|

|

La sòla

Aug 10, 2018 4:32:16 GMT -5

Post by Entendance on Aug 10, 2018 4:32:16 GMT -5

John Alexander, Ship of Fools, 2006-2007, oil on canvas, Smithsonian American Art Museum 8th and F Streets, NW Washington, DC

Previously on The Beach: Jun 28, 2017- Aug 8, 2018 Italiani -Ormai la salvezza è solo individuale

("We're all Jesuits")Bota na conta do Papa

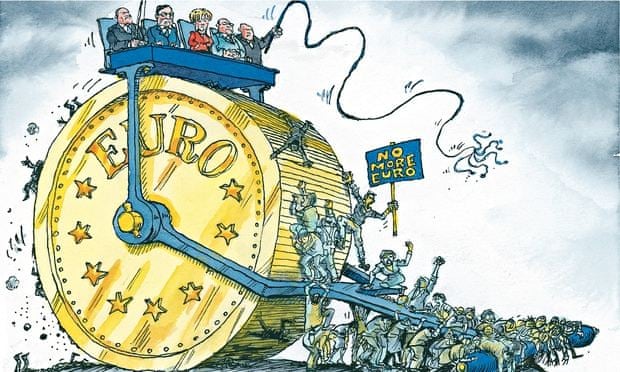

Persino a seguito di una tragedia come quella odierna di Genova, i galantuomini al governo, ex opposizione ora divenuta istituzione, si affrettano a spargere chiacchere narcotizzanti. I frequentatori smemorati di questa spiaggia possono leggere e guardate i video nel thread Italians did it better! per comprendere l'inversione ad U messa in atto da quando questi gentiluomini sono ora establishment ed il loro, non certo il nostro, divincolarsi dalla vera tematica e causa di dolore (peraltro cavallo di battaglia utilizzato da "i soliti noti" per ottenere voti): EU, €, pareggio di bilancio etc.

Qui alla spiaggia non demordiamo: fuori dall'EU, fuori dall'€, reset! March 1, 2016-March 6, 2017: Italians Did It Better!

March 22, 2016-March 9, 2017: The stunning hypocrisy of the EU

2017: the Euro Area Breakup

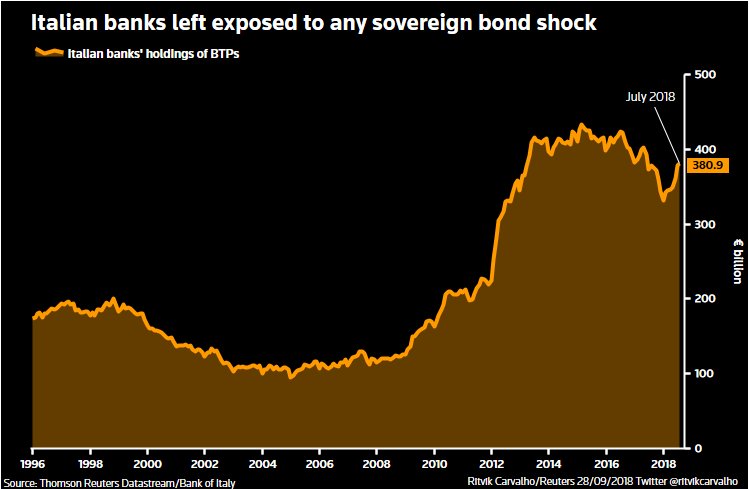

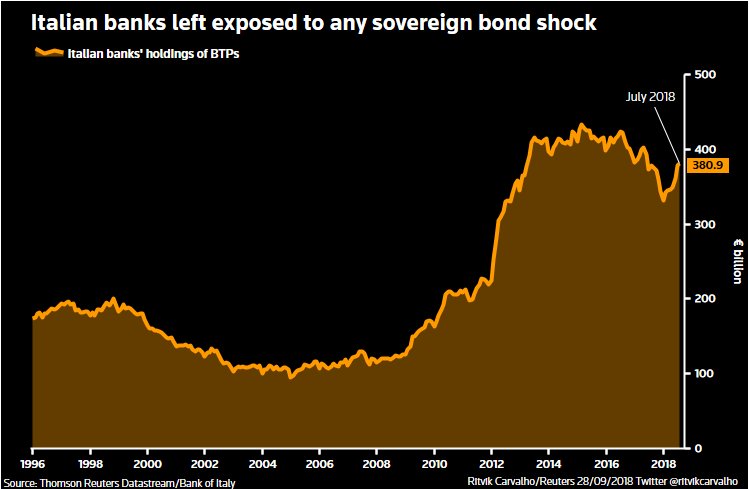

"...According to a study by the Bank for International Settlements in March, Italian government debt represents nearly 20% of Italian banks’ assets — one of the highest levels in the world. Italian banks hold around 18% of all of Italy’s public debt..." The Eurozone’s “Doom Loop” Re-Grips Italian Banks

"What happens in Rome can affect what happens in New York—and Wall Street, specifically. The Italian situation is, as some have said, reminiscent of Greece. Only it’s amplified several times over by Italy’s role in the world economy. The markets could experience another Greece 2014–2015 situation. If some EU countries were prepared to let Greece walk away, they won’t be in Italy’s case. And this will generate tension on the EU. Yet, even more than a single stock market crash, the Italian situation could trigger another protracted recession in Europe. And the United States would not be immune from the resulting shock. Unlike the United States, Italy cannot print more currency to avert the effects of its debt. Italy is bound by the rules of the euro.  The consequence will be more malcontent. The formula is one of protracted crisis. A stock market crash is not even the worst effect that the Italian political situation could produce. All the ingredients exist to fuel the worst political crisis in modern European history (excluding the break-up of Yugoslavia and related issues like Kosovo) since World War II. The euro is merely one, and not even the most important, victim of the political crisis in Italy. The biggest victim, which has a global dimension, is risk. Or rather, a sudden lack of appetite for risk. The consequence will be more malcontent. The formula is one of protracted crisis. A stock market crash is not even the worst effect that the Italian political situation could produce. All the ingredients exist to fuel the worst political crisis in modern European history (excluding the break-up of Yugoslavia and related issues like Kosovo) since World War II. The euro is merely one, and not even the most important, victim of the political crisis in Italy. The biggest victim, which has a global dimension, is risk. Or rather, a sudden lack of appetite for risk.

In June 2015, when the Greek political crisis intensified, the world markets—including Wall Street—suffered significant losses.

That was Greece. Italy has a bigger market and a much bigger role in the global economy, one that no major stock exchange or government can ignore. The European exchanges have already started the hemorrhage. The financial situation in Italy, as in Greece in 2015, has been used as blackmail. The impression that many Italians have is that markets count more than citizens. It’s an opinion with long legs, and one that the EU leaders should not disregard. Uncertainty in Italy is no guarantor of stability elsewhere. And there’s no easy way out. Financial austerity and more job cuts will lead to an extreme situation. Whether John Q. Public in Texas or Idaho can even locate Italy on a map, he will soon find out that a crisis there can trigger a major stock market crash in New York." -Alessandro Bruno

Using the analogy of what happens just before a tsunami hits shore, the recent action in the Italian financial market is indicating to me that the water at the beach has begun to recede. Some are fleeing to higher ground; while others who have not yet learned what these ominous signs mean, are walking on the beach observing the unusual spectacle with great curiosity.

My opinion?

Unaware of the great wave of financial implications that roars towards the coast, many unfortunately will be lost in the disaster that lies ahead. E.

DEFAULT risk is RISING fast Italian zombie-bank UniCredit

FIVE STAGES OF DECLINE STAGE 1: HUBRIS BORN OF SUCCESS STAGE 2: UNDISCIPLINED PURSUIT OF MORE STAGE 3: DENIAL OF RISK AND PERIL STAGE 4: GRASPING FOR SALVATION STAGE 5: CAPITULATION TO IRRELEVANCE OR DEATH How the Mighty Fall: A Primer on the Warning Signs

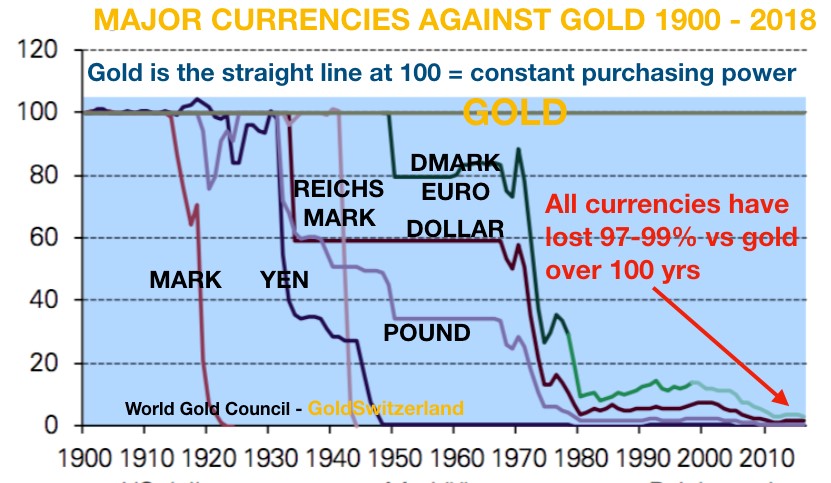

Global reset supposedly coming since most of the world is in hopeless debt. Always Updated: The Only Honest & Sound Money Left

Entendance on twitter

"The Rome vs. Brussels/Berlin circumstances are effectively the same problems that plagued Europe several years ago when Greece was at the edge of the economic precipice, except that Italy's GDP is effectively 8.1 x's that of Greece's!" -Dennis Gartman

"...The world financial crisis of 2008 is not over. It has been swept under the rug of massive money creation by the US, EU, UK, and Japanese central banks. The creation of money has far outpaced the growth of real output and has driven up values of financial assets beyond what can be supported by “conditions on the ground.”

How this crisis plays out remains to be seen. It could result in the destruction of Western civilization. Will Dog eat dog? After Greece, will it be Italy, Spain, Portugal, France, Belgium, Australia, Canada, until none are left?

The entirety of the Western World lives in lies fomented by powerful economic interest groups to serve their interests. There is no independent media except online, and those elements are being demonized and denied access. Peoples who live in a world of controlled information have no idea of what is happening to them. Therefore, they cannot act in their interest..."

|

|

|

|

La sòla

Aug 14, 2018 18:25:05 GMT -5

Post by Entendance on Aug 14, 2018 18:25:05 GMT -5

La preghiera cambia tutto

Ferragosto Italiano 2018

Genova:è giorno di lutto, almeno qui alla spiaggia, ma la fede separata dall’etica, le parole non seguite da fatti concreti, sono inutili. La Parola di Dio non va solo ascoltata, ma messa in pratica. La fede non va soltanto dichiarata, ma vissuta: la lettera di Giacomo

La saggezza nel parlare (3,1-12)

2015-2018: Ferragosto

La distopia realizzata, il neoliberismo

"...We have heard talk of “contagion” before. Not long ago, Italy’s political shift toward a supposedly populist government led to fears of debt contagion within the European Union; this is still a valid concern, just not for the reasons the mainstream financial media usually presents..." Economic Contagion? Central Banks Are The Real Culprit

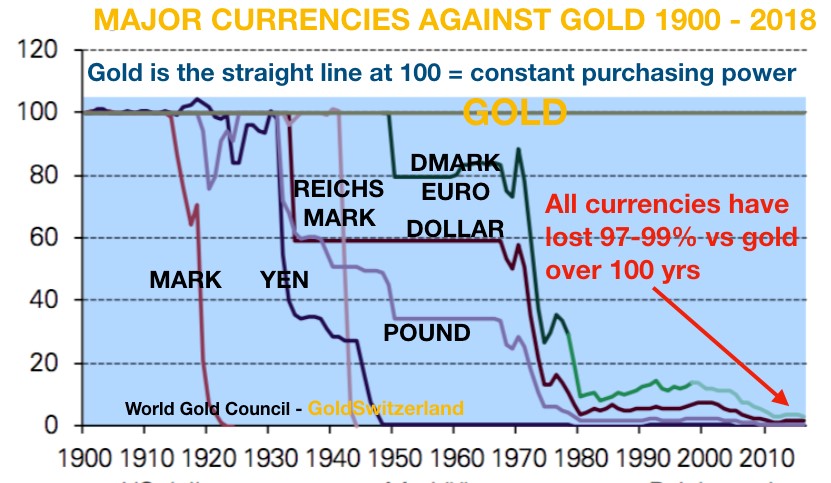

The Global Fiat Currency Regime Turns 47 Today Interesting to note, that address to the world was given on what day of the week in 1971?

You guessed it: A Sunday evening.

Typical.

Let’s recap the last several major changes in the monetary system in the last several decades:

•1933/1934 Gold demonetized for citizen’s daily use, and gold revalued from $20.67 in 1933 to $35 in 1934 (in other words – dollar devaluation).

•WWII Bretton Woods era (US pegs to gold, nations peg to US dollar)

•1965 Silver removed from coinage

•August 15th, 1971 – Nixon ‘temporarily’ suspends convertibility of dollar into gold (kills off remaining tie to sound money)

From 1971 to the present, the system is commonly referred to as the “petro-dollar” era. This scheme was devised in the 1970s, and the foundation of the scheme is that nations, mainly Saudi Arabia, would sell their oil for US dollars only. This placed a permanent demand for the US dollar as oil is the most consumed commodity in the world. This standard has been backed up by the might of the US military.

Where do we find ourselves now?

We find ourselves near the end of the current monetary system. The pure fiat monetary system is a debt based system that requires unsustainable, exponential growth in debt. This system will come to an end. un-backed fiat currency systems always do. The US and the US dollar are not immune from this demise.

The only real question is this: How bad will it get before it comes to an end?

The longer we take to transition to the new monetary system, which for the last 5000 years has always reverted to gold and silver, the more painful it will be.

But the illusion continues, in part because the US is still the dominant global power, and half of the people in this nation, at least the half that still has any savings left, thinks the US has never been in a better position.

So this could current system can go on for a while longer.

We’ll see.

Bottom line: Change is coming, resets happen, and we’re overdue. -Paul Eberhart

"...Nowadays, trade and "prosperity" are dependent on currencies that are created out of thin air via borrowing or printing. The problem with gold, in the view of predatory globalization, is that it can't be printed or conjured out of thin air. That won't do, because predatory globalization's primary export is newly printed currencies: dollars, euros, yen and yuan.

This puts every nation that can't print a global reserve currency at an extreme disadvantage. While the U.S. can conjure "money" out of thin air and trade it for goods, other nations must cough up resources and goods in exchange for the "money," and borrow it at hefty rates of interest if they want to use the global "money" for development or investment.

That leaves them highly vulnerable to foreign exchange fluctuations which can raise the cost of their interest due in dollars, etc. to punishing heights while devaluing whatever they built with the dollars, etc. they borrowed.

Then there's a financial crisis of loan defaults and those who created and loaned out their global reserve currency demand the debtor nation sell all its assets and resources at bargain prices. Being a member of the European Union didn't save Greece from this fate; no peripheral nation can protect itself from the predatory powers who can create currency at zero cost and send the value higher by restricting its issuance after other nations have loaded up on loans denominated in the reserve currency.

This is how "free" trade works in predatory globalization: The only thing that's free is the cost of issuing trillions in global reserve currency. Everything else will cost you dearly."

"The Turkey issue is something on the radar, but it is far more idiosyncratic at a bank level and all eyes will be on Italy"

Chaos is coming |

|

|

|

La sòla

Aug 17, 2018 12:24:16 GMT -5

Post by Entendance on Aug 17, 2018 12:24:16 GMT -5

|

|

|

|

La sòla

Aug 21, 2018 13:28:58 GMT -5

Post by Entendance on Aug 21, 2018 13:28:58 GMT -5

August 25, 2018

"...The EU hypocrisy: did Germany,France, Spain, the Netherlands, or any other country volunteer to take the migrants?

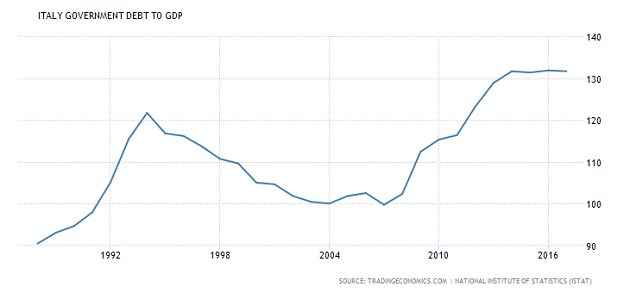

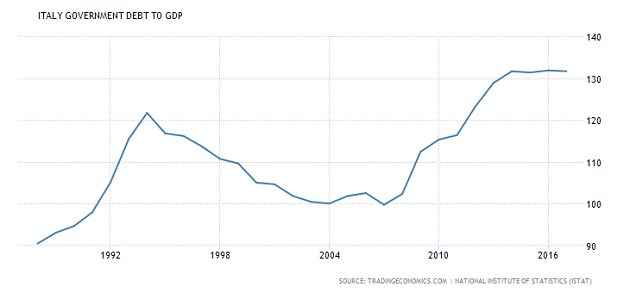

The EU hypocrites want Italy, with an unemployment rate near 112%, a youth unemployment rate over 32%, and a massive debt-to-GDP problem to single-handedly take on all migrant comers. These people generally have no skills, no money, and cannot speak Italian. They will be a drain on resources the government does not have. If Italy takes in these refugees, there will be millions more of them. No, of course not. Rather they insist Italy take them. The problem is unfixable. Why? For the same reason every EU and EMU (Eurozone) fundamental flaw is unfixable: It takes unanimous consent to change anything. Germany, France, the Netherlands, nor any other non-port of entry will agree to change the treaty. Italy and Greece will forever be left holding the bag.

Eurobonds cannot happen for the same reason: Germany, the Netherlands, Austria, and Finland will say no, and it only takes one.

EU trade treaties take forever to negotiate because every country in the EU has to sign off on them. The more countries in the EU, the harder it is to do anything. Italy has many problems of its own making of course, but the EU and Eurozone add to Italy's problems. Italy should never have been in the Eurozone..." Mike "Mish" Shedlock here

"...Claims that none of this matters and that there would be no consequences if Italy left the Eurozone and defaulted are more ridiculous as ever.

The harder people attempt to come up with reasons that none of this matters, the sillier they look.

The bond market is talking. Who's listening?"

August 23, 2018 Mike "Mish" Shedlock HERE

Italy saw record-high capital outflow of €76bn in May-Jun, larger than €51bn outflow in Jun-Jul2011 and €56bn in Feb-Mar2012, Citi has calculated. Foreigners sold €33bn of Italian govt debt & €9.4bn of private sector assets in June. Adds to €33bn sold in May.

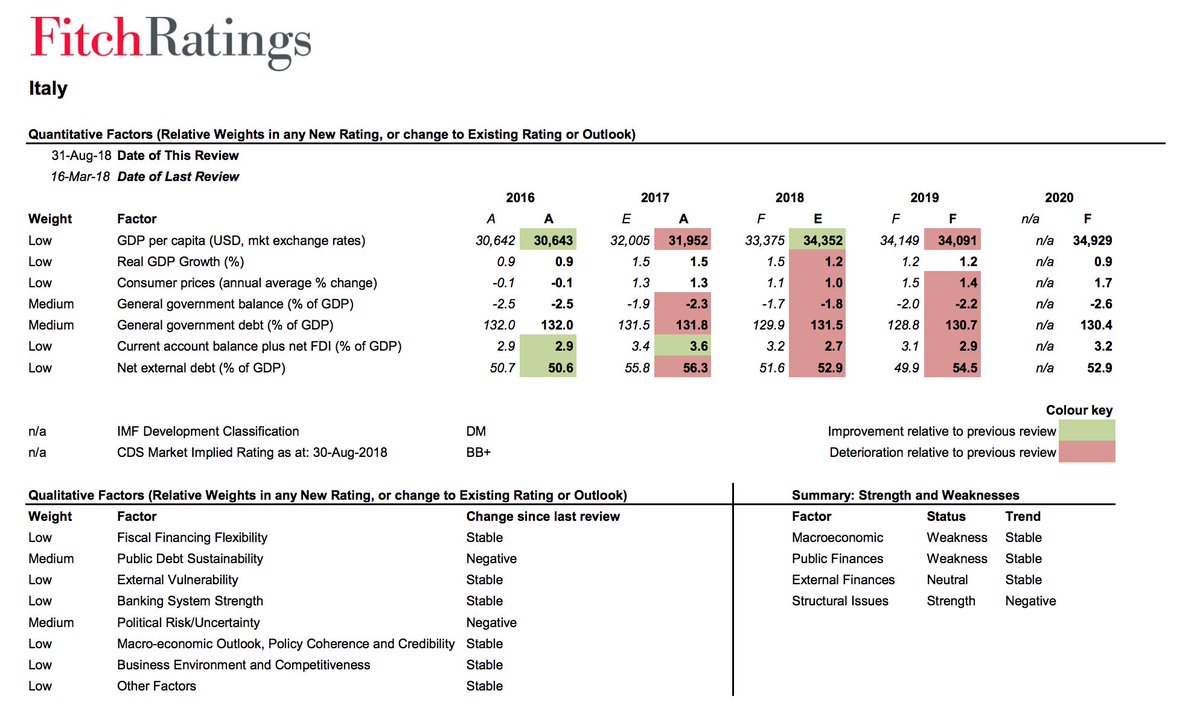

Italy is already priced for a downgrade, Citi says. Expects a 1-notch downgrade by Moody's to Baa3 after current review.

"...Italian banks hold large amounts of government debt, raising the danger of a sovereign debt loop. Italian banks hold approximately 400 billion euros of government debt and therefore act as a conduit for contagion between bond markets and banks. At the height of the Eurozone crisis in 2011, sell-offs in government bond markets depleted the capital of banks, freezing the interbank lending market and further depressing Eurozone economies. With Italian banks still holding large amounts of government debt, this “doom loop”, triggered by a severe panic in the bond markets, is still a realistic possibility..." Italian Government Bond Sell-Off Limits Room for Populist Spending

"...Being in Italy, though, it’s hard to not notice the obvious deterioration of this beautiful country.

Italy was the world’s superpower TWO times in its history– first during the time of the ancient Romans, and second during the early Renaissance when city-states like Venice and Florence became the dominant economies of Europe. Each time they screwed it up.

Too much wasteful spending, too much debt, too many regulations, too many wars, too much debasement of the currency.

It doesn’t matter how strong your country or empire is. If enough time goes by with those destructive forces at play, the country weakens and loses its power. It’s inevitable.

No country in history has ever been able to indefinitely indebt itself, overspend, wage endless wars, etc. without consequence. And it would be foolish to think that this time is any different. What could possibly go wrong?..." Podcast here

Bota na conta do Papa, Updated: Why You CANNOT Take In Refugees

"...The world financial crisis of 2008 is not over. It has been swept under the rug of massive money creation by the US, EU, UK, and Japanese central banks. The creation of money has far outpaced the growth of real output and has driven up values of financial assets beyond what can be supported by “conditions on the ground.”

How this crisis plays out remains to be seen. It could result in the destruction of Western civilization. Will Dog eat dog? After Greece, will it be Italy, Spain, Portugal, France, Belgium, Australia, Canada, until none are left?

The entirety of the Western World lives in lies fomented by powerful economic interest groups to serve their interests. There is no independent media except online, and those elements are being demonized and denied access. Peoples who live in a world of controlled information have no idea of what is happening to them. Therefore, they cannot act in their interest..." Genocide

Gold is important to me because...click HERE

|

|

|

|

La sòla

Aug 25, 2018 20:18:10 GMT -5

Post by Entendance on Aug 25, 2018 20:18:10 GMT -5

"In che senso?" Capitolo V

We all bleed the same color (e cerca 'e me capì')

Allora, la faccio corta e vi dico quel che posso dire II ("Allora, la faccio corta e vi dico quel che posso dire I" lo trovate qui)

Chi ha intuito cosa ho fatto nella vita per procurarmi cibo e capanna ha anche afferrato con che tipo di entità singole e/o strutturate sono andato a impattare. Chi vede un film, vede immagini proiettate su uno schermo; io sono stato sul set, dietro ai tubolari che reggono lo scenario visto dagli spettatori, can you dig it? Bene. Allora, la faccio corta e vi scrivo quel che posso scrivere. - Badate che il momento è serio e le chiacchere stanno a 0. Le boe in acqua e i contatti che ho in giro per il pianeta mi suonano un univoco, inequivocabile segnale, nella stessa direzione ed intensità uguale ai links che trovate qui alla spiaggia. E' nel vostro interesse, anche se lo negaste, abbandonare questa bestia mai maledetta abbastanza, al fine di concentrarvi su ciò chi vi impatta ed impatterà personalmente voi e quelli cari a voi. Sono rimaste tante maschere ma pochissimi volti, ed ancor meno quelli animati da genuino spirito d'altruismo, quindi l'eventuale errore personale -di valutazione o di giudizio- si può fatalmente trasformare in tragedia definitiva sulla singola testa, prima ancora che sulla generalità dei cittadini, a causa dell'effetto gas e della regola base della storia. I rimasti che mi leggono non facenti parte dell'1% si parino, ora.

(System Down Event Qui) (System Down Event Qui)

- Prima che molti fossero (consapevoli), io -e lo dico con pena e non certo con vanto- ero (a causa dei galantuomini che ho impattato sul "set cinematografico" di cui sopra); dalla fine del secolo scorso, la palma che ho visto piantare sapevo che sarebbe cresciuta storta, perché è stata e l'ho vista piantata storta a proposito. Immigrazione selvaggia e €/EU anyone?

- Loro, in preda al delirio d'onnipotenza, pensano di cavarsela e magari qualcuno se la svignerà (purtroppo per i nativi, alcuni rimarranno anche se, mi auguro, finalmente ridimensionati - qui la breaking news ) e se la caverà; se, a ragione, non pensaste di essere quel qualcheduno, allora paratevi. (Del resto, chi segue la spiaggia aveva presumibilmente intuito, come Garibaldi 169 anni prima, il peso del macigno.)

- Prima di risalire, se e quando mai avvenisse,

si scenderà e sarà brutale. Il finale è in vista solo nelle chiacchere narcotizzanti dei lupi travestiti da buoni pastori. Paratevi. si scenderà e sarà brutale. Il finale è in vista solo nelle chiacchere narcotizzanti dei lupi travestiti da buoni pastori. Paratevi.

- In questa fase temporale, è veramente nodale pensare al proprio prossimo, quello più prossimo, cioè voi stessi e coloro fisicamente intorno a voi a cui tenete. Lo scrivo di nuovo: paratevi e parateli, serious troubles ahead, a dicey period coming up. E.

|

|

|

|

La sòla

Aug 31, 2018 15:09:37 GMT -5

Post by Entendance on Aug 31, 2018 15:09:37 GMT -5

|

|

|

|

La sòla

Sept 2, 2018 5:27:13 GMT -5

Post by Entendance on Sept 2, 2018 5:27:13 GMT -5

"In che senso?" Capitolo VI

This beach gave them space from the beginning, inserting their writings videos and conferences, spreading their activity (here & here) among our visitors and foreign investors (which here are the vast majority, from the Americas to Russia, from Oceania to the European continent and that do not use twitter, but take the time to exchange private messages to Fred & Entendance Beach), supporting the preliminary information for an exit from the €, a return to sovereignty, always with the Entendance Beach suggestion of the Gold Standard.

This beach has affectionately admonished them and their most uncritical fans, but has nevertheless supported them, until the election result.

This beach began to expose them, after the unfortunate contract.

Here we are, in no uncertain terms and tactics, for the exit from the EU lager and from €, this being, in our way of knowing (unfortunately we were before they were), the priority.

Here we abhor narcissism (all about narcissist and narcissism) in which some fell, badly addressing/distracting with their use of twitter those who voted for them to the pretentious contraposition of good = who defends the government of change in which they sit & bad = who exposes contradictions, who questions about their swaying, rating agencies, cruel markets, the defeated X party etc.

Here we think at least singular (not to write malicious) the continuous omission about the financial risks that the fans in their loop are running; I understand that for some the € 20k per month + various ammenities constitute a being there to stay there (the 2015 video not to be missed is here) and, moreover, for the next possible round, we have identified the surname of the best candidate.

This beach has facts and data at heart. Data and facts call for the reset; and reset will be, first better than later. Spasms lead to liberating vomiting, it is nature. Know this. E.

Questa spiaggia ha dato loro spazio dall'inizio, inserendo i loro scritti video e convegni, diffondendo la loro attività (qui & qui) fra i nostri frequentatori ed investitori esteri (che qui sono la stragrande maggioranza, dalle Americhe alla Russia, dall'Oceania al continente europeo e che non usano twitter, ma si prendono però il tempo di scambiarsi private messages a Fred & Entendance Beach), supportando l'informazione propedeutica ad un'uscita dall'€, ad un ritorno alla sovranità, sempre con l' Entendance Beach suggerimento del Gold Standard. Questa spiaggia ha affettuosamente ammonito loro ed i loro fans più acritici, ma ha li ha comunque sostenuti, fino al risultato elettorale. Questa spiaggia ha iniziato ad esporli, dopo l'infausto contratto. Qui siamo, senza mezzi termini e stolte tattiche, per l'uscita dall'EU lager e dall'€, questa essendo, a nostro modo di sapere (purtroppo eravamo prima che loro fossero), la priorità. Qui aborriamo il narcisismo (tutto sui narcisisti ed il narcisismo) nel quale taluni sono caduti, malamente indirizzando/distraendo con il loro uso di twitter chi li ha votati verso la contrapposizione pretestuosa di buoni=chi difende il governo del cambiamento nel quale siedono & cattivi=chi espone contraddizioni, chi si interroga sui loro ondeggiamenti, le agenzie di rating, i mercati crudeli, il partito X sconfitto etc. Qui riteniamo quantomeno singolare (per non scrivere dolosa) la continua loro omissione circa i rischi finanziari che i fans nel loro loop stanno correndo; capisco che per taluni gli €20k mese + ammennicoli vari costituiscano un essere lì per rimanere lì (il video del 2015 da non perdere è qui) e peraltro, per il prossimo eventuale giro, qui alla spiaggia abbiamo individuato il cognome del miglior candidato.

Questa spiaggia virtuale ha a cuore i fatti e dati. I dati e i fatti chiamano il reset; e reset sarà, prima meglio che dopo (terra di nessuno). Gli spasmi portano al vomito liberatorio, è la natura. Sappiatelo. E.

6 settembre 2018 09:45 Italy's Populists Begin Their Big Betrayal 6 settembre 2018 09:45 Italy's Populists Begin Their Big Betrayal

Gouvernement: if you think the problems we create are bad, just wait until you see our solutions.

|

|

|

|

La sòla

Sept 7, 2018 3:37:45 GMT -5

Post by Entendance on Sept 7, 2018 3:37:45 GMT -5

"...un omino, davvero “diversamente abile”, che volle superare il proprio handicap, non per salire sul gradino più alto di un podio, ma per guadagnarsi il diritto a morire per la Patria."

«Le giuro che ho del fegato e qualunque impresa, la più difficile che mi venisse ordinata, la eseguirei senza indugio». -Enrico Toti

Allora, dov'è il nuovo Toti? (chi ve lo domanda ha avuto un nonno colonnello del suo stesso reggimento) Previously, on the beach: Where Is Our Ferdinand Pecora? (Grandi Italiani contro i banksters) The Slave Mentality: Tutto sulla mentalità da schiavi

Fra i tanti private messages ricevuti qui alla spiaggia dopo questo post, uno su tutti, da una terra di confine: <Purtroppo é proprio cosí, la gente nemmeno si rende conto di riporre il proprio futuro nelle mani del nemico stesso. I malati: che si affidano ai vari "centri di tutela contro il cancro, contro il diabete, contro le malattie degenerative del cervello" tutte finanziate e controllate dall'industria farmaceutica, quelli politicamente "informati": che delegano questo o quel partito, quelli che seguono i diversi media "anternativi", tutti creati e controllati dal sistema,

Un bellissimo esempio lo abbiamo noi qui in Alto Adige: il movimento anti-pesticidi di Malles, che é rappresentato a Bruxelles da "PAN - EUROPE", Lei sa chi la ha fondata? Il conte Coudenhove-Kalergi, quello del piano Kalergi, hahahaha, ed é solo uno dei tanti esempi...poi ci sono tutte le ONG finanziate da Soros, le Universitá sostenute dalla Fondazione Rockefeller, gli aiuti in Africa della fondazione Bill&Melinda Gates, le Thinktanks, le start-up, c'è poco da fare, sono troppo furbi, ma immagino ci sia qualcuno più potente di loro: non conosciamo il suo piano, probabilmente perché fuori dalla nostra cognizione, ma mi fido di lui!>

Nel frattempo...monete d'oro romane a Como

Qui alla spiaggia...siamo tutti romani. E. |

|

|

|

La sòla

Sept 12, 2018 3:34:19 GMT -5

Post by Entendance on Sept 12, 2018 3:34:19 GMT -5

|

|

|

|

La sòla

Sept 15, 2018 2:10:32 GMT -5

Post by Entendance on Sept 15, 2018 2:10:32 GMT -5

"In che senso?" Capitolo VII

Largest US Weapons Store – in Italy

Trust Barometer 2018 PDF 42,41MB Trust Barometer 2018 PDF 42,41MB

Reset Italia: Bus in ritardo, stracolmi tra urla e spintoni: sui mezzi pubblici è Odissea Capitale

"Governo Del Cambiamento In Peggio: H/T Michele Savignano" I video del 2017 che vanno rivisti oggi sono qui

2015, quando Alberto Bagnai lo chiamava (e la spiaggia lo supportava) il reddito della gleba

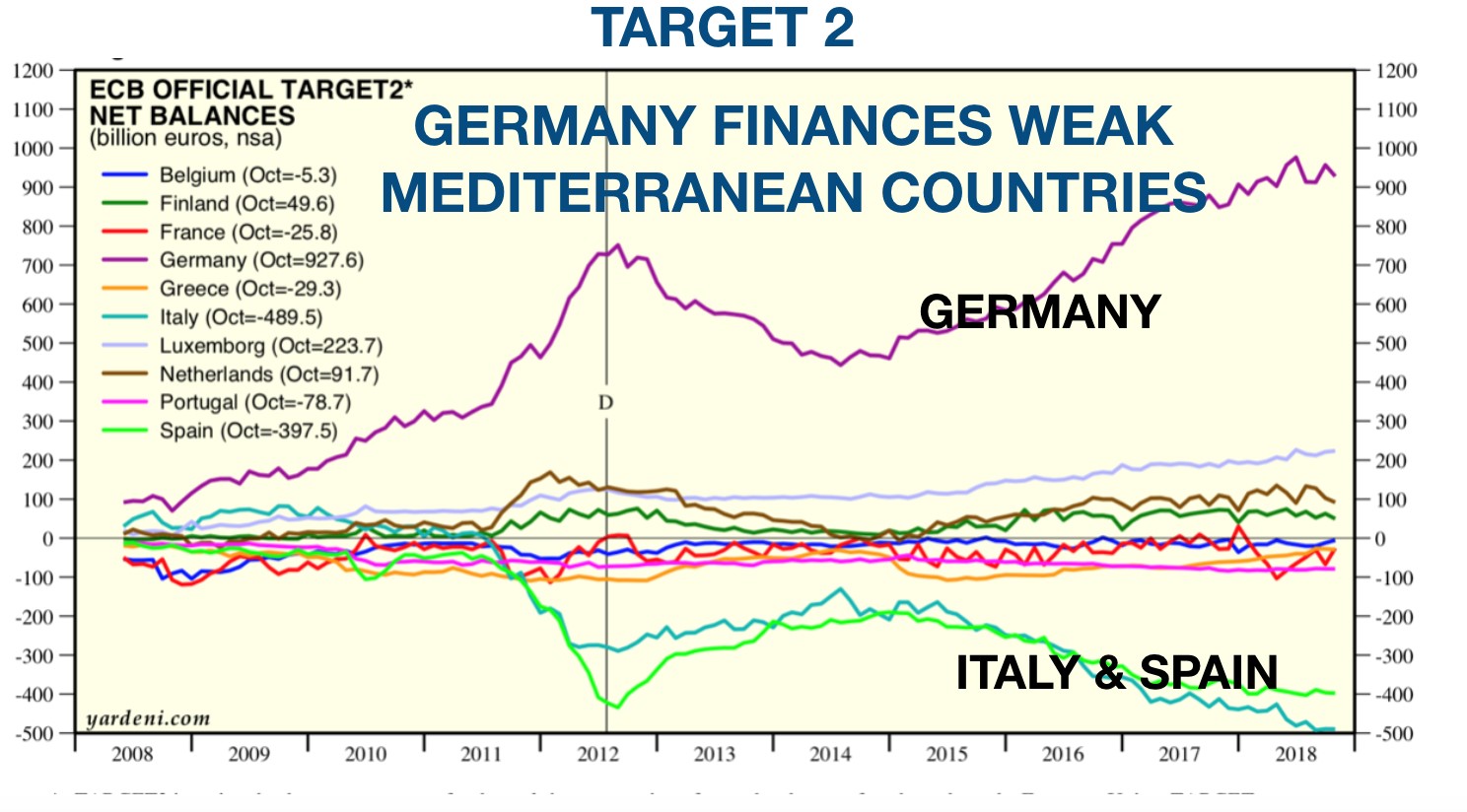

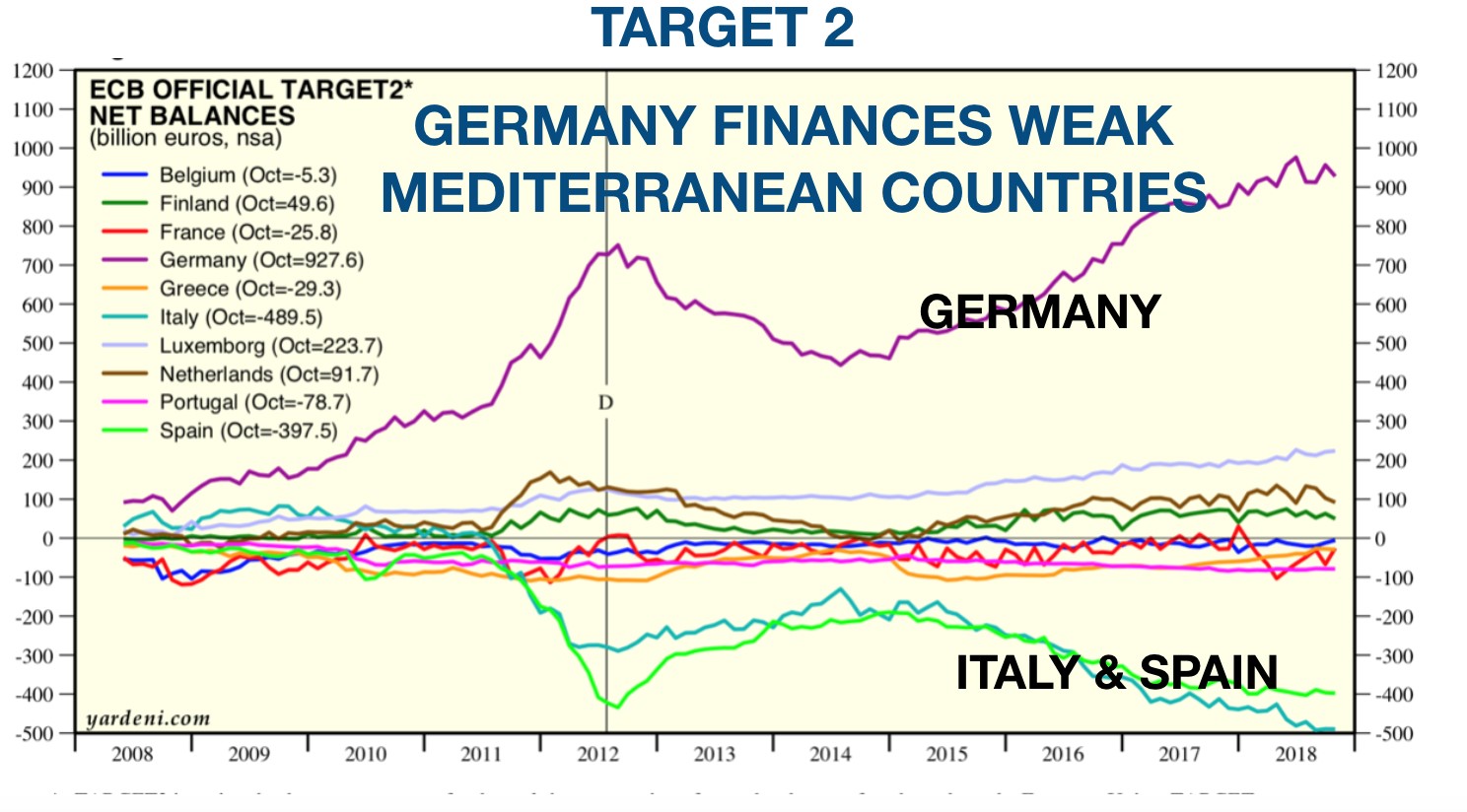

Target 2

"...Italian and Spanish bank require € 900 billion in liquidity support on a permanent basis.

This element is mostly ignored by academics and others because they do not understand the implications of Target 2 as a capital flight phenomenon. This is a hidden crisis.

The verdict is negative...Contagion Risk

We learned from 2008 that interbank markets can freeze. Liquidity is no longer available. How much more than the € ,400 billion is the eurosystem willing to provide to insolvent Spanish, Italian and Greek banks?" State of European Banks: The ECB View vs Reality

*** Bank Run Explained

Mentre, dal secolo scorso, divulghiamo la necessità di uscire dall'€ e dalla EU e propugniamo il ripristino del Gold Standard, c'è chi scrive demenzialità neanche degne di essere commentate se non fosse che, per ora, i suoi pupilli stanno con le leve del potere in mano. Il suggerimento della spiaggia è sempre lo stesso: si boicottino questi ed altri galantuomini convertendo carta in lingotti. Reset. E.

|

|

|

|

La sòla

Sept 18, 2018 3:17:01 GMT -5

Post by Entendance on Sept 18, 2018 3:17:01 GMT -5

"...Target 2: It is a payment system in which banks process cross-border payments in real time. In Target 2, surpluses or deficits arise when money flows from one eurozone country to another. During the aggravation of the last euro debt crisis in 2011 and 2012, capital from particularly affected countries like Spain and Italy fled through the Target 2 banking market to countries like Germany and Luxembourg, which were considered safe havens. Germany’s claims against the poorer southern European countries reached 700 billion euros at the time (see chart below).

The situation only returned to normal when ECB President Mario Draghi made it clear that, if necessary, he could adjust the balance sheet by printing additional money. Target 2 prevented the countries from collapsing. If Spain had stayed with Peso and Italy with Lira, they would have collapsed. Target 2 protected them from bankruptcy at the expense of German, Luxembourg and Dutch citizens. Since 2015 we have been observing the flight of capital to the north again, at a time when the money printing machine in Frankfurt am Main is working like crazy. This time, however, the capital flight is the result of Draghi starting QE in 2015 and the Bundesbank starting to buy back bonds on the market.

The Italian central bank is dependent on the ECB and has to buy Italian government bonds. German investors have to exchange these bonds for euros in Italy and transfer the money via Target 2 to their German bank. The growing differences in the Target 2 balance sheets therefore result from this:

1.that the Germans, who own the Italian bonds, dissolve them in Italy and transfer the money thus obtained to Germany. It is the consequence of the earlier problems with trade balances: Italians bought German products with their bonds in the past. Germany therefore has more debt claims than any of its neighbours.

2.that Italians liquidate their bonds and send their money abroad – a usual flight of capital.

So again enormously high debt claims arose on the German side. This year they have already reached a trillion euros, i.e. a huge amount of 25% of German GDP.

The immense German Target 2 claims are not covered by any securities. If Italy or Spain withdraw from the euro zone, the Germans will be left to their own devices.  There is still no unrest in Germany over this, because confidence in the Bundesbank is well known in Germany. Jaques Delors once said: “Not all Germans believe in God, but all believe in the Bundesbank.” There is still no unrest in Germany over this, because confidence in the Bundesbank is well known in Germany. Jaques Delors once said: “Not all Germans believe in God, but all believe in the Bundesbank.”

Everyone probably believes in the ECB and Mario Draghi. At his press conference on 26 July this year, he wanted to have a calming effect when he spoke about Target 2: “It has nothing to do with the movement of capital from country to country”. In fact, it is only the clearing balances that can be overdrawn as long as no one leaves the euro zone.

So Italy must not leave the euro zone. It is “too big to fall”: its debt amounts to 2.3 trillion euros (!), liabilities in Target 2 rose in June 2018 from -164.5 billion euros in 2015 to -481 billion euros. This means that Banca d’Italia owes the Bundesbank almost half a trillion euros!

On the one hand there is Draghi, the Italian who uses his position to save his country, and on the other there are many German economists who criticise Target 2. Professor Hans Werner Sinn, for whom Target 2 is a cheque that cannot be cashed, is particularly well known. In one of his articles he describes the situation in Spain and Italy as follows:

“In these countries radical socialists rule who don’t want to know anything about budgetary discipline, in Italy the old parties were swept away. The radical government of Five Stars and Lega wants to take out much more credit under the protection of the other euro countries than it is taking anyway and threatens to leave the euro if the EU refuses to do so."

Draghi takes a different view:

“The euro is indispensable because it is strong, because societies want it (!), and it is in no one’s interest to doubt the sense of its existence. It is not worth discussing the abolition of what is inevitable (!). That can only do harm.”

Comrade Draghi, of course, you are right, our transfer ruble is untouchable, and it is not worth discussing the existence of our (socialist?) community and currency. It will continue to exist for another 1000 years!

In 1990, Russia owed Germany 6.4 billion transfer rubles (7.4 billion euros) on account of its foreign trade balances. Schröder gave Putin 7.1 billion, and Russia only paid back 500 million euros. How much will Merkel give away to the south if something goes badly?"

|

|

|

|

La sòla

Sept 19, 2018 5:21:59 GMT -5

Post by Entendance on Sept 19, 2018 5:21:59 GMT -5

Video-conferenza appena conclusa con un membro storico della spiaggia, residente in un centro di potere del pianeta. Temi trattati: - il rumore in rete dei collusi che si cibano delle cospicue briciole volutamente fatte cadere dal tavolo dell'1% (The Rules for rulers)

- l'importanza di disidentificarsi al fine di essere utili a se stessi ed agli altri

- la responsabilità che grava su chi ha talenti non solo di condividerli ma, specialmente, di non creare scandalo

- la preghiera come momento nodale per comprendere la rotta da mantenere

- la gestione del senso di solitudine che talvolta avvolge chi ha il dono di Cassandra

- la necessità di essere attenti a sostenere gli ultimi

- il rifiuto di giocarsi l'aldilà per un proprio vantaggio

Facciamo parte, agli occhi di questo mondo, dell'esercito degli assenti? Whatever. E. Qui

*******************************

The eurozone faces an even worse fate when the global cycle turns since the European Central Bank has yet to build up safety buffers against a deflationary shock. The half-constructed edifice of monetary union almost guarantees than any response will be too little, too late.

"The Europeans don't have a fiscal backup. They don't have anything. At least you have your own central bank and treasury in Britain," he said.

"In the narcissist's surrealistic world, even language is pathologized. It mutates into a weapon of self-defence, a verbal fortification, a medium without a message, replacing words with duplicitous and ambiguous vocables.

When narcissism fails as a defense mechanism, the narcissist develops paranoid narratives: self-directed confabulations which place him at the center of others' allegedly malign attention." -Sam Vaknin

“It is not love that should be depicted as blind, but self-love.” -Voltaire

|

|

|

|

La sòla

Sept 20, 2018 4:57:39 GMT -5

Post by Entendance on Sept 20, 2018 4:57:39 GMT -5

"...Since no bank will survive in its present form, people need to think seriously if they should lend the bank any money. Bail-ins will certainly be back. Personally if I lent the bank my money, I would ask for collateral in physical gold. With bank leverage of 10 to 50 times how can anyone deposit money with them without taking security.

With the current state of most banks’ loan portfolios, no bank would stand today if they had to provide properly for all non performing loans. And that is today. When credit losses increase, central banks will crank up the printing presses but this time it will have no effect. You can’t solve a debt problem with more debt..." A PRINTING PRESS CAN NEVER CREATE REAL VALUE

Italy Stopping Concordats All Jesuits

|

|

|

|

Post by Entendance on Oct 2, 2018 5:17:04 GMT -5

October 3, 2018 Italy And The Euro Currency…Unplugged

Fatte 'na pizza c'a pummarola 'ncoppa

vedrai che il mondo poi ti sorriderà

Fatte 'na pizza e crescerai più forte nessuno

nessuno più ti fermerà

Fatte 'na pizza lievete 'o sfizio

<Whenever you find you are on the side of the majority it is time to pause and reflect.> -Mark Twain

"...If you understood what the Fed was doing, you would be buying gold, but most people don’t understand. You can look at what has happened to gold prices in terms of other currencies, such as emerging markets. Obviously, gold prices in those countries measured in those currencies have gone up dramatically. So, gold has acted as a store of value and a store of purchasing power in every country where the currency has come down. The same thing is going to hold true of the United States. . . . We could do a reset. We could go back to sound money. We could go back on a gold standard, and we could devalue the dollar officially. I don’t know exactly how high the price of gold would have to be, $10,000 per ounce, $20,000 per ounce, who knows, but there is a price where we could go back to a gold standard. If we want to stay on a gold standard, that means the government would have to live within its means. That’s why governments hate gold standards because it provides discipline to government..."

Beware: There is no trap so deadly as the trap you set for yourself.

Gold, a true depository of wealth that transcends the problems of nation states and their currencies and, come hell or high water, a better alternative than the fiat currencies  |

|

|

|

Post by Entendance on Oct 4, 2018 7:32:30 GMT -5

Italian banks -32% from April highs Short

Oct. 8, 2018 Yields on Italian Bonds Hit 4½ Year High Oct. 8, 2018 Yields on Italian Bonds Hit 4½ Year High

Don Quijones • Oct 7, 2018 Italy’s Debt Crisis Flares Up, Banks Get Hit

October 5, 2018: Italy. ECB President Draghi met with the Italian President Matterella apparently cautioning on the budget. Although the government revised down its deficit projections, the growth estimates, revealed and too optimistic. It forecasts 1.5% GDP next year, 1.6% in 2020 and 1.4% in 2021. Private sector economists do not see growth over 1.2% over the next three years. Moreover, and most troubling for the EC is the government's projection of structural deficit, which adjusts for cyclical and one-off measures, is projected at 1.7%, or nearly double the 0.9% anticipated for this year.

"...Un esperimento antropologico che non ha eguali al mondo. Pentafessi" "...Un esperimento antropologico che non ha eguali al mondo. Pentafessi"

Roma Updated

October 4, 2018

"...The excesses and moral decadence of the magnitude the world is experiencing today can never vanish in an orderly way. Sadly, only a total economic collapse can solve the problem. And this is of course inevitable. No government, no corporation and no individual can or will ever repay the $250 trillion debt that is owed...

❖ Rates surging

❖ Dollar collapsing

❖ Stocks crashing

❖ Gold and Silver exploding

...Although it is impossible to predict what the catalyst will be for the coming economic cataclysm, there are innumerable candidates. For example, the whole of the EU is a total disaster from Brussels policies, Brexit, migration, deficits, banking problems and much more. Italy’s populist government has just pushed through a spending splurge. That means still higher deficits and debts. But what does it matter since Italy is already bankrupt with debts of EUR 2.4 trillion, 140% of GDP. Add to that non performing bank loans of 20% which if recognised would shut down the banking system. In addition Italian banks have borrowed EUR 500 billion from the ECB via Target2. This is another disaster waiting to happen that no one dares to even discuss..." GLOBAL DEBT IS A PEST THAT MUST BE ERADICATED

Arkadiusz Sieroń: Does Gold Speak Italian?

Italy Borrows Too Much, The US Borrows More

Seychelles debt drops to 60 percent of GDP, IMF says Seychelles debt drops to 60 percent of GDP, IMF says |

|

|

|

Post by Entendance on Oct 9, 2018 2:38:21 GMT -5

Confirmation bias è un disturbo mentale e si può eliminare

October 10, 2018 Now is the time to be safe rather than sorry

6 mesi persi e i membri qui alla spiaggia non ne sono meravigliati.

Notable Quotable

In bonds, you're nothing more than the nearest source of spare change. When you lend money to somebody, the best you can hope for is to get it.

"A real contrarian with patience, conviction and discipline -- he's the kind of person anyone would want to handle their money" If you're not a professional, for the sake of your sanity and your heirs stay out of these markets. Just keep it simple, stack Physical Gold & Silver. E.

B-25s fly past erupting Vesuvius, Italy 1944

"...Italy is another question altogether. Firstly, its national debt stands at a staggering €2 trillion. That makes it the third biggest indebted nation in the world, behind the US and Japan.

Its economic growth has almost been non-existent since the crash and youth unemployment stands at 40%. The country is still involved in bailing out its banks, while the rest of Europe has moved on.

And here is a staggering statistic: Greek 10-year bonds, which yielded 20% a few years ago, are now at 4.3%. The Italian 10-year bond rate is 3.3%. Basically, the market will only pay you an additional 1% to take on Greek risk over Italian debt.

Last week, the populist Italian coalition produced a 2019 budget showing an increase in the deficit. That means Italy will need to borrow more money, on top of the 132% debt-to-GDP it already owes. In response, Italian borrowing costs jumped from 2.9% to 3.3%. This matters, as even a small rise in debt servicing interest rates, adds up to a lot when you owe €2 trillion. Shares in Italy’s two largest banks, UniCredit and Intesa Sanpaolo fell over 10%.

Matteo Salvini of the Northern League isn’t worried, telling the Financial Times “the markets will come to terms with it”. The ECB is watching closely. Italy’s problem is the country is not going to accept the severe restructuring. So the eventual outcome is likely some form of default. That can come in many guises: An under-the-table soft deal from the ECB; a Greek-style bailout that runs forever; or a crash out of the eurozone and a currency devaluation.

One of the main reasons the euro negotiators dealing with Brexit have to beat up the UK is they need to show Italy that this is not a path for them. You could argue Italy’s debt burden is not so bad: the US and Japan have more elevated levels and markets are not panicking.

Western economies do keep running deficits and go to the well of the bond markets to borrow more.

This is a tried and tested method for emerging markets and they are allowed to default when debt gets too big. The market is used to it. However, we do not want big western economies to default because we have seen the carnage that can follow.

Italy is the now the story but the US may be in the spotlight be in the future. These debt level risks are like volcanoes, they lie dormant and unnoticed for long periods until something sparks an eruption." -Peter Brown here

“Datemi il controllo sulla moneta di una nazione e non mi preoccuperò di chi ne fa le leggi”

Gold Standard !!

|

|

|

|

La sòla

Oct 12, 2018 16:46:23 GMT -5

Post by Entendance on Oct 12, 2018 16:46:23 GMT -5

<...The collapse of the ‘everything bubble’ created by central banks does thus directly threaten not just asset markets but also the real economy. If (when) the asset markets crash, we will see a dramatic fall in global liquidity which will paralyze both capital investment and consumption. A perfect storm in global capital markets, banking sectors and—most importantly—the real economy is likely to develop with frightening speed. What this means is that we might be heading to the largest economic crash in human history, whose aftermath would not spare any corner of the global economic order. This is truly a scenario from our worst nightmare, and we know the creators. Central bankers have set us up.> The (ominous) problem with global liquidity

European Stability Mechanism... IMF does not intend to participate in state bankruptcies in Europe

You Can Kick The Can Down The Road, But Reality Will Catch Up With You Eventually Nobody can defy the laws of economics forever. Whether it is an individual, a company or the nation as a whole, reality always catches up with everyone eventually.

Wolf Richter: Here Comes the ECB with a Bubble Warning, After it Caused the Most Absurd Bond Bubble Ever

Bolle da debito: la sòla, spiegata. Debt bubbles: from recession into a depression. Rip-off explained.

Economies prone to depressions have high debt levels and high fixed costs. Both generate self-reinforcing feedback loops: as loans issued to uncreditworthy borrowers default, liquidity dries up and marginal borrowers are pushed into default. As credit dries up, sales decline, profits drop, employees are laid off to cut operational costs and previously sound borrowers slide into default.

As defaults beget more defaults, lenders are pushed into insolvency, sparking a banking crisis. Borrowers sell assets at fire-sale prices to raise cash, pushing assets prices lower, putting borrowers underwater. As this insolvency is liquidated in bankruptcy / defaults, lenders must sell assets, driving prices ever lower in a self-reinforcing feedback loop.

The key here is to understand the difference between fixed costs and operational costs. Fixed costs are, well, fixed: they don't decline even if income, sales or tax revenues decline. Fixed costs include: rent, mortgage payments, debt service, mandated healthcare insurance premiums, etc.

Operational costs decline rapidly in recessions; fixed costs don't. Operational costs include wages paid to recent hires, fuel for the company trucks, etc. As business slows, some employees are laid off, reducing costs, and company vehicles log fewer miles, reducing fuel costs, and so on.

Fixed costs remain the same even as sales, profits, income and tax revenues plummet. Economies burdened with high fixed costs have very little wiggle-room (i.e. buffers) before reductions in sales, profits, income and tax revenues trigger losses, i.e. expenses are no longer covered by income.

You can't get blood from a stone, or make an insolvent entity solvent with more debt. Losses will have to taken, and nose-bleed fixed-costs will have to be slashed; reality will eventually have to be dealt with.

But everyone will resist this process because high fixed costs are the gravy train everyone depends on. Slashing fixed costs destroys the income needed to support asset valuations which are the collateral for the stupendous mountains of debt that define the economy. Once that debt is written down, the entire financial system collapses.

End of story. Stack physical gold & silver (Pensate alle tasche vostre, così come i gentiluomini politici pensano bene alle loro) E.

19 Oct 2018 Rating Action: Moody's downgrades Italy's ratings to Baa3, stable outlook |

|

|

|

La sòla

Oct 22, 2018 16:17:03 GMT -5

Post by Entendance on Oct 22, 2018 16:17:03 GMT -5

European banksters Updated: Value of Euro Zone Banks Drops by a Third From 2018 Peak European banksters Updated: Value of Euro Zone Banks Drops by a Third From 2018 Peak

"...The idea floated that if Italy's bonds come under too much pressure, the ECB could buy them is fantasy. First, QE is winding down, and Draghi will reiterate that at his press conference in a couple of days. Second, for the ECB to support Italian bonds, Italy has to enter into a program which would likely force it to reduce its deficit and debt levels, which would entail a larger primary budget surplus. "-Marc Chandler

Mike Mish Shedlock: <...Who will buy Italian bonds, and at what price? And what about the Italian bond inevitable downgrade to junk?

Good luck with that, too.

Word of Advice

If you have money in Italian banks, get it out now, while you can. Capital controls are coming and Italy is increasingly likely to leave the Eurozone entirely>

One Size Fits Germany Math Impossibility, Get Your Money Out of Italy Now! Italy Openly Defiant of Eurozone Stability Pact, Deliberately and Knowingly

"...the European banks remain a mess and have an excellent chance of getting still get messier..." It’s the Banks Again

The oncoming collapse of the ‘everything bubble’ created by central banks explained here

The 2011 Ron Paul's forgotten lesson: what the real money is

|

|

|

|

La sòla

Oct 26, 2018 15:12:58 GMT -5

Post by Entendance on Oct 26, 2018 15:12:58 GMT -5

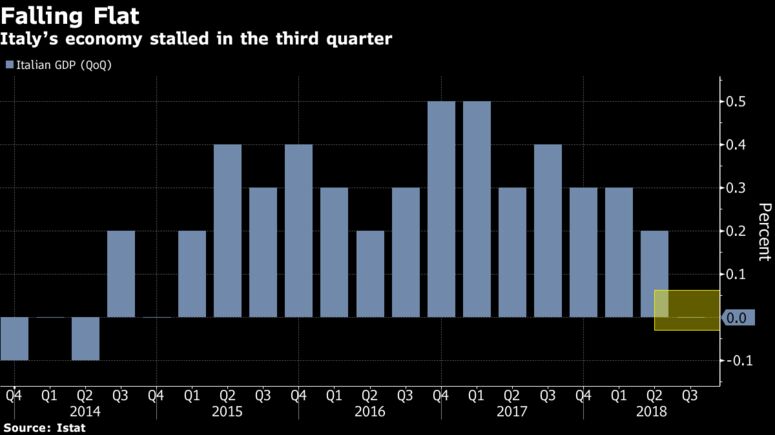

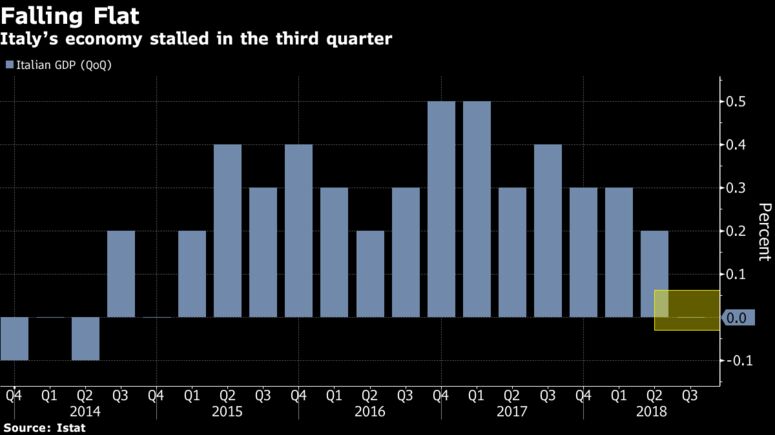

October 30, 2018: Italian Gross Domestic Product w.d.a. (YoY) (3Q P) Actual: 0.8% Expected: 1.0% Previous: 1.2%

The economy did not grow in Q3 after expanding 0.2% in Q2. The year-over-year pace eased to 0.8% from 1.2%. We suspect the Italian government's fiscal proposals would go over much easier if investors and others could be confident that the efforts would boost growth on a sustained (structural) basis. But, alas, judging by the government's even optimistic forecasts, they don't believe it either. -Marc Chandler

October 26, 2018: ITALY OUTLOOK TO NEGATIVE FROM STABLE BY S&P

S&P AFFIRMS ITALY AT BBB, OUTLOOK CUT TO NEGATIVE FROM STABLE

STANDARD & POOR'S MAINTIENT LA NOTE SOUVERAINE DE L'ITALIE À BBB MAIS ABAISSE SA PERSPECTIVE À "NÉGATIVE" CONTRE "STABLE" Standard & Poor's: rating Italia grado BBB e Outlook negativo

Meanwhile...China Just Took Delivery Of A Massive Amount Of Gold A great interview here

Suave, mari magno turbantibus aequora ventis

e terra magnum alterius spectare laborem;

non quia vexari quemquamst iucunda voluptas,

sed quibus ipse malis careas quia cernere suavest.

Suave etiam belli certamina magna tueri

per campos instructa tua sine parte pericli;

sed nihil dulcius est, bene quam munita tenere

edita doctrina sapientum templa serena,

despicere unde queas alios passimque videre

errare atque viam palantis quaerere vitae,

certare ingenio, contendere nobilitate,

noctes atque dies niti praestante labore

ad summas emergere opes rerumque potiri. -Lucretius

FYI, EntendanceInvestors own Physical Gold & Silver |

|

|

|

La sòla

Oct 31, 2018 7:18:26 GMT -5

Post by Entendance on Oct 31, 2018 7:18:26 GMT -5

"In che senso?" Capitolo VIII

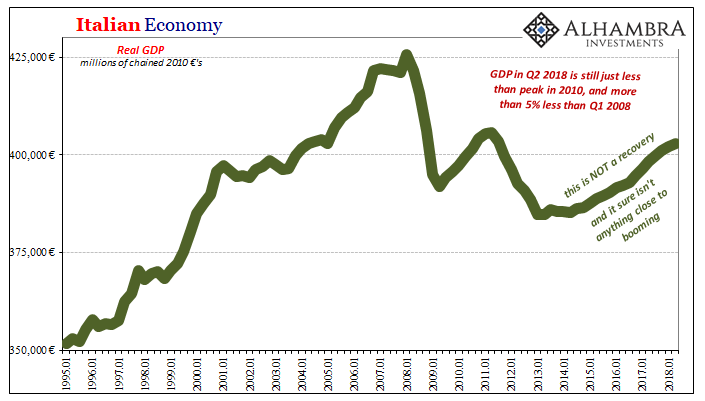

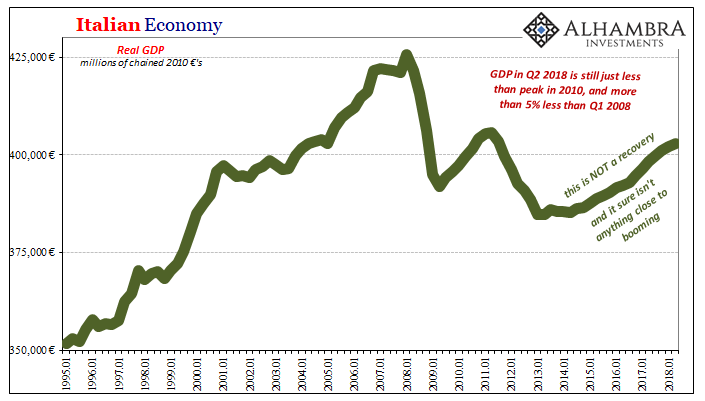

"...Now, all of a sudden, the European economy as a whole is slowing and even contracting in some parts. You never felt this boom they talked about endlessly and now you can sense even that might be gone.

And that’s why it is really dangerous. Because Italy’s economy, Europe’s third largest, has shrunk. In Q2 2018, the latest Eurostat figures for Italy alone, Italian GDP was still 5% below the peak in Q1 2008. Five percent is a huge contraction for any single recession. Stretched out over ten and a half years it is nothing at all like recession, it is absolute criminal corruption. Not the kind where officials are looting the Treasury, but intellectual corruption that is far more dastardly and ultimately destructive...

And if Europe’s economy as a whole is now at best slowing, you know as an Italian the chances Italy’s economic condition will somehow change for the better is practically nothing. For if Europe isn’t growing, Italy hasn’t a prayer.

The Italians, they are data dependent..." Europe More Than Europe: From Boom To The Precipice of Recession

Pino Pino

The Entendance Beach & Games people play The Entendance Beach & Games people play

A Che Gioco Giochiamo, Eric Berne

Iniziate col cliccare i links sopra... Volete sapere in anticipo come andrà a finire per il Bel Paese? Scoprite i giochi che i vostri beniamini mettono in atto, li riconoscerete uno per uno leggendo il libro di Berne. Qualche esempio?

Chi gioca il gioco del "debitore"? E quello di "prendetemi a calci"? Chi è l'esperto del gioco "ti ho beccato, figlio di puttana"? E a chi piace "non è la volontà che mi manca"? E chi, da maggio 2018, preferisce il gioco "vedetevela fra di voi"? Qualora non lo aveste ancora fatto... leggete il libro e godete nel trovare da soli le risposte...  Nessun risultato senza preparazione, come al solito. E.

Nel frattempo...vanità e sòla..."Ora si capisce l'insana passione di questa amministrazione per le mafiette dei bancarellari!..."Oltre ogni ridicolo. La borsa di Hermès era tarocca. E Raggi se ne vanta pure! **********************  By 2080, Italians will be a minority in their own country By 2080, Italians will be a minority in their own country

**********************

"A me me piace chi da 'nfaccia senza 'e se ferma'

Chi è tuosto e po' s'arape pecchè sape see'adda da'

Aiza 'o vraccio 'e cchiù per nun te fa 'mbruglia'

E dalle 'nfaccia senza te ferma'..."  The eurozone could have survived Greece’s exit from the EU (Grexit), but it will hardly survive Italy’s exit. The eurozone could have survived Greece’s exit from the EU (Grexit), but it will hardly survive Italy’s exit.

...Today, the banks have a problem on the asset side of their ledgers — all these exotic securities that the market does not know how to value.

02 November 2018 EBA publishes 2018 EU-wide stress test results

Here's a hint: stack Gold/Silver bars/coins and thank me in 2020...  |

|

|

|

La sòla

Dec 7, 2018 15:33:43 GMT -5

Post by Entendance on Dec 7, 2018 15:33:43 GMT -5

"In che senso?" Capitolo IX

«Fra sabbie non più deserte

sono qui di presidio per l'eternità i ragazzi della Folgore

fior fiore di un popolo e di un Esercito in armi.

Caduti per un'idea, senza rimpianti, onorati dal ricordo dello stesso nemico,

essi additano agli italiani, nella buona e nell'avversa fortuna,

il cammino dell'onore e della gloria.

Viandante, arrestati e riverisci.

Dio degli Eserciti,

accogli gli spiriti di questi ragazzi in quell'angolo di cielo

che riserbi ai martiri ed agli Eroi»

13 DICEMBRE 2018, a seguito della codarda resa ai burocrati non eletti della Eu: miserabili! Coerenza e credibilità pari a 0. A nome anche dei morti della Folgore, RESET.

22 dicembre 2018:  "Mesi di trattative politiche, battaglie con l'Ue, balletti dello spread per arrivare al rapporto deficit/Pil al 2%. Poco sopra l'1,8% fissato dal precedente governo Gentiloni. Con tutti i danni economici annessi" Qui "Mesi di trattative politiche, battaglie con l'Ue, balletti dello spread per arrivare al rapporto deficit/Pil al 2%. Poco sopra l'1,8% fissato dal precedente governo Gentiloni. Con tutti i danni economici annessi" Qui

"Come era prevedibile e come spesso ho scritto, le speranze che con il governo giallo verde potesse resistere all’assalto europeo, erano davvero poche e adesso si sono estinte definitivamente: la trattativa ad oltranza che si sta conducendo a Bruxelles è soltanto una resa ad oltranza condotta da Tria e da Conte che sono uomini dell’establishment euro liberista, senza che i loro referenti politici siano in grado di mettere la parola fine a questa farsa e cominciare un nuovo film. Si tratta di un errore clamoroso perché viene alzata bandiera bianca quando Bruxelles si trova in grave difficoltà e la sua voce burbanzosa è soltanto un bluff dietro il quale si nasconde la paura che il castello di carte e di denaro se ne vada in fumo..." La resa ad oltranza

Global debt has reached a record high of $184 trillion in nominal terms

"They (ECB) are going to stop expanding their balance sheet. They are the only buyer of Italian debt."

Read more and watch the video: Hot financial news that could affect you

Gigantic ECB money printing (QE) program will end after 1371 days (Mar 15- Dec 18)

Total money created:

EUR 2.600.000.000.000

Per day:

EUR 1.896.425.966

Per person (Eurozone):

EUR 7.614

Everybody who did not received this sum of money was robbed.

Inflation is theft.

December 14, 2018 "...In a bunch of sick economies, it is always difficult to determine who should get the prize for the sickest. Italy certainly has a good chance to win that obscure prize. That they can never repay the debt is a certainty and this will soon lead to Rome burning and the rest of the EU also catching fire..."

2019 – A TURBULENT YEAR

“Those entrapped by the herd instinct are drowned in the deluges of history. But there are always the few who observe, reason, and take precautions, and thus escape the flood. For these few gold has been the asset of last resort.”

December 12, 2018 Italy: The Brewing Storm

**********************

Un sabato pomeriggio di fine novembre, in un aeroporto italiano, in transito. Il vostro E. viaggia leggero, solo la sacca Valentino con un paio di giacche e bagaglio a mano, alla volta della prossima meta. Mi guardo intorno e la mia attenzione viene attratta da un uomo che si aggira nervoso, con un telefono in mano, passo lungo nonostante la statura media, una testa pelata che mi sembra di riconoscere...lo seguo con lo sguardo mentre ritorna sui suoi passi, inconsapevolmente verso di me. Quale migliore opportunità per ricordargli cosa penso di lui? Mi affianco sul lato alla sua sinistra, lo scruto per un attimo attraverso i miei impenetrabili occhiali da sole Serengeti, poi gli sussurro: -Capitoni in libera uscita nel week-end, eh? -Capitoni? risponde trasecolato, mentre fa un inconsulto passo in avanti...il suo cervello cerca una risposta mentre investiga i suoi archivi mentali- Capitoni? Io conosco i capitolini...che capitoni? -Quelli che si divincolano nel secchio- gli rispondo guardando davanti a me.

-Manca ancora un po', tempo per un altro caffè- Il senatore si gira a centottanta gradi e si allontana di gran passo, mentre io gli sogghigno immobile

Cassandra Updated Negli incontri individuali/meetings di gruppo di Cassandra in questo anno al termine, una domanda ricorre ineluttabilmente: -Come mai non si accorgono di essere raggirati? La risposta di Cassandra è sempre la stessa e suona all'incirca così: -E' il meccanismo ben noto della difesa della decisione presa che, a causa del pregiudizio di conferma , impedisce a centinaia di migliaia di retroagire adeguatamente al mutare degli eventi che esse/essi non percepiscono assolutamente mutati! Perdono perciò tempo ed energie a immaginare che nulla è cambiato, che proceda tutto come da film che si sono fatti nella loro testa, che finirà come ognuno di loro stessi si auspica che finisca. Ignorano involontariamente o, peggio, dolosamente, Eraclito e altri concetti (2 pagine qui) ben noti ai frequentatori di questa spiaggia virtuale. -Allora non c'è una possibilità di salvezza per tutti! -Esatto, non c'è ("The opiate of the masses is not just religion, but the propaganda, misinformation, lies and technological distractions designed by the invisible government ruling class to provide the masses with pleasant illusions about their country, society, and material situation..." Mad World qui) In a nutshell:

Giunti a questo punto, la salvezza, come preannunciato 2 anni fa, è solo individuale.

Sociopathy

"...Italy, a country which is bankrupt and right now is dependent on EU money...the country will not survive..."

...e così questo thread si conclude.

Si passa al 2019, l'anno del reset globale con il nuovo thread Capitulation to irrelevance: Italia 2019.

In un mondo ideale e da venire, quelli che si mettono in affari garantiti a costo 0 per loro stessi (i politici) andrebbero pagati (se da pagare) a fine mandato, sì da prendersi le ricadute economiche delle loro scelte.

Stàteve buono guagliù! Entendance

|

|

|

|

La sòla

Aug 31, 2022 11:40:43 GMT -5

Post by Entendance on Aug 31, 2022 11:40:43 GMT -5

|

|

The consequence will be more malcontent. The formula is one of protracted crisis. A stock market crash is not even the worst effect that the Italian political situation could produce. All the ingredients exist to fuel the worst political crisis in modern European history (excluding the break-up of Yugoslavia and related issues like Kosovo) since World War II. The euro is merely one, and not even the most important, victim of the political crisis in Italy. The biggest victim, which has a global dimension, is risk. Or rather, a sudden lack of appetite for risk.

The consequence will be more malcontent. The formula is one of protracted crisis. A stock market crash is not even the worst effect that the Italian political situation could produce. All the ingredients exist to fuel the worst political crisis in modern European history (excluding the break-up of Yugoslavia and related issues like Kosovo) since World War II. The euro is merely one, and not even the most important, victim of the political crisis in Italy. The biggest victim, which has a global dimension, is risk. Or rather, a sudden lack of appetite for risk.

Italy, slow-down & more "Eurozone inflation (CPI) accelerated to +2.1% in July insuring our Quad 3 (stagflation) view of EuropeSlowing," writes

Italy, slow-down & more "Eurozone inflation (CPI) accelerated to +2.1% in July insuring our Quad 3 (stagflation) view of EuropeSlowing," writes

(System Down Event

(System Down Event  si scenderà e sarà brutale. Il finale è in vista solo nelle chiacchere narcotizzanti dei lupi travestiti da buoni pastori. Paratevi.

si scenderà e sarà brutale. Il finale è in vista solo nelle chiacchere narcotizzanti dei lupi travestiti da buoni pastori. Paratevi.

6 settembre 2018 09:45

6 settembre 2018 09:45

Trust Barometer 2018

Trust Barometer 2018

There is still no unrest in Germany over this, because confidence in the Bundesbank is well known in Germany. Jaques Delors once said: “Not all Germans believe in God, but all believe in the Bundesbank.”

There is still no unrest in Germany over this, because confidence in the Bundesbank is well known in Germany. Jaques Delors once said: “Not all Germans believe in God, but all believe in the Bundesbank.”

"...Un esperimento antropologico che non ha eguali al mondo.

"...Un esperimento antropologico che non ha eguali al mondo.

Seychelles debt drops to 60 percent of GDP,

Seychelles debt drops to 60 percent of GDP,

The Entendance Beach &

The Entendance Beach &

By 2080, Italians will be a minority in their own country

By 2080, Italians will be a minority in their own country

C’è un tempo

C’è un tempo