|

|

Post by Entendance on Feb 9, 2024 13:01:11 GMT -5

Penso e prevedo che siamo vicini al momento collettivo descritto nell'espressione latina Ubi maior, minor cessat. La noia di questi anni verrà presto ripagata. Vae victis.

May 13, 2015-Today: Here Here |

|

|

|

Post by Entendance on Feb 25, 2024 12:52:02 GMT -5

It’s almost comical to watch policy makers of all stripes and country codes caught in a corner It’s almost comical to watch policy makers of all stripes and country codes caught in a corner yet pretending we don’t notice.

|

|

|

|

Post by Entendance on Mar 7, 2024 9:27:37 GMT -5

People talking but they just don't know

What's in my heart, and why I love you so

I love you, baby, like a miner loves Gold

Come on, sugar, let the good times roll

Hey!

|

|

|

|

Post by Entendance on Mar 16, 2024 10:11:36 GMT -5

At King World News, GoldMoney founder James Turk remarks on the decline of gold holdings claimed by major exchange-traded funds despite the upward trend of the gold price.

Turk writes: "There are so many loopholes in the prospectus of some of the gold ETFs, it has been my contention that they are used by central banks and their bullion bank agents to control the gold price. Their aim is to make fiat currency look better than it deserves by killing the canary in the coal mine, which is the role of an unfettered gold market."

Turk's analysis is headlined "What Is Happening In The Gold Market Is Shocking" and it's posted at King World News here

⏬ |

|

|

|

Post by Entendance on Mar 27, 2024 11:20:52 GMT -5

H/T Tom from Florida

'...Gold prices are being driven higher by U.S. threats to steal $300 billion in U.S. Treasury securities from the Russian Federation. Those assets were legally purchased by the Central Bank of Russia as part of their reserve position.

The actual securities are held in custody in digital form at European banks, U.S. banks and the Brussels-based Euroclear clearinghouse. Only about $20 billion of those Treasury securities are held by U.S. banks; the majority are held by Euroclear. Those assets were frozen by the United States at the outbreak of the war in Ukraine.

Freezing assets means the Russians cannot collect interest or sell or transfer the assets or pledge them as collateral. Asset freezes are used frequently by the U.S. including in the cases of Iran, Syria, Cuba, North Korea, Venezuela and other nations. Often the assets are frozen for years but ultimately released to the owner as happened in the case of Iran after 2012.

Now the U.S. wants to go further and actually seize the assets, which may be viewed as outright theft under international law. The U.S. proposes to use the $300 billion to finance the war in Ukraine. European entities have expressed considerable uncertainty about this plan but the U.S. has maintained the pressure and wants to complete the theft before the June and July summits of G7 leaders and NATO members.

If the U.S. steals these assets, Russia will likely confiscate an equivalent amount of industrial and commercial assets located in Russia and owned by German, French, and Italian interests among others...'

Why gold is the everything hedge

|

|

|

|

Post by Entendance on Apr 3, 2024 7:07:16 GMT -5

|

|

|

|

Post by Entendance on Apr 10, 2024 10:58:37 GMT -5

Having risen by about 40% since last October, Gold is on a moonshot. Many investment professionals consider gold prices to be a macro barometer, measuring the level of anxiety in the economy, inflation, currency, and geopolitics...

Is Gold Warning Us Or Running With The Markets?

Everything changes and nothing remains still; you can’t step twice into the same stream. -Heraclitus of Ephesus⏬ '...they want Gold because Gold is being remonetized all around the🌐!...' [On February 8, 2023 Gonzalo Lira (February 29,1968 - January 12,2024) was spot on]⏬ ⏬ |

|

|

|

Post by Entendance on Apr 15, 2024 12:10:25 GMT -5

|

|

|

|

Post by Entendance on Apr 22, 2024 1:53:05 GMT -5

Expect VAST Currency Devaluation to Accelerate-AND YOU LOSE Expect VAST Currency Devaluation to Accelerate-AND YOU LOSEOver the weekend CON-gress approved another $95 billion dollar foreign “aid” package, which is in reality a weapons package, for Israel, Ukraine, and Taiwan. The measure passed with OVERWHELMING bipartisan support- and YOU LOSE.

Moreover, and just in case you were wondering if this will be the last time that CON-gress will be doing something like this, the answer is flat out no. This new $95 billion is just the latest installment with much more going out.

How this latest installment was sold to you.

For several months now this $95 billion dollar “aid” package had stalled in CON-gress as it lacked support, but now all that has changed. Just by coincidence of course, IMMEDIATELY after “The Big Show” over the skies of Israel, our loving/caring representatives here in the US wasted no time seeking approval for the $95 billion.

Much like the Inflation Reduction Act, which cost the American people $369 billion and yet to no one’s surprise inflation continues to rise outpacing every single “official” projection. Every single dollar which is either spent on funding for the expansion of war or sold to the American people as a way to reduce inflation, MUST BE borrowed into existence and therefore created out of thin air-AND HERE IS HOW YOU LOSE AGAIN.

The BIG SECRET that you are not supposed to know.

This mechanism of creating cash out of thin air/borrowing it into existence is MASSIVELY currency purchasing power negative, and here is how it works.

When a dollar is created, whether if it is a printed dollar or one added to a digital screen it makes no difference, that newly created dollar IS NOT just automatically worth a dollar, no. For a newly created bill to attain any purchasing power it MUST steal a fraction, of a fraction, of a fraction, of purchasing power from every other already existing bill. Now, multiply this process by tens of billions of times, and YOU HAVE A REAL PROBLEM- mass currency devaluation which results in a loss of purchasing power. And guess what YOU LOSE.

So, who benefits from currency creation out of thin air?

Well, it is certainly NOT We the People who benefit, ITS CENTRAL BANKS.

Collectively, and I have been warning about this for MANY years now, world central banks are in a race to the bottom. That is central banks are deliberately, WITH THE OBVIOUS DIRECT HELP OF LAW MAKERS, destroying the purchasing power of the currency they issue. Moreover, it’s a vicious cycle, here is how it works.

The faster that a central bank devalues their currency, the more cash MUST BE BORROWED INTO EXISTENCE, as it now takes more currency to make purchases and YOU LOSE.

A great myth must be dispelled here.

A central bank cannot ever go bankrupt. The more debt a central bank can issue, or are called on to issue, for ANY reason, THE STRONGER THEY BECOME… and again YOU LOSE. -Gregory’s Newsletter

Debts at levels that can never be repaid – sovereign, corporate & private.

Epic global bubbles in stocks, bonds & property – all about to collapse.

Major geopolitical conflicts with no desire for peace – major wars likely.

Energy imbalances and shortages, most self-inflicted. Food shortages leading to major famine and civil unrest.

Inflation, leading to hyperinflation & global poverty. Political and economic corruption in US, Europe and most countries.

Counterparty

Counterparty risk is the risk associated with the other party to a financial contract not meeting its obligations.

|

|

|

|

Post by Entendance on Apr 27, 2024 7:30:24 GMT -5

|

|

|

|

Post by Entendance on May 6, 2024 1:52:30 GMT -5

'Poor America. Poor Jerome Powell…

A Real Cliff, Fake Smile

It is no fun to be openly trapped, and even less fun to be in open decline while meekly declaring all is fine.

I have the image of Uncle Sam (or Aunt Yellen) hanging off a cliff with a forced (i.e., political) smile.

Above the cliff is a grizzly bear; below the cliff is a pool of sharks.

In short: Whichever direction one picks, the end result is messy.

And yet the markets still wait for Powell to make the right choice.

What right choice?

Rate Cut Salvation?

As of today, the markets, pundits and FOMC circus followers are all wondering when Powell’s promised rate cuts will come to save the Divided States of America and its Dollar-thirsty, debt-dependent “growth narrative.”

In January, Powell was “forward guiding” rate cuts and thus, right on cue, the Pavlovian markets, which react to Fed liquidity in the same way Popeye reacts to spinach, ripped north on words alone.

YTD, the S&P, SPX and NASDAQ are rising on rising rates hoping to morph lower.

Even Gold and BTC are rising on rising rates—all of which makes no traditional sense—unless, of course, markets are just waiting for the inevitable rate cuts, right?

And who could blame them? After all, Powell promised the same, and Powell, the voice of “transitory inflation,” never mis-speaks, right?

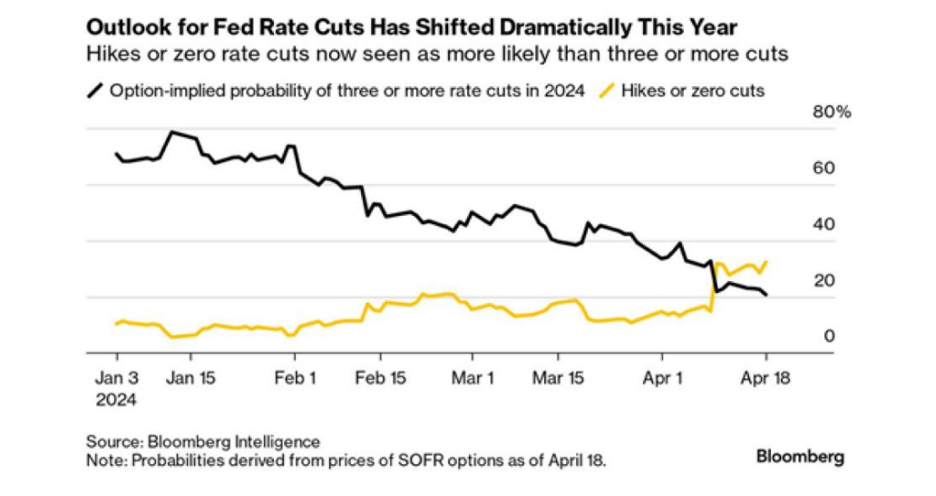

But now the May markets, and even the Bloomberg Intelligence Reports, are worrying out loud about no rate cuts at all for 2024?

EU Officials Eye Bailout Fund as Source of ‘Cheap Loans to Buy Weapons’ - Report

![]() The Entendance Beach Policy: The Entendance Beach Policy:

The praetor does not concern himself with trifles.

Il pretore non si occupa di cose di poca importanza.

'Current international events confirm the correctness of the direction observed within the multipolar world order main forces and their closest allies. Namely, a full-fledged dialogue with the Western minority is absolutely not necessary in order to achieve the contemporary multipolar world supporters objectives. The Western planetary minority still lives in a completely different and parallel reality. This therefore means that there is absolutely no point in wasting precious time...' |

|

|

|

Post by Entendance on May 17, 2024 11:33:53 GMT -5

- Zionism and its impact on Jewish people and the world. (0:03)

- Zionism and its compatibility with human rights principles. (4:35)

- Free speech and principles in the context of Israeli-Palestinian conflict and college campuses. (9:50)

- Palestinian rights and Zionism, with emphasis on human dignity and universal principles. (16:07)

|

|

|

|

Post by Entendance on May 26, 2024 5:36:17 GMT -5

Central banks are buying gold. Why? Because they print money and know its value …or lack of.

|

|

|

|

Post by Entendance on Jun 3, 2024 7:41:16 GMT -5

The endgame ain't tomorrow, it's right now, it's playing out right now...

|

|

|

|

Post by Entendance on Jun 7, 2024 10:55:55 GMT -5

- Gradualism vs. catastrophism in geology and finance. (0:03)

- Gradualism vs. sudden collapse in geology and finance. (4:33)

- The potential collapse of the US dollar and the importance of diversifying assets to protect against financial catastrophe. (9:18)

- Financial news, market collapse, and government manipulation. (16:29)

- Financial collapse, gold and silver investments, and censorship lawsuit. (19:48)

UN chief Antonio Guterres will add Israel to a global list of offenders for committing violations against children.

The global list is included in a report on children and armed conflict due to be submitted to the UNSC on June 14.

|

|

|

|

Post by Entendance on Jun 9, 2024 3:40:09 GMT -5

|

|

|

|

Post by Entendance on Jun 14, 2024 5:39:13 GMT -5

|

|

|

|

Post by Entendance on Jun 16, 2024 7:07:34 GMT -5

|

|

|

|

Post by Entendance on Jun 20, 2024 2:16:13 GMT -5

|

|

|

|

Post by Entendance on Jul 8, 2024 7:16:48 GMT -5

|

|

|

|

Post by Entendance on Jul 19, 2024 3:30:31 GMT -5

|

|

|

|

Post by Entendance on Jul 24, 2024 2:13:20 GMT -5

|

|

|

|

Post by Entendance on Aug 4, 2024 11:24:49 GMT -5

|

|

|

|

Post by Entendance on Aug 11, 2024 12:23:54 GMT -5

Silver can solve major global problems such as wars, debt crises, inflation, recession, and crime by implementing a constrained monetary system and reducing the incentive for war.

The importance of silver in addressing global challenges is a thought-provoking concept that challenges traditional solutions.

Silver is claimed to solve five of the world’s biggest problems: Wars, debt crisis, inflation, recession, and crime.

Only a select few really benefit from wars, while the mass government spending and debt financing have long-term negative effects on the economy.

The US economy is facing a recession despite claims of strength, with inflation rates potentially much higher than reported.

The massive increase in money supply in the past two or three years has led to a 40-year high in inflation, causing unprecedented volatility in the economy.

Canada is now the car theft capital of the world, with a car being stolen every five minutes.

Silver eliminates Wars because printed money finances them.

|

|

|

|

Post by Entendance on Aug 17, 2024 14:46:23 GMT -5

|

|

|

|

Post by Entendance on Aug 24, 2024 12:49:23 GMT -5

|

|

|

|

Post by Entendance on Sept 7, 2024 3:05:44 GMT -5

|

|

|

|

Post by Entendance on Sept 9, 2024 1:38:32 GMT -5

|

|

|

|

Post by Entendance on Sept 16, 2024 2:45:34 GMT -5

|

|

|

|

Post by Entendance on Sept 20, 2024 1:55:33 GMT -5

|

|