|

|

Post by Entendance on Nov 20, 2016 4:34:52 GMT -5

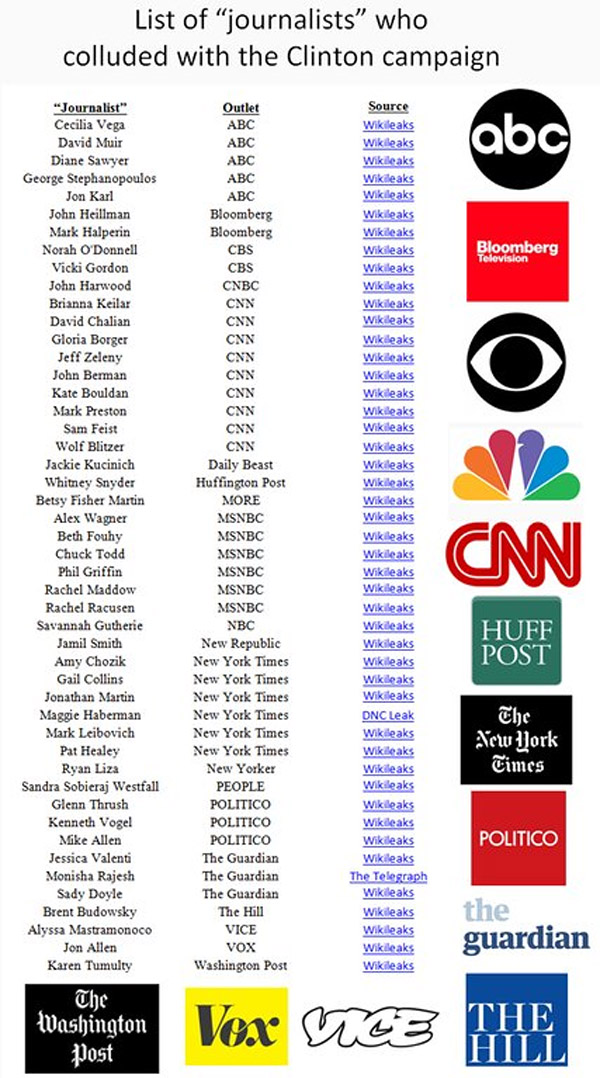

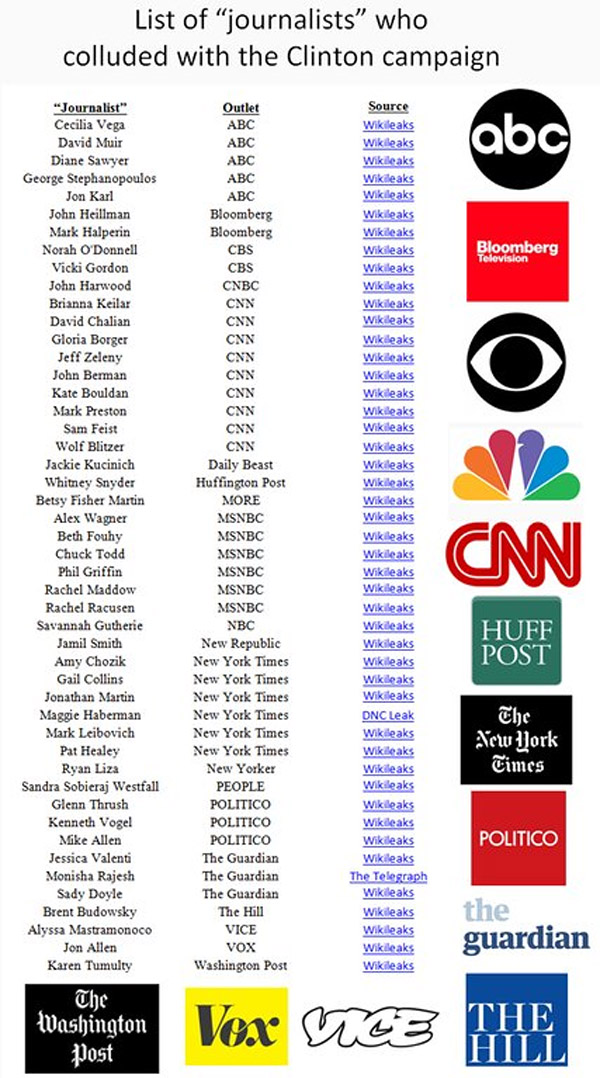

...This list contains the culprits who told us that Iraq had weapons of mass destruction and lied us into multiple bogus wars. These are the news sources that told us "if you like your doctor, you can keep your doctor." They told us that Hillary Clinton had a 98% of winning the election. They tell us in a never-ending loop that "The economy is in great shape!"

"You have to decide whether to look like an idiot before the crash or an idiot after it." -John Hussman

Mainstream Media ZERO CREDIBILITY

"With Hillary's loss, the mainstream media and its distressed and discredited allies are in a panic like we have never seen before. They understand that alternative voices now influence the public as much, if not more so, than the mainstream press, and they are now out to destroy those voices. The way they are going about this is by placing anti-establishment voices under the blanket umbrella of "fake news," or in the case of Twitter, they just seem to purge people they don't like from the platform altogether..."

***Zerohedge Included in What NY Magazine Calls Extremely Helpful List of Fake and Misleading News Sites

Zero Hedge: < We have a confession to make, everything we've said over the past ~7 years has been fake. Well, not really, but that's what the ultra-liberal, Assistant Professor of Communications at Merrimack College, Melissa "Mish" Zimdars, would like for you to believe...>

UPDATED: List of False, Misleading, Clickbait-y, and/or Satirical “News” Sources

Malik Obama joins president elect in calling out biased press...Obama’s Brother Calls for Boycott of CNN, MSNBC, New York Times |

|

|

|

Post by Entendance on Jan 3, 2017 17:39:57 GMT -5

|

|

|

|

Post by Entendance on Jan 9, 2017 15:02:47 GMT -5

2011

2017: "...While the document demonstrates that Bergoglio has not a clue of basic monetary theory, it shows again that the “pope” is a radical socialist who has more in common with the loony ideas of Karl Marx than he does with Roman Catholicism.

The ongoing and deepening financial crisis that Bergoglio seeks to address is not because there has been no global central bank to regulate more effectively the money and credit flow of the various nation states, but the crisis is because of the machinations of central banking. Central banking, through the fraudulent practice of fractional-reserve banking, has been the culprit in almost every financial calamity that has beset the Western world since the institution was first created.

If “Pope” Francis was truly interested in solving the financial crisis and alleviating the income gap between rich and poor, he would call for the abolition of this evil institution and advocate the re-establishment of an honest international monetary order based on gold and silver as money. But, as a good neo-Marxist, Francis is more concerned with the redistribution of wealth from rich to poor..."

***Pope Francis Now International Monetary Guru?

"Come può la Compagnia prestarsi ad essere strumento del cieco capitalismo?" PALERMO - L'istituto dei gesuiti |

|

|

|

Post by Entendance on Jan 16, 2017 13:19:29 GMT -5

|

|

|

|

Post by Entendance on Jan 19, 2017 10:07:37 GMT -5

January 27, 2017 Update: Furious native Hawaiians to protest wall at Zuckerberg estate

***Mark Zuckerberg sues to protect HIS privacy: facebook CEO in legal battle to force hundreds of native Hawaiians who have ancestral rights to patches of his vast $100m estate to sell up

• Facebook co-founder has filed lawsuits against a few hundred people, Honolulu newspaper reported Wednesday

• Some Hawaiian citizens own land via law dating back to 1850 called Kuleana Act

• About a dozen parcels on Zuckerberg's 700-acre estate belong to such families

• CEO now wants these families to sell their patches during a public auction

• Using the law to induce land sales is thought to be problematic because it severs the link between native community and their land H/T Tom from Florida  here here

"...At this point, I’ve seen enough. It’s becoming quite clear that facebook’s Mark Zuckerberg wants to be President of these United States..."

|

|

|

|

Post by Entendance on Jan 20, 2017 5:30:34 GMT -5

|

|

|

|

Post by Entendance on Feb 5, 2017 4:32:13 GMT -5

|

|

|

|

Post by Entendance on Feb 14, 2017 17:38:46 GMT -5

Public confidence in the EU fading by the month! New data from out from Demos shows that trust in the EU’s powerful Commission is at an all-time low across the continent: check it out***here***

|

|

|

|

Post by Entendance on Mar 15, 2017 16:33:52 GMT -5

"This crime is already 285 times bigger than the LIBOR scandal, and 500 times bigger than Madoff’s swindle. It is, in fact, the largest, most destructive financial crime in history.

According to the mainstream financial media (MFM), the biggest financial frauds in history are the Bernie Madoff Ponzi scheme, with roughly $20 billion in net investor losses, and the Bank State rigging of LIBOR, which resulted in 16 guilty banks paying $35 billion in fines, which supposedly equated to their theft.

The MFM have conveniently ignored a far larger financial crime that has been perpetrated for 37 years and counting, and that has netted its orchestrators more than $1,000,000,000,000.00 ($1 trillion) in stolen profits. This crime is so powerful that it can produce fraudulent proceeds of $1+ billion on demand and in minutes, making it unique in the annals of theft. It is a crime that has been committed literally thousands of times since 1980, and is now being committed in the most blatant and brazen manner ever. This crime is already 285 times bigger than the LIBOR scandal, and 500 times bigger than Madoff’s swindle. It is, in fact, the largest, most destructive financial crime in history..."

***Gold & Silver Manipulation: The Biggest Financial Crime In History - Stewart Dougherty H/T Tom from Florida, E's old good gold warrior!... Fighting together since 2005!

|

|

|

|

Post by Entendance on Mar 16, 2017 9:24:32 GMT -5

"...We know for an absolute fact that precious metals prices are manipulated. (The evidence is absolutely overwhelming, and we would like to offer special thanks to GATA (and now Deutsche Bank) for proving it without a shadow of doubt over many years’ worth of tireless work.) Current prices of gold and silver are therefore fake, and in our view, far below what they would be in an honest market. When the Deep State Crime Syndicate loses control over prices, which could result from any one of a large number of likely developments, true prices will be re-established, a process that was occurring in 1980 and again in 2011 before being sabotaged both times. As fake prices are crushed and honest ones return, a global “herd” buying phenomenon could develop, as has happened in the past. This would lead to significant shortages of available physical metals and a meaningful increase in premiums. History has been clear that when it comes to precious metals, it is always best to buy in halcyon times, particularly if one can do so at a good price..."

***Gold & Silver Manipulation: The Biggest Financial Crime In History

The Complete Banksters Cartel International

Sound and Honest Money: Physical Gold & Silver

|

|

|

|

Post by Entendance on Mar 19, 2017 5:18:37 GMT -5

|

|

|

|

Post by Entendance on Mar 23, 2017 5:07:07 GMT -5

McAlvany: Printing Money To Save The System Will Not Work Anymore

"In an inane study of the world’s countries by the U.N. and released on World Happiness Day (what an absurd concept) the land locked nation with its active printing press was heralded as ranking FOURTH while the U.S. fell to 14th. To paraphrase Tolstoy: Happy countries are all alike; every unhappy country is unhappy in its own way. On March 17 Bloomberg ran a story, “Swiss National Bank (SNB) Foreign Reserves Soar, Signaling Interventions.” In February the SNB’s reserves increased by 3.8% to 668.2 billion francs, “the biggest increase since December 2014.”

SNB President Thomas Jordan regularly opines that is Swiss currency is overvalued. The SWISS bank reserves are not increasing because of robust Swiss exports. However, the SNB regularly turns on the printing presses to produce Swiss francs to sell and purchase other currencies in an effort to meet the insatiable demand for the Swiss foreign currency. Currently, SNB foreign reserve holdings are equivalent to the entire GDP of the Swiss economy. The SWISS FRANC represents the fragility of the global financial and political system as investors are willing buy Swiss assets with negative yields out to over TEN years.

The Swiss are doing nothing more than printing more SWISS FRANCS to meet the demand. When they use the fiat francs to purchase other currencies the SNB converts those currencies into EQUITY AND BOND assets in a symphony of some of the most high-quality worldwide corporations. THIS IS FINANCIAL ALCHEMY OF THE HIGHEST ORDER. The SNB owns almost $2 billion of APPLE Corporation.

While the Swiss increased its portfolio of foreign assets by almost 21 billion francs last month, the targeted EURO/SWISS crossrate barely moved as it remains in a well-defined range of 1.06 to 1.08 during the last eight months. Yet again the SNB is merely keeping the FRANC from appreciating and not having any success in weakening its OVERVALUED currency. No wonder the Swiss are so happy. They are laughing as the world keeps willing to swap its banknotes for real assets, helping Swiss citizens become the world’s largest hedge fund.

The SNB has discovered the PHILOSOPHER’S STONE and lo and behold it is a printing press. The VIX may represent investor complacency but the SNB’s attempts at financial alchemy represent something else. Not sure as of yet but if I were a Swiss national I would be voting for the SNB to be increasing its GOLD RESERVES..." More here

"...A poignant point needs to be raised as my pulse races: How can global investors maintain buying SWISS FRANCS when the SNB is pursuing the greatest con since tulip bulbs, Mississippi Stock and any number of other events from the Madness of Crowds?..." Aug 9, 2016 at 11:55am

|

|

|

|

Post by Entendance on Apr 4, 2017 4:58:57 GMT -5

"The Comex Is The World’s Most Corrupted Market While no additional silver was put on deposit at the Comex during the [past] week, The Banks sold contracts for 120MM oz. This is fraud. -@tf MetalsReport

If you were to poll the public about comparing the investment returns between gold, silver and stocks during the first quarter of 2017, it’s highly probable that the majority of the populace would respond that the S&P 500 outperformed the precious metals. That’s a result of the mainstream media’s unwillingness to report on the precious metals market other than to disparage it as an investment.

In reality, among silver, gold, the Nasdaq 100 and the S&P 500, the S&P 500 had the lowest ROR in Q1. Silver led the pack at 14%, followed by tech-heavy Nasdaq 100 at 11.1%, gold at 8.6% and the S&P 500 at 4.8%. Put that in your pipe and smoke it, Cramer. Imagine the performance gold and silver would have turned in if the Comex was prevented from creating paper gold and silver in amounts that exceeded the quantity of gold and silver sitting in the Comex vaults.

As an example, as of Friday the Comex is reporting 949k ozs of gold in the registered accounts of the Comex vaults and 9 million ozs of total gold. Yet, the open interest in paper gold contracts as of Friday totaled 41.7 million ozs. This is 44x more paper gold than the amount of physical that has been designated – “registered” – as available for delivery. It’s 4.6x more than the total amount of gold sitting on Comex vaults.

With silver the situation is even more extreme. The Comex is reporting 29.5 million ozs of silver as registered and 190.2 million total ozs. Yet, the open interest in paper silver is a staggering 1.08 billion ozs. 1.08 billion ozs of silver is more silver than the world mines in a year. The paper silver open interest is 5x greater than the total amount of silver held in Comex vaults; it’s an astonishing 37x more than the amount of silver that is available to be delivered.

This degree of imbalance between the open interest in CME futures contracts in relation to the amount of the underlying physical commodity represented by those contracts never occurs in any other CME commodity – ever. Historically, when the amount of paper exceeds the amount of underlying commodity that is available for delivery by more than 20-30%, the CFTC intervenes by investigating the possibility of market manipulation. But never with gold and silver.

The Comex is perhaps the most corrupted securities market in history. It is emblematic of the fraud and corruption that has engulfed the entire U.S. financial and political system. The U.S. Government has now issued $20 trillion in Treasury debt for which it has no intention of every redeeming. It’s issued over $100 trillion in unfunded liabilities (entitlements, pensions, etc) for which default is not a matter of “if” but of “when.” In today’s episode of the Shadow of Truth, we discuss “The Big Lie,” which is also known as the “Comex,” and explain why those looking to protect their savings should be buying physical gold and silver now"

|

|

|

|

Post by Entendance on Apr 6, 2017 12:25:27 GMT -5

|

|

|

|

Post by Entendance on Jun 2, 2017 5:35:42 GMT -5

E. on twitter!

"Bilderberg 2017 will take place at the Westfields Marriot in Chantilly, Virginia, June 1-4. The annual gathering features industrial magnates, silicon valley tech giants, and political and economic luminaries, including economic ministers (G7, G20 etc.), the World Economic Forum, and leaders of other multilateral globalist groups. Here, our elected officials collude in secret with billionaire elites and globalist agents in order to thrash out the globalist agenda for the next 12 months..." ***BILDERBERG: Who Benefits?

:origin()/pre14/d646/th/pre/f/2012/067/f/5/angela_merkel_vampire_by_paristechno-d4s4fhj.jpg) ***Their Web ***Their Web |

|

|

|

Post by Entendance on Jun 9, 2017 11:51:42 GMT -5

Fallacia alia aliam trudit (One deceit drives out another) (Un inganno tira l'altro)

"It’s no secret that Big Pharma is fuelled by profit, often putting business interests ahead of patients’ lives and well-being. And North American culture practically worships the pharmaceutical industry, failing to recognize many of the issues within it. Many Americans are completely unaware that new prescription drugs have a 1 in 5 chance of causing serious reactions, even after being approved, or that Harvard University stated that prescription drugs are the fourth leading cause of death. We’re not talking overdosing or misprespcribing; these are drugs that are deemed safe and properly prescribed to patients who simply have an adverse reaction to them.

Despite these facts, people take the risks of pharmaceuticals very lightly, turning to them when they’re sick only to provide a “bandaid” effect, covering up the symptoms rather than treating and preventing the root cause. The public isn’t entirely to blame for their ignorance; Big Pharma paints a perfect image of themselves, making false claims and highlighting the “benefits” of drugs while minimizing the potential risks associated with them (or printing them in extremely small font sizes).Here Are 10 False Health Claims Big Pharma and the Mainstream Media Make..." ***10 Colossal False Health Claims Made By Big Pharma & Mainstream Media

|

|

|

|

Post by Entendance on Jun 14, 2017 16:02:10 GMT -5

$600 Billion A Year Eh? "So the Fed is going to shed $600 billion a year in bonds, beginning this year and going to that level in 2018 yet both long-term interest rates and the stock market ignored that?

May I remind you that this is awfully close to the rate of accreation.

Here's reality: The market doesn't believe The Fed.

There's utterly no way you have the curve this flat, with the long end this far suppressed, if the Fed is actually going to do this and the economy remains "ok".

If the economy is not ok then the bond market is right but the stock market is at double its legitimate price -- or more.

If you want to take a bet on who's right you bet on the bond market and short the hell out of stocks. Why? Because this looks like 1999's Greenspan games with the Fed and we know how that ended.

Of course you must remember in 1999 the Naz doubled before it all blew up, which makes being short something that might very well wind up with you being dead right (in other words, you're right but you're both broke and forced out of your position first!)

Yeah." K. Denninger

"...How Long Will It Take?

At $10 billion a month, $120 billion a year, it would take the Fed 29 years to reduce its balance sheet to $1.0 trillion from $4.5 trillion.

At $50 billion a month, $600 billion a year, it would take 5.8 years. If the Fed slowly ratchets up its cap, we are talking about a 10-year time frame.

Those are the absolute minimum and maximums assuming the Fed starts reduction and does not stop until it’s done. Both are highly unlikely in actual practice.

Those timeframes are highly unlikely in actual practice because they presume the Fed won’t halt or reverse balance sheet reductions when the next recession starts.

From a practical standpoint, somewhere between 30 years and never is about right." -Mike “Mish” Shedlock

all properly marked I'm sure...lol....The whole bond market is a lie. all properly marked I'm sure...lol....The whole bond market is a lie.

The zero credibility banksters made our day on gold miners. The funny thing about these miners is who the hell is left to sell them?..lol this is like a bad comedy.

|

|

|

|

Post by Entendance on Jun 21, 2017 13:55:57 GMT -5

|

|

|

|

Post by Entendance on Jul 9, 2017 2:10:52 GMT -5

"...With wars in Afghanistan, Iraq, Syria, Yemen and beyond adding up to trillions for defense contractors and including weapon systems designed to fight them, with the F-35 joint strike fighter alone topping one trillion US dollars and as the West continues to openly act with impunity when and where it pleases despite violating the very international law it claims it is upholding globally, it is clear that, for now, this strategy is working.

If and when the general public understands the truth of why their lives are put in danger and their nation’s resources are being squandered abroad instead of at home for building their own futures, this strategy will be less successful. Until then, it appears that simplistic propaganda still works in convincing the public that governments like in London are simply incapable of arresting terrorists who appear regularly on TV, in the media and who openly operate in public with apparent and otherwise inexplicable impunity..."

***Terror in Europe – Why Terrorists Are Allowed to Strike

Serving the Status-Quo ***Why Experts Get the Gold Standard Wrong

***Bota na conta do Papa

***Buying physical Gold & Silver is by far the greatest act of rebellion any citizen can and should be doing right now

|

|

|

|

Post by Entendance on Jul 24, 2017 17:09:17 GMT -5

"...When you read Google News headlines about Trump, Putin, Syria, Ukraine, or anything else for that matter, understand your news has been put in charge of the gatekeepers. And they are gatekeepers with no qualms about punishing people for simply disagreeing. This is where we are." ***When the Gatekeepers of Press Freedom Deride Trump or Putin…

***Ukraine’s NATO Referendum A Vote For War

1. Mass Marketing

2. Defining Social Norms

3. Classifying Information and Keeping Secrets

4. Education

5. Fake News

6. Entertainment Industry

7. Food

8. Financial System ***HERE***

|

|

|

|

Post by Entendance on Aug 2, 2017 0:27:10 GMT -5

<...The focus of Google’s new censorship algorithm is political news and opinion sites that challenge official government and corporate narratives. Gomes writes: “t’s become very apparent that a small set of queries in our daily traffic (around 0.25 percent), have been returning offensive or clearly misleading content, which is not what people are looking for.”

Gomes revealed that Google has recruited some 10,000 “evaluators” to judge the “quality” of various web domains. The company has “evaluators—real people who assess the quality of Google’s search results—give us feedback on our experiments.” The chief search engineer does not identify these “evaluators” nor explain the criteria that are used in their selection. However, using the latest developments in programming, Google can teach its search engines to “think” like the evaluators, i.e., translate their political preferences, prejudices, and dislikes into state and corporate sanctioned results.

Gomes asserts that these “evaluators” are to abide by the company’s Search Quality Rater Guidelines, which “provide more detailed examples of low-quality webpages for raters to appropriately flag, which can include misleading information, unexpected offensive results, hoaxes and unsupported conspiracy theories.”

Once again, Gomes employs inflammatory rhetoric without explaining the objective basis upon which negative evaluations of web sites are based.

Using the input of these “evaluators,” Gomes declares that Google has “improved our evaluation methods and made algorithmic updates to surface more authoritative content.” He again asserts, further down, “We’ve adjusted our signals to help surface more authoritative pages and demote low-quality content.”

What this means, concretely, is that Google decides not only what political views it wants censored, but also what sites are to be favored.

Gomes is clearly in love with the term “authoritative,” and a study of the word’s meaning explains the nature of his verbal infatuation.

Gomes’s statement is Google-speak for saying that the company does not want people to access anything besides the official narrative, worked out by the government, intelligence agencies, the main capitalist political parties, and transmitted to the population by the corporate-controlled media...> ***Google’s chief search engineer legitimizes new censorship algorithm H/T Tom from Florida

google? amazon bezos? facebook?: no room at Fred & EntendanceInvestors Beach. |

|

|

|

Post by Entendance on Aug 8, 2017 2:58:17 GMT -5

"This affair is a huge scandal which involves the president incumbent of the European Council and his son. How was it possible that a politician who is now so eager to supervise the rule of law in Poland when he was Poland’s prime minister ignored information given to him by the Chief of the Internal Security Agency and the President of the National Bank of Poland that he and his son were involved in a Ponzi scheme called Amber Gold? Donald Tusk’s claims not to have been warned by General Krzysztof Bondaryk of the ISA appear to be a mere defensive strategy of the former Polish prime minister and the current president of the European Commission, while his attacks on the Warsaw government are not an attempt at enforcing democracy and the rule of law in Poland but rather serve the purpose of toppling the present government, which set up the Inquiry Committee on the Amber Gold..."

***Donald Tusk and his son in the centre of a fraud

Meanwhile...***Vladimir Putin on the jesuit pope Meanwhile...***Vladimir Putin on the jesuit pope

|

|

|

|

Post by Entendance on Aug 17, 2017 11:41:49 GMT -5

|

|

|

|

Post by Entendance on Sept 19, 2017 3:09:10 GMT -5

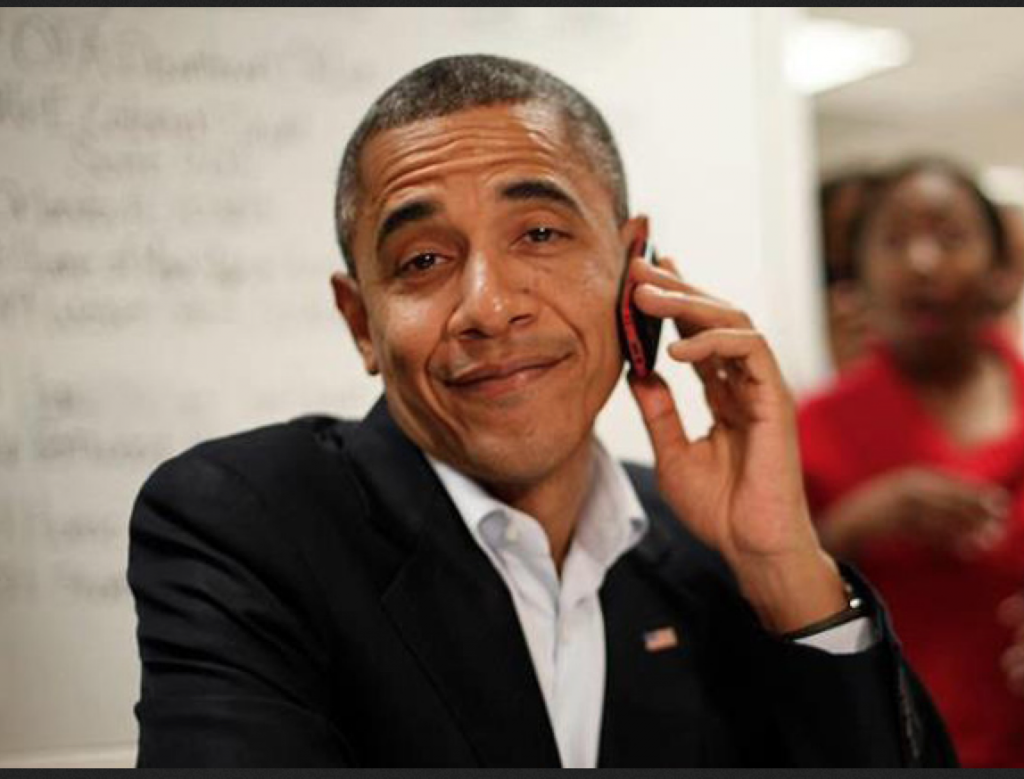

"After Hillary lost the Presidential election in 2016, in no small part because of her close financial ties to Wall Street and her obscene speaking fees from Goldman Sachs and other Wall Street firms, it is a tragic commentary on the greed within the so-called leadership of the party that former President Obama is following along the same jaded path. We can only hope it will be the final straw to give the real progressive wing of the Democratic Party, that led by supporters of Senators Bernie Sanders and Elizabeth Warren, a groundswell of support from the bench sitters..."

***Obama Has the Same Retirement Plan as the Clintons: Lavish Speaking Fees from Wall Street ***Obama Has the Same Retirement Plan as the Clintons: Lavish Speaking Fees from Wall Street

***When Wall Street Owns Main Street — Literally |

|

|

|

Post by Entendance on Oct 3, 2017 2:11:06 GMT -5

|

|

|

|

Post by Entendance on Oct 12, 2017 4:37:45 GMT -5

|

|

|

|

Post by Entendance on Oct 26, 2017 3:53:35 GMT -5

Con-men/analysts

"There are a few important rules you have to follow if you want to join the consortium of mainstream economic con-men/analysts. Take special note if you plan on becoming one of these very "special" people:

1) Never discuss the reality that government fiscal statistics are not the true picture of the health of the economy. Just present the stats at face value to the public and quickly move on.

2) Almost always focus on false positives. Give the masses a delusional sense of recovery by pointing desperately at the few indicators that paint a rosier picture. Always mention a higher stock market as a symbol of an improving economy even though the stock market is irrelevant to the fundamentals of the economy. In fact, pretend the stock market is the ONLY thing that matters. Period.

3) Never talk about falling demand. Avoid mention of this at all costs. Instead, bring up "rising supply" and pretend as if demand is not a factor even worth considering.

4) Call any article that discusses the numerous and substantial negatives in the economy "doom porn." Ask "where is the collapse?" a lot, when the collapse in fundamentals is right in front of your face.

5) Avoid debate on the health of the economy when you can, but if cornered, misrepresent the data whenever possible. Muddle the discussion with minutia and circular logic.

6) When a crash occurs, act like you had been the one warning about the danger all along. For good measure, make sure alternative economic analysts do not get credit for correct examinations of the fiscal system.

7) Argue that there was nothing special about their warnings and predictions and that "everyone else saw it coming too;" otherwise you might be out of a job... ...In 2017, the EIA claims there has been a rise in global demand since the second quarter. And has "projected" increasing demand including higher U.S. demand going into 2018, outpacing supply. Yet, at the same time the EIA admits a frustrating stagnation in global oil demand, with the U.S. being the primary drag on consumption since 2010.

So, which trend are we supposed to believe? The one that is right in front of us, or the one that is optimistically projected? ...."

***Lies And Distractions Surrounding The Diminishing Petrodollar

|

|

|

|

Post by Entendance on Oct 31, 2017 1:57:22 GMT -5

|

|

|

|

Post by Entendance on Nov 5, 2017 4:09:42 GMT -5

Saudi billionaire Prince Alwaleed detained in corruption inquiry

***Citigroup, 21st Century Fox, Twitter: Prince’s Arrest Touches Many

Per anni, nei '90 ci siamo incontrati a Petit Anse, io proveniente da una camminata nella foresta di oltre 30 minuti per raggiungerla con successiva discesa a scapicollo da una stupenda collina e lui dal mare in motoscafo. Io e chi stava con me, lui, le sue "compagne" (le mogli le lasciava o nello yacht o nell'albergo che requisiva per intero) e le sue guardie del corpo e nessun altro. Era incredibile che ogni volta che io arrivassi a Mahè dall'Europa, a Pasqua o a Natale, a luglio o in settembre o in qualunque altro mese dell'anno ci incontrassimo. Mi accorgevo che sarebbe arrivato a Petit Anse già dal giorno prima; decine di inservienti infatti la affollavano -era fra le spiagge più inaccessibili dell'isola e si poteva stare nudi tutto il giorno senza incrociare nessun altro- costruendo un improbabile capanno fatto di bamboo e foglie di palma e posizionando sdraie e bottiglie d'acqua minerale ovunque. Il giorno dopo il gentile signore arrivava e faceva un brevissimo bagno. Appena arrivato al bagnasciuga, le ragazze lo innaffiavano con grazia utilizzando l'acqua minerale; evidentemente il principe non gradiva la salsedine, peraltro scarsa se confrontata con quella del Mediterraneo. Mangiava qualcosa e ripartiva via mare. Per inciso, subito dopo le sue guardie del corpo, riconoscendomi, mi invitavano ad assaggiare una o più torte al cioccolato che erano nei frigo portati dal suo jet; il resto veniva gettato in acqua ai fortunati pesci della baia. Bene, per decine di volte ci siamo incontrati, a pochi metri l'uno dall'altro (non mi facevo certo intimorire dal suo ambaradam) e mai, ripeto, mai ha voltato la testa o incrociato lo sguardo con me. Questa scena è andata avanti per anni, finchè non ha pensato bene di comperare tutto e fare quel che ha fatto di quel paradiso di posto. Karma day today?

|

|

|

|

Post by Entendance on Apr 17, 2018 10:25:53 GMT -5

"...We know a few things, but they're not "news." We know oil and natural gas are still the primary energy sources of the industrialized global economy. So-called renewables (so-called because wind turbines and solar panels don't last forever and thus they are more correctly called replaceables rather than renewables) remain a tiny sliver of total global energy consumption...

..It is a grave mistake to take any narrative or set of "facts" presented by interested parties as being anything more than propaganda or signaling. Only those on the ground with intelligence on all the other players on the ground have anything close to a useful understanding of the situation, and they can only claim to have a useful understanding if they also possess a nuanced grasp of the regional contexts, histories and dynamics that are in play...

In summary: anyone accepting "facts" or narratives from any interested party is being played. It's best to retain a healthy skepticism of all narratives and an equally healthy appreciation of how little we know or can ever know about the full spectrum of events and dynamics in Syria."

***What Do We Know About Syria? Next to Nothing

The Entendance Beach on Syria: 2 pages here

|

|

***

***

theshadowbrokers to Donald Trump:

theshadowbrokers to Donald Trump:

:origin()/pre14/d646/th/pre/f/2012/067/f/5/angela_merkel_vampire_by_paristechno-d4s4fhj.jpg) ***

***

all properly marked I'm sure...lol....The whole bond market is a lie.

all properly marked I'm sure...lol....The whole bond market is a lie.

***

***

Meanwhile...***

Meanwhile...*** ***‘

***‘

***

***