|

|

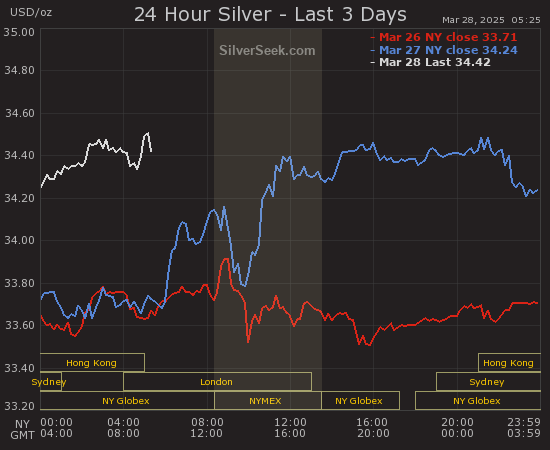

Post by Entendance on Apr 11, 2015 9:12:40 GMT -5

E. on twitter E. on Brighteon.Social E. on gab

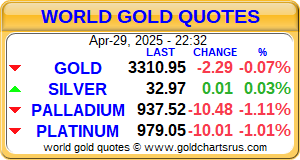

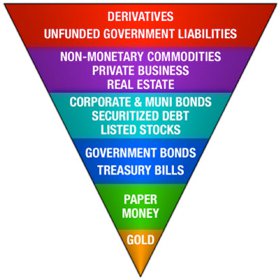

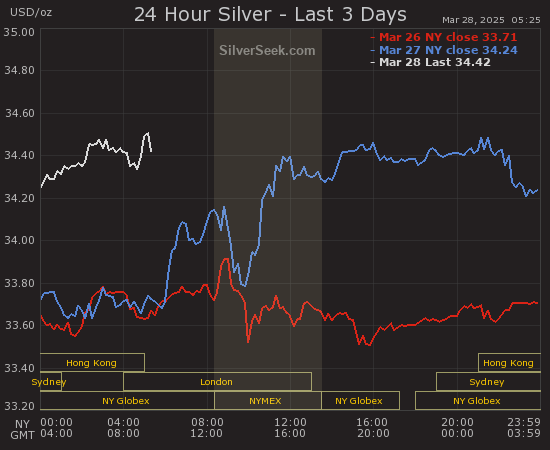

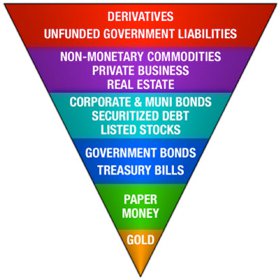

***Where to store your Gold & Silver Bars

***Gold and Silver

Money Economy Markets

"...So NOW you should understand WHY out of control government hates gold. It’s because a rising gold price exposes government fraud and corruption for all to see..."

Investors without the humility to admit mistakes are not going to last long. On the other hand, good investors who are willing to analyze their mistakes and be frank about what environments will and will not favor their strategies have the chance to transcend and become great.

Remember: "There is only one corner of the universe you can be certain of improving, and that's your own self.”― Aldous Huxley

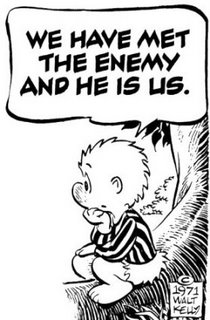

Successful investing is more about avoiding mistakes than anything else. The real leverage in the long game of investing is us—through our decisions. We have all the power and we have all the leverage. We know this conclusively in a negative way from the numerous studies on investor behavior showing how bad choices over time leverage themselves into consistently poor long-term returns.

If investors’ consistently bad choices are penalizing their long-term results, that means that consistently good choices will enhance them. So there must be something specific and persistent that is keeping investors from making what, at the end of the day, are simple and common sense choices. -Marshall Jaffe  More here More here

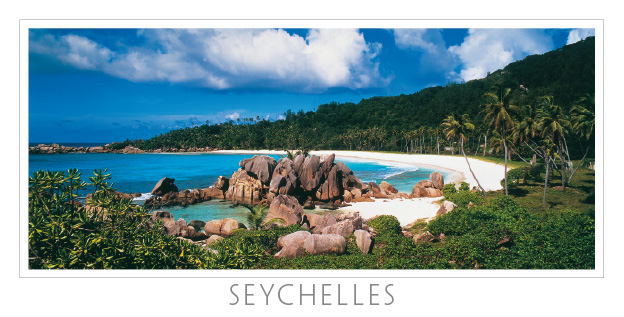

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information! Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst. Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

Fred & EntendanceInvestors Beach advice to buyers of physical precious metals is the same as always: if you purchased it and you can't hold it in your hand, it isn't yours.

|

|

|

|

Post by Entendance on Apr 13, 2015 10:40:02 GMT -5

2018: Investing & Trading

Your stops should be at a location where your initial trading idea is invalidated.

Trading without trailing stops is the ego wanting to never be held accountable (to admit that a position was a mistake) if a certain level is breached or if a certain set of circumstances play out in an unexpected manner.

Anybody who doesn't use trailing stops is going to be out of business at some point. It's not if, it's when. -Entendance

The placement of stops and limits is a critical component to successful trading. Stops are put on a trade to take a trader out of a trade at a predetermined point at a worse price than the current price. Think of them as a safety net that will prevent you from losing more money on this trade. Stops are often set based on a certain percentage of loss relative to the size of the trader’s account, or based levels of support and resistance. These are two of the more widely used criteria. Whatever method is chosen, it is imperative to have a protective stop in place on each and every trade that is placed. Without them, a trader leaves themselves open to potentially catastrophic losses.

Jonathan Hoenig: "Trailing, trailing, trailing! Stops, stops, stops!" (THE ULTIMATE STOP-LOSS order is zero.)

<For many pundits, investment tips exist in a fantasy world with no capital constraints, margin limits or time horizons. Because pundits focus on stocks picks, and not portfolio management, most of their work centers on where to put new money rather than how to deal with existing positions. So while in a perfect world we'd always have a clean slate to work with, in the real world most of us travel with baggage. And in your portfolio, that boils down to existing positions. That's always the starting point for smart financial decisions. More than anything else, your existing positions should influence how you invest. Since it's always preferable to maximize an existing position rather than open a new one, I suggest looking at what's already happening within a portfolio instead of focusing on what might happen in the market.

The best way to begin evaluating a position is to determine whether you own it as a gain or a loss. But use caution: It's at this initial step that many investors' discipline goes horribly awry. Why? Because people tend to get rid of stocks that have made money, yet hold on to shares that have gone down the drain.

The hardest thing about trading is often sitting on your hands. To that end, often the best way to maximize a winning position is to let it be. No covered-call writing. No fancy intraday swing trading. No shorting-against-the-box option strategies. When you have a winning position, just try your darndest to stay out of its way. The market doesn't know where you bought it, and although nothing feels as good a taking a profit, you can't maximize your winning trades if you're always nipping them in the bud.

Even if a winning position has grown so large that a portfolio's diversification is compromised, I still don't advocate arbitrary selling. So if you have a big winner on your hands, don't just toss it out. To maximize the position, use stop-loss orders underneath the current price of the stock, and let the market, not your judgment, guide your sales. This deters a single ill-timed trade from limiting profits. And no matter what, don't sell a share more than necessary. With winning trades, we maximize our positions by trying to stay in them.

Losing trades, however, aren't generally given the benefit of the doubt. The truth is, when it comes to portfolio management, if you worry about the losses, the profits take care of themselves. I spend most of my time looking at stocks in my portfolio that have declined and figuring out the best way to make the best of an admittedly bad situation. Not every stock is a winner. And one of the most productive ways to maximize a losing position is to learn from it. You lost money on XYZ. Fine. But as we often suggest, what often hangs traders isn't the market — it's their own poor technique.

So as painful as it might be, analyze the trade and try to understand just what went wrong. Were you trading too big? Did you get stupid and double-down? Was XYZ part of a well-thought-out strategy or just a poorly planned lottery ticket? Dealing with losses hurts — and it should. The more you dislike that pain, the better you'll be at avoiding it.

Another way to maximize a losing position is to analyze it within the context of the current market environment, perhaps making a case for keeping it. As we often like to point out, trading is first and foremost an exercise in observation. So contrast what's going on in your portfolio to what's currently happening in the market. If an old position (or group to which that position belongs) is showing new life, I'm more likely to hold the loss or tax-swap it into a similar type of security, trying to turn lemons into lemonade. Instead of always looking for new positions, it's always more advantageous to try and maximize the ones you already have. And finally, because losing trades do tend to stay losing trades, the best way to maximize an underwater position is to set a plan for getting out of it. Big losses start out as small ones, and no matter how good the story is, the sure method of handling a losing trade is to throw in the towel. The art lies in the technique. So instead of just arbitrarily selling losers, I try and maximize my position and "trade out of them." This is accomplished by setting stop-loss levels below the current market price at which you will sell a portion, if not all, of your losing position.

Even though I've ridden XYZ from $50 to $45, I won't necessarily dump the stock at $45. What I will do, however, is to set an exit strategy by establishing stop-loss orders to sell somewhere in the $44, $43 or $42 region. And while we're always fearful of "selling the low" and missing out on the big rebound, I'd rather get stopped-out than hold vigil over a losing position that might go nowhere for years. The point is that you liked it at $50, not $45. If XYZ ever gets back up there, then you can always buy it back.

The reason to use stop-loss orders below the current market price is that while losing positions tend to stay losing positions, the fact is we never really know for sure. A stop-loss order gives the stock a small amount of wiggle room in which it can potentially show some strength. As we've discussed before, as the stock moves higher, so should your stops. Should the stock continue to decline, you've already limited your risk, and because the order is placed in advance of the price being traded, you're first in line to get out.

Because the market is always unknown, even the best traders can't always predict what's going to happen. And because we're not just trading stocks, but rather positions within a portfolio, the trick isn't always to find winning names, it's to maximize the ones we've already got. By taking a skillful approach to both the winners and the losers, profitable trades are preserved to grow, while the inevitable losers are cut off, or at the very least, controlled.

Regardless of whether you take a fundamental or technical approach, stop-loss orders should be an integral part of every trading discipline. They succeed simply by design: By placing one, you're quietly acknowledging that, yes, even great stock picks can end up as lousy trades.

Stop-loss trades are the bedrock of disciplined trading. Yet the most common problem with stop-loss orders is that they never get executed. Instead of actually placing orders, most folks use "mental stops," expecting that once a certain price is hit they'll be available (and able) to make the trade. Few ever are, making mental stops about as useful to a portfolio as mental sit-ups are to abs.

So even with XYZ down 25% from the purchase price, hitting low after low far below where a stop should've been placed, many traders will hang on, naively certain that a bottom and rally aren't far off. Is it denial? Is it delusion? Either way it's expensive to your bottom line.

Once you've committed to trading with stops, the next challenge comes in knowing just where to place them. Some people opt for a technical signal, like placing stop orders at a security's 100-day moving average. Some use a mathematical approach, selling stocks if they decline 15% from the purchase price or a recent intraday high. Regardless of the approach, the most frequent grievance I hear is from people who complain that their stops always get hit, only to have the market reverse and continue higher.

The real purpose of a stop order isn't to save a few dollars, but to ensure that you move on from a trade when a market's trend has legitimately changed. And yes, when you place a stop order a mere 3% below the current market price, it will get hit. So because most stocks, just like a rodeo bull, will try and toss you off before moving higher, it's much preferable to trade a smaller position with a wider stop rather than a larger position with a tighter stop. A final thought on stops: Although there's no concrete data available, trader superstition suggests that you never place stops at "obvious" prices such as $10.00, $25.50 or other round, commonplace numbers that are likely to appeal to the herd. The rationale? The public is lazy, so when Ma or Pa Kettle establishes a stop, you can bet it's at $30.00, not $29.87. Because markets tend to cluster and churn where the herd's stops rest, I try to pick slightly more unusual prices to avoid getting tangled up in the public's clumsy tracks.>

Stocks: The Psychology of Stop Loss Levels In Praise of the Simple Stop Loss Trading Psychology and the Risk of Ruin How to Use Trading Stop-Loss Orders Day Traders – How and Why to Use a Daily Stop Loss Forex: How To Exit Forex Trades Properly How to Set Stops Can you explain Trailing Stops? Why a Stop Needs to be in Place on Every Trade

Hidden, trailed or stop on quote or even stop limit on quote orders for certain securities like OTC Bulletin Board stocks or penny stocks can't be accepted. Any broker will not allow for stop-loss orders. E.

Eric Scott Hunsader: Retail Stop Orders - how they really work

Short Selling: A Trader's Guide

When the herd go towards the water, never stand between the beasts and the river. Entendance

|

|

|

|

Post by Entendance on Apr 14, 2015 10:25:14 GMT -5

|

|

|

|

Post by Entendance on Apr 15, 2015 17:28:19 GMT -5

Psychopathic Times (Narcissist Nation) The Entendance Beach mentioned & inserted here

Inquiring minds only:***Transactional Analysis***

(Mi piace dedicare questo messaggio riguardante l'analisi transazionale e i prossimi messaggi sulla psicosintesi e sulla psicocibernetica al mio grande amico e maestro Giuseppe Cipollina Mangiameli

Io già dal 1977 avrei dovuto iniziare ad esercitare la psicoterapia grazie alla sua guida. Invece ho intrapreso la mia attività professionale nel settore finanziario internazionale, gestendo prima capitali, poi uomini e capitali e finendo come consulente personale di esseri umani che decidono sulle vite degli altri. Ringrazio quindi ogni giorno il Signore per aver donato a me e tutti Giuseppe C.M., Eric Berne, Thomas Anthony Harris, Roberto Assagioli, Maxwell Maltz   Libri da evitare: Libri da evitare:

L’ATTO DI VOLONTA’ - Roberto Assagioli, Astrolabio

TE STESSO AL CENTO PER CENTO - Wayne W. Dyer, Rizzoli

A CHE GIOCO GIOCHIAMO - Eric Berne, Bompiani

IO SONO OK TU SEI OK - Thomas A. Harris, Supersaggi Rizzoli

COME OTTENERE IL MEGLIO DA SE’ E DAGLI ALTRI - Anthony Robbins, Bompiani

PSICOCIBERNETICA - Maxwell Maltz, Astrolabio

COME TRATTARE GLI ALTRI E FARSELI AMICI -Dale Carnegie, Bompiani

Ad maiorem Dei gloriam. -Entendance)

In the 50 years since the first publication of Eric Berne’s “Games People Play,” and the formation of the International Transactional Analysis Association (ITAA), the transactional analysis community has grown from a small gathering in San Francisco to a global community.

γνῶθι σεαυτόν (know thyself)...keep your Adult Ego State

|

|

|

|

Post by Entendance on Apr 18, 2015 4:32:28 GMT -5

Always ask yourself the question “what is the one thing I can do today that will make everything else easier or unnecessary”. Focus on that one thing. If you don’t know what that one thing is, then your one thing is to find out. Always ask yourself the question “what is the one thing I can do today that will make everything else easier or unnecessary”. Focus on that one thing. If you don’t know what that one thing is, then your one thing is to find out.

Don’t focus on being busy; focus on being productive. Allow what matters most to drive your day.

If you chase two rabbits, you will not catch either one. More here here & here

Gutta cavat lapidem; non vi, sed saepe cadendo. -Publius Ovidius Naso (A water drop hollows a stone not by force, but by falling often)

Libri muti magistri (Books are silent teachers)

Mental and spiritual preparation I Mental and spiritual preparation I

Psychosynthesis

The Italian psychiatrist Roberto Assagioli began Psychosynthesis in 1910. Seeing the need to expand beyond Freud’s analysis and “talking cure”, he added synthesis and a broader use of our human abilities, such as will, imagination, and intuition. He included even our spiritual side, our higher aspirations, and our center, which he called the Self. People use Psychosynthesis as a way of life – and in a wide variety of fields, such as education, psychology, business, and spirituality. Whether student or sage, we all can enhance our development, live a more centered life, have freer use of will, and enjoy a greater sense of mutual responsibility and caring. Psychosynthesis offersl tools for many purposes: embracing opposed parts of our inner worlds, enriching each other with our differences, making groups and organizations function with greater purpose, and enjoying a respectful interchange with the world that envelops us. The main goal of the broad-ranging theory and methods of Psychosynthesis is to enhance the full range of human experience and support our movement toward Self-realization.

Roberto Assagioli was one of the masters of modern psychology in the line that runs from Sigmund Freud through C. G. Jung and Abraham Maslow. Himself a colleague of all these men, Assagioli was among the pioneers of psychoanalysis in Italy, though he pointed out that Freud had largely neglected the higher reaches of human nature. Over many years until his death in 1974 Dr. Assagioli developed a comprehensive psychology known as psychosynthesis. Psycho-synthesis sees man as tending naturally toward harmony within himself and with the world. Dr.Assagioli's concept of the will is a key part of that vision.

Roberto Assagioli: The Act Of Will

Here You Go The Complete Book Here You Go The Complete Book Excerpts from The Act Of Will:

Introduction

If a man from a previous civilization—an ancient Greek, let us say, or a Roman— suddenly appeared among present-day humanity, his first impressions would probably lead him to regard it as a race of magicians and demigods. But were he a Plato or a Marcus Aurelius and refused to be dazzled by the material wonders created by advanced technology, and were he to examine the human condition more carefully, his first impressions would give place to great dismay.

He would soon notice that, though man has acquired an impressive degree of power over nature, his knowledge of and control over his inner being is very limited. He would perceive that this modern "magician," capable of descending to the bottom of the ocean and projecting himself to the moon, is largely ignorant of what is going on in the depths of his unconscious and is unable to reach up to the luminous superconscious levels, and to become aware of his true Self.

This supposed demigod, control ling great electrical forces with a movement of the finger and flooding the air with sound and pictures for the entertainment of millions, would be seen to be incapable of dealing with his own emotions, impulses, and desires.

As several writers, Toynbee among them, have pointed out, this wide gulf between man's external and inner powers is one of the most important and profound causes of the individual and collective evils which afflict our civilization and gravely menace its future. Man has had to pay dearly for his material achievements. His life has become richer, broader, and more stimulating, but at the same time more complicated and exhausting. Its rapidly increasing tempo, the opportunities it offers for gratifying his desires, and the intricate economic and social machinery in which it has enmeshed him make ever more insistent demands on his energy, his mental functions, his emotions, and his will. For convincing evidence of this it would suffice to observe the day of the average businessman or politician, or career woman or housewife.

The individual often lacks the resources to cope with the difficulties and pitfalls of this kind of existence. His resistance may crumble in the face of the demands, the confusions, and the enticements it imposes. The ensuing disturbance leads to increasing discouragement and frustration—even to desperation.

The remedy for these evils—the narrowing and eventual closing of the fatal gap between man's external and his inner powers—has been and should be sought in two directions:

the simplification of his outer life and the development of his inner powers. Let us examine in what ways and to what extent these two procedures can provide the needed remedies...

...I shall use three categories—or dimensions—in describing the will: aspects, qualities, and stages. The first category, aspects, is the most basic, and represents the facets that can be recognized in the fully developed will. The second category, qualities, refers to the expression of the will: these are the modes of expression of the will-in-action. Finally, the stages of the will refer specifically to the process of willing, the act of will as it unfolds from beginning to end.

The fully developed will can be thought of as having a number of different major aspects; these should be thought of as the principal facets of our main subject, the major elements in the outline of the will. Each of these aspects can be trained in specific and appropriate ways. Because the bulk of Part One of this volume is concerned with these major aspects, it is well to outline them at once. The aspects of the fully developed human will are the strong will, the skillful will, the good will, and the Transpersonal Will…

...Before we embark on a detailed examination of the four major aspects of the will and how they can be developed by training, it will be useful to review the qualities of the will. If we study the phenomenology of the will-in-action, that is, the characteristics displayed by willers, we find a number of qualities which are outstanding in the great willers, and which exist also in some measure, however small, in each of us and, if necessary, can be aroused from latency manifestation. These qualities are likely to be more familiar to most readers than the aspects.

The qualities of the will are:

1. Energy—Dynamic Power—Intensity

2. Mastery—Control—Discipline

3. Concentration—One-Pointedness—Attention— Focus

4. Determination—Decisiveness—Resoluteness— Promptness

5. Persistence—Endurance—Patience

6. Initiative—Courage—Daring

7. Organization—Integration—Synthesis

QUALITA’ DELLA VOLONTA’:

1. ENERGIA - DINAMISMO - INTENSITA’

2 . DOMINIO - CONTROLLO - DISCIPLINA

3 . CONCENTRAZIONE - CONVERGENZA - ATTENZIONE - FOCALIZZAZIONE

4 . DETERMINAZIONE - DECISIONE - RISOLUTEZZA - PRONTEZZA

5 . PERSEVERANZA - SOPPORTAZIONE - PAZIENZA

6 . INIZIATIVA - CORAGGIO - AUDACIA

7. ORGANIZZAZIONE - INTEGRAZIONE - SINTESI

ASPETTI DELLA VOLONTA’:

VOLONTA’ FORTE

VOLONTA’ SAPIENTE

VOLONTA’ BUONA

VOLONTA’ TRANSPERSONALE

Roberto Assagioli “ L’atto di volontà ” ed. Astrolabio 1977

...Exercises for strenghtening the will... the complete book

Free Psychosynthesis download

The U.S.A. Association for the Advancement of Psychosynthesis

The U.S.A. Synthesis Center

Roberto Assagioli - His Life and Work

The Act of Will ROBERTO ASSAGIOLI, M.D APPENDIX ONE

SELF-IDENTIFICATION EXERCISE

DISIDENTIFICATION AND SELF-IDENTIFICATION

We are dominated by everything with which our self becomes identified. We can dominate, direct, and utilize everything from which we disidentify ourselves.

The central, fundamental experience of self-consciousness, the discovery of the"I," is implicit in our human consciousness.* It is that which distinguishes our consciousness from that of the animals, which are conscious but not self-conscious. But generally this self-consciousness is indeed "implicit" rather than explicit. It is experienced in a nebulous and distorted way because it is usuallymixed with and veiled by the

contents of consciousness.This constant input of influences veils the clarity of consciousness and produces,spurious identifications of the self with the content of consciousness, rather than with consciousness * "Self-consciousness" is used here in the purely psychological sense of being aware of oneself as a distinct individual and not in the customary sense of egocentric and even neurotic "self-centeredness" itself.

If we are to make self-consciousness explicit, clear, and vivid, we must first disidentify ourselves from the contents of our consciousness. More specifically, the habitual state for most of us is to be identified with that which seems, at any one time, to give us the greatest sense of aliveness, which seems to us to be most real, or most intense.This identification with a part of ourselves is usually related to the predominant function or focus of our awareness, to the predominant role we play in life. It cantake many forms. Some people are identified with their bodies. They experience themselves, and often talk about themselves, mainly in terms of sensation; in other words they function as if they

were their bodies. Others are identified with their feelings; they experience and describe their state of being in affective terms, and believe their feelings to be the central and most intimate part of themselves, while thoughts and sensations are perceived as more distant, perhaps somewhat separate. Those who are identified with their minds are likely to describe themselves withintellectual constructs, even when asked how they feel. They often consider feelings and sensations as peripheral, or are largely unaware of them. Many areidentified with a role, and live, function, and experience themselves in terms of that role, such as "mother," "husband," "wife," "student," "businessman,""teacher," etc.This identification with only a part of our personality may be temporarily satisfactory, but it has serious drawbacks. It prevents us from realizing the experience of the "I," the deep sense of self-identification, of knowing who we are. It excludes, or greatly decreases, the ability to identify with all the other parts of our personality, to enjoy them and utilize them to their full extent. Thus our "normal" expression in the world is limited at any one time to only a fraction of what it can be. The conscious—or even unconscious—realization that wesomehow do not have access to much that is in us can cause frustration and painful feelings of inadequacy and failure. Finally, a continuing identification with either a role or a predominant function leads often, and almost inevitably, to a precarious life situation resulting sooner or later in a sense of loss, even despair, such as in the case of an athlete who grows old and loses his physical strength; an actress whose physical beauty is fading; amother whose children have grown up and left her; or a student who has to leave school and face a new set of responsibilities. Such situations can produce serious and often very painful crises. They can be considered as more or less partial psychological "deaths." No frantic clinging to the waning old "identity" can avail.The true solution can be only a "rebirth," that is, entering into a new and broader identification. This sometimes involves the whole personality and requires andleads to an awakening or "birth" into a new and higher state of being.

The process of death and rebirth was symbolically enacted in various mystery rites and has been lived and described in religious terms by many mystics. At present it is being rediscovered in terms of transpersonal experiences and realizations.This process often occurs without a clear understanding of its meaning and often against the wish and will of the individual involved in it. But a conscious, purposeful, willing cooperation can greatly facilitate, foster, and hasten it.It can be best done by a deliberate exercise of disidentification and self-identification.

Through it we gain the freedom and the power of choice to be identified with, or disidentified from, any aspect of our personality, according to what seems to us most appropriate in each situation. Thus we can learn to master,direct, and utilize all the elements and aspects of our personality, in an inclusive and hannonious synthesis. Therefore this exercise is considered as basic in psychosynthesis

The Act of Will ROBERTO ASSAGIOLI, M.D. Chapter 5 ***THE SKILLFUL WILL: PSYCHOLOGICAL LAWS

Personal notes: since 1981 I've been reading, studying, copying again, summarizing over and over this book and practicing its excercises 2/3 times any given year. From 1983 to 2002 I have showed & teached Psychosyntesis and Assagioli's Act Of Will to many First Class Ceos and managers under my guidance. The Act of Will is the most influential and important book to me. I urge you to take your own-time just on the path of being Man/Woman for Others: read meditate and apply the Act of Will and Psychosyntesis.

|

|

|

|

Post by Entendance on Apr 26, 2015 6:46:23 GMT -5

Πάντα χωρεῖ καὶ οὐδὲν μένει καὶ δὶς ἐς τὸν αὐτὸν ποταμὸν οὐκ ἂν ἐμβαίης. -Ἡράκλειτος ὁ Ἐφέσιος

Everything changes and nothing remains still; you can’t step twice into the same stream. -Heraclitus of Ephesus

Heraclitus was born somewhere between 535 and 540 B.C. in Ephesus, the second great Greek Ionian city, and died 475 B.C. He was a man of strong, independent philosophical spirit. Heraclitus was a contemporary of Pythagoras, Lao-tzu, Confucius, and Siddhartha, the Buddha.

Unlike the Milesian philosophers whose subject was the material beginning of the world, Heraclitus focused instead on the internal rhythm of nature which moves and regulates things, namely, the Lógos, that is, Rule, Order or Reason.

Heraclitus is the philosopher of eternal change. Heraclitus' philosophy can be captured in just two words: "panta rei", literally everything flows, meaning that everything is constantly changing, from the smallest grain of sand to the stars in the sky. Thus, every object ultimately is a figment of one's imagination. Only change itself is real, constant and eternal flux, like the continuous flow of the river which always renews itself. For him everything is "in flux", πάντα χωρεῖ καὶ οὐδὲν μένει (Plato, «Cratylus»), 'everything flows and nothing is left unchanged'. In fact, according to Heraclitus, there is no permanent reality except the reality of change; permanence is an illusion of the senses.

Very little of his work has been preserved - what is left are dozens of quotes, or rather fragments of text that have been quoted by others.

"Those rivers one steps into are not the same. other and yet other waters keep flowing on"

"Into the same rivers we step and yet we do not step, we exist and at the same time we do not exist"

"In the end, there is only flux, everything gives way"

Heraclitus and Politics Jan 29, 2017: ***Changing Yourself By Changing Your Self

Heraclitus for traders and investors: certain folks are slow in realizing and accepting change. Change happens and if you do not factor macro and microeconomic shifts into your investing strategy, you get squashed: "The only constant is change." That doctrine is especially true in the markets. Therefore, as we constantly upgrade our skills, we should remain supple enough to adapt to an ever-changing field of play. Human nature -- especially in herds -- is unchanging. But these behaviors must be contemplated within their larger context. Add a new element -- PCs, lower trading costs, the Internet, vast amounts of cheap data and you introduce a new factor that impacts all the players on the field.

As conditions change, we should decipher how they impact our strategy, our emotions and our trading & investing and adjust accordingly. (Assagioli's qualities of the will) Entendance

The Entendance Beach & Heraclitus |

|

|

|

Post by Entendance on Jun 11, 2015 5:04:36 GMT -5

2017: Investing & Trading

Brett S.: "It is very important to understand the difference between trading and asset management. Trading takes advantage of short-term dislocations and seeks to make relatively quick returns. Asset management is a balanced approach to investment, in which the investor seeks long term returns from underlying factors that drive the returns across markets.

Traders are like skilled poker players at the casino, sizing up their hands, sizing up the other players, and making intelligent bets when odds are favorable.

Asset managers are like casino owners who dedicate resources to a variety of games that appeal to different gamblers.

If you live life like a good trader, you will step aside from noise and pounce on life's opportunities as they present themselves.

If you live life like a good asset manager, you will identify the factors that drive your happiness, fulfillment, and success and pour your resources into those.

It's a theme I don't hear people talking about: how you manage your money is how you should be managing your life.

Are you living life like a good trader, identifying and pursuing real opportunities, while standing aside amidst noise?

Are you living life like a good asset manager, balancing your life's assets to achieve a continuous stream of favorable returns?

Too many people live like bad traders and bad investors: they overtrade and fail to invest.

The ability to pounce on real opportunity here and now combined with the investment across many areas of opportunity--not a bad formula for running one's finances. Also not a bad formula for leading one's life."

Top Mistakes Many Traders Make Fred & EntendanceInvestors Beach goal is simple...

...in hot pursuit of excellence in trading and investing...E.

Robert V. Green: Trading And Investing Are Different

"When you confuse the two approaches at the same time, you are just asking for trouble. Here are some basic definitions.

Trading Defined

A trade, by definition, is a short term approach to making a profit.

Most trading profits are derived from volatility in a stock price. Stock prices fluctuate whenever the market is trying to determine the proper price for a stock.

But there is no such thing as the proper price. If there were, stock prices would stabilize very closely around whatever that price was. Who would sell for less? Who pay more?

True trading strategies involve exploiting short-term gaps in the market's attempt to properly value a stock.

How to determine these gaps, however, is a whole field of study by itself.

Trading Strategies

Almost any rationale can be used for trading, particularly very short term trades. Many trade on the basis of momentum, which is simply the premise that any stock currently going up is more likely to continue going up, than it is to fall. Momentum based trading has never been more popular than in the advent of the new information investing era of the last five years. In fact, many people blame the bubble on momentum investing's rise to prominence.

Technical analysis is another very useful approach for trading. In the lack of other news events, technical analysis of a price/volume chart can provide clues as to the latent buying or selling pressure still in the market, but not yet implemented. Proper reading of the chart can help determine the level of that demand - and exploit it.

But it is wrong to assume that everyone comes to the same conclusion when reading a TA chart. There is no single interpretation to any chart. Often new investors learn a single TA approach, and begin believing that, because a pattern fits the one described in their TA book, the predicted outcome is inevitable. It just doesn't always happen that way.

Trading And Analyzing Fundamentals

Trading does not mean that analysis of fundamentals is ignored.

In fact, many successful traders exploit the market's attempt to properly value a stock by arguing that the current valuation on the stock is not "in-line" with the trends shown in the company's fundamentals. A trading argument can be made that, eventually, the market will more properly value the fundamentals. Capturing this "gap in valuation is a basic trading strategy, that may or may not be short-term.

Of course, there are many extremely successful traders who do not deeply analyze the underlying business behind the stock. Their techniques are based on shorter term fluctuations in the market's pricing.

Daytrading Defined

Daytrading, as term to describing an investment approach, has always been used poorly by the media.

In most stories, "daytrading" is meant to imply mindless or reckless investing. Nothing could be further from the truth. Most of the major capital behind "daytrading" is driven by large institutions. There is, unfortunately, no widely agreed upon definition of daytrading that we could argue is the "right" definition. Many people attempt to use the single word "daytrading" to capture two very different styles of trading. By definition, a person doing "daytrading" should be closing positions by the end of the day. Otherwise, it isn't daytrading. Selling a stock three days after you buy it is trading, not daytrading.

Investing Defined

Investing is ownership of the underlying business behind a stock. The expectation is that when the business grows, the stock price will rise as the market prices the "better" business atf a higher level.

Fundamental analysis is used to determine the health of the underlying business. Comparative analysis is used to determine the value of the stock, relative to others in its industry. An understanding of technology is helpful for technology stocks. Some of the best investments are made on the cusp of change in technology, before the fundamentals of the company have actually shown the impact of the change.

Investing on a fundamental premise is almost always, by definition, a long term investment. It often takes years for a business to fulfill its business "vision."

In order to have an investment premise successfully "pay off," the following has to occur:

• An articulated premise is formed describing "why" the business will grow earnings eventually

• A reasoned "projection" of how the market will value those "eventual" earnings is developed

• A target price for the eventual fulfillment of the investment premise can then be developed (which calculates your reward potential)

• An analysis of what can go wrong in the business is developed.

• A judgment of how the market would value the company, if those "wrong" events occur is made. (This calculates your "risk" potential.

• At this point, an assessment is made of the risk/reward potential. Some great companies are simply titled too far to the risk side of the ratio to argue for an investment.)

• A list of metrics is developed that can be followed in every quarterly earnings report, to judge whether a stock is: a) headed towards fulfilling its business vision; b) headed the wrong direction; or c) has fulfilled the vision you initially articulated.

With actual metrics defined, an investment premise can be judged fairly easily whenever new fundamental data is available (earnings reports or SEC filings or guidance revisions).

However, patience is required for an investment premise - and can sometimes be sorely tested.

Frankly, as an investor, if you can't withstand a 35% paper loss in your position, you probably should not be holding growth stocks at all.

Getting the Two Styles Confused

Both styles have their place, and both are valid approaches.

However, it is important not to get the two styles confused, especially with respect to a single position.

All too common is the person who takes a position for a short term trade (I'll sell when I get 5 points out of it!) and then winds up holding the stock for six months, just waiting to break even. When you enter for trading reasons, and then hold for investment reasons, you are actually exposing yourself to the downside of both approaches.

Another example of confusing the issues is when a stock rises a lot on particular news. Do you back off from jumping in, because yesterday it was $5 cheaper? It may, in fact, be "cheaper" at the higher price, if a significant risk has just been removed by the news.

How you view such an event is largely dependent on whether you have a trading premise or an investing premise.

Know Yourself - But Know Your Positions More

Most people tend to think of themselves as either primarily a trader or an investor. But, there is nothing that states you have to be "one or the other" for all of your positions.

It is, however, important to remember which hat you have on at any given time."

The Ten Reasons Why So Many Traders Lose So Much Money The Ten Reasons Why So Many Traders Lose So Much Money

Brett Steenbarger: Who should I try to dissuade from trading?

*The Ill-prepared. This goes without saying. No one should commit their money to a trading career without thorough and rigorous preparation. I have been harping on this since the inception of this blog.

**The Lazy. Like our anonymous trader who was so incensed because Woodie would not call out his entries or exits - and for free! If someone is unwilling to put in the work, then how can they really expect to reap any reward?

***Substance Abusers. I've talked about this frequently. How alcohol and other drugs of abuse will deleteriously affect our judgment and ability to learn. That is, to modify our behaviors.

****People with psychiatric disorders. The severely depressed or manic patient will view the market and, indeed, the world through his own distorted view. How can he objectively assess a complex market when he is nihilistic or wildly exuberant? *****The Rigid Perfectionist. The market, no matter how good your indicator, is not amenable to rigid analysis. It is chaotic and even tempestuous. The perfectionist will demand 100% perfection in his indicator. Or worse, in his performance. Frustration at the inevitable inability to be perfect in a chaotic market will erode his self-confidence and emotional control. It will likely lead to emotional eruptions as the acute stress response arises when trades do not go as predicted.

******The Gambler. This is kind of the opposite of The Perfectionist. The perfectionist demands predictable, reproducible results. The gambler knows that this is not the case. He throws his money into a trade and hopes to be rescued by "Lady Luck" or "The Gods of Chance." As they don't exist, his wins and losses are random events. The worst thing for a gambler is to hit a winning streak. His belief in his "luck" or his "winning system" will encourage him to rapidly escalate his "bets" and, therefore, his losses.

*******The Indecisive. This may, or may not be, a sub-category of The Perfectionist. He demands predictability, but knows that that is impossible. And so he hesitates. Or, he may be inadequately prepared, and so lacks confidence in his trading plan. Or he may have experienced a loss or series of losses and so that weighs on him. He may know that losses are a part of the game, but is unwilling to accept that fact.

********The Under Capitalized. As noted above, losses are a part of the game. You may have an excellent indicator with an 80% win rate. But what if your first 20 trades are losers?  Can you withstand the draw-down? Can you withstand the draw-down?

*********The Impulsive. Are you willing to wait for the proper circumstances. Are you willing to sit and wait? Can you follow your trading plan without modifying it on the fly? Can you say to yourself: "Wait. Be patient. Do the harder thing."

**********Those, who by training and education, becomes perfectionists. By this, I mean Doctors, Architects, Engineers, and, perhaps Lawyers. Many professionals are trained to go "beyond a reasonable doubt." They frequently demand absolute certainty in their decision-making. Would like an architect or engineer to design and build a skyscraper or bridge that would only be safe 55% or 65% of the time? Would you go to a doctor or trial lawyer who could accept losses; cut them short; and walk away saying: "Well, the next one will turn out better"? And yet, that is exactly what the trader must accept and do. It may thus become very difficult for these highly-trained professionals to mentally switch gears and do what, instinctively, goes contrary to their very nature.

A successful trader has to have an independent mind; otherwise they will simply see markets and trade them like everyone else. Being able to stand apart from the herd, being able to develop fresh ideas and perspectives, looking for opportunities in unusual places: these are skills that are common among very successful traders.

When you have that independence of mind, you tend to be a bit unconventional. And that's why successful traders aren't boring people. They have unique views; they see things differently. True, there's more to trading success than nonconformity. Still, it's difficult to imagine sustaining success if you don't have the ability to question consensus views and maintain confidence in your own, unique perspectives."

Action without study is fatal. Study without action is futile.

Debt is BETTER than cash? Debt is BETTER than cash?

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

|

|

|

|

Post by Entendance on Jul 25, 2015 3:33:29 GMT -5

"The real voyage of discovery consists not in seeking new landscapes but in having new eyes." – Marcel Proust

“Times will change for the better when you change.” ― Maxwell Maltz

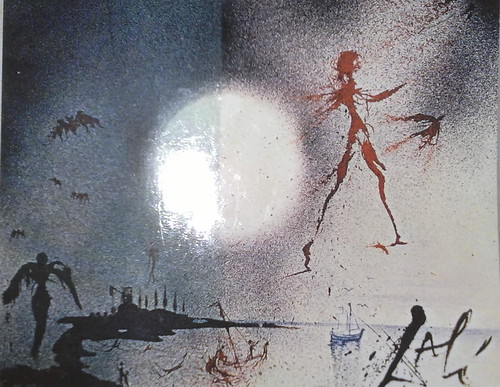

In 1966 Salvador Dali painted “Darkness and Light” depicting his experience with Psycho-Cybernetics, which he presented as a gift to Maxwell Maltz. The following is Dr. Maltz’s description of the painting, based on his conversation with Salvador Dali when first presented with the painting.

“In the center of this painting is a world divided into two parts. The left is a a world in shadow from frustration. Here in the middle, you have a man’s image, shrunken to the size of a small potato, moving away from reality, toward the black angel of desctruction. Below you see a ship without any sails about to capsize in the rough seas of frustration. Now, the other half of a man’s inner world is of sunlight, of coincidence. Here, man’s image is ten feet tall and is walking towrad the sun. Below you see a ship in calm waters about to reach port. And what is this port? Peace of mind! We can learn to walk away from this shadow world of frustration into the dawn of a new world, through confidence.”

Libri muti magistri (Books are silent teachers)

Maxwell Maltz: Psycho-Cybernetics (1960) Your Brain as a Self-Image Guided Missile! here you go the complete book/ More here

<One of the best books I have ever read in the field of psychology and identity. This book is a must read for anyone interested in personal development, understanding yourself and understanding others.>- F.Jefferson <Great book about how our perceptions create our reality. I recommend this to anyone who is wanting to change their lives in any way, shape or form. The author was a plastic surgeon and was able to change people's lives with a knife, but he learned that it took more than a change of the body to change someone's self image. It's an easy read and easy to follow book. This book changed my life and my self-image and improved my self-esteem. This is one of the few books that I am going to keep on re-reading for the rest of my life.> -K.Charmaine

Maxwell Maltz on YouTube

Oh, well, don't forget the R.Assagioli Law 1 – ***Images or mental pictures and ideas tend to produce the physical conditions and the external acts that correspond to them.... Assagioli at Fred & EntendanceInvestors Beach  ***Be the Person You Want to Become ***Be the Person You Want to Become

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst. Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen! |

|

|

|

Post by Entendance on Aug 16, 2015 3:14:12 GMT -5

The Real Fight Is Within: Mental Hygiene II (The Real Fight Is Within: Mental Hygiene I here)

***Mistakes Were Made (But Not by Me): Blind Spots

1. Denial 2. Regression 3. Acting Out 4. Dissociation 5. Compartmentalization 6. Projection 7. Reaction Formation 8. Repression 9. Displacement 10. Intellectualization 11. Rationalization 12. Undoing 13. Sublimation 14. Compensation 15. Assertiveness ***15 Common Defense Mechanisms

< Amygdala is the integrative center for emotions, emotional behavior, and motivation. If the brain is turned upside down the end of the structure continuous with the hippocampus is called the uncus. If you peel away uncus you will expose the amygdala which abuts the anterior of the hippocampus. Just like with the hippocampus, major pathways communicate bidirectionally and contain both efferent and afferent fibers... < Amygdala is the integrative center for emotions, emotional behavior, and motivation. If the brain is turned upside down the end of the structure continuous with the hippocampus is called the uncus. If you peel away uncus you will expose the amygdala which abuts the anterior of the hippocampus. Just like with the hippocampus, major pathways communicate bidirectionally and contain both efferent and afferent fibers...

As was the case with the hippocampus, fibers carrying inputs to the amygdala are in virtually all cases combined with fibers carrying outputs from the amygdala.

The amygdala receives inputs from all senses as well as visceral inputs Since the amygdala is very important in emotional learning it is not surprising that visceral inputs are a major input source. Visceral inputs come from the hypothalamus, septal area, orbital cortex, and parabrachial nucleus. Olfactory sensory information comes from the olfactory bulb. Auditory, visual and somatosensory information comes from the temporal and anterior cingulate cortices. Stimulation of the amygdala causes intense emotion, such as aggression or fear.

Irritative lesions of temporal lobe epilepsy have the effect of stimulating the amygdala. In its extreme form irritative lesions of temporal lobe epilepsy can cause a panic attack. Panic attacks are brief spontaneously recurrent episodes of terror that generate a sense of impending disaster without a clearly identifiable cause. PET scans have shown an increase in blood flow to the parahippocampal gyri, beginning with the right parahippocampal gyrus. Similar but attenuated blood flow increases occurs during anxiety attacks.

Destructive lesions such as ablation of the amygdala cause an effect opposite to the irritative lesions of temporal lobe epilepsy. Destructive lesions of the amygdala cause tameness in animals, and a placid calmness in humans characterized as a flatness of affect. Lesions of the amygdala can occur as a result of Urbach-Wiethe disease where calcium is deposited in the amygdala. If this disease occurs early in life then these patients with bilateral amygdala lesions cannot discriminate emotion in facial expressions, but their ability to identify faces remains. The anatomical area for face recognition and memory is in the multimodal association area of the inferotemporal cortex. This is a good example of how emotion in one area (amygdala) is linked with perception in another area (inferotemporal cortex) to create an intense emotionally charged memory...Fear Conditioning: How the Brain Learns about Danger ...>

**Amygdala hijack

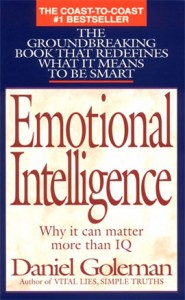

The term amygdala hijack describes any situation in which a person responds inappropriately based on emotional rather than intellectual factors. The amygdala is the emotional center of the human brain and can create split-second responses when a person is threatened. An inappropriate emotional response to a perceived threat is thus called an amygdala hijack. The term was invented by psychologist and journalist Daniel Goleman in his 1996 science bestseller, Emotional Intelligence. The term was invented by psychologist and journalist Daniel Goleman in his 1996 science bestseller, Emotional Intelligence.

More on Daniel Goleman and his works

****Emotional Intelligence and Trading

***11 Signs You Have High Emotional Intelligence

And remember: needless drama, the "games", gossip and negativity stop us from being the best we can be. Entendance gossip and negativity stop us from being the best we can be. Entendance  The Real Fight Is Within: Mental Hygiene I

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

James Montier’s behavioral investing The brain has two main information processing systems; the reflexive and the reflective. The brain defaults naturally to the emotional or reflexive system, as opposed to the objective, or reflective system. It may surprise you to know that reflective thinking is tiring. The brain is a muscle, and when used for a long period it becomes fatigued. Brain fatigue can, and does, affect performance.

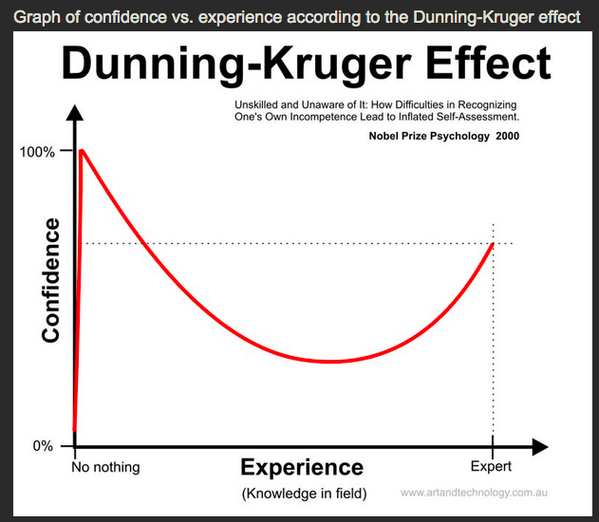

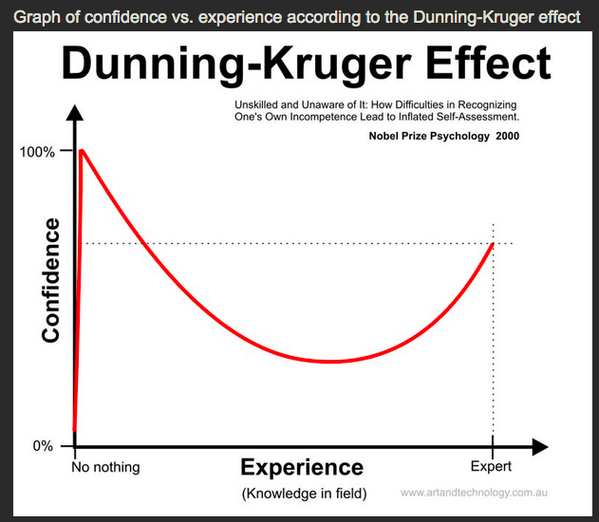

Unfortunately, there are two human qualities that complicate decision-making. Firstly, the brain is hardwired to enjoy short-term gratification. Secondly, the brain dislikes social-exclusion behavior (the brain prefers a herd mentality). What's more, according to James Montier, the brain is also susceptible to 22 other forms of bias. The majority of these biases revolve around self-deception, simplification, emotion and social interaction. The Brandes Institute researchers picked out eleven key emotional biases that they believe are the most damaging to investor performance over the long run.

The first four key criteria relate to the central bias of self-deception. Two of these are overconfidence and overoptimism. More often than not, investors overestimate their ability and feel more confident than they should. Two other self-deception factors are self-attribution and hindsight. Simply put, people credit their skill for good outcomes and blame bad luck for bad outcomes.

On the central topic of simplification, once again there are four primary traits that hold investors back. Firstly, anchoring: People often grasp non-relevant information, often believing that are making better decisions. Secondly, representativeness: People judge by appearance rather than likelihood. People like a good story over hard facts. Thirdly, framing: More often than not, investors will give different answers depending on the same, but differently framed, questions. Fourth, loss aversion: People usually give more weight to losses than to corresponding gains. On the two central topics of emotional and social interaction, James Montier notes that the two main traits holding investors back are:

1.Regret theory: The fear of being wrong outweighs the cost in objective economic terms

2.Herding: Neurologists have found that real pain and social pain are felt in the same part of the brain. Contrarian strategies are the investment equivalent of seeking out social pain...

[PDF]

NEW! Real-Time Trader's Feed at Investing & Trading *Inquiring minds only!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst. Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

We will never underestimate our own stupidity! Stupidity Chapters I II III IV V VI & VII here We will never underestimate our own stupidity! Stupidity Chapters I II III IV V VI & VII here

|

|

|

|

Post by Entendance on Sept 17, 2015 17:19:53 GMT -5

2017: Investing & Trading

someone just copied me...Dear mr. Lund, why on earth are you copying me!  "Trading for a living is a business. Treat it as such." Must read! So, You Want to Trade for a Living? Getting Started

2018: Cheap Stocks

Traders only

Steve Burns Here are the errors we make that cause the market to take our money:

1. Traders miss a trade setup, then take it late in the move. Chasing a trade is rarely a good decision. Buy right or sit tight.

2. Traders buy a dip before it really reaches a good risk/reward setup.

3. Traders buy a dip before there is any sign of a reversal.

4. Traders wait for the perfect moment and end up with no setups.

5. Traders hold onto opinions after price action has proven them wrong.

6. Traders are stopped out of ordinary price action because their stop losses are too close, and their trades aren’t given enough room to breathe.

7. Traders perpetually short uptrends and buy downtrends, missing the easy money and creating losses.

8. Those that spend more time trading than studying will have their money taken by traders devoted to learning.

9. Caring more about personal opinions than price action is the best way to donate money to the market.

10. Holding onto a losing trade because you don’t want to take the initial loss, is a great way to turn a small loss into a big one.

Are you ready to trade?

1. Do you have a quantified trading system of entries and exits? Have you found a way to capture trends in your time frame by studying historical price action?

2. Have you backtested your system adequately? Do you know what the possible odds are for your trade setups based on historical price data?

3. Do you have a strong support system in place? Do you have friends and family that support your desire to be a trader?

4. Do you have enough trading capital? Serious active traders should have adequate capital. Low capital will have trouble overcoming commissions, and even the bid/ask spread in lower volume markets.

5. Do you have a written trading plan? You should create a written plan when the market is closed so you know what actions you will take when the market is open.

6. Do you fully understand proper risk management? It is imperative that you understand the mathematical risk of ruin before you start trading. Never losing more than 1% of your trading capital on any one trade, is a great place to start.

7. Have you decided what position size you are emotionally comfortable trading? You must trade with a position size small enough that you can follow your trading plan. A position size too large can distract you and make you veer from your plan.

8. Do you have realistic expectations about returns? The greatest traders in the world return 15% -25% a year. Trying to get rich quick is the fastest way to go broke.

9. Do you have enough faith in your methodology to trade it through drawdowns? You have to know the consecutive losses to expect from your trading system, and accept it when it happens.

10. Do you have faith in your abilities to trade like it is a business? You have to trade like you are a casino, knowing the odds are in your favor long term, and not like a gambler who disregards the odds that are against you.

Trading is tough

"A speculator is a man who observes the future, and acts before it occurs." - Bernard M. Baruch

So You Want To Trade For A Living...Be advised: there are no shortcuts to any place worth going...Entendance

Action without study is fatal. Study without action is futile.

<...When a stock you own is crashing, you need to ask yourself two things:

1) Is the reason I bought it still valid?

If you bought a tiny biotech stock because you thought its drug was going to succeed, but it failed, you need to get out... Don't say, "Well, the company has other things cooking, too" or "Well, I've lost SO MUCH already, how much worse can it get?"

Don't catch yourself saying either of those things. If the reason you bought the stock is no longer valid, get out.

2) What is my "point of maximum pain"?

How much are you willing to lose before crying "uncle"?

You should try to define this point when you enter the trade. That way you've made a rational decision to sell in advance, not an emotional decision right at the moment the stock is down.

My preferred exit strategy:"trailing stops.> -Dr. Steve Sjuggerud

Jonathan Hoenig: The 80/20 rule

<One of the most influential — though seldom mentioned — economists of the 20th century was Vilfredo Pareto, an Italian who in 1906 developed a simple mathematical formula now widely known as the 80/20 rule. Although other scholars have subsequently refined it, the basic idea remains the same: In almost all cases, the vast majority of the results are created by a small number of causes.

Although it's most commonly applied to sales and management issues, the 80/20 rule applies to trading quite well. Despite the high premium often placed on being a good stock picker, I've found that the vast majority of profits come from a small handful of trades. And while picking a stock that drops isn't fun, it's the cost of doing business and can't be permitted to derail one's confidence. The best traders are selective in where they put their money to work. They can't bet on everything; what counts is focusing on only their top ideas.

As I always point out, the point of investing is to make money. It would be quite convenient if every investment rose a comfortable 10% — but in reality, it's always a small handful of big winners that account for the majority of a portfolio's overall return.

The lesson of the 80/20 rule is to focus on the 20% that actually matter. While many stocks go nowhere at all, investors who have the patience to let their winners run will usually find two or three trades a year that can rise 50% or more. A relatively small amount of risk capital produces the lion's share of the overall gain.

Of course, traders never know in advance which investments will be the important 20%. Some are intent on making money with a specific stock; it's the flexible traders who don't fight a trend, but follow it. Although they were certain that XYZ was the next big thing, if the market isn't confirming this suspicion, good traders are humble enough to move on.

Just as only a small percentage of winners will garner big gains, the 80/20 reality of trading is that an equally modest number of trades ever become winners in the first place. In my experience, I'd say close to 80% of my total trades are either break-even "scratches" or downright losers. I'm "right" only about 20% of the time. But by focusing on keeping the losses small, the relatively few number of winners more than make up for the stocks that drop or go nowhere at all.

Of course, what usually cripples investors isn't the market, but their own self-destructive loss of discipline. Because many of trades will be downright wrong, investors must to learn to emotionally let themselves off the hook. Yet what motivates many traders isn't making money, but being right. So when XYZ moves five points against them, they don't just chalk it up as a loss and move on, but obsessively add to the position, intent on saving face more than money. I've been there, and trust me: You inevitably end up losing both.

The lesson of the 80/20 rule is being able to handle the 80% of trades that don't work out. Being wrong, even on a majority of trading ideas, matters only to the extent that the trader can't deal with it. As a veteran of far too many shame spirals, let me tell you: A disciplined approach beats going from the gut every time. Remember, it's managing the trade — not simply picking a stock — that has the biggest impact on the bottom line. Repeat this to yourself often enough, and dumping an investment becomes as mundane as taking out the trash.

There are thousands of investment options out there — and some people act as if it's their constitutional responsibility to have positions in as many of them as possible. This results in far too many portfolios being a patchwork of ideas rather than a few strategic themes. There's a big difference between being diversified and being disorganized.

As I often point out, traders can't invest in everything. Selectivity is crucial. Trading for the mere thrill of it results in far too many suckers' bets. It's a losing approach.

Out of the total number of trades I consider, I focus on only the top 20% of my ideas. It's just too expensive and time consuming to put money to work on anything but my best.

So don't just buy a stock because you know the company, like its product or hear it mentioned on cable TV. To quote Gordon Gekko, "I look at a hundred deals a day...I choose one." You should be equally discriminating. The trades I make are those I feel compelled to make out of my own selfish interest. They don't just excite me — they keep me up at night.

Although the 80/20 rule wasn't developed for traders, it's relevant nonetheless. Whether you're evaluating your profits, trades or ideas, the lesson is always the same. First, focus on what matters. Next, run with it.>

CONDITIONAL ORDERS TUTORIAL

|

|

|

|

Post by Entendance on Sept 22, 2015 16:45:14 GMT -5

2017: Investing & Trading

***Meeting With Triumph and Disaster: Some Lessons

Brett Steenbarger: <1) Resilience - Successful traders take risk. Successful traders are sometimes wrong. Successful traders take hits. Successful traders learn from the hits, get up, and move on. They are resilient. They succeed, as Churchill observes, by moving from failure to failure with enthusiasm.

2) Selectivity - Successful traders have clear criteria for what makes good trade ideas. They also have separate criteria for what turns good ideas into good trades. They don't watch everything, and they certainly don't trade everything. They wait for good ideas to become good trades. 2) Selectivity - Successful traders have clear criteria for what makes good trade ideas. They also have separate criteria for what turns good ideas into good trades. They don't watch everything, and they certainly don't trade everything. They wait for good ideas to become good trades.

3) Calling - Successful traders have an uncanny sense that this is what they're meant to be doing. It's not a job, and it's not a career for them. It's a calling. That's the only thing that can keep people searching and re-searching, banging away for good ideas and good trades. And it's the only thing that enables them to gain the immersive pattern recognition experience that separates them from average traders.>

"Accept that every time you invest, you take a risk with your money. Do all you can to minimize those risks. Work through the alternatives. Spread your wealth around. Look for antifragile opportunities. And banish the word ‘guaranteed’ from your mind." -Monevator

"When you personalize the market, you fall into the trap of trying to be right rather than trying to make money." -Ben Carlson

Fred & EntendanceInvestors Beach...because this place is for Uncolonized Minds.

|

|

|

|

Post by Entendance on Jan 15, 2016 6:06:24 GMT -5

2017: Investing & Trading

20 Terrible Ways to Trade

Good trading is very basic; it’s trading with an edge to capture a trend in your own time frame, while managing your risk exposure carefully with the right position sizing and stop loss.

There are endless ways to trade badly. You can change these if you make an effort and become self-aware. Be on the lookout for these pitfalls.

Here are the top 20:

1.Angry trading: When you trade angry and want to win from the time you enter to the time you exit, you get angrier and make mistakes if your trade goes against you.

2.Loose trading: You trade too big, you stay in losing trades too long, you chase trades after the entry has passed, and you shift from discipline to opinions.

3.Tight trading: You set stop losses too close, you trade too small, or you exit winning trades too quickly.

4.Aggressive trading: Trading too big on every entry with an all or nothing mentality. You think each entry is a great trade, and you try to maximize your gains by risking large losses through big position sizing.

5.Passive trading: You have no strategy for entries or exits. You chase the price action any way it goes with no defined strategy.

6.Over trading: You take more trades than you really should, causing excessive commissions. Over trading is caused by boredom and the fear of missing out.

7.Entitlement trading: You believe the market owes you money because of the effort you have put into your trading system. You view losses as unfair.

8.Annoyed trading: Each loss causes you to be frustrated. The more times you lose, the more erratic your trading becomes as you search for trade entries with no edge.

9.Biased trading: You believe so strongly in the direction of the market you become blind to the fact that you are wrong. You begin to filter everything through your bias so you can maintain your belief in market direction, even when all the evidence is against you.

10.Injustice trading: You believe that they are out to get you. They went after your stop, they are idiots, they are out to cause you to lose. Schizophrenic trading.

11.Frustration trading: You can not make good decisions because the price action frustrates you.

12.Sloppy trading: You don’t do your homework. You are disorganized and have no trading plan or system.

13.Revenge trading: You trade with the belief that the market owes you money. It skews your perspective and gives your trading a bad motivation.

14.Underfunded trading: You trade with an account so small that commissions are a high percent of your account. You trade too large in an attempt to grow your money fast and blow up your account.

15.Shame trading: You are embarrassed to trade because you were to confident and vocal about trades that went sideways.

16.Distracted trading: Your trading is low on your priority list and you easily lose your focus.

17.Scared trading: You have trouble entering your trades because you are afraid of losing trades.

18.Envy trading: You get demoralized by someone else’s great trading that you find it hard to trade your own system.

19.Demolition trading: You feel unworthy of trading success and money so you subconsciously trade in a way that destroys your account and helps you fulfill your prophecy.

20.Trading with no edge: Your trades and results are random. The money you make through luck are given back during unlucky streaks.

-Steve Burns

**The safest places in the world to store your gold your silver and your cash

***Losses Hurt Psychologically far more than Gains Give Pleasure – Prospect Theory

****How to Determine Proper Position Size When Forex Trading & more...at How to safely protect your life your liberty and your assets Fred & EntendanceInvestors Private Beach. Members Only Area. Join us: become members!

Linda Bradford Raschke: 1.Buy the first pullback after a new high. Sell the first rally after a new low.

2.Afternoon strength or weakness should have follow through the next day.

3.The best trading reversals occur in the morning, not the afternoon.

4.The larger the market gaps, the greater the odds of continuation and a trend.

5.The way the market trades around the previous day’s high or low is a good indicator of the market’s technical strength or weakness.

6.The previous day’s high and low are two very important “pivot” points, for this was the definitive point where buyers or sellers came in the day before. Look for the market to either test and reverse off these points, or push through and show signs of continuation.

7.The last hour often tells the truth about how strong a trend truly is. “Smart” money shows their hand in the last hour, continuing to mark positions in their favor. As long as a market is having consecutive strong closes, look for up-trend to continue. The up trend is most likely to end when there is a morning rally first, followed by a weak close.

8.High volume on the close implies continuation the next morning in the direction of the last half-hour. In a strongly trending market, look for resumption of the trend in the last hour.

9.The first hour’s range establishes the framework for the rest of the trading day.

10.A greater percentage of the day’s range occurs in the first hour then was the case in the past, and thus it has become increasingly important to trade aggressively if there are early signs of a strong trend for the day.

11.There are four basic principles of price behavior which have held up over time. Confidence that a type of price action is a true principle is what allows a trader to develop a systematic approach. The following four principles can be modeled and quantified and hold true for all time frames, all markets. The majority of patterns or systems that have a demonstrable edge are based on one of these four enduring principles of price behavior. Charles Dow was one of the first to touch on them in his writings.Principle One: A Trend Has a Higher Probability of Continuation than Reversal

Principle Two: Momentum Precedes Price

Principle Three: Trends End in a Climax

Principle Four: The Market Alternates between Range Expansion and Range Contraction!

12.In the world of money, which is a world shaped by human behavior, nobody has the foggiest notion of what will happen in the future. Mark that word – Nobody! Thus the successful trader does not base moves on what supposedly will happen but reacts instead to what does happen.

Sometimes you just have get away from the screens. Entendance

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information. |

|

|

|

Post by Entendance on Jan 31, 2016 5:06:39 GMT -5

2017: Investing & Trading

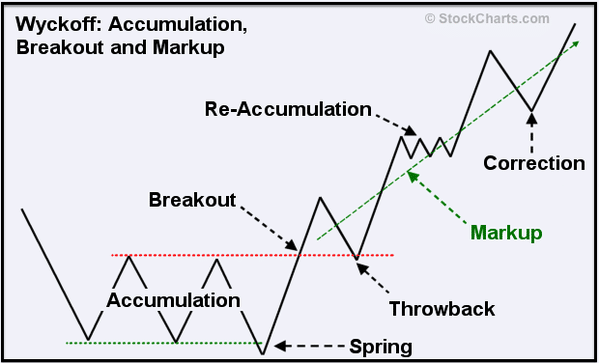

***The Best Trading Strategy for Trading Trend and Range***

**********

"I’ll tell you now that the best strategy in almost any case is to find a role-model, someone who’s already getting the results you want, and then tap into their knowledge. Learn what they’re doing what their core beliefs are, and how they think. Not only will this make you more effective, it will also save you a huge amount of time because you won’t have to reinvent the wheel." — Anthony Robbins

***The Ultimate Trading Education***

More at Fred & EntendanceInvestors Private Beach. Members Only Area.

Join us! Become a member!

|

|

|

|

Post by Entendance on Apr 4, 2016 2:58:04 GMT -5

It doesn’t take long to identify one or more of these in your thinking. Just recognizing these traps can be helpful.

10 Cognitive Distortions 1. All-or-nothing thinking : You look at things in absolute, black-and-white categories.

2. Overgeneralization: You view a negative event as a never-ending pattern of defeat.

3. Mental filter: You dwell on the negatives and ignore the positives.

4. Discounting the positives: You insist that your accomplishments or positive qualities don’t count (my college diploma was stroke of luck…really, it was).

5. Jumping to conclusions (loves alcoholic families): You conclude things are bad without any definite evidence. These include mind-reading (assuming that people are reacting negatively to you) and fortune-telling (predicting that things will turn out badly).

6. Magnification or minimization: You blow things way out of proportion or you shrink their importance.

7. Emotional reasoning: You reason from how you feel: “I feel like an idiot, so I must be one.”

8. “Should” statements (every other word for me): You criticize yourself or other people with “shoulds,” “shouldn’ts,” “musts,” “oughts,” and “have-tos.”

9. Labeling: Instead of saying, “I made a mistake,” you tell yourself, “I’m a jerk” or “I’m a loser.”

10. Blame: You blame yourself for something you weren’t entirely responsible for, or you blame other people and overlook ways that you contributed to a problem.

-Therese Borchard All about***Cognitive Dissonance

I've said it before and I'll say it again:

The Act of Will is the most influential and important book to me. I urge you all to please take your own-time just on the path of being Man/Woman for Others: read meditate and apply the Act of Will and Psychosyntesis. Entendance

The Act of Will ROBERTO ASSAGIOLI, M.D. Chapter 5 THE SKILLFUL WILL: PSYCHOLOGICAL LAWS