|

|

Post by Entendance on Apr 16, 2023 16:17:16 GMT -5

'The word Bankruptcy originates from the Italian Banca Rotta or broken bench. Bankers in the 16th century Italy would conduct their business from a bench or table. When they could no longer fulfil their obligations, their bench was smashed to signify that they were out of business... ...no one should hold any major assets in any bank in any country...'

|

|

|

|

Post by Entendance on Apr 30, 2023 2:22:25 GMT -5

Derivatives Derivatives

|

|

|

|

Post by Entendance on May 8, 2023 11:26:09 GMT -5

|

|

|

|

Post by Entendance on Jul 31, 2023 12:18:35 GMT -5

July 31, 2023

'The Everything Bubble is about to turn to the Everything Collapse! 'The Everything Bubble is about to turn to the Everything Collapse!This is the inescapable outcome for the Western world.

The world economy should have collapsed in 2008 were it not for a massive Hocus Pocus exercise by Western central banks. At that time, global debt was $125 trillion plus derivatives. Today debt is $325 trillion plus quasi-debt or derivatives of probably $2+ quadrillion.

The US is today running bigger deficits than ever at a time when:

The interest rate cycle is strongly up

There is only one buyer of US debt – the Fed

Dedollarisation will lead to a rapid decline of the dollar.

The financial system should have been allowed to collapse 15 years ago when the problem was 1/3 of today. But governments and central bankers prefer to postpone the inevitable and thus passing the batten to their successors thereby exacerbating the problem...' |

|

|

|

Post by Entendance on Aug 24, 2023 4:38:58 GMT -5

|

|

|

|

Post by Entendance on Aug 27, 2023 14:09:06 GMT -5

|

|

|

|

Post by Entendance on Sept 3, 2023 0:47:57 GMT -5

Analyst, financial writer and professional trader Rick Ackerman is forecasting a “deflationary end” to our debt-bloated financial system. Ackerman contends, “I think everybody agrees we have more debt than we can ever repay. So, it’s going to have to be repaid one way or another. The debt has to be discharged. Every penny of every debt has to be paid, if not by the borrower, by the lender. Hyperinflation would let borrowers skip free...The powers that be are not going to go for that. The lenders are going to be in charge. This is why I said all of the mortgage contracts will come to resemble leases. This is so the lenders don’t wind up evicting 110 million Americans from their homes...Things have gotten far crazier than I could have imagined a decade ago when I was forecasting a deflationary end.”

What is the big deflationary downward spiral going to look like for John Q Public? Ackerman predicts, “On the scale I believe it has to happen, it looks like a barter economy. We are talking about kind of a Stone Age. There are a lot of jobs in the economy where you would be hard pressed to say what these people do. Most people would not be able to tell you why they are worth what they are being paid. This would be true for 98% of the people who work for Twitter. A lot of those jobs will disappear. Imagine what you have when you have that kind of disposable cash taken out of the economy. It has more than a ripple effect. It has a tsunami effect. Everything downstream collapses too. So, I really see a state of barter... What is the big deflationary downward spiral going to look like for John Q Public? Ackerman predicts, “On the scale I believe it has to happen, it looks like a barter economy. We are talking about kind of a Stone Age. There are a lot of jobs in the economy where you would be hard pressed to say what these people do. Most people would not be able to tell you why they are worth what they are being paid. This would be true for 98% of the people who work for Twitter. A lot of those jobs will disappear. Imagine what you have when you have that kind of disposable cash taken out of the economy. It has more than a ripple effect. It has a tsunami effect. Everything downstream collapses too. So, I really see a state of barter...

Full disclosure, I said we were close to a collapse 10 years ago, but I really think we are close this time. I think we are not further away than a stock market implosion. This inflated stock market is a crazed animal right now that does not relate to reality, earnings or anything. It’s always in danger of collapsing tomorrow. As far as a precipitous deflation, it will be simultaneously with the collapse of the stock market...We are at a much higher threshold than the past. The edifice is much more fragile and precarious than it has ever been. All we need is for the inevitable bear market to begin, and then it is game over.”

Ackerman also predicts the dollar will get stronger in the short to medium term, and its strength will be another sign of deflation. Ackerman predicts very hard times for commercial real estate that has already started and predicts a 70% fall in residential real estate prices. Ackerman also talks about the value of having cash. He also recommends gold and silver as a core investment, along with food and survival strategies. Yes, it’s going to get that bad.

Ackerman points out, “The financial mess today is so much worse than America faced in the 1920’s and 1930’s. Ackerman says count on big deflation, and this will include how you get medical care too. Ackerman says, “Deflation is all encompassing.”

|

|

|

|

Post by Entendance on Sept 18, 2023 16:51:58 GMT -5

When a wave breaks, it is the top that crashes first. Watch a great roller

surging in upon a shelving shoal. It may seem to be about to break

several times before it really does; several times its crest may gleam with

white, and yet the wall of water will maintain its balance and sweep on

undiminished. But at last the wall becomes precariously narrow. The

shoal trips it. The crest, crumbling over more, topples down, and what was

a serenely moving mass of water becomes a thundering welter of foam... |

|

|

|

Post by Entendance on Sept 19, 2023 16:42:09 GMT -5

|

|

|

|

Post by Entendance on Sept 25, 2023 12:34:07 GMT -5

|

|

|

|

Post by Entendance on Sept 29, 2023 3:07:02 GMT -5

There is a storm coming. All this debt is going to lead to what excessive debt inevitably leads to which is a gigantic financial crisis. We can't stop it, but there's a lot that we can do as individuals, families, and communities, he says, to come out of it in good shape...

|

|

|

|

Post by Entendance on Oct 8, 2023 12:07:24 GMT -5

'I believe a crash of Biblical proportions is now imminent. When I say “crash”, I am speaking of stocks, bonds, and real estate, and thus it will lead to breakdown of society. Stocks averages have been held up by only a handful of stocks, very similar to the Nifty Fifty, 1987, the Dot-com bubble, and 2008-09. The averages themselves are now rolling over. Credit markets (bonds) have already been destroyed.[ Treasury-Bond Collapse Ranks Among the Worst Market Crashes in History ]

The reality is that credit has already crashed and it is the ONLY market that really matters. The credit markets have been in the worst bear market bonds have ever experienced in all of history. The simple reason is that rates started upward from zero, “zero coupon bonds” are THE most volatile of all. Essentially, the entire world became a financial “zero coupon bond”, the resulting rate rise is absolute death for the entire system. Everything is levered and this time around the “debt saturation trap” includes nearly all central banks and sovereign treasuries. Central banks and sovereign treasuries still had room to expand credit in 2008-09, balance sheets today are blown out everywhere! If you know nothing about macro finance, please understand that credit (bonds) are the “foundation” to EVERYTHING in today’s world… the foundation has cracked! Everything “financial” is based on credit, and more importantly, the “real world” ( production, distribution etc.) is entirely based on credit. Any stoppage of credit anywhere in the world will begin to snowball and engulf ALL credit. Nothing, NOTHING that you now do in your everyday life will be the same, or maybe not even function at all when credit is no longer available. Credit is entirely based on confidence and this con game is over!

This is it folks, it is the end of our “credit based” society. You think crime is bad now? Think “everyone for themselves”, this is what is unfortunately coming. How do I know this? Because once credit is no longer advanced, NO ONE WILL BE PAID! Workers, vendors, suppliers, first responders…NO ONE! Mathematically, the amount of debt currently outstanding worldwide can never be repaid in current terms. It is either print to oblivion or outright default, either way the result is total financial collapse. The amount of “unrealized losses” systemwide is staggering. The Federal Reserve itself already has far more unrealized losses than the paltry $65billion of equity they used to claim. They are upside down but now hiding their balance sheet within the US Treasury since they were merged a couple of years ago. The Treasury itself is in a debt service death spiral as it must pay $1.5 trillion per year in interest going forward, up from $400billion just two or three years ago.

If you have been paying any attention at all, you know that almost everything you are being fed and told has been a lie. I hate to be the bearer of bad news but, your “lifestyle” has been a lie. We are told that one can change their gender if they wish? Financial and economic numbers used to be massaged, now they are outright fantasy. Climate change, racism, sexism, or whatever “isms” are put forth as fact and parroted by a captured media. Speech is severely censored and throttled if you don’t go along with the bullshit du jour. Elections are a complete farce. Government at all levels is pitted and pointed against citizens who for the most part just want to live their lives and be left alone. If you cannot see how abnormal your world has become, you are part of the problem.

The “lies” could never have passed as “truth” were it not for asset prices. Sky high stock, bond, and real estate prices masked what was really happening. As long as 401k balances and homestead prices were good, the masses were placated. Asset prices could never have come close to where they are, were it not for the easy money available at interest rates resembling “free”. If the Dow jones and housing were trading at 50 cents on the dollar, people would be pissed and then ask some tough questions with some very disturbing answers. These questions, and thus answers are just around the corner, spiking interest rates assure this!

Now that rates have spiked, buyers have been drastically culled due to the debt service required. If your income level two years ago allowed you to bid on a $1 million house, today you are only able to look at half of that. Credit is a double edged sword, wonderful when rates are low and easy application, disastrous when rising …especially when rising against the largest pile of debt the world has ever seen. We are living in and watching THE biggest credit bubble of all time deflate, the result will be disaster in so many ways, most importantly to “society” itself. I was laughed at six or seven years ago when I used the term “Mad Max” as the end result to the credit bubble. I have only one question for you, CAN YOU HEAR ME NOW?

Standing a terrified watch.' -Bill Holter here

'...It was my consistent belief that despite no official gold-backed BRICS currency or explicit arbitrage of gold for oil, gas or other real assets, a more natural and expected trade would be unfolding with nearly the same intent and result, all of which will spur further Chinese gold buying (and Dollar dumping) over time.

Net result? Western gold pricing will be chasing/rising to the levels of domestic Chinese gold.

As the Chairman of the Shanghai Gold Exchange, Xu Luode, said in 2014:

“Shanghai Gold will change the current gold market with its ‘consumed in the East but priced in the West’ arrangement. When China has the right to speak in the international gold market, the true price of gold will be revealed.”

Please read that last line again.

As we warned literally from day-1 of the suicidally myopic sanctions against Russia, the net result would be tighter relations between Russia and China, two countries already openly tired of the USD being the tail that wags the global dog.

If you haven’t noticed, Russia is selling much-needed oil to an openly oil-thirsty China in CNY rather than USD.

As gold, priced in CNY, buys more energy in China than in the west, more of that monetary metal will flow toward Shanghai, whose power over the London pricing of gold is about to ratchet upwards.

This was so easy to foresee, but the Western media likes to hide such foreseeable facts. After all, one of their greatest sins is the sin of omission.

When weaponizing the world reserve currency against Russia, the US-lead West forgot to mention what Luke Gromen described as its “Achilles Heel”—namely, the unallocated gold markets based out of London.

Changing Battle Tactics

By changing the trench lines of the gold-for-energy battlefield, China and Russia are slowly, but predictably, weaponizing gold and energy commodities against a weaponized USD.

In the long run, my bet is on gold and I’m not alone.

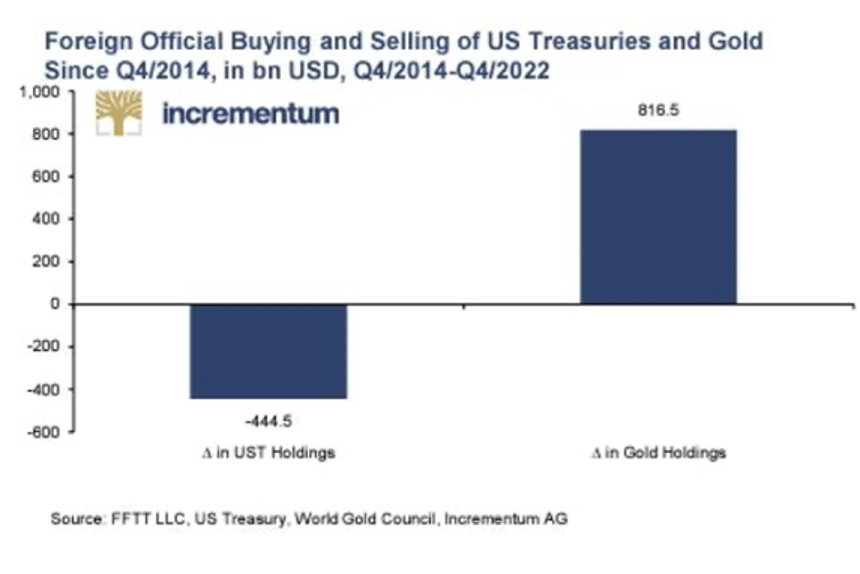

Just ask all those central banks stacking the physical metal and dumping America’s paper debt at record levels.

Like an army amassing troops, cannons, horses and supply wagons at the border, these central bank gold movements are obvious signs of a coming battle for a new trading system with less focus on Uncle Sam’s debt-based trading model and debt-soaked currency.

Needless to say, this is bullish for gold, which unlike the US markets and economy, is the true “resilient” asset, holding its price power despite positive (though manipulated) real rates and spiking UST yields.

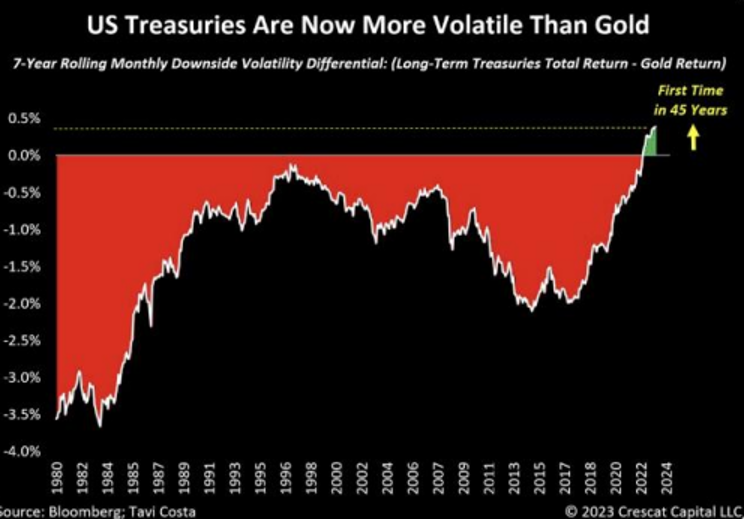

This may further explain why the downside volatility for long-duration USTs is now higher than the downside for physical gold, something not seen in almost half a century.

Just saying…'  The Economic Future is Sad, Simple & Already Obvious The Economic Future is Sad, Simple & Already Obvious

|

|

|

|

Post by Entendance on Oct 10, 2023 11:10:58 GMT -5

'...A ground invasion of Gaza will be difficult and likely lead to massacres - on both sides. Hezbollah in Lebanon and Syria would likely see a ground invasion of Gaza as a reason to intervene. It has missiles and drones that are precise and can reach any part of Israel. Israel may then retaliate by attacking the Syrian government. Iran and Russia would thereby get involved in the war. The U.S. of course would jump in on Israel's side. '...A ground invasion of Gaza will be difficult and likely lead to massacres - on both sides. Hezbollah in Lebanon and Syria would likely see a ground invasion of Gaza as a reason to intervene. It has missiles and drones that are precise and can reach any part of Israel. Israel may then retaliate by attacking the Syrian government. Iran and Russia would thereby get involved in the war. The U.S. of course would jump in on Israel's side.

This war could really, really escalate and do so soon.' Here

|

|

|

|

Post by Entendance on Oct 12, 2023 1:02:55 GMT -5

|

|

|

|

Post by Entendance on Oct 13, 2023 12:22:18 GMT -5

'...Israel has used White Phosphorus on the people in Gaza, another war crime. Israel has given all people in north Gaza, 1.1 million human beings, 24 hours to move to south Gaza. That is impossible and will not happen. It is an attempt of ethnic cleansing... '...Israel has used White Phosphorus on the people in Gaza, another war crime. Israel has given all people in north Gaza, 1.1 million human beings, 24 hours to move to south Gaza. That is impossible and will not happen. It is an attempt of ethnic cleansing......Al-Aqsa is holy to all Muslims, Shia and Sunni alike. Its destruction would inevitably lead to war. The West is clearly underestimating what forces calls like this one can rise...'

**********

Quando nel 1974 visitai la moschea al-Aqsa, mi colpì un segno su un muro che la guida locale mi additò: sulla spianata, il sangue arrivava fin lì, mi spiegò il palestinese che mi accompagnava.

"...la carneficina fu così grande che i nostri uomini camminavano nel sangue che arrivava fino alle caviglie..." Secondo Raimondo di Aguilers "gli uomini cavalcavano con il sangue fino alle ginocchia ed alle redini." Fulcherio di Chartres, che non fu testimone oculare dell'assedio in quanto si trovava con il futuro re Baldovino I ad Edessa, narra di 10000 morti solo nell'area del Monte del Tempio." [luglio 1099]

|

|

|

|

Post by Entendance on Oct 15, 2023 2:09:02 GMT -5

Chris Hedges: Washington and European governments are cheerleading Israel’s genocidal campaign in Gaza. The failure to intervene to halt the carnage threatens to ignite violence throughout the region...

|

|

|

|

Post by Entendance on Oct 30, 2023 12:16:01 GMT -5

321Gold Bob Moriarty: 321Gold Bob Moriarty: 'Bibi has been quoting a lot of old testament verses lately but Matthew 26:52 seems quite appropriate about now. Bibi seems to believe that the Zionists were handed everything from the Nile to the Euphrates by the big guy in the sky. If you are one of those people who believe a fingernail from a Jew is worth more than the lives of a thousand goyim you might think that’s just wonderful. Jews are after all, The Chosen People superior to everyone else on earth.

Like the former head of the IDF Air Force I suspect Bibi just fell into a giant trap by someone. The phrase “beware of what you wish for” comes to mind.

Israel knew Hamas had a plan to break out of their concentration camp. There were lots of warnings. All ignored. It certainly appears Bibi greased the skids and made it possible. Like everyone else I was shocked at the level of war crimes committed by the terrorists on October 7th with babies being decapitated and many hundreds of innocent civilians murdered in cold blood. Now it turns out that multiple reports suggest actually Israel has been lying through their teeth about the babies torn out of their mother’s womb and decapitated. When the motto of the Mossad is “By way of Deception” we pretty much know in advance just how much we can trust what the Zionists tell us. And the IDF murdered many of the innocent civilians using the quaint Hannibal Directive as their guide.

We stand on the edge of a cliff. All indications are that the mostly Jewish Neocons running the Biden administration have convinced him that since the US just lost another pointless conflict in Ukraine and killed over 500,000 Ukrainian soldiers through their incredible stupidity that the US might as well push all their chips onto the table and go all in before the final financial and moral collapse. In any civilized law-abiding country Brandon would be wearing prison stripes by now but the DOJ and FBI need more evidence of his corruption than the forty informants who have been detailing all his dirty deals for many years. Bibi also faces jail once Israel accepts that he’s so crooked that when he dies they are going to have to screw him into the ground. There are several important factors here that have led us to the verge of World War Three.

1. Bibi faces criminal charges once he is out of office.

2. Brandon probably will end up facing criminal charges once the DOJ understands who they really work for.

3. Israel wants to blow up the Al-Aqsa Mosque and rebuild the Temple on the Temple Mount. Once the rest of the Muslim world realizes what is really behind the actions of Israel, they will go all in. The Al-Aqsa Mosque is one of the most revered Mosques for Muslims.

4. There is a giant natural gas and oil field off Gaza. Israel pretty much stole the portion that by all international law belongs to the Palestine.

5. Israel would love to use their nukes on both Syria and Iran. If they could get the US to destroy the Iranian oil fields it would increase the value of their stolen natural gas and oil field.

6. I think Israel sees a total war against the 2.3 million people in Gaza as a final solution. They have gotten away with war crimes for 75 years so Bibi and the rest of the war criminals running Israel can pull off one last trick.

Without a doubt, while Hamas has all the right in the world under the Geneva Convention to break out of their concentration camp and open-air prison, that does not extend to the deliberate murder of civilians. Israel spends a lot of time whining about their right of self-defence but the three US carriers and one British carrier do not qualify as self-defence. If Israel wants self-defence they should defend themselves not call in their attack dogs that they own and operate. But if Israel has a right of self-defence, so does Hamas. The 2006 election in Gaza that led to Hamas running the camp was a lot more honest and legal than the 2020 election in the US.

I spent twenty months in heavy combat in Vietnam from July of 1968 until March of 1970. While primarily I was a pilot, I was also an intelligence officer.

This war like all others gives everyone an opportunity to show off their moral compass. That is, those who actually have a moral compass have a right to be proud of it. Many simply lack a moral compass such as the former PM of Israel who made it clear that he was insulted by the interviewer asking him about the safety of children in Gaza in hospitals when Israel pulled the power. He made it clear that the Muslim and Christian children in Gaza were beneath his consideration. Certainly Bibi has made it clear that the target in Gaza is all of the 2.3 million Arabs and Christians. Yes, about 30 percent of those incarcerated in Gaza are Christian, not Muslim. When the IDF proudly announced firing a JDAM into the hospital that murdered somewhere between four hundred and five hundred, it was a Baptist hospital. And when they destroyed one of the oldest Christian churches in the Middle East in Gaza, it was a Catholic church.

We may have already passed the point of no return on the rush to World War Three. The West has contributed a hundred or more ships. In the past 24 hours the US has made over fifty flights of transports delivering both troops and ammo to Israel for their supposed “Self Defence” that is anything but self-defence. At the same time, Turkey has sent over one hundred combat ships to the Med. China has ships on the way. This is spinning wildly out of control.

I’m going to tell you something that very few people will say because frankly they lack my background and qualifications. The Russians have hypersonic missiles on Mig 31s flying over the Black Sea on a 24/7 basis. Those rockets have a nine-minute flight time from the Black Sea to the Eastern Med. Even on a non-nuclear basis the Russians can take out all three US Carrier groups in the first ten minutes of a major war. We have no defence against the missiles. If they hit the carriers 12,000 Americans are going to die. Frankly if I was faced with such as well armed and led military, I wouldn’t fuck with Russia or China or Iran or Turkey. The assholes running the US military are far more concerned with use of the correct gender identity and how effective drag queens are at attracting the right sort of American warrior. The BRICS nations are far better led and frankly better armed than the Debt Based systems of the West now in a state of final collapse.

Let me make this abundantly clear. Like the last stupid war in Ukraine brought on by the US and Nato, we are going to get our asses handed to us. Bibi has pissed off the entire Muslim world. This is turning into the last battle between the forces of good and the forces of evil. And frankly if you support the genocide of 2.3 million mostly innocent people in Gaza, you are in bed with Satan. All the Arab world has to do is cut off the oil and without firing a shot, the war will be lost for the west. It will be the end for Israel, the US and the Western Debt Based financial system.

The only real question at this point is do we kill innocents in the tens of millions or does it go into the billions.

My advice.

Get some extra food and water. Keep your car filled up and stock up with some spare ammo. And call those you love and tell them goodbye. It’s highly possible that either they or you or both will no longer be alive very soon. This is no drill.' Do Israel and the US end with a bang or a whimper? |

|

|

|

Post by Entendance on Nov 21, 2023 5:26:43 GMT -5

|

|

|

|

Post by Entendance on Nov 30, 2023 0:51:02 GMT -5

|

|

|

|

Post by Entendance on Dec 6, 2023 5:44:54 GMT -5

We Can Have Either Billionaires or Democracy. Not Both

|

|

|

|

Post by Entendance on Dec 11, 2023 5:42:07 GMT -5

|

|

|

|

Post by Entendance on Dec 16, 2023 4:18:22 GMT -5

|

|

|

|

Post by Entendance on Dec 27, 2023 4:58:22 GMT -5

The big war will come to Middle East. May be a bit later, but it will. Houthis will not stop. Ships will not enter any more Red Sea. The oil prices will go up. Iran will respond to provocations. Collapse of Israel is inevitable. Call it as you wish. We call it end time agenda. Apocalypsis it is now. Right now or a bit later. May be not yet. But soon. -Alexander Dugin

|

|

|

|

Post by Entendance on Dec 28, 2023 11:23:15 GMT -5

'...It was Russia that wanted to put Gold on the BRICS agenda, proposed as a medium for trade settlement. Presumably, instead of importers and exporters having to use the dollar as the conversion medium between two currencies, Russia was going to develop Gold in its place. This would have meant that demand for physical gold would have soared, further undermining fiat currencies — a price for which other nations without sufficient gold reserves was not prepared to pay just yet. But Russia becomes president of BRICS from 1 January.

If he follows through on his anti-dollar comments with action, Putin has the potential to inflict serious damage on the dollar and the other western alliance currencies. Furthermore, China has also made a major step forward in her agreement with Saudi Arabia to replace the petrodollar with a petro-yuan.

Throughout history, Gold, which is legal money, has maintained its value in general terms with only modest variation. It is fiat currencies which have lost purchasing power to the point where from 1970 the dollar has lost over 98% of it. The comparison between gold and the dollar is simply between legal money and fiat credit — the only way in which relative values can be determined between them.

Our last chart will not be a technical presentation of Gold, but of the dollar, for which we will use a log scale so that we can think in terms of percentages. Watch for the break below the current support line at about 2%.

The modest fall projected by the arrowed line, if and when it gets to 1 on the chart, is a halving of the dollar’s purchasing power, measured in real money, which suggests a Gold price for the dollar at 1/3,500 gold ounces. This is not a forecast but gently chides those who think it is the gold price which changes. Where the rate actually settles in 2024 will probably depend on President Putin, who takes the BRICS chair next week and will probably put gold back on the agenda. More than any technical analyst, more than any western investment strategist, and even more than the Fed itself this has the power to set the dollar’s future price measured in Gold.

One thing we will admit, and that is when fiat currencies begin to slide to the point where domestic Americans realise that it is the dollar falling and not Gold rising, a premium will develop for Gold’s real value, fully reflecting the awful damage a currency collapse does to the collective wealth of a nation.' |

|

|

|

Post by Entendance on Jan 3, 2024 1:21:41 GMT -5

|

|

|

|

Post by Entendance on Jan 12, 2024 1:51:18 GMT -5

|

|

|

|

Post by Entendance on Jan 15, 2024 8:08:53 GMT -5

|

|

|

|

Post by Entendance on Jan 17, 2024 11:46:10 GMT -5

Almost everyone is getting the interest rate outlook wrong Almost everyone is getting the interest rate outlook wrong

The shift between commercial bank credit to "support" from excessive US Government spending is highly inflationary

Almost every broker’s analysis is forecasting lower interest rates. This is essentially a common view based on Keynesian and monetarist macroeconomic theory in the face of a widely anticipated economic recession. Keynesians argue that declining consumer demand leads to lower prices, ignoring the fact that production output always declines first. And monetarists simply link a contracting money supply to prospective rates of price inflation. These mathematical theories dominate contemporary thinking and to an extent can act as self-fulfilling prophesies, until the economic reality corrects them — usually violently.

Both disciplines ignore the subjectivity factor which is inherent in the value of any medium of exchange that depends entirely upon the users’ faith in it. They have failed in their mathematics to adjust from the days when currencies’ values were anchored however loosely to real, legal international money with no counterparty risk — which is only Gold. Furthermore, they fail to understand the wider market realities of contracting bank credit, which even under a solid gold standard makes up the vast bulk of a circulating medium. And they make the simple error of not understanding that in a recession it is not demand for credit which declines, leading to lower interest rates, but bankers perceiving heightened lending risk and restricting the availability of credit leading to higher borrowing rates.

The reality is simple: if the banks restrict the expansion of credit, then borrowers face having to pay up in order to secure credit. And to accommodate increased lending risk, banks widen their margins by increasing interest paid to depositors as little as possible. Does this not describe current bank credit conditions? So long as it remains the case, whatever a central bank says interest rates will remain stubbornly high.

Nevertheless, the situation over US bank credit does require more detailed examination, partly because regulatory changes have distorted money supply statistics. We must start with a simple definition of modern money supply: it is entirely comprised of credit in the form of central and commercial bank credit liabilities to the general public. But recently, the Fed has been taking in credit from money funds which would otherwise be recorded as bank deposits. This has come about because under Basel 3 net stable funding rules, large deposits face a haircut of 50% for the purpose of funding balance sheet assets, compared with only 5% for small, insured deposits. And commercial banks are not prepared to cut their interest rate margins to compete for these deposits anyway.

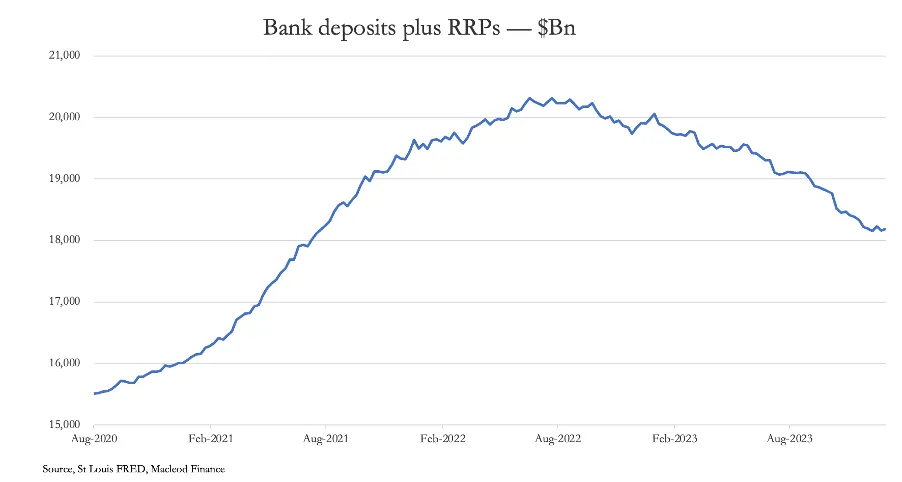

Consequently, the Fed extended its reverse repurchase facility to money funds by using its stock of Treasury and agency collateral in exchange for money funds’ deposits, taking them out of public circulation. This has had the initial effect of reducing apparent money supply growth and then accelerating its decline when money funds reduced their repurchase positions in favour of treasury bills. The sum of bank deposits and reverse repurchase agreements is illustrated in the chart below.  Most of the decline has been due to the fall in reverse repos, which have declined from $2.24 trillion in December 2022 to $681 billion recently, while M2 itself declined by only $340 billion over the same period. The funds tied up in reverse repos have since migrated to the T-Bill market, where 1 month maturities yield 5.4%. Essentially, they have disappeared into the government’s coffers, doubtless further enhanced by banks switching their own loan books and bond holdings into short maturity T-Bills in a general flight away from lending risk. Additionally, total money funds have increased by about $1.4 trillion since last March to nearly $6 trillion all of which have also disappeared into T-Bills.

The extent to which the Biden administration is sucking credit out of the US financial system is truly remarkable. While indicating that its own finances are in crisis, it shows that the level of risk aversion in private credit availability from the banking system is considerably greater than generally realised.

While the credit shortage for the private sector is acute, a combination of money fund flows and banks de-risking their balance sheets has allowed the US Government to borrow $2.6 trillion since this time last year, allowing for changes in its general account at the Fed. These funds are leaking back into the economy through government spending, none of which is productive in the sense that it is freely demanded. In other words, far from being deflationary as the monetarists suggest, by being taken out of the commercial banking system and redirected into government hands the apparent contraction of the sum of bank deposits and reverse repos is a more inflationary deployment of credit.

These are precisely the credit dynamics which fuelled stagflationary conditions in the 1970s. They lead to the opposite conditions currently discounted in financial markets. Therefore, far from an outlook for stable, lower interest rates and bond yields, the opposite is in prospect. And with the economic outlook deteriorating, even tighter credit conditions for businesses and consumers are certain. Furthermore, they are sure to lead to higher interest rates and bond yields reflecting higher inflation, and a severe bear market in equities as well.

This much will become increasingly obvious in the coming months.  Alasdair Macleod Alasdair Macleod

Qui cum sapientibus graditur sapiens erit amicus stultorum efficietur similis. -Prov. 13:20

Whoever walks with the wise becomes wise.The friend of the foolish will become like them.

Chi conversa con i saggi sarà saggio; l'amico degli stolti diventerà simile a loro.

'...Western credibility has been shredded irrevocably.

Of course, Western hypocrisy is nothing new. According to Western governments, the world should be up in arms about Russian aggression but should be perfectly happy with Israeli brutality and flouting of international norms. Ukrainians who throw Molotov cocktails at Russian occupation forces are heroes and freedom fighters, while Palestinians (and others) who dare to speak out against Israeli apartheid are terrorists. White-skinned refugees from Ukraine are more than welcome, while black and brown-skinned refugees from conflicts in the Middle East, Asia and Africa (most of which the West are behind) can sink to the bottom of the Mediterranean. The Western attitude has truly been: rules for thee, not for me.

The Western position towards China exhibits the same insincerity. China is virtually encircled by American and allied military bases, armed to the hilt. Yet it is China that is guilty of… what? Unable to point to any concrete infraction, Western governments and media can only accuse China of “increased assertiveness”, ie, not knowing its assigned subjugate place in the Western hegemonic order.

International justice has become a sick joke. Were the International Criminal Court (ICC) functioning effectively, Israeli leaders would be on trial even as we speak, and there would have been no need for South Africa to approach the ICJ. As it stands, though, the ICC only indicted Africans until 2022, when it announced an investigation into the Russian invasion of Ukraine less than a week after its start. The ICC issued indictments, including for Russia’s President Vladimir Putin, in less than a year. Conversely, it took over six years for the ICC to open an investigation into the situation in Palestine, and even now, years later, meaningful action has yet to be taken. While Israel continued its orgy of violence against the people of Gaza, Karim Khan, the British Chief Prosecutor of the ICC, visited Israel and stressed the need for Hamas’s crimes to be prosecuted, while going soft on Israeli crimes. Little wonder many civil society organisations are calling for him to be fired.

Of course, Western hypocrisy is nothing new. From the get-go, international legal norms were intended to apply only to so-called “civilised” – read white – peoples. Savages did not count, and the powerful Western states could – and did – do to them what they pleased. Natives certainly did not “own” land or natural resources, and colonial powers were free to steal and exploit those as they wished. Zionism was also founded on such racist attitudes – attitudes that remain at the core of Israeli policies to this day.

These double standards are apparent with regard to the right to national self-determination – the fundamental right of all peoples to choose their own political system and control their own natural resources. After World War I, US President Woodrow Wilson insisted that self-determination be the guiding principle of the new world order – but, of course, only for Europeans. Palestinians and other Arab peoples found out the hard way that colonialism was alive and well: They were subject to League of Nations Mandates, which justified colonial rule for “peoples not yet able to stand by themselves”. The Charter of the United Nations also included provisions for Trusteeship, essentially along similar lines as the Mandates of the League...'

By supporting Israel’s atrocities in Gaza, the West has shredded what remains of its credibility and brought the ‘rules-based’ world order it purports to lead to the point of no return

|

|

|

|

Post by Entendance on Jan 25, 2024 0:47:16 GMT -5

'This year is likely to see wealth destruction on a massive scale. The reason this is not widely anticipated in financial markets is due to a mistaken belief that interest rates are at their peak and will decline over the year. The reason interest rates will rise is due to the colossal mountain of government debt to be financed and the restriction of commercial bank credit for non-financial businesses, forcing borrowing rates up and guaranteeing an economic slump...'

Summary of the dangers facing us in 2024

|

|

|

|

Post by Entendance on Jan 30, 2024 12:36:38 GMT -5

|

|