in mortgage-backed securities as officials work through a backlog of crisis-era bank cases.

The Swiss lender will pay a $2.48 billion civil penalty and $2.8 billion in relief for homeowners and communities hit by the collapse in home prices, according to bank statement on Friday. Credit Suisse will take a pre-tax charge of about $2 billion in addition to its existing reserves during the fourth quarter.

Credit Suisse Agrees to Pay $5.3 Billion in U.S. Mortgage Accord

“Is There A Way Out?” Not for most. And do give the ECB a special place in this: they are responsible for setting one single rate in countries that need completely different rates. ***Central banks have cut interest rates 690 times since Lehman Brothers: Is there a way out?

The Chain.

Big Banks OWNS Politicians

Wall Street OWNS Big Banks

1% (Elites) OWNS Wall Street

"...the benefits of asset bubbles are concentrated in the top 5%, as most of these assets are owned by the top 5%. The next 15% benefits modestly, but the bottom 80% don't own enough assets to get any boost at all...

If you create and distribute money only in the apex of the wealth/power pyramid, it can only benefit the few rather than the many..."  Why the Massive Expansion of Money Hasn't Trickled Down to The Rest of Us Why the Massive Expansion of Money Hasn't Trickled Down to The Rest of Us

|

|

|

|

Post by Entendance on Feb 13, 2017 5:54:00 GMT -5

"...If the Trump administration really wishes to live up to its campaign promise “Make America great again,” there is no way of getting around addressing Fed policy. A first step in that direction is the idea to subject the US central bank to public scrutiny (“Audit the Fed”), bringing to public attention the scope of the Fed’s interventions into the world’s banking system.

Of course, the liquidity swap agreements in particular can be expected to be heavily defended by central bankers, bank representatives, big business lobbyists, and mainstream economists as being indispensable for financial system stability. And for sure, a sudden withdrawal from this practice would almost certainly deal a heavy blow to financial markets.

If push comes to shove, it could even make the worldwide credit pyramid, built on fiat money, come crashing down. However, the really important argument in this context is that the continuation of the practice of central bank cartelization will eventually result in a despotic regime: and that is a single world fiat currency regime.

Of course, change for the better doesn’t come from politics. It comes from better ideas. For it is ideas that determine human action. Whatever these ideas are and wherever they come from: They make humans act. For this reason the great Austrian economist Ludwig von Mises (1881 – 1973) advocates the idea of the “sound money principle”:

The sound-money principle has two aspects. It is affirmative in approving the market's choice of a commonly used medium of exchange. It is negative in obstructing the government's propensity to meddle with the currency system.1

Mises also explains convincingly the importance of the sound money principle for each and every one of us:

It is impossible to grasp the meaning of the idea of sound money if one does not realize that it was devised as an instrument for the protection of civil liberties against despotic inroads on the part of governments. Ideologically it belongs in the same class with political constitutions and bills of right.

Mises’s sound money principle calls for ending central banking once and for all and opening up a free market in money. Having brought to a halt political globalism for now, the new US administration has now also a once in a lifetime chance to make the world great again — simply by ending the state’s monopoly of money production.

If the US would move in that direction — ending legal tender laws and giving the freedom to the American people to use, say, gold, silver, or bitcoin as their preferred media of exchange — the rest of the world would most likely have to follow the example. That said, Mr. Trump could really make a real change, simply by embracing Mises’s sound money principle..."

***What Will Trump Do About the Central-Bank Cartel?

|

|

|

|

Post by Entendance on Feb 15, 2017 14:45:04 GMT -5

...Every gram of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system. What you have done is removed those “dollars” from the hands of government. They now have fewer “dollars” to use to purchase weapons of war, surveillance technology and the other weapons they use against us. Today would be a good day to remove a few “dollars” from their hands and place another weapon in your back pocket. Gold and silver are free from tyranny, accepted around the world in good faith and provides a piece of insurance from, what appears to be, a system in change...

Latest from the fat banksters

"Increasingly, under the mantra of liquidity, trading activity on Wall Street that would have resulted in criminal charges in another era is yawned at by regulators.

The week that Donald Trump shocked markets around the globe by getting himself elected President of the United States, Wall Street banks like Citigroup, JPMorgan Chase, Bank of America and others traded millions of shares of each other’s stocks – as well as trading millions of shares of their own publicly traded stock.

The trades were not directed to a regulated stock exchange like the New York Stock Exchange. Instead, the trades were conducted internally by the Wall Street bank’s own Dark Pool – an entity appropriately named for its darkness and hands-off regulation..." ***Wall Street Banks Are Trading in Their Own Company’s Stock: How Is This Legal?

|

|

|

|

Post by Entendance on Feb 19, 2017 5:49:56 GMT -5

"Created in 1913 after the Panic of 1907, the Federal Reserve was founded to keep the public’s faith in the buying power of the U.S. dollar. After failing miserably in the 1930s, the Fed aimed to be more responsive. This led the institution to find discipline in the rising macroeconomic models championed by top monetary theorists. During the ensuing “Quiet Period” in American banking, deposit insurance prevented panics, the Fed controlled interest rates and manipulated the money supply, and though occasional disruptions flared, like the failure of Continental Illinois National Bank and Trust Company in 1984, no systemic risk erupted for seventy years. The Fed had tamed the volatile U.S. economy.

Until September 2008, when all hell broke loose in a worldwide panic that completely blindsided and, embarrassed the Federal Reserve..."

***How the Fed went from lender of last resort to destroyer of American wealth***

|

|

|

|

Post by Entendance on Feb 26, 2017 4:02:25 GMT -5

The biggest banks on Wall Street, both foreign and domestic, have been repeatedly charged with rigging and colluding in markets from New York to London to Japan. Thus, it is natural to ask, have the big banks formed a cartel to rig the prices of their own stocks? ***Are Big Banks’ Dark Pools Behind the Run-Up in Bank Stock Prices? The biggest banks on Wall Street, both foreign and domestic, have been repeatedly charged with rigging and colluding in markets from New York to London to Japan. Thus, it is natural to ask, have the big banks formed a cartel to rig the prices of their own stocks? ***Are Big Banks’ Dark Pools Behind the Run-Up in Bank Stock Prices?

|

|

|

|

Post by Entendance on Mar 2, 2017 12:05:28 GMT -5

|

|

|

|

Post by Entendance on Mar 22, 2017 4:53:31 GMT -5

|

|

|

|

Post by Entendance on Mar 27, 2017 11:18:44 GMT -5

A study of Europe's largest banks by Oxfam has concluded that the continent's 20 biggest banks all use jurisdictions with favorable tax and regulatory rules to avoid paying their full liabilities, draining public finances by in the process... Tax havens such as Bermuda, the Cayman Islands and the Isle of Man are key destinations for fleeing bank profits, with the report sardonically noting bank employees working in tax havens appear to be four times more productive than an average full-time bank employee. On average, a bank employee generates a profit for their company of US$50,000 per year, but employees in tax havens make an average US$186,000 per year. An employee of Italian bank Intesa Sanpaolo based in a tax haven appears to be 20 times more "productive" than a worker at the bank's Italian branches... The research was made possible by new EU transparency rules that require European banks to publish information on the profits they make and the tax they pay in every country they operate. The report finds:

•Tax havens account for 26 percent of the profits made by the 20 biggest European banks - an estimated €25 billion - but only 12 percent of banks’ turnover and 7 percent of the banks’ employees.

•Subsidiaries in tax havens are on average twice as lucrative for banks as those elsewhere. For every €100 of activity, banks make €42 of profit in tax havens compared to a global average of €19.

•Bank employees in tax havens appear to be 4 times more productive than the average bank employee – generating an average profit of €171,000 per year compared to just €45,000 a year for an average employee.

•In 2015 European banks posted at least €628 million in profits in tax havens where they employ nobody. For example, the French bank BNP Paribas made €134 million tax-free profit in the Cayman Islands despite having no staff based there.

•Some banks are reporting profits in tax havens while reporting losses elsewhere. For example, Germany’s Deutsche Bank registered low profits or losses in many major markets in 2015 while booking almost €2 billion in profits in tax havens.

•Luxembourg and Ireland are the most favored tax havens, accounting for 29 percent of the profits banks posted in tax havens in 2015. The 20 biggest banks posted €4.9 billion of profits in the tiny tax haven of Luxembourg in 2015 – more than they did in the UK, Sweden and Germany combined.

•Banks often pay little or no tax on the profits they post in tax havens. European banks paid no tax on €383 million of profit they posted in seven tax havens in 2015. In Ireland, European banks paid an effective tax rate of no more than 6 percent – half the statutory rate – with three banks (Barclays, RBS and Crédit Agricole) paying no more than 2 percent.

Manon Aubry, Oxfam’s Senior Tax Justice Advocacy Officer said: “New EU transparency rules give us a glimpse into the tax affairs of Europe’s biggest banks and it’s not a pretty sight. Governments must change the rules to prevent banks and other big businesses using tax havens to dodge taxes or help their clients dodge taxes.”

“All companies and individuals have a responsibly to pay their fair share of tax. Tax dodging deprives countries throughout Europe and the developing world of the money they need to pay for doctors, teachers and care workers,” said Aubry.

Many countries are being cheated out of the money needed to tackle poverty and inequality by corporate tax dodgers, with poor countries being hit the hardest. Tax dodging by multinational companies costs poor countries over €90 billion every year. This is enough money to provide an education for the 124 million children who aren’t in school and fund healthcare interventions that could prevent the deaths of at least six million children.

Transparency measures, such as the EU rules on public country-by-country reporting, are vital tools in the global fight against tax dodging. However, a new European Commission proposal designed to extend public reporting beyond the banking sector is flawed. The proposal is limited to companies with a turnover of €750 million or more, a measure that would exclude up to 90 percent of multinationals, and does not require companies to report on their activities in all the countries they operate - including developing countries.

“The EU’s transparency rules are starting to open up the often murky world of corporate taxation to public scrutiny. These rules must now be extended to ensure all large corporations provide financial reports for every country where they operate. This will make it easier for all countries – including the poorest – to establish if companies are paying their fair share of tax or not,” said Aubry.

Opening the vaults: the use of tax havens by Europe’s biggest banks PDF here |

|

"

"

Interactive DB chart

Interactive DB chart

"...This is Cyprus ten times over – they just haven’t realized it yet...Gold Price Skyrockets in India after Currency Ban..."

"...This is Cyprus ten times over – they just haven’t realized it yet...Gold Price Skyrockets in India after Currency Ban..."

How can anyone trust these people?

How can anyone trust these people?

The biggest banks on Wall Street, both foreign and domestic, have been repeatedly charged with rigging and colluding in markets from New York to London to Japan. Thus, it is natural to ask, have the big banks formed a cartel to rig the prices of their own stocks? ***

The biggest banks on Wall Street, both foreign and domestic, have been repeatedly charged with rigging and colluding in markets from New York to London to Japan. Thus, it is natural to ask, have the big banks formed a cartel to rig the prices of their own stocks? ***