|

|

Post by Entendance on Apr 21, 2016 16:45:43 GMT -5

No room for anti-Americanism at Fred & Entendance Beach

Bank fines the last 20 years:

Bank of America: $58.4B

JPMorgan: $29.7B

Citigroup: $17.2B

Wells Fargo: $14.7B

Deutsche Bank: $12.5B

Goldman Sachs: $9.6B HSBC $5.7B

ING $1.5B while Danske Bank is fined in the range of $8B over a $220B money laundering scandal, among others.

When reached out for a comment, each bank had the same two words to say: "Worth it".

I have discovered the secret of the philosopher's stone; it is to make gold out of paper. -John Law

This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many...

"Central" Banking is the only profession where you get to spend trillions of dollars & face no personal consequences for lack of results.

"Central" bank(st)ers are not the solution. They have become the problem.

And the complete lack of accountability is the disease.

Think of the press as a great keyboard on which the government can play. -Joseph Goebbels

The entrenchment of a callous and corrupt political and economic oligarchy? STARVE THE CONSUMERISM BEAST. (No more debt slavery, no more banksters)

U.S. taxpayers have already injected $187.5 billion into Fannie Mae and Freddie Mac, two companies that prior to the 2008 financial crash traded on the New York Stock Exchange, had shareholders and their own Board of Directors while also receiving an implicit taxpayer guarantee on their debt. The U.S. government put the pair into conservatorship on September 6, 2008. The public has been led to believe that the $187.5 billion bailout of the pair was the full extent of the taxpayers’ tab. But in an astonishing acknowledgement on February 25 of this year, the Government Accountability Office, the nonpartisan investigative arm of Congress, issued an audit report of the U.S. government’s finances, revealing that the government’s “remaining contractual commitment to the GSEs, if needed, is $258.1 billion.”

This suggests that somehow, without the American public’s awareness, the U.S. government is on the hook to two failed companies for $445.6 billion dollars. And that may be just the tip of the iceberg of this story...because...

***U.S. Government Is Now a Major Counterparty to Wall Street Derivatives

Every gram of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system. What you have done is removed those “dollars” from the hands of government. They now have fewer “dollars” to use to purchase weapons of war, surveillance technology and the other weapons they use against us. Today would be a good day to remove a few “dollars” from their hands and place another weapon in your back pocket. Gold and silver are free from tyranny, accepted around the world in good faith and provides a piece of insurance from, what appears to be, a system in change.

Stupidity Chapter XIII: Never underestimate the propensity for central bank(ster)s stupidity

...Moneyness is a market perception. The epicenter of danger lies in the virtual insatiable demand for “money.” This leaves it prone to over-issuance. There is a powerful proclivity for government intervention, manipulation and inflation. The perception of moneyness is, in the end in a world of fiat, self-destructive...

|

|

|

|

Post by Entendance on Apr 28, 2016 3:51:06 GMT -5

"...It’s not really country-against-country, such as the powers-that-be pretend; it’s the aristocracy against the public, everywhere. Sectarianism, jihadists, bigotries of all types, are among the main means by which aristocracies become enabled to control the public and turn them into cheap cannon-fodder to achieve their conquests. It’s an ancient technique, and commonly called “Divide and rule.” One public then hates another public. Enslaving the public mentally, by such lies and myths, is the model that every aristocracy has found to be most fruitful, the cheapest way for conquests to be achieved. The cannons might not be cheap (the aristocracy sell those to the taxpayers, the publics, of every country), but the fodder are: the public are a real bargain — they don’t just pay for the weapons, they use them, against some other public." NATO causes refugees, then uses them as excuse for more invasions

Paul Craig Roberts here: ...If Killary Clinton makes it to the White House, we could get the neocon's war.

The neocons have flocked to the support of Killary. She is their person. Watch the feminized women of America put Killary in office. Keep in mind that Congress gave its power to start wars to the president...

More about the man here

Fred & Entendance Beach: The stunning hypocrisy of European politicians & banksters

Fred & Entendance Beach: The Fred & E. Beach Zero Credibility Corner

Fred & Entendance Beach: Gold & Silver Fred & EntendanceInvestors Private Beach. Members Only Area. Fred & EntendanceInvestors Private Beach: Hot financial news that could affect you Fred & EntendanceInvestors Private Beach: How to safely protect your life your liberty and your assets

This jesuit ex-alumnus is leading people to the slaughter

|

|

|

|

Post by Entendance on May 3, 2016 15:46:13 GMT -5

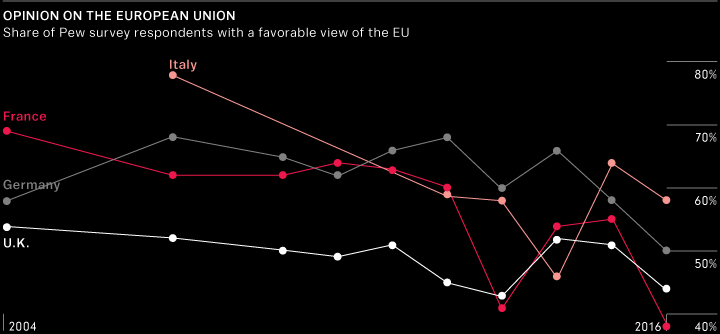

Warning: Europe is not the same as the European Union. The European Union is only an episode in Europe’s history and is doomed to failure.

...according to the unelected bureaucrats who printed all the money to begin with, people have been saving too much.

Consequently, everyone must be punished with negative interest rates. And they’re your fault.

That’s like a rapist saying, “she deserved it.” It was an appalling response, and astonishingly stupid... ***ECB blames you for negative interest rates

|

|

|

|

Post by Entendance on May 7, 2016 5:57:44 GMT -5

|

|

|

|

Post by Entendance on May 11, 2016 17:37:31 GMT -5

New: ECB Governing Council bankster member Vitas Vasiliauskas:  We Are Magic People We Are Magic People How many times have I said here that :origin()/pre14/d646/th/pre/f/2012/067/f/5/angela_merkel_vampire_by_paristechno-d4s4fhj.jpg) they r sociopaths they r sociopaths Any more doubts? I thought not. Any more doubts? I thought not.

More here More here

'Miracle' needed to save the world, because central banks can't, says BTIM's Vimal Gor

There are a number of potential triggers to a new crisis.

The first potential trigger may be equity prices The second potential trigger may be debt markets

A third possible trigger may be problems in the banking system fed by falling asset prices and non-performing loans A fourth potential trigger may be changes in liquidity conditions exacerbate stress

A fifth potential trigger will be currency volatility and the currency wars that are not, at least according to policy makers, under way A sixth potential trigger may be weakness in global economic activity A seventh potential trigger may be a loss of faith in policy makers A final trigger is political stress More here

|

|

|

|

Post by Entendance on May 16, 2016 13:55:33 GMT -5

<The Federal Reserve’s “invisible hand” in the markets is no longer “invisible.” It’s become obvious to most market participants that the Fed is working hard to keep the stock market from collapsing and the price of gold below $1300. But why? The price of gold moved up $15 overnight from the time the Asian markets opened until the Comex gold pit opened. Shortly after the Comex paper gold market trading was underway, an avalanche of paper contracts was dumped onto the Comex – both the electronic trading system and the floor. This is what it looked like

Gold’s path looks like Niagra Falls in the graph above because shortly after the Comex opened this morning because “someone” decided to dump over 55,000 contracts onto the Comex. 55k contracts translates into 5.5 million ounce of theoretical gold.

“Theoretical” because it’s only in theory that the Comex has 5.5 million ounces of gold to deliver. Currently the Comex is reporting a little over 697k ounces that are available to be delivered into the paper gold contracts that the banks print up and dump on the market. The Comex vaults are showing a little over 7 million ounces in total in the vaults. This is highly theoretical because most of the gold is accounted for the big bullion banks. I use “accounted for” loosely because there is no mechanism in place to hold the banks accountable for what they are reporting.

In other words, the amount of “physical” gold reported by the Comex is likely nothing more than a “suggestion.”  In the graph to the left there’s been a definitive trading pattern that doesn’t take Einstein’s eyes and brain to see. For the last three trading days, gold has moved higher prior to the opening of the Comex floor in NYC only to be price-smashed with a deluge of paper contracts representing little more that theoretical gold. In the graph to the left there’s been a definitive trading pattern that doesn’t take Einstein’s eyes and brain to see. For the last three trading days, gold has moved higher prior to the opening of the Comex floor in NYC only to be price-smashed with a deluge of paper contracts representing little more that theoretical gold.

But I prefer the real thing. I actually welcome these price hits because it enables me to move theoretical electronic currency from my bank account into a bona fide gold currency in a BITGOLD account. When gold moves higher, my net worth will be the beneficiary of the Fed’s market interventions. I look at it as grabbing my share of the wealth being transferred by the Fed/Government from the besotted middle class to those who know what’s going on.

Of course, the more interesting question begs to know the real reasons the Fed is compelled to make its market intervention activities so blatant. One look at the economic reports being released from non-Government sources and the condition of the U.S. Government’s balance sheet readily answers that question...> IRD

Meanwhile... Putin: The ruble is the most gold-backed currency in the world. Putin: The ruble is the most gold-backed currency in the world.

Central banks are turning into the world’s biggest hedge funds, financed by their own money printing The major central banks are no longer just the Banks of Last Resort. They are turning into Investors of First Resort. In the long run, it’s hard to imagine that having the central monetary planners buy corporate bonds and stocks with the money they print can end well. In effect, the central banks are turning into the world’s biggest hedge funds, financed by their own internal primary (money-printing) dealers and backstopped by the government--which can always borrow more from the central bank or force taxpayers to make good on this Ponzi scheme. Nevertheless, in the short run, it should be bullish for bonds and stocks. Consider the following... Central Banks: Buying Into Risk-On

...and don't forget the dumb Swiss National Bank buying AAPL at the top.

"The wise are instructed by reason, average minds by experience, the stupid by necessity and the brute by instinct."

-Marcus Tullius Cicero

|

|

|

|

Post by Entendance on May 18, 2016 17:23:40 GMT -5

My take is that the the greatest beneficiaries of financialization ie private equities, hedge funds etc and thiefs in general have a quid pro quo with gov't to keep ponzi alive... The Cayman Islands are now the third-biggest foreign owner of US government debt

US probe: Banks Sued Over Manipulation on $9 Trillion Agency-Bond Market "Bank of America Corp. and Deutsche Bank AG were among five banks sued over claims that traders conspired to manipulate the market in agency bonds, which is made up of an estimated $9 trillion of debt issued by government entities and institutions like the World Bank.

The suit, filed by the Boston Retirement System, a pension fund representing city workers, follows inquiries by the U.S. and U.K. into the market for the securities, known as supranational, sub-sovereign and agency bonds, or SSAs. The probes target alleged illegal collusion in international bank trading, after regulators reached billions of dollars in settlements over manipulation claims involving interest-rate benchmarks and currency markets.

The suit, filed Wednesday in Manhattan federal court, adds the threat of possible triple damages available under U.S. antitrust law for investors harmed by any illegal price-fixing. Also sued were Credit Agricole SA, Credit Suisse Group AG and Nomura Holdings Inc. or their units.

The SSA market is generally defined to include international development organizations, government-sponsored entities and some sovereign debt. Depending on the securities which are included, the market could range from $9 trillion to $15 trillion, according to data compiled by Bloomberg. The bonds generally have high credit ratings because many are backed by explicit or implicit guarantees..."

How Is This Not Criminal: Goldman Underwrites $2 Billion Tesla Stock Offering Hours After Upgrading Stock To A Buy

Change is coming. It must come, because the status quo is unsustainable, and has been so for some time.

How many times will our 'very serious people' with access to the public information channels continue to miss the obvious dissonance of the common reality from the official story that they tell each other about everything from the economy to politics?

At the root of this inequality, hidden as it is in the fog of fine sounding theories and economic models, is simple injustice.

The longer that change is delayed, the longer that the professional class continues to insulate itself, looking down on the broader public with smug contempt from privileged perches, blinding themselves with hypocritical arguments that deny what is happening all around them, the more disruptive that change will finally be.

And, as always, 'no one,' or at least no one who matters in their world, will have ever been able to see it coming. Because by definition no one who is an insider can ever publicly admit that the insiders have blown it completely, once again. -Jesse

|

|

|

|

Post by Entendance on May 24, 2016 2:21:56 GMT -5

Will Deutsche Bank Survive This Wave Of Trouble Or Will It Be The Next Lehman Brothers?

The “elites” don’t get it – no one trusts them anymore

The people and ideas at the top of our society cheer-led us into the financial crisis of 2008. They dismissed anyone who thought that the global economy was on an unsustainable path.

They were wrong. We experienced a near-financial apocalypse.

Yet today, those same people and ideas are still in charge, both in government and in the high-level debate. The same politicians, central bankers, academics, think tanks, and columnists are still sneering derisively at alternative views and insisting that they know best, even although history – incredibly recent history at that – demonstrates that they patently don’t. -John Stepek

The zombie “bull market” doesn’t know it’s dead Earnings growth for companies in the S&P 500 has shrunk for three quarters in a row while companies piled up on debt to keep their stock prices from falling by cannibalistizing themselves with stock buybacks. The pileup of corporate debt reached critical mass and is now a mushroom cloud. Since the close of 2014, delinquencies in commercial and industrial loans have spiked 124% to reach a point higher than they were in 2008 when Lehman Bros. crashed. We don’t know what will happen with a Brexit or whether a Grexit will raise its ugly head again or whether immigration tensions will spontaneously combust in Europe or the United State’s porous border has already allowed a terrorist invasion; but I think the frying pan will certainly be sizzling this summer to cook up the last of the market’s bully beef for the bears to feast upon.

The increasingly scarce market bulls are dead cattle walking thanks to zombie economics. -David Haggith

Despite “Bazookas”, Eurozone Composite PMI at 16-Month Low

"We must hammer rates into the ground"

Wall Street on Parade: The U.S. Government Is Quietly Paying Billions to Wall Street Banks |

|

|

|

Post by Entendance on May 25, 2016 11:47:32 GMT -5

Helen Chaitman-Big Bank Customers Destroyed in Next Economic Meltdown Attorney Helen Chaitman, who represents victims of the Bernie Madoff $65 billion fraud, contends the big banks are like mobsters. Chaitman says, “There is no question about it. They operate illegally because they can generate huge profits by doing so. They go from one crime to another, and when they get caught committing one crime, nobody gets fired. Nobody disgorges bonuses. They just take those people and put them in a new area where they haven’t yet been prosecuted.”

What will happen to the customers of the big banks in the next financial meltdown? Chaitman warns, “The customers will be destroyed, and if the banks still have enough money to buy Washington, the government will protect them just like it has since 2008.”

Join Greg Hunter as he goes One-on-One with Helen Chaitman, author of the new book “JP Madoff.”

"...the Big Bank crime syndicate remains totally in control of what we call our “markets” (for lack of a better word). Currency prices remain fixed (rigged). Equity market prices remain fixed (rigged). Bond market prices remain fixed (rigged). Are we to believe that the banksters simply 'forgot' to continue their precious metals price-fixing – even as the mainstream media was shouting the word “rally” at the top of its lungs? ..." The Big Banks remain in complete control of all markets

There will be blood. |

|

|

|

Post by Entendance on May 26, 2016 2:06:21 GMT -5

Steve Hilton, David Cameron's former director of strategy EU campaigns ‘treating people like simpletons’: voting to leave the EU would be a “decisive blow” against the “technocratic elite”. Video here

Charles Hugh Smith: The system is rigged to benefit the protected few and marginalize the unprotected many.

The problems are not just political; they are structural. As I outline in my new book, Why Our Status Quo Failed and Is Beyond Reform, there are two structural engines of disorder at the heart of the system:

1. Automation, software and the forces of globalization are disrupting jobs and wages everywhere.

2. Centralized hierarchies and the forces of financialization have extended the power of privilege globally so the few are benefiting at the expense of the many, as revealed in this chart of global wealth:  The Anger of the Unprivileged Is Rising Globally The Anger of the Unprivileged Is Rising Globally

|

|

|

|

Post by Entendance on May 31, 2016 10:19:53 GMT -5

|

|

|

|

Post by Entendance on Jun 1, 2016 5:34:02 GMT -5

"...The central planners at the Fed have systematically funneled trillions of dollars into the pockets of those who least needed and deserved it least, and in the process served to further enrich and entrench a criminal oligarchy while pounding the middle class into oblivion. What’s worse, the financial armageddon faced thus far by the 99.99% is just getting started..." The Federal Reserve Has Created an Unprecedented Disaster for Pension Funds

Damnatio ad bestias H/T Tom from Florida |

|

|

|

Post by Entendance on Jun 4, 2016 5:23:18 GMT -5

|

|

|

|

Post by Entendance on Jun 7, 2016 7:38:46 GMT -5

...the fund seeks to eliminate "derivatives risk (i.e., the use of unallocated gold, gold certificates, exchange-traded products, derivatives, financial instruments, or any product that represents encumbered gold)," as well as "'empty vault risk' or gold bullion lending risk (i.e., the practice of the gold custodian lending, pledging, hypothecating, re-hypothecating, or otherwise encumbering any of the investors' underlying gold bullion)."

<...Imagine -- a bank warning against the shady practices in the gold market of other banks. While that's something else that will never make the mainstream financial news organizations, at least the word is getting around anyway...> Bank of Montreal warns against other banks in gold business H/T Tom from Florida

|

|

|

|

Post by Entendance on Jun 10, 2016 7:38:23 GMT -5

UPDATE: It’s past time the EU breaks up. It’s time to end these vile institutions that are designed to enslave humanity. End the UN. End the IMF/Federal Reserve central banking oligarchy. And while we’re at it, round up all the Bilderberg attendees and put them all in prison. Here’s a good message I came across last night that aligns with my views:

Millions of Taxpayers worked for a lifetime, earning and saving for retirement, only to have it stolen in 2008 by criminals on Wall Street. This money was not lost or destroyed. It was stolen. By deception, lies of omission, and outright lies, illegal collusion, insider trading pump & dumps, and 101 other means not yet revealed, the life savings of millions of Taxpayers was stolen. These are not baseless accusations. The testimony of Alayne Fleischmann is sufficient to convict JP Morgan of criminal behavior that was commonly practiced by its peers. Overall, trillions of Dollars were stolen from millions of Taxpayers.

The injured parties demand full restitution, since this savings is their sole means of survival. Given the unreasonable disparity in wealth between those who control and directed the criminal actions, versus the victims, restitution is justified. The amount owed is due to the extent of the fraud.

Due to the fraud described above, each Taxpayer is owed at least one million Dollars. Social Security is an appropriate mechanism by which to return the stolen wealth.

Do what Iceland did. Repudiate the debt they create out of thin air. Kick the banker-aligned politicians out. Kick the bankers out or put them in prison. End their sick and immoral system of money. Make them pay back hard working Americans. They have been stealing from us for over 100 years now. Time for pay back! Stop importing millions of people who do not want to assimilate into western culture–a culture of freedom worth preserving.

Maybe Brexit will be the start of this trend!

—Ben Garrison

Brexit logic is a curious thing.

The list of names of organizations who are against Brexit are the very same names that ignite memories of housing bubbles, blown economic forecasts, and the rising income inequality woes the left rails against.

Yet, the British left sings the praises of preposterous claims made by Goldman Sachs, JP Morgan, the IMF, and David Cameron who have all blown economic call, after call, after call!

Will Anyone On the Left Stand Up for Brexit?

LS: What’s your comment on Deutsche Bank’s recent agreement in New York City to settle gold and silver rigging claims? In particular, I would be interested in your comment on the fact that the Western financial mainstream press does not comment on this.

GW: Well, the stories of rigging in the gold and silver markets are legendary. There are so many of them. Some of them are wackier than others, but if the last three or four years has taught us anything, it’s that all financial markets are rigged and I truly believe they are. I’ve been involved in financial markets for 30 years, and so if you want to tell me that they can rig Libor, one of the key rates in the entire world, but no one wants to rig the gold and silver market, I think you’re out of your mind. I’m absolutely certain that the gold and silver markets are rigged in some way, shape or form. How deep that rigging goes and the actual mechanics of it, I don’t know. But you can see all kinds of strange behaviour in the wee small hours overnight. You can see trades being done which are clearly not done by any kind of full profit organization. So I think there is definitely manipulation of the gold and silver claims. I think the Deutsche Bank agreement is just the tip of the iceberg. Part of that agreement was that they were going to share information a) about how the markets were rigged and b) who else was involved, so I fully suspect to see a lot more news on that coming out.

Now, whether it makes the mainstream media or not, I don’t know. I’m continually confused as to why they don’t report these stories because they are so interesting, but unlike the rigging of Libor or foreign exchange markets or the treasury market or any of the other rigged markets, when people rig the gold market, they are rigging a claim on a physical asset that’s been money for 6,000 years. It’s not a paper contract, and so if this becomes mainstream, if people understand what’s going on in the gold markets and they believe that some gold they believe they’ve bought is subject to rigging, again, people are going to want to get their own gold, they’re going to want it allocated, they’re going to want it in their own safety deposit box outside the system, and it really just takes a few people; the numbers are extraordinarily small for people to say, “Okay, I’m going to take my gold out of the banking system and I’m going to put it in a safety deposit box”. You don’t need too many people doing that to really let the tide go out, and as Warren Buffet is famed for saying, “We will then see who’s swimming naked”, and I suspect there’ll be quite a few people in that predicament.

THE MATTERHORN INTERVIEW H/T Tom from Florida

|

|

|

|

Post by Entendance on Jun 16, 2016 12:47:00 GMT -5

"...There is no question that mega banks and stock markets controlled by the mega banks’ financing of margin loans are throwing a Brexit tantrum in much the same way they threw taper tantrums when the U.S. Federal Reserve hinted it would be ending its previous Quantitative Easing program, i.e., buying up their piles of toxic debt..." Why Brexit Is Such a Threat to the New World Order

...no more fair markets, thanks to the magic people...

The Kuroda effect! Japan's 40-year bond is now up a staggering 44% YTD & the NIkkei is down 19%. A 63% return gap

At least there's a 50-yr Swiss guvvie out there yielding 9.8 bps

0 credibility |

|

|

|

Post by Entendance on Jun 22, 2016 13:01:36 GMT -5

Fed Uncertainty Principle Corollary Number Three: “Don’t expect the Fed to learn from past mistakes. Instead, expect the Fed to repeat them with bigger and bigger doses of exactly what created the initial problem.” Simply remove the word “Fed” in the previous sentences and replace with ECB, Bank of Japan, or any other central bank of your choice. -Mish Talk here

|

|

|

|

Post by Entendance on Jun 24, 2016 9:49:07 GMT -5

There’s nothing at all to worry about. There’s nothing at all to worry about.

As of its 2015 annual report, Deutsche Bank had a mere €32.87 trillion position in interest rate derivatives and a minuscule €6.3 trillion position in currency derivatives.

What can possibly go wrong with that? ***-Mish Talk

|

|

|

|

Post by Entendance on Jun 28, 2016 1:48:31 GMT -5

"...According to the Office of the Comptroller of the Currency (OCC), as of December 31, 2015, there was $237 trillion in notional derivatives (face amount) at the 25 largest bank holding companies in the U.S. with the vast majority of that amount held by just five bank holding companies: JPMorgan Chase, Citigroup, Goldman Sachs, Bank of America, and Morgan Stanley..." The Market Just Held a Stress Test: Morgan Stanley, Met Life and Citigroup Flunk

You cannot stop this collapse, nor can you talk it into happening with negativity either. It is going to happen because it has to happen. It has inevitability all over it. Economic structures that should never have been created in the first place are giving way in what will become total structural failure. They are giving way because of their own flawed design:

◦You cannot create mountains of enduring wealth by carving out caverns of debt beneath them.

◦You cannot create stable economies by focusing all the benefits toward the rich industrialists and hoping they will trickle down to create demand later.

◦You cannot deplete your nation’s treasure with endless wars around the world by putting the wars of budget and beguiling yourself to think that means there was no cost to your own greatness.

◦You cannot cram people from divergent cultures together by the millions without creating huge social costs that become economic costs.

◦You cannot bail out rich bankers without creating moral hazard that entices them to repeat their sins.

◦You cannot centrally manage economies in a way that benefits the periphery.

The list could be bigger. The earthquake has happened. The aftershocks will come. -Knave Dave

|

|

|

|

Post by Entendance on Jun 29, 2016 16:15:58 GMT -5

HSBC Holdings Plc and Credit Suisse Group AG are next in the ranking, according to the IMF

Deutsche Bank Poses The Greatest Risk To The Global Financial System: IMF

Italian Banks Achilles Heel of the Eurozone Financial System

June 29, 2016

For release at 4:30 p.m. EDT The Federal Reserve Board on Wednesday announced it has not objected to the capital plans of 30 bank holding companies participating in the Comprehensive Capital Analysis and Review (CCAR). The Board objected to two firms' plans. One other firm's plan was not objected to, but the firm is being required to address certain weaknesses and resubmit its plan by the end of 2016.

CCAR, in its sixth year, evaluates the capital planning processes and capital adequacy of the largest U.S.-based bank holding companies, including the firms' planned capital actions such as dividend payments and share buybacks and issuances. Strong capital levels act as a cushion to absorb losses and help ensure that banking organizations have the ability to lend to households and businesses even in times of stress.

When considering a firm's capital plan, the Federal Reserve considers both quantitative and qualitative factors. Quantitative factors include a firm's projected capital ratios under a hypothetical scenario of severe economic and financial market stress. Qualitative factors include the strength of the firm's capital planning process, which incorporate the risk management, internal controls, and governance practices that support the process. The Federal Reserve may object to a capital plan based on quantitative or qualitative concerns. If the Federal Reserve objects to a capital plan, a firm may not make any capital distribution unless expressly authorized by the Federal Reserve.

"Over the six years in which CCAR has been in place, the participating firms have strengthened their capital positions and improved their risk-management capacities," Governor Daniel K. Tarullo said. "Continued progress in both areas will further enhance the resiliency of the nation's largest banks."

The Federal Reserve did not object to the capital plans of Ally Financial, Inc.; American Express Company; BancWest Corporation; Bank of America Corporation; The Bank of New York Mellon Corporation; BB&T Corporation; BBVA Compass Bancshares, Inc.; BMO Financial Corp.; Capital One Financial Corporation; Citigroup, Inc.; Citizens Financial Group; Comerica Incorporated; Discover Financial Services; Fifth Third Bancorp; Goldman Sachs Group, Inc.; HSBC North America Holdings, Inc.; Huntington Bancshares, Inc.; JP Morgan Chase & Co.; Keycorp; M&T Bank Corporation; MUFG Americas Holdings Corporation; Northern Trust Corp.; The PNC Financial Services Group, Inc.; Regions Financial Corporation; State Street Corporation; SunTrust Banks, Inc.; TD Group US Holdings LLC; U.S. Bancorp; Wells Fargo & Company; and Zions Bancorporation. M&T Bank Corporation met minimum capital requirements on a post-stress basis after submitting an adjusted capital action.

The Federal Reserve did not object to the capital plan of Morgan Stanley, but is requiring the firm to submit a new capital plan by the end of the fourth quarter of 2016 to address certain weaknesses in its capital planning processes. The Federal Reserve objected to the capital plans of Deutsche Bank Trust Corporation and Santander Holdings USA, Inc. based on qualitative concerns. The Federal Reserve did not object to any capital plans based on quantitative grounds.

U.S. firms have substantially increased their capital since the first round of stress tests led by the Federal Reserve in 2009. The common equity capital ratio--which compares high-quality capital to risk-weighted assets--of the 33 bank holding companies in the 2016 CCAR has more than doubled from 5.5 percent in the first quarter of 2009 to 12.2 percent in the first quarter of 2016. This reflects an increase of more than $700 billion in common equity capital to a total of $1.2 trillion during the same period. Comprehensive Capital Analysis and Review 2016: Assessment Framework and Results ***(PDF)

Wasted Money: Wow. Seems banks want to be equity market saviors. Goldman, JPM, Citi, BoA and Morgan Stanley, Amex so far announce large stock buybacks... Santander Is First to Fail for Three Straight Years; Failed Fed's Exam in 2014, 2015, 2016

...Deutsche Bank's troubles seem to carry on and on...

Deutsche Bank and Santander US Units Fail Fed Stress, Morgan Stanley passes conditionally, must resubmit...

Today, at 4:30 p.m., the Federal Reserve is scheduled to release the second leg of its annual stress tests of 33 banks holding $50 billion or more in total consolidated assets.

"...In addition to the regular stress tests, eight large banks with significant trading and/or clearing operations are required to show losses if a major counterparty defaulted. Those banks are: Bank of America, Citigroup, Bank of New York Mellon, Goldman Sachs, JPMorgan Chase, Morgan Stanley, State Street Corp. and Wells Fargo.

In the data released last Thursday, the Fed showed a total loss of $52.6 billion at all eight banks combined on derivatives, securities lending, and repurchase agreement activities should a major counterparty default. Wall Street veterans are highly skeptical that $52.6 billion captures the reality of the problem when those same banks are holding hundreds of trillions of dollars in notional amounts of derivatives and the tally has grown since the epic crash of 2008.

It’s tough to believe that $52.6 billion would cover the tab because at the big insurer AIG, which received a $185 billion taxpayer bailout in the crash, over half of that amount went out the back door as a stealth bailout of the big banks. A total of $93.2 billion was paid by AIG to Wall Street and foreign banks for their derivative bets and securities loan transactions.

Since the size of the derivative exposure has grown and become more interconnected, why would the losses be expected to diminish in the next crash?..."

***Big Banks May Get a Jolt When Fed Releases Final Results of Stress Tests Today

|

|

|

|

Post by Entendance on Jun 30, 2016 17:31:40 GMT -5

"Voters are angry. Donald Trump, Marine Le Pen, Nigel Farage, UKIP, and the AfD party in Germany have all been accused of stirring up anger and hatred.

But anger is not the problem. None of those individuals or political parties are the problem.

Protectionism and isolation culminating in the Brexit vote in the UK, and the nomination of Donald Trump in the US are not the problem.

What is the problem? Why the anger?

People Angry Because

1.Banks were bailed out and they weren’t

2.Middle class is shrinking

3.President Bush’s Bankruptcy Reform Act of 2005 made kids with student loans debt slaves for life.

4.Warmongering by the Bush and Obama administrators alike made billions for defense contractors at the expense of everyone but the contractors and their employees.

Instead of blowing up the world, making enemies in the process, and creating ISIS in the process, wouldn’t we have been better off building US infrastructure?

Social Anger

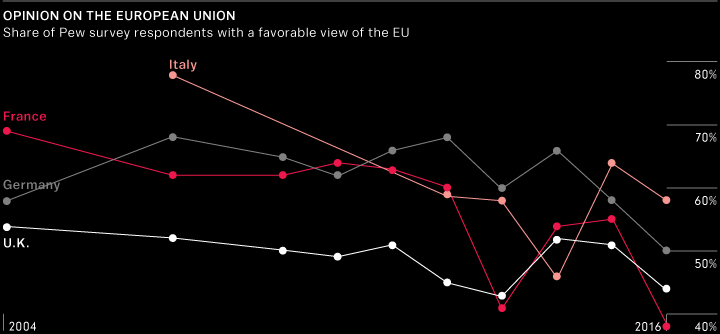

The above chart explains rising social anger perfectly. However, that chart does not portray the real problem.

Income inequality, the shrinking middle class, angry voters, and the rise of extreme political parties are all symptoms of the real problem: Central banks and their inflationary policies..." More here

Banking Sector Malaise

Instead of pondering the obvious problems, what about other things?

1.Targe2 imbalances starting to matter

2.Italian banking woes starting to matter

3.Rising chance that Eurosceptic leaders take control of Italy.

4.What if Eurozone intrabank balances are in question?

My best guess is that Deutsche Bank share prices reflect all of the above but something in the second set of reasons, or something we still do not fully understand is the primary reason behind the collapse.

|

|

|

|

Post by Entendance on Jul 7, 2016 3:03:10 GMT -5

Fri Jul 8, 2016: Goldman Sachs hires former EU chief Barroso.*** We are all Jesuits! The stunning hypocrisy of EU ruled by jesuit trained pupils

"...it is a basic right for us to own our own money rather than have it owned by the banks..." These six former Goldman Sachs bankers want to destroy your savings

"...The fear about the global banks is also driving the 10-year U.S. Treasury note to all-time record lows as a safe haven play. As of early this morning, it’s trading to yield 1.35 percent after hitting a new low yesterday. Treasury yields during the Great Depression were significantly higher than today, which should warrant a serious dialogue on what the Federal Reserve’s experiments in quantitative easing and reinvestment of principal on a $4.5 trillion Fed balance sheet has done to monetary policy and the safety and soundness of the handful of behemoth banks that constitute the core of the U.S. financial system..." Get Ready for JPMorgan and Goldman Sachs to Get Yanked from the Dow

Jesse Felder: Long Bonds Enter The Blowoff Stage

|

|

|

|

Post by Entendance on Jul 9, 2016 10:48:24 GMT -5

It’s been almost 10 years in the making, but the fate of one of Europe’s most important financial institutions appears to be sealed.

After a hard-hitting sequence of scandals, poor decisions, and unfortunate events, Frankfurt-based Deutsche Bank shares are now down -48% on the year to $12.60, which is a record-setting low.

Even more stunning is the long-term view of the German institution’s downward spiral.

With a modest $15.8 billion in market capitalization, shares of the 147-year-old company now trade for a paltry 8% of its peak price in May 2007.

The Beginning of the End

If the deaths of Lehman Brothers and Bear Stearns were quick and painless, the coming demise of Deutsche Bank has been long, drawn out, and painful.

In recent times, Deutsche Bank’s investment banking division has been among the largest in the world, comparable in size to Goldman Sachs, JP Morgan, Bank of America, and Citigroup. However, unlike those other names, Deutsche Bank has been walking wounded since the Financial Crisis, and the German bank has never been able to fully recover.

It’s ironic, because in 2009, the company’s CEO Josef Ackermann boldly proclaimed that Deutsche Bank had plenty of capital, and that it was weathering the crisis better than its competitors.

It turned out, however, that the bank was actually hiding $12 billion in losses to avoid a government bailout. Meanwhile, much of the money the bank did make during this turbulent time in the markets stemmed from the manipulation of Libor rates. Those “wins” were short-lived, since the eventual fine to end the Libor probe would be a record-setting $2.5 billion.

The bank finally had to admit that it actually needed more capital.

In 2013, it raised €3 billion with a rights issue, claiming that no additional funds would be needed. Then in 2014 the bank head-scratchingly proceeded to raise €1.5 billion, and after that, another €8 billion.

A Series of Unfortunate Events

In recent years, Deutsche Bank has desperately been trying to reinvent itself.

Having gone through multiple CEOs since the Financial Crisis, the latest attempt at reinvention involves a massive overhaul of operations and staff announced by co-CEO John Cryan in October 2015. The bank is now in the process of cutting 9,000 employees and ceasing operations in 10 countries. This is where our timeline of Deutsche Bank’s most recent woes begins – and the last six months, in particular, have been fast and furious.

Deutsche Bank started the year by announcing a record-setting loss in 2015 of €6.8 billion.

Cryan went on an immediate PR binge, proclaiming that the bank was “rock solid”. German Finance Minister Wolfgang Schäuble even went out of his way to say he had “no concerns” about Deutsche Bank.

Translation: things are in full-on crisis mode.

In the following weeks, here’s what happened:

•May 16, 2016: Berenberg Bank warns that DB’s woes may be “insurmountable”, noting that DB is more than 40x levered.

•June 2, 2016: Two ex-DB employees are charged in ongoing U.S. Libor probe for rigging interest rates. Meanwhile, the UK’s Financial Conduct Authority says there are at least 29 DB employees involved in the scandal.

•June 23, 2016: Brexit decision hits DB hard. The bank is the largest European bank in London and receives 19% of its revenues from the UK.

•June 29, 2016: IMF issues statement that “DB appears to be the most important net contributor to systematic risks”.

•June 30, 2016: Federal Reserve announces that DB fails Fed stress test in US, due to “poor risk management and financial planning”.

Doesn’t sound “rock solid”, does it?

Now the real question: what happens to Deutsche Bank’s derivative book, which has a notional value of €52 trillion, if the bank is insolvent?

Meanwhile...EU-jesuit hypocrisy knows no bounds

|

|

|

|

Post by Entendance on Jul 11, 2016 7:12:46 GMT -5

German Deutsche Bank faced threat of bankruptcy - ANALYSIS |

|

|

|

Post by Entendance on Jul 13, 2016 18:52:34 GMT -5

"...Here’s the bottom line: the banking crisis of 2008 never fully healed.

It just got shuffled under the carpet while the public was fed a phony narrative that everything is fantastic.

This turned out to be a gigantic farce; many of the world’s banking systems are just as risky as they were back in 2008.

Do yourself a favor: don’t keep 100% of your savings trapped in a risky banking system.

What’s the point? They’re only paying you 0.1% anyhow. Why take on so much risk?

If you have savings of even more than $10,000 (and definitely if you’re in the six to seven figure range), move some funds to a stronger, better capitalized banking system abroad.

And definitely consider owning precious metals, plus holding at least a month’s worth of expenses in physical cash in a safe at your home.

Given how low interest rates are, you won’t be any worse off. But should Bancopalypse 2.0 be upon us, cash and gold could end up being a phenomenal insurance policy."

More at How to safely protect your life your liberty and your assets Fred & EntendanceInvestors Private Beach. Members Only Area.

|

|

|

|

Post by Entendance on Jul 15, 2016 4:36:23 GMT -5

|

|

|

|

Post by Entendance on Jul 18, 2016 11:55:15 GMT -5

Hang the central banksters

“The longer-term returns of the fund -- the three-, five-, 10-, 15- and 20-year total returns of the fund -- are now below the assumed rate of 7.5 percent for the fund,” Eliopoulos said. “That’s a significant policy issue for us."

Calpers must average at least 7.5 percent a year to match its assumed rate of return or turn to taxpayers to make up the difference...

Calpers Earned 0.6% as Long-Term Returns Fall Below Target H/T Tom from Florida

|

|

|

|

Post by Entendance on Aug 2, 2016 10:41:42 GMT -5

• Inmates leaving prison were required to get Chase debit cards

• Lawsuit claimed the bank swamped ex-inmates with steep fees

JPMorgan Chase & Co.’s contract to provide debit cards to inmates released from federal prison is backfiring after the bank agreed to settle a class-action lawsuit filed by inmates who said they were charged exorbitant fees to access their money.

JPMorgan agreed to pay a total of $446,822 to thousands of former inmates to reimburse them for fees they were charged, according to a filing on Monday in federal court in Philadelphia. The bank also agreed to pay as much as $250,000 in plaintiffs’ attorneys’ fees and costs, the filing said.

The bank charged exorbitant fees that are inconsistent with the fees they charge other customers, former inmate Jesse Krimes, the lead plaintiff in the case, said in the complaint. The fees included inactivity charges, a $10 toll for withdrawing money from a bank-teller window and $2 for non-network ATM transactions, according to the suit.

The complaint, filed in September 2015, said inmates released from all U.S. federal prisons since at least 2008 were required to get Chase debit cards to receive the balance in their inmate account, under the bank’s no-bid contract with the Bureau of Prisons. The inmates weren’t allowed to review or approve the terms and conditions, the plaintiffs’ group said. The group called JPMorgan’s contract a fraudulent scheme "to exploit one of the most vulnerable groups imaginable -- releasees from federal corrections facilities..." ***JPMorgan Pays Prison Inmates Who Couldn’t Get Out of Jail Free

no wonder................American financial lock down next?

Warren Buffett says Jamie Dimon best person to lead U.S. Treasury Department H/T Tom from Florida

Meanwhile...Banksters stress tests are meant to be useless. Pure lipstick. None so dumb here at the beach

|

|

|

|

Post by Entendance on Aug 11, 2016 17:19:26 GMT -5

|

|

|

|

Post by Entendance on Aug 20, 2016 3:10:52 GMT -5

The Fed focus is always on their owners.

The 2016 best own goal is here

The Fed has not only failed to fix what's broken in the U.S. economy--it has actively made those problems worse.

***What the Fed Hasn't Fixed (and Actually Made Worse)

Since the Wall Street crash in 2008 crippled the U.S. economy, Congress has played the role of a spectator at a big league baseball game – munching on popcorn and licking its greasy fingers soiled with corporate campaign loot – as the real players on the field, the Federal Reserve, controlled the action...

The Fed Has Been Winging It for Eight Years; It’s Time for Congress to Step Up

Swiss Central Bank Holds $5.3 Billion in Amazon, Apple, Google, Facebook and Microsoft Stocks Swiss Central Bank Holds $5.3 Billion in Amazon, Apple, Google, Facebook and Microsoft Stocks

There will be blood, soon.

Swiss National Bank and stocks...This is the greatest scam in history: Central Banks buying real assets with electrons

BOJ set to become top owner of 55 firms in the Nikkei 225

Central banks purchasing corporate bonds is unusual and signals how bad things are in Europe. When the Central Banks try to keep coffee producers afloat.

When the public wakes up and realizes their standard of living going down was a direct function of monetary intervention and malfeasance, the RESET will be magnificent. H/T Tom from Florida

More*** here

...Every gram of gold or silver you acquire using fiat currency effectively removes that many “dollars” from the current financial and economic system. What you have done is removed those “dollars” from the hands of governments. They now have fewer “dollars” to use to purchase weapons of war, surveillance technology and the other weapons they (the central banksters) use against us Today would be a good day to remove a few “dollars” from their hands and place another weapon in your back pocket. Gold and silver are free from tyranny, accepted around the world in good faith and provides a piece of insurance from, what appears to be, a system in change...

Gold is money. Everything else is debt.

...the video the banksters don't want you to watch is*** here

"This coming autumn, we are likely to see the beginning of the hyperinflationary phase of the sovereign debt crisis..."

Fred & EntendanceInvestors Private Beach. Members Only Area.

2016: The chickens come home to roost!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information. |

|

:origin()/pre14/d646/th/pre/f/2012/067/f/5/angela_merkel_vampire_by_paristechno-d4s4fhj.jpg) they r

they r Any more doubts? I thought not.

Any more doubts? I thought not. More

More

In the graph to the left there’s been a definitive trading pattern that doesn’t take Einstein’s eyes and brain to see. For the last three trading days, gold has moved higher prior to the opening of the Comex floor in NYC only to be price-smashed with a deluge of paper contracts representing little more that theoretical gold.

In the graph to the left there’s been a definitive trading pattern that doesn’t take Einstein’s eyes and brain to see. For the last three trading days, gold has moved higher prior to the opening of the Comex floor in NYC only to be price-smashed with a deluge of paper contracts representing little more that theoretical gold. Putin:

Putin:

There’s nothing at all to worry about.

There’s nothing at all to worry about.

Swiss Central Bank Holds $5.3 Billion in Amazon, Apple, Google, Facebook and Microsoft Stocks

Swiss Central Bank Holds $5.3 Billion in Amazon, Apple, Google, Facebook and Microsoft Stocks