|

|

Post by Entendance on Apr 9, 2020 3:47:01 GMT -5

Banksters Cartel International XIX

"...Since March 11, the Fed created $1.77 trillion and handed it to Wall Street either as loans or to purchase financial instruments. The sole purpose of this was to inflate asset prices and bail out asset holders. It’s apparently against the law in the US for the Fed to allow the wealthy to lose their shirts, or something. The crumbs offered to small businesses or the real economy have not materialized yet. Those are future projects, if they ever materialize.

If the Fed had sent that $1.77 Trillion to the 130 million households in the US, each household would have received $13,600. But no, this was helicopter money exclusively for Wall Street and for asset holders..." More here

Repetita Iuvant

Gold/Silver Ratio Gold/Silver Ratio  Each bar has a different weight. These bars are used in settlements in the London Metal Exchange and other exchanges and are very heavy compared to smaller bullion bars. Although metal purity is standardized these bars vary greatly in shape, manufacturer (brand) and mass which can vary between 750 and 1,100 oz although the vast majority of the bars will be between 950 and 1030 oz. Good delivery bars are normally readily available in large quantities. Each bar has a different weight. These bars are used in settlements in the London Metal Exchange and other exchanges and are very heavy compared to smaller bullion bars. Although metal purity is standardized these bars vary greatly in shape, manufacturer (brand) and mass which can vary between 750 and 1,100 oz although the vast majority of the bars will be between 950 and 1030 oz. Good delivery bars are normally readily available in large quantities.

Premiums per oz are lower and these bars always come with a serial number.

|

|

|

|

Post by Entendance on Apr 23, 2020 4:49:21 GMT -5

"...The Fed has printed $2.26 trillion since March 11 to inflate asset prices and bail out asset holders and Wall Street. If the Fed had spread that $2.26 trillion equally over the 130 million households in the US, each would have received $17,380. But this was helicopter money for Wall Street and the wealthy that were losing part their wealth in the sell-off. Those are the folks that matter to the Fed." -Wolf Richter

+ starve the banksters (here)

The disgust big banks have toward Main Street and small business is palpable at this point. -Nomi Prins

How Wall Street enabled a global financial scandal

"This past January, Goldman Sachs CEO and chairman David Solomon strode onto a stage at the bank’s lower Manhattan headquarters to launch the first “Investor Day” in the famously secretive institution’s one-hundred-and-fifty-year history. The celebration was promoted as an inspiring review of Goldman’s “strategic road map and goals,” and the presentations were replete with pledges of “transparency” and “sustainability,” though the overall performance was unkindly summarized by bank analyst Christopher Whalen as “investment bankster BS.” Early in his opening address, Solomon expounded the “core values” of the firm he had headed since October 2018. After “Partnership” and “Client Service” came “Integrity.” Solomon stressed that he was “laser-focused” on this last term, emphasizing that the company “must always have an unrelenting commitment to doing the right thing, always.” There followed, however, a glancing reference to a singular black cloud hovering over the proceedings. “In the wake of our experience with Malaysia,” he said, “I am keenly aware of how the actions of a few can harm our reputation, our brand, and our performance as a firm.” With that brief mention, he moved on to a fourth core Goldman value: “Excellence.”

Everyone in the room had recognized the allusion. “Malaysia” was shorthand for a gigantic fraud—possibly the largest in financial history—in which, beginning in 2009, billions of dollars were diverted from a Malaysian sovereign-wealth fund called 1Malaysia Development Berhad (1MDB) into covert campaign-finance accounts, U.S. political campaigns, Hollywood movies, and the pockets of innumerable other recipients. The “few” Solomon referred to were those Goldman executives whose active participation in the scam’s bribery and money laundering had since become undeniable.

Despite efforts by Solomon and other senior employees to plead innocence by reason of ignorance, Goldman’s pivotal role in the heist has exposed another obvious, if unspoken, core value: greed. But years of diligent investigation into 1MDB by courageous journalists and law-enforcement officials have revealed a network that extends far beyond Wall Street.

Like the veins and arteries of a patient highlighted by an angiogram, the money’s crooked pathways illuminated the bloodstream of a corrupt world and the lengths to which its beneficiaries were prepared to go to protect themselves and their gains..." The Malaysian Job (H/T Tom from Florida)

"When the history books of this era are finally written, this will go down as a time when regulators allowed a no-law zone to be drawn around Wall Street. As the Federal Reserve Bank of New York is using taxpayer money to buy up junk bonds to shore up the sagging balance sheets of the behemoth banks on Wall Street and making ¼ of one percent interest loans to those banks against tanking stocks as collateral, those same Wall Street banks are trading their own bank’s stock in their own thinly-regulated internal stock exchanges known as Dark Pools.

It simply can’t get any crazier than this — and yet somehow it always does in this unprecedented era..."

5 This is what the Lord says:

“Cursed is the one who trusts in man,

who draws strength from mere flesh

and whose heart turns away from the Lord.

6 That person will be like a bush in the wastelands;

they will not see prosperity when it comes.

They will dwell in the parched places of the desert,

in a salt land where no one lives.

7 “But blessed is the one who trusts in the Lord,

whose confidence is in him.

8 They will be like a tree planted by the water

that sends out its roots by the stream.

It does not fear when heat comes;

its leaves are always green.

It has no worries in a year of drought

and never fails to bear fruit.”

9 The heart is deceitful above all things

and beyond cure.

Who can understand it?

10 “I the Lord search the heart

and examine the mind,

to reward each person according to their conduct,

according to what their deeds deserve.” -Jeremiah 17:5-10

5 Così dice il Signore: "Maledetto l'uomo che confida nell'uomo,

che pone nella carne il suo sostegno

e dal Signore si allontana il suo cuore.

6 Egli sarà come un tamerisco nella steppa,

quando viene il bene non lo vede;

dimorerà in luoghi aridi nel deserto,

in una terra di salsedine, dove nessuno può vivere.

7 Benedetto l'uomo che confida nel Signore

e il Signore è sua fiducia.

8 Egli è come un albero piantato lungo l'acqua,

verso la corrente stende le radici;

non teme quando viene il caldo,

le sue foglie rimangono verdi;

nell'anno della siccità non intristisce,

non smette di produrre i suoi frutti.

9 Più fallace di ogni altra cosa

è il cuore e difficilmente guaribile;

chi lo può conoscere?

10 Io, il Signore, scruto la mente

e saggio i cuori,

per rendere a ciascuno secondo la sua condotta,

secondo il frutto delle sue azioni." -Geremia 17,5-10 |

|

|

|

Post by Entendance on Apr 29, 2020 7:17:02 GMT -5

Printed Money for the banks, always available; printed out of fine air, as usual, to the banksters.

HELICOPTER MONEY FOR BANKS. ECB's Lagarde: €3tn now available to banks at negative rates HELICOPTER MONEY FOR BANKS. ECB's Lagarde: €3tn now available to banks at negative ratesApril 30, 2020 ECB Lagarde:  "Our new targeted lending facility provides for around €3 trillion in liquidity to banks at a negative rate" HERE "Our new targeted lending facility provides for around €3 trillion in liquidity to banks at a negative rate" HERE

"...In other words, with the ECB flooding the European financial system with a tsunami of liquidity - one which it expanded today with yet another meaningless long-term refi operation as if that will do anything to help banks who can no longer earn a net interest margin arb become solvent - Europe's banks no longer need deposits, and in fact will do everything they can to push away all but the smallest depositors. The good news, for now, is that "existing account contracts are not affected" however we expect that to change soon.

So with European banks finally cracking down on the bulk of their depositors instead of just the top 1% and corporate clients, what happens next?

Well, savers who collectively owns trillions in European bank deposits that are now non grata have two options: either pull the money out, convert it to cash and store it in a safe (something Germany has a lot of experience with especially in late 2016 when Deutsche Bank was on the verge of collapse, sparking a rush to buy safes) where it is outside of the financial system - this is precisely the alternative the ECB prepared for several years ago when it stopped printing the €500 banknote, or more likely, buy alternative physical assets which - in a time of pervasive deflation and negative rates - do not charge a penalty rate, such as gold or even cryptos. So if over the next few months a wave of "mysterious" buying emerges and lifts all non-traditional assets which prevent central banks from imposing penalty rates, we will know why: the real great rotation has finally begun." Deutsche Bank Capitulates: Starts Charging Negative Rate On All New Deposit Accounts Over €100,000

"...The conclusion is clear. No banking system in the world is safe, including Switzerland’s. So anyone who holds major assets within the financial system be it cash or securities, is exposed to an unacceptable risk in coming months and years..."

Meanwhile, in the USA...

|

|

|

|

Post by Entendance on May 19, 2020 1:16:49 GMT -5

As Buckminster Fuller said, “You never change things by fighting the existing reality. To change something, create a new model that makes the old model obsolete.” Post-COVID-19, the world will need to explore new models; and publicly-owned banks should be high on the list.

May 21, 2020 In Last Bailout, the Fed Outsourced Management to the Banks Being Bailed Out – then Paid them Huge Fees for their Work

|

|

|

|

Post by Entendance on May 28, 2020 6:04:37 GMT -5

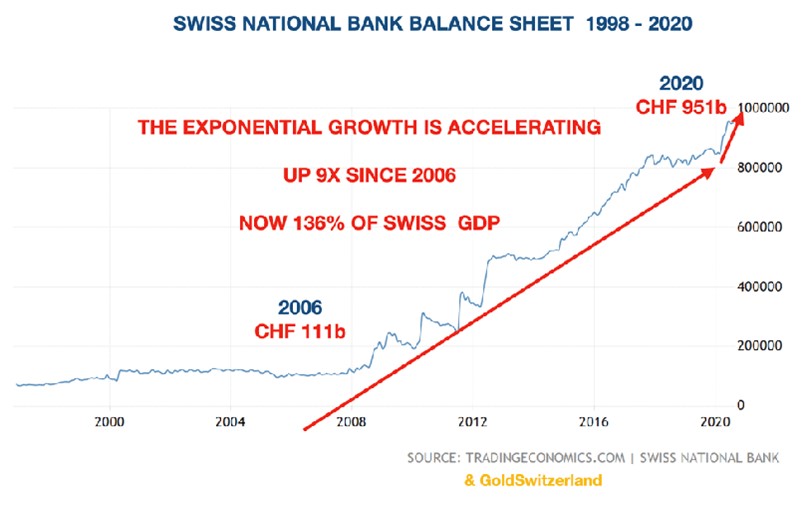

"...The fund flow is simple: the SNB prints CHFs, which it then sells for USDollars - in the process depressing the value of one of the world's most sought after safe haven currencies - and uses the proceeds to buy US stocks of which it owns about $100 billion. In many ways, this is similar to what the Fed does, only instead of buying Tsys, MBS, and now corporate bonds, the SNB is buying equities..." here

|

|

|

|

Post by Entendance on May 30, 2020 5:28:40 GMT -5

"...Perhaps its about time for a discussion of who the Fed is, who they serve, and either amend the Constitution to include them...or follow the Constitution and discard them?" |

|

|

|

Post by Entendance on May 31, 2020 7:32:57 GMT -5

Classification of central banks by ownership

Zerohedge: "...Now if only someone could explain to all those millions of angry Americans that the source of virtually all of society's ills is to be found in the building below (which just happens to house an unknown amount of freshly printed dollar bills), it would be a much-needed start to the reset the US so desperately needs to avoid complete destruction." More here

"...America has plenty of law enforcement, prosecutors and prison cells for those who loot a Whole Foods, but none for those who loot the public treasury, commit stock market swindles or financial fraud on a monumental scale. Not only did no one go to prison for the rampant institutionalized fraud of the 2008 looting, a.k.a. the Global Financial Meltdown--the looters were bailed out by the Federal Reserve and Treasury." More here |

|

|

|

Post by Entendance on Jun 2, 2020 4:21:25 GMT -5

williambanzai7: "...Who created our wonderfully fucking fake Potemkin economy?

The fake capitalists who repeatedly bail themselves out to the order of trillions and trillions of FRNs to preserve and further increase their already obscenely oversized wealth which derives primarily from humongous asset bubbles.

You know, the big time looters in pinstripes who are telling you that street looters are political heroes fighting social injustice. What injustice? Economic injustice? No, another white cop killed a black man. Now be a good fucking prole and go tear your shitty blue neighborhoods apart.

They own the banks and everything else (including many of the chain stores being looted) and they’ll pick your pockets and rob you blind without any worry that negative consequences might ever follow.

And what of the genuinely oppressed masses? How do they achieve justice when they allow themselves to be lead by politicians bought and paid for by the big time looters? The problem is they are too damned stupid to see the forest from the trees. The fucking masses are fucking asses as they say.

Are the heroic social justice warriors parked in front of the Fed, Goldman Sachs, JP Morgan or the NYSE? Not on your life.

And that folks is precisely how they want it to stay.

"It’s one big club. And you ain’t in it."—George Carlin"

Ideas For A Righteous Revolution

Elements of a righteous revolution for our modern era could include:

1. Boycotting The Big Banks

2. Living Debt-Free

3. Converting The Media

4. Exposing The Villains

"...A Europe free of unscrupulous bankers, self-referential bureaucrats and inadequate politicians is at the forefront of those pushing for their respective countries to exit the EU or call for its reformation. However, for this to be achieved, a major state must lead the charge, and it appears that Italy will take on this mantle and could very well be the first Eurodollar state to leave the EU if drastic reformations are not made. And Italian exit will surely have a domino effect felt all across Europe..." Will Italy be the next country to leave EU?

June 3, 2020

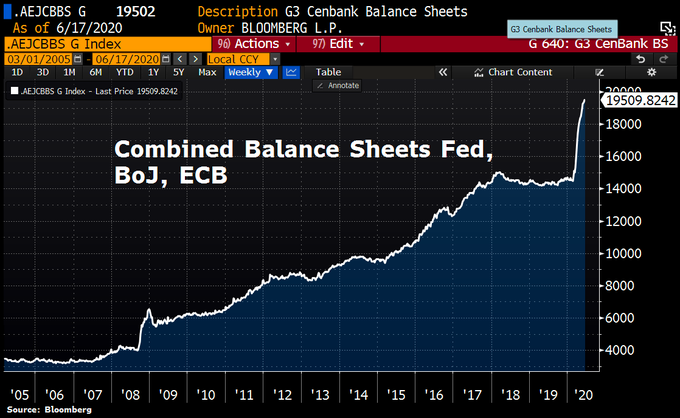

Macroeconomic analyst Rob Kirby has long predicted Fed money printing would have to go “on a vertical curve where money has to be added to the system . . . to keep the system from crapping out and imploding.” With the official federal debt at more than $25 trillion and the Fed balance sheet doubling since September, that day has clearly arrived. Add to that total the rarely talked about so-called “missing money” that stands at $21 trillion and money printing is off the charts. Kirby explains, “The $21 trillion and the $10 trillion in 2019 is the part of the money creation we don’t get to see. There is no transparency on that at all. What we do get to see, though, is the Fed in the last three months reversed their quantitative tightening and are now expanding their balance sheet, once again. Their balance sheet has grown from $3.7 trillion, at the beginning of the year, to more than $7 trillion right now, and it’s projected to get as high as $10 trillion to $11 trillion by the end of the year. So, we have money creation happening in spades . . . and the game to hide the rampant monetary debasement has no end. It’s Keynesian quackery with money.”

With all this money creation, why isn’t gold, silver and Bitcoin much higher in price? Kirby says, “They want to stunt the natural anti-dollar trades, whether it’s the precious metals, gold & silver or crypto marketplace best expressed by Bitcoin in this day and age. Basically, all these things are viewed by the monetary officials as Kryptonite to the dollar, and they all represent anti-dollar trades.”

Kirby says the interventions and manipulations are losing their price suppressing effect. Kirby points out, “An attack on gold where the price would be dropped dramatically it would take the gold market weeks, if not months, for the market to recompose itself and move higher again. Now, we see the markets recompose itself and move higher in a matter of minutes. We see the same thing in the crypto space, and we see the same thing with silver. The attacks are vicious, and the recovery time is becoming shorter and shorter. . . . The Federal Reserve acts on the Treasury’s behalf clandestinely . . . to make the dollar look pretty when it’s being desecrated by the people who are sworn to uphold its value.”

Kirby says dollar debasement is all part of the globalist plan to destroy America because it stands in the way of the Marxist/communist inspired New World Order. This is what the rioters tearing America’s cities apart are doing in the name of race, but it is in fact being done by the newly designated terror group Antifa, which is supported by the Democrat party. Kirby closes by saying, “Globalism is the true enemy of humanity and it’s the true enemy of America, and America needs to wake up to this and get their heads around it very quickly. . . . This is all going to end when the dollar is no longer accepted in trade by the rest of the world. . . . They will say you have created too many dollars, and we want payment in something other than dollars because we don’t know what a dollar is really worth. Will these clowns that destroyed the dollar take that as an act of war? I suspect they will.”

"...One of the protesters in Los Angeles on Friday night carried a handmade sign that read: “White Silence Is Compliance.” To that we would add that silence by mainstream media on what the Fed and Wall Street banks are doing today must become part of the national conversation."

It’s getting too risky out here

Ive never said this at a protest

This is a riot

This is different

Police are nowhere to be seen

Rioters are cracking open ATMs now

Destroying everything they can

Absolute lawlessness

The city of Dallas mourns as it falls apart tonight - The Gateway Pundit

"...With the decay of the social contract and the emergence of monopolistic search and social media platforms, the suppression of competing narratives has accelerated as ruling elites tighten their grip in response to the unraveling of the social order.

Thus we get Federal Reserve Comedian Jay Powell claiming the Fed doesn't create wealth inequality, when it's pathetically obvious the Fed is the primary engine of wealth inequality. (Give me $10 billion at near-zero interest rates and I'll get rich, too.)We can summarize the current era in one sentence: truth is what we hide, cover stories are what we sell. Jean-Claude Juncker's famous quote captures the essence of the era: "When it becomes serious, you have to lie."

And when does it become serious? When the hidden facts of the matter might be revealed to the general public. Given the regularity of vast troves of well-hidden data being made public by whistleblowers and white-hat hackers, it's basically serious all the time now, and hence the official default everywhere is: truth is what we hide, self-serving cover stories are what we sell.

The self-serving cover stories always tout the nobility of the elite issuing the PR: we in the Federal Reserve saved civilization by saving the Too Big To Fail Banks (barf); we in the corporate media do investigative reporting without bias (barf); we in central government only lie to protect you from unpleasant realities--it's for your own good (barf); we in the NSA, CIA and FBI only lie because it's our job to lie, and so on..."

[Starve the banksters: gold & silver, outside their banking system. Buying physical Gold & Silver is by far the greatest act of wisdom and rebellion anyone can and should be doing right now.] |

|

|

|

Post by Entendance on Jun 4, 2020 7:27:16 GMT -5

BlackRock Is Bailing Out Its ETFs with Fed Money and Taxpayers Eating Losses; BlackRock Is Bailing Out Its ETFs with Fed Money and Taxpayers Eating Losses;

JUNE 4, 2020

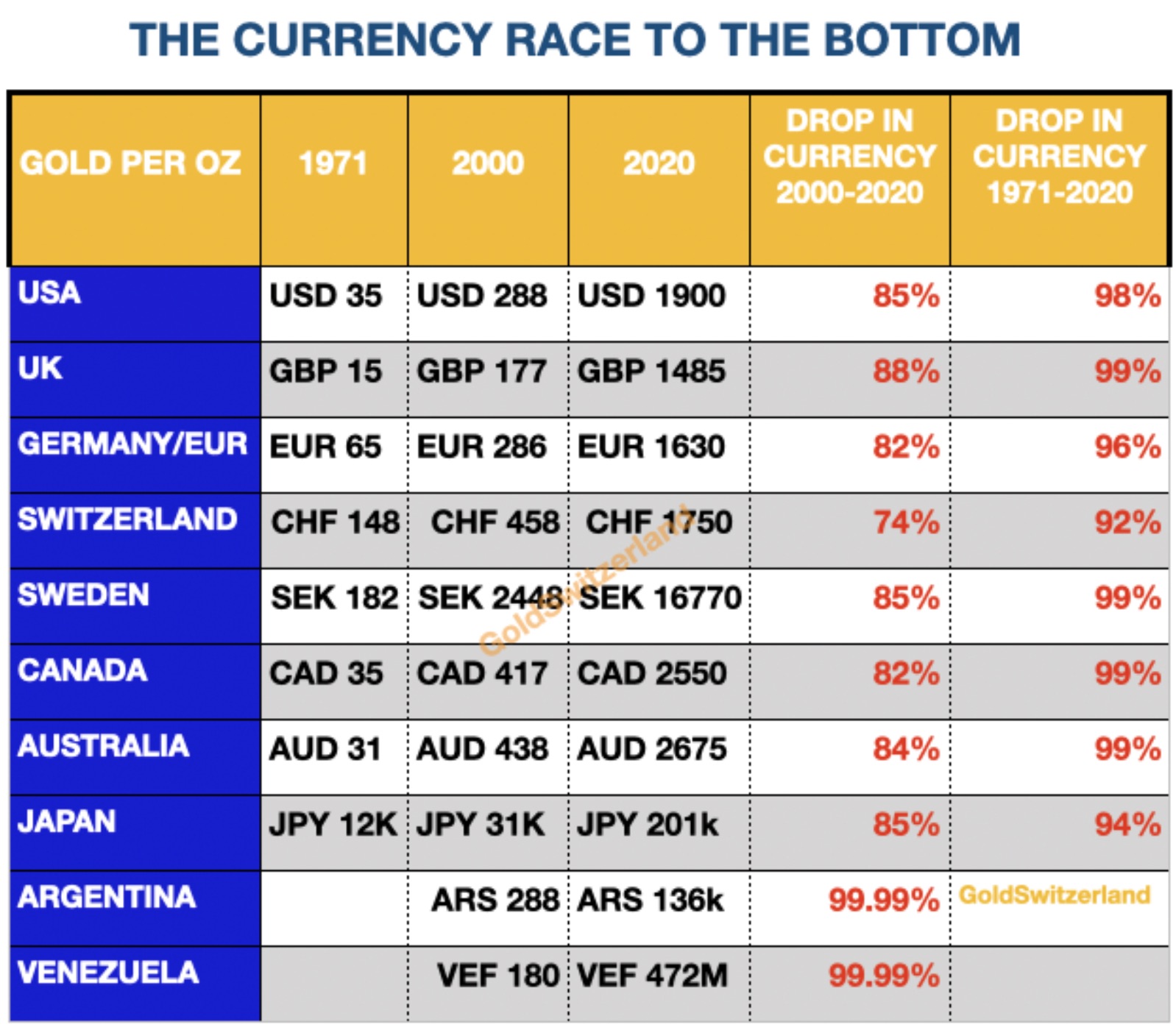

The world’s major central banks continue to debase the purchasing power of their Fiat currencies –by orchestrating consumer and/or asset price inflation...the banksters don't even have the guts to call it printing money out of thin air instead they hide behind the term 'quantitative easing' QE has been a massive deceit & a huge factor in driving inequality! Fiat currency: a currency which is not physically backed! You have a fiat monetary system which means that you can print whatever amount of money you want – and that’s what central banksters do.

In a time where money printing seems endless, remember - central banksters cannot reproduce gold/silver as they do with fiat currencies.

"Gold money is the source of all Good. Paper money is the source of all Evil." -Ayn Rand

Physical Gold isn't debt, equity or any other financial promise. It doesn't rely on anyone else's survival to exist. It can't be destroyed any more than it can be created at will.Physical Gold is instant liquidity. Gold has served as money/barter in every period of distress in history. Gold and silver are direct enemies of fiat dollars or fiat anything.Physical Gold is scarce and cannot be manufactured or printed Gold is eternal. All the gold ever produced still exists! Fiat means money issued by government not backed by anything as opposed to gold!

4 June 2020

At today’s meeting the Governing Council of the ECB took the following monetary policy decisions: Monetary policy decisions Monetary policy decisions Previously, on the Entendance Beach...here |

|

|

|

Post by Entendance on Jun 9, 2020 3:08:37 GMT -5

Barking up the wrong tree; inequality caused by the banksters and politicians is the problem, not the police. E.

Pam Martens and Russ Martens: "...This is the timeline of events suggesting that a financial crisis was in the works months before December 31, 2019..." |

|

|

|

Post by Entendance on Jun 11, 2020 1:43:17 GMT -5

(H/T our member theunderdog & Tom from Florida)

"...The current mass delusion is that the Fed can bail everyone out with cost-free cash. But we have to keep in mind what the Fed can't do:

1. It can't reverse the unprecedented wealth inequality its policies have pushed to the point of civil breakdown.

2. It can't make people take on the risks and heartaches of starting new businesses.

3. It can't force employers to hire more employees.

4. It can't make unprofitable businesses profitable.

5. It can't force people to buy assets at prices that no longer make financial sense.

6. It can't make insolvent businesses and local governments solvent.

7. It can't force people who now realize their priority is to save money to spend their cash, even if the Fed forces negative interest rates so it costs money to have savings.

8. It can't lower the unaffordable cost structure of the entire economy.

9. It can't de-link all the financial dependencies in the financial system that make it so vulnerable to the first domino falling.

10. It can't stop people from selling their assets.

In summary, it can't stop the reverse wealth effect. We are entering The Greatest Depression because there is no exit. Either the phantom wealth of asset bubbles completely vanishes, or the phantom purchasing power of fiat currency vanishes. Both paths lead to the same destination: systemic collapse."

|

|

|

|

Post by Entendance on Jun 13, 2020 3:31:40 GMT -5

June 14, 2020: Federal Reserve’s Desperate Act – Bill Holter

"...We’re simply not buying the idea that these six mega banks with $202 trillion notional (face amount) in opaque derivatives are going to provide the strength we need in this storm. It’s long past the time to break up these banks and restore the Glass-Steagall Act where the casino trading houses are separated from the federally-insured, deposit-holding banks." Here |

|

|

|

Post by Entendance on Jun 17, 2020 1:18:19 GMT -5

The FED is buying corporate debt. The FED is buying corporate debt.

You know, those bonds that corporations were issuing in big numbers to buy back their stock, to prop up the price and fatten their stock options. The looting is being taken to a whole new level.

"You pompously call yourselves Republicans and Democrats. There is no Republican Party. There is no Democratic Party. There are no Republicans nor Democrats in this House. You are lick-spittles and panderers, creatures of the plutocracy.” -Jack London, The Iron Heel

The world does not love you.

Those dark powers of the world whom you serve are like ravening lions, seeking only to devour you.

Time to leave their service, and come home. -Jesse

The Fed has created a full on gambling casino and the gamblers have moved in and are pulling the ‘buy’ triggers non stop. The Fed is not saving the economy, it’s zombifying it and in process of inserting itself ever deeper into markets the Fed itself is becoming too big to fail. The Fed losing control over the asset bubble is now the biggest risk factor to the economy. A rescue model that relies solely on ever higher stock prices ever more divergent from the underlying economy creating an ever larger wealth gap in the process. It’s a spiral out of control that is masking what is really going on: The structural economy is circling the drain and zombifying the economy will only clog it up with dire consequences to come, consequences masked for now as markets are still busy chasing every liquidity headline. More here

Repetita Iuvant. The Fed bond purchasing has little restrictions on executive compensation, buybacks, layoffs, offshoring, or paying out private equity. All factors in inequality. Again, the Fed is not an innocent party here.-The great Nomi Prins

The end of capitalism as we know it: G3 Central Banks (Fed, BoJ, ECB) have pumped more than $5tn into the markets since March. They bought all kinds of assets, a kind of nationalization through the back door? -Holger Zschäpitz

|

|

|

|

Post by Entendance on Jun 25, 2020 2:57:17 GMT -5

Dimittis pullos sub custodia vulpis

(You're leaving the chickens in the care of the fox)

Quivi venimmo; e quindi giù nel fosso

vidi gente attuffata in uno sterco

che da li uman privadi parea mosso.

E mentre ch’io là giù con l’occhio cerco,

vidi un col capo sì di merda lordo,

che non parea s’era laico o cherco.

-Divina Commedia/Inferno/Canto XVIII

Chart: Less Gold underlying per unit of currency in circulation

"...central bankers are making a grave mistake of taking on an aggressive loose (lower) interest rate policy and flooding the economy with more and more paper money in order to revive the economic activity. But, that is not going to work as it would not lead to real economic growth.

Let me explain this in more detail. It’s not very long before paper receipts with gold in storage were used as currencies. This era was known as a “The Gold standard”. People exchanged these paper notes for goods or services they required as it was more convenient to carry them rather than carrying a lot of physical gold. So every paper receipt issued had an equal amount of gold backing it.

Over time, those who held the gold and issued the receipts noticed that physical gold was seldom claimed even though the receipts changed hands several times.

The temptation to issue more receipts than the gold in storage became too large to resist, and fractional banking was invented. This allowed the issuers to charge interest and increase the amount of currency or paper in circulation many times more than the underlying Gold.

The scheme would work as long as everyone did not claim his or her gold at the “same time” Those issuers who abused the system suffered from bank-runs, in which receipt holders came in to claim their gold in large sizes. Since there was not enough gold to cover all the outstanding receipts, only the first claimants that entered the door first, would get any gold.

The system was based on the faith the public had in the gold receipts, with all issuers not being equal. The Federal Reserve Bank (RBI of USA) was therefore created to regulate the system and stand ready to bail out any bank that could not meet its obligations. Fractional banking was allowed to continue subject to additional regulation and scrutiny, but the system is still based purely on the faith and confidence that people have in paper currencies.

A monetary system based on fiat money amounts to no more than a confidence game. The value of fiat money is determined solely by our confidence in the issuers of that money. The confidence is that the country's currency is "valuable" because of the country's economic and military strength. This is what we have been made to believe in.

Actually speaking, fiat currency is simply the printing of a currency out of thin air with no intrinsic value.

If too much money is created the public will lose confidence in its purchasing power and the perceived value of the money can collapse.

Remember, fiat money has no intrinsic value; it only has perceived value. This is why most of the fiat currencies met with disaster if you look back in history." -Chirag Mehta

|

|

|

|

Post by Entendance on Jul 3, 2020 1:16:53 GMT -5

The Entendance Beach. This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many...

"...The consumption-driven U.S. economy is under attack from many angles. There are still 29 million people collecting some form of unemployment insurance. This includes the over 9 million “off balance sheet” individuals covered under the Pandemic Unemployment Assistance program that the MSFM and the White House are fond to ignore.

We also have 2.2 million people that are finding gainful employment inside Zombie companies. Unfortunately, these businesses were being kept alive by record-low borrowing costs for junk debt and a reasonably good economy. However, now the cost of rolling over this debt has increased while their business models have been torpedoed by the Wuhan virus.

The major averages are struggling to get back towards all-time highs, but the underlying economic support is disintegrating quickly. Hence, the economic chasm between the rich and poor is plunging deeper into record depths. But the mirage of semi-normalcy is being perpetuated by massive and unprecedented fiscal and monetary stimuli..."

AP: Catholic Church lobbied for taxpayer funds, got $1.4B

"thank you banksters": here

Gold, the only honest and sound money left. E. |

|

|

|

Post by Entendance on Jul 5, 2020 3:06:45 GMT -5

|

|

|

|

Post by Entendance on Jul 11, 2020 3:04:28 GMT -5

Buying physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve a tyrant. E.

|

|

|

|

Post by Entendance on Jul 15, 2020 23:07:33 GMT -5

4 pages: The Entendance Beach & Bail-in

4 pages: The Entendance Beach & Bailout

|

|

|

|

Post by Entendance on Jul 20, 2020 0:41:20 GMT -5

"...By targeting asset prices to bolster the economy, the Federal Reserve is again creating an asset bubble. The US central bank’s loose monetary policy, more than China, is really to blame for the US’ troubles now "...By targeting asset prices to bolster the economy, the Federal Reserve is again creating an asset bubble. The US central bank’s loose monetary policy, more than China, is really to blame for the US’ troubles now

The multi-year mania continues unchecked by Covid-19All these tech billionaires are really the children of Fed chair Jerome Powell. Alan Greenspan’s dotcom babies were worth merely billions briefly; Powell’s children are worth tens of billions and hanging on and on. Earnings reporting season is coming. The numbers are probably going to be very bad. If the market crashes again, the Fed might buy stocks directly this time...Expectations that the Fed will do whatever it takes to keep the market up are drawing back speculators time and again. When earnings don’t matter any more, more and more CEOs will do a Musk to keep stock prices up. The tech Kardashians are taking over Wall Street...Is there such a thing as a free lunch, though? Karma will eventually catch up with the Fed. When China joined the global economy, its size and low wages added to deflationary pressure. The resulting low inflation in the world was really due to this shock, not overly tight monetary policy. Greenspan interpreted low inflation as a call for loose monetary policy, which led to asset bubbles. His successors have maintained the policy..." More than $8.5 trillion is now held in funds benchmarked to various indexes, representing 41% of the fund industry’s assets, up from 14% in 2005. Stock index funds account for 14% of the domestic equity market, versus less than 4% in 2005 (H/T Tom from Florida)

|

|

|

|

Post by Entendance on Jul 23, 2020 2:13:27 GMT -5

GITA (Gold is the alternative) -Steve Henningsen

"...The ‘world’ then, was Egypt. Osiris had inherited the fertile Nile Delta, and his younger brother, Seth, had received only a lesser, more arid portion.

Mean-spirited and destructive, Seth aspired to ‘grasp the world’. He murdered Osiris, and hid his body; but Osiris’ wife/sister, Isis, after endless search, finally found it. Osiris was outraged and angry at her: he again seized the body. He dismembered it into parts. And had the parts hid, and spread far around distant regions. Yet Isis did it again: She ‘came back’. She found Osiris’ ‘bits’, re-assembled him, and had Apollo blow life into him. They had a son: Horus.

There are many messages in this story, but a principal one was that Seth’s dismemberment of Osiris brought only violence, instability and calamity to Egypt. Horus fought for decades against Seth. But neither ultimately were able to prevail. The fighting brought only strife and ruin – and Egyptians came to detest Seth as the symbol of a destruction that tainted everything. Eventually the council of gods decided that Seth be expelled and exiled from Egypt, for all the tensions and turmoil he had caused.

Seth was understood by Egyptians to represent a capsized human; a one-sidedness of character that had failed to accomplish wholeness – was incomplete, and inadequate. Significantly, it was only by the intervention of the opposite pole, the female Isis, in alchemical marriage to Osiris, who brought back fecundity – in all its meanings – and harmony to Egypt.

If we look back to the ancient concept of the ‘two lands’ of Egypt – the fertile Black Lands of the Nile and the barren Red Lands of the surrounding desert – we get an inkling of how the waxing and waning of one polarity, yielding ultimately to the rise of its ‘opposite’ value, was understood in earlier times. Everything is in flux: polarities swap places, as in a formal dance, and potencies of the invisible world jostle and shove against the ebb and flow of human activity.

The ‘Two Lands’ of Egypt represents something more than some mere geographical distinction. In ancient Egypt, the physical landscape had a metaphysical resonance of which the ancient Egyptians were keenly aware: The Two Lands were comprehended as the two contending, yet mutually interpenetrating, realms of life and death.

The combined landscape of the Two Lands is one of ‘paradise’ and ‘hell’, at war with one another, yet united in precarious balance and reciprocity. ‘Horus’ thus symbolises the harmonious, creative unity of cultivation in the valley; and ‘Seth’ that of in-coherence, of chaos and death in the desert areas.

But even Seth, who in so many respects symbolises a destructive, voracious negativity, embodies too a certain duality. He was never perceived as intrinsically bad or evil, but as a necessary component of the Cosmos: aridity, desiccation and death. His ambivalence is experienced in the Egyptian desert: mercilessly hot, with nowhere to shelter from the sun; but in this landscape of rock and silence, where no bird flies and no animal, save the desert viper moves, there is too, a deep stillness which the Valley cannot give.

Seth may, in one sense, personify the force of life-sapping, decay and death, but his dramatic polarity lies precisely in his very necessity to renewal. Ancient Egyptians saw themselves held in this balance and interplay of polarities: life and death, abundance and scarcity, light and dark – the very landscape teaches the principle of oscillating polarities. Maintaining balance was a succession of destructions and renaissances; allowing Seth’s insidious, sapping barrenness to be overcome by Horus’s subsequent reviving inundations, was the central preoccupation of the Egyptian King. Seth and Horus were thus to be held in equilibrium.

We might understand this double movement – compounded in aspects that are always in polar tension, but yet a co-constituent to each other – as being somehow a reflection, an analogy, and a consequence of a deep inner life-rhythm: the systole and diastole of human creativity itself.

Later historians such as Plutarch (Greek writer, d. CE 120) observed that Seth is said to have wandered the region where he fathered sons – whom, fuelled by their resentment at Egypt’s treatment of them, chose to redeem the mortal enmity of Egypt, by precisely identifying themselves with a vengeful, ambitious – but now exclusive deity – Seth. In short, Plutarch is saying that the Sethian impulse and polarity was perpetuated (i.e. that it descended down through the human condition).

The U.S. may believe that dismembering and scattering the institutional limbs of its perceived nemeses – China, Russia and Iran – will Make America Great Again; but this ancient wisdom tells U.S. that it will fail, precisely because of its one-sidedness, and lack of the feminine faculty of empathy – and not because a weaponized reserve currency is no potent tool.

The region faces – like ancient Egypt – a period of travail, as neither the U.S., nor its nemeses, initially will prevail; but ultimately, America will be, like Seth, forced into exile to taste its own bile at the failure of its exceptionalist mission (and deity).

The upside here is that this crisis holds the promise to discredit the mainstream illusion that there exists, and there needs be, therefore, no limits – and no accountability – to using the Fed’s dollar printing press, and threats of exclusion from the dollar sphere, to impoverish lives in much of the rest of the world. And that this action is consequence free – that it portends no come-back." The Dismemberment of the World

GOLD will become a new asset class for institutional investors as investment properties become clear.

Exposure now near 0. No need to own govt bonds at 1% or lower when gold can do similar job+ in portfolio.

Ann. trading volume $40 trillion.

Exposure should be 10% of NAV. Regarding gold vs fiat, yes gold small but that's what will also drive the price. Only a very small % of fiat needs to go looking for a home in gold to move price substantially. -Dan Tapiero

“When citizens begin to resent the ruling upper class, aristocracy degenerates into an oppressive oligarchy. The lust for power causes few to oppress many.”

(H/T Tom from Florida) Buying physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve a tyrant. E. |

|

|

|

Post by Entendance on Jul 26, 2020 1:26:51 GMT -5

All Roads Lead to Gold in a Credit Implosion – Bill Holter Financial writer and precious metals expert Bill Holter says, “Gold is like a tractor in first gear pulling up a hill,” as it touches all-time highs once again. Holter thinks the “gold tractor” is going to be shifting up a few gears in the not-so-distant future. Holter, who has been dubbed the new “Mr. Gold” by the reigning “Mr. Gold,” Jim Sinclair, explains, “There is no rush like a gold rush. The reason being is you get momentum followers. You get people who are greedy who want to make money. Then you have the fear trade, and the fear trade is probably the most powerful emotion. What you are seeing around the world is big money understands we have a credit implosion coming, which is going to take the currencies with it. Where do you hide? The place to hide is in gold and silver.”As much as Holter likes gold, he says silver is way undervalued compared to gold. Holter has long said when silver prices takes off, “it will be like gold on steroids.” Holter says, “The reason silver is undervalued is it comes out of the earth at 10 (ounces of silver) to 1(ounce of gold). That’s God’s ratio. Man’s ratio had gotten to 120 to 1. I can tell you which ratio is right and which ratio is wrong.” Holter thinks God’s ratio is the correct one.Holter says, “ All roads lead to gold” especially in today’s economic environment. Holter explains, “Gold is the arch enemy of fiat currencies...You can just use your common sense and see we have a big, big problem out there, and capital is going to need a place to hide. Gold and silver are the only money that do not have any liability. Gold and silver are proof that labor, capital and equipment were used to create that. It already has been done, whereas everything else is a future promise, and promises are made to be broken... The central banks must either inflate or die...The central banks have to reflate or inflate, whatever you want to call it; otherwise, the entire credit system comes down. If they don’t inflate and they let the credit system come down, then you have a massive deflationary event where credit implodes. All the currencies themselves are credit. So, if the credit system comes down, it also takes the currencies with it...With all the debt out there, the central banks must hyper-inflate. Where’s the best place to be in a hyperinflation? Gold and silver. If they don’t hyper-inflate, and they let the credit markets completely collapse and everything defaults, what’s the best place to hide? Gold and silver because they have no liability. They are pure money. That’s why all roads lead to gold.” Holter goes on to say, “You could have both. We could have a credit implosion, and the Fed creates $100 trillion and puts it into the system. That’s the only response they have if things get out of hand... It’s inflate or die.” In closing, Holter warns people to get ready and buy physical assets. This include food and water and anything else you might need. Holter predicts, “You are going to lose purchasing power. Just look at history. Every time a currency has failed, the population loses its purchasing power. Just because this is the United States, it doesn’t mean we can break the laws of Mother Nature. We are going to face a huge drop in purchasing power and a huge drop in our standard of living. We have said this for years and have been trolled for years, and now here we are.” Holter also points out the legendary gold investor Jim Sinclair is the original Mr. Gold, and Holter says, “Jim is Mr. Gold emeritus.”

|

|

|

|

Post by Entendance on Jul 30, 2020 1:10:00 GMT -5

“Why do they hate gold so much?”

That one is easy—the banksters and their crony politicians hate gold for the same reason tanning salons hate the sun. Because gold cannot be printed or destroyed, it exists in limited and quantifiable amounts, and therefore, unlike paper money, there is a limit, a tether, on the amount of incompetence and financial mismanagement our elected governments can get away with without being called to account.

On the other hand, the amount of paper (or digital) currency that a government can create (usually through the mechanism of its “agent,” or third-party central bank) is limited only by the amount of available ink and paper, the processing capacity of its computer systems, and the ignorance of its citizens. And all of these are now in plentiful supply, it would seem...

FOMC Translation: The Economy is absolute dogshit, we are printing 24/7 to try and keep the DOW from collapsing. The 1% have been bailed out, the 99% you are on your own. Dollar at the lows, Gold at highs, and stocks...at highs. God Bless. -Stalingrad & Poorski

The coronavirus economy is exacerbating inequalities, esp. in housing. The wealthy are buying bigger homes at the cheapest interest rates ever. Poor renters have suffered the greatest job losses and fear eviction. Over 12 million couldn't pay June rent. -Heather Long

Banksters Cartel International XXI

|

|

|

|

Post by Entendance on Aug 10, 2020 3:30:47 GMT -5

|

|

|

|

Post by Entendance on Aug 11, 2020 11:15:30 GMT -5

Offshore companies linked to Lebanon c.bank governor have assets worth nearly $100 mln - report

(H/T Tom from Florida)

"Risk cannot be destroyed it can only be shifted in time and redistributed in form." -Chris Cole, Artemis Capital

Over the last decade, CEO pay at S&P 500 companies increased more than $340,000 a year to an average of $14.8 million in 2019.

Wages for average workers at those same companies over the same period of time rose just $836 a year. More here

"One group lives high off debt proliferation, the other impoverished by it." -Tom from Florida

Buying physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve a tyrant. E.

|

|

|

|

Post by Entendance on Aug 14, 2020 0:09:56 GMT -5

(H/T Tom from Florida)

1. Apple sells billions in bonds, even though they don't need to; 2. @federalreserve buys the bonds with taxpayer-supported funds;

3. Then $AAPL buys back their own stock, pushing price up, making the rich richer.

If Americans understood this, they would be burning down D.C. -𝕊𝕝𝕠𝕡𝕖 𝕠𝕗 ℍ𝕠𝕡𝕖

"Downturns in bank credit expansion always lead to systemic problems. We are on the edge of such a downturn, which thanks to everyone’s focus on the coronavirus, is unexpected.

We can now identify 23 March as the date when markets stopped worrying about deflation and realised that monetary inflation is the certain outlook. That day, the Fed promised unlimited monetary stimulus for both consumers and businesses, and the dollar began to fall.

The commercial banks everywhere  are massively leveraged and their exposure to bad debts and a cyclical banking crisis is now certain to wipe many of them out. In this article we look at the global systemically important banks — the G-SIBs — as proxy for all commercial banks and identify the ones most at risk on a market-based analysis..." An unexpected systemic crisis is for sure are massively leveraged and their exposure to bad debts and a cyclical banking crisis is now certain to wipe many of them out. In this article we look at the global systemically important banks — the G-SIBs — as proxy for all commercial banks and identify the ones most at risk on a market-based analysis..." An unexpected systemic crisis is for sure

|

|

|

|

Post by Entendance on Aug 20, 2020 3:26:12 GMT -5

If you're not part of the solution, you're part of the problem. -Sydney J. Harris On the Entendance Beach we starve the banksters: gold & silver bullions, outside their banking system.Yes, starve the banksters by stacking gold & silver bullions and storing them outside their rotten banking system. E.

Central bankers annihilate the middle class, funnel trillions to oligarchs, lie about everyone’s cost of living and then prance around like god-kings to be worshipped instead of the society destroying charlatans they are. -Michael Krieger

Inequity is fast approaching a boiling over point with the masses. -Adam Taggart

(H/T Tom from Florida)

(H/T Tom from Florida)

|

|

|

|

Post by Entendance on Aug 23, 2020 2:13:00 GMT -5

Repetita iuvant Repetita iuvantRepeating things helps

August 24, 2020: "...Credit losses for the banks will be astronomical. Even with current low interest rates, bad debts are increasing rapidly. And most banks have most certainly not yet recognised the problem adequately. The 15 largest US banks have so far set aside $76b to cover bad debts and the 32 biggest European banks €56b.

|

|

|

|

Post by Entendance on Oct 16, 2020 4:11:34 GMT -5

October 18, 2020 "...As the world’s central banks desperately fight for the survival of the world financial system, they will print unlimited amounts, initially in the hundreds of trillions and when the derivative bubble bursts, we are likely to see quadrillions of dollars, euros etc being magically created out of thin air. Whether this will be current dollars or euros or new digital currencies will make zero difference. Fiat money will always remain fiat money, whatever spin central bankers will put on it.

June 8, 2021

So investors who are not yet prepared for this still have a small window of opportunity before currencies, led by the dollar, collapse.

Precious metals, especially physical gold and silver will obviously reflect the collapse of the fiat currencies and continue their uptrend, which will soon be exponential..." More here

This has all been planned in advance.

A Widely Known Plan among Top Central Bankers?

"...If top central bankers not only knew of a 2020 Reset and its Covid trigger, but actively planned years in advance with prior knowledge to prepare for such a reset event, the legal implications are grave and serious. Only time will tell.

The last word for now goes to German physician, Dr. Heiko Schöning, who, speaking from London on 27 September, succinctly explains how the creation of the Covid plandemic points to powerful banks and their private controlling interests, while being used by these powerful banks to reset the financial system."

|

|

|

|

Post by Entendance on Oct 21, 2020 10:06:44 GMT -5

Welcome to the hopeless result of banksters manipulation: stagnation, soaring inequality and rampant corruption.

October 30, 2020: "Wake up, America, and see the Fed for what it really is: a totalitarian tool of kleptocracy."

(H/T Tom from Florida)

The Fed Did a Lot of Talking Yesterday about a Big Bank Failure: Should We Worry?

"As global central banks’ balance sheets are exploding, with disastrous consequences, the Swiss National Bank (SNB) stands out as the “biggest hedge fund” and speculator in the world. Its balance sheet is over $1 trillion or 136% of Swiss GDP..."

"As long as the SNB can bamboozle global speculators into chasing after the incredibly watered-down tiny Swiss franc, it can continue to print money to buy up global assets at essentially no cost..."

U.S. Stocks at the Swiss National Bank Balloon to Record: Gains, Bought, Sold, and How it Keeps that Racket Going

(H/T Tom from Florida)

Holding precious metals is the only way to destroy the fiat system & hurt the banksters.

Buying physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve a tyrant. E. |

|

|

|

Post by Entendance on Nov 12, 2020 8:38:48 GMT -5

Fubar! Fubar!

(H/T Tom from Florida)

"Crowds, like sheep, are only as safe as the shepherds who guide them.If the shepherd is mad, so too is the crowd.  Today, central bank shepherds are leading the vast majority of investors over a currency cliff. This is easy to predict, despite the fact that most forecasting models are woefully flawed... Today, central bank shepherds are leading the vast majority of investors over a currency cliff. This is easy to predict, despite the fact that most forecasting models are woefully flawed... Fantasy has replaced facts...trust ends once currencies lose their value and the madness of crowd faith in fantasy is replaced by a mad crowd of broke investors Fantasy has replaced facts...trust ends once currencies lose their value and the madness of crowd faith in fantasy is replaced by a mad crowd of broke investors  ..." THE MADNESS OF CROWDS ..." THE MADNESS OF CROWDS

|

|

Gold/Silver Ratio

Gold/Silver Ratio

HELICOPTER MONEY FOR BANKS. ECB's Lagarde: €3tn now available to banks at negative rates

HELICOPTER MONEY FOR BANKS. ECB's Lagarde: €3tn now available to banks at negative rates "Our new targeted lending facility provides for around €3 trillion in liquidity to banks at a negative rate"

"Our new targeted lending facility provides for around €3 trillion in liquidity to banks at a negative rate"

Canada's CIBC lost $64 million

Canada's CIBC lost $64 million

Rage Against

Rage Against

Lebanese protesters shut down roadways with fires as currency collapses;

Lebanese protesters shut down roadways with fires as currency collapses;

The history of bailouts in the United States is

The history of bailouts in the United States is

"...By targeting asset prices to bolster the economy, the Federal Reserve is again creating an asset bubble. The US central bank’s loose monetary policy, more than China, is really to blame for the US’ troubles now

"...By targeting asset prices to bolster the economy, the Federal Reserve is again creating an asset bubble. The US central bank’s loose monetary policy, more than China, is really to blame for the US’ troubles now

The Entendance Beach

The Entendance Beach

Italian banksters &

Italian banksters &

Repetita iuvant

Repetita iuvant

Delusional Faith in

Delusional Faith in  Despite JPMorgan’s record spoofing fine,

Despite JPMorgan’s record spoofing fine,  The destruction of the world economy

The destruction of the world economy

Fubar!

Fubar!

6 CENTRAL BANKS AND THE PONZI SCHEME

6 CENTRAL BANKS AND THE PONZI SCHEME

Fantasy has replaced facts...trust ends once currencies lose their value and the madness of crowd faith in fantasy is replaced by a mad crowd of broke investors

Fantasy has replaced facts...trust ends once currencies lose their value and the madness of crowd faith in fantasy is replaced by a mad crowd of broke investors  ..."

..."