|

|

Post by Entendance on Jun 19, 2024 2:58:20 GMT -5

'...Ted was the only precious metals commentator on the Internet with any commodity-trading experience...twenty-five years worth...first at Drexel Burnham Lambert -- and then with Merrill. He was an authority on futures, options, swaps, spreads, precious metals leasing...the lot -- as that was his livelihood. Nobody -- and I mean nobody, held a candle to him... Ted was very opinionated...bordering on irascible -- and because of the thousands of times we spoke, I never quite knew what version of Ted I was going to get when he picked up the phone. And by the way, he never called me...as he was the master -- and I the student. That unsaid relationship was firmly established at the beginning -- and we both knew the rules, even though they were never spoken. There are times in life when one has to set one's ego aside if you wish to advance in life -- and for me, this was one of them.

He had a low opinion of everybody that wrote about the precious metals on the Internet -- and for very good reason...even me at times.

|

|

|

|

Post by Entendance on Jun 20, 2024 11:16:08 GMT -5

📉Janet Yellen, the BRICS & Gold sales woman of the year😂 - US theft of Russian assets, with US Treasury Secretary Janet Yellen justifying the action as legal. (0:03)

- US economic sanctions and their impact on global currencies. (2:03)

- The potential of the BRICS currency as a decentralized, non-US-dominated world reserve currency. (7:13)

- New economic system using gold and currencies for international trade. (12:23)

- The potential replacement of the US dollar as the global reserve currency with the BRICS currency. (17:46)

- The potential of the BRICS currency as an alternative to the US dollar and its implications for global finance. (23:20)

- The potential collapse of the US dollar and the BRICS currency, with references to gold and economic destruction. (27:42)

- Investing in gold and silver for financial protection. (33:37)

|

|

|

|

Post by Entendance on Jun 22, 2024 5:27:18 GMT -5

GOLD PRICE vs. S&P 500 THIS CENTURY

Gold Price vs Stock Market - 100 Year Chart with related charts➡️ HERE ...Why this ongoing Western derivative price containment scheme is going to fall apart spectacularly...

...We will continue that battle onwards to the eventual Mania phase that will vindicate his life's effort...

Rest in peaceTed Butler

⬇️

|

|

|

|

Post by Entendance on Jul 14, 2024 2:58:02 GMT -5

'...Going Around Rather than Replacing the Dollar

For me  , debating a gold-backed new currency or “end of the dollar” drama thesis is missing the bullseye. , debating a gold-backed new currency or “end of the dollar” drama thesis is missing the bullseye.

The facts and evolving history of today and tomorrow suggest that the real story is not about replacing the dollar, but simply going around it in a new price direction paved in both black and real gold.

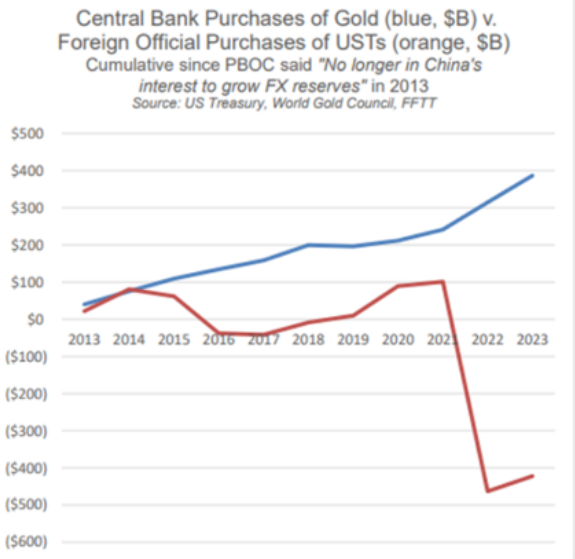

Toward that end, look at what the rest of the world and its central banks are doing, not what they (or our financial leadership) are saying:

Since 2008’s GFC, Putin has been hording gold;

Since 2014, global central banks have been net-sellers of USTs and net buyers of physical gold;

In 2023, 20% of global oil sales were outside of the USD;

Despite being pegged to the USD, Saudi Arabia, the UAE, and other GCC nations’ favorite import out of Switzerland this year is physical gold;

More than 44 nations are currently executing trade settlements outside of the USD;

Both Japan and China, historically the most reliable buyers of Uncle Sam’s IOUs, are now dumping billions and billions worth of them;

Russia is the world’s greatest commodity exporter, and China is the world’s greatest commodity importer—and they like each other far more than they do Biden or the next White House resident; more importantly, it is a matter of national survival for China to buy oil outside the USD;

Russia is now selling oil to China in yuan, which the Russians then use to buy Chinese goods (once made in America); thereafter, any delta in the trade is net settled in gold (not dollars) on the Shanghai Exchange. This, folks, is BRICS scalable (think India…);

Between swap lines, the CIPS alternative to the SWIFT system and rising negotiations between Gulf oil nations and other BRICS+ big-whigs, the current move away from dollar-denominated oil trades is real rather than imaginary;

Given the growing decline of physical gold and silver levels in the New York and London exchanges, they can no longer price fix gold as in the days of yore, nor can they justify a different 200 moving day gold price than one more fairly priced in China’s exchange;

The BRICS+ nations are no longer USD pawns but rising rooks. Their share of global GDP is surpassing that of the G-7;

In 2023, the Bank of International Settlements declared physical gold a tier-one asset alongside the 10Y UST;

Nations are openly (and naturally) preferring gold as a reserve asset over the other “tier-one” option–a dollar-based IOU of “risk-free-return,” which by any honest (current and future) measure of inflation offers a negative real yield, in other words: “return-free-risk;”

No matter how enamored the green crowd is of ESG, we are decades and decades (as well as trillions and trillions) away from carbon-neutral, and like it or not, energy matters and fossil fuels literally fuel the world;

China and India each have populations of over 1.4B. If oil demand increases even slightly in either of these BRICS countries, oil prices in rupees and yuan (and every other fiat currency) will explode—and two of the biggest players in the oil space don’t want to use dollars to pay for it. Instead, they’d prefer to net settle their oil and gas in gold, which buys more energy than dollars can;

Given that the annual production capacity for oil is 12-15X that of global gold, and with gold increasingly becoming the favored oil payment, gold’s price relative to oil can only go up;

This explains why gold is openly (not theoretically) becoming a more trusted reserve asset than the UST:

In short, Energy matters, and rather than the USD being the base layer of money (see above), energy very well could be.

And THAT, folks, is how a system changes “violently and or militarily,” as most US direct and proxy wars have something to do with…oil.

And that oil, by the way, is increasingly being net-settled in gold—day by day, and minute by minute, for the simple reason that history is like a hockey puck: You play where it is headed (gold), not where it sits (the USD).

The Other Bullies Are Coming Together

Returning to the prior assumptions of the Immortal Dollar thesis above, if money is whatever the strongest bully/power says it is, what happens to the previous notion of “money” when a collection of rising and resource-rich bullies/powers (BRICS+) is growing stronger, and their preferred focus is oil and not the dollar?

What happens after a neutral reserve asset is weaponized against a major nuclear power and energy exporter (Russia) already in financial bed with the world’s largest energy importer (China)?

The answer is simple: That once “immortal” reserve currency is less trusted and hence less in demand.

Is it any coincidence, for example, that after DC weaponized the USD, the BRICS+ roster of nations increased to include the major oil exporters?... In short, there’s a far better “king” than the USD—it was always there.

...The central bankers just don’t want you to see it...'

And this precious king has a crown of gold rather than paper.

Which king will you choose?'

|

|

|

|

Post by Entendance on Jul 20, 2024 3:18:11 GMT -5

|

|

|

|

Post by Entendance on Jul 21, 2024 3:25:15 GMT -5

‼️ INDIA SLASHES IMPORT TAXES ON GOLD + SILVER TO 6%

- Import duties were reduced by 60%

- Import duties were 15% for Gold and Silver

- Retail demand is expected to jump

July 22, 2024 Bill’s Commentary: ”A good history and explanation of silver price manipulation.” July 22, 2024 Bill’s Commentary: ”A good history and explanation of silver price manipulation.”

In the July 18 edition of Gold Newsletter, editor and publisher Brien Lundin wrote about the failure of silver prices to keep up with gold prices. “I’m not the kind of conspiracy buff that many of my friends in the industry are,” Lundin wrote, “but it’s hard to look at silver and not see some hidden hands at work (especially considering who holds so much of the metal in both physical and paper forms while acting as custodian for the biggest silver exchange-traded fund).”

Of course Lundin meant investment bank JPMorganChase and silver ETF SLV.

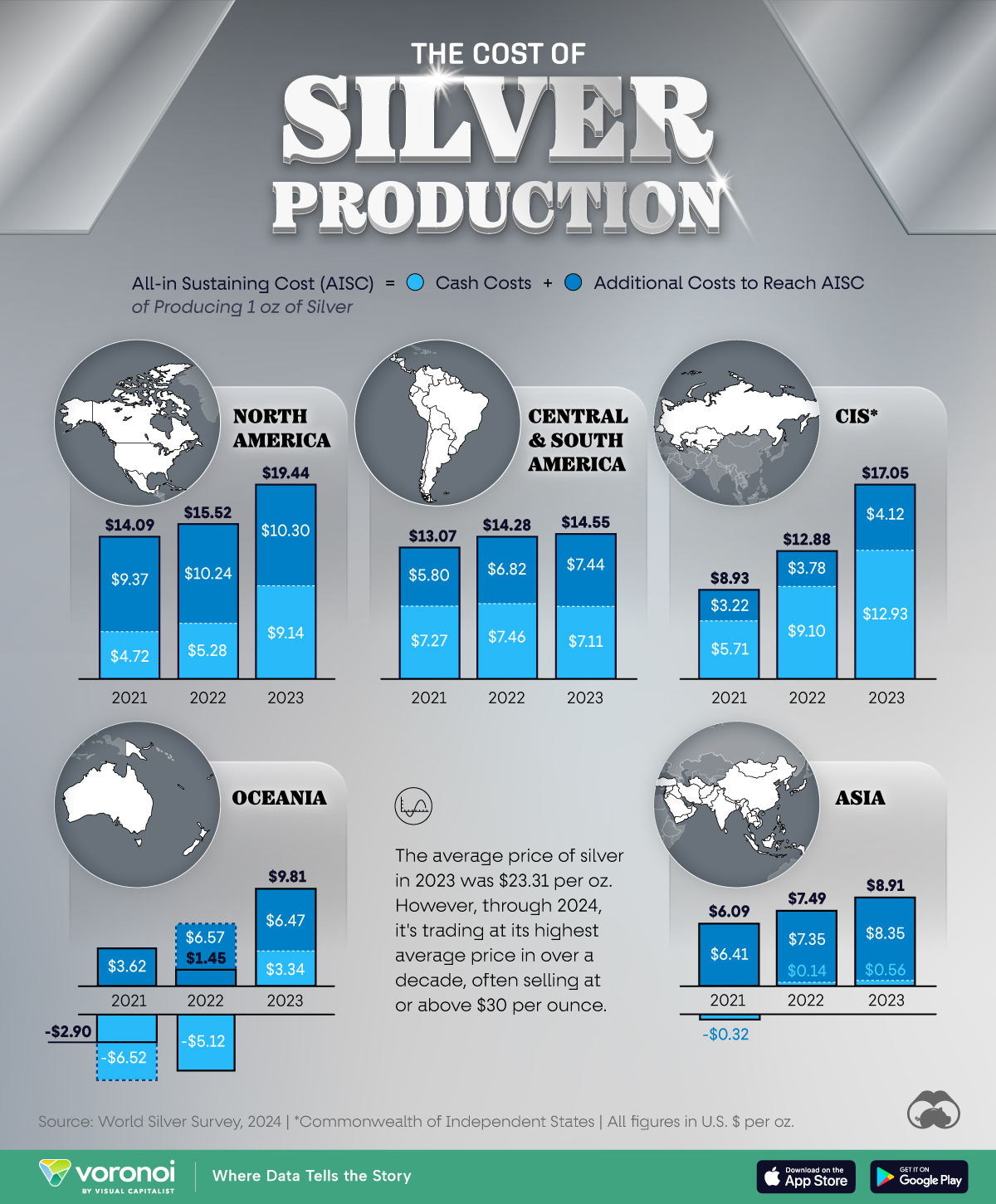

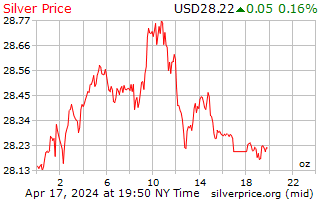

We posted this chart a little over 3 weeks ago. Silver did break higher but was contained at $32. Was it real selling or paper? I believe it was vastly paper but for now it does not matter, price is price. It will certainly matter when failure to deliver finally arrives. So here we are, right back at $29 support. This should hold, if not there is strong support at $25.50-26. If it does hold, it will require a week or two to stabilize but $32.50 should fall. This is all short term technical stuff, the reality is fundamental, not technical. The Western world has gone hyperbolic in its issuance of debt, $2-3 trillion per year just from the US alone, then add the other sovereign treasuries. Silver supply/demand has been in deficit for 3+ years and continues today. Between the supply deficit, Western central banks shortly being forced to ease due to financial stress and the fact that they have reached “debt saturation” levels, once this pullback is done, silver looks to me like we will see a spectacular 2nd half of the year after performing as the best asset in the 1st half. Hold tight and do not be shaken out. The biggest outlying gains always come in compressed timeframes! A great change in “global currency” is about to occur, you must be in place while it happens. You will either be IN, or you will be OUT, likely for the remainder of your financial life!”

GATA board member Ed Steer, proprietor of Ed Steer's Gold and Silver Digest, is interviewed by Mike Maharrey of Money Metals Exchange about silver price suppression on the New York Commodities Exchange, where paper trading is still dominating physical trading despite signs of a big shortage of metal for the physical market. The physical shortage, Steer says, is indicated by the increasingly frantic movement of silver in and out of the Comex and silver exchange-traded funds to cover metal deficits...Ed Steer on Money Metals GATA board member Ed Steer, proprietor of Ed Steer's Gold and Silver Digest, is interviewed by Mike Maharrey of Money Metals Exchange about silver price suppression on the New York Commodities Exchange, where paper trading is still dominating physical trading despite signs of a big shortage of metal for the physical market. The physical shortage, Steer says, is indicated by the increasingly frantic movement of silver in and out of the Comex and silver exchange-traded funds to cover metal deficits...Ed Steer on Money Metals |

|

|

|

Post by Entendance on Jul 25, 2024 1:51:04 GMT -5

Here is my bull market game plan. Those that stick to it will make life changing gains over the next several years.

First off we put most of our metals capital in physical. We don't trade physical. This is strictly a buy and hold long term position. The reason we choose physical is two fold. First and foremost we won't be tempted to over trade physical. It's easy to hold physical through any and all corrections big and small. You won't panic sell at bottoms,and you won't sell way too early. I didn't think twice about my physical during the crash in March of 2020. I could care less if I buy at tops or time perfect bottoms. I just accumulate, and I don't much care about my purchase price during this phase of the bull.

And second we are entering a major economic crash period where government debt reaches the end game and governments will be looking everywhere for wealth to confiscate. I want a big chunk of my wealth in physical and out of the banking system during this period.

I will buy some close to tops as insurance in case I'm wrong and the bubble phase begins sooner than I think, and I will buy when I think metals are at an intermediate cycle low (I plan to buy another 100 oz. in Sept.). I'm not going to sell until we get into a bubble phase and I see every Tom, Dick, and Jane buying gold and silver. I expect gold will be somewhere around $10,000 or higher by that time. So it is irrelevant to me if I bought at $1800 (most of my physical was bought at this level), $2400 or $3000. I consider anything under $3000 a steal...- Gary Savage

While the United States added a record amount of new Solar PV capacity last year, it pales in comparison to the Chinese Solar Behemoth. The numbers were literally off the charts, which is why there was a huge increase in global industrial silver consumption in 2023…

Matthew Piepenburg: 'The additional de-dollarization forces add further pressures against the USD (and fiat money in general) and point directly to the undeniable case for (and role of) Physical Gold as an essential allocation'Egon von Greyerz: YOUR PERSONAL GOLD BANK

|

|

|

|

Post by Entendance on Jul 27, 2024 4:59:47 GMT -5

'Silver held below $28 per ounce on Friday and was set to decline for the third consecutive week amid a dismal industrial outlook and persistent demand concerns in top consumer China. Expectations that silver demand from the renewable energy sector would lead to a shortfall in the coming years have largely been priced in by markets, leading investors to unwind long silver bets. A key political meeting in Beijing earlier this month also failed to excite investors hoping for fresh stimulus measures to support growth. Meanwhile, China’s central bank delivered surprise cuts to several benchmark lending rates this week. Data also showed that the US economy grew more than expected in the second quarter amid solid gains in consumer spending and business investment, while bets for Federal Reserve rate cuts remained intact.' 'Silver held below $28 per ounce on Friday and was set to decline for the third consecutive week amid a dismal industrial outlook and persistent demand concerns in top consumer China. Expectations that silver demand from the renewable energy sector would lead to a shortfall in the coming years have largely been priced in by markets, leading investors to unwind long silver bets. A key political meeting in Beijing earlier this month also failed to excite investors hoping for fresh stimulus measures to support growth. Meanwhile, China’s central bank delivered surprise cuts to several benchmark lending rates this week. Data also showed that the US economy grew more than expected in the second quarter amid solid gains in consumer spending and business investment, while bets for Federal Reserve rate cuts remained intact.'

Repetita Iuvant. Silver supply is falling for three reasons:

Declining mine production due to low base metal prices

Declining silver mine capacity

Declining reserves of silver

The Entendance Beach Policy: The praetor does not concern himself with trifles.

Il pretore non si occupa di cose di poca importanza.

|

|

|

|

Post by Entendance on Aug 3, 2024 4:57:40 GMT -5

August 4, 2024

Matthew Piepenburg: The World is Catching On

|

|

|

|

Post by Entendance on Aug 7, 2024 0:52:49 GMT -5

|

|

|

|

Post by Entendance on Aug 8, 2024 3:00:05 GMT -5

'We have empirical evidence that Chinese monetary gold purchases actually increased!'🪙🌏

Gold is the best instrument for protecting against currency devaluation and the potential risks of the financial system, especially in times of elevated debt levels and economic uncertainty.

Gold is the best instrument to protect against the risk of currency devaluation, especially in times of elevated debt levels.

The next move in the financial system has started due to the acceleration of debt, deficits, and risks within the banking, financial, and corporate systems.

Central banks are converting their reserve assets from dollars to gold, indicating a shift towards gold as an investment.

More than 47 nations are now trading outside the US dollar, with over 30 countries repatriating their gold out of Western exchanges, showing a clear shift away from reliance on the US dollar.

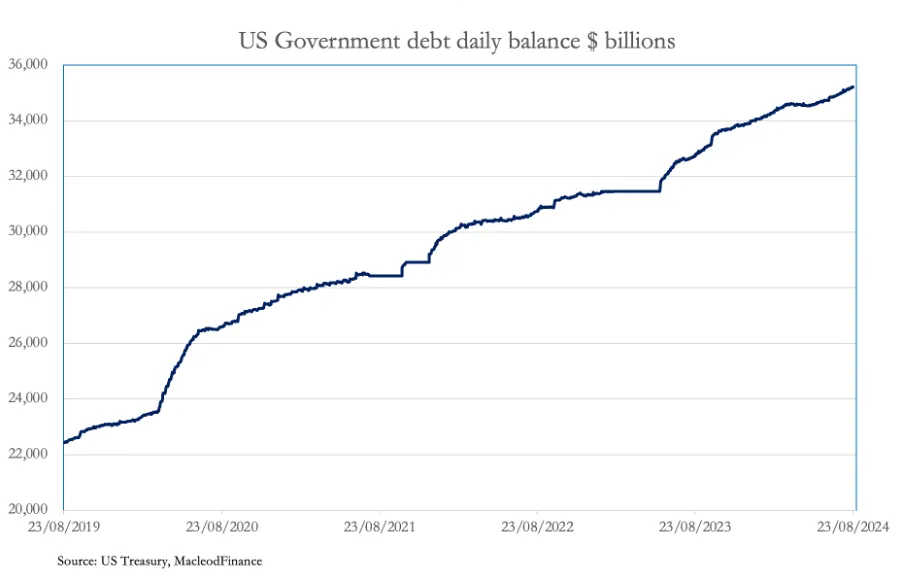

The exponential increase in US debt is a cause for concern, as it will lead to a rapid devaluation of currencies in the next few years.

“I’m not worried about the return on my money, I’m worried about the return of my money.” – Mark Twain

Economic and social difficulties are inevitable, and it’s crucial to be prepared and support each other during these challenging times.

Gold is a wealth preservation asset that will go to higher levels due to government actions destroying currencies.

– What triggered the stock market falls this week

– Why investors must not buy the dips in stocks

– The dangers facing the world due to irresponsible deficit and debt creation

– Warren Buffet’s clear warning signal

– Why so few understand gold – only 0.5% of global financial assets

– Critical factors that will lead to a revaluation of gold by multiples

– Gold’s significance as a wealth preservation asset

– The importance of family and friends in a socially and economically fractured world

'...Under the gold standard, macroeconomic theory played little part in the formulation of policy. Under the PhD standard, macroeconomic theory drives policy making.... '...Under the gold standard, macroeconomic theory played little part in the formulation of policy. Under the PhD standard, macroeconomic theory drives policy making.... The “exact opposite” of the gold standard is really the system in place today in the United States. One might call it the PhD standard. It’s the system of discretionary manipulation of interest rates by doctors of economics to achieve a little inflation—not too much, mind you—and maximum employment. The “exact opposite” of the gold standard is really the system in place today in the United States. One might call it the PhD standard. It’s the system of discretionary manipulation of interest rates by doctors of economics to achieve a little inflation—not too much, mind you—and maximum employment.

It’s a feature of the balance sheet of today’s Federal Reserve that operating losses swamp stated capital. Paying out in interest much more than it earns in interest, the Fed finds itself in the position that made Silicon Valley Bank infamous in 2023.

Under the gold standard, a central bank balance sheet held few, if any, government securities. Under the PhD standard, a central bank balance sheet holds almost nothing else.

Under the gold standard, the policy of each participating nation conduced to the prosperity of all participating nations; it was a synchronous, outward-looking system. Under the PhD standard, each nation looks entirely to its own interests.

Under the gold standard, macroeconomic theory played little part in the formulation of policy (indeed, the phrase monetary policy went uncoined until the 1930s). Under the PhD standard, macroeconomic theory drives policy making. And there is the rub. Which theory is correct? Which is relevant?

“Inflation is always and everywhere a monetary phenomenon,” Milton Friedman pronounced. Updating Friedman, John Cochrane, one of the brightest of today’s economic lights, declares, in so many words, that inflation is always and everywhere a fiscal phenomenon. With due respect to each theorist, it’s as if physicists were still arguing about the laws of motion.

“Things without all remedy should be without regard,” said Lady Macbeth. In other words, what’s done cannot be undone.

I take the point that the shift away from convertible currencies to the pure paper kind is a historical fact. But I wonder whether what stands in the way of a fundamental reappraisal of our monetary and fiscal arrangements isn’t really a cultural impasse.

The gold standard was a constructively inhibiting institution. How it would fare in this, the age of the overheard cell-phone discussion about the speaker’s ugly impending contested divorce, is anybody’s guess. Perhaps we should prepare the cultural ground for fundamental monetary reform by bringing back the telephone booth—and, of course, the fedora.'

|

|

|

|

Post by Entendance on Aug 10, 2024 5:27:04 GMT -5

|

|

|

|

Post by Entendance on Aug 12, 2024 2:05:17 GMT -5

Silver can solve major global problems such as wars, debt crises, inflation, recession, and crime by implementing a constrained monetary system and reducing the incentive for war.

The importance of silver in addressing global challenges is a thought-provoking concept that challenges traditional solutions.

Silver is claimed to solve five of the world’s biggest problems: Wars, debt crisis, inflation, recession, and crime.

Only a select few really benefit from wars, while the mass government spending and debt financing have long-term negative effects on the economy.

The US economy is facing a recession despite claims of strength, with inflation rates potentially much higher than reported.

The massive increase in money supply in the past two or three years has led to a 40-year high in inflation, causing unprecedented volatility in the economy.

Canada is now the car theft capital of the world, with a car being stolen every five minutes.

Silver eliminates Wars because printed money finances them.

|

|

|

|

Post by Entendance on Aug 13, 2024 1:24:22 GMT -5

|

|

|

|

Post by Entendance on Aug 16, 2024 2:24:12 GMT -5

Bullion dealer Andrew Schectman of Miles Franklin in Minnesota, the guest on this week's installment of Kinesis Money's Live from the Vault program with London metals trader Andrew Maguire, discusses the Bank for International Settlements' orchestration of a shift away from the U.S. dollar to Gold as the primary world reserve currency. Miles Franklin's Andrew Schectman, on LFTV, reviews how the BIS is shifting the world back to Gold

|

|

|

|

Post by Entendance on Aug 17, 2024 1:55:29 GMT -5

We meet with the CEO of Goldbacks and discuss why they can be an incredibly unique and valuable way to store and USE gold as actual money, which I believe is key to stopping CBDCs! -Rob Kientz, The Freedom Report

!

'At some point, and it’s not too far away, US citizens are not going to be able to transfer dollars out of the US. There will be exchange controls. I have experienced that in the UK in the early 1970s. It’s going to happen again. It’s going to happen in the US. It’s going to happen in other countries also. Now is the time…' 'At some point, and it’s not too far away, US citizens are not going to be able to transfer dollars out of the US. There will be exchange controls. I have experienced that in the UK in the early 1970s. It’s going to happen again. It’s going to happen in the US. It’s going to happen in other countries also. Now is the time…'

|

|

|

|

Post by Entendance on Aug 20, 2024 1:54:08 GMT -5

|

|

|

|

Post by Entendance on Aug 22, 2024 8:27:07 GMT -5

Central banks continue orderly buying of gold in anticipation of BRICs move, Maguire says

Central banks continue to purchase gold in an orderly way, waiting for the occasional U.S. Federal Reserve-instigated price smashes to load up in anticipation of a formal remonetization of the monetary metal by the BRICs group in October, London metals trader Andrew Maguire tells this week's edition of Kinesis Money's "Live from the Vault" program.

Curious about how a sound money economy would look? Read on...

H/T Tom from Florida

|

|

|

|

Post by Entendance on Aug 24, 2024 4:45:44 GMT -5

|

|

|

|

Post by Entendance on Aug 29, 2024 1:40:19 GMT -5

Market commentator Bill Holter joins London metals trader Andrew Maguire on this week's edition of Kinesis Money's "Live from the Vault" program, discussing the likely incorporation of gold into the trading currency contemplated by the BRICS nations, as well as the longstanding manipulation of the monetary metals markets...

A debt crisis always leads to a currency crisis, bringing inflation, asset and debt implosion, political and geopolitical instability, social unrest, and even wars. We're closer to this risk than ever. -Egon von Greyerz

|

|

|

|

Post by Entendance on Aug 31, 2024 2:21:18 GMT -5

|

|

|

|

Post by Entendance on Sept 2, 2024 6:58:44 GMT -5

Andy Schectman joins Mike Adams for emergency update: Emergency Interview Introduction and Background (0:01)

- Turkey's Potential BRICS Membership and Its Implications (2:47)

- Global Currency Embargo and the Bretton Woods System (5:35)

- The Unit Settlement Currency and Project Enbridge (10:25)

- The Role of Gold and the Future of the Dollar (31:33)

- The Mechanics of the Unit Settlement Currency (34:59)

- The Impact of Gold and Silver on the Financial System (35:13)

- The Role of Miles Franklin and Gold and Silver Investments (49:34)

- The Future of the BRICS and the Global Financial System (56:20)

- Conclusion and Final Thoughts (56:40)

|

|

|

|

Post by Entendance on Sept 7, 2024 1:36:11 GMT -5

Dear Friend of GATA and Gold:

Your secretary/treasurer was interviewed this week by Mike Maharrey of Money Metals, explaining the longstanding hostility of central banks to gold and their aggression against the monetary metal, a powerful competitor to their own currencies. GATA's work is also discussed, along with gold's hastening progress toward restoration as the world reserve currency. Chris Powell Explains Government Hostility Toward Gold in Exclusive Interview

'...I predicted gold would hit $2,500 in the middle of this year. We talked about that last year. I think it can get past $3,000 at the beginning of next year. So I think we continue this trend up. And I think gold can get to $4,000 at the end of next year...' -Nomi Prins here

|

|

|

|

Post by Entendance on Sept 8, 2024 2:07:53 GMT -5

|

|

|

|

Post by Entendance on Sept 10, 2024 3:35:28 GMT -5

|

|

|

|

Post by Entendance on Sept 13, 2024 1:46:18 GMT -5

Bill’s Commentary:

“Regarding ‘weapons of mass financial destruction’…”

The Fed Just Kicked the Capital Increases for the Dangerous Megabanks and their Derivatives Down the Road for Years

When the next megabank blows up from its derivative exposure, you can add the names Jamie Dimon and Patick McHenry to former Republican Congressmen Randy Hultgren and Kevin Yoder as four of the men who greased the skids for another derivatives banking crisis. (For our report on the role played by Hultgren and Yoder, see our 2021 report here.)

Dimon and McHenry are the latest lead players in the disastrous history of derivative regulation in the U.S. The Fed Just Kicked the Capital Increases for the Dangerous Megabanks and their Derivatives Down the Road for Years

|

|

|

|

Post by Entendance on Sept 14, 2024 7:43:57 GMT -5

There are no wrong notes; some are just more right than others. -Thelonious Monk

Why Chinese Traders May Soon Propel Gold to $3,000

|

|

|

|

Post by Entendance on Sept 17, 2024 3:16:02 GMT -5

|

|

|

|

Post by Entendance on Sept 19, 2024 2:07:27 GMT -5

|

|

|

|

Post by Entendance on Sept 21, 2024 1:40:58 GMT -5

Gold breaks $2,600 barrier Gold breaks $2,600 barrier

Bullion banks are heavily short as Gold continues hitting new all-time highs. This is creating a fascinating situation in the gold market. Take a look

|

|

!!➡️

!!➡️

.JPG)

.JPG)

, debating a gold-backed new currency or “end of the dollar” drama thesis is missing the bullseye.

, debating a gold-backed new currency or “end of the dollar” drama thesis is missing the bullseye.

It's

It's  July 22, 2024 Bill’s Commentary: ”A good history and explanation of silver price manipulation.”

July 22, 2024 Bill’s Commentary: ”A good history and explanation of silver price manipulation.” Suppressing silver prices

Suppressing silver prices

GATA board member Ed Steer, proprietor of

GATA board member Ed Steer, proprietor of

'

'

'...I would not be touching the silver market.➡️

'...I would not be touching the silver market.➡️

.png)

BIS annual report again confirms

BIS annual report again confirms

The “exact opposite” of the gold standard is really the system in place today in the United States. One might call it the PhD standard. It’s the system of discretionary manipulation of interest rates by doctors of economics to achieve a little inflation—not too much, mind you—and maximum employment.

The “exact opposite” of the gold standard is really the system in place today in the United States. One might call it the PhD standard. It’s the system of discretionary manipulation of interest rates by doctors of economics to achieve a little inflation—not too much, mind you—and maximum employment.

Fiat Currency Apocalypse Approaches as

Fiat Currency Apocalypse Approaches as

A metals vault bigger than Fort Knox

A metals vault bigger than Fort Knox

The Beach &

The Beach &

The Monthly Gold Compass

The Monthly Gold Compass

.png)

Russian Buying Has Stunned

Russian Buying Has Stunned

Gold breaks $2,600 barrier

Gold breaks $2,600 barrier