|

|

Post by Entendance on Jun 7, 2016 6:39:01 GMT -5

No room for anti-Americanism at Fred & Entendance Beach

WE DID IT!  INDIPENDENCE DAY JUNE 23, 2016

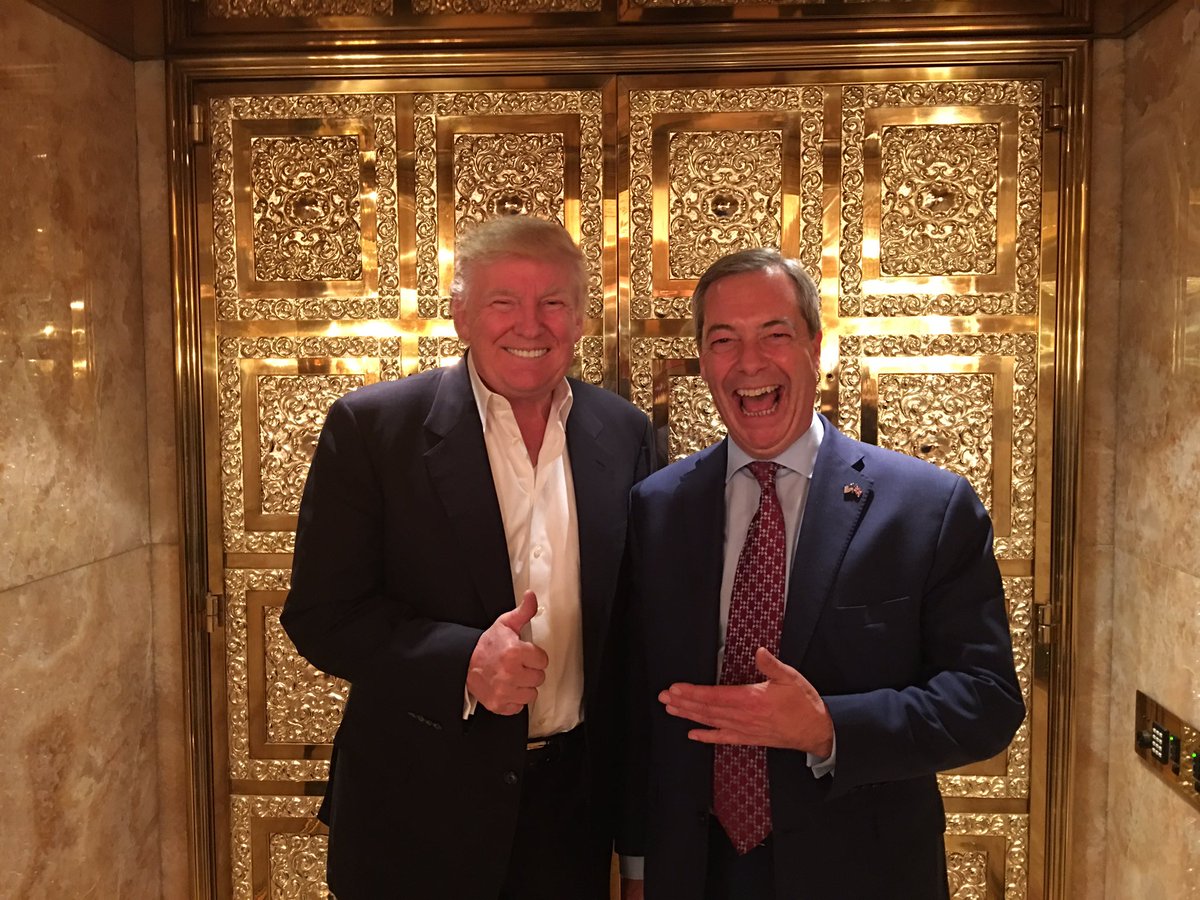

June 28, 2016: "Just spoke in the European Parliament, they were pleased to see me as you can tell." Nigel Farage*** here 'EU needs to GROW UP' over Brexit: Nigel Farage booed & jeered over EPIC EU exit speech Brexit "Do Over" Petition Exposed As A Scam...Signatories" came from Ghana, Vietnam, Uganda and Turkmenistan

...Nigel...  "June 23rd will bring an end to this entire project " "June 23rd will bring an end to this entire project "

***The stunning hypocrisy of EU ruled by jesuit trained pupils

***Hang the banksters!

***Zero Credibility, F.Media, Politicians, Banksters & More ***Italians Do It Better! Or not?

The 400-ounce (12.4kg) "Good Delivery" gold bars. It's the live dealing in these 400-oz gold bars, along with the trade in Comex gold market-approved bars in New York (100 oz), that creates the spot gold price you see quoted on the internet!

|

|

|

|

Post by Entendance on Jun 16, 2016 13:32:53 GMT -5

More here

"If you think that a referendum vote on June 23 by UK citizens on whether to withdraw from the European Union (called Brexit, short for British Exit), is simply a proxy on whether the UK should dislodge itself from the edicts of Brussels, think again. It’s morphed into a much broader debate on whether citizens worldwide should surrender their right to a participatory democracy in order to further the interests of multinational corporations, secret trade agreements packed with secret court tribunals, global banking hegemony and central banks attempting to keep all these balls in the air for their one percent overlords..."

Why Brexit Is Such a Threat to the New World Order

Labour MP Jo Cox Murdered On Street: Widely quoted eyewitness Abdallah admits he didn't hear killer shout

“..only “a few lunatics” may want to join the EU now...”

***Switzerland withdraws longstanding application to join EU

<Angela Merkel Diagnosed by Psychoanalyst as Narcissistic, Verging on Mental Breakdown>

More here |

|

|

|

Post by Entendance on Jun 24, 2016 0:42:53 GMT -5

The British are showing the rest of Europe a new way, they no longer have to comply with Corporate EU control.

UNLEASH HELL! UNLEASH HELL!

It's about damn time someone took their nation back.

Today, it begins. May it not end here but rather be the beginning of the end of the "multiculturalists", "border-free freaks" and, most-importantly, the cabal of central bankers who think they run it all.

Take that, Brussels and Draghi.

Take heed, Yellen.

We are locked up in the futures as I write this, limit down. Listen to the talking heads, did you, buy into the rally, did you? Well, you're officially screwed blind -- you can't hedge, you can't do anything except wait for tomorrow morning and pray the /ES doesn't gap down another 100 handles on the open -- which it very well might. On margin, are you? You're dead and buried -- congratulations. This time I will not weep for you.

Unlike in 2000, or even in 2008, instead this evening I cheer.

You deserve it. -Karl Denninger

(It's time for a nice adult beverage... and a toast).

|

|

|

|

Post by Entendance on Jun 29, 2016 11:00:07 GMT -5

|

|

|

|

Post by Entendance on Jul 4, 2016 4:13:17 GMT -5

Brexit Is a Lehman Moment for European Banks

German arms exports almost doubled in 2015: report **** ...there is one group of interests that have only benefited from the refugee crisis, and in particular

from the European Union’s investment in ‘securing’ its borders. They are the military and security

companies that provide the equipment to border guards, the surveillance technology to monitor frontiers,

and the IT infrastructure to track population movements. Most perverse of all, it shows that some of the beneficiaries of border security contracts are some of the

biggest arms sellers to the Middle-East and North-African region, fuelling the conflicts that are the cause

of many of the refugees... BORDER WARS:

THE ARMS DEALERS PROFITING FROM EUROPE’S REFUGEE TRAGEDY. Full Report***here

...Silver... ...Silver...

|

|

|

|

Post by Entendance on Jul 18, 2016 4:54:42 GMT -5

|

|

|

|

Post by Entendance on Aug 4, 2016 4:21:12 GMT -5

|

|

|

|

Post by Entendance on Aug 18, 2016 4:47:19 GMT -5

...the video the banksters don't want you to watch is*** here

"This coming autumn, we are likely to see the beginning of the hyperinflationary phase of the sovereign debt crisis..."

Fred & EntendanceInvestors Private Beach. Members Only Area.

2016: The chickens come home to roost! |

|

|

|

Post by Entendance on Aug 23, 2016 15:52:39 GMT -5

"Students of history will find eerie but quite predictable parallels between the collapse of the Roman Empire in the 4th Century AD and the collapse of America’s global hegemony today. Not only has the choice of political so-called leaders become the near-exclusive province of big money patriarchs and their corporate interests. The choice of politicians voters are offered is worse than abysmal. As President Barack Obama tries every sneaky trick in the book to ram through a hugely unpopular Trans-Pacific Partnership free trade corporate scam, a report has emerged that there is a staggering $6.5 trillion of US taxpayer dollars that cannot be properly accounted for by standard good accounting methods. That’s trillion, not million, not billion, but trillion. That is almost 40% of the annual USA Gross Domestic Product. Missing in action…"

The Collapse of Rome: Washington’s $6.5 trillion Black Hole

|

|

|

|

Post by Entendance on Sept 9, 2016 17:03:36 GMT -5

Caution: Central Banks Trapped, No Exit From ZIRP/MRP

"Buckle up, because there is a lot to talk about, as something has finally happened. Namely, world bond markets tanked pretty hard overnight, with 10-year yields worldwide rising somewhere between 8 and 10 basis points. And while that was a big percentage change, given how low yields are, it really doesn't signify that much, though (if it continues) it is liable to be very painful for everyone around the globe who has been madly chasing fixed income.

Most likely, fixed income is declining because that market has exhausted itself on the upside, as central bank monetization pushed it to one place, and in conjunction, tons of entities scrambled for yield out of the fear that rates would go even lower, which helped take it to the "final" peak. (I'm not saying that is definitively what happened, but it very well could be.) Having said that, there is no indication that there has been any sort of change in psychology, which is what really matters.

Such Insubordination Nonetheless, I would like to point out that the fact the bond market has declined despite central bank buying and wanting rates even lower proves a point that I think a lot of people who have only been investors for the last 20 years have a hard time understanding, and that is: when markets want to do something, they are bigger than the central banks. I'm not saying CBs are panicked about the backup in yields, but I am pretty sure they are not excited about it. People get used to rates (or stocks) only rallying, and they change their behavior, then all of a sudden rates go against them and it causes problems.

So the bond market may have exhausted itself, or it may not have. It is quite likely that if we are going to see more bond weakness, or even just this amount, it will precipitate a long-overdue break in equity markets. If that occurs, bonds could rally again. In fact, if we get a big enough decline, which we will at some point, then we will start the discussion of QE4 in America and other countries doing something similar. That could produce a blow-off or it could lead to a failing rally. We just don't know.

Hold That Thought The point is, yields have backed up in a way that signifies something important may have happened, but it doesn't indicate any sort of change in psychology that would trigger other investment decisions. So while it is quite possible the 34-year-old bond bull market is done on the upside, it doesn't mean much to anything else. Yet.

That said, it does impact equity markets and, to the extent the stock market has been an accident waiting to happen (just like fixed income), we are liable to see stock prices start to decline. And of course the economic news will be interpreted as weak (as it has been) instead of folks trying to pretend it has been strong simply because the stock market has gone up. (Or as I like to say, the SPOOs write the news.)

Stock market weakness and the perception of economic stagnation means there is no chance the Fed will hike in September or December. They only talk about it because they are trying to act as though their policies work, and they can hike if they need to because the economy merits a hike, even though all of those thoughts are false. (Rates are far too low, but that is a totally different discussion.)

Running Out of Road If I were to sketch out a roadmap I would suggest we are liable to see more stock market weakness, as there are plenty of reasons for the market to decline. Quite frankly, I believe the only reason it has held up is because of the monetization that has taken place around the globe. If you take a step back you can see that the SPOOs pretty much stopped going up when QE3 ended. We went sideways for a long time and they couldn't make a new high, then they did after Brexit, but I believe the U.S. stock market has only held together because of the central bank monetization of other G7 countries. Now even that is not enough.

From here, weakness in the stock market will lead to QE chatter and ultimately QE4. However, any signs of said weakness is just a trade leading up to that. The next monetization scheme will set the stage for the investment landscape for the next couple of years. But you can't look at what central banks do in isolation. It has to be as a function of what they do and how markets respond. If the bond market blows off to make a new high, that will require thought and analysis to understand what it may mean. If they have a failing rally, that will be really important and have severe consequences.

Who's In Charge Here? The truly important moment in time will be when the central banks ease and bond markets decline. That will signify a loss of control. If central banks ease and bond markets rally, and the rally sticks, they haven't lost control. That doesn't mean they will get their own way, but it is not the big psychological sea change we are looking for. The only way the investment landscape is going to change for real is when psychology about the efficacy of central bank policies changes, and in my opinion that can only happen after QE4. So life has potentially become interesting, unless today turns out to be a one-day wonder, which I don't expect.

As for the metals markets, they could see a bit of a bumpy ride as the crosscurrents of what all this means get sorted out, but the fact of the matter is we are closing in on the moment in time that it is clear that central bank policies don't work and they are trapped, yet they keep doing the same thing over and over again. That is a recipe for a much higher gold price, while CBs trying to fight a decline in the bond market after they have lost control -- which is several steps away -- would be even more wildly bullish for gold.

While that may be getting ahead of ourselves, it does appear that the recent script that everyone wanted -- i.e., stocks and bonds gently going up ad nauseam forever -- has finally been shredded.

The Unicorns In the Coal Mine Turning to the action, the market here lost almost 1.5% through midday, with the Nasdaq leading the charge lower and almost every stock on the screen red. The fact that the market has run higher on fumes, ignored bad news, and traded sideways for a couple of months leads me to believe that today's action is the start of a much bigger break.

In the afternoon the market kept on sinking -- instead of rallying, as it has done so many times recently -- and closed on the lows, losing over 2% (and potentially setting the stage for more weakness on Monday). Away from stocks, green paper was slightly stronger, as dollar bulls continue to believe that the Fed knows what it is doing and a rate hike is imminent. Fixed income was roughed up here, although not quite as bad from a basis-point perspective as the rest of the world, and certainly not in percentage terms, either. As for the metals, silver lost 2.5% to gold's 0.75% and the miners were hit pretty hard."

|

|

|

|

Post by Entendance on Sept 15, 2016 22:46:52 GMT -5

|

|

|

|

Post by Entendance on Sept 23, 2016 16:56:24 GMT -5

Part 2

A self-appointed stock sleuth finds financial giants trading extensively in little penny stocks like the one he owned that tanked. And he learns something amazing: Some brokers can sell shares that don’t actually exist.

"... in naked short selling, you don’t even borrow the stock. You sell additional, phantom shares. This is even more likely to drive down the price than regular shorting, because suddenly the supply is larger but the demand is the same. “I can think of a number of stocks where the shares on the short exceeded the shares ever issued by the company,” said Alabama Securities Commission Director Joseph Borg. “You can’t do that unless it’s naked.”

Naked short selling is, not surprisingly, illegal in most circumstances.

But market makers like Knight have an exemption from naked short selling restrictions, on the grounds that they use the practice to maintain liquidity in markets. For example, if there’s high demand for a stock, the market maker can fill orders even if it doesn’t have the shares available.

As the Securities and Exchange Commission explains, “A market maker engaged in bona fide market making, particularly in a fast-moving market, may need to sell the security short without having arranged to borrow shares.” This often occurs in thinly traded stocks, like penny stocks... Big Players, Little Stocks, and Naked Shorts

Part 3 is here

Part 1 is here |

|

|

|

Post by Entendance on Oct 4, 2016 7:30:27 GMT -5

|

|

|

|

Post by Entendance on Oct 7, 2016 1:57:20 GMT -5

|

|

|

|

Post by Entendance on Oct 9, 2016 9:37:07 GMT -5

...Raising more debt to pay for legal costs…

***Deutsche Bank CEO Hasn’t Reached Accord With U.S., Bild Reports

...Deutsche Bank...What's next?

Deutsche Bank Stock Crashes..."if it walks like Lehman, and talks like Lehman... it is Lehman." Time for Deutsche Bank to change its Ticker Symbol to DBW (Dead Bank Walking)?

Since 2008 all policy makers have done to date has been to squander public funds to protect the full interests of bankers. Stop Bailing Out Billionaire Bankers! Since 2008 all policy makers have done to date has been to squander public funds to protect the full interests of bankers. Stop Bailing Out Billionaire Bankers!

The poor people bailing out the rich people. This is a porn economy. We have a bunch of zombies that are only around at this point because the taxpayer is propping them up.

Can we just drop the pretence and start calling the bank bailout what it is: Financial terrorism.

Terrorism can be defined as achieving one’s aims through fear. Since 2008 the banksters and their friends in Worldwide governments extorting money from the taxpayers (you and me) with a threatening “or else” that goes something like this: “Give us the money or the entire financial system will implode."

The reason we’re still in such a mess is that people got greedy. They using leverage and structured products then and now to hide problems, to make it look as if they were making huge profits when they really weren’t. Since 2008 these banks paying high bonuses and high dividends on phantom profits.

How can you expect to find solutions in the crowd that caused the problems? These incompetent corporate clowns should be falling on their own swords.

To me, this financial crisis is nowhere near over for one simple reason: we continue to perpetuate the VERY same business practices that created it in the first place and the bureaucrats that designed this bailout are either in the pocket of the banks or they're incompetent.

EntendanceInvestors own physical gold and silver

|

|

|

|

Post by Entendance on Oct 19, 2016 5:58:13 GMT -5

America the Beautiful Bankrupt

“...this is going to be a global recession and it’s going to be bad...” Mike shows you how much the government controls the economy today. And why it will be very difficult to get out of this mind-boggling level of debt. You’ll see this is not just a problem in the Western world, it’s the entire world. As Mike says, “this is going to be a global recession and it’s going to be bad.”

|

|

|

|

Post by Entendance on Nov 18, 2016 6:24:00 GMT -5

|

|

|

|

Post by Entendance on Jan 5, 2017 4:52:26 GMT -5

|

|

|

|

Post by Entendance on Jan 12, 2017 5:47:41 GMT -5

This is the America that Obama leaves for Trump... ***160 million Americans can't afford to treat a broken arm

"...It is insane to encourage an unhealthy lifestyle and then wonder why the costs of treating the illnesses we've generated are skyrocketing. The obvious solution is to look at health as an ecosystem of inputs and dynamics that interact in predictable ways. If we put garbage in, we get garbage (poor health) out. In essence, the current system relieves the participants ("patients") of the responsibility to be part of the solution, and offers few ways for people to participate in regaining their health..." ***What's Truly Progressive? |

|

|

|

Post by Entendance on Jan 16, 2017 17:00:21 GMT -5

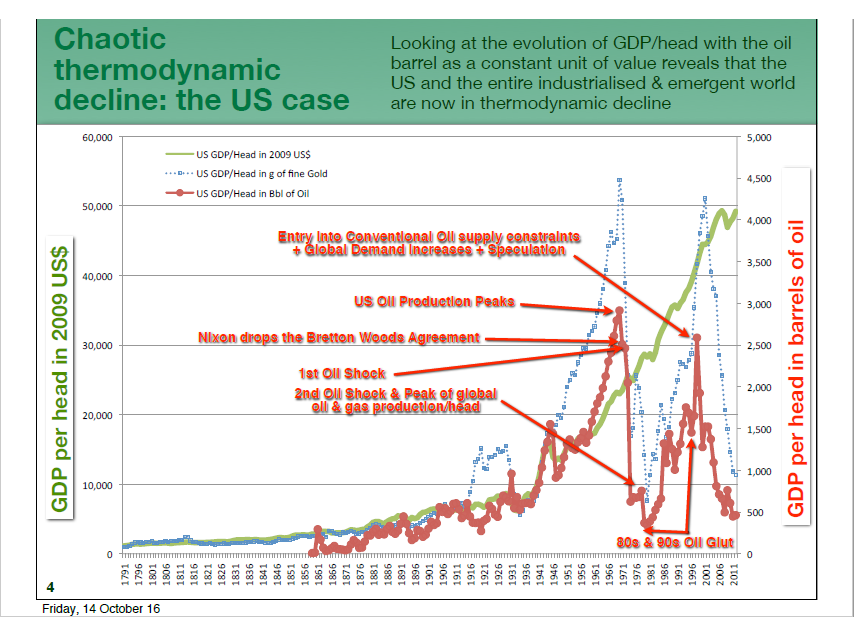

"...The reason I am so certain of the upcoming disintegration of the GREATEST PONZI SCHEME in history, has to do with the information in the following chart:

There are three lines. The GREEN LINE is the U.S. GDP divided by the population. Then the DOTTED BLUE LINE is U.S. GDP in gold and the RED LINE is the U.S. GDP in oil.

I will simplify the chart by saying, for the public to enjoy real wealth creation, all three lines need to move up in the same direction. You will notice that all three did from 1900 to 1970. Then all of a sudden gold and oil shot up in the 1960’s and crashed in the 1970’s. The same thing took place in gold and oil in the late 1990’s and then crashed in 2011.

However, as the gold and oil trend lines reacted violently up and down twice, the GDP continued to move higher without a care in the world. The REAL U.S. GDP should have followed along with the GOLD & OIL trend lines. Furthermore, the U.S. GDP per head should have collapsed with oil and gold, but didn’t.

Thus, this is the SETUP for the GREATEST FINANCIAL ENEMA in history..."

***Are You Prepared For The Great Financial Enema? H/T Tom from Florida |

|

|

|

Post by Entendance on Jan 24, 2017 9:20:44 GMT -5

|

|

|

|

Post by Entendance on Jan 31, 2017 4:49:13 GMT -5

|

|

|

|

Post by Entendance on Feb 15, 2017 18:18:40 GMT -5

"...Say you want to launch an organization called “Movement Blue,” and you and others have gone through great struggle to grow this organization from the ground up. However, just as your movement is about to achieve widespread recognition, someone else comes along, someone with extensive capital and media influence, and they saturate every outlet with the narrative that your movement is actually more like “Movement Red,” and that Movement Red is a terrible, no-good, bad idea. They do such a good job, in fact, that millions and millions of people start calling you “Movement Red” without even knowing why, and they begin to believe all the negative associations that this label entails.

Through the art of negative branding, your enemy has stolen your most precious asset — the ability to present yourself to the public as you really are.

Negative branding is a form of psychological inoculation..."

***The Globalist Long Game - Redefine Liberty Activism As Evil Populism

***THE SLAVE MENTALITY & ***The sheeple attitude

A World Of Deception

•Mainstream Media

•Fiat Currency

•Central Bankers

•Elites

See through the smoke by being curious

Discover Truths

Fred & EntendanceInvestors Beach...because this place is for Uncolonized Minds. We speak our mind even though it may cost readership.

...because when the storm comes — oh it will come — you'll be thankful you have gold!

David Siegel, co-founder of $35 billion quantitative hedge fund firm Two Sigma, says he’s “very worried” that machines could soon cost large swaths of the workforce their jobs.

“Most people in the bulk of the job market are not involved in super-high-value jobs,” Siegel said Monday at the Milken Institute Global Conference in Beverly Hills, California. “They are doing routine work and tasks and it’s precisely these tasks that computers are going to be better at doing,” just as combustion engines replaced horses or ATMs replaced most bank tellers...***Two Sigma Co-Founder `Very Worried' Machines Will Take Jobs

|

|

|

|

Post by Entendance on Mar 1, 2017 18:54:00 GMT -5

Fred & EntendanceInvestors Beach, Bijoutier, Outer Islands, Seychelles

|

|

|

|

Post by Entendance on Apr 7, 2017 7:13:14 GMT -5

|

|

|

|

Post by Entendance on May 9, 2017 6:25:54 GMT -5

|

|

|

|

Post by Entendance on May 22, 2017 5:36:10 GMT -5

|

|

|

|

Post by Entendance on May 25, 2017 13:50:44 GMT -5

"...The problem with cryptocurrencies is that whereas Bitcoin cannot increase in supply, other cryptocurrencies can be created. In order to be trusted, each cryptocurrency would have to have a limited supply. However, an endless number of cryptocurrencies could be created that would greatly increase the supply of cryptocurrencies. If entrepreneurs don’t bring about this result, the Federal Reserve itself could organize it.

Therefore, cryptocurrency might be only a temporary refuge from fiat money creation. This would leave gold and silver, whose supply can only gradually be increased via mining, as the only refuge from wealth-destroying fiat money creation..." May 31, 2017 Dave Kranzler here

Cryptocurrencies? No, thanks.

New currencies, same money changers. Holding*** precious metals is the only way to destroy the fiat system and investing in anything other than money only perpetuates their schemes which includes stocks and other paper or digital instruments prone to manipulation, regulation, and infiltration. Don't get hooked.

|

|

|

|

Post by Entendance on Jul 24, 2017 16:49:27 GMT -5

|

|

|

|

Post by Entendance on Aug 3, 2017 7:35:07 GMT -5

"Living through a collapse is a curious experience. Perhaps the most curious part is that nobody wants to admit it’s a collapse. The results of half a century of debt-fueled “growth” are becoming impossible to deny convincingly, but even as economies and certainties crumble, our appointed leaders bravely hold the line. No one wants to be the first to say the dam is cracked beyond repair..." ***Paul Kingsnorth on Life in the End Times with the Cult of Growth

"Tracking geopolitical and fiscal developments over the past several years is a bit like watching a slow motion train wreck; you know exactly what the consequences of the events will be, you try to warn people as much as possible, but, ultimately, you cannot reverse the disaster. The disaster has for all intents and purposes already happened. What we are witnessing is the aftermath as a forgone conclusion.

This is why whenever someone asks me as an economic and political analyst "when the collapse is going to happen," I have to shake my head in bewilderment. The "collapse" is here now. It is done. It is a historical fact. It's just that not many people have the eyes to see it yet, primarily because they are hyper-focused on all the wrong things..." ***Geopolitical Tensions Are Designed To Distract The Public From Economic Decline

|

|