|

|

Post by Entendance on Oct 10, 2016 16:12:09 GMT -5

|

|

|

|

Post by Entendance on Oct 11, 2016 15:10:28 GMT -5

"...Citigroup had been serially charged by its regulators for abusing its customers and targeting the poor and financially uneducated. But key executives at the bank had played major roles in raising funds for the Barack Obama campaign so it was richly rewarded for that.

According to emails released by WikiLeaks yesterday, which came from a hack of the email account of John Podesta, a co-chair of Obama’s 2008 Transition Team, we learn that despite the obvious fact that Citigroup was both corrupt and derelict in handling its own financial affairs, Barack Obama gave executives of that bank an outsized role in shaping and staffing his first term..."

WikiLeaks Bombshell: Emails Show Citigroup Had Major Role in Shaping and Staffing Obama’s First Term

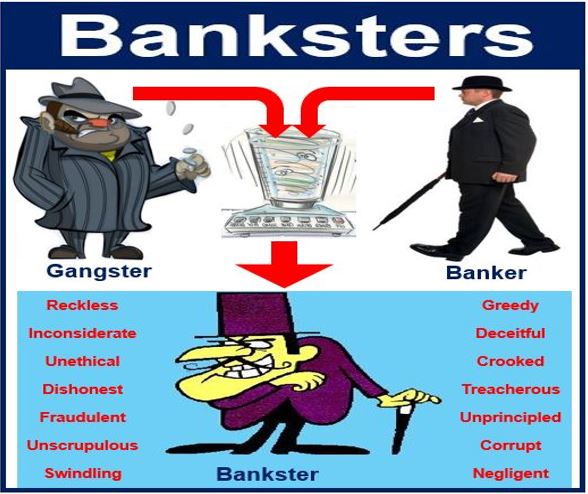

***The banksters

.jpg)

The Real Fight Is Within: All about mental and spiritual preparation***here

|

|

|

|

Post by Entendance on Oct 21, 2016 16:43:27 GMT -5

great piece on our "infallible, clairvoyant and beneficent" central banksters

"...When I was a student I was taught that central banks that printed money and bought public debt with that money belonged in banana republics and ultimately destroyed their currency or their countries. Central banks have by now turned many developed countries into banana republics, and we shall have to face the consequences. These will doubtless be negative, but I fear there is a possibility that they may be horrendous, to the extent of risking a total disintegration of the system." ***Destructive monetary policies H/T Tom from Florida

All about the banksters

***The Man Who Busted the ‘Banksters’

JAN. 5, 2009 Where Is Our Ferdinand Pecora?

|

|

|

|

Post by Entendance on Jan 3, 2017 18:08:50 GMT -5

"It’s a new year. And the war on cash opens on a new front…

India launched a major offensive in November when it banned the most widely used bank notes. Chaos was the result. And now… Greece is launching its latest offensive against cash…" ***Elites Don’t Need to Ban Cash to Eliminate It

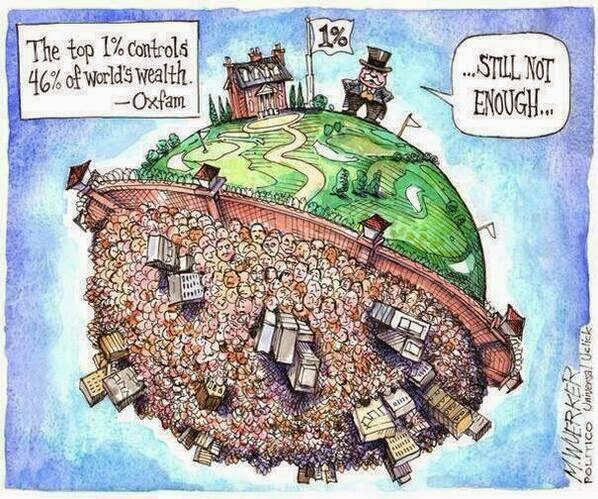

This is what we're up against: a status quo that has institutionalized soaring inequality and rising poverty as the only possible output of defending the privileged few at the expense of the many.

The EU project is dead.

Here and here at Fred & EntendanceInvestors Beach show why.

The question is how long it will take for the whole thing to break up.

|

|

|

|

Post by Entendance on Jan 19, 2017 16:58:31 GMT -5

"...As we have tried to show, the era of prosperity for all, began to waver in the 70s in America, and started its more serious stall from 2001 onwards. The Establishment approach to this faltering of growth has been to kick the can down the road: ‘extend and pretend’ – monetised debt, zero, or negative, interest rates and the unceasing refrain that ‘recovery’ is around the corner..." ***What is this ‘Crisis’ of Modernity?

"...Try telling that to the Iraqis, Libyans and Syrians who have been on the receiving end of neocon-neoliberalism policies. The reality is very unpleasant: for those targeted by America's neocon-neoliberalism, nothing worse is imaginable, because the worst has already happened.

The cold reality is America's 25 years of neocon-neoliberalism has been great for the top 5% and an unmitigated disaster for everyone else in the U.S. and the nations it has targeted for intervention.

Those defending the Democratic Party's 16 years of neocon-neoliberalism (Clinton and Obama) and the Republican Party's 8 years of neocon-neoliberalism (Bush) are defending a system that benefited the few at the expense of the many..."

25 Years of Neocon-Neoliberalism:***Great for the Top 5%, A Disaster for Everyone Else

The Dying Days of Liberalism...How Orthodoxy, Professionalism, and Unresponsive Politics Finally Doomed a 19th-century Project |

|

|

|

Post by Entendance on Feb 3, 2017 4:31:37 GMT -5

***Understanding demonetisation: The problem with the war on cash

"...I continue to think that cash elimination is the biggest story out there. It is a fraud of epic proportions, and its implications are dark and deeply disturbing. I realize that I keep coming back to this theme, but it’s because it registers with me as being so incredibly important. Sometimes, you have to say something five times before people say, “Wow. This is important. I better do something about it.” If people decide to “do something about it,” they are going to find that their options are limited. Gold being one of the few of them. Gold demand would go nuts if only the people could finally understand why they need to buy it right now. I feel a bit like Don Quixote, but I also think that the dam of realization is coming very close to breaking, and that there could be an outright flood of new, popular awareness and action..."

***Currecide: The Globalists’ Planned Annihilation of Your Savings and Freedom

Fred & E. Beach: The War on Cash |

|

|

|

Post by Entendance on Feb 16, 2017 17:21:00 GMT -5

The association between gold and the US dollar has existed since 1900. During the gold standard from 1900 to 1971, value of a unit of currency was tied to the specific amount of gold. It moved to floating exchange rates after 1971. The US dollar and gold were freed from their association.

Now the US dollar is a fiat currency, which means it gets its value from government regulation. The US dollar is used as a reserve currency. According to the International Monetary Fund (IMF), around 40–50% of the moves in the gold prices since 2002 were dollar-related. A one percent change in the effective external value of the US dollar led to more than a one percent change in gold prices.

So, why is there is an inverse co-relation between gold and the US dollar? Gold is traded mainly in the US currency, so a weaker dollar makes gold less expensive for other nations. A falling dollar increases the value of other countries’ currencies. When the US dollar starts to lose its value, investors look for alternative investment sources to store value. And that alternative is gold.

Now the next question is from where is gold price derived? Isn’t the price derived by looking at demand and supply? The answer is unfortunately a big no; or else, gold prices would have been up as the physical demand for gold was strong in 2016 with inflows into Exchange Traded Fund (ETF) reaching second highest on the record. Now the next question is from where is gold price derived? Isn’t the price derived by looking at demand and supply? The answer is unfortunately a big no; or else, gold prices would have been up as the physical demand for gold was strong in 2016 with inflows into Exchange Traded Fund (ETF) reaching second highest on the record.

The gold and silver futures markets are not a place where people buy and sell gold and silver. This is the market where speculators and hedge funds use gold futures to hedge against other bets. The gold prices are determined in this speculative market and not in physical market where people buy and sell gold.

This is the reason why large speculators or bullion banks can drive the price of gold down even if the demand for the physical metal is rising. There is physical tightness in the global gold market.

The ratio of 542:1 gives such an indication. This ratio is that of COMEX (Chicago Mercantile Exchange): 542 paper ounce of gold is traded for every one ounce of registered gold, which means that if gold buyers after buying future contracts ask for delivery, COMEX would default as there isn’t physical gold to fulfil the buy contracts (1 ounce available out of 542 ounces traded).

Of course, hardly any buyer in COMEX will ask for delivery as they are all speculators. So, this proves that a weakness in the US dollar does not necessarily make gold prices go up as it is more appealing and less expensive as physical buying will hardly prop up the gold prices. In fact in COMEX, there are very few physical buyers. -Aashif Hirani

***What Is the Gold-to-Silver Ratio, and Does It Matter?

This 4,000-year old financial indicator says that a major crisis is looming

Over 4,000 years ago during Sargon the Great’s reign of the Akkadian Empire, it took 8 units of silver to buy one unit of gold.

This was a time long before coins. It would be thousands of years before the Lydians in modern day Turkey would invent gold coins as a form of money.

Back in the Akkadian Empire, gold and silver were still used as a medium of exchange.

But the prices of goods and services were based on the weight of metal, and typically denominated in a unit called a ‘shekel’, about 8.33 grams.

For example, you could have bought 100 quarts of grain in ancient Mesopotamia for about 2 shekels of silver, a weight close to half an ounce in our modern nits.

Both gold and silver were used in trade. And at the time the ‘exchange rate’ between the two metals was fixed at 8:1.

Throughout ancient times, the gold/silver ratio kept pretty close to that figure.

During the time of Hamurabbi in ancient Babylon, the ratio was roughly 6:1.

In ancient Egypt, it varied wildly, from 13:1 all the way to 2:1.

In Rome, around 12:1 (though Roman emperors routinely manipulated the ratio to suit their needs). In the United States, the ratio between silver and gold was fixed at 15:1 in 1792. And throughout the 20th century it averaged about 50:1.

But given that gold is still traditionally seen as a safe haven, the ratio tends to rise dramatically in times of crisis, panic, and economic slowdown.

Just prior to World War II as Hitler rolled into Poland, the gold/silver ratio hit 98:1.

In January 1991 as the first Gulf War kicked off, the ratio once again reached 100:1, twice its normal level.

In nearly every single major recession and panic of the last century, there was a sharp rise in the gold/silver ratio.

The crash of 1987. The Dot-Com bust in the late 1990s. The 2008 financial crisis.

These panics invariably led to a gold/silver ratio in the 70s or higher.

In 2008, in fact, the gold/silver ratio surged from below 50 to a high of roughly 84 in just two months.

We’re seeing another major increase once again. Right now as I write this, the gold/silver ratio is 69. This isn’t normal.

In modern history, the gold/silver ratio has only been this high three other times, all periods of extreme turmoil—the 2008 crisis, Gulf War, and World War II.

This suggests that something is seriously wrong. Or at least that people perceive something is seriously wrong.

There are so many macroeconomic and financial indicators suggesting that a recession is looming, if not an all-out crisis.

In the US, manufacturing data show that the country is already in recession (more on this soon).

Default rates are rising; corporate defaults in the US are actually higher now than when Lehman Brothers went bankrupt back in 2008.

These defaults have put a ton of pressure on banks, whose stock prices are tanking worldwide as they scramble to reinforce their balance sheets against losses.

I just had a meeting with a commercial banker here in Sydney who told me that Australian regulators are forcing the bank to increase its already plentiful capital reserves by over 40% within the next several months.

This is an astonishing (and almost impossible) order.

The regulators wouldn’t be doing that if they weren’t getting ready for a major storm. So even the financial establishment is planning for the worst.

Good times never last forever, especially with governments and central banks engineering artificial prosperity by going into debt and printing money.

These tactics destroy a financial system. And the cracks are visibly expanding.

So while the gold/silver ratio isn’t any kind of smoking gun, it is an obvious symptom alongside many, many others.

Now, the ratio may certainly go even higher in the event of a major banking or financial crisis. We may see it touch 100 again.

But it is reasonable to expect that someday the gold/silver ratio will eventually fall to more ‘normal’ levels.

In other words, today you can trade 1 ounce of gold for 69 ounces of silver.

But perhaps, say, over the next two years the gold/silver ratio returns to a more historic norm of 55. (Remember, it was as low as 30 in 2011)

This means that in the future you’ll be able to trade the 69 ounces of silver you acquired today for 1.45 ounces of gold.

The final result is that, in gold terms, you earn a 22% “profit”. Essentially you end up with 45% more gold than you started with today.

So bottom line, if you’re a speculator in precious metals, now may be a good time to consider trading in some gold for silver. -Simon Black

|

|

|

|

Post by Entendance on Mar 7, 2017 17:49:29 GMT -5

|

|

|

|

Post by Entendance on Mar 20, 2017 10:10:28 GMT -5

|

|

|

|

Post by Entendance on Apr 12, 2017 5:40:21 GMT -5

"...Syria remains a highly useful catalyst for the globalists to achieve the crisis they need to push their great reset forward. Being that they have tried to thrust Americans into that quagmire so many times over the past few years, I think it is safe to say they plan to use Syria as trigger point whether we cooperate or not."

***The Real Dangers Behind The Syrian Crisis Are Economic

|

|

|

|

Post by Entendance on Jul 13, 2017 14:40:24 GMT -5

***Wall Street: It’s More Corrupt Than You Can Imagine

"...As a matter of fact, when adjusted for inflation, the NASDAQ is still 17.6% below its March 2000 peak..." ***The universe is under no obligation to make sense to you

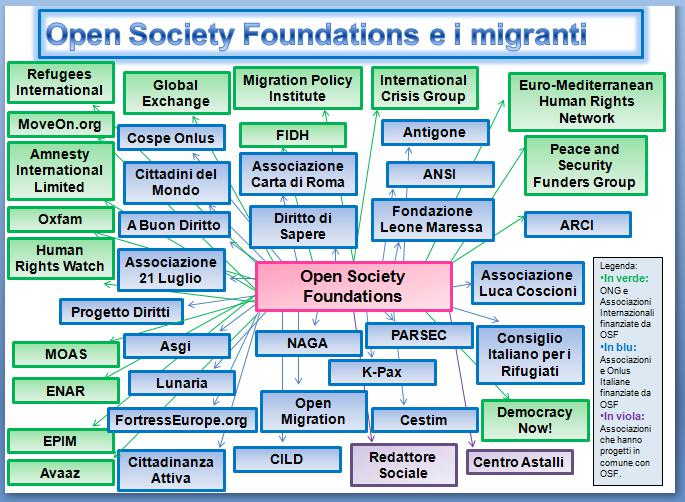

"Open Borders, Media Censorship

Why is there a migrant crisis in the Mediterranean? Why are NGOs involved? Because there is an extensive network of open borders activists and organizations behind it; many of them are directly funded by or cooperated with George Soros’ Open Society. Is it illegal? Not really. Political activism is an essential part of democratic societies. However, sometimes it goes too far, or the promoted causes prove to be either unrealistic or unsustainable.

The network of the “immigration lobby’’ in Italy is made up of International NGOs financed by the Open Society Foundation (green), Italian NGOs financed by OSF (blue), and organizations with shared projects with OSF (purple)..."

(Once again, guess who owns Centro Astalli? Have fun in investigating where else the jesuits are...) ***Soros-sponsored immigration network in Italy

More at

***Bota na conta do Papa & ***Italiani |

|

|

|

Post by Entendance on Jul 20, 2017 5:38:20 GMT -5

***The world has made more than 9 billion tons of plastic, says new studyProduction is not just growing, growth is still accelerating.***World’s Plastic Waste Could Bury Manhattan 2 Miles Deep

<Correspondent Bart D. (Australia) captured the entire global economy in three words: The Landfill Economy. Stuff is manufactured, energy is consumed shipping it somewhere, consumers buy it and shortly thereafter it ends up as garbage in the landfill.

This is of course the definition of "economic growth": waste, inefficiency, environmental destruction--none of these matter. Only two things matter: maximize "growth" by any means necessary, and maximize profits by any means necessary.

The Landfill Economy now encompasses the entire planet. The swirling gyre of plastic trash the size of Texas between Hawaii and California: it's just one modest example of the planetary trash dump that "growth" and profit generate as byproducts/blowback.

The planet's oceans are one giant trash dump. Everything from plastic water bottles to abandoned fishing nets to radiation to containers that fell off ships is floating around even the most distant corners of the seas. Seabirds nesting in remote islands die of starvation as their guts fill with plastic bits of "permanent growth."

Globalization has turned the planet's land masses and rivers into trash dumps. Want to make a quick profit along a tropical sea coast? Dig some big holes near the coast, dump in baby prawns, food and chemicals to suppress algae blooms and diseases and then harvest the prawns to ship to the insatiable markets of the developed world.

Once the prawn farms are poisoned wastelands, move on and despoil another coastline elsewhere.

Globalization has greased the slippery slope from factory to landfill by enabling the global distribution of defective parts. Whether they are pirated, designed to fail or just the result of slipshod quality control, the flood of defective parts guarantee that the entire assembly they are installed in--stoves, vacuum cleaners, transmissions, electronics, you name it--will soon fail and be shipped directly to the landfill, as repairing stuff is far costlier than buying a new replacement.

QE/ZIRP Is Crushing the Global Supply Chain, Product Quality and Profits (October 17, 2016)

The Keynesian Cargo Cults that rule global economics love The Landfill Economy because it means more "growth". Never mind the poisoned seas, rivers and land, or the immense waste of energy, commodities and labor that result from the global manufacture and distribution of shoddy products: if it adds to "growth," it's all good in the warped view of the Keynesian Cargo Cults.

We got your "growth" right here.

People are also tossed on the trash heap with careless abandon. The health of workers is a cost that reduces profits, so it's ignored unless it can be turned into a profit center via state funding for managing preventable diseases, i.e. sickcare.

A worker sickened by industrial waste or lifestyle illnesses who becomes a profit center is a wonderful source of "growth" and profits. A worker who can't generate a corporation or state a profit is dumped on the trash heap as a matter of routine. A worker who can't generate somebody a profit or "growth" by taking on more debt to spend spend spend is worthless.

If a robot or software can do the same work, then it is self-destructive for an enterprise to pay a human worker: if profits fall, Wall Street will crucify the enterprise and competitors will eat it alive.

This "maximizing growth and profits is the highest good" mode of production is insane. It doesn't have to rule the world. As I outline in my book A Radically Beneficial World: Automation, Technology & Creating Jobs for All, other more efficient, sustainable and humane modes of production are within reach if we escape from the global grip of the destructive "growth by any means" cult.>

This elephant is thought to have died after eating crops sprayed with pesticides in Assam, India REUTERS ***70% Of Wildlife Gone: World Faces Mass Extinction On Scale Of Dinosaurs

***Mass Consumption Is Causing Mass Extinction. Can We Stop Ourselves?

We are not here to gain power, we are here to distribute power We are not here to gain power, we are here to distribute power

***Prepare For the Pirates – Direct Democracy Driven Political Party May Gain Power in Iceland (Iceland: Few days before elections and the Icelandic Pirate Party is in the LEAD! WOW!)

Meanwhile...the Video of the Day is here

|

|

|

|

Post by Entendance on Aug 13, 2017 7:24:32 GMT -5

|

|

|

|

Post by Entendance on Aug 31, 2017 14:58:31 GMT -5

|

|

|

|

Post by Entendance on Sept 13, 2017 5:17:11 GMT -5

|

|

|

|

Post by Entendance on Sept 29, 2017 3:45:02 GMT -5

"...The Koyaanisqatsi film doesn’t have a happy Hollywood ending, and it makes no pretense of it. Our Koyaanisqatsi economy will not end with ‘they lived happily ever after’ either. The protagonists wouldn’t know how to achieve that. They don’t understand what makes an economy run, and keeps it running.

And they don’t want to understand, because they think it’ll make them less rich. Nobody gives balance a second’s thought. Presumably because they think the system, like nature, will eventually balance itself. And they’re right in that. They just haven’t considered what that balancing act might mean for them personally.

if you’re rich, good on you. But don’t forget what made it possible for you to gather your riches, or you’ll lose them, and probably a lot more too."

***The Koyaanisqatsi Economy***

***Inequality Updated |

|

|

|

Post by Entendance on Oct 12, 2017 5:43:56 GMT -5

|

|

|

|

Post by Entendance on Nov 7, 2017 9:06:32 GMT -5

“There are crooks everywhere you look now. The situation is desperate.” Final blog entry by Daphne Caruana Galizia, 53, renowned Maltese investigative reporter who specialized in exposing state corruption; posted on 16 October 2017, one day before she and her vehicle were blown to bits by a car bomb in Bidnija, Malta

<In 2011, gold pulled a “Bitcoin” before anyone even knew what Bitcoin was: its price went vertical to $1,900 per ounce. Inflation-adjusted, the price was still far below its 1980 all-time high, and from all indications, it was going to keep heading north toward its free market print.

In surging, gold blurted out the Deep State Central Planners’ strategy for dealing with the Great Financial Crisis: the hyperinflation of bond, equities and real estate prices via the hyperinflation of both official and totally clandestine, off-the-books money supply, in order to create the hyperinflation of tax revenues desperately required by the government to forestall its fiscal collapse. Gold’s exposure of the Deep State Central Planners’ secret strategy was absolutely unacceptable to them, and had to be stopped.

Worse, gold’s price breakout interfered with the continuation of the largest and most profitable financial crime in history: gold price manipulation. As we have outlined in previous articles, including “Gold and Silver Price Manipulation: The Biggest Financial Crime in History,” from its commencement in 1980, this crime has netted its perpetrators more than $1 trillion in criminal, Mafia-style profits. The epic scale of this crime is exactly why it continues unabated to this day. (While the gold price rigging crime is virtually identical to the manipulation of silver prices, in the interests of brevity, we will solely focus on gold in this article.)

The weapon used in the gold price manipulation crime is paper, or, better stated, electronic gold in five distinct forms: gold futures; gold options on futures; bullion-bank controlled, deliberately audit-proof gold ETFs; gold EFPs (Exchanges for Physical); and the equities of bullion bank-controlled major mining companies. (The major miners serve the bullion banks, not their shareholders, and have actively participated in gold’s price destruction for years, starting with the “hedging” campaign that handed guaranteed profits to the banks and pitiful share prices to the stakeholders.)

These electronic (in other words, non-physical and unreal) gold products are used by Deep State financial insiders to misdirect funds intended by investors to flow into gold, away from gold. Those who “invest” in electronic gold are, in fact, aiding and abetting the exact financial criminals who are stealing from them. The Deep State financial elite is laughing itself sick that suckers still fall for the electronic gold scam nearly four decades after they first hatched it and after already having stolen $1 trillion from their marks. Proof that many people in our world never learn.

Simplified, the gold price rigging scam works by the orchestrators allowing natural market forces to increase the price in roughly $50 – 100 increments, whereupon they unleash massive, synchronized, simultaneous, shock-and-awe-style naked short sales, unbacked by any physical gold they actually own, that take the price right back down by $50 to $100 in a matter of minutes to a few days. This forces the price-attacked longs to dump their losing positions, enabling the shorts to cover at an illegal profit. Each such large-scale price raid produces hundreds of millions of dollars in profits for the criminal orchestrators, not just from the futures market, but from the companion options, swaps and equities markets, all of which act in unison, and in a price-predictable up or down manner. This identical wash, rinse, repeat cycle has occurred literally hundreds of times over the past 38 years, with no serious investigations or prosecutions whatsoever in that this is official, state-sponsored, for-profit corruption.

For any one of hundreds of reasons, gold should be in a raging bull market at this time. Given that its price remains lackluster and greatly disappointing, rich gallows humor has emerged as a form of therapy for those attempting to deal with the irrationality of it all...>

***Electronic Gold: The Deep State’s Corrupt Threat to Human Prosperity and Freedom

AVOID PAPER GOLD: 6 PAGES HERE

|

|

|

|

Post by Entendance on Apr 15, 2018 4:04:41 GMT -5

|

|

|

|

Post by Entendance on May 12, 2018 5:50:46 GMT -5

It’s All A Matter of Perspective

"This week brought forward more evidence that we are living in a fabricated world...How is it possible that the unemployment rate is 3.9 percent, yet wage growth is softer than a warm pile of mashed potatoes? Simple. The unemployment rate is fake. So what’s an industrious fellow to do, to get ahead in today’s economy? "

***How to Get Ahead in Today’s Economy

Maronna mia Maronna mia

Se so' arrubato 'e sordë

Comme faccio comme 'a metto a nomme

So' state duje guaglioni muccusielli

S'hanno arrubbato 'e sordë e pure 'aniellö

Maronna mia Maronna mia

Era 'a primma mesata

Chi ce 'o dice 'a casa

Si ll'ancappo? Si ll'ancappo

Saje che succede

Nce faccio 'o mazzo tanto!

Maronna mia Maronna mia

Era chillu guaglione

Ueh! viene ccà, viene ccà, nun fa' l'indiano

Che faje abbedè ca nun saje niente

Ce stava tutta chesta gente

Ma che succede, chesta gente nun me vò

aiutà'

E' gente 'e niente

E' gente 'e niente

|

|

|

|

Post by Entendance on Jul 12, 2018 0:57:19 GMT -5

Numquam nimis dicitur, quod numquam satis discitur

Nie wird zuviel gesagt, was nicht genug gelernt werden kann Mai si dice abbastanza, perchè mai si impara abbastanza It can never be repeated too often, since it can never be learned too well

Do people read these articles..? The numbers are insane...if you ain't cheating, you ain't beating...WINNING! Pass this article to anyone in a financialized coma.

“The effect of that when it happens will be larger than people expect because it’s like a coiled spring,” said Dan Zwirn, chief executive officer at Arena Investors, which manages about $1 billion in investments including loans to small-to-mid-sized companies. When yield-chasing investors “finally feel that shock, whatever that shock is, they’ll be surprised about the actual underlying credit quality of what they own—and then realize that what they thought was liquid actually has no bid. Then we’ll see fire and brimstone.”

Titans of Junk: Behind the Debt Binge That Now Threatens Markets |

|

|

|

Post by Entendance on Jul 19, 2018 10:48:06 GMT -5

"...It is absolutely unreal how the world pays so much respect to mediocrity or even incompetence when it comes to running the financial system. Central banks and their heads have created this monster balloon which is now waiting to be popped. They have given the world the impression that they have been instrumental in saving the world economy when they in fact have created the bubble..." Here |

|

|

|

Post by Entendance on Aug 30, 2018 13:03:33 GMT -5

"The world economy has been living on borrowed time since the 2006-9 crisis. The financial system should have collapsed at that time. But the massive life support that central banks orchestrated managed to keep the dying patient alive for another decade. Lowering interest rates to zero or negative and printing enough money to double global debt seem to have solved the problem. But rather than saving the world from an economic collapse, the growth of debt and asset bubbles has created a system with exponentially higher risk." More here |

|

|

|

Post by Entendance on Sept 4, 2018 10:23:20 GMT -5

Numquam nimis dicitur, quod numquam satis discitur. - Seneca

you can never repeat too often what is never sufficiently learned

Nie wird zuviel gesagt, was nicht genug gelernt worden ist

The History of Gold-Oil Ratios: 1946-1969

The History Of Gold-Oil Ratios: 1970-2018

****************************************************

Prime Minister Tun Dr Mahathir Mohamad said he will not be surprised if the Chinese yuan takes over the United States dollar as a global trading currency.

Speaking at University of Brunei today, the 93-year-old prime minister pointed out that 1.4 billion Chinese who are very productive, dynamic and wealthy might just decide that anyone trading with them must use the Chinese currency rather than the US greenback.

“Imagine 1.4 billion Chinese who are very productive becoming very, very rich... why should they use the US dollar? They are the people with the money, property with the wealth.

“So one day they may decide that if you want to buy, you have to use the Chinese currency. And you will have no choice, you will have to use Chinese currency. I don’t know how long we can resist, but it will come one day,” Dr Mahathir said.

However, he also pointed out that such a move will definitely displease the United States of America which will go bankrupt if the US dollar is no longer used as the world’s trading currency.

Explaining how the US currency became the world standard, he said at one time an ounce of gold was the equivalent of US$36 (RM148), but today the price is US$1,200, forcing America to go off the gold standard while “maintaining the fiction that it carries the same value”.

“Now one ounce of gold is about US$1,200. That’s how much the US dollar has depreciated but we have been brought up to think of the US dollar as the standard. Why should the US dollar be the standard?

“Other currencies too can be the standard but the US will feel very unhappy if you drop the dollar as the standard for currencies. If you don’t use the US dollar, the US will go bankrupt immediately because it owes the world 14 trillion dollars which they cannot pay.

“They don’t have that much gold to pay. So if you switch from US to the Chinese currency, the US is going to feel very unhappy and I think some people had ideas about that and they have been taught not to have such ideas,” he said. Dr M predicts Chinese yuan will replace USD as trade currency

|

|

|

|

Post by Entendance on Oct 6, 2018 4:08:54 GMT -5

<...The liquidity-sucking vampire Jerome Powell, shortly after rising from his coffin at dusk. Upon hearing what he recently said about the economy, we thought he may have uttered what is colloquially known as “famous last words” – but obviously, there is no such thing as “last words” for the undead.> Fed President Kashkari Hears Voices – Are They Lying?

LIARS

"...Markets are supposed to be efficient. An efficient market would know that the derivatives dangers are still concentrated among a handful of big Wall Street banks and life insurance companies. A spike in interest rates is going to throw a wrench into the gears of those trades. And since trillions of dollars of those trades are still black holes, written privately between two parties as over-the-counter contracts, the typical reaction is to sell all the stocks of the major suspects first and ask questions later. That’s what a normal market would do. This was not normal..." If you’re not paying close attention, you don’t notice that the subtle changes become big ones over time

The yield on the all-important 10-Year US Treasury has broken its multi-decade downtrend...This is a MASSIVE warning to everyone. If you wanted a comparable situation… this is the equivalent of when subprime mortgages started blowing up before the last crisis.

The only difference is that bubble in mortgages/ real estate was a bubble in a relatively senior asset class. The bubble in sovereign bonds is a bubble in THE MOST senior asset class… the bedrock of the entire global financial system.

Did the next crisis just start? We are about to find out. |

|

|

|

Post by Entendance on Oct 27, 2018 5:28:01 GMT -5

|

|

|

|

Post by Entendance on Jan 24, 2019 3:41:01 GMT -5

"...The word crisis itself is Greek and can be loosely translated as “the turning point” or “judgment day.” The crisis is the price all of us are about to pay for investing the money we don’t own in depreciating asset that we don’t really need or want. It would be naive to think that the rich will become poorer during the crisis, as the crisis itself is nothing but a tool for the redistribution of capital..." Brace for Impact ("It’s hardly a secret that during the global crisis salaries are slashed in half, while price tags in stores are rising, employees are being laid off, housing prices are falling, loans are getting more expensive. But this time around we may as well add public widespread public disobedience, riots, mass looting, revolutions and military conflicts plunging a number of continents into chaos")

here

"....over history, throughout history a ratio at that level has meant currency collapse..."

"Because it is always easier for politicians to borrow rather than pursue a responsible fiscal course, there is a propensity for sovereign debts to grow over time, not only in absolute terms, but also as a percentage of GDP. Since the 2008 financial crisis, aggregate global sovereign debt has nearly doubled, and most major sovereign debtors have experienced a significant increase in their debt-to-GDP ratios. In the U.S., this ratio actually had declined for many years after wartime spending started to wind down in 1945, but then it began ramping up significantly between 1980 and today. The ratio of U.S. government debt to GDP, for example, has grown from over 74% of GDP in 2008 to 105% in 2017. For the U.K., the ratio has surged from 50% to 88%. For France, 69% to 98%. For Italy, from 102% to 132%. For Spain, from 39% to 98%. Canada has gone from 68% to 90%. China from 27% to 47%. The seeds of the next major financial crisis (or the one after that) may well be found in today's sovereign debt levels." More here

|

|

|

|

Post by Entendance on Feb 25, 2019 14:57:41 GMT -5

February 25th: Gold fundamentals are seeing 3 major factors at work positively. A Gold price breakout is imminent, or else very soon. 1) QE is the internal factor, from a new QE FOREVER to be announced. It is urgently required to avoid a systemic breakdown. 2) SGE is the external factor, from the Shanghai Gold-RMB window. It assures the death of the LBMA gold market and the demise of the USDollar itself. 3) BIS is the systemic factor, from the Basel Plan kicking into gear. It calls for Gold counted as Tier-1 Asset in the banking reserves system. Many details surround each of the 3 major factors. The major central banks are all insolvent after serving as bond buyers of last resort. The Basel Plan calls for a much higher Gold price after significant acquisition by central banks, in order to restore them to health. The QE monetary policy for the last seven years has created a terrible reality: US TREASURY BONDS ARE THE GLOBAL SUBPRIME BOND. The Gold price is looking strong in short-term, intermediate term, and long-term. The Global Financial Crisis grows worse by the month, and it will blossom in a magnificent manner.

"The Gold suppression game appears finally to be coming to an end. A Perfect Storm is hitting the Gold market, with an internal factor (QE), an external factor (SGE), and a systemic factor (Basel). These factors can be identified, each very powerful, each with a very new recent twist to alter the landscape. All three forces are positive in releasing Gold from the corrupt clutches of the Anglo-American banker organization. They have been willing to destroy the global financial structure and many national economies, in order not just to maintain the political power, but also to continue the privilege of granting themselves $trillion free loans. The owners of the US Federal Reserve, Euro Central Bank, and Bank of England have granted themselves free money in gifted pilferage for a full century. As the saying goes, a nation needs a central bank like an oyster needs a piano. In the last ten years since the Lehman Brothers failure, all systems have undergone the same reckless treatment that the mortgage bonds endured. They saw corrupted underwriting, corrupted title database, and corrupted demand functions..." Gold Breakout: Three Major Factors

|

|

|

|

Post by Entendance on Apr 12, 2019 3:39:38 GMT -5

|

|

|

|

Post by Entendance on Apr 15, 2019 10:12:14 GMT -5

- The Gold price is the paper price, a mechanism to make physical available at a huge discount. There's 100:1 + leverage, that's over 100 notional claims for every ounce of physical.

- In short, as a measure of controlling the paper prices of gold and silver, The Bullion Banks that operate on The Comex act as de facto market makers of the paper derivative, Comex futures contract. This gives them the nearly unlimited ability to simply conjure up new contracts from thin air whenever demand for these contracts exceeds available supply and, almost without exception, these Banks issue new contracts by taking the short side of the trade versus a Spec long...

- When the Fed pushes down the price of gold with paper during NY Comex floor-trading hours, take advantage of it by buying some physical gold or silver.

- The Federal Reserve’s “invisible hand” in the markets is no longer “invisible.” It’s become obvious to most market participants that the Fed is working hard to keep the stock market from collapsing and the price of gold below $1300.

- If you are buying gold for wealth preservation, you know what you are looking at on a computer screen is not the real price of gold, just the paper price of gold and the manipulation of gold. It has nothing to do with physical gold. Therefore, our investors are not worried because they know they are holding gold to preserve their wealth outside the banking system. Also, they are holding gold as insurance for risks in the system, which are bigger than ever. So, we don’t see anyone being nervous and ringing up and complaining about the gold price because they know gold will reflect what is happening in the world. . . . I am not upset because I know one day, COMEX will default. The futures market will default. The banks will not be able to deliver the paper gold they have issued. One day people will come in and try to get their gold, and there won’t be any gold when they ask for it. How can you be nervous (holding gold)? The truth will eventually come out, and that truth will be very painful for all the paper holders of gold.

- Informed investors no longer trust the paper gold markets.

Currently the paper market in gold is at least 100 times greater than the physical market. Many investors are under the illusion that they own gold when all they have is a piece of paper with no physical gold backing. Gold dealers such as Comex, the interbank market, futures markets, many gold Exchange Traded Funds (ETFs), derivatives market etc would have no possibility of delivering physical gold against their paper commitments.

- Gold bullion refers to specific pieces of physical metal held in your name and title. It is not a paper proxy for gold, but the real thing—and you own it outright.

When you own gold bullion, you can never suffer a default. There’s no counterparty to make good on a paper contract. Once you buy gold bullion, it’s yours, and it doesn’t require the backing of any bank, government, or brokerage firm.

- The most expensive investment anyone can buy today is paper gold. For $1,280, an investor will get a piece of paper saying he owns 1 ounce of gold. But he is unlikely to ever see that gold. Firstly, most investors who buy paper gold have no understanding of the real reason for holding gold and will therefore never contemplate taking delivery. And even if he did understand the importance of holding real gold, he is quite happy to hold the surrogate alternative which is paper rather than physical. This is of course what the issuer of the paper gold wants. He knows that paper gold buyers have no intention of taking delivery. This is perfect for the seller because he has no intention of making delivery either. And this is how paper markets function. Buyers and sellers are willing to trade pieces of paper that are said to represent an underlying instrument whether it is a stock, bond, currency or commodity.

- But paper markets are illusory. They give the impression that the buyers acquire a real share in the underlying instrument. That would be the case if for each unit of for example a currency or gold was backed by real money or real gold. But in today’s false markets that is far from the case. We live in a world of the Emperor’s New Clothes. The people is made to believe that the emperor is dressed in a suit made of gold whilst in fact he is naked. And that is exactly how the gold market functions today. Shorts are always naked which means that there is never an underlying asset backing the gold short sale. What the buyer is getting is a piece of paper with zero intrinsic value.

This is a perfect situation for central banks, banks and major trading houses such as hedge funds. With sufficient capital, they can manipulate any market without ever worrying about delivery. The result is markets which are totally fictitious and bears no resemblance to the instrument that is traded.

The gold price is not the price of gold!

That is why the price of a paper commodity has nothing to do with the underlying instrument. Paper trading can be leveraged hundreds of times or more and whatever the price the paper market trades at sets the price for the actual commodity. Thus, the paper market sets the gold price. The gold price is the paper price that the false gold market trades at. That has very little to do with the price of gold which is what the physical market would trade at if there was not a manipulated paper market. But buyers and sellers are not concerned about the real price of gold. Because they have no intention of owning the physical since they don’t understand its function.

But one day there will be this little boy who will shout out “The Emperor is naked” and then all hell will break lose. At that particular point, all holders of paper gold will ask for delivery and just like the Emperor, they will find out that there is no gold left in the vaults. The manipulators have then lost control of the market and the gold (and silver) price will go “no offer”. This means that gold is not offered for sale at any price because there isn’t any to sell.

- Time and time again we are seeing fraud taking place in the precious metals’ market. Thousands of tonnes of paper silver and paper gold are being dumped over just a few hours or days. For anyone who doesn’t understand what is happening, let me categorically state that this has nothing to do with the real physical market in gold and silver. No, this is blatant manipulation by governments and bullion banks as well as speculators. And since governments are involved, it is sanctioned by them with no consequences for the traders who are rigging the market.

BULLION BANKS FEAR THE DAY THEY MUST TURN PAPER GOLD INTO PHYSICAL

What is happening has nothing to do with real markets or real supply and demand. What we are seeing is governments trying to obfuscate their total mismanagement of the economy and the currency. So far, the bullion banks have been fortunate that gold and silver paper holders haven’t called their bluff and asked for physical delivery. Because we know and the banks know that the day they will need to come up with the real gold and silver bars, it is game over. Because they haven’t got physical gold or silver to cover even a fraction of their paper shorts. Between futures exchanges, bullion banks, including precious metals derivates contracts, there are hundreds of ounces of paper gold and silver outstanding for every ounce of physical backing.

The problem is that it is not only the bankers that are the culprits in this game. No, governments are just as culpable. Western banks officially hold 30,000 tonnes of gold. Virtually no Western central bank has ever had a physical audit of their gold. The US had their last audit during Eisenhower’s reign in 1953?

Western central banks have in the last few decades been liquidating a major part of their gold holdings. For example, he UK sold half of their gold holdings at the end of the 1990s and Switzerland sold over half. Norway sold ALL their holdings in the early 2000s.

What the central banks didn’t sell, they lent or leased to the market. They did this to earn a return on their gold. Most of the lending took place through LBMA (London Bullion Market Association) banks in London and some in New York. So a central bank would lend part of its gold to the market and the gold would stay within the London or New York pool. But that changed in the 2000s. The big buyers of gold are now China and India. Neither of these countries is interested in keeping their gold in London or New York. Instead they want physical delivery. The normal pattern is for the 400 oz bars to be sent from primarily London to the Swiss refiners to be broken down into 1 kg bars. The kilo bars are then exported from Switzerland to the buyers in China and India plus other major buyers like Russia. This is why the UK appears as a major exporter of gold.

- All you need to kmow on PAPER GOLD is here

If you're looking for a trend in paper gold thus far in 2019, it's clearly shown below.

Note the overt determination of The Banks to roll price backward following each Fed announcement.

Jan 30: FOMC meeting

Feb 20: January minutes

Mar 20: FOMC meeting

Apr 11: March minutes

Your daily Gold smackdown courtesy of a little man rapidly clicking a mouse button on behalf of fat cat cartelists

Asymmetrical markets thanks to the banksters Cartel International

That's the real gold!

Japanified World Ahead

|

|