|

|

Post by Entendance on Jun 5, 2016 4:38:33 GMT -5

Welcome to the single largest stock market bubble of all time! “when the balloon on this pops, we’re going to wish that we were on another planet…”-John Embry

When the herd go towards the water, never stand between the beasts and the river. -Entendance

"It takes a man a long time to learn all the lessons of all his mistakes. They say there are two sides to everything. But there is only one side to the stock market; and it is not the bull side or the bear side, but the right side. It took me longer to get that general principle fixed firmly in my mind than it did most of the more technical phases of the game of stock speculation." -Jesse Livermore

Sociopaths & Psychopaths. Your Complete Guide To The Predator Class. Just click HERE

E. on twitter

*** The Entendance Beach Free Links For You

|

|

|

|

Post by Entendance on Mar 17, 2017 14:29:33 GMT -5

|

|

|

|

Post by Entendance on May 9, 2017 4:59:36 GMT -5

They're all happy with Macron's win...France Elects Its Bankster

"See you on the barricades, babe"

Pro-Frexit Marine Le Pen received a record 10,600,000 French votes, anti-EU parties gained seats in the Netherlands and parties that oppose the Euro now dominate the Italian political scene.

The young across Europe are becoming increasingly eurosceptic, as illustrated by the fact that Marine Le Pen’s biggest support came from 18 – 24 year olds.

Meanwhile...The season is just starting: “..the trend points to around 250,000 people arriving over the course of 2017”. There is no place for these people in Italy and Greece. Nearly 200 missing, 11 dead as migrant boats sink off Libya. Europe’s reputation is tarnished for decades. But everyone thinks they can deflect responsibility. Time for skin in the game. Hundreds of migrants feared dead in Mediterranean over weekend: survivors

"Trump Lessons in Europe

If there’s one lesson from the Brexit and Trump experience, its don’t listen to establishment (bias) tainted polls.

This time Last Year, we were Lectured by the Global Media:

“There’s No Trump path to victory.”

“We’re looking at an insurmountable blue wall.”

“Trump is polling at less than 7% with women and Latinos, he’s unelectable with those numbers.”

Next

Then Trump won 84% of America’s counties (2623 of 3112), and Michigan, Wisconsin and Pennsylvania for the first GOP win in 30 years in those states. The lesson, don’t underestimate silent populism.

Today, the France – Germany two year bond spread at fresh five year wides, while final round polling data consistently is showing a 60-40 no contest, Le Pen loss.

Euro vs Le Pen, an Inverse Relationship As you can see above, as odds markers see Le Pen bets on the rise – the Euro has been on the other side. The Euro is off nearly 3% since March 27, around the same time Le Pen’s fortunes started to pick up.

With the first round of France’s presidential election less than three weeks away, Bloomberg is reporting the yield difference between the nation’s two-year bonds and similar-maturity German securities has widened to the most since 2012.

Trump’s victory was derived from states hit hardest by globalization, winning Ohio, Michigan, Indiana, Pennsylvania, Wisconsin.

From 2010-2016, wages in these states were off anywhere from 18% to 3%, BLS, Bloomberg data.

Le Pen in France is using the same playbook." ***Listen to Credit Markets, Not Polls in Europe

Fred & EntendanceInvestors Beach...because this place is for Uncolonized Minds. Inquiring and Uncolonized Minds dwell here!

* Adapting to challenging times

* Building on strengths

* Cultivating creativity

* Developing best practices and processes!

That's why you are here at Fred & EntendanceInvestors Beach!

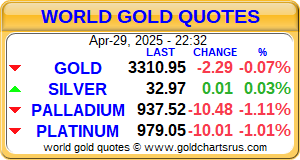

***Sound and Honest Money: Fred & Entendance Gold & Silver Beach

***2017: the Euro Area Breakup

***The Fred & E. Beach Zero Credibility Corner

***How to safely protect your life, your liberty and your assets

***Inspire Your Day at the Beach!

|

|

|

|

Post by Entendance on Aug 1, 2017 11:27:40 GMT -5

E. von Greyenz: "Printing $1/2 quadrillion or more will make no difference. Not even Deus ex Machina will save the world this time"

- “If you tell a big lie often enough...”

- The old style honest banking is a thing of the past

- Fake everything in spite of due to onerous legal and compliance system

- End of a major era

- Bubbles everywhere

- NYSE Margin Debt

- Real US worker wages peaked in 1973

- A borrowed prosperity

- Gold has outperformed all asset classes in the 2000s

***WILL PRINTING HALF A QUADRILLION DOLLARS SAVE US?

***The collapse is here now

|

|

|

|

Post by Entendance on Aug 6, 2017 1:46:35 GMT -5

As worries about stagflation  mount, gold will get an additional boost from safe-haven buying. mount, gold will get an additional boost from safe-haven buying.

"If you are digging yourself into a dangerous hole, should you stop digging, or dig faster?..."

If it looks like insanity, smells like insanity, tastes like insanity, feels like insanity and struts about barking, “This is insanity”, then perhaps it might just be insanity. Here's where we're.

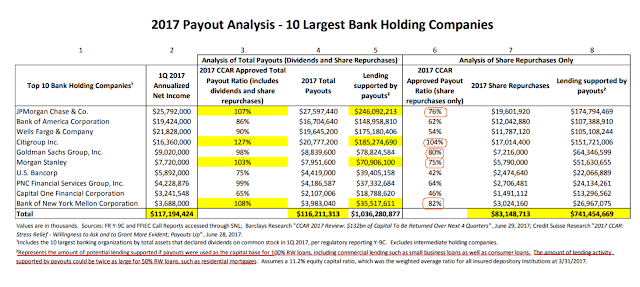

"The Banks are spending a substantial amount of their current income on dividends to shareholders and very large stock buyback programs designed to increase their share prices.

The chart below shows in the first column the almost shocking Payout Ratios being maintained by some of the Banks

In the second column there is an estimate of how many more loans the Banks could have made at current capital requirements if they had not spent their cash buying back their own shares.

Since Bank managers are personally heavily rewarded on the share price of the Banks through bonuses and share options, the cause of this is clear.

There has been insufficient reform in the Banks. Lending and basic banking would better function like a utility, with much more efficient and effective levels of risk management.

Basic banking including loans and deposits ought not to be an adjunct or cover for the kinds of speculation and gambling with other people's money that led to the last financial crisis that brought the global economy to its knees.

This problem was addressed by Glass-Steagall and functioned very well, keeping the banking system essentially sound for almost seventy years, until it was repealed under the Clinton Administration in conjunction with a Congress all too willing to sacrifice the interests of their voters to Big Money.

And that is why Hillary lost the presidential election, and why the Democrats are in a steady decline as a political party despite the ability to raise huge sums of money from their wealthy patrons." -Jesse ******************************************************** "This story is about a trader, or a group of traders, or possibly even Bitfinex themselves manipulates the price of Bitcoin. The past few months I’ve slowly collected screenshots of a trader I like to call ‘Spoofy’. You’ll see evidence of spoofing, wash trading, a sketchy scheme associated closely with Bitfinex known as ‘Tether’ among other shenanigans. Spoofy makes the price go up when he wants it to go up, and Spoofy makes the price go down when he wants it to go down, and he’s got the coin… both USD, and Bitcoin of course to pull it off, and with impunity on Bitfinex..."

Meet ‘Spoofy’.***How a Single entity dominates the price of Bitcoin.

Based on the simple reflection that arithmetic is more than just an abstraction, we offer a modest observation. The social safety nets of industrialized economies, including the United States, have frayed at the edges. Soon the safety net’s fabric will snap. This recognition is not an opinion. Rather, it’s a matter of basic arithmetic. The economy cannot sustain the government obligations that have been piled up upon it over the last 70 years...Growing wrinkle coefficient… as the global population increasingly ages, the “pay-as-you-go” social security and pension Ponzi schemes of developed welfare states are inexorably careening toward insolvency.

In other words, the post-World War II boom is nearly over and the bills are coming due...

***Mathematical Certainties

The end of a century of illusions

|

|

|

|

Post by Entendance on Aug 16, 2017 8:59:08 GMT -5

“...Look at the crypto currency area because they know that’s where they want to go.  Little Bighorn Ambush Little Bighorn Ambush

...They have to take us there so they can get rid of cash, and they can control everything directly. . . . Generally speaking, all these new crypto coins that are coming out and are making lots of money and people marry that money because of nominal confusion, what is really happening is they are preparing us . . . for a money standard shift...every fiat currency will reset against gold and silver, and if it happened today, she estimates gold would be more than $9,300 per ounce and silver would be more than $625 per ounce...” ***They Want to Get Rid of Cash – Lynette Zang

***The War On Cash Updated

***Cryptocurrencies Updated |

|

|

|

Post by Entendance on Oct 30, 2017 11:09:00 GMT -5

"...As usual, all of Taleb’s warnings and rational analysis of how the world really works have been forgotten or ignored, as the actions of the captured Fed, corrupt DC politicians, and greedy Wall Street shysters propel the nation and the world toward another historic financial collapse. The “experts” will be proven to be knaves and fools once again...

... No one knows when or how this collapse will appear, but we do know Bernanke, Yellen, Draghi, Kuroda, Wall Street, Washington DC, and the fake news corporate media are culpable in weakening our economic and financial systems through their reckless, arrogant, corrupt solutions to the last collapse caused by their irresponsible, greedy, fraudulent schemes designed to enrich their wealthy oligarch constituents. They’ve created a supremely fragile financial system. When the losses begin to mount, we (the deplorables) will need to get in touch with our inner butcher. These turkeys will need to pay for their evil miss-deeds." ***BULL IN A CHINA SHOP ... No one knows when or how this collapse will appear, but we do know Bernanke, Yellen, Draghi, Kuroda, Wall Street, Washington DC, and the fake news corporate media are culpable in weakening our economic and financial systems through their reckless, arrogant, corrupt solutions to the last collapse caused by their irresponsible, greedy, fraudulent schemes designed to enrich their wealthy oligarch constituents. They’ve created a supremely fragile financial system. When the losses begin to mount, we (the deplorables) will need to get in touch with our inner butcher. These turkeys will need to pay for their evil miss-deeds." ***BULL IN A CHINA SHOP

H/T Tom from Florida

<As year end approaches, certain "headline stocks" capture the public's attention. Massive media hype regarding the "inevitability" of certain "unique" stocks, destined to go up forever. The investment committees are staffed with individuals who have been subjected to the hype in not only financial media but also so-called "main stream" media. Money managers KNOW they will be grilled if those "unique" stocks are absent in the portfolio review sessions. At this point, rational evaluation disciplines don't matter. It's a "new era" where those "old rules" don't apply. It is now, in the "new era", where it is entirely logical for a 'Quality" growth company to sell at 60 to 100 times earnings while growing at low single digit rates. The "old" rules dictated P/E multiples of 3 to 5 times the identifiable growth rate but those old, fossilized rules, no longer apply. Polaroid, Xerox, Sears Roebuck, K Mart, Eastman Kodak, IBM, Avon Products, Burroughs, Simplicity Patterns, MGIC, International Flavors and Fragrances, Phillip Morris, etc. Most of these "Greats" are gone. However, there was a small handful that went on to better days, AFTER getting killed in the 1973-74 bear market. These included, McDonalds, 3M, Disney, Procter & Gamble, Coca Cola, Johnson & Johnson.

Under immense pressure to "conform", money managers sent these stocks into a straight line ramp in late 1972, only to top out in mid December. They dropped 50% to 90% over the next two years. The companies did not change but the stocks went from over valued to under valued as the PSYCHOLOGY changed. Today, the "headline" stocks are the FAANG complex, plus some biotech mysteries, and other assorted "playthings" like the poster child for "nuts" - TSLA. If a money manager fails to show AMZN in that year end "performance" review, he's fired. Or, at least he fears being fired with the all important threat to AUM (assets under management). It is important to note that while these psychological similarities tend to exist at all market tops (narrowing "leadership", "new era" convictions, well advertised, aged "bull market", etc.) there were a few "technical" warnings in late 1972 that a bust was about to unfold. One subtle warning was tightening monetary conditions. However, today's "technical" picture remains relatively benign, despite numerous "warnings" about the coming bear market. Sure, it is coming but probably not just yet. Seems like too much chatter about such an event. Meanwhile, the monetary picture has been completely distorted by CB insanity. Therefore, trying to read anything into traditional monetary "signals" is likely useless. Will CB balance sheet shrinkage result in LOOSER monetary conditions? Will interest rates rising from zero to zero plus, actually tighten conditions? Is there some other insane "policy" about to be unleashed? Whatever "it" turns out to be, the robots and passive "investors" don't seem to care UNLESS whatever "it" is makes a headline. Otherwise, fun and games keep on rolling!> Thanks to Mr. Skin for that update. And remember what followed late 1972!

|

|

|

|

Post by Entendance on May 20, 2018 12:53:39 GMT -5

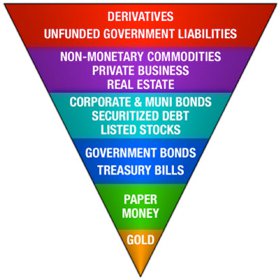

<...If you understand that ***EVERYTHING is manipulated and rigged in price, and if you understand this has and is done using leverage (borrowed money and derivatives), then you should ask “why”. This is simple, it is ALL about the dollar and the ability of the US Treasury to borrow literally unlimited amounts of capital. It is all about control and the ability to pay for and continue control. Gold and silver are direct enemies of fiat dollars or fiat anything. They have been suppressed in price in an effort to support the value of paper currencies.

The important thing to understand is this, because the world has reached “debt saturation”…credit markets will seize up and the funding for manipulation will begin to wane and ultimately cease. Gold and silver will explode in price because they are not only the reverse of paper currencies but the “leverage” applied in these markets are positioned short in the effort to suppress pricing versus positioned long in paper assets in an effort to support prices...>

“Do you agree with Michael Pento that silver will not do anything on the upside if we enter a depression?" ***A Popular Question

“Why do they hate gold so much?”

...That one is easy—the central banksters and their crony politicians hate gold for the same reason tanning salons hate the sun. Because gold cannot be printed or destroyed, it exists in limited and quantifiable amounts, and therefore, unlike paper money, there is a limit, a tether, on the amount of incompetence and financial mismanagement our elected governments can get away with without being called to account.

On the other hand, the amount of paper (or digital) currency that a government can create (usually through the mechanism of its “agent,” or third-party central bank) is limited only by the amount of available ink and paper, the processing capacity of its computer systems, and the ignorance of its citizens. And all of these are now in plentiful supply, it would seem...

In 524 BC, a group of pirates set sail for Sifnos, an ancient Greek island famed for its vast gold and silver mines.

The mines of Sifnos were unparalleled in the ancient world.

They produced so much gold and silver that the local government at Sifnos could erect countless monuments, invest in new public works, and still easily have a substantial balance remaining at the end of each year to distribute to the citizens.

When the pirates arrived, they robbed the island of 100 talents of gold, an unfathomable sum at the time.

In the ancient world, a talent was a unit of weight equivalent to 26 kilograms, or about 836 troy ounces.

So 100 talents of gold would be worth just shy of $100 million today, ranking that ancient robbery as one of the biggest heists in history.

It’s amazing that thousands of years have passed, and yet that very same gold could still be traded in modern financial markets.

There are few other assets on the planet that have had such a long history of value, durability, and marketability.

Gold very clearly holds its value over time, whether over decades or millennia.

Now, in fairness, it’s not like any of us is going to live for 2500+ years, so realistically it shouldn’t matter if our money will maintain its value until the year 4500.

But gold has plenty of other benefits. For example, it’s also a type of insurance.

If there’s ever a major problem with your home country’s currency or monetary system (which we’ve seen over the last several years from India to Iceland, Argentina to Zimbabwe) gold will maintain its value and survive the currency crisis.

Owning some physical gold will ensure that you still have something of value in your pocket.

This is an insurance policy that you hope you’ll never need. But if you ever do, you’ll be damn glad you have it.

Another type of insurance policy we’ve discussed in this letter is physical cash.

Most people keep the vast majority of their savings in a bank, and in normal times we can access this savings online, at ATMs, and in the checkout line with our debit cards.

We view physical cash and bank balances as the same thing, i.e. $1 in a savings account is the same thing as a one-dollar bill with George Washington’s face on it.

They’re not the same thing. These are actually two distinct forms of money, they just happen to have a 1:1 exchange rate right now.

Your bank balance is nothing more than an accounting entry on a bank’s ledger.

It’s a technically a claim– an amount that the bank owes you, one of its millions of unsecured creditors.

And if there are ever any major problems at the bank, you’ll quickly see how worthless this claim can be.

Think about what happened in Cyprus back in 2013. An entire nation woke up one morning and found out that the government had frozen every account at every bank in Cyprus.

It turned out that the entire Cypriot financial system was near collapse, and the government cut people off from their funds in order to protect the banks.

At that point, bank balances were fundamentally worthless. It didn’t matter how much money you had in the bank… you couldn’t do anything with it.

But anyone who was holding physical cash could still buy food, fuel, and other necessities until the crisis subsided.

The 1:1 exchange rate between cash and bank balances broke down, literally overnight.

One day everything was normal. The next day, cash was far more valuable than anyone’s bank balance.

This is why it makes sense to hold both– gold AND physical cash.

It’s perfectly fine to stay optimistic and hope for the best. And there’s plenty to be optimistic about.

But with bank insolvencies rising (especially in Europe) and a US debt level closing in on $20 trillion, does it make sense to bet everything you’ve ever worked for on hope and optimism?

We insure ourselves against all sorts of risks.

We have fire insurance in case our houses burn down. We have life insurance in case we have an early departure.

Those risks may be extremely low. But they’re important enough that we spend money to protect ourselves against them.

The systemic risks we’re talking about may also be low. (Though I would suggest the risks are much higher than anyone realizes…)

But their impacts are extraordinary.

Yet unlike conventional insurance, these policies, i.e. cash and gold, don’t really cost anything.

Gold prices may fluctuate from day to day, but over the long-term, the metal holds its value. And it’s an asset that you’ll be able to sell, worldwide, in an instant.

It’s the same with cash.

With interest rates at historic lows and a checking account yielding 0.1%, there’s virtually no opportunity cost in holding some physical cash versus keeping all of your savings at the bank.

These are no-brainer solutions with minimal (nearly zero) cost that provide time-tested insurance against some obvious risks.

Do you have a Plan B?

If you live, work, bank, invest, own a business, and hold your assets all in just one country, you are putting all of your eggs in one basket.

You’re making a high-stakes bet that everything is going to be ok in that one country — forever.

All it would take is for the economy to tank, a natural disaster to hit, or the political system to go into turmoil and you could lose everything—your money, your assets, and possibly even your freedom.

Here

|

|

|

|

Post by Entendance on May 25, 2018 3:56:17 GMT -5

Federal Reserve Meeting June 12-13 International Trade War Will Not Be Denied North Korean Peace Summit Farce Iranian Peace Agreement Merely A Pause For War Prep ***A Summer Of Disappointments Will Lead To An Extended Economic Crash

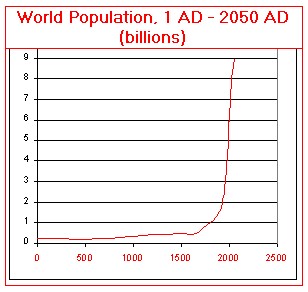

" Current world population has already passed the 7.5 billion mark. Our world population clock shows our estimate based on UN numbers" here " Current world population has already passed the 7.5 billion mark. Our world population clock shows our estimate based on UN numbers" here

"...So after over 100 years of major growth in GDP, technological innovations, industrialism, food production, health care etc, there are still 2.5 billion below the poverty line. In the 1850s global population was 1 billion and today we are at 7.5 billion. A graph of a major sample, like world population, that is a spike straight up, will at some point turn into a spike straight down. This means that world population will come down dramatically due to poverty, disease, war or a combination of all three factors. Thus, a major decline in world population is likely in the next few decades to maybe half or 3 billion. This sounds dramatic and terrifying but similar reductions have happened throughout history..." "...So after over 100 years of major growth in GDP, technological innovations, industrialism, food production, health care etc, there are still 2.5 billion below the poverty line. In the 1850s global population was 1 billion and today we are at 7.5 billion. A graph of a major sample, like world population, that is a spike straight up, will at some point turn into a spike straight down. This means that world population will come down dramatically due to poverty, disease, war or a combination of all three factors. Thus, a major decline in world population is likely in the next few decades to maybe half or 3 billion. This sounds dramatic and terrifying but similar reductions have happened throughout history..." WILL POVERTY, DISEASE AND WAR LEAD TO 3 BILLION FEWER PEOPLE? |

|

|

|

Post by Entendance on Jun 7, 2018 3:37:00 GMT -5

|

|

|

|

Post by Entendance on Jul 19, 2018 9:33:42 GMT -5

"...The numbers are simply staggering. Magic money out of thin air..." ***Tech Alert BNOGAF (but no one gives a fuck) In collaboration with Tom from Florida

GLOBAL DEBT AND ASSET BALOON IS EMPTY INSIDE "...When the global debt and asset balloon pops, the world will find out that there was nothing inside. Of course, some of that has been real assets and real wealth. But the problem is that when the balloon pops, all the debt will implode as no one can repay it and with that a lot of the assets will become worthless too..." July 19, 2018 Egon von Greyerz here

"...I’ve always said that the occurrence of events triggering the price of gold to soar will make life unpleasant for everyone..." Prelude To A 2008 Event: Paper Gold Manipulation Intensifies |

|

|

|

Post by Entendance on Aug 3, 2018 16:05:43 GMT -5

"...So, the BIG PROBLEM for the U.S. Government is what happens when the markets crack? When U.S. stock and real estate values crash, so will the government’s tax receipts. The only way to keep the U.S. government from going bankrupt during this time is to print money and lower interest rates.

Unfortunately, this time around, the country will not have the domestic energy supply to pull itself out of the next recession-depression as it did from 2008 to 2018. U.S. shale oil production will likely peak within the next 1-3 years. However, if the oil price drops like a rock along with the stock market, then the collapse of U.S. shale oil production could be even much bigger and sooner than the market anticipates.

All I can say is that the next few years are going to be one heck of a surprise for most Americans"

|

|

|

|

Post by Entendance on Aug 26, 2018 3:47:10 GMT -5

|

|

|

|

Post by Entendance on Sept 5, 2018 2:16:54 GMT -5

|

|

|

|

Post by Entendance on Sept 19, 2018 1:34:37 GMT -5

September 19, 2018 Money manager Michael Pento says the massive bubble blown by global central banks is “unraveling now.” Pento explains, “It is a fact, it is starting already. If you look at Chinese shares, if you look at all the emerging markets and if you look at commodity prices, the collapse is already starting. It starts here (in the U.S.) in the fall, and it really defuses around commodities and assets in general in 2019.”

So, countries are going to default on debt? Pento says, “Yeah, but it might not be Argentina that defaults. It could be the entire world that defaults, but first, before that happens . . . the Fed is on record, and it says it made a lot of mistakes. One of the mistakes they say is it acted too slowly. Too slowly? The Fed was lowering rates in 2007. They took rates to 0% by 2008. They went very quickly. They are going to lower rates even faster next time. By the time the next disaster hits, they are only going to have 250 basis points, not 525. The Fed also said they are going to go into quantitative easing (money printing) much quicker and much faster. They did not rule out negative interest rates. In other words, the Fed says they are going to go all in immediately at the first sign that things have gone bad. So, the first time they understand we are headed for the next global meltdown, boom–all in right away . . . . They also said another massive fiscal stimulant is needed.”

What happens to gold and silver prices when the Fed “goes all in” during the next financial crisis? Pento says, “They are going to explode . . . when the stock markets melt down and deficits are rising . . . where is the money going to come from? It has to come from another unprecedented wave, a tidal wave, a tsunami of money printing from the Federal Reserve. If that doesn’t get gold and silver prices, which are on death’s door awakened from their slumber, then nothing will. . . . The physical demand for precious metals is going to skyrocket. . . .The CFTC futures positions are net short in a huge way. There are record net shorts. When that rally comes, it’s going to be a dizzying rally. . . .The inflationary pressures that are building in debt and in base money supply make me believe that the inflationary pressures are going to be unprecedented, the likes of which we have never seen. It might even make the 1970’s and 1980’s look quiescent. That’s the kind of inflationary insolvency that has been built up. When that is released, you are really going to want to own precious metals.”

May 9, 2018 ***Worldwide Depression Coming, Buy Gold – Michael Pento

***Global Synchronized Slowdown

"...The Argentinians and Venezuelans would have avoided misery by holding gold instead of paper money. It is now too late for them as they have little money left. But there is time for Americans, Europeans and other nations to protect themselves today by owning physical gold and silver. Anyone who doesn’t heed this warning is certain to regret it in coming years.

Just follow the wisdom of the East who understand the importance of gold and history, as***the chart above shows..."

Fred & EntendanceInvestors Beach goal is simple: to help you achieve personal liberty and financial prosperity no matter what happens.

|

|

|

|

Post by Entendance on Oct 3, 2018 12:25:36 GMT -5

|

|

|

|

Post by Entendance on Jan 14, 2019 16:28:41 GMT -5

"If you're incompetent, you can't know you're incompetent... the skills you need to produce a right answer are exactly the skills you need to recognize what a right answer is." Why ignorance fails to recognize itself

"...First reset...then second reset..."

"...Backwardation structure is where the spot market has a higher price than the forward or the future price. The opposite of that is called contango, where the future price is a higher price and it reflects the cost. If you buy a contract in the futures market, it reflects partially the cost of storage and insuring the material for that period of time. And, when you have a backwardation structure, what that means is that the demand is so high in the spot market for immediate delivery that it overwhelms those forward held costs. And it really signals that there's so little metal in the market that those who have the metal are not able to meet the need with a guaranteed profit in fiat dollars. If you sell spot and buy a future contract, you're notionally guaranteed to get the metal back or have a high likelihood of getting the metal back. And you should be able to net a very handy profit in a very short period of time.

So, when you see these sustained backwardations, as you're seeing in palladium, it's really a further signal of the problem in the market that even offering a guaranteed profit that you can't source enough metal to drive that metal price structure back into the normal contango, where the future price is higher than the spot or immediate delivery market..." Big Silver Move Foreshadowed as Industrial Panic Looms

E. on twitter

Starving Billionaires |

|

|

|

Post by Entendance on Mar 4, 2019 14:49:29 GMT -5

"If you have been a long term reader here you know that I have something called a 'Crash Signature.' ..." Crash Signatures

March 4, 2019 Italy public debt level climbed again in 2018: Highest Since Mussolini

|

|

|

|

Post by Entendance on Mar 21, 2019 3:52:06 GMT -5

"The original silver dollar, created at the birth of the United States, was based upon the silver Spanish “Pieces of Eight” minted at the Royal Mint in Mexico City, under Spanish rule at that time. This was a very widely used coin throughout the world. Because in its early years the US had no mint, the first US silver dollars were minted in Mexico, for the Revolutionary Government of the US. The US silver dollar contained .774 ounce of pure silver.

Since the prevailing ratio between silver and gold was 16 ounces of silver = 1ounce of gold, and the silver dollar only contained .774 oz of silver, it required 20.67 silver dollars, to equal 1 ounce of gold in value.

1 ounce gold = 16 ounces of silver.

.774 oz. silver x 20.67 = 16 ounces of silver.

This is why the original price of gold was $20.67 – 20.67 was the number of silver dollars necessary to equal the value of 1 ounce of gold.

Consider the following table:

1776 to Dec. 1913: Price of gold $20.67/ oz. = 20.67 silver dollars.

1914 to 1933: Price of gold $20.67/ oz. = $20.67 Federal Reserve (FR) dollars.

1933 to 1934: Price of gold rises as FDR fiddles with the price of gold.

1934 to 1971: Price of gold $35.00/ oz. = $35.00 FR dollars.

1971 to 2019: Price of gold rises from $35/ oz. to $1300/ oz. = $1300.00 FR dollars.

When the Federal Reserve began issuing "One Dollar" Federal Reserve Notes (1914), people very naturally began to use these bills instead of silver dollars: the population of the US valued the silver dollars more than the paper "One Dollar" bills; people kept the silver dollars back and tendered paper "One Dollar" bills in their purchases. Thus began the disappearance of silver dollars from everyday use in the US. (A Federal Reserve Note is a remarkable thing: it is a promise to pay, with another promise to pay).

We can – and should – present the monetary history of the Federal Reserve, created in December 1913, as follows:

1913 – 1933: One Federal Reserve dollar would purchase 0.0484 oz. of gold (1 oz of gold divided by $20.67 FR dollars = 0.0484 ounces of gold per FR dollar).

1933-1934: Federal Reserve dollars purchased less and less gold, as FDR fiddled with the currency.

1934 to 1971: Federal Reserve dollar purchased 0.0286 oz. of gold (1 oz. of gold divided by $35 FR dollars = 0.0286 ounces of gold per FR dollar).

1971 to 2019: Collapse of the Federal Reserve dollar, able to purchase only 0.000769 oz. of gold (1oz. of gold divided by $1300 FR dollars = 0.000769 oz of gold per FR dollar, March, 2019).

The monetary history of the USA in the 19th Century is a history of banking collapses, either from poor management or outright fraud upon unsuspecting populations.

In the early 20th Century, 1907, a massive banking collapse in NYC was only averted by the intervention of J.P. Morgan who funded the rescue.

It has been famously said that the only thing a banker needs to know, is “the difference between a Bill and a Mortgage” – meaning to say that a Bill was usually dated payable at 90 days, whereas a Mortgage was liquidated over the course of up to 30 years.

The fundamental crime habitually committed by bankers has been to “lend long and borrow short”. This means, to lend money for a long term, for a high interest rate, and fund the operation with low-interest money which is returnable to the depositor either after a short period of time, or even immediately, at the depositors option – which inevitably leads to illiquidity and banking collapse. This is what had to cause the crisis of 1907 in NYC.

After the 1907 crisis, the top bankers in NYC decided that it was time to set up a system which would avert banking crises: they got together in secret, at the famous Jekyll Island, to cook-up their scheme, and came up with the idea to found a “Federal Reserve”, which would serve to bail-out banks that got into trouble by "lending long and borrowing short".

There is nothing “Federal” about the “Federal Reserve” – it is a private corporation formed by big banks, which are shareholders.

The public was told that the Federal Reserve would guarantee the safety of deposits, in a banking system which would operate under FR supervision. However, the banks that made the most money were the ones that broke the rules the most, and so what happened, had to happen: they all broke the rules – they all became illiquid zombies - as no banker wanted to get left behind, in the scramble for profits from bad banking.

This explains why the Fed dollar is now worth only 0.000769 oz. of gold. And it also tells us, if we want to know, what lies ahead:

The Federal Reserve is in box; it’s boxed itself into an insoluble problem. It cannot stop creating more credit, expanding its Balance Sheet, no matter what Mr. Jerome Powell, President of the Fed, may say he is doing or going to do. To stop creating more FR dollars means only one thing – total collapse of the whole humongous FR dollar scheme.

The small-town shysters who established State Banks out in the rural countryside of the USA, back in the 19th Century, and issued fake money as “scrip”, which time and again turned out to be worthless, have simply been supplanted by polished shyster economists at the Fed who now deal in trillions of money that is not even paper any longer – it’s mostly imaginary digital FR money in bank accounts, which the public moves around through credit cards.

What lies ahead:

Federal Reserve dollar = 0.00000000 oz. of gold."

The Road Ahead for the Dollar |

|

|

|

Post by Entendance on May 9, 2019 4:43:28 GMT -5

"...The trigger last time was derivatives on mortgage debt. But clearly the world has a short memory since the synthetic CDO market (Collateralised Debt Obligations) is back with a vengeance. US synthetic CDOs have grown 40% this year. This time the CDOs are not on mortgages but on corporate debt. That market is considered a lot safer than the mortgage CDOs according to the issuers which are banks like Citigroup, Barclays, BNP Paribas and Societe Generale. "...The trigger last time was derivatives on mortgage debt. But clearly the world has a short memory since the synthetic CDO market (Collateralised Debt Obligations) is back with a vengeance. US synthetic CDOs have grown 40% this year. This time the CDOs are not on mortgages but on corporate debt. That market is considered a lot safer than the mortgage CDOs according to the issuers which are banks like Citigroup, Barclays, BNP Paribas and Societe Generale.

Well that’s what they always say. But if we look at corporate debt, it is today at an all time high against GDP at 73% up from 45% in 1971.The synthetic CDO is a highly leveraged instrument that can involve multiple bets on the same loans.

So, these CDOs are just another example of “the more it changes, the more it stays the same”.

In other words, global debt is at an all-time high and the dangerous derivatives we saw last time are back again..."

MOVES IN GOLD & SILVER WILL BE 1970s ON STILTS

|

|

|

|

Post by Entendance on May 13, 2019 11:02:26 GMT -5

Plan for the worst and hope for the best

"Get ready for the real hardcore yet to come" US-China: the hardcore is yet to come

Remember: It's a porn economy

here here

DEBT? SELF-DESTRUCTIVE BEHAVIOR: here here here here here DEBT? SELF-DESTRUCTIVE BEHAVIOR: here here here here here

Members Only Area: here here here here here

"...The current monetary order is nearing its end. The elimination of over-indebtedness is inevitable, which will reduce the monetary savings by at least 50%. Naturally, this process will take years, however, in this scenario, the price of gold could increase about tenfold at its peak."

Visualizing The National Debt Boom in the Last Few Years

May 14, 2019 Recalling 2010

"...There is no other possible outcome of the mess the world is in today. That is absolutely guaranteed..." The Elites Nightmare Endgame

Scottsdale Mint

"As it was in the days of Noah...They ate, they drank, they married, they were given in marriage, until the day when Noah entered the ark, and the flood came and destroyed them all."

Nothing is risk-free in this system of chaos

In the Coming Crash We’ll be Falling from Higher Height

|

|

|

|

Post by Entendance on Jun 3, 2019 10:01:21 GMT -5

|

|

|

|

Post by Entendance on Jun 19, 2019 15:39:27 GMT -5

"Speditemi urgentemente il doppio del campionario: qua sono tutti scalzi!"

“Gold prices could outperform a lot of assets in the coming months. In fact, don’t rule out gold going for even $2,000 per ounce.The case for owning gold keeps getting stronger. You really potentially be making a big mistake if you ignore the yellow precious metal. Why be so bullish on gold? Well, there are a few factors that could raise the price of gold, including uncertainty, volatility, low interest rates, and money devaluation. And right now, a lot of these factors are coming into play, which could lead to gold prices skyrocketing.” $2,000 or More

|

|

|

|

Post by Entendance on Jul 18, 2019 8:41:11 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

Just out: Stocks will decline by 75-95% in real terms as the stock market bubble implodes

◾Bonds will lose 90-100% of their value as sovereign and private borrowers default

◾Property values will implode by 75-95% with rates at 15%+ and no credit available

◾Private Equity investments will lose 70-100% slaughtered by high leverage and rates

◾Cash will either be bailed in or lost in bankruptcy of banks or totally debased by governments

GOLD – NEXT TARGET $1,600 – $1,750 BE READY FOR SILVER EXPLOSION

|

|

|

|

Post by Entendance on Aug 1, 2019 9:18:02 GMT -5

Please note: updated by Tom from Florida while E. unplugged, disconnected and off the grid until September 2019

Now is not the time to think about making money on investments. But rather to lose as little as possible in the next five years. Because everyone will be a loser. Even if you don’t own stocks or bonds, you will lose on the value of your house or you will lose your pension, or your job or unemployment benefits. You are also likely to lose the money you have in the bank, either through pure debasement of the currency, or bail-ins, or bankruptcy of the bank. NEXT 5 YEARS NOT ABOUT WINNING BUT SURVIVING

Since it was first discovered by man, gold has played a unique role in the history of the world, in the economic growth of civilisations and in every major religion. The history of the world is inextricably linked to gold. Gold has also played a unique and ever present role in the monetary history of the world.

The use of gold as money has been traced back to 4000 B.C. when the Egyptians used gold bars of a set weight as a medium of exchange. From the 6th century B.C. to the 20th century A.D., gold coins circulated in numerous civilizations all over the world. In doing so, gold facilitated trade and enabled economic activity. It is only in our lifetimes or the lifetimes of our parents that gold has not circulated universally as money. This is a relative blip in time compared to the previous thousands of years in which gold circulated as the ultimate form of money, Gold is not called the money of Kings for no good reason.

For much of the 19th and 20th century, gold played the role as the anchor stone for the entire international monetary system, from the classic gold standard through to the Bretton Woods era. Since 1971, the world has been engaged in a fiat currency experiment the likes of which have never been witnessed before, with central banks pretending that gold is not important while busily stacking all the gold they can find.

If the architects and rulers of the world’s former civilisations and empires were to see a glimpse into the contemporary world where circulating gold coinage has disappeared, how do you think they would react? The History of the World is a History of Gold

|

|

|

|

Post by Entendance on Sept 8, 2019 4:24:21 GMT -5

Goldmoney Insights October 03, 2019 Alasdair Macleod: "...Sentiment in banking circles will turn on a dime, when bankers stop believing their mollifying in-house economists and pay attention to what their banking antennae tell them. They will rapidly discover that the crisis in international trade is undermining the creditworthiness of domestic non-financial businesses. They will also do everything they can to reduce counterparty risk with foreign banks deemed to be at risk of bankruptcy in their own markets.

As night follows day, another banking crisis will rapidly escalate, this time likely to be on a greater scale than ten years ago. And the evidence from failures in the dollar repo market in recent weeks points to the banking system beginning to unravel now.

Between the wars, the world suffered a deflationary depression. This time, we appear to be travelling towards an inflationary depression"

Biggest Inflation in the History of History Coming – Bill Holter

|

|

|

|

Post by Entendance on Oct 15, 2019 6:40:09 GMT -5

November 13, 2019: "...We are being primed for a major, major catastrophe in the financial world. I believe we are probably on the eve of it in that something nasty comes our way very, very soon. The amount of money being created is so much bigger than what is being acknowledged. It wreaks of desperation. Metaphorically, someone is driving around and they’ve got a dead skunk in their trunk, and they are wondering what the smell is."

"Below I outline a potential scenario for the next 5-10 years:

BIGGEST ECONOMIC DISASTER IN HISTORY

The world is heading for an economic disaster of a magnitude that is much greater than the 1930s depression. There is really nothing to compare with in history since the world has never been in a similar situation before when every single major economy is at risk.

GLOBAL DEBT WILL KILL THE WORLD ECONOMY

Never before in history have all major countries lived above their means for such an extended period. And never before has global debt been almost 4X global GDP.

$2 QUADRILLION DEBT AND LIABILITIES

In addition, unfunded liabilities, like medical care and pensions, are at least $300 trillion globally. If we add gross derivatives of $1.5 quadrillion, which are likely to turn into real debt as counterparties fail, the total debt and liabilities are above $2 quadrillion.

DEBT AT 30X GLOBAL GDP CAN NEVER BE REPAID

$2 quadrillion is almost 30X global GDP. Who is going to repay this debt? Certainly not the current generation which has incurred most of it. And certainly not future generations which will neither have the means, nor the inclination to pay for the sins of the previous generation.

DEBT IS GROWING AT AN EVER FASTER RATE

Most major economies are continuing to spend money they haven’t got and thus to print money and expand credit at an ever faster rate. The US for example has increased debt by $800 billion since June. As the US economy falters, annual deficits of $1-2 trillion will increase manifold in the coming years. And when the banking system comes under pressure, which is happening right now, money printing will accelerate at an ever faster pace. As the global economy falters, most major countries will see deficits and debts rising quickly.

NEGATIVE RATES – A RECIPE FOR DISASTER

Negative rates are a disaster for the world. Over $17 trillion debt now carries negative interest. Firstly, it kills the incentive to save. A fundamental economic principle is that savings equal investments. The world cannot grow soundly with investments financed solely by debt or printed money. With no savings, most banks do not have funds to lend to businesses. Thus investments will slow down dramatically. Negative rates also lead to investors chasing ever riskier investments to get a higher return. Also, pension funds will not achieve adequate returns to cover outstanding liabilities.

DEBT AND ALL BUBBLE ASSETS LIKE STOCKS AND PROPERTY WILL IMPLODE

Like the climate virtually all asset classes are overheated. The bubbles that the credit expansion has created will implode in the next few years together with the debt that created the bubbles. Central banks around the world will make a desperate attempt to save the world economy by printing unlimited amounts of money.

ALL CURRENCIES WILL GO TO ZERO – DEFLATION WILL FOLLOW HYPERINFLATION

As money printing accelerates, paper money will become worthless and a depressionary hyperinflation will hit the world. Hyperinflationary periods on average last for around 1-3 years and are followed by a deflationary implosion of all asset values in real terms. At that point substantial parts of the financial system will cease to function properly or go bankrupt.

GOVERNMENTS WILL LOSE CONTROL

Before new financial and political systems emerge, there will be social upheaval and unrest. Criminality will be widespread as desperate and hungry people will do what they can to feed themselves and their children. In many countries, immigrants will be blamed for the misery of the people. Right and left wing radicals will fight immigrants. There are likely to be periods of anarchy as governments lose control. I do not believe that an elite will control the world at that point. The disorderly unwinding of asset bubbles and the world economy will be uncontrollable..." |

|

|

|

Post by Entendance on Nov 17, 2019 11:26:19 GMT -5

"...And guess who’s on the hook for all that debt? The bottom 90%. Yes, it is the blatant absurd system we have. The top 10% reaping all the benefits of all this monetary policy enabled debt expansion while the bottom 90% get to foot the bill.

And people wonder why there’s so much populist discontentment with unemployment at 3.6%. Hence no accident that so many billionaires are worried about political backlash..." The Day of Reckoning

Comment Of The Day

No result without preparation |

|

|

|

Post by Entendance on Dec 1, 2019 0:28:33 GMT -5

<...Some people see a “Mad Max” scenario might be coming because of the enormous unpayable global debt. Ackerman contends, “I am a little more bearish than that. I see a Mad Max scenario as inevitable...>

Meanwhile... |

|

|

|

Post by Entendance on Jan 8, 2020 19:25:42 GMT -5

|

|