|

|

Post by Entendance on Apr 27, 2016 7:22:58 GMT -5

This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many...

"Central" Banking is the only profession where you get to spend trillions of dollars & face no personal consequences for lack of results. "Central" bank(st)ers are not the solution. They have become the problem.

And the complete lack of accountability is the disease. "Central Banksters are subsidising systematically those who have least need of assistance"

|

|

|

|

Post by Entendance on Apr 29, 2016 18:01:53 GMT -5

Walking The Talk At Fred & EntendanceInvestors Beach

The first four months of 2016

GOLD

12/31/2015 1,060.30US$/oz

04/29/2016 1,292.76US$/oz

+21.93%

SILVER

12/31/2015 13.28US$/oz

04/29/2016 17.81US$/oz

+34.11%

MUX

12/31/2015 1.06

04/29/2016 2.60

+145.28%

EXK

12/31/2015 1.42

04/29/2016 4.15

+ 192.25%

|

|

|

|

Post by Entendance on May 7, 2016 18:39:49 GMT -5

...the central bank(ster)s have nurtured a very unhealthy market dependence on their words and actions. Indeed, the central banks in Japan, the US and Europe have all shown a severe dislike of falling equity prices, and so routinely trot out a series of officials to make soothing noises every time the broad indexes fall even a few percent.

What are they so afraid of?

Well, for starters, they know full well that the global economy is shaky, at best. Financial markets valuations are so high that you might say they are 'priced for perfection'.

The fear is that if these market ever get rolling to the downside, they'll fall a very long way before finally finding a true bottom. And along that path lies a bevy of failed mega-banks and ruined political careers. So, the status quo has a very strong interest in keeping the financial markets propped up for as long as possible... The systems that support us are breaking down

|

|

|

|

Post by Entendance on May 13, 2016 15:46:05 GMT -5

Brussels and Berlin would make a deal with Hitler if it suited them...EU to Work with African Despot to Keep Refugees Out

More at The stunning hypocrisy of EU ruled by jesuit trained pupils

lessico teologico: Austerità è un dio, Europa una fede, la carne dei cittadini un sacrificio

7 maggio 2016 schultz junker draghi merkel tusk phillipp lindel

più che un'udienza in vaticano,sembrava essere al parlamento eu

Joseph Stiglitz, a Nobel-prize winning economist, has said that the UK could be better off leaving the European Union if the Transatlantic Trade and Investment Partnership passes.

“I think that the strictures imposed by TTIP would be sufficiently adverse to the functioning of government that it would make me think over again about whether membership of the EU was a good idea,” Stiglitz said.

TTIP gives corporations the power to sue governments when they pass regulation that could hit that corporation's profits.

Think of the press as a great keyboard on which the government can play. -Joseph Goebbels

|

|

|

|

Post by Entendance on May 14, 2016 17:23:15 GMT -5

George Carlin was way ahead of his time.

"It's a big club, and you aren't in it"

“There’s a reason education SUCKS, and it’s the same reason that it will never, ever, ever be fixed. It’s never going to get any better, don’t look for it, be happy with what you’ve got. Because the owners of this country don’t want that. I’m talking about the REAL owners, now. The REAL owners, the BIG WEALTHY business interests that control things and make all the important decisions — forget the politicians. The politicians are put there to give you the idea that you have freedom of choice. YOU DON’T. You have no choice. You have OWNERS. They OWN YOU. They own EVERYTHING. They own all the important land, they own and control the corporations; they’ve long since bought and paid for the Senate, the Congress, the State houses, the City Halls; they’ve got the judges in their back pockets, and they own all the big media companies so they control just about all the news and information you get to hear.

They gotcha by the BALLS. They spend billions of dollars every year lobbying — lobbying to get what they want. Well, we know what they want — they want MORE for themselves and less for everybody else. But I’ll tell you what they don’t want. They DON’T want a population of citizens capable of critical thinking. They don’t want well-informed, well-educated people capable of critical thinking. They’re not interested in that, that doesn’t help them. That’s against their interests. That’s right. They don’t want people who are smart enough to sit around the kitchen table and figure out how badly they’re getting FUCKED by the system that threw them overboard 30 fuckin’ years ago. They don’t want that.

You know what they want? They want OBEDIENT WORKERS. OBEDIENT WORKERS. People who are just smart enough to run the machines and do the paperwork, and just dumb enough to passively accept all these increasingly shittier jobs with the lower pay, the longer hours, the reduced benefits, the end of overtime, and the vanishing pension that disappears the minute you go to collect it. And now they’re comin’ for your SOCIAL SECURITY MONEY. They want your fuckin’ retirement money. They want it BACK. So they can give it to their criminal friends on Wall Street. And you know something? They’ll get it. They’ll get it ALL from you sooner or later — ‘cuz they OWN this fuckin’ place. It’s a big CLUB. And YOU AIN’T IN IT. You and I are NOT IN the big club. By the way, it’s the same big club they use to beat you over the head with all day long when they tell you what to believe. All day long, beating you over the in their media telling you what to believe — what to think — and what to buy. The table is tilted, folks. The game is rigged. And nobody seems to notice. Nobody seems to care. Good honest hard-workin people — white collar, blue collar — doesn’t matter what color shirt you have on. Good honest hard-workin people CONTINUE — these are people of modest means — continue to elect these RICH COCKSUCKERS who don’t GIVE a fuck about them. They don’t give a fuck about you, they don’t GIVE A FUCK ABOUT YOU. THEY DON’T CARE ABOUT YOU — AT ALL. AT ALL. AT ALL. You know? And nobody seems to notice, nobody seems to care … that’s what the owners count on, the fact that Americans will probably remain willfully ignorant of the big red, white and blue dick that’s being jammed up their assholes every day. Because the owners of this country know the truth — it’s called the American Dream … ‘cuz you have to be asleep to believe it.”

05/14/2016 ZeroHedge: The ECB Met With Goldman, Other Banks At Shanghai G-20 Meeting, Allegedly Leaking March Stimulus

What used to be a market is now just a casino where gamblers bet on what the next central bank policy statement will be. Forget about price discovery, supply and demand, charts, etc. All markets have become instruments of Deep State policy.

|

|

|

|

Post by Entendance on May 19, 2016 10:58:27 GMT -5

Banksters Banksters

Destroying our ability to discover the real cost of assets, credit and risk has not just crippled the markets--it's crippled the entire economy.

Is anyone else fed up with the Federal Reserve? To paraphrase Irving Fisher's famous quote about the stock market just before it crashed in 1929, we've reached a permanently high plateau of Fed mismanagement, Fed worship and Fed failure.

The only legitimate role for a central bank is to provide emergency liquidity in financial panics to creditworthy borrowers. Once the bad debt (credit extended to failed enterprises and uncreditworthy borrowers) is written off, the system resets as asset valuations adjust to reality--how ever unpleasant that might be for the credulous participants who believed the ever-present permanently high plateau shuck and jive.

Just to state the obvious: Fed policies are not just insane, they're destructive:

-- Bringing future sales/demand forward by lowering interest rates to zero just digs a gigantic hole in future sales/demand. Funny thing, the future eventually becomes the present, and instead of a brief recession of low demand we get an extended recession of weak demand and over-indebted households and enterprises.

-- Enabling massive systemic speculation by those closest to the Fed's money spigot is insane and destructive, as capital is no longer allocated on productive returns and risk but on the speculative gains to be reaped with the Fed's free money for financiers

-- Buying assets to artificially prop up markets completely distorts the markets' ability to price assets based on real returns and real risk.

Manipulating interest rates creates a hall of mirrors economy in which nobody can possibly discover the real price and risk of borrowing money. What would mortgage rates be without the Fed and the federal housing agencies (Freddie and Fannie Mac and the FHA) pumping trillions of dollars of federally backed mortgages into the housing market?

Nobody knows, because the mortgage market in America has been effectively taken over by the central bank and state.

The Fed's entire policy boils down to obscuring the real price of assets, credit and risk with a tsunami of debt. The Fed's "solution" to the economy's structural ills is: don't worry about risk, valuation or costs--just borrow more money for whatever you want: new houses, vehicles, stock buy-backs, Brazilian bonds, worthless college degrees, it doesn't matter: there's plenty of credit for everything.

The only thing that matters is your proximity to the Fed money spigot. If you're a poor student, you get a high-cost student loan from the Fed's flood of credit. If you're a corporation or financier, well, the sky's the limit: how many billions do you want to borrow or skim for stock buybacks or speculative carry trades?

The Fed's control of the machinery of obfuscating price and risk has made us all members of the Keynesian Cargo Cult. Now we all dance around the Fed's idols, beseeching the Fed the save us from our financial sins. We study the tea leaves of the Fed's announcements, and hold our breath lest the worst happen--gasp--the Fed might push interest rates up a quarter of a percent.

This is of course totally insane.

Destroying our ability to discover the real cost of assets, credit and risk has not just crippled the markets--it's crippled the entire economy. Wake up, America, and stop worshiping the false gods of the Fed. The sooner we smash the Fed's idols and strip away their power to enrich the few at the expense of the many, the better off we'll be. -Charles Hugh Smith

|

|

|

|

Post by Entendance on May 23, 2016 3:19:53 GMT -5

German pharmaceutical/chemical giant with no core competency in food buys company whose crop products are banned in Germany. German pharmaceutical/chemical giant with no core competency in food buys company whose crop products are banned in Germany.

Northy: Hey Mario can you pay me interest so I can blow $62B at a PEG 5+ valuation on a company with negative revenue growth?

So how does a company with $83B in market cap and $4.6B in cash make a $62B cash offer? So $23B in debt already, $62B cash offer + $9B Monsanto debt = $94B debt? with -12% quarterly revenue growth for $MON. Bayer holders should at least get a bottle of aspirin if the deal goes through...The Bayer buyer top. Best of luck.:origin()/pre14/d646/th/pre/f/2012/067/f/5/angela_merkel_vampire_by_paristechno-d4s4fhj.jpg)

Meanwhile...in Washington DC...

"...The global financial system is in the eye of an unprecedented hurricane. While central bankers are congratulating themselves on their god-like mastery of Nature, and secretly praying to the idols of the Keynesian Cargo Cult every night, the inevitable consequence of borrowing from the future, the obsession with "growth" at any cost and financialization /monetary stimulus, a.k.a. the rich get richer thanks to central banks is systemic collapse.

Don't fall for the mainstream media and politicos' shuck-and-jive that all is well and "growth" will return any day now. The only "growth" we're experiencing are the financial cancers of systemic risk and financialization's soaring wealth/income inequality."

|

|

|

|

Post by Entendance on May 27, 2016 17:37:47 GMT -5

|

|

|

|

Post by Entendance on Jun 15, 2016 6:01:35 GMT -5

For seven years the world has operated under a complete delusion that Central Banks somehow fixed the 2008 Crisis.

All of the arguments claiming this defied common sense. A 5th grader would tell you that you cannot solve a debt problem by issuing more debt. Similarly, anyone with a functioning brain could tell you that a bunch of academics with no real-world experience, none of whom have ever started a business or created a single job can’t “save” the economy.

However, there is an AWFUL lot of money at stake in believing these lies. So the media and the banks and the politicians were happy to promote them. Indeed, one could very easily argue that nearly all of the wealth and power held by those at the top of the economy stem from this fiction.

So it’s little surprise that no one would admit the facts: that the Fed and other Central Banks not only don’t have a clue how to fix the problem, but that they actually have almost no incentive to do so. 1) The REAL problem for the financial system is the bond bubble. In 2008 when the crisis hit it was $80 trillion. It has since grown to over $100 trillion.

2) The derivatives market that uses this bond bubble as collateral is over $555 trillion in size.

3) Many of the large multinational corporations, sovereign governments, and even municipalities have used derivatives to fake earnings and hide debt. NO ONE knows to what degree this has been the case, but given that 20% of corporate CFOs have admitted to faking earnings in the past, it’s likely a significant amount.

4) Corporations today are more leveraged than they were in 2007. As Stanley Druckenmiller has noted, in 2007 corporate bonds were $3.5 trillion… today they are $7 trillion: an amount equal tot nearly 50% of US GDP.

5) The Central Banks are now all leveraged at levels greater than or equal to Lehman Brothers was when it imploded. The Fed is leveraged at 78 to 1. The ECB is leveraged at over 26 to 1. Lehman Brothers was leveraged at 30 to 1.

6) The Central Banks have no idea how to exit their strategies. Fed minutes released from 2009 show Janet Yellen was worried about how to exit when the Fed’s balance sheet was $1.3 trillion. Today it’s over $4.5 trillion.

Today, Central Bankers are now actively punishing depositors and bond holders with negative interest rates. Globally, over $10 trillion in debt currently have negative yields in nominal terms, meaning the bond literally has a negative yield when it trades. In the simplest of terms this means that investors are PAYING to own these bonds.

Bonds are not unique in this regard. Switzerland, Denmark and other countries are now charging deposits at their banks. In France and Italy, you are not allowed to make cash transactions above €1,000. So if get fed up with the banks and want to pull your money out, you cannot.

We are heading for a crisis that will be exponentially worse than 2008. The global Central Banks have literally bet the financial system that their theories will work. They haven’t. All they’ve done is set the stage for an even worse crisis in which entire countries will go bankrupt. -Graham Summers

|

|

|

|

Post by Entendance on Jun 26, 2016 11:36:51 GMT -5

"Silver traded last Friday at 18 months high. What is the take-away?

1. The world is welcoming a new class of investors numbering in the tens of millions with hundreds of billions in speculative dollars.

2. Those investors may prefer metals over stocks and bonds.

3. When those finicky investors arrive, they will create a torrential wave.

They may not arrive at silver this month or the next, but I soon suspect they will buy into this compelling, easy-to-understand investment choice..."

The events of last Friday not only speed the eventual collapse of the Bullion Bank Paper Derivative Pricing Scheme, they also highlight the fraud of this current system and shine light upon the utter desperation of these Banks to maintain it.

In short, as a measure of controlling the paper prices of gold and silver, The Bullion Banks that operate on The Comex act as de facto market makers of the paper derivative, Comex futures contract. This gives them the nearly unlimited ability to simply conjure up new contracts from thin air whenever demand for these contracts exceeds available supply and, almost without exception, these Banks issue new contracts by taking the short side of the trade versus a Spec long... Friday's Brexit vote truly was a game-changer and the single most important financial event since 2008. That it might accelerate the death throes of the Bullion Bank Paper Derivative Pricing Scheme is not something that is fully appreciated by the global gold "community"...

***Onward Toward Bullion Bank Collapse More at Fred & EntendanceInvestors Private Beach: Gold & Silver

"When gold and silver finally are able, through price action, to have their say about the state of Western fiscal and monetary policy actions, it may break a few ear drums and shatter a more than a few illusions about the wisdom and honesty of the money masters.

Slowly, but surely, a reckoning is coming. And what has been hidden will be revealed.

Have a pleasant evening." JesseThe next bear market in equity -- which is looming, if not well underway already -- will crush a lot of wannabe money managers.- Fleck

Giorno dopo giorno, lentamente e accuratamente settore per settore, paese per paese, stiamo vendendo allo scoperto questi mercati fasulli e questa valuta artefatta chiamata €. Credete a me, quando verranno giù -perché verranno giù- non faremo prigionieri. Entendance

There are a number of potential triggers to a new crisis.

The first potential trigger may be equity prices

The second potential trigger may be debt markets

A third possible trigger may be problems in the banking system fed by falling asset prices and non-performing loans

A fourth potential trigger may be changes in liquidity conditions exacerbate stress

A fifth potential trigger will be currency volatility and the currency wars that are not, at least according to policy makers, under way

A sixth potential trigger may be weakness in global economic activity

A seventh potential trigger may be a loss of faith in policy makers

A final trigger is political stress

More here

|

|

|

|

Post by Entendance on Jun 28, 2016 1:59:58 GMT -5

EU elites & their courtiers consider it foolish to allow a vote by peons on their fate.

The contemptuous reaction to the Brixit vote shows with rare clarity the desire of Europe’s elites to roll back the past century’s shift to democratic institutions. Why should the peons have a say in their fate, interrupting the smooth government by their betters? When people vote the way of the IYI elite (“IYI”: intellectual yet idiots), it is "democracy". Otherwise it is misguided, irrational, swayed by populism & lack of education. -NassimNicholasTaleb

Freudian slip? Merkel: We must act to prevent countries from FLEEING the EU. Fleeing is right. Meanwhile...Schulz: "The British have violated the rules. It is not the EU philosophy that the crowd can decide its fate".

European SUPERSTATE to be unveiled: EU nations 'to be morphed into one' post-Brexit |

|

|

|

Post by Entendance on Jun 29, 2016 9:01:29 GMT -5

|

|

|

|

Post by messier94 on Jun 29, 2016 9:16:27 GMT -5

...and take our weapons, under the guise of protecting us, so that someday we will be powerless and forced into submission and subservience of these elitist globalist clowns. The little babies want to punish Britain for having the audacity to want freedom. Good for Britain! Screw them all!

|

|

|

|

Post by Entendance on Jul 2, 2016 2:42:42 GMT -5

"We are magic people"

Everyone’s a Winner in Brexit Aftermath as *** Doves Rescue Market

The Central Banks went overboard with the latest round of stock market intervention.

"As you can see, the move in the metals accelerated since the BREXIT vote. The latest Central Bank induced market spike has pierced the boundaries of absurdity:

Smart investors smell Central Bank blood and the latest market intervention just reeks of desperation..."

"...The elite mainstream media, especially the financial media, is intolerable. Tabloids of and for the opinion makers. If one has been inclined to put a peg on the nose and tolerate the smell for the odd bit of useful information, the Brexit coverage should surely show that the daily sacrifice is not worth the candle. Universal hysteria has reigned. It has been a tsunami of shit..." |

|

|

|

Post by Entendance on Jul 7, 2016 5:07:07 GMT -5

|

|

|

|

Post by Entendance on Jul 20, 2016 5:24:02 GMT -5

|

|

|

|

Post by Entendance on Jul 27, 2016 9:10:46 GMT -5

|

|

|

|

Post by Entendance on Aug 5, 2016 14:33:31 GMT -5

|

|

|

|

Post by Entendance on Aug 22, 2016 11:28:31 GMT -5

|

|

|

|

Post by Entendance on Aug 26, 2016 2:49:19 GMT -5

|

|

|

|

Post by Entendance on Aug 31, 2016 12:42:24 GMT -5

|

|

|

|

Post by Entendance on Sept 11, 2016 6:42:32 GMT -5

|

|

|

|

Post by Entendance on Sept 11, 2016 23:07:59 GMT -5

|

|

|

|

Post by Entendance on Sept 14, 2016 3:52:17 GMT -5

|

|

|

|

Post by Entendance on Sept 30, 2016 6:59:57 GMT -5

Be Warned: The Deutsche Bank Implosion is About “Something” Far Bigger Than The $14 Billion DOJ Settlement

...and now some comments from the web: -LOL!!! The bankers and financiers have had years and years of FREE MONEY (ZIRP/NIRP) while everyone else has had to actually work and face real risk....

-Fuck em!!! Nothing was fixed or learned. This isn't a liquidity issue, it's still a DEBT/SOLVENCY/COLLATERAL problem!!!

-How the fuck did they think their "let the majority eat cake" monetary experiment would turn out? -Bring all this shit down hard and fast. I prefer anarchy and chaos to this bullshit laden world -You got all this free money for years and now you're broke?

-These people are fucking retards. Any moron can balance the books with free money.

|

|

|

|

Post by Entendance on Oct 5, 2016 9:58:01 GMT -5

Twelve years ago, John Perkins published his book, “Confessions of an Economic Hit Man.” Today, he says “things have just gotten so much worse.” More Confessions of an Economic Hit Man:***This Time, They’re Coming for Your Democracy

New: ***Apple biggest tax avoider in US stashing $215bn offshore

New: Throng of Corporate Criminals Demands “Rule of Law” in Apple EU Tax Case

"...The trick is the use of a shell company that is based in Ireland but which is officially “stateless”. By directing all the money it makes outside the US into it’s “Irish” shell company Apple – thanks to the Irish government – walks away with a tax rate of “0.005%”. That is: apart from the token amount it pays to the Irish government at the usual 12.5% rate – Apple walks away with everything it can get it’s hands on. But since this special tax package is offered “only” to Apple the EU judged it to be a breach of it’s competition rules.

Ireland in other words has been “subsidising” Apple’s international profits (in October 2015 it recorded an annual profit of $53.4 billion). By offering a phantom address and turning the other way Ireland is facilitating a world wide tax dodge. And what does Ireland get in return for this “service”? Six thousand Apple jobs. And what can the EU do about it? It is attacking the shell company and demanding that it pay the “Irish” taxes it has been avoiding all these years. It calculates an unpaid Apple tax bill of $14.6 billion plus interest (a world record penalty). And Ireland’s response? It claims innocence and doesn’t want any money from Apple!

That’s right. The Irish state which is up to it’s neck in debt (it owes $232 billion) refuses in the face of it’s EU masters to “tax” the richest corporation on the planet (Apple is sitting on a mountain of cash worth $231 billion). The asymmetry is perfect. And is a true reflection of globalisation. For the sake of the corporation – the nation state is impoverished. And for the sake of the corporation – the nation state impoverishes other nation states. You would think that Ireland learned it’s lesson after it bailed out it’s banks. But no: it continues to carry water for the corporation. And sees nothing wrong with this – even when it is dying of thirst. It is obvious therefore that “dignity” is excluded from the official Irish lexicon. And justice – at home and abroad? That’s a foreign language in the corridors of Irish power.

The irony is that Ireland – a victim of the EU’s extreme financial capitalism – is making the EU look good. Neoliberal Ireland is being called to order by Neoliberal Europe. And Ireland dares to protest even though it has been caught red handed cheating Europe and the world. In the name of competition Europe wants justice. And in the name of globalisation Ireland rejects justice. It’s a right wing joke. It’s a neoliberal farce. But it’s deadly serious too.

The issue is taxation. And in the age of austerity this is an explosive subject. And it looks like the EU understands this while Ireland has it’s head buried in the sand. It is no surprise that the EU is coming after Apple and Ireland because the OECD has been openly targeting tax havens since 2014 (see the OECD’s Beps project). When Western governments are bailing out every bank in the Western world – tax avoidance becomes a real issue. The significance of Tuesday’s ruling against Ireland and Apple is that it has set a strong precedent. The EU intends to hit Europe’s tax havens hard. Luxembourg and Holland beware!

And the USA? The USA is angry. Because it’s corporations have been caught red handed. And because it’s government is controlled by it’s corporations. The likes of Apple, Amazon, Microsoft, Starbucks and McDonalds have lodged themselves into the dark corners of Ireland, Luxembourg and Holland. And are walking away with staggering amounts of untaxed profits. The US government fears that it will now have to pay for the sins of it’s corporations. But that will be the case only if it is spineless. The USA can fight it’s tax dodging corporations if it wants to. However that would mean ultimately a break with Wall Street. Is that possible?

In any case sit back for the moment and enjoy seeing the Atlantic establishment fight each other over the issue of taxation. The fragmentation of the Atlanticist Agenda is for the benefit of us all because it is a Corporate Agenda. If the neoliberal fanatics – the competitive hardliners – in the EU are the source of this current concern for justice: who cares? We welcome justice whenever it comes along. And isn’t history after all dialectical? Contradictions in the system will transform it. And who knows this current discord may even block the Transatlantic Trade and Investment Partnership (TTIP). Perfect!

And Apple? Surely it will have to change it’s smug wording on the back of it’s products. Not only is it “Designed in California” and “Assembled in China”. It is also “Dodging tax in Ireland”. Taxpayers of the world unite!" Apple and Ireland: Partners in Crime

Irish cabinet decides to fight EU on Apple tax Irish cabinet decides to fight EU on Apple tax

|

|

|

|

Post by Entendance on Oct 21, 2016 14:07:49 GMT -5

|

|

|

|

Post by Entendance on Oct 26, 2016 7:48:09 GMT -5

"...The major media outlets are controlled by five corporate giants – Time Warner, Disney, Rupert Murdoch’s News Corp., Bertelsmann of Germany, and Viacom – the largest purveyors of crony capitalism and cultural Marxism the world has ever witnessed. No dissent is allowed to be heard on these outlets nor is there any hope of career advancement for journalists or writers if the Leftist paradigm is not trumpeted... ...A free society does not exist because of a free press. In fact, every society which has naively allowed a free press to exist, invariably finds that the press will seek to undermine it, especially its most innovative and successful individuals. The reason, as Hayek so brilliantly explains, is that the press, and in this age the electronic media, is part of the intelligentsia which by its nature is envy ridden since it has little to offer the world in the production of actual goods and services. Its members, therefore, are constantly denigrating their betters..." ***It’s Still the Media, Stupid!

***THE LANDFILL ECONOMY |

|

|

|

Post by Entendance on Oct 29, 2016 7:02:19 GMT -5

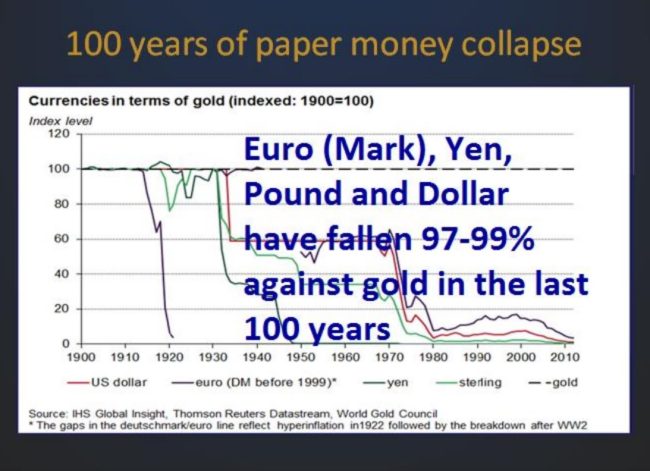

"Most people have no idea what money is. They believe that if they have 100 dollars or euros, that this represents real value as well as durability. Few people realise that their currency which they call money has nothing to do with real money at all. All paper currencies are ephemeral and return to their intrinsic value of zero. This is because reckless governments cling on to power by printing or borrowing endless amounts of fiat money in the hope that they will placate the people and buy votes. Fiat money as the name indicates, can never be real money. It is issued by edict and is not backed by anything but debt and liabilities.

Power corrupts and money corrupts.

It is a lethal combination which not only destroys people but also nations. And sadly, we have now reached a point in history when the unlimited amounts of fiat money that have been created will also destroy continents...

There will never be a sound currency system

|

|

|

|

Post by Entendance on Nov 2, 2016 18:38:53 GMT -5

|

|