|

|

Post by Entendance on Jan 26, 2020 3:18:48 GMT -5

January 28, 2020

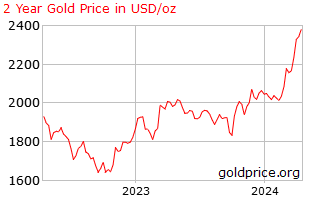

“I made the calculation that if the system breaks down and we have to go back to the gold standard, then gold would be around $60,000 per ounce. Who knows what’s going to happen.”

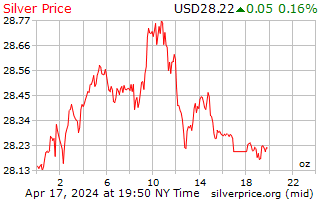

Gold-silver ratio to drop to 20; next silver price bull run will "shock" markets

...Silver has hit an all-time high of $49 per ounce twice – in January 1980 and then again in April 2011.

If you adjust that $49 high for inflation, you’re looking at a price of around $150 per ounce.

In other words, silver has a long way to run up. As one analyst put it, “With the long-term downside potential of silver very low versus its current valuation, the risk/reward is one of the best investments on the planet.”

The Silver-Gold Ratio Is Still Way Out of Whack

The War On Cash, The War On Gold: Jan 25, 2020 "...Owning gold is a way to get out of this “debt trap”, but governments don’t want you to own gold. They prefer you to invest in the stock market, in real estate, to make all your purchases on debit or credit because these transactions are trackable. You are trackable. The last thing the government wants is a bunch of gold bugs running around “off-grid” especially during tough economic times, when they could be shopping instead of tying up their money in gold bars and coins.

|

|

|

|

Post by Entendance on Feb 9, 2020 1:14:53 GMT -5

February 11, 2020

"Historically the greatest economic depressions have started with unexpected events on the periphery of major financial markets. That was the case in May 1931 with the surprise collapse of the Austrian Creditanstalt Bank in Vienna which brought the entire fragile banking system of postwar Germany down with it, triggering the Great Depression in the United States as major US banks were rocked to their foundations..."

No, The Fed Will Not "Save the Market"--Here's Why

With More Than One Million Chinese Living in Africa and no Strict Controls at Airports, the Dark Continent is Where the Coronavirus Outbreak Will Totally Explode Out-Of-Control as Health Workers Warn They Are Definitely not Ready to Face a New Epidemic

Mon, 02/10/2020: <...This shocking "change in definition" of a coronavirus infection naturally prompts the question: just how is China gaming the other infection data to make the disease appear more contained, and more manageable, and can one even remotely trust the official coronavirus numbers published by the National Health Commission?> Zerohedge: This Is How China Is Rigging The Number Of Coronavirus Infections |

|

|

|

Post by Entendance on Feb 20, 2020 17:16:42 GMT -5

"...There will be destruction of financial asset values and the economic consequences for ordinary people will be dire. We can expect widespread civil unrest and political instability..." - Alasdair Macleod here

|

|

|

|

Post by Entendance on Feb 27, 2020 11:24:01 GMT -5

"Things are going to be getting very real this year, even as some continue to deny reality, to an almost astonishing degree of self-absorption and denial." -Jesse

PONZI SCHEMES EVENTUALLY RUN OUT OF MONEY CENTRAL BANKS HAVE PRINTED $4 TO ACHIEVE $1 INCREASE IN GDP WORLD ECONOMY RUNNING ON EMPTY QE TO INFINITY NEXT WEALTH DESTRUCTION OF EPIC PROPORTIONS |

|

|

|

Post by Entendance on Feb 28, 2020 17:33:50 GMT -5

GMO (Get me Out)

Always Updated:  Breaking News & Videos On Coronavirus Covid-19 here Breaking News & Videos On Coronavirus Covid-19 here

New visitors: The Entendance Beach Free Quick Links For You here

|

|

|

|

Post by Entendance on Mar 10, 2020 13:30:01 GMT -5

Jun 7, 2017 at 9:16pm

"When the music finally stops, the perma-bubble bulls will be looking for that proverbial “seat” in all the wrong places. But the next stampede of capital will be out of stocks, bonds, cryptos and “investment” homes and into physical gold, silver and mining stocks. Over the completion of the current market cycle, we estimate that roughly half of U.S. equity market capitalization will simply vanish. Nobody will “get” that wealth. It will simply disappear, like a game of musical chairs where players think they've won by finding chairs as the music stops, and suddenly feel them dissolving as if they had never existed in the first place..."

Sven Henrich: "...This is mass destruction. It’s a complete horror show..."

Meanwhile...keep on printing fake money...Italy to spend EUR 25bln on measures to combat coronavirus

|

|

|

|

Post by Entendance on Mar 26, 2020 13:08:07 GMT -5

"...We have entered a depression that is going to turn our world upside down. Before it ends the general stock market will be down 85-92%, banks will close and governments fall. People still do not realize the impact of the Coronavirus. It will kill tens of millions of people in the world before it fades away. It will change how we physically interact with each other.

The quarantine is going to create a measurable increase in the number of babies born in about nine months. In two weeks or so, the number of divorces filed will skyrocket. Suicides are going to increase a lot, some people not only can’t be alone with others, they can’t even be alone with themselves..."

The Entendance Beach & The Reset: 4 pages! The Entendance Beach & The Reset: 4 pages!

|

|

|

|

Post by Entendance on Apr 8, 2020 2:53:06 GMT -5

Sometimes I feel like I’m the only one hammering away at this, so this is good to see, coming from two doctors.

You can forget about re-opening your economy without all-out testing. You can forget about travel if you haven’t been tested. At least twice.

But universal testing is still very far away. All we see is countries inventing excuses to not test. I haven’t seen one that has tested even 1% of its population.

-Raúl Ilargi Meijer

We have the technology to administer tests and assess categories of risk. We just need the leadership.

To End the Pandemic, Give Universal Testing the Green Light

|

|

|

|

Post by Entendance on Apr 14, 2020 6:35:44 GMT -5

"...With a dollar collapse, the populace will have little choice but to either bow down to the new digital system or go rogue and start building their own systems using their own production, barter, local scrip, and gold and silver. This is the world we are heading into, make no mistake. Be ready for it."

|

|

|

|

Post by Entendance on Apr 19, 2020 1:36:37 GMT -5

“People are losing faith in fiat currencies. The price of gold in other currencies is already at all-time record highs. Even in dollar terms it’s $1,700 per ounce and on its way to record highs. What is the government going to do when you have insolvency and inflationary implosion of the bond market? The real crash is coming. . . . A government cannot issue more debt to bail out an insolvent condition—fact. A government cannot print more money to placate a market that is afraid of inflation—fact. That’s what they are going to be faced with: Yields spiking because of inflation and insolvency concerns, and then there is nothing a government can do. It’s not going to be just the United States, it’s going to be the case globally. . . . That’s when the money is no good, and the bonds are no good.”

"Central banks and governments can mask this in the short-term by substituting bailouts for revenues, but bailouts are not sustainable replacements for revenues, incomes, profits and debt service. The global economy has already fallen out of its sustainable envelope, and the only questions are its rate of descent and how long the remaining fuel will last.

There is no way authorities can limit the coronavirus and restore global growth and debt expansion to December 2019 levels. This is not what people want to hear, but it's the reality we will have to deal with." - Charles hugh Smith

|

|

|

|

Post by Entendance on Apr 23, 2020 6:30:33 GMT -5

The Physical Gold & Silver Beach Updated

|

|

|

|

Post by Entendance on Apr 24, 2020 11:29:31 GMT -5

|

|

|

|

Post by Entendance on May 1, 2020 5:42:43 GMT -5

"Never believe anything in politics until it is officially denied." -Otto von Bismarck

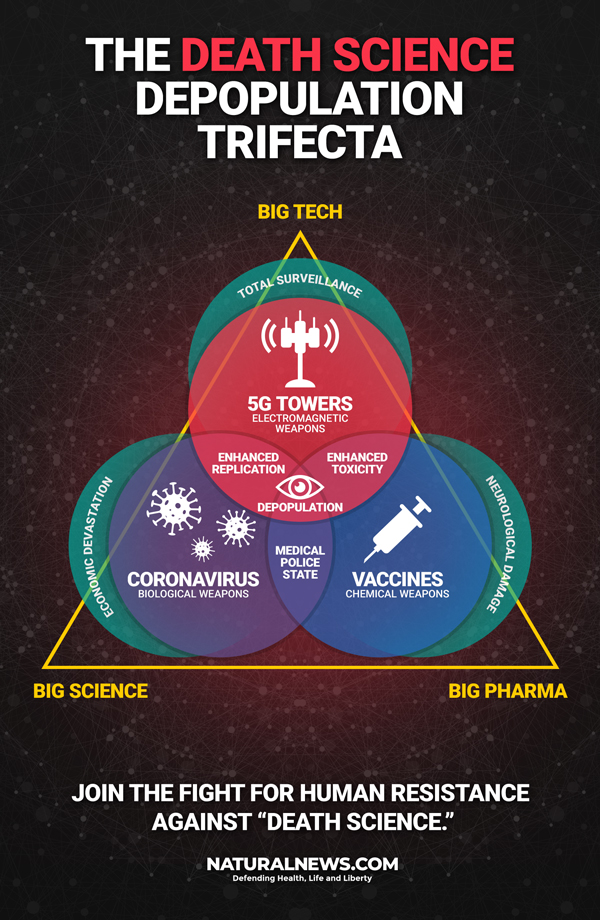

"Globalists have decided they don’t need humans any longer, and their final act will be the global financial “reset” looting of all assets..." "Globalists have decided they don’t need humans any longer, and their final act will be the global financial “reset” looting of all assets..."

|

|

|

|

Post by Entendance on May 6, 2020 8:02:20 GMT -5

We now have a recipe for what is sometimes called a “stagflationary event”, which means price inflation in certain necessities and hard assets and deflation in other parts of the economy. Economic War And The Elites Who Benefit

The lesson to learn for any investor is this: it is very likely that the US dollar, as well as all other unbacked paper currencies around the world, will continue to suffer. The currencies’ purchasing power is the first victim of central banks’ “rescue policies.” The debasement will come either through asset price inflation and/or consumer price inflation, or a combination of both. As things stand, it is difficult to imagine that this scenario will not occur.

US National Debt Spiked by $1.5 trillion in 6 Weeks, to $25 trillion. Fed Monetized 90% US National Debt Spiked by $1.5 trillion in 6 Weeks, to $25 trillion. Fed Monetized 90%

A testimony to the success of the immersive brainwashing of our capitalist society would be the pro-covid rallies (what else can you call them?) Screaming signs being held by screaming protesters—those demanding that restrictions be removed so commerce can continue despite the risks. The rallies don’t ask for the kind of support the corporations get during these times–no, they request the right to die in order to keep the wheels greased. It’s really pretty astonishing. Like an Aztec saying, please, please take me instead…..”I want my heart cut out for the needs of the sun god!”

But many of the protesters look to be retirement aged. They are protesting for others to be put in harm’s way to serve them. This is part and parcel of capitalism’s thick and smothering entitlement. Capitalism’s Voracious Appetite: Bodies are the Commodities

We all have choices — sometimes we don’t like particularly like any of them, but it’s important to know that we have them. We aren’t trapped or powerless. |

|

|

|

Post by Entendance on May 8, 2020 5:07:07 GMT -5

"As the world economy is about to implode, very few investors realise what will hit them. The dip buyers of stocks don’t understand that it really is different this time as the world is now facing the biggest destruction of wealth in history. Stocks, bonds, and property are likely to decline by at least 95% in real terms in the next few years. With both sovereign and private defaults, many bonds will go to zero and interest rates to infinity. "As the world economy is about to implode, very few investors realise what will hit them. The dip buyers of stocks don’t understand that it really is different this time as the world is now facing the biggest destruction of wealth in history. Stocks, bonds, and property are likely to decline by at least 95% in real terms in the next few years. With both sovereign and private defaults, many bonds will go to zero and interest rates to infinity.

We are not just talking about the US and Europe but the whole world, including China, Japan, and emerging markets. This will clearly involve a very unpleasant and disorderly reset leading to great suffering. But there is no other way of solving a gigantic debt problem caused by central banks. What these central banks are now doing is obviously a travesty. A debt problem of the proportions the world is facing can never be solved by issuing more debt which is the fallacious solution central banks around the world are again embarking on... ...Many people are asking what I am forecasting regarding the gold price for this year and coming years. Since we have been invested in gold for 18 years, we have never worried about the price. It was always clear to me that money printing was going to accelerate and that the financial system would come under enormous pressure. Even to the extent that it might not survive in its present form. ...Many people are asking what I am forecasting regarding the gold price for this year and coming years. Since we have been invested in gold for 18 years, we have never worried about the price. It was always clear to me that money printing was going to accelerate and that the financial system would come under enormous pressure. Even to the extent that it might not survive in its present form.

With that background, it is totally irrelevant what the gold price will be tomorrow or in 6 or 12 months time. We are holding physical gold to protect against a rotten financial system and currencies which will be printed to death. Why then does it matter if gold goes to $10,000 or $100,000 in today’s money or billions or trillions in hyperinflationary money?

The alternative of not owning gold is not worth thinking about..." BEWARE OF THE BEAR – HE IS SOON BACK |

|

|

|

Post by Entendance on May 17, 2020 2:00:26 GMT -5

Countries went on a gold-buying spree before coronavirus took hold – here’s why

"Cycle expert and financial analyst Bo Polny predicted in late March “something epic is going to happen on April 21st.” Something did happen that had never happened before. Oil went to $0 per barrel, and the contract for oil expired at around -$37 per barrel. Polny says, “That is a more important event than the stock market. There is one specific reason because oil is attached to the dollar. It’s a petro dollar. So, that event triggered the end of the United States monetary system as you know it. The stock market would have to go to zero to be as important as the event of oil going to zero. Oil was the marker that is attached to the dollar, the paper monetary system. That is far more critical because that event told the world that the paper monetary system as you know it ended on that date.”

Polny also predicted that after April, there would be a “new era of time that would be Biblical.” That, too, has happened in our shutdown Covid 19 world. Nothing looks like it will ever be quite the same. Now, Polny predicts that what is coming is a “Great Awakening.” Polny explains, “Between May 31st and September 18th, that is expected to be a major world transition point where God’s Hand is seen upon the earth. . . .We might want to call that time point the ‘Great Awakening.’ Somewhere in this time point, people are going to realize the lies, deceptions and what has been going on in this Earth, and there is going to be a mass awakening.”

Polny says gold and silver are going to be volatile but will continue to steadily move upward in price over the next few years. Polny also says, “I believe we are going to see the fall of the U.S. dollar, and I think we will see hyperinflation on this Earth. We will see the U.S. currency begin to hyper-inflate. I also think before this period ends on September 18th, we should start to see a gold backed monetary system to repair the damage that has happened. . . . God’s timing is going to cause gold and silver to explode. I think that is going to tie into a gold and silver backed monetary system. I think we are going to see the start of that before the 18th of September.”

Polny thinks the stock market will have another leg down to “around 15,000 on the DOW, if not lower, by June of 2021.” Polny also says, “The markets are finished. We have only seen the start of a recession, and the next thing coming is a worldwide depression. So, what we have seen in the markets is only a warmup. We are in a recession going into a depression. This is the third seal of revelation which is a rebalancing of the financial system as we know it. The rebalancing specifically relates to gold, silver and paper. The world has been using a paper based monetary system that is, in essence, backed by nothing. You might want to say it is backed by good faith and confidence, but I don’t see much faith and confidence in this world anymore. . . . We are going to have a gold rush, and it is going to be epic.”

Polny thinks silver will go up much higher on a percentage basis because all the new innovations and technology will require silver as a critical component. Polny says “That means prices for silver will skyrocket.”

Polny thinks there will also be great deceptions and attacks on Christians. Polny predicts, “The whole agenda is to get rid of Christianity.”

Polny does not want to see people be deceived by evil. He says a “great deception is coming.” Polny says it will ultimately come down to choosing Christ as your Savior or renouncing Christ altogether. Polny says there is only one right choice."

Physical Gold & Silver Beach Updated

|

|

|

|

Post by Entendance on Jun 22, 2020 10:24:42 GMT -5

|

|

|

|

Post by Entendance on Jul 15, 2020 1:52:03 GMT -5

Suave, mari magno turbantibus aequora ventise terra magnum alterius spectare laborem;non quia vexari quemquamst iucunda voluptas,sed quibus ipse malis careas quia cernere suavest.Suave etiam belli certamina magna tueriper campos instructa tua sine parte pericli;sed nihil dulcius est, bene quam munita tenereedita doctrina sapientum templa serena,despicere unde queas alios passimque videreerrare atque viam palantis quaerere vitae,certare ingenio, contendere nobilitate,noctes atque dies niti praestante laboread summas emergere opes rerumque potiri. -Lucretius  ("Pleasant it is, when over the great sea the winds shake the waters, ("Pleasant it is, when over the great sea the winds shake the waters,

To gaze down from shore on the trials of others;

Not because seeing other people struggle is sweet to us,

But because the fact that we ourselves are free from such ills strikes us as pleasant.

Pleasant it is also to behold great armies battling on a plain,

When we ourselves have no part in their peril.

But nothing is sweeter than to occupy a lofty sanctuary of the mind,

Well fortified with the teachings of the wise,

Where we may look down on others as they stumble along,

Vainly searching for the true path of life.") |

|

|

|

Post by Entendance on Jul 23, 2020 11:27:07 GMT -5

Egon von Greyerz: "...only 0.5% of world financial assets are in physical gold"

"...FOUR FACTORS TO DRIVE THE GOLD PRICE

To summarise, the gold price will be fuelled by four incredibly strong factors:

- Major debasement of currencies due to money printing

- Substantial shortages of gold in LBMA and Futures markets

- Major new private and institutional gold investors entering the market

- Only smaller quantities of gold available at current prices..."

|

|

|

|

Post by Entendance on Aug 10, 2020 3:37:04 GMT -5

|

|

|

|

Post by Entendance on Aug 16, 2020 0:11:19 GMT -5

Precious metals expert and financial writer David Morgan says, “There is a lot of buying pressure in the silver market right now and for gold as well.” Morgan points out that even more buying pressure from the industrial side of the market could catapult demand and price. Morgan says, “We are probably entering into what I call ‘The Great Silver Crisis.’ ‘The Great Silver Crisis’ really is verified when the commercial bar category is bought for industrial use, and they panic. So, when Apple says we can’t make the 5G phone because it’s going to take silver and it’s on back order, and it will take two months to get it, they’ll have to shut down the production line. That spills over into the electric vehicle market and spills over into a lot of electronic manufacturing. When that happens, the industrial side, which is 60% of the market, panics into buying silver and has to warehouse it because they are afraid they are going to run out because without silver, it would put them out of business. That would be ‘The Great Silver Crisis’. . . . We are not that close yet, but we are getting closer.”

On the financial end of the market for precious metals, it look dire. People are getting scared. Morgan says, “We are at a point now where they are printing so much money that people are trusting the currency less and less and less. It becomes worth less and worth less, and then it becomes worthless. We seem to be going to worthlessness. That’s when you will see greater demand than we are already seeing. We are seeing the precursor to what happens. We are in the third leg up in a bull market. The third leg in any market is the most substantial increase. . .”

Morgan points out that inflation is much more extreme than most people realize. Morgan explains, “If you look at the metrics that we used in 1980 where food and energy, the two things humans need most to survive, were not taken out of the CPI (consumer price index) and they left that in, and we went with the same calculation, which is far more honest that the calculation we have now, it’s a simple math problem, and $50 silver in 1980 is $600

right now. The $50 that silver hit in 2011 really didn’t buy you anything, and certainly not what it would have bought you in 1980.”

In closing, Morgan says, “A bull market is very much like riding a bull that will buck to try to get that rider off its back. You will see these huge moves down like we saw this past week, 15% in one day, that will take weak hands off the bull, and they are never going to get back on it. The main function as an investor is to hang on to that bull all the way up to near the top of the market, and then take a profit or whatever. So, be prepared folks. Bull markets go up and down, and you are going to see some real scary moves up and down.”

|

|

|

|

Post by Entendance on Dec 16, 2020 9:25:38 GMT -5

"2021 is likely to be a year of awakening. This is when the world will start to realise that the $280 trillion global debt has no value and will never be paid back.

But even worse than that, of the $280t a staggering $200t has been created in the last 20 years.

Let’s say that it took 2,000 years to go from zero to $80t in 2000. It doesn’t really matter where we start counting since most of the $80t debt was created after Nixon closed the gold window in 1971..."  GOLD VS xxxxxxx & DEATH OF MONEY GOLD VS xxxxxxx & DEATH OF MONEY

![]()  Please Stop Asking Me About xxxxxxx Please Stop Asking Me About xxxxxxx |

|

|

|

Post by Entendance on Jan 8, 2021 8:02:14 GMT -5

|

|

|

|

Post by Entendance on Feb 15, 2021 13:18:37 GMT -5

Marie Demetriou, a lawyer for investment funds suing seven banks, said that some of the newly discovered chat rooms were instant message groups that lasted just a few hours while others were “permanent” fixtures established over months.

The chat rooms, as well as emails, telephone calls and WhatsApp messages will play a central role in a suit brought by investment funds. They’re suing banks including Barclays Plc, Citigroup Inc. and JPMorgan Chase & Co over allegations they lost money as a result of illegal manipulation of the FX market.

(H/T Tom from Florida)

Oct 7, 2015 at 12:05pm Stupidity Chapter VIII: "Bandit", one that harms others while gaining self advantage (Cipolla calls them “bandits”). ...If we don't know who they really are, how to defeat them? Masters of Manipulation

Stupidity Chapter VIII: "Bandit", one that harms others while gaining self advantage (Cipolla calls them “bandits”). ...If we don't know who they really are, how to defeat them? More here |

|

|

|

Post by Entendance on Feb 23, 2021 8:17:16 GMT -5

|

|

|

|

Post by Entendance on Mar 7, 2021 2:58:37 GMT -5

Speculative bubbles pop Speculative bubbles pop

The central bank system is the greatest scam ever perpetrated on an ignorant public.

The eternal enemy of every central bank is Gold & Silver. -Richard Russell

Precious metals expert and financial writer David Morgan says the entire world is printing huge amounts of money, and nobody ever plans on paying any of it back. It’s all going into the so-called “Everything Bubble” that gets stretched a little more each and every day. With another $1.9 trillion Corona stimulus package that just passed in the Senate, we are getting closer to finding out how much funny money a country can print out of thin air before it all blows up. Morgan says, “It’s all about the currency reset or currency crisis that I have been writing and talking about for so long. So, if you don’t trust the currency du jour, the U.S. dollar which is the reserve currency of the world, you are going to look for some place to go that you trust more than that. I think this is what the Bitcoin phenomenon is all about. Rich people don’t need another country home of a third yacht. So, they are going to put money in something they trust more than the U.S. Dollar. . . . I think it‘s an indicator that there is money, big money, that is scared to death about what’s going to happen with the dollar in the future, and they are seeking a place to park it. There is greed too, but the primary thing they are looking for is something that is outside the system at large.”

Morgan has long predicted a “Great Silver Crisis” is coming. While the price of the white metal has backed off recently, it is still way up from last year. Morgan thinks silver is still the most undervalued asset out there, and he expects more frenzied buying as people flee fiat currencies printed to infinity. He also predicts very big price moves higher at some point after years of manipulation. Morgan thinks, “The Great Silver Crisis’ is starting now.”

Morgan warns, “We are reaching a limit on everything across the board with the ‘Everything Bubble,’ the overvalued ‘Everything Bubble.’ What is not overvalued? It’s pretty much the commodities. We are going from a financial economy where 70% is a consumer economy to an economy of what is needed. This is the commodity sector. You need corn, wheat, rice, soybeans, cotton and look at lumber. I mean all these things are going up. The financial system that is running 40% of the economy is just paper promises going back and forth across trading desks all day. We are not a productive society.”

In closing, Morgan says, “You can hobble along with an injured leg for a long time as a metaphor, but there is a point that you can’t go any further, and I think we are reaching that point. The silver market is signaling something. The Treasury market is signaling something. I think the stock market with the NASDAQ getting hammered is signaling something. I think the Bitcoin surge is signaling something. I think there are a lot of clues out there, that if you stop and look, they are signaling loud and clear that we are getting very close to what I am calling “The Great Currency Debacle” or currency crisis I have warned about for years.” Join Greg Hunter as he goes One-on-One with David Morgan, publisher of “ The Morgan Report” Video here

|

|

|

|

Post by Entendance on Mar 9, 2021 4:34:49 GMT -5

In order to know what is going to happen, one must know what has happened. -Niccolò Machiavelli

|

|

|

|

Post by Entendance on Mar 23, 2021 2:15:49 GMT -5

|

|

|

|

Post by Entendance on Apr 18, 2021 3:15:12 GMT -5

|

|

|

|

Post by Entendance on May 18, 2021 0:02:24 GMT -5

|

|

click:

click:  click:

click:  Breaking News & Videos On Coronavirus Covid-19

Breaking News & Videos On Coronavirus Covid-19  Realize what "stimulus" is:

Realize what "stimulus" is:

"

" US National Debt Spiked by $1.5 trillion in 6 Weeks, to $25 trillion.

US National Debt Spiked by $1.5 trillion in 6 Weeks, to $25 trillion.

"As the world economy is about to implode, very few investors realise what will hit them. The dip buyers of stocks don’t understand that it really is different this time as the world is now facing the biggest destruction of wealth in history. Stocks, bonds, and property are likely to decline by at least 95% in real terms in the next few years. With both sovereign and private defaults, many bonds will go to zero and interest rates to infinity.

"As the world economy is about to implode, very few investors realise what will hit them. The dip buyers of stocks don’t understand that it really is different this time as the world is now facing the biggest destruction of wealth in history. Stocks, bonds, and property are likely to decline by at least 95% in real terms in the next few years. With both sovereign and private defaults, many bonds will go to zero and interest rates to infinity.  ...Many people are asking what I am forecasting regarding the gold price for this year and coming years. Since we have been invested in gold for 18 years, we have never worried about the price. It was always clear to me that money printing was going to accelerate and that the financial system would come under enormous pressure. Even to the extent that it might not survive in its present form.

...Many people are asking what I am forecasting regarding the gold price for this year and coming years. Since we have been invested in gold for 18 years, we have never worried about the price. It was always clear to me that money printing was going to accelerate and that the financial system would come under enormous pressure. Even to the extent that it might not survive in its present form.  May 20, 2020 Egon von Greyerz :

May 20, 2020 Egon von Greyerz :

Please Stop Asking Me About

Please Stop Asking Me About

Speculative bubbles

Speculative bubbles

Perth Mint

Perth Mint

The Entendance Beach &

The Entendance Beach &