|

|

Post by Entendance on Jul 23, 2023 2:00:50 GMT -5

Good Delivery Current List - Gold

|

|

|

|

Post by Entendance on Aug 6, 2023 3:25:47 GMT -5

'...Despite such objective facts (and the media-ignored power of gold as an open threat to fiat money), gold makes up only 0.5% of the global investments.

This, it might be said, makes such lonely “gold bugs” crazy, but as alluded to above, sometimes one must keep their heads when all about them are losing theirs.

The question, then, like the title of Kipling’s poem, is not “If” fiat money dies, but “When.”

The former is obvious, the latter is approaching.'

|

|

|

|

Post by Entendance on Aug 12, 2023 2:02:55 GMT -5

|

|

|

|

Post by Entendance on Aug 13, 2023 0:39:11 GMT -5

|

|

|

|

Post by Entendance on Aug 15, 2023 0:42:27 GMT -5

Ferragosto, or Assumption Day, is an Italian national holiday celebrated on August 15. Assumption Day is a nationwide public holiday in Italy. Many businesses and shops in Italy are closed on August 15 although on the coast and near major tourist sites shops are more likely to be some open. Most museums and tourist sites are open on August 15. Italians head to the beach for Ferragosto, so the coast (and coastal roads) are usually very crowded while the cities may be fairly empty. Ferragosto, or Assumption Day, is an Italian national holiday celebrated on August 15. Assumption Day is a nationwide public holiday in Italy. Many businesses and shops in Italy are closed on August 15 although on the coast and near major tourist sites shops are more likely to be some open. Most museums and tourist sites are open on August 15. Italians head to the beach for Ferragosto, so the coast (and coastal roads) are usually very crowded while the cities may be fairly empty.

The Global Fiat Currency Regime Turns 52 Today

Interesting to note, that address to the world was given on what day of the week in 1971?

You guessed it: A Sunday evening.

Typical.

Let’s recap the last several major changes in the monetary system in the last several decades:

•1933/1934 Gold demonetized for citizen’s daily use, and gold revalued from $20.67 in 1933 to $35 in 1934 (in other words – dollar devaluation).

•WWII Bretton Woods era (US pegs to gold, nations peg to US dollar)

•1965 Silver removed from coinage.

•August 15th, 1971 – Nixon ‘temporarily’ suspends convertibility of dollar into gold (kills off remaining tie to sound money)

From 1971 to the present, the system is commonly referred to as the “petro-dollar” era. This scheme was devised in the 1970s, and the foundation of the scheme is that nations, mainly Saudi Arabia, would sell their oil for US dollars only. This placed a permanent demand for the US dollar as oil is the most consumed commodity in the world. This standard has been backed up by the might of the US military.

Where do we find ourselves now?

We find ourselves near the end of the current monetary system. The pure fiat monetary system is a debt based system that requires unsustainable, exponential growth in debt.

This system will come to an end. Un-backed fiat currency systems always do.

'...the gold swap data reveals more about financial reality on Planet Earth than anything else -- reveals that all financial values are rigged by an essentially totalitarian system and not determined by markets -- and thanks to Lambourne the data is available only from GATA.'

|

|

|

|

Post by Entendance on Aug 19, 2023 3:01:15 GMT -5

|

|

|

|

Post by Entendance on Aug 19, 2023 23:49:48 GMT -5

|

|

|

|

Post by Entendance on Aug 22, 2023 1:19:13 GMT -5

|

|

|

|

Post by Entendance on Aug 22, 2023 17:01:29 GMT -5

|

|

|

|

Post by Entendance on Aug 23, 2023 2:48:44 GMT -5

|

|

|

|

Post by Entendance on Aug 26, 2023 1:49:26 GMT -5

|

|

|

|

Post by Entendance on Aug 29, 2023 1:33:58 GMT -5

|

|

|

|

Post by Entendance on Aug 30, 2023 1:44:10 GMT -5

Gold is forever wealth. Empires come and go. Gold remains. Gold is forever wealth. Empires come and go. Gold remains.

...Piepenburg opens with a sober look at US debt to GDP and Debt to Tax Receipts data to underscore the increasingly unsustainable profile of US debt levels and the increasingly ineffective solution of paying for that debt with “mouse-click” money.

Piepenburg addresses the four turning points which placed America in this openly absurd situation. He then turns toward current, yet failed, policies to save a central bank and US system now trapped between a rock and a hard place…

Debt levels monetized with fiat money are naturally inflationary. But now Powell is “fighting” this inflation with rising rates—which are dis-inflationary. Piepenburg explains how such temporary measures are ultimately inflationary, despite desperate attempts in DC to claim a slow victory over inflation. In the meantime, Piepenburg gives example after example of the hard rather than soft consequences of Powell’s “war on inflation,” which he compares to Napoleon’s march on Moscow—that is: You win a battle but lose the war.

In the end, and despite dis-inflationary (and even deflationary market corrections), the end-game for an America with increasingly unloved bonds and increasingly distrusted dollars is more central bank liquidity—which by definition is inflationary. Of course, gold is then discussed as history’s most obvious answer to this equally historical debt and currency trap.

3:30 BRICS+ update

Any fool can know. The point is to understand. -Albert Einstein

|

|

|

|

Post by Entendance on Sept 1, 2023 2:47:34 GMT -5

The World Is Hurtling Toward A New Gold Standard

'As evidence mounts that the major Western economies are heading into a banking and monetary crisis due to contracting credit, we face the consequences of unsound money. The era of fiat is drawing to a close and its death will be painful for the highly indebted advanced economies in North America, Europe, and Japan. History and legal precedent tell us that fiat will die and gold will return to provide an anchor to credit system values.

As always, there are lessons to be learned from monetary history, particularly in the context of credit-dependent post-feudal economies, when a gold standard was expected to support mountains of credit in the forms of bank notes and commercial bank deposits.

In this article, I look at lessons from nineteenth-century gold standards and the mistakes made. Mostly, they could have been easily avoided.

The debate over the return of gold backing for credit is becoming urgent, not just because the fiat currency system has run its course, but because it is increasingly in the developing world’s interests to embrace it. And unless Russia moves urgently towards backing its rouble with gold, her economy will almost certainly suffer from increasing instability, which explains why she is so keen to do so...'

|

|

|

|

Post by Entendance on Sept 1, 2023 9:25:48 GMT -5

|

|

|

|

Post by Entendance on Sept 2, 2023 4:37:54 GMT -5

'...How high could prices go if we enter a new gold bull market? '...How high could prices go if we enter a new gold bull market?

In past gold bull markets, the value of the Treasury’s gold holdings has surpassed the monetary base by over 1.5 times – including in 1980 after the US dollar was no longer backed by gold.

Given the Fed’s balance sheet explosion since 2009, a projected target price for gold seems outlandish. The Fed’s monetary base today stands at $5.6 tr. For the Treasury’s gold holdings to cover the monetary base by 1.5 times, gold would have to reach $32,000 per ounce. Critics might argue the monetary base is distorted by excess reserves left on balance at the Fed. At present, excess reserves foot to $3.2 tr, and the Fed has talked of someday draining them out of the system. If that were to happen, the Fed’s monetary base would fall to $2.4 trillion. Even under this conservative scenario, gold would have to reach $14,000 for the Treasury’s gold position to cover the monetary base by 1.5 times. Although these numbers sound outlandish, they represent relationships that have emerged twice in the past 100 years. The first time (the late 1930s) was during massive deflation, while the second (1970) was during inflation. In both scenarios, gold had become the “must own” asset class that all investors clamored for, and the valuation of gold was pushed to the extreme.

Could the dollar value of the Treasury’s gold holdings reach 1.5 times the monetary base-- as it has twice in the last 100 years? We believe it’s highly probable. As financial turmoil surges this decade, investors will aggressively buy gold as an asset class that provides both wealth protection and the opportunity for huge speculative profit. In such a scenario, gold’s valuation could very well be pushed to extremes just like it was in the late 1930s and1980...' |

|

|

|

Post by Entendance on Sept 16, 2023 5:46:19 GMT -5

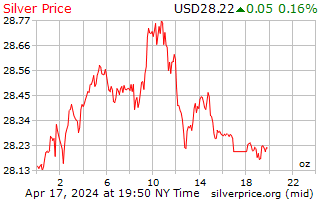

This month, we’re shining a spotlight on Silver. Did you know that in over 14 languages, the word for "silver" is synonymous with "money"? That's no coincidence...

It’s far more than your ordinary metal, silver is a versatile marvel that has fascinated humanity and been used as money for thousands of years.

If you're new to the precious metals game or even a seasoned investor, here’s some of the reasons why silver should belong in your portfolio.

Silver Is The World’s Most Reflective Metal— Polished silver reflects 95% of the visible light spectrum, which makes it the most reflective metal known to man. Its reflective properties are also used for objects like mirrors, telescopes, microscopes and solar panels.

Silver Has The Highest Thermal Conductivity Of Any Element — Out of all the elements, silver is the best electric conductor, and is actually used as the standard by which other conductors are measured. On a scale of 0 to 100, silver ranks 100 in terms of electrical conductivity. Meanwhile copper ranks 97 and gold ranks 76.

Silver Is One Of The First Five Metals To Ever Be Discovered — Silver artifacts have been found dating as far back as 4000 B.C. Silver was the first metal to be used as currency, and in ancient Egypt, it was even valued higher than gold.

Stretching The Limits: Thin As Paper, Yet Unbreakable — Silver is an incredibly ductile element, capable of being shaped, compressed, and stretched while maintaining its structural integrity. For example, a single grain of silver can be pressed into a plate 150 times thinner than a typical sheet of paper.

In 1965, Public Law 88-36 Reduced Silver In Coins From 90% To 40%— Silver was eliminated from all coins in the United States beginning in 1970. As a result, silver coins containing 90% are valuable based on their silver content and are extremely desirable to collectors and investors.

Silver Is More Than Just Money

Many people are familiar with silver’s history as an investment – but unfortunately its numerous industrial applications are often overshadowed. The truth is nearly 50% of the annual silver supply is used in industrial applications and manufacturing. And that silver is truly indispensable in modern society.

Electronics: Silver’s Invisible Everyday Presence

You may not see it, but silver is used in virtually every single one of your electronic devices. If you're interacting with a gadget that has an on/off button, it's highly likely that silver is a key component.

Known for its unparalleled electrical conductivity, silver is the perfect material for a wide array of applications. It's found in everything from printed circuit boards and switches to TV screens, telephones, microwave ovens, children's toys, and even the keys beneath our computer fingertips.

As of 2023, there are over 15 billion devices connected to the internet worldwide – and that figure is expected to double by 2030. As we further embrace the digital age, the demand for silver in these sectors is poised to rise.

Renewable Energy: Silver’s Role In Powering A Sustainable Future In the pursuit of sustainability, silver has been proven to be a vital component, particularly in the photovoltaic cells that make up solar panels.

So, how exactly does silver function in solar cells? Silver powder is converted into a paste, which is then applied to a silicon wafer. When sunlight strikes this silicon, electrons are set free. Silver, being the world's most efficient conductor, swiftly channels this electricity either for immediate utilization or for storage in batteries for future use.

As many nations around the world increase their clean energy investment, the demand for silver is set to rise in tandem, further solidifying its critical role in our sustainable future.

Silver's Healing Power: From Ancient Voyages To Modern Medicine

Long before the scientific community understood silver's antibacterial properties, the metal was already being used to combat harmful germs. During lengthy ocean voyages, sailors would drop silver coins into water and wine casks to keep them from spoiling. For years, physicians applied drops of silver nitrate into the eyes of newborns to stave off infections. Even in the grim conditions of World War I, silver foil dressed battlefield wounds, and silver sutures were used to stitch up severe injuries.

It is only in recent years that scientists have unraveled the mechanisms behind silver's antibacterial effects. Silver ions have the unique ability to penetrate bacterial cell walls without harming mammalian cells. This disrupts the essential chemical and structural bonds within the bacteria, effectively neutralizing them.

Today, the medical community is leveraging silver's unique properties in innovative ways. Medical devices like breathing tubes and catheters are now coated with silver to ward off infections. The metal is also applied to artificial bones and scaffolding materials to aid in the healing process. Silver-infused bandages and ointments are increasingly common, as they inhibit bacterial growth, allowing wounds to heal more quickly. Remarkably, silver has proven effective against bacteria that have developed resistance due to the overuse of chemical antibiotics.

The Electric Vehicle Boom Is Driving Up Silver Demand From 2021 to 2022, the number of electric cars sold almost doubled, breaking records, and increasing from 3.75 million to 6.75 million globally.

Electric cars depend heavily on silver. Much like many other devices these days, the electrical and thermal conductivity of silver makes it an ideal material as part of an automobile battery. It is also ideal for use in EVs because it’s non-toxic and hypoallergenic.

As it stands, the automotive industry consumes a staggering 55 million ounces of silver each year. By 2025, this figure is projected to leap to 90 million ounces.

So, where is all this silver coming from? If these electric vehicle companies all want to continue their rapid growth, it will require a huge increase in silver production.

However, there's a snag: the demand for silver is currently outpacing its supply, creating a looming bottleneck for the industry.

Silver Supply Constraints And A Looming Crisis According to the World Silver Survey 2023, the global appetite for silver surged by 18% last year, reaching a record-breaking 1.24 billion ounces and resulting in a significant supply deficit.

In 2021, the silver market faced a shortfall of 51.1 million ounces. However, the situation deteriorated dramatically in 2022, with a staggering undersupply of 237.7 million ounces. The Silver Institute has labeled this as "possibly the most significant deficit on record," and forecasts indicate that the shortages are likely to continue in the years ahead.

The reasons for this tightening supply are multifaceted:

Rising Operational Costs: The mining sector is wrestling with escalating expenses, particularly in energy and labor.

Environmental Regulations: An influx of stringent environmental laws is adding layers of complexity to the mining process.

Mexico's Policy Shift: In a significant setback, Mexico, the world's leading silver producer, has instituted a ban on open-pit silver mining.

With global sustainable investments reaching an astonishing $35.3 trillion, as reported by the Global Sustainable Investment Alliance, the demand for silver — integral in many green technologies — is poised to skyrocket.

For many investors, alarm bells are ringing. When record high demand meets a tightening supply, at some point, something has to give. Either the supply of silver somehow increases a great deal, or the price of silver will increase.

Given these market conditions, the logical outcome could be a surge in silver prices in the years ahead.

Many analysts like Tavi Costa, renowned portfolio manager at Crescat Capital, agree that silver prices are going higher.

He says, “Going back to 2011, you can see the monthly chart, the resistance has lessened for over a decade now. And we’re very, very close to a breakout with this chart. This could happen any month really.”

Seizing The Silver Opportunity

The evidence is clear: silver is not just a precious metal – it's a critical component in modern technology, renewable energy, and healthcare. With supply constraints and rising demand, the future for silver looks incredibly promising.

If you've been contemplating diversifying your portfolio, there's never been a better time to get started investing in silver today. -Michael Maloney

Asia Gold-China premiums SURGE on strong buying; premiums jump to $90-$135/oz

|

|

|

|

Post by Entendance on Sept 17, 2023 4:09:46 GMT -5

September 17, 2023

YES

◾Each gold bar is directly owned by the investor

◾The investor receives a certificate of ownership with the unique serial numbers of his gold bars

◾Gold storage in specialised bullion vaults outside the banking system.

◾The investor has personal access to his gold

◾The investor can physically withdraw all or part of his gold during office hours or in an emergency

◾The investor can send a representative (e.g. accountant) to inspect the gold

◾The gold is insured by a major international insurer

◾Full control over your own physical assets

NO

◾Exchange Traded Funds – A gold ETF is more of a trading tool which mirrors the price of the underlying asset. Not all Gold ETF's are fully backed by the metal!

◾Futures, Unallocated Gold – A 100% derivative of the physical metal and used for speculative or short term hedging purposes.

◾Bank allocated Gold – Allocated gold in a bank means that, on paper, specific bars belong to you only as long as the bank has adequate stock. You have no immediate access to your gold.

◾Bank Safe Deposit Box – You are holding metals outside the Good Delivery chain which makes selling and insurance costly. In case of a longer bank holiday you will not have access.

◾Storing gold at home – If sizeable this is a high risk solution and very difficult to move, insure or sell.

◾Part or Mutual ownership – Owning a share in a bar does not give you full control and access in case of an emergency. |

|

|

|

Post by Entendance on Sept 18, 2023 4:13:09 GMT -5

'After 40 years of silver price manipulation and suppression on the Comex, the physical market has experienced a lack of production growth as well as enhanced demand brought about by too-low silver prices...'

|

|

|

|

Post by Entendance on Sept 23, 2023 3:30:39 GMT -5

|

|

|

|

Post by Entendance on Sept 25, 2023 4:13:31 GMT -5

Greyerz – Gold Is On The Verge Of Being Revalued Thousands Of Dollars Higher

West's suppressed Gold price is increasingly arbitraged in East, Maguire says

|

|

|

|

Post by Entendance on Sept 27, 2023 4:06:13 GMT -5

'China is suddenly full of gold bugs. It's a flight to safety familiar to students of economic stress. 'China is suddenly full of gold bugs. It's a flight to safety familiar to students of economic stress.

"With the yuan falling, the property market slumping and capital controls keeping money from leaving the country, investors are buying gold," Bloomberg economists David Qu and Chang Shu wrote in a report. It also marks a sharp reversal from earlier in the year, when China's slowdown curbed interest in the metal as consumers responded to uncertain economic conditions by conserving cash. The so-called Shanghai premium started rising in June, a response in part to import curbs imposed by the People's Bank of China, which may have been trying to shore up the value of the yuan by shrinking the need for dollars to buy gold. But now the currency's plunge is having the opposite effect, as investors chase dollar-denominated assets to preserve value.

Although import restrictions have been loosened, bullion should remain supported by firm demand, Standard Chartered analyst Suki Cooper said in a note last week. Factor in China's protracted property crisis, loose monetary policy, and tumbling bond yields, and it's no mystery why demand for a haven like gold would soar...' China’s Gold Prices Surge, Hitting a Record Against the World

|

|

|

|

Post by Entendance on Sept 28, 2023 3:24:06 GMT -5

'With the Asian hegemons undoubtedly able to introduce gold standards, where does that leave the dollar?

This article describes just how precarious the fiat dollar’s position has become. For now, the dollar appears to be buoyed up by rising bond yields. However, as they rise further portfolio losses for foreign investors are likely to increase, leading to dollar liquidation. It is not generally realised how many dollars and dollar securities are owned by foreigners, the bulk of them being held outside the US banking system. And the quantity of foreign currency owned by Americans to absorb this selling is very small in comparison.

Higher interest rates and bond yields also threaten to destabilise the banking system, a problem equally faced by the Eurozone, the UK, and Japan. But how can the US Government protect itself from this danger?

The only answer is to admit to the end of the fiat era and put the dollar back onto a gold standard. However, the US Government does not have the mandate to take the required actions and officially at least is still in denial over the need to stabilise the currency. The legal position referring to the constitution is briefly touched upon, because laws will have to be considered to secure the dollar’s future. Unfortunately, the US Treasury’s gold holdings are almost certainly compromised. Furthermore, since the Asian hegemons have accumulated substantial holdings of bullion in addition to their official reserves, there is bound to be a strong reluctance to hand economic power to Russia and China by endorsing a return to gold standards.

My conclusion is that the era of the fiat dollar based global currency system is rapidly ending, and for America and the dollar there can be no Plan B. It will almost certainly lead to the end of the fiat dollar, and the end of the US hegemony...' The end of the road for the dollar

|

|

|

|

Post by Entendance on Sept 29, 2023 7:37:12 GMT -5

Something big is about to happen... Something big is about to happen...

|

|

|

|

Post by Entendance on Sept 30, 2023 3:57:37 GMT -5

...'We are devaluing American money so rapidly that in America today, you can't even bribe Democrat senators with cash alone. You need to bring Gold bars to get the job done, just so the bribes hold value.'...

'So sad and so obvious. JP Morgan is back in the Price Driver's seat in the COMEX silver derivative market so expect the rigs to become more violent and more obvious. Also, after a few months of increased Silver Eagle Sales the US Mint has once again STOPPED sales of Silver Eagles only half way through September in order to help with the Silver Price Suppression! The closer we get to the end the more intense the Silver Price Rigging will become. Stay in your lawn chairs and WATCH THE SHOW!'

|

|

|

|

Post by Entendance on Oct 2, 2023 17:13:33 GMT -5

Pam and Russ Martens: JPMorgan Chase gets another fine, for 40 million derivative violations

'In the eyes of Wall Street veterans who are paying close attention to what’s going down at the mega banks on Wall Street, federal regulators are making the crime wave at these banks worse, not better. The federal fines for egregious behavior at these banks are getting smaller and more meaningless by the day. Take, for example, what happened on Friday...'

Over and Over Again: Goldman’s Corporate Culture of Violating Federal Laws, Getting Caught, and Settling Federal Enforcement Cases

|

|

|

|

Post by Entendance on Oct 5, 2023 3:35:20 GMT -5

Gold premiums in Moscow and Shanghai will bust Comex, Maguire says

“...I’m looking not for higher prices but for sharply higher prices...'

The taking of your securities for collateral...

JPMorgan’s relationship with gold...

Unwinding the financial system Unwinding the financial system

|

|

|

|

Post by Entendance on Oct 7, 2023 7:24:50 GMT -5

Jim Sinclair, the 'Mister Gold' of the United States, dies at 83 Jim Sinclair, the 'Mister Gold' of the United States, dies at 83

|

|

|

|

Post by Entendance on Oct 8, 2023 5:29:11 GMT -5

|

|

|

|

Post by Entendance on Oct 10, 2023 3:33:46 GMT -5

The Big Picture

We continue to tell our global readers to remain focused on the big picture for gold. There is massive money printing taking place. This money printing must be done in order to sustain the system. Therefore Western debt levels will continue to skyrocket, and fiat money will continue to be devalued, resulting in a historic bull market for commodities. All of this is bullish for gold and silver. Do not be distracted by the games that have been played in the paper markets. Continue to trade in fiat money for physical gold and silver and remain focused on the big picture during times of volatility. -King World News

|

|