|

|

Post by Entendance on Jul 17, 2018 14:50:47 GMT -5

"There is of course only one way to learn a lesson properly which is the hard way. And the hard way in the case of the world economy is that the monster bubble pops. And like with many bubbles, this one only contains hot air..." ***$240 TRILLION MONSTER BUBBLE & $2.5 QUADRILLION MONSTER BALOON

"Several of us who stick our neck out in public with analytic opinions on the market have been thinking that gold has reached a tradable bottom. I’m sure many would say that view is flawed based on today’s action. Let me preface my thoughts by saying that, over the last 17 years of daily active involvement in the precious metals sector, I don’t pull my hair out over intra-day or even intra-year volatility. Measured from the beginning of 2002, gold is up 441% while the S&P 500 is up 158%.

The point here is that, given how easy it is to print up paper gold contracts and flood the market, the price of gold can do anything on any given day. If you want to own gold for the reasons to own gold, you have be play the long game. The mining stocks do not seem to care about the day-to-day vagaries of the gold price right now. You shouldn’t either.

The trading pattern in gold is somewhat similar to its trading pattern in the summer of 2008, right before the great financial crisis (de facto banking system collapse) was set in motion. The price of gold was taken down from $1020 in mid-March to $700 by October, while the financial system was melting down. That set up gold’s record run to $1900 over the next three years.

It’s becoming obvious to anyone who chooses to not put their head in the sand or become intoxicated with the copious amounts of official propaganda, that the U.S. Government is technically bankrupt and the financial bubbles fomented by a decade of money printing, credit creation and near-zero interest rates are about to explode. It’s not coincidental that gold was slammed ahead of Congressional testimony by Fed-head Jerome Powell, one of the primary propaganda-spinning hand-puppets.

Gold started rolling downhill after the London a.m. fix. Right after it. The cliff-dive occurred as the Comex floor was opening. This is a pure paper operation. It’s either the hedge funds or the banks piling into the short-side of the market by flooding the market with paper gold and hitting all bids in sight. The managed money category of trader segment in the COT report has been getting net short and more net short the last two weeks. Hedge funds could be shorting even more paper gold, trying to push it further downhill to book profits on their shorts. OR it could be the banks piling into the short side but hide this by booking the trades they report to the CME (daily o/i) and the CFTC (weekly COT) into the managed money trader account in the COT report.

The latter is entirely possible. JP Morgan was already caught once doing this in silver. If you don’t trust the Government to report the truth, why would you trust the banks to report the truth? After all, the banks ARE the Government.

Today’s action has nothing to do with the $/yuan to gold relationship or the $/yen to gold relationship. The dollar is higher and gold usually trades inversely to the dollar. Gold likely is being managed like this to help disguise the coming financial and economic bombs that are set to explode – just like in 2008.

We’re dealing with a system in which banks and other big corporations control the Government and there is no RULE OF LAW whatsoever. Think about what you would do if you completely lacked a moral compass and were in control of the system, to a large degree. You would do exactly what they are doing. And I’m not talking about just gold. It’s everything. They have used debt to put the squeeze on the population." ***What’s Going On With Gold?

We are in the right camp; cancer spreads. E.

***Depression then Hyperinflation Coming – Charles Nenner

(USAGOLD – Wednesday, July 18, 2018) – "We could not let the latest downside break in the gold price pass without a word or two. My first instinct is to point to the volumes on the COMEX yesterday and ask what on earth might have generated such an interest in gold on the short side?

At precisely 9am yesterday, 5,458,000 ounces of gold were presented for sale on the exchange – a paper trade of over 170 metric tonnes. It was followed by another sale within the hour of another nearly 5,500,000 ounces, or another 170 metric tonnes, all toll 340 tonnes of paper gold dumped on a market that lacks a champion sufficient enough to oppose it – at least on the COMEX.

Are we to believe that thousands of commodity speculators the world over suddenly woke up Tuesday morning and decided to sell hundreds of tonnes of the metal on the basis of upcoming Congressional testimony on the part of the Fed chairman? And how could it have occurred before even knowing the nature of that testimony?

It is unlikely yesterday's sell-off in gold occurred because thousands of investors suddenly lost faith in the safe haven qualities of the metal, as some in the press are wont to claim. More likely, it came the result of a small group, or perhaps even a single entity, deciding to short the market for its own purposes.

Of course, to the speculator in gold hoping to garner a profit, pointing out the nature of the problem is a poor salve for the wound inflicted. Know, though, that the short position taken today must be reconciled with a purchase farther down the road lest the profits be left on the table. That is why gold typically bounces back from these waterfall drops – though usually over a much more extended period of time than the original application of the short. For the paper speculator, the wound might have been debilitating if not fatal. For the well-capitalized investor, though, who holds the metal as a long-term safe haven in physical form, the wound – if a wound at all – is at worst superficial.

As is always the case in financial markets, for every action there is an equal and opposite reaction. The reaction in this case will come in the form of stronger demand for the physical metal from buyers – including nation states, major financial institutions and individual investors – who understand the real nature of what just transpired and how to take advantage of it. It is interesting to note as posted here Yesterday that 17% of fund managers polled by Bank of America Merrill Lynch see gold as a bargain at these prices – a record number."

|

|

|

|

Post by Entendance on Jul 22, 2018 1:50:33 GMT -5

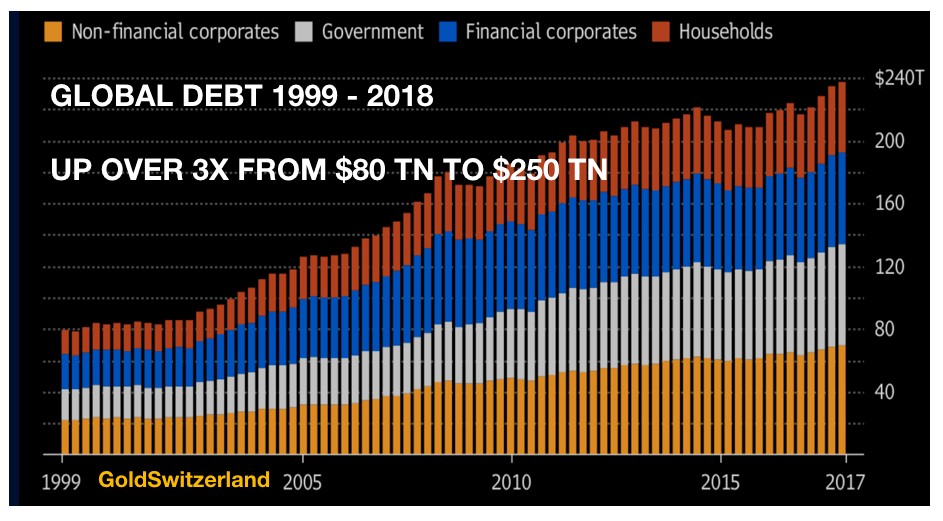

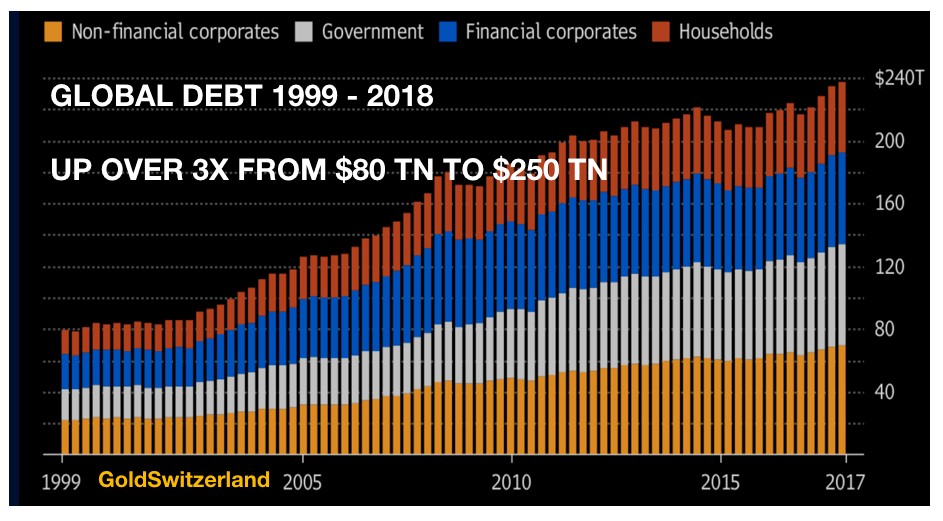

Financial and precious metals expert Egon von Greyerz (EvG) vaults gold for clients at two secret locations on two continents. He says his wealthy clients have at least 20% of their net worth in physical gold and silver. Some have much more. Why so much physical metal? EvG says it is because of record risk in the world today. EvG explains, “There is only ½% of all world financial assets held in physical gold. So, this is a very small group, but it is still a lot of money. Of course, the majority doesn’t believe this because if they did, all the other markets would collapse. The particular people that are concerned about risk that we deal with, and they are not concerned in a minor way . . . look at all the asset classes, whether you take the stock markets, bond markets or property markets, they are all in the most massive bubbles fueled by exponential growth in credit. Global credit has tripled since 1999 to today. Global debt went from $80 trillion to $240 trillion. When debt triples, it doesn’t mean that risk triples. Risk goes up exponentially. Then you add to that all the off-balance sheet items and unfunded liabilities. The derivatives are at least $1.5 quadrillion. . . . Officially, it is reported $600 billion, but it is probably $1.5 quadrillion. . . . So, you are talking about risk that no one understands, and no one can measure. Most of it is in paper or air, if you will. It’s like a balloon, and when you pop that balloon, you will find it is mostly air. This means asset values will implode, and so will debt.”

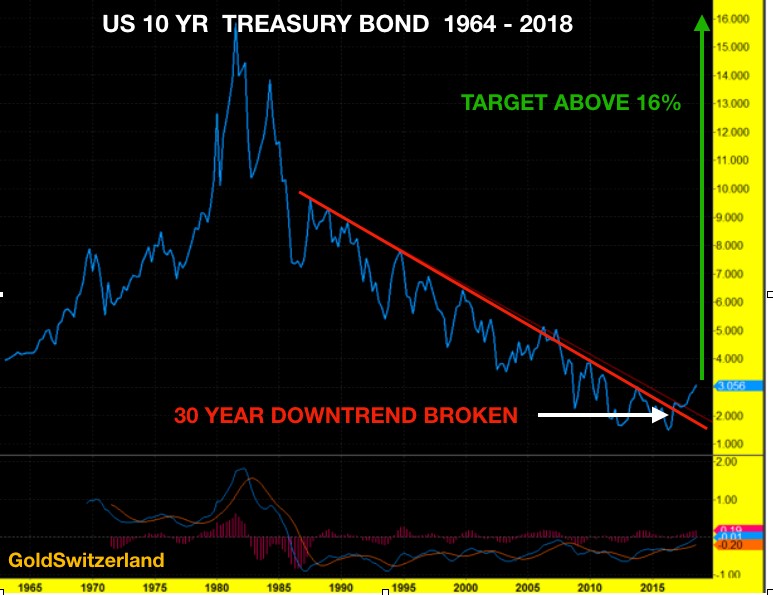

How bad is this going to get? EvG says, “I think stock markets and bond markets will go down by at least 75%, and I would say it could be up to 95% or more. A lot of companies will disappear. I am not saying the world is going to end. You must remember, in 1929 risk and debt was nowhere near where what it is today and certainly not globally either. This is a global problem, and not just in the U.S. In 1929, the stock market went down by 90% between 1929 and 1932. It took 25 years to get back to the 1929 level. So, it could go down by 95% today and that would not surprise me at all because we are talking about a much bigger problem. And don’t believe that central banks and governments are going to rescue this. They have used all their tools. They have inflated the money supply with printed money, and they are telling us all that they have it under control. They have nothing under control, and there is no margin to lower interest rates anymore either. Therefore, in my view, interest rates are going to surge. They could try to lower them when the markets get into trouble. It will not succeed, and it will be like in the 1970’s, and you will see 20% interest rates.”

EvG also says, “With this risk, people have to take insurance. This business is not a business, it is a passion, and I have a passion to help the few people that see the risks. . . . I think your best wealth preservation will be gold.”

In closing, EvG says, “. . . At some point, all hell will break loose. There is no question about it. It could be something very serious coming this autumn. The whole political system is fighting against Trump, and that is going to be tough, very tough. . . . The markets are giving me the signal that things are going to turn in the autumn, and you can easily find a number of catalysts for this to happen.” ***Risk Exponential and Unmeasurable – Egon von Greyerz

With global debt at historic highs, its only a matter of time before this debt causes a major reset!

|

|

|

|

Post by Entendance on Aug 1, 2018 3:00:39 GMT -5

August 3, 2018 ***Gold Stocks’ Autumn Rally 3

***The Bull in the China Shop

Gold is Money Gold is a Currency Holding gold: an act of personal responsibility Gold: safeguarding purchasing power ***Gold: respect for history

"Currencies are in crisis mode which has been going on for quite some time now. Admittedly many have left these concerns behind because of all the Algo trading and the accumulated irresponsibility’s brought on by bad legislation and government accounting gimmicks. The only cure for this issue (in a central bankers head) is to keep printing, then to keep adding the debt of other nations on the credit side of the leger in order to print more money in order to do the same thing over and over again, until a reset is forced upon everyone. We have history as our guide here. Each and every time we’ve reached this point in the credit/debt cycle, Silver and Gold wind up being the savior, not only of nations, but for the individual who didn’t follow the crowd into the final phase. So keep you precious metals close to you and away from all third parties and as always …Stay Strong!" -J. Johnson

"...Investors can hold both physical gold and gold mining stocks and funds, Its just important to remember that they are different things, and different asset classes. Gold mining stocks are risk securities issued by corporations that trade on stock exchanges. Physical gold is a tangible asset with no counterparty risk or default risk. Physical gold exists in limited supply and cannot be created, nor can it be issued by governments or monetary authorities..." ***Gold Mining Equities – Not the Same as Physical Gold

"Oh, this is cute...a government agency softball game featuring the CFTC vs the SEC.

The SEC team name? "The Naked Shorts". The CFTC? "The Sultans of Swap".

Contempt, ambivalence, complicity.

No wonder The Criminals have zero fear of prosecution." -Craig Hemke

MUX EXK

The Act Of Will Talent & Knowledge |

|

|

|

Post by Entendance on Aug 18, 2018 0:57:24 GMT -5

August 29, 2018

Inflation Has Run Amok Gold is the Ultimate Hiding Place

In Next Crisis, Gold Won’t Drop Like 2008

Iran, Venezuela & Turkey reveal gold’s true value when paper money becomes worthless

*************** “Gold Swap”: How central banks can sell their gold while simultaneously keeping it on their balance sheet. Central banks have even used at least one gold mining company [Barrick Gold ABX] to help the keep the price of gold under control.” The Big Reset, p. 175

If You Can't Stand the Hate… On the subject of the metals, a friend sent some data from Jason Goepfert's website in which Goepfert noted that a sentiment measure he has developed, which tracks the collective optimism in gold, silver, and platinum, now ranks at its lowest level in 27 years. So for those of you, like me, who feel like the recent bashing of the metals was seemingly out of proportion and extremely lopsided, you weren't wrong. That appears to be the case.

Lastly, late in the day the CFTC data showed commercials were net long 11,000 contracts (combining futures and options). The last time they were long was in mid-2001 on the bear-market lows. This is a very positive development, so I wanted to be sure readers saw it.

This sort of upside down situation could only occur in the mad, mad, mad world of computer/quant/algo-driven trend trading nuthouse we have today. Humans (many of them at least)couldn't be so stupid to get this far short(over their skis). I bought a couple of favorite miner names. COT report confirms what I've been saying.This gold decline is all about leveraged speculative futures SHORTING. Another 20K added to the shorts to a mammoth 215.5K - 200% higher than 2 months ago. As seen before,no long contract liquidation -actually 3,500 longs added(thru Tues) -fred hickey

The direct relationship between growth in the federal debt and the price of gold. The national debt, by the way, now stands at $21.372 trillion with $880 billion added so far in 2018. The direct relationship between growth in the federal debt and the price of gold. The national debt, by the way, now stands at $21.372 trillion with $880 billion added so far in 2018.

Place your bets, please. Dollargeddon - Gold Price to Soar Above $6,000

A global currency war is occurring

|

|

|

|

Post by Entendance on Sept 10, 2018 15:24:28 GMT -5

Gold debt is redeemable. That’s because a lump of gold is not someone else’s liability, the way a dollar is. A lump of gold just is. When you hand it to someone, then that is final payment on the debt. By contrast, when you hand someone a dollar, then you merely shift the debt to the Federal Reserve.

"It’s not every day that a clear example showing the horrors of central planning comes along—the doublethink, the distortions, and the perverse incentives. It’s not every year that such an example occurs for monetary central planning. One came to the national attention this week..." Why the Fed Denied the Narrow Bank

("Every day I get more disgusted...they conjure money, estimates, numbers...nothing matters...but gold  " H/T Tom from Florida) " H/T Tom from Florida)

November 2, 2016 Bank Run, Depositors and Game Theory

Your money will be gone

|

|

|

|

Post by Entendance on Oct 4, 2018 8:17:07 GMT -5

|

|

|

|

Post by Entendance on Oct 23, 2018 11:57:47 GMT -5

Inquiring Minds Only!

There is No Escaping History: Fiat Currency Eventually Fails

Does the financial system need an apex predator to maintain stability, mirroring the hierarchy of the world’s natural ecosystems? Grant Williams, the author of Things That Make You Go Hmmm… and co-founder of Real Vision, believes that gold played a crucial role in the stability of the financial system. Grant’s presentation, Cry Wolf, delivered on 1st October at the 2018 Stansberry Alliance Conference in Las Vegas can be viewed in full on Real Vision’s Think Tank. Grant Williams – Keynote Speech H/T Tom from Florida

Meanwhile...Only One Notch Above Being Junk! October 26, 2018 Standard & Poor’s: ITALY OUTLOOK TO NEGATIVE FROM STABLE  (THE BULL IS DYING) (THE BULL IS DYING)

October 8, 2018 The Gold Standard: Protector of Individual Liberty and Economic Prosperity

RESET UPDATED

Why Am I Fighting for the Gold Standard? By Keith Weiner

Life is good. They could not have imagined what we have, back in the dark ages.

So I have never understood why people prep for a return to the dark ages. The only thing I can think of is that they don’t really picture what life is like. 14 hours a day of back-breaking labor to eke out a subsistence living. Subject to the risks of rain, sun, and insects.

Prepping makes no sense to me. I don’t know if I would choose to be alive after collapse. That is, even assuming I would survive the events immediately after—I expect more than 90% to die when energy and food production come to a halt.

I am fighting to preserve our civilization, and the life I love. We have so many things that we take for granted, including the Internet, medicine, cars and airplanes, music, and food from all over the world. We think nothing of putting formerly-exotic spices on food, and eating under electric lighting, while playing recorded music and watching the football game on a TV in the other room. Central heating keeps the cold at bay, or if you live in Arizona, central air condition banishes the heat.

Video cameras allow anyone to record themselves speaking their mind, and anyone in the world can watch.

It is for this, that I fight. Gold is just the means, honest money that will reverse the perverse incentives that are causing us to undermine our civilization by consuming its capital.

I recorded my thoughts. H/T Tom from Florida

Back To Gold Standard! HERE HERE HERE HERE HERE HERE HERE HERE HERE HERE

Gold Price Brazil Gold Price Mexico Gold Price South Africa Gold Price India...HERE  Entendance on twitter Entendance on twitter

|

|

|

|

Post by Entendance on Jan 5, 2019 3:31:52 GMT -5

|

|

|

|

Post by Entendance on Jan 20, 2019 1:46:24 GMT -5

2019 banksters Cartel International

January 21, 2019 "Anyone who denies that Governments and Central Banks manipulate the gold and silver markets using paper derivatives and deceptive physical metal custodial operations is ignorant of history and facts. Currently the gold and silver price capping is as oppressive as I’ve witnessed in 18 years.

As of Tuesday, January 15th, the open interest in gold had soared by 89,120 contracts to 501,605. 89,120 contracts is 8.9 million ozs of paper gold, or 278.5 tons – about 30 tons more than the amount of gold produced by mines in the U.S. in one year.

But artificial market intervention creates information inefficiencies. This in turn generates exploitable profit opportunities for traders who know how to identify the set-ups from official manipulation..." Unprecedented Manipulation And Trading The Precious Metals Ratios

Dear Friend of GATA and Gold:

Barron's this week has a surprisingly favorable report about the prospects for the gold price and gold miners in light of the recent Newmont-Goldcorp and Barrick-Randgold combinations. But the report repeats without question the worst misinformation about the gold price, quoting a fund manager as saying gold is attractive because "it's an alternative currency whose supply can't be increased much."

Of course the longstanding disparagement of the failure of the gold price to keep up with inflation arises precisely from the unchecked increase in the supply of imaginary gold -- "paper gold" -- by central banks and their bullion bank agents.

Your secretary/treasurer has tried posting this comment at the bottom of the Barron's story but the magazine doesn't seem to want to allow it:

"The problem is that, contrary to fund manager Keith Trauner's comment, the gold supply not only can be increased much but has been increased much by gold swapping and leasing by central banks to bullion banks. Some expert analysis suggests that 'paper' gold -- unbacked claims issued by central banks and bullion banks -- have created as many as 90 or 100 claims to every ounce of gold actually in possession by the issuers of the claims. This explains the longstanding disparagement of gold: that its price in recent decades has not kept pace with inflation. Fund managers and gold miners alike should review the work done in this respect by the Gold Anti-Trust Action Committee at gata.org."

Maybe others can try posting similar comments there to get the magazine's attention.

The Barron's report is headlined "Why Gold Mining Stocks Are an Unalloyed Bargain" and it's appended.

CHRIS POWELL, Secretary/Treasurer Gold Anti-Trust Action Committee Inc.

June 26, 2017 Gold sees a 56 Tonne Sale in 60 Seconds June 26, 2017 Gold sees a 56 Tonne Sale in 60 Seconds

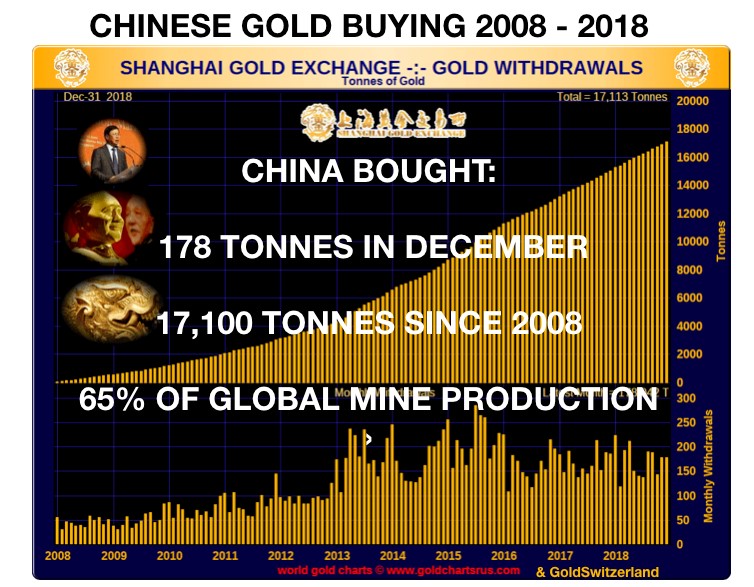

"The Russian central bank added another 9.33 tonnes to its strategic gold reserves in December 2018, to round out a year in which it bought an incredible 273.6 tonnes of gold. Russia now holds 2112 tonnes of strategic monetary gold reserves, and is 5th place in world rankings. Having accumulated 273.6 tonnes of gold in 2018 and 223 tonnes of gold in 2017, the Bank of Russia has now added an incredible 500 tonnes of gold to its strategic reserves in just two years (2017-2018), and the rate of Russia's accumulation of gold continues to accelerate. At this rate of accelerated gold buying, the Russian Federation will have more gold than either France (2436 tonnes) or Italy (2452 tonnes) in about one year's time, in early 2020." -BullionStar

Gold Russian': Why Moscow's Bullion Reserves Continue to Set Records Gold Russian': Why Moscow's Bullion Reserves Continue to Set Records

Gold Hemorrhaging Out Of Western Central Bank Vaults

"...we must remember that nearly 60% of silver mine supply is a by-product of copper, zinc, and lead production. Base metal production will likely fall considerably when the world begins to collapse due to the unraveling of the highly leveraged debt-based economy… an economy that will no longer have a growing energy supply to service the massive amount of debt propping up the financial system.

Thus, falling base metal production will impact world silver mine supply more than gold. Which is precisely why I believe silver will outperform gold in the future" |

|

|

|

Post by Entendance on Jan 24, 2019 4:55:51 GMT -5

Not your vault, not your gold HERE Not your vault, not your gold HERE

"...Despite, or maybe because of, most people’s total ignorance of gold, it will be the most superb asset to hold in the next few years both as insurance and for capital appreciation purposes. But remember to hold physical gold and store it outside the financial system in a very safe vault and jurisdiction." January 24, 2019 HOLDING GOLD – A SINE QUA NON

Nicolas Maduro’s embattled Venezuelan regime was denied in its bid to pull $1.2bn worth of gold out of the Bank of England.

"The Bank of England’s decision to deny Maduro officials’ withdrawal request comes after top U.S. officials, including Secretary of State Michael Pompeo and National Security Adviser John Bolton, lobbied their U.K. counterparts to help cut off the regime from its overseas assets, according to one of the people, who asked not to be identified..." U.S. lobbied U.K. officials to cut off the Maduro regime

"...We are at a stage now where the debt is growing faster than the economy..."

****Brace for Impact ****Act accordingly |

|

|

|

Post by Entendance on Mar 1, 2019 2:55:59 GMT -5

2019 banksters Cartel International Bank fines the last 20 years:

Bank of America: $58.4B

JPMorgan: $29.7B

Citigroup: $17.2B

Wells Fargo: $14.7B

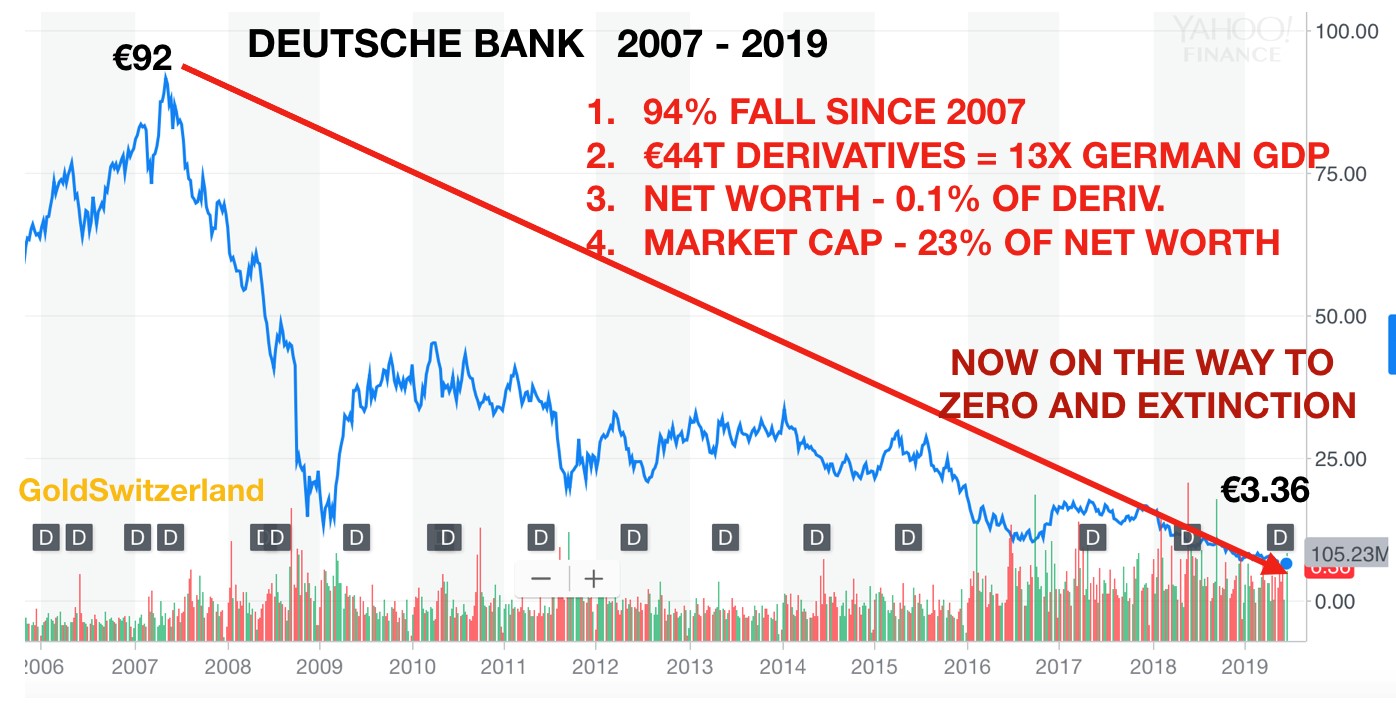

Deutsche Bank: $12.5B

Goldman Sachs: $9.6B

HSBC $5.7B

ING $1.5B

while Danske Bank is fined in the range of $8B over a $220B money laundering scandal, among others.

When reached out for a comment, each bank had the same two words to say: "Worth it".

Inventories at GLD lost 35.54 metric tonnes in February to date and now sit at 788.33mt, the lowest level of 2019. Also, the GLD price/inventory ratio is at lows not seen since early 2016.

Over the years, I believe I’ve written on this topic three or four times but now it is even more relevant. “What” would you sell your gold for? The question is not “why” because the answer to this could be far ranging and differs by individual. You might want or even need to sell gold for any number of reasons such as living expenses, to pay off a debt(s), for medical reasons, or any number of other circumstances.

Before getting to the topic of “what”, as you can imagine, we get all sorts of questions that don’t really make sense once you break the question down. For instance, I can’t tell you how many times people have asked “but if the system goes down, how can I sell my gold if no one has money to buy it from me? Who will buy it”? When this becomes the case and markets are either in disaster mode or even closed (and gold is priced at much higher levels in dollar or any other currency terms), unless you are selling your metal for something you absolutely need …what would be the purpose of your sale? To lock in your “profit”? Really?

Think this one through from the eyes of a Venezuelan? Gold has skyrocketed (as has everything else) in Bolivar terms, would it make sense for a Venezuelan to sell his metal and accept Bolivars in return? What happens the next day or day after that when the Bolivar devalues even more? What happens when the Bolivar goes to zero? The reality is this, gold IS money itself whereas Bolivars are simply a currency. Currencies are a medium of exchange, NOT a store of value. History is full of similar examples.

Now on to “what” will you sell your gold for. Whenever you sell gold (unless you are bartering for something directly), you will receive currency in exchange. But didn’t you “buy” your gold or silver in the first place to get out of the system? Or did you purchase to speculate on the price? If you bought in the hopes of the metal rising in price and plan to cash out and take your “profit”, you are sorely mistaken and will be gobbled up in the coming currency collapse.

Using the Venezuelan experience as a real life example, suppose you bought metal a year ago with Bolivars and sold when your metal doubled? You now have twice as many Bolivars as you started with but with one small problem …the Bolivar has declined 90%. What happens when the Bolivar is not accepted anywhere, externally or even internally and is valued at zero? The simple math is this; two (twice as many Bolivars) times zero is still zero …!

When you purchase metal, you are acting to get out of the system. You are getting out of the freely printable currency AND out of the underlying financial system ie. the banking system. By selling metal for currency you are re entering the banking system AND the currency, are you crazy?

The above topic was chosen after having a discussion with Jim over the weekend. We spoke of the above which led Jim to mention THIS is the reason why when the dollar (and all currencies) trade in panic mode and the metals are marked up, there will be no big crash in price afterward similar to the 1980 and 2011 experiences.

He has said this for several years now and I must confess I wasn’t sure why. But the more I thought about it the more it makes sense. Please follow this through; last year I was employed as an expert witness in a very large lawsuit because the money manager took the “crazy” stance of buying physical gold and silver for his client. Upon my deposition I realized how wrong and uninformed opposing council was. It was his belief that even “if” we are correct and the dollar hyperinflates …the system will right itself and the dollar will recover in similar fashion as stock markets do eventually after they crash.

Do you see the connection to Jim’s thought that gold and silver will not crash back down this time around? It is all about currencies collapsing under the weight of un repayable debt. The only central bank response can be QE to infinity, fiat currencies in general will NEVER come back in purchasing power, thus they will never regain versus their principal value versus precious metals …or anything else for that matter!

To bring this full circle, anyone who sells their PMs for fiat currency is not only coming back into the system, they are making a bet that fiat currencies will get stronger and actually gain in purchasing power. Over long periods of time, this has NEVER ever happened over several thousand years. And no, this time is not different. The only thing different is the speed at which information travels and trades can be done. What was true of monetization throughout all of history is still true today, if you overcreate “anything” …its value will decrease.

To finish, it would be advisable not to sell any precious metal except in the case of emergency or to trade for something else that is real which you desire. Trading gold for any current currency goes against all historical precedent as well as common sense and logic. I guess it could be said, once you break out of jail, don’t walk back in of your own accord?" -Bill Holter

"...The simple way to bypass the control mechanisms meant to control you is to have a medium of exchange that is universal so it cannot be controlled by any one person or group. Many people see the block chain system as a good way to go because it is secure but there is something you need to keep in mind. This system requires the use of electronic systems to process and transmit these digital units. Those who control the electronic systems control the flow of digits. You may have a wallet full of coins but if you cannot connect to the person you want to trade with, how much are they really worth?

A system that cannot be controlled by anyone has been around for millennia. That system is gold and silver. The free market constantly adjusts the value of these metals when they are used as money. They are time tested and proven methods of exchange and stores of wealth.

A population that wishes to rid itself of the corrupt money makers has only to begin using gold and silver as the primary means of exchange..."

How Individuals Can Reset The Financial System

The Entendance Beach: Starve the banksters, starve the beast, out of the fiat currencies.

"The next decline of the Dow/Gold ratio is likely to reach 1/2 which means a further fall of 98% from here" -Egon von Greyerz

"...To fully grasp the nature of inequality in our twenty-first-century gilded age, it’s important to understand the difference between wealth and income and what kinds of inequality stem from each. Simply put, income is how much money you make in terms of paid work or any return on investments or assets (or other things you own that have the potential to change in value). Wealth is simply the gross accumulation of those very assets and any return or appreciation on them. The more wealth you have, the easier it is to have a higher annual income..."

Inequality: A Dilemma With Global Implications. ***How Does It End?

The Entendance Beach & Inequality: 2 pages

Bijoutier Island, Outer Islands, Seychelles

The Entendance Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours!! Here

European investors TAXES:What you need to know when buying/importing SILVER BARS/COINS. VAT RATES here USA Gold & Silver Sales Taxes here |

|

|

|

Post by Entendance on Mar 15, 2019 8:00:48 GMT -5

March 16, 2019: "...Ideally, a currency would be perfectly stable in value. The market economy is organized via prices, profit margins, returns on capital and interest rates. Changes in the value of the currency derange this process, creating chaos and havoc..." Why Gold Is Still The Best Basis For Money

An In-Depth Examination of the Bible Verses that Mention Gold and Silver: the link between gold, silver and money in the Biblical text

Egon: 3 DOZEN REASONS TO HOLD GOLD |

|

|

|

Post by Entendance on Mar 21, 2019 5:01:20 GMT -5

Die Deutschen horten mehr Gold als die Bundesbank

April 11, 2019 The Silver Institute PDF: WORLD SILVER SURVEY 2019

Degussa PDF: The case for Gold

"...metals and minerals are underpriced, along with most commodities, because of the price suppression engineered by central banks to defend their currencies and government bonds. Central banks and governments in the developed world don't want gold, silver, other metals, and other commodities to compete with their currencies as stores of value"

April 2, 2019 Chris Powell: Gold market manipulation update, April 2019 PDF here

It’s complacency that gets you killed. Told ya.

"Il tuo oro è il nostro oro". Chiunque non capisca, merita ciò che gli accadrà. La noncuranza uccide.

March 30, 2019 Russia Continues to Dump Dollar, Buying Up 31 Tonnes of Gold in Single Month

March 21, 2019 ONLY GOLD STANDS AGAINST THE FINAL CATASTROPHE

US Mint Silver Eagle Price Premiums: Recent History

|

|

|

|

Post by Entendance on Apr 17, 2019 4:28:47 GMT -5

May 1, 2019: Gold & Silver are in an inverse bubble Why?

Paul “Half Dollar” Eberhart: Cartel Desperate To Keep Gold & Silver Prices Down Right Up Until The Collapse

Operating with their bullion bank agents, central banks now are trying to break the 200-day moving average price of gold to offset all the fundamental factors arguing for a higher price, the TF Metals Report's Craig Hemke writes at Sprott Money

Jim/Bill,

President Trump always wants to know who’s behind everything; who’s manipulating news against him.

Congress always wants to know who’s behind supporting Trump and who can prove false allegations against him.

But no one, and I mean NO ONE, looks behind the curtain to expose the nefarious dealings in the gold market.

It’s so obvious when you look at the timing and the manner in which contracts are sold. Even a child can see it!

Manipulating gold is no different than manipulating the news to influence the public. It’s a form of propaganda with its agenda hidden from the public’s eyes.

Goebbels, the Master Propagandist, would be proud.

People should demand to know. Just like they should demand to know what the FED is involved with.

Anything that affects our country and concerns the public’s money, should have full transparency.

Imagine if corporations were to manipulate their numbers! Oh wait...-CIGA Wolfgang Rech

Financial writer and precious metals expert Bill Holter is “not worried at all” about the current price smash down for precious metals. Holter says, “We live in a world where all liabilities are more than all liabilities in history. This whole system is going to come down. . . . If you see a house burn down, the only thing left is the foundation. That’s the only thing left because the foundation doesn’t burn. That’s what gold and silver are, and that’s what’s going to be left when this house of financial cards burns down.”

Why are dark powers intentionally driving metal prices down? It’s all part of a very simple thought control message. Holter explains, “Basically, it’s so the people believe that gold is bad and the dollar is good. It’s basically to support the dollar, and also thus support the Treasury market. . . . This has to have an official backing to it. It could not be done if they were not given a pass. This would not be going on if there was true rule of law. . . . We don’t have free markets. There are no markets. All markets are rigged. . . . Markets should be panicking that we are moving towards hyperinflation. All markets are locked down, and they are locked down by derivatives. . . . In 2008, there were $1.4 quadrillion in derivatives. How is it possible that derivatives are larger than the system as a whole? The answer to that is because derivatives have become the system. Derivatives are what price the system. You are basically putting up one cent to control $1. So, it’s easy to put the price of something where you want it to be.”

Holter contends, “The entire system is based on debt. The entire system is a liability. So, some people are getting some of their money out of the system into real money (gold and silver) which is no one else’s liability. . . . The biggest thing is there is too much debt in the system. Everybody owes everybody, and all you need is one link in the chain to break. All you need is one entity that cannot make good on what they promised.”

While travelling, in the last 2 days I happened to be seated in front of a screen just to watch the paper gold price smashed once again at 8:30 a.m., so I felt compelled to update The Members Only Area on that. Thanks also to Chris Powell explanations, my seminars & meetings will be so cool...  Take heart. E.

Chris Powell, Treasurer and Secretary of the Gold Anti-Trust Action Committee (GATA), says price manipulation of all markets is a major problem the world faces. Powell explains, “This is an issue far bigger than gold and silver. Gold and silver are just minerals, atomic elements. The issue for us is much bigger than that. The issue is free and transparent markets and having an accountable government. You cannot have those things unless you have freely traded monetary metals markets and freely trading currency markets as well. We don’t worship the golden calf or the silver bull. We are pursuing a much more justice oriented agenda here. We want government to tell us what they are doing in the markets. We want them to be open and accountable, and that requires a free and transparent monetary metals market.”

No matter how much financial manipulation is occurring on a global scale, you cannot suppress the outcome of those policies. One of the outcomes is inflation, and yet the new cover of Bloomberg/Newsweek asks the question “Is Inflation Dead?” Powell says, “This is worse than a prediction. It’s a delusion. Inflation is all around us. I don’t know what world the government is living in where they put out monthly reports saying inflation is tame. These people are not paying medical insurance premiums. They are not paying college tuition. They are not paying state taxes. They are not going to the grocery store and seeing prices rise monthly and, of course, they are not noticing the inflation that has manifested itself in the stock market. . . . Inflation is not dead. It’s all around us, and it has been all around us.”

GATA has been trying to get the U.S. government to come clean about massive market manipulations. GATA says they have hit a stone wall of silence. Powell concludes, “Presumably, the U.S. Treasury is secretly trading in any number of markets and refuses to say which markets they are. . . . I heard a U.S. Assistant Attorney move for a Summary Judgement dismissal of our lawsuit saying, without admitting the U.S. government was rigging the markets as we complained in our lawsuit, the U.S. government does claim the power to do what our lawsuit complained of, and that was to secretly rig the markets. I think we have established this now to the satisfaction of any reasonable person . . . . Especially since the CME Group, which operates the major futures exchanges in the United States, has just renewed what it calls its central bank incentive program, which gives enormous volume trading discounts to governments and central banks for surreptitiously trading all the futures markets. . . . So, we know the CME group has created mechanisms for secret trading by the U.S. government and other governments to get discounts in all of the futures trading in the United States.”

In closing, Powell reminds us, “At some point, manipulations do fail . . . . Manipulations only work because of deception.”

Powell contends that global financial powers are trying to suppress inflation through the manipulation of all futures and commodities, but it’s not working: This is Bigger than Gold & Silver Manipulation – Chris Powell

Bye bye dollar! Buy buy gold! Russia fills vaults with another 600,000 ounces

|

|

|

|

Post by Entendance on May 4, 2019 5:18:15 GMT -5

Is Turkey The Snowflake That Unleashes The European Banking System Avalanche?

My analyst told me that I was right out of my head

The way he described it, he said I’d be better dead than live

I didn’t listen to his jive

I knew all along he was all wrong

And I knew that he thought I was crazy but I’m not

Oh no!

My analyst told me that I was right out of my head

He said I’d need treatment, but I’m not that easily led

He said I was the type that was most inclined

When out of his sight to be out of my mind

And he thought I was nuts, no more ifs or ands or buts

Oh no!

They say as a child I appeared a little bit wild

With all my crazy ideas

But I knew what was happenin’, I knew I was a genius

What’s so strange when you know that you’re a wizard at three?

I knew that this was meant to be

Well I heard little children were supposed to sleep tight

That’s why I drank a fifth of vodka one night

My parents got frantic, didn’t know what to do

But I saw some crazy scenes before I came to

Now do you think I was crazy?

I may have been only three but I was swingin’

They all laughed at Al Graham Bell

They all laughed at Edison and also at Einstein

So why should I feel sorry if they just couldn’t understand

The litany and the logic that went on in my head?

I had a brain, it was insane

Don’t you let them laugh at me

When I refused to ride on all those double decker buses

All because there was no driver on the top

My analyst told me that I was right out of my head

The way he described it, he said I’d be better dead than live

I didn’t listen to his jive

I knew all along he was all wrong

And I knew that he thought I was crazy but I’m not

Oh no!

My analyst told me that I was right out of my head

But I said, “Dear doctor, I think that it’s you instead

‘Cause I have got a thing that’s unique and new

It proves that I’ll have the last laugh on you

‘Cause instead of one head… I got two

And you know two heads are better than one”

May 11, 2019 Global Synchronized Depression: Buy Gold And Silver Not Copper

May 9, 2019 MOVES IN GOLD & SILVER WILL BE 1970s ON STILTS

Russia becomes world's largest buyer of gold in 2019

China increases gold holdings for 5th straight month

Drop Gold, Buy Bitcoin Drop Gold, Buy Bitcoin

JP Morgan Metals Manipulation Probe Continues

Silver backwardation signals rally, Maguire tells KWN

Rational Roadmap For Gold And Dow In 2019

The gold-to-silver ratio is downright ridiculous

Deeply Irrational Markets

The overdue bear market is still coming, make no mistake

|

|

|

|

Post by Entendance on May 15, 2019 15:01:17 GMT -5

...an offer they would be hard-pressed to refuse

the paper price has absolutely zero to do with gold & silver’s value

May 17, 2019 Pay-to-Play: LBMA shows contempt for the wider Gold and Silver markets

The Lone Ranger’s Horse (Silver) Breaks Free! Or Did He? The Lone Ranger’s Horse (Silver) Breaks Free! Or Did He?

CENTRAL BANKS WILL FAIL TO KEEP INTEREST RATES LOW

In the second part of his recent interview with GoldCore's Mark O'Byrne, Chris Powell discusses:

-- The counterintuitive movements in the gold price that are caused by surreptitious government interventions.

-- The silly explanations for these counterintuitive movements that are contrived by market analysts.

-- The ability of gold investors themselves to defeat price suppression by wising up and avoiding "paper gold" and keeping their metal outside the banking system, where derivatives turn it into imaginary supply that is used to smash gold prices down.

-- The failure of the governments of developing countries to oppose the market manipulations by which the developed countries exploit them.

-- GATA's primary objectives, which are limited, transparent, and accountable government and fair dealing among nations.

The interview: We Have The Power To End Gold Price Suppression – Interview with Chris Powell (Part 2)

“The countries with the highest country risk,” says analyst Daniel LaCalle of Thinking Heads Agency, “are also those that have abused most of the financing of public spending by the central bank through the printing of currency. Argentina has a higher country risk than apparently more fragile economies due to the constant refusal on the part of the successive governments to adopt a prudent monetary policy and to defend the purchasing power of the currency.” As economies around the globe weaken, the temptations presented by the monetary printing press will become increasingly difficult to resist. In each instance, domestic gold demand is likely to rise as a consequence. It is usually only a matter of time until the price in that currency follows suit. The two short-term charts shown above illustrate the process. -USAGOLD

Live Gold Price

|

|

|

|

Post by Entendance on May 24, 2019 8:58:30 GMT -5

NONE OF THE WEALTHY OWNS GOLD NONE OF THE WEALTHY OWNS GOLD

SOCIALISM IN THE WEST WILL LEAD TO VENEZUELAN HYPERINFLATION GOLD REVEALS GOVERNMENTS’ FAILURE COMING QE WILL HAVE NO POSITIVE EFFECT WILL AI BE THE END OF HUMANITY? GOLD INVESTORS HAVE HAD 7 LEAN YEARS INVESTORS SHOULD NOW BE OUT OF STOCKS GOLD AND SILVER STARTING SPECTACULAR BULL MARKET

"The massive explosion of wealth in the world could be a sign of general prosperity but that is certainly very far from the truth. The printed money and credit expansion has only benefited a very small minority. The gap between the rich and the poor is getting ever wider but it will soon shrink dramatically..."

WITHOUT GOLD THE WEALTHY WILL BE WIPED OUT

That's the performance of various currencies against gold over the long term – past and present. Those who tout the proposition that gold is not really an inflation hedge, or that it is not really a safe-haven against currency debasement would be well-served to give it some undivided attention. Those who own gold and believe in it as a vehicle for long-term asset preservation will see it as vindication. For those who do not own gold, we hope it will serve as an inspiration and a call to action. -USAGOLD

PDF here PDF here

|

|

|

|

Post by Entendance on Jun 2, 2019 2:29:23 GMT -5

“Now, this next time when the economy crashes, which it will inevitably will, they’ll be exposed for the charlatans that they are, stringing everybody along, pretending like they’ve got it under control, confidence in the central bank is going to crash. This means confidence in fiat currency is going to crash, and the only real alternative to fiat currency is sound money and that’s gold. That’s the first big part of why it’s different this time. The other big part is just the math. We are up to $22 trillion in debt versus $10 trillion back in 2009. . . . The deficit through 2029 is $1 trillion a year, and that is under a forecast of 3% economic growth. You are not going to get 3% economic growth. When it’s 1% or 0%, then your tax receipts fall dramatically. Then your deficit explodes.”  June 6, 2019 Stupidity Updated: The Sellers of Silver Continue on Suiciding Themselves June 6, 2019 Stupidity Updated: The Sellers of Silver Continue on Suiciding Themselves

Clive P. Maund: DOLLAR BREAKING DOWN SIGNALS START OF GOLD BREAKOUT DRIVE ABOVE $1400

Take heart, we are going to see major moves in the precious metals & mining stocks as the masses run for the exits on their failing government currencies & grossly overvalued stock/bond portfolios. Just stack physical silver & gold outside the banksters system.

Sights

Gold is important to me because...here

U.S. Silver Exports To India Explode Past Six Months

*********************** Financial Crisis III: Stores of Precious Metals in Trusts and Funds - Junk Bond and Credit Market Concerns ***********************

"Liechtenstein-based investment fund Incrementum's annual "In Gold We Trust" report, compiled by Ronald-Peter Stoeferle and Mark J. Valek, was published this week and again described the reasons for gold's glorious prospects. Among them:

-- Loss of trust in international relations and everyday society amid ever-more-polarized politics.

-- Gold's generally good performance in most currencies apart from the U.S. dollar.

-- The extreme lows at which commodity prices generally now reside, implying a reversal.

-- Increasing purchases by central banks.

But while the report mentions past currency market interventions by governments and central banks that have affected asset prices, there doesn't seem to be anything in the report explaining why, despite the longstanding supportive fundamentals, gold has yet to realize its glorious prospects -- why gold's future never comes.

For example, there doesn't seem to be anything in the report about the constant and surreptitious gold trading by the Bank for International Settlements on behalf of its member central banks, the discounts given to governments and central banks by CME Group for surreptitiously trading all major futures contracts in the United States, or the refusal of the U.S. Federal Reserve and Treasury Department to answer a congressman's questions about which markets they are surreptitiously trading in and why.

All these developments have been extensively reported by GATA over the past year. It would seem hard for any gold market analyst to overlook them.

So while the Incrementum report is full of great research, analysis, and charts, it offers little insight about the thing that matters most: gold's price and its primary determinant, intervention in the gold market by central banks, as lately summarized by GATA here When even gold's scholars and mining companies are indifferent to the primary determinant of the monetary metal's price, gold's great future can seem only more distant." -CHRIS POWELL

2019 Extended Version PDF here 2019 Compact Version here 2019 Extended Version PDF here 2019 Compact Version here

Gold in the Age of Eroding Trust************************** "Will Atlas save the world? Global debt of $250 trillion can neither be serviced nor ever repaid. More likely, it will continue to grow exponentially until the world financial system collapses under the weight of the debt plus unfunded pension and medical liabilities of at least $250 trillion plus derivatives of $1.5 quadrillion, making a total of over $2 quadrillion.

No normal human can ever save the world but maybe Atlas will be the saviour. Atlas was one of the Titans and brother of Prometheus who created man from clay. Atlas led the Titans in the war against the Gods. When the Titans lost, Zeus punished Atlas to hold the celestial sphere on his shoulders until the end of time. If Greek mythology could save the world, now is the time that this is really needed. Without Atlas protecting the earth from collapsing under its debt burden of $ quadrillions, how can the world survive the coming debt implosion?

The problem is even worse, because no one even sees the need for Atlas to support the world financial system. Instead, debts and liabilities in the trillions are added on every month. Investors are continuing to buy overvalued stocks and property as well as worthless bonds. And governments can’t even make ends meet in good times with low to negative interest rates. How can anyone believe that the world can survive when hard times hit with escalating deficits and rates in the teens or higher. At that time even Atlas will have problems!..."

BRITS – GOLD MORE LIKELY TO SAVE YOU THAN ATLAS

Index Mundi Index Mundi

|

|

|

|

Post by Entendance on Jun 10, 2019 9:26:58 GMT -5

The following table shows what the silver price would be, based on the gold price and the gold/silver ratio

Three Questions to Answer

|

|

|

|

Post by Entendance on Jun 14, 2019 17:54:35 GMT -5

GOLD MAGINOT LINE BROKEN

"...The key, as Pericles pointed out 2,700 years ago, is not to predict the future but to be prepared for it. But how can investors be prepared for a financial crisis if they limit themselves to the instruments that depend on financial counterparties and markets?

This is why the current bubble in complacency is so pernicious. It has left investors defenseless by instilling blind faith in the ability to hedge systemic risks with instruments that are vulnerable to the very risks they are supposed to hedge. This is akin to plugging one’s backup generator into the electric grid - it will work perfectly until the power cuts out, which is when one really needs a backup generator! This brings us to physical gold - the only universally liquid financial asset that is cyber-immune and can be effectively custodied and negotiated without relying on financial institutions or markets. It is no accident that many central banks have been aggressively accumulating gold reserves. Who if not an arsonist would smell the smoke first?.." The Bubble in Complacency H/T Tom from Florida

|

|

|

|

Post by Entendance on Jun 21, 2019 5:43:27 GMT -5

If you don't want to be a creditor, gold and silver are your assets.

June 27, 2019 GOLD PRICE SIGNALS NEXT GLOBAL CRISIS

Gold Will Spike To $1,700 In A Matter Of Months Gold Will Spike To $1,700 In A Matter Of Months

In Gold We trust :The concept of trust and the continuing loss of confidence in global institutions A conversation with Ronni Stoeferle

banksters Cartel International XI

"...The central bank cartel’s claim that the coordinated sales transactions are designed to avoid market turmoil is true, but not in the way they imply. It’s a hidden in plain sight nod to the fact that their threat of gold sales is to prevent market turmoil in every other asset class that they watch over. Just not the physical gold market..." The Fifth Wave: A new Central Bank Gold Agreement?

"Central banks can get away with promiscuous monetary schemes until gold and then bonds revolt.

Gold is now in revolution against central banks. Historically bonds eventually align with gold. But central banks and governments have cornered the bond market. Gold might have to carry the pitchforks and torches by itself for quite some time.

Gold is telling the world that a critical mass of investors is allocating central bank liquidity to gold because the liquidity is unlikely to be economically effective. This means financial assets, including currencies, are overvalued and too risky. As in any bull market, psychology and momentum build and become self-reinforcing. George Soros calls it "reflexivity." Bullishness begets more bullishness ad infinitum and alters psychology about fundamental issues. As the trend builds, humans manufacture reasons to be bullish and eventually irrationally exuberant (excess global savings, Mexico turning the corner, dot-com mania, yada, yada, yada).

When gold is in a robust rally, pundits and the financial media have to produce fundamental reasons for the move. Inevitably with gold it is lack of confidence in -- take your pick -- forex, bonds, central banks, politicians, the world, or all of the above. The Street and media will create the self-reinforcing loop.

Central banks and Keynesian politicians have always detested gold because it can usurp their scams. It is also why central banks and sovereigns have engaged in gold rigging schemes to the downside for decades. They will do it again in the coming weeks and months -- because they have no choice.

For years Street denizens have asked the question: What is the end game for central banks after 10 years of record promiscuity? The Fed and (probably) the People's Bank of China tried to exit the quantitative easing roach motel. They were unable to do so. Gold and possibly bonds will be the major factors in the end game.

It is far too early to guess if or when bonds will join gold in the revolt. The longer that central banks maintain their bond corner, the higher gold should go and the worse the end game should be."

King Report: Despite central banking's price-suppression schemes, gold revolts

Banksters Cartel International Explained

GOVERNMENTS CAN’T SERVICE THEIR DEBTS AT CURRENT RIDICULOUSLY LOW RATES

Precious Metals Breakout Rally or Reversal Time?

|

|

|

|

Post by Entendance on Jul 13, 2019 7:52:18 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

The Dominos Are Starting to Fall PDF here

GOLD IS FOR FREEDOM AND BENEFIT Read more here

A whale is accumulating silver futures Read more here

|

|

|

|

Post by Entendance on Jul 25, 2019 10:54:34 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

For several years now, Russia’s central bank has been on a gold-buying spree, bulking up its already impressive stockpiles and setting off all manner of speculation.

And the buying frenzy appears to be going nowhere. According to the bank’s latest press release, the country bought another 597,000 ounces or 18.67 tonnes of gold in June, bringing its total reserves to 2,208 tonnes worth about $100.3 billion.

Russia purchased 200,000 ounces in January, one million ounces in February, 600,000 ounces in March, 550,000 ounces in April and 200,000 ounces in May thus bringing year-to-date purchases to more than 96 tonnes. Moscow’s appetite for the yellow metal appears insatiable. Gold now makes up 19 percent of the country’s foreign reserves compared to just two percent a decade ago.

Russia is now officially the world’s largest gold buyer

The truth will often only be known after the event STOCKS NO BID – GOLD NO OFFER

The Financial System May Disappear Into A Black Hole

Gold Roundtable & $700,000 Silver 2 videos here

Russian gold reserves top $100 billion after adding another 600,000 ounces to its vast stockpile Here

Silver Manipulation Confirmed: 2008 Price Plunge From $21 to $9 Explained

Looking into Gold’s Future Coins

Gold is calling out the insanity of the European Union

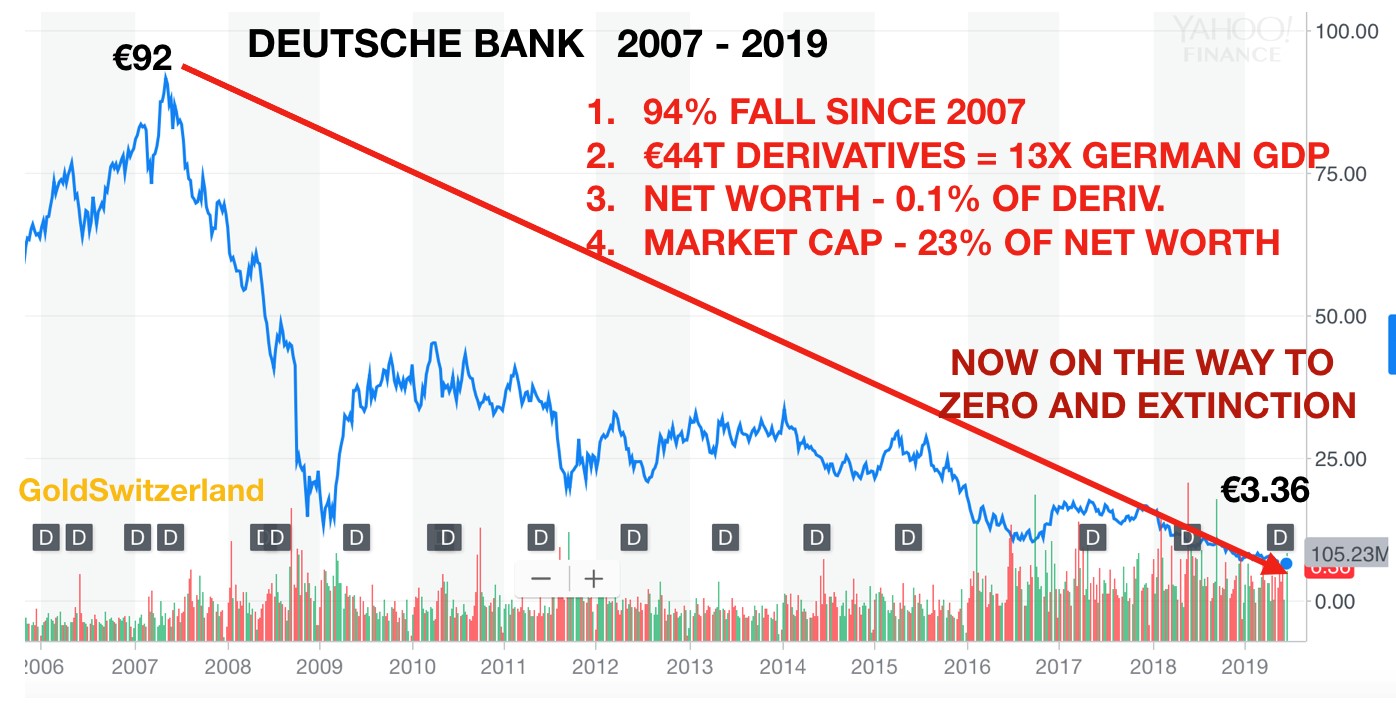

CHART OF THE DAY: The Great German Train Wreck

|

|

|

|

Post by Entendance on Aug 31, 2019 3:59:34 GMT -5

|

|

|

|

Post by Entendance on Sept 8, 2019 4:30:46 GMT -5

"Russia has been stockpiling gold bullion in recent years in an attempt to lessen its economy’s reliance on the US dollar, with forecasts showing the country’s gold and foreign exchange reserves are set to outstrip those of Saudi Arabia"

|

|

|

|

Post by Entendance on Sept 13, 2019 2:16:26 GMT -5

September 17, 2019: JP Morgan Was Criminally Rigging The Gold & Silver Markets In A Conspiratorial Racket? INCONCEIVABLE!

September 11, 2019 Egon von Greyerz: "...My long standing minimum forecast for gold is at least $10,000. If we assume that the gold/silver ratio goes back to its long term historical average of 15 (82 today), that would give a silver price of $666. People who think that this figure is ominous have read the wrong chapter in the bible..." KING SOLOMON AND 666 GOLD

Central bankstersThe Silver Series: The Start of A New Gold-Silver Cycle (Part 1 of 3) The world has experienced a decade of growth fueled by record-low interest rates, a burgeoning money supply, and historic debt levels – but the good times only last so long.

As the global economy slows and eventually begins to retract, can precious metals offer a useful store of value to investors?

Part 1: The Start of a New Cycle

Today’s infographic comes to us from Endeavour Silver, and it outlines some key indicators that precede a coming gold-silver cycle in which exposure to hard assets may help to protect wealth.

Bankers Blowing Bubbles

Since 2008, central bankers around the world launched a historic market intervention by printing money and bailing out major banks. With cheap and abundant money, this strategy worked so well that it created a bull market in every sector — except for precious metals.

Stock markets, consumer lending, and property values surged. Meanwhile, the U.S. Federal Reserve’s assets ballooned, and so did corporate, government, and household debt. By 2018, total debt reached almost $250 trillion worldwide.

Currency vs. Precious Metals

The world awash in unprecedented amounts of currency, and these dollars chase a limited supply of goods. Historically speaking, it’s only a matter of time before the price of goods increases or inflates – eroding the purchasing power of every dollar.

Gold and silver are some of the only assets unaffected by inflation, retaining their value.

Gold and silver are money… everything else is credit.

– J.P. Morgan

The Perfect Story for a Gold-Silver Cycle?

Investors can use several indicators to gauge the beginning of the gold-silver cycle:

Gold/Silver Futures

Most traders do not trade physical gold and silver, but paper contracts with the promise to buy at a future price. Every week, U.S. commodity exchanges publish the Commitment of Traders “COT” report. This report summarizes the positions (long/short) of traders for a particular commodity.

Typically, speculators are long and commercial traders are short the price of gold and silver. However, when speculators and commercial traders positions reach near zero, there is usually a big upswing in the price of silver.

Gold-to-Silver Ratio Compression

As the difference between gold and silver prices decreases (i.e. the compression of the ratio), history suggests silver prices can make big moves upwards in price. The gold-to-silver ratio compression is now at high levels and may eventually revert to its long-term average, which implies a strong movement in prices is imminent for silver.

Scarcity: Declining Silver Production

Silver production has been declining despite its growing importance as a safe haven hedge, as well as its use in industrial applications and renewable technologies.

The Silver Exception

Silver is not just for coins, bars, jewelry and the family silverware. It stands out from gold with its practical industrial uses which account for 56.1% of its annual consumption. Silver will continue to be a critical material in solar technology. While photovoltaics currently account for 8% of annual silver consumption, this is set to change with the dramatic increase in the use of solar technologies.

The Price of Gold and Silver

Forecasting the exact price of gold and silver is not a science, but there are clear signs that point to the direction their prices will head. The prices of gold and silver do not accurately reflect a world awash with cheap and easy money, but now may be their time to shine...More here

|

|

|

|

Post by Entendance on Oct 25, 2019 0:28:14 GMT -5

November 10, 2019

In comments at King World News, Swiss gold fund manager Egon von Greyerz notes the unreality of the paper gold market.

"The corrupt and manipulated paper gold market is guaranteed to fail," von Greyerz contends. "A market that is leveraged at 300 times the underlying physical or real market has no chance of survival. When the holders of paper gold realize that they are holding a worthless piece of paper, the whole paper market will implode and the price of gold will skyrocket. This is not a question of if but when." Here

A reckoning seems to be coming: “The time is coming,” (when) global financial markets stop focusing on how much more medicine they will get (QEs) and instead focus on the fact that it does not work.”

Chartbook of the In Gold We Trust report 2019: “Gold Shining Through the Darkening Recession Clouds” Chartbook of the In Gold We Trust report 2019: “Gold Shining Through the Darkening Recession Clouds”

|

|

|

|

Post by Entendance on Nov 15, 2019 2:16:36 GMT -5

|

|

|

|

Post by Entendance on Nov 20, 2019 3:10:02 GMT -5

|

|

|

|

Post by Entendance on Dec 28, 2019 4:26:37 GMT -5

December 31, 2019: 2 new videos here

"...The case for honest money must be made on ethical grounds. The current system must be exposed and shown for the scam that it is: a massive redistribution scheme enriching the political elites and their closely aligned business and financial allies. While it is undeniable that a gold standard would lead to enormous prosperity, its reinstatement would remedy one of the great injustices that plague the world – central banking!" The Ethics of a Gold Standard

Click here

The Entendance Beach & The Gold Standard: here

"Governments and Central Banks are now supreme experts in the total destruction of your money": The War On Cash

"Reports have emerged depicting long lines in front of a physical gold sales location in Germany, in view of pending legislation which would once again lower the anonymous purchase limit, this time from €10,000 to €2,000. The last drop happened in 2017 when the limit was set at €15,000. A draft bill from the German finance ministry is being pointed to as the reason for the change, which is scheduled to take effect from Jan. 10, 2020..."  Germans Rush to Buy Gold as Draft Bill Threatens to Restrict Purchases

Smart Germans

The Must Watch Videos: Inside the Vault Series - Expert Tips on Gold and Silver  January 5, 2020: Gold Market Update & Silver Market Update January 5, 2020: Gold Market Update & Silver Market Update

|

|

The direct relationship between growth in the federal debt and the price of gold. The national debt, by the way, now stands at $21.372 trillion with $880 billion added so far in 2018.

The direct relationship between growth in the federal debt and the price of gold. The national debt, by the way, now stands at $21.372 trillion with $880 billion added so far in 2018.  " H/T Tom from Florida)

" H/T Tom from Florida)

Gold & Silver in Singapore, Gold & Silver in The Cayman Islands:

Gold & Silver in Singapore, Gold & Silver in The Cayman Islands:

June 26, 2017

June 26, 2017

Gold Russian':

Gold Russian':

Not your vault, not your gold

Not your vault, not your gold

NONE OF THE WEALTHY OWNS GOLD

NONE OF THE WEALTHY OWNS GOLD

PDF

PDF  June 6, 2019 Stupidity Updated:

June 6, 2019 Stupidity Updated:

2019 Extended Version PDF

2019 Extended Version PDF

How to safely protect your life your liberty and your assets:

How to safely protect your life your liberty and your assets:

Chartbook of the In Gold We Trust report 2019: “Gold Shining Through the Darkening Recession Clouds”

Chartbook of the In Gold We Trust report 2019: “Gold Shining Through the Darkening Recession Clouds”