|

|

Post by Entendance on Nov 19, 2020 3:13:10 GMT -5

Banksters Cartel International XXII

(Still manipulating silver prices in order to accumulate physical silver)

Why ‘the gold price’ is different to ‘the price of gold’! Here

The European Central Bank could “neither go bankrupt nor run out of money” even if it were to suffer losses on the multi-trillion-euro pile of bonds it has bought under its stimulus programmes, ECB President Christine Lagarde said on Thursday The European Central Bank could “neither go bankrupt nor run out of money” even if it were to suffer losses on the multi-trillion-euro pile of bonds it has bought under its stimulus programmes, ECB President Christine Lagarde said on Thursday. (H/T Tom from Florida)

|

|

|

|

Post by Entendance on Nov 25, 2020 5:48:07 GMT -5

Banksters Cartel International XXIII

"...This massive, concentrated exposure to derivatives at four mega Wall Street banks has been allowed to persist by both Democrat and Republican-led administrations despite the fact that derivatives played a central role in blowing up the U.S. economy in 2008.

Until Congress gets serious about restoring the Glass-Steagall Act, which would separate federally-insured, deposit-taking banks from the trading casinos on Wall Street, the financial system of the United States remains at grave risk, regardless of who sits at the helm of the regulators." More here

"...the gross hypocrisy of the LBMA in lecturing others about ethics and business practices when all the while some of the LBMA’s most powerful member banks, banks that essentially run and control the LBMA, have recently been prosecuted and fined for the manipulation of precious metals prices in both criminal and civil actions. Such actions have been brought by both the US Department of Justice (DoJ) and the Commodities Futures Trading Commission (CFTC).

This includes two of the LBMA’s most powerful banks..." Reeks of Hypocrisy

"...Bitcoin is quoted hourly, on CNBC, and its price does not suffer from constant attacks, as Gold and Silver do.

This signals to me, that Bitcoin is accepted by "The Powers That Be" (TPTB).

If TPTB accept the existence of Bitcoin, it means that Bitcoin does not present a threat to the fiat monetary system upon which the World depends today..." The Bitcoin Game |

|

|

|

Post by Entendance on Dec 19, 2020 5:56:01 GMT -5

The Jesuit Order controls a worldwide network of schools, colleges, universities, seminaries, etc. This global network of Jesuit institutions is, in reality, a cover for a massive network of training centers that are used to let the Jesuits groom/indoctrinate/make-contact-with promising individuals, so that they can get them to positions of power in exchange for their obedience.  Many top movers and shakers have been trained by the Jesuits and that is how they came into contact with the Order that they now are completely controlled by. More here Many top movers and shakers have been trained by the Jesuits and that is how they came into contact with the Order that they now are completely controlled by. More here

|

|

|

|

Post by Entendance on Jan 17, 2021 6:18:16 GMT -5

Banksters Cartel International XXIX

"...the manipulation on the Comex market have little if anything to do with the physical demand in this industry and when you see a paper price that was raded on Friday last week, dropping the silver price by over a dollar, that was completely non-reflective with physical demand as the physical demand accentuates in moments like that. People are being able to see the transparency and the desperation of a market that is slammed down in the middle of the night in the United States...  ...People are realizing that this is desperation and so I sense that the efforts by the banking cartel to suppress the price are growing lese and less effective ...People are realizing that this is desperation and so I sense that the efforts by the banking cartel to suppress the price are growing lese and less effective  and they're becoming more and more transparent to the people who are using said pullbacks as a subsity to increase their holdings.." and they're becoming more and more transparent to the people who are using said pullbacks as a subsity to increase their holdings.."

|

|

|

|

Post by Entendance on Jan 25, 2021 3:07:39 GMT -5

Banksters Cartel International XXX

Pam and Russ Martens: Yellen's speaking fees have Chinese Communist taint

What if the big silver futures shorts are trading for the government?

|

|

|

|

Post by Entendance on Feb 2, 2021 17:08:29 GMT -5

"...only physical demand can truly break The Banks and force an unwinding of the leverage. Buying futures is fun...but...The Banks will simply create more in order to dilute supply and the CME will just raise margins in order to force some selling..."

An embedded force of market insiders operating under lax regulation and astonishing leverage of physical to paper would like you to read these headlines. An embedded force of market insiders operating under lax regulation and astonishing leverage of physical to paper would like you to read these headlines.

The global bullion banks with direct pipelines to Fed cash are laughing at the rookies.

|

|

|

|

Post by Entendance on Feb 4, 2021 4:06:22 GMT -5

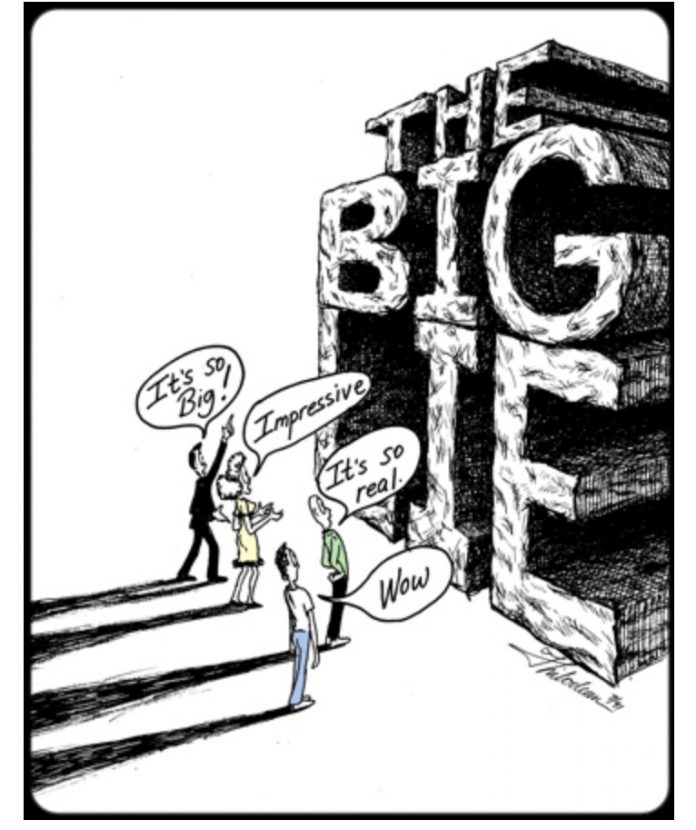

Meanwhile...the banksters & their media...

Mocking at physical newbies & precious metals investors here & headlines here + here Mocking at physical newbies & precious metals investors here & headlines here + here

|

|

|

|

Post by Entendance on Feb 6, 2021 3:48:04 GMT -5

In the video: What SLV investors should know about JP Morgan, & send to the CFTC, SEC, and DOJ

A lot of money has been flowing into the SLV silver trust in the last week, and there are some red flags emerging about the relationship between SLV and JP Morgan, the custodian, that shareholders have a right to know about.

I also encourage you to send this video, along with any of the following questions to your CFTC representative:

Did the CFTC pull trading records for the following dates in question:

February 2, 2021

March 6,2020

March 13, 2020

March 16, 2020

Did JP Morgan short silver before they issued their report on February 2? Did others who were aware of the report before it was issued short silver?

What would the CFTC say to silver investors about the information presented in this video?

Where did JP Morgan get the silver to add into SLV trust last week?

When will the next audit of the SLV trust be? Will they address these questions?

Did JP Morgan pay the $980 million dollar fine yet? Where does that fine go? What are the plans to reimburse the investors who have been victimized by this ongoing crime?

Was JP Morgan short silver before the downgrade report was issued? Were any other banks who had early access to that report short SLV. Were any of those short SLV short First Majestic Silver?

The global banks fear rising gold prices as evidence of their failed monetary experiments. -Egon von Greyerz

|

|

|

|

Post by Entendance on Feb 9, 2021 2:02:22 GMT -5

Banksters Cartel International Chapter XXXII

"In the latest Commitment of Traders report (COT), the issue I have nearly beaten to death for decades – the concentrated short position in COMEX silver futures – took center stage to a degree that had me check and recheck the data. It seems the 4 largest shorts in COMEX silver doubled down and added more new shorts in the reporting week ended Tuesday than in any other week (save one) in the last few years.

The four big silver shorts added an astounding 6,672 new shorts (33.4 million ounces). This is the largest concentrated short position by the 4 largest traders in 13 years where JPMorgan wasn’t one of the 4. ... If you are looking for a reason why silver was capped at $30 and declined in the face of visible physical shortages in the retail market and extreme tightness in the wholesale (thousand-ounce bar) market, then look no more.The price capping was caused by concentrated short selling on the Comex and highly illegitimate and easy to prove selling in the silver ETFs..." Ted Butler: The Cat’s out of the Bag

|

|

|

|

Post by Entendance on Feb 16, 2021 3:24:46 GMT -5

Stop financing your enemy!

“This is different than your traditional bank — a traditional bank lends money,” said Texas Representative Giovanni Capriglione, who authored and sponsored the legislation. “Especially if you’re in Greece right now, you know that if you go to the bank, and everybody went to the bank to try to get their deposits out, there’s not enough paper money to cover it. That causes a whole bunch of concerns. What this depository does is, it doesn’t allow that — if there are 5,000 bars of gold in there, there will be 5,000 gold bars there, and you’ll be able to access your deposits directly upon demand.” “This is different than your traditional bank — a traditional bank lends money,” said Texas Representative Giovanni Capriglione, who authored and sponsored the legislation. “Especially if you’re in Greece right now, you know that if you go to the bank, and everybody went to the bank to try to get their deposits out, there’s not enough paper money to cover it. That causes a whole bunch of concerns. What this depository does is, it doesn’t allow that — if there are 5,000 bars of gold in there, there will be 5,000 gold bars there, and you’ll be able to access your deposits directly upon demand.”

Depositors will also be able to write checks against their gold deposits to pay others, continued Rep. Capriglione, calling the measure a “big deal.” “You can write checks to individuals who have gold depository accounts, and you’ll also be able to write checks to individuals and corporations who don’t have gold depository accounts,” he explained. “We set up a system of depository agents so you can have any corporation, any group, basically start a depository agent, and they can send and receive through this depository system, outside of the Federal Reserve System.” Public entities will also be able to participate.

It will not be just Texas citizens, governments, agencies, and businesses taking advantage of the new options, either. “We are not talking Fort Knox,” Capriglione told the Star-Telegram newspaper. “But when I first announced this, I got so many emails and phone calls from people literally all over the world who said they want to store their gold … in a Texas depository. People have this image of Texas as big and powerful … so for a lot of people, this is exactly where they would want to go with their gold.”

Some conservative and liberty-minded activists expressed concerns about the law because it creates yet another state agency. However, writing in the market-oriented Ludwig von Mises Institute, economist Ryan McMaken argued that the benefits outweigh the downsides in this case. “While the Texas depository is a government-owned enterprise, it nevertheless is an improvement since it is a case of decentralization (and arguably nullification) which provides alternatives to the federally controlled monetary and banking systems,” he said. “As Hayek and other Austrians noted for decades, a decentralization of the monetary system is a key first step in moving toward more sound money...” ***Texas Launches Gold-backed Bank, Challenging Federal Reserve(H/T Tom from Florida)

"...Many economists and commentators are certain that the world will not see inflation or higher interest rates for years. They can’t see a demand led inflation.

Let’s go back to history again. History helps us to predict the future but very few so called experts understand the significance of history.

Virtually every major debt bubble in history has ended in a currency collapse and hyperinflation. Few understand that hyperinflation is a currency driven event and not demand driven.

With most currencies down 97-99% since Nixon’s fatal decision in 1971 to close the gold window, the world will soon experience the final move to ZERO.

But remember that this move involves a 100% fall of the currencies from today. This is what will lead to hyperinflation. Just study history.

Hyperinflation normally only lasts a short period like 1-3 years. Thereafter the world will experience a deflationary implosion of debt and asset prices. The banking system is unlikely to survive such a collapse..." CALLING THE HOLDINGS OF CENTRAL BANKS “ASSETS” IS A TRAVESTY

|

|

|

|

Post by Entendance on Feb 23, 2021 3:35:27 GMT -5

Banksters Cartel International Chapter XXXIII

"...Only physical demand can free us from the bondage of the criminal bullion banks. Don't fall for hype. Educate yourself. Be persistent. Take delivery. And I can assure you that we will prevail in the end." More here

|

|

|

|

Post by Entendance on Mar 6, 2021 11:01:10 GMT -5

Banksters Cartel International Chapter XXXIV

|

|

|

|

Post by Entendance on Mar 12, 2021 4:01:49 GMT -5

March 12, 2021

"With nobody left to devour, the cannibals turned to their last resort: the Federal Reserve. Please print us up some more bodies to feast on, Federal Reserve. We demand it. We want it, we need it, we're starving.

Alas, the Fed can print currency to inflate speculative bubbles, but it can't print real flesh for the cannibals. All the Fed can do is finance stimulus offal to feed the zombies.

Sorry, cannibals, there's nothing left to consume. There's only inedible zombies kept alive by the Fed. There's some sort of karmic irony in this, it seems: a starving cannibal grabs a staggering zombie corporation to devour and the zombie instantly turns to dust.

The cannibals are starving and their servants in the Fed are powerless to help..."

|

|

|

|

Post by Entendance on Mar 16, 2021 7:39:59 GMT -5

Always Remember to Never Forget. Always Remember to Never Forget.

(Post in collaboration with Tom from Florida)

|

|

|

|

Post by Entendance on Mar 24, 2021 11:06:36 GMT -5

Banksters Cartel International Chapter XXXV

May 11, 2015 at 11:32pm Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours. Here |

|

|

|

Post by Entendance on Apr 6, 2021 3:34:22 GMT -5

"There is moral hazard involved in bailing out risk-takers rather than forcing them to suffer losses. And stocks are now so expensive that the Fed risks having to fight yet another crisis should the current bubble burst chaotically." Nomi Prins

Banks Face Shockwaves Of Losses As The World Teeters Near The Edge Of Collapse Egon von Greyerz

POSTSCRIPT

Since this article was written, a small hedge fund has lost $30 billion due to ludicrous risk taking in the derivatives market. Banks like Credit Suisse will also lose billions. I have consistently warned readers about these dangers. The whole derivative $1.5 quadrillion timebomb is at risk. More about this in the next article. Remember Confucius’ warning! |

|

|

|

Post by Entendance on Apr 11, 2021 3:45:13 GMT -5

April 13, 2021

(H/T Tom from Florida)

April 10, 2021 Matthew Piepenburg

When it comes to the topic of banking risk, well…one can only lean back in a chair, sigh and say: “Where to begin?”...

- A Rich and Deep History of the Absurd

- Modern Banking Risk: No Less Absurd

- The OTC Derivatives Trade: The Real Killer Virus

- Keeping Derivatives Simple

- Simple Arbitrage, Simple Leverage, Simply Crazy

- A Side-Market Premised on Only Good Times

- A Ticking Timebomb

- That’s Banking Risk

Buying Physical Gold & Silver is by far the greatest act of rebellion any human being can and should be doing right now. Any excuse will serve a tyrannic bankster. E. |

|

|

|

Post by Entendance on Apr 15, 2021 5:10:01 GMT -5

A nation of sheep will beget a government of wolves. -  Edward R. Murrow Edward R. Murrow

A reminder why they always will be sound money and why bitcoin cannot fill that role

Cryptocurrencies are tulip bulbs, without the practical beauty.

At some point the reversion to the mean is coming, and it may be a rough ride. -Jesse At some point the reversion to the mean is coming, and it may be a rough ride. -Jesse

"...The middle class  has finally surrendered the last of its rational risk-aversion and gone all-in on bets in the Fed's rigged casino. Big players don't use margin accounts in brokerages; they have immense lines of credit and tools to leverage their bets. It's the so-called retail traders who use margin, and so the unprecedented highs in margin debt are evidence that the middle class has gone all-in on bets markets will only loft higher forever..." has finally surrendered the last of its rational risk-aversion and gone all-in on bets in the Fed's rigged casino. Big players don't use margin accounts in brokerages; they have immense lines of credit and tools to leverage their bets. It's the so-called retail traders who use margin, and so the unprecedented highs in margin debt are evidence that the middle class has gone all-in on bets markets will only loft higher forever..."

"...Why are we dumb and proud?

I blame our schools. We learn facts, but not how to think. Rhetoric, debate, logical reasoning are after-school activities. So we grow up believing that everyone is entitled to their opinion, each as valid as any other, even though this cannot possibly be true..."***Aug 27, 2015 at 7:09pm

Stefan Gleason discusses the Federal Reserve System and why pushing for sound money at that level is difficult. They are pressing for audits of America's gold holdings since these have not been audited in over 70 years. There are concerns regarding the quantity and quality of the metal, and just because the gold is in a vault doesn't mean the United States has ownership...

The True Slave: The true slave is not a person who has been shackled, beaten, tortured, and made to comply under threat of death. As long as that poor soul has the spirit of rebellion and is ever seeking freedom, they are not imprisoned fully. The true slave is a person who enjoys their subservience, who is weighted with fear by the very idea of independence from the system, and who would actually fight and die to maintain the establishment which enslaves them. The true slave is not able to imagine living any other life beyond his micro-managed existence. Understanding The Slave Mentality

The Entendance Beach & The Slave Mentality: 2 pages

The Sheeple

Sheeple are people that have no capacity for self leadership. They will follow whoever they think has the best chance of securing their survival, even if those people have evil intentions. Sheeple are not necessarily nefarious minded, they just don't care about the bigger picture and they only see what is right in front of them. This is a different mindset from those of us that look for leadership in people that display integrity, experience and competence; Sheeple don't care about any of that. They just want to feel protected and secure no matter what, even if they have to sacrifice their freedoms in exchange for that feeling. They are a prime target for The Collectivists and The Global Elites. Trying to talk sense to sheeple is almost impossible. They will not listen. You probably know a few Sheeple in your life who even now in the midst of a global collapse still think this crisis will be over in a matter of weeks and that the government will save them. Attempting to convince them otherwise is a waste of time.

All you can do is provide a better solution than the collectivists and hope The Sheeple follow your lead instead of the evil empire's when the crash hits hardest. -Brandon Smith

|

|

|

|

Post by Entendance on Apr 18, 2021 3:09:11 GMT -5

**************************************************************

**************************************************************  Greatest Violations of Nuremberg Code in History – Catherine Austin Fitts Greatest Violations of Nuremberg Code in History – Catherine Austin Fitts Investment advisor and former Assistant Secretary of Housing Catherine Austin Fitts contends CV19 and the vaccines to cure it are more about control than depopulation. Fitts explains, “I think the bankers are trying to chip us. Moderna describes their injection, gene therapy as an ‘operating system.’ I agree with them. I think they are trying to download an operating system into our bodies. I don’t think it was an accident . . . the man President Trump appointed as head of ‘Operation Warp Speed’ was an expert at Brain-Machine interface. . . . Just like Bill Gates downloaded an operating system into your computer and made you update it regularly because of the threat of another virus, I think they are trying to play the same game with human bodies. It’s hard for people to fathom if they have not been following the advancements in biotech and to fathom how much money the bankers can make if they can achieve this. We just saw the Chairman of the Federal Reserve talking about the economy was getting better because the vaccination rate was going up. I think that’s code for the bank stocks are going up because we are downloading operating systems in more and more people, and our stock reflects that. We get a pop on our stock for every person we can remotely control with our operating system. . . . If you look at the deaths and adverse events, and the failure to provide true informed consent, we are talking about the greatest violations of the Nuremberg Code in history—now.”

Fitts says don’t believe the hype on the number of CV19 vaccines being given. Fitts explains, “One of the things I have seen and gotten feedback on is that the resistance is much greater than anything they are indicating in any kind of official statistics. There are also indications that the deaths and adverse events (from the vaccines) are much worse, and that has to be spreading virally. If you look at the people most resistant, including healthcare workers and nursing staff, they are seeing the adverse events, and they are seeing the deaths. So, I don’t trust the statistics. . . . The top doctors I trust essentially say this is an experiment, and it’s true. These vaccines are not approved by the FDA. These are authorized under experimental use. So, this is a trial, a human trial. The doctors I trust say we won’t know for 4, 6, 12 or 18 months what the real impact is. These are not vaccines. It is gene therapy and downloading an operating system. I would argue that they are not vaccinations, but whatever they are, if it follows the history of vaccinations, what you are going to see is a tremendous diminution of people’s immune systems and a whole world of autoimmune diseases that can be explained away by other things. I would guess that the leadership’s goal is not necessarily to depopulate, and I could be wrong, but their goal is to install an operating system. To get that done, they don’t care how many people they kill.”

In closing, Fitts says, “Naomi Wolf was giving an interview about the vaccine passports, and she said this is the end of human liberty in the west, and that’s right. If those things are allowed, along with the operating system, it is the end of liberty. We are talking about a slavery system. . . . The greatest navigation tool ever created is prayer.” The Video Is HERE

well, not so off topic... well, not so off topic...

|

|

|

|

Post by Entendance on Apr 20, 2021 1:56:15 GMT -5

April 29, 2021

*************************

If you’ve been wondering how the world economy has been hijacked and humanity has been kidnapped by a completely bogus narrative, look no further than this video by Dutch creator, Covid Lie.

What she uncovers is that the stock of the world’s largest corporations are owned by the same institutional investors. They all own each other. This means that “competing” brands, like Coke and Pepsi aren’t really competitors, at all, since their stock is owned by exactly the same investment companies, investment funds, insurance companies, banks and in some cases, governments. This is the case, across all industries. As she says:

“The smaller investors are owned by larger investors. Those are owned by even bigger investors. The visible top of this pyramid shows only two companies whose names we have often seen…They are Vanguard and BlackRock. The power of these two companies is beyond your imagination. Not only do they own a large part of the stocks of nearly all big companies but also the stocks of the investors in those companies. This gives them a complete monopoly.

A Bloomberg report states that both these companies in the year 2028, together will have investments in the amount of 20 trillion dollars. That means that they will own almost everything.

Bloomberg calls BlackRock “The fourth branch of government”, because it’s the only private agency that closely works with the central banks. BlackRock lends money to the central bank but it’s also the advisor. It also develops the software the central bank uses. Many BlackRock employees were in the White House with Bush and Obama. Its CEO. Larry Fink can count on a warm welcome from leaders and politicians. Not so strange, if you know that he is the front man of the ruling company but Larry Fink does not pull the strings himself.

BlackRock, itself is also owned by shareholders. Who are those shareholders? We come to a strange conclusion. The biggest shareholder is Vanguard. But now he gets murky. Vanguard is a private company and we cannot see who the shareholders are. The elite who own Vanguard apparently do not like being in the spotlight but of course they cannot hide from who is willing to dig.

Reports from Oxfam and Bloomberg say that 1% of the world, together owns more money than the other 99%. Even worse, Oxfam says that 82% of all earned money in 2017 went to this 1%.

In other words, these two investment companies, Vanguard and BlackRock hold a monopoly in all industries in the world and they, in turn are owned by the richest families in the world, some of whom are royalty and who have been very rich since before the Industrial Revolution. Why doesn’t everybody know this? Why aren’t there movies and documentaries about this? Why isn’t it in the news? Because 90% of the international media is owned by nine media conglomerates..." Monopoly: An overview of the Great Reset – Follow the Money

Banksters Cartel International Chapter XXXVI

Recently, in a Boca Raton interview, the Chairman of the CFTC, speaking in regards to silver futures said, “the market structure of the futures market were able to tamp down what could have been a much worse situation”. In other words he admitted that there is no free market when it comes to silver.

"The silver price is today half of the January 1980 level. That was the peak at $50 which silver reached again 31 years later in 2011. But alas, the bullion banks, aided by the BIS (Bank for International Settlement) and central banks have again managed to push it down again and today silver is only $26.10.

The current silver price has nothing to do with supply and demand. In a real market the Price of Silver would be substantially higher. In a fake market, the manipulators have no problem to suppress the price by selling virtually unlimited fake paper silver..."

Essentially, the CFTC chairman looks like he's saying that the rigged nature of COMEX silver futures allowed the banks to bomb the silver price to prevent a crisis: “the market structure of the futures market were able to tamp down what could have been a much worse situation” -BullionStar

or essentially the CTFC commissioner is totally cool and therefore complicit with the February 2nd drive by shooting of the silver market. And there’s no blow back from the Justice Department (or is it the Just us Department ?) or Congress? I guess crime does pay. -TheStormGaleForce

When we look back on this time with the perspective of history, we will see markets dominated by control frauds and mispricing of risk that will seem painfully obvious. Why do we not see this now? Why did so few see it in 2007, and 2000? Perhaps because the money is too good, and our societal judgement is too corrupted, often willfully so. Still, bubbles have a resiliency, as does evil in a hardened heart. -Jesse

December 28, 2012

WE'RE ALL JESUITS! In 1972, Jerome Powell graduated from Georgetown Preparatory School, a Jesuit university-preparatory school. He received a Bachelor of Arts in politics from Princeton University in 1975, where his senior thesis was titled "South Africa: Forces for Change". In 1975–76, he spent a year as a legislative assistant to Pennsylvania Senator Richard Schweiker (R). Powell earned a Juris Doctor degree from Georgetown University Law Center in 1979, where he was editor-in-chief of the Georgetown Law Journal.

Career

Legal and investment banking (1979–2012)

In 1979, Powell moved to New York City and became a clerk to Judge Ellsworth Van Graafeiland of the United States Court of Appeals for the Second Circuit. From 1981 to 1983, Powell was a lawyer with Davis Polk & Wardwell, and from 1983 to 1984, he worked at the firm of Werbel & McMillen.

From 1984 to 1990, Powell worked at Dillon, Read & Co., an investment bank, where he concentrated on financing, merchant banking, and mergers and acquisitions, rising to the position of vice president.

|

|

|

|

Post by Entendance on May 2, 2021 4:28:17 GMT -5

Banksters Cartel International Chapter XXXVII  The Silver Squeeze ain't over yet! The Silver Squeeze ain't over yet!

Archegos Unpacked:

Gold Silver Music Class & Style, that's our old Italian way of life on the E. Beach!

|

|

|

|

Post by Entendance on May 4, 2021 1:19:58 GMT -5

GameStop House Hearing this Thursday Will Look at Cozy Relationship of Wall Street’s Oversight Bodies: SEC, DTCC and FINRA

blind faith

The equity ""markets"" are dead

It's mainly because of The Fed

Rigging our prices

With printing devices

A system collapse, straight ahead!

Bankster Overlords know the desperate economic score, which is why both sides of their political puppet-show are now singing the same "free lunch" tune. This will not end well. -The Limerick King

99.9% Of The Global Population Lives In A Country With A Central Bank here

"The banksters control most of the world’s money and will stop nothing short of fueling wars and creating economic havoc to keep growing their money and control. Commercializing peace or commercializing war — never the first, daily routine the second." Gary Brumback

"The entire global financial system is Enron as far as I’m concerned" Michael Krieger here

"...while Morgan Stanley’s own hedge fund was shorting the hell out of subprime and the Wall Street banks, the Federal Reserve was secretly infusing $16 trillion cumulatively in secret loans to shore up the Wall Street banks, including $2.04 trillion in revolving loans to Morgan Stanley..." HERE

April 3, 2019: “MAINTAIN STABLE PRICES” – WHO ARE THE CENTRAL BANKS KIDDING?

[When you sell credit protection, you are on the hook to pay the buyer if that entity goes belly up. When you are selling credit protection on subinvestment grade entities, it is far more likely that they could go belly up.] Here We Are Again! JPMorgan Sold Credit Derivative Protection On $177 Billion Of Junk Credits

Mega Banks Tell SEC: Derivatives Could Blow Up Wall Street Again

The Entendance Beach Members Only Area: Derivatives

It’s complacency that gets you killed: Told ya.

“The reason nobody really knows what caused the financial crisis is that no one asked Ben Bernanke, Chairman of the Federal Reserve at the time, or Hank Paulson, the Treasury Secretary at the time, exactly why they were lying about why those banks supposedly needed a bailout” – John Titus, “The $1 Trillion Devil in the Details

March 28, 2019: Central banks have been totally detrimental to the world economy

2019 banksters Cartel International

"Central bankers collectively crossed their Rubicon when they began to expand their balance sheets by printing money, with which they bought fixed-income securities and equities. They became the biggest manipulators in modern financial history, of which today’s investors may not be fully aware.

Most retail investors think that markets function like they do today, but in fact they are highly manipulated by those who can print money out of thin air. While the interventions in a situation of crisis like in 2009 (that was the result of previously misguided central bank policies) was justified to stabilize the system, they did not stop and did not let the system heal by itself as should have been the case in a free market and capitalist system.

That was because central bankers thought it would be too painful, and they also think they have an order to create (artificial) prosperity. The Fed, the ECB, the Bank of England, the Bank of Japan, the Swiss National Bank and the People’s Bank of China, to name only the most important ones, continued to print money for years and started the biggest financial market speculation ever seen in modern history.

This insane policy is wreaking havoc on our financial ecosystem, as there are big losers and big winners created by these policies. In that sense, it is considered unfair by the losers and they revolt today against the establishment stems. This revolt does not come from hell or heaven but results from unsound policies..." -Felix Zulauf here

Let that sink in for a moment: two banks out of 5,385 represent 67 percent of all trading revenues in the United States Goldman Sachs’ Trading Bloodbath Looks to be Coming from JPMorgan and Citi

“Don’t Think The Fed Or Other Central Banks Are Going To Save Your Ass, It’s Time To Buckle Up And Own Some Gold” Boockvar here

|

|

|

|

Post by Entendance on May 6, 2021 2:27:36 GMT -5

You were bought at a price; do not become slaves of human beings. -1 Corinthians 7:23

Banksters Cartel International Chapter XXXVIII

"If you want to end silver manipulation, here’s how you can actually help: PDF "

***THE SILVER SHELL GAME REPORT

"...The financial crisis of 2008, which left millions of Americans in foreclosure and jobless and the U.S. economy in the worst shape since the Great Depression, was a direct result of failure to regulate the Wall Street cabal..." Here

|

|

|

|

Post by Entendance on May 12, 2021 2:49:52 GMT -5

Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort.

-Antony C. Sutton

May 20, 2021 Alasdair Macleod:

"This article looks at the likely consequences of the Bank for International Settlements’ introduction of the net stable funding requirement (NSFR) for bank balance sheets, insofar as they apply to their positions in gold, silver and other commodity markets. "This article looks at the likely consequences of the Bank for International Settlements’ introduction of the net stable funding requirement (NSFR) for bank balance sheets, insofar as they apply to their positions in gold, silver and other commodity markets.

If they are introduced as proposed, banks will face significant financing penalties for taking trading positions in derivatives. The problem is particularly important for the London gold market..." The end of paper gold and silver markets

"In a shocking retraction, the bullion bank dominated London Bullion Market Association (LBMA) has just announced that it has been overstating LBMA silver vault holdings by a massive 3,300 tonnes of silver. This overstatement relates to the total quantity of physical silver bars that the LBMA claimed were being held in LBMA vaults in London as of end of March 2021... ...So the LBMA want us to believe than in March 2021, the month-on-month silver holdings increase was a whopping 11.04%, and that no one in the LBMA staff or LBMA marketing team or in the LBMA vault committee noticed this outlier, and that it just was let go and ‘led to the publication’ of the fake data, the fake record stocks claims and subsequent quotation of this data in an LBMA – Metals Focus report on Investment Silver? Where is the oversight within the LBMA on checking data that is about to be published?...None of this LBMA vault data can be trusted at this point..."

|

|

|

|

Post by Entendance on May 24, 2021 2:19:33 GMT -5

Beware of SLV and GLD

(H/T Tom from Florida)

"...Regardless of how long it takes for either a tanking market (Hawkish Fed) or Main-Street crushing inflation (Dovish Fed) to become fully evident, the bobble-head media and consensus-think financial industrial complex will tell you to stay the course.

Why?

Because they only get paid by investors staying the course, even if that course means steaming straight into an iceberg of debt and increasingly worthless fiat money.

But as for staying the course in the backdrop of the largest debt expansion in history, as well as an equally unprecedented bubble environment in stocks, bonds, real estate and cryptos, it might be worth considering a little bit of math and history to shape your thinking and curb your enthusiasm.

Markets, currently sustained by debt bluff, hot air, and fake money, are poised for an “uh-oh” moment far more painful than anything seen in the Great Depression.

Yet in case you are thinking of riding such a course out (as most risk-parity advisors suggest), take a moment to think about how long and painful that ride can and will be..."

Silver is the real power of the people, and it is the one thing the Cartel fears more than anything in the entire world because if the Cartel can maintain control of silver, the Fed and the Federal government can maintain freedom and liberty destroying power over the people, and it’s obvious we’re at the end of the current Cartel’s grip on silver, with the “current Cartel” being the ESF, the Fed, and agents acting on behalf of one or both, and unless it’s not blindingly obvious, let me go ahead and spell it out: This fight will go on for the Cartel until the bitter end, and the closer we get to that end, the uglier and nastier the markets and the economy will be. -Paul “Half Dollar” Eberhart

Robert Kientz of GoldSilverPros.com reported that a statement from the Perth Mint confirms what he alleged this week after a detailed examination of the mint's annual report -- that the mint is operating a fractional-reserve gold sales business and has sold its customers nearly a billion Australian dollars in metal the mint has not yet obtained.

Of course this is the nature of any business offering free "storage" of "unallocated" metal, as the Perth Mint long has done. Anyone owning "unallocated" metal held by a financial institution is only a creditor of that institution and accepts extra counterparty risk. Storage is free because a customer's metal does not necessarily exist, at best being comingled with metal belonging to others, at worst not being in hand at all. Owners of "unallocated" gold may be investing less in the metal than in the solvency and integrity of the financial institution they have given their money to. They have indirect exposure to the gold price more than they have gold itself.

Kientz's latest report may be most interesting for including a long and seemingly contradictory statement by fund manager and gold advocate Peter Schiff. A dealer for the Perth Mint, Schiff assures mint customers that their unallocated gold at the the mint is really there and belongs to them even as he acknowledges that their gold is being used to create gold products for other customers and that disruptions caused by the worldwide virus epidemic may delay its delivery to the people who think they own it and want to claim it.As a practical matter the counterparty risk posed to customers of the Perth Mint may not be so great, since the mint is owned by the government of the state of Western Australia and thus its liabilities carry a government guarantee.

But such guarantees may become less persuasive as gold owners increasingly realize that the monetary metal's price long has been suppressed by the sale of claims on metal that doesn't exist -- imaginary supply, "paper gold," which defeats the premise of gold ownership: limited supply. Owning "unallocated" gold at the Perth Mint or any other institution perpetuates imaginary supply and thus gold price suppression.

|

|

|

|

Post by Entendance on May 28, 2021 1:07:40 GMT -5

"...The only thing that need to trigger the coming collapse is the evaporation of confidence. And once confidence goes so will the system with it.

But governments and central banks will clearly not give up without a final stand. This will involve money printing into the hundreds of trillions and eventually quadrillions as the global derivatives bubble implodes. Remember that when counterparty fails, the gross derivatives of $1.5 to $2 quadrillion will remain gross. Hyperinflation will obviously be the consequence as the currency collapses..." GET OUT OF THE SYSTEM

Banksters Cartel International Chapter XXXIX

! In Gold We Trust 2021: Here

|

|

|

|

Post by Entendance on Jun 4, 2021 4:16:37 GMT -5

"Basel 3" Net Stable Funding Ratio regulations appear staged for implementation by banking regulators in the United States on July 1 and that the banks trading gold futures on the New York Commodities Exchange appear to be steadily closing their short positions...Basel III and COMEX Gold

"The imminent introduction of Basel 3’s net stable funding ratio is going to have a major impact on the global banking system, and it is a reasonable assumption that government agencies concerned with geopolitical implications will be considering it from that point of view. And nowhere is this more important than for gold, and by implication the dollar’s unrivalled hegemony..." -Alasdair Macleod

"...The Bank of International Settlements’ (BIS) Basel 3 net stable funding requirement goes into effect before the end of June. That’s a mouthful, I know, but the net effect will be the demise of the “paper” gold markets that have been used by interested parties to queer the gold price and thus protect the value of the dollar for decades. Combine that move with the — what? — $11-trillion that “Joe Biden’s” handlers seek to print-up and distribute the next year or so and it kind of looks like the US dollar should be given last rites..." - James Howard Kunstler

"The Fed’s Real Mandate: Faking It!"

The Federal Reserve will release the results of its stress tests of the mega banks on Wall Street on June 24. That exercise is nothing more than a shell game to mislead Congress and the public into believing that actual due diligence is being done by the Fed on these massive federally insured banks with their inhouse trading casinos...More here

Banksters Cartel International Chapter XXXX

THE WHOLE WORLD LIVES UNDER THE SWAY OF THE WICKED ONE – BILL HOLTER

"A wave of panics could force banks to sell even more assets, further depressing asset prices... and further increase the public’s unease about banks. This dynamic could, in turn, trigger more runs in a chain reaction that threatened the entire financial system." -Nomi Prins

The bullion banks are having trouble closing their short positions on the New York Commodities Exchange and that their attack on the metal this week did not help them much, since "managed money" traders did not substantially increase their long positions.

So the banks, Macleod writes, are "deepening their losses" in gold futures.

Macleod adds: "This does not mean the attack on gold and silver will be over in a matter of days... only that it is very unlikely to yield significant closure for the Swaps. Furthermore, it is worth noting that since last Thursday, 57.6 tonnes of gold and 377 tonnes of silver were stood for delivery on Comex."

The Empire strikes back

|

|

|

|

Post by Entendance on Jun 10, 2021 23:44:46 GMT -5

"...The banks affected are a Who’s Who of global banking with Deutsche Bank AG, Nomura Holdings Inc., UniCredit SpA, NatWest Group Plc, Natixis SA and Credit Agricole SA also barred. Spokespeople for the 10 banks declined or didn’t respond to requests for comment. IFR reported the news earlier..."

June 14, 2021

Matthew Piepenburg: "...History confirms that when nations get too far (waaayyyyy tooooo far) over their skis in debt, the only way to get their debt-to-GDP levels below the deadly 100% marker (130% for the US today) is to “de-lever” their bloated balance sheet over a 5-10-year horizon.

Such deleveraging would require high-teens GDP growth acceleration against a US debt growth rate of 8.75% CAGR.

In our mind, the Yellen-telegraphed policy of “serial stimulus” ahead to achieve such growth and de-leveraging will likely be inflationary.

In such a tragic yet openly telegraphed setting, gold is prepared.

Egon von Greyerz: "...What a beautiful system! Politicians have access to all the money they need to please the people whilst the bankers both issue and control the money. A real win-win for the bankers with unlimited financial benefits and power by total control of the politicians and the financial system in one fell swoop.

It is only with this ingenious Hocus Pocus scheme that the politicians have been able to increase the US federal debt every single year for 90 years without a financial collapse. And at the same time the scheme has allowed the politicians to stay in power without the system going bankrupt.

Obviously the politicians are only given the illusion by the bankers that they are actually in power. The bankers constantly make the politicians insecure by letting the opposing party win regularly. The bankers know that fear and insecurity combined with financial power give them perfect control of the politicians.

US debt to GDP is now at 135%, the highest in history and above the WW II level. The average debt to GDP since 1790 is 35% so the current level is 100 percentage points above that. In the next few years, I would expect the ratio to go substantially above 200% in a banana republic fashion..."

"Senator Elizabeth Warren of Massachusetts chairs the Senate Banking Committee’s Subcommittee on Economic Policy. On Wednesday the Subcommittee held a hearing on a topic that is becoming ever more timely with each new Bitcoin extortion attack on an essential U.S. business. The hearing was titled: “Building A Stronger Financial System: Opportunities of a Central Bank Digital Currency.” "Senator Elizabeth Warren of Massachusetts chairs the Senate Banking Committee’s Subcommittee on Economic Policy. On Wednesday the Subcommittee held a hearing on a topic that is becoming ever more timely with each new Bitcoin extortion attack on an essential U.S. business. The hearing was titled: “Building A Stronger Financial System: Opportunities of a Central Bank Digital Currency.”

To set the stage for the need for a regulated alternative to the crime network now trafficking in cryptocurrencies, Warren explained all the ways that cryptocurrencies are simply “lousy” for any socially-redeeming purpose..." Senator Elizabeth Warren Has One Word for Cryptocurrencies: “Lousy”

More  Investing & Trading Videos: HERE Investing & Trading Videos: HERE

7 Years after Michael Lewis Described on National TV How the U.S. Stock Market Is Rigged, |

|

|

|

Post by Entendance on Jun 19, 2021 4:06:46 GMT -5

Wisdom is better than strength, and a wise man is better than a strong man.

Listen then, kings, and understand; rulers of remotest lands, take warning;

hear this, you who govern great populations, taking pride in your hosts of subject nations!

For sovereignty is given to you by the Lord and power by the Most High, who will himself probe your acts and scrutinise your intentions.

If therefore, as servants of his kingdom, you have not ruled justly nor observed the law, nor followed the will of God,

he will fall on you swiftly and terribly. On the highly placed a ruthless judgement falls;

the lowly are pardoned, out of pity, but the mighty will be mightily tormented. For the Lord of all does not cower before anyone, he does not stand in awe of greatness, since he himself has made small and great and provides for all alike;

but a searching trial awaits those who wield power.

To you, therefore, O kings, are these my words, that you may learn wisdom, and not fall from it.- Book of Wisdom, 6 1-9

Ascoltate, o re, e cercate di comprendere; imparate, governanti di tutta la terra. Porgete l'orecchio, voi che dominate le moltitudini e siete orgogliosi per il gran numero dei vostri popoli.

La vostra sovranità proviene dal Signore; la vostra potenza dall'Altissimo, il quale esaminerà le vostre opere e scruterà i vostri propositi;

poiché, pur essendo ministri del suo regno, non avete governato rettamente, né avete osservato la legge né vi siete comportati secondo il volere di Dio. Con terrore e rapidamente egli si ergerà contro di voi poiché un giudizio severo si compie contro coloro che stanno in alto.

L'inferiore è meritevole di pietà, ma i potenti saranno esaminati con rigore.

Il Signore di tutti non si ritira davanti a nessuno, non ha soggezione della grandezza, perché egli ha creato il piccolo e il grande e si cura ugualmente di tutti.

Ma sui potenti sovrasta un'indagine rigorosa.

Pertanto a voi, o sovrani, sono dirette le mie parole, perché impariate la sapienza e non abbiate a cadere. -Sapienza, 6 1-9 |

|

|

|

Post by Entendance on Jun 21, 2021 22:49:51 GMT -5

Banksters Cartel International Chapter XXXXI

"...Central banks have covered up their failures by inflating financial markets, in the manner of John Law in France 301 years ago. Law printed unbacked livres to keep the shares in his Mississippi venture rising. His bubble collapsed, driving the livre into worthlessness in only six months. The lesson forgotten, central banks, led by the Fed, are repeating John Law’s experiment on a global scale.

It matters not whether markets are at their peak and the bubble is about to burst. There are strong indications, particularly the $900bn of debt leverage behind financial markets, that we are within a gnat’s whisker of the market’s peak. The bubble will burst that is for sure. And when it does, $11 trillion of foreign owned equities will seek an panicked exit, not just from the deflating investment bubble, but from the dollar as well. Interest rates will then be forced to rise as markets take control of everything away from the Fed.

The moment the bubble begins to deflate, investors will awaken from their hopium-induced slumber and events are likely to develop with unexpected rapidity. We must hope that governments back their currencies credibly with gold before they become completely worthless."

"...Tragically, despite two unprecedented bailouts by the Fed of Wall Street in 2007-2010 and again in 2019-2021, the Fed has yet to be reformed. And when Congressional hearings like yesterday’s are called to examine the Fed’s actions, they fall seriously short of serious examinations."

Gold & Silver Spoofing

"One thing is for sure. When the current stock market bubble does eventually crash, Federal Reserve Chairman Jerome Powell is not going to be able to sit before Congress and tell lawmakers that nobody could have seen it coming.

Wall Street veterans have gone on record repeatedly in recent months to warn of a coming crash...

...What has been holding this Wall Street house of cards together this long is the New York Fed’s willingness (even eagerness) to throw trillions of dollars at the problem at the earliest sign of a hiccup. The fly in this ointment is that the New York Fed is literally owned by these same Wall Street mega banks while simultaneously creating emergency bailout programs and then outsourcing the work to the banks being bailed out.

If ever there was the perfect design for a replay of the Hindenburg, this is it." More here

|

|