|

|

Post by Entendance on Apr 11, 2015 12:09:00 GMT -5

No room for anti-Americanism at Fred & Entendance Beach

We trade what we see, not what we crystal ball.

Investors without the humility to admit mistakes are not going to last long. On the other hand, good investors who are willing to analyze their mistakes and be frank about what environments will and will not favor their strategies have the chance to transcend and become great. Remember: "There is only one corner of the universe you can be certain of improving, and that's your own self.”― Aldous Huxley

When the herd go towards the water, never stand between the beasts and the river. Entendance (trailing stops)

*** <Am I Stupid?>

The Entendance Beach Free Quick Links For You

2021: The Physical Gold & Silver Beach

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

|

|

|

|

Post by Entendance on Apr 14, 2015 18:15:04 GMT -5

Mental Hygiene III

“Better to preserve capital on the downside rather than outperform on the upside” – William J. Lippman

Disaster Is Inevitable When The Two Decade-Old Stock Bubble Bursts

Top Mistakes Many Traders Make Mistake #1: Wrong Risk-to-Reward Ratio Mistake #2: Not Matching Your Strategy to the Market Conditions Mistake #3: Using Too Much Leverage more here

Eliminating Trading Mistakes

Importance of Discipline When Trading

***<The greatest investments don't start as the most optically appealing choices in many cases. Similarly, great trades to the long side often start as scarily weak markets--October, 2014 being a recent case in point. If you study one winning idea after another, however, you begin to see common threads. You immerse yourself in winning trades and, after a while, you recognize patterns as they emerge...> A Simple Strategy for Developing Yourself as a Trader |

|

|

|

Post by Entendance on Apr 21, 2015 16:40:06 GMT -5

So You Want To Trade For A Living...

Jonathan Hoenig: The 80/20 rule

"One of the most influential — though seldom mentioned — economists of the 20th century was Vilfredo Pareto, an Italian who in 1906 developed a simple mathematical formula now widely known as the 80/20 rule. Although other scholars have subsequently refined it, the basic idea remains the same: In almost all cases, the vast majority of the results are created by a small number of causes.

Although it's most commonly applied to sales and management issues, the 80/20 rule applies to trading quite well. Despite the high premium often placed on being a good stock picker, I've found that the vast majority of profits come from a small handful of trades. And while picking a stock that drops isn't fun, it's the cost of doing business and can't be permitted to derail one's confidence. The best traders are selective in where they put their money to work. They can't bet on everything; what counts is focusing on only their top ideas.

As I always point out, the point of investing is to make money. It would be quite convenient if every investment rose a comfortable 10% — but in reality, it's always a small handful of big winners that account for the majority of a portfolio's overall return.

The lesson of the 80/20 rule is to focus on the 20% that actually matter. While many stocks go nowhere at all, investors who have the patience to let their winners run will usually find two or three trades a year that can rise 50% or more. A relatively small amount of risk capital produces the lion's share of the overall gain.

Of course, traders never know in advance which investments will be the important 20%. Some are intent on making money with a specific stock; it's the flexible traders who don't fight a trend, but follow it. Although they were certain that XYZ was the next big thing, if the market isn't confirming this suspicion, good traders are humble enough to move on.

Just as only a small percentage of winners will garner big gains, the 80/20 reality of trading is that an equally modest number of trades ever become winners in the first place. In my experience, I'd say close to 80% of my total trades are either break-even "scratches" or downright losers. I'm "right" only about 20% of the time. But by focusing on keeping the losses small, the relatively few number of winners more than make up for the stocks that drop or go nowhere at all.

Of course, what usually cripples investors isn't the market, but their own self-destructive loss of discipline. Because many of trades will be downright wrong, investors must to learn to emotionally let themselves off the hook. Yet what motivates many traders isn't making money, but being right. So when XYZ moves five points against them, they don't just chalk it up as a loss and move on, but obsessively add to the position, intent on saving face more than money. I've been there, and trust me: You inevitably end up losing both.

The lesson of the 80/20 rule is being able to handle the 80% of trades that don't work out. Being wrong, even on a majority of trading ideas, matters only to the extent that the trader can't deal with it. As a veteran of far too many shame spirals, let me tell you: A disciplined approach beats going from the gut every time. Remember, it's managing the trade — not simply picking a stock — that has the biggest impact on the bottom line. Repeat this to yourself often enough, and dumping an investment becomes as mundane as taking out the trash.

There are thousands of investment options out there — and some people act as if it's their constitutional responsibility to have positions in as many of them as possible. This results in far too many portfolios being a patchwork of ideas rather than a few strategic themes. There's a big difference between being diversified and being disorganized.

As I often point out, traders can't invest in everything. Selectivity is crucial. Trading for the mere thrill of it results in far too many suckers' bets. It's a losing approach.

Out of the total number of trades I consider, I focus on only the top 20% of my ideas. It's just too expensive and time consuming to put money to work on anything but my best.

So don't just buy a stock because you know the company, like its product or hear it mentioned on cable TV. To quote Gordon Gekko, "I look at a hundred deals a day...I choose one." You should be equally discriminating. The trades I make are those I feel compelled to make out of my own selfish interest. They don't just excite me — they keep me up at night.

Although the 80/20 rule wasn't developed for traders, it's relevant nonetheless. Whether you're evaluating your profits, trades or ideas, the lesson is always the same. First, focus on what matters. Next, run with it."

Jesse Felder: shooting fish in a barrel "...The reason phenomenal investors are able to forego diversification like this is because their skill set is different. They are capable of doing the research such that they can have a high level of confidence in an idea. And when they are very, very confident about an idea they can afford to swing for the fences because their batting average with high confidence ideas is very, very good (and, probably even more important, they’re also willing to admit when they’re wrong and get out quickly). And why put any money into anything else when you have one really, really good idea?

Most investors can’t do this simply because they just don’t have very good batting averages. So bridging the gap between being an average investor and being a phenomenal one is first raising your batting average. This requires both knowledge and experience. The second step is trusting your knowledge and experience when you find a high confidence idea (while also limiting the damage when you’re wrong)...

...Bridging the gap between being an average investor and phenomenal investor is a process. The average investor should be diversified in order to protect them from their own lack of investing skill. But the phenomenal investor throws it out the window and says I’ll just be in cash until there’s a trade opportunity so compelling that I simply can’t resist. Then I’ll back up the truck..." |

|

|

|

Post by Entendance on May 23, 2015 8:13:10 GMT -5

|

|

|

|

Post by Entendance on Jun 1, 2015 10:51:13 GMT -5

DynamicHedge: "I want to touch on a couple reasons why momentum works and why I see it as one of the few durable edges in the market. With markets becoming more efficient every year, and edges coming and going faster than ever it’s important to understand principles. Momentum is a principle that can be used as a pillar of strategy development for trend following or swing trading.

Markets trend. End of story. When news comes out on a stock, prices do not instantly reset to a new equilibrium price. Sometimes stocks gap on the news release but they often undershoot and continue to trend toward what eventually becomes a new fair value. Overshooting the equilibrium price also happens but is far more common in the most mature large market cap stocks and news after a prolonged run. There are a million variations, models and theories we can debate.

When price trends to the upside it can take a long time to develop and continue for long periods of time. Sometimes trends turn into manias and markets overshoot on the upside. There is a good reason for this. On the downside, prices can be quick to reset but are equally slow and often stubborn to trend lower and then often cascade once momentum is achieved to the downside.

Point number one: Upside momentum is usually slower and appears more methodical. Upside parabolic moves are the exception, not the rule.

Point number two: Downside momentum happens equally slowly but resets happen faster. Cascading downside moves are the norm, and orderly declines are anomalies.

Why does this happen?

1. Investors as a whole tend to underreact to news.

2. Investors are risk-averse to upside moves and loss-averse to downside moves.

Investors underreact in part because they anchor themselves in past events that are already well understood. Once an idea has taken hold in the mind of an investor or analyst, it’s tough to detach the old view and fully appreciate the new view. Since we have such a hard time digesting new data, trending markets can partly be seen as the digestion of information.

There is also an asymmetric risk-utility at work. Investors are risk-averse with their winners. They value gains and losses equally but prefer certainty over uncertainty. If there’s an opportunity to make certain gains as opposed to uncertain ones, the investor takes the certain gains every time. When a market is trending higher, investors have certain gains, and continually realize these gains as the market moves up. At the same time, other rational participants identify the same opportunity and buy, only to sell shortly after. This continual realization of small gains applies steady selling pressure to a market that might naturally move higher faster, thus prolonging the trend. Risk averse behavior partially explains why we see long uptrends riding the wall of worry on their way to higher prices.

When it comes to losing trades, investors are loss averse — nobody likes taking a loss. Perversely, not liking to take a loss means investors actually value losses higher than gains. Not a typo, let me explain. When a market is moving against them, investors prefer to take more risks in hopes they can make up for the loss by waiting it out. At a certain point, the risks to total wealth overwhelm the preference to not realize the loss and the investment is sold. The key here is that the losing investment is sold much lower than a corresponding winning trade. Investors don’t let their winners run the same way they let their losers run. Loss averse behavior can account for the cascading effect we see in down trending stocks. At a certain point, stocks cross an imaginary line, sentiment changes, and everyone wants to get out.

The process:

Some event or news motivates investors to buy a stock. Many others are also motivated but are underreacting to the news and either take no action or less action then they rationally should. Price moves higher, validating the risk-averse investors who took action or already own the stock and will soon sell for certain gains. The underreacting investors now become motivated to buy because prices have confirmed their thesis, and they don’t want to be left behind. Once these new buyers have a small certain gain, they sell. This process is ongoing and inches the stock up the chart. Ironically, as stocks rise, many investors interpret rising prices with increased risk. The truth is that while upside price discovery is actively occurring there is an embedded momentum mechanism to support it. In addition, if the price moves up too fast, the chase instinct engages, higher prices stop looking expensive as fear of missing gains overcomes fear of loss and you can get a parabolic move. Let me be clear, stocks can and do get too expensive over various holding periods, but active upside price discovery supports further active upside price discovery.

Think about the same process on the downside. Something happens to decrease the price of the stock. Some sell right away, and others underreact to the information and wait longer than they rationally should. The price initially moves down quickly in reaction, then slowly moves lower. Fewer investors are selling because they are loss averse and do not wish to realize the loss. As the price continues lower, selling cascades as it breaches the utility point of holding the loss for each investor. Loss realization coupled with lower liquidity sends price overshooting to the downside. As prices decrease, investors believe that there is less risk in the stock because “news must be priced in by now” and are constantly baffled by how unreasonably low prices are getting. As downside price discovery is actively occurring, support is only definable by the available liquidity. Selling will not stop until the most loss-averse investors realize their losses and move on or buyers with a different time frame intervene. Stocks that are objectively cheap can and do get cheaper.

Hopefully, the mechanics of momentum make more sense. This article represents a simplified illustration and I purposefully left out variables around short sellers and the vagueries of understanding the motivations behind different classes of investors (retail vs institutional, momentum traders vs value investors)."

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information.

|

|

|

|

Post by Entendance on Jun 10, 2015 9:00:20 GMT -5

High-Frequency Trading Insights on Markets

"The Ten Reasons Why So Many Traders Lose So Much Money:

1.One of the biggest reasons that many traders lose money is that they simply trade with no plan. Their entries, exits, and position sizes are simply random opinions so they have no edge, and their money is taken by those traders that do have an edge.

2.A great way to lose money is to continually fight the trend in their time frame. The easiest money in the market is made trading in the right direction that the majority of cash is flowing. Buying dips in up trends, and shorting strength in down trends, is a profitable endeavor.

3.Trading with no study of past price action, or historical perspective of chart patterns, is like trading in the dark. Back testing and chart studies shed light on what a robust trading system really looks like.

4.Bad traders chase moves after it is already too late, while profitable traders take high probability, robust entries with great risk/reward ratios.

5.A huge difference with profitable traders is they trade consistently small position sizes, rather than the large position sizes of unprofitable traders. Those that continually ‘bet the farm’ on enough trades eventually lose their farm, and their trading account.

6.Egos are very expensive things in the markets. Profitable traders are able to admit they are wrong fast, and remain cautious in every trade, regardless of their confidence level.

7.Being emotional as a trader is very expensive. Fear makes traders get out of a trade when they should be getting in, and greed makes them buy into the end of a trend when they should have been taking profits. Much of a successful trader’s earnings come from trading off other people’s emotions.

8.Not doing your homework before you trade is a great way to get schooled by those that have.

9.Not understanding the real odds of out-of-the-money options is a great way to transfer wealth from option buyers to option sellers.

10.Not understanding the risk of ruin is a great way to be ruined. Your position sizing, total market risk exposure, stop losses, and discipline will determine if you survive long enough to be profitable." -Steve Burns

|

|

|

|

Post by Entendance on Jul 1, 2015 10:31:42 GMT -5

Austin Kirk: "Traders hear the terms “buy fear and sell greed” over and over again. However, these sayings are meaningless outside the context of specific price action.

Fear is not a buy signal. Fear can set up a dip buying signal with a good risk/reward ratio, or a short side trade out of an overbought area. Fear itself is meaningless outside of quantified signals.

Greed is what causes breakouts of ranges and big uptrends. Greed can cause bull markets to last longer than actually makes sense. You can’t sell greed short until it goes overextended, and shows signs of reversing.

Fear and greed are the primary influences that drive trends. The majority of traders and investors make personal decisions based on their own pain and greed threshold, rather than macro-economic and fundamental valuations.

You can’t trade emotional noise until it gives you a quantified signal."

There are no shortcuts to any place worth going...

|

|

|

|

Post by Entendance on Jul 2, 2015 11:12:19 GMT -5

|

|

|

|

Post by Entendance on Aug 22, 2015 5:44:46 GMT -5

Why Trading Financial Markets Is So Difficult

The Real Fight Is Within: Mental Hygiene II

*** Updated Strategy &Trading VIDEOS Weekly Forecast

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

|

|

|

|

Post by Entendance on Sept 6, 2015 6:14:04 GMT -5

Mental and spiritual preparation IV

"... over the years, I have met with a number of very emotionally controlled, disciplined, and process-focused traders who have not been able to make money. Mastering cognitive biases is necessary for success in markets, but I found it's not sufficient.

What I'm calling the 2.0 version of trading psychology begins with a different set of premises: markets are ever-changing, such that patterns and relationships that yield profits in one time period (regime) may be spectacularly unsuccessful in another. A good example from recent financial history has been the impact of quantitative easing on the trading of stocks. QE resulted in a crushing of volatility in stocks and a transfer of flows from lower-yielding bonds to stocks that possess both yield and the prospect of higher returns. When the end of QE and possibility of interest rate normalization comes to the fore (think taper tantrum and the recent prospect of a Fed hike), stocks have traded with far greater volatility and risk-off bias.

What has made recent trading challenging is that the stock market is not behaving in anything like the way it behaved for much of the past two years. We see higher volatility and strong selling flows. For all intents and purposes, the trader who trades stocks now and in the first half of 2015 might as well be trading different asset classes. As long-time readers are aware, I build non-linear regression models of short-term returns in SPX. Typically these models predict returns over a 3-5 day horizon. The recent model I built covers market periods displaying a medium level of volatility; the prior model covered market periods with low volatility. The variables in the models are entirely different, and they have different predictive power. One important difference is that short-term strength and weakness is more likely to reverse in the higher vol regime; more likely to show near-term continuation in the low vol, QE period.

Now if a trader starts with the traditional set of assumptions and strictly adheres to a particular process, that trader will get torched when markets change from choppy, low volatility range movement to high volatility decline. If discipline is defined as sticking to a particular set of rules and practices, then discipline eventually sows the seeds for a failure of adaptation. The trader who used to make consistent money and now cannot succeed has not suddenly morphed into an emotional basket case or a massively biased thinker. Rather, that trader has failed to adapt to a changing set of market conditions. It is often a trader's virtues--consistency and discipline--and not vices that create losses during periods of market flux.

This is why the single most important trait of traders who achieve career success is adaptability. Adaptability does require discipline and self-control, but importantly it also requires self-awareness, market awareness, creativity, and flexibility. Companies continued to churn out personal computers when laptops gained traction. Companies continued to emphasize laptops when tablets became popular. There will be companies pushing tablets when wearable computing devices become the rage. All of those companies had fine processes and disciplined execution. They simply failed to adapt to changing markets.

Do stocks trade with higher or lower correlation to one another? Is that correlation waxing or waning? Are we trading with higher or lower volume and volatility? Is volume and volatility waxing or waning? Do we show evidence of trending/momentum or reversal on short time frames? Longer time frames? Do we see signs of weakening breadth or strengthening breadth as we make successive price highs or lows? Which sectors of the market are leading performance? Lagging? Is leadership stable or changing? How are stocks correlated with other asset classes? Is that correlation changing recently? What do those cross-asset correlations and patterns of leadership tell us about the U.S. economy? The global economy? How are we responding to economic data releases and market movements overseas? Is that pattern of response changing? What are those patterns of response telling us?

When you ask those questions, you take the first step toward developing meta-processes: processes for adapting your best practices to changing market conditions. Trading is *not* like poker, chess, or athletics: the rules in typical games of skill do not change from one competition to another. Trading is like business. The business marketplace never stays still. Success is not about finding a magic formula and slavishly adhering to it. It's about staying flexible and finding new formulas under evolving conditions. The faster the pace of change, the more creativity becomes the essence of discipline." -Brett Steenbarger, Ph.D.

Meb Faber: "There is a lot of talk about stocks being expensive, but also a lot of people not really doing anything about it. Many simply don’t know how to tackle the problem, and others don’t want to think about it at all. Below, for some perspective, are historical returns to stocks since 1970 and the 10 worst months for the S&P. On average you’re looking at a 11% decline, and that only happens every four years or so (last was Feb 09). Many others have produced charts like this, but I wanted to demonstrate the returns and batting average for typical asset classes when it hits the fan for stocks.

First observation is that when US stocks go down, all stocks go down. It doesn’t matter if you are small cap US, foreign developed or emerging, the high correlation means you all suffer.

Bonds of all flavors do a good job, but you can only count on them a little more than half the time. Good ol’ 10 year US bonds had the highest median return of any asset during stock drops, However, the lower maturities have a higher hit rate, and of course cash is king with a perfect batting average, but doesn’t do much to diversify and zag when stocks zig.

Commodities are a coin flip, but also had a monster -28% month, so also volatile (ditto for gold). REITs, being stocks, don’t help.

One of the best of course is managed futures (hooray for trend!), but FYI pre-1980s this series is hypothetical. I would argue that this is one of the biggest areas investors are under-allocated. I think having trend strategies as a percentage of a stocks/bonds/real assets portfolio is one of the best diversifiers, and anywhere up to 33% allocation is completely reasonable. I’ve said a number of times that a 1/3 each global stocks, global bonds, and managed futures or trend strategy is really hard to beat. (or do 25% each and add in real assets.) Stay tuned for a future post on the subject.

So You Want To Trade For A Living...Be advised: there are no shortcuts to any place worth going...Entendance Action without study is fatal. Study without action is futile.  Trailing Stops Trailing Stops If Itching to Invest, Consider A 'Mad Money' Account "We all have to grapple with our inner gambler from time to time. As stocks show a pulse, some of us are likely getting the itch to make an outsized bet on one tantalizing sector or another. The good news is, you can give in to these urges without sabotaging your portfolio.

Even Benjamin Graham, the sober father of value investing, advised enterprising investors to open a small "mad money" account aside from their portfolio strictly to exercise their speculative demons, in his seminal book "The Intelligent Investor."

"Speculating can be fascinating and it can be a lot of fun," Mr. Graham wrote in the 1973 edition. "If you want to try your luck at it, put aside a portion -- the smaller the better -- of your capital in a separate fund for this purpose."

Mr. Graham's reasoning: Rather than try to squelch the temptation to invest in what seems like a can't-miss stock or sliver of the market, act on it in a sensible way. In fact, indulging yourself in a small side account can help you be disciplined, if boring, with the bulk of your money." -Ian McDonald

|

|

|

|

Post by Entendance on Sept 18, 2015 7:35:57 GMT -5

Inquiring Minds Only!

Investing & Trading *Inquiring minds only! ETFs

Trading without trailing stops is the ego wanting to never be held accountable (to admit that a position was a mistake) if a certain level is breached or if a certain set of circumstances play out in an unexpected manner.

Anybody who doesn't use trailing stops is going to be out of business at some point. It's not if, it's when. -Entendance

|

|

|

|

Post by Entendance on Sept 21, 2015 16:18:22 GMT -5

The Real Fight Is Within: Mental Hygiene V

“The art of being wise is the art of knowing what to overlook.” -William James “It is of the highest importance in the art of detection to be able to recognize, out of a number of facts, which are incidental and which vital.” -Arthur Conan Doyle’s

The strength of a human being is in the knowledge of her/his limits. Entendance

SUN TZU'S THE ART OF WAR SUN TZU'S THE ART OF WAR

Applying Sun Tzu's Art of War to Trading Lessons From Sun Tzu's The Art Of War For Your Trading Applying Sun Tzu's Art of War to Trading Lessons From Sun Tzu's The Art Of War For Your Trading

Sovereign Man Simon Black: ...As Sun Tzu wrote in Chapter VI, “You can be sure of succeeding in your attacks if you only attack places which are undefended.” We’re seeing this right now with many petroleum and mining stocks, many of which are trading for less than the value of their net assets, yet still paying a dividend. It’s basically free money– like an undefended enemy position. This is the nature of value investing.

Sun Tzu continues: “Hence that general is skillful in attack whose opponent does not know what to defend; and he is skillful in defense whose opponent does not know what to attack.” This is how most retail investors think– like the opponent who does not know what to attack or defend.

People seem to think that a falling stock price means that it will fall forever, or that a rising stock price means that it will rise forever. We tend to buy what’s expensive and sell what’s cheap, instead of the other way around. It’s a totally non-sensical mentality.

Sun Tzu again: “It is only one who is thoroughly acquainted with the evils of war that can thoroughly understand the profitable way of carrying it on.”

True words. There are countless risks out there, and it takes a tremendous amount of experience to not only understand what’s happening, but to safely profit from it.

This is what makes financial education and mentorship so paramount: investing, especially in times of epic crisis, can bring tremendous reward… as long as you have the right knowledge and experience. The great general opens his treatise by introducing five primary factors in war strategy; and as he has told all the would-be generals for the past 2,500 years, “he who knows them will be victorious; he who knows them not will fail.”

Fred & EntendanceInvestors Beach? Hic Sunt Leones  Hic Sunt Leones in Latin, meaning "Here there are lions" was written on uncharted territories of old maps. The objective was to dissuade eager adventurers from exploring the uncharted land and claiming it as their own. For the few smart adventurers out there, "Hic Sunt Leones" truly meant, "Here lies uncharted territory -- explore it vigorously and conquer!" And so we do here! E.

|

|

|

|

Post by Entendance on Oct 5, 2015 16:43:09 GMT -5

The ignorance and the presumption always travel in the same compartment. The wisdom and the humility too. But on another train. -S. W. Field (L'ignoranza e la presunzione viaggiano sempre nello stesso scompartimento. La saggezza e l'umiltà anche. Ma su un altro treno.) (Die Unwissenheit und die Überheblichkeit reisen immer im selben Abteil. Die Weisheit und die Bescheidenheit ebenso, aber auf einem anderen Zug.)

AdamHGrimes: "Most people think trading is about having great ideas and great reasons for those ideas. I’d argue that everything else–everything that people talk about so little–those are the things that really matter. When someone first comes to financial markets, it’s natural to want to know where to buy or short something, to want to know when something is going to go up or down. Over time, most traders begin to realize that everything else matters a lot too. What is “everything else”? Here’s a short (and partial) list of things worthy of your focus and attention:

1.How much to buy or sell. Position sizing is critical. Make one mistake here and you could be out of business.

2.What you do after you get into the trade, or trade management. I’d argue that position management is responsible for more of your results than entry techniques. It’s also a much more complicated subject, and a lot less sexy. It’s easy for me to write a blog telling you why you should buy a stock or short a currency, but once you’re into the trade complexity multiplies. Every moment is an opportunity to make many decisions: do you add to the trade? Get out? Tighten stop? Where is your initial stop? Is it for full or partial position? Will you ever widen the stop? Take partial profit? Reduce the trade at a loss? Plan to add to the trade at a later time? Hedge the trade? The list goes on and on.

3.Discipline. You must be consistent. The market is very random, and your results will have a wide degree of variability. The only defense you have is to be as consistent as you can in your behavior.

4.Process. What do you do and how do you do it? Who are you, as a trader? How does trading fit into your professional and personal life? All of these are questions that are addressed in your process, and you better have one.

The list could go on and on, but I would challenge you to think about where you put your time and attention. How much of your focus is on ideas for trade entry? How much time do you spend thinking about everything else, and what can you improve? Sometimes very small adjustments can make a big difference.

It’s not what you think: most people think trading is about having great ideas and great reasons for those ideas. I’d argue that everything else–everything that people talk about so little–those are the things that really matter. Those are the things that are going to create your success, and ensure a long and enduring career in the market. Where is your focus?"

Joshua M Brown: Big one-day rallies and price swings are characteristic of downtrends, not bull markets. Before you get excited about the big reversal… More here

|

|

|

|

Post by Entendance on Oct 9, 2015 7:49:46 GMT -5

"Here are the ten key things I have learned that have allowed me to make money in the markets, and some of the characteristics of the best traders I know.

1.The ability to buy pullbacks in uptrends. Buying at the right pullback levels while everyone else is afraid is typically profitable.

2.Selling strength short at key resistance levels during downtrends. The ability to sell short after a big move inside a range bound or down trending market can be profitable with the risk/reward ratio is in your favor.

3.Top traders use stop losses and limited position sizing to control their risk per trade. They never risk all their capital, their lifestyle, or their careers on any one trade.

4.Top traders are flexible and can be bullish or bearish at any given moment, depending on the price action and market trend.

5.Top traders like to trade in the path of least resistance in their time frame, always going with the flow.

6.If you want to be a top trader you have to love to trade. Just wanting to make money is rarely enough motivation to do the work necessary to be successful.

7.Top traders do thousands of hours of homework on historical charts and price action trends to see what actually works.

8.Top traders HATE to lose money so they keep their losses small.

9.Top traders maximize their winning trades and minimize their losing trades.

10.Top traders don’t give up when they are exhausted and beaten down, they only stop when they have won." -Steve

***Meeting With Triumph and Disaster: Some Lessons here  Walking The Talk At Fred & EntendanceInvestors Beach: Vultus indicat mores Sovereign Man: the banks just get to keep pretending that they’re safe. What to do

If you like this beach, then you can help your friends locate it by letting them know about Fred & EntendanceInvestors Beach.

Let's all make this place a thriving sheltered Club for excellence, education and information!

Sollte dir dieser Strand gefallen, dann kannst du deinen Freunden behilflich sein, indem du sie über Fred & EntendanceInvestors Beach informierst.

Lasst uns gemeinsam diesen Ort zu einen blühenden Club für Vortrefflichkeit, Bildung und Information machen!

|

|

|

|

Post by Entendance on Dec 22, 2015 16:34:09 GMT -5

“I realized that every time I had a loss, I needed to learn something from the experience and view the loss as tuition at the College of Trading. As long as you learn something from a loss, it’s not really a loss.”

“When your account has these massive swings up and down, there’s a tendency to feel a rush when the market is going your way and devastation when it’s going against you. These emotions do absolutely nothing to make you a good trader. It’s far better to keep the equity swings manageable and strive for a sense of balance each day, no matter what happens.”

“I probably do more mental exercises now than I ever did. Each morning while I’m driving to work, I make a conscious effort to relax. I mentally rehearse any conflict that might happen that day. The process of mentally organizing and relaxing before I get to work helps me start my day in a very positive frame of mind.”

“Also, it helps if you view your life as a movie. If you go to a video store and rent a horror movie, you’re voluntarily letting yourself be horrified, and it’s not stressful because deep down you know it’s just a movie. What if you had the same attitude about life?”

“I think investment psychology is by far the most important element, followed by risk control, with the least important consideration being the question of where you buy and sell.” – Tom Basso

|

|

|

|

Post by Entendance on Jan 15, 2016 6:36:57 GMT -5

20 Terrible Ways to Trade Good trading is very basic; it’s trading with an edge to capture a trend in your own time frame, while managing your risk exposure carefully with the right position sizing and stop loss.

There are endless ways to trade badly. You can change these if you make an effort and become self-aware. Be on the lookout for these pitfalls.

Here are the top 20 |

|

|

|

Post by Entendance on Mar 3, 2016 6:21:14 GMT -5

Mental Hygiene VI

"You’re never going to save everyone. There are some people that are never going to get it. It’s sad, but true.

There will always be investors that can’t help themselves or get out of their own way.

I used to think everyone could be saved if they would only learn. But changing behavior is simply too difficult for many.

In order for one group of investors to prosper, another group has to fail. It’s an unfortunate truth of the financial markets."

-Ben Carlson

|

|

|

|

Post by Entendance on Mar 6, 2016 5:19:44 GMT -5

Brett Steenbarger: " I recently wrote on the topic of how the ways in which we analyze markets can generate the frustration we experience as traders. When we try to fit markets into the ways we prefer to trade, we not only distort our processing of information; we also create inevitable drawdowns. One trader, needing to trade trends, views a non-trending market as "choppy" and untradable. But the trader who views markets in terms of cycles knows that there are trending periods in markets and there are mean-reverting periods. There are higher frequency cycles and there are lower frequency ones. The markets will tell us how they're trading. We can listen and adapt or we can impose our own agendas and accumulate frustration.

Similarly, life has its cycles as well. Sometimes we profit in our life experience and sometimes we face career or relationship setbacks. Rarely does life progress in a straight line. If we view our setbacks as opportunities to learn and adjust, we can continuously grown. If we view our setbacks as failures, we will always internalize the sense of falling short and never sustain the confidence needed to truly move forward.

The trading psychology literature speaks a great deal of discipline and confidence and emotional control. Rarely do we focus on acceptance as a cardinal virtue. If we can accept the present and learn from it, we can forge a profitable future--in markets and in life."

|

|

|

|

Post by Entendance on Mar 20, 2016 6:07:52 GMT -5

Fred & EntendanceInvestors Beach: Inquiring and Uncolonized Minds dwell here

* Adapting to changing markets

* Building on strengths

* Cultivating creativity

* Developing best practices and processes!

That's why you are here at Fred & EntendanceInvestors Beach!

|

|

|

|

Post by Entendance on May 3, 2016 3:06:24 GMT -5

John Kicklighter: • Cognitive biases are a patterns where people frequently deviate from rationality - and are very common in trading

• We focus on three biases that commonly build on each other: anchoring, confirmation bias and availability cascade

• Monetary policy themes, cross correlations and risk connections are reviewed with these biases in mind.

|

|

|

|

Post by Entendance on May 26, 2016 16:52:25 GMT -5

Mental and spiritual preparation VII

Investor psychology is an interesting phenomenon to study. Despite the obviously negative implications, a large percentage of investors have a tendency to buy high and sell low. When the price has been rising and everyone is bullish, they decide to jump in near a top. When prices are dropping sharply and everyone is selling, they get fearful and decide to exit their positions near the bottom.

Herd mentality, or mob mentality, describes how people are influenced by their peers to adopt certain behaviors, follow trends, and/or purchase items.

Investors looks for social proof around them. If they see others making money buying certain sectors or stocks, they decide it must be a good time to buy and they follow the herd. And if everyone is selling, they panic and decide it must be a good time to sell. This is a recipe for financial disaster. Investors like making money, but hate losing money a lot more. The good feeling of a 50% gain is not nearly as intense as the bad felling of a 50% loss. This is why when there is a large drop and money is lost (on paper), investors are shy about buying more and freeze up at exactly the moment they should be buying. Still feeling the sting of a decline, investors rush to exit their positions for fear of losing more, regardless of the fundamental and technical factors.

And on the other end of the spectrum, most investors buy when prices are high because they haven’t lost anything and feel good about paper gains they have generated. They also feel good about the future direction, because the most recent direction has been favorable. As emotional beings, we buy when we feel good after gains (greed) and sell when we feel bad after losses (fear). Human emotions have a huge impact on the markets, distort prices and create opportunities. In poker, players that do not allow their emotions to get the best of them (avoiding tilt) are almost always going to outperform emotional players. It is the same in the investing world. The more you are able to invest as a rational, fact-based, data-based investor and less as an emotional being, the more success you are likely to experience. This means being able to go against the herd, avoiding any feelings of discomfort from not going with the crowd and aligning with your peers.

Successful investors must find the fortitude inside to be a contrarian and run against the herd. Successful investors will buy when others are fearful and sentiment is negative and sell when others are greedy and sentiment is positive. It is difficult to do, especially when you first break the mold and force yourself to do the opposite of everyone else around you. -Jason Hamlin

Day Trading Belief 1. Anything Can Happen Day Trading Belief 2. You Don’t Need to Predict to Make Money Day Trading Belief 3. Wins and Losses Are Randomly Distributed Day Trading Belief 4. Your Strategy Simply Indicates One Outcome Has a Slightly Higher Probability Than Another Day Trading Belief 5. Every Moment in The Market is Unique 5 Beliefs You Must Accept to Improve Day Trading Performance

|

|

|

|

Post by Entendance on Jul 28, 2016 7:49:45 GMT -5

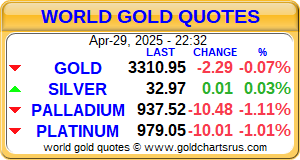

Mining Weekly this week quotes DRD Gold CEO Niel Pretorius as recognizing a growing problem with "paper gold," with the supply expanding while gold production declines.

"There's a shortage of real gold to cover the paper gold position that's out there," Pretorius says.

Of course there's no guarantee that investors will not continue to prefer "paper gold" over real metal, thereby allowing central banks to inflate the supply of the former and in effect lock the exits from their fiat currency system. But it's nice to see a gold mining executive willing to acknowledge what's really going on.

The Mining Weekly report is headlined "World Heading for Shortage of Physical Gold -- DRDGold" and it's posted here

!NEW: The video bankster don't want you to watch is here

|

|

|

|

Post by Entendance on Sept 1, 2016 7:10:17 GMT -5

"...I regularly get emails from people who don’t have major assets to invest and wonder what they can do to protect themselves. Wealth protection is all relative. Many people can afford to spend say $40 per month or more to buy 1 gram (1/30 of an oz). If you do this every month for a few years you will have built up a nice little nest egg as the gold price goes up many times from here. Thus there is no excuse not to save in gold even for people with less capital.

The risks in the financial system and world economy are now at an extreme and it is most likely that one of several of these risks will turn into serious problems for the world in the next few months." ***Gold is for the wealthy as well as for the less wealthy

|

|

|

|

Post by Entendance on Sept 15, 2016 3:57:02 GMT -5

"...Yuval Harari, in his excellent history of mankind, ‘Sapiens’, points out that just about everything in the infrastructure of the modern economy is either some kind of narrative or myth. The buildings on Wall Street and in the Square Mile may be solid enough, but the rest of the fabric of our financial system is dependent on trust or collective belief rather than the material and the ‘real’.

Money, for example, is based on two universal principles:

•Universal convertibility: with money as an alchemist, you can turn land into loyalty, justice into health, and violence into knowledge;

•Universal trust: with money as a go-between, any two people can cooperate on any project.

Note that use of the word ‘trust’. Our monetary system requires mass collective belief. When administrations abuse the public trust – as central banks do today by printing money out of thin air and using it to buy shares in productive businesses that the rest of us had to sweat for, in order to purchase them – they run the risk of shattering the system they were instituted to protect.

And our concept of money is extraordinarily fragile. At one point it had literal substance, in the form of precious metals or other commodities. But since 1971 it has been entirely virtual, and backed by nothing but the promises of politicians.

It is also almost magically insubstantial. Satyajit Das:

“Less than 8 percent of all dollars are in the form of paper money or coins. The vast majority of dollars exist in the form of entries in the accounts of borrowers or lenders. Paper money is an abstraction or, as most of it does not exist physically, the abstraction of an abstraction. Its sole reason for existence is as a medium of exchange. There are no limits to the amount of money that can be created.”

Which is a principle that the central banks have come dangerously close to abusing..." ***Ease this

|

|

|

|

Post by Entendance on Sept 28, 2016 7:17:43 GMT -5

There are risk-averse traders who never make significant money. There are risk-seeking traders who blow up. Then there are smart traders who take calculated risks. They make selective bets. Like the skilled poker player, they know when they have a good hand and they know how and when to bet that hand.

But to take calculated risks, you have to know how much risk you're truly taking. Several factors impact the risks in your trading:

* The sizing of your positions - It's not uncommon for small traders to have big dreams and take positions that are unusually large for the amounts of capital they're trading. Any trader can experience strings of losing trades merely by chance. When position sizes are too large, those strings of losers incur a risk of ruin. Once you're down 50%, it takes a doubling of remaining capital just to return to break even.

* The volatility of your markets - Volatility can change dramatically from day to day, week to week, depending on the participation in your markets. This can be particularly true around major events, such as central bank meetings, earnings reports, etc. You want to size your positions, not only for the current volatility of the market you're trading, but also for the expected "vol of vol": the expectable variation in volatility over the life of your intended holding period.

* The correlation of positions you are trading - When the positions you are trading are negatively correlated, the overall risk in your book can be smaller than the risk associated with each of the positions. Conversely, when you trade multiple positions that become correlated, your total risk exposure can grow exponentially. Some short-term traders only hold one position at a time, but can experience correlation-related risk if they habitually lean one way in markets (long or short, for example). They end up taking bets that are not truly independent ones. Traders of individual equities often treat their positions as independent when, in fact, those positions can respond very similarly to large moves in the overall market.

Risk is important because it impacts trader psychology. If the amount of risk you're taking dramatically expands or shrinks, you're likely to react to the change in the ebb and flow of your P/L. In order to take calculated risks, you have to be able to estimate and calculate risk--and the possible ways risk can shift over time. We often think of trades as directional bets, when in fact they are also implicit bets on *how* markets move.

|

|

|

|

Post by Entendance on Oct 4, 2016 9:40:54 GMT -5

Empires are born, and empires die. Right now, the American empire is dying, and the empires of China and India are being born. The death of the American empire is not caused by debt or even demographics. It’s caused by time.

There’s a time to live, and a time to die, and it’s the American empire’s time to die. Insane levels of debt and entitlements do appear as an empire reaches the end of its life, but reducing those debts and entitlements doesn’t change the fact that it’s time to die.

The 2008 super-crisis involved limited deleveraging, and massive transfer of leveraged assets from the private sector to the public sector (central banks). The next crisis will be a full deleveraging event that involves both public and private assets. I call it the “End Game”.

As it unfolds I expect markets to act more like they did in 1929 than 2008, and end with gold revaluation. The 1930s gold revaluation was really a revaluation of US government gold, and a devaluation of the American citizen. This revaluation will be best described as a revaluation of the gold held by Chindian citizens, and a massive devaluation of the citizens of the Western world. Business cycles tend to last about eight years. The current up cycle is long in the tooth, and as it ends, the end game winds will begin to blow. Opportunities for gold to stage a parabolic price advance only occur about once every eight years, and the next opportunity is coming soon. -Stewart Thomson

|

|

|

|

Post by Entendance on Nov 7, 2016 17:54:34 GMT -5

|

|

|

|

Post by Entendance on Nov 24, 2016 8:24:21 GMT -5

We trade what we see, not what we crystal ball.

"Too often, traders take in one piece of information after another, reading emails, scanning charts, reviewing research pieces, tracking news, and talking with other traders, and never get to the point where the information is transformed into knowledge. Someone trading the stock of a company may compile all sorts of statistics and news items about that company, but those in themselves don't ensure a knowledge of the company's competitive advantages and disadvantages or its growth potential. If someone gathered pieces of information about our lives, would they truly understand us?

We often hear that the heart of trading psychology is discipline and the control of emotions. Other times, we hear that openness to and awareness of our emotions is crucial to enlightened decision making. Both perspectives have merit, yet both make the mistake of assuming that trading psychology is basically about what and how we feel.

Not so.

Every bit as important to our trading as our emotional psychology is our cognitive psychology: how we process information and turn it into knowledge. Indeed, I would argue that, as we move from beginning traders to experienced ones, emotion becomes less of a central focus for trading and information processing becomes more critical. Lo and Repin, for example, found that traders responded to heightened market volatility with emotion, with inexperienced traders far more reactive than experienced ones. Experienced, successful traders may or may not wrestle with emotional responses to a market scenario, but they will always be actively involved in processing that scenario and searching for opportunity.

Two cognitive psychology mistakes are common among traders:

1) Not making the time to assemble information into knowledge - Key to knowledge is finding meaningful patterns in data and placing those patterns into a framework for understanding. In my trading, I track statistics ranging from volume, breadth, sentiment, and buying/selling pressure, but it's the integration of the data that contributes to understanding. One form of integration is in the form of a mathematical model. Another form is a conceptual framework that is grounded in the concept of market cycles. If I get so caught up following the data that I don't engage in integration, I will fail to perceive valid trading opportunity. Equally problematic, I will tend to act on individual pieces of information that grab my attention without placing that information into proper context.

2) Not playing to our information processing strengths when we generate trading ideas - Each of us is quite different in how we make sense of the world. Some of us are quite mathematical and analytical, assembling views from the ground up. Others are conceptual and qualitative, looking for broad patterns to derive a top-down view of the world. My most native form of information processing is writing. Quite literally, writing is my way of thinking aloud and generating an internal dialogue that places information into perspective. Other traders accomplish the same thing by reading and taking notes; still others by engaging in multiple conversations. Far too often, traders fail to reach their potential because they're not accessing their cognitive potentials. They are making sense of markets in someone else's style, not their own.

I've recently begun an experiment in which I engage in very extended journaling, writing out my assessment of the most recent day's market and where it fits into the broader picture of market cycles, but also writing out every single trade that I place, why I placed it, what worked and didn't work, and what I have done well or could have done differently. The depth of the journaling is far different from the typical end of day notes on trading and markets. In practice, I keep writing and writing until I get to the point where knowledge results from the information.

It's early days, but the method so far has been helpful. One unintended consequence: I find myself feeling more confidence in trades when I've processed the opportunity in greater depth, in ways that are most productive for my sense-making."

|

|

|

|

Post by Entendance on Jan 8, 2017 8:29:41 GMT -5

"...When starting out investing, one of the first important words you learn is transparency, which is essentially being able to see clearly how the company functions, who manages it, how it earns money and perhaps even more important how it loses it.

You can follow the OTC stocks at otcmarkets.com, which separates stocks into different market levels based on their transparency. This categorization is more about how much information is available and does not guarantee a stock’s success or failure, or that it’s a good or bad company. However, if more information is better for keeping the perspective on a company, then you may consider this ranking as a starting point. If you belong to an online brokerage firm, it will indicate whether the stock is over-the-counter or an exchange-listed one.

The following tiers of the OTC are based on overall transparency and reporting requirements, information available, etc. It does not list all of the requirements for each tier. It’s also not a qualitative designation and the essential thing to remember is that important information can be withheld. There are exceptions, but as a rule, the lower the listing, the lower the transparency.

OTCQX is the highest tier of the three-tiered OTC markets. As defined by the OTC Markets, OTCQX “is for established investor-focused U.S. and global companies.” The SEC imposes more stringent financial and reporting requirements on the OTCQX stocks than the tiers below.

OTCQB is the second tier of the OTC markets and “is for entrepreneurial and development stage U.S. and international companies unable to qualify for OTCQX.” The OTC Markets further indicates that “companies must be current in their reporting and undergo an annual verification and management certification process.” Additionally, companies on the OTCQB must meet a minimum bid price test and cannot be in bankruptcy.

OTC Pink, with pink being a historical reference to the color of the pages that prices at this tier were quoted on, has the lowest level of reporting requirements. According to the OTC Markets, companies on this listing are “there by reasons of default, distress or design.

Beyond these three tiers, there are three additional marketplace designations that potential investors need to understand.

The OTC Bulletin Board, an interdealer quotation system, is for subscribing members of FINRA. Proprietary quotations can be entered into the OTCBB and updated in real-time. Members that submit quotes must comply with FINRA’s rules and regulations.

OTC Grey Market designates stocks that are not currently traded on OTCQX, OTCQX or OTC Pink, but broker-dealers may still be trading them without an exchange or interdealer quotation system. Because there is no centralized information on these trades, there is virtually no transparency when it comes to stocks trading the OTC Grey Market. Be wary of stocks in this category.

Caveat Emptor designates companies that have serious discrepancies and irregularities in their reporting. These could be companies on paper only or outright scams. On the OTC Markets, Caveat Emptor stocks are branded with the skull and cross bones symbol, i.e., “Buyer beware.”

More at Market 101 – Introduction

AdamHGrimes:

"There are so many things we can’t predict; surprises, good and bad, happen. Sometimes these surprises can have a dramatic impact on our positions. One of the core tasks of trading is to respond to new developments and shifts in the market, but it’s also important to do what we can do reduce the number of surprises. Too many times, developing traders are hit by things they could and should have seen coming..." ***Trading macro events and reports (part I)

"Every day, we are hit with economic reports, earnings for stocks, speculation, opinion, and a flood of other information. Some of these events move markets; some are non-events. How can we manage the volatility around these reports and what do they mean for the tactical/technical trader?" *** Trading around macro events (part II) *** Here’s what to actually do around events and reports (part III)

A summary of the basic SEC documents you should know

Filing Requirements

All public companies are required to file financial documents with the SEC, unless they meet certain exemptions.

Public companies can be exempted from filing the standard SEC forms if they have less than 500 stockholders and have less than $10 million in total assets. Exceeding either of these criteria requires them to file.

However, non-filing companies are required to provide shareholders with financial information on request. If you own stock in a non-filing company, you can call them and ask for financial data.

All other companies must file regular reports of all kinds with the SEC. Since 1996, these filings must be made in a HTML format in order to be easily stored in the EDGAR database operated by the SEC. There are numerous sources on the Internet for accessing these electronic filings.

Registration Forms

S-1 and S-2 forms are the initial filings by a private company that intends to become public. The filing of this form is the first step in an IPO. The forms require disclosure of the current owners of the stock, the past revenue and earnings history, a description of the business plan, all known risks associated with the stock (many of these are boilerplate), and the company's intentions for the capital raised.

S-1's are typically filed first with blanks for such things as the number of shares to be sold and the price. An S-1/A is filed when these blanks are known.

A 424A or 424B filing is an amendment to the original S-1 or S-2 filings but which contains an substantial change other than filing in the blanks of the original S-1.

An S-4 filing is used for new securities issued when two existing public companies merge or combine businesses.

Financial Reporting Forms

10-K The annual financial filing form required of all companies. The 10-K is the single most complete description of a company, with a complete description of all risks and history of the business.

The 10-K must be filed within 90 days after the closing of the company's fiscal year.

10-Q The 10-Q is the quarterly filing of financial reports. It often does not have the three year history of financials as the 10-K does, though some companies include this.

The 10-Q must be filed within 45 days of the closing of the quarter. There is no 10-Q for the fourth fiscal quarter, as the 10-K fulfills this function.

Amendments to previously filed 10-Ks and 10-Qs are identified with a /A as in 10-K/A.

When either of these forms cannot be filed on time, the NT 10-Q or NT 10-K form is filed, which grants the company a 45 day extension.

Material Events

Whenever a material event occurs, the company must file a Form 8-K describing the event and its possible effect on the company's business. By the very nature, 8-K reports have no schedule. A material event includes such things as bankruptcy, a lawsuit, a merger, resignation of a key officer or director, patent denial, or other significant event.

Insider Transactions

Insider is a general term for officers and directors of a company. However, most insider rules also apply to shareholders who have more than 10% of the company's stock.

Restricted stock, in general, is stock which has been purchased in any way other than a public offering. There may, or may not, be actual restrictions imposed by the company or underwriters on how the owner can dispose of the stock (often there are). However, for SEC purposes, restricted stock means stock sold directly by the company to an investor in a privately arranged sale and which has not been registered with the SEC for public sale. Exercise of stock options generally do not fall into this category, as the company registers the entire stock option plan.

Form 144 filings reports the proposed sale of any restricted stock. While this includes company insiders, it also includes anyone who owns restricted stock, as defined above, regardless of how many shares are sold.

It is important to note that many insider trading reporting agencies list filings of Form 144 by directors and officers, but do not include Form 144 filings by unaffiliated shareholders.

It is also important to note that the filing of a Form 144 does not obligate the filer to sell any or all of the shares listed. The filer has 90 days in which to make the transaction, or portion of it. If the 90 days passes without a transaction, a new Form 144 may be filed.

Form 3 filings state the ownership totals for a new officer, director, or 10% owner. The form must be filed within 10 days of the event that makes the person a Form 3 filer.

Form 4 filings state the changes to an insider's holdings when they occur. The Form 4 includes purchases and sales as well as exercise of options, disposition by gift, or other transactions. Form 4 must be filed before the end of the second business day when the change occurs.

Form 5 filings are an annual summation of the Form 4 changes to give a annual summation of the ownership by officers, directors, and 10% owners.

Large Position Shareholders

Forms 13D and 13G are used to report positions by large shareholders, which is defined as any shareholder who owns more than 5% of the outstanding shares.

Form 13D is a required filing by any entity which becomes a 5% holder. This filing must be made at the time (within ten days) the holder crosses the 5% threshold.

Form 13G is the same form, but used when the person or entity is making the purchase for investment only.) Additional purchases by this holder do not have to be reported on Forms 3, 4, or 5, until the holder crosses the 10% threshold .

|

|

|

|

Post by Entendance on Jan 20, 2017 17:36:56 GMT -5

2017: Investing & Trading

Determine value. Then buy low, sell high.

•Missing trades is commonplace. If this experience impacts your mental or emotional ability to trade, then you should not be trading.

•There is temptation for traders to employ substantially more leverage at tail end of good markets, when they should be scaling back risk.

•Markets always attempt to shake a trader out of position in direction of a strong trend. Seldom markets make it easy to hold winning hands.

|

|