|

|

Post by Entendance on Mar 28, 2023 12:09:10 GMT -5

Previously: Gold and Silver in 2023 I & The Physical Gold And Silver Beach 2015-2022

|

|

|

|

Post by Entendance on Mar 29, 2023 11:57:49 GMT -5

PHYSICAL GOLD BECAUSE:

◾It has been money for 5,000 years

◾It is the only money which has survived throughout history.

◾It guarantees stable purchasing power over time.

◾It is scarce – It cannot be printed.

◾It is durable – All the gold ever produced still exists.

◾It is nobody else’s liability – Thus no counterparty risk.

◾It is held and traded outside a fragile financial system – Thus gives independence.

◾It is the ultimate wealth preservation asset and insurance against a rotten world economy.

It's funny how sometimes a small decision today can change so much tomorrow. It's funny how sometimes a small decision today can change so much tomorrow. |

|

|

|

Post by Entendance on Apr 1, 2023 4:08:58 GMT -5

|

|

|

|

Post by Entendance on Apr 3, 2023 10:19:41 GMT -5

Banksters Cartel International LXXI Dear Friend of GATA and Gold:

Pam and Russ Martens note that JPMorganChase Bank holds 53% of all the monetary metals derivatives contracts in the U.S. banking system, through the bank and some of its traders have been criminally charged with rigging the monetary metals markets.

The Martenses write: "It is hard to understate the regulatory failure of allowing JPMorgan Chase to continue to have this outsized presence in the precious metals derivatives market."

Well, yes and no. For it's not hard to understand the regulatory failure. It is almost certainly a matter of law -- a matter of JPMorganChase's operating as the agent of the U.S. government in surreptitiously controlling gold and silver prices to protect the value of the U.S. dollar and U.S. government bonds.

This rigging is completely legal, since the U.S. government is authorized by the Gold Reserve Act of 1934 and related legislation to intervene in and manipulate any market in the world.

The Martenses long have done tremendous investigative reporting about corruption and unfairness in the financial system. So maybe they won't resent a suggestion for a little more such reporting.

That is, how about pressing the U.S. Commodity Futures Trading Commission as to whether it has jurisdiction over manipulative futures trading undertaken by or at the behest of the U.S. government?

That question has been put to the CFTC by both GATA and U.S. Rep. Alex X. Mooney, R-West Virginia, and the commission has refused to answer:

www.gata.org/node/19917

www.gata.org/node/20089

Of course that refusal is almost as good as an admission that JPMorganChase rigs markets for the U.S. government, but not quite.

Twenty-two years ago in U.S. District Court in Boston, seeking dismissal of GATA's lawsuit accusing the U.S. government, JPMorganChase, other bullion banks, and the Bank for International Settlements of surreptitiously rigging the gold market, an assistant U.S. attorney told the court that the government had the power to do exactly what the lawsuit complained of:

gata.org/node/4211

The assistant U.S. attorney did not admit that the government was doing what the lawsuit complained of, but the government's claiming the power should have provoked a little journalistic curiosity. It still should. Of course no such curiosity has yet been demonstrated by mainstream financial news organizations.

So if you want to know why the government lets JPMorganChase get away with so much of what seems like criminality, it's because in certain circumstances JPMorganChase is the government and the government is JPMorganChase, and while what they do together may be immoral and concealed, it's perfectly legal -- just as the biggest scandals usually are.

CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

CPowell@GATA.org

|

|

|

|

Post by Entendance on Apr 5, 2023 1:59:32 GMT -5

How a Central Bank in the Caribbean Recently Used Its Gold Revaluation Account to Cover Losses

'...Ultimately, COMEX and LBMA are going to fail to deliver, and then you will see an absolute moonshot in Gold and Silver...'

JPMorgan batters the Gold price again

A major development last week was the large amount of gold issued by JPMorgan over the first two days of the Comex April contract. Total gold deliveries by JPMorgan of 14,326 contracts, including 10,682 contracts (1.07 million ounces) by JPM from its proprietary house account were the largest by JPM in history.

This is big news because it demonstrates clear and blatant price manipulation by JPMorgan. With more than 19,000 contracts of gold standing for delivery, what would have been the price of gold had JPM not delivered more than 10,000 contracts from its house account? JPM Again

|

|

|

|

Post by Entendance on Apr 7, 2023 3:30:00 GMT -5

|

|

|

|

Post by Entendance on Apr 10, 2023 7:08:24 GMT -5

|

|

|

|

Post by Entendance on Apr 14, 2023 9:37:58 GMT -5

Being prepared for turbulent times ahead is key  Gold's biggest advantage? Gold cannot go bankrupt, unlike a bank. Gold over $2,000/oz is the new normal. Gold's biggest advantage? Gold cannot go bankrupt, unlike a bank. Gold over $2,000/oz is the new normal.

Schectman reports that retail demand for gold and silver exploded after the recent U.S. bank failures and that while demand long had been heaviest in silver, demand lately has shifted to gold. He recommends purchase of smaller coin units for their greater liquidity and flexibility in spending.

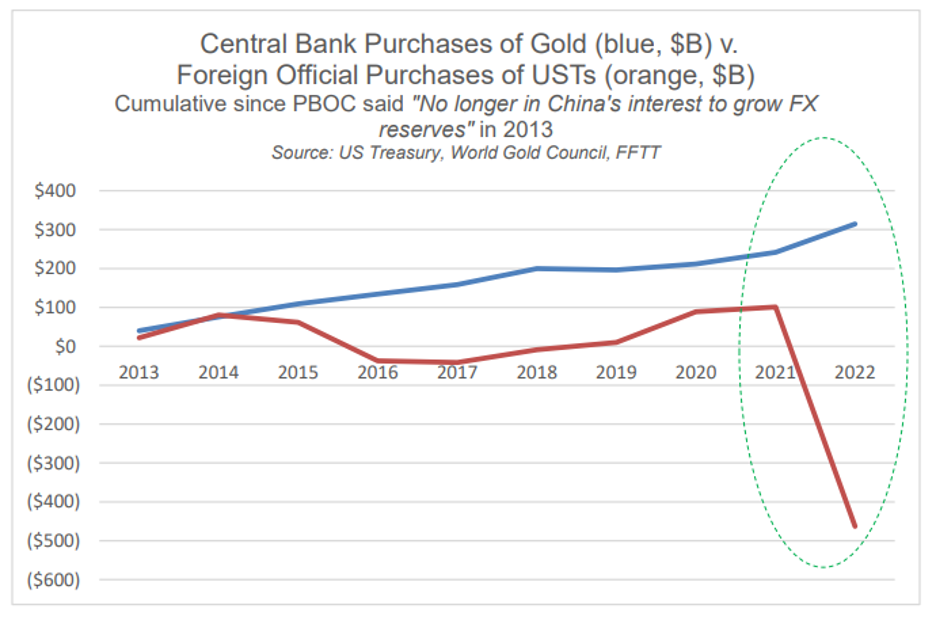

Weaponization of the U.S. dollar, Schectman notes, is uniting much of the world against the West and causing many nations to move out of the dollar. Meanwhile, he adds, central banks around the world are rapidlty adding to their gold reserves, indicating that some new international currency system arrangements will heavily involve gold.

Schectman wonders if the looming destruction of the dollar is meant as U.S. policy.

People should acquire the monetary metals, Schectman says, not to try to get rich but to protect themselves against the risk of currency destruction and the insolvency of banks.

|

|

|

|

Post by Entendance on Apr 17, 2023 1:14:48 GMT -5

Gold and silver cannot be debased by central banks expanding the money supply and precious metals do not carry counterparty risk as bank deposits do.

Ronan Manly: JPMorgan traders appeal, claiming that their 'spoofing' hurt no one

|

|

|

|

Post by Entendance on Apr 21, 2023 11:00:28 GMT -5

Ascent of central bank digital currencies bodes well for gold

|

|

|

|

Post by Entendance on Apr 25, 2023 4:24:49 GMT -5

Gold leading ‘revolt against dollar’ – economist

Is Saudi Arabia Selling Oil to China for Gold?

GATA – Gold Anti-Trust Action Committee

'...Breakup? '...Breakup?

So, the euro is facing soaring debt, political turmoil, a hobbled German industrial base, and demographic decline. Yep, not a pretty picture. And certainly not conducive to other countries viewing the euro as a safe haven asset.

Here’s the break-up scenario: Rising inflation forces the ECB to raise rates, which makes borrowing prohibitively expensive for the most overindebted eurozone countries. Under the threat of bankruptcy, they drop the euro and return to — and immediately devalue — their old currencies. The eurozone either reforms around a smaller core or disbands completely. Either way, the turmoil diminishes the euro’s reserve appeal.

The beneficiaries: Gold and the dollar in the short run, and gold-backed currencies further out.' Can The Euro Be Saved?

|

|

|

|

Post by Entendance on Apr 28, 2023 1:58:44 GMT -5

|

|

|

|

Post by Entendance on Apr 29, 2023 3:24:21 GMT -5

Singapore's central bank (MAS) bought another 17.24 tonnes of during March, bringing its total gold reserve holdings to 222.4 tonnes. MAS has now bought 68.6 tonnes of gold during Q1 2023.

'Most investors are totally ignorant of the purpose of gold or its historical significance.

After all, Gold is the only money that has survived in history but virtually nobody is aware of this vital information.

That’s why only 0.5% of global financial assets are invested in gold. Still most people put their trust in paper money.

In spite of the title, in this article I will be a Mug for a day and make some gold and silver projections.

Investment managers ignorance of gold is mainly due to the fact that they can’t churn commission by holding physical gold. Their primary job is to convince investors that they have superior skills and knowledge of the market.

Still, 99% of these so called experts underperform the market by a wide margin.

Most of them, for example, are not aware that their clients could have put their money into gold at the beginning of this century and today would have seen their investment multiply 7 times or more depending on their base currency...

...SILVER – GOLD ON STILTS

So let’s look at gold on stilts which is SILVER. Silver is very volatile and not for orphans and widows. Silver normally goes both up and down at least twice as fast as gold. That means absolute euphoria on the upside but total misery when it goes down.

Currently both the fundamental picture (industrial demand, shortages etc) and the technical picture is superb. At some point, probably this year, silver could reach $50 on its way to much higher levels.

If gold reaches my very old target of at least $10,000 (remember I am now a mug) and the gold-silver ratio reaches its historical average of 15, silver would go to $666!

666 for gold is also a biblical number. In the Chronicles 9:13 it says:

“The weight of gold that came to Solomon in one

year was six hundred sixty-six talents of gold.”

666 Talents is 22 tonnes of gold which today is worth $1.4 billion

MUG FOR A DAY

I stopped making price projections in gold and silver some time ago since they are meaningless.

Measuring Gold – Nature’s Money and Eternal Wealth in what governments and central banks destroy on a daily basis clearly makes no sense whatsoever. Therefore price projections of gold are totally meaningless.

Still I decided to be a mug for a day and make the forecast that everyone wants to hear. So please ignore the gold “forecasts” above of $10,000, $20,000 or $200,000 or silver $666. Just take it as an oddity!

More importantly, remember that PHYSICAL gold and some silver are likely to give you protection in what will probably be the worst crisis in the history of the world.

And even more importantly, it could make it possible for you to help family and friends who will suffer in the coming difficult times...'

People talking but they just don't know

What's in my heart, and why I love you so

I love you, baby, like a miner loves Gold

Come on, sugar, let the good times roll

Hey!

|

|

|

|

Post by Entendance on May 2, 2023 1:59:24 GMT -5

|

|

|

|

Post by Entendance on May 3, 2023 11:16:00 GMT -5

|

|

|

|

Post by Entendance on May 4, 2023 2:20:53 GMT -5

In his weekly appearance on Kinesis Money's "Live from the Vault" program with Shane Morand, London metals trader Andrew Maguire predicts that dips in gold and silver futures prices will be shallow because speculators have mostly been driven out of the market and physical demand is strong.

Official intervention in the monetary metals markets is becoming more difficult, Maguire says.

May 4, 2023 May 4, 2023

|

|

|

|

Post by Entendance on May 6, 2023 4:22:16 GMT -5

'You can't make this up. The banksters are crying for the SEC to ban shorting of banking stocks because it distorts and misrepresented the underlying value and confidence in the industry. REALLY?! What about the 50 years of concentrated Silver shorting by less than 4 large bullion banks?! WHAT COMES AROUND GOES AROUND! PS - The SEC won't change the rule until they get to FRY some of the current banking shorts! Next week maybe?'

'...From a technical point of view, the gold price’s bullish chart is almost perfect. The only question is how long the price will consolidate at or above the previous highs at $2070. Once that is dealt with, price targets above $2500 become mere debating points.

Driving it all is growing evidence of a banking crisis in America which is likely to worsen. And no one yet seems to be talking about problems in other banks in other jurisdictions. Particularly in the Eurozone, commercial banks have the same problems with a tightening cycle that started later than that of the US.

All this means heightened counterparty risk. The response by banks is sure to be to tighten their lending standards further, and to contract total credit. What almost no one seems to realise is that contracting credit leads to higher interest rates reflecting credit shortages.

This throws the burden of credit creation increasingly onto central banks. They have lost control over interest rates, and they need to make a choice: do they act to save their financial systems and stop an economic slump, or do they save their currencies? they cannot do both.

Meanwhile, the only banking systems seeing rising share prices are the Chinese. For the rest, there is increasing uncertainty and fear of failures. There is no room for central bankers and treasury ministries to exercise judgement over moral hazard.'

|

|

|

|

Post by Entendance on May 10, 2023 3:21:21 GMT -5

|

|

|

|

Post by Entendance on May 12, 2023 1:20:17 GMT -5

Precious metals expert David Morgan talks gold, silver, crypto, banks and fiat with Mike Adams

Remember: the technicians do not help produce yachts for the costumers, but they do help generate the trading that produces yachts for the brokers.

|

|

|

|

Post by Entendance on May 13, 2023 6:07:05 GMT -5

Alaska House passes bill to make gold and silver legal tender |

|

|

|

Post by Entendance on May 15, 2023 8:22:12 GMT -5

GoldSeek's Waltzek and GATA's Murphy await blastoff for monetary metal

|

|

|

|

Post by Entendance on May 19, 2023 1:42:41 GMT -5

London metals trader Andrew Maguire, speaking with Shane Morand on this week's "Live from the Vault" program from Kinesis Money, says central banks, excepting the Federal Reserve, are positioning themselves for an upward revaluation of gold, that the price for physical gold in China is already substantially higher than the nominal price in the West, and that suppression of gold prices on the New York Commodities Exchange is being exploited to drain gold out of London. !

[H/T Tom from Florida]

|

|

|

|

Post by Entendance on May 19, 2023 23:54:40 GMT -5

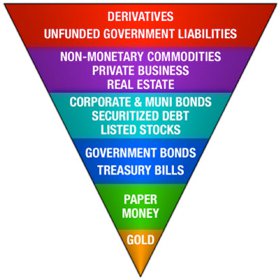

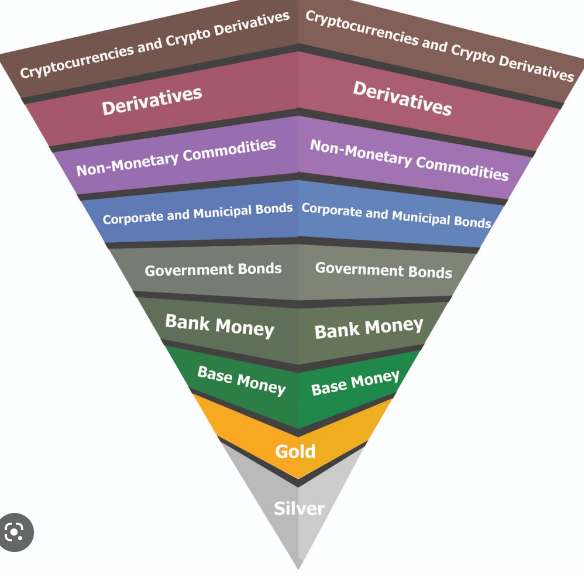

I find John Exter’s upside down debt pyramid to be an extremely useful model for developing a visual understanding of the monetary system and economic cycles.

In order to make use of it though, we must first make the distinction between real wealth and claims on wealth. Real wealth is represented by actual items that people want or need. This can be food, land, natural resources, buildings, factories etc. Financial assets, shown as layers in the pyramid, represent claims on real wealth. In a fully developed financial system, in good perceived standing, there is a high ratio of claims on wealth to actual underlying real wealth. In this environment the average buying power of the financial assets is lower. This can best be observed by looking at the purchasing power at the bottom of the pyramid. Gold is at a minimum here. It is competing with all of the other claims on wealth for a relatively constant amount of underlying real assets.

According to Exters theory of money, when economies get into trouble through the accumulation of too much debt, the levels of the pyramid disappear in order from highest to lowest. As the pyramid contracts downward, the remaining layers represent a proportionally higher claim on the real underlying wealth. In other words their value increases. Using gold as our reference point, it’s relative purchasing power increases as the pyramid contracts. Gold finds itself in a secular bull market.

In the extreme hypothetical case where all other assest classes are destroyed, including the currency itself, only gold remains. In this case the holders of gold compete with no other financial assets for claims on the underlying wealth. This scenario represents the ultimate clearing of the economy. All currency denominated debts have been wiped clean.

If a market economy remains in place then the pyramid begins to expand and grow again. The wealth claims represented in gold will be deployed as investments and a new currency will emerge that garners the faith of those who use it. As this new economy grows and expands, the previous instruments of credit and financing will appear again. Layer upon layer are added back to the pyramid. From the perspective of gold, its relative purchasing power decreases as it competes with these new financial assets for claims on the underlying real wealth. Gold is in a secular bear market as the newest levels of the pyramid are in their growth phase.

This model provides a useful intuitive understanding of the alternating secular bull and bear markets of commodities vs. equities. Bear in mind that normal cycles of expansion and contraction of the system involve only the outermost levels of the pyramid. Only in extreme historical examples does the contraction reach the lowest levels in which the currency itself is destroyed.

Of course a visualization this simplistic is only intended to give a very broad understanding of some of the root fundamentals that drive economic cycles. On top of this are many complications that arise from not only the extraordinary complexity of the global financial system but also of the massive non market interventions of government and central banking.

Bailouts and the propping up of assets represent distortions in the anticipated successive evaporation of layers from the pyramid. Layers may temporarily appear and disappear out of order as non market forces hold temporary reign.

Additional complexities arise when the currency itself is at risk as it usually serves are the numeraire or reference point by which the purchasing power of other asset classes is measured. During rapid currency debasement an asset may appear to be rising in nominal terms but actually decreasing as a claim on the underlying wealth. A good example of this is the difference in the DOW since 2000 when priced in Dollars vs. ounces of gold.

-Paul on November 20, 2010

|

|

|

|

Post by Entendance on May 23, 2023 1:48:43 GMT -5

Unveiling India's fascinating relationship with Gold Unveiling India's fascinating relationship with Gold ⭐

|

|

|

|

Post by Entendance on May 24, 2023 5:02:34 GMT -5

|

|

|

|

Post by Entendance on May 25, 2023 1:26:24 GMT -5

|

|

|

|

Post by Entendance on May 27, 2023 5:37:11 GMT -5

Fiat currencies don’t float. They just sink at different rates. Fiat currencies don’t float. They just sink at different rates.

Physical Gold is not bought for instant gains but as insurance and protection against a rotten financial system and constantly depreciating currencies.

If you buy Gold for the right reason, you are buying ounces or kilos of real wealth that should not be measured on a regular basis in a currency which is being debased on a daily basis with unlimited printing of worthless paper money.

Your best friend when it comes to supporting the value of Gold is your central bankster. Remember that throughout history he has without fail worked diligently to destroy the currency.

Right now we are in the midst of the biggest global money printing exercise in history. Gold has not even started to reflect the total annihilation of paper money

Like all manipulation the chicanery in the paper Gold and Silver markets will eventually fail spectacularly.

In the coming bear market for currencies and bull market for precious metals, Gold and Silver will not just maintain purchasing power but massively outperform and become the must have investment.

But above all, do not buy Gold and Silver for speculative purposes. Gold and Silver is your insurance against the coming end of a monetary era when all currencies and bubble assets will implode.

|

|

|

|

Post by Entendance on Jul 18, 2023 4:46:03 GMT -5

“Imagine that? We have said this for years and been called “conspiracy theorists” for even having the thought. ALL markets are rigged and it starts with Gold and Silver as they are direct competitors to the world’s fiat currencies. It all starts with suppression of Gold’s (and Silver) price so they can point at Gold and say “see, dollar good …Gold BAD!” As the global Ponzi is about to fail, these riggers are about to get the religious experience of their lives! Gold will again be seen as “money”, which will make high quality Gold and Silver bearing properties “banks”. The train is now leaving the station.

You either get on board now and take a ride to the greatest redistribution of wealth in human history, or…wallow with no purchasing power in the debt-based currency system as it bankrupts into a vortex that will take everything paper straight to hell! - Bill Holter

|

|

|

|

Post by Entendance on Jul 20, 2023 3:15:06 GMT -5

|

|

|

|

Post by Entendance on Jul 21, 2023 11:51:18 GMT -5

|

|