|

|

Post by Entendance on Mar 25, 2024 6:11:55 GMT -5

Meanwhile... Gold Investing Handbook for Asset Managers PDF Gold Investing Handbook for Asset Managers PDF

|

|

|

|

Post by Entendance on Mar 31, 2024 1:57:01 GMT -5

Local currency planning for potential US collapse. (0:03)

- Using gold-backed currency to revitalize state economies. (2:36)

- Funding Texas government without income tax. (6:24)

- Gold-backed currency and its benefits. (8:40)

- Off-grid money options during economic collapse. (13:09)

- Violence, firearms, and self-defense in the US. (0:00)

- Potential violence in the US. (2:45)

- Defensive preparedness in the face of violence. (6:29)

- Gold-backed currency and laboratory testing. (10:13)

- Gold and silver as off-grid money during economic collapse. (14:01)

|

|

|

|

Post by Entendance on Apr 3, 2024 2:06:58 GMT -5

|

|

|

|

Post by Entendance on Apr 6, 2024 1:48:17 GMT -5

Sell everything whose value only exists as a result of confidence in central banksters!

|

|

|

|

Post by Entendance on Apr 10, 2024 2:41:26 GMT -5

Everything changes and nothing remains still; you can’t step twice into the same stream. -Heraclitus of Ephesus

⏬

'...they want Gold because Gold is being remonetized all around the🌐!...'

[On February 8, 2023 Gonzalo Lira (February 29,1968 - January 12,2024) was spot on] ⏬

⏬

|

|

|

|

Post by Entendance on Apr 13, 2024 1:35:59 GMT -5

[🏝️At some point the market will discover that much of Western society's wealth has become entrapped in non-cash-flowing malinvestments. That is when PMs will shoot into the multi-K of 💲 per ounce.] [🏝️At some point the market will discover that much of Western society's wealth has become entrapped in non-cash-flowing malinvestments. That is when PMs will shoot into the multi-K of 💲 per ounce.]

The U.S. government may be tempted to restrain gold prices, but this would only serve to drive bullion higher, according to the latest Greed & Fear Report from Christopher Wood, Global Head of Equity Strategy at Jeffries.

Wood wrote that there is an "obvious temptation on the part of a major central bank to seek to try to manage the gold price," and shared an anomalous move in Comex gold futures as an example of how this kind of management might appear.

"At 3 p.m. New York time last Thursday there was a $1. billion sale of gold futures in about three minutes that temporarily knocked the bullion spot price," he pointed out, and while he has no idea who was behind it, he noted that "a soaring gold price is not in the interest of the relevant authorities any more than a surging oil price is."

Wood wrote that while the drivers of the oil price rally are fairly obvious, "the near-term drivers of the current gold rally are much less clear." ...

865MM ounces is about a full year of global mine supply!

|

|

|

|

Post by Entendance on Apr 14, 2024 1:22:08 GMT -5

Gold

Goldman Sachs is bullish to $2,700

Bank of America is expected to be $3,000

...The Malignant Seven ...The Malignant Seven

1. Every debt crisis leads to a currency crisis—hence: Good for gold.

2. All paper currencies, as Voltaire quipped, eventually revert to their paper value of zero, and all debt-soaked nations, as von Mises, David Hume and even Ernest Hemingway warned, debase their currencies to retain power—hence: Good for gold.

3. Rising rates (and fiscal dominance) used to “fight inflation” are too expensive for even Uncle Sam’s wallet, thus he, like all debt-soaked nations, will debase his currency to pay his own IOUs—hence: Good for gold.

4. Global central banks are dumping unloved and untrusted USTs and stacking gold at undeniably important levels—hence: Good for gold.

5. After generations of importing US inflation and being the dog wagged by the tail of the USD, the BRICS+ nations, prompted by a weaponized Greenback, are now turning their tails slowly but surely away from the USD dog—hence: Good for gold.

6. The Gulf Cooperation Council oil powers, once seduced (circa 1973) into a Petrodollar arrangement by a high-yielding UST and globally revered USD, are now openly selling oil outside of the 2024 version of that far less-yielding UST and far less-trusted USD—hence: Good for gold.

7. That legalized price-fixing sham otherwise known as the COMEX employed in 1974 to keep a permanent boot to the neck of the gold price, is running out of the physical gold needed to, well…price fix gold—hence: Good for gold... Why Is Gold Rising Now,

|

|

|

|

Post by Entendance on Apr 17, 2024 2:14:07 GMT -5

Bill’s Commentary:

Recently I have fielded several e-mails asking about selling gold and silver to wait for a pullback. While a pullback seems surely warranted, there is huge risk in trying to trade at this juncture. We are in the end game already, what is happening is multigenerational and global. We are witnessing the end of Dollar dominance with a fiat “competitive” devaluation across the board.  We are witnessing end of empire! The danger of being cute and trying to time a trade here is enormous. You must be “in place” when the music stops, which it mathematically will. If you have taken profit and intend to trade, what happens if (when) the system breaks and gold nor silver are even available for purchase? Your “profit” will be sitting in a bank/broker, and will be bailed in. So you lose your cash and sold someone else your ounces? THIS is the rally you cannot afford to sell. You presumably bought metal to get your capital out of the system, if you purchased to make “dollars” as profit, then this brief article is not for you. Please remember this, in a very short time, you will be counting your net worth in ounces, not dollars. Be your own Central Bank! We are witnessing end of empire! The danger of being cute and trying to time a trade here is enormous. You must be “in place” when the music stops, which it mathematically will. If you have taken profit and intend to trade, what happens if (when) the system breaks and gold nor silver are even available for purchase? Your “profit” will be sitting in a bank/broker, and will be bailed in. So you lose your cash and sold someone else your ounces? THIS is the rally you cannot afford to sell. You presumably bought metal to get your capital out of the system, if you purchased to make “dollars” as profit, then this brief article is not for you. Please remember this, in a very short time, you will be counting your net worth in ounces, not dollars. Be your own Central Bank!

Standing watch, Bill Holter Standing watch, Bill Holter

SILVER RED ALERT! 2024 World Silver Survey is FAKE NEWS! ALL HISTORICAL #'s WERE CHANGED! -Bix Weir📢⚡️📢

World Silver Survey 2024 World Silver Survey 2024 PDF PDF

⏬ ⏬

|

|

|

|

Post by Entendance on Apr 23, 2024 3:29:52 GMT -5

Dear Friend of GATA and Gold:

This week's edition of Kinesis Money's "Live from the Vault" program has London metals trader Andrew Maguire and U.S. monetary metals dealer Andy Schectman discussing Asia's revolt from the United States' system of manipulating commodity prices via the futures markets. They think the climax of that revolt, the world's "de-dollarization," is far closer than the conventional wisdom maintains.

Maguire and Schectman preface their discussion with compliments for GATA's work exposing gold market manipulation...

15:00 The military application of silver and its affect on supply & demand

21:30 The Fed has been trapped for over 20 years

27:00 Historical statements by the chairman of the Shanghai Gold Exchange

34:00 BRICS currency update

Dear Friend of GATA and Gold:

Jeffrey Christian, managing director of metals consultancy CPM Group, today spent 16 minutes on YouTube raising and knocking down some straw men to give his viewers the misleading impression that there is nothing to be doubted about the U.S. government's involvement with the gold market.

Christian challenged long-made but usually anonymous assertions that the U.S. gold reserve at Fort Knox, Kentucky, is gone or missing in large part. He notes that there are official audits asserting that all the gold is where it should be. Those who cast doubt on the integrity of the audits, Christian says, are "scum"...

'...There are a large number of different investment products that aim to help investors gain exposure to silver but nearly all of them are variants of the risky paper silver discussed earlier. In these precarious times, there is no substitute for physical silver and gold that you have in your possession, free and clear from any claims on it. When the going gets tough, nothing compares to the peace of mind that comes from owning physical precious metals that have helped humans preserve their wealth for thousands of years.' -Jesse Colombo here

|

|

|

|

Post by Entendance on Apr 30, 2024 2:25:20 GMT -5

|

|

|

|

Post by Entendance on May 4, 2024 4:30:31 GMT -5

|

|

|

|

Post by Entendance on May 6, 2024 1:35:40 GMT -5

'...the biggest push is for solar panels, which pretty much everyone sees as silver’s deus-ex-machina...'

'Poor America. Poor Jerome Powell…

A Real Cliff, Fake Smile

It is no fun to be openly trapped, and even less fun to be in open decline while meekly declaring all is fine.

I have the image of Uncle Sam (or Aunt Yellen) hanging off a cliff with a forced (i.e., political) smile.

Above the cliff is a grizzly bear; below the cliff is a pool of sharks.

In short: Whichever direction one picks, the end result is messy.

And yet the markets still wait for Powell to make the right choice.

What right choice?

Rate Cut Salvation?

As of today, the markets, pundits and FOMC circus followers are all wondering when Powell’s promised rate cuts will come to save the Divided States of America and its Dollar-thirsty, debt-dependent “growth narrative.”

In January, Powell was “forward guiding” rate cuts and thus, right on cue, the Pavlovian markets, which react to Fed liquidity in the same way Popeye reacts to spinach, ripped north on words alone.

YTD, the S&P, SPX and NASDAQ are rising on rising rates hoping to morph lower.

Even Gold and BTC are rising on rising rates—all of which makes no traditional sense—unless, of course, markets are just waiting for the inevitable rate cuts, right?

And who could blame them? After all, Powell promised the same, and Powell, the voice of “transitory inflation,” never mis-speaks, right?

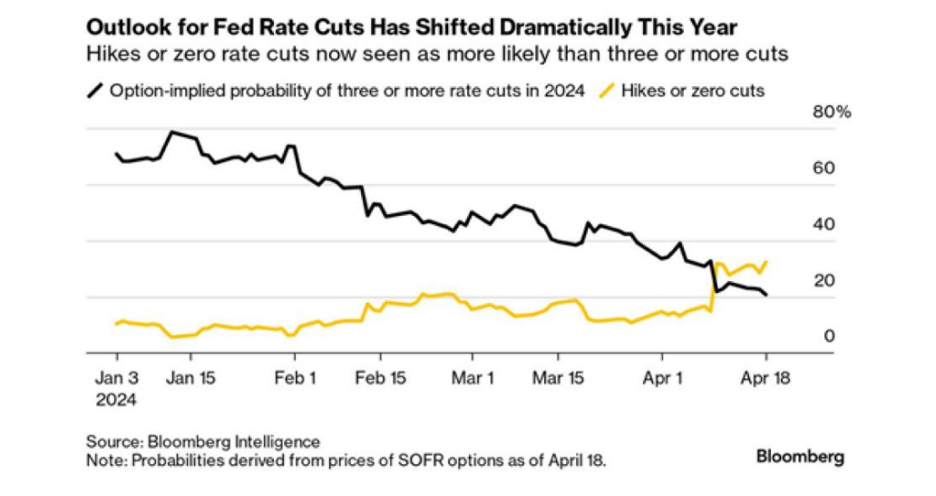

But now the May markets, and even the Bloomberg Intelligence Reports, are worrying out loud about no rate cuts at all for 2024?

So, what will it be? Higher for longer? No more cuts? Three cuts in 2024?

What to do? How to know?

Break out the tarot cards? Read Powell’s palm? Beg?

Here’s My Take: Stop Caring, Because Either Way, We’re Screwed…

EU Officials Eye Bailout Fund as Source of ‘Cheap Loans to Buy Weapons’ - Report

The Entendance Beach Policy:

The praetor does not concern himself with trifles.

Il pretore non si occupa di cose di poca importanza.

|

|

|

|

Post by Entendance on May 11, 2024 2:44:37 GMT -5

🇮🇪You have to choose (as a voter) between trusting to the natural stability of Gold and the natural stability of the honesty and intelligence of the members of the Government. And, with due respect for these gentlemen, I advise you, as long as the Capitalist system lasts, to vote for Gold. -George Bernard Shaw

🇮🇪Tara Coins is inspired by the beautiful ‘Hill of Tara’ - the ancient and sacred seat of Irish High Kings in Ireland for over 5,000 years. Tara Coins evokes this deep and rich mythological, historical, cultural and spiritual tradition and the brand signifies freedom, beauty and abundance.

The precious metals complex had a pretty good run since early March. Gold, silver, and the miners got quite overbought and deserved to relax and digest those gains, which is what we’ve seen the past 2-3 weeks. For many years now, metals bulls have repeatedly asked “when”? It looks to me like “when” is NOW! I believe this coming week may be the most interesting week we have seen in many many years. I have pasted 3 charts, gold, silver and the HUI mining index. Before you tell me that because the metals complex is so rigged that charts are meaningless, please be patient. Something has definitely changed. That change is what we believed all along, that the physical markets would overwhelm the paper markets. This is, and has, been happening with China a huge buyer of physical gold and India the same with silver. There are now premiums on the SGE over and above COMEX and LBMA which has led to arbitrage moving physical metal from West to East and definitely tightening available supply for the paper traders to use to satisfy deliveries. The precious metals complex had a pretty good run since early March. Gold, silver, and the miners got quite overbought and deserved to relax and digest those gains, which is what we’ve seen the past 2-3 weeks. For many years now, metals bulls have repeatedly asked “when”? It looks to me like “when” is NOW! I believe this coming week may be the most interesting week we have seen in many many years. I have pasted 3 charts, gold, silver and the HUI mining index. Before you tell me that because the metals complex is so rigged that charts are meaningless, please be patient. Something has definitely changed. That change is what we believed all along, that the physical markets would overwhelm the paper markets. This is, and has, been happening with China a huge buyer of physical gold and India the same with silver. There are now premiums on the SGE over and above COMEX and LBMA which has led to arbitrage moving physical metal from West to East and definitely tightening available supply for the paper traders to use to satisfy deliveries.

This first chart is gold which moved to all time highs. You will see a roughly 33% move up since last October, and close to a 20% move since late February. The move since February saw some serious overbought readings which you would expect to see with a move of this magnitude. If you look at the bottom of the chart, you will see the MACD (moving average convergence/divergence). This indicator can be quite useful leading up to a breakout or a breakdown. In this case, it looks to me like another push higher to further new highs is imminent. You will see a “hook” turning up, it has not crossed over yet but very close indeed! Here we have silver. Silver has been JP Morgan’s beaten up and battered red headed stepchild. The silver market is maybe only 1/10th the size of gold, so obviously it is much easier to “manage” or manipulate. Since late February it’s had a nearly 40% move. Just as gold, it is no longer overbought but a little further advanced on the MACD “hook”. In fact, it closed Friday minutely crossing over to positive. The setup tells me that the coming week (maybe two) will be extremely telling of the future direction and do so in a huge way. “They” (the cabal) must either slam the metals complex here and now to abort the chart patterns, or suffer the consequence of a full on (and more importantly GLOBAL) “bank run” out of dollars/US Treasuries and into gold/silver/miners. $30+ silver looks like it could be only a day or a few days away. This will green light a very quick move to the $50 level where another battle will be fought …unless of course if a failure to deliver occurs, then all bets are off and the sky (floor for fiats) is the limit. I have been on the record for years that the entire fiat experiment would end in a failure to deliver physical metal. We may see this in very short order!

Lastly we have the beaten up HUI index. Same as silver, no longer overbought and the MACD infinitesimally crossed over higher on Friday. A picture perfect set up if you ask me, not severely overbought and within spitting distance of a breakout!

In conclusion, it looks like this week could be super exciting for those who have held “real money” for so many arduous years. Please remember, gold and silver do not “go up or down”, they are merely a mirror image of fiat. The real way to say the above is, this may be the week where the collapse of fiat is seen in its full nakedness! Though there are some who buy gold and silver because they believe they will “go up”, the REALLY BIG money buys metal to get out of fiat and the system as a whole. A bank run away from the system if you will? Whether or not they can find and kill Bin Laden for a 9th time remains to be seen, but they had better pull some sort of rabbit out of the hat immediately. Otherwise, we will see gold, silver, and the miners breaking out to new ground and the train fully pulled out of the station within a week or two.

There is no bull market like a gold bull market the saying goes. This is because “fear is a far greater emotion than greed”.  A stampede into the metals will ultimately create a failure to deliver. When you tell a human that something is not available at any price, they only want it that much more! You are watching the canary in the coal mine, how much life is left in the empire? Stay tuned! A stampede into the metals will ultimately create a failure to deliver. When you tell a human that something is not available at any price, they only want it that much more! You are watching the canary in the coal mine, how much life is left in the empire? Stay tuned!

Standing watch, Bill Holter

|

|

|

|

Post by Entendance on May 14, 2024 4:46:04 GMT -5

I’ve previously said that gold could reach $15,000 by 2026. Today, I’m updating that forecast.

My latest forecast is that gold may actually exceed $27,000. -James G. Rickards here

Silver has seen notable upticks before the last two presidential Silver Outlook: Technical Setup Supports Summer Price Spike

Confirmation of this trend would be a breach above $30.00, likely triggering a surge towards $40 between June and August.

Should prices fail to overcome the $30.00 mark in May, the next opportunity will arise following the next intermediate cycle low expected in the first half of June. Presidential Election Silver Spikes Volatility increases ahead of presidential elections as markets anticipate leadership change or more of the same. In 2016 and 2020, prices spiked into July and August respectively, setting up a potential repeat in 2024. A short-covering rally could drive prices towards $40 by late summer, with a spike to $50 possible. Metals and Mining Update

GOLD- Gold is breaking away from its consolidation pattern and could make fresh cycle highs in May. To promote this view, I'd like to see one or more closes above $2400. SILVER- Silver is breaking strongly from the consolidation pattern and could reach fresh highs in May. Should prices break through $30.00, the ingredients are in place for an explosive rally. PLATINUM- A breakout above $1000 appears imminent and could spark an explosive move towards $1150. GDX- Miners closed above $35.00, and prices could challenge $40.00 in May should gold make fresh cycle highs. GDXJ- Juniors closed decisively above $43.00, and we may be entering the next stage of this advance.

SILJ- Silver juniors jumped over 5% and finished just above $12.00. We could see significant upside, especially if spot silver breaks through $30.00. Metals and miners confirmed new bull markets. The setup in silver looks explosive and prices could rip to the upside above $30.00. - AG Thorson

|

|

|

|

Post by Entendance on May 17, 2024 4:32:13 GMT -5

|

|

|

|

Post by Entendance on May 18, 2024 4:56:01 GMT -5

|

|

|

|

Post by Entendance on May 23, 2024 2:57:50 GMT -5

|

|

|

|

Post by Entendance on May 25, 2024 7:09:10 GMT -5

$39 oz Silver premium peak paid this week in China...

Silver still -80% off rigged CPI high of Jan 1980

|

|

|

|

Post by Entendance on May 28, 2024 10:45:39 GMT -5

- Gold-backed currencies as alternative to collapsing US dollar. (0:03)

- Gold and silver as currencies in a post-dollar world. (4:21)

- Using gold and silver as currency alternatives to replace the current financial system. (10:03)

- Investing in gold and silver for financial security. (15:15)

H/T Tom from Florida

|

|

|

|

Post by Entendance on May 31, 2024 1:14:50 GMT -5

Russia could retaliate by freezing the entire Western clearance system, warns Jim Richards, New York Times bestselling author. In an exclusive interview with Daniela Cambone, Richards explains that if Western countries seize Russian assets, Russia could sue Euroclear, the largest clearing, settlement, and custody organization in Europe, to recover damages. “You could throw a monkey wrench into the entire global clearance and settlement system by disrupting Euroclear, which is probably second only to DTCC in terms of settlement and clearance.” Additionally, Richards states that we may need to return to the gold standard to restore confidence in the U.S. dollar. “But if you have to go back to a gold standard, $27,000 would have to be the price in order to avoid massive deflation.”

|

|

|

|

Post by Entendance on Jun 1, 2024 5:25:08 GMT -5

|

|

|

|

Post by Entendance on Jun 2, 2024 2:22:04 GMT -5

US debt is a Ponzi scheme that is coming to an end. Gold is forever.

|

|

|

|

Post by Entendance on Jun 4, 2024 3:10:22 GMT -5

Banksters Cartel International LXXXIX

|

|

|

|

Post by Entendance on Jun 8, 2024 1:47:01 GMT -5

Scott Ritter another American voice for sanity and peace gets cancelled

|

|

|

|

Post by Entendance on Jun 9, 2024 3:46:33 GMT -5

|

|

|

|

Post by Entendance on Jun 11, 2024 1:42:44 GMT -5

Banksters Cartel International LXXXX

|

|

|

|

Post by Entendance on Jun 14, 2024 2:05:17 GMT -5

Two fundamentally different bull markets are both being driven by physical demand, leaving bullion banks and the entire western financial system trapped by its paper obligations...Gold and silver’s physical drivers

|

|

|

|

Post by Entendance on Jun 15, 2024 2:54:23 GMT -5

Nations who have submitted applications to join BRICS:

Azerbaijan, Algeria, Bangladesh, Bahrain, Belarus, Bolivia, Venezuela, Vietnam, Honduras, Zimbabwe, Indonesia, Kazakhstan, Cuba, Kuwait, Morocco, Nigeria, Nicaragua, Palestine, Pakistan, Senegal, Syria, Thailand, Turkey, Uganda, Chad, Sri Lanka, Equatorial Guinea, Eritrea and South Sudan. 'There is but one party in Washington D.C..The Republicans and the Democrats form a Uniparty of Debt and Death with each election. No matter who is elected we get further into debt. In fact, the interest on the debt is larger than the largest U.S. military budget ever! Now comes the crisis inflection where the debt rises trillions in mere months. At some point the paychecks stop and the party is over. This will not end well and silver is the best financial protection from the collapse. Silver Shield strikes offer real tangible ICO collectible value above silver.' HERE

|

|

|

|

Post by Entendance on Jun 17, 2024 1:42:32 GMT -5

Dear Friend of GATA and Gold (and Silver):

Friends confirmed tonight that silver market analyst Ted Butler, who exposed and became the scourge of silver market manipulation for almost three decades, died Saturday. Butler lived in Florida and wrote about silver market manipulation since 1996. In 2009 he formed Butler Research LLC and began publishing a subscription newsletter. He often scolded the U.S. Commodity Futures Trading Commission for its failure to recognize or even look for silver market manipulation, peppering the agency with detailed letters and usually receiving replies that were at best evasive. But in the process he did much to alert investors that powerful forces were striving to suppress silver prices, and increasingly having trouble doing so.

GATA sends its respects to Butler's family and will aim to distribute his formal obituary when it becomes available.

-CHRIS POWELL, Secretary/Treasurer

Gold Anti-Trust Action Committee Inc.

|

|

|

|

Post by Entendance on Jun 18, 2024 3:00:49 GMT -5

|

|