|

|

Post by Entendance on May 28, 2015 5:41:35 GMT -5

...Every gram of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system. What you have done is removed those “dollars” from the hands of government. They now have fewer “dollars” to use to purchase weapons of war, surveillance technology and the other weapons they use against us. Today would be a good day to remove a few “dollars” from their hands and place another weapon in your back pocket. Gold and silver are free from tyranny, accepted around the world in good faith and provides a piece of insurance from, what appears to be, a system in change...

The Most Powerful Weapon Ever

Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours.

Unallocated Gold versus Allocated Gold

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

World markets at a glance NOW & Updated Trading VIDEO

|

|

|

|

Post by Entendance on Jun 6, 2015 7:08:35 GMT -5

Brett S.: "The quieter we become, the more we can hear. It is difficult listening to markets when we are generating an internal racket. A recent post from Bruce Bower discusses the topic of filtering out noise and making better trading decisions. I'm not surprised that SMB readers selected it as one of the most important issues they face. When traders manage risk and track markets on very short time frames, the internal dialogue easily goes into hyperdrive. During active trading mode, there is relatively little time for reflecting and quieting the mind. A deadly situation sets up when aggressive, competitive traders feel the need to trade more, thereby ramping up their internal noise.

We cannot master markets if we fail to master our minds. The state of our trading relies on the state of our consciousness. This is why work on my own trading increasingly focuses on brain training. If markets can change their behavior faster than I can shift mindsets, I will be behind the curve. We can train our minds not only to get into certain states--relaxed ones, focused ones, positive ones, quiet ones--but also to move flexibly among states. None of that is possible if we're glued to screens, amped up on each market move, immersed in fight-or-flight mode rather than calm deliberation mode.

Here is one thing I've learned from my personal trading experiment: If I do not spend five times as much time generating the trade idea as actually trading it, my results suffer. The best trades come from situations in which multiple factors line up. To detect that lining up, I need to update my factor measures (breadth, volatility, momentum, sentiment, and correlation), and I need to step back from these measures to see the larger picture in which they are lining up. There is analysis, there is synthesis--and all of that is time away from actively trading and following what is happening on the screen.

If you want to get away from market noise, a great first step is to know what constitutes signal and spend quality, focused, relaxed time on that."

Updated Trading Video & Weekly Trading Forecast

|

|

|

|

Post by Entendance on Jun 9, 2015 13:19:59 GMT -5

Simon Black: <In the 5th century BC during the Golden Age of Athens, culture and intellect flourished in Ancient Greece more than at any other time or place in history up to that point.

It was an amazing period of discovery.

Philosophers Socrates and Plato, writers Sophocles and Euripides, historians Herodotus and Thucydides, all lived during this period and completely revolutionized their fields.

One of their contemporaries was the physician Hippocrates, who did more to advance medical science than any other human being until Louis Pasteur.

In his book “On Sacred Disease,” Hippocrates became one of the first to propose that illness wasn’t a curse from the gods, but rather the result of some natural cause.

In his book “On Ancient Medicine”, he wrote extensively about how good food and regular physical activity were the best ways to ward off disease and stay healthy.

But most famously, his book “The Oath” describes his solemn vow to practice medicine exclusively for the benefit of the patient, which is often colloquially summarized as ‘do no harm.’

To this day physicians still recite some version of the Hippocratic Oath, swearing to uphold standards of integrity and professionalism for the benefit of the patient.

Over drinks last night in London, my colleague Tim Price wondered aloud why there is no Hippocratic Oath in finance.

It’s incredible when you think about it– finance is one of the most heavily regulated industries on the planet.

And yet with legions of bureaucrats regulating their every move, and compliance officers looming over banking like Dark Lords of the Sith, there’s still an incredible amount of impropriety going on.

Brokers and exchanges happily sell away our investment data to give an edge to High Frequency Trading firms.

Just a few weeks ago some of the largest banks in the world pled guilty to CRIMINAL charges of rigging foreign currency rates.

In fact, they’ve fixed just about every market they’ve ever gotten their hands on, from silver to LIBOR to just about everything else in between.

Banks gamble away their depositors’ savings on risky investment fads, and money managers stuff their clients’ retirement accounts full of overpriced stocks and ho-hum mutual funds.

Where is the oath for bankers and money managers to stand up and say “I promise to do my best for the sole benefit of the client”..?

It doesn’t exist. Even more importantly, every incentive in the industry is to do the exact opposite.

Chuck Prince, who once presided over banking giant Citigroup famously said once that “as long as the music is playing, you’ve got to get up and dance.”

Prince ultimately resigned from Citi after the bank suffered massive losses in the credit crisis. Apparently his dancing skills weren’t up to snuff.

But consider the magnitude of that statement if you’re a young banker.

The guy who dominates your industry is basically telling you that you’ve got to get out there and keep dancing, even when all the indicators suggest that the market is about to collapse.

This pretty much sums up the financial industry today.

It’s not that these guys are stupid. It’s not that they can’t see the writing on the wall. It’s not that they’re blind to the tremendous amount of risk in the system.

The issue is that their jobs are on the line.

Finance doesn’t take kindly to mavericks. Despite all multi-million dollar bonuses and huge salaries, people have absolutely every incentive to follow the herd and continue putting their clients’ savings in risky investments.

Anyone who doesn’t tow the line is quickly fired.

This is nowhere close to ‘do no harm.’ It’s much closer to ‘screw anyone you have to screw to keep your job.’

Sound, safe, objective financial advice is a rare thing. And that’s why your ultimate financial decisions, like your health decisions, should never be outsourced.

If you don’t understand investing and personal finance, that’s not a reason to outsource everything to a money manager.

Rather, it’s a reason to educate yourself about investing and personal finance.

But like Hippocrates told us about health, it doesn’t need to be complicated.

Just like a brisk walk and a quality meal go a long way in promoting good, long-term health, sometimes good, long-term investing can be as simple as buying quality companies run by honest, talented managers.>

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

|

|

|

|

Post by Entendance on Jun 10, 2015 16:37:34 GMT -5

MEDITATE! Prayer is asking and meditation is listening.

"Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves. Which is a better trading strategy, momentum or mean-reversion? Try this mathematical thought experiment for yourself..." *** Momentum v. mean-reversion

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

|

|

|

|

Post by Entendance on Jul 7, 2015 14:30:59 GMT -5

"...The irony here, the historical irony, is something I think we need to understand. Back in 1953, the Germans, with a very crushed economy—in that case, because of the Great Depression and the fact that they lost World War II—went to the United States, France and Britain and said, "We can’t join you as a bulwark against the Soviet Union unless you relieve us of our enormous debts, which are hampering our ability to grow." Across 1953, they had meetings in London. When those meetings concluded, with the so-called London Agreement, here’s what Germany got from the United States, France and Britain: 50 percent of their outstanding debt, which was very high, was erased, and the other 50 percent of their debt was stretched out over 30 years. In effect, Germany got the relief of all of its basic indebtedness, based on two world wars that they were held accountable for, and that enabled them to have the so-called Wirtschaftswunder, the economic miracle that happened. They now refuse to give to Greece what they got. They refuse to allow Greece to have the chance to solve its economic problems just the way Germany asked for and got. And this discrepancy between these two countries is producing a stress inside Europe that is, what Paul Mason correctly points to, fundamentally dangerous to the whole project of a United States of Europe..."

Economist Richard Wolff on Roots of Greek Crisis, Debt Relief & Rise of Anti-Capitalism in Europe

|

|

|

|

Post by Entendance on Jul 8, 2015 6:26:22 GMT -5

VIDEO

Nigel Farage tells Greece: Have the courage to quit the euro " There is a new Berlin Wall and it's called the euro. "

|

|

|

|

Post by Entendance on Jul 24, 2015 18:18:49 GMT -5

The Real Fight Is Within: Mental Hygiene

Fred & EntendanceInvestors Beach goal is simple: to help you achieve personal liberty and financial prosperity no matter what happens.

Let's remember this: life is what happens to us while we're busy making other plans.

Exploring Biases And Aversions...The difference between school and financial markets? In school, we're taught a lesson and then given a test. In financial markets, we're given a test that teaches us a lesson.

You may hate that, still...financial markets do not know we exist.

If you think education is expensive, try ignorance. Action without study is fatal, so..."Melius est abundare quam deficere" (it is better too much than not enough), but study without action is futile. Cognitive Biases - A Visual Study Guide News, rumors, noise, don't let them daze you, take your own "me time" and...linger longer in this beach. -E. The Real Fight Is Within: Mental Hygiene II

Villa Malaparte, Capri Malaparte, a house like me

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

|

|

|

|

Post by Entendance on Jul 28, 2015 16:38:27 GMT -5

<...The law of supply and demand is the basis of economics. Yet the price of gold and silver in the Comex futures market, where paper contracts representing 100 troy ounces of gold or 5,000 ounces of silver are traded, is inconsistent with the actual supply and demand conditions in the physical market for bullion. For four years the price of bullion has been falling in the futures market despite rising demand for possession of the physical metal and supply constraints.

We begin with a review of basics. The vertical axis measures price. The horizontal axis measures quantity. Demand curves slope down to the right, the quantity demanded increasing as price falls. Supply curves slope upward to the right, the quantity supplied rising with price. The intersection of supply with demand determines price. (Graph 1) A change in quantity demanded or in the quantity supplied refers to a movement along a given curve. A change in demand or a change in supply refers to a shift in the curves. For example, an increase in demand (a shift to the right of the demand curve) causes a movement along the supply curve (an increase in the quantity supplied).

Changes in income and changes in tastes or preferences toward an item can cause the demand curve to shift. For example, if people expect that their fiat currency is going to lose value, the demand for gold and silver would increase (a shift to the right).

Changes in technology and resources can cause the supply curve to shift. New gold discoveries and improvements in gold mining technology would cause the supply curve to shift to the right. Exhaustion of existing mines would cause a reduction in supply (a shift to the left).

What can cause the price of gold to fall? Two things: The demand for gold can fall, that is, the demand curve could shift to the left, intersecting the supply curve at a lower price. The fall in demand results in a reduction in the quantity supplied. A fall in demand means that people want less gold at every price. (Graph 2)

Alternatively, supply could increase, that is, the supply curve could shift to the right, intersecting the demand curve at a lower price. The increase in supply results in an increase in the quantity demanded. An increase in supply means that more gold is available at every price. (Graph 3) To summarize: a decline in the price of gold can be caused by a decline in the demand for gold or by an increase in the supply of gold.

A decline in demand or an increase in supply is not what we are observing in the gold and silver physical markets... How can this be explained?

Supply and Demand in the Gold and Silver Futures Markets

...The bullion banks’ attack on gold is being augmented with a spate of stories in the financial media denying any usefulness of gold. On July 17 the Wall Street Journal declared that honesty about gold requires recognition that gold is nothing but a pet rock. Other commentators declare gold to be in a bear market despite the strong demand for physical metal and supply constraints, and some influential party is determined that gold not be regarded as money.

Why a sudden spate of claims that gold is not money? Gold is considered a part of the United States’ official monetary reserves, which is also the case for central banks and the IMF. The IMF accepts gold as repayment for credit extended. The US Treasury’s Office of the Comptroller of the Currency classifies gold as a currency, as can be seen in the OCC’s latest quarterly report on bank derivatives activities in which the OCC places gold futures in the foreign exchange derivatives classification.

The manipulation of the gold price by injecting large quantities of freshly printed uncovered contracts into the Comex market is an empirical fact. The sudden debunking of gold in the financial press is circumstantial evidence that a full-scale attack on gold’s function as a systemic warning signal is underway.

It is unlikely that regulatory authorities are unaware of the fraudulent manipulation of bullion prices. The fact that nothing is done about it is an indication of the lawlessness that prevails in US financial markets.>

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours.

|

|

|

|

Post by Entendance on Aug 5, 2015 7:01:08 GMT -5

Simon Black: Remember why you own gold to begin with.

"Gold is a very long-term store of value. Notwithstanding a few down years, gold has maintained its purchasing power for thousands of years.

Paper currencies come and go. They get devalued, revalued, and extinguished altogether.

How much would you be able to buy today with paper money issued by the 7th century Tang Dynasty? Nothing. It no longer exists.

Or a pound sterling from 1817? Very little. It’s barely pocket change today.

Yet the gold backing up that same pound sterling from 1817 is worth over $250 today (165 pounds).

Even in modern history, the gold backing up a single US dollar from 1971 is worth vastly more than the paper currency that was printed 44 years ago.

But even more importantly, aside from being a long-term store of value, gold is a hedge— a form of money that acts as an insurance policy against a dangerously overleveraged financial system.

How much will your dollars and euros buy you in the event of real financial calamity? Or if there’s a major government default or central bank failure?

No matter what happens in the financial system– whether it collapses under its own weight, or cryptofinance technology revolutionizes how we do business– gold ensures that you’re protected.

Resist the urge to value gold in paper currency. We all have this tendency– we invest in something, and then hope it goes up in value.

But that’s a mistake with gold. It’s a hard thing for some people to do, but try to stop yourself from thinking about gold in terms of its paper price.

(It’s also important to remember that there’s a huge disconnect between the ‘paper price’ of gold, and the physical price of gold.)

Remember, gold is not an investment; there are plenty of better options out there if you’re looking for a great speculation.

So the notion of trading a stack of paper currency for gold, only to trade the gold back for a taller stack of paper currency misses the point entirely.

Having said that, if you find it too difficult to do this, and you catch yourself constantly refreshing the gold price and checking your portfolio, you might own too much.

Listen to your instincts; if you’re always feeling frantic about the daily gyrations in the market, lighten your load.

Don’t love anything that won’t love you back. Stay rational. Own enough gold that, in the event of a crisis, you will feel comfortable that you have enough ‘real savings’… but don’t own so much that you’re constantly worrying about the paper price."

Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours.

Will China Play The 'Gold Card'?

Estate

"...It will get crazier. There is a significant global change coming as the trends of the past forty to fifty years stretch to the extreme.

Unfortunately for us, gold and silver will once again be in the focal point of these changes."

In Gold We Trust 2015 - Extended Version

Fred & EntendanceInvestors Beach, because this place is for Uncolonized Minds

|

|

|

|

Post by Entendance on Aug 19, 2015 9:34:38 GMT -5

“This entire fiat money circus the world has been on is coming to a head. I see many comments from diverse people, and the problems are just mounting up. You have Greece with 11 million people, and if they get this last bit of money, they will have some $400 billion of debt. How can 11 million people work off a debt of $400 billion? It just can’t be done. The people running the euro are in dreamland.”

It’s not just Greece or the European Union. Salinas Price, an 83 year old billionaire, says, “The world has never been in such a plight. The world has never gotten into such a situation—never. The United States receives goods from China and sends them dollars, and they can send them any amount of dollars. . . . There is no longer balanced trade in the world. There are imbalances that are built into the system. What that has lead up to is this present chaos. This is going to come apart in a very ugly way sooner or later.”

The other big problem is the huge amount of bond debt floating around in the world. The central banks are trying to “stop a deluge of liquidations.” Salinas Price explains, “It means that the owners of the debt get wiped out. Somebody owns all that debt. It can’t be liquidated. It’s going to go into default, and that will mean a loss for all those holders of debt. . . . People think they have jillions of dollars or euros or whatever currency, and it’s all going to come to nothing, it can’t be liquidated. The debtors cannot pay. . . .Greece is the whole world. The whole world is in huge debt, which is unpayable. . . . So, this thing is like a cloud that is hanging up there, and then it begins to rain. The whole debt is going to come down like a cloud burst. We are going to be drowning in worthless paper. . . . I think the world is going to have an epileptic fit.”

On gold, Salinas Price says, “I have a feeling we may be at a bottom in gold. I also think when we see a rising trend of gold, that will be the last rising trend that we see. It will lead to a new monetary order in the world. . . . When it starts rising again, it is going to rise a heck of a lot, and that will be the last rise in the price of gold because after that comes a new monetary order. I don’t think the world can wait or there will be anymore declines in the price of gold because of speculation. This is the last gasp for gold. . . . It will be leading up to a new world order.”

Beginning of a Breakdown in International Trade-Hugo Salinas Price H/T my good friend Tom B. in Florida

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

|

|

|

|

Post by Entendance on Aug 20, 2015 0:39:15 GMT -5

John Kicklighter Strategy Video: What are Your Trading Goals? • Without a clear objective for trading, it is difficult to gauge progress and to shape a successful strategy

• A big-picture goal needs to be more than 'become a millionaire' - it needs to be specific, measurable, timely

• We discuss reasonable objectives and how to set a goal for trading that will offer a foundation for strategy

Emerging Markets : "I'm here for the blood test..." Investing & Trading Investors Member Comments : "I'm here for the blood test..." Investing & Trading Investors Member Comments

|

|

|

|

Post by Entendance on Sept 5, 2015 8:15:01 GMT -5

Meditation is intended to purify the mind. It cleanses the thought process of what can be called psychic irritants, things like greed, hatred, and jealousy, which keep you snarled up in emotional bondage. Meditation brings the mind to a state of tranquillity and awareness, a state of concentration and insight.

In our society, we are great believers in education. We believe that knowledge makes a person civilized. Civilization, however, polishes a person only superficially. Subject our noble and sophisticated gentleperson to the stresses of war or economic collapse, and see what happens. It is one thing to obey the law because you know the penalties and fear the consequences; it is something else entirely to obey the law because you have cleansed yourself from the greed that would make you steal and the hatred that would make you kill.

Meditation is a lot like cultivating a new land. To make a field out of a forest, first you have to clear the trees and pull out the stumps. Then you till the soil and fertilize it, sow your seed, and harvest your crops. To cultivate your mind, first you have to clear out the various irritants that are in the way— pull them right out by the root so that they won’t grow back. Then you fertilize: you pump energy and discipline into the mental soil. Then you sow the seed, and harvest your crops of faith, morality, mindfulness, and wisdom.

Meditation sharpens your concentration and your thinking power. Then, piece by piece, your own subconscious motives and mechanics become clear to you. Your intuition sharpens. The precision of your thought increases, and gradually you come to a direct knowledge of things as they really are, without prejudice and without illusion.

More here

Conquer the Four Fears!

Merriam-Webster's dictionary defines fear as "an unpleasant, often strong emotion caused by anticipation or awareness of danger, going on to explain that fear...implies anxiety and usually the loss of courage." This definition of fear is useful in helping define the issues that traders face when coping with fear. The reality is that all traders feel fear at some level, but the key is how we prepare to address our concerns related to taking on risk as a trader. In this article I will review four major fears experienced by traders, and I'll take it a step further by noting how the outcomes of these fears create undesirable trading behaviors. Basically, my aim is to have you walk away with an understanding of these dangers so you can and implement strategies that will address your fears and let you get on with your trading plan. Mark Douglas, an expert in trading psychology, noted in his book, Trading in the Zone, that most investors believe they know what is going to happen next. This causes traders to put too much weight on the outcome of the current trade, while not assessing their performance as "a probability game" that they are playing over time. This manifests itself in investors getting too high and too low and causes them to react emotionally, with excessive fear or greed after a series of losses or wins. As the importance of an individual trade increases in the trader's mind, the fear level tends to increase as well. A trader becomes more hesitant and cautious, seeking to avoid a mistake. The risk of choking under pressure increases as the trader feels the pressure build.

All traders have fear, but winning traders manage their fear while losers are controlled by it. When faced with a potentially dangerous situation, the instinctive tendency is to revert to the "fight or flight" response. We can either prepare to do battle against the perceived threat, or we can flee from this danger. When an investor interprets a state of arousal negatively as fear or stress, performance is likely to be impaired. A trader will tend to ?freeze.? In contrast, when a trader feels the surge of adrenaline but interprets this as excitement or a state of greater alertness before placing a trade, then performance will tend to improve. Many great live performers talk of feeling butterflies just before they go on stage, and how they interpret this as a wake-up call to go out and perform at their highest level. That's clearly a more empowering response than someone who might interpret these butterflies as a reason to run back to his dressing room to get sick! Winners take positive action in spite of fear. Read below for tips to conquer the four major fears in trading:

"Here are the four major fears in trading, and how you can work to handle them:

1. Fear of Loss

The fear of losing when making a trade often has several consequences. Fear of loss tends to make a trader hesitant to execute his trading plan. This can often lead to an inability to pull the trigger on new entries as well as on new exits. As a trader, you know that you need to be decisive in taking action when your approach dictates a new entry or exit, so when fear of loss holds you back from taking action, you also lose confidence in your ability to execute your trading plan. This causes a lack of trust in your method or, more importantly, in your own ability to execute future trades.

Thus, you can see how fear can set in place a vicious cycle of recurring doubt and, in turn, reinforce a traders' lack of confidence in executing new positions. For example, if you doubt you will actually be able to exit your position when your method tells you to get the heck out, then as a self-preservation mechanism you will also choose not to get into new trades. Thus begins the analysis paralysis, where you are merely looking at new trades but not getting the proper reinforcement to pull the trigger. In fact, the reinforcement is negative and actually pulls you away from making a move.

Looking deeper at why a trader cannot pull the trigger, I believe the root stems from a lack of confidence about the trading plan, which then causes the trader to believe that by not trading, he is moving away from potential pain as opposed to moving toward future gain. No one likes losses, but the reality is, of course, that even the best professionals will lose. The key is that they will lose much less, which allows them to remain in the game both financially and psychologically. The longer you can remain in the trading game with a sound method, the more likely you will start to experience a better run of trades that will take you out of any temporary trading slumps.

When you're having trouble pulling the trigger, realize that you are worrying too much about results and are not focused on your execution process. Make sure your have a written plan and then practice executing your plan.

Start with paper trades if you prefer, or consider trading smaller positions to get the fear of losing out of your system and get yourself focused on execution. When in the heat of battle and realizing you need to get in or out of a trade, consider using market orders, especially on the exit. That way you can't beat yourself up for not pulling the trigger on your trade.

Many traders may get too cute with a trade and try to work out of a position at a limit price better than the current market price, hoping they can squeeze more out of a trade. But as famed trader Jesse Livermore advised in the classic book Reminiscences of a Stock Operator by Edwin Lefevre, "give up trying to catch the last eighth." Keep it simple with a market order to exit allows you to bring closure when you need it, which reinforces the confidence-building feelings that come from following your trading plan. In the past when my indicators noted it was time to exit, I have experienced firsthand the pain of not getting filled at my limit, watching the option drop and then placing a new limit back where I should have exited at the market in the first place! Then I have realized I was not going to get filled there either, so I again kept lowering my limit until, in frustration, I placed a market order to exit much lower than I could have closed the position initially. Not only can you feel the pain of loss financially but more importantly, you can chip away at your internal state of confidence and create frustration by not getting filled.

You should be more concerned about avoiding big losses and less concerned about taking small losses. If you can't bear to take a small loss, you will never give yourself an opportunity to be around when a big winning idea comes along, as every trade you enter has the risk of first turning against you for a loss. You must execute by knowing what your risk is in each trade, and define parameters to make sure you can ride favorable trends correctly as well so that your winners will be larger than you losers. And never get stuck in the mindset of hoping a loser will come back to "breakeven," as that is one of the trader's most deadly mental fantasies. Billions of dollars have been lost by technology investors hoping their stocks would bounce back in recent years to allow them to escape the downtrend. That only led to even greater losses in most cases. That's how a short-term trader can become a long-term investor unintentionally, and that is a position in which you never want to put yourself.

Ask how well you trust yourself to execute your trading plan. You want to judge your effectiveness based on how well you get in and out of the market when your method gives entry and exit signals. You'll need to be decisive, not hesitant, know in your heart that your method is well tested and that your risk is low compared to your likely reward. In other words, you must be fully prepared before you go into the heat of battle during a trading day. You need to know where you will enter and where you will exit if you are a discretionary trader. Or you need to know what system you are following and be prepared to enter and exit as the system dictates. This keeps you disciplined and focused on following a process that can generate favorable results over time.

2. Fear of Missing Out

Every trend always has its doubters, but I often notice that many skeptics of a trend will slowly become converts due to the fear of missing out on profits or the pain of losses in betting against that trend. The fear of missing out can also be characterized as greed of a sorts, for an investor is not acting based on some desire to own the security - other than the fact that it is going up without him on board. This fear is often fueled during runaway booms like the technology bubble of the late-1990s, as investors heard their friends talking about newfound riches. The fear of missing out came into play for those who wanted to experience the same type of euphoria.

When you think about it, this is a very dangerous situation, as at this stage investors tend essentially to say, "Get me in at any price - I must participate in this hot trend!? The effect of the fear of missing out is a blindness to any potential downside risk, as it seems clear to the investor that there can only be gains ahead from such a "promising" and "obviously beneficial" trend. But there's nothing obvious about it.

We remember the stories of the Internet and how it would revolutionize the way business was done. While the Internet has indeed had a significant impact on our lives, the hype and frenzy for these stocks ramped up supply of every possible technology stock that could be brought public and created a situation where the incredibly high expectations could not possibly be met in reality. It is expectation gaps like this that often create serious risks for those who have piled into a trend late, once it has been widely broadcast in the media to all investors.

3. Fear of Letting a Profit Turn into a Loss

I get many more questions from subscribers asking if it is time to take a profit than I do subscribers asking when they should take their loss. This represents the fact that most traders do the opposite of the "let profits run, cut losses short" motto: they instead like to take quick profits while letting losers get out of control. Why would a trader do this? Too many traders tend to equate their net worth with their self-worth. They want to lock in a quick profit to guarantee that they feel like a winner.

How should you take profits? Should you utilize a fixed target profit objective, or should you only trail your stop on a winning trade until the trend breaks?

Those who can accept more risk should consider trailing a stop on their trending position, while more conservative traders may be more comfortable taking profits at their target objective. There is another alternative as well, which is to merge the two concepts by taking some profits off the table while seeking to ride the trend with a trailing stop on the remaining portion of the position.

When I trade options, I usually recommend taking half of the position off at a double or more, and then following the half position still open with a trailing stop. This allows you to have the opportunity to ride my best trading ideas further, as these are the trades where I am mostly likely to continue being right. Yet, I am also able to get the initial capital at risk back in my pocket, which frees me from worrying about letting a profit turn into a loss; I am guaranteed a breakeven even if the other half position were to go to nothing overnight. My general rule for the remaining half position is to exit if it reaches my trailing stop of half its maximum profit on an end-of-day closing basis, or scale out of the remaining half position every time it doubles again.

I'm also a big fan of moving your stop up to breakeven relatively quickly once the position starts to move in your favor, by about five percent on a stock or by roughly 25 percent on the option. It is also critical to recognize the impact of time spent waiting for a position to move. If you are not losing but not yet winning after several trading days, there are likely better opportunities elsewhere. This is known as a "time stop," and it will get your capital out of non-performers and free it up for fresher trading ideas.

4. Fear of Not Being Right

Too many traders care too much about being proven right in their analysis on each trade, as opposed to looking at trading as a probability game in which they will be both right and wrong on individual trades. In other words, their overall method will create positive results.

The desire to focus on being right instead of making money is a function of the individual's ego, and to be successful you must trade without ego at all costs. Ego leads to equating the trader's net worth with his self-worth, which results in the desire to take winners too quickly and sit on losers in often-misguided hopes of exiting at a breakeven.

Trading results are often a mirror for where you are in your life. If you feel any sort of conflict internally with making money or feel the need to be perfect in everything you do, you will experience cognitive dissonance as you trade. This means that your brain will be insisting that you cannot exit a trade at a loss because it ruins your self-image of perfection. Or if you grew up and feel guilty about having money, your mind and ego will find a way to give up gains and take losses in the markets. The ego's need to protect its version of the self must be let go in order to rid ourselves of the potential for self-sabotage.

If you have a perfectionist mentality when trading, you are really setting yourself up for failure, because it is a given that you will experience losses along the way in trading. Again, you have to think of trading as a probability game. You can't be a perfectionist and expect to be a great trader. If you cannot take a loss when it is small because of the need to be perfect, then the loss will often times grow to a much larger loss, causing further pain for the perfectionist. The objective should be excellence in trading, not perfection.

In addition, you should strive for excellence over a sustained period, as opposed to judging that each trade must be excellent. The great traders make mistakes too, but they are able to keep the impact of those mistakes small, while really riding their best ideas fully.

For the trader who is dealing with excessive ego challenges (yet, who wants to admit it?), this is one of the strongest arguments for mechanical systems, as you grade yourself not on whether your trade analysis was right or wrong. Instead you judge yourself based on how effectively you executed your system's entry and exit signals. This is much easier for those traders who want to leave their egos at the door when they start to trade. Additionally, because we are raised in a highly competitive culture, the perception of a contest or competition will also bring out your ego's desire to win and beat others.

You will be better off seeing trading as a series of opportunities that will become apparent to you, and your task is to create a plan that finds opportunities with potential rewards that are several times greater than the risks you incur.

Be sure you are writing down your reasons for entering each trade, as the ego will play tricks and come up with new reasons to hang on to losing positions once the original reasons have evaporated. One of our survival mechanisms is remembering the good and omitting the bad in our minds, but this is dangerous in trading. You must acknowledge the risk and use a stop on every trade to admit when the analysis is no longer timely. This helps prevent undesirable situations where you get stuck in a position because you did not adhere to your original stop. This is a bad use of capital being tied up in an under-performing position, when there are likely to be many better opportunities elsewhere. Trading without stops is an ego-driven approach that hopes to avoid accountability for a losing trading idea. This is an unacceptable behavior to the successful trader, who knows he must limit risk with stops to stay in the game for the next trading opportunity.

In summary, your trading plan must account for the emotions you will be prone to experience, particularly those related to managing fear. As a trade, you must move from a fearful mindset to mental state of confidence. You have to believe in your ability as well as the effectiveness of your plan to take profits that are larger than the manageable losses. This builds the confidence of knowing that you are on the right track. It also makes it easier to continue to execute new trades after a string of losing positions. Psychologically, that's the critical point where many individuals will pull the plug, because they are too reactive to emotions as opposed to the longer-term mechanics of their plan. If you're not sure if you can make this leap, know that you can if you start small.

Too many investors have an "all-or-none" mentality. They're either going to get rich quick or blow out trying. You want to take the opposite mentality - one that signals that you are in this for the longer haul. This gives you "permission" to slowly get comfortable and to keep refining your plan as you go. As you focus on execution while managing fear, you realize that giving up is the only way you can truly lose. You will win as you conquer the four major fears, to gain confidence in your trading method and, ultimately, you will gain even more confidence in yourself."

This article by Price Headley was originally published in Stock Futures and Options Magazine

When all you have is a hammer, everything becomes a nail.  (Mental and spiritual preparation) (Mental and spiritual preparation) More here & here

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information. |

|

|

|

Post by Entendance on Sept 22, 2015 17:38:45 GMT -5

***Meeting With Triumph and Disaster: Some Lessons here |

|

|

|

Post by Entendance on Sept 30, 2015 16:40:37 GMT -5

...It seems "everyone" wants/needs/expects - some kind of rally. "...successful test of the lows...",, "...oversold, therefore, rally time...". It's like they think - (the only way they CAN think - based on their "experience") that "rally" is the only meaningful term in their vocabulary.

The recent break that turned down all meaningful trend measures, thus clearly defining a new bear market (in the classic sense) appears to have convinced the majority of "players" that it was just a little 10% "correction" - a term that is about as stupid as suggesting that a 20% down move constitutes a "bear market". This sort of "analysis" is ridiculous and reflects the utter lack of competence/experience among the so-called financial reporters and TV "personalities". For over a year, more and more stocks entered their own "bear markets" (down 20% or more) while the headline indices (DJIA, etc.) moved slightly higher to flat. At first, only about 5% of the universe had "enjoyed" that "bear market" distinction. After the big break into September, anywhere from 30% to 50% of the entire stock universe had dropped at least 20%. The largest numbers of such declines were among small and mid cap stocks. The big caps universe wasn't quite as badly damaged DJIA and SPX, etc. only down about 10% but most of the component stocks down much more. (They aren't all NKE ) Consequently, there are some technicians suggesting the worst is over and it's time to buy again. (Of course, it's ALWAYS time to buy something. Can't let those accounts go to cash and abandon the commission game !!) However, this "thing" has only begun to percolate. The two most recent bear markets bottomed when between 85% and 95% of ALL issues were down 20% or more. In 1929-32, 1937-38, and 1973 -74, virtually 100% of all issues dropped 20% or more. In the 1929-32 market, only about a half dozen stocks resisted the market's "tidal pull" (mostly gold mining stocks which actually went up!)

Bear markets tend to require about half the length of time that was spent on the bull run. It usually takes that long for slow learners to fully recognize and embrace all the "reasons" to sell. It takes that long to fully expose the excesses of the prior bull run. In the interim, rallies come along to keep the hopes alive, but in the end, the "news-follows-the-trend" until it exhausts itself, usually by over discounting the negative case. I suspect that day is a couple of years away (unless, of course, we simply go straight down - an unlikely event)...

-an educated opinion from "Mr. Skin"... What is Carry Trade? More here

|

|

|

|

Post by Entendance on Oct 6, 2015 11:49:07 GMT -5

"Having a bull mindset in a bear market is not profitable. Bear markets have no long term support, they can make lower lows for a long time. Buying pullbacks is not profitable in bear markets because pullbacks turn into downtrends, and old support becomes the new resistance.

1. Buying dips stops working. Bulls end up getting trapped at higher price levels, unable to profit from rebounds because they are waiting to break even.

2.Momentum entries fail to be profitable. Rallies are usually chances for shareholders at higher prices to sell their shares and short sellers to take new, short positions.

3.Perma-bulls confuse short covering rallies for bounces off a bottom. They are dead cat bounces that will later make lower lows.

4.Perma-bulls stay long into 10% corrections and think the sell-off is over, but end up staying long through the 20% upcoming bear market.

5.The perma-bulls fail to understand that when equities are under distribution, all stocks go down regardless of the underlying business and fundamentals.

6.Stock markets go down when the majority is primarily long and the market runs out of new buyers.

7.10% corrections and 20% pullbacks into bull markets are normal; 2012 – 2015 price action is abnormal.

8.All markets can trend in two different directions; you must stay flexible. Perma-bulls only think that stocks will go higher.

9.Margin debt and leverage are great vehicles for creating bubbles, but they have their limits.

10.The central bank can create bubbles, but they can’t sustain them forever." -Steve

A Liquidity Crisis Hit The Banking System In September More here

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

Fred & EntendanceInvestors Beach goal is simple: to help you achieve personal liberty and financial prosperity no matter what happens.

|

|

|

|

Post by Entendance on Oct 20, 2015 17:04:31 GMT -5

Tyler Yell: Know When the Water is Safe to Enter & When It’s Not

A correction can be identified as any disruption in the trend that is not a reversal. If an uptrend does not reverse and become followed by lower highs and lower lows, we’re looking at a correction and not a reversal. Often the first break of a prior extreme or fractal can show you the water is at least no longer safe as a trader and it’s best to let someone else test the waters before you jump in a trade.

To carry the analogy further, a correction is clean when it follows any of the common pre-trend or trend correction patterns. A reversal is clean when after a bottom or high is made, a series of higher-highs or lower-lows begin to develop showing that a new force is taking over. A correction is messy and not worth trading when levels break higher and lower and no clear direction is taking shape. This can be a sign for traders with a limited sense of capital to stay away from the trade. From an emotional standpoint, it’s exciting to think about finding and catching the one big turn...of course, emotions and money rarely mix well. Many traders could fare better by focusing on clean set-ups. Clean set-ups mean that you’ll likely miss the first move of the new trend but you’ll know that the balance has shifted and you can at least be early on the new trend and ride it until it reverses. Learn how to manage your trade so the trade doesn’t manage you.

Larry Swedroe: Battles are won in the preparatory stage, not on the battlefield (or in the middle of a bear market). On the battlefield, stomachs often take over the decision-making. And I’ve yet to meet a stomach that makes good decisions...  If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

...The key to success is to stay disciplined. And the only way you’re likely to do that is to make sure your asset allocation doesn’t assume more risk than you have the ability, willingness or need to take.

Otherwise, when the risks do show up, your stomach will reach its “GMO” limit—the point at which it screams: “Get me out!” Not many investors can resist that siren’s cry. Smart investors know that bear markets are inevitable, and that no one has shown the ability to successfully time them in an effort to avoid their occurrence.

|

|

|

|

Post by Entendance on Dec 20, 2015 0:49:29 GMT -5

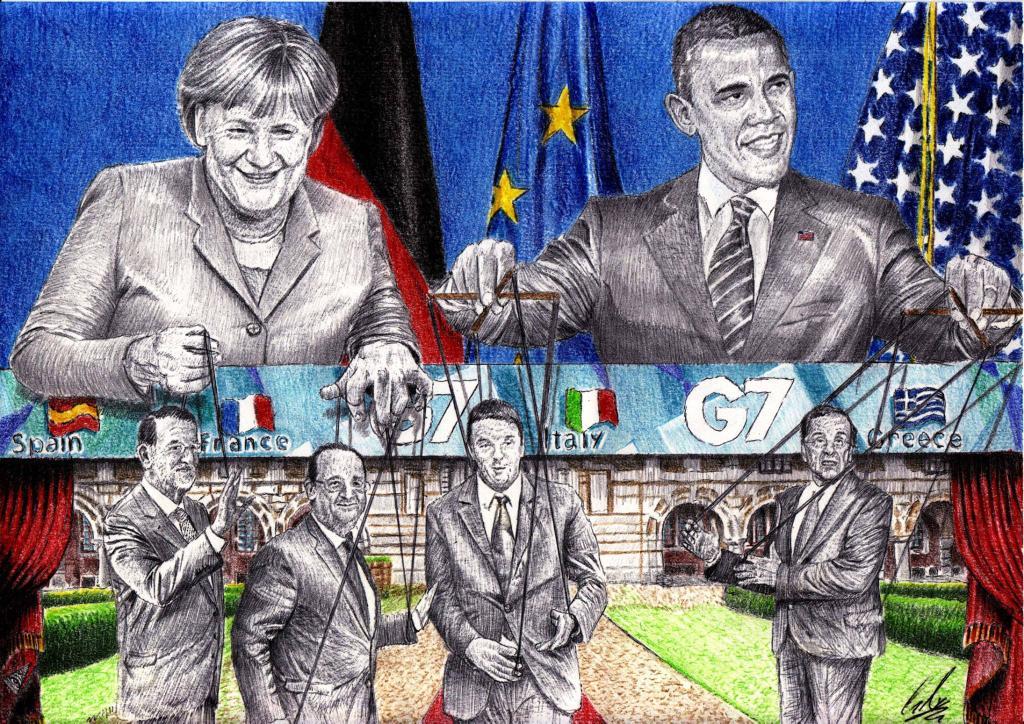

January 22, 2016 Greece Falls Prey to ECB Diktats and Blackmail

“The Soviet Union was governed by 15 unelected people, who appointed each other and who were not accountable to anyone. The European Union is governed by two dozen people, who appoint each other and are not accountable to anyone.” The EU is a lesson in deceit...Is the EU the new USSR?

Crac banche. L'economista Lars Feld: l'Italia dovrà colpire i risparmi privati Ci siamo! Feld sull'esproprio Italian bank rescue leaves bitter families marooned

ORMAI E’ DECISO: ITALIANI, DOVETE PERDERE I VOSTRI SOLDI, LO VOGLIONO LA UE E LA GERMANIA.

“This is a Coup” – The Story of How Greece Lost Democracy

August 23, 2018: All you need to know about Greece The riot dog: THE STORY OF LOUKANIKOS

Germany made €100bn profit on Greek crisis – study Germany made €100bn profit on Greek crisis – study

Troika come Erode: la mortalità infantile cresce del 43% in Grecia

An historic betrayal has consumed Greece. Greek Parliament Approves 86 Billion Euro Bailout Package. Greeks are officially confirmed as slaves to the banksters.

After 70 years in the making Germany finally arrives at an expansionist blueprint that works.

They failed with fire arms, they failed with tanks, now they are absorbing Europe with their huge current account surplus.

The Greek Revolution starts now.

John Wight: "...Like spectators at the Roman Coliseum, the world has been bearing witness to the economic slaughter of a nation.

It is a spectacle none who witnessed it should ever forget. It is a crime that must never be forgotten."

Tsipras turned out to be a sellout  Tsipras Should Resign An historic betrayal has consumed Greece. Tsipras Should Resign An historic betrayal has consumed Greece. Tsipras addio So long Tsipras

July 13, 2015 Embarrassing total capitulation by Tsipras Fatal Flaws

<Chiunque non si opponga all'euro è un utile idiota del capitale. Sono cinque anni che ve lo dico. Adornerò di sali azotati il luogo del vostro ultimo riposo, perché voi siete i nemici del mio paese, della mia gente, della mia famiglia, dei miei studenti, della mia persona. La legittima difesa è riconosciuta dall'ordinamento, e voi perderete, oh, se perderete! E non ci sarà nessuna pietà, perché avete distrutto tante vite e tanto benessere non per vostro tornaconto, ma per la vostra immensa ottusità, per la vostra incapacità di elaborare un pensiero autonomo, per aver mangiato il fiore di loto dell'appartenenza.>

Meanwhile...in Spain...

Jesuits, not the Rothschilds, Openly Display Complete Control of European Finance

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

World Market at a glance Now

La tourmente greque

|

|

|

|

Post by Entendance on Feb 7, 2016 9:17:35 GMT -5

How To Trade With Macro Winds To Your Back

What does it mean to have the wind to your back as a trader?

Many would respond in terms of trend behavior. You have the wind at your back, many believe, if you are trading in the direction of the trend.

A different way of viewing wind at your back is aligning yourself with the behavior of the largest market participants. If you can see large institutions lining up on the buy or sell side, you have an opportunity to be nimble and participate. Rarely are large directional participants trading for a matter of ticks. Rather, they are trading on the basis of macroeconomic themes that provide the fuel for market trends.

So how can you identify macro themes in the making and place the wind of portfolio managers at your back? Three ways stand out:

1) Watch intermarket correlations - When money managers are placing bets on macro themes, those themes find multiple expressions across currency, equity, and rates markets. They also find expressions across global markets. When you see correlations rise among assets, there's a good likelihood that the correlations are part of important macro themes. A good example during 2016 to date has been the high correlations among oil, stocks, and emerging market currencies.

2) Watch volume and volatility - If institutional participants are betting on a theme, you can expect volume and volatility to expand in the direction of that theme. A market with low volume is a market dominated by market makers. They do not make their living trading medium-term market themes. When large, directional participants enter a market, they contribute volume and that contributes volatility--especially when market makers stand aside to avoid getting run over by large directional flows. In the stock market, you can see where enhanced volume leads to high levels of upticking or downticking across a large group of stocks (NYSE TICK). That's a great tell for enhanced directional interest.

3) Watch relative performance among stock sectors - Many times we see macro themes reflected in the relative performance of one stock market sector versus others. For example, energy stocks for quite a while underperformed the overall market and underperformed consumer shares as part of the weak oil/deflation theme. Recently, we've seen concerns over global debt weigh on the relative performance of banking shares both within the U.S. and globally. When sectors persist in underperforming or outperforming, the chances are good that there's a macro story involved.

It's a common mistake to become tunnel visioned during times of market stress and only follow the position(s) you are trading. That blinds us to the waxing and waning of macro themes and the influence of large market participants. You may not trade the markets thematically yourself, but it helps to have those themes at your back--and certainly not in your face. -Brett Steenbarger

|

|

|

|

Post by Entendance on Feb 13, 2016 8:03:45 GMT -5

|

|

|

|

Post by Entendance on Feb 28, 2016 7:39:33 GMT -5

Fred & EntendanceInvestors Beach...because this place is for Uncolonized Minds. We speak our mind even though it may cost readership.

Fred & EntendanceInvestors Beach, Bijoutier, Outer Islands, Seychelles

***Members Only Area

|

|

|

|

Post by Entendance on Mar 11, 2016 11:03:12 GMT -5

...There is and has been no recovery no matter how much “flooding” of whatever format, just the intermittent flirtation with positive numbers interspersed between slowdowns, rough patches and even re-recession. Stimulus is just a word.

***It’s Been A Seven-Year Bull Market In Fraud, Corruption And Insanity

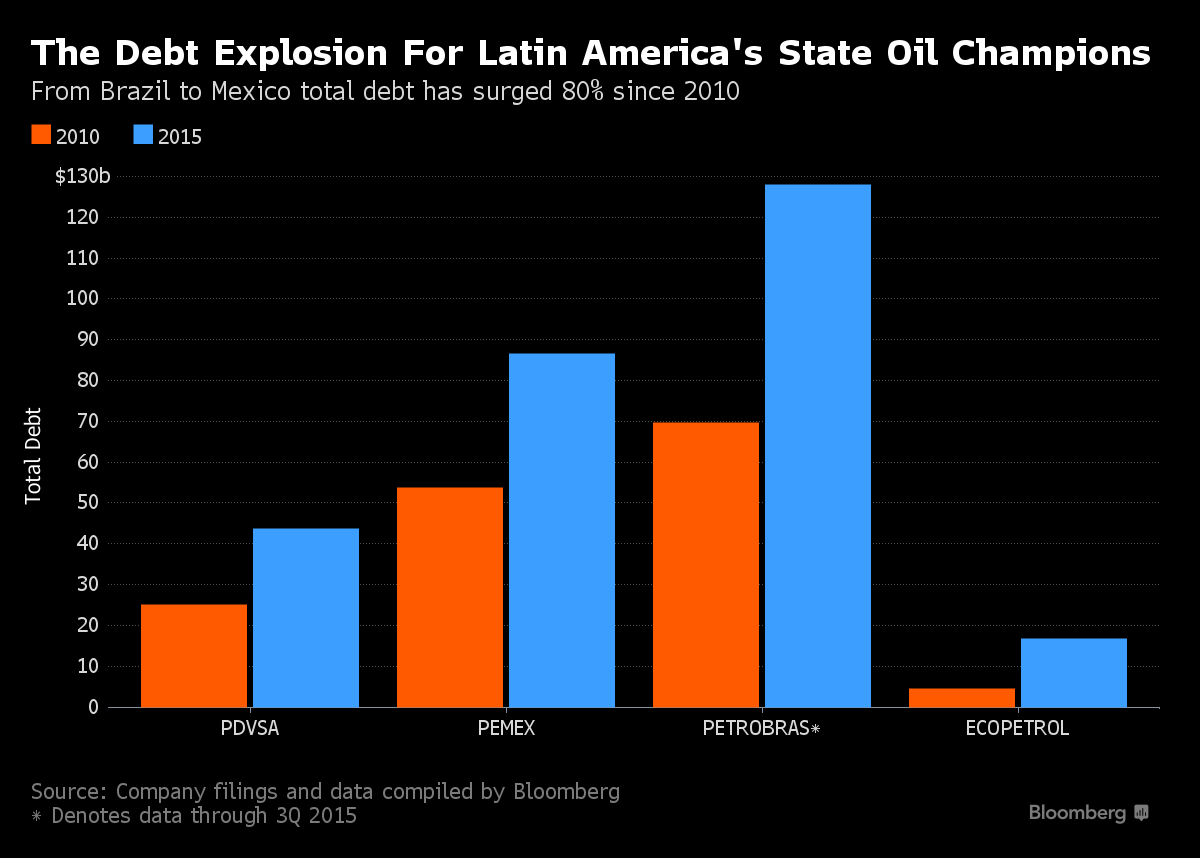

* Cheap money encourage emerging markets to double debt

* Spreads widen in high yield debt making borrowing costlier

* Defaults rise in Asia as profitability slows

Emerging market credit hangover squeezes firms, economic growth

Staggering debt levels means higher default risks

EEV UltraShort MSCI Emerging Markets

EUM ProShares Short MSCI Emerging Markets

EDZ Daily Emerging Markets Bear 3x Shares

******************

The Deflationary Spiral Life and Times During the Great Depression

The Collapse Of Italy’s Banks Threatens To Plunge The European Financial System Into Chaos More here

Fred & EntendanceInvestors Private Beach. Members Only Area ***How to safely protect your life, your liberty and your assets

"You’re never going to save everyone. There are some people that are never going to get it. It’s sad, but true.

There will always be investors that can’t help themselves or get out of their own way.

I used to think everyone could be saved if they would only learn. But changing behavior is simply too difficult for many.

In order for one group of investors to prosper, another group has to fail. It’s an unfortunate truth of the financial markets."

-Ben Carlson

Fred & EntendanceInvestors Beach

Gold and Silver will thrive as paper assets are increasingly infected by financial viruses! Fred & E. Private Beach: Become Members!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

|

|

|

|

Post by Entendance on Apr 29, 2016 17:25:28 GMT -5

Walking The Talk At Fred & EntendanceInvestors Beach

The first four months of 2016

GOLD 12/31/2015 1,060.30US$/oz 04/29/2016 1,292.76US$/oz +21.93% SILVER 12/31/2015 13.28US$/oz 04/29/2016 17.81US$/oz +34.11% MUX 12/31/2015 1.06 04/29/2016 2.60 +145.28% EXK 12/31/2015 1.42 04/29/2016 4.15 + 192.25%

|

|

|

|

Post by Entendance on May 5, 2016 9:00:12 GMT -5

|

|

|

|

Post by Entendance on Jun 9, 2016 6:44:16 GMT -5

|

|

|

|

Post by Entendance on Jun 21, 2016 16:22:55 GMT -5

|

|

|

|

Post by Entendance on Aug 9, 2016 4:55:34 GMT -5

"...A poignant point needs to be raised as my pulse races: How can global investors maintain buying SWISS FRANCS when the SNB is pursuing the greatest con since tulip bulbs, Mississippi Stock and any number of other events from the Madness of Crowds? The Swiss print currency and exchange the ever-increasing fiat paper for the assets of real corporations. Last month, the SNB–through currency market intervention–added roughly TEN BILLION to its balance sheet by exchanging Swiss francs for global stocks and bonds..."

***Taking Pulse of a Dead Market H/T Tom from Florida, vigilant in the night

Can’t say it enough: ““There is no means of avoiding a final collapse of a boom brought about by credit expansion.” ***A crisis of intervention

|

|

|

|

Post by Entendance on Aug 29, 2016 14:19:01 GMT -5

To outsiders, Wall Street is a manic, dangerous and ridiculous republic unto itself – a sort of bizarro world where nothing adds up and common sense is virtually inapplicable.

Consider the following insane things that we believe on Wall Street, that make no sense whatsoever in the real world:

1. Falling gas and home heating prices are a bad thing

2. Layoffs are great news, the more the better

3. Billionaires from Greenwich, CT can understand the customers of JC Penney, Olive Garden, K-Mart and Sears

4. A company is plagued by the fact that it holds over $100 billion in cash

5. Some companies have to earn a specific profit – to the penny – every quarter but others shouldn’t dare even think about profits

6. Wars, weather, fashion trends and elections can be reliably predicted

7. It’s reasonable for the value of a business to fluctuate by 5 to 10 percent within every eight hour period

8. It’s possible to guess the amount of people who will get or lose a job each month in a nation of 300 million

9. The person who leads a company is worth 400 times more than the average person who works there

10. A company selling 10 million cars a year is worth $50 billion, but another company selling 40,000 cars a year is worth $30 billion because its growing faster.

Away from Wall Street, no one believes in any of this stuff. It’s inconceivable. On Wall Street, these are core tenets of our collective philosophy.

No wonder everyone else thinks we’re insane. -Joshua M Brown

|

|

|

|

Post by Entendance on Sept 2, 2016 12:31:15 GMT -5

Psychological Manipulation and Economic Deception are now the Order of the day (A man has free choice to the extent that he is rational. -St. Thomas Aquinas)

It is possible if one takes the right actions to make money and remain relatively unscathed in such an environment. One cannot say the same for the masses because they are walking with their eyes wide shut. In other words, they do not see what’s happening; their heads are stuck in the sand. They are oblivious to what’s going around, and if you try to warn them, they are apt to strangle you. This situation is strikingly similar to “Plato’s allegory of the cave.”

Psychological Manipulation

It is being used ubiquitously to control the masses and their perceptions. The goal is to alter the perception; modify the perception and you change reality. You need to start positioning yourself to be in the land of neutrality when it comes to taking a stance. Neutral does not mean running and hiding in some zone. You should be able to look at the argument from both sides of the coin and agree with either side if necessary without becoming emotionally attached to the outcome. When you commit yourself to a certain position you hamper your ability to see the full picture; you have willingly reduced your range of observation by 50% or more. Take this principle to the stock markets; you should not forcefully try to find a camp you belong to. In other words being a perma-bull or a perma-bear is utterly silly for now you only have access to 50% of the data; you will block any bullish scenario if you are perma-bear and vice versa. Data is there to be used not to be blocked, and that is where the top players are getting the masses; they are forcing them to make permanent choices or take permanent positions that are detrimental to their welfare. The players doing the pushing though are not plagued with these handicaps; they easily navigate from one camp to another, never forming any attachment with any of these camps.

Economic Deception via Hot Money

Everything going forward is going to be driven by hot money. To control a beast, you need to make that beast feel helpless, once the creature feels helpless no matter how ferocious it was before, it will refuse to resist. Experiments have shown that once rats are made to feel helpless and then put into a pool of water, they give up trying to survive rather rapidly. Instead of swimming for hours and hours trying to live, they usually give up almost immediately and drown. However, these same rats that were made to feel helpless can revert to their former selves, if they are given some encouragement, before being put into the pool. Just the bare minimum of exposure in such an environment is enough to make these guys fight for their lives. Central bankers are utilising the same strategy, only this time, they are working with human test subjects and not mice; the goal here is to push the majority into a state of helplessness, and if you look around we are almost there. Nobody seems to want to resist; compare today’s resistance to that of the 50’s, 60.s, 70’s, 80’s, etc. and it appears pathetic in nature. The purpose of hammering this point in so deeply is to make you understand that hot money is not going away because the masses are not making an issue of it; they are quiet so the raid will continue. It is going to get even hotter; it is going to get so hot that we will not bother getting into the details now; you will not believe us at this point. As we get closer to these levels, we will address them in more detail. Moreover, you are right; this experiment will not end well, but even more important is that no one knows when it will end. It will only end when the masses have had enough, but what if you can control or alter their perception of what they deem to be “enough”; then the word takes on a whole new meaning.

Conclusion

Since we went off the Gold standard, the Fed’s primary function has not been to control interests rates for the benefit of the masses. Their goal has been to use interest as a weapon to trigger boom and bust cycles. The masses still don’t understand what is going on and with the passage of each day, fewer and fewer individuals know the dangers of Fiat. It took roughly 100 years for the debt to go from 0 to 1 trillion dollars, now we add that amount to the debt each year. It is insane, but the masses are silent, and who knows when they will finally decide enough is enough. So far, everyone that has attempted to place a date and time on the masses snapping out of their slumber has been proven wrong. One can assume that this experiment will continue for quite awhile and with no resistance, the Feds will continue to flood this market with money. In such an environment, one should view sharp corrections as buying opportunities, and it would be prudent to allocate a portion of one’s fund to precious metals. -Sol Palha

(A person usually has two reasons for doing something: a good reason and the real reason. -Thomas Carlyle)

|

|

|

|

Post by Entendance on Sept 6, 2016 4:42:21 GMT -5

"...The divide between the haves and the have-nots is growing exponentially. If the 99 percent can’t contribute to the economy because of the dire financial situations they find themselves in, then you see gross domestic product growth reports of 1 percent, such as we have seen lately.

Don’t be fooled into thinking that the stock market is any indication of the health of an economy.

It’s a rigged market to placate the masses — most of whom do not have much skin in the game — and convince them that all is well, when in fact the opposite is true.

We are entering the problem months for the markets. September and October are historically times of greater market volatility to the downside.

There was a time when this was very explainable. In the last two centuries, huge amounts of cash would move from the Eastern money markets over the mid- to late summer to the Midwest and Western states to buy crops, leaving the equity and bond markets in a liquidity squeeze come late summer/early fall.

Now it’s down to the returning traders from the Hamptons or the Cape realizing that their trading book looks a little sick. Their bonus will depend on them making the right moves in the next three months, and they need to sell those dog stocks soon..." -Michael Gray

|

|

|

|

Post by Entendance on Sept 21, 2016 8:20:54 GMT -5

"...The narrative is already being set. International financiers, central bankers and media personalities are consistently mentioning the great danger of the “populists.” They say the deplorables are going to destroy the world. This is nonsense, of course. The world has already been destroyed by the banking elite and their cronies, but, the average person doesn’t really grasp this. We have to educate them quickly because we are about to be targeted as scapegoats for one of the greatest engineered fiscal catastrophes of all time..."

The “Deplorables” - Who We Are And What We Want

|

|